Abstract

We provide stylized facts on the short-run resilience of exports to the COVID-19 pandemic across product characteristics. Relying on global monthly product-level exports to the United States, Japan, and 27 European Union countries from January 2018 to December 2021, we show that products with a higher reliance on China or few countries as input suppliers saw stronger declines in exports as a result of the COVID-19 shock while those with more automated production processes saw exports increase. Our analysis also shows that product characteristics played different roles mediating export responses at different stages of the 2020-2021 COVID-19 crisis. We document rapid reductions in vulnerabilities for exports of unskilled-intensive production. Reliance on diversified inputs from abroad progressively contributed to resilience following an initial negative role when trade was severely disrupted globally.

Keywords: Exports, Vulnerability, Resilience, COVID-19, Shock, High-frequency data

1. Introduction

The sudden onset of the COVID-19 shock in early 2020 resulted in substantial disruptions as restrictions aimed at reducing virus spread were introduced. The sudden drop in the supply of Chinese products led to disruptions in global production as China had turned into the world’s manufacturing powerhouse. The unprecedented social distancing restrictions brought by COVID-19 challenged in-person production activities. Between January and June 2020, global trade volumes retraced by 13% before sharply rebounding thereafter (World Bank, 2020). Trade policies going forward require understanding which vulnerabilities shaped the evolution of exports.

This paper provides stylized facts on products’ export vulnerabilities, or its contrary the resilience, to COVID-19 in 2020–2021. We focus on product characteristics related to global value chain linkages – products relying on dominant and foreign input suppliers – and requirements for in-person production. We use a difference-in-differences specification for bilateral monthly product exports by all countries to 29 major markets — the 27 European Union (EU) countries, Japan, and the United States (US) — on interactions between COVID-19 incidence measures and product vulnerability proxies controlling for a stringent set of fixed effects.

The stylized facts are as follows. First, countries with higher COVID-19 incidence decrease more their exports of products relying on inputs whose foreign supply is highly concentrated in a few countries or dominated by China. But exports of products relying on foreign inputs per se were more resilient to COVID-19. Second, countries with higher COVID-19 incidence increase their exports of products relying more on robots for production. This evidence suggests that diversifying value chains and increasing automation and virtual collaborations can increase resilience. Third, product characteristics played different roles mediating export responses at different stages of the COVID-19 crisis. Dynamics reflect reduced vulnerabilities over time for product characteristics that benefited from production adjustments, such as unskilled-intensive production. Reliance on diversified inputs from abroad progressively contributed to resilience following an initial negative role when trade was severely disrupted globally. Robot production was mostly a force for resilience. They also reflect the shifting global dynamics of where the pandemic hit most, affecting Chinese imports and the benefits of supplier diversification.

The study mainly contributes to the literature on COVID-19’s effects on trade (e.g., Berthou and Stumpner, 2022, Bonadio et al., 2021, Bricongne et al., 2021, Demir and Javorcik, 2020, Espitia et al., 2022, Lafrogne-Joussier et al., 2022, Liu et al., 2022) by showing where short-term vulnerabilities in global product supply arose.

2. Conceptual discussion

To guide our empirical analysis, we identify two hypotheses related to potential vulnerabilities of exports to the COVID-19 shock. First, we hypothesize that export responses to COVID-19-driven global disruptions in production and trade are more negative for products whose supply chains rely on a poorly diversified portfolio of input suppliers or those whose inputs have China as main supplier, while imported input reliance per se captures diversification away from domestic sources and should support export resilience. Second, we hypothesize that exports of products whose production process was more hurt by social distancing and lockdowns, i.e., those less automated and more unskilled-labor intensive, were negatively affected.1

3. Data and empirical approach

Our analysis relies on several sources of data. For trade outcomes, we use monthly data on import flows by EU, Japan, and US in January 2018–December 2021 at importing country-Harmonized System (HS) 4-digit product-partner country-month-year level. For COVID-19 incidence, we use country-month total number of reported COVID-19 deaths per capita from the Oxford COVID-19 Government Response Tracker. Our incidence measures use specific lags by product and country-pair combining US Census import data by transport mode with searates.com data on shipping days between capital cities to account for distance and transport mode (Bas et al., 2022). For product resilience, we use data from US NBER-CES Manufacturing Industry Database on unskilled labor production intensity; OECD’s harmonised input–output tables for reliance on foreign inputs combined with UN COMTRADE for reliance on China as main input supplier, and concentration in exports of inputs; robots usage (Artuc et al., 2023); and product complexity (Hidalgo and Hausmann, 2009). Table A.1 provides details on these measures and Table A.2 provides a correlation between these measures.

