Abstract

Background:

Many working-age individuals with advanced chronic kidney disease (CKD) are unable to work, or are only able to work at a reduced capacity and/or with a reduction in time at work, and receive disability payments, either from the Canadian government or from private insurers, but the magnitude of those payments is unknown.

Objective:

The objective of this study was to estimate Canada Pension Plan Disability Benefit and private disability insurance benefits paid to Canadians with advanced kidney failure, and how feasible improvements in prevention, identification, and early treatment of CKD and increased use of kidney transplantation might mitigate those costs.

Design:

This study used an analytical model combining Canadian data from various sources.

Setting and Patients:

This study included all patients with advanced CKD in Canada, including those with estimated glomerular filtration rate (eGFR) <30 mL/min/m2 and those on dialysis.

Measurements:

We combined disability estimates from a provincial kidney care program with the prevalence of advanced CKD and estimated disability payments from the Canada Pension Plan and private insurance plans to estimate overall disability benefit payments for Canadians with advanced CKD.

Results:

We estimate that Canadians with advanced kidney failure are receiving disability benefit payments of at least Can$217 million annually. These estimates are sensitive to the proportion of individuals with advanced kidney disease who are unable to work, and plausible variation in this estimate could mean patients with advanced kidney disease are receiving up to Can$260 million per year. Feasible strategies to reduce the proportion of individuals with advanced kidney disease, either through prevention, delay or reduction in severity, or increasing the rate of transplantation, could result in reductions in the cost of Canada Pension Plan and private disability insurance payments by Can$13.8 million per year within 5 years.

Limitations:

This study does not estimate how CKD prevention or increasing the rate of kidney transplantation might influence health care cost savings more broadly, and does not include the cost to provincial governments for programs that provide income for individuals without private insurance and who do not qualify for Canada Pension Plan disability payments.

Conclusions:

Private disability insurance providers and federal government programs incur high costs related to individuals with advanced kidney failure, highlighting the significance of kidney disease not only to patients, and their families, but also to these other important stakeholders. Improvements in care of individuals with kidney disease could reduce these costs.

Keywords: kidney disease, Canada Pension Plan, private disability insurance, disability benefit

Abrégé

Mise en contexte:

De nombreux individus en âge de travailler et atteints d’insuffisance rénale chronique (IRC) de stade avancé sont incapables d’occuper un emploi ou se voient dans l’obligation de travailler à temps réduit ou à des postes ne requérant pas de trop grandes capacités physiques. La situation de ces individus les contraint à recevoir des prestations d’invalidité, soit de la part du gouvernement du Canada, soit auprès d’assureurs privés. On ne connaît toutefois pas l’ampleur réelle de ces prestations.

Objectif de l’étude:

Évaluer le montant des prestations d’invalidité versées par le Régime de pensions du Canada et par des assureurs privés à des Canadiens vivant avec l’IRC de stade avancé. Déterminer à quel point des améliorations possibles au niveau de la prévention, du diagnostic et de l’intervention précoce, et d’une meilleure accessibilité à la transplantation rénale pourraient soit réduire ces coûts, soit retarder ou raccourcir les périodes de paiement.

Modèle de l’étude:

Il s’agit d’un modèle analytique combinant des données canadiennes provenant de diverses sources.

Participants:

Tous les patients canadiens atteints d’IRC de stade avancé, y compris ceux présentant un débit de filtration glomérulaire (DFGe) <30 mL/min/1,73 m2 et les patients sous hémodialyse.

Mesures:

Estimés en matière de prestations d’invalidité dans le cadre d’un programme provincial de soins en néphrologie, jumelés à la prévalence de l’IRC de stade avancé, de même que le montant approximatif des prestations d’invalidité versées par le Régime de pensions du Canada et les régimes d’assurance privés.

Résultats:

Nous estimons que les Canadiens souffrant d’IRC de stade avancé reçoivent au moins 217 millions de dollars par an en prestations d’invalidité. Cette estimation dépend de la proportion de personnes incapables de travailler et donc, une variation possible de cette estimation pourrait signifier que les patients atteints d’IRC de stade avancé reçoivent en fait jusqu’à 260 millions de dollars par an en prestations d’invalidité. Les stratégies applicables pour réduire la proportion de personnes atteintes d’une maladie rénale de stade avancé, soit par le biais de la prévention, du ralentissement de la progression de la maladie ou de la diminution de sa gravité, ou alors par l’augmentation du nombre de transplantations pourraient réduire le montant des prestations versées par le Régime de pensions du Canada et les régimes d’assurance privée de 13,8 millions de dollars par an en cinq ans.

Limites de l’étude:

Cette étude ne tient pas compte de la manière dont la prévention de l’IRC ou l’augmentation du nombre de transplantations rénales seraient susceptibles de permettre d’économiser sur les coûts en santé de façon plus globale.

