Abstract

China has had a large gender gap in labor force participation, sectors of employment, and earnings. This study shows that disadvantages in the labor market for women are the primary drivers of the gender pension gap. Among people age 60 and older, women receive about half of the amount of men’s social pensions. Using the 2013 wave of China Health and Retirement Longitudinal Study (CHARLS) and the CHARLS Life History Survey of 2014, this contribution has three main findings. First, about three-quarters of the deficit in women’s pensions is explained by women’s lower likelihood of receiving occupational pensions, and one-third is due to smaller benefits when they do receive them. Second, the gender deficit in receiving an occupational pension can be explained by education level and employment sector. Third, among pension recipients, nearly one-third of the gender benefit gap is explained by women’s fewer years of employment and lower salaries.

Keywords: Gender pension gap, occupational segregation, employment history, statutory retirement age, China

INTRODUCTION

China has achieved a dramatic reduction in poverty as a result of economic development (Park and Sangui 2014). While regionally oriented development efforts have alleviated poverty in many of the previously poor areas, poverty among the elderly has emerged as a notable social problem, even in non-poor regions. According to the 2013 wave of the China Health and Retirement Longitudinal Study (CHARLS), if we measure the standard of living using per capita consumption and apply a US$1.8 per day poverty line, 16.6 percent of Chinese age 60 and older lived in poverty.1 This figure is much higher than the national poverty rate for the population as a whole.2 A substantial gender difference exists in poverty rates. Of all people age 60 and older, 17.3 percent of women live in poverty, whereas15.9 percent of older men do. The gender difference is even larger for older groups. Among those 75 and older, 19.2 percent of women are poor, in contrast to 15.5 percent of men.

In developed countries, poverty is found to be more prevalent among elderly women, and the gender gap in social security coupled with women’s longer life expectancy are seen as the main reasons (Stark et al. 2005; Gornick et al. 2009). In developing countries, family, rather than a social pension, has traditionally been the safeguard against poverty. However, with rapid declines in fertility and out-migration of children, family support is gradually becoming unreliable, and social pensions are expected to play a larger role in determining the livelihood of the elderly.

The CHARLS data reveal a substantial gender gap in pension benefits, with women receiving less than half of the amount of men’s pensions (Table 1). Due to data limitations in the past, this large gender gap in pension benefits has received little attention in academic research, and no serious efforts have been made to understand the source of this difference. Our study will fill this gap by using the CHARLS data.

Table 1.

Pension coverage and benefits of Chinese age 60 and older

| All | |||

|---|---|---|---|

| Men | Women | Total | |

| Mean monthly pension (yuan) | 833 | 411 | 623 |

| Any public pension (%) | 75.4 | 69.1 | 72.2 |

| Monthly pension among recipients (yuan) | 1,105 | 595 | 862 |

| Public Sector Pension (%) | 11.8 | 4.8 | 8.3 |

| Monthly pension (yuan) | 3,162 | 2,592 | 2,999 |

| Firm Workers Pension (%) | 19.1 | 11.9 | 15.5 |

| Monthly pension (yuan) | 2,109 | 1,744 | 1,969 |

| Urban Resident Pension (%) | 1.5 | 3.2 | 2.3 |

| Monthly pension (yuan) | 1,101 | 1,170 | 1,148 |

| New Rural Resident Pension (%) | 41.6 | 47.8 | 44.7 |

| Monthly pension (yuan) | 86 | 81 | 83 |

| Unified Urban and Rural Resident Pension (%) | 1.3 | 1.5 | 1.4 |

| Monthly pension (yuan) | 314 | 325 | 320 |

Notes: All numbers are weighted.

Previous literature has shown that the gender pension gap is a derivative of the gender wage gap (Vara 2013; Möhring 2015). The concentration of women’s employment in sectors that offer lower pension benefits is also one of the causes of the pension gap (Warren 2006). Research on developed countries has documented substantial gender differences in labor force participation, sectors of employment, hours of paid work, and hourly earnings (Killingsworth and Heckman 1986; Altonji and Blank 1999; Elborgh-Woytek et al. 2013). The gender wage gap in the Chinese urban labor market is also substantial and has been rising since marketization reforms (Zhang et al. 2008). Thus, the first goal of this study is to demonstrate how gender differences in the labor market contribute to the gender pension gap in older age.

Due to the existence of a large informal sector that was not covered by Chinese social insurance until recently, participation in formal sector employment has been a defining characteristic of the Chinese labor market and likely a key factor determining the amount of pension a person receives. Therefore, to explain the gender pension gap, we first focus on gender differences in terms of enrollment in the generous occupational pension programs, and then we explain the coverage and benefit gaps in these programs with reference to the length of labor force participation and earnings while working.

Even if women participate in the privileged formal sector, they are still punished for leaving the labor market at a much younger age than men – very often by five or ten years in China. The gap is due mainly to the retirement policy, but other forces are at play as well.3 For instance, during the public sector restructuring in the late 1990s, women were more likely than men to be laid off (Appleton et al. 2002). Additionally, women are more likely than men to take the responsibility of caring for grandchildren or elderly parents, and caregiving reduces one’s labor force participation (Liu, Dong, and Zheng 2010; Mao, Connelly, and Chen 2017; Wang and Zhang 2017). If retirement occurs at a point when women’s age-earning profile is rising, retiring earlier may incur a substantial loss in pension benefits. This is especially the case in China, where pension benefits are determined solely by earnings in the terminal year of employment multiplied by a replacement rate based on years of employment. Although existing research has examined the effect of career interruptions on the gender pension gap in Spain (Cebrián and Moreno 2015) or retrospective employment experience in the United States and United Kingdom (Even and MacPherson 1994; Bardasi and Jenkins 2010), much less attention has been paid to the fact that, in China, the length of a woman’s career is often cut short by earlier mandatory retirement ages. We will show that the large gender difference in retirement age has a statistically significant and negative impact on women’s pension eligibility and benefits.

PUBLIC PENSION PROGRAMS AND RETIREMENT IN CHINA

In most years since 1949, social pensions in the People’s Republic of China have only been available to formal sector workers in urban areas. Prior to the onset of the economic reforms in the 1980s, employees became eligible for pension upon reaching retirement age without having to make individual or employer contributions. The statutory retirement age was set at 60 for men, 50 for blue-collar women workers, and 55 for white-collar workers.4 These retirement ages remain effective today. A minimum of fifteen years of service is required to receive pension benefits, but the replacement rate goes up with more years of employment. The amount of the pension is based on the salary of the last year of employment multiplied by the replacement rate.

