Abstract

Objective

To evaluate how an abrupt drop‐off, or “cliff,” in Medicaid dental coverage affects access to dental care among low‐income Medicare beneficiaries. Medicaid is an important source of dental insurance for low‐income Medicare beneficiaries, but beneficiaries whose incomes slightly exceed eligibility thresholds for Medicaid have fewer affordable options for dental coverage, resulting in a dental coverage cliff above these thresholds.

Data Source

Medicare Current Beneficiary Surveys (MCBS) from 2016 to 2019.

Study Design

We used a regression discontinuity design to evaluate effects of this dental coverage cliff. This study design exploited an abrupt difference in Medicaid coverage above income eligibility thresholds in the Medicaid program for elderly and disabled populations.

Data Collection

The study included low‐income community‐dwelling Medicare beneficiaries surveyed in the MCBS whose incomes, measured in percentage points of the federal poverty level, were within ±75 percentage points of state‐specific Medicaid income eligibility thresholds (n = 7508 respondent‐years, which when weighted represented 26,776,719 beneficiary‐years).

Principal Findings

Medicare beneficiaries whose income exceeded Medicaid eligibility thresholds were 5.0 percentage points more likely to report difficulty accessing dental care due to cost concerns or a lack of insurance than beneficiaries below the thresholds (95% CI: 0.2, 9.8; p = 0.04)—a one‐third increase over the proportion reporting difficulty below the thresholds (15.0%).

Conclusions

A Medicaid dental coverage cliff exacerbates barriers to dental care access among low‐income Medicare beneficiaries. Expanding dental coverage for Medicare beneficiaries, particularly those who are ineligible for Medicaid, could alleviate barriers to dental care access that result from the lack of comprehensive dental coverage in Medicare.

Keywords: coverage cliff, dental coverage, Medicaid and Medicare

What is known on this topic

Medicare beneficiaries rely on a patchwork of supplemental insurance programs for dental coverage, while many lack dental coverage altogether.

Medicaid is one important source of dental insurance for Medicare beneficiaries, but coverage through Medicaid is restricted to individuals with incomes below state‐specific eligibility limits.

Medicare beneficiaries whose incomes exceed Medicaid's eligibility limits may have few affordable alternatives for dental coverage, and therefore face a dental coverage “cliff.”

What this study adds

We examined the effects of this dental coverage cliff on low‐income Medicare beneficiaries' access to dental care using a regression discontinuity design.

We found that the coverage cliff increases by one‐third the probability that low‐income Medicare beneficiaries could not get needed dental care due to concerns about cost or insurance coverage.

These findings highlight an opportunity for expanding dental coverage to alleviate barriers to dental care among low‐income Medicare beneficiaries.

1. INTRODUCTION

Public health and medical professionals concur that oral health is inextricably connected to overall health. 1 , 2 , 3 , 4 , 5 Caries (tooth decay), tooth loss, and periodontal disease (gum infection) may be indicative of an individual's overall health, and untreated oral disease may exacerbate other chronic conditions such as cardiovascular disease and diabetes. 1 , 6 Conditions such as tooth loss can make it difficult for individuals to eat or engage in other social activities 3 , 7 and increase the risk of depression. 8 Routine dental care can help detect and slow the progression of oral disease 3 and avert downstream health care costs linked to untreated oral disease. 9 , 10 , 11

Despite the importance of dental care to overall health, in the United States, insurance coverage for dental care is less common and often less complete than coverage for other medical care. 3 , 12 This is especially true in the Medicare program—the main source of health insurance for older adults, disabled individuals, and persons with end‐stage renal disease. Traditional Medicare excludes dental care as a covered benefit, except in circumstances where it is considered a medically necessary component of a Medicare‐covered service (e.g., surgery to the jaw for treatment of cancer). 13 , 14 , 15 Consequently, some Medicare beneficiaries rely on supplemental insurance for dental coverage, while 47% lack dental coverage altogether. Moreover, the scope of dental coverage varies widely among Medicare beneficiaries: some beneficiaries have coverage for preventive dental services only (e.g., exams and cleanings), while others have coverage for both preventive and extensive services (e.g., dental implants and crowns). 15 , 16

