Abstract

This paper develops a methodology for tracking in real-time the impact of shocks (such as natural disasters, financial crises or pandemics) on gross domestic product (GDP) by analyzing high-frequency electricity market data. As an illustration, we estimate the GDP loss caused by COVID-19 in twelve European countries during the first wave of the pandemic. Our results are almost indistinguishable from the official statistics during the first two quarters of 2020 (the correlation coefficient is 0.98) and are validated by several robustness tests. We provide estimates that are more chronologically disaggregated and up-to-date than standard macroeconomic indicators and, therefore, can provide timely information for policy evaluation in time of crisis. Our results show that pursuing “herd immunity” did not shelter from the harmful economic impacts of the first wave of the pandemic. They also suggest that coordinating policies internationally is fundamental for minimizing spillover effects from non-pharmaceutical interventions across countries.

Keywords: COVID-19, Economic impact, Mortality, Electricity demand, Real-time indicators

1. Introduction

In order to mitigate the spread of the pandemic of coronavirus disease 2019 (COVID-19), governments across the world introduced a variety of non-pharmaceutical interventions (NPIs), including mobility restrictions, school closures, lockdowns and businesses shutdowns. Prior to the diffusion of vaccines, these policies were the main options to reduce contagion and alleviate the burden on health care systems (Chernozhukov et al., 2021; Flaxman et al., 2020, Toxvaerd and Rowthorn, 2020). However, they also generated remarkable economic and social disruption (e.g. Altig et al. 2020, Keane and Neal 2021, Kong and Prinz 2020, Miles et al. 2020), which lead to an extensive debate on the existing trade-offs between slowing the pace of the pandemic and limiting its financial consequences (e.g. Acemoglu et al. 2020, Allcott et al. 2020, Aubert and Augeraud-Veron 2021; Giannitsarou et al. 2021, Kong and Prinz 2020, Lin and Meissner 2020; Sheridan et al., 2020, Toxvaerd and Rowthorn, 2020).

Monitoring both the diffusion of the virus and the magnitude of the economic disruption is vital for policy design and evaluation. However, while the media broadcast an updated picture of the public health perspective (e.g., new cases, deaths, reproduction rates) practically every day, economic evidence is erratic and delayed. In this respect, traditional macroeconomic indicators are insufficient, since they are published with a typical 2-3 months delay and with relatively slow frequency, creating a substantial window of uncertainty. This manuscript addresses this issue by developing a generalized methodology for measuring in real-time the impact of shocks on economic activity by using publicly available electricity market data.

Our approach is founded on two main features of electricity consumption which, following the energy economics literature, we indicate with the term “load”. First, almost all economic activity requires electricity as an input that is difficult to substitute away from, at least in the short-run. For example, consumption decreases significantly during night-time, weekends and public holidays, when many businesses are shut down, creating the characteristic multi-level (daily, weekly and annual) seasonality of electricity load time-series (Fezzi and Bunn, 2010). Second, information on electricity consumption is publicly accessible in real-time, since electricity is traded on hourly or half-hourly basis in most developed countries across the globe. Therefore, our methodology is widely applicable for cross-country comparisons.

A few studies already pointed out the strong correlation between the economic disruption caused by the current pandemic and the consequent reduction in electricity consumption (e.g., Fezzi and Fanghella 2020, Leach et al. 2020, Werth et al. 2020). However, there is not yet an agreement on the methodology that should be used to correctly estimate such causal impacts. In this respect, some authors employ as counterfactual (i.e., the value of electricity consumption had the pandemic not occurred) the value of consumption in the same days of previous years (Chen et al., 2020), while others implement forecasting models (Agdas and Barooah, 2020; Prol and Sungmin, 2020) or fixed-effect approaches (; Demirgüç-Kunt et al., 2021; Fezzi and Fanghella, 2020; Leach et al., 2020). Unfortunately, none of these studies present any formal testing. Therefore, it is impossible to evaluate if they successfully encompass the many long- (e.g. technological change) and short- (e.g. temperature, weekly seasonality) run drivers of electricity demand, thereby deriving unbiased causal effects. Another crucial gap in this literature is the lack of a systematic and validated approach to rescale electricity load changes into economic indicators, such as Gross Domestic Product (GDP) changes.

This manuscript builds upon and significantly extends the approach we introduced in Fezzi and Fanghella (2020), which employs a regression with fixed effects to control for the different short-run drivers of load, thereby isolating the impact of COVID-19 during the first 6 months of 2020 in Italy. In such article, we take advantage of the recent slow Italian GDP growth in order to employ the average temperature-adjusted electricity consumption in 2015–19 as a counterfactual for year 2020. While valid in that setting, such approach is not applicable to study GDP shocks in other contexts, since such a stylized counterfactual is not generally appropriate. This article moves beyond that case study and develops a generalized methodology that allows tracking in real-time the impact of shocks on economic activity by estimating a counterfactual which is widely applicable to a variety of countries and settings. While our method is demonstrated by analyzing the impact of the first wave of COVID-19 across Europe, our approach is much broader and not limited to the study of the current pandemic. It can also estimate the implications of other types of shocks, including financial crises (Crucini and Kahn, 1996) and natural disasters (Cavallo et al., 2013).

Our strategy follows a two-steps approach. In the first step we pre-filter the load time-series in order to remove both long-run (e.g., technological change, GDP evolution) and short-run (e.g., temperature, holidays) drivers, and in the second step we estimate the impact of shocks using fixed effects. We also introduce two different in-time placebo tests designed to ensure that our results are not biased by unobserved factors and, therefore, can be interpreted as causal impacts. Finally, unlike any previous paper, we validate our approach by comparing our GDP estimates of the impact of COVID-19 across Europe against the available macro-economic statistics. The almost perfect correspondence during the first two quarters of 2020 (with a correlation coefficient of 0.98) demonstrates the reliability of our methodology.

This manuscript extends the literature on “nowcasting” economic activity using indicators and models with high temporal (Aruoba et al., 2009; Andreou et al., 2013; Onorante and Raftery, 2016) and spatial resolution (Henderson et al., 2012; Lessmann and Seidel, 2017), which flourished in recent months in response to the urgent need of tracking in a timely fashion the effects of the pandemic. Recent studies analyze consumers’ transactions (Carvalho et al., 2020; Sheridan et al., 2020), mobile phone records (Goolsbee and Syverson, 2021), labor market trends (Forsythe et al., 2020; Kong and Prinz, 2020), nitrogen oxide emissions (Demirgüç-Kunt et al., 2021), social distancing measures (Bonaccorsi et al., 2020; Fang et al., 2020), or mixtures of different indicators (Chetty et al., 2020; Foroni et al., 2020; Lewis et al., 2020).

Our second contribution is empirical and consists in quantifying the short-run economic disruption caused by the first wave of COVID-19 and related NPIs. We take advantage of the wide availability of electricity load data in order to track GDP impacts across 12 European countries, selected to ensure heterogeneity in terms of severity of virus outbreaks and strength (and timing) of NPIs implementation. We discuss the trade-offs (or lack thereof) between financial and public health costs by complementing our analysis with mortality data. In this respect, it is important to recognize that our GDP impacts refer to the overall effect of the pandemic (including, for example, behavioral changes and policy spillover effects) and cannot be tied down to specific national policies. Furthermore, the effect of COVID-19 on countries’ economic and health performance can be exacerbated or moderated by the complex interactions of several factors that go beyond domestic policies, such as population density (Thomas et al., 2020), behavioral changes (Sheridan et al., 2020), weather (Carlson et al., 2020), age distribution (Remuzzi and Remuzzi, 2020), health system (Hopman et al., 2020), economic structure (Guan et al., 2020), international policy spillovers (Keane and Neal, 2021) and supply chain shocks (Guan et al., 2020).

