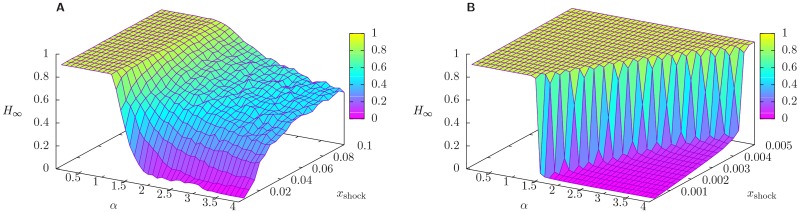

Fig 4. Equity loss in 2008.

Surface plot of H∞, the total relative equity loss in the steady state, as a function of the size of the shock suffered by external assets of banks xshock and of the parameter α, which tunes the non-linearity of the algorithm. All points are averaged over a sample of 100 reconstructed networks with connectivity p = 0.05, and compatible with 2008 balance sheets, and over 10 realization of the shock in which each bank is shocked with probability pshock = 0.05 (panel A) and pshock = 1 (panel B). Note that the range of the total size of the shock pshock ⋅ xshock is the same for both panels. As α increases, the propagation of the shock is dampened, resulting in smaller losses, and in two different regimes, whose separation is especially evident for pshock = 1, i.e. when all banks are shocked.