Key Points

Question

Is midlife wealth mobility associated with cardiovascular risk after 65 years of age?

Findings

In a cohort study of 5579 adults without cardiovascular disease in the Health and Retirement Study, participants who experienced upward wealth mobility (by at least 1 quintile) had independently lower cardiovascular risk compared with participants with stable wealth from 50 to 64 years of age, and participants who experienced downward wealth mobility had higher cardiovascular risk after 65 years of age.

Meaning

These findings suggest that midlife wealth mobility, independent of baseline wealth, is associated with incident cardiovascular events.

Abstract

Importance

The association of socioeconomic status and cardiovascular outcomes has been well described, but little is known about whether longitudinal changes in wealth are associated with cardiovascular health status.

Objective

To evaluate the association between midlife wealth mobility and risk of cardiovascular events.

Design, Setting, and Participants

This longitudinal, retrospective cohort study included US adults 50 years or older who participated in the Health and Retirement Study. Participants in the primary analysis had no history of cardiovascular disease and had observations in at least two of three 5-year age intervals (50-54, 55-59, and 60-64 years) and follow-up after 65 years of age. Data were collected from January 1, 1992, to December 31, 2016, and analyzed from November 10, 2020, to April 26, 2021.

Exposures

Quintiles of wealth (reflecting total nonhousing assets) were defined within each of 4 birth cohorts (1931-1935, 1936-1940, 1941-1945, and 1946-1950). Wealth mobility was defined as an increase or a decrease of 1 or more wealth quintiles and was compared with wealth stability (same quintile over time) using covariate-adjusted Cox proportional hazards regression models.

Main Outcomes and Measures

Composite outcome of nonfatal cardiovascular event (myocardial infarction, heart failure, cardiac arrhythmia, or stroke) or cardiovascular death.

Results

A total of 5579 participants were included in the primary analysis (mean [SD] age, 54.2 [2.6] years; 3078 women [55.2%]). During a mean (SD) follow-up of 16.9 (5.8) years, 1336 participants (24.0%) experienced a primary end point of nonfatal cardiovascular event or cardiovascular death (14.4 [95% CI, 13.6-15.2] per 1000 patient-years). Higher initial wealth (per quintile) was associated with lower cardiovascular risk (adjusted hazard ratio [aHR] per quintile, 0.89 [95% CI, 0.84-0.95]; P = .001). When compared with stable wealth, participants who experienced upward wealth mobility (by at least 1 quintile) had independently lower hazards of a subsequent nonfatal cardiovascular event or cardiovascular death (aHR, 0.84 [95% CI, 0.73-0.97]; P = .02), and participants who experienced downward wealth mobility had higher risks (aHR, 1.15 [95% CI, 1.00-1.32]; P = .046).

Conclusions and Relevance

These findings suggest that upward wealth mobility relative to peers in late middle age is associated with lower risks of cardiovascular events or death after 65 years of age.

This cohort study evaluates the association between midlife wealth mobility and risk of cardiovascular events among participants of the RAND Health and Retirement Study older than 65 years.

Introduction

In the US, wealth and health are closely interlinked such that there is a 10- to 15-year difference in life expectancy between the richest 1% and the poorest 1%.1 Unfortunately, from 1999 to 2016, disparities in cardiovascular health have widened further.2 Differences in health outcomes across socioeconomic gradients are greater in the US than other developed countries.3 Multiple mechanisms have been proposed to explain the differences in outcomes across income levels, including differences in access to care,4 receipt of appropriate care,5 and barriers to appropriate cardioprotective therapies and interventions.6,7

Although the interplay between socioeconomic status and health outcomes has been well established,1,8,9 studies often rely on cross-sectional data and thus are unable to assess the implications of wealth trajectories. More recently, longitudinal wealth changes have been the focus of multiple studies.10,11 In a large sample of US adults,10 negative wealth shocks during an acute period were associated with significant increases in mortality. Another study11 showed that income volatility over several years was associated with increased cardiovascular disease (CVD) and mortality.

Although the effect of negative wealth changes on cardiovascular risk has been evaluated, few studies have focused on the benefit of positive wealth changes. These data may be important as federal policies are considered that specifically target low-income families with income volatility. Recently, a study suggested that county-level economic flourishing is associated with lower cardiovascular risk.12 However, the individual-level benefit of upward wealth mobility on cardiovascular risk has not been evaluated and represents an important gap in our understanding of the health-wealth association. In this study, we longitudinally evaluated healthy adults to study the association between midlife wealth mobility with the risk of cardiovascular events after 65 years of age.

Methods

Data Source

We used the RAND Health and Retirement Study (HRS) longitudinal file for this cohort study.13,14 The HRS is sponsored by the National Institute on Aging and is conducted by the University of Michigan. This data set is publicly available and contains longitudinal survey data of US adults 50 years and older regarding health and wealth. Respondents are surveyed every 2 years, and changes in health and wealth are recorded. To maintain a steady cohort size, the HRS replenishes the sample with new participants every 6 years from younger birth cohorts. Surveys collected from January 1, 1992, to December 31, 2016, were included in this data set. For deceased participants, surveys were answered by surrogate family members. The HRS was approved by the institutional review board at the University of Michigan. Due to the deidentified nature of these data, the University of Texas Southwestern Human Research Protection Program determined that this secondary analysis did not require institutional review board approval. This study followed the Strengthening the Reporting of Observational Studies in Epidemiology (STROBE) reporting guideline.

Population

We identified participants who were interviewed in at least two of three 5-year age intervals (50-54, 55-59, and 60-64 years) and who had available follow-up after 65 years of age. Wealth was defined as total nonhousing assets, expressed in 2012 US dollars. Participants were divided into quintiles based on their wealth at the time of survey response for each 5-year interval. To minimize era factors (such as changes in economic environment or advances in preventive medicine) that may have affected each birth cohort differently, wealth quintiles were stratified by birth cohort (eg, wealth was compared across participants who were born between 1931 and 1935). Because each wealth quintile was specific for age at interview and birth cohort, the ranges for each quintile varied. For the primary analysis, we restricted the analysis to participants without a reported history of underlying CVD, stroke, hypertension, or diabetes from 50 to 64 years of age.