Conclusions:

Les fournisseurs d’assurance-invalidité privée et les programmes du gouvernement fédéral supportent des coûts très élevés face aux personnes atteintes d’IRC de stade avancé. Ce constat met en lumière la portée de l’insuffisance rénale non seulement pour les patients et leurs familles, ou pour le système de santé, mais également pour ces autres intervenants majeurs. Des améliorations dans les soins prodigués aux personnes souffrant de maladies rénales pourraient contribuer à réduire ces coûts.

What was known before

Many working-age individuals with advanced chronic kidney disease are unable to work, or are only able to work at a reduced capacity, and therefore receive disability payments, either from the government or private insurers. The magnitude of those payments is unknown.

What this adds

Private disability insurance providers and Canadian federal government programs incur high costs related to individuals with advanced kidney failure (in excess of Can$210 million per year), highlighting the significance of kidney disease not only to patients, and their families, but also to these other important stakeholders. Improvements in care of individuals with kidney disease could reduce these costs by more than Can$13 million per year.

Background

Chronic kidney disease (CKD; defined as abnormalities of kidney structure or function, present for >3 months) represents a major public health burden,1,2 affecting more than 4 million Canadians. Of the 4 million Canadian adults living with CKD, 43 000 have end-stage renal disease (ESRD), of whom 24 500 are treated with dialysis and 18 500 are treated with a kidney transplant.3 Care of those on dialysis costs nearly Can$100 000 per year, which means the Canadian health care system spends nearly Can$2.5 billion annually caring for the 0.06% of Canadians who are on dialysis.4 Health care costs for those living with CKD more broadly in Canada exceed Can$40 billion per year in Canada.

In addition to high health care costs, advanced kidney failure and the burden of its treatment with dialysis lead to significant financial and social consequences for patients and their families. Data from Ontario indicate that 90% of patients with CKD have an annual income of less than Can$30 000, while 45% of those have an annual household income of less than Can$15 000. Moreover, the second largest budget expense for the Kidney Foundation of Canada (aside from administration and research) relates to requests for financial assistance from patients with kidney disease.

As patients with advanced kidney disease are often unable to work due to their kidney disease and related conditions, there is also a high cost to employers and insurers, including the federal government which funds the Canada Pension Plan that provides disability insurance for eligible individuals. Data from the Canadian Organ Replacement Registry show that between 1992 and 2011, there has been a 3.3-fold increase in the number of prevalent patients on dialysis between the ages of 45 and 64, suggesting that the personal cost to patients, their families, and employers and insurers continues to increase.3

The financial impact to patients, families, employers, and Canadian federal and provincial governments can be reduced by preventing advanced kidney failure through improved identification and management of those with earlier stages of CKD,5 and by increasing the number of people with ESRD who receive transplants, as transplant can increase the likelihood of a return to the workforce.6 Although more can be done to increase prevention and treatment in early CKD,7 and the rehabilitation of patients with advanced kidney failure, resources will be needed and justification is required to increase health care spending in this area.

Many studies have focused on the cost of health care for people with kidney disease. No studies have accurately estimated the financial impact of advanced kidney failure on disability payments through private and public insurance programs, and what strategies might be implemented to mitigate this impact. In this study, we estimate the Canada Pension Plan and private disability insurance costs for those with advanced kidney failure (defined as those with estimated glomerular filtration rate [eGFR] <30 mL/min/m2 and those on dialysis), and how feasible improvements in prevention, identification, and early treatment, and access to kidney transplantation might mitigate those costs.

Perspective of an Expert in Disability Insurance and Person With Lived Experience of Kidney Failure

The Canada Health Act states, as the objective of Canadian Health Care policy, “that continued access to quality health care without financial or other barriers will be critical to maintaining and improving the health and well-being of Canadians.” The primary objective of the Act is “to protect, promote and restore the physical and mental well-being of residents of Canada and to facilitate reasonable access to health services without financial or other barriers” (Section 3). The Act names several stated conditions for provinces to receive funding from the federal government, namely, public administration, comprehensiveness, universality, portability, and accessibility.

The Act also states that provincial health care insurance plans must cover “all insured health services provided by hospitals, medical practitioners or dentists” (Section 9).

In recent past, the expenses associated with the provision of these services to Canadians have been rapidly increasing both in dollar terms and as a percentage of both federal and provincial revenues and expenditures. It has been widely recognized that this cannot continue unabated without health care costs eventually consuming the entirety of provincial revenues.

The cost of health care that is borne by individual Canadians and their private health care, supplemental, plans has also been increasing annually, so as to be of concern to individuals, their employers, and insurers. Of particular concern are the increasing costs of medications and disability income replacement insurance benefit payments, for those who are insured. When Canadians are unable to work, they not only incur exceptional costs for medication and treatment, whether provided by a governmental program, an insured plan, or by the patient from their savings, but they also are often unable to continue to contribute financially to their own care, to increase their savings, or to contribute to the coffers of governments through tax payments, as their income may have been substantially reduced, if not ended, by their disease and the consequences of treatment for their disease and its symptoms.

