Figure 5.

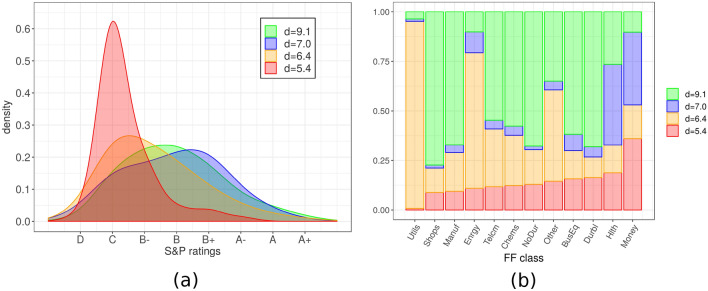

Financial data. For firms selected from the COMPUSTAT database, we compute variables from their yearly balance sheets. Hidalgo finds four manifolds of intrinsic dimensions 5.4, 6.4, 7.0, and 9.1. Panel (a) shows the fractions of firms assigned to the four manifolds for each type of firm, according to the Fama–French classification. The four manifolds contain unequal proportions of firms belonging to different classes, implying that some classes of firms are preferentially assigned to manifolds of high versus low dimension. Panel (b) shows the probability distribution of the S&P ratings of the firms assigned to each manifold. Firms with low ratings preferentially belong to low-dimensional manifolds. Results are obtained with and . To correct for firm size, we normalize the variable vector of each firm by its norm, and then applied standard Euclidean metric.