Effective carbon taxation is politically feasible when combining international involvement and revenue recycling.

Abstract

Carbon taxes are widely regarded as a potentially effective and economically efficient policy instrument for decarbonizing the global energy supply and thus limiting global warming. The main obstacle is political feasibility because of opposition from citizens and industry. Earmarking revenues from carbon taxation for spending that benefits citizens (i.e., revenue recycling) might help policy makers escape this political impasse. On the basis of choice experiments with representative samples of citizens in Germany and the United States, we examine whether revenue recycling could mitigate two key obstacles to achieving sufficient public support for carbon taxes: (i) declines in support as taxation levels increase and (ii) concerns over the international economic level playing field. For both countries, we find that revenue recycling could help achieve majority support for carbon tax levels of up to $50 to $70 per metric ton of carbon, but only if industrialized countries join forces and adopt similar carbon taxes.

INTRODUCTION

Current commitments (nationally determined contributions) by the parties to the Paris Agreement are clearly insufficient for reaching an early peak of global greenhouse gas emissions and then reducing them drastically so as to achieve the envisaged 1.5° to 2° global warming target (1, 2). Fiscal policy reforms focusing on carbon taxation are widely regarded as both necessary and effective for closing the current gap between existing commitments and the said target (1). Because almost all carbon in fossil fuels is emitted as CO2, which has had the largest effect on global warming from 1750 until today, carbon taxes are paramount to taxing CO2 emissions (3).

The rationale for carbon taxation is simple, compelling, and widely accepted in academia (4). Taxing carbon raises the cost of fossil fuel, thus reducing fossil fuel consumption and the associated CO2 emissions. Likewise, it internalizes local externalities from polluting behavior because businesses and consumers are ultimately required to pay the full cost of their consumption, meaning not only the fossil fuel costs per se but also the damage that fuel consumption imposes on nature and society. Last, it discourages the consumption of fossil fuel, where this can be achieved at the lowest marginal cost, and incentivizes research and development of substitutes while avoiding technology lock-in associated with myriads of detailed command-and-control regulations.

Despite enthusiasm about the potential of carbon taxes for decarbonizing the global energy supply, many countries are, in reality, imposing “negative” carbon taxes on fossil fuel consumers through their energy policies, that is, they subsidize fossil fuel consumption on a massive scale (4, 5). Thus far, relatively few countries have introduced nonsymbolic “positive” carbon taxes. Only 10% of the CO2 emissions from energy use in Organisation for Economic Co-operation and Development countries, which account for 80% of global emissions, are priced—through emission trading schemes, excise taxes, and carbon taxes—at levels consistent with the 2° target (1, 4–7).

The main reason for the glaring gap between existing carbon pricing levels and those required for deep emission cuts is political feasibility: Most citizens appear to have very little appetite for new taxes that would increase their total tax burden [e.g. (8, 9)]. Obvious manifestations are the “Gilets Jaunes” demonstrations in France against fuel price increases, unsuccessful ballots on carbon taxes in U.S. states, and rather unambitious or completely absent carbon tax initiatives in most other countries, with the partial exception of Finland, Norway, Sweden, Switzerland, Alberta, and British Columbia (Canada), California (United States), and very recently Canada (4, 9). As noted by Rabe, “compelling ideas from economics do not necessarily suspend the laws of politics.”

Policy makers, aware of these political problems, have turned to highlighting how the revenue generated from carbon taxation could be used to benefit citizens. Commonly referred to as “revenue recycling,” this approach is considered the most feasible solution to achieving sufficient public support for enacting effective carbon taxation [(9–11); see also (1, 4, 12)]. Revenue recycling refers to mechanisms through which income generated from carbon taxation is earmarked and returned back to society. This policy design idea is somewhat reminiscent of the long-standing “Double Dividend Argument” [e.g., (13–16)] in the sense that carbon taxation could be designed so as to generate environmental and other benefits to society in ways that result in a favorable public perception of the overall cost-benefit ratio of the policy intervention. Specifically, carbon taxes impose costs that are immediate and directly experienced by citizens/consumers, whereas the environmental benefits accrue to society in the longer term. Revenue recycling serves to modify this otherwise politically challenging cost-benefit structure by generating additional immediate and direct benefits to offset the equally immediate and direct costs.

Initial research in this vein has revealed the willingness of U.S. citizens to accept carbon taxes (17). Jagers et al. (11) showed that Swedish citizens are more likely to accept a carbon tax on car fuel if combined with an income tax cut. Carattini et al. (18) found that Swiss citizens are more likely to support energy taxes when revenue recycling is included. In addition, in a very recent publication, Carattini et al. (19), on the basis of an experimental study design, showed how different forms of revenue recycling could increase support at differing carbon taxation levels.