Starting in the mid 1990s, the government reformed the pension system for employees of firms, but left the system intact for public sector employees (civil servants and government-funded noncommercial institutions, such as schools and hospitals). The new pension scheme for firms included contributions by both the employee and the employer, but pension benefits remained largely pay-as-you-go, with a small element of individual accounts (Zhao and Xu 2002). This reform effectively lowered the replacement rate among firm retirees, setting the stage for diverging benefits between public sector and firm employees. In 2016, to counter tremendous resentment among firm employees and promote mobility between the two sectors, the government also began to require contributions by public sector employees in an effort to unify the two systems.

Despite controversies, the two occupational pension programs (public sector pensions, covering civil servants and employees in government-funded institutions, and firm workers’ pensions, covering employees in urban firms) were the only pension programs for a long time but covered only a small segment of the Chinese population. The vast majority of the population (that is, those in rural areas) was not covered, and neither were the self-employed or those not working in the labor market in urban areas. Since embarking on economic reforms in the early 1980s, the urban informal sector has grown substantially, drawing a workforce from rural migrants, new job-market entrants, and those who had lost jobs in the state sectors. Women were laid off at a much higher rate than men during the economic restructuring in the 1990s. At the same time, more women than men have precipitously withdrawn from the workforce for family reasons (Zhang et al. 2008). As a result, a gender disparity has emerged in pension program coverage.

Since the late 1990s, the government has opened up enrollment to include private enterprises and later allowed the self-employed to participate. However, many employees choose not to join or to collude with their employers to underreport their wages (Zhao and Xu 2002). Since 2009, a pension program for rural residents (New Rural Pension Program [NRPP]) has been established to cover rural residents regardless of employment status, and the Urban Resident Pension (URP) covered those not working in the labor market in urban areas. In some provinces, the two residential pension programs have been combined into one, namely the Unified Urban and Rural Resident Pension. Unlike the two occupational pension programs (Public Sector Pension and Firm Workers Pension), which determine benefits based on employment history, the two residential pension programs made those older than age 60 immediately eligible for a basic pension benefit without ever contributing, though younger persons must first contribute.

By 2013, the two residential pension programs covered most of the population not previously covered by an occupational pension and became the largest pension programs in China in terms of enrollment. However, as we show later, the amounts of benefits are enormously different, and this segmentation explains a substantial amount of the gender pension gap.

DATA AND DESCRIPTIVE STATISTICS

The survey

We use the 2013 wave of the CHARLS, a nationally representative longitudinal survey of middle-aged and older people in China collected by the Institute of Social Science Surveys of Peking University (CHARLS n.d.; Zhao et al. 2014). The national baseline survey of CHARLS was conducted in 2011 and 2012 and covers 150 randomly selected county-level units (county or city districts) and 450 village-level units (villages in rural areas and urban resident communities in urban areas). The 2013 wave of the CHARLS survey included 18,613 respondents in 10,807 households. Information about pension incomes, as well as demographic information, is derived from this dataset.

Additionally, we rely on the CHARLS Life History Survey conducted on the same respondents in 2014 for information on their employment history (CHARLS Life History Survey n.d.). This survey, collected by the CHARLS team, is a retrospective survey documenting events in migration, family, health, education, and employment of the CHARLS respondents since they were born. To ensure the accuracy of answers, the survey uses the event-history calendar method: respondents were first reminded of the timing of important national events, then, as personal history unfolded, important events in the respondents’ residential and family histories were used to anchor answers to employment histories. In this way, the survey successfully recorded all employment episodes lasting at least six months. For each employment episode, the beginning and ending salaries were requested, and the salary at the mid-point was requested for employment lasting more than twenty years.

We restrict our attention to people older than age 60 because this is when men retire and start to collect pensions. This results in a sample of 8,116 respondents – 4,040 women and 4,076 men (Table 2). Among these, 75.5 percent held rural hukou (registration status) and 24.5 percent had urban hukou. The average age was 69.3 years (69.1 for men and 69.4 for women). The level of education of this group was quite low; 36.8 percent were illiterate, with women having a much higher illiteracy rate than men (19.6 percent among men versus 54.1 percent among women). Only 19.6 percent of this population completed junior high school or more (11.8 percent of the women and 27.4 percent of the men). Many had lost their spouse and remained single (30.7 percent of women and 14.1 percent of men).

Table 2.

Summary statistics

| All | Men | Women | |

|---|---|---|---|

| Age (years) | 69.3 | 69.1 | 69.4 |

| Agriculture hukou (current hukou; %) | 75.5 | 72.5 | 78.6 |

| Agriculture hukou (first hukou; %) | 87.9 | 87.0 | 88.8 |

| Education (%) | |||

| Illiterate | 36.8 | 19.6 | 54.1 |

| Did not finish primary school | 20.7 | 23.3 | 18.2 |

| Finished primary school | 22.9 | 29.8 | 16.0 |

| Junior high school | 12.3 | 17.1 | 7.5 |

| Senior high school and above | 7.3 | 10.3 | 4.3 |

| Unmarried (%) | 22.4 | 14.1 | 30.7 |

| N | 8,116 | 4,076 | 4,040 |

Pension enrollment and benefits

Due to the expansion of the two residential pension programs, the enrollment rate in any pension program reached 72.2 percent by 2013, with 80.2 percent enrollment among urban residents and 68.6 percent among rural residents (Table 1). The NRPP had become the largest pension program in terms of coverage, benefiting 44.7 percent of all people older than 60. The second largest was the Firm Workers Pension, covering 15.5 percent, followed by the Public Sector Pension, which covered 8.3 percent. The two smallest programs were the URP Program, covering only 2.3 percent of the older people, and the Unified Urban and Rural Pension Program, covering 1.4 percent. The government is currently moving to unify all urban and rural pension programs; thus, in the future, there will be an expansion of the unified program and shrinkage in the urban and rural resident pension programs.

Large differences exist in benefits across the pension programs. The two occupational pension programs afford much higher benefits than the three residence-based programs. The average pension benefit for the Public Sector Pension is the highest (2,999 yuan), followed by the Firm Workers Pension (1,969 yuan). Residential pensions are considerably less generous. Of the three, the URP pays the most (1,148 yuan), followed by Unified Urban and Rural Resident Pension (320 yuan); the least generous is the NRPP (83 yuan). These large differences have been noted by Lijian Wang, Daniel Béland, and Sifeng Zhang (2014).

