Abstract

The COVID‐19 pandemic presented a severe crisis to the agricultural sector and the economy at large. To confront it, the administration and Congress had to mobilize vast resources very quickly and introduce creative emergency measures to mitigate the unprecedented impacts on the economy. This article takes a closer look at the impacts of the COVID‐19 pandemic on the agricultural sector and the policy measures that USDA implemented to help farmers and ranchers weather the immediate crisis.

Keywords: Agriculture, CFAP, Policy, Trade, COVID

JEL codes: General Economics and Teaching

The first case of COVID‐19 was documented in the United States in January 2020. Even at that time, the pandemic was already affecting global markets as a result of the outbreak in China and Europe. Prices for livestock and dairy, alongside cotton, corn, soybeans, and wheat, started to tumble in January and continued through July. Market weakness undermined the buoyancy felt by the US agricultural sector following the successful negotiation of the China Phase One deal, the Japan free trade agreement, and the completion of the new USMCA regional trade agreement with Canada and Mexico. At the annual U.S. Department of Agriculture (USDA) Agricultural Outlook Forum on February 20, 2020, analysts noted the downturn in commodity prices, the strengthening of the US dollar, and new downgrades to economic growth prospects in the wake of the pandemic's expansion.1

In anticipation of large‐scale economic effects, Congress passed the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 (Public Law 116–123 2020), enacted on March 6, 2020 (Public Law 116–123 2020), which provided $8.3 billion in emergency funding for federal agencies to prepare for and respond to COVID‐19. A week later, on March 13, 2020, the president declared a national emergency, which provided the federal government with emergency authorities and released emergency aid to assist in response to conditions created by the disease outbreak, including for food and agriculture (White House 2020). Further legislative and regulatory actions followed in the coming months, many with direct impact on food supply chains and agriculture, such as the Coronavirus Food Assistance Programs (7 C.F.R. § 9) 1 and 2 (CFAP 1, CFAP 2) and additional agricultural sector stimulus in pending legislation.

The COVID‐19 pandemic presented a severe crisis to the agricultural sector and the economy at large. To confront it, the administration and Congress had to mobilize vast resources very quickly and introduce creative emergency measures to mitigate the unprecedented impacts on the economy. This article takes a closer look at the impacts of the COVID‐19 pandemic on the agricultural sector and the policy measures that USDA implemented to help farmers and ranchers weather the immediate crisis.

Shock to the Agriculture System

Economists generally model short‐run shocks to agricultural production using partial equilibrium representations of the agriculture sector and trading partners. Longer‐run impacts are usually estimated using more elaborate representations of differentiated economic growth and trade – perhaps in a general equilibrium framework to illustrate how factors of production might shift between sectors. Critically, both modeling frameworks are calibrated to parameters that are based on historical market relationships which in turn captures the experience of previous supply and demand shocks. However, COVID19 was a black swan event—an extremely rare outlying economic shock with no modern historical precedent. It quickly became apparent that standard tools, which are fundamentally based on past historical experiences, would not provide a good predictor of what would lie ahead. Both partial and general equilibrium models did not possess the means to show how the supply and demand shocks inflicted by the global pandemic might translate into basic commodity price and production changes. To put it simply, the modern US economy had never experienced such severe quarantine shutdowns and social distancing measures. For example, the widespread business closings and slowing global economic growth severely impacted demand. Gasoline demand fell abruptly as the public sheltered in place, which in turn reduced demand for ethanol and for corn. Meatpacking plant shutdowns due to worker illness resulted in unprecedented supply chain disruptions and record‐level surges in wholesale margins. Severe supply interruptions also occurred as cases of COVID‐19 rose and states began to close parts of their economies.