Thus far, various public opinion surveys have gauged public support for carbon taxes in a very general form, but very few studies have tried to systematically explain support levels for carbon taxation in specific forms. The few studies of the latter type, as noted above, convey a rather optimistic picture with respect to the political feasibility of using this policy instrument to achieve major emission cuts. Yet, these studies have some limitations that should be addressed. First, the most sophisticated of these studies, which rely on experimental study designs, either vary carbon taxation levels or gauge support for various revenue usage schemes. This prevents a comprehensive assessment of whether revenue recycling, per se and in different forms, could mitigate declines in support as the price of carbon is increased via taxation. Second, they do not consider international level playing field concerns, another key issue with carbon taxation. This concern, which is frequently expressed by policy makers and business leaders, and may also be prevalent among the mass public, is that failure of other countries to adopt similar carbon taxes would result in competitive disadvantages for home country industries and, ultimately, in domestic job losses. For instance, a very sophisticated recent study by Carattini et al. (19) assumes that all countries globally adopt the same carbon tax, a scenario that appears rather unlikely.

Recent research suggests that citizens do not care much about the behavior of other countries when forming their preferences on climate policy (20). However, it is not clear a priori whether this also applies to carbon taxation. Carbon taxation, unlike climate policy or international environment agreements more generally, has more explicit and easy-to-grasp economic effects. This might encourage citizens to put more emphasis on international reciprocity when forming preferences about carbon taxation. In other words, a more complete assessment requires analysis of whether revenue recycling could mitigate negative effects for political feasibility that emerge both from increasing carbon taxation levels and from international level playing field concerns, with the latter concerns likely to grow with carbon taxation levels.

RESEARCH DESIGN

To address these issues, we conducted conjoint choice experiments embedded in representative surveys of German (n = 3620) and U.S. citizens (n = 3640) (see Materials and Methods for details). On the basis of these experiments, we sought to identify the effect of specific forms of carbon taxation upon public acceptance, willingness to pay for carbon taxation, and the causal effect of revenue recycling in this regard. These experiments were fielded in Germany and the United States, given their global prominence in climate negotiations and in view of notable differences in general public support for climate policy and more general taxation acceptance. Our intention was to find out how well empirical findings travel across different country contexts.

We are primarily interested in identifying empirically whether revenue recycling per se, or specific forms thereof, has a public support increasing effect. Although the existing literature offers theoretical arguments as to individual determinants of support for carbon taxation [e.g., (21)] and the impact of revenue recycling in general [(11, 22)], it has less to say on differences in support for specific forms of revenue recycling. Rather, the existing literature tends to offer mostly empirical insights on this matter. In line with the argument on cost-benefit structures above, however, we expect that revenue recycling forms that generate benefits that are more immediate and directly experienced by citizens are likely to have a more positive effect on support for carbon taxes. This preference could occur because of a number of mechanisms. For example, a preference for direct benefits may arise from a lack of trust that money will be returned to individuals if absorbed into the general budget [e.g., (23)], or it may arise from low-income individuals, who are generally less supportive of carbon taxation [e.g., (24)], being the primary beneficiaries of direct transfers such as a flat tax rebate. Together, we expect the most positive effect from tax rebates paid to everyone and from a reduction in personal income taxes, and the least positive effect from using carbon tax revenue to reduce the federal government deficit and corporate income taxes. The effects of the other recycling forms are likely to fall somewhere in between.

Table 1 displays key characteristics of carbon tax policy designs, on which we focus in our conjoint experiment. We are particularly interested in the effects of two fundamental sets of policy characteristics (called attributes). The first set consists of carbon tax levels and characteristics that pertain to international level playing field and carbon leakage argument (rules concerning exporting industries, foreign competitors, and corresponding policies of other countries). Our expectations derive from current political debates over carbon taxation and common expectations advocated in the existing scientific literature [e.g., (25, 26)]. Specifically, we expect support to:

Table 1. Attributes of carbon tax policy.

| Attribute | Values |

| 1. Cost of carbon tax | 1. $10 per metric ton ($144 per year for average consumer) 2. $20 per metric ton ($288 per year for average consumer) 3. $30 per metric ton ($432 per year for average consumer) 4. $40 per metric ton ($576 per year for average consumer) 5. $50 per metric ton ($720 per year for average consumer) 6. $60 per metric ton ($864 per year for average consumer) 7. $70 per metric ton ($1008 per year for average consumer) |

| 2. Energy-intensive products imported from other countries |

1. Fully exempted (pay no carbon tax) 2. Taxed at half rate (pay only half of the carbon tax) 3. Taxed equally (pay full carbon tax) |

| 3. Domestic companies exporting energy-intensive products to other countries |

1. Fully exempted (pay no carbon tax) 2. Taxed at half rate (pay only half of the carbon tax) 3. Taxed equally (pay full carbon tax) |

| 4. Similar carbon tax introduced by | 1. No other countries 2. European countries (European Union) 3. China 4. United States 5. India 6. Canada 7. Japan 8. All industrialized countries 9. All developing countries |

|

[Randomly assigned to be seen by half of the respondents] 5. Additional public revenue, i.e., carbon dividends, used for |