One important source of dental coverage for Medicare beneficiaries is Medicaid, a state‐administered program that supplements Medicare for beneficiaries with sufficiently low incomes and assets. 17 In 2021, Medicaid programs in 47 states including the District of Columbia covered at least some dental services for individuals dually enrolled in Medicaid and Medicare. 18 Federal law limits cost sharing (e.g., copayments) in Medicaid, 19 meaning that out‐of‐pocket costs for Medicaid‐covered dental services are generally low. However, Medicaid's eligibility rules are restrictive: for older adults and disabled individuals, 24 states limit eligibility to individuals with incomes of roughly 75% of the federal poverty level (FPL) or lower 20 (≤$10,192 in 2022), and all but one state imposes additional limits on assets. 21 Medicare beneficiaries whose income or assets exceed these limits face expensive alternatives for dental coverage, resulting in a “cliff” in dental coverage just over these limits.

We examined the effects of this coverage cliff on access to dental care among low‐income Medicare beneficiaries using a regression discontinuity design. 22 This design leverages an abrupt drop‐off in Medicaid enrollment, and thus Medicaid dental coverage, above the income eligibility limits for Medicaid, enabling us to isolate effects of this coverage cliff from confounders. We also used this design to examine effects of the coverage cliff on dentist visits and out‐of‐pocket spending on dental care.

The coverage cliff provides a unique setting to evaluate how incomplete dental coverage affects care for low‐income Medicare beneficiaries—evidence that is important for informing policy in two key ways. First, low‐income Medicare beneficiaries have substantial unmet needs for dental care. 23 Among beneficiaries with incomes below 200% of FPL, for example, 27% had untreated caries, 1 68% did not see a dentist in 2016, and 17% avoided seeking dental care due to cost. 14 Inadequate dental care in this low‐income population can contribute to socioeconomic disparities in oral health, 24 underscoring the importance of identifying factors that contribute to unmet needs. Second, our results can inform proposals now being considered by lawmakers to close gaps in dental coverage by including a dental care benefit in the Medicare program. 25 , 26

2. METHODS

2.1. Study design and policy context

Our regression discontinuity design reflects key features of Medicaid's eligibility rules, Medicaid dental coverage, and alternative sources of dental coverage available to Medicare beneficiaries who are ineligible for Medicaid.

Medicare beneficiaries must have sufficiently low incomes to enroll in “full” Medicaid (hereafter, Medicaid), which includes all services covered by their state's Medicaid program. 17 As detailed in Appendix A (Supporting information), income eligibility thresholds for Medicaid vary by state. We focus on thresholds for elderly or disabled persons, which apply to the Medicare population. Across states, the modal income eligibility threshold is approximately 75% of FPL (25 states) and the maximum is 100% of FPL (17 states). 27 Most states also impose asset limits, although individuals who meet Medicaid's income eligibility criteria generally have sufficiently low assets. 21 These income thresholds lead to an abrupt drop‐off in Medicaid coverage among Medicare beneficiaries whose incomes exceed these limits, creating the coverage “cliff” we leverage in the regression discontinuity design. 28

Medicaid programs in 45 states (including the District of Columbia) covered some dental services for adults in 2018, when the most complete record of state Medicaid dental coverage policies in our study period was available. 15 Among these states, Medicaid's dental coverage varied along multiple dimensions, including coverage of preventive services (e.g., exams, cleanings, and x‐rays), extensive services (e.g., restorative treatments), and annual spending limits. However, Medicaid programs are not required to cover dental care for adults, and in 2018 six states (Alabama, Delaware, Maryland, Tennessee, Texas, and Virginia) did not cover any dental services for adults. 15 Small sample sizes in the Medicare Current Beneficiary Surveys (MCBS) limited the extent to which we could stratify analyses according to the level of dental coverage different states offered. Therefore, our main analyses modeled the dental coverage cliff among all states in which Medicaid programs covered at least some dental services for adults in 2018. We conducted sensitivity analyses excluding states whose Medicaid programs only covered emergency dental care. Out‐of‐pocket costs for dental services covered by Medicaid are generally low because federal law limits aggregate out‐of‐pocket spending in Medicaid to 5% of household income. 19

