Abstract

Objective

To estimate the extent to which work-related injuries contribute to medical expenditures paid for by group health insurance.

Methods

Administrative data on OSHA recordable injuries spanning 2010–2013 were obtained for female patient care workers (n=2,495). Expenditures were aggregated group health insurance claims for 3 and 6 month periods before/after injury. Group health insurance plan type, age group, and job category were control variables.

Results

Being injured is associated with the odds of having expenditures at both 3 months, OR 2.17 [95% CI (1.61, 2.92)], and 6 months, 2.95 [95% CI (1.96, 4.45)]. Injury was associated with $275 of additional expenditures [95% CI ($38, $549)] over 3 months and $587 of additional expenditures [95% CI ($167, $1140)] over 6 months.

Conclusions

Injury was associated with increased odds of positive expenditures and increased expenditures paid for by group health insurance.

Keywords: Work-related Injury, Healthcare Workers, Hospital, Medical Expenditures, Group Health Insurance

INTRODUCTION

Workers’ compensation is the primary system that provides insurance against lost earnings and medical and rehabilitation costs incurred by workers with occupational injuries and illnesses. In 2013, state and Federal workers’ compensation benefits totaled $61.9 billion, and employer costs were $83.2 billion (1). Yet, despite substantial workers’ compensation expenditures, evidence continues to grow about the costs of occupational injuries and illnesses that are paid for outside the systems by workers and their families, by citizens in general through other social safety net programs, and by non-workers’ compensation health insurance.

A growing literature has demonstrated that many workers injured on the job do not file for workers’ compensation (2–4). They may be unaware of their eligibility, be unwilling to spend the time and resources associated with claim filing, be aware of the potential for a disagreeable experience, be concerned about retaliation, pressured by their managers, or may not see the benefits of the filing process. For these workers, the costs of lost income and medical care fall outside the workers’ compensation system. Even if they file for and receive benefits, those benefits have been shown to cover only a small fraction of lost earnings (5–9). Recent studies have estimated the extent to which health care providers may use their discretion to direct claims to either Workers’ Compensation or group health insurance depending on which payer provides more generous reimbursement (10). Non-traumatic injuries may be reclassified from group health to Workers’ Compensation, particularly when the group health plan is capitated (10).

Research has also addressed whether workers’ compensation insurance covers the full cost of medical care for accepted work-related injury claims. Workers’ compensation is unique among health insurance schemes because, in principle, it covers all medical costs related to accepted claims, without deductibles, copays, or coinsurance. However, in about half the states, employers and insurers have control over the initial choice or change of medical providers. In addition, insurers can delay or reject care they do not consider medically necessary. Workers may feel that it is too difficult to get the care they need through workers’ compensation and may look elsewhere to pay for it, particularly if they are not missing sufficient work (5 days in MA) to be eligible for wage replacement payments. Also, physicians may prefer payment by group health insurance to avoid low reimbursement rates, difficulty getting paid, or uncompensated time spent completing forms reporting on disability or assessing ability to return to work (11). Additionally, a work-related injury may increase the risk of other conditions that are difficult to tie directly to the initial injury and therefore are not paid for by workers’ compensation (12–15).

Some studies addressing this question have used the Medical Expenditure Panel Survey (MEPS), a survey of medical expenditures in a national probability sample of households in the U.S. civilian non-institutionalized population. The MEPS is a stratified random sample of the U.S. population that captures all injuries relayed by respondents, not just those reported to the employer or receiving workers’ compensation benefits. The MEPS captures out-of-pocket costs outside the reach of insurance-based data. One drawback is that the respondent’s employment location is not recorded, and most workers’ compensation systems are state-based, with substantial programmatic and eligibility variation among states. These differences can create unobserved heterogeneity in workers’ compensation coverage of medical care.

Several recent studies using the MEPS focused on specific categories of injured workers. Each showed that workers’ compensation covers well under 100 percent of these costs with estimates ranging from 46 to 56 percent of medical costs of injured construction workers paid by workers’ compensation (16–18). Estimates for Hispanic construction workers, immigrant workers, and those with persistent disabilities were even lower (17–19).

Bhattacharya and Park (18) used Thomson Reuters MarketScan (workers’ compensation and group health insurance data from large employers) to determine whether a workers’ compensation claim was associated with subsequent increases in group health. Among those with any group medical expenditures, a prior workers’ compensation claim was associated with an 11 percent increase in those costs and an odds ratio of 1.25, [95% CI (1.23, 1.28)] for having any expenditures.

