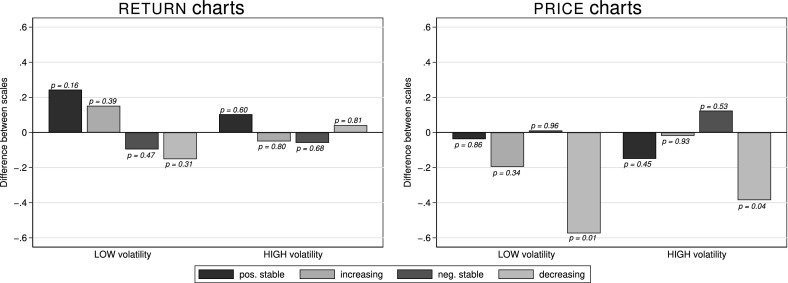

Fig. 6.

Differences in average investment propensity (in NARROW minus WIDE) by trend and scale presented as RETURN charts (left) and PRICE charts (right). This figure depicts differences in average investment propensity (on a scale from 1 = “very unlikely to invest” to 7 = “very likely to invest”) for chart and chart representations of (left bars in each panel) and (right bars in each panel) volatility assets. p-values above the bars are from Fisher-Pitman permutation tests on the subject-demeaned data. Each of the sixteen bars summarizes between 179 and 206 observations