As an individual’s work is curtailed, or ended, it is likely that Canada Pension Plan Disability Benefit payments would become payable, as would payments from provincial programs (such as Trillium in Ontario), and that Tax Credit program claims (such as the Disability deduction) would be required as would payments from private insurance plans. Much of the cost of chronic disease connects directly to lost time at work and the resultant payment of long-term disability benefits. The knock-on effect of preventing or delaying the progression of acute and chronic kidney disease would reduce those governmental and private insurance payments dramatically and immediately, saving governments, insurers, society, and the individuals from the above effects of the disease on their finances.

Kidney failure can be caused by many different conditions, including acute kidney failure. Prevention is particularly important for both CKD and acute kidney failure, which can lead to irreversible kidney failure or hasten the decline of kidney function, even after kidney function has partially recovered.

Kidney disease is silent and may not be recognized or treated until it reaches more advanced stages. At that point, there is less opportunity to intervene with effective treatments that would delay the onset of acute treatment, or need for dialysis or transplantation.

Once kidney disease has reached an advanced state, it has been widely recognized that the more quickly a transplant is completed, the better the prognosis for the full recovery of the affected individual and the lower the cost to governments, governmental plans, insurers, the affected individual, and to society as a whole. It is widely recognized that the outcome for a transplant recipient is improved when the donation is from a living donor, rather than a deceased. Canada lags behind its peer group of countries in achieving widespread living donor acceptance, and this, along with a relatively low rate of deceased organ donation, results in high numbers of patients with advanced kidney failure spending many years, often the remainder of their lifetime, on transplant lists, requiring highly expensive ongoing treatment and medication regimens and removing them from the workforce and tax roles.

Living donation is not, however, always a panacea, and living organ donors may face challenges that they would not, otherwise, have encountered. These must be acknowledged and considered as we seek to increase living donation. Many donors suffer consequences of donation, but the Canadian experience fails to account for this due to a lack of any effective long-term follow-up on the ongoing health of organ donors or of any conditions that they may suffer from that had not affected them prior to their donation. This may reduce the cost saving that would otherwise benefit governmental health care systems and private health insurers, while, at the same time, having possible adverse consequences for income tax contributions.

This article aims to begin to quantify potential savings to all parties from preventing and delaying acute and chronic kidney disease and increasing transplantation of kidneys from living donors to those afflicted with the disease who would otherwise either not receive transplants or receive transplants from deceased organ donors after a prolonged period on organ transplant lists.

Methods

Overview

Patients with advanced CKD (eGFR <30 mL/min/m2) often have multiple other chronic diseases including diabetes and cardiovascular disease, and the accumulation of these illnesses and requirement for ongoing medical care frequently lead to the inability to work (full-time or part-time).6 Less than 20% of people with ESRD who are treated with dialysis are able to work6—due to a combination of high symptom burden, including severe fatigue and mental slowing, and the rigors of the dialysis treatment that they require to survive. As the frequency of kidney failure increases significantly with age, and acknowledging that most individuals retire at age 65, our analysis focuses on people aged 40 to 64.

In this study, we used an analytical model to combine Canadian data to estimate the costs to Canada Pension Plan and private disability insurance related to disability claims in 2 groups of people aged 40 to 64 with advanced kidney failure: those with eGFR <30 mL/min/m2 and those on dialysis. To enable this, we combined data on the frequency of advanced kidney failure with estimates of the proportion of patients with advanced kidney failure who are unable to work, and estimates of the cost of disability to employers, insurers, and Canada Pension Plan.

Frequency of Advanced CKD

A recent population-based survey identified that 1.3% of Canadians between the ages of 40 and 64 have eGFR <60 mL/min/m2,2 and analyses from Alberta show that of those with eGFR <60 mL/min/m2, 10.4% have eGFR <30 mL/min/m2.8 As such, in our baseline analyses, we assumed that 0.135% of Canadians aged 40 to 64 have eGFR <30 mL/min/m2. Data from the Canadian Organ Replacement registry show that 0.0813% of individuals aged between 40 and 64 have kidney failure requiring dialysis.9

Employment and Frequency of Disability

Overall, there are 12 350 913 Canadians between the ages of 40 and 64,10 and data show that 72.2% (8 923 000) of individuals in this age group are employed (number of persons who, during the reference week, worked for pay or profit, or performed unpaid family work, or had a job but were not at work due to own illness or disability, personal or family responsibilities, labor dispute, vacation, or other reason).11 Recent data from the province of British Columbia estimate that of individuals managed in multidisciplinary CKD clinics with eGFR<30 mL/min/m2, 30% do not work due to their illness (personal communication; www.BCPRA.ca). Of the 30% who are not working, we estimated, based on clinical experience, that 50% have severe and prolonged disability and would qualify for Canada Pension Plan disability support (see below), and 50% are unable to work but do not qualify for Canada Pension Plan disability support. Of these individuals, those with private insurance would receive short- or long-term disability benefits. For people with kidney failure on dialysis, this same data source shows that 80% of individuals aged 40 to 65 are unable to work due to their illness, and based on clinical experience, we estimate that all individuals on dialysis would qualify as having a severe and prolonged disability and therefore be eligible for federal disability support. If they have private disability insurance, they would also be eligible for short- or long-term disability benefits.

