Abstract

In recent years, State Medicaid programs have begun adopting health-based payment systems to help ensure quality care for people living with human immunodeficiency virus (HIV) and acquired immunodeficiency syndrome (AIDS), and to ensure equity for the managed care organizations (MCOs) in which these people are enrolled. In this article, the authors discuss reasons why such payment systems are needed and describe AIDS-specific capitation rates that have been adopted in several State Medicaid waiver programs. The authors also examine comprehensive risk-adjustment systems both within Medicaid and outside the program. Several research questions needing further work are discussed.

Introduction

The rapid growth of managed care in State Medicaid programs has caused unease in the care community that serves people living with HIV and the advanced form of HIV infection, AIDS. One reason for the concern is that most capitation rates paid to MCOs for the care of people living with HIV or AIDS (PLWH) have been substantially lower than the cost of care (Conviser, Kerrigan, and Thompson, 1997). This financial shortfall gives MCOs a disincentive for maintaining or improving the quality of care provided to PLWH and, under some conditions, can threaten MCOs' viability and that of providers in their care networks. In this article, we explore ways of adjusting capitation rates on the basis of enrollee health status and describe health-based payment methods that some State and local Medicaid managed care programs have begun adopting to ensure both quality care for PLWH and equitable payment for MCOs in which these people are enrolled.

Until the enactment of the Balanced Budget Act (BBA) in 1997, States had to submit applications and go through an approval process administered by HCFA to institute Medicaid managed care section 1115 or 1915(b) waivers. By November 1993, only two statewide waivers had been awarded under section 1115 of the Social Security Act. But 4 years later, section 1115 Medicaid managed care programs had been instituted in 13 States (Alabama, Arizona, Delaware, Hawaii, Maryland, Massachusetts, Minnesota, Ohio, Oklahoma, Oregon, Rhode Island, Tennessee, and Vermont), most for mandatory programs (Gearon, 1997). In addition, section 1115 waiver approval had been given to five more States (Arkansas, Florida, Illinois, Kentucky, and New York). Moreover, by early 1998, section 1915(b) waivers had been approved for 88 mostly voluntary Medicaid managed care programs operating in 38 States; these are more limited than section 1115 waivers in either the scope of the services or the geographical areas they cover.

The BBA includes a provision that may speed the growth of Medicaid managed care: The legislation contains a State plan option that removes the necessity for a HCFA waiver review process for certain aspects of managed care. The BBA's limited exemption from new managed care requirements for waiver processes under section 1115 or section 1915(b) gives States some flexibility in designing their managed care programs. There will still be a need for States to comply with fairly complex regulations and requirements of section 1932(c) (passed as part of the BBA), concerning such matters as quality assessment and performance improvement.

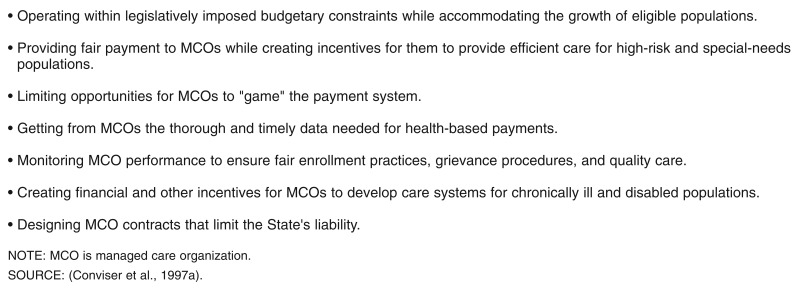

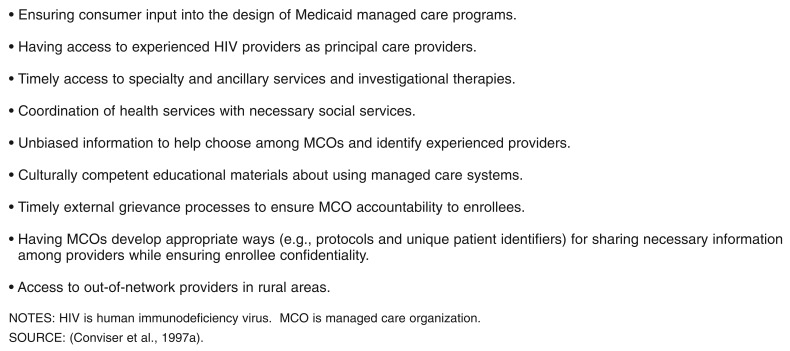

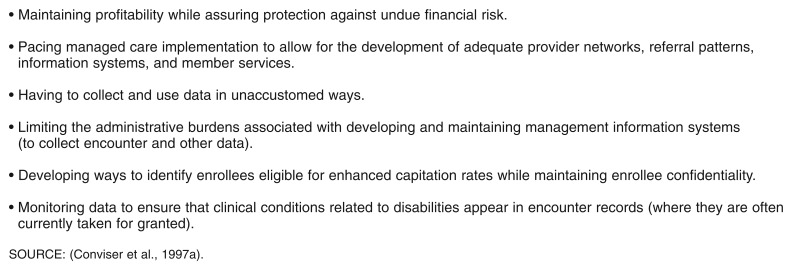

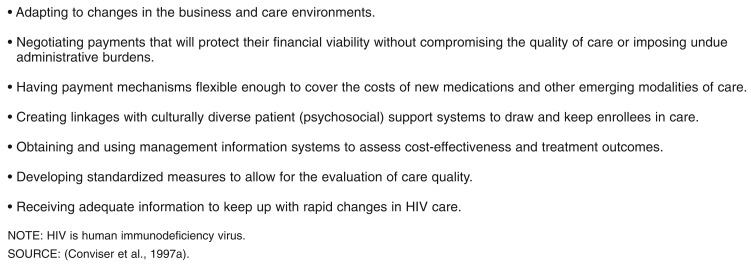

This rapid growth of managed care in Medicaid programs has quality of care and financial implications not only for PLWH and other disabled or chronically ill populations but also for providers, MCOs, and States. Some of these issues were explored at a May 1997 conference on HIV Capitation Risk Adjustment cosponsored by the Health Resources and Services Administration (HRSA), HCFA, the Kaiser Family Foundation, and others (Conviser et al., 1997a). Figures 1-4 incorporate and expand upon concerns that were expressed by conference participants about problems facing States, MCOs, providers, and consumers. The concerns listed in these figures include issues relating to access, cost, equity, and quality; many of the concerns can be addressed by (or have relevance for) the design of payment methods that base the capitation rates paid to MCOs upon the health status of their enrollees. Indeed, there was broad agreement among HIV Capitation Risk Adjustment Conference participants that such health-based payments to MCOs could help to ensure quality care for PLWH.

Figure 1. State Medicaid Agency Concerns.

Figure 4. Consumer and Consumer Advocate Concerns.

Variations in Medicaid Care Costs

Medicaid managed care programs serve diverse subpopulations, including families with children—through Aid to Families with Dependent Children (AFDC), now replaced by Temporary Aid to Needy Families (TANF)—and people with chronic illnesses and disabilities, typically through Supplemental Security Income (SSI) programs. The costs of care for these two subpopulations are quite different. “[P]oor families with children… [account nationally] for 72 percent of Medicaid recipients but [incur] only 29 percent of Medicaid expenditures. Services to elderly and disabled persons account for 59 percent of Medicaid expenditures” (Bodenheimer, 1997).