Afsaw, Rosa, and Mao (20) also used Thomson Reuters MarketScan data to determine whether group health insurance at least partially covered work-related injury costs. Controlling for pre-injury group health insurance cost, they found increased group health insurance utilization and costs regardless of the value of workers’ compensation medical claims; increases were higher for zero-cost workers’ compensation claims than for positive workers’ compensation claims. The MarketScan database has some advantages over the MEPS data, because insurer payments may be captured more accurately. However, work-related injuries are only identified when workers’ compensation claims are filed, potentially missing less severe or other injuries not eligible for workers’ compensation.

Injury rates in some occupations are much higher than others; types and severity of injuries vary by occupation as well.(21) In the private sector, nursing assistants were one of the three occupations with the highest number of cases resulting in days away from work in 2015.(21) In a sample of direct patient care workers and Occupational Safety and Health Administration reportable injuries, back injuries were the most common injury that required days away from work while sharps injuries were the most common injuries that did not require days away from work.(22)

Given the general level of concern from employers about the costs of both workers’ compensation and group health insurance, we use a sample of healthcare workers to estimate the extent to which work-related injuries contribute to higher medical expenditures paid for by group health insurance after controlling for other factor.

METHODS

Study Design and Data Sources

This study was conducted by the Harvard T.H. Chan School of Public Health Center for Work, Health and Well-being. We determined work-related injury status and date using individuals injured from July 1, 2010, through June 30, 2013, in the hospitals’ injury and illness reporting system that fulfills Occupational Safety and Health Administration (OSHA) requirements.

Expenditures were derived from claim-level group health insurance data aggregated to the individual level based on time period. We integrated data from several different systems, including the hospitals’ injury data, payroll data, staffing and human resources data, and health insurance claims. This study was approved by the Harvard T.H. Chan School’s Office of Human Research Administration.

Setting/Participants

The study population was female nurses and aides in two large tertiary care hospitals in the same hospital system in the northeastern United States. All were patient-care workers (nurses and aides) working at two large teaching hospitals. Both hospitals are in the same urban area and the same hospital system and covered through an employer self-insurance program using a single third party administrator. All nurses and aides are covered by one of three group health insurance plans, all PPOs, which differ by premium and benefit generosity. Only individuals with 12 months of group health insurance coverage before and after the date of injury were included in the sample to reduce the likelihood of noise from changes in healthcare plans and providers. Using the major diagnostic category codes available in the data, we excluded women who were pregnant to reduce the noise in the data. During the study period, 674 individuals had hospital-recorded occupational injuries. For each injured worker, three workers who did not have a work-related reported injury were randomly selected with replacement after being matched on job (nurse or aide) and whether they worked in a low-injury-risk unit (pediatric, neonatal, and post-partem obstetrics) to create a sample of 2696. We began observation of all uninjured workers at the injury date of their matched injured counterparts.

Variables

The hospital system provided group health insurance data at the claim level. We cleaned the data to eliminate duplicate claims and combine claims that were adjustments. Remaining negative claim amounts (adjustments) were dropped from the analysis (0.8%). Amounts paid reflected only the employer’s payment, not the employee’s cost. Payments were aggregated for 3 and 6 month periods before and after dates of injury. Expenditures included medical, outpatient, pharmacy, and mental health/substance abuse claims. Because we have a relatively small sample and inpatient expenditures are large, sporadic, and rare, we excluded them in this analysis. We Winsorized (p=0.002) expenditures after injury to limit the most extreme values.

We included OSHA-recordable injury in the model as a binary indicator. An injury is OSHA-recordable if it involves death, days away from work, restricted work or transfer to another job, medical treatment beyond first aid, or loss of consciousness. Sharps injuries involving potentially infectious materials are also OSHA-recordable.

Sharps injuries involve a needle, blade, or other sharp instrument that penetrates the skin, as well as fluid splashes to mucous membranes, resulting in a risk of infection. The vast majority of sharps injuries require only blood testing of the source patient to determine infectivity. Also, the hospitals’ occupational health services department provides specialized evaluation and care for sharps injuries that is not charged to group health insurance. As a consequence, significant medical treatment is uncommon. We separated injuries into sharps and non-sharps to evaluate whether sharps injuries have an impact on group health insurance costs as a sensitivity analysis.

To allow for potentially nonlinear effects, we first aggregated pre- injury expenditures into 3 and 6 month periods to match our outcomes and then entered the variable into each model based on indicators for quartiles. For example, in the 3 month model we summed expenditures for the 3 months prior to injury and used indicator variables for each quartile of pre-injury expenditures. To control for differences in the out-of-pocket costs to employees that might influence their utilization of healthcare, we also controlled for the type of insurance during the study period. There were two primary plans available to employees over the period, a “value plan,” that entailed greater cost-sharing for care and higher annual out-of-pocket maximums but lower premiums and the “premium plan” that entailed lower cost-sharing but higher premiums. Both plans were PPOs. Additionally, a few employees were eligible for grandfathered plans during the period (hereafter “grandfathered”) that had higher deductibles and co-pays but lower premiums.