1. Tax rebate paid to everyone 2. Reduce federal government deficit 3. Fund renewable energy sources (e.g., solar, wind, and geothermal power) 4. Fund infrastructure (e.g., railways, roads, and public transportation) 5. Fund programs for low-income families 6. Reduce income tax 7. Reduce corporate tax 8. Fund retraining programs for workers in fossil fuel sector |

(i) decrease with increasing carbon tax level

(ii) decrease with exemptions for energy-intensive products imported from other countries (level playing field concern)

(iii) increase with exemptions for domestic companies exporting energy-intensive products to other countries (level playing field concern)

(iv) increase when other countries are introducing a similar carbon tax (reducing carbon leakage and achieving a level playing field)

The second set of carbon tax design characteristics focuses on revenue recycling. Whereas the first set of characteristics (attributes) is always included in policy proposals assessed by our study participants, the revenue recycling attribute appears randomly between participants. This study design allows us to estimate how the inclusion of revenue recycling, per se, affects support for carbon taxation. It also allows us to estimate which form of revenue recycling is more effective in terms of positively affecting public support. Because of random assignment, individuals completing the conjoint experiment tasks will, in expectation, only differ by the receipt of this attribute. In other words, any differences in the effect of carbon tax levels, exemptions for firms, and participation of other countries are then the result of receiving information on revenue usage. It is, of course, reasonable to expect that study participants in this group will hold beliefs about how revenues from a carbon tax would be spent in the absence of a specific commitment. Therefore, we consider this baseline condition to reflect the state of public discourse before a specific carbon tax is introduced. This means that comparing a revenue recycling scheme to this condition captures the causal effect of committing to a specific form of revenue usage rather than leaving it ambiguous.

We chose the specific revenue recycling mechanisms for our study based on their prevalence across a combination of sources, such as policy analyses, academic research, public initiatives, and popular discussion. For example, researchers at the U.S. Treasury examined the distributional impact of a $50 carbon tax if revenue is used for a tax rebate, a reduction in income tax, and a reduction in corporate tax. Emanuel Macron’s planned increase in fuel duty stipulated that the revenues would be used to reduce the government deficit. Washington Initiative 1631, a defeated ballot measure to implement a carbon tax in the U.S. state of Washington, pledged that the revenue would be used to fund environmental projects. Last, most of the revenue recycling measures that we include were examined as a part of previous academic research, such as (17).

The surveys in which the experiment was embedded were fielded using representative online panels in Germany and the United States. To ensure representativeness, sampling for the surveys was based on hard quotas for age, sex, income quintile, and region, as well as on soft quotas for education and employment status. The sample size was 3620 and 3640, respectively. Further details can be found in the Methods section located in the appendix.

In the experimental part of the survey, respondents were given an explanation of the concept of carbon taxation, as well as descriptions of each of the attributes considered, before completing the conjoint tasks. This information gives individuals sufficient details to provide a realistic understanding of the carbon tax in question.

RESULTS

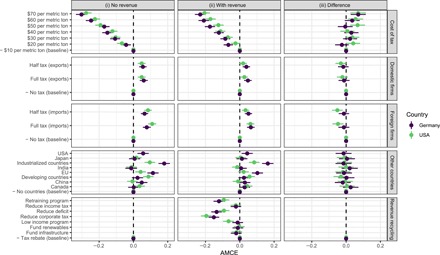

Figure 1 displays the main results of the conjoint experiment. First, the level of carbon taxation significantly affects support levels. The highest carbon tax level ($70 per metric ton in the U.S. case) reduces the probability of support by approximately 30%, on average, compared to a carbon tax proposal of $10 per metric ton. Second, citizens prefer carbon tax policies that do not grant exemptions to either domestic or foreign firms. Fully taxing these firms significantly increases support for a carbon tax proposal compared to the baseline of no taxation. Third, citizens are responsive to carbon taxation by other countries, although this varies significantly by country. In Germany, citizens are much more supportive of carbon tax proposals if other European Union countries, or all industrialized countries, also adopt carbon taxes. In contrast, carbon taxes imposed by other countries do not generate large increases in support for U.S. respondents.

Fig. 1. Average marginal component effects.

The first two columns refer to the conjoint experiments with and without revenue information. The final column displays how revenue usage information conditions the effect of the other attributes. This is estimated as the difference between the average marginal component effect (AMCE) for the estimate when revenue usage information is provided and when revenue usage information is not provided. The darker points are the results for the Germany sample, and the lighter points are those for the U.S. sample. The lines display 95% confidence intervals constructed using individual clustered standard errors.