Gender gap in pension coverage and benefits

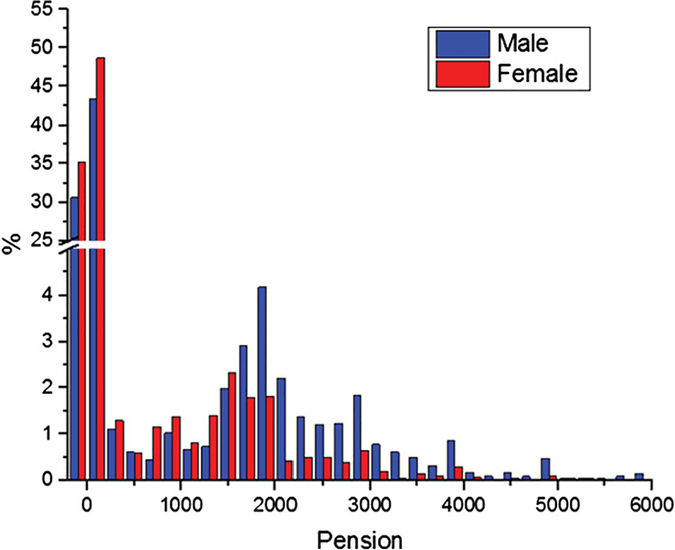

Figure 1 shows the distribution of pension benefits by gender for all respondents older than age 60, including those who do not receive a pension. Clearly, women are disproportionately represented among those not receiving a pension or receiving low pension incomes.

Figure 1.

Distribution of public pension incomes

Average benefits by gender, hukou, and program type are reported in Table 1. Overall, women receive an average of 411 yuan per month, less than half of the 833 yuan received by men. The pension coverage rate for women is 6.3 percentage points lower (75.4 percent for men versus 69.1 percent for women). Conditional on receiving pensions, women receive 595 yuan per month, whereas men receive 1,105 yuan.

Given the large benefit differences across types of pension programs detailed above, it is to be expected that if women are disproportionately placed in low-benefit programs, they will receive fewer benefits. This is confirmed in Table 1. While 11.8 percent of men receive the Public Sector Pension, only 4.8 percent of women do; 19.1 percent of men receive the Firm Workers Pension, but only 11.9 percent of women do.

Not only are women less likely to receive an occupational pension, they also receive fewer benefits when they do receive a pension. Among recipients of the Public Sector Pension, men receive an average of 3,162 yuan, whereas women receive 2,592 yuan. Among beneficiaries of the Firm Workers Pension, men receive an average of 2,109 yuan, compared with 1,744 yuan for women.

CONTRIBUTIONS OF PENSION TYPES TOWARD THE GENDER PENSION GAP

Given the large differences in benefit levels across pension types and the large gender gap for the most generous types of pension programs, we investigate how much of the gender pension gap is due to the enrollment gap and how much is due to benefit gaps within programs. This distinction is important because these two sources of the gender gap warrant different policy responses. While both are related to labor market outcomes, the enrollment gap can be fixed by extending the Firm Workers Pension to the entire population in the labor market, whereas the benefit gap reflects gender differences in labor market outcomes.

To discuss the respective contributions of enrollment and within-program benefits to the total gender gap, we first introduce the formula of the average benefits for each sex as the weighted average of the benefits of all programs, with the weights being the probability of receiving that type of pension. We then rearrange terms to obtain the part of the pension gap due to program differences and the part due to benefit differences within each program. The decomposition procedure is as follows:

| (1) |

where and are the mean pension income for all older men and women, respectively. Subscript n (n = 1 . . . 6) represents each of the five pension programs plus those who did not receive pensions. Since the mean pension for non-pensioners is 0, it will be dropped out, and not affect the result. and are the enrollment rates of the nth pension program for men and women, respectively. and are the mean pension benefits of the nth pension program for men and women, respectively.

The first term of the last line in Equation 1 is the gender pension gap due to enrollment differences. It is the sum of gender difference in enrollment rate for each program weighted by the mean pension benefits of both sexes, given enrollment in that program. The second term is the gender pension gap due to benefits differences within each program. It is the sum of the gender gaps within each pension program weighted by the mean enrollment rate of both sexes in that program.

Table 3 shows the decomposition results. Overall, the gender gap in program enrollment is the primary contributor to the gender pension gap, accounting for three-quarters of the gap. The remaining one-quarter is explained by within-program benefit differences. Looking at each individual program, we find that the gender participation gap for the Public Sector Pension has the largest explanatory power, accounting for 48 percent of the pension gap, followed by the participation gap for the Firm Workers Pension, which explains 33 percent. Although not the dominant factor contributing to the gender pension gap, within-program gender benefit gaps in these two occupational pension programs contribute significantly to the gap: the Public Sector Pension contributes 11 percent and the Firm Workers Pension 13 percent. Contributions by the three types of resident pension programs are mostly negligible, with the exception of the URP, for which the gender participation gap narrowsthe gender pension gap by 5 percent.

Table 3.

Decomposition of gender pension gap for the elderly, by pension type

| Due to benefits difference | Due to benefits difference | |||

|---|---|---|---|---|

| Total pension gap (yuan 422) | Yuan | % | Yuan | % |

| Part A: Decomposition of pension gap based on five pension categories | ||||

| Public Sector Pension | 203 | 48.1 | 47 | 11.2 |

| Firm Workers Pension | 140 | 33.1 | 57 | 13.4 |

| Urban Resident Pension (URP) | − 19 | − 4.6 | −2 | −0.4 |

| New Rural Resident Pension | − 5 | −1.2 | 2 | 0.5 |

| Unified Urban and Rural Resident Pension | 0 | − 0.1 | 0 | 0.0 |

| Total | 318 | 75.3 | 104 | 24.7 |

| Part B: Decomposition of pension gap based on two pension categories | ||||

| Occupational Pension | 322 | 76 | 125 | 30 |

| Residents Pension | − 11 | −3 | − 13 | −3 |

| Total | 310 | 74 | 111 | 26 |

Notes: All numbers are weighted.

One important message evident in the decomposition analysis above is that the two occupational pensions (Public Sector Pension and Firm Workers Pension) more than explain all of the pension gender gaps. Enrollment gaps in these two types of pensions together explain 81.2 percent (48.1 percent plus 33.1 percent), and benefit gaps explain 24.6 percent (11.2 percent plus 13.4 percent). This leads us to shift our attention to these two programs.