Our findings can be summarized as follows. First, we find that the countries that experienced the most severe initial outbreaks (e.g. Italy, Spain) also grappled with some of the hardest economic recessions. However, we detect widespread signs of recovery at the end of the first wave, consistent with a “U-shaped” shock (Sharma et al., 2021), at least in the short-run. Second, countries with low initial exposure that introduced early and relatively less stringent NPIs (e.g., Denmark, Norway) experienced low financial and mortality impacts. By contrast, countries that failed to coordinate with others (e.g., Great Britain, GB, and Sweden) underperformed under both perspectives. Taken together, our findings suggest that not implementing any lockdown does not protect from economic recession, since supply shocks (e.g., international spillovers in real and financial markets) and demand shifts (e.g., consumption reductions) affect countries regardless of their NPIs. The introduction of early and relatively less stringent NPIs coordinated among neighboring countries appears to have been the most effective strategy to minimize both financial and mortality impacts during the first wave of the COVID-19 pandemic in Europe.

2. Methodology

Electricity consumption time series are affected by a multitude of short- and long-term determinants, which needs to be appropriately taken into account for deriving unbiased estimates of the impacts of shocks on economic activity. Therefore, the first step of our methodology consists in removing such determinants by pre-filtering (e.g. Brockwell and Davis, 2016). We then estimate impacts on electricity consumption via fixed-effects and, finally, calculate GDP implications.

2.1. Prefiltering

We first eliminate all weekends from the data, in order to reduce the weekly seasonality and to focus on the days in which most economic activity is carried out (this choice does not affect our results, as shown in the online Appendix 2, A2). We then implement a two-step pre-filtering approach as follows.

In the first step, we control for the impact of short-run drivers of consumption such as temperature, holidays and weekly seasonality. We use only the data before the shock which, in our empirical application to the COVID-19 pandemic, range from the 1st of January 2015 to the 3rd of March 2020. The latter date is defined as a week before the start of the lockdown in Italy, which was the first country in Europe to experience the outbreak. We estimate the model:

| (1) |

where yt is the natural logarithm of electricity load in day t, tempt is the mean daily air temperature, dkt is a dummy variable equal to 1 if temp t > k and equal to 0 otherwise, dwt are four dummy variables identifying the day of the week (with Monday as baseline), dht are six dummy variables identifying six different types of public holidays effects (generic public holidays, gap day between a holiday and a Sunday, gap day between a holiday and a Saturday, Christmas, New Year's Day, 31st of December), et is the error component and the remaining symbols are parameters to be estimated. In this specification the non-linear effect of temperature is captured by a joint piecewise linear function, which allows for an asymmetric V-shaped effect in which k is the threshold at which the relationship between electricity demand and temperature reverts. After estimating Eq. (1) via Ordinary Least Squares (OLS) we obtain, on the entire sample, the “short-term adjusted” electricity load as: , where the “hat” accent indicates the prediction from Eq. (1). This measure of electricity load can be interpreted as the fraction of consumption independent from temperature, weekly seasonality and holidays.

The second step of our pre-filtering approach controls for energy efficiency, technology and the general level of economic activity in different years (i.e. the long-run determinants) by estimating yearly fixed effects. This step cannot be run on the entire dataset, since the fixed effect for year 2020 would capture also the average impact of the pandemic. Therefore, for each year we consider only the data corresponding to the period before the outbreak, i.e. from the 1st of January to the 3rd of March (this corresponds to 56 days in each year for a total of 336 observations). We specify the following model:

| (2) |

where di are 5 dummy variables for the years 2015–2019 (with 2020 as the base year), vi is the error component and α0, …, α5 are the fixed-effect parameters that we estimate via OLS. We then subtract to the appropriate fixed effect in each year, obtaining our electricity load time series adjusted for temperature, weekly seasonality, holidays and long-run determinants, which we indicate with . This is the dependent variable for the rest of our analysis.

2.2. Electricity consumption impacts

We employ two different series of fixed effects in order to capture the remaining features of electricity consumption and to isolate the causal impact of COVID-19. This model can be written as:

| (3) |

where is the natural logarithm of electricity load after the two-steps pre-filtering process, γt are week-of-the-year fixed effects, γ∗t, 2020 are week-of-the-year fixed effects interacted with a dummy variable identifying year 2020, and ut is the random component. The week-of-the-year fixed effects γt encompass the slow-moving yearly seasonality connected to the remaining effect of weather, daylight hours and cultural habits, such as the reduction in economic activity during summer and winter. The impact of the pandemic is represented by the γ∗ t2020 parameters. These coefficients measure the differences in electricity consumption between each week of year 2020 and the average of the corresponding week in the previous five years which is not explained by any of the other observed factors. We expect these coefficients to be negative and significant when the NPIs and the general crisis generated by the pandemic affect economic activity.1

We specify the random component ut as autocorrelated moving-average (ARMA) process in order to capture autocorrelation and estimate Eq. (3) via maximum likelihood. Potential causes of autocorrelation are measurement errors (e.g., we represent temperature with the average daily value in each country's capital, but this is unlikely to perfectly represent the weather profile of the whole country) and omitted variables (such as local events and other types of dynamic adjustment in demand, e.g., Ramanathan et al. 1997). As a robustness test we also re-estimate our model with OLS and apply the heteroscedasticity and autocorrelation consistent (HAC) covariance matrix correction proposed by Newey and West (1987). As shown in Appendix A2, our findings remain unaffected.

We calculate the impact of COVID-19 on electricity consumption by comparing daily in-sample predictions for year 2020 obtained by (a) the full model in Eq. (3) and (b) the same model in which all the γ∗w, 2020 parameters are set to zero. While the former predictions represent our best-fitting estimates, the second one corresponds to the value that, according to our model, electricity consumption would have had if the pandemic had not happened, i.e. if the pre-filtered electricity consumption would have followed the same dynamics of the previous years. Indicating these two predictions (on the original scale of the variable) respectively with and , we can write the percentage impact of COVID-19 on electricity load as:

| (4) |

and derive appropriate confidence intervals running 5000 Monte Carlo simulations from the estimated joint distribution of the model's parameters.2

To control that our estimates are not affected by omitted variable bias, we develop two in-time placebo tests. In both tests we evaluate the coefficients of the interaction terms between year and weekly fixed-effects γ∗w, 2020 during time periods in which no significant impact should be present. If our approach is successful in capturing all the peculiar features of electricity consumption, all these coefficients should be non-significantly different from zero, with the exception of a few “false positives” compatible with type-I errors at the given significance level. In the first test, we simply evaluate the γ∗w, 2020 corresponding to the weeks before the outbreak (weeks 1–8). In the second one, we remove the data for year 2020 and run the entire analysis as if the pandemic happened in year 2019.

2.3. Economic impacts

We employ some deliberately simple assumptions to transform electricity load changes into economic impacts. We assume that, in each country, GDP changes are proportional to changes in electricity consumption in all productive sectors, i.e. all sectors but the residential one. Therefore, we rescale our estimates in Eq. (4), which are calculated on total electricity consumption, as follows. During regular days (i.e. no lockdown) we assume that residential consumption has remained unaffected and, therefore, that all the reduction in electricity load due to the pandemic can be traced back to the other sectors. The resulting impact on GDP corresponds to: GDP nl, t = lt 100 / (100 – r), where r represents the percentage of consumption of the residential sector for the relevant country. During lockdown days, we follow International Energy Agency (IEA, 2020) estimates reporting that residential consumption has increased by 40% when lockdowns were in place, and rescale our calculations accordingly: GDP l, t = lt 100 / (100 – 1.4r). In the next section we show how these simple assumptions lead to estimates which are remarkably close to the official GDP changes published for the first two quarters of 2020 by the organization for Economic Co-operation and Development (OECD, 2020).