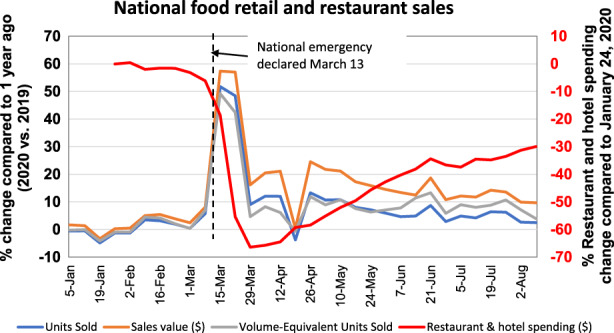

One of the unusual impacts of the COVID‐19 pandemic was the immediate and drastic drop in food demand by restaurants and hotel customers, which cut off farmers and food processors from some of their biggest buyers, especially for meat, dairy, and specialty crops (see figure 1).

Figure 1.

Provides data on percentage change in national food retail sales & food service transactions between January and September 2020 compared with one year ago. The figure shows the immediate and drastic drop in food demand by restaurants and hotel customers, after the national emergency measures were declared in March in response to COVID‐19. Variables included are: units sold, volume‐equivalent units sold, sales revenue, and number of food service transactions. Data: USDA‐ERS calculations using data from IRI and NPD Crest Performance Alerts. [Color figure can be viewed at wileyonlinelibrary.com]

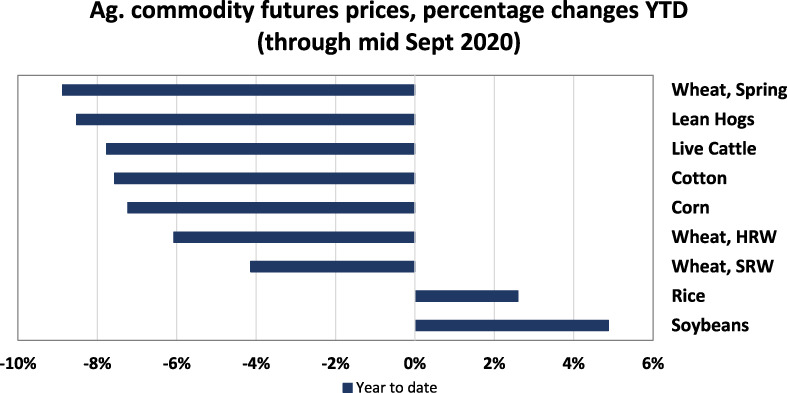

As a result, agricultural commodity prices declined significantly through the spring and summer of 2020 (see figure 2) even as consumers faced localized food shortages and rising retail food prices when food processors could not divert supplies from closed restaurants and hotels quickly enough to meet the surge in demand at grocery stores.

Figure 2.

The bar chart shows percentage change in agricultural commodity futures prices through mid‐September 2020 compared to one year ago. The prices of field crops and livestock declined significantly through the spring and summer of 2020. Variables included are: prices change for wheat, lean hogs, live cattle, cotton, corn, wheat HRW, wheat SRM, rice and soybeans. Data: Chicago Board of Trade, Intercontinental Exchange, Minneapolis Grain Exchange. Data compiled by Bloomberg (2020). [Color figure can be viewed at wileyonlinelibrary.com]

Normally, cyclical changes in supply or demand do not disrupt the US food system. As prices rise or fall, the integrated agriculture and food system rebalances. For example, demand for pork rises annually as Americans emerge with warmer weather to start grilling. Beef demand rises leading into the fall holiday seasons and turkey demand spikes around Thanksgiving. Producers ramp up production in anticipation. By contrast, crop prices in the summer often fall when weather in the summer provides adequate moisture and moderate temperatures which portends a good harvest. However, the COVID‐19 shocks were unprecedented, and the efficiency and integration of the US food and agriculture system generated unusually large price movements at the farmgate and grocery stores that could not be easily rebalanced and that continue to reverberate through commodity markets.