The translation of these costs from the aggregate to an individual level can be illustrated by a study of fee-for-service Medicaid expenditures in Colorado (Kronick et al., 1996). There, annual expenditures during 1994 for AFDC children averaged $649, compared with $1,646 for AFDC adults and $4,763 for Medicaid recipients with disability. Such differences in expenditures are reflected in the different capitation rates that States with managed care plans pay MCOs for people in different eligibility categories. Thus, for example, Arizona—which in 1982 was the first State to institute Medicaid managed care—was paying monthly capitation rates during 1996 of $109-$123 for persons eligible for AFDC Medicaid and $275-$337 for persons eligible for SSI but not covered by Medicare (Conviser, Kerrigan, and Thompson, 1997). Variations in the capitation rates States pay for an eligibility category generally correspond to enrollee differences in demographic variables (primarily age and sex) and the geographic regions in which the enrollees reside.

However, there can also be a great deal of variability in the cost of care for people within a given Medicaid eligibility category. For example, in a study using data from 1991-94 from 5 States—Colorado, Michigan, Missouri, New York, and Ohio—annual expenditures for SSI enrollees diagnosed with schizophrenia averaged $9,506, but those for SSI enrollees with AIDS averaged $22,836 (Kronick et al., 1996; Dreyfus, Kronick, and Tobias, 1997). The authors of this study also report that among Colorado's 1994 Medicaid recipients with disabilities, “the most expensive 10 percent of recipients accounted for 63 percent of expenditures, and the least expensive 40 percent accounted for only 3 percent of expenditures” (Kronick et al., 1996)—figures that are typical of a wide range of insurance programs (Lee and Rogal, 1997). The existence of this variability can create an opportunity for Medicaid MCOs to engage in risk selection (“creaming”) by trying to attract through advertising, program design, or network composition, enrollees who have relatively low health care needs.

As some of the entries in Figure 4 suggest, the institution of managed care has raised concerns about the quality of care that will be available to Medicaid enrollees who have disabilities or chronic illnesses such as HIV. Many commercial MCOs that participate in Medicaid managed care programs have relatively little experience in caring for disabled populations. Moreover, managed care's emphasis on decisionmaking by primary care providers may conflict with the need that chronically ill or disabled enrollees have for ready access to specialists, while the financial constraints associated with prepaid health insurance may discourage MCOs from providing that access. MCOs that do not receive health-based payments might not only shy away from or underserve people with disabilities and chronic illnesses but might also avoid early diagnosis or underuse prevention, outreach, and education services that could detect these conditions and encourage treatment.

Why Health Based Payments are Needed

For MCOs that attract disproportionate shares of people living with HIV/AIDS, there is the further problem of adverse risk selection. The cost of HIV care is substantially higher than the typical (unadjusted) capitation rates paid for SSI enrollees by States with Medicaid managed care. For example, in the first nine States to implement section 1115 waiver programs, monthly capitation rates for persons under age 65 who were eligible for SSI ranged in 1996 from $240 in Minnesota to $721 in Delaware. Although capitation rate differences such as these may result from differences in covered services (Conviser, Kerrigan, and Thompson, 1997), the latter do not account for the gap between the rates and the cost of HIV care. The monthly rates just cited translate to an annual payment range of $2,880-8,652, or about 13-38 percent of the average expenditure (from 1991-94 data) of $22,936 for people with AIDS in the five-State study of Medicaid enrollees by Kronick et al. (1996). Similarly, during the 3 years ending in June 1995, annual (fee-for-service [FFS]) care costs for Medicaid clients with HIV or AIDS who received their care at the Johns Hopkins University HIV Service in Maryland were well above these capitation rates, averaging $18,096 for people in all disease stages and $29,232 for those with CD4 counts below 200 (Moore and Chaisson, 1997); since 1993, a CD4 count below 200 has been an AIDS-defining condition.

The prospective payment system of managed care puts MCOs at risk for care costs in excess of capitation payments. To some degree, that risk can be mitigated by stop-loss reinsurance; this limits an MCO's liability to only a fixed percentage of the annual cost for the care of an enrollee that exceeds a specified threshold. There are also “risk corridor” arrangements that place a percentage limit on both profits and losses for MCOs, with some or all amounts outside the corridor reverting to (or becoming the financial liability of) the State. MCOs can also share risk by capitating (and thus placing at risk) the providers in their networks, although MCOs often elect to pay providers on a FFS basis instead.

In principle, an equitable distribution of high-cost enrollees across MCOs would allow capitation payments in excess of costs for healthy enrollees to make up for underpayments for enrollees requiring high resource utilization. However, not all MCOs may be equally attractive to enrollees with certain conditions. Several studies (Kitahata et al., 1996; Conviser et al., 1997b) have shown that PLWH have better access to new treatments and better health outcomes if they are cared for by experienced HIV care providers. These providers typically are not distributed evenly across MCOs. Also, without financial incentives to compensate for the relatively high costs of HIV care, many MCOs may shy away from providing services that would attract PLWH and those with other chronic or disabling conditions, or from publicizing the programs they may already have developed.

PLWH may thus tend to gravitate toward a relatively small subset of the MCOs participating in a State's Medicaid program. This phenomenon has already occurred in Oregon's statewide Medicaid managed care program, where one Medicaid-only MCO has a rate of HIV/AIDS patients nearly four times the statewide average. “CareOregon, with only 9 percent of the enrollees in the Oregon Health Plan, provides services to 50 percent of the plan's HIV-infected patients who have CD4 counts below 500 per cubic millimeter. Yet the Oregon Health Plan has not yet provided CareOregon with higher capitation rates to compensate for this clear case of adverse risk selection” (Bodenheimer, 1997).

One solution to adverse risk selection is to base capitation payments to MCOs on the recent care costs or the health status of the enrollees they draw; Oregon has recently indicated an intent to adopt this option (discussed later). Recent care costs are perhaps the best predictor of future costs, especially for the chronically ill and disabled, whose care costs tend to be more stable than those of the general population (Kronick et al., 1996). However, current information on the cost of care generally becomes unavailable at the State level when Medicaid programs shift from FFS into prepaid systems, although this information may be available from MCOs. It is more sustainable over the long run for States to base capitation rates on information about recent enrollee health service utilization. A modified version of this option, proposed by Newhouse (1998), would base payments to MCOs partly on past enrollee utilization and partly on the cost of the services actually delivered. Over time, as there came to be more experience with the adjustment of capitation rates, the weight given to utilization-based payment could increase.

When States make the initial switch from FFS payment, they generally base capitation rates on historic costs. However, this information cannot take into account recent treatment advances; for example, the HIV treatment costs already cited for years ending in 1995 include neither the new protease inhibitor combination therapies and associated viral-load testing, with a joint cost on the order of $1,000 per month, nor any changes in resource consumption that may be associated with the therapies. In addition, historic costs may be based on below-market payment rates that FFS Medicaid programs paid providers, may reflect suboptimal levels of care, or may exclude claims not submitted by inefficient providers. They may also exclude the cost of care provided by community-based programs such as those funded through the Ryan White CARE Act.

These cautions notwithstanding, a health-based payment system would pay MCOs more equitably for the care they are called upon to deliver than traditional categorical payment rates that are adjusted only by demographic factors. A health-based payment system would also encourage specialization, e.g., the development of centers of excellence or disease management programs by MCOs willing to operate within small niches. To maintain health-based payment systems, it is necessary for MCOs to collect and submit good-quality encounter data to provide the information necessary to compute and adjust capitation rates.