Turning to the impact of revenue recycling mechanisms, the second column displays the results from the subsample that completed the version of the conjoint experiment that included revenue usage information. These results show that support for a carbon tax proposal varies significantly depending on how revenue is used. Echoing some results from a nonexperimental survey study by Kotchen et al. (10), we find that using carbon tax revenue to reduce corporate taxation is very unpopular in both countries. Using this revenue to fund retraining programs or to reduce the general government budget deficit also leads to a significant decline in support, although slightly more so in the United States than in Germany. Last, using revenues from carbon taxation to fund programs for low-income people also leads to a significant decline in support in the United States but has no significant effect in Germany.

Furthermore, we find that providing information on revenue usage significantly affects individuals’ preferences over the design of carbon taxation. We calculate how the effects of attributes other than revenue recycling differ between those study participants who randomly received the conjoint experiment with revenue recycling information versus those who did not. The third column of Fig. 1 displays these effects. First, we can see that providing information about revenue usage significantly increases the willingness to pay for a carbon tax. At the high end of carbon pricing ($50 to $70), solely providing revenue usage information causes the negative effects shown in the first column to decrease by approximately one-third, i.e., 7% points. Second, including revenue usage information also induces U.S. respondents to be less sensitive to exemptions for both domestic and foreign firms, although this is not the case for German respondents. Third, providing information on revenue usage has no effect on the impact of other countries adopting a similar tax. In brief, we observe that, without information about revenue usage, citizens are significantly less willing to pay for carbon taxation.

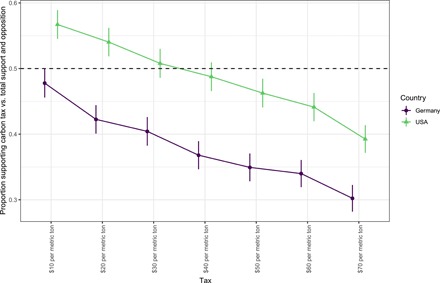

When assessing public acceptance, in the sense of majority support, of certain carbon taxation levels, our experiments can also generate information on willingness to pay contingent on certain policy design characteristics, such as revenue recycling. As a starting point, Fig. 2 displays how citizens’ ratings of carbon tax proposals vary by taxation level for those who received no revenue recycling information. Specifically, we focus on how many individuals support a given carbon tax policy as a proportion of those who support, and oppose, that particular carbon tax proposal. As one might expect, we find that support generally decreases as the cost of the carbon tax increases. Yet, a remarkable observation is how strong the variation across the two countries is in terms of carbon tax levels that would be well received by at least half of the country’s citizens. For the United States, we observe a majority for carbon taxation up to $30 and significant opposition from $50 onward. In stark contrast, a majority of opposition to carbon taxation in Germany starts already at a lower level, from $20 onward. Further research should address these differences, which are quite surprising in view of lower climate change concern (27) and greater tax aversion in the United States, relative to Germany. One potential explanation could be stronger skepticism in Germany, relative to the United States, regarding the use of market instruments in environmental policy. Another explanation might be that Germany’s climate policy already relies on a myriad of end-of-pipe and technology regulations, alongside carbon pricing through the European Union Emissions Trading System, rather than carbon taxation. Last, Germany has a substantially lower social cost of carbon than the United States (28), even being negative under some scenarios, which could capture less public pressure to take action to price carbon.

Fig. 2. The proportion of support for a carbon tax, at different costs, relative to the sum of those who oppose or support a carbon tax.

Points indicate the proportion, with vertical lines indicating the 95% confidence intervals. The dashed line indicates the point where an equal number of individuals support and oppose the carbon tax.

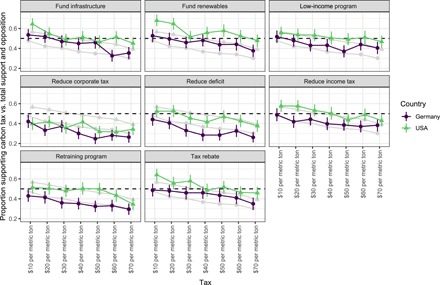

Figure 3 displays the causal effects of revenue recycling, in different forms, upon individuals’ ratings of carbon taxation proposals. The results suggest that some forms of revenue recycling are able to maintain majority support even at relatively high levels of carbon taxation. Focusing on the United States, we observe that funding for infrastructure and renewables, low-income programs, and tax rebates either maintain full majority support or do not lead to a statistically significant level of opposition even at the highest tax level ($70). While these revenue recycling mechanisms also increase support in Germany, they only do so at lower levels, with a statistically significant majority opposing from $50 onward. The carbon tax recently introduced in Canada, which includes strong revenue recycling mechanisms, will start at $20 per metric ton in 2019 and will increase by $10 annually up to $50 per metric ton by 2022. Unless revised, it would then remain at this level. In contrast, revenue recycling mechanisms, such as reducing deficit or income tax and retraining programs, do not significantly improve support for carbon taxation. Last, reducing corporate taxation with the revenues from carbon taxation significantly reduces support, particularly in the United States.