Medicare beneficiaries who are ineligible for Medicaid may obtain dental coverage through alternative sources, which can require higher out‐of‐pocket costs than Medicaid. 15 For example, beneficiaries can purchase a private stand‐alone dental coverage plan, requiring a premium payment. 29 Few pursue this option, likely because it is costly. 15 Alternatively, Medicare beneficiaries can enroll in a Medicare Advantage plan (in lieu of traditional Medicare) that includes a supplemental dental benefit. 30 However, Medicare Advantage plans may not cover a full range of dental services (e.g., both preventive and extensive services) or may charge a premium for additional services. Moreover, Medicare Advantage plans can require substantial enrollee cost sharing for dental services (e.g., coinsurance of 20%–50%) and impose annual caps on coverage. 15 , 16 Higher Medicare Advantage enrollment above the eligibility thresholds for Medicaid may mitigate effects of the coverage cliff, but it is unlikely to eliminate these effects entirely given Medicaid's much lower out‐of‐pocket costs.

2.2. Data

We analyzed 2016–2019 data from the MCBS and 2016–2018 data from the MCBS Cost Supplement (the 2019 Cost Supplement was not available at the time of our analysis). The MCBS is a national longitudinal survey that follows rotating cohorts of Medicare beneficiaries for up to 4 years. 31 Pooled across cohorts, the MCBS includes approximately 11,000 respondents annually. When weighted, estimates from the MCBS are designed to be representative of the Medicare population. We analyzed restricted‐use files that included detailed information about respondents' income, demographic characteristics, use of care and spending, barriers obtaining care, and linked administrative indicators of Medicaid enrollment.

2.3. Study sample

We analyzed a sample of community‐dwelling respondents to the MCBS, excluding respondents who lived in a nursing facility at the time of the survey. We excluded nursing facility‐dwelling respondents because Medicaid eligibility rules differ for this population versus the community‐dwelling Medicare population 27 and because the MCBS asks different questions about difficulty obtaining care for the two populations. Our sample included individuals enrolled in both traditional Medicare and Medicare Advantage.

We implemented five additional exclusions. First, we dropped respondent‐year observations with missing income data because income is needed to assess Medicaid eligibility. Enrollment in Medicaid—a proxy for low‐income status—was nearly identical across respondent‐years in which income data were complete versus missing (Appendix B, Supporting information), demonstrating that missingness was unrelated to income levels.

Second, we excluded years in which MCBS respondents did not complete the survey's health status and functioning questionnaire (used to construct covariates), or the access to care questionnaire (used to assess unmet dental care needs). Completion rates for these questionnaires were similar for respondents with income above versus below Medicaid eligibility thresholds, allaying concerns that this exclusion would lead to an imbalance between populations compared via the regression discontinuity design (Appendix B, Supporting information).

Third, we excluded respondents in Connecticut because Medicaid's income eligibility rules differ across regions of the state.

Fourth, we limited our sample to respondents whose annual income, measured in percentage points of the FPL, was within ±75 percentage points of the Medicaid income threshold in the respondent's state. We selected this bandwidth to include comparable populations of beneficiaries above and below thresholds while retaining enough observations for analysis. We also excluded respondents within a small band (±5 percentage points of FPL) of the thresholds to minimize attenuation bias from minor discrepancies in how income may be reported to state Medicaid agencies versus in the MCBS (e.g., differences in lookback periods). 28

Fifth, we excluded respondents in six states that did not cover any Medicaid dental benefits for adults in 2018. 15 Appendix B (Supporting information) details these inclusion criteria.

2.4. Independent variable

Our main independent variable was an indicator that a respondent's income exceeded the eligibility threshold for full Medicaid in their state in the year of the survey. Appendix A (Supporting information) describes how we applied Medicaid income counting rules to income variables in the MCBS to determine whether a respondent's income exceeded these thresholds.

2.5. Dependent variables

We analyzed four primary outcomes, each measured at the level of the respondent‐year: (1) enrollment in Medicaid for ≥1 month; (2) respondent‐reported difficulty obtaining needed dental care due to cost or a lack of insurance coverage; (3) respondent‐reported visits with dentists; and (4) out‐of‐pocket dental care spending. The last two measures were available in the MCBS Cost Supplement, which collects detailed information about health services use and spending for a subset of MCBS respondents (48% of our study sample). Because approximately 70% of Medicare beneficiaries in our analysis had no annual out‐of‐pocket dental spending, we assessed whether such spending was ≥$100 (80th percentile of spending).