3. Data and software

Our empirical application employs a large database integrating information from multiple sources, which we summarize in Table 1 . Electricity load is represented by day-ahead market data, which we aggregate on a daily basis from the hourly (or half-hourly) information reported by the European Network of Transmission System Operators for Electricity (ENTSO-E). We consider the time period between 01 and 01–2015 and 26–08–2020, which includes the entirety of the first wave of COVID-19 infection across Europe. Day-ahead load is a measure of the amount of power drawn from the grid from industrial, commercial and residential users, minus the small share of self-generation. We include 12 countries in order to represent the wide range of both health impacts and policy responses to the pandemic across Europe.3

Table 1.

Data sources.

| Data | Description | Source | Web address |

|---|---|---|---|

| Electricity load | Hourly (or intra-hourly) day-ahead electricity consumption | European Network of Transmission System Operators for Electricity (ENTSO-E) | https://transparency.entsoe.eu/ |

| Temperature | Daily average temperature in each country's capital retrieved from the University of Dayton weather archive. Missing data are filled by collecting information for the same city from NOAA or Weather Underground, depending on availability. | University of Dayton; National Oceanic and Atmospheric Administration (NOAA); Weather Underground |

http://academic.udayton.edu/kissock/http/Weather https://www.ncdc.noaa.gov/cdo-web/datatools https://www.wunderground.com/ |

| Residential load | Share of annual electricity load consumed by the residential sector in 2017 in each country. | International Energy Agency (IAE). | https://www.iea.org/data-and-statistics |

| GDP | GDP growth in the first and second quarter of 2020, relatively to the previous quarter. | Organization for Economic Cooperation and Development (OECD) | https://data.oecd.org/gdp/quarterly-gdp.htm |

| Excess deaths | Weekly excess death for each country in year 2020 compared with the average 2015-2019 are provided by the open source database of The Economists, which downloads data from EuroMOMO. | The Economist European Monitoring of Excess Mortality for Public Health Action (EuroMOMO) |

https://github.com/TheEconomist/covid-19-excess-deaths-tracker https://www.euromomo.eu/ |

| Policies | Information on NPIs and lockdowns in each country. | Various online sources, for example (but not limited to) politico.eu (see Appendix A4) | https://www.politico.eu/article/europe-coronavirus-post-lockdown-rules-compared-face-mask-travel/ |

One of the main drivers of electricity demand (e.g. Auffhammer et al., 2017) is temperature, which we represent using average air temperature in each country's capital (e.g. Fezzi and Fanghella, 2020). The only exceptions are France and Austria for which we use Bordeaux and Innsbruck because of data availability. Such data is retrieved from the University of Dayton archive, with the missing days filled in with information from the monitoring stations of the National Oceanic and Atmospheric Administration (NOAA) and Weather Underground, depending on availability. We control that temperature does not differ significantly across databases by running a linear regression on the overlapping data, and accepting the alternative source only if the R2 > 0.85. We then use the OLS coefficients to impute missing values.

Country-level data on the share of residential load is provided by the International Energy Agency (IEA). Official statistics on GDP growth, which we compare with our estimates, are available from the OECD. Importantly, the official indicators report GDP changes, not the GDP impact of the pandemic. Therefore, to perform an appropriate comparison with our estimates, we need to subtract from the OECD statistics the GDP change that would have happened if the pandemic had not occurred. For simplicity, we use assume this counterfactual to be the change in the corresponding quarter of 2019. Alternative measures are the variation of the last quarter of 2019 or the rescaled annual forecast for 2020 made in 2019 by the International Monetary Fund. Using one measure or another does not significantly affect our comparison. Data on excess deaths, which we use to represent the health impact of COVID-19, comes from the European Monitoring of Excess Mortality for Public Health Action (EuroMOMO) and The Economist. We derive information on lockdown dates and holidays from different online sources, detailed in Table A4 in the Online Appendix.

All our analysis is implemented with the free software R (R. Development Core Team, 2006). We use the packages lmtest (Zeileis and Hothorn, 2002), MASS (Venables and Ripley, 2002), forecast (Hyndman et al., 2020) and sandwich (Zeileis, 2004).

4. Empirical results

4.1. The impact of the pandemic on electricity consumption

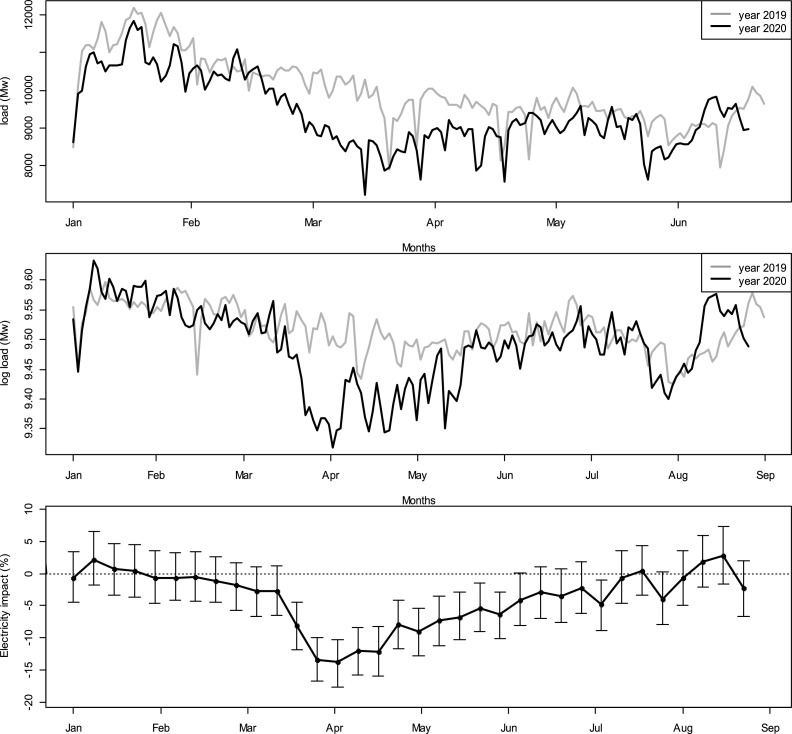

We begin by illustrating our empirical estimates of the impact of COVID-19 on electricity consumption. To preserve space, in this section we present in detail the findings for Belgium, which was one of the European countries most severely hit by the first wave of the pandemic. The results for each of the 12 countries in our analysis are reported in Appendix A1.

Panel A of Fig. 1 illustrates the key features of electricity consumption and provides a first, visual inspection of the impacts of COVID-19 by comparing daily load time series for years 2019 and 2020. Following the gray line, which represents load in 2019, we notice all the peculiar characteristics of electricity demand, such as the pronounced weekly seasonality, with the reduced business activity on the weekends and public holidays translating into roughly a 20% drop in load. We also observe a smoother, annual seasonality, which follows the path of temperature, with peaks in winter and summer. Electricity load in 2020, shown by the black line, follows similar patterns. Focusing only on the data before the lockdown, however, we notice how the overall level of consumption is somewhat lower than in 2019. This gap can be explained by differences in air temperature and by the long-run evolution of electricity demand, which, in turn, is affected by a variety of factors including economic growth and technological innovation. However, the difference between the two series increases significantly around the middle of March, when the COVID-19 outbreak spread in Belgium and the first NPIs were introduced to contain it. The gap is at its widest in April, when the most restrictive measures were in place, and then gradually reduces with the steady re-opening of the economy in the following weeks.