A central issue discussed at the HIV Capitation Risk Adjustment Conference was whether States should develop special capitation rates for AIDS alone or adopt comprehensive health-based payment mechanisms. Health policy analysts often distinguish between two stages in the process of arriving at health-based payments: risk assessment and risk adjustment. Risk assessment involves using health-status information—sociodemographic characteristics, clinical history (which can be obtained from health-status surveys, claims data, or medical records), and past use of medical services (associated with International Classification of Diseases, 9th Revision [ICD-9] diagnostic codes and/or cost information). Some risk-assessment methods take into account inpatient or outpatient services alone, while others mix the two. Those that use information on inpatient services only tend to work against a goal of managed care programs to provide care in outpatient settings (e.g., clinic, community, or home), which are less costly than inpatient hospitals. Risk adjustment involves converting the categories generated by the risk-assessment process into capitation rates for MCO payment. Comprehensive risk adjustment thus requires a substantial amount of data collection and analysis, and States need to determine under what circumstances the amount of work is worth the cost. The benefit is clear; as Weiner et al. (1996) have suggested, risk adjustment can “encourage health plans to compete on the basis of efficiency and quality and not risk selection.”

Instead of adopting comprehensive risk adjustment, some States might choose to pay an enhanced capitation rate only for enrollees with AIDS. This can reduce the amount of work States have to do initially before deciding whether to move forward with comprehensive programs. The increasing number of studies documenting AIDS costs provides information that could be used in determining such a rate, although some State Medicaid programs may insist on using their own data rather than information from other places to compute an AIDS rate. States adopting such a rate may have to face the issue of inequity, because many MCOs have disproportionate shares of enrollees requiring care for other costly conditions such as organ transplants, heart procedures, or diabetes.

Either approach (a special AIDS rate or global risk adjustment) will eventually have to deal with the uncertainties introduced by combination therapies, which change both the course of HIV disease and the patterns of expenditures for people at various stages of HIV infection.

Aids Specific Medicaid Capitation Rates

Two basic questions raised at the conference on HIV Capitation Risk Adjustment were how many HIV/AIDS rates States should adopt, and what criteria should be used to determine them. To date, no State has adopted an HIV rate (i.e., one for people whose illness has not yet progressed to AIDS), although New York State is planning to do so in conjunction with Special Needs Plans for PLWH that will be instituted when the State implements a section 1115 waiver program, at a date still to be determined. In mid-1998, Maryland also began to explore the possibility of adopting a special HIV rate. Several States have adopted AIDS rates in either section 1115 or section 1915(b) waiver programs; information about these rates is shown in Table 1. Most of the programs have specified a single capitation rate for people living with AIDS; the two exceptions are Maryland and Massachusetts. For the year beginning July 1997, Maryland adopted different rates for people who live in Baltimore City and those who live in the remainder of the State—$2,161 and $1,812 per member per month, respectively. At the end of that year, the State announced that these rates would be cut by 25 percent for the following year. (Note that Maryland also has adopted a comprehensive risk-adjustment methodology for most other enrollees in its Medicaid managed care program, including those with HIV; the methodology is discussed later.)

Table 1. Special AIDS Capitation Rates in State Medicaid Programs.

| Program and Region or State | Waiver Authority | Eligibility Criteria | Protease Inhibitors | Viral-Load Testing | Other | Capitation Rate(s)1 |

|---|---|---|---|---|---|---|

| AIDS Healthcare Foundation, Los Angeles | 1915(b) Voluntary | 1993 CDC AIDS Definition | Excluded | Included | Excludes | 2 $1,139 Inpatient Care |

| California Two-Plan Counties 3 | 1915(b) Voluntary | 1993 CDC AIDS Definition | Varies | Included | — | $1,000-1,070 |

| CalOPTIMA, Orange County, California | 1915(b) Mandatory | 1993 CDC AIDS Definition | Excluded | Included | Excludes Mental Health, Dental, SNF, and Pharmacy | 4 $1,722 |

| HealthChoice, Maryland | 1115 Mandatory | 1993 CDC AIDS Definition | Excluded | Excluded | Excludes Children | 5 $2,161 Baltimore, $1,812 Elsewhere |

| Massachusetts | 1915(b) Voluntary | 6HIV+ Test, CD4 Count Less Than 200 or Percentage Below 14, Treatment Within Past 12 Months for Active or Advanced AIDS | Excluded | Included | — | $2,300 Active AIDS, $2,988 Advanced AIDS |

| Enhanced Capitation Rate, New York State | 1115 Mandatory (Planned) | 7CD4 Count Less Than 200, Certain ICD-9 Codes, State AIDS Registry Certification | Excluded | Included | — | 8 Increase Based on AIDS Enrollment |

| Special Needs Plan, New York State | 91115 Voluntary (Planned) | HIV or AIDS and Uninfected Family Members to Age 19 | Excluded | Included | — | To Be Determined |

| Accessing Better Care, Ohio | Pilot Program | 1993 CDC AIDS Definition | Included | Included | 10 2 counties | 11 Variable |

| Salt Lake County, Utah | Voluntary | 1993 CDC AIDS Definition | Excluded | Included | — | $1,198 Plus Eligibility Category Rate |

Per member per month, paid by the State.

Inpatient care is capitated at an additional $657 per person per month. This expected inpatient hospitalization amount is placed in a risk pool, and any savings from the pool are divided between the State and the AIDS Healthcare Foundation.

Enrollees may choose between a public and a commercial plan.

This is the rate paid for AIDS patients to participating MCOs by CalOPTIMA, but CalOPTIMA does not receive this amount from the State.

For the program's second year, which began July 1998, rates have been cut 25 percent, and the State is exploring adopting an HIV capitation rate.

See Technical Note for lists of ICD-9 codes corresponding to definitions of active and advanced AIDS.

See Technical Note for list of AIDS-defining ICD-9 codes.

See Table 6.

To be voluntary for the first 2 years of the program, then mandatory.

Columbus and Cincinnati; Cleveland was also in the program originally but dropped out.

There are 7 payment categories geared to prior year's expenditures for enrollee.

NOTES: AIDS is acquired immunodeficiency syndrome. CDC is Centers for Disease Control and Prevention. SNF is skilled nursing facility. HIV is human immunodeficiency virus. ICD-9 is the International Classification of Diseases, 9th Revision. MCO is managed care organization.

SOURCE: Conviser, R., Health Resources and Services Administration, Rockville, MD, 1998.

Massachusetts' program is the only one currently paying different capitation rates for people at different stages of AIDS. In general, clinical markers that indicate health status and that may be predictive of care costs for PLWH include CD4 cell counts and percentages (i.e., the proportion of all CD cells that are CD4 cells) as well as viral-load measurements. Historic information about enrollees' opportunistic infections can also be useful, along with information about comorbidities, including substance use, mental illness, and homelessness. Massachusetts' criteria for its AIDS rates include CD4 counts and percentages, as well as diagnoses of specific opportunistic infections, but not comorbidities; the one mental condition included in the criteria is AIDS dementia complex. More specifically, for MCOs to receive AIDS rates, they must document that enrollees have positive HIV antibody test results and CD4 counts below 200 or CD4 percentages below 14 percent, and the enrollees must have received treatment within the past 12 months for certain AIDS-related conditions. The State's distinctions between active AIDS, with a capitation rate of $2,300 per member per month, and advanced AIDS, with a rate of $2,998, are based on the conditions for which enrollees have received treatment, corresponding to specific lists of ICD-9 diagnostic codes (see Technical Note).

