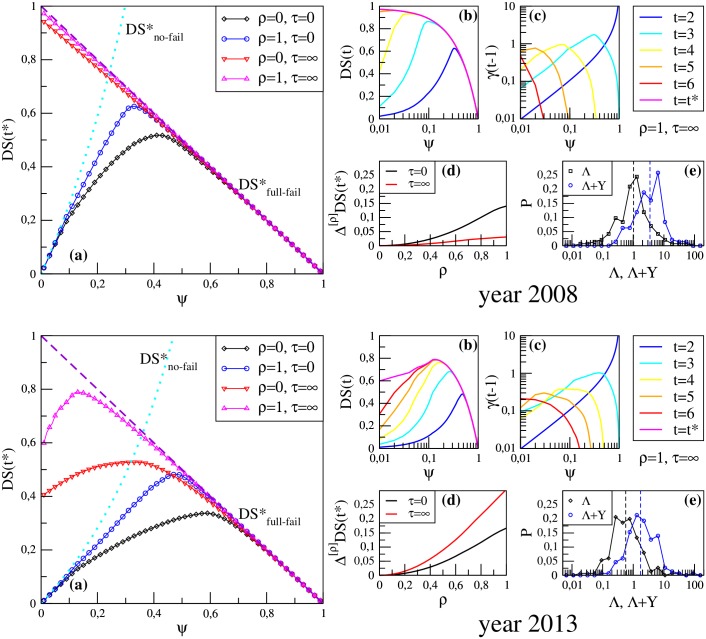

Fig 1. Detailed results of group DS Rank for years 2008 (upper panels) and 2013 (lower panels).

(a) Stationary value DS(t*) as a function of the initial shock ψ, in the cases of maximal or vanishing strength of liquidity shocks (ρ = 1 or ρ = 0, respectively) and of instantaneous or vanishing damping of shocks (τ = 0 and τ = ∞, respectively). (b,c) Temporal dynamics of the system: DS and fire sale devaluation factor γ as a function of ψ for various iteration steps t, in the setting with liquidity shocks ρ = 1 and multiple shocks propagation τ = ∞. (d) Progressive effect of liquidity shocks: difference Δ[ρ] DS(t*) between DS[ρ](t*) (when banks must sell illiquid assets for a fraction ρ of the lost funding) and DS[0](t*) (when no liquidity shocks occur), for ψ maximizing the overall equity loss. (e) Probability distributions of banks leverages Λ (black diamonds) and Λ + ϒ (blue circles), with relative median given by a dashed vertical line.