Fig. 3. The proportion of support for a carbon tax, at different costs, by different forms of revenue recycling relative to the sum of those who oppose or support a carbon tax.

Points indicate the proportion, with vertical lines indicating the 95% confidence intervals. The gray points and lines indicate the relevant proportions from Fig. 3 where individuals receive no revenue recycling information. The dashed line indicates the point where an equal number of individuals support and oppose the carbon tax.

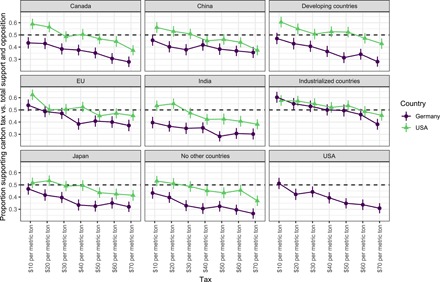

Last, we assess the relevance of international level playing field concerns when considering the level of carbon taxation that citizens are willing to support. As shown in Fig. 4, we find that support is clearly sensitive to the behavior of other countries. In Germany and the United States, carbon taxation by all industrialized countries is needed to achieve majority support for high carbon tax levels. This suggests that previous findings indicating majority support for carbon taxation (19) may have resulted from study designs presuming (and exposing study participants to information) that all countries adopt carbon taxes. Our findings show, however, that international level playing field concerns are critical to the formation of citizens’ policy preferences and support for effective levels of carbon taxation.

Fig. 4. The proportion of support for a carbon tax, at different costs, by different levels of international involvement in the carbon tax.

Points indicate the proportion, with vertical lines indicating the 95% confidence intervals. The dashed line indicates the point where an equal number of individuals support and oppose the carbon tax.

CONCLUSION

Our findings provide strong support for the hypothesis that revenue recycling can increase citizens’ support for carbon taxation and, more specifically, that it can increase the willingness to pay at a rate that is likely to induce major emission cuts. While citizens do have distinct preferences over particular forms of revenue recycling (and some forms clearly turn out to be more popular than others), our findings also reveal an independent causal effect of most forms of revenue recycling on support and willingness to pay. These results suggest that policy makers should not shy away from public debate around the usage of revenues from carbon taxation under the presumption that this could engender distributional conflict and prevent the adoption of carbon taxes altogether.

These findings also indicate, however, that revenue recycling is not a silver bullet and perhaps less effective in increasing public support than suggested by previous studies. It will remain very challenging to initiate and raise carbon taxes to levels that induce large cuts in carbon dioxide emissions not only in the United States with its per capita carbon emissions of around 16.5 metric tons but also in Germany where per capita emissions are much lower (around 8.9 metric tons per capita, as of 2014). This is particularly the case under conditions where it remains very difficult to line up support among industrialized countries for somewhat similar policies with respect to carbon taxation. In other words, both revenue recycling and similar carbon taxation policy among industrialized countries are required to achieve majority support for effective carbon tax levels (around $50 to $70 per metric ton of carbon).

We also find considerable cross-country variation in support for carbon taxation. Individuals in the United States are, on average, more supportive of higher levels of carbon taxation than individuals in Germany. This difference in willingness to pay across countries also matches differences in their relative social cost of carbon (28). However, in the absence of international involvement and/or revenue recycling, U.S. respondents support levels of carbon taxation substantially lower than the social cost of carbon. Therefore, future research could examine whether this mismatch occurs because of respondents’ lack of knowledge about the social cost of carbon and whether willingness to pay could be increased by providing information on this matter.

Whether mass support for carbon taxation is sufficient to achieve adoption nevertheless remains an open question. Previous research in political science does suggest that policy is responsive to public preferences [e.g., (29)]. Anderson et al. (30) found support for this link between public opinion and policy to hold in the case of environmental policy, with changes in public opinion predicting policy outputs. However, formidable vested interests that stand in the way of implementing effective carbon tax policy still remain. A large body of research in political economy suggests that groups of actors that experience high opportunity costs per actor/capita are likely to be easier to organize and politically more influential, particularly when the policy benefits are diffuse [e.g., (31–33)]. In the climate policy area, these actors include fossil fuel suppliers, the automobile industry, and economy sectors that are large consumers of fossil fuels. Nevertheless, this paper suggests that there is considerable room for maneuver in crafting popular carbon tax policy, which may also be used to coopt currently opposed interest groups. Even if this public support is not sufficient to achieve adoption of effective carbon taxes, it is likely to be necessary regardless.

