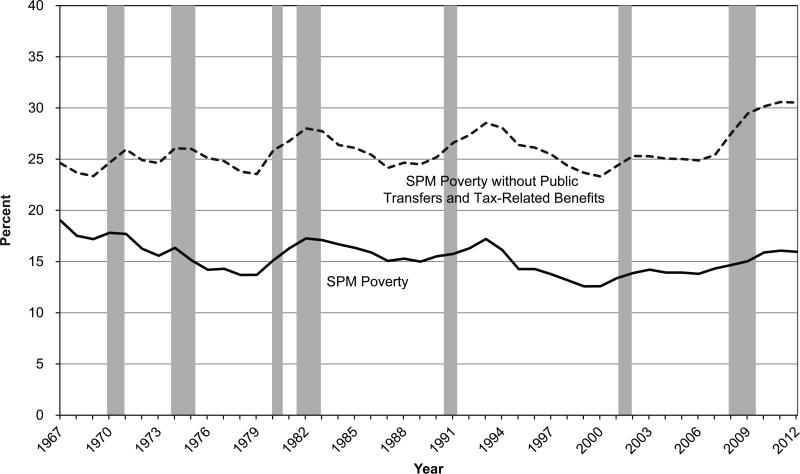

Figure 4. Supplemental Poverty Measure, with and without Public Cash and In-Kind Transfers and Tax-Related Benefits, 1967–2012.

Source: Fox et al. (2014).

Note: Shaded bars are recessions as defined by the National Bureau of Economic Research. The SPM poverty rate shown in the bottom line includes both cash transfers (cash welfare, Supplemental Security Income, Social Security, Unemployment Insurance, Workers’ Compensation, and veterans’ payments) and several in-kind transfers and tax-related benefits (Supplemental Nutrition Assistance Program; housing aid; school lunch; energy subsidies; Supplemental Nutrition Program for Women, Infants, and Children; Earned Income Tax Credit; and stimulus payments). The top line indicates what the SPM poverty rate would be if these cash and in-kind transfers and the tax-related benefits were not included in the SPM.