Abstract

Retirement timing is associated with health and economic outcomes for older adults. However, it is unclear how the pressures of supporting older parents and young adult children are associated with retirement. This study uses a life course perspective to consider how the linked lives of working older adults and their support of adult children and parents are associated with retirement. Cox proportional hazard models are estimated using the Health and Retirement Study (1992–2014) to assess the relationship between intergenerational support exchanges and retirement timing by gender and race/ethnicity. Providing most types of intergenerational support and especially providing time support are associated with an increased risk of retirement. Unlike all other respondents, Hispanic women providing intergenerational time support have similar retirement risks as those not providing any intergenerational support. These differing patterns by race/ethnicity suggest that earlier life course trajectories may shape older adults’ ability to respond to family needs.

Keywords: life course, retirement, intergenerational support, race/ethnicity, aging, family

Introduction

In recent years the average age of retirement has been increasing. In 2010, 42% of workers expected to retire after 65 or not at all compared to only 11% two decades earlier; this trend is likely driven by a combination of several changes that increase the incentives to work longer as the burden of ensuring enough retirement savings increasingly falls on individuals and their families (Quinn 2010). Despite these increases, most workers, either by choice or inability to continue working, retire before their full Social Security eligibility (Purcell 2016). Although many individual social, demographic, and economic characteristics are associated with retirement timing, researchers increasingly recognize the importance of understanding retirement decisions as family decisions rather than solely individual decisions (Dentinger and Clarkberg 2002; Matthews and Fisher 2012; Szinovacz, DeViney, and Davey 2001; Whitaker and Bokemeier 2018). Retirement timing has important implications for financial and psychological wellbeing, with evidence suggesting that early retirement can have negative economic and psychological consequences for older adults (Fisher, Chaffee, and Sonnega 2016). Therefore, if family demands push older adults out of the labor force earlier, this may have long-lasting effects on their financial security and psychological wellbeing as older adults.

Midlife and older adults simultaneously face the pressures of preparing for retirement and supporting either aging parents or young adult children. Among older adults in midlife, over 80% provide intergenerational support to at least one generation, and about one-third support two generations simultaneously (Margolis and Wright 2016). The strains from providing intergenerational support may therefore shape retirement timing decisions. Providing instrumental caregiving support may crowd out work, whereas demands to help financially may pressure older adults to remain in the labor force.

Most research on intergenerational transfers has focused on the recipients’ characteristics and family structure. Recently, research has begun to examine what implications these intergenerational transfers may have for those providing these transfers. Previous research has found that parents with co-resident adult children have fewer assets and save less money (Maroto 2017, 2019). Additionally, research has shown that parents’ retirement expectations are sensitive to the events of their adult children. When coresident adult children move out, parents’ expectations of working longer decrease (Miller, Tamborini, and Reznik 2018). Much of the research has focused on a limited type of assistance, such as coresidence or caregiving; however, as older adults are potentially providing support to multiple generations, we need to assess the effects of all types of intergenerational support. Parents may grapple with the needs of both their adult children and their aging parents. Therefore, understanding how the overlapping intergenerational supports shape retirement decisions can advance family sociology and gerontological research on retirement. This study uses a life course framework to consider how competing intergenerational support demands shape retirement timing and how divergent life course pathways by race/ethnicity may alter the relationship between intergenerational support and retirement timing.

Background

Intergenerational Family Exchanges

Support in the form of financial resources, time, and shared housing are frequently exchanged across generations within families to help those in need of assistance (Bianchi et al. 2008). These types of exchanges may be especially significant during critical periods of transition, such as the transition to adulthood, transition to parenthood, and transition to a care-dependent (Seltzer and Bianchi 2013; Swartz 2009).

The transition to adulthood has been elongated as expectations for education have increased and economic independence has become more complex, leading many parents to assist their adult children as they manage the transition to adulthood (Swartz et al. 2011). This, in part, reflects the fact that young adults stay in school until later ages and have higher rates of unemployment and structural changes to the economy that have made economic independence more challenging to attain for young adults (Sironi and Furstenberg 2012; Vespa 2017). With the elongation of the transition to adulthood, parents support their adult children, in whole or in part, for a more extended period (Henretta, Van Voorhis, and Soldo 2018). Over the past 30 years, transfers from parents to young adults have increased in prevalence and amount (Wightman et al. 2013). Almost half of the adult children in their 20s receive either financial or housing support from their parents (Swartz et al. 2011). With adult children dependent on their parents until later ages, this may influence the retirement timing decisions of older adults. Not only are parents supporting their adult children longer, but when adult children have their own children, the presence of grandchildren can also increase demands on older adults. Many grandparents provide childcare assistance or financial assistance, especially when grandchildren are younger (Ho 2013; Luo et al. 2012). Caregiving support to grandchildren may pose a competing demand with work and encourage an earlier retirement.

Norms and trends for intergenerational support exchanges are not uniform across race/ethnicity. White families tend to exchange more financial support, whereas black and Hispanic families are more likely to provide housing support (Sarkisian, Gerena, and Gerstel 2007; Sarkisian and Gerstel 2004). Inequalities explain a large portion of racial differences in income transfers to children because structural factors such as wealth, income, and education are not equal across groups (Berry 2006). Black and Hispanic parents are also more likely to provide care for grandchildren (Luo et al. 2012). These differences in intergenerational exchanges suggest that the tradeoffs of providing time help compared to monetary support may also vary by race/ethnicity. The cumulation of life experiences may shape how older adults weigh these tradeoffs as they approach retirement.

At the other end of the life course, as older adults age, their need for care and support increases as they become at greater risk of health declines (Schulz et al. 2016). For instance, by age 65, older parents become equally likely to be residing in their adult child’s home as the reverse (Ruggles 2007). Coresidence at older ages often facilitates the provision of care, and about 40% of disabled older adults rely on unpaid care (Seltzer and Bianchi 2013; Spillman and Pezzin 2000). Providing caregiving support to older parents by assisting with care activities is a more common form of upward transfer than providing financial transfers and is more commonly performed by daughters than sons (Seltzer and Bianchi 2013; Wolff et al. 2016). Though Black adult children are more likely than white children to support their parents through financial transfers, this too may be associated with health declines to help offset the cost of medical needs (Park 2018).

Over time intergenerational exchanges have increasingly flowed from older generations to younger generations (Kahn, Goldscheider, and García-Manglano 2013). Nevertheless, about one-third of older adults find themselves helping parents (Margolis and Wright 2016). Those who provide help to both generations simultaneously are often termed the “sandwich generation” to recognize the financial and emotional strains that may arise from supporting two generations (Chassin et al. 2010; Margolis and Wright 2016; Spillman and Pezzin 2000). As life expectancy has increased, few adults provide care for aging parents and dependent children simultaneously (Grundy and Henretta 2006). However, intergenerational exchanges to young adult children, such as financial support or caring for grandchildren, may still strain middle and older-age parents who feel financial and occasional time demands from both generations.

Consequences of Intergenerational Support

Most research has focused on the patterns of intergenerational exchange and what predicts receipt of support, as opposed to the consequences of providing intergenerational assistance. One exception is research about the strain experienced by the sandwich generation. The pressures of the sandwich generation are negatively associated with health behaviors and individual wellbeing (Chassin et al. 2010; Rubin and White-Means 2009). Beyond health, sandwiched caregivers also face work-life tradeoffs. Previous research has noted that reductions in work hours and labor force exits are more common for those providing support to both generations (Rubin and White-Means 2009; Spiess and Schneider 2003). However, we know less about the more common types of support many older workers make, such as financial support to young adults.

As support to young adults has become increasingly prevalent, researchers have also begun investigating the long-term consequences of providing support to young adults. This research has primarily focused on the effects of coresidence as this trend has become more common. For example, having an adult child move in is also associated with increased depressive symptoms among older adults (Caputo 2019). Parents whose adult children co-reside or rely on them for financial support also have decreased levels of wealth and an increase in debt in Canada (Maroto 2019). Coresidence of adult children has also been linked to a decrease in parental assets and a significant reduction in savings when their children co-reside in the United States (Maroto 2017). On the flip side, having a young adult child leave the parental home is associated with increased retirement contributions (Dushi et al. 2015).

Although most research on the consequences of intergenerational support has not focused on race/ethnic differences, given different family norms and wealth profiles by race/ethnicity, the consequences of parents’ intergenerational support may vary as well. Blacks and Hispanics, on average, have less income and wealth to transfer, yet they exhibit strong familial norms; therefore, they may be more likely to shortchange their savings for retirement by retiring earlier than whites. Previous research has found racial differences in the effect of motherhood on work choices, which may extend later in the life course and shape retirement decisions as well (Florian 2018). Given these differences, understanding how the linked lives of parents and their adult children differ across race and socioeconomic status is essential for understanding the intergenerational family processes.