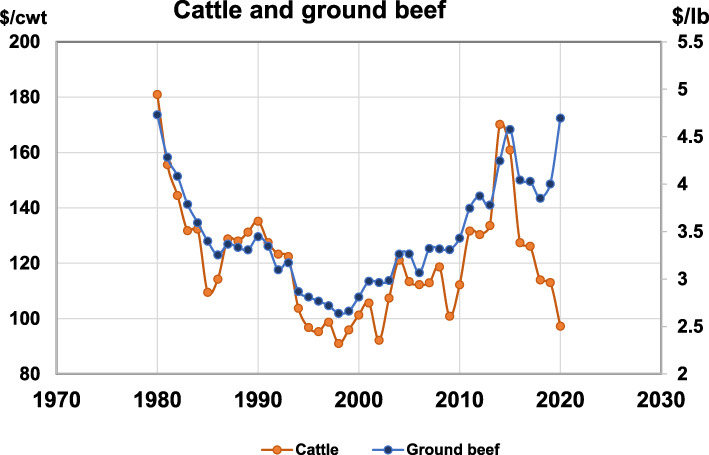

Data on differences in prices at the farm and retail levels during this period reflect that wide gap between prices received by producers and those seen by consumers (e.g., see figure 3). While retail ground beef prices had settled in August at 5% above January, after soaring 30% between January and June, producers have seen a decline of 20% in cattle prices.

Figure 3.

Line chart shows data on differences in prices at the farm and retail levels since and shows that wide gap between prices received by producers and those seen by consumers. Prices shown are in $/CWT for ground beef and cattle. Data: U.S. Bureau of Labor Statistics (2020) and USDA National Agricultural Statistical Service [Color figure can be viewed at wileyonlinelibrary.com]

Similarly, while milk prices for consumers were up by nearly 5% between January and August, the all‐milk price for producers fell by 4%. Additionally, dairy producers faced a steady decline in prices from February to May, leaving prices 31% lower than they had been in January. Many producers grappled with falling farmgate prices and a supply of farm products with no immediate outlet. Those with commodities that could not be stored, processed, or sold faced the need to depopulate livestock herds, dump milk, and dispose of perishable crops.

Margins Were Already Tight

The pandemic disruption came on top of the downward trends in the farm economy that have been developing for a number of years. Since the historic 2012 US drought and peak in commodity prices in 2013, global commodity production has generally outpaced demand, fueling continued price declines—in nominal and real terms. Between 2012–2019, producer prices for corn fell 48% from $6.89 per bushel to $3.56, and producer prices for soybeans fell 40%—almost $6 per bushel. Prices for cattle, hogs, broilers, and milk have also been on downward trend over the past five years.

As prices have fallen, US farmers have faced growing global trade competition and recent tariffs imposed by traditional trading partners. Multiple weather‐related challenges (drought, hurricanes, and wildfires, among others) over the past several years have kept production costs relatively high, squeezing the margins for many crop, livestock, and dairy producers. Assistance from crop insurance and both permanent and ad hoc disaster programs have helped producers weather these events, as have trade mitigation programs. However, the underlying financial balance sheet remains precarious for many US producers.

As a result, investment in equipment is down, farmer debt is up, and so is borrowing against land. By the end of 2019, the delinquency rate on commercial loans hit a six‐year high, and the delinquency rate on farmland loans was at its highest level since 2013.2 Inflation‐adjusted farm income increased in 2019, but only when including federal farm assistance. Since then, the volume of total nonreal estate loans declined for a fourth consecutive quarter, falling by 13% in the second quarter of 2020 compared to a year ago.3 Outstanding farm debt during the second quarter of 2020 did decline with an overall slowdown of lending, but farm loan delinquency rates continued to edge higher. Although composing less than 2.5% of farm loans, the volume of delinquent farm real estate and nonreal estate loans increased about 17% and 13%, respectively, compared to a year ago. The volume of loans past due more than 90 days continued to account for the smallest share of total delinquencies, but increased at a similar rate, suggesting that previously past due loans remained delinquent.