In what follows, we explain gender differences in participation and within-program benefits. We will simplify the analysis by combining these two types of pension programs into one occupational pension and combining the three resident pension programs into one resident pension. This will allow us to analyze the generous occupational pensions relative to the others. This simplification will not cause a loss of generality because both the Public Sector Pension and Firm Workers Pension are provided by the employer and have similar screening mechanisms, although government jobs are more prestigious. Similarly, the participation mechanisms for the three resident pension programs are also similar; that is, anyone without an occupational pension is eligible at retirement age.

Before turning our focus to the occupational pension, we add a decomposition of gender pension benefits based on dividing all pensions programs into two – the occupational pension and the resident pension. This will be useful when we compute the contribution of factors that are important in getting access to an occupational pension to the overall gender pension gap. The decomposition of pension gap based on two instead of five pension categories is methodologically similar to the previous decomposition, so we omit the formula here. The results are presented in Table 3. Of the entire gender pension gap, 76 percent is due to the gender gap in receiving an occupational pension, and 30 percent is due to the benefits difference within the occupational pension. The contribution of participation in occupational programs in this two-category decomposition (76 percent) is somewhat smaller than what we found by adding up the contributions of participation in the Public Sector Pension and Firm Workers Pension in the previous five-category decomposition (81.2 percent). This is because there is a barrier between these two types of pensions that contributes to the overall pension gap; thus, when the two types are combined into one, this contribution is lost.

EXPLAINING PENSION COVERAGE AND BENEFIT GAPS

We have shown that women’s deficit in pension incomes can be explained by women having a lower likelihood of receiving an occupational pension and smaller benefits when they do receive them. Next, we examine which factors contribute to women’s disadvantages in occupational pension eligibility and benefit levels. Because the pension system was designed to be gender neutral, any difference at the retirement stage should derive from differential labor market experiences in the past. We employ the Oaxaca- Blinder-style decomposition (Blinder 1973; Oaxaca 1973). This method requires regressing by men and women separately the outcome of interest against a host of variables that help to explain the gender difference. The raw difference in the outcome variable is then decomposed into a part that is due to differences in the explanatory variables and another that is due to differences in coefficients.

Gender gap in receiving an occupational pension

Receiving a generous occupational pension is a later-life outcome of labor market experiences, thus we first focus on explanatory variables that are commonly used in earnings equations – that is, age, education, and the type of hukou. Because all the respondents had passed the age of retirement, age is a reflection of cohort differences. We expect education to affect access to the occupational pension and pension benefits. We include the type of hukou (agricultural or nonagricultural) at birth to indicate rural or urban origin.5 As discussed above, access to occupational pensions was historically limited to employees of the government, government-run institutions, and state-owned enterprises, therefore we include ownership categories of employment before a person retired in the regressors: self-employed farming, self-employed nonfarm business, government, government-run institutions, state-owned enterprises, collective enterprises, other enterprises (private or joint venture), and informal sector. We define the ownership categories at age 45 for each person, rather than at the actual retirement age, because the retirement age differs across individuals and may be influenced by access to an occupational pension. Many people eligible for early retirement in the state sector start collecting pensions prior to the statutory retirement age and go to work in self-employment or the private sector. Age 45 is five years prior to the statutory retirement age for women blue-collar workers and should give a good representation of the career.

Table 4 presents Probit regression results of receiving the occupational pension, with the dependent variable being set at 1 if he or she receives one. Column 1 pools men and women, and columns 2 and 3 are separate regressions. We reduced the sample size used in these analyses by 911 people due to missing life-history information. In line with Equation 2, we use coefficients from the equations using men’s samples as a benchmark to evaluate the part of gender difference in receiving an occupational pension due to differences in explanatory variables. We use coefficients in separate regressions to evaluate the effect of “prices.”

Table 4.

Probit regressions of occupational pension programs participation (Dependent variable: 1 = having occupational pension)

| Marginal effects (standard error) | Mean value of variables (standard deviation) | ||||

|---|---|---|---|---|---|

| Variables | (1) All | (2) Men | (3) Women | (4) Men | (5) Women |

| Having occupational pension | 0.232 (0.422) |

0.118 (0.322) |

|||

| Female | − 0.018*** (0.006) |

||||

| Age | 0.002*** (0.000) |

0.002*** (0.001) |

0.001 (0.001) |

69.005 (6.538) |

69.158 (6.998) |

| Agriculture hukou (first hukou) | − 0.084*** (0.008) |

− 0.106*** (0.014) |

- 0.056*** (0.008) |

0.902 (0.297) |

0.913 (0.281) |

| Education (Base: Illiterate) | 0.197 (0.398) |

0.545 (0.498) |

|||

| Did not finish primary school | 0.025*** (0.009) |

0.027* (0.016) |

0.016 (0.010) |

0.238 (0.426) |

0.184 (0.388) |

| Finished primary school | 0.054*** (0.008) |

0.063*** (0.015) |

0.037*** (0.009) |

0.303 (0.459) |

0.160 (0.366) |

| Junior high school | 0.075*** (0.009) |

0.070*** (0.016) |

0.082*** (0.011) |

0.169 (0.375) |

0.073 (0.260) |

| Senior high school and above | 0.110*** (0.011) |

0.134*** (0.018) |

0.074*** (0.013) |

0.094 (0.291) |

0.037 (0.190) |

| Work unit type at age 45 (Base: Agriculture sector) | 0.575 (0.494) |

0.679 (0.467) |

|||

| Government | 0.219*** (0.011) |

0.269*** (0.015) |

0.184*** (0.022) |

0.048 (0.215) |

0.008 (0.0908) |

| Government-run institution | 0.248*** (0.010) |

0.309*** (0.015) |

0.188*** (0.013) |

0.061 (0.240) |

0.031 (0.174) |

| Stated-owned enterprise | 0.257*** (0.008) |

0.329*** (0.012) |

0.186*** (0.011) |

0.107 (0.309) |

0.055 (0.227) |

| Collective-owned enterprise | 0.193*** (0.011) |

0.225*** (0.018) |

0.168*** (0.014) |

0.029 (0.168) |

0.020 (0.140) |

| Other enterprise | 0.115*** (0.025) |

0.133*** (0.037) |

0.106*** (0.035) |

0.008 (0.0879) |

0.003 (0.0526) |

| Informal sector | 0.063*** (0.011) |

0.073*** (0.017) |

0.056*** (0.017) |

0.068 (0.251) |

0.026 (0.159) |

| Unit type missing | 0.087*** (0.008) |

0.100*** (0.014) |

0.074*** (0.009) |

0.104 (0.305) |

0.179 (0.383) |

| Province | Yes | Yes | Yes | ||

| Observations | 7,205 | 3,599 | 3,606 | 3,599 | 3,606 |

Notes:

denote statistical significance at the 1, 5, and 10 percent levels, respectively.

