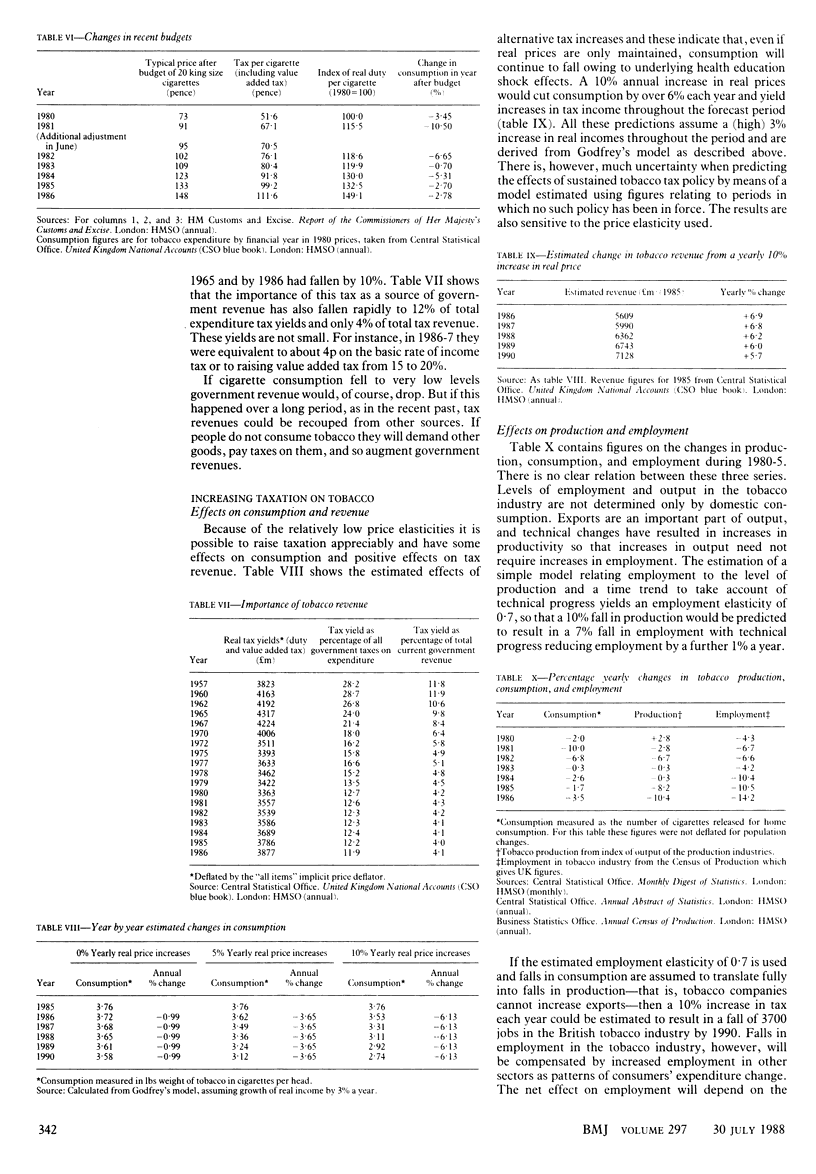

Abstract

Tax levels have important effects on cigarette prices and tax revenues. Over 70p of every pound spent on tobacco goes to the Chancellor of the Exchequer, yielding over 5 billion pounds. But the value of tobacco tax revenues have generally fallen--by 1986 they were 10% lower than at their peak in 1965, and tobacco revenue is becoming a smaller proportion of total tax receipts. The impact of a consistent increase in tobacco taxation is important in terms of reduced consumption (and harm to health) as well as in terms of reduced employment. Revenue may, however, increase in the short term. Finally, if the findings of Townsend and Atkinson et al (see above) still apply then the distributive effects of increased taxation on the poor might be less than is sometimes feared.

Full text

PDF

Selected References

These references are in PubMed. This may not be the complete list of references from this article.

- DOLL R., HILL A. B. MORTALITY IN RELATION TO SMOKING: TEN YEARS' OBSERVATIONS OF BRITISH DOCTORS. Br Med J. 1964 Jun 6;1(5396):1460–CONCL. doi: 10.1136/bmj.1.5396.1460. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Leu R. E. Anti-smoking publicity, taxation, and the demand for cigarettes. J Health Econ. 1984 Aug;3(2):101–116. doi: 10.1016/0167-6296(84)90001-8. [DOI] [PubMed] [Google Scholar]

- WYNDER E. L., GRAHAM E. A. Tobacco smoking as a possible etiologic factor in bronchiogenic carcinoma; a study of 684 proved cases. J Am Med Assoc. 1950 May 27;143(4):329–336. doi: 10.1001/jama.1950.02910390001001. [DOI] [PubMed] [Google Scholar]