Family Influences on Retirement

Decisions related to retirement timing are increasingly recognized as family decisions rather than exclusively individual decisions. Early work found that a spouse’s retirement was predictive of the retirement timing of husbands’ and wives’ retirement (Henkens 1999). When a spouse remains in the labor force, men are less likely to retire (Gustman and Steinmeier 2004). Further, women are more likely to retire early when married, mainly because of age differences between husbands and wives (Denaeghel, Mortelmans, and Borghgraef 2011; Finch 2013). Recent research has elucidated the mechanisms underlying retirement decision-making within couples by studying partners’ preference for their spouse’s retirement and found that both male and female workers are susceptible to spousal preferences directly or indirectly (Eismann, Henkens, and Kalmijn 2019). Retirement timing is related not only to marital factors; children’s characteristics are also important in shaping decisions about when to retire for older workers (Szinovacz et al. 2001; Whitaker and Bokemeier 2018).

The number, age, and relationships with children also influence retirement timing. Having more children is associated with delays in retirement (Reitzes, Mutran, and Fernandez 1998). Furthermore, having children who are financially dependent on parents is also associated with delays in retirement (Pienta and Hayward 2002; Szinovacz et al. 2001). Additionally, parents paying for their child’s college education are less likely to be retired, and having a child in school may also deter retirement (Bailey, Haynes, and Letiecq 2013; Handwerker 2011). Furthermore, helping adult children by providing childcare to grandchildren is also associated with an increased likelihood of retirement among women (Lumsdaine and Vermeer 2015). Additionally, full retirement and postretirement work increase the likelihood of grandparenting compared to those remaining in their career employment (Grünwald, Damman, and Henkens 2021).

Much of the work understanding the influence of family on retirement has focused on the gendered effects of family factors on retirement, with women being more sensitive to family demands than men (Dentinger and Clarkberg 2002; Pavalko and Artis 1997; Reitzes et al. 1998; Whitaker and Bokemeier 2018). One of the reasons women may be more likely to retire earlier than men is because they are more likely to take on a caregiving role and more likely to face a wage penalty for providing parental care than men (Glauber 2019). Previous research has found that women are more likely to retire to facilitate caregiving (Dentinger and Clarkberg 2002; Lumsdaine and Vermeer 2015). Those who take time off work due to family demands are less likely to be working later in life (Pienta, Burr, and Mutchler 1994).

Current Study

Drawing on key principles of the life course perspective, I argue that the decision to retire is shaped by one’s own circumstances and family needs over the working life course. As lives are linked or interconnected, the experiences of the family and the experiences of work are therefore linked throughout the life course. Each, in turn, shapes decision-making regarding retirement (Elder Jr 1977; Moen 1996). The life course perspective also stresses the importance of understanding that transitions, such as retirement, are the product of immediate circumstances and the accumulation of life circumstances that jointly shape life course social and economic capital (Ferraro, Shippee, and Schafer 2009; O’Rand 1996). The timing of children’s or parents’ needs and anticipated retirement may shape decisions to provide intergenerational support and alter retirement timing decisions.

The transition to retirement typically results in increased free time and decreased income. Consequently, the type of intergenerational support parents provide, an exchange of time or money, may encourage or discourage retirement. I make three hypotheses about the relationship between intergenerational transfers and retirement timing that emphasize the importance of the type of transfer:

Financial Support Hypothesis:

Helping children or parents financially may delay retirement through two mechanisms. Providing support could interfere with savings for retirement and encourage working longer to ensure sufficient income to provide monetary transfers.

Time Support Hypothesis:

Providing caregiving support to parents or children may accelerate retirement timing because it requires having more free time and may not be compatible with work schedules.

Coresidence Support Hypothesis:

Helping children through shared housing is an indirect form of financial support in many cases and has been linked to reduced savings. With reductions in savings, coresidence with adult children is hypothesized to delay retirement timing.

Gender and Race Differences:

The key mechanism of both the financial support hypothesis and coresidence support hypothesis involves the provision of financial support. Therefore, I hypothesize that men and non-Hispanic whites will be more sensitive to their families’ financial needs than women and Black or Hispanic respondents. Societal norms shape expectations of providing, and therefore, men and non-Hispanic whites may be more likely to delay retirement to provide financial support. Specifically, I argue that men’s retirement decisions may be more sensitive to the financial needs of intergenerational family members as they are often perceived as the primary economic provider, which is central to men’s identity and cultural norms of masculinity (Loretto and Vickerstaff 2013; Townsend 2010). Additionally, white respondents may be more sensitive to the financial needs of families because they have a greater propensity to provide financial exchanges than other race/ethnic groups (Sarkisian and Gerstel 2004). Although coresidence is common in Black and Hispanic families because it may be motivated by more than financial support, I do not expect Black and Hispanic workers’ retirement decisions to be as sensitive to coresidence support as white workers.

As the time support hypothesis requires providing care to parents or grandchildren, groups with a greater social expectation to provide care may be more sensitive to the time support hypothesis. Therefore, I hypothesize that women will be more sensitive to the time support hypothesis than men and be more likely to retire earlier when they provide time assistance. Women in these cohorts often take on greater family responsibilities regardless of labor force participation, especially in the domain of caregiving (Lee and Tang 2015; Moen, Robison, and Fields 1994; Patterson and Margolis 2019), and previous work has suggested that women are more sensitive to these types of family needs than men (Dentinger and Clarkberg 2002; Whitaker and Bokemeier 2018). Similarly, Black and Hispanic families may be more sensitive to the time support hypothesis than non-Hispanic white families because of their stronger family obligations for providing caregiving support. These norms, coupled with lower average wages for Black and Hispanic workers, may increase the likelihood of earlier retirement to provide care assistance.

Data and Methods

This study utilizes longitudinal data from the Health and Retirement Survey (HRS), 1992–2014. The HRS is sponsored by the National Institute on Aging (NIA U01AG009740) and is conducted by the University of Michigan. Respondents aged 50 and older are interviewed every two years, with new cohorts added every six years to keep the sample representative of older adults aged 50 and older over time. HRS collects information on a wide range of topics, including work, retirement, and family. Data from the RAND HRS Family Data 2014 is combined with HRS core data on the respondent.1.

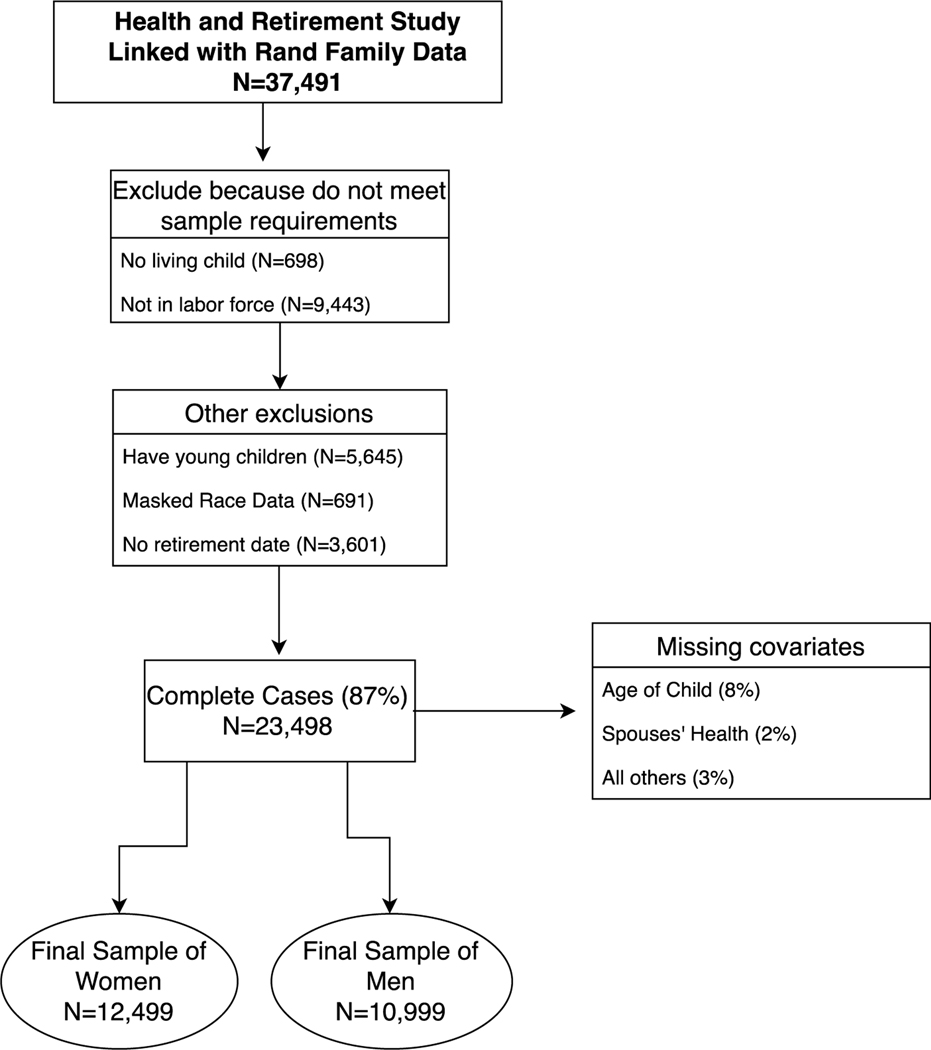

To identify the time ordering of events, this analysis is restricted to adults observed in the labor force at their first observation (as opposed to retired or not in the labor force). The analysis is also limited to respondents who are parents of children aged 25 and older. Respondents who HRS aggregates in the “other” race category are excluded from the sample (N=703) because they are too small to compare to other race/ethnic groups. Those who are missing on any of the covariates are also excluded. Sample selection decisions are documented in Appendix Figure A1.