For each of these healthy participants, we calculated relative wealth mobility as the quintile change between observed 5-year intervals before age 65 years. For participants with observations in all three 5-year intervals, we only used the change between first and last intervals. We define starting wealth quintile as the first observed quintile measurement and ending quintile as the last observed quintile measurement. Upward relative wealth mobility was defined as an increase of 1 or more wealth quintiles between observations, whereas downward wealth mobility was defined as a decrease of 1 or more wealth quintiles. Participants who remained in the same quintile between observations were defined as having stable wealth. In this study, we refer to the first quintile as the bottom 20% and the fifth quintile as the top 20%. In addition, negative wealth values indicate debt and positive wealth values indicate assets.

Outcomes

Our primary outcome was the composite of a nonfatal cardiovascular event (defined as acute myocardial infarction, heart failure, cardiac arrhythmia, or stroke) or cardiovascular death from 65 to 85 years of age. Our secondary outcome was cardiovascular death alone. Nonfatal cardiovascular events among HRS participants were obtained via subsequent interviews. Deaths among HRS participants were obtained from 2 primary sources, postmortem interviews of family members and the National Death Index. Once a death was reported by a family member, death information and cause of death were obtained through death records via the National Death Index.15 This method of death ascertainment has been validated, with more than 95% of all deaths confirmed by both sources.

Statistical Analysis

Data were analyzed from November 10, 2020, to April 26, 2021. We first evaluated the rates of long-term cardiovascular events of participants by baseline relative wealth quintile. Cox proportional hazards regression models were built and stratified by birth cohort, and associations were expressed as hazard ratios (HRs) and 95% CIs. Analyses were adjusted for a prespecified set of covariates (marital status, race/ethnicity, sex, completion of college education, history of smoking, and history of obesity). Race/ethnicity was divided into non-Hispanic White, non-Hispanic Black, Hispanic, and other. We then evaluated the association between relative wealth mobility and subsequent cardiovascular risk; these models accounted for these same covariates and additionally adjusted for starting wealth quintile. We further assessed the magnitude of relative wealth changes (upward or downward mobility by 1 or 2 or more quintiles) compared with relative wealth stability. The proportional hazards assumption was met for all models. Kaplan-Meier survival curves were constructed and compared using the log-rank test.

To further characterize the association between wealth mobility and nonfatal cardiovascular events or cardiovascular death at the extremes of wealth quintiles, we repeated focused analyses of relative wealth mobility among subgroups of participants who were ever in the bottom quintile and participants who were ever in the top quintile (eMethods in the Supplement). We then analyzed each component of the primary composite end point separately. We used competing risks regression analysis by the proportional subhazards method developed by Fine and Gray16 to evaluate the hazards associated with wealth changes on risk for nonfatal cardiovascular events, accounting for competing risks of cardiovascular death.17 The competing risks regression model was adjusted for the same covariate set as the main model, and effect sizes were reported as subdistributional HRs and 95% CIs.

To examine the association between absolute changes in wealth and subsequent time to the primary end point, we used Cox proportional hazards regression models and evaluated change in wealth as a continuous function as the exposure of interest. In addition, we performed restricted cubic spline analyses of Cox proportional hazards regression, with the number of knots selected to minimize the bayesian information criterion. Tests of linearity and nonlinearity were also performed.

To test the association between wealth changes and subsequent cardiovascular outcomes by race, we performed race-specific analyses evaluating potential effect modification using interaction analyses. Because substantial wealth shifts may occur with the sale or purchase of housing properties, we examined the association between continuous changes in combined (housing and nonhousing) wealth and our primary end point using a Cox proportional hazards regression model, adjusting for the same covariates as our main model and a restricted cubic spline analysis.

Finally, to evaluate whether wealth mobility affects participants with underlying CVD, we performed Kaplan-Meier and Cox proportional hazards regression analyses of participants initially excluded owing to CVD. Because these participants already had underlying CVD, our outcome for this secondary analysis was cardiovascular death. We adjusted for similar covariates as our primary models.

Results

Cohort Demographics

A total of 42 052 adults participated in the HRS across 4 birth cohorts (1931-1935, 1936-1940, 1941-1945, and 1946-1950). Participant selection is described in eFigure 1 in the Supplement. The main analysis focused on 5579 participants without known CVD. The mean (SD) age at enrollment was 54.2 (2.6) years; 2501 (44.8%) were men and 3078 (55.2%) were women. Most participants were White individuals (4260 [76.4%]), whereas 654 (11.7%) were Non-Hispanic Black individuals, 545 (9.8%) were Hispanic individuals, and 120 (2.2%) self-reported other race/ethnicity category.

The demographics stratified by birth cohort are presented in the Table. At baseline, 3711 participants had a history of CVD and were excluded from the primary analysis (but included in a subsequent secondary analysis). The demographics of the combined cohort with and without CVD are included in eTable 1 in the Supplement.

Table. Participant Characteristics by Birth Cohort.

| Characteristic | Birth cohorta | ||||

|---|---|---|---|---|---|

| 1931-1935 (n = 1201) | 1936-1940 (n = 2214) | 1941-1945 (n = 1229) | 1946-1951 (n = 935) |