Fig. 1.

Electricity time series and COVID-19 impact for Belgium

Notes: plot A presents the original electricity consumption time-series, plot B presents the same time-series after prefiltering and plot C presents the estimated impacts of electricity consumption, with the vertical lines indicating 95% confidence intervals.

In panel B, we observe the same time series after prefiltering. Now the yearly seasonality is less evident, and the two series are much closer to each other during the pre-pandemic period, which we interpret as a sign that our approach functions well. In line with the un-adjusted data, also in this panel we notice the clear reduction in electricity consumption during lockdown weeks. The gap between the two series diminishes alongside the gradual easing of the restrictions and the reduction in COVID-19 cases.

Panel C shows our estimated weekly impact of the pandemic on electricity load. We do not restrict the parameters before the outbreak to be zero but, rather, include them in the model to serve as the first in-time placebo test for our results. As expected, the corresponding fixed effects are all non-significantly different from zero. Regarding the impacts of the pandemic and related NPIs, we estimate a strong and significant reduction in electricity consumption, varying between −15% and −10% during the weeks of strictest policies. The loosening of the restrictions, which started after the first week of May, prompted a gradual resumption of electricity demand. In the last four weeks of our sample (August 2020) electricity consumption is not significantly different from what it would have been had the pandemic not occurred. Therefore, our findings indicate that after weathering the first wave of the pandemic, the Belgian economy has returned to normality in the short run.

Table 2 summarizes our model specifications across nations and reports goodness-of-fit indicators and diagnostics. The first two columns present the number of AR and MA components that we use to model the error term in each country, with the Ljung and Box (1978) tests confirming that no significant autocorrelation remains. The fifth and sixth columns illustrate the goodness-of-fit. The APF-R2 indicates the fit of the deterministic part of Eq. (3), while the T-R2 represents the total share of electricity-load variability captured by the deterministic part of our entire modeling approach, including pre-filtering. This last measure indicates that our models explain between 90 and 95% of the variability of the logarithm of the electricity load, depending on the country.

Table 2.

Model fit and diagnostics.

| Country | Error-term | Autocorrelation | Goodness-of-fit | In-time placebo 1 | In-time-placebo 2 | ||||

|---|---|---|---|---|---|---|---|---|---|

| AR | MA | Ljung-Box test | APF R2 | T R2 | 5% | 10% | 5% | 10% | |

| Austria | 4 | 0 | 5.88 [0.44] | 0.63 | 0.95 | 0 | 0 | 0 | 2 |

| Belgium | 3 | 0 | 6.22 [0.51] | 0.62 | 0.93 | 0 | 0 | 2 | 5 |

| Denmark | 1 | 2 | 6.69 [0.46] | 0.49 | 0.94 | 1 | 1 | 0 | 2 |

| France | 3 | 0 | 11.21 [0.13] | 0.45 | 0.91 | 1 | 1 | 4 | 6 |

| Germany | 3 | 1 | 8.74 [0.19] | 0.62 | 0.91 | 0 | 0 | 23 | 26 |

| Great Britain | 3 | 1 | 7.15 [0.31] | 0.55 | 0.93 | 0 | 0 | 1 | 2 |

| Italy | 3 | 0 | 4.99 [0.66] | 0.77 | 0.94 | 0 | 0 | 8 | 10 |

| Netherlands | 2 | 1 | 7.77 [0.35] | 0.62 | 0.92 | 0 | 0 | 3 | 7 |

| Norway | 2 | 0 | 9.24 [0.33] | 0.27 | 0.95 | 0 | 0 | 4 | 6 |

| Spain | 5 | 0 | 4.98 [0.42] | 0.63 | 0.92 | 0 | 0 | 4 | 6 |

| Sweden | 2 | 1 | 7.78 [0.35] | 0.47 | 0.96 | 0 | 0 | 2 | 5 |

| Switzerland | 2 | 1 | 10.03 [0.19] | 0.43 | 0.90 | 0 | 0 | 2 | 12 |

| Average | – | – | – | – | – | 0.2 | 0.2 | 2.7 | 5.7 |

| Expected type I error | – | – | – | – | – | 0.5 | 0.9 | 2.6 | 5.2 |

Notes: The error-term columns report the number of autoregressive (AR) and moving average (MA) parameters for each country. The after pre-filtering (APF) R2 indicates the fit corresponding to the deterministic part of Eq. (3), while the total (T) R2 indicates the overall variability of the log of electricity load captured by the deterministic part of all our modeling approach (including pre-filtering). To test autocorrelation, we use the Ljung and Box (1978) test at lag 10 (two weeks), with p-values reported in square brackets. The in-time-placebo columns reports the number of tests failed at each significance level. The average calculated after excluding Germany, expected type I error is the number of failed test compatible with the significance level.

The last two columns report the results of the in-time placebo tests. In the first one, we test the significance of the coefficients γ∗w, 2020 before the outbreak (weeks 1–8 of 2020), while in the second one we eliminate the data for 2020 and run the analysis as if the pandemic happened in year 2019. All countries pass the first test. Regarding the second test, all countries except Germany and, to a lesser extent, Italy, have a number of failed tests compatible with the significance levels. After excluding Germany, the average number of failed tests is in line with the expected number of type-I errors (results reported in the last two rows). Despite Germany failing to pass this second test, the next section shows that our estimated GDP impacts are very close to the official indicators for the first two quarters of 2020, indicating that our misspecification is likely to be not very severe. Overall, the results for all other nations appear to be very robust.

We also evaluate the robustness of our findings to changes in variable definitions and estimation methods. In our main specification we calculate daily electricity load by averaging all hourly (or intra-hourly) information of each day after excluding weekends. We consider two alternatives: in the first one we model the entire profile of weekly data and, therefore, we do not exclude weekends. In the second one we go in the other direction and focus only on the time periods in which the share of electricity consumption from work activities is higher, which we define as the weekday peak hours (between 8 am and 6 pm). Regarding the estimation method, we also test how our findings change if we simply use OLS with HAC standard errors to model residual autocorrelation. In order to preserve space results are presented in Appendix A2. The three alternative approaches estimate dynamic impacts that are consistent with those provided by our main specification.

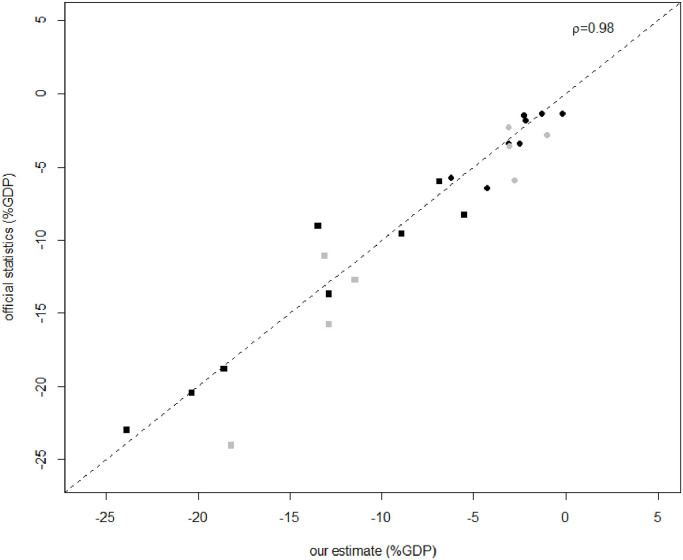

4.2. From electricity consumption to economic activity

Before illustrating GDP impacts in detail, we compare our results with the official statistics. At the time of writing this manuscript, this information is available for all the countries in our sample for only the first and second quarter of 2020, with some estimates still being marked as “provisional”. The scatter plot in Fig. 2 provides a comparison: excluding provisional values, which we represent with a gray color, the correlation between the two estimates is 0.98 (it reduces to 0.96 after including the provisional values) and most points are along the 45° line. This assessment reassures us on the validity of our method for inferring GDP changes from electricity data.