Understanding Disability Benefits

Not all employed individuals are eligible for disability through personally arranged or employer-provided disability income replacement insurance benefits, or the Canada Pension Plan. To qualify for a Canada Pension Plan disability benefit, individuals must have contributed in 4 of the last 6 years, or 3 of the last 6 years if they have contributed for at least 25 years,12 and patients must have a “severe and prolonged” disability. Those who qualify receive Can$10 103 per year from the Canada Pension Plan,12 which may be subtracted from their personal disability insurance or employer-provided long-term disability benefit (if applicable).

To be eligible for long-term disability, employees must either receive this insurance as a benefit through their employment or pay for this insurance through a supplementary private plan. In a recent Canadian survey, 56% of Canadian employees surveyed had long-term disability benefits.13 To receive full long-term disability, beneficiaries must be deemed totally unable to work due to a medical illness (depending on the plan provisions), and once the claim is accepted, they receive up to 70% of their income, usually up to a maximum benefit.13 If individuals also qualify for Canada Pension Plan disability benefits, then this amount may be subtracted from their group long-term disability or private disability insurance benefit payments. Recent Canadian employment data show that the average income for those between the ages of 45 and 64 is Can$49 483,12 meaning that on average, individuals on long-term disability may receive Can$34 638 per year.

Ways to Mitigate the Financial Impact of Advanced CKD

Within a Canadian national research network (www.CanSOLVECKD.ca) that is working with provincial kidney care organizations, several large-scale projects are planned to improve outcomes for Canadians with, or at risk of, advanced kidney failure. To illustrate how the expected improvements in care and outcomes from these projects would impact both the Canada Pension Plan and employer-sponsored or private disability insurance costs, we examine the impact of 3 programs of work within this network. First, we examine a strategy (focusing on risk prediction within routine clinical laboratory tests and clinical pathways) to increase the use of preventive medications, including angiotensin-converting enzyme inhibitors (ACEi) and angiotensin receptor blockers (ARBs) in people with patients with CKD and albuminuria. Recent Alberta analyses have shown that only 65% of people with CKD and albuminuria are treated with these agents, despite them lowering the risk of advanced CKD by more than 40%.14,15 We used a validated decision analysis model8 to determine that a 5%, 10%, and 20% increase in the use of ACEi or ARBs would translate to a 0.14%, 0.5%, and 1% reduction in the number of Canadians with advanced CKD at 5 years.

We also assessed the impact of a program to identify patients at high risk for CKD earlier, because improved management of early CKD has been shown to delay advanced kidney failure significantly. We did this by assessing the impact that a 10% and 20% reduction in the risk of new cases of advanced kidney failure or dialysis-requiring kidney failure (which would translate to a 1% and 2% reduction in the number of Canadians with advanced CKD at 5 years—estimated using a validated decision model8) would have on Canada Pension Plan and employer-sponsored or private disability insurance costs.

Finally, we modeled the impact of increasing kidney transplantation rates, which previous studies have shown can increase the proportion of individuals working by 20%.6,16-18 We did this by assessing the impact that a 10% and 25% increase in the rate of kidney transplantation (which would translate to a 4% and 10% reduction in the number of people on dialysis after 5 years—estimated using a validated decision model8) would have on both the Canada Pension Plan and employer-sponsored or private disability insurance costs.

Analysis

We created a financial model using Microsoft Excel 2007 to combine the above prevalence and costing estimates and determine the costs to Canada Pension Plan and employer-sponsored or private disability insurance related to disability claims for individuals with advanced kidney failure aged 40 to 64. A series of sensitivity analyses were performed to determine the impact of plausible changes in each of the estimates, as well as to determine the extent to which Canada Pension Plan and employer-sponsored or private disability insurance costs would be reduced by a reduction in the prevalence of advanced kidney failure, or increasing the use of kidney transplantation over dialysis.

As in the primary analysis we only included the cost of patients with total disability, we also conducted a scenario analysis to consider the impact of partial disability. Acknowledging that some patients with private disability insurance would be eligible for partial disability (also known as residual benefit), and that they may continue to work, but for fewer hours or with altered duties, and a reduction in earnings, we also considered an analysis where patients with CKD might also receive partial disability payments. For this analysis, we assumed that for individuals with eGFR <30 mL/min/m2 and those with ESRD, an additional 15% and 10%, respectively, would continue to work at a reduced level and receive “partial disability payments”—assumed to be at 35% of their original income.