Age categories were: 22–29, 30–39, 40–49, and 50–77. Job category was an indicator for whether the employee worked as an aide or a nurse.

Statistical Methods

The expenditure data were highly skewed, and many individuals in the sample had no expenditures. To deal with these issues we constructed a two-part model (23). The first part of the model used all observations to predict whether individuals had expenditures greater than zero. The second part included only individuals with positive expenditures and predicted the amount of those expenditures. The expected value of the overall effect is given by multiplying the estimated probability of having positive medical expenditures times the expected level of medical expenditures.

We estimated the first using logistic regression and the second part using log-linear regression. We chose the functional form of the second part of the model after examining studentized residuals from log-OLS (Kurtosis was 4.12—well above 3), and conducting a modified Park test to evaluate the shape parameter (gamma and other tested families were all rejected with p<0.001) (24).

Results are shown with odds ratios and 95% confidence intervals for the first part and the impact on adjusted mean expenditures conditional on having nonzero expenditures (second part). The overall effect was estimated by multiplying the expectation of positive expenditures by the expected cost per person, and then averaging across all observations for those with and without recorded injuries. The difference in these expectations was then averaged across observations. We estimated 95% confidence intervals of the overall effect using 1000 bootstrap replications with bias-corrected intervals. After conducting a Cook-Weisberg test for constant variance (Chi-squared of 26.04 and 37.97 for 3 and 6 month samples respectively) and inspecting residual plots, we chose the normal heteroskedastic form for the smear factors used to estimate the unconditional margin for the second part of the model(25, 26). We selected the matched non-injured controls using SAS version 9.4, and all other analyses were conducted in STATA 13(27).

RESULTS

Sample Description

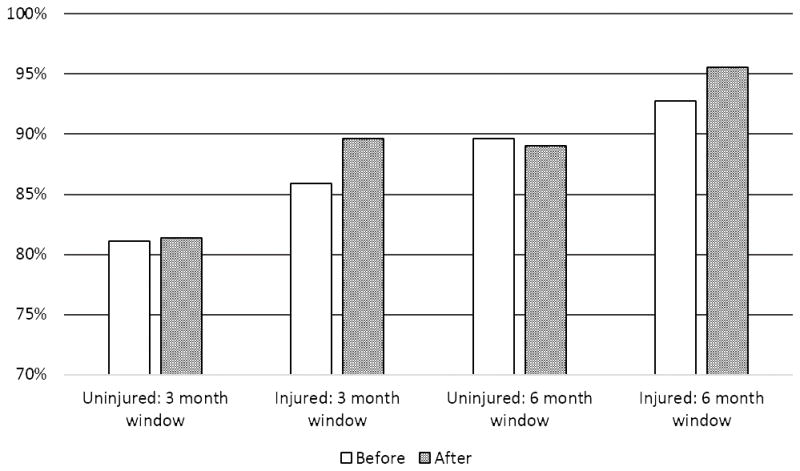

While most of the sample had positive expenditures in the 3 and 6 month post-injury periods (Figure 1 and Table 1), the range of expenditures was quite large with a long right tail—typical for expenditure data. Most of the injuries were not related to sharps. Almost all employees were part of the Premium health insurance plan, with small groups in the Grandfathered and Value plans. The sample primarily includes nurses rather than aides.

Figure 1.

Percent of Patient Care Workers with Medical Expenditures

This chart shows the percentage of patient care workers with medical expenditures greater than zero based on 3 and 6 month periods before and after injury (or simulated injury date after matching for uninjured workers).

Table 1.

Sample Descriptive Statistics (N=2696)

| Injured (N=674) | Uninjured (N=2022) | |||

|---|---|---|---|---|

| Variable | Mean (SD) or Percent | Range | Mean (SD) or Percent | Range |

| Medical expenditures | ||||

| 3 months after injury | $1459 ($2591) | [$0, $27809] | $1357 ($4739) | [$0, $14813] |

| 3 months before injury | $1273 ($2876) | [$0, $51477] | $1318 ($4208) | [$0, $137433] |

| 6 months after injury | $2889 ($4289) | [$0, $41649] | $2461 ($4938) | [$0, $60168] |

| 6 months before injury | $2570 ($4184) | [$0, $52546] | $2546 ($6029) | [$0, $176530] |

| Injured (25% of entire sample) | ||||

| Sharps | 24.2% | NA | ||

| Non-sharps | 75.8% | NA | ||

| Health insurance plan | ||||

| Plus | 86.8% | 91.5% | ||

| Grandfathered | 8.8% | 5.5% | ||

| Value | 4.5% | 3.0% | ||

| Age | ||||

| 22–29 years | 17.2% | 16.4% | ||

| 30–39 years | 26.1% | 26.1% | ||

| 40–49 years | 24.6% | 23.7% | ||

| 50–77 years | 32.1% | 33.8% | ||

| Job | ||||

| Nurse | 78.3% | 78.3% | ||

| Aide | 21.7% | 21.7% | ||

Notes: Dollar amounts were rounded to the nearest dollar.