There is substantial variation in the rates shown in Table 1. Some reflects regional differences in health care costs, and some results from the inclusion or exclusion of protease-inhibitor combination therapies in the capitation rates. Maryland has excluded both the therapies and associated viral-load tests from its AIDS capitation rates—paying for these on a FFS basis—because it had no historical data on which to base estimates. (In Arizona's Medicaid managed care program, which does not have a special AIDS rate, the State pays MCOs $634.50 per month for each enrollee with HIV documented to be receiving the therapies and viral-load tests. In Wisconsin, for AFDC/TANF enrollees with AIDS, the State retrospectively adds FFS costs to the capitation rate it pays MCOs, effectively excluding people with AIDS from the managed care cost structure.)

California is phasing in Medicaid managed care under section 1915(b) waivers on a county-by-county basis. Three models are available to counties: (1) a single, locally organized non-profit MCO; (2) two MCOs, one local and non-profit, and the other commercial for-profit; and (3) multiple for-profit and non-profit MCOs (Korenbrot et al., 1998). The AIDS Healthcare Foundation (AHF) in Los Angeles County has negotiated a higher AIDS capitation rate with the State than that paid in any of the two-plan counties. Although AHF is receiving only a slightly higher monthly amount than the others, it does not have to include hospitalization in its capitation rate. The rate shown in Table 1 for CalOPTIMA, a multiplan model, is that paid to the five participating MCOs. CalOPTIMA does not receive any special AIDS rate from the State but sets aside funds for AIDS care out of the total allocation it receives from the State before setting MCO capitation rates (Pearce, 1998). It prepays MCOs at standard rates and has them invoice CalOPTIMA monthly for the difference between those rates and the AIDS rate.

In Ohio, the capitation rate for AIDS varies according to per client expenditures made during the previous year. There are seven “bins” (capitation rate categories) for enrollees with at least 6 months of claims data in the State Medicaid system, and one rate category for newer enrollees. A study (Payne et al., 1998) has shown that Ohio's “bin” reimbursement system makes better overall predictions of Medicaid expenditures than the more complex Disability Payment System (DPS, described later). However, for certain conditions such as HIV/AIDS and blood disorders, DPS is a far better predictor of expenditures.

As Table 1 indicates, New York State plans to follow two different approaches toward capitation of HIV and AIDS care. One approach is to enhance the capitation rates paid to an MCO for all of its enrollees if the MCO can document that enrollees with symptomatic AIDS comprise in excess of 1/10th of 1 percent of its members and 20 percent of the people living with AIDS in its operating region.1 MCOs must requalify every 6 months to receive the enhanced rates; the amount of the enhancement depends upon the proportion of enrollees with AIDS among its own enrollees or relative to the region's total AIDS population that the MCO can document, as shown in Table 2.

Table 2. Rate Adjustments for New York MCOs Enrolling AIDS Patients.

| Percent of Region's Symptomatic AIDS Population Enrolled | Symptomatic AIDS Enrollees as a Percent of Health Plan's Total Total Medicaid Membership | Total Capitation Adjustment |

|---|---|---|

|

| ||

| Percent | ||

| 0 Through 20 | 0.0 Through 0.1 | Included in Base Rate |

| Greater Than 20 Through 40 | Greater Than 0.1 Through 0.2 | 1.16 |

| Greater Than 40 Through 60 | Greater Than 0.2 Through 0.3 | 2.32 |

| Greater Than 60 Through 80 | Greater Than 0.3 Through 0.4 | 3.48 |

| Greater Than 80 Through 100 | Greater Than 0.4 Through 0.5 | 4.64 |

NOTES: AIDS is acquired immunodeficiency syndrome. MCO is managed care organization.

SOURCE: Planning documents submitted to the Health Care Financing Administration by the New York State AIDS Institute, 1998.

New York State's other approach toward managed HIV care is to develop Special Needs Plans (SNPs), consisting of a system of MCOs designed specifically to respond to the needs of PLWH and their family members. Many details of that program are yet to be worked out. The HIV planning process for both aspects of New York's Medicaid managed care program has received support from HRSA under a Special Projects of National Significance (SPNS) grant to the New York State AIDS Institute for the purpose of examining capitation of HIV care. Three of the other programs represented in Table 1 also have received or worked with recipients of similar SPNS grants; the grantees are the AIDS Healthcare Foundation in Los Angeles, the Community Medical Alliance in Boston, and the Johns Hopkins University HIV Program in Baltimore.

Planning grants awarded by the New York State AIDS Institute have generated several benefits recommendations for the SNPs, including a need for coordination among case management providers, exclusion of new drugs and tests from the capitation rate until their costs and effectiveness are known, flexible hospice benefits, and coverage for transportation or alternatives such as telemedicine. For MCOs to become SNPs, they will be required to demonstrate appropriate staffing patterns, acceptable outreach and enrollment practices, culturally and linguistically competent communication procedures, continuity of care and timely service delivery, monitoring techniques to ensure quality of care consistent with AIDS Institute clinical standards, and appropriate complaint and grievance mechanisms (Conviser et al., 1997a). New York's SNP is the only program listed in Table 1 that plans to have special capitation rates for people living with HIV, as opposed to AIDS, although Maryland may do so. However, several States have adopted global health-based payment programs that cover HIV; we turn now to those.

Implemented Comprehensive Health Based Programs

In general, comprehensive health-based payment methods assess the risk of enrollees on the basis of diagnoses reported from health care encounters during the previous year. The associated risk-adjustment mechanisms then capitate MCOs on the basis of the mix they get of enrollees with risks assessed at various levels. Methods that have been proposed for comprehensive health-based payment use a variety of risk-assessment and risk-adjustment techniques. One such method is the Ambulatory Care Group (ACG) approach developed at Johns Hopkins University (Weiner et al., 1996); it was adopted in 1997 by Maryland for its statewide mandatory Medicaid managed care program. A second is the Disability Payment System (DPS) method developed by Kronick and his colleagues (Kronick et al., 1996), which was adopted by Colorado for its voluntary Medicaid managed care program, which also took effect in 1997. A third approach is the Diagnostic Cost Group (DCG) methodology developed by Ash and her colleagues (Ash et al., 1986, 1989) to analyze Medicare data; the DCG approach has since given rise to several variants, such as the Hierarchical Coexisting Conditions model (Ellis et al., 1996), which takes into account multiple coexisting conditions. Several other approaches have been advanced as well (Lee and Rogal, 1997). Because only the first two of these models have thus far been adopted in Medicaid programs, we will focus on them in the discussion that follows.

Disability Payment System in Colorado

The risk-assessment methodology for the DPS instituted in Colorado distinguishes 18 diagnostic categories, including one for AIDS. Some of the categories are based on body systems and others on types of illness or disability, and the diagnostic categories fit into two broad classes. Eight of them are fully counted categories (e.g., cancer), for which all diagnoses in the category are taken into account in risk assessment; the other 10 are hierarchic diagnostic categories (e.g., AIDS, substance abuse, and mental illness), for which only the most severe diagnosis is taken into account.2 In a study of DPS involving data from 1991-94 in five States—Colorado, Michigan, Missouri, New York, and Ohio—the frequency of diagnoses for various disabilities was similar in all the States, with one exception: There was a significantly higher proportion of AIDS cases in New York than in the other States (Kronick et al., 1996).