Results

Population Receiving Disability Insurance

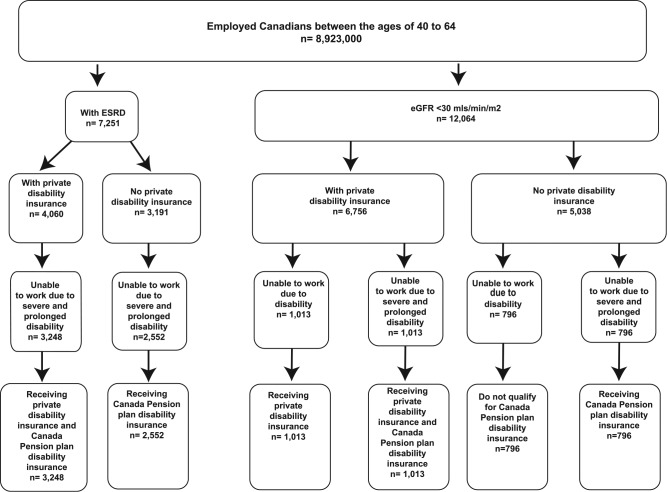

We estimate that there are 12 064 Canadians with advanced kidney failure (eGFR <30 mL/min/m2 not requiring dialysis) who are between the ages of 40 and 64, employable, and eligible for Canada Pension Plan or employer-sponsored and/or private disability insurance (Figure 1). Of these, 2026 would be unable to work and be receiving employer-sponsored or privately arranged disability insurance payments (with half of these also receiving Canada Pension Plan Disability Insurance), and 796 would have severe and prolonged disability and be receiving disability benefits from the Canada Pension Plan (Table 1).

Figure 1.

The number of patients with eGFR <30 mL/min/m2 and ESRD who would qualify for Canada Pension Plan and private disability insurance.

Note. eGFR = estimated glomerular filtration rate; ESRD = end-stage renal disease.

Table 1.

Canadians Aged 40 to 64 With Advanced Kidney Failure Who Are Unable to Work and Receive Canada Pension Plan Disability Insurance or Employer-Sponsored or Private Disability Insurance.

| People with eGFR <30 mL/min/m2 not on dialysis | ||||

|---|---|---|---|---|

| Number eligible | Number who are unable to work but do not have severe and prolonged disability | Number who are unable to work (severe and prolonged disability) and receive benefits | Total number disabled and receiving benefits | |

| Total number of individuals with eGFR <30 mL/min/m2 who are eligible for Canada Pension Plan disability insurance and do not have private disability insurance | 5308 | None | 796 | 796 |

| Total number of individuals with eGFR <30 mL/min/m2 who have private disability insurance | 6755 | 1013 | 1013 | 2026 |

| Cost (Can$) for those who are unable to work but do not have severe and prolonged disability | Cost (Can$) for those who are unable to work (severe and prolonged disability) and receive benefits | Total costs (Can$) | ||

| Amount paid out by Canada Pension Plan disability insurance for patients with eGFR <30 mL/min/m2 who are eligible for Canada Pension Plan disability insurance and do not have private disability insurance | 0 | 8 044 500 | 8 044 500 | |

| Amount paid by private insurance | 35 101 116 | 24 862 601 | 59 963 717 | |

| Amount paid by Canada Pension Plan disability insurance | 0 | 10 238 425 | 10 238 425 | |

| Amount paid out to individuals with eGFR <30 mL/min/m2 and private disability insurance | 35 101 116 | 35 101 026 | 70 202 142 | |

| Total Canada Pension Plan disability insurance and private disability insurance payments for those with eGFR <30 mL/min/m2 | 35 101 116 | 43 145 526 | 78 246 642 | |

| People with ESRD on dialysis | ||||

| Number eligible | Number who are unable to work but do not have severe and prolonged disability | Number who are unable to work (severe and prolonged disability) and receive benefits | Total number disabled and receiving benefits | |

| Total number of individuals with ESRD who are eligible for Canada Pension Plan disability insurance and do not have private disability insurance | 3190 | None | 2552 | 2552 |

| Total number of individuals with ESRD who have private disability insurance | 4062 | None | 3248 | 3248 |

| Cost (Can$) for those who are unable to work but do not have severe and prolonged disability | Cost (Can$) for those who are unable to work (severe and prolonged disability) and receive benefits | Total costs (Can$) | ||

| Amount paid out by Canada Pension Plan disability insurance for patients with ESRD who are eligible for Canada Pension Plan disability insurance and do not have private disability insurance | 0 | 25 786 827 | 25 786 827 | |

| Amount paid by private insurance | 0 | 79 697 825 | 79 697 825 | |

| Amount paid by CPP disability insurance | 0 | 32 819 599 | 32 819 599 | |

| Amount paid out to individuals with ESRD who have private disability insurance | 0 | 112 517 424 | 112 517 424 | |

| Total Canada Pension Plan disability insurance and private disability insurance for those with ESRD | 0 | 138 304 251 | 138 304 251 | |

| Total Canada Pension Plan disability insurance and private disability insurance for all patients with kidney failure | 216 550 893 | |||

Note. CPP = Canada Pension Plan; eGFR = estimated glomerular filtration rate; ESRD = end-stage renal disease.

The bolded text is meant to highlight that it is the summation of that subsection of costs (i.e. 79.7million plus 32.8million adds up to 112.5million).

Similarly, there are 7251 Canadians with advanced kidney failure on dialysis who are between the ages of 40 and 64, employable, and eligible for Canada Pension Plan and employer-sponsored and/or privately arranged disability insurance benefits (Figure 1). Of these, 3248 would be unable to work due to severe and prolonged disability and be receiving employer-sponsored or privately arranged disability insurance payments and disability benefits from the Canada Pension Plan, and 2552 would have a severe and prolonged disability and be receiving disability benefits from the Canada Pension Plan.