COVID‐19 Impacts on Farm Income

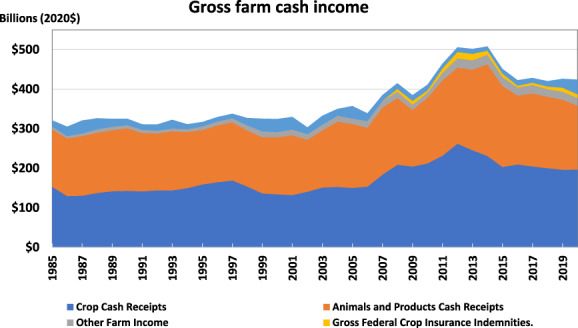

USDA's most recent forecast for farm income, released on September 2, suggested that producers could see $26 billion less in cash receipts for 2020 compared to the pre‐COVID February expectations. However, that decline will be offset by federal assistance, much of it from new programs related to COVID‐19. Direct government payments to producers have tripled since 2014 as of September 2020. Approximately $37 billion in direct payments to producers (including both Farm Bill and COVID‐19 programs) are forecast to make up roughly 9% of gross cash farm income or 36% of net farm income (see figure 4 below).

Figure 4.

Area chart shows US gross farm cash income between 1985 and 2020. It shows that approximately $37 billion in direct payments to producers (including both Farm Bill and COVID‐19 programs) are forecast to make up roughly 9% of gross cash farm income or 36% of net farm income. Included variables are crop cash receipts, other farm income, direct government payments, animal products cash receipts and crop insurance indemnities. Data: USDA‐Economic Research Service (2020). Note: Prior to 2008, federal crop insurance indemnities were grouped with other farm income. The direct government payment forecast for 2020 includes $16 billion for the CFAP 1 and $5.8 billion for the Small Business Administration's forgivable Paycheck Protection Program loans. [Color figure can be viewed at wileyonlinelibrary.com]

Unprecedented Responses

As of October 2020, USDA has developed and implemented two programs to assist producers with financial burdens caused by the market disruptions of COVID‐19, Coronavirus Food Assistance Program 1 (CFAP 1) and Coronavirus Food Assistance Program 2 (CFAP 2). The programs provided direct payments to producers of a broad range of agricultural commodities, unlike the more limited eligibility of most other farm direct payment programs. Producers could sign‐up for CFAP 1 between late May 2020 and mid‐September 2020, and sign‐up for CFAP 2 lasted from late September through mid‐December. While the two programs had common elements, CFAP 2 was adjusted to improve ease of application and implementation and to increase scope of eligible producers. Both programs uniquely combined appropriations from the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act (Public Law No: 116–136, 2020) with discretionary borrowing authority provided the Secretary under the Commodity Credit Corporation Charter Act.

Any nonprocessed agricultural commodity (crop, livestock, dairy, or aquaculture) was potentially eligible for a CFAP 1 payment if the average weekly price of the commodity for the week of April 6, 2020 was more than 5% below that price for the week of January 13, 2020. Program payments were also available when market disruptions resulted in a producer not receiving payment for purchased commodity because it had spoiled in transit or a producer being forced to leave crops unsold on the farm. For CFAP 2 payment rates for most field crops and major livestock commodities4 for which price data were available through the futures market or USDA sources continued to be based on price information.5 However, payment rates for specialty crops and minor livestock commodities payments were based on a percentage of 2019 sales. Additionally, under CFAP 2, field crops for which sufficient price data were not available or which did not meet the 5% price decline trigger received a flat $15 per acre payment.

As mentioned, funding for CFAP 1 and CFAP 2 also differed, with implications for program design. CFAP 1 funding combined appropriations under the CARES Act and funds available through Commodity Credit Corporation (CCC) borrowing authority. In using funds appropriated under the CARES Act, USDA could compensate producers directly for market losses as directed by Congress. The uses of funds provided under CCC borrowing authority, however, are limited to those specified in the CCC Charter Act, including surplus disposition, making facilities and materials available, and expanding domestic markets.6 Due to the split nature of CFAP 1 funding, the CARES funded component of CFAP 1 directly indemnified producers, while the CCC funded portion was designed to facilitate marketing and to address surplus. Since CFAP 2 was primarily funded under CCC borrowing authority, thus its design had to conform to the specified uses as noted above.7