One solution to the political bottleneck arising from international level playing field problems might be pairing of carbon taxation (including revenue recycling) with other complementary energy and climate policies. Recent research shows that climate and energy policy defined in broader terms is likely to be less susceptible to reciprocity and free-riding concerns than carbon taxation (20). Further research on how carbon taxes could be combined with other policy instruments, such as subsidies for renewables, as well as technology and end-of-pipe regulations, to create combinations of policies able to develop winning coalitions behind support for ambitious mitigation policies is thus required (9, 18, 20, 34, 35). This research should also take into account that, depending on the characteristics of political systems (e.g., governance quality and trust in government), the extent to which citizens prefer market instruments, such as carbon taxes, over conventional regulatory instruments could vary [e.g., (36)].

Examining the complementary nature of policies could also be extended to revenue recycling mechanisms themselves. Here, we provided carbon tax proposals where the revenue was used for one specific use, or none at all. Future research could expand this to examine whether using combinations of revenue recycling mechanisms could generate additional support for carbon taxation. This policy packaging has previously been found to be relevant in the transportation sector (37) and may provide policy makers further leverage in building new coalitions supporting carbon taxation.

Last, our study has focused on support for carbon tax policy in two major industrialized countries. This choice reflects the current attention that this policy has faced in these countries, as well as their global importance in climate diplomacy and finance. Nevertheless, the pricing of carbon remains beyond these countries. As China and India are two of the largest global emitters, pricing carbon emissions in these countries will also be important to achieve effective global reductions. Our research finds that the inclusion of these countries is not sufficient to boost public support for carbon taxation substantially in Germany and the United States. However, future research could examine the opposite side of this coin, by examining how support for the adoption or expansion of a carbon tax in China and India, respectively, depends on the efforts of industrialized countries in general and Germany and the United States in particular. In these cases, the behavior of developed countries is likely even more pertinent, given China’s previous emphasis on the historical responsibility of advanced economies for global emissions.

MATERIALS AND METHODS

Survey procedure and respondents

The survey was fielded with Ipsos online panels in February 2018. Fielding the survey directly with Ipsos means that they engaged in a number of quality control steps, for instance, excluding speeders or preventing duplicate responders, details of which can be found at https://ems.ipsos-mori.com/Assets/Docs/Techniques/ESOMAR-28-Questions.pdf.

Ipsos used quota sampling for the survey with hard quotas based on an individual’s age, income quintile, sex, and region and soft quotas based on education and employment status. For Germany and the United States, the sample sizes are 3620 and 3640, respectively.

Conjoint experiment

In our study, a conjoint experiment, also known as stated preference choice experiment, consists of respondents choosing between one of two carbon taxation proposals with randomly assigned attribute values. Participants choose which of the pair of proposals they support and rate these proposals, on a scale of 1 (fully oppose) to 7 (fully support), five different times. By randomly manipulating the values of each attribute within a proposal, we are able to estimate a variety of quantities of interest. First, we can estimate the causal effect of attribute values upon the choice of proposal, known as the average marginal component effect (AMCE) (38), relative to some baseline. Second, as the conjoint design shares similarities to factorial designs, we can then measure the causal effect of attribute values upon the average level of support for a carbon tax policy.

For our conjoint experiment, participants were asked to choose between randomly assigned policy proposals whose characteristics differ along a set of attributes: cost, exemptions for domestic or foreign firms, and participation by other countries. Respondents were further randomly assigned whether or not to receive an additional attribute in their conjoint experiment about revenue usage. Study participants were then provided background information on each of the attributes, describing their relevance to the design of a carbon tax. The conjoint experiment then consisted of respondents being shown sets of two proposed carbon taxes, side by side, where the values on specific policy attributes are manipulated and randomly assigned. Participants then chose which policy they prefer and noted their level of support for each proposed carbon tax on a Likert scale of 1 to 7. They performed this task by choosing between and rating two randomly generated carbon taxes five times in total. The 3620 and 3640 participants in Germany and the United States, respectively, thus generate information on their support levels for a total of 36,200 and 36,400 hypothetical carbon taxes, respectively (five rounds times two proposals, times the number of study participants).

Estimation

To estimate the AMCEs, i.e., treatment effects for the attribute values of a carbon tax policy, we used ordinary least squares (OLS) where the dependent variable is whether the policy was chosen or not in the forced choice. The difference in these effects, depending on whether an individual did or did not receive revenue information, was estimated by including interaction effects for these experimental conditions.

