Abstract

Commercializing research is fraught with pitfalls, but a thoughtful checklist can ensure you set off on the right path and give your fledgling business the best chance of success.

These days, it feels as though more and more academics are venturing into the dynamic and fast-paced world of life-science startups. Many US academic institutions now provide access to training programs for academic founders. But taking the plunge into the realm of business, finance and law can nevertheless be a daunting process. A new startup founder faces numerous (often unforeseen) obstacles when seeking to commercialize their research. This article lays out those critical issues and provides some helpful tips for faculty members seeking to commercialize their research.

Valuing your idea

New life sciences companies are almost always founded around a novel idea, technology or invention. Hence, the first step in the startup process for you should be an honest and in-depth assessment of the commercial potential of your research. To accomplish this, you will need to conduct a freedom-to-operate (FTO) search, which is a way to determine whether your idea—which could eventually be a product or process—would infringe any existing patents. The FTO search, whether performed as part of a patent application filing or more formally by an intellectual property (IP) attorney, is valuable because it can provide a path to developing a workaround should the need arise. One important thing to note is that you should not confuse the patentability of your findings with FTO; your patents would block others from doing the same thing, but an issued patent provides some assurance that you are not, in fact, blocked by others. Although there are instances in which companies are launched solely based on proprietary know-how and without any patent filings, that happens more frequently in technical fields outside biotech.

You will also need to study the potential market need and size for your potential product. Scoping out the potential ‘upside’ of your business is a key parameter both for attracting investors and for justifying the overall value of your idea.

So where can you go to do a FTO search, carry out a market analysis and assess whether your research is enough to form the basis for a startup? The usual place to start is your institution’s Technology Transfer Office (TTO). Your TTO can help with these evaluations, depending on the level of complexity involved, and the resulting analysis can allow a collegial and confidential discussion about whether a viable new company (NewCo) opportunity may exist. If there is agreement in the affirmative, then the process can continue, with proper TTO support and all of its accompanying resources.

For researchers at institutions that do not have an experienced TTO, the IP assessment can be outsourced to any reputable IP law firm as a one-off project, with the price negotiated in advance. Depending on the complexity and desired level of depth, this can range from $5,000 all the way up to $40,000 or more. In deciding which law firm to use, you should interview a few of them, assess whether their attorneys’ expertise is a fit for your specific technology and also ask for referrals from other founders.

For the market assessment, the internet is a reasonable place to start. Beyond this, you may be able to get help from business school students looking for a case-study project. You could also enlist one of the many consulting groups that can research the field for a fee, ranging anywhere from $5,000 to $20,000. If your institution has an entrepreneurship center, this might also be a source of guidance. What you need to find out is whether there is a viable and ultimately profitable customer base (i.e., ‘total addressable market’) for your invention, technology or product. It is possible that, after the assessment of FTO and market opportunity, the TTO might not agree that your idea merits IP protection and that the opportunity is suitable for a startup (see Box 1 for next steps). But if the FTO search and potential market opportunity are encouraging, and you and the TTO are in agreement, that creates the initial momentum for forming a NewCo.

Box 1 ∣. Getting a red light.

An initial assessment of a researcher’s idea may lead the TTO to conclude that there is insufficient opportunity for a NewCo. For example, an FTO search may reveal existing patents in the space that might prove difficult to work around. Or there might be differing interpretations of the market opportunity. In such cases, however, the researcher may still have options.

Many institutions still allow a researcher the ability (with reasonable economic returns back to the institution) to personally obtain the IP rights to their inventions. In the United States, if the invention was generated using government funding, the agreement will have to follow federal IP management guidelines that will basically return the title of the invention to the researcher. Outside the United States, rules governing the return of rights vary by region and employer. Researchers should understand that although the institution will retain the right to use the invention for research, institutional policies may prohibit development or improvement of the idea using institutional facilities. Any release by the institution will be limited to what is disclosed to the institution. This return-of-rights process can be complicated, and the arrangement requires the inventor to take on all obligations and liabilities for advancing the IP. These may include payments back to the institution, development reports and requirements to indemnify the institution from any liabilities that arise during the commercialization of the invention. If, as a researcher, you find yourself in a position where you have secured the rights back from the institution, you have to carefully navigate the issue of not doing any additional work on the subject matter of the invention in your academic lab. You will have to find affordable law firms that will file patent applications for your company. As with any other NewCo, you will have to network and find the appropriate entities (angel networks, venture capitalists) interested in funding your work, and although the fact that your institution declined to protect the idea is not a deal-killer, it is an issue that some investors may not view favorably.