We analyzed two secondary outcomes. First, we examined whether respondents reported difficulty obtaining dental care due to factors other than cost or a lack of insurance. This enables a falsification test since we would not expect a discontinuity in this outcome at a threshold pertaining to an insurance coverage cliff. Second, we examined whether there was an abrupt increase in Medicare Advantage enrollment for those with income slightly above Medicaid thresholds. Definitions of dependent variables are in Appendix C (Supporting information).

2.6. Covariates

We controlled for covariates that were potentially correlated with income and study outcomes, but which were unlikely to be affected by the receipt of dental coverage through Medicaid. These covariates included demographic characteristics (age, sex, and respondent‐reported race and ethnicity); education; lifetime tobacco use; marital status; difficulty performing activities of daily living and instrumental activities of daily living; and functional limitations that could impede the ability to obtain medical care (difficulty getting places such as a doctor's office). Race and ethnicity were self‐reported by respondents to the MCBS. We also controlled for the annual county‐level supply of dentists per capita from the Area Health Resources File.

2.7. Statistical analyses

For each study outcome, we estimated a respondent‐year‐level linear regression discontinuity model:

In this model, denotes an outcome for respondent i living in state s during year t; indicates that the respondent's income exceeded the eligibility threshold for Medicaid in their state; is a continuous (linear) measure of income centered at state‐specific eligibility thresholds, and E(.) denotes expectation. We included the continuous income term and an interaction between it and an indicator for exceeding eligibility thresholds to model the continuous relationship between income and outcomes above and the Medicaid eligibility thresholds. 32 When we adjust for this continuous relationship, the regression coefficient captures the abrupt difference (i.e., discontinuity) in the outcome associated with exceeding the Medicaid eligibility thresholds. Under assumptions of the regression discontinuity design, which we test below, represents a causal effect of the coverage cliff.

We adjusted for annual respondent‐level characteristics and the county‐level supply of dentists per capita to account for any imbalances among these covariates across the thresholds; state fixed effects to adjust for time‐invariant differences between states' Medicaid programs; and year fixed effects to control for secular trends. We weighted estimates to be representative of the community‐dwelling Medicare population and used robust variance estimation, clustering standard errors at the respondent level, to construct 95% confidence intervals. Appendix D (Supporting information) gives additional details about our analyses.

We conducted three analyses to test assumptions of the regression discontinuity design. 28 , 32 First, to test the assumption that study outcomes would have trended smoothly (i.e., without discontinuities) through thresholds in the absence of a Medicaid coverage cliff, we conducted falsification tests by checking for discontinuities in outcomes at income levels below the Medicaid eligibility thresholds. Second, to test the assumption that the regression discontinuity design isolates effects of the coverage cliff from observable confounders, we assessed whether covariates trended smoothly through the thresholds. Specifically, we tested for discontinuities in covariates across the Medicaid eligibility thresholds and conducted graphical analyses (described in the Appendix, Supporting information) to identify any compositional differences among the populations of Medicare beneficiaries above versus below the thresholds. Third, to check the assumption that respondents did not sort systematically around the thresholds (a potential source of confounding), we examined the frequency distribution of observations and annual changes in respondents' eligibility for Medicaid based on income around the thresholds. 28 , 33

We conducted three sensitivity analyses. First, we estimated models without adjustment for covariates to assess whether any imbalances in measured confounders affected our adjusted estimates. Second, we re‐ran our analyses excluding eight states whose Medicaid programs only covered emergency dental services for adults in 2018 (these states were: Arizona, Georgia, Hawaii, Nevada, New Hampshire, Oklahoma, Utah, and West Virginia). 15 Third, we estimated models using income bandwidths of ±50 and ±100 percentage points of FPL. Broader bandwidths enable estimates that are more precise but may introduce bias if the continuous relationship between income and an outcome above and below the Medicaid threshold is misspecified. Narrower bandwidths may yield less precise estimates but are also less susceptible to misspecification bias. Thus, these analyses allow us to explore a bias‐variance tradeoff when different bandwidths are used to generate estimates. 32