Producer eligibility for payments also changed between CFAP 1 and CFAP 2. Under CFAP 1, a producer's commodity needed to be “unpriced” to receive a payment, i.e., the producer needed to be exposed to price risk on that commodity after January 15, 2020. CFAP 2 did not include that stipulation. Also, under the CCC‐funded component of CFAP 1 producers received payment on their highest livestock inventory between mid‐April and mid‐May; under CFAP 2, producers received payment for their highest market inventory (i.e. excluding breeding stock) for mid‐April through the end of August 2020.

Producer income‐based eligibility and payment limitations remained the same for both CFAP 1 and CFAP 2: payment limitations of $250,000 and average adjusted gross income (AGI) limitation of $900,000 with an exemption for individuals who make more than 75% of their income from farming, ranching, or forestry‐related activities. Most commodity programs8 under the Farm Bill have payment limitations of $125,000 and are restricted to producers with an average AGI less than $900,000 without exemptions. CFAP also allowed for corporations to claim up to three payment limits if three individuals in the corporation contributed “at least 400 hours of active personal labor or active personal management.” Under Farm Bill programs, corporations are restricted to a single payment limit.

Despite provisions that expanded some areas of eligibility, both CFAP 1 and CFAP 2 excluded contract livestock growers on the basis that they do not market their commodities and are therefore not exposed to price risk in the same way as growers who own their livestock. Timber and seafood also were not included under CFAP1 or CFAP 2. Multiple versions of new COVID‐19 stimulus bills are being considered by Congress, making it possible that additional financial support may be made available in the next COVID‐19 stimulus act.

Farm Policy Context

CFAP 1 and CFAP 2 were developed and implemented with the Agriculture Improvement Act of 2018 (Pub. L. No. 115–334, 2018; i.e., the 2018 Farm Bill) as a backdrop. The 2018 Farm Bill provides for a farm safety net through income support programs (Agriculture Risk Coverage (ARC), Price Loss Coverage (PLC), Dairy Margin Coverage, and marketing assistance loans), supplemental disaster programs (Livestock Forage Disaster Program; Livestock Indemnity Program; Emergency Assistance Program for Livestock, Honey Bees, and Farm‐Raised Fish; and Tree Assistance Program) and crop insurance. Yet Congress and the administration saw a need for additional emergency programs to respond to COVID‐19. The context in which the current Farm Bill programs were developed may help to explain that need.

Several of the current farm programs originated in the Agricultural Act of 2014 (2014 Farm Bill), when conditions in the farm economy differed greatly from those we have seen in more recent years. The PLC reference price for corn was set at $3.70 per bushel, well below the $4.46 per bushel 2013/2014 marketing year price for corn, while the ARC five‐year moving average county revenue guarantee was poised to capture recent high commodity prices during the first few years after the enactment of the 2014 Farm Bill. As a result, many producers chose ARC over PLC. But as the farm economy entered a lower commodity price environment following enactment of the 2014 Farm Bill, ARC payments quickly dwindled.

While the 2018 Farm Bill provided an opportunity for producers to switch to PLC, which offered the prospects of higher income support based as market prices fell towards what had seemed as low reference prices, other safety net innovations that might have addressed the needs of growing stress in the farm economy were constrained by the requirement that the 2018 Farm Bill remain budget neutral—the projected cost of the new Farm Bill safety net under strained economic conditions could not exceed the cost of a safety net designed during one of the highest farm income periods in US history. As a result, the 2018 Farm Bill saw only small changes in commodity programs—a change in production data used to set ARC benchmarks, greater flexibility in the ARC/PLC choice and in the PLC reference price, and increased flexibilities in dairy margin coverage—and no major changes to crop insurance. For the most part, stakeholders expressed support for maintaining the status quo, despite some indications that more difficult times might be on the horizon.