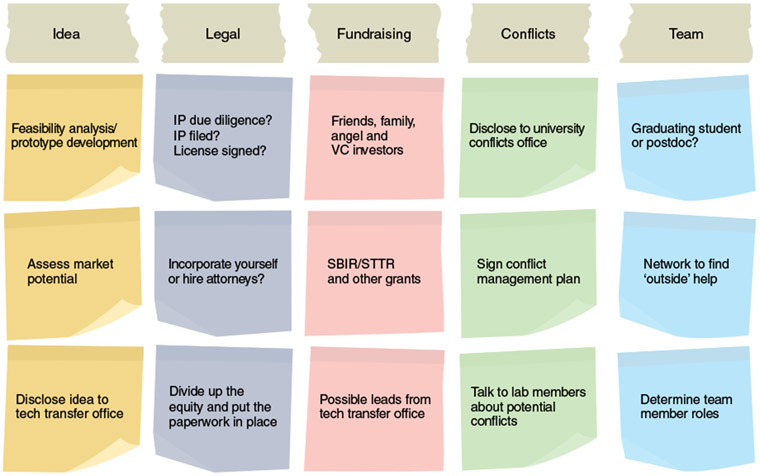

Now both you and the institution are ready for the next stage of startup company creation. A set of subsequent questions now arise (Fig. 1). These can be answered one by one, or concurrently, or in pretty much any order you choose, depending on the resources available to you and the stage of the technology.

Fig. 1 ∣. A bioentrepreneur’s to-do list.

At every step of the journey, there are tasks that must be tackled.

Determining your role

At some point early on, you will need to consider what your role, as the inventor, will be in the new company. This could include chief executive officer, chief scientific officer or simply taking a place on the scientific advisory board (SAB). This is obviously a big decision, and there are important questions you should ask before deciding. For example, do you have any executive experience and, if so, what was the outcome? Do you have the resources (such as unpaid time) and flexibility to commit to an executive role? If the answer to some or all of these questions is “no”, then does it really make sense for you to have a pivotal role?

In addition, many institutions either prohibit or strongly discourage their researchers from taking on executive positions within their own startups. Or, an institution might require that their personnel give up such company roles at a future point as the startup makes a certain amount of progress, either financially or operationally (for example, advancing toward the clinic). Consequently, be sure to check on these details with your institution before making any decisions.

Regardless, although some researchers do leave their institutions to help run startups, the vast majority do not go that far. Instead, inventors often remain involved by taking on key advisory roles within the company—perhaps as chairperson of the SAB–while leaving executive positions to other people. Also, if permitted by their institution, faculty members might take a sabbatical from teaching and research to fully participate in the venture’s earliest days.

The next consideration is creating the relevant founder team. Often the most pressing need is for a formal or de facto CEO, and the relationship between the inventor and CEO is vital to the success of any new venture. Faculty who have more experience with commercialization may be able to identify a possible CEO through their own networks; another useful resource is the TTO, which often can suggest an entrepreneur-in-residence or other credible individual for the position. Additional team members may also be required, and in some cases it is possible to recruit interested junior staff from the inventor’s own lab, such as graduating students or postdocs who are nearing the ends of their fellowships. Such a staffing proposal will need to be vetted from a potential conflict-of-interest perspective depending on the particular circumstances.

The overall objective when creating ‘founding team’ should be to ensure that this initial group of two or more people shares a common purpose and vision of launching the company and that everyone understands their obligations toward that goal. In its embryonic stage, the NewCo may have been an idea only in your mind as a founder, and you were best qualified to provide all the insights about the opportunity and the innovation. However, it is crucial to remember that even though this company came from you, you will need to hire people with diverse skill sets to enable it to grow and mature. As such, the team will need to be energized by the same vision around, and aligned with, the company’s ideological and commercial goals.

Lining up the ducks

You will need to hire various service providers, such as a law firm, to represent your NewCo. It is also recommended that you, as inventor, consider enlisting a separate, personal attorney who will represent your individual interests. Despite all the initial best intentions, sometimes inventors and their companies part ways, in which case inventors will need their own representation. The NewCo also will need an IP lawyer at some stage in its development. For many academic startups, the law firm engaged by the institution can suffice in early stages, but founders must always be aware that their institution’s patent attorney represents the institution, rather the NewCo, which is fine unless, or until, the interests of those two parties begin to diverge.