Main Results

The results for the adjusted model of medical expenditures after injury are given in Tables 2 (3 month) and 3 (6 month) with coefficient estimates given in the Appendix. Columns (a) and (b) in each table give the results for each part of the two-part model using odds ratios and change in expenditures conditional on having nonzero expenditures. Column (c) of each table gives the full impact of each covariate based on both parts of the model (the unconditional margin). Injury is significantly associated with the odds of having group health expenditures both three and six months following injury, (OR 2.17 and 2.95, respectively). The coefficients from the second part of the model were not statistically significant at the 5% level for 3 month expenditures, but were for the 6 month expenditures. The estimated change in expenditures in the conditional model was significant at the 5% level for the 6 month model. Being injured was associated with an additional $275 expenditure over 3 months [95% CI ($38, $549)], and an average of an additional $587 of expenditures in the 6 month model [95% CI ($167, $1140)].

Table 2.

Two-Part Model of 3 Month Post-Injury Medical Expenditures, Nurses and Aides (95% Confidence Interval in Brackets)

| (A) Part One: Odds Ratio For Any Expenditure (N=2696) |

(B) Part Two: Change In Expenditures Given Any Expenditure (N=2250) |

(C) Overall: Change In Expenditures (N=2696) |

|

|---|---|---|---|

| Injured | 2.17 [1.61, 2.92] | $176 [−$84, $474] | $275 [$38, $549] |

| Quartile of previous medical expenditures | |||

| 1st | reference | reference | reference |

| 2nd | 4.15 [3.14, 5.49] | −$54 [−$323, $169] | $222 [$47, $401] |

| 3rd | 7.28 [5.27, 10.04] | $447 [$172, $692] | $736 [$515, $935] |

| 4th | 10.08 [7.06, 14.40] | $2253 [$1754, $2818] | $2464 [$2013, $2999] |

| Health insurance plan | |||

| Premium | reference | reference | reference |

| Grandfathered | 0.36 [0.23, 0.56] | −$189 [−$365, $1080] | −$72 [−$509, $615] |

| Value | 0.86 [0.51, 1.44] | $335 [−$371, $1585] | $265 [−$352, $1419] |

| Age | |||

| 22–29 years | 0.90 [0.63, 1.28] | −$914 [−$1267, −$615] | −$827 [−$1130, −$552] |

| 30–39 years | 0.80 [0.58, 1.09] | −$528 [−$871, −$192] | −$502 [−$810, −$198] |

| 40–49 years | 0.58 [0.44, 0.78] | −$81 [−$515, $302] | −$177 [−$552, $153] |

| 50–77 years | reference | reference | reference |

| Job | |||

| Nurse | reference | reference | reference |

| Aide | 0.72 [0.55, 0.93] | −$49 [−$320, $264] | −$101 [−$344, $168] |

Notes: The model also included a constant term and was estimated using a two part model. The first part of the model used logit regression to predict whether an individual had any expenditures and the second part predicted the amount of expenditures for individuals who had a least some expenditures using log-transformed expenditures and ordinary least squares. Dollar amounts were rounded to the nearest dollar. Estimates using the log-OLS portion of the model were obtained using the appropriate retransformation algorithm for normal heteroskedastic residuals and bias-corrected bootstrapped 95% Confidence intervals with 1000 replications.

Table 3.

Two-Part Model of 6 Month Post-Injury Medical Expenditures, Nurses and Aides (95% Confidence Interval in Parentheses)

| (A) Part One: Odds Ratio For Any Expenditure (N=2696) |

(B) Part Two: Change In Expenditures Given Any Expenditure (N=2444) |

(C) Overall: Change In Expenditures (N=2696) |

|

|---|---|---|---|

| Injured | 2.95 [1.96, 4.45] | $469 [$30, $1032] | $587 [$167, $1140] |

| Quartile of previous medical expenditures | |||

| 1st | reference | reference | reference |

| 2nd | 2.43 [1.76, 3.37] | $152 [−$142, $451] | $312 [$63, $551] |

| 3rd | 6.26 [4.09, 9.57] | $1211 [$843, $1625] | $1429 [$1085, $1825] |

| 4th | 19.60 [10.14, 37.87] | $4376 [$3710, $5330] | $4631 [$3995, $5362] |

| Health insurance plan | |||

| Premium | reference | reference | reference |

| Grandfathered | 0.26 [0.15, 0.43] | $388 [−$568, $1797] | $27 [−$790, $1228] |

| Value | 1.05 [0.53, 2.07] | $280 [−$640, $1685] | $272 [−$599, $1595] |

| Age | |||

| 22–29 years | 1.29 [0.80, 2.06] | −$1354 [−$1801, −$906] | −$1252 [−$1678, −$831] |