3. RESULTS

Our sample consisted of 7508 observations (respondent‐years) from the 2016–2019 MCBS, which when weighted represented 26,776,719 beneficiary‐years in the community‐dwelling Medicare population. Among Medicare beneficiaries with incomes just below Medicaid's eligibility thresholds, 26.0% were aged ≤64 years and qualified for Medicare because of a disability or end‐stage renal disease; 62.4% were female; and 57.6% were non‐Hispanic White, 21.4% were non‐Hispanic Black, and 16.2% were Hispanic (Table 1). We did not find statistically significant discontinuities in respondent‐level characteristics or the supply of dentists per capita among Medicare beneficiaries above versus below Medicaid's eligibility thresholds. However, in graphical analyses in Appendix E (Supporting information), we observed a distinct difference in the racial composition of Medicare beneficiaries above versus below the thresholds, consistent with point estimates from Table 1 indicating that the proportion of Black beneficiaries was 3.8 percentage points lower just above the thresholds. Our graphical analyses did not reveal differences in other measured respondent characteristics, including factors that may affect oral health (e.g., lifetime tobacco use) or functional limitations that could impede the ability to obtain dental care (e.g., difficulty getting places such as a doctor's office).

TABLE 1.

Respondent characteristics and the supply of dentists below versus above income eligibility thresholds for Medicaid

| Variable | Mean or proportion below Medicaid eligibility thresholds a | Discontinuity above versus below Medicaid thresholds b | 95% confidence interval c | p‐value |

|---|---|---|---|---|

| Respondent characteristics | ||||

| Age, % in category | ||||

| ≤64 years d | 26.0 | 3.7 | (−2.2, 9.6) | 0.22 |

| 65–69 years | 18.7 | 2.2 | (−3.5, 7.9) | 0.46 |

| 70–74 years | 20.0 | −3.2 | (−8.5, 2.1) | 0.22 |

| 75–59 years | 15.5 | −3.2 | (−7.3, 0.9) | 0.13 |

| 80–84 years | 9.0 | 0.8 | (−1.9, 3.5) | 0.57 |

| ≥85 years | 10.7 | −0.2 | (−3.1, 2.7) | 0.89 |

| Female sex, % | 62.4 | −0.5 | (−6.8, 5.8) | 0.87 |

| Race and ethnicity, % in category e | ||||

| Non‐Hispanic White | 57.6 | 1.9 | (−4.2, 8.0) | 0.55 |

| Non‐Hispanic Black | 21.4 | −3.8 | (−8.7, 1.1) | 0.13 |

| Hispanic | 16.2 | −1.1 | (−5.4, 3.2) | 0.61 |

| Asian | 1.5 | 1.0 | (−1.4, 3.4) | 0.43 |

| Other | 3.2 | 2.1 | (−0.6, 4.8) | 0.13 |

| Education, % in category f | ||||

| Less than high school | 34.1 | 0.0 | (−5.9, 5.9) | 1.00 |

| High school | 41.1 | −2.8 | (−9.1, 3.5) | 0.39 |

| College or higher | 24.5 | 2.2 | (−3.5, 7.9) | 0.46 |

| Lifetime tobacco use, % with substantial use g | 57.6 | −1.3 | (−7.8, 5.2) | 0.70 |

| Marital status, % in category h | ||||

| Married | 30.2 | −1.5 | (−7.4, 4.4) | 0.61 |

| Separated or divorced | 32.3 | −0.9 | (−7.0, 5.2) | 0.77 |

| Widowed | 22.3 | 1.9 | (−3.2, 7.0) | 0.46 |

| Never married | 15.1 | 0.6 | (−4.1, 5.3) | 0.79 |

| Difficulty with ADLs, count i | 0.9 | 0.0 | (−0.2, 0.1) | 0.71 |

| Difficulty with IADLs, count j | 0.7 | −0.1 | (−0.2, 0.1) | 0.28 |

| Difficulty getting to places, for example, doctor's office (%) | 31.3 | −3.8 | (−9.3, 1.7) | 0.17 |

| Supply of dentists per capita | ||||

| Number of dentists per 1000 county residents k | 0.64 | 0.00 | (−0.03, 0.03) | 0.88 |

Note: Based on 7508 observations from the 2016–2019 Medicare Current Beneficiary Survey (MCBS). Limited to community‐dwelling Medicare beneficiaries as described in the study methods and Appendix (Supporting information). When weighted, this sample represented 26,776,719 beneficiary‐years in the community‐dwelling Medicare population.