It is possible that you might have a friend or neighbor who is an attorney, perhaps specializing in something like divorce law, but this person would not be a wise choice of counsel for your startup. The TTO may point you in the direction of experienced and appropriate law firms, but also may not be in a position to recommend any particular firm, as the office itself will likely be negotiating an option or license with this firm in the future.

If there is no obvious candidate, you should meet with multiple attorneys before deciding on the right one. The right attorney should be familiar with the intricacies of startups, preferably life science startups, and should have extensive experience in licensing matters. Many major law firms with specialties in the life science offer ‘startup’ programs that provide decreased and/or defrayed expenses, with the idea that this ‘investment’ by the law firm can result in substantial future billings should the startup prove successful. The attorneys will help set up the legal paperwork and will ensure that your obligations in any agreement are identified and recorded. This extends beyond simple IP licensing matters: for example, many early investors retain participation rights for subsequent rounds of funding, and the company therefore has an obligation to notify the investors of such rounds so that such investors may choose to exercise those rights.

A similar process should be undertaken to identify and retain an accounting firm; here, again, life science experience and a startup ‘package’ should be high on your list of considerations. You will also need a commercial bank, hopefully one with at least some familiarity with the idiosyncrasies of life sciences companies as well as the ability to provide the needed services as your company grows.

Forming (and naming) the startup

At some point you will need to formally create the company and give it a name. You can do this after the market analysis, or after you’ve talked to lawyers. When choosing the name, be sure to secure an appropriate domain name and confirm that no other company or commercially available products by the same (or a highly similar) name exist1. This momentous occasion will establish an entity into which IP from your institution can be in-licensed (or optioned). There are two main choices for structuring your NewCo: C corporations and limited liability companies (LLCs) (see Supplementary Glossary for further explanation of these terms). Both structures serve to protect founders from lawsuits against the corporate entity, though C corporations are typically used when the entity expects to raise institutional capital, whereas LLCs can have tax advantages for individual investors. And although you might be able to navigate the incorporation process without legal assistance, it is often economical (and prudent) to bring the chosen corporate attorney in at the outset to help with identifying the most appropriate structure and avoiding mistakes that can prove costly to correct later on.

When you are incorporating the company, you must also decide on how the founder’s equity will be divided. This can be the most contentious part of the early phase of startup formation, as individuals often disagree on the true value that they have provided (and will continue to provide) to the enterprise. There are a few things to consider that might help (Box 2).

Box 2 ∣. Dividing your pie.

Deciding on proportions of founder shares can depend on several aspects, but getting answers in these three areas can help guide the decision5,6.

Who came up with the key idea(s) for the technology, and who did the actual work?

Different founders’ extent of active involvement in the company going forward (you get more equity if you leave your academic post, versus remaining safely ensconced in the hallowed halls).

Overall status and reputation: for example, with all due apologies to talented postdocs, Nobel Laureate lab heads will receive a premium in recognition of their fame and past accomplishments, which makes sense because their imprimatur could well allow more successful fundraising.

As you proceed, it is likely that there will be changes to either your core team or the company’s business objectives. This is part of the growing process. It’s possible you may end up disagreeing with the direction your company is taking; however, the founding team should understand that change will happen and that the underlying goal is to create a vibrant NewCo that can successfully commercialize the proposed technology.

Next you’ll need to decide where your company will be physically located, or if it’s best to start with a virtual structure. If wet labs are required and if the institute allows sponsored research by the NewCo on its premises (with appropriate conflict management plans), then that would be a good place to start. If not, then finding a nearby incubator that all personnel involved could have access to is the next best choice, as easier face-to-face communication will improve productivity. However, if the founding entity is located somewhat ‘off the beaten track’ when it comes to biotech startups, you might consider moving the company to a well-established life sciences ‘hub of excellence’ once initial (or subsequent) external financing is acquired. There are good reasons for doing this, including the ability to recruit an experienced and talented team and the availability of shared laboratory space. Groups such as Alexandria LaunchLabs, JLabs and BioLabs have relatively large turnkey operations in many major (as well as some not-so-major) cities all over the world, at which your NewCo can rent lab benches, desks, offices and specialized technical services (for example, cell culture capability) on an a la carte basis. A final reason for relocating is the social, troubleshooting and networking value gained by being in close proximity to a cohort of similarly staged companies.

Securing institutional approval

In most cases, IP discovered or developed at an institution will be assigned to the relevant institution, rather than being owned by the investigator themselves, and the NewCo and its legal representatives will therefore be responsible for negotiating a license with the institution for this IP. Securing the license comes with its own set of challenges in regard to addressing every relevant issue that is required to put the license in place. Most institutions worldwide have been out-licensing for a substantial period of time by now and have adapted their policies to the times.