Cost of Disability Claims in Those With Advanced Kidney Failure

Overall, we estimate that Canadians with advanced kidney failure are receiving disability benefit payments of at least Can$217 million annually. Because more people with ESRD are off work, disability payments for those on dialysis (Can$138 million) exceed payments to those with eGFR <30 mL/min/m2 who are not yet receiving dialysis (Can$78.2 million). We estimate that the total paid by Canada Pension Plan disability insurance is Can$76.8 million, with private insurance plans paying the remainder (Can$140 million) (Table 1).

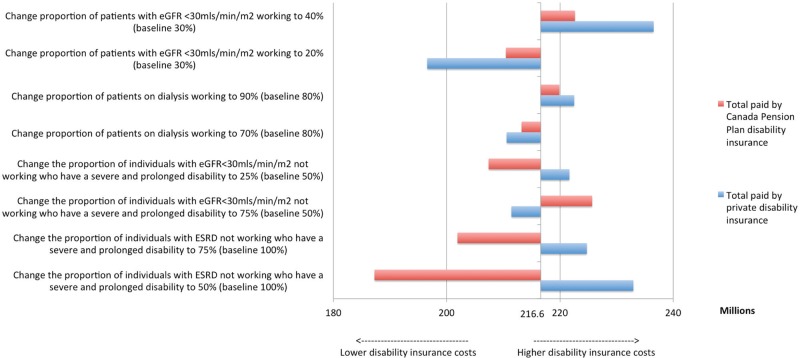

As there is uncertainty with respect to the proportion of Canadians with advanced kidney failure who are off work due to disability, and the proportion of those who are off work who would meet the definition of severe and prolonged disability (and therefore be eligible for Canada Pension Plan disability payment), we conducted a series of scenario analyses (Figure 2). We identified that if people with advanced kidney failure (not yet on dialysis) were more likely to be off work (40% vs 30%), that disability payments would increase by Can$26 million, whereas a 10% increase in the proportion of individuals with advanced kidney failure on dialysis receiving disability payments (90% vs 80%) would increase disability payments by Can$17 million. A reduction in the proportion of patients meeting the definition of a severe and prolonged disability—a key uncertainty in our analysis—would lower Canada Pension Plan disability costs by Can$9 million (4.2%) and raise private disability payments by Can$5 million (2.4%) (Figure 2).

Figure 2.

Sensitivity analysis: The impact of changes in the proportion of individuals with advanced kidney failure who work on Canada Pension Plan and private disability insurance cost.

Note. eGFR = estimated glomerular filtration rate; ESRD = end-stage renal disease.

We also considered how changes in average income might impact private disability payments, noting that a 25% change in average income would result in a Can$46 million increase or decrease in private disability payments. Finally, we noted that a reduction in the proportion of income that private disability insurance pays to 50% (instead of 70%) would reduce private disability payments by Can$52 million (37.3%).

The Impact of Partial Disability

Assuming that an additional 15% of individuals with eGFR <30 mL/min/m2 and 10% of those with ESRD would be receiving partial disability, we estimate that this could result in additional private disability insurance payments of Can$25 million annually.

Potential Savings in Disability Payments Related to Improving Care in Early CKD and Increased Use of Kidney Transplantation

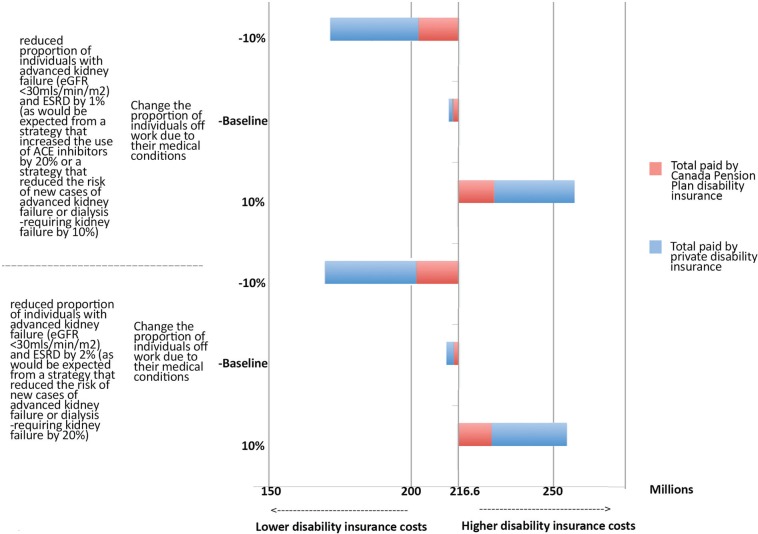

We considered a variety of scenarios with respect to their impact on the costs incurred by Canada Pension Plan disability insurance and private disability insurance (Figures 3 and 4). We assessed the impact that reductions in both advanced kidney failure (eGFR <30 mL/min/m2) and those on dialysis would have on disability costs (as would occur with an increase in the use of ACEi/ARB), and noted that plausible reductions in the prevalence of advanced kidney disease could lead to reductions in disability insurance payments of Can$4.3 million annually (Figure 3). Larger reductions in the costs incurred by Canada Pension Plan disability insurance and private disability insurance were noted in situations where a smaller proportion of patients might be off work—for instance, due to lower patient morbidity (Figure 3).