| 30–39 years | 1.09 [0.72, 1.65] | −$730 [−$1235, −$254] | −$676 [−$1160, −$221] |

| 40–49 years | 0.72 [0.50, 1.04] | −$146 [−$688, $521] | −$198 [−$705, $441] |

| 50–77 years | reference | reference | reference |

| Job | |||

| Nurse | reference | reference | reference |

| Aide | 0.52 [0.38, 0.72] | −$2 [−$484, $467] | −$112 [−$561, $328] |

Notes: The model also included a constant term and was estimated using a two part model. The first part of the model used logit regression to predict whether an individual had any expenditures and the second part predicted the amount of expenditures for individuals who had a least some expenditures using log-transformed expenditures and ordinary least squares. Dollar amounts were rounded to the nearest dollar. Estimates using the log-OLS portion of the model were obtained using the appropriate retransformation algorithm for normal heteroskedastic residuals and bias-corrected bootstrapped 95% Confidence intervals with 1000 replications.

As expected, expenditures before injury were significantly positively associated with the odds of having any post-injury group health expenditures and with greater expenditures among those who had expenditures in both models. Having the grandfathered plan compared to the premium plan was associated with an odds ratio of 0.36 in the 3 month model, and 0.26 in the 6 month model (both significant at the 1% level). Younger ages were generally associated with lower expenditures for people with any expenditures, but the effect was only significant at the 5% level for ages 22–29 and 30–39 compared to those 50–77 in both 3 and 6 month estimates. Aides had lower expenditures compared to nurses, with an odds ratio of 0.72, [95% CI (0.55, 0.93)], in the 3 month estimates, and of 0.52 [95% CI (0.38, 0.72)] in the 6 month estimates.

Comparing the Impact of Sharps and Non-Sharps Injuries

About 1/3 of reported injuries were sharps injuries. Using an indicator for the type of injury (sharps or non-sharps) yielded estimates for non-sharps injuries that were close to the estimates from the main model (Table 4). The unconditional margin for non-sharps injury in the 3 month model was $420, [95% CI ($120, $779)], and was $777, [95% CI ($300, $1455)], in 6 month model. The indicator for sharps injuries was not statistically significant except in the 6 month model where it was associated with an odds ratio of 2.99 for having expenditures greater than zero. (Given that the probability of positive expenditures was over 90 percent, an odds ratio of 2.99 translates into less than a 7 percent increase in this probability.) The unconditional margin of the indicator for sharps injuries was not statistically significant in either the 3 month or 6 month models.

Table 4.

Results of the Analysis of Model of 3 And 6 Months Post-Injury Medical Expenditures Accounting For Sharps versus Non-Sharps Injuries.

| Model With Indicators For Sharps Vs. Non-Sharps Injury | Model Excluding All Sharps Injuries | |||

|---|---|---|---|---|

| 3 Months (N=2696) | 6 Months (N=2696) | 3 Months (N=2044) | 6 Months (N=2044) | |

| Sharps injury | ||||

| Part one: odds ratio for any expenditure | 1.40 [0.85, 2.29] | 2.99 [1.31, 6.84] | -- | -- |

| Part two: change in expenditures given any expenditure | −$215 [−$540, $319] | −$129 [−$756, $649] | -- | -- |

| Overall: change in expenditures | −$136 [−$427, $334] | $7 [−$584, $771] | -- | -- |

| Non-sharps injury | ||||

| Part one: odds ratio for any expenditure | 2.57 [1.80, 3.66] | 2.94 [1.86, 4.65] | 2.57 [1.79, 3.69] | 2.86 [1.80, 4.55] |

| Part two: change in expenditures given any expenditure | $311 [−$19, $679] | $665 [$168, $1384] | $278 [−$72, $681] | $696 [$162, $1366] |

| Overall: change in expenditures | $420 [$120, $779] | $777 [$300, $1455] | $396 [$77, $768] | $806 [$293, $1460] |

Notes: All models controlled for quartile of pre-injury medical expenditures, health insurance plan type, age group, and job category. Each model also included a constant term and was estimated using a two part model. The first part of the model used logit regression to predict whether an individual had any expenditures and the second part predicted the amount of expenditures for individuals who had a least some expenditures using log-transformed expenditures and ordinary least squares. Dollar amounts were rounded to the nearest dollar. Estimates using the log-OLS portion of the model were obtained using the appropriate retransformation algorithm for normal heteroskedastic residuals and bias-corrected bootstrapped 95% Confidence intervals with 1000 replications.