Outcome Measure

Retirement is measured using an indicator of retirement and age at retirement as the duration variable. Age at retirement is calculated by using the first self-reported retirement date and birthdate to estimate the age at retirement. Although during the survey, individuals can “unretire,” that is, report retired in one wave, and in the labor force in future waves, the focus of this study is on the first self-reported retirement transition because it signals crucial shifts in social and economic resources as well as social identity (Bordia, Read, and Bordia 2020; Maestas 2010). For those who are not observed retiring during the survey, their age at the last interview is estimated using the interview date and birthdate. An indicator of ever retiring is used to indicate those cases that are right-censored in the model.

Key Independent Variables

The key variables of interest for this study are seven measures of cumulative intergenerational support. These measures capture intergenerational exchange that occurs before retirement—the first three capture downward intergenerational support through money, time, and housing. Financial transfers to adult children indicate the respondent provided financial help or gifts totaling more than $500. Grandchild care is operationalized as providing at least 100 hours taking care of non-resident grandchildren or great-grandchildren. Co-residence of an adult child captures sharing a residence with a child over the age of 25. The following three measures include upward transfers to parents along the same three dimensions: money, time, and housing. Financial transfers to parents give a parent at least $500 toward helping pay bills or covering specific costs such as medical care. Parental caregiving is operationalized as providing personal care assistance to either parent. The coresidence of a parent is sharing a residence with a parent. The last measure of intergenerational support, financial dependent, captures significant financial support to parents, children, or other relatives. Financial dependent is a binary measure of any relative outside a respondent’s household being financially dependent on them for more than half of their support. These variables are also used to construct two categorical combinations of support: any intergenerational support (yes/no) and type of assistance (financial support only/financial and/or coresidence/any time help).

Gender and race/ethnicity are included as key sociodemographic variables. Gender is used to stratify the analysis for women and men. Race/ethnicity is coded into three categories: non-Hispanic white, non-Hispanic black, and Hispanic.

Control Variables

In addition to intergenerational support measures, two family composition measures are also included that previous research has found to be significant for understanding retirement decisions: marital status and the number of children (Matthews and Fisher 2013). Marital status is a dichotomous measure of married/partnered or single, and the number of children is a continuous variable of the number of living children.

A set of control variables is included that have been associated with retirement timing in previous research to capture socioeconomic status, work characteristics, and health (Fisher et al. 2016). Time-varying controls are measured in the wave prior to retirement for those observed retiring and in the last observed wave for those not observed retiring.

Differences in socioeconomic status are captured by controlling for logged household income, logged household wealth, homeownership, and education level. The household income variable measures the respondent’s and their spouse’s total income for the past year and includes earnings, pensions, government transfers, and capital income. Household wealth consists of all sources of financial wealth while excluding housing wealth and debt. Missing values for both income and wealth were imputed by HRS (for details, see: (Cao 2001). Homeownership is a dichotomous measure indicating the respondent owns their own home. Education is categorized as less than high school, high school, some college, and bachelor’s or more.

Employment status and job characteristics are captured with indicators of full-time employment, self-employment, pension type, and job stress. Pension type is categorized as no pension, defined benefit (regardless of having a defined contribution), or defined contribution.

Workers who strongly agree or agree that their job involves a lot of stress are coded as having job stress. Respondents’ own self-rated health and spouse’s health are also included.

Analysis

I estimate Cox proportional hazard models of retirement to assess differences in retirement timing by intergenerational support measures. Cox proportional hazard models analyze the time to event and allow for censored data allowing the inclusion of respondents who do and do not experience retirement in the same model (Cox 1972). All models are stratified by gender to account for known gender differences in work-retirement transition timing. Additional models to test for gender differences are estimated. Race/ethnicity is examined on its own and as a moderator of intergenerational support measures to assess race/ethnic differences in the relationship between intergenerational support and retirement timing.

In testing the assumption of proportional hazards, race, education, and marital status have a significant interaction with time. Sensitivity tests, including interaction terms between time and race, education, and marital status in the models, suggests this does not alter the substantive conclusions from the models. Following previous research, unweighted data is used because there is a lack of consensus on incorporating time-varying weights in Cox proportional hazards models (Lumsdaine and Vermeer 2015; Sonnega et al. 2018). As a robustness check, analyses using the pre-retirement interview weight are estimated, and findings are unchanged. Robust standard errors are estimated to account for clustering and other uncontrolled aspects of survey design.

Results

Table 1 presents frequencies of intergenerational support variables by gender and race/ethnicity. Providing intergenerational support is very common, with at least three-quarters of respondents in each demographic providing intergenerational assistance (Table 1). Black men are the least likely to be providing intergenerational support, at 76% providing any help compared to over 80% for other groups. Helping adult children, especially financial transfers to adult children, is the most common form of intergenerational exchange. Notable differences by race/ethnicity and, to a lesser extent, gender are evident across the different types of intergenerational support. White parents are much more likely to be giving financial transfers to their children than Black or Hispanic parents and less likely to be giving financial transfers to their parents. Caregiving for a parent is most common among Hispanic men and women at 24% and 25%. Financial transfers to parents and coresidence of parents are also most common among Hispanic men and women. Women are more likely to be providing grandchild care, especially Black women, of whom 50% provide grandchild care compared to only about 44% of white women.

Table 1:

Intergenerational Support Exchanges by Gender and Race/Ethnicity

| Men | Women | |||||

|---|---|---|---|---|---|---|

| White | Black | Hispanic | White | Black | Hispanic | |

|

| ||||||

| Any intergenerational Support | 81.5 | 75.9 | 84.4 | 81 | 81.6 | 83.7 |

| Individual Measures of Support | ||||||

| Financial Transfer to Adult Child | 69.3 | 54.1 | 51.4 | 66.1 | 57.1 | 51.2 |

| Grandchild Care | 43.7 | 39.6 | 45.8 | 44.1 | 50.2 | 47.6 |

| Co-residence of Adult Child | 31.9 | 36.3 | 48.7 | 36.3 | 47.8 | 51.4 |

| Financial Transfer to Parent | 7.6 | 13.4 | 18.2 | 8.7 | 13.4 | 18 |

| Caregiving for Parent | 18.3 | 16.6 | 24.4 | 19.4 | 18.4 | 25 |

| Co-residence of Parent | 5 | 6.1 | 7.3 | 5.4 | 6.2 | 7.4 |

| Financial Dependent | 20.9 | 24.8 | 32.2 | 23.1 | 33.5 | 36.6 |

| Type of Support | ||||||

| None | 18.5 | 24.1 | 15.6 | 19 | 18.4 | 16.3 |

| Only Financial | 19 | 14.9 | 10.9 | 16.2 | 9.7 | 8.6 |

| Coresidence & Financial | 11.4 | 13.5 | 17.8 | 13.2 | 14.7 | 17.4 |

| Any Time Help | 51.1 | 47.5 | 55.7 | 51.6 | 57.2 | 57.7 |

|

| ||||||

| N | 7088 | 1269 | 780 | 7807 | 2128 | 867 |

When collapsing by the type of support provided, apparent race/ethnic differences emerge. White men and women are more likely than Black and Hispanic respondents to be providing only financial help. In contrast, coresidence was most common among Hispanic men and women. Women, especially Black and Hispanic women, were more likely to provide time help than men.

Hazard ratios of retirement timing for women by intergenerational support are presented in Table 2. A hazard ratio of less than one can be interpreted as a lower risk of retirement than the reference category, and a hazard ratio greater than one can be interpreted as a greater risk of retirement than the reference group. Adjusting for social and demographic characteristics associated with retirement, providing any type of intergenerational support is associated with a significantly higher risk of retirement than those providing no support (Model 1). When looking at each intergenerational exchange individually, three out of the seven are associated with earlier retirement: providing monetary transfers to children, caring for grandchildren, and caring for a parent (Model 2). Only one intergenerational exchange is associated with retiring later: having a financially dependent family member.