Our difference-in-differences specification estimates the relationship between bilateral product exports and COVID-19 mediated by proxies for production vulnerability:

| (1) |

where is export value (in logarithms) by country e of HS4 product p to destination market i in month-year t and is an independent and identically distributed error term. The main coefficients () are those on the interactions between each measure of at product level -p- (robots, unskilled labor intensity and complexity) or at product-exporting country level -ep- (reliance on foreign inputs, export concentration of inputs, and China export share in inputs) and is total COVID-19 deaths per capita per exporting-country-month with specific lags n. We include exporting country-importing country-product fixed effects thereby exploiting variation within exporting country-importing country-product over time as COVID-19 unfolded, relative to pre-pandemic. Exporting country-month-year and importing country-month-year fixed effects control for time-varying unobservable supply and demand shocks affecting exports. includes indicators for COVID-19 medical products defined at HS4 (WTO, 2022) and the longevity of product trade relations (Martin et al., 2022). Standard errors are clustered by exporting country and broad sector.

4. Results

Table 1 shows in columns (1) and (2) a negative correlation between COVID-19 incidence measure and exports on average across all products, followed by evidence for our hypotheses. Our estimates confirm that exports of products whose inputs are concentrated in few supplier countries or in China decline more in countries with higher COVID-19 incidence (columns 3 and 4). However, exports of products relying more on imported inputs increase in such countries (column 5). This finding confirms that diversification away from domestic inputs per se increases resilience but the lack of international diversification hurts it. Exports of products with more automated production processes are more resilient during the pandemic (column 7). Unskilled intensive production played no role in mediating export responses to COVID-19 on average over 2020–2021 (but this is due to divergent dynamics over time shown below). Product complexity does not mediate significantly the impact of COVID-19 on exports. Column (8) estimates imply that countries with higher COVID-19 incidence by its median value (0.66) experience a decline in exports of 0.6 percentage points for products relying more on inputs with higher concentration of suppliers, of 1.4 percentage points for products relying more on inputs for which China is a dominant supplier but an increase in exports of 2.1 percentage points for products relying more on foreign inputs and 1.9 percentage points for products relying more on robots, with higher reliance captured by difference between the 10th and 90th percentiles of the specific product characteristic.

Table 1.

COVID-19 and exports depending on product resilience.

| Dependent variable: | Export value by country of product to destination market in time |

|||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Death rate () | −0.035⁎⁎⁎ | −0.152⁎⁎⁎ | ||||||

| (0.011) | (0.034) | |||||||

| Death rate () × Share of top input suppliers () | −0.122⁎⁎⁎ | −0.109⁎⁎⁎ | −0.101⁎⁎⁎ | −0.106⁎ | ||||

| (0.036) | (0.032) | (0.031) | (0.064) | |||||

| Death rate () × China export share in inputs () | −0.092⁎⁎ | −0.148⁎⁎⁎ | −0.094⁎⁎ | |||||

| (0.047) | (0.051) | (0.047) | ||||||

| Death rate () × Imported input reliance () | 0.056⁎⁎⁎ | 0.038⁎⁎ | ||||||

| (0.016) | (0.016) | |||||||

| Death rate () × Unskilled intensity () | −0.034⁎ | 0.002 | 0.015 | |||||

| (0.018) | (0.018) | (0.021) | ||||||

| Death rate () × Robots () | 0.012⁎⁎⁎ | 0.008⁎⁎⁎ | ||||||

| (0.003) | (0.003) | |||||||

| Death rate () × Product complexity () | 0.001 | |||||||

| (0.005) | ||||||||

| Death rate () × Shorter trade relations () | −0.038⁎⁎⁎ | −0.041⁎⁎⁎ | −0.040⁎⁎⁎ | −0.037⁎⁎⁎ | −0.036⁎⁎⁎ | −0.030⁎⁎⁎ | −0.033⁎⁎⁎ | |