To estimate the proportion who support a policy relative to those who oppose it (Figs. 2 to 4), we created a binary variable that takes on the value of 1 if the individual rates the policy in a supportive manner (5 to 7 on the seven-point Likert scale) and 0 if the individual rates the policy in an oppositional manner (1 to 3 on the seven-point Likert scale). This is analogous to the exclusion of indifferent respondents conducted in (19). We then estimated using OLS how the mean of this variable, equivalent to the proportion who support the policy, varies depending on the cost and revenue usage of the policy.

Supplementary Material

Acknowledgments

We thank R. A. Huber for help with the German translations. Funding: This research was financially supported by European Research Council (ERC) Advanced Grant No. 295456 (Sources of Legitimacy in Global Environmental Governance) and ETH Zürich. Ethics statement: The surveys that generated the data for this study were a part of ERC Advanced Grant project no. 295456 (Sources of Legitimacy in Global Environmental Governance). Ethical approval for the project as a whole was obtained at the beginning of the project (ETH Ethics Committee approval, 28 September 2012, EK-2012-N-41, extended to March 2018). The Ethics Committee of ETH Zürich and the ERC Ethics Monitoring Unit regularly monitored the project, with the final survey items provided on a continuous basis. The surveys for this study were fielded by Ipsos, and respondents were first informed about the nature of the study before being asked to consent. The study also followed the no-deception principle, whereby only factual information was provided to respondents. Competing interests: The authors declare that they have no competing interests. Author contributions: L.F.B.-M. and T.B. jointly designed the study and wrote the paper. L.F.B.-M. analyzed the data. Data and materials availability: All data needed to evaluate the conclusions in the paper are present in the paper and/or the Supplementary Materials. Code and data to replicate the results presented in this paper will be available on the Harvard Dataverse at https://doi.org/10.7910/DVN/OABGY2. Additional data related to this paper may be requested from the authors.

SUPPLEMENTARY MATERIALS

Supplementary material for this article is available at http://advances.sciencemag.org/cgi/content/full/5/9/eaax3323/DC1

Section S1. Geographic distribution of respondents

Section S2. Wording of experimental treatments

Fig. S1. Geographic distribution of respondents compared to population distribution.

Fig. S2. Market size of respondents’ location.

REFERENCES AND NOTES

- 1.United Nations Environment Program, Emissions Gap Report 2018 (United Nations Environment Program, 2018). [Google Scholar]

- 2.Intergovernmental Panel on Climate Change, Global Warming of 1.5°C: An IPCC Special Report on the Impacts of Global Warming of 1.5°C Above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change (Intergovernmental Panel on Climate Change, 2018). [Google Scholar]

- 3.Intergovernmental Panel on Climate Change, Climate Change 2014: Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change, Core Writing Team, R. K. Pachauri, L. A. Meyer, Eds. (Intergovernmental Panel on Climate Change, 2014). [Google Scholar]

- 4.World Bank and Ecofys, State and Trends of Carbon Pricing 2018 (May) (World Bank, 2018). [Google Scholar]

- 5.Ross M. L., Hazlett C., Mahdavi P., Global progress and backsliding on gasoline taxes and subsidies. Nat. Energy 2, 16201 (2017). [Google Scholar]

- 6.Carl J., Fedor D., Tracking global carbon revenues: A survey of carbon taxes versus cap-and-trade in the real world. Energy Policy 96, 50–77 (2016, 2016). [Google Scholar]

- 7.Haites E., Carbon taxes and greenhouse gas emissions trading systems: What have we learned? Clim. Policy 18, 955–966 (2018). [Google Scholar]

- 8.Kosnik L.-R., Cap-and-trade versus carbon taxes: Which market mechanism gets the most attention? Clim. Change 151, 605–618 (2018). [Google Scholar]

- 9.Carattini S., Carvalho M., Fankhauser S., Overcoming public resistance to carbon taxes. Wires Clim. Change 9, e531 (2018). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Klenert D., Mattauch L., Combet E., Edenhofer O., Hepburn C., Rafaty R., Stern N., Making carbon pricing work for citizens. Nat. Clim. Change 8, 669–677 (2018). [Google Scholar]

- 11.Jagers S., Martinsson J., Matti S., The impact of compensatory measures on public support for carbon taxation: An experimental study in Sweden. Clim. Policy 19, 147–160 (2018). [Google Scholar]

- 12.Climate Leadership Council, The Dividend Advantage (2018); www.clcouncil.org/media/The-Dividend-Advantage.pdf

- 13.Porter M. E., America’s green strategy. Sci. Am. 264, 168 (1991). [Google Scholar]

- 14.R. A. Mooij, The double dividend of an environmental tax reform, in Handbook of Environmental and Resource Economics, J. C. J. M. van der Bergh, Ed. (Edward Elgar, 1999). [Google Scholar]

- 15.Jaeger W. K., The welfare effects of environmental taxation. Environ. Resour. Econ. 49, 101–119 (2011). [Google Scholar]