Because sample means are used in the decomposition, we also report mean values of explanatory variables by gender and their standard deviations in Table 4, columns 4 and 5. We skip the discussion of gender differences in age, education, and hukou, as they are similar to those reported in Table 2. The differences in employment ownership at age 45 have not been discussed elsewhere, so we will take a close look at them now. The means reveal the expected patterns: women are disproportionately employed in sectors that have lower pay and benefits, and they are underrepresented in sectors that have higher pay and benefits. Self-employed agriculture, being the least-favored, but dominant, sector of employment among our respondents at age 45, saw many more women than men – 67.9 percent versus 57.5 percent. The most favored sector, namely government, had 4.8 percent of men but only 0.8 percent of women. The next most favored sector, government-run institutions, employed 6.1 percent of men and 3.1 percent of women. State-owned enterprises, being the largest nonfarm employer and also the preferred employer of all types of firms among our older respondents when they were age 45, also employed twice as many men as women – 10.7 percent versus5.5 percent.

All the characteristics in which women have disadvantages – hukou, education, and sectors of employment – can raise the probability of receiving an occupational pension. We use the pooled model in Table 4, column 1 to demonstrate these correlations.

Having agricultural hukou in the past reduces the likelihood of receiving an occupational pension by 8.4 percentage points (35.3 percent). Education also has large and statistically significant correlations with pension status. Compared with the illiterate who have no schooling, those who attended but did not graduate, primary school graduates, junior high school graduates, and those who finished senior high school and above are 2.5 percentage (10.5 percent), 5.4 percentage points (22.7 percent),7.5 percentage points (31.5 percent), and 11.0 percentage points (46.2 percent) more likely to receive an occupational pension, respectively. Because we have already controlled for the sector of employment in the regression, these large educational gradients may reflect the quality of employment within each sector. For example, state-owned enterprises used to hire urban local workers on a permanent basis with social protections, whereas others, such as rural migrant workers, were hired as temporary workers without social insurance.

As expected, employment type at age 45 is highly correlated with receiving an occupational pension. Compared with workers in the agricultural sector, those who have worked in government (institutions) are 21.9 (24.8) percentage points more likely to receive an occupational pension, and those who have worked in state-owned enterprises (collective enterprises) have a 25.7 (19.3) percentage point higher likelihood of receiving an occupational pension. Other (mainly private) enterprises or nonfarm self-employment also have an advantage over farming, but the magnitudes of the marginal effects are much smaller, at 11.5 and 6.3 percentage points, respectively.

After controlling for education, hukou, and sector of employment, the probability of women receiving an occupational pension is only 1.8 percentage points lower than men. Considering that the total gender difference in the likelihood of receiving an occupational pension is 11.4 percentage points, almost all of the gender difference is explainable. We will confirm this with decomposition next.

Because the regression models by gender are nonlinear, we employ a modified decomposition method developed by Myeong-Su Yun (2004). Given a regressions model of P(Y = 1) = Φ (X, β), where Φ is a standard normal cumulative distribution function and X and β are vectors of independent variables and coefficients, respectively, the mean gender difference in Y can be decomposed as:

| (2) |

where i denotes one of K explanatory variables, subscripts m and f denote men and women, respectively, is a weight indicating the share of contribution of a particular explanatory variable (coefficient) in the gender differences explained by all explanatory variables (coefficients), and the “over bar” represents the value of the sample average.

The decomposition results are presented in Table 5. Of the gender difference in occupational pension participation (14.2 percentage points), the type of employment at age 45 explains 53.1 percent and education explains 41.7 percent of the gender gap. These two factors together explain 96 percent of the gender difference in receiving an occupational pension. Differences in age, province, and type of hukou at birth contribute little to the pension participation gap because the gender gap for receipt of an occupational pension in these dimensions is not large.

Table 5.

Decomposition of gender gap in occupational pension participation

| Participation difference (men—women) | Percent | |

|---|---|---|

| Difference | 0.112 | 100 |

| Explained | 0.106 | 94 |

| Unexplained | 0.007 | 6 |

| Explained | ||

| Age | − 0.000 | − 0.3 |

| First hukou type | 0.002 | 1.4 |

| Education | 0.047 | 41.7 |

| Work unit type at age 45 | 0.060 | 53.1 |

| Province | − 0.002 | − 1.8 |

Gender gap in benefits

We now restrict our attention to those who have an occupational pension and examine factors contributing to the gender difference in pension amount. To enable the decomposition, we run three ordinary least squares (OLS) regressions of pension benefits, as shown in Table 6. Column 1 pools men and women, and columns 2 and 3 are for men and women separately. We also include mean values and standard deviations of the regressions in columns 4 and 5.

Table 6.

OLS regression of occupational pension programs benefits (Dependent variable: Logarithm of occupational pension benefits)

| Estimated coefficient (standard error) | Mean values of variables (standard deviation) | ||||