Total (N = 5579) | |

| Sex | |||||

| Men | 513 (43) | 992 (44.8) | 556 (45.2) | 440 (47.1) | 2501 (44.8) |

| Women | 688 (57.3) | 1222 (55.2) | 673 (54.8) | 495 (52.9) | 3078 (55.2) |

| Race/ethnicity | |||||

| Non-Hispanic White | 945 (78.7) | 1662 (75.1) | 945 (76.9) | 708 (75.7) | 4260 (76.4) |

| Non-Hispanic Black | 139 (11.6) | 258 (11.7) | 151 (12.3) | 106 (11.3) | 654 (11.7) |

| Hispanic | 92 (7.7) | 249 (11.2) | 108 (8.8) | 96 (10.3) | 545 (9.8) |

| Otherb | 25 (2.1) | 45 (2.0) | 25 (2.0) | 25 (2.7) | 120 (2.2) |

| College educated | 214 (17.8) | 431 (19.5) | 308 (25.1) | 331 (35.4) | 1284 (23.0) |

| Married | 924 (76.9) | 1788 (80.8) | 989 (80.5) | 707 (75.6) | 4408 (79.0) |

| Obesec | 429 (35.7) | 876 (39.6) | 497 (40.4) | 312 (33.4) | 2114 (37.9) |

| Smokerd | 257 (21.4) | 426 (19.2) | 213 (17.3) | 138 (14.8) | 1034(18.5) |

| Wealth, mean (SD), 2012 US $1000 | |||||

| On first measurement | 292 (683) | 260 (696) | 300 (888) | 321 (746) | 286 (748) |

| On second measurement | 342 (711) | 334 (779) | 420 (1387) | 371 (835) | 361 (944) |

| On third measurement | NA | 366 (1027) | 498 (1658) | 396 (701) | 413 (1209) |

Abbreviation: NA, not applicable.

Unless otherwise indicated, data are expressed as number (percentage) of patients. Percentages have been rounded and may not total 100.

Includes American Indian, Alaska Native, Asian, Native Hawaiian, and Pacific Islander.

Defined as any measurement of body mass index greater than 30 (calculated as weight in kilograms divided by height in meters squared) from 50 to 64 years of age.

Defined as any reported tobacco use from 50 to 64 years of age.

Wealth Characteristics

Across birth cohorts, the bottom wealth quintile ranged from −$581 447 to $7460, whereas the top wealth quintile ranged from $327 064 to $22 661 450. The wealth quintile ranges for each 5-year age interval, by birth cohort, are described in eTable 2 in the Supplement.

Primary Outcome

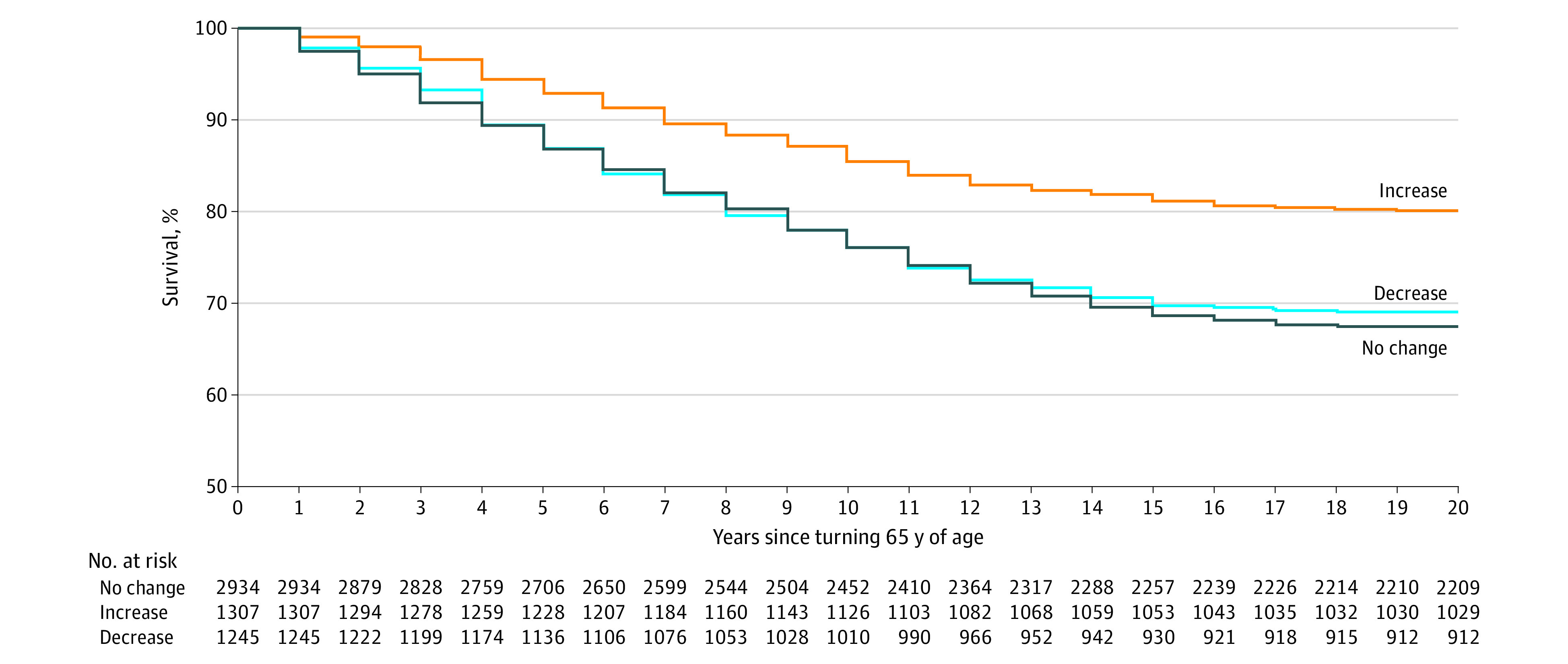

During the mean (SD) follow-up of 16.9 (5.8) years, 1336 (24.0%) participants reached the primary end point of nonfatal cardiovascular event or cardiovascular death (14.4 [95% CI, 13.6-15.2] per 1000 person-years). Participants who started in the bottom quintile had 15.3 nonfatal cardiovascular events or cardiovascular deaths per 1000-person years compared with 13.0 per 1000-person years among those who started in the top quintile (eTable 3 in the Supplement). Similarly, participants who ended in the bottom quintile of wealth had 17.6 nonfatal cardiovascular events or cardiovascular deaths per 1000 person-years compared with 12.3 per 1000 person-years for those who ended in the top quintile. When considering wealth trajectory, nonfatal cardiovascular events or cardiovascular deaths occurred in 22.5% (95% CI, 20.0%-25.1%) of participants who increased by 1 wealth quintile compared with 28.1% (95% CI, 25.4%-30.1%) of participants who decreased by 1 wealth quintile (eTable 4 in the Supplement). A Kaplan-Meier survival analysis revealed that any upward wealth mobility was associated with lower nonfatal cardiovascular event or cardiovascular death after adjustment for starting wealth quintile (Figure 1).