| (0.010) | (0.006) | (0.005) | (0.005) | (0.005) | (0.004) | (0.005) | ||

| Death rate () × Medical supplies goods () | 0.055⁎⁎⁎ | 0.056⁎⁎⁎ | 0.057⁎⁎⁎ | 0.055⁎⁎⁎ | 0.053⁎⁎⁎ | 0.051⁎⁎⁎ | 0.053⁎⁎⁎ | |

| (0.006) | (0.004) | (0.004) | (0.005) | (0.005) | (0.005) | (0.005) | ||

| Product-exporting country-importing country fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Exporting-country-time (month-year) fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | ||

| Importing-country-time (month-year) fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 10 417 637 | 10 417 637 | 10 417 637 | 10 417 637 | 10 417 637 | 10 417 637 | 10 417 637 | 10 417 637 |

| R-squared | 0,85 | 0,85 | 0,85 | 0,85 | 0,85 | 0,85 | 0,85 | 0,85 |

Notes: Robust standard errors clustered by exporting country and broad sector in parentheses.

Significance at the 1 percent level.

Significance at the 5 percent level.

Significance at the 10 percent level.

Our stylized facts are robust to the use of alternative product vulnerability measures and COVID-19 incidence (total cases per capita, stay-at-home requirements, different lag structures), clustering of standard errors, the exclusion of China or the US as exporting countries and of medical products, controlling for the China-US tariff war, and the possibility of a positive COVID-19 demand shock (for home office products).

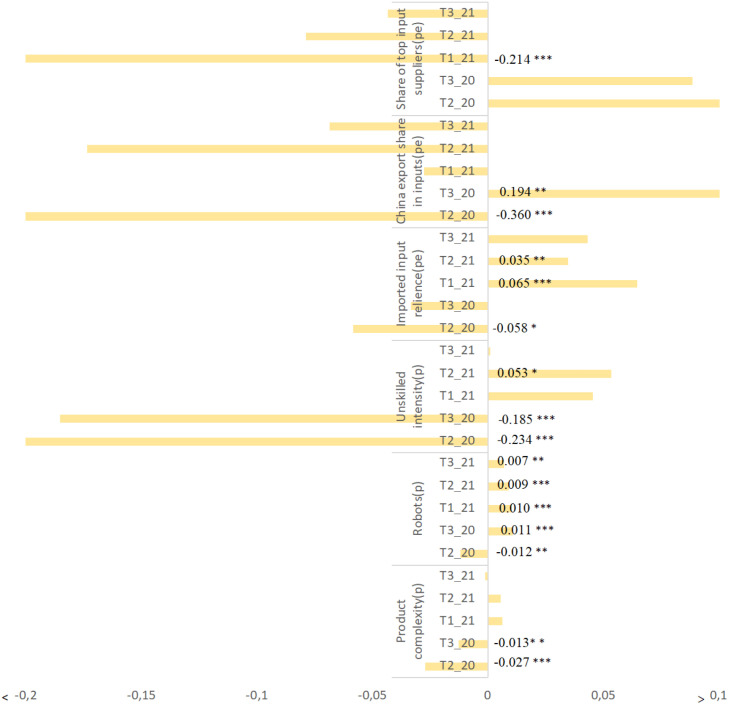

Interestingly, the product characteristics shown in Table 1 played different roles mediating export responses at different stages of the 2020–2021 COVID-19 crisis. Estimates of dynamic effects as the pandemic unfolded in Fig. 1 show initial export declines for products relying more on imported inputs or on unskilled labor in 2020’s second and third quadrimesters as lockdowns and trade disruptions took first place, but exports subsequently increased for those products. Exports of products relying more on inputs for which China is a dominant supplier moved according to the pandemic evolution in China, declining in all quadrimesters except 2020’s third quadrimester. The same reasoning applies to exports of products relying on inputs supplied by few countries which increased initially in 2020 but declined in 2021 as international supplier diversification became an element of resilience. Finally, exports of products whose production is more automated increase in late 2020 and in 2021 as such production modes became more resilient after gaining experience operating under lockdowns and absenteeism due to COVID-19.