Those indications began to appear in the farm program provisions incorporated in the Bipartisan Budget Act of 2018 (BBA), which preceded the 2018 Farm Bill by some months. Changes to 2014 Farm Bill programs outside the regular farm bill process reflected a perception that the baseline for the new legislation might be inadequate for some commodities. The BBA established new flexibilities in the Margin Protection Program for Dairy, lifted premium subsidy caps for federal livestock insurance, and reintroduced cotton (in the form of seed cotton base) to the ARC/PLC program. The BBA also previewed a growing view that crop insurance could not on its own provide sufficient support to producers facing severe adverse natural disaster events. While it had performed well in response to the prolonged drought conditions in the Midwest in 2012/2013, crop insurance coverage was less widespread for many specialty crop commodities. Through the BBA, Congress provided $2.36 billion in appropriations to fund for ad hoc crop disaster assistance resulting from the multiple hurricanes and wildfires in 2017. Congress repeated this approach for a similar rash of natural disasters in 2018 and 2019, providing $3.01 billion under the Additional Supplemental Appropriations for Disaster Relief Act, 2019. Under the Further Consolidated Appropriations Act, 2020, Congress added eligible causes of loss for ad hoc disaster payments—drought and excessive moisture in 2018 and 2019—and allowed use of leftover ad hoc disaster funds from 2017 disasters to be used for the 2018 and 2019 disasters.

In addition to Congressional ad hoc initiatives, USDA has increasingly turned to its authority to use CCC funds to provide emergency assistance. USDA used this authority for certain components of CFAP as described above, as well as for the Market Facilitation Programs in 2018 and 2019. While the Charter Act allows USDA discretion on when and how to use Section 5 authority, expenditures are limited by CCC's $30 million borrowing authority; replenishing this borrowing authority requires Congressional action.

| CFAP 1 | CFAP 2 | |

|---|---|---|

| Direct payments | Yes | Yes |

| Payment & income limit |

|

|

| Signup period | Late May‐mid September 2020 | Late September‐mid December 2020 |

| Eligible products | Most nonspecialty crops, specialty crops (not all eligible for price‐decline‐related payment), and beef cattle, swine, wool, lamb, floriculture and nursery crops, aquaculture, liquid and frozen eggs. | Nonspecialty crops, wool, livestock (excluding breeding stock), dairy, specialty crops, floriculture and nursery crops, aquaculture, broilers and eggs, and tobacco. |

| Payments |

|

|

| Producer eligibility |

|

|

| Contract livestock growers included | No | No |

What's on the Horizon?

Earlier this year, when we released the Department's initial projections for 2020 at USDA's Agricultural Outlook Forum, the immediate future looked bright.9 We were expecting better weather, improved trading relationships, and global economic growth that would fuel demand for U.S. agricultural exports. The COVID‐19 outbreak has dampened those expectations for 2020 and for 2021. However, while the timing and pace of postpandemic economic recovery remain uncertain, the fundamentals of US agriculture are sufficiently strong to withstand the crisis. The sector continues to chart productivity gains and continuing technological and management innovation are helping farmers build resilience in the face of adverse weather conditions. Although the early August derecho in the Midwest and hurricanes in the Southeast US caused severe localized losses, from a national perspective weather conditions have improved relative to 2018 and 2019, promising a harvest of a large crop. Record levels of meat and dairy production are also expected in 2020 and 2021. And some costs may be falling—data on rental rates released by USDA at the beginning of August show average cash rent was marginally lower in 2020 compared with 2019, led by irrigated cropland: The average cropland rental rate fell from $140 to $139 per acre, with irrigated cropland falling from $220 to $216 per acre and nonirrigated cropland falling from $127 to $126 per acre. For pastureland, the average rate per acre was unchanged from 2019 at $13 per acre.10