Table 2:

Cox Proportional Hazards of Retirement for Women by Intergenerational Support (N=12,499)

| Model 1 | Model 2 | Model 3 | Model 4 | |||||

|---|---|---|---|---|---|---|---|---|

| HR | SE | HR | SE | HR | SE | HR | SE | |

|

| ||||||||

| Race/Ethnicity (Ref=NH White) | ||||||||

| NH Black | 1.00 | (0.03) | 1.01 | (0.03) | 1.00 | (0.03) | 0.95 | (0.10) |

| Hispanic | 0.76*** | (0.04) | 0.78*** | (0.04) | 0.76*** | (0.04) | 0.63* | (0.11) |

| Married | 1.35*** | (0.04) | 1.33*** | (0.04) | 1.34*** | (0.04) | 1.34*** | (0.04) |

| Number of Children | 1.02*** | (0.01) | 1.02*** | (0.01) | 1.02** | (0.01) | 1.02** | (0.01) |

| Any Intergenerational Support | 1.45*** | (0.05) | ||||||

| Grandchild Care | 1.30*** | (0.03) | ||||||

| Child Financial Transfer | 1.18*** | (0.03) | ||||||

| Parent Co-reside | 1.00 | (0.05) | ||||||

| Parent Financial Transfer | 0.96 | (0.04) | ||||||

| Parent Care | 1.16*** | (0.04) | ||||||

| Child Co-reside | 1.06* | (0.03) | ||||||

| Financial Dependent | 0.89*** | (0.03) | ||||||

| Type of Support (Ref=Only Financial) | ||||||||

| None | 0.75*** | (0.03) | 0.73*** | (0.04) | ||||

| Coresidence/Financial | 0.93 | (0.04) | 0.91 | (0.05) | ||||

| Time | 1.25*** | (0.04) | 1.24*** | (0.05) | ||||

| Type of Support*Race | ||||||||

| None*Black | 1.04 | (0.14) | ||||||

| None*Hispanic | 1.59* | (0.34) | ||||||

| Cores*Black | 1.10 | (0.14) | ||||||

| Cores*Hispanic | 1.20 | (0.25) | ||||||

| Time*Black | 1.05 | (0.12) | ||||||

| Time*Hispanic | 1.16 | (0.21) | ||||||

Notes: Notes: HR=Hazard Ratio; SE=Standard Errors; NH=Non-Hispanic; statistical significance indicated by

p<0.05

p<0.01

p<0.001; All models include controls for education, family income, wealth, homeownership, full-time employment, self-employment, job stress, pension type, poor health, and spouses’ health.

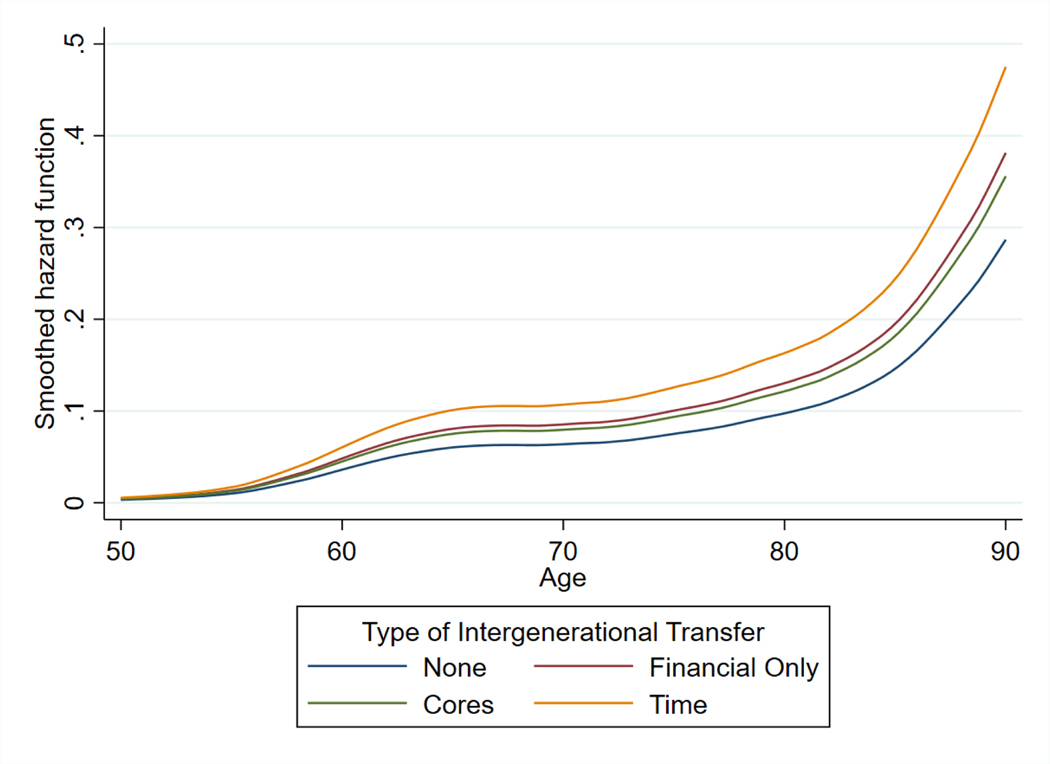

In the next model, intergenerational exchanges are categorized by type, and significant differences in the association between type of support and retirement timing are observed (Model 3). These patterns are evident from looking at the hazards of retirement (Figure 1). Providing no intergenerational support is associated with the lowest risk of retirement, followed by only financial and coresident support, and then giving time assistance is associated with the highest risk of retirement. The differences in retirement risk by type of support emerge around age 60 and increase with age.

Figure 1:

Hazard of retirement for women by type of intergenerational transfer, Health and Retirement Study, 1992–2014

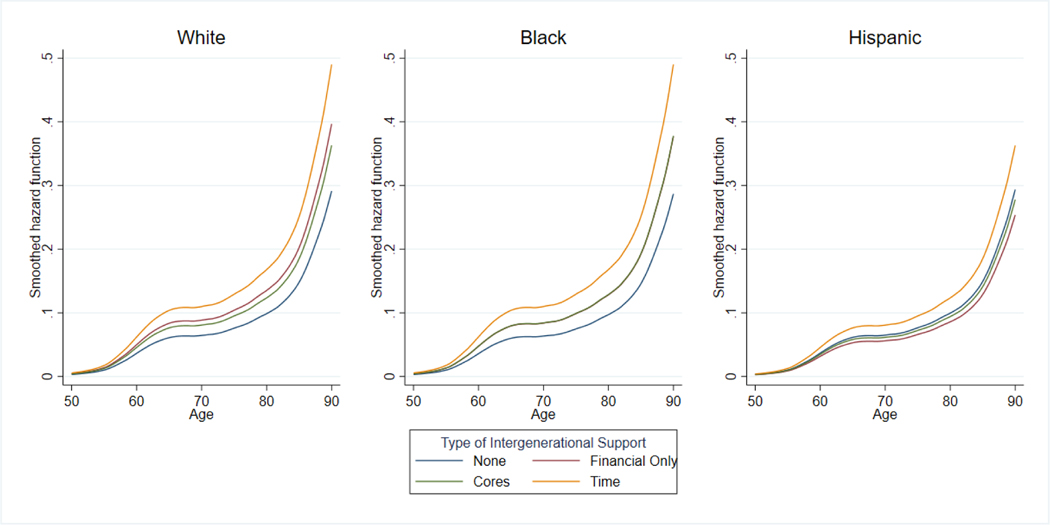

This pattern is not consistent across race/ethnicity (Model 4). The difference in the patterns by race/ethnicity is evident from the estimated hazard functions (Figure 2). White and Black women follow a similar pattern. Those only helping financially or providing coresidence have a higher hazard of retirement than those providing no intergenerational exchange but a lower risk of retirement than those providing time help. Hispanic women have a lower hazard of retirement overall, and differences by type of support follow a different pattern and are much smaller. Hispanic women providing only financial support have the lowest hazard of retirement, though it is not significantly different from no support. Hispanic women who provide time assistance appear to have a slightly higher risk of retirement, though this increased risk is negligible.

Figure 2:

Hazard of retirement for women by race/ethnicity and type of intergenerational transfer, Health and Retirement Study, 1992–2014

Turning to men, the hazard ratios of retirement timing by intergenerational support are presented in Table 3. As with women, they are providing intergenerational support is associated with retiring earlier for men (Model 1). Again, differences for each exchange are estimated in Model 2. Five types of intergenerational support are associated with an increased risk of retirement for men: providing monetary transfers to children, providing care for grandchildren, having a parent or adult child co-reside, and providing care to a parent. Two types of intergenerational support are associated with a lower risk of retirement: having a financial dependent and providing financial support to parents.