Figure 3.

Two-way sensitivity analysis: The impact of changes in the proportion of individuals with advanced kidney failure and the proportion of those working on Canada Pension Plan and private disability insurance costs.

Note. eGFR = estimated glomerular filtration rate; ESRD = end-stage renal disease.

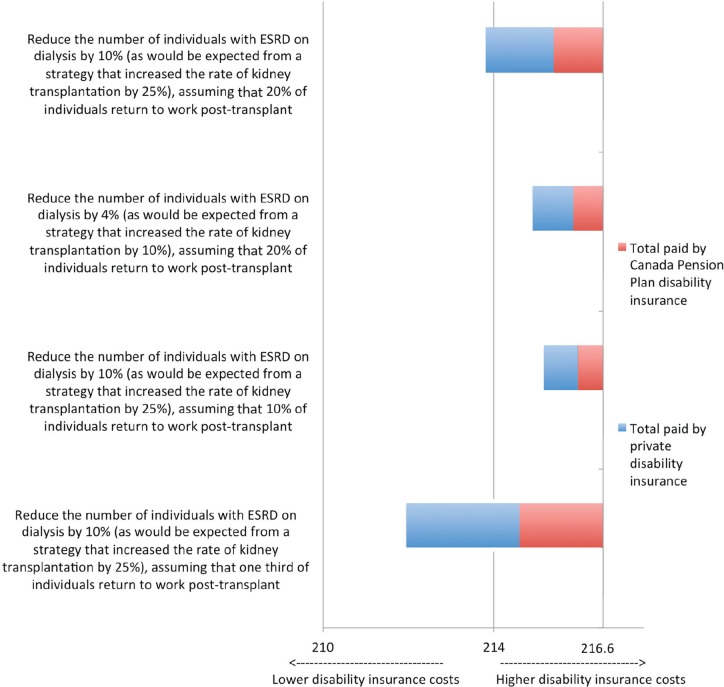

Figure 4.

The impact of changes in the prevalence of advanced kidney failure through increased transplant rates on Canada Pension Plan and private disability insurance costs.

Note. ESRD = end-stage renal disease.

When we decreased the number of people of working age being treated with dialysis, by increasing transplant rates by 10% and 25%, assuming that an additional 20% of individuals return to work after transplant,6,16-18 we noted that disability insurance payments were reduced by Can$1.7 million and Can$2.8 million, respectively. We considered other scenarios where we increased transplant rates by 25%, varying the proportion who return to work post transplant to 10% or 33% overall, noting that disability insurance payments would be lower by Can$1.4 million and Can$4.6 million, respectively.

Discussion

We estimate that the disability insurance costs for Canadians with advanced kidney failure exceed Can$200 million each year in Canada, with more than 70% being incurred by private disability insurance. As individuals on dialysis are less likely to be employed than those with advanced kidney failure not on dialysis, disability costs are higher for those with ESRD, even though there are significantly more individuals with eGFR<30 mL/min/m2.

Previous studies have identified reduced employment status for individuals with advanced kidney failure, with previous studies identifying only 19% to 30% of dialysis patients of working age employed.6,16-18 Previous prospective studies of individuals on a transplant wait-list show that 25% to 30% of individuals on dialysis (pretransplant) were employed compared with more than 50% of individuals 2 years after a successful transplant.6

Our analysis shows that disability costs for individuals with advanced kidney failure can be reduced significantly by reducing the prevalence of advanced kidney disease, by improving employability rates (for instance, by reducing the impact of kidney failure and comorbid illness through optimal management), and by increasing the use of transplantation rather than dialysis in individuals with ESRD.

Our study had limitations. We did not have an accurate estimate of the proportion of patients with private insurance that offers partial disability, and therefore might be receiving partial disability. We did not estimate other costs borne by patients such as copayments for their medications, travel to and from dialysis and other medical appointments, or other costs borne by them. It also does not include the health care costs paid by the health care system (and borne by tax payers). Finally, it does not include the costs for individuals who are not eligible for Canada Pension Plan or do not have either employer-sponsored long-term disability or privately arranged disability insurance; these costs are sometimes borne by provincial government programs (such as the Assured Income for the Severely Handicapped program in Alberta or the Ontario Disability Support Program in Ontario), or by the patients themselves. As such, we feel that our estimates, while informative, are a significant underestimate of the cost of advanced kidney failure to government, insurance companies, employers, and society more broadly.

This study suggests that private disability insurance providers and the federal government incur high costs related to individuals with advanced kidney failure, highlighting the importance of kidney disease not only to patients, and their families, as well as to the health care system, but also to these important stakeholders. The potential savings that we noted highlight the importance of strategic investments into improving care and management in early CKD and increased use of kidney transplantation.