Figure 1. Kaplan-Meier Survival Curve for Freedom From Cardiovascular Event or Cardiovascular Death by Midlife Wealth Mobility.

Survivor functions were adjusted for starting quintile. Event curves were compared using the log-rank test (P = .003).

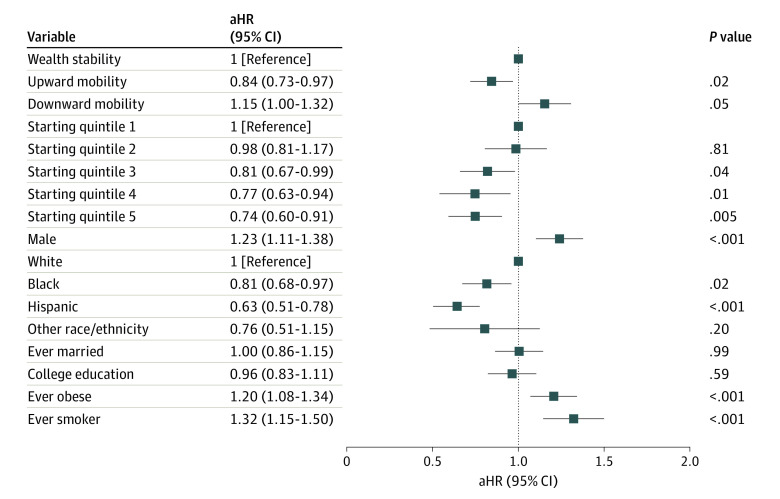

In multivariable Cox proportional hazards regression analyses, participants in wealthier starting quintiles experienced lower cardiovascular risk in graded fashion compared with the poorest (first) quintile (Figure 2). Higher initial wealth quintile was associated with lower subsequent cardiovascular risk (adjusted HR [aHR] per quintile, 0.89 [95% CI, 0.84-0.95]; P = .001). When compared with stable wealth, participants who experienced upward wealth mobility (by at least 1 quintile) had independently lower hazards of a subsequent nonfatal cardiovascular event or cardiovascular death (aHR, 0.84 [95% CI, 0.73-0.97]; P = .02) after stratification for birth cohort and adjustment for starting wealth quintile, marital status, race/ethnicity, sex, educational attainment, history of midlife smoking, or history of midlife obesity. Compared with relative wealth stability, participants who experienced downward wealth mobility (by at least 1 quintile) had an independently higher risk of meeting the primary end point (aHR, 1.15 [95% CI, 1.00-1.32]; P = .05).

Figure 2. Adjusted Hazards of Wealth Mobility and Nonfatal Cardiovascular Event or Cardiovascular Death.

aHR indicates adjusted hazard ratio; limit lines, 95% CIs.

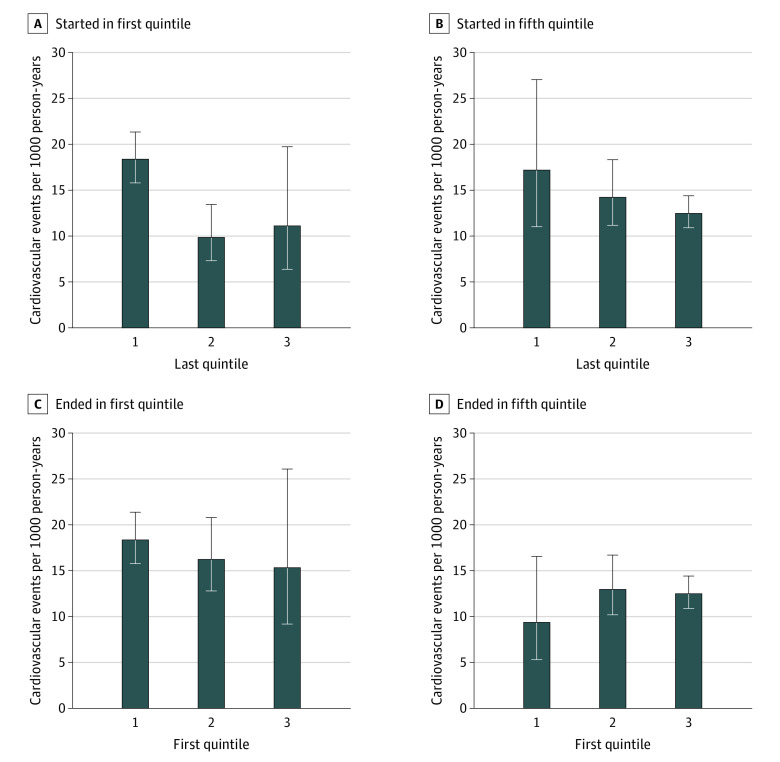

Although not statistically significant, larger jumps in relative wealth quintile trended toward greater magnitude of cardiovascular risk associations corresponding to an aHR of 0.82 (95% CI, 0.62-1.08) for an increase of 2 quintiles, 0.84 (95% CI, 0.72-0.99) for an increase of 1 quintile, 1.00 (reference) for no change, 1.13 (95% CI, 0.98-1.30) for a decrease of 1 quintile, and 1.25 (95% CI, 0.96-1.62) for a decrease of 2 quintiles (eFigure 2 in the Supplement). Data regarding the prognostic implications of relative wealth changes among those participants who were ever in the wealthiest or poorest quintiles are presented in the eResults in the Supplement and Figure 3.

Figure 3. Cardiovascular Event Rates Based on Observed Starting and Ending Quintiles of Wealth.