|---|---|---|---|---|---|

| Variables | (1) All | (2) Men | (3) Women | (4) Men | (5) Women |

| Occupational pension benefits | 2500.11 (2077.76) |

2061.42 (853.11) |

|||

| Female |

− 0.107*** (0.025) |

||||

| Age | 0.004** (0.002) |

0.004* (0.002) |

0.001 (0.003) |

69.86 (6.42) |

69.27 (6.46) |

| Agricultural hukou (current hukou) | 0.171*** (0.043) |

− 0.184*** (0.049) |

− 0.083 (0.119) |

0.098 (0.297) |

0.021 (0.142) |

| Education (Base: Illiterate) | 0.057 (0.232) |

0.119 (0.325) |

|||

| Did not finish primary school | − 0.057 (0.051) |

− 0.097 (0.071) |

0.009 (0.072) |

0.108 (0.311) |

0.092 (0.290) |

| Finished primary school | 0.034 (0.046) |

0.036 (0.065) |

− 0.001 (0.065) |

0.232 (0.422) |

0.198 (0.399) |

| Junior high school | 0.087* (0.046) |

0.102 (0.065) |

− 0.010 (0.063) |

0.284 (0.451) |

0.314 (0.465) |

| Senior high school and above | 0.292*** (0.046) |

0.302*** (0.065) |

0.233*** (0.066) |

0.319 (0.466) |

0.276 (0.448) |

| The type of retired unit (Base: Government) | 0.110 (0.313) |

0.038 (0.190) |

|||

| Government-run institution | − 0.069 (0.045) |

− 0.083 (0.053) |

0.004 (0.093) |

0.170 (0.376) |

0.167 (0.374) |

| Stated-owned enterprise | 0.224*** (0.044) |

0.242*** (0.054) |

− 0.164* (0.092) |

0.182 (0.386) |

0.324 (0.469) |

| Collective-owned enterprise | − 0.193*** (0.062) |

− 0.170* (0.091) |

− 0.149 (0.104) |

0.030 (0.171) |

0.092 (0.290) |

| Other enterprise | − 0.348** (0.153) |

− 0.355* (0.212) |

− 0.273 (0.220) |

0.005 (0.067) |

0.007 (0.083) |

| Enterprise (type missing) | − 0.184*** (0.058) |

− 0.193*** (0.071) |

− 0.133 (0.112) |

0.059 (0.235) |

0.058 (0.234) |

| Informal sector | − 0.319* (0.193) |

− 0.219 (0.357) |

− 0.384* (0.211) |

0.0015 (0.039) |

0.007 (0.083) |

| Unit type missing | − 0.209*** (0.040) | 0.221*** (0.047) |

− 0.181** (0.090) |

0.444 (0.497) |

0.307 (0.462) |

| Total years of work in a pension-eligible sector | 0.007*** (0.001) |

0.005*** (0.002) |

0.011*** (0.002) |

31.52 (7.736) |

26.49 (8.032) |

| Logarithm of wage at age 45 | 0.070*** (0.012) |

0.058*** (0.015) |

0.089*** (0.019) |

6.144 (0.959) |

5.821 (0.940) |

| Constant | 7.063*** (0.176) |

7.150*** (0.229) |

6.975*** (0.288) |

||

| Province | Yes | Yes | Yes | ||

| Observations | 958 | 665 | 293 | 665 | 293 |

| R-squared | 0.414 | 0.367 | 0.544 | ||

Notes:

denote statistical significance at the 1, 5, and 10 percent levels, respectively.

The dependent variable is the logarithm of the amount of occupational pension benefits. The amount of the occupational pension is jointly determined by salary at the point of retirement and total years of eligible employment. Therefore, in the regressions, we first include education as a measure of human capital that may affect both the salary level and length of employment. Because our respondents have all retired, the age variable in our model does not measure experience; rather, it measures cohort differences in pension benefits. We include the type of employment at retirement to capture segregations across sectors, with the classifications of the sectors the same as in Table 4.6 We add two more variables – total years of employment in eligible jobs and salary level at age 45, both derived from the CHARLS Life History Survey. For each job episode, the respondent reported whether the job offered retirement benefits, and we add up all years of employment for jobs that were eligible. Looking at the mean values in columns 4 and 5 in Table 6, we find that men have, on average, 31.5 years, whereas women have 26.5; the deficit for women is 5 years. We intend to use this variable to study the effect of retirement age policy on women’s pension benefits. Wage at age 45 is meant to capture the career wage level and is not affected by the retirement age. Because this age is substantially ahead of retirement, it should be a good indicator of the height of the age-earnings profile at prime age. On average, among people who receive occupational pension benefits, women’s wages at age 45 are 30 percent lower than men’s.

We now discuss the estimation results. As shown in column 1, women receive 10.7 percent less occupational pension benefits than men, conditional on other observed characteristics. The raw difference of gender benefits is 17.2 percent; thus, our model explains more than half of it. Having agricultural hukou in the past reduces occupational pension benefits by 17.1 percent. There is also a strong education gradient. Compared to people who are illiterate, those who have finished junior high school (senior high school and above) received 8.7 percent (29.2 percent) more benefits. As expected, the sector of employment is strongly associated with post-retirement pension benefit levels. Compared to retirees from the government sector, those who retire from state-owned enterprises, collective enterprises, other enterprises (mainly private enterprise), and the informal sector (mainly self-employed) receive 22.4 percent, 19.3 percent, 34.8 percent, and 31.9 percent less pension benefits, respectively.

Turning to our key variables of interest, total years of employment in the pension-eligible sector and wage at age 45 are both positively and statistically significantly associated with occupational pension benefits. One more year of paid work is associated with a 0.7 percent increase in pension benefits. A 1 percent increase in wage at age 45 is associated with a 0.07 percent increase in pension benefits.

The decomposition is a modified version of the Oaxaca–Blinder composition where the reference coefficient comes from the pooled regression (Neumark 1988) and shown in Table 7. Overall, gender differences in observed characteristics can explain 30.1 percent of the gender gap in occupational pension benefits, and this portion can be explained entirely by the gender gap in total years of pension-eligible employment (explaining 19.3 percent) and gender wage gap at age 45 (explaining another 13.0 percent). The gender education gap explains 6.8 percent of the benefits gap, and the gender difference in the type of employment explains 11.0 percent of the benefits gap. Gender differences in geographic location and hukou reduce the gender difference in pension benefits. This is because women are better represented in high pension areas and in urban hukou as a result of their higher labor force participation in more developed and urban areas. If we aggregate the effects of labor market characteristics (years of pension eligible work, wage, education, and type of employment), half of the gender pension gap in benefits is explained.

Table 7.

Decomposition of gender gap in occupational pension benefits

| Benefits difference (men-women) | Percent | |

|---|---|---|

| Difference | 0.172 | 100 |

| Explained | 0.052 | 30.1 |

| Unexplained | 0.120 | 69.9 |

| Explained | ||

| Age | 0.001 | 0.7 |

| Current hukou type | − 0.014 | − 8.4 |

| Education | 0.012 | 6.8 |

| Type of retired unit | 0.019 | 11 |

| Total years of work in the pension-eligible sector | 0.033 | 19.3 |

| Logarithm of wage at age of 45 | 0.022 | 13 |

| Province | − 0.021 | − 12.2 |

DISCUSSION AND CONCLUSION

Chinese women older than age 60 receive about half of what men receive from their social pensions. We investigated the causes of this gap using the 2013 wave of the CHARLS and the CHARLS Life History Survey of 2014. Three conclusions have emerged. First, nearly three-quarters of the gender pension gap can be explained by women’s lower likelihood of receiving an occupational pension that is offered to employees in the government, government-funded institutions, and urban firms, and the remaining quarter can be explained by the smaller amount of occupational benefits women receive if they have such a pension. Second, women’s disadvantages in receiving the occupational pension can be explained by the lower educational levels of women and sectors of employment. Third, among recipients of an occupational pension, nearly one-third of the gender benefit gap can be explained by women’s fewer years of employment and lower salaries before retirement.