Removing individuals with sharps injuries (and their matched controls) from the model also yielded qualitatively similar results to the main analyses (Table 4). Being injured at work was significantly associated with the odds of having group health expenditures greater than zero at the 1% level using 3-month and 6-month intervals, odds ratios of 2.57 and 2.86 respectively. In the 3 month model, being injured was associated with an additional $396 expenditures overall [95% CI of ($77, $768)], larger than in the main results as was the unconditional margin in the 6 month model, $806 [95% CI ($293, $1460)].

DISCUSSION

Given that all medical expenditures related to work-related injuries should by law be covered by worker’s compensation insurance (28), there should be no association between injury and workers’ group health insurance expenditures after controlling for other relevant factors. In this study we have shown a significant difference between the two groups, implying that at least some of the medical costs of work-related injuries are borne by group health insurance plans rather than the workers’ compensation system. These group health insurance costs may occur because a workers’ compensation claim has not been filed or has not been accepted, because workers’ compensation paid only some of the costs of treating the injury, or because group health insurance covered additional care caused by an unrecognized work-related injury. An example of the last category is treatment of disability-related depression.

We studied a relatively sophisticated health care organization with an onsite occupational health service, so we think that spillovers from workers’ compensation to group health insurance are likely to be lower than for many other employers. As a consequence, ours are likely to be lower-bound estimates of the spillover from workplace injuries to group health insurance among patient care workers. Additionally, we did not use inpatient data, and therefore our estimates of the increase in health-care costs may underestimate the full impact of occupational injuries on general health insurance costs.

The increase in group medical costs in the six months after injury was about twice the three-month increase, suggesting that there was little decline in expenditure over the observed period. Our observation period was inadequate for a longer follow-up, but future studies could address whether the increase in expenditures continues.

In addition, we rely on hospital reported work-related injuries through records mandated by the Occupational Safety and Health Administration (OSHA), rather than on workers’ compensation claim data. By doing so, we were able to identify a subset of work-related injuries (sharps injuries) that do not normally incur significant medical costs, and test whether they also increased group health insurance costs. In running the models with separate indicators for the type of injury we found that sharps injuries were generally not significantly associated with increased group medical expenditures, while non-sharps injuries had very similar results to the main model. The same was true when we excluded individuals and matched controls with sharps injuries from the model. People with sharps injuries do not experience increased group health costs, while those with other injuries do. Given these results, it is likely that using all injuries reported on the job, including sharps, would create a downward bias in the estimates of medical care use after injury and supports the inference that the increase in these costs for other work-related injuries is related to the injury itself.

Our results are similar to previous studies that evaluated the group health insurance costs of injuries, especially when we consider the stark differences in samples (workers in many industries and occupations compared to hospital patient care workers), definitions of injuries (worker’s compensation claims compared to hospital reporting), and heterogeneity of health insurance plan (unobserved plan variation compared to three defined plans). Our results were qualitatively similar to the results from Afsaw, Rosa, and Mao (20) but our odds ratios and estimated expenditures were higher than the results from Bhattacharya and Park, although they looked only at one month post-injury rather than three (18). We evaluated only patient care workers, a group with higher than average injury rates and presumably good access to care and were able to capture a wide array of injuries including those without worker’s compensation claims. Our results also support the conclusions of the previous studies that used the MEPS data to evaluate the costs associated with workplace injuries.

A quick calculation using data for the study subjects shows the relative importance of group medical costs from injury. In our sample worksites, we used workers’ compensation data to derive paid workers’ compensation medical benefits. About 54% of workers with OSHA-recordable injuries received worker’s compensation benefits. The average 6-month increase in group health insurance costs per injured worker (including those who received no workers’ compensation benefits) was $587, about half the mean workers’ compensation medical benefits per injured worker of $1,162.

Limitations

Our estimates apply only to these patient care workers, all of whom had group health insurance. The expenditure information excludes individuals’ out-of-pocket costs and other sources of medical care payment. Although we cannot measure out-of-pocket costs, we can reasonably assume that workers also paid some deductible, copayment, or coinsurance amount. However, by including expenditures before injury and the type of health insurance plan we have limited bias from existing care patterns/preferences and likely degree of cost-sharing. The reliance on a single employer data source limits the variation in healthcare plan type and other work policies that may affect utilization. By restricting our focus to a relatively homogenous population, we cannot generalize to the U.S. population. On the other hand, we see advantages to this approach in that geographic factors and health insurance plan generosity are constant across the sample. We offer this study as a proof of concept that a reasonably large employer can determine the extent to which its group health insurance costs are affected by occupational injuries and illnesses.