Incident rates are expressed per 1000 patient-years of follow-up; error bars indicate 95% CI.

Individual Nonfatal and Fatal Cardiovascular Events

In competing risks regression analysis evaluating the nonfatal cardiovascular event alone (accounting for cardiovascular death as a competing risk), relative changes in wealth quintiles were associated with consistent but nonsignificant covariate-adjusted associations with nonfatal cardiovascular events in follow-up (subdistributional aHR for relative wealth quintile increase, 0.93 [95% CI, 0.79-1.09; P = .38]; subdistributional aHR for relative wealth quintile decrease, 1.13 [95% CI, 0.98-1.31; P = .10]). When evaluating the cardiovascular death outcome alone (eFigure 3 in the Supplement), relative wealth increases were associated with a significantly lower risk of cardiovascular death (aHR, 0.59 [95% CI, 0.41-0.84]; P = .003), and relative wealth decreases were associated with consistent but nonsignificant higher risk of cardiovascular death (aHR, 1.19 [95% CI, 0.87-1.64]; P = .28).

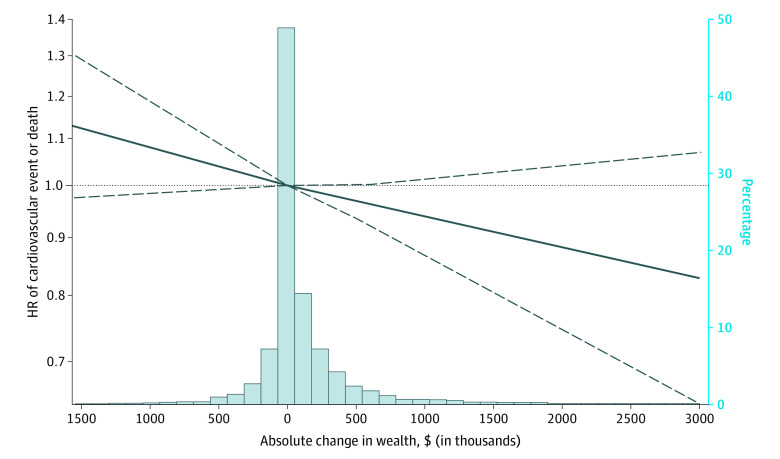

Wealth Changes as a Continuous Variable

Consistent with quintile-based analyses, when analyzing absolute changes in wealth, each incremental increase of $100 000 in nonhousing wealth trended toward reductions in cardiovascular risk (aHR, 0.994 [95% CI, 0.987-1.000] per $100 000 increase; P = .052) after stratification by birth cohort and adjustment for starting quintile and the covariate set. Restricted cubic spline analyses identified a consistent linear association (without observed inflection) between absolute wealth change and hazards for cardiovascular event or death (likelihood ratio test χ2 = 5.11; P = .02 for linearity) (Figure 4).

Figure 4. Hazards of Absolute Change in Wealth and Nonfatal Cardiovascular Event or Cardiovascular Death.

Restricted cubic spline analyses identified a consistent linear association (without observed inflection) between absolute wealth change and hazard ratio (HR) for cardiovascular event or death (0 indicates reference) (P = .02 for linearity). The histogram represents the percentage of participants experiencing varying absolute changes in wealth.

Racial/Ethnic Subgroups

No statistical heterogeneity was observed in the associations between relative wealth changes and cardiovascular events across racial/ethnic subgroups (P > .10 for interaction). Qualitatively, consistent directionality of effect sizes was observed for the prognostic association of upward wealth mobility in all racial/ethnic subgroups. However, it appeared that the prognostic association of downward wealth mobility with adverse cardiovascular outcomes was primarily observed in White participants (aHR, 1.21 [95% CI, 1.05-1.41]) (eTable 5 in the Supplement).

Combined Housing and Nonhousing Wealth Change

When evaluating changes in combined wealth (housing and nonhousing assets) as the exposure variable, absolute combined wealth increases were associated with lower risk of nonfatal cardiovascular event or cardiovascular death (aHR, 0.993 [95% CI, 0.987-0.999] per $100 000 increase; P = .02). This association appeared to be linear (P = .007 for linearity) (eFigure 4 in the Supplement).

Secondary Analysis: Participants With CVD

In a cohort of participants with a history of CVD (n = 3360), 377 participants experienced cardiovascular death (7.2 [95% CI, 6.5-8.0] per 1000 person-years). In fully adjusted multivariable analyses, downward wealth mobility was associated with increased risk of cardiovascular death (aHR, 1.48 [95% CI, 1.13-1.93]; P = .004) (eFigure 5 in the Supplement). However, the association between upward wealth mobility and lower subsequent cardiovascular death did not meet statistical significance with wide confidence limits (aHR, 0.86 [95% CI, 0.65-1.14]; P = .30).

Discussion

In this longitudinal sample of adults without CVD, we demonstrate that relative wealth mobility from 50 to 64 years of age was associated with a risk of composite nonfatal cardiovascular events or cardiovascular death beyond 65 years of age, independent of starting wealth and other sociodemographic factors. Consistent with prior studies describing the inverse association between cross-sectional wealth and health outcomes,9,18 we show that wealth is independently associated with long-term cardiovascular risk, with higher cardiovascular risk concentrated in the poorest quintiles. Both wealth loss and income volatility have been shown to be associated with higher mortality.10,11 We found that participants who experienced any upward or downward wealth mobility had lower or higher cardiovascular risk, respectively, independent of starting quintile. We estimate that each $100 000 increase in wealth was associated with a roughly 1% lower hazard of cardiovascular outcome in follow-up.

Interestingly, proximal observations of wealth before 65 years of age appear to be more important than remote measures of wealth. Those who started in the bottom quintile but experienced upward wealth mobility had observed lower cardiovascular risk than those who remained in the bottom quintile. Participants who ended in the top quintile had cardiovascular risk similar to that for participants who started and stayed in the top quintile. These findings were comparable among those who ended in the bottom quintiles. Notably, participants who started in the top quintile and experienced downward wealth mobility still had cardiovascular rates similar to those for participants who were stably in the top quintile. This finding may suggest a potential legacy protection of wealth present among the wealthiest individuals, but not the poorest.