Table 3:

Cox Proportional Hazards of Retirement for Men by Intergenerational Support (N=10,999)

| Model 1 | Model 2 | Model 5 | Model 6 | |||||

|---|---|---|---|---|---|---|---|---|

| HR | SE | HR | SE | HR | SE | HR | SE | |

|

| ||||||||

| Race/Ethnicity (Ref=NH White) | ||||||||

| NH Black | 0.94 | (0.04) | 0.95 | (0.04) | 0.94 | (0.04) | 0.85 | (0.09) |

| Hispanic | 0.72*** | (0.04) | 0.76*** | (0.04) | 0.73*** | (0.04) | 0.57*** | (0.08) |

| Married | 1.11** | (0.04) | 1.08* | (0.04) | 1.07* | (0.04) | 1.07* | (0.04) |

| Number of Children | 1.00 | (0.01) | 1.00 | (0.01) | 0.99 | (0.01) | 0.99 | (0.01) |

| Any Intergenerational Support | 1.58*** | (0.07) | ||||||

| Grandchild Care | 1.25*** | (0.03) | ||||||

| Child Financial Transfer | 1.21*** | (0.04) | ||||||

| Parent Co-reside | 1.23*** | (0.07) | ||||||

| Parent Financial Transfer | 0.90* | (0.04) | ||||||

| Parent Care | 1.19*** | (0.04) | ||||||

| Child Co-reside | 1.07* | (0.03) | ||||||

| Financial Dependent | 0.85*** | (0.03) | ||||||

| Type of Support (Ref=Only Financial) | ||||||||

| None | 0.69*** | (0.03) | 0.68*** | (0.04) | ||||

| Coresidence/Financial | 0.96 | (0.05) | 0.95 | (0.05) | ||||

| Time | 1.24*** | (0.05) | 1.21*** | (0.05) | ||||

| Type of Support*Race | ||||||||

| None*Black | 1.05 | (0.15) | ||||||

| None*Hispanic | 1.70** | (0.34) | ||||||

| Cores*Black | 1.21 | (0.18) | ||||||

| Cores*Hispanic | 1.06 | (0.19) | ||||||

| Time*Black | 1.12 | (0.13) | ||||||

| Time*Hispanic | 1.35* | (0.21) | ||||||

Notes: HR=Hazard Ratio; SE=Standard Errors; NH=Non-Hispanic; statistical significance indicated by

p<0.05

p<0.01

p<0.001; All models include controls for education, family income, wealth, homeownership, full-time employment, self-employment, job stress, pension type, poor health, and spouses’ health.

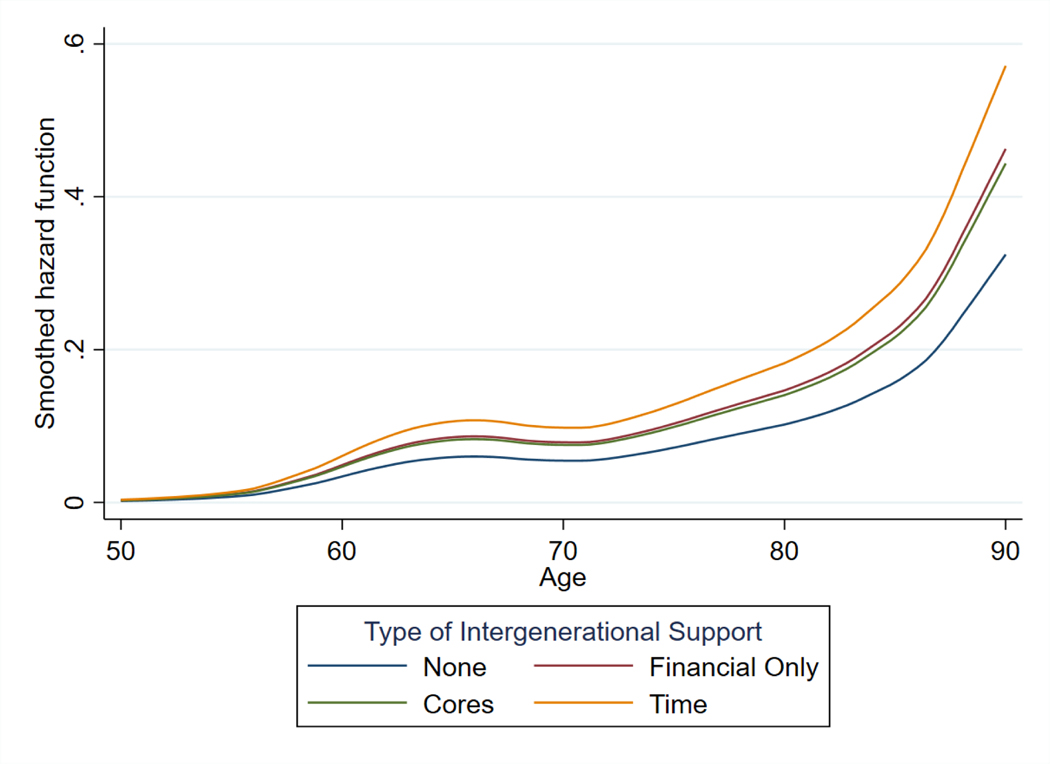

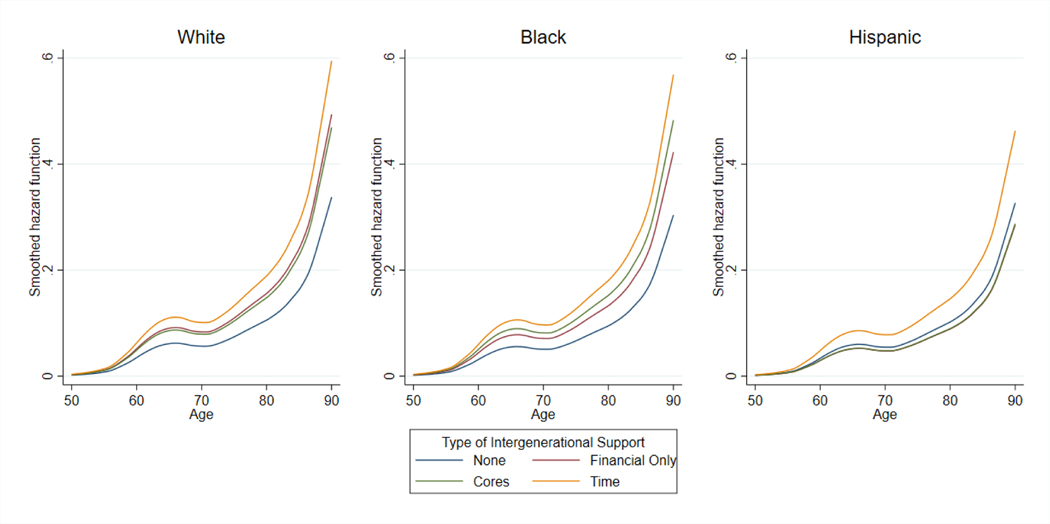

In the next model, intergenerational exchanges are collapsed into categories by type (Model 3). Significant differences in retirement timing by type of support are also found for men. The hazards of retirement by type are plotted in Figure 3. Like women, men providing no intergenerational support have the lowest retirement risk, followed by coresidence support and then closely by only financial support. Those giving time support have the highest risk of retirement. Differences in these patterns by race/ethnicity are estimated in Model 4. The association between type of support and retirement timing is moderated by race/ethnicity, and these differences are shown in Figure 4. White men follow a similar pattern as observed for the full sample. White men providing only financial support have a greater risk of retirement than those providing none but less than those providing time assistance. The pattern is slightly different for Black men, with those providing coresidence support having a higher risk of retirement than those providing only financial support. The higher risk of retirement for those providing time assistance is smaller among Black men. The type of intergenerational support has a different association with retirement timing for Hispanic men. Hispanic men providing only financial and coresidence have similar hazards of retirement as those providing no assistance. Providing time assistance is associated with the greatest retirement risk among Hispanic men, and this increase for providing time support is larger than for White and Black men.

Figure 3:

Hazard of retirement for men by type of intergenerational transfer, Health and Retirement Study, 1992–2014

Figure 4:

Hazard of retirement for men by race/ethnicity and type of intergenerational transfer, Health and Retirement Study, 1992–2014

Discussion

This study demonstrates the importance of taking a family life course perspective for understanding retirement timing and how intergenerational exchanges shape the lives of those who provide support. Intergenerational family support dynamics have significant associations with retirement timing, supporting a life course framework of retirement that incorporates the linked lives of family support exchanges. Further, these relationships do appear to vary by race/ethnicity, indicating a combination of different familial expectations and life course experiences that may lead to different work-family tradeoffs.