From the moment you decide to start a company, you are required to disclose this intent to your relevant compliance office so that a conflict management plan can be put into place. The inventor disclosure process should include (i) the amount of equity estimated to be held in the company; (ii) the role that the inventor will play in the company and (iii) the time commitment required by the inventor to fulfill these roles. If the total compensation package changes after disclosure, the disclosure must be updated with the most recent numbers.

Most institutions have a business conflict or compliance office that will review each case independently. If such an office does not exist at your institution, you must ensure that your actions do not run afoul of your employer’s policies and any other relevant laws. Institutions are careful about allowing commercial activities to proceed on campus, as doing so may affect their status as a not-for-profit entity. If you are a physician–scientist, there will be a higher level of scrutiny of your activities related to the Newco because patient care might be affected. And if your new company wishes to fund research at the institution, there will be questions around the involvement of other institutional employees. For example, there can be no restrictions on graduate students publishing and incorporating into their theses any work they have performed in the lab. If you plan to require lab members and other collaborators to sign confidentiality agreements, this may or not be accepted depending on the particular circumstances. If you will need company scientists to visit the lab for transfer of know-how, then you’ll need a formal visiting scientist agreement. The founder will also need to share copies of any agreements that they sign, such as consulting or SAB member agreements, with the institution’s conflicts office. This helps ensure that agreements are not in conflict with the founder’s existing employment agreement with the institution.

During license negotiations, remember that most institutions are seeking the best partner to develop the technology, and that if the research was funded by the federal government, the institution is required to add certain provisions to the license agreement to comply with the Bayh–Dole Act. This act allows institutions to elect to take title of federally funded inventions under certain terms and conditions, and it stipulates that companies licensing institution technologies must agree to grant the government a non-exclusive, irrevocable, paid-up license to use the subject invention throughout the world; require substantial manufacture in the United States for any exclusive licensee; and allow the US government to exercise march-in rights (i.e., the government can require the company to license the patent to others on reasonable terms).

It is important to understand that although institutions may have some leeway on the business terms, they have relatively little latitude with diligence requirements and contract stipulations that might compromise academic freedom or federal regulations. A typical license will lay out the up-front fee and an agreement to reimburse previous payment made for the IP in question and to pay for future costs, royalties, maintenance and milestone payments and a percentage of any sublicensing income, as well as any equity that will be allocated to the institution. Most institutions understand that NewCos need to spend funds on developing their technology in their early years and therefore are willing to consider back-end-loaded payments. And they will usually expect to be shareholders because of their historical contribution and support of your technology.

Investors in startups want to see that companies have an exclusive worldwide license for patent-based technologies, and this is what you should seek from your institution. If you want to license know-how either instead of, or in addition to, patents and/or patent applications, note that your institution will generally only offer a non-exclusive license to this particular class of IP.

Tuning up for the road show

As an academic, you are probably used to presenting ideas as grant proposals and sharing findings with the research community. But as a founder, you should be prepared to present ideas for raising funds or securing corporate partnerships. These presentations will take a different form. You’ll need a short, non-confidential slide deck and/ or a one-or two-page executive summary to describe the underlying problem, the core technology involved, how the implementation will take place and, finally, your team. This is basically your NewCo’s ‘story’ (or ‘elevator pitch’). It’s a cliched term, but a company founder should always be ready to pitch if the opportunity arises.

You’ll also need to participate in ‘road shows’, to present the technology in front of investors. Many investors will be ex-researchers themselves, or will have access to technical experts, and will ask relevant due-diligence questions that you will be expected to address in a transparent manner (though it is always better to say you’ll get them answers later, rather than make something up). The slide deck for an investor meeting should look different from the one presented at scientific conferences. Keep in mind the expertise of your potential investors (their bios are often available on the internet), and keep your message simple and direct. For ‘podium’ presentations, as with academic presentations, the team is usually shown on one of the last slides, but for ‘sit-down’ presentations, present the team slide early, as investors are as interested in the team as in the science.

The deck normally includes a summary of how the inventor began working on the problem, and by the time they have seen the first few slides, investors should understand why they should pay attention to the innovative ideas and solution on offer. This can be done by describing an unmet need or a pain point in the market that your technology will address. Practice this pitch, so that you know how much substantiating data to show, and tailor your message to the particular audience. A highly technical group of investors may want to see your data, whereas a more finance-focused group may want to be assured that you have the ‘secret sauce’ to solve the problem at hand. Advance consulting with a few subject matter industry experts will help you find this balance.