US agriculture has historically been highly competitive in global markets and the trade outlook is looking more favorable with expected global economic recovery in 2021. The new USMCA agreement, Japan agreement, and Phase One deal with China offer the prospect of expanding the markets of our largest customers. Agricultural exports during the COVID‐19 period appear to have been holding up relatively well compared to overall US exports. In the first seven months of 2020, US ag exports were down 3.5% from last year compared to a decline of 18% for non‐ag exports. The more limited impact of the crisis on agricultural exports reflects the relatively income‐inelastic demand for food, as well as agriculture's greater reliance on marine transportation, which has not been significantly disrupted by the pandemic. US agricultural exports in Fiscal Year 2021 are projected at $140.5 billion, up $5.5 billion from FY 2020, primarily driven by higher exports of soybeans and corn. Soybean export volume is forecast to rise nearly 26% year‐over‐year as growing demand in China and significantly reduced export volume forecast from Brazil opens the door for a rise in US exports. Corn exports are also forecast to rise by $700 million to reach $9 billion in FY2021. Horticultural exports are expected to reach $35 billion, an increase of $500 million due to expected increases in sales of tree nuts, among other products. Similarly, livestock, poultry, and dairy exports are forecast up a total of $500 million, reaching $32.3 billion for the year.

But despite these encouraging signs, many US farmers continue to confront significant challenges, and the immediate outlook for the sector remains highly uncertain: a forecast by the Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri expects farm income to fall again in 2021—mainly as a result of COVID‐19 continuing to slow global economic growth.11 And in both the FAPRI and USDA estimates, the aggregate changes do not reflect the uneven losses experienced by certain regions or crops—some producers may experience much larger losses, while others may actually see gains.

The CFAP program and other measures implemented by USDA, together with the recent surge in exports of some agricultural commodities have brought much‐needed relief to the farming sector. But with uncertainty about recovery from the pandemic still clouding the horizon and longer‐term trends in the farm economy continuing to weigh on farm financial health, it is hard to predict whether an end to tight times is in sight or if continuing challenges loom for farmers for the foreseeable future.

While the use of ad hoc emergency programs may not be unprecedented, the scope and speed of implementation seen with CFAP certainly surpasses other recent efforts. Continuing debate surrounds the use of the CCC Section 5 specific powers outside Farm Bill authorizations, which were at the core of this rapid response, and raises questions about what emergency federal assistance to the farm sector may look like in the future. These issues will undoubtedly play an important role in discussions leading up to the next Farm Bill in 2023.

Robert Johansson, Ashley Hungerford, Mirvat Sewadeh, USDA Office of the Chief Economist, and Anne Effland, USDA, Economic Research Service.

Editor in charge: Craig Gundersen

Disclaimer: “The findings and conclusions in this (publication/presentation/blog/report) are those of the author(s) and should not be construed to represent any official USDA or U.S. government determination or policy.”

Footnotes

See discussion available at https://www.usda.gov/oce/ag-outlook-forum/session-details.

See Board of Governors of the Federal Reserve System (2020) at https://www.federalreserve.gov/releases/chargeoff/delallsa.htm.

See Kauffman and Kreitman (2020) at https://www.kansascityfed.org/research/indicatorsdata/agfinancedatabook/articles/2020/7-16-20/ag-finance-dbk-7-16-2020

Beef cattle, swine, lamb, broilers, and table eggs.

Average weekly price changes between the week of January 17, 2020 and the week of July 27, 2020 were used to determine payment rates.

Under the CCC Charter Act, USDA has borrowing authority (currently $30 billion) to fund a host of mandatory programs authorized under the Farm Bill, including income support (ARC/PLC), commodity loans (Marketing Assistance Loans and Loan Deficiency Payments), supplemental disaster programs (LFP, LIP, ELAP, TAP), conservation programs, and export programs. It also provides the secretary with discretionary authorities, as mentioned above, for creating additional programs.

CFAP 2 did also utilizer CARES Act appropriations to provide payments to eligible tobacco growers, since the CCC borrowing authority explicitly prohibits use of funds for purposes related to tobacco.

Dairy Margin Coverage, which has no AGI limit and no payment limitation, is the exception.