Footnotes

Ethics Approval and Consent to Participate: Not applicable

Consent for Publication: All authors provide their consent for publication.

Availability of Data and Materials: Please contact the corresponding author for further information on the data.

Declaration of Conflicting Interests: The author(s) declared no potential conflicts of interest with respect to the research, authorship, and/or publication of this article.

Funding: The author(s) received no financial support for the research, authorship, and/or publication of this article.

References

- 1. Eckardt KU, Coresh J, Devuyst O, et al. Evolving importance of kidney disease: from subspecialty to global health burden. Lancet. 2013;382:158-169. [DOI] [PubMed] [Google Scholar]

- 2. Arora P, Vasa P, Brenner D, et al. Prevalence estimates of chronic kidney disease in Canada: results of a nationally representative survey. CMAJ. 2013;185:E417-E423. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3. Canadian Institute for Health Information (CIHI). Canadian Organ Replacement Register Annual Report: Treatment of End-Stage Organ Failure in Canada, 2004 to 2013. Ottawa, Ontario, Canada: Canadian Institute for Health Information (CIHI); 2015. [Google Scholar]

- 4. Manns BJ, Mendelssohn DC, Taub KJ. The economics of end-stage renal disease care in Canada: incentives and impact on delivery of care. Int J Health Care Finance Econ. 2007;7:149-169. [DOI] [PubMed] [Google Scholar]

- 5. Kidney Disease: Improving Global Outcomes (KDIGO). KDIGO clinical practice guideline for the evaluation and management of chronic kidney disease. Kidney Int. 2013;3(1): 1-150. [Google Scholar]

- 6. Laupacis A, Keown P, Pus N, et al. A study of the quality of life and cost-utility of renal transplantation. Kidney Int. 1996;50:235-242. [DOI] [PubMed] [Google Scholar]

- 7. Interdisciplinary Chronic Disease Collaboration: Quality of care in early stage Chronic kidney disease 2012-2013. http://www.albertahealthservices.ca/assets/about/scn/ahs-scn-kh-annual-kidney-care-2015-supp.pdf. Accessed April 1, 2017.

- 8. Manns B, Hemmelgarn B, Tonelli M, et al. Population based screening for chronic kidney disease: cost effectiveness study. BMJ. 2010;341:c5869. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9. Canadian Institute for Health Information (CIHI). Canadian Organ Replacement Register Annual Report: Treatment of End-Stage Organ Failure in Canada, 2003 to 2012. Ottawa, Ontario, Canada: Canadian Institute for Health Information (CIHI); 2014. [Google Scholar]

- 10. Statistics Canada. Table 051-0001 1, 2, 6, 7: Estimates of Population, by Age Group and Sex for July 1, Canada, Provinces and Territories Annual (Persons Unless Otherwise Noted). Ottawa, Ontario, Canada: Statistics Canada; 2015. [Google Scholar]

- 11. Statistics Canada. Table 282-0002 11: Labour Force Survey Estimates (LFS), by Sex and Detailed Age Group Annual (Persons × 1,000). Ottawa, Ontario, Canada: Statistics Canada; 2016. [Google Scholar]

- 12. Government of Canada. Canada Pension Plan disability benefit-eligibility. http://www.esdc.gc.ca/en/cpp/disability/eligibility.page. Accessed May 28, 2016.

- 13. Canadian Life and Health Insurance Association (CLHIA). Canadian Life and Health Insurance Facts, 2015 Edition. Toronto, Ontario, Canada: Canadian Life and Health Insurance Association (CLHIA); 2015. [Google Scholar]

- 14. Strippoli GF, Craig M, Deeks JJ, Schena FP, Craig JC. Effects of angiotensin converting enzyme inhibitors and angiotensin II receptor antagonists on mortality and renal outcomes in diabetic nephropathy: systematic review. BMJ. 2004;329:828. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15. Giatras I, Lau J, Levey AS. Effect of angiotensin-converting enzyme inhibitors on the progression of nondiabetic renal disease: a meta-analysis of randomized trials. Angiotensin-Converting-Enzyme Inhibition and Progressive Renal Disease Study Group. Ann Intern Med. 1997;127:337-345. [DOI] [PubMed] [Google Scholar]

- 16. Julian Mauro JC, Molinuevo Tobalina JA, Sanchez Gonzalez JC. Employment in the patient with chronic kidney disease related to renal replacement therapy. Nefrologia. 2012;32:439-445. [DOI] [PubMed] [Google Scholar]

- 17. Julian-Mauro JC, Cuervo J, Rebollo P, Callejo D. Employment status and indirect costs in patients with renal failure: differences between different modalities of renal replacement therapy. Nefrologia. 2013;33:333-341. [DOI] [PubMed] [Google Scholar]

- 18. Helantera I, Haapio M, Koskinen P, Gronhagen-Riska C, Finne P. Employment of patients receiving maintenance dialysis and after kidney transplant: a cross-sectional study from Finland. Am J Kidney Dis. 2012;59:700-706. [DOI] [PubMed] [Google Scholar]