Fig. 2.

Relationship between our estimates and official statistics

Notes: The dots represent estimates for the 2020 Q1 and the squares for 2020 Q2. In gray we plot estimates that are indicated as “provisional” in the OECD database. The correlation coefficient ρ is calculated excluding these provisional data. Including such provisional data, it decreases to 0.96.

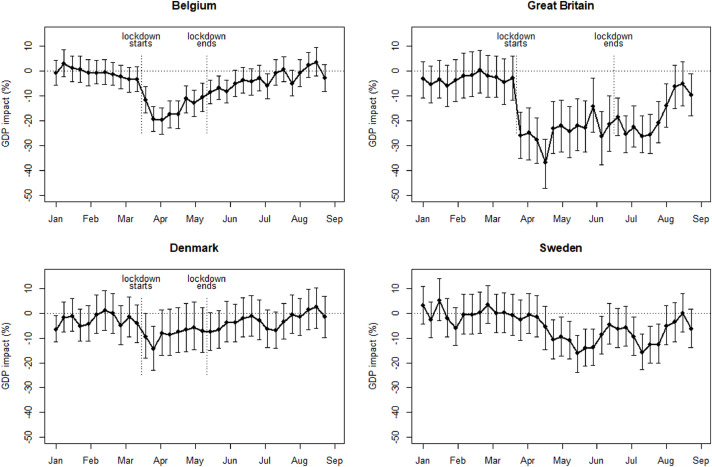

Our estimates are considerably more chronologically disaggregated and up-to-date than the official statistics and, therefore, allow us to monitor in real-time the impact of the pandemic. Fig. 3 and Table 3 illustrate such findings in detail by focusing on four countries, which represent the whole range of developments of the pandemic across Europe, taking into account both the severity of the outbreak and the strength of governments’ reactions (results for all countries are in Appendix A3). The top-left panel illustrates our estimates for Belgium. We observe an initial steep decline, coinciding with the introduction of the lockdown (18th of March 2020), and a gradual path of return to normalcy alongside the lifting of the restrictions and the reduction in COVID-19 cases. As shown in A3, all countries that experienced early COVID-19 outbreaks and introduced swift and strict lockdown policies (e.g., France, Italy, Spain) show similar dynamics, consistent with a U-shaped economic shock (Sharma et al., 2021). These patterns are lost if we only observe the official, quarterly information and, yet, are crucial for policy makers who need to timely assess the impact of alternative NPIs and the effectiveness of the monetary and fiscal stimuli developed to re-start the economy.

Fig. 3.

Estimated impact of COVID-19 on GDP

Notes: The plots present weekly GDP impacts, with the vertical lines indicating the 95% confidence intervals. In different countries lockdowns were implemented and then gradually lifted following different strategies. To allow comparisons, here we indicate as “lockdown ends” the date in which all retail shops are reopened (dates for all countries are in Appendix A4).

Table 3.

Monthly GDP impacts.

| Month | Belgium | Great Britain | Denmark | Sweden |

|---|---|---|---|---|

| March | −8.54 *** | −7.55 ** | −6.82 | −0.52 |

| (−11.78 ; −5.47) | (−14.39 ; −0.24) | (−13.96 ; 0.75) | (−6.27 ; 5.42) | |

| April | −16.22 *** | −27.74 *** | −7.50 * | −5.38 * |

| (−19.87 ; −12.69) | (−35.43 ; −20.51) | (−15.09 ; 1.08) | (−11.11 ; 0.54) | |

| May | −9.13 *** | −21.79 *** | −6.46 * | −13.96 *** |

| (−12.39 ; −5.87) | (−29.63 ; −13.56) | (−13.43 ; 0.72) | (−19.36 ; −8.59) | |

| June | −4.44 ** | −22.15 *** | −2.61 * | −7.43 ** |

| (−7.55 ; −0.77) | (−28.94 ; −15.54) | (−8.91 ; 4.29) | (−12.72 ; −1.92) | |

| July | −2.63 * | −22.65 *** | −3.99 | −12.41 *** |

| (−6.14 ; 0.80) | (−28.66 ; −16.25) | (−10.56 ; 2.40) | (−17.27 ; −7.23) | |

| August | 0.75 | −7.92 ** | 0.48 | −3.68 |

| (−3.19; 4.65) | (−14.56 ; −0.62) | (−6.78 ; 7.65) | (−8.66 ; 2.38) |

Notes: In parenthesis we indicate 95% confidence intervals obtained with 5000 Monte Carlo replications. Stars indicate significance as follows: *** = 1%, ** = 5%, * = 10%.

In the top-right corner we represent GB. This country also experienced a rapid increase in COVID-19 cases, but somewhat delayed intervention. Eventually, the number of infections skyrocketed and also Britain adopted strict lockdown policies, enacted from the 26th of March 2020. Balmford et al. (2020) argue that this delay is one of the main reasons why GB experienced a longer lockdown compared to all other European countries (British residents were under full lockdown for 12 weeks while, for example, in Belgium and Italy similar restrictions lasted only 8 weeks). Our estimates indicate steep economic losses, which appear to have reduced British GDP between 20% and 30% during the lockdown weeks. Weak signs of recovery start appearing in August 2020.

On the bottom panels we represent two countries that in March 2020 were experiencing much lower number of COVID-19 cases per capita and, therefore, had more time to prepare their policy response to the pandemic: Denmark and Sweden. Most countries in Northern and Eastern Europe experienced similar initially low number of cases. The two countries represented here dealt with COVID-19 following two very different approaches. Denmark acted quickly and imposed a relatively “light” lockdown, e.g., closing schools, large shopping centers and urging people to work from home. Sweden, on the other hand, enforced no strong restriction, and simply encouraged social-distancing, thereby relying on individual responsibility to curtail the spread of the virus (Sherdian et al., 2020; Orlowski and Goldsmith, 2020). According to our estimates, Denmark experienced a limited reduction in economic activity during the lockdown period, roughly between 5 and 10% (while on a weekly basis most effects are non-significant, when aggregated to the monthly level they all become significant at the 10% level, as shown in Table 3), which quickly recovered after the loosening of the restrictions. Conversely, we initially do not detect any significant reduction of GDP in Sweden. However, starting around the end of April 2020 we observe important losses, which last almost until the tail end of our observation period. Therefore, Swedish laissez-faire policy may have delayed the economic impact of the pandemic, while, simultaneously, it might have contributed to exacerbating the recession.

Taken together, these findings suggest that not implementing any restriction does not shelter a country from the adverse economic impacts of COVID-19. Most European countries that introduced and lifted lockdowns roughly at the same time (see Table A4), initially experienced economic disruption, but also recovered quickly with the shared re-opening of their economies. Sweden, on the other hand, did not implement a lockdown, but still faced economic losses and failed to recover together with the other countries that acted in coordination. Similarly, we cannot rule out that the deep recession experienced by GB during the first wave of the pandemic was, at least in certain aspects, aggravated by its delayed intervention. In this respect, our results support the view that national policies are not the sole culprit of economic disruption (Goolsbee and Syverson, 2021; Sheridan et al., 2020).