We could not capture the costs of unreported injuries/illnesses or measure the severity of the injuries (although all costs of work-related injuries should, in principle, appear in worker’s compensation rather than private health insurance). It is also possible that some costs directly tied to work-related injuries might eventually be recovered by the group health insurer. On the other hand, the use of a single employer’s data source and a relatively narrow spectrum of workers limit the probability of unobserved confounding. There are of course, many factors that influence healthcare utilization, such as preference for healthcare and additional social factors; however, we do not have evidence that these factors would affect injured workers differentially. Our control for previous expenditures likely reduces this potential source of bias.

Summary and Conclusions

Using a sample of matched patient care workers at two different hospitals, we found that injury was associated with increased group health insurance expenditures after controlling for previous expenditures, health insurance plan type, age, and job category. This result held for non-sharps injuries and when individuals with sharps injuries were excluded from the model. Although workers’ compensation is designed to cover all medical costs stemming from work-related injuries, some costs are likely borne by group health insurance. Workers’ compensation costs are often used as one key indicator of the impact of occupational injuries and illnesses. To the extent that we understate their true medical costs, we understate their importance as preventable conditions.

Supplementary Material

Clinical Significance.

Injuries to patient care workers are treated in both the workers’ compensation system and group health insurance. For clinicians, this increases the complexity of treating patients because care may be received in a variety of settings with little coordination among them.

Acknowledgments

Support: This work was supported by a grant from the National Institute for Occupational Safety and Health (U19 OH008861) for the Harvard T. H. Chan School of Public Health Center for Work, Health and Well-being.

This study would not have been accomplished without the participation of Partners HealthCare System and leadership from Joseph Cabral and Kurt Westerman. The authors thank all the participants of the study for supplying the data and Partners Occupational Health Services including Lisa Dimarino and Rachel Corbin in Human Resources, Terry Orechia and Chris Kenwood for programming support. We also thank individuals at each of the hospitals, including Jeanette Ives Erickson, and Jacqueline Somerville, in Patient Care Services leadership, and Jeff Davis and Julie Celano in Human Resources. Additionally, the authors would like to thank Truven Health Analytics for providing access to the health insurance data.

Footnotes

The authors declare no conflicts of interest.

References

- 1.Sengupta I, Baldwin M. Workers’ Compensation: Benefits, Coverage, and Costs, 2013. National Academy of Social Insurance; 2015. [Google Scholar]

- 2.Azaroff LS, Levenstein C, Wegman DH. Occupational injury and illness surveillance: Conceptual filters explain underreporting. Am J Public Health. 2002;92:1421–1429. doi: 10.2105/ajph.92.9.1421. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Rosenman KD, Kalush A, Reilly MJ, et al. How much work-related injury and illness is missed by the current national surveillance system? Journal of Occupational and Environmental Medicine. 2006;48:357–365. doi: 10.1097/01.jom.0000205864.81970.63. [DOI] [PubMed] [Google Scholar]

- 4.Boden LI, Ozonoff A. Capture-recapture estimates of nonfatal workplace injuries and illnesses. Annals of epidemiology. 2008;18:500–506. doi: 10.1016/j.annepidem.2007.11.003. [DOI] [PubMed] [Google Scholar]

- 5.Seabury SA, Scherer E, O’Leary P, et al. Using linked federal and state data to study the adequacy of workers’ compensation benefits. American Journal of Industrial Medicine. 2014;57:1165–1173. doi: 10.1002/ajim.22362. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Reville RT, Boden LI, Biddle J, et al. An evaluation of New Mexico workers’ compensation permanent partial disability and return to work. Santa Monica, CA: Rand Institute for Civil Justice; 2001. [Google Scholar]

- 7.Boden LI, Galizzi M. Income losses of women and men injured at work. Journal of Human Resources. 2003;38:722–757. [Google Scholar]

- 8.Tak S, Grattan K, Boden L, et al. Impact of differential injury reporting on the estimation of the total number of work-related amputations. Am J Ind Med. 2014;57:1144–1148. doi: 10.1002/ajim.22378. [DOI] [PubMed] [Google Scholar]

- 9.Davis LK, Grattan KM, Tak S, et al. Use of multiple data sources for surveillance of work-related amputations in Massachusetts, comparison with official estimates and implications for national surveillance. Am J Ind Med. 2014;57:1120–1132. doi: 10.1002/ajim.22327. [DOI] [PubMed] [Google Scholar]