Overall, I find strong support for the time support hypothesis that providing care support is associated with earlier retirement timing than providing no support. This is consistent with previous research and adds to the body of research suggesting that family dynamics are an important factor in retirement decision-making. Like everyone, older workers have competing demands on their time and must decide whether to continue to work or provide time assistance to their families as there are only so many hours in a day. Those providing time help may retire earlier to have more time to assist children or parents. Previous work has also documented earlier retirements among those providing care to family (Dentinger and Clarkberg 2002; Lumsdaine and Vermeer 2015; Stoiko and Strough 2019). Providing substantial childcare for a grandchild and helping a parent with personal care can be time-consuming and may make combining work and support difficult.

However, for the most part, the results do not support the financial support hypothesis, given that most forms of financial transfers are not associated with retirement delays. Instead, financial transfers to adult children are also associated with earlier retirement. One exception is that having a dependent family member is associated with later retirement. Given that making financial transfers to adult children are the most common form of exchange, this may represent a selection of who can provide this type of support. Pre-retirement may also represent a time in the life course when parents can make transfers and when children need the most help. When financial transfers are made to supplement a child’s income and not because they are dependent, they may represent surplus income among the same respondents who have enough retirement savings to retire earlier. Most financial transfers to young adult children only supplement children’s income as a majority do not report having a financial dependent. Providing surplus support to children beyond what they need for survival may reduce the pressure to continue working to provide support. Whereas when financial supports represent more than half of the family member’s income, as in the case of financial dependents, this may exert pressure to continue working until later ages. This level of support may also signal some greater need among the family member receiving the help that spurs older adults to continue working.

Given the varying effects of different types of intergenerational support exchanges, it is important to examine different types and combinations of intergenerational support. For instance, much of the recent work understanding older adult retirement behavior has focused on adult-child coresidence (Dushi et al. 2015; Maroto 2019; Miller et al. 2018); however, this type of support is rarely provided on its own. When looking at all types of support, coresidence was not significantly related to retirement timing for men or women. Instead, financial transfers to children and time help appear to be significantly related to earlier retirement. Additional sensitivity analyses attempted to tease out the effect of only providing coresidence assistance; however, this represented less than 5% of the sample, and no association with retirement timing could be detected. Coresidence and financial support may signal that the adult child is financially dependent; alternatively, when an adult child co-resides, this could coincide with additional caring responsibilities for coresident grandchildren. Each of these effects might operate in the opposite direction, canceling each other out.

There is no support for the gender differences hypothesis. Despite previous work suggesting women may be more sensitive to care demands than men, the results indicate that providing time support has a similar effect on retirement timing for men and women. Intergenerational financial support also has a similar relationship with retirement timing for men and women, and men are not more sensitive to financial demands than women. The timing of retirement is different for men and women, but providing intergenerational support appears to delay retirement in the same ways.

The association of intergenerational support with retirement timing was not consistent across race/ethnicity for men or women. However, these patterns were not consistent with hypothesized differences. The retirement timing of older Hispanic men and women is less sensitive to intergenerational support exchanges despite many forms of exchange being more common among older Hispanics than other racial groups. Hispanic women are the most likely to be providing caregiving to parents, yet providing time support is only weakly associated with increased retirement for Hispanic women. This may reflect the greater rates of combining caregiving responsibilities with work among Hispanic caregivers than among White and Black caregivers. The financial imperative of work may make retirement less feasible. However, combining work and caregiving can have detrimental effects on many aspects of their employment (Feinberg 2016). Previous work has also suggested that later retirement among Hispanics may be driven by the later retirement of foreign-born Hispanics who have lower income and often lower levels of retirement savings (Johnson, Mudrazija, and Wang 2017). Hispanic respondents are also most likely to be providing transfers to parents and have a family dependent, potentially signaling that more family members rely on them for income, encouraging them to continue working. This may explain why providing financial support for Hispanic men and women is not associated with earlier retirement compared to no support as it is for White and Black respondents. These differing patterns by race/ethnicity suggest that earlier life course trajectories may shape older adults’ ability to respond to family needs.

Overall, these results suggest that intergenerational support, especially time support, is associated with earlier retirement timing. The lack of social policy support for childcare or eldercare places an increasing burden on families at midlife to provide these types of instrumental support. These results suggest that public policies need to take a life course perspective that incorporates the linked lives of families. For instance, policies aimed at increasing the age of retirement, such as increasing the age of eligibility for Social Security, should also consider the increasing demand for care work. The interplay between public policies that increase access to high-quality care for children and older adults may simultaneously increase the retirement age. Working longer has many benefits for workers, including greater wellbeing and financial resources, as well as for society (Fisher et al. 2016). Individual retirement decisions have implications for Social Security and Medicare sustainability, and these concerns are only magnified as the population ages.

As older adults who leave the labor force earlier have less time to save for retirement, they may increase their likelihood of spending down resources or becoming dependent on their adult children later in life (Munnell and Sass 2008). This suggests that these intergenerational family support exchanges may have not only an immediate influence on retirement timing but may also have longer-term implications for the financial security of older adults and intergenerational transmission of economic resources by limiting bequests, a significant source of the racial wealth gap (Francis and Weller 2021; Taylor and Meschede 2018).

Although this study attempts to use a life course framework to assess how late-life intergenerational transfers are associated with retirement timing, some limitations should be noted. For many older adults, retirement is increasingly becoming temporary, and a planned or unplanned return to work may be on the horizon (Maestas 2010). Although respondents may retire from their current work to facilitate family exchanges, it is unclear to what extent they may plan to return to work later. Additional factors not accounted for in this study are also important in shaping retirement decisions and may contribute to group differences, such as attitudes and preferences. Further, not all forms and levels of intergenerational exchanges are captured, and less frequent types of support may be less influential on retirement timing. Another limitation of the intergenerational support measures is that they are one-sided, and previous research has found that individuals tend to overestimate the support they are providing (Lin and Wu 2018). Nonetheless, subjective reporting is essential for understanding how these intergenerational exchanges shape their retirement decisions.

Future research should assess the implications of earlier retirement due to intergenerational care responsibilities for financial and psychological wellbeing. Although research has documented adverse physical and mental health effects from off-time retirement, it is unclear if the motivation for retiring earlier may moderate those effects. The timing of retirement has important implications for society as well as families’ ability to accumulate savings across generations. Future research should also investigate how these patterns may exacerbate the accumulation of disadvantages or advantages across generations.

This study contributes to the literature by examining intergenerational support exchanges of varying types to assess their association with retirement timing. The results suggest that those providing intergenerational support, especially those providing time exchanges, are more likely to retire. This does not hold for older Hispanic men and women, who keep working despite making these time exchanges. Overall, these results support the life course perspective of retirement decisions as related to the accumulation of life experiences and the linked lives across generations.

Funding:

This work was supported by the National Institutes of Health P30AG066583. The content is solely the responsibility of the author and does not necessarily represent the official views of the National Institutes of Health.

APPENDIX

Appendix

Figure A1:

Flowchart of sample exclusions and construction of analytic samples

Footnotes

The RAND HRS Family Data contains detailed information about the characteristics of respondents' families, including kids, kids-in-law, parents, and siblings. These files were developed at RAND with funding from the National Institute on Aging and the Health and Retirement Study (2018).

References:

- Bailey Sandra J., Haynes Deborah C., and Letiecq Bethany L. 2013. “‘How Can You Retire When You Still Got a Kid in School?’: Economics of Raising Grandchildren in Rural Areas.” Marriage & Family Review 49(8):671–93. doi: 10.1080/01494929.2013.803009. [DOI] [Google Scholar]

- Berry Brent. 2006. “What Accounts for Race and Ethnic Differences in Parental Financial Transfers to Adult Children in the United States?” Journal of Family Issues 27(11):1583–1604. doi: 10.1177/0192513X06291498. [DOI] [Google Scholar]

- Bianchi Suzanne M., V. Joseph Hotz, McGarry Katheleen, and A. Seltzer Judith. 2008. “Intergenerational Ties: Theories, Trends, and Challenges.” Booth A, Crouter AC, Bianchi SM, and Seltzer JA. The Urban Institute 3–44. [Google Scholar]

- Bordia Prashant, Read Shari, and Bordia Sarbari. 2020. “Retiring: Role Identity Processes in Retirement Transition.” Journal of Organizational Behavior 41(5):445–60. doi: 10.1002/job.2438. [DOI] [Google Scholar]

- Cao Honggao. 2001. A SAS Application System for Missing Value Imputation. Survey Research Center: University of Michigan. [Google Scholar]

- Caputo Jennifer. 2019. “Crowded Nests: Parent–Adult Child Coresidence Transitions and Parental Mental Health Following the Great Recession.” Journal of Health and Social Behavior 60(2):204–21. doi: 10.1177/0022146519849113. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chassin Laurie, Macy Jon T., Seo Dong-Chul, Presson Clark C., and Sherman Steven J. 2010. “The Association between Membership in the Sandwich Generation and Health Behaviors: A Longitudinal Study.” Journal of Applied Developmental Psychology 31(1):38–46. doi: 10.1016/j.appdev.2009.06.001. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Cox DR 1972. “Regression Models and Life-Tables.” Journal of the Royal Statistical Society: Series B (Methodological) 34(2):187–202. doi: 10.1111/j.2517-6161.1972.tb00899.x. [DOI] [Google Scholar]