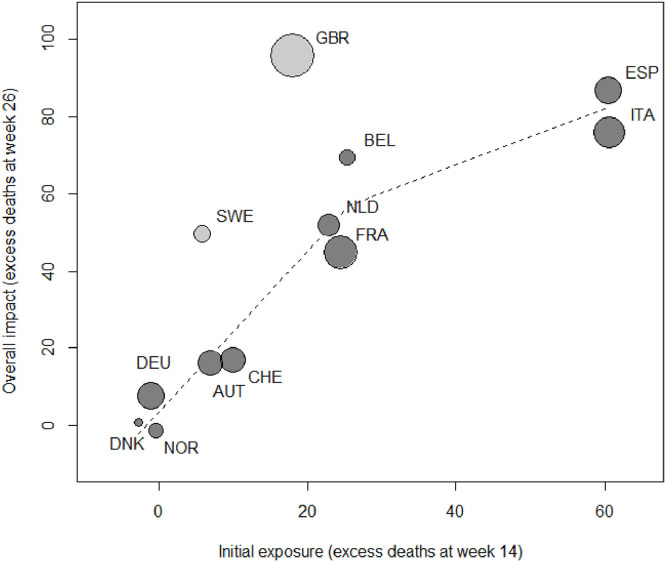

4.3. Comparing economic and health outcomes across countries

This section presents the economic impacts of the first wave of COVID-19 across European countries alongside mortality information. We do not rely on the official infection and mortality rates statistics, since differences in national reporting methods invalidate cross-country comparisons (e.g. Bilinski and Emanuel, 2020). Instead, we identify the impact of the pandemic by comparing weekly excess deaths in 2020 with the average of the same period in the previous five years (Ciminelli and Garcia-Mandicó, 2020, The Economist (2020)). This measure has the additional advantage of including both direct and indirect deaths due to COVID-19 and, therefore, allows us to evaluate the full extent of the mortality caused by the pandemic.

Fig. 4 summarizes the economic and health impacts. On the horizontal axis we present the cumulated excess deaths per 100,000 residents until the first week of April 2020. Considering that the development of COVID-19 infections (including incubation) is about 3–4 weeks, this measure is a proxy for the rate of infected individuals in the first week of March 2020, i.e., roughly when COVID-19 was declared a pandemic by the World Health Organization . At that time, NPIs were not yet implemented systematically and, therefore, the horizontal axis represents the exposure of each country to COVID-19 a priori of any significant national-level policy intervention. At the higher end, we find Italy and Spain, where the pandemic developed the earliest, while, at the lower end, we observe the Scandinavian countries, which had a more fortunate outset. On the vertical axis, we present the overall mortality rate of the pandemic until the end of the first wave. Not surprisingly, there is a strong and positive relation between the two measures, represented by the dashed line: the countries most exposed to the initial outset of the pandemic are also those recording the highest total number of deaths per capita. On the other side of the spectrum, countries that introduced NPIs earlier in the course of the pandemic experienced lower mortality rates. Economic impacts (represented by the size of the bubbles) indicate a similar trend, with the most exposed countries facing the hardest losses.

Fig. 4.

Public health and economic impacts of COVID-19

Notes: Excess deaths calculated as the difference between the cumulated total deaths per 100,000 residents during each week of 2020 and the average cumulated deaths for the same week in the years 2015-2019. Week 14 corresponds to cumulated excess deaths until the first week of April, and week 26 corresponds to comulated excess deaths until the last week of June. The size of the balloons represents the overall GDP reduction estimated by our model until the end of our sample (26-08-2020). Dashed line represents the best fitting local linear regression via non-parametric estimation.

This generalized relationship presents two outliers: Sweden and Britain, the only two countries that did not coordinate with the rest of the European states and, at least initially, tried to pursue a “herd immunity” strategy (Orlowski and Goldsmith, 2020; Hunter, 2020). With respect to comparable nations with similar initial exposure (e.g., Norway for Sweden and France for GB), they underperformed under both economic and health outcomes. On the one hand, it is evident how postponing or not implementing lockdowns increases the health burden of the pandemic, at least in the short run (Hsiang et al., 2020). On the other hand, countries’ economic performance depends on a larger set of factors than national policies. Therefore, not restricting domestic economic activity does not appear to shelter nations from economic recessions. This comparison further highlights that trade-off between public health and economic impacts are somewhat limited at the level of a single country. An international coordinated effort seems to be the most appropriate approach to minimize both the economic and health consequences of the COVID-19 pandemic. These conclusions, however, should acknowledge the substantial differences characterizing health, social and economic systems across countries which, in turn, can greatly affect both the financial and public health impacts of the pandemic (Fernández-Villaverde and Jones, 2020).

5. Conclusions

This study demonstrates that widely available electricity consumption data can be harnessed for tracking in real-time the impact of economic shocks on GDP. Our methodology includes two companion in-time placebo tests, that safeguard our estimates against omitted variable bias. We also validate our findings against official, quarterly indicators. Our approach can be used to assess the economic impact of COVID-19 and the path of recovery, in order to gauge the effectiveness of the monetary and fiscal stimuli introduced to address the crisis. Our method is widely applicable, since electricity load data are publicly available for virtually all developed economies in the world. While our approach is generally valid to assess short-run impacts of sudden shocks (such as those caused by natural disasters, financial crises or pandemics) it cannot be used to detect gradual GDP changes, since such effects are potentially confounded by demand responses to prices and technological innovations. Nevertheless, such factors are, most likely, not significant over the time horizon in which official indicators are unavailable.

Our empirical estimates of the first wave of COVID-19 across different European countries need to be interpreted as the overall impact of the pandemic, since they do not disentangle the effect of domestic policies from those of other drivers, such as behavioral changes and international spillovers. On the demand side, for example, consumers appear to respond to both domestic and overseas restrictions (Keane and Neal, 2021). Furthermore, the risk of contracting the virus can reduce consumption even when no restrictions are in place, in particular among the more at-risk individuals (Sheridan et al., 2020). On the supply side, another type of contagion is at work. Countries do not exist in isolation, and their economic activity strongly depends on how businesses are faring in partner economies. For example, the interruptions of global supply chains, especially in the manufacturing sector (e.g. Guan et al., 2020), and the various types of uncertainty generated by the pandemic (Altig et al., 2020) create ripples that propagated across both financial and real markets. Finally, countries may learn which restrictions to introduce (or lift) from their neighbors, thereby generating spillovers also at the NPIs level. This adds further complexity in disentangling the effect of domestic and international policies (Holtz et al., 2020). Our empirical analysis does not distinguish among all these different aspects, but simply tracks the state of the economy.

Finally, NPIs impose significant restrictions on individual rights and freedom, have wide social and psychological impacts (Pfefferbaum and North, 2020), promote an increase in inequalities (Blundell et al., 2020; Bonaccorsi et al., 2020; Palomino et al., 2020) and may present other long-run consequences such as impacts on human capital which, at the moment, are very difficult to forecast. Our estimates do not consider any of these issues.

Funding

This research was supported by the OCEN—COVID19 Project, funded by the University of Trento under the “Covid 19″ research fund.

Footnotes

Many thanks to Ian Bateman, Marco Cucculelli and the participant of the webinar “Economics and Covid 19″ organized by the Italian Economics Society for their constructive comments on a previous version of this paper. We are grateful to the Guest Editors, Cecile Aubert and Flavio Toxvaerd, and the anonymous Reviewers for their suggestions which greatly helped improving the quality of this work.

Our model, similarly to those of Fezzi and Fanghella (2020) and Leach et al. (2020), does not include any price effect. In fact, electricity demand function can be thought as completely inelastic in the short-run, since the majority of final users are supplied by utility companies at fixed tariffs (Fezzi and Bunn, 2010). Because of this feature, even short-run electricity load forecasting models do not typically include price information (Taylor et al. 2006) and, practically, all short-run price forecasting methods treat quantity as exogenous (Fezzi and Mosetti, 2020).

