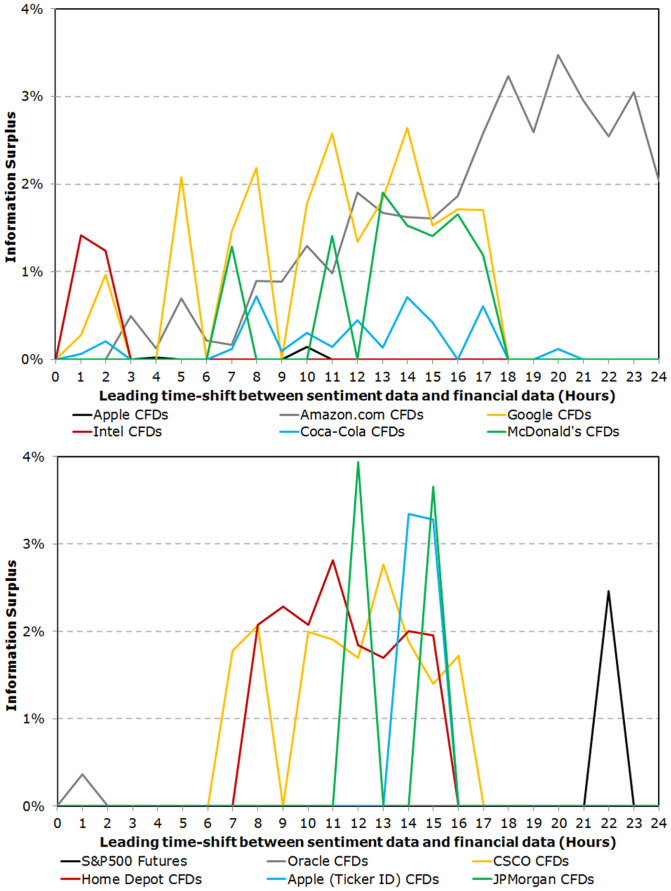

Figure 1. Examples of when hourly changes in social media sentiment contain lead-time information securities' hourly returns ahead of time.

We refer to the percentage increase in Mutual Information between hourly changes in the social media sentiment data and securities' hourly returns at leading time-shifts, relative to zero time-shift, as the information surplus. Here, social media sentiment data is offset such that it precedes financial data, and the Mutual Information between the two time-series is compared to that which is available at no time-shift. If the information surplus is positive, then sentiment data contains more Mutual Information about financial data at an exploitable leading time-shift, compared with the no-offset configuration. We suggest that in such scenarios, hourly changes in the sentiment data contain lead-time information about securities' hourly returns as they remove more uncertainty, ahead of time, about the financial data time-series than if the two time-series are not offset. To determine eligibility for social media to lead financial data, three further caveats were met: the assets' Twitter Filters attracted a minimum mean message volume of 60 messages per hour from our connection to Twitter's 10% Gardenhose feed; the information surplus values were greater when sentiment data preceded financial data, than the converse (when financial data preceded sentiment data); and finally that the observations were statistically-significant to the 99% confidence interval (relative to sentiments generated from randomly permutated data). In this manner, we identify twelve instruments for which hourly changes in the sentiments of social media messages contain lead-time information about securities' hourly returns ahead of time. In this figure, we show the maximum information surplus seen per time-shift. Of the permitted assets, Apple Inc. was the only company for which such an indication was visible using a Twitter Filter searching solely for an asset's industry Ticker-ID (rather than the company name). Tweets on the remaining individual stocks were obtained by filtering Twitter for Company Names AND/OR their industry Ticker-IDs. Finally, the sentiments of string-unfiltered Tweets from the USA were shown to lead the returns of S&P500 Futures for one time-shift.