See Johansson (2020) at https://www.usda.gov/oce/ag-outlook-forum.

USDA‐National Agriculture Statistics Service. (August 2020). Cash Rents Survey 2020. https://quickstats.nass.usda.gov/results/58B27A06-F574-315B-A854-9BF568F17652#7878272B-A9F3-3BC2-960D-5F03B7DF4826

Food and Agricultural Policy Research Institute. (April, 2020). Early Estimates of the Impacts of COVID‐19 on U.S. Agricultural Commodity Markets, Farm Income and Government Outlays. Report #02‐20 University of Missouri. https://www.fapri.missouri.edu/wp-content/uploads/2020/04/FAPRI-Report-02-20.pdf

References

- Bloomberg . 2020. Future Commodity Prices. September, 2020. Data retrieved in September 2020. https://www.bloomberg.com/markets/commodities/futures/agriculture

- Board of Governors of the Federal Reserve System . 2020. “Charge‐Off and Delinquency Rates on Loans and Leases at Commercial Banks.” federalreserve.gov, August 24, 2020. https://www.federalreserve.gov/releases/chargeoff/delallsa.htm.

- Johansson, Robert. 2020. “2020 Agricultural Economic and Foreign Trade Outlook.” USDA 2020 Agricultural Outlook Forum, Arlington, VA. February 20–21. https://www.usda.gov/sites/default/files/documents/2020-Johansson-Slides.pdf

- Kauffman, Nathan and Kreitman Ty. 2020. “Agricultural Lending Consistently Slower”. Federal Reserve Bank Of Kansas City, July 16, 2020. https://www.kansascityfed.org/research/~/link.aspx?_id=5F97996A8E0346CCBE51E2BB7D3DD114&_z=z#:%7E:text=Farm%20lending%20slowed%20alongside%20the,outlook%20for%20agricultural%20economic%20conditions.&text=agricultural%20economic%20conditions.-,The%20volume%20of%20total%20non%2Dreal%20estate%20farm%20loans%20continued,the%20second%20quarter%20of%202020

- U.S. Bureau of Labor Statistics . 2020. “Consumer Price Index Database.” https://fred.stlouisfed.org/series/APU0000703111 (accessed September 2020).

- U.S. Department of Agriculture . 2020a. Agricultural Outlook Forum. February 20–21. https://www.usda.gov/oce/ag-outlook-forum/session-details

- U.S. Department of Agriculture . 2020b. USDA Announces Coronavirus Food Assistance Program. April 17, 2020. Release No. 0222.20. https://www.usda.gov/media/press-releases/2020/04/17/usda-announces-coronavirus-food-assistance-program

- U.S. Department of Agriculture, Economic Research Service . 2020. Farm Income and Wealth Statistics. Data retrieved in September 2020 https://www.ers.usda.gov/data-products/farm-income-and-wealth-statistics/

- U.S. Department of Agriculture, Farmers.gov . 2020. Coronavirus Food Assistance Program. Farmers.gov. https://www.farmers.gov/cfap/data (accessed November 16, 2020).

- U.S. Department of Agriculture, National Agricultural Statistics Service (USDA‐NASS) . 2019. Cattle Inventory. July 19, 2019. https://downloads.usda.library.cornell.edu/usda-esmis/files/h702q636h/p2677603p/08612z925/catl0719.pdf

- U.S. Department of Agriculture, National Agricultural Statistics Service (USDA‐NASS) . 2020. Cash Rents Survey. August 2020. Data retrieved in September 2020. https://quickstats.nass.usda.gov/results/58B27A06-F574-315B-A854-9BF568F17652#7878272B-A9F3-3BC2-960D-5F03B7DF4826

- White House . 2020. “Proclamation on Declaring a National Emergency Concerning the Novel Coronavirus Disease (COVID‐19) Outbreak.” Whitehouse.gov. March 13, 2020. https://www.whitehouse.gov/presidential-actions/proclamation-declaring-national-emergency-concerning-novel-coronavirus-disease-covid-19-outbreak/