Because of Jensen's inequality, the prediction on the original variable scale is not simply the exponent of the prediction on the log, but actually depend on the distribution of the random component (Santos Silva and Tenreyro, 2006). Since, in our case, the difference is negligible because of the low noise-to-signal ratio, for simplicity we employ the Gaussian distribution i.e. Yt = exp[yt + (s2/2)], with s indicating the estimated standard deviation of the error component.

Specifically, we include: Austria, Belgium, Denmark, France, Germany, Great Britain, Italy, Netherlands, Norway, Spain, Sweden and Switzerland.

Supplementary material associated with this article can be found, in the online version, at doi:10.1016/j.euroecorev.2021.103907.

Appendix. Supplementary materials

References

- Acemoglu D., Chernozhukov V., Werning I., Whinston M.D. National Bureau of Economic Research; 2020. Optimal Targeted Lockdowns in a Multi-Group SIR Model. NBER Working Papers 27102. [Google Scholar]

- Agdas D., Barooah P. Impact of the COVID-19 pandemic on the U.S. electricity demand and supply: an early view from data. IEEE Access. 2020;8:151523–151534. doi: 10.1109/ACCESS.2020.3016912. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Allcott H., Boxell L., Conway J., Gentzkow M., Thaler M., Yang D.Y. Polarization and public health: partisan differences in social distancing during the Coronavirus pandemic. J. Public Econ. 2020;191 doi: 10.1016/j.jpubeco.2020.104254. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Altig D., Baker S., Barrero J.M., Bloom N., Bunn P., Chen S., Mizen P. Economic uncertainty before and during the COVID-19 pandemic. J. Public Econ. 2020;191 doi: 10.1016/j.jpubeco.2020.104274. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Andreou E., Ghysels E., Kourtellos A. Should macroeconomic forecasters use daily financial data and how? J. Bus. Econom. Stat. 2013;31(2):240–251. [Google Scholar]

- Aruoba S.B., Diebold F.X., Scotti C. Real-time measurement of business conditions. J. Bus. Econom. Stat. 2009;27(4):417–427. [Google Scholar]

- Aubert C., Augeraud-Véron E. The relative power of individual distancing efforts and public policies to curb the COVID-19 epidemics. PLoS One. 2021;16(5) doi: 10.1371/journal.pone.0250764. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Auffhammer M., Baylis P., Hausman C.H. Climate change is projected to have severe impacts on the frequency and intensity of peak electricity demand across the United States. Proc. Natl. Acad. Sci. 2017;114(8):1886–1891. doi: 10.1073/pnas.1613193114. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Balmford B., Annan J.D., Hargreaves J.C., Altoè M., Bateman I.J. Cross-country comparisons of COVID-19: policy, politics and the price of life. Environ. Resour. Econ. 2020;76(4):525–551. doi: 10.1007/s10640-020-00466-5. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bilinski A., Emanuel E.J. COVID-19 and excess all-cause mortality in the US and 18 comparison countries. JAMA. 2020;324(20):2100–2102. doi: 10.1001/jama.2020.20717. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Blundell R., Dias M.C., Joyce R., Xu X. COVID-19 and inequalities. Fisc. Stud. 2020;41:291–319. doi: 10.1111/1475-5890.12232. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bonaccorsi G., et al. Economic and social consequences of human mobility restrictions under COVID-19. Proc. Natl. Acad. Sci. 2020;117:15530–15535. doi: 10.1073/pnas.2007658117. (2020) [DOI] [PMC free article] [PubMed] [Google Scholar]

- Brockwell P.J., Davis R.A. Springer; 2016. Introduction to Time Series and Forecasting. [Google Scholar]

- Carlson C.J., Gomez A.C.R., Bansal S., Ryan S.J. Misconceptions about weather and seasonality must not misguide COVID-19 response. Nat. Commun. 2020;11:4312. doi: 10.1038/s41467-020-18150-z. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Carvalho V., Garcia J., Hansen S., Ortiz A., Rodrigo T. CEPR Discussion Papers; 2020. Tracking the COVID-19 Crisis With High-Resolution Transaction Data; p. 14642. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Cavallo E., Galiani S., Noy I., Pantano J. Catastrophic natural disasters and economic growth. Rev. Econ. Stat. 2013;95(5):1549–1561. [Google Scholar]

- Chen S., Igan D., Pierri N., Presbitero A.F. International Monetary Found; 2020. Tracking the Economic Impact of COVID-19 and Mitigation Policies in Europe and the United States. Working Paper n. 20/125. [Google Scholar]

- Chernozhukov V., Kasahara H., Schrimpf P. Causal impact of masks, policies, behavior on early covid-19 pandemic in the US. J. Econ. 2021;220(1):23–62. doi: 10.1016/j.jeconom.2020.09.003. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chetty R., Friedman J.N., Hendren N., Stepner M., The Opportunity Insights Team . National Bureau of Economic Research; 2020. How Did COVID-19 and Stabilization Policies Affect Spending and employment? A new Real-Time Economic Tracker Based On Private Sector Data. NBER Working Paper 27431. [Google Scholar]

- Ciminelli G., S. Garcia-Mandicó (2020) Mitigation policies and emergency care management in Europe's ground zero for COVID-19, available at: 10.2139/ssrn.3604688.

- Crucini M.J., Kahn J. Tariffs and aggregate economic activity: lessons from the great depression. J. Monet. Econ. 1996;38(3):427–467. [Google Scholar]

- Demirgüç-Kunt A., Lokshin M., Torre I. The sooner, the better: the economic impact of non-pharmaceutical interventions during the early stage of the COVID-19 pandemic. Econ. Trans. Inst. Change. 2021 (Forthcoming) [Google Scholar]

- Fang H., Wang L., Yang Y. Human mobility restrictions and the spread of the Novel Coronavirus (2019-nCoV) in China. J. Public Econ. 2020;191 doi: 10.1016/j.jpubeco.2020.104272. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Fernández-Villaverde J., Jones C.I. Macroeconomic Outcomes and COVID-19: a progress report. Brook. Pap. Econ. Act. 2020 (fall 2020) [Google Scholar]

- Fezzi C., Bunn D. Structural analysis of electricity demand and supply interactions. Oxf. Bull. Econ. Stat. 2010;72:827–856. [Google Scholar]

- Fezzi C., Fanghella V. Real-time estimation of the short-run impact of COVID-19 on economic activity using electricity market data. Environ. Resour. Econ. 2020;76:885–900. doi: 10.1007/s10640-020-00467-4. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Fezzi C., Mosetti L. Size matters: estimation sample length and electricity price forecasting accuracy. Energy J. 2020;41(4) [Google Scholar]

- Flaxman S., Mishra S., Gandy A., Unwin H.J.T., Mellan T.A., Coupland H., Monod M. Estimating the effects of non-pharmaceutical interventions on COVID-19 in Europe. Nature. 2020;584(7820):257–261. doi: 10.1038/s41586-020-2405-7. [DOI] [PubMed] [Google Scholar]

- Foroni C., Marcellino M., Stevanovic D. Forecasting the covid-19 recession and recovery: lessons from the financial crisis. Int. J. Forecast. 2020 doi: 10.1016/j.ijforecast.2020.12.005. (forthcoming) [DOI] [PMC free article] [PubMed] [Google Scholar]

- Forsythe E., Kahn L.B., Lange F., Wiczer D. Labor demand in the time of COVID-19: evidence from vacancy postings and UI claims. J. Public Econ. 2020;189 doi: 10.1016/j.jpubeco.2020.104238. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Giannitsarou C., Kissler S., Toxvaerd F. Waning immunity and the second wave: some projections for SARS-CoV-2. Am. Econ. Rev. Insights. 2021;3(3):321–338. [Google Scholar]