- Cross Christina J., Nguyen Ann W., Chatters Linda M., and Robert Joseph Taylor. 2018. “Instrumental Social Support Exchanges in African American Extended Families.” Journal of Family Issues 39(13):3535–63. doi: 10.1177/0192513X18783805. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Denaeghel Kim, Mortelmans Dimitri, and Borghgraef Annelies. 2011. “Spousal Influence on the Retirement Decisions of Single-Earner and Dual-Earner Couples.” Advances in Life Course Research 16(3):112–23. doi: 10.1016/j.alcr.2011.06.001. [DOI] [Google Scholar]

- Dentinger Emma, and Clarkberg Marin. 2002. “Informal Caregiving and Retirement Timing among Men and Women Gender and Caregiving Relationships in Late Midlife.” Journal of Family Issues 23(7):857–79. doi: 10.1177/019251302236598. [DOI] [Google Scholar]

- Dushi Irena, Munnell Alicia H., Sanzenbacher Geoffrey, and Webb Anthony. 2015. Do Households Increase Their Savings When the Kids Leave Home? SSRN Scholarly Paper. ID 2669704. Rochester, NY: Social Science Research Network. doi: 10.2139/ssrn.2669704. [DOI] [Google Scholar]

- Eismann Maria, Henkens Kène, and Kalmijn Matthijs. 2019. “Origins and Mechanisms of Social Influences in Couples: The Case of Retirement Decisions.” European Sociological Review 35(6):790–806. doi: 10.1093/esr/jcz037. [DOI] [Google Scholar]

- Glen Elder Jr. 1977. “Family History and the Life Course.” Journal of Family History 2(4):279–304. [DOI] [PubMed] [Google Scholar]

- Feinberg Lynn Friss. 2016. The Dual Pressures of Family Caregiving and Employment. Washington D. C.: AARP Public Policy Institute. [Google Scholar]

- Ferraro Kenneth F., Tetyana Pylypiv Shippee, and Schafer Markus H. 2009. “Cumulative Inequality Theory for Research on Aging and the Life Course.” Handbook of Theories of Aging 413–33. [Google Scholar]

- Finch Naomi. 2013. “Why Are Women More Likely than Men to Extend Paid Work? The Impact of Work–Family Life History.” European Journal of Ageing 11(1):31–39. doi: 10.1007/s10433-013-0290-8. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Fisher Gwenith G., Chaffee Dorey S., and Sonnega Amanda. 2016. “Retirement Timing: A Review and Recommendations for Future Research.” Work, Aging and Retirement 2(2):230–61. doi: 10.1093/workar/waw001. [DOI] [Google Scholar]

- Florian Sandra M. 2018. “Racial Variation in the Effect of Motherhood on Women’s Employment: Temporary or Enduring Effect?” Social Science Research 73:80–91. doi: 10.1016/j.ssresearch.2018.02.012. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Francis Dania V., and Weller Christian E. 2021. “Retirement Inequality by Race and Ethnicity.” Public Policy & Aging Report 31(3):83–88. doi: 10.1093/ppar/prab009. [DOI] [Google Scholar]

- Glauber Rebecca. 2019. “The Wage Penalty for Parental Caregiving: Has It Declined Over Time?” Journal of Marriage and Family 81(2):415–33. doi: 10.1111/jomf.12555. [DOI] [Google Scholar]

- Grundy Emily, and Henretta John C. 2006. “Between Elderly Parents and Adult Children: A New Look at the Intergenerational Care Provided by the ‘Sandwich Generation.’” Ageing & Society 26(5):707–22. doi: 10.1017/S0144686X06004934. [DOI] [Google Scholar]

- Grünwald Olga, Damman Marleen, and Henkens Kène. 2021. “The Differential Impact of Retirement on Informal Caregiving, Volunteering, and Grandparenting: Results of a 3-Year Panel Study.” The Journals of Gerontology: Series B 76(3):607–19. doi: 10.1093/geronb/gbaa221. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Gustman Alan L., and Steinmeier Thomas L. 2004. “Social Security, Pensions and Retirement Behaviour within the Family.” Journal of Applied Econometrics 19(6):723–37. doi: 10.1002/jae.753. [DOI] [Google Scholar]

- Handwerker Elizabeth Weber. 2011. “Delaying Retirement to Pay for College.” Industrial & Labor Relations Review 64(5):921–48. doi: 10.1177/001979391106400505. [DOI] [Google Scholar]

- Henkens Kène. 1999. “Retirement Intentions and Spousal Support: A Multi-Actor Approach.” The Journals of Gerontology: Series B 54B(2):S63–73. doi: 10.1093/geronb/54B.2.S63. [DOI] [PubMed] [Google Scholar]

- Henretta John C., Van Voorhis Matthew F., and Soldo Beth J. 2018. “Cohort Differences in Parental Financial Help to Adult Children.” Demography 55(4):1567–82. doi: 10.1007/s13524-018-0687-2. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ho Christine. 2013. “Grandchild Care, Intergenerational Transfers, and Grandparents’ Labor Supply.” Review of Economics of the Household 13(2):359–84. doi: 10.1007/s11150-013-9221-x. [DOI] [Google Scholar]

- Johnson Richard W., Mudrazija Stipica, and Wang Claire Xiaozhi. 2017. “Hispanics’ Retirement Transitions and Differences by Nativity.” Journal of Aging and Health 29(6):1096–1115. doi: 10.1177/0898264317711608. [DOI] [PubMed] [Google Scholar]

- Kahn Joan R., Goldscheider Frances, and García-Manglano Javier. 2013. “Growing Parental Economic Power in Parent–Adult Child Households: Coresidence and Financial Dependency in the United States, 1960–2010.” Demography 50(4):1449–75. doi: 10.1007/s13524-013-0196-2. [DOI] [PubMed] [Google Scholar]

- Lee Yeonjung, and Tang Fengyan. 2015. “More Caregiving, Less Working: Caregiving Roles and Gender Difference.” Journal of Applied Gerontology 34(4):465–83. doi: 10.1177/0733464813508649. [DOI] [PubMed] [Google Scholar]

- Lin I.-Fen, and Hsueh-Sheng Wu. 2018. “Intergenerational Transfer and Reporting Bias: An Application of the MIMIC Model.” The Journals of Gerontology: Series B 73(1):19–29. doi: 10.1093/geronb/gbx080. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Loretto Wendy, and Vickerstaff Sarah. 2013. “The Domestic and Gendered Context for Retirement.” Human Relations 66(1):65–86. doi: 10.1177/0018726712455832. [DOI] [Google Scholar]

- Lumsdaine Robin L., and Vermeer Stephanie J. C. 2015. “Retirement Timing of Women and the Role of Care Responsibilities for Grandchildren.” Demography 52(2):433–54. doi: 10.1007/s13524-015-0382-5. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Luo Ye, LaPierre Tracey A., Elizabeth Hughes Mary, and Waite Linda J. 2012. “Grandparents Providing Care to Grandchildren A Population-Based Study of Continuity and Change.” Journal of Family Issues 33(9):1143–67. doi: 10.1177/0192513X12438685. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Maestas Nicole. 2010. “Back to Work Expectations and Realizations of Work after Retirement.” Journal of Human Resources 45(3):718–48. doi: 10.3368/jhr.45.3.718. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Margolis Rachel, and Wright Laura. 2016. “Older Adults With Three Generations of Kin: Prevalence, Correlates, and Transfers.” The Journals of Gerontology Series B: Psychological Sciences and Social Sciences gbv 158. doi: 10.1093/geronb/gbv158. [DOI] [PubMed] [Google Scholar]

- Maroto Michelle. 2017. “When the Kids Live at Home: Coresidence, Parental Assets, and Economic Insecurity.” Journal of Marriage and Family 79(4):1041–59. doi: 10.1111/jomf.12407. [DOI] [Google Scholar]

- Maroto Michelle. 2019. “Sharing or Limiting the Wealth? Coresidence, Parental Support, and Wealth Outcomes in Canada.” Journal of Family and Economic Issues 40(1):102–16. doi: 10.1007/s10834-018-9588-1. [DOI] [Google Scholar]

- Matthews Russell A., and Fisher Gwenith G. 2012. “Family, Work, and the Retirement Process: A Review and New Directions.” in The Oxford Handbook of Retirement. [Google Scholar]

- Miller Marina, Tamborini Christopher R., and Reznik Gayle L. 2018. “Parental Retirement Timing: The Role of Unanticipated Events in the Lives of Adult Children.” Journal of Population Economics 31(3):747–81. doi: 10.1007/s00148-018-0698-8. [DOI] [Google Scholar]