Our results indicate that women’s disadvantages in labor force participation, sectors of employment, and earnings at working age are the primary drivers of the gender pension gap at older ages. The most notable labor market disadvantage affecting women’s old-age pensions is the disproportionate employment of women in low-benefit sectors, which compounds the old-age consequence of the educational deficit among older Chinese women. Additionally, the shorter span of women’s careers as a result of the differential retirement age policy has augmented women’s disadvantage in terms of market wages and has contributed substantially to lower pension benefits after retirement.

Our findings have important policy implications for reducing women’s poverty in old age. First, encouraging women to take part in nonfarm sector jobs can improve their access to occupational pensions. Past studies show that rural women are less likely to be employed in cities than men (Rozelle et al. 1999; Zhao 1999; Zhang, De Brauw, and Rozelle 2004). In urban areas, women’s labor force participation has also declined since the economic reforms (Zhang et al. 2008). An important barrier for women to take part in nonfarm formal sector employment has been the lack of childcare facilities (Du and Dong 2013). Thus, improving access to childcare services can raise women’s pension prospects.

Second, prolonging the length of women’s careers can narrow the gender benefit gap. The literature has shown that women have a higher likelihood of being laid off when employers downsize and face greater difficulty finding new employment afterward (Knight and Song 1995; Du and Dong 2009). The retirement age policy also forces women to retire earlier than men by five years or more. The current deficit in women’s number of years of employment in sectors that offer an occupational pension is exactly five years; thus, equalizing the retirement ages can immediately eliminate deficit in the length of employment for women. However, even if the policy allows women to retire at the same age as men, caregiving responsibilities may still force women to exit early. Women around age 50 shoulder the greatest burdens in caring for elderly parents and grandchildren. If women are to stay in the workforce longer, social support for the care of children and the elderly should be strengthened.

The third policy option is to allow women to share their husbands’ social pensions. Widely adopted in developed countries, this policy, or some variant of it, recognizes that women often sacrifice labor market earnings for the sake of their families and are thus more vulnerable in old age if their pension amount is solely determined by their contributions while in the labor market. Such a policy would reduce, rather than enlarge, as is the case with current policy in China, the gender gap in retirement incomes relative to the gender earnings gap in the labor market.

ACKNOWLEDGMENTS

We acknowledge support from the International Development Research Center of Canada (107579), the National Natural Science Foundation of China (71704147, 71450001, 71130002, 71603013), the Knowledge for Change Program at the World Bank (RF-P131518-RESE-TF015161), the National Institute on Aging (R01AG037031, R03AG049144), and the China Medical Board (16–249). We benefitted greatly from the comments and suggestions of Xiao-yuan Dong, Jin Feng, Fiona MacPhail, Nan Jia, Zhen Wang, and the three anonymous referees.

NOTES ON CONTRIBUTORS

Rui Zhao is Assistant Professor in the School of Economics at Southwest University of Political Science and Law in China. He holds a PhD in economics from Wuhan University. His research focuses on poverty and inequality, development economics, and labor economics.

Yaohui Zhao is Yangtze River Scholar Professor of economics at Peking University. She is the Principal Investigator of the China Health and Retirement Longitudinal Study (CHARLS), a nationally representative sample of Chinese residents age 45 and older. Her research interests include labor and demographic economics, social security system pertaining to the elderly, and health economics.

Footnotes

The latest official poverty line is 2,300 yuan per year, as published in 2011 (US$1.8 per day using the purchasing power parity exchange rate). We use this as the base for the rural poverty line and adjust for inflation to obtain the 2013 poverty line of 2,674 yuan in 2013. The urban poverty line takes into account the higher cost of living in urban areas and is set at 3,491 yuan.

The rural poverty rate in 2013 was 8.5 percent (calculated from National Bureau of Statistics of China [2014]). The urban poverty rate was not provided in official statistics. Since urban poverty is much less serious, the rural poverty rate is an overestimation of the national rate.

Requiring women to retire earlier than men is not unique to China. Until recently, many Organisation for Economic Co-operation and Development (OECD) countries had set earlier retirement ages for women, but over time, this practice has been abandoned or is in the process of being phased out (Latulippe 1993; OECD 2015). Many Eastern European and former Soviet-bloc countries still require women to retire earlier than men.

An extremely small minority of elite women (high-ranking government officials and professors) can work in the labor market until age 60.

We do not use current hukou status because many people received nonagricultural hukou status due to urbanization in recent decades.

There are unfortunately many missing values in the type of work unit. Nevertheless, we include them, treating missing categories as a dummy variable.

Contributor Information

Rui Zhao, School of Economics, Southwest University of Political Science and, Law No. 301, Baosheng Ave, Yubei District, Chongqing 401120 China.

Yaohui Zhao, National School of Development, Peking University, 5 Yiheyuan Road, Haidian District, Beijing 100871 China.

REFERENCES

- Altonji Joseph G. and Blank Rebecca M.. 1999. “Race and Gender in the Labor Market” In Handbook of Labor Economics, Vol. 3, Part C, edited by Ashenfelter Orley C. and Card David, 3143–259. Amsterdam: Elsevier. [Google Scholar]

- Appleton Simon, Knight John, Song Lina, and Xia Qingjie. 2002. “Labor Retrenchment in China: Determinants and Consequences.” China Economic Review 13(2–3): 252–75. [Google Scholar]

- Bardasi Elena and Jenkins Stephen P.. 2010. “The Gender Gap in Private Pensions.”Bulletin of Economic Research 62(4): 343–63. [Google Scholar]

- Blinder Alan S. 1973. “Wage Discrimination: Reduced Form and Structural Estimates.”Journal of Human Resources 8(4): 436–55. [Google Scholar]

- Cebrián Inmaculada and Moreno Gloria. 2015. “The Effects of Gender Differences in Career Interruptions on the Gender Wage Gap in Spain.” Feminist Economics 21(4): 1–27. [Google Scholar]