Fig. 1.

Dynamics of COVID-19 and exports depending on product resilience.

Notes: The figure plots estimates of the equation where is an indicator for the quadrimester in 2020–2021. Robust standard errors clustered by exporting country and broad sector used. , , and indicate significance at the 1, 5 and 10 percent levels respectively.

5. Conclusion

COVID-19 generated a more negative response across countries in their exports to EU, Japan, and US in 2020 of products relying on inputs with fewer suppliers or those for which China is a dominant supplier but a positive response of those whose production process depends more on robots. As the pandemic unfolded, vulnerabilities related to unskilled-intensive production modes decreased, pointing to quick adjustments to the shock. Reliance on diversified inputs from abroad progressively contributed to resilience following an initial negative role when trade was severely disrupted globally. Our evidence informs debates on the need for supplier diversification to rethink global production arrangements (Javorcik, 2020) and the increased resilience to future pandemics that automation and remote collaborations can allow (Barrero et al., 2021).

Uncited References

Footnotes

This paper is a substantially modified version of the World Bank Policy Research Working paper 9975 with the same title. We thank Siddhesh Kaushik, Ganeshkumar Sathiyamoorthy, Mohammad Shahbazi, Sandra Topalovic and Maurice Nsabimana for helping us to access high-frequency trade data. We thank Roman Zarate Vasquez for obtaining data on road transportation times and Natalia Camelo, Bishakha Sharman, and Irene Iodice for excellent research assistance. Comments by Cristina Constantinescu and participants at the Paris-1 research-in-progress seminar (March 2021) and the Empirical Trade Online Seminar (ETOS) (April 2021) are gratefully acknowledged. This paper has benefited from support from the Umbrella Facility for Trade trust fund financed by the governments of the Netherlands, Norway, Sweden, Switzerland and the United Kingdom. The findings, interpretations, and conclusions expressed in this paper are entirely those of the authors. They do not necessarily represent the views of the OECD, the International Bank of Reconstruction and Development/World Bank and its affiliated organizations, or those of the Executive Directors of the World Bank or the countries they represent. All errors are our responsibility.

While this conceptual discussion focuses on COVID-19-driven supply shocks, our estimates might capture supply and demand shocks.

Appendix.

Table A.1.

Variables definition.

| Variable Name | Description | Source |

|---|---|---|

| Export value () | The logarithm of the value of exports by country e of HS4 product p to destination market in month-year | Eurostat monthly trade flows for EU countries, the Ministry of Finance for Japan, and the United States International Trade Commission for the US |

| Death rate () | The Covid-19 incidence variable constructed as the number of reported COVID-19 deaths per capita per month in each exporting country using the lags defined as follows: | COVID-19 death rate: Oxford COVID-19 Government Response Tracker. Data to construct lags: Census data on HS4 imports by transportation mode in 2015 and searates.com data on shipping days between capital cities as of early 2020. To measure the shortest road distance, we rely on Google Maps |

| Exporting involves lags between the product departure from the exporting country and arrival to the destination country (2–3 months in Bricongne et al., 2021 and 5–10 weeks in Flaaen et al., 2021). Lags depend on the transportation mode which varies with the type of product. The lag structure we use for the COVID-19 incidence variable is product-specific origin–destination country-specific and it combines US Census data on HS4 imports by transportation mode in 2015 with searates.com data on shipping days between capital cities as of early 2020 as follows: | ||

| (i) For HS4 products whose share of imports by air transport is above 75 percent, a one-month lag is used; | ||

| (ii) For other HS4 products, the lag length depends on the number of shipping days between the country pair: one-month for less than 7 shipping days, two-month for 7 to 29 shipping days, three-month for 30 to 59 shipping days, and four-month for more than 60 shipping days; | ||