Ratesetting under the DPS operates in the same fashion as a linear regression equation. There is a base monthly rate for each enrollee that is analogous to an intercept (which amounted to $166 in the five-State study), an age-sex adjustment (which ranged from -$47 to +$29 in the study), a geographic adjustment (e.g., urban-rural), an incremental payment for any of the 10 hierarchic categories in which an enrollee has a diagnosis, and an incremental payment for each diagnosis an enrollee may have within the 8 fully counted categories; all of the adjustments are analogous to β weights in a linear regression. The monthly increment for the AIDS category in the five-State study was $1,107, but this is only a part of the total payment that an MCO would receive for an enrollee with AIDS. It would also receive the baseline payment; adjustments for enrollee age, sex, and geographic location; and increments for other illness categories recorded in encounter data. Thus, the annual figure already reported from the five-State study translates to a monthly payment of $1,903. This does not include protease inhibitors, for which Colorado's Medicaid program pays on a FFS basis. In practice, each State using the DPS is encouraged to set its own increments based on historic Medicaid FFS data.

Rather than paying an individual capitation rate to MCOs for each enrollee, Colorado decided to compute a single capitation payment for each MCO on the basis of its case mix of enrollees. Thus, MCOs with disproportionate shares of high-cost clients are paid a capitation rate proportionately higher than the statewide average, and those with low shares of such clients are getting a rate lower than the statewide average. The capitation rates that took effect in October 1997 were computed to make expenditures under the managed care program total 95 percent of the FFS Medicaid expenditures during fiscal year 1996-97. The base rates (subject to adjustment) are shown in Table 3; case-mix adjustments were anticipated to range from 0.83 to 1.27. It should be noted that the DPS was developed specifically to set rates for people with disabilities; however, Colorado is using it to set rates for AFDC/TANF Medicaid enrollees as well, having found in a pilot study that DPS was a reasonable predictor of resource utilization in that population (Tollen and Rothman, 1998).

Table 3. Colorado's Base Medicaid Capitation Rates for 1997-98.

| Program | Geographic Area | Rate per Member per Month |

|---|---|---|

| AFDC Adults | Denver | $139.55 |

| Non-Metro Area | 137.82 | |

| AFDC Children | Denver | 58.68 |

| Non-Metro Area | 57.92 | |

| Aid to Disabled | Denver | 306.03 |

| Non-Metro Area | 330.12 |

NOTE: AFDC is Aid to Families with Dependent Children.

SOURCE: (Conviser et al., 1997a).

ACG Model in Maryland

In addition to developing the special AIDS rates shown in Table 1, Maryland has instituted a global health-based payment system for its Medicaid managed care program, based on the ACG model. This model has been under development for several years, during which time it has been revised several times and has generated several variants, including Major Diagnostic Category and Hospital Dominant models (Weiner et al., 1996). The first of these takes into account only ambulatory diagnoses, while the second uses diagnostic categories recorded for an enrollee in both inpatient and outpatient settings.

The central feature of the ACG mechanism is a set of 32 distinct Ambulatory Diagnostic Groups (ADGs), which incorporate a majority of the ICD-9 diagnostic codes used in medical records (see Technical Note). The ADGs are constructed in such a way that the diagnoses within each should have roughly equivalent likelihoods of:

Persistence or recurrence,

Return visits or the need for continued treatment,

The need for specialist services,

A decreased life expectancy,

Short- or long-term patient disability,

The need for diagnostic and treatment, procedures with similar costs, and

Required hospitalization (Johns Hopkins University, 1997).

There are three other steps by which the ACG methodology assigns Medicaid enrollees to distinct categories for ratesetting purposes. The first step involves reducing the number of ADGs from 32 into 12 collapsed ADGs (CADGs); the entries within each CADG are intended to have the same likelihood of persistence or recurrence.3 This step decreases by a factor of more than 1 million the 232 possible multiple ADG combinations to just over 4,000 (212) CADG combinations. In the next step, certain of the 12 collapsed diagnostic groups are combined to form 26 Major Ambulatory Categories (MACs). The MACs include the 12 individual CADGs, 11 particular (frequently occurring) combinations of them,4 a category for all other combinations, one for infants under 1 year of age, and one for non-users of services and individuals without any classifiable diagnoses. (The latter is analogous to the base rate in the DPS.) Finally the methodology sorts enrollees within each MAC into 52 ACGs, selected so as to minimize variance in resource use within each ACG and maximize variance between the groups. The sorting of enrollees into ACGs is based on age, sex, the number of ADGs in which they had diagnoses, the number of diagnoses in the eight ADGs that best predict health-resource usage, and the presence or absence of two particular conditions: allergies, and recurrent or persistent unstable psychological diagnoses.

Maryland maps the ACGs into capitation rates for its Medicaid managed care enrollees in different ways for families with children than for people with disabilities. For families with children, the State groups the ACGs into nine rate cells; for people with disabilities, it groups them into eight different cells. A given ACG may be associated with rate cells of different levels for the two Medicaid-eligible groups. During the program's first year, which began in July 1997, capitation rates for families with children ranged from $45 to $721 per member per month; rates for people with disabilities ranged from $95 to $1,102.

At present, Maryland's ACG system has no special rate category for HIV. Instead, PLWH are sorted into ACGs and rate cells on the basis of the specific presenting diagnoses they manifested during the previous year. Note that for PLWH, the State excludes protease inhibitor therapy and viral-load tests from the capitation rate, paying MCOs for them on a FFS basis, just as it does for people living with AIDS. Also, the care of children living with HIV is paid for on a FFS basis; it is not handled under the ACG global risk-adjustment mechanism.

Non-Medicaid Experiments With Health-Based Payment

There are three other examples of health-based payment systems that have been instituted outside of Medicaid programs whose experience could be of value to States considering the adoption of comprehensive health-based payments for Medicaid. These are programs for Washington State Government employees, employees of small businesses in California, and employees of a 28-member Buyers Health Care Action Group in Minneapolis-St. Paul.

The government employee program in Washington is administered by the State Health Care Authority. It began development of a risk-adjustment methodology in 1996, and, during a phase-in period that began in 1998, is using both an Enhanced Demographic Model (EDM) based on age, gender, and member status and a Health Status Model (HSM) based on these demographic variables and the DCG model (Dunn, 1998). For 1998, payment to MCOs is based on the EDM, with adjustments of ± 2 percent to be paid to the 17 participating MCOs for differences in health risk as measured by the HSM. The complete changeover to the HSM is to take place in 2000 (Dunn, 1998).

A simulation conducted in 1997 showed that adjustments to MCOs would be -10 to +12 percent under a demographic model, -18 to +18 percent under the EDM, -16 to +19 percent under the phase-in adjustment adopted for 1998, and -35 to +30 percent under the fully implemented HSM model (Dunn, 1998). Data-quality issues (as shown by inconsistent results across the models) suggest the wisdom of a phased-in implementation process. Dunn (1998) identifies the following among the lessons learned: “Don't expect to address every issue before implementation. Small steps are better than no steps. Continue to work toward refinement.”

The Health Insurance Plan for California (HIPC) insures small businesses with 3-50 employees and has been in operation since July 1993. HIPC conducted two simulation studies of risk exposure that took into account gender, family size, age, and ICD-9 codes associated with inpatient stays or annual health care charges above $15,000. Its risk-assessment methodology uses only inpatient diagnoses because of carrier data limitations; the ICD-9 codes identified by the methodology correspond to approximately 120 high-cost diagnoses that require inpatient admission, with weights being assigned to each diagnosis based on average California managed care experience in the years 1992-94 (Dunn, 1998). Excluded from the list of codes are normal maternity, trauma, mental health, and chemical dependency (Lee and Rogal, 1997). Claims experience from 2 years prior to a rate period is used to predict risk attributes for the rate period.

