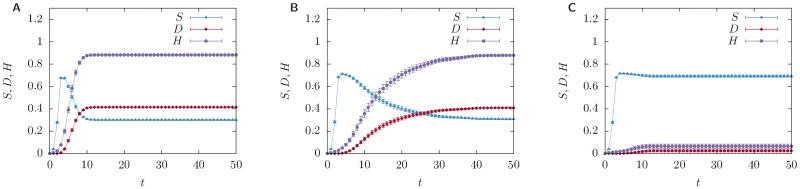

Fig 3. Unraveling of shocks propagation over time.

Fraction of stressed banks S(t) (blue line), fraction of defaulted banks D(t) (red line), and H(t) (violet line), total relative equity loss experienced by the system as a function of the time t over which shocks propagate. Banks experience a shock in the external assets, which suffer a relative loss equal to xshock = 0.5%. All points are averaged over a sample of 100 reconstructed networks with connectivity p = 0.05 and compatible with 2008 balance sheets, and over 10 realisations of the shock in which each bank is shocked with probability pshock = 0.05. Error bars span three standard errors. α = 0 in panel A and the algorithm reduces to the linear DebtRank, while α = 1 in panel B, and α = 2 in panel C. We see that the dynamics unravels within a few time steps in the panels A and C, while it takes considerably more time steps in panel B.