| (iii) For landlocked exporter and/or importer countries, we add the number of days needed to transport goods by road from (or to) the closest port to (or from) the capital using the shortest road distance. | ||

| Share of input suppliers () | The concentration (across producer countries) in the exports of intermediates used by a sector. For each HS4 product, first the share of its largest exporter in the world in 2015 is computed. Then, we use each country’s input–output table to construct for each given broad sector X the export concentration of its inputs as the weighted average across all the broad sectors’ average share of the largest exporter, where weights are given by the shares of inputs from each broad sector used for production of broad sector X’s output. Then, we map these measure at the broad sector level into the HS4 level. Finally, we assign to each of those countries not int the input–output tables with the input–output table from the country that is most similar in terms of three dimensions: level of development captured by GDP per capita, size captured by population and economic structure captured by share of manufacturing value added, all from World Development Indicators. We assign to countries with no input–output table the table of the country with the lowest aggregate difference across the three dimensions, which we aggregate using inverse-variance weighting. | Export data from UN COMTRADE at the exporting country-HS4 year level combined with the OECD harmonized input–output tables (2011) |

| China export share in inputs () | For each HS4 product, first the share of China in the product’s world exports in 2015 is computed, and then, the average of this share by ISIC revision 3 broad sector (the classification used in the input- output tables), after mapping HS4 products to broad sectors. Then, we use each country’s input- output table to construct for each given broad sector X the reliance on China as supplier of its inputs as the weighted average across all the broad sectors’ average China share, where weights are given by the shares of inputs from each broad sector used for production of broad sector X’s output. Then, we map these measure at the broad sector level into the HS4 level. Finally, we assign countries with no input–output tables the table of the country closest to them in the same way as done for the Share of input suppliers variable (see explanation above). | Export data from UN COMTRADE at the exporting country-HS4 year level combined with the OECD harmonized input–output tables (2011) |

| Imported input reliance () | We compute sectoral imported input reliance following Hummels et al. (2001) as the ratio of imports over the sum of output plus imports minus exports by ISIC revision 3 broad sector and exporting country. We map these measures at the broad sector level into the HS4 level. Finally, we assign countries with no input–output tables the table of the country closest to them in the same way as done for the Share of input suppliers variable (see explanation above). | OECD harmonized input–output tables |

| Unskilled intensity () | The ratio of unskilled (blue-collar) employment to capital in the US for each 6-digit 1997 NAICS industry in 2011 (the most recent year available). | US NBER-CES manufacturing industry database |

| Robots () | Robot usage is the stock of robots used by sector in 2015 for the US where the stock of robots is constructed using the perpetual inventory method assuming a depreciation rate of 10%. | Artuc et al. (2023) based on data from the International Federation of Robotics (IFR) |

| Product complexity () | Product complexity defined as the weighted average of the GDP per capita of the countries that export the HS4 product, where weights are given by countries’ revealed comparative advantage (RCA) index in that product following Hidalgo and Hausmann (2009). | Export data from UN COMTRADE and GDP per capita data from the World Development Indicators for 2012 |

| Shorter trade relations () | Shorter trade relations is a product-level index of relationship stickiness estimated by Martin, Mejean and Parenti (2021) relying on detail French data on firm-to-firm exports to their European partners for the period 2002–2006. This measure captures the mean duration of firm-to-firm trade relationships, where products with higher stickiness are those for which the firm-to-firm trade relationships are longer. | Martin et al. (2022) |

| Medical supplies goods () | HS4 products identified by the World Trade Organisation as COVID-19 medical products. | WCO-WHO (2022) |

Table A.2.