Race, wealth, and health are closely interrelated, and race has the potential to modify the association between wealth changes and health status. In our study, we did not observe any statistical interaction between race/ethnicity and wealth mobility. However, we observed lower overall risks of cardiovascular events among non-Hispanic Black and Hispanic individuals, and the prognostic implications of downward wealth mobility were qualitatively less evident in these subgroups. Owing to the reliance on self-reported information in the HRS, we believe these findings are likely a byproduct of collider bias, in which Black and Hispanic participants who experience downward wealth mobility are more likely to experience barriers to care and subsequently less likely to receive a diagnosis of CVD. Similar findings have been seen in other national surveys.19

For participants with preexisting CVD, we show that longitudinal wealth loss was associated with higher risk of cardiovascular death. However, the directionality of this association is difficult to assess in our study given the heightened financial hardship associated with cardiovascular care, especially among individuals with progressive disease and recurrent events.20

Biological explanations of the apparent cardiovascular protection of upward wealth mobility have not been studied explicitly. Much of the evidence describing the causal pathways of wealth and health focus on financial hardship and are divided into 3 main categories. First, new wealth loss has been associated with increased stress, poorer health, worsened depression and anxiety,21,22 elevated blood pressure and inflammatory marker levels,23 and increased social isolation.24 Second, sudden economic hardship has been associated with changes in healthy behaviors and spending. Increased tobacco, alcohol,25 and drug26 use and declines in healthy eating patterns27 and overall spending on health care have also been observed.28 Third, wealth fluctuations alter how time is spent. Time previously dedicated to healthy behaviors may instead be used to handle the new stress of financial difficulty.23 Indeed, leisure time physical activity (which may be limited during financial hardship), but not occupational physical activity, has been shown to be associated with lower cardiovascular risk. All these factors likely accelerate the development and progression of CVD.29 In contrast, it is plausible that these mechanisms that confer increased risk during financial difficulty may confer decreased risk during financial thriving. Taken together, improvements in stress, healthy behaviors, and leisure time may help explain the observed cardiovascular risk reduction among participants with upward wealth mobility.

Our study provides potential insights for public policy interventions. Policies aimed at educational attainment and opportunity may theoretically support upward wealth mobility but may be challenging to operationalize in middle-aged adults. Policies aimed at building resilience against large wealth losses and shocks should be prioritized. Universal coverage requirements for common catastrophic expenses with low-income subsidies could represent a viable path forward but fail to address the upstream market environment that allows these unbearable costs to exist. A more viable policy would curb charges from industries in which catastrophic wealth loss can occur (such as the health care and legal industries) and link maximum expenses for catastrophic events to a percentage of disposable income.

However, opportunities to accrue and use wealth are closely tied with existing social structures. Greater wealth provides access to safer neighborhoods, higher-rated school districts, healthier restaurants, cleaner air, and more active recreation.30 Structural racism in the form of discriminatory housing and lending practices, biased policing and sentencing patterns, and implicit biases, combined with disparities in financial literacy, all represent barriers to equitable opportunity to build wealth.30 A substantial racial wealth gap exists in the US, with White families having 10-fold greater wealth than Black families,31 and CVD is known to occur earlier among Black adults.32 Thus, any new policy aimed at improving the financial health of adults must also target existing systemically racist policies that disproportionately prevent minorities from building and using wealth. Although our analyses attempt to adjust wealth for inflation and compare individuals with similar life trajectories (birth cohorts), the purchasing power associated with a given unit of wealth may still vary from individual to individual. Broadly, wealth mobility needs to be contextualized in the background of an individual’s local social and economic environment because these factors may powerfully shape how wealth may ultimately be accrued and used.

Strengths and Limitations

Our study has notable strengths. First, by selecting only participants without a history of CVD for the primary analysis, we attempted to attenuate the potential influence of reverse causality (ie, that wealth fluctuations were primarily due to expenditures related to CVD). Second, by stratifying for birth cohort, we accounted for temporal events, such as economic recessions, changes to tax law, and advances in medicine, that may have affected each birth cohort at different ages and had varying effects on long-term wealth accumulation.

Our study also has multiple limitations. First, because of our inclusion criteria, our findings may not be generalizable to participants younger than 50 years. Although the HRS is a representative sample, we intentionally selected a low-risk cohort to understand temporal patterns of wealth accumulation or loss on subsequent cardiovascular health, which may further limit generalizability to the US population. However, because low socioeconomic status portends higher cardiovascular risk, we may have excluded a higher proportion of economically disadvantaged participants owing to the presence of early CVD. Second, our measurement of wealth primarily focused on nonhousing assets; thus, we may be underestimating wealth among participants who have a large portion of their assets in housing. However, we opted for this measure to reduce the risk of birth cohort–specific differences in housing wealth33 and because we believed that a participant’s liquid wealth was more resilient against exogenous factors such as housing recessions.34 Analyses evaluating combined housing and nonhousing wealth yielded consistent findings. Third, we measured wealth differences between each 5-year window; however, we might not have captured brief interim significant fluctuations of wealth. Similarly, we were unable to capture geographical variation in wealth, purchasing power, or cost of living that could have affected lifestyle and cardiovascular risk. Fourth, because most data in the HRS are self-reported, it is possible that wealth measurements and self-reported cardiovascular events may be inaccurate owing to reporter error or collider bias. Fifth, because more than 70% of participants in the HRS were White, the study is unable to comment on the interplay among race, residential segregation, and wealth. Further investigation is required regarding the cardiovascular health implications of wealth trajectory in more diverse samples. Last, although we have attempted to posit potential reasons underlying the observed association between wealth changes and cardiovascular health, dedicated follow-up studies are needed to more closely examine these mechanisms.