In mid-1996, HIPC adopted a risk-adjustment methodology that transfers payments among plans with risk-exposure scores that deviate more than 5 percent from the average. In general, transfer levels are computed at the beginning of each rate period, but for the first year of the program, they were announced midway through the year. Two MCOs withdrew from the program during a simulation period, and two others withdrew just prior to implementation, but one large carrier and several smaller ones have since joined it. Transfers in the program's first year amounted to 1 percent of total premiums, with the relative aggregate risk of MCO enrollees ranging from 0.93 to 1.32 and amounts transferred per month ranging from -$11 to +$46 per member (with 7 MCOs making payments, one receiving them, and 16 having no adjustment). In the second year, transfers comprised just 0.15 percent of total premiums, with the decrease in transfers attributable to lower MCO variation in risk, better data reporting, or a change in methods; per member per month transfers ranged from -$8 to +$16 (with 4 MCOs making payments, one receiving them, and 23 having no adjustment; Dunn, 1998). The one MCO receiving payments in both years reportedly has a disproportionate share of PLWH.

The Minneapolis Buyers Health Care Action Group implemented health-based payments in January 1997. It contracts with provider care systems (integrated provider groups) that assume some or all of the risk for their enrolled populations; the risk of the enrolled population for a system is assessed using the ACG methodology, with locally derived weights. Under the methodology, each individual is assigned a weight, and each care system is paid according to a weighted average of its enrolled individuals. Quarterly fee schedules are adjusted in accordance with actual system risk; however, catastrophic claims are excluded. Care systems are limited to 10-percent exposure for non-hospital services exceeding $10,000 per person per year and 10-percent exposure for hospital inpatient and outpatient services exceeding $30,000 per person per year (Dunn, 1998).

During the first quarter of the program's operation, provider care system risk scores ranged from 0.78 to 1.25, resulting in monthly capitation adjustments of between -$20 and +$22. A new version of the ACG methodology was used in the mid-year adjustment whose changes involved mainly the classification of births and newborns. The adoption of the new methodology resulted in a substantial increase in payments to a pediatric care system but negligible changes otherwise. Lessons learned include: “The actual method used for risk adjustment is probably less important than establishing a receptive context for its application. … Educate plans, providers, purchasers and policy makers so they have a very clear understanding of the purpose … and at least a basic understanding of the … logic and methods. … Set expectations that implementing risk adjustment is an evolutionary process” (Dunn, 1998).

Other State Medicaid Plans

A number of other States have begun planning for the implementation of comprehensive risk adjustment in portions of their Medicaid managed care programs that would affect payment for enrolled PLWH (Kronick and Dreyfus, 1997). Washington State had planned to adopt a DPS system for its SSI population in early 1998 but has cancelled implementation; utilization and costs in a pilot program in eastern Washington rose 48 percent over previous FFS costs, largely because of improved enrollee access to care (Watts, 1998). Missouri plans to introduce a voluntary program for SSI recipients in one of its six health centers during 1999, based on the DPS. Oregon plans to adopt some method of health-based payment for AFDC/TANF enrollees in 1998 and is considering adopting the DPS for SSI recipients in 1999. Michigan planned to base payments on primary eligibility diagnosis for Children with Special Health Care Needs beginning in late 1997, using separate risk-adjustment pools for Medicaid-eligible and non-Medicaid-eligible children. Indiana began a small voluntary SSI program in 1997, also with payments based on enrollees' primary eligibility diagnosis. Wisconsin began a voluntary program in 1994 that pays for the care of SSI beneficiaries on the basis of prior utilization. New Jersey, Illinois, and Massachusetts all are weighing voluntary implementation of managed care in 1998 or 1999 for SSI recipients, and Maine is considering submitting a section 1115 waiver application that would have special AIDS rates.

Perhaps the most comprehensive planning for health-based payments in Medicaid has been taking place in Minnesota, where a report on risk adjustment and ratesetting commissioned by the State legislature was released by the Minnesota Department of Health in January 1998 (Health Economics Program, 1998). On the basis of preliminary studies, the State is planning to adopt an ACG case-mix system for its Prepaid Medical Assistance and MinnesotaCare Programs, with simulations of risk-assessment methods to take place in 1999 and a health-based payment system to begin operation in 2000. One reason for the choice of ACGs is that many Minnesota MCOs are already using them in managing utilization and costs, so there is a convenience factor. In addition, the State believes that ACGs may be optimal for non-disabled Medical Assistance populations; the ADGs that drive the ACG system were found to “have superior individual predictive accuracy” (Health Economics Program, 1998).

The ACG model Minnesota has been exploring uses 94 mutually exclusive ACG categories (compared with the 52 being used in Maryland). Moreover, because the distribution of health care charges in populations tends to have a long tail at the high end of the range, the State did some modeling involving mathematical transformations of charges to make their distribution more nearly normal (Health Economics Program, 1998). The State has found that the model has predictive accuracy far superior to that of models including demographic factors alone or those using untransformed health charges. Minnesota's intent is to set a monthly capitation rate for each eligible person; the individual risk weight would be capable of being modified further based on conversion factors related to policy decisions such as trending, legislatively mandated adjustments, or geographic payment policy. The State is also looking at using DPS or a blend of ACG and DPS for its Prepaid General Assistance Medical Care program and for the Demonstration Projects for People with Disabilities.

Evaluation and Implementation Issues

In addition to Minnesota's recent efforts, several analysts (including Kronick et al., 1996) have conducted studies to ascertain the extent to which health-based payment methodologies are indeed predictive of future resource utilization. All of the health-based payment methods discussed have been shown to have predictive power far superior to the adjusted average per capita cost (AAPCC) payment method that has been used for Medicare payment by HCFA, which takes into account only demographic variables and enrollee eligibility categories (Dreyfus, Kronick, and Tobias, 1997).

In general, health-based payment models overpredict costs for low users of health resources and underpredict them for high users. This should not be surprising; many conditions requiring treatment arise suddenly and may be resolved quickly, making much of the variation in health care costs unpredictable. However, the explanatory power of the models may be improved in several ways. As noted, Minnesota is using transformations of costs in some of its models. Another approach is to eliminate high-cost outliers from consideration. Capping medical expenditures at a threshold (which simulates real-life stop-loss reinsurance arrangements, like that of the Minneapolis Buyers Health Care Action Group) has been shown to improve significantly the predictions made by the ACG methodology (Weiner et al., 1996) and should have similar effects upon other models.

Several criteria have been advanced for the evaluation of health-based payment methods such as those discussed in this article. The criteria include ease and cost of administration, resistance to manipulation or “gaming” (such as inflated diagnosis coding), incentives created for MCO efficiency, and sensitivity to the quality of data required to compute them (Lee and Rogal, 1997). However, it has been asserted that the choice between methods is less important than cooperation between the State and MCOs, data quality, and the State's ability to adapt quickly to changes in caseloads and reported diagnoses (Kronick et al., 1996).