Correlation matrix.

| Share of top input suppliers () | China export share in products () | Imported input reliance () | Unskilled intensity () |

Robots () | Product complexity () | Medical () | Short lived relations () | |

|---|---|---|---|---|---|---|---|---|

| Share of top input suppliers () | 1 | |||||||

| China export share in products () | −0,05 | 1 | ||||||

| Imported input reliance () | −0,17 | 0,16 | 1 | |||||

| Unskilled intensity () | 0,28 | −0,17 | −0,21 | 1 | ||||

| Robots () | −0,30 | −0,33 | 0,15 | −0,47 | 1 | |||

| Product complexity () | −0,24 | −0,15 | 0,13 | −0,40 | 0,38 | 1 | ||

| Medical () | 0,00 | 0,05 | 0,03 | −0,13 | 0,07 | 0,05 | 1 | |

| Short lived relations () | 0,02 | 0,16 | −0,03 | 0,18 | −0,21 | −0,17 | 0,05 | 1 |

Note: Correlation matrix based on average at HS4-exporting country average of HS4 and export countries contained in the estimating sample. Not using just average of the estimating sample.

Data availability

Data will be made available on request.

References

- Artuc Erhan, Bastos Paulo, Rijkers Bob. Robots, tasks and trade. J. Int. Econ. 2023 (forthcoming) [Google Scholar]

- Barrero, J., Bloom, N., Davis, S., 2021. Why Working from Home Will Stick. National Bureau of Economic Research Working Paper 28731.

- Bas, M., Fernandes, A., Paunov, C., 2022. How Resilient Was Trade to COVID-19. World Bank Policy Research Working Paper 9975.

- Berthou, A., Stumpner, S., 2022. Trade Under Lockdown. Banque de France Working Paper No. 867.

- Bonadio B., Huo Z., Levchenko A., Pandalai-Nayar N. Global supply chains in the pandemic. J. Int. Econ. 2021;133 doi: 10.1016/j.jinteco.2021.103534. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bricongne, J.-C., Carluccio, J., Fontagne, L., G. Gaulier, D., Stumpner, S., 2021. From Macro to Micro: Heterogeneous Exporters in the Pandemic. Banque de France Working Paper Series 88.

- Demir B., Javorcik B. Trade finance matters: Evidence from the COVID-19 crisis. Oxf. Rev. Econ. Policy. 2020;36(Supplement_1) S397-S408. [Google Scholar]

- Espitia A., Mattoo A., Rocha N., Ruta M., Winkler D. Pandemic trade: Covid-19, remote work and global value chains. World Econ. 2022;45(2):561–589. doi: 10.1111/twec.13117. [DOI] [PMC free article] [PubMed] [Google Scholar]

- di Giovanni, J., Levchenko, A., Mejean, I., 2020. Foreign Shocks as Granular Fluctuations. National Bureau of Economic Research Working Paper 28123.

- Hidalgo C., Hausmann R. The building blocks of economic complexity. Proc. Natl. Acad. Sci. 2009;106:10570–10575. doi: 10.1073/pnas.0900943106. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Javorcik B. In: COVID-19 and Trade Policy: Why Turning Inward Won’t Work. Baldwin R., Evenett S., editors. CEPR Press; 2020. Global supply chains will not be the same in the post-COVID-19 world. [Google Scholar]

- Lafrogne-Joussier R., Martin J., Mejean I. Supply shocks in supply chains: Evidence from the early lockdown in China. IMF Econ. Rev. 2022 (forthcoming) [Google Scholar]

- Liu X., Ornelas E., Shi H. The trade impact of the Covid-19 pandemic. World Econ. 2022;45(12):3751–3779. doi: 10.1111/twec.13279. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Martin, J., Mejean, I., Parenti, M., 2022. Relationship Stickiness and Economic Uncertainty. CEPR Discussion Paper 15609.

- WCO-WHO X. The World Customs Organization (WCO) and World Health Organization (WHO); 2022. HS Classification Reference for Covid-19 Medical Supplies HS 2022 Edition. https://www.wcoomd.org/-/media/wco/public/global/pdf/topics/nomenclature/covid_19/hs-classification-reference_edition-3_en.pdf?la=en. [Google Scholar]

- World Bank . World Bank; Washington, DC: 2020. COVID-19 Trade Watch. various issues. https://www.worldbank.org/en/topic/trade/brief/trade-watch. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Data Availability Statement

Data will be made available on request.