Conclusions

In this longitudinal cohort study of relatively healthy adults, upward or downward relative wealth mobility during midlife was associated with lower or higher levels of cardiovascular events, respectively, regardless of initial wealth. These findings suggest that wealth mobility may offset some of the cardiovascular risk associated with past economic hardship. Further work is necessary to examine this wealth-health association in more diverse populations, elucidate mechanisms for these observations, and identify potential policy interventions to facilitate wealth mobility among low-income adults.

eMethods. Subgroup Analyses of Participants at the Extremes of Wealth

eResults. Subgroup Analyses of Participants at the Extremes of Wealth

eTable 1. Combined Demographics of Participants With and Without Underlying Cardiovascular Disease

eTable 2. Birth Cohort-Specific Wealth Quintile Ranges by 5-Year Age Intervals

eTable 3. Incidence Rates of Cardiovascular Events by Starting and Ending Wealth Quintile

eTable 4. Incidence Proportion of Nonfatal Cardiovascular Event or Cardiovascular Death by Wealth Quintile Change

eTable 5. Incidence Rates and Adjusted Hazards for Nonfatal Cardiovascular Event or Cardiovascular Death by Race

eFigure 1. Participant Selection Flow Diagram

eFigure 2. Hazards of Nonfatal Cardiovascular Event or Cardiovascular Death by Magnitude of Wealth Mobility

eFigure 3. Hazards of Total Absolute Wealth Change (Including Housing and Nonhousing Assets and Debts) and Nonfatal Cardiovascular Event or Cardiovascular Death

eFigure 4. Kaplan Meier Survival Curve for Freedom From Cardiovascular Death Alone Among Participants With and Without Upward Wealth Mobility

eFigure 5. Hazards of Cardiovascular Death by Wealth Mobility Among Participants With Cardiovascular Disease

References

- 1.Chetty R, Stepner M, Abraham S, et al. The association between income and life expectancy in the United States, 2001-2014. JAMA. 2016;315(16):1750-1766. doi: 10.1001/jama.2016.4226 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Abdalla SM, Yu S, Galea S. Trends in cardiovascular disease prevalence by income level in the United States. JAMA Netw Open. 2020;3(9):e2018150. doi: 10.1001/jamanetworkopen.2020.18150 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Choi H, Steptoe A, Heisler M, et al. Comparison of health outcomes among high- and low-income adults aged 55 to 64 years in the US vs England. JAMA Intern Med. 2020;180(9):1185-1193. doi: 10.1001/jamainternmed.2020.2802 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Parikh PB, Yang J, Leigh S, et al. The impact of financial barriers on access to care, quality of care and vascular morbidity among patients with diabetes and coronary heart disease. J Gen Intern Med. 2014;29(1):76-81. doi: 10.1007/s11606-013-2635-6 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Lemstra ME, Alsabbagh W, Rajakumar RJ, Rogers MR, Blackburn D. Neighbourhood income and cardiac rehabilitation access as determinants of nonattendance and noncompletion. Can J Cardiol. 2013;29(12):1599-1603. doi: 10.1016/j.cjca.2013.08.011 [DOI] [PubMed] [Google Scholar]

- 6.Yong CM, Abnousi F, Asch SM, Heidenreich PA. Socioeconomic inequalities in quality of care and outcomes among patients with acute coronary syndrome in the modern era of drug eluting stents. J Am Heart Assoc. 2014;3(6):e001029. doi: 10.1161/JAHA.114.001029 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Khera R, Valero-Elizondo J, Okunrintemi V, et al. Association of out-of-pocket annual health expenditures with financial hardship in low-income adults with atherosclerotic cardiovascular disease in the United States. JAMA Cardiol. 2018;3(8):729-738. doi: 10.1001/jamacardio.2018.1813 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Mackenbach JP, Stirbu I, Roskam AJ, et al. ; European Union Working Group on Socioeconomic Inequalities in Health . Socioeconomic inequalities in health in 22 European countries. N Engl J Med. 2008;358(23):2468-2481. doi: 10.1056/NEJMsa0707519 [DOI] [PubMed] [Google Scholar]

- 9.Demakakos P, Biddulph JP, Bobak M, Marmot MG. Wealth and mortality at older ages: a prospective cohort study. J Epidemiol Community Health. 2016;70(4):346-353. doi: 10.1136/jech-2015-206173 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Pool LR, Burgard SA, Needham BL, Elliott MR, Langa KM, Mendes de Leon CF. Association of a negative wealth shock with all-cause mortality in middle-aged and older adults in the United States. JAMA. 2018;319(13):1341-1350. doi: 10.1001/jama.2018.2055 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Elfassy T, Swift SL, Glymour MM, et al. Associations of income volatility with incident cardiovascular disease and all-cause mortality in a US cohort. Circulation. 2019;139(7):850-859. doi: 10.1161/CIRCULATIONAHA.118.035521 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Khatana SAM, Venkataramani AS, Nathan AS, et al. Association between county-level change in economic prosperity and change in cardiovascular mortality among middle-aged US adults. JAMA. 2021;325(5):445-453. doi: 10.1001/jama.2020.26141 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.University of Michigan. Health and Retirement Study. RAND HRS Longitudinal File 2016 (V2) public use dataset. Accessed August 25, 2020. https://hrsdata.isr.umich.edu/data-products/rand-hrs-longitudinal-file-2018

- 14.RAND Center for the Study of Aging . RAND HRS Longitudinal File 2018. Accessed August 25, 2020. https://hrsdata.isr.umich.edu/data-products/rand-hrs-longitudinal-file-2018

- 15.David RW. Validating Mortality Ascertainment in the Health and Retirement Study. Survey Research Center, Institute for Social Research, University of Michigan; 2016. [Google Scholar]

- 16.Fine JP, Gray RJ. A proportional hazards model for the subdistribution of a competing risk. J Am Stat Assoc. 1999;94(446):496-509. doi: 10.1080/01621459.1999.10474144 [DOI] [Google Scholar]