In the context of a discussion on Medicare, Weiner et al. (1996) have raised a variety of issues that clearly apply also to State Medicaid programs adopting health-based payment systems:

Getting MCOs to collect certain diagnosis-related encounter data that, for some MCOs, will constitute an addition to what they already collect;

Developing a method to update information annually to take into account inflation, care advances, and demographic shifts;

Compensating for inflation and other changes during the interval between data collection and the computation of capitation payments;

Figuring out how to pay plans for new enrollees for whom prior information on the cost of care is not available;

Modifying health-based payment methods in accordance with policy decisions on geographic adjustments, stop-loss reinsurance, or high-cost disease carve-outs; and

Giving MCOs time to gear up for the individualized scoring approach of health-based payment models, as opposed to more typical actuarial rate-cell systems.

Future Research Needs

As the foregoing discussion suggests, several experiments with health-based payment methods are taking place that are of great potential importance for both the quality of care given PLWH and the financial viability of the providers and provider systems that are furnishing that care. In the coming years, it will be necessary to evaluate and refine these methods and to disseminate information about them so that additional States and localities can examine and consider them. The recent rapid evolution in standards of HIV care and related technologies underscores the importance of understanding how care practices affect costs and outcomes; this evolution also raises questions concerning what services should be included in and excluded from HIV capitation rates (Conviser et al., 1997a). More refined health-based payment systems for PLWH could take into account clinical markers (such as CD4 and viral-load measurements), risk factors (such as injection drug use), and other comorbidities (such as mental illness and homelessness). However, information about these factors is unlikely to be available in Medicaid claims data, and even medical records seldom contain accurate or comprehensive information about HIV risk factors, mental health, substance use, or homelessness. Thus, continued research on risk adjustment must go hand in hand with concurrent studies on the cost of care (such as Moore and Chaisson, 1997) that may provide some of this information.

There are two additional questions that cry out for research in the changing care environment. Because of the success of new medications in stopping and even reversing the damage to the immune system caused by HIV, fewer and fewer people will be progressing to AIDS, the late stage of the disease, and some of those who have already received AIDS and disability diagnoses may regain the ability to participate in the work force. In addition to the policy decisions that will have to be made to figure out how to maintain health insurance for such people, research on health-based payment systems will have to focus more closely on payment for the care of people with HIV and not AIDS. (The related question of whether public insurance programs will expand to provide PLWH with early access to antiretroviral medications is likely to be the subject of considerable political debate in the coming years. In 1997 the executive branch of the Federal Government considered expanding Medicaid to give PLWH access to the medications, but there does not appear to be the political will to assume the associated costs. This option also raises confidentiality concerns.) To date, although a number of States have developed AIDS rates, no State has yet adopted special payment rates for HIV care. The comprehensive health-based payment systems adopted in Colorado and Maryland do take HlV-related diagnoses into account, but further refinements of these systems could gear payment more closely to enrollee health-status measures.

A second question that needs to be addressed concerns who ultimately benefits from risk-adjusted capitation rates. The adoption of health-based payment systems helps to ensure that MCOs are paid equitably on the basis of the health status of their enrollees. But there is no assurance that the enhanced payments MCOs receive wind up in the hands of the appropriate provider groups. To begin with, MCOs generally take a flat percentage of the capitation rate to cover administrative costs. But 15 percent, say, of a $2,000 monthly capitation rate for a person living with AIDS is substantially larger than 15 percent of a $100 monthly capitation rate for an AFDC/TANF child. Moreover, the distribution of costs among cost centers is shifting as a result of changing care practices and standards. The new HIV therapies appear likely to increase the costs of pharmaceuticals, particularly for those in early disease stages, and decrease hospitalization costs (Palella et al., 1998). More fundamentally, one of the principles that moves managed care forward is increasing the responsibility of the primary care provider for managing illness, so that more care can take place in home, community, and office settings and less in inpatient hospital and other high-cost settings. Most immediately, this shift suggests that primary care providers—whose office visits with HIV patients are more complex and time-consuming than those with patients having most other illnesses—may deserve to receive a larger proportion of the total payment amount than they historically have received. Clearly, research studies can document the extent to which this is true. But even if the evidence is there, getting MCOs to distribute capitation dollars appropriately among provider types may not be an easy task. This critical aspect of provider payment generally is not regulated by States, and attempts to regulate it will likely encounter resistance from MCOs.

Technical Note

Criteria for active AIDS in the Massachusetts program include candidal pneumonia (ICD-9 112.4) pneumocystis carinii pneumonia (136.3), cutaneous Kaposi's sarcoma (176.0), recurrent mucosal candida (112.0, 112.1), herpes simplex, including disseminated, with ophthalmic complications (054, 054.X, 054.XX), peripheral sensory neuropathy (357.8, 357.9), salmonella septicemia (003.1), tuberculosis (010-018, 010.X-018.X, 010.XX-018.XX), or two episodes of bacterial pneumonia (481, 482, 482.X, 482.XX, 485, 486). Criteria for advanced AIDS include coccidiosis, isosporiasis, cryptosporidiosis (007.2), mycobacterium avium intercellulare or complex (031.8, 031.9), PML (046.3), cytomegalovirus (078.5, 484.1), toxoplasmosis (130, 130.X), KS, organ involvement (176.1-176.9), lymphoma (non-Hodgkins) (200, 200.0, 200.2, 200.8), coccidiomyosis (114, 114.X), histoplasmosis (115, 115.X, 115.XX), cryptococcosis, cryptococcal meningitis (117.5, 321.0), chronic renal failure (585, 586), myelopathy (336.9), cardiomyopathy (425.9), disseminated candida (112.5), invasive cervical cancer (180, 180.X), AIDS dementia complex with moderate or severe functional limitations not attributable to alcohol, substance abuse, substance abuse withdrawal, or psychiatric disorders (290.1, 294.1, 294.9, 348.3), abnormal weight loss, or wasting [involuntary weight loss > 10 percent in addition to daily loose stools for >1 month or weakness and fever in the absence of an explanatory concurrent illness] (783.2, 799.4).

The ADG categories currently in use in Maryland include four Time Limited categories—Minor, Minor-Primary Infections, Major, and Major-Primary Infections; Allergies; Asthma; three Likely to Recur categories—Discrete, Discrete-Infectious, and Progressive; two Chronic Medical categories—Stable and Unstable; three Chronic Specialty: Stable categories— Orthopedic; Ear, Nose, and Throat; and Eye; three Chronic Specialty: Unstable categories, with the same groupings; Dermatologic; two Injuries/Adverse Effects categories—Minor and Major; three Psychosocial categories—Time Limited, Minor; Recurrent or Persistent, Stable; and Recurrent or Persistent, Unstable; three Signs/Symptoms categories—Minor, Uncertain, and Major; Discretionary; See and Reassure; Prevention/Administrative; Malignancy; Pregnancy; and Dental.

Figure 2. Managed Care Organization Concerns.

Figure 3. Provider Concerns.

Footnotes

The authors are with the HIV/AIDS Bureau, Health Resources and Services Administration, U.S. Department of Health and Human Services. The opinions expressed herein are those of the authors and do not necessarily represent the views of the Health Resources and Services Administration or the Health Care Financing Administration (HCFA).

To document the AIDS diagnoses of enrollees, MCOs in New York State may show evidence of CD4 counts below 200; ICD-9 codes of 042.0, 042.1, 042.2, or 042.9; codes for diagnosis-related groups (DRGs) 700-716; or certification by the Department of Health's AIDS Registry.