- China Health and Retirement Longitudinal Study (CHARLS). n.d. “Introduction.” Peking University; http://charls.pku.edu.cn/en. [Google Scholar]

- CHARLS Life History Survey. n.d. “2014 CHARLS Life History Survey.” Peking University; http://charls.pku.edu.cn/en/page/data/2014-charls-wave3. [Google Scholar]

- Du Fenglian and Dong Xiao-yuan. 2009. “Why Do Women Have Longer Durations of Unemployment than Men in Post-Restructuring Urban China?” Cambridge Journal of Economics 33(2): 233–52. [Google Scholar]

- Du Fenglian and Dong Xiao-yuan. 2013. “Women’s Employment and Child Care Choices in Urban China during the Economic Transition.” Economic Development and Cultural Change 62(1): 131–55. [Google Scholar]

- Elborgh-Woytek Katrin, Newiak Monique, Kochhar Kalpana, Fabrizio Stefania, Kpodar Kangni, Wingender Philippe, Clements Benedict, and Schwartz Gerd. 2013. “Women, Work, and the Economy: Macroeconomic Gains from Gender Equity” IMF Staff Discussion Note SDN/13/10, International Monetary Fund. [Google Scholar]

- Even William E. and MacPherson David A.. 1994. “Gender Differences in Pensions.”Journal of Human Resources 29(2): 555–87. [Google Scholar]

- Gornick Janet C., Munzi Teresa, Sierminska Eva, and Smeeding Timothy M.. 2009. “Income, Assets, and Poverty: Older Women in Comparative Perspective.” Journal of Women, Politics and Policy 30(2–3): 272–300. [Google Scholar]

- Killingsworth Mark R. and Heckman James J.. 1986. “Female Labor Supply: A Survey” In Handbook of Labor Economics, Volume 1, edited by Ashenfelter Orley C. and Layard Richard, 103–204. Amsterdam: Elsevier. [Google Scholar]

- Knight John and Song Lina. 1995. “Towards a Labour Market in China.” Oxford Review of Economic Policy 11(4): 97–117. [Google Scholar]

- Latulippe Denis. 1993. “Retirement Policy: An International Perspective.” Transactions of Society of Actuaries 45: 187–214. [Google Scholar]

- Liu Lan, Dong Xiao-yuan, and Zheng Xiaoying. 2010. “Parental Care and Married Women’s Labor Supply in Urban China.” Feminist Economics 16(3): 169–92. [Google Scholar]

- Mao Shangyi, Connelly Rachel, and Chen Xinxin. 2017. “Stuck in the Middle: Off-Farm Employment and Caregiving among Middle-Aged Rural Chinese.” Feminist Economics. doi: 10.1080/13545701.2017.1387670. [DOI] [Google Scholar]

- Möhring Katja. 2015. “Employment Histories and Pension Incomes in Europe.” European Societies 17(1): 3–26. [Google Scholar]

- National Bureau of Statistics of China. 2014. China Statistical Yearbook 2014. Beijing: China Statistics Press. [Google Scholar]

- Neumark David. 1988. “Employers’ Discriminatory Behavior and the Estimation of Wage Discrimination.” Journal of Human Resources 23(3): 279–95. [Google Scholar]

- Oaxaca Ronald. 1973. “Male–Female Wage Differentials in Urban Labor Markets.”International Economic Review 14(3): 693–709. [Google Scholar]

- Organisation for Economic Co-operation and Development (OECD). 2015. Pensions at a Glance 2015: OECD and G20 Indicators. Paris: OECD Publishing. [Google Scholar]

- Park Albert and Sangui Wang. 2014. “Poverty” In The Oxford Companion to the Economics of China, edited by Fan Shenggen, Kanbur Ravi, Wei Shang-Jin, and Zhang Xiaobo, 411–6. Oxford: Oxford University Press. [Google Scholar]

- Rozelle Scott, Guo Li, Shen Minggao, Hughart Amelia, and Giles John. 1999. “Leaving China’s Farms: Survey Results of New Paths and Remaining Hurdles to Rural Migration.” The China Quarterly (158): 367–93. [Google Scholar]

- Stark Agneta, Folbre Nancy, Shaw Lois B., Smeeding Timothy M., Sandström Susanna, Lee Sunhwa, and Chung Kyunghee. 2005. “Explorations Gender and Aging: Cross-National Contrasts.” Feminist Economics 11(2): 163–97. [Google Scholar]

- Vara María Jesús. 2013. “Gender Inequality in the Spanish Public Pension System.”Feminist Economics 19(4): 136–59. [Google Scholar]

- Wang Lijian, Béland Daniel, and Zhang Sifeng. 2014. “Pension Fairness in China.” China Economic Review 28: 25–36. [Google Scholar]

- Wang Yafeng and Zhang Chuanchuan. 2017. “Gender Inequalities in Labor Market Outcomes of Informal Caregivers near Retirement Age in Urban China.” Feminist Economics. doi: 10.1080/13545701.2017.1383618. [DOI] [Google Scholar]

- Warren Tracey. 2006. “Moving beyond the Gender Wealth Gap: On Gender, Class, Ethnicity, and Wealth Inequalities in the United Kingdom.” Feminist Economics 12(1–2): 195–219. [Google Scholar]

- Yun Myeong-Su. 2004. “Decomposing Differences in the First Moment.” Economics Letters 82(2): 275–80. [Google Scholar]

- Zhang Junsen, Han Jun, Liu Pak-Wai, and Zhao Yaohui. 2008. “Trends in the Gender Earnings Differential in Urban China, 1988–2004.” ILR Review 61(2): 224–43. [Google Scholar]

- Zhang Linxiu, De Brauw Alan, and Rozelle Scott. 2004. “China’s Rural Labor Market Development and its Gender Implications.” China Economic Review 15(2): 230–47. [Google Scholar]

- Zhao Yaohui. 1999. “Labor Migration and Earnings Differences: The Case of Rural China.” Economic Development and Cultural Change 47(4): 767–82. [Google Scholar]

- Zhao Yaohui, Hu Yisong, Smith James P., Strauss John, and Yang Gonghuan. 2014. “Cohort Profile: The China Health and Retirement Longitudinal Study (CHARLS).” International Journal of Epidemiology 43(1): 61–8. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Zhao Yaohui and Xu Jianguo. 2002. “China’s Urban Pension System: Reforms and Problems.” CATO Journal 21(3): 395–414. [Google Scholar]