- Moen P. 1996. “A Life Course Perspective on Retirement, Gender, and Well-Being.” Journal of Occupational Health Psychology 1(2):131–44. doi: 10.1037//1076-8998.1.2.131. [DOI] [PubMed] [Google Scholar]

- Moen Phyllis, Robison Julie, and Fields Vivian. 1994. “Women’s Work and Caregiving Roles: A Life Course Approach.” Journal of Gerontology 49(4):S176–86. doi: 10.1093/geronj/49.4.S176. [DOI] [PubMed] [Google Scholar]

- Munnell Alicia H., and Sass Steven. 2008. The Decline of Career Employment. 8–14. Center for Retirement Research: Boston College. [Google Scholar]

- O’Rand Angela M. 1996. “The Precious and the Precocious: Understanding Cumulative Disadvantage and Cumulative Advantage Over the Life Course.” The Gerontologist 36(2):230–38. doi: 10.1093/geront/36.2.230. [DOI] [PubMed] [Google Scholar]

- Park Sung S. 2018. “Life Events and Black–White Differences in Adult Children’s Financial Assistance to Mothers.” The Gerontologist 58(5):883–93. doi: 10.1093/geront/gnx069. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Patterson Sarah E., and Margolis Rachel. 2019. “The Demography of Multigenerational Caregiving: A Critical Aspect of the Gendered Life Course.” Socius 5:2378023119862737. doi: 10.1177/2378023119862737. [DOI] [Google Scholar]

- Pavalko Eliza K., and Artis Julie E. 1997. “Women’s Caregiving and Paid Work: Causal Relationships in Late Midlife.” The Journals of Gerontology: Series B 52B(4):S170–79. doi: 10.1093/geronb/52B.4.S170. [DOI] [PubMed] [Google Scholar]

- Pienta Amy M., Burr Jeffrey A., and Mutchler Jan E. 1994. “Women’s Labor Force Participation in Later Life: The Effects of Early Work and Family Experiences.” Journal of Gerontology 49(5):S231–39. doi: 10.1093/geronj/49.5.S231. [DOI] [PubMed] [Google Scholar]

- Pienta Amy Mehraban, and Hayward Mark D. 2002. “Who Expects to Continue Working After Age 62? The Retirement Plans of Couples.” The Journals of Gerontology: Series B 57(4):S199–208. doi: 10.1093/geronb/57.4.S199. [DOI] [PubMed] [Google Scholar]

- Purcell Patrick J. 2016. “Employment at Older Ages and Social Security Benefit Claiming.” Social Security Bulletin 76(4):1–18. [Google Scholar]

- Quinn Joseph F. 2010. “Work, Retirement, and the Encore Career: Elders and the Future of the American Workforce.” Generations 34(3):45–55. [Google Scholar]

- RAND HRS Family Data 2014. 2018. Produced by the RAND Center for the Study of Aging, with Funding from the National Institute on Aging and the Social Security Administration. Santa Monica, CA. [Google Scholar]

- Reitzes Donald C., Mutran Elizabeth J., and Fernandez Maria E. 1998. “The Decision to Retire: A Career Perspective.” Social Science Quarterly 79(3):607–19. [Google Scholar]

- Rubin Rose M., and White-Means Shelley I. 2009. “Informal Caregiving: Dilemmas of Sandwiched Caregivers.” Journal of Family and Economic Issues 30(3):252–67. doi: 10.1007/s10834-009-9155-x. [DOI] [Google Scholar]

- Ruggles Steven. 2007. “The Decline of Intergenerational Coresidence in the United States, 1850 to 2000.” American Sociological Review 72(6):964–89. doi: 10.1177/000312240707200606. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sarkisian Natalia, Gerena Mariana, and Gerstel Naomi. 2007. “Extended Family Integration Among Euro and Mexican Americans: Ethnicity, Gender, and Class.” Journal of Marriage and Family 69(1):40–54. doi: 10.1111/j.1741-3737.2006.00342.x. [DOI] [Google Scholar]

- Sarkisian Natalia, and Gerstel Naomi. 2004. “Kin Support among Blacks and Whites: Race and Family Organization.” American Sociological Review 69(6):812–37. doi: 10.1177/000312240406900604. [DOI] [Google Scholar]

- Schulz Richard, Eden Jill, National Academies of Sciences, and Medicine. 2016. “Older Adults Who Need Caregiving and the Family Caregivers Who Help Them.” in Families Caring for an Aging America. National Academies Press (US). [PubMed] [Google Scholar]

- Seltzer Judith A., and Bianchi Suzanne M. 2013. “Demographic Change and Parent-Child Relationships in Adulthood.” Annual Review of Sociology 39(1):275–90. doi: 10.1146/annurev-soc-071312-145602. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sironi Maria, and Furstenberg Frank F. 2012. “Trends in the Economic Independence of Young Adults in the United States: 1973–2007.” Population and Development Review 38(4):609–30. doi: 10.1111/j.1728-4457.2012.00529.x. [DOI] [Google Scholar]

- Sonnega Amanda, Brooke Helppie-McFall Peter Hudomiet, Willis Robert J., and Fisher Gwenith G. 2018. “A Comparison of Subjective and Objective Job Demands and Fit With Personal Resources as Predictors of Retirement Timing in a National US Sample.” Work, Aging and Retirement 4(1):37–51. doi: 10.1093/workar/wax016. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Spiess C. Katharina, and A. Ulrike Schneider. 2003. “Interactions between Care-Giving and Paid Work Hours among European Midlife Women, 1994 to 1996.” Ageing & Society 23(1):41–68. doi: 10.1017/S0144686X02001010. [DOI] [Google Scholar]

- Spillman Brenda C., and Pezzin Liliana E. 2000. “Potential and Active Family Caregivers: Changing Networks and the ‘Sandwich Generation.’” The Milbank Quarterly 78(3):347–74. doi: 10.1111/1468-0009.00177. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Stoiko Rachel R., and Strough JoNell. 2019. “His and Her Retirement: Effects of Gender and Familial Caregiving Profiles on Retirement Timing.” The International Journal of Aging and Human Development 89(2):131–50. doi: 10.1177/0091415018780009. [DOI] [PubMed] [Google Scholar]

- Swartz Teresa Toguchi. 2009. “Intergenerational Family Relations in Adulthood: Patterns, Variations, and Implications in the Contemporary United States.” Annual Review of Sociology 35(1):191–212. doi: 10.1146/annurev.soc.34.040507.134615. [DOI] [Google Scholar]

- Swartz Teresa Toguchi, Kim Minzee, Uno Mayumi, Mortimer Jeylan, and Bengtson O’Brien Kirsten. 2011. “Safety Nets and Scaffolds: Parental Support in the Transition to Adulthood.” Journal of Marriage and Family 73(2):414–29. doi: 10.1111/j.1741-3737.2010.00815.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Szinovacz Maximiliane E., Stanley DeViney, and Adam Davey. 2001. “Influences of Family Obligations and Relationships on Retirement Variations by Gender, Race, and Marital Status.” The Journals of Gerontology Series B: Psychological Sciences and Social Sciences 56(1):S20–27. doi: 10.1093/geronb/56.1.S20. [DOI] [PubMed] [Google Scholar]

- Taylor Joanna, and Meschede Tatjana. 2018. “Inherited Prospects: The Importance of Financial Transfers for White and Black College-Educated Households’ Wealth Trajectories.” American Journal of Economics and Sociology 77(3–4):1049–76. doi: 10.1111/ajes.12227. [DOI] [Google Scholar]

- Townsend Nicholas. 2010. Package Deal: Marriage, Work And Fatherhood In Men’S Lives. Temple University Press. [Google Scholar]

- Vespa Jonathan. 2017. The Changing Economics and Demographics of Young Adulthood: 1975–2016. P20–579. Washington, DC: US Census Bureau. [Google Scholar]

- Whitaker Elizabeth Ann, and Bokemeier Janet L. 2018. “Spousal, Family and Gender Effects on Expected Retirement Age for Married Pre-Retirees.” Journal of Family and Economic Issues 39(3):371–85. doi: 10.1007/s10834-018-9564-9. [DOI] [Google Scholar]

- Wightman Patrick, Patrick Megan, Schoeni Robert, and Schulenberg John. 2013. Historical Trends in Parental Financial Support of Young Adults. Research Reports. 13–801. Population Studies Center: University of Michigan. [Google Scholar]

- Wolff Jennifer L., Spillman Brenda C., Freedman Vicki A., and Kasper Judith D. 2016. “A National Profile of Family and Unpaid Caregivers Who Assist Older Adults With Health Care Activities.” JAMA Internal Medicine 176(3):372–79. doi: 10.1001/jamainternmed.2015.7664. [DOI] [PMC free article] [PubMed] [Google Scholar]