The “fully counted” DPS categories cover the central nervous system, skeletal and connective disorders, the gastrointestinal system, metabolic disorders, cancers, eye and ear disorders, skin conditions, and gynecological conditions. The “hierarchic” categories cover psychiatric disorders, the pulmonary system, the cardiovascular system, diabetes, hematological conditions, substance abuse, mental retardation, renal problems, cerebrovascular ailments, and AIDS. Some of the 18 categories have 2 to 4 subcategories of diagnoses that correspond to different levels of expected resource consumption.

The 12 collapsed ADG (CADG) categories in use in Maryland are (1) Acute Minor, (2) Acute Major, (3) Likely to Recur, (4) Asthma, (5) Chronic Medical: Unstable, (6) Chronic Medical: Stable, (7) Chronic Specialty: Stable, (8) Eye/Dental, (9) Chronic Specialty: Unstable, (10) Psychosocial, (11) Prevention/Administrative only, and (12) Pregnancy.

The MACs include 5 combinations of ADG (1) with other categories—(2), (3), (6), (8), and (10); the combination of (2) with (3); that of (1) with (2) and (3); of (1) with (3) and (8); of (1) with (3) and (10); of (1) with (2), (3), and (6); of (1) with (2), (3), and (10).

Reprint requests: Richard Conviser, Office of Science and Epidemiology, HIV/AIDS Bureau, Health Resources and Services Administration, 5600 Fishers Lane, Room 7A-07, Rockville, MD 20857.

References

- Ash A, Porell F, Gruenberg L, et al. An Analysis of Alternative AAPCC Models Using Data from the Continuous Medicare History Sample. Baltimore, MD.: Health Care Financing Administration; Sep, 1986. Contract Number 99-C-98526/1, Health Policy Research Consortium, Brandeis University and Boston University. [Google Scholar]

- Ash A, Porell F, Gruenberg L, et al. Adjusting Medicare Capitation Payments Using Prior Hospitalization. Health Care Financing Review. 1989;10(4):17–29. [PMC free article] [PubMed] [Google Scholar]

- Bodenheimer T. The Oregon Health Plan-Lessons for the Nation. The New England Journal of Medicine. Aug 28;337(9):651–655. doi: 10.1056/NEJM199708283370923. [DOI] [PubMed] [Google Scholar]; 1997 Sep 4;337(10):720–723. [Google Scholar]

- Conviser R, Aschman D, et al. HIV Capitation Risk Adjustment: Conference Report. Washington, DC.: Kaiser Family Foundation; 1997a. [Google Scholar]

- Conviser R, Amaya MA, Harris JA, Gates JD. The Role of Physician Experience and Training in Providing Access to Protease Inhibitors. Paper presented at the American Public Health Association annual meeting; Indianapolis, IN.. November 1997b. [Google Scholar]

- Conviser R, Kerrigan D, Thompson S. The Adequacy of Reimbursement for HIV under Section 1115 Medicaid Waivers. AIDS & Public Policy Journal. 1997 Fall;12(3):112–127. [PubMed] [Google Scholar]

- Dreyfus T, Kronick R, Tobias C. Using Payment to Promote Better Medicaid Managed Care for People with AIDS. Portland, ME.: National Academy for State Health Policy; 1997. [Google Scholar]

- Dunn DL. Applications of Health Risk Adjustment: What Can Be Learned From Experience To Date? Inquiry. 1998 Summer;35:132–147. [PubMed] [Google Scholar]

- Ellis RP, et al. Diagnosis-Based Risk Adjustment for Medicare Capitation Payments. Health Care Financing Review. 1996 Spring;17(3):101–128. [PMC free article] [PubMed] [Google Scholar]

- Ellis RP, Ash A. Refinements to the Diagnostic Cost Group (DCG) Model. Inquiry. 1995/96 Winter;32:418–29. [PubMed] [Google Scholar]

- Gearon CJ, editor. Status of 17 State Medicaid Programs Under Section 1115 Waivers. News and Strategies for Managed Medicare & Medicaid. 1997 Sep 8;3(31):3–4. [Google Scholar]

- Health Economics Program. Risk Adjustment and Rate Setting Methods in Public Programs. St. Paul, MN.: Minnesota Department of Health; Jan, 1998. A Report to Legislature. [Google Scholar]

- Johns Hopkins University. Clinician's Guide: The Johns Hopkins University ACG Case-Mix Adjustment System, Version 4.0. Baltimore, MD.: Mar, 1997. [Google Scholar]

- Kaiser Commission on the Future of Medicaid. Where is Medicaid Spending Headed? Washington, DC.: Dec, 1996. [Google Scholar]

- Kitahata MM, et al. Physicians' Experience with the Acquired Immunodeficiency Syndrome as a Factor in Patients' Survival. New England Journal of Medicine. 1996 Mar 14;334(11):701–706. doi: 10.1056/NEJM199603143341106. [DOI] [PubMed] [Google Scholar]

- Korenbrot C, Miller G, Greene J. Effects of Medicaid Managed Care on Community Clinics in California. Paper presented at the annual meeting of the Association for Health Services Research; Washington, DC.. June 1998. [Google Scholar]

- Kronick R, et al. Diagnostic Risk Adjustment for Medicaid: The Disability Payment System. Health Care Financing Review. 1996 Spring;17(3):7–33. [PMC free article] [PubMed] [Google Scholar]

- Kronick R, Dreyfus T. The Challenge of Risk Adjustment for People with Disabilities: Health Based Payment for Medicaid Programs. Princeton, NJ: Center for Health Care Strategies; Nov, 1997. [Google Scholar]

- Lee C, Rogal D. Risk Adjustment: A Key to Changing Incentives in the Health Insurance Market. Washington, DC.: Alpha Center; 1997. [Google Scholar]

- Moore RD, Chaisson RE. Costs to Medicaid of Advancing Immunosuppression in an Urban HIV-Infected Patient Population in Maryland. Journal of Acquired Immune Deficiency Syndromes and Human Retrovirology. 1997 Mar;14(3):223–31. doi: 10.1097/00042560-199703010-00005. [DOI] [PubMed] [Google Scholar]

- Newhouse JP. Risk Adjustment: Where Are We Now? Inquiry. 1998 Summer;35:122–131. [PubMed] [Google Scholar]

- Palella FJ, Delaney KM, Moorman AC, et al. Declining morbidity and mortality among patients with advanced Human Immunodeficiency Virus infection. The New England Journal of Medicine. 1998 Mar 26;338(13):853–860. doi: 10.1056/NEJM199803263381301. [DOI] [PubMed] [Google Scholar]

- Payne SM, Cobul RD, Singer MD, et al. Prior Use and Diagnoses as Risk Adjusters for the Medicaid Disabled. Paper presented at the annual meeting of the Association for Health Services Research; Washington, DC.. June 1998. [Google Scholar]

- Pearce CL. Personal communication. Los Angeles: Jul, 1998. [Google Scholar]

- Tollen L, Rothman M. Case Study: Colorado Medicaid HMO Risk Adjustment. Inquiry. 1998 Summer;35:154–170. [PubMed] [Google Scholar]

- Watts R. Washington State's Experience with Medicaid Capitation for the Disabled Population. Paper presented at the AiC Conference on Capitating HIV/AIDS Services for Managed Care; San Francisco. June 1998. [Google Scholar]

- Weiner JP, et al. Risk-Adjusted Medicare Capitation Rates Using Ambulatory and Inpatient Diagnoses. Health Care Financing Review. 1996 Spring;17(3):77–99. [PMC free article] [PubMed] [Google Scholar]