- Goolsbee A., Syverson C. Fear, lockdown, and diversion: comparing drivers of pandemic economic decline 2020. J. Public Econ. 2021;193 doi: 10.1016/j.jpubeco.2020.104311. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Guan D., Wang D., Hallegatte S., et al. Global supply-chain effects of COVID-19 control measures. Nat. Hum. Behav. 2020;4:577–587. doi: 10.1038/s41562-020-0896-8. [DOI] [PubMed] [Google Scholar]

- Henderson J.V., Storeygard A., Weil D.N. Measuring economic growth from outer space. Am. Econ. Rev. 2012;102(2):994–1028. doi: 10.1257/aer.102.2.994. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Holtz D., Zhao M., Benzell S.G., Cao C.Y., Rahimian M.A., Yang J., Aral S. Interdependence and the cost of uncoordinated responses to COVID-19. Proc. Natl. Acad. Sci. 2020;117(33):19837–19843. doi: 10.1073/pnas.2009522117. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hopman J., Allegranzi B., Mehtar S. Managing COVID-19 in low-and middle-income countries. JAMA. 2020;323(16):1549–1550. doi: 10.1001/jama.2020.4169. [DOI] [PubMed] [Google Scholar]

- Hunter D.J. Covid-19 and the stiff upper lip - The pandemic response in the United Kingdom. N. Engl. J. Med. 2020;382:e31. doi: 10.1056/NEJMp2005755. [DOI] [PubMed] [Google Scholar]

- Hyndman R., Athanasopoulos G., Bergmeir C., Caceres G., Chhay L., O'Hara-Wild M., Petropoulos F., Razbash S., Wang E., Yasmeen F. (2020). Package ‘forecast’: forecasting functions for time series and linear models.

- IEA (2020), Global Energy Review 2020, IEA, Paris, available at: https://www.iea.org/data-and-statistics.

- Keane M., Neal T. Consumer panic in the COVID-19 pandemic. J. Econ. 2021;220(1):86–105. doi: 10.1016/j.jeconom.2020.07.045. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kong E., Prinz D. Disentangling policy effects using proxy data: which shutdown policies affected unemployment during the COVID-19 pandemic? J. Public Econ. 2020;189 [Google Scholar]

- Leach A., Rivers N., Shaffer B. Canadian electricity Markets during the COVID-19 pandemic: an initial assessment. Can. Public Policy. 2020;46:S145–S159. doi: 10.3138/cpp.2020-060. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lessmann C., Seidel A. Regional inequality, convergence, and its determinants – a view from outer space. Eur. Econ. Rev. 2017;92:110–132. [Google Scholar]

- Lewis D., Mertens K., Stock J.H. National Bureau of Economic Research; 2020. U.S. Economic Activity During the Early Weeks of the SARS-Cov-2 Outbreak. NBER Working Papers 26954. [Google Scholar]

- Lin Z., Meissner C.M. National Bureau of Economic Research; 2020. Health vs. wealth? Public health Policies and the Economy During Covid-19. NBER Working Papers 27099. [Google Scholar]

- Ljung G.M., Box G.E.P. On a measure of lack of fit in time series models. Biometrika. 1978;65:297–303. [Google Scholar]

- Miles D., Stedman M., Heald A. Living with Covid-19: balancing costs and benefits in the face of the virus. Natl. Inst. Econ. Rev. 2020;253:R60–R76. [Google Scholar]

- Newey W.K., West K.D. A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica. 1987;55:703–708. [Google Scholar]

- OECD (2020) Quarterly national accounts database, OECD, Paris, available at: https://data.oecd.org/gdp/quarterly-gdp.htm.

- Onorante L., Raftery A.E. Dynamic model averaging in large model spaces using dynamic Occam׳s window. Eur. Econ. Rev. 2016;81:2–14. doi: 10.1016/j.euroecorev.2015.07.013. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Orlowski E.J.W., Goldsmith D.J.A. Four months into the COVID-19 pandemic, Sweden's prized herd immunity is nowhere in sight. J. R. Soc. Med. 2020;113:292–298. doi: 10.1177/0141076820945282. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Palomino J.C., Rodriguez J.G., Sebastian R. Wage inequality and poverty effects of lockdown and social distancing in Europe. Eur. Econ. Rev. 2020;129 doi: 10.1016/j.euroecorev.2020.103564. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Pfefferbaum B., North C.S. Mental Health and the Covid-19 pandemic. N. Engl. J. Med. 2020;383:510–512. doi: 10.1056/NEJMp2008017. [DOI] [PubMed] [Google Scholar]

- Prol J.L., Sungmin O. Impact of COVID-19 measures on short-term electricity consumption in the most affected EU countries and USA states. iScience. 2020 doi: 10.1016/j.isci.2020.101639. [DOI] [PMC free article] [PubMed] [Google Scholar]

- R. Development Core Team . R Foundation for Statistical Computing; Vienna, Austria: 2006. R: A language and Environment For Statistical Computing. ISBN 3-900051-00-3. [Google Scholar]

- Ramanathan R., Engle R., Granger C.W., Vahid-Araghi F., Brace C. Short-run forecasts of electricity loads and peaks. Int. J. Forecast. 1997;13(2):161–174. [Google Scholar]

- Remuzzi A., Remuzzi G. COVID-19 and Italy: what next? Lancet North Am. Ed. 2020;395:1225–1228. doi: 10.1016/S0140-6736(20)30627-9. (2020) [DOI] [PMC free article] [PubMed] [Google Scholar]

- Santos Silva J.M.C., Tenreyro S. The log of gravity. Rev. Econ. Stat. 2006;88:641–658. [Google Scholar]

- Sharma D., Bouchaud J.P., Gualdi S., Tarzia M., Zamponi F. V–, U–, L–or W–shaped economic recovery after Covid-19: insights from an agent based model. PLoS One. 2021;16(3) doi: 10.1371/journal.pone.0247823. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sheridan A., Andersen A.L., Hansen E.T., Johannesen N. Social distancing laws cause only small losses of economic activity during the COVID-19 pandemic in Scandinavia. Proc. Natl. Acad. Sci. 2020;117:20468–20473. doi: 10.1073/pnas.2010068117. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Taylor J.W., De Menezes L.M., McSharry P.E. A comparison of univariate methods for forecasting electricity demand up to a day ahead. Int. J. Forecast. 2006;22:1–16. [Google Scholar]

- The Economist (2020) Tracking covid-19 excess deaths across countries, The Economist Group Limited, available at: https://github.com/TheEconomist/covid-19-excess-deaths-tracker.

- Thomas L.J., et al. Proceedings of the National Academiy of Science. 2020. Spatial heterogeneity can lead to substantial local variations in COVID-19 timing and severity. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Toxvaerd F, Rowthorn R. On the management of population immunity. Cambridge-INET Working Papers in Economics. 2020;2020-37 [Google Scholar]

- Venables WN, Ripley BD. Modern Applied Statistics with S. Fourth edition. Springer; New York: 2002. [Google Scholar]

- Werth A., Gravino P., Prevedello G. Impact analysis of COVID-19 responses on energy grid dynamics in Europe. Appl. Energy. 2020;281 doi: 10.1016/j.apenergy.2020.116045. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Zeileis A. Econometric computing with HC and HAC covariance matrix estimators. J. Stat. Softw. 2004;11(10):1–17. [Google Scholar]

- Zeileis A., Hothorn T. Diagnostic Checking in Regression Relationships. R News. 2002;2(3):7–10. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.