- 16.Freire-González J., Environmental taxation and the double dividend hypothesis in CGE modelling literature: A critical review. J. Policy Model. 40, 194–223 (2018). [Google Scholar]

- 17.Kotchen M. J., Turk Z. M., Leiserowitz A. A., Public willingness to pay for a US carbon tax and preferences for spending the revenue. Environ. Res. Lett. 12, 094012 (2017). [Google Scholar]

- 18.Carattini S., Baranzini A., Thalmann P., Varone F., Vöhringer F., Green taxes in a post-Paris world: Are millions of nays inevitable? Environ. Resour. Econ. 68, 97–128 (2017). [Google Scholar]

- 19.Carattini S., Kallbekken S., Orlov A., How to win public support for a global carbon tax. Nature 565, 289–291 (2019). [DOI] [PubMed] [Google Scholar]

- 20.Beiser-McGrath L. F., Bernauer T., Commitment failures are unlikely to undermine public support for the Paris agreement. Nat. Clim. Change 9, 248–252 (2019). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Shwom R., Bidwell D., Dan A., Dietz T., Understanding U.S. public support for domestic climate change policies. Glob. Environ. Chang. 20, 472–482 (2010). [Google Scholar]

- 22.Kaplowitz S. A., McCright A. M., Effects of policy characteristics and justifications on acceptance of a gasoline tax increase. Energy Policy 87, 370–381 (2015). [Google Scholar]

- 23.Fairbrother M., When will people pay to pollute? Environmental taxes, political trust and experimental evidence from Britain. Br. J. Polit. Sci. 49, 661–682 (2019). [Google Scholar]

- 24.Fairbrother M., Rich people, poor people, and environmental concern: Evidence across nations and time. Eur. Soc. Rev. 29, 910–922 (2013). [Google Scholar]

- 25.Klenert D., Mattauch L., How to make a carbon tax reform progressive: The role of subsistence consumption. Econ. Lett. 138, 100–103 (2016). [Google Scholar]

- 26.Gonand F., The carbon tax, ageing and pension deficits. Environ. Model. Assess. 21, 307–322 (2016). [Google Scholar]

- 27.Pew Research Center, Climate Change Still Seen as the Top Global Threat, but Cyberattacks a Rising Concern (Pew Research Center, 2019). [Google Scholar]

- 28.Ricke K., Drouet L., Caldeira K., Tavoni M., Country-level social cost of carbon. Nat. Clim. Change 8, 895–900 (2018). [Google Scholar]

- 29.Wlezien C., The public as thermostat: Dynamics of preferences for spending. Am. J. Polit. Sci. 39, 981–1000 (1995). [Google Scholar]

- 30.Anderson B., Böhmelt T., Ward H., Public opinion and environmental policy output: A cross-national analysis of energy policies in Europe. Environ. Res. Lett. 12, 114011 (2017). [Google Scholar]

- 31.M. Olson, The Logic of Collective Action: Public Goods and the Theory of Groups (Harvard Univ. Press, 1965). [Google Scholar]

- 32.Stigler G. J., The theory of economic regulation. Bell J. Econ. Manag. Sci. 2, 3–21 (1971). [Google Scholar]

- 33.Levy D. L., Business and international environmental treaties: Ozone depletion and climate change. Calif. Manag. Rev. 39, 54–71 (1997). [Google Scholar]

- 34.Baranzini A., Carattini S., Effectiveness, earmarking and labeling: Testing the acceptability of carbon taxes with survey data. Environ. Econ. Policy Stud. 19, 197–227 (2017). [Google Scholar]

- 35.Baranzini A., van den Bergh J. C. J. M., Carattini S., Howarth R. B., Padilla E., Roca J., Carbon pricing in climate policy: Seven reasons, complementary instruments, and political economy considerations. Wires Clim. Change 8, e462 (2017). [Google Scholar]

- 36.Harring N., Reward or punish? Understanding preferences toward economic or regulatory instruments in a cross-national perspective. Polit. Stud. 64, 573–592 (2015). [Google Scholar]

- 37.Eriksson L., Garvill J., Nordlund A. M., Acceptability of single and combined transport policy measures: The importance of environmental and policy specific beliefs. Transp. Res. A 42, 1117–1128 (2008). [Google Scholar]

- 38.Hainmueller J., Hopkins D. J., Yamamoto T., Causal inference in conjoint analysis: Understanding multidimensional choices via stated preference experiments. Polit. Anal. 22, 1–30 (2013). [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Supplementary material for this article is available at http://advances.sciencemag.org/cgi/content/full/5/9/eaax3323/DC1

Section S1. Geographic distribution of respondents

Section S2. Wording of experimental treatments

Fig. S1. Geographic distribution of respondents compared to population distribution.

Fig. S2. Market size of respondents’ location.