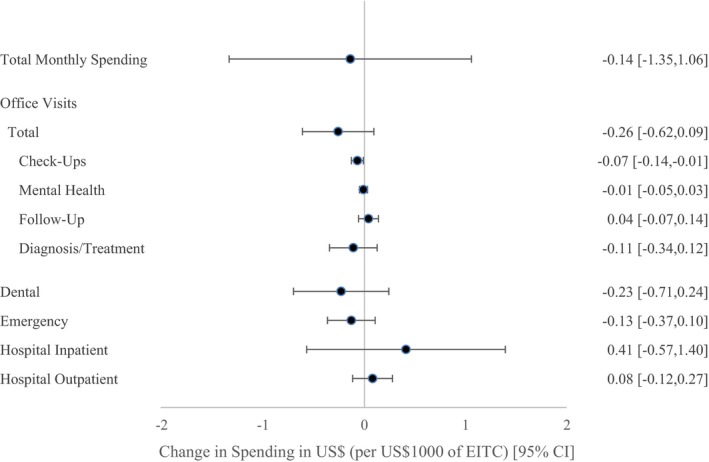

Figure 3.

Effects of the earned income tax credit on short‐term out‐of‐pocket health care expenditures, February‐March specification [Color figure can be viewed at wileyonlinelibrary.com]

Note: N = 1 282 080 adults surveyed in the 1997‐2012 waves of the Medical Expenditure Panel Survey. EITC: earned income tax credit. Estimates derived from multivariable linear regressions using difference‐in‐differences analyses, adjusting for gender, race, marital status, a third‐degree polynomial for age (ie, age, age‐squared, age‐cubed), a fifth‐degree polynomial for family income, number of children in the household, number of adults in the household, insurance status, and year. Observations during the months of February and March were considered to fall in the “treatment” window. Expenditures on provider visits were reported on a monthly basis for each individual in the family. Robust standard errors clustered at the family level.