Most investors will want to see a timeline for a profitable exit. By providing one, and detailing milestones for potential value inflection points, you will indicate that you understand the commercial side of company development. Also, you should be prepared to answer questions about technical, regulatory, financial and IP-related risks, and describe ways you plan to mitigate these risks. If you find that a particular question comes up repeatedly, that’s a good indication that you should include an answer in the presentation itself.

You will also need to make clear how much funding you are seeking and how you’ll spend those funds. Investors want to see that you have a laid-out plan to perform proof-of-concept studies and the standard preclinical work, and plans for potential clinical trials. Use easy-to-understand graphics to describe complex science, and consider simplifying your writing in ways that are not necessary with scientific papers. Your presentation must be understood by a broad range of individuals with varying levels of expertise in your field, and you’ll need to reach all of them.

Final thoughts

Once you’ve checked off all the designated items on this list, it is then time to raise your first round of funding. This is a multistep, intense process that has been covered in detail elsewhere2-4. The old expression that advises entrepreneurs to “take the hors d’oeuvres when they’re being passed” remains just as true today. But it’s also advisable to seek out all the places where the food is being cooked. And although it might appear from media reports that funding is everywhere, be prepared to look under every rock for the money you need (Box 3).

Box 3 ∣. Multiple potential sources of funding.

For that first round of funding, you’ll likely need to tap a combination of sources. (More information can also be found at these links7-9.)

Typical non-dilutive funding sources (no equity involved):

Federal Small Business Innovation Research (SBIR) and small business technology transfer (STTR) grant programs

Entrepreneurship competition awards

Crowdfunding (if for future rewards)10

Some (but not all) foundation grants

Collaborations with larger or more established companies (although in this case ‘dilution’ may often take the form of giving up certain downstream economics)

Typical dilutive funding (equity-based):

Friends and family investment

High-net-worth (non-friends-and-family) investors (also known as ‘angels’)

Family offices

Institution internal investment funds

Foundation grants

Venture capitalists and other ‘institutional’ investors

Most institutions now offer a variety of resources on campus to support a startup idea, and these often are coordinated via the institutional TTO. But even before embarking on such an endeavor, one of the best things you can do is speak to others who have done it before, either within your own institution or outside. The journey is not easy, but by being prepared mentally and strategically, you can at least minimize the jolts from speed bumps along the way. Ultimately, the challenges are well worth it to turn innovations, papers and concepts into products that improve people’s lives.

Supplementary Material

Footnotes

Competing interests

The authors declare no competing interests.

Supplementary information The online version contains supplementary material available at https://doi.org/10.1038/s41587-022-01239-9.

References

- 1.Harroch R 12 tips for naming your startup business. Forbes https://www.forbes.com/sites/allbusiness/2016/10/23/12-tips-for-naming-your-startup-business/?sh=4c2507b1904e (2016). [Google Scholar]

- 2.Ford D & Nelsen B Nat. Biotechnol 32, 15–23 (2014). [DOI] [PubMed] [Google Scholar]

- 3.Ford D & Kohlbrenner W Nat. Biotechnol 34, 226–230 (2016). [DOI] [PubMed] [Google Scholar]

- 4.Beylin D, Chrisman C & Weingarten M Bioentrepreneur 10.1038/bioe.2011.5 (2011). [DOI] [PubMed] [Google Scholar]

- 5.Seibel M How to split equity among co-founders. Y Combinator https://www.ycombinator.com/library/5x-how-to-split-equity-among-co-founders (accessed 1 February 2022). [Google Scholar]

- 6.Wasserman N & Hellman T The very first mistake most startup founders make. Harv. Bus. Rev https://hbr.org/2016/02/the-very-first-mistake-most-startup-founders-make (2016). [Google Scholar]

- 7.University Lab Partners. Funding options for biotech startups. University Lab Partners blog; https://www.universitylabpartners.org/blog/funding-options-for-biotech-startups (2021). [Google Scholar]

- 8.Murphey R Top biotech venture capital funds of 2018–2021. Bay Bridge Bio https://www.baybridgebio.com/blog/top_vcs_2018.html (2021). [Google Scholar]

- 9.Henderson B Guide: how to approach life sciences fundraising. Brex https://www.brex.com/blog/approaching-life-sciences-fundraising/ (2020). [Google Scholar]

- 10.Moran N Nat. Biotechnol 35, 299–300 (2017). [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.