- 17.Austin PC, Lee DS, Fine JP. Introduction to the analysis of survival data in the presence of competing risks. Circulation. 2016;133(6):601-609. doi: 10.1161/CIRCULATIONAHA.115.017719 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Makaroun LK, Brown RT, Diaz-Ramirez LG, et al. Wealth-associated disparities in death and disability in the United States and England. JAMA Intern Med. 2017;177(12):1745-1753. doi: 10.1001/jamainternmed.2017.3903 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Heckbert SR, Austin TR, Jensen PN, et al. Differences by race/ethnicity in the prevalence of clinically detected and monitor-detected atrial fibrillation. Circ Arrhythm Electrophysiol. 2020;13(1):e007698. doi: 10.1161/CIRCEP.119.007698 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Khera R, Valero-Elizondo J, Nasir K. Financial toxicity in atherosclerotic cardiovascular disease in the United States: current state and future directions. J Am Heart Assoc. 2020;9(19):e017793. doi: 10.1161/JAHA.120.017793 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Swift SL, Elfassy T, Bailey Z, et al. Association of negative financial shocks during the Great Recession with depressive symptoms and substance use in the USA: the CARDIA study. J Epidemiol Community Health. 2020;74(12):995-1001. doi: 10.1136/jech-2020-213917 [DOI] [PubMed] [Google Scholar]

- 22.Pool LR, Needham BL, Burgard SA, Elliott MR, de Leon CFM. Negative wealth shock and short-term changes in depressive symptoms and medication adherence among late middle-aged adults. J Epidemiol Community Health. 2017;71(8):758-763. doi: 10.1136/jech-2016-208347 [DOI] [PubMed] [Google Scholar]

- 23.Boen C, Yang YC. The physiological impacts of wealth shocks in late life: evidence from the Great Recession. Soc Sci Med. 2016;150:221-230. doi: 10.1016/j.socscimed.2015.12.029 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 24.Hawkley LC, Zheng B, Song X. Negative financial shock increases loneliness in older adults, 2006-2016: reduced effect during the Great Recession (2008-2010). Soc Sci Med. 2020;255:113000. doi: 10.1016/j.socscimed.2020.113000 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.Kalousova L, Burgard SA. Unemployment, measured and perceived decline of economic resources: contrasting three measures of recessionary hardships and their implications for adopting negative health behaviors. Soc Sci Med. 2014;106:28-34. doi: 10.1016/j.socscimed.2014.01.007 [DOI] [PubMed] [Google Scholar]

- 26.Glei DA, Weinstein M. Drug and alcohol abuse: the role of economic insecurity. Am J Health Behav. 2019;43(4):838-853. doi: 10.5993/AJHB.43.4.16 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27.Dave DM, Kelly IR. How does the business cycle affect eating habits? Soc Sci Med. 2012;74(2):254-262. doi: 10.1016/j.socscimed.2011.10.005 [DOI] [PubMed] [Google Scholar]

- 28.Mortensen K, Chen J. The Great Recession and racial and ethnic disparities in health services use. JAMA Intern Med. 2013;173(4):315-317. doi: 10.1001/jamainternmed.2013.1414 [DOI] [PubMed] [Google Scholar]

- 29.Kivimäki M, Steptoe A. Effects of stress on the development and progression of cardiovascular disease. Nat Rev Cardiol. 2018;15(4):215-229. doi: 10.1038/nrcardio.2017.189 [DOI] [PubMed] [Google Scholar]

- 30.Braveman P, Acker J, Arkin E.. Wealth Matters for Health Equity: Executive Summary. Robert Wood Johnson Foundation; 2018. [Google Scholar]

- 31.McIntosh K, Moss E, Nunn R, Shambaugh J.. Examining the Black-White Wealth Gap. Brooking Institutes. 2020. [Google Scholar]

- 32.Carnethon MR, Pu J, Howard G, et al. ; American Heart Association Council on Epidemiology and Prevention; Council on Cardiovascular Disease in the Young; Council on Cardiovascular and Stroke Nursing; Council on Clinical Cardiology; Council on Functional Genomics and Translational Biology; Stroke Council . Cardiovascular health in African Americans: a scientific statement from the American Heart Association. Circulation. 2017;136(21):e393-e423. doi: 10.1161/CIR.0000000000000534 [DOI] [PubMed] [Google Scholar]

- 33.Lusardi A, Mitchell OS. Baby Boomer retirement security: the roles of planning, financial literacy, and housing wealth. J Monet Econ. 2007;54(1):205-224. doi: 10.1016/j.jmoneco.2006.12.001 [DOI] [Google Scholar]

- 34.Buiter WH. Housing Wealth Isn't Wealth. National Bureau of Economic Research; 2008. doi: 10.3386/w14204 [DOI] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

eMethods. Subgroup Analyses of Participants at the Extremes of Wealth

eResults. Subgroup Analyses of Participants at the Extremes of Wealth

eTable 1. Combined Demographics of Participants With and Without Underlying Cardiovascular Disease

eTable 2. Birth Cohort-Specific Wealth Quintile Ranges by 5-Year Age Intervals

eTable 3. Incidence Rates of Cardiovascular Events by Starting and Ending Wealth Quintile

eTable 4. Incidence Proportion of Nonfatal Cardiovascular Event or Cardiovascular Death by Wealth Quintile Change

eTable 5. Incidence Rates and Adjusted Hazards for Nonfatal Cardiovascular Event or Cardiovascular Death by Race

eFigure 1. Participant Selection Flow Diagram

eFigure 2. Hazards of Nonfatal Cardiovascular Event or Cardiovascular Death by Magnitude of Wealth Mobility

eFigure 3. Hazards of Total Absolute Wealth Change (Including Housing and Nonhousing Assets and Debts) and Nonfatal Cardiovascular Event or Cardiovascular Death

eFigure 4. Kaplan Meier Survival Curve for Freedom From Cardiovascular Death Alone Among Participants With and Without Upward Wealth Mobility

eFigure 5. Hazards of Cardiovascular Death by Wealth Mobility Among Participants With Cardiovascular Disease