- 10.Fomenko O, Gruber J. Claims-shifting: The problem of parallel reimbursement regimes. Journal of Health Economics. 2017;51:13–25. doi: 10.1016/j.jhealeco.2016.12.002. [DOI] [PubMed] [Google Scholar]

- 11.Lax MB, Manetti FA. Access to medical care for individuals with workers’ compensation claims. New Solutions: A Journal of Environmental and Occupational Health Policy. 2002;11:325–348. doi: 10.2190/YVMM-JQMD-EJRC-2EN7. [DOI] [PubMed] [Google Scholar]

- 12.Asfaw A, Souza K. Incidence and cost of depression after occupational injury. Journal of Occupational and Environmental Medicine. 2012;54:1086–1091. doi: 10.1097/JOM.0b013e3182636e29. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Kim J. Depression as a psychosocial consequence of occupational injury in the US working population: findings from the medical expenditure panel survey. BMC public health. 2013;13:303. doi: 10.1186/1471-2458-13-303. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Nimgade A, McNeely E, Milton D, et al. Increased expenditures for other health conditions after an incident of low back pain. Spine (Phila Pa 1976) 2010;35:769–777. doi: 10.1097/BRS.0b013e3181c06a89. [DOI] [PubMed] [Google Scholar]

- 15.Asfaw A, Souza K. Incidence and cost of depression after occupational injury. J Occup Environ Med. 2012;54:1086–1091. doi: 10.1097/JOM.0b013e3182636e29. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16.Dong X, Ringen K, Men Y, et al. Medical costs and sources of payment for work-related injuries among Hispanic construction workers. Journal of Occupational and Environmental Medicine. 2007;49:1367–1375. doi: 10.1097/JOM.0b013e31815796a8. [DOI] [PubMed] [Google Scholar]

- 17.Xiang H, Shi J, Lu B, et al. Medical expenditures associated with nonfatal occupational injuries among immigrant and US-born workers. BMC public health. 2012;12:678. doi: 10.1186/1471-2458-12-678. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Bhattacharya A, Park RM. Excess healthcare costs associated with prior workers’ compensation activity. American journal of industrial medicine. 2012;55:1018–1027. doi: 10.1002/ajim.22112. [DOI] [PubMed] [Google Scholar]

- 19.Shi J, Wheeler KK, Lu B, et al. Medical Expenditures Associated with Nonfatal Occupational Injuries among US Workers Reporting Persistent Disabilities. Disability and Health Journal. 2014 doi: 10.1016/j.dhjo.2014.10.004. [DOI] [PubMed] [Google Scholar]

- 20.Asfaw A, Rosa R, Mao R. Do zero-cost workers’ compensation medical claims really have zero costs? The impact of workplace injury on group health insurance utilization and costs. Journal of Occupational and Environmental Medicine. 2013;55:1394–1400. doi: 10.1097/JOM.0000000000000030. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Bureau of Labor Statistics. Nonfatal Occupational Injuries And Illnesses Requiring Days Away From Work, 2013. Washington D.C: U.S. Department of Labor; 2014. pp. 1–31. [Google Scholar]

- 22.Boden LI, Sembajwe G, Tveito TH, et al. Occupational injuries among nurses and aides in a hospital setting. Am J Ind Med. 2011;55:117–126. doi: 10.1002/ajim.21018. [DOI] [PubMed] [Google Scholar]

- 23.Afifi AA, Kotlerman JB, Ettner SL, et al. Methods for improving regression analysis for skewed continuous or counted responses. Annu Rev Public Health. 2007;28:95–111. doi: 10.1146/annurev.publhealth.28.082206.094100. [DOI] [PubMed] [Google Scholar]

- 24.Manning WG, Mullahy J. Estimating log models: to transform or not to transform? Journal of Health Economics. 2001;20:461–494. doi: 10.1016/s0167-6296(01)00086-8. [DOI] [PubMed] [Google Scholar]

- 25.Manning WG. The logged dependent variable, heteroscedasticity, and the retransformation problem. Journal of Health Economics. 1998;17:283–295. doi: 10.1016/s0167-6296(98)00025-3. [DOI] [PubMed] [Google Scholar]

- 26.Duan N. Smearing Estimate: A Nonparametric Retransformation Method. Journal of the American Statistical Association. 1983;78:605–610. [Google Scholar]

- 27.StataCorp. Stata Statistical Software: Release 13. College Station, TX: StataCorp LP; 2013. [Google Scholar]

- 28.Adequate and reasonable health care services; preferred health care provider. Part I, Title XXI, Chapter 152, Section 30. Massachusetts 1993

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.