Mean or proportion of the outcome among individuals whose income was just below states' Medicaid eligibility thresholds (pooled across states), adjusted for state fixed effects, year fixed effects, and survey weights (see Appendix, Supporting information for details of this calculation).

Estimated discontinuity in the mean or proportion of respondents with a given characteristic above versus below state‐specific Medicaid income eligibility thresholds, adjusted for state fixed effects, year fixed effects, and survey weights (pooled across states).

Confidence intervals and p‐values calculated using used robust standard errors adjusted to account for clustering within respondents across survey years.

Respondents aged ≤64 years are eligible for Medicare because of a disability or end‐stage renal disease.

Assessed from respondent‐reported race and ethnicity data in the MCBS.

High school education includes individuals with a high school Graduate Equivalency Degree. A small proportion of respondents did not report their education, which we do not show here to avoid reporting estimates for small samples. We retained these observations in our regression models by including an indicator variable that education was not reported.

Substantial lifetime use defined as ever having smoked 100 or more cigarettes or 50 or more cigars.

A small proportion of respondents did not report their marital status (not shown here to avoid reporting estimates for small samples). We retained these observations in our regression models by including a missing marital status indicator.

Count (0–6) of difficulties with the following activities of daily living (ADLs): bathing, dressing, eating, toileting, walking, and getting out of a chair.

Count (0–5) of difficulties with the following instrumental activities of daily living (IADLs): using the telephone, shopping, managing money, doing light housework, or preparing meals.

Number of dentists per county divided by 1000 residents, measured from the Area Health Resources File. We assigned the characteristics of counties to respondents when comparing the supply of dentists among respondents below and above Medicaid eligibility thresholds.

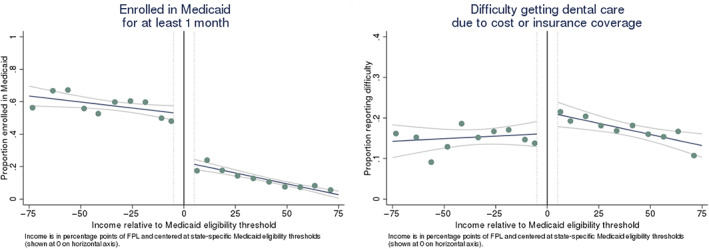

Approximately one‐half (49.5%) of Medicare beneficiaries with income just below Medicaid's eligibility thresholds were enrolled in the program, while 20.6% of beneficiaries whose income exceeded these thresholds were enrolled in Medicaid, representing a coverage discontinuity of 28.9 percentage points (95% CI: −34.0, −23.7; p < 0.001; Figure 1 and Table 2). This abrupt drop‐off in Medicaid coverage, but balance on most measured covariates, across the thresholds support assumptions of the regression discontinuity design.

FIGURE 1.

Enrollment in Medicaid and difficulty obtaining dental care due to cost or insurance coverage as a function of income. Graphs show the proportions of Medicare beneficiaries enrolled in Medicaid (left panel) and who reported difficulty getting dental care due to cost or insurance coverage (right panel) as a function of income relative to state‐specific Medicaid eligibility thresholds (pooled across states). Income is measured in percentage points of the federal poverty level (FPL) and centered at state‐specific Medicaid income eligibility thresholds (shown at 0 on horizontal axis). Estimated and reported for 20 equally sized income bins. We omitted individuals within ±5 percentage points of Medicaid eligibility thresholds, shown as dotted vertical lines in the figure, to mitigate attenuation bias from differences in how income may be reported to state Medicaid programs versus in the MCBS (e.g., differences in lookback periods). Fitted regression lines and 95% confidence intervals overlaid on the scatterplots show the relationship between income and outcomes above versus below Medicaid income eligibility thresholds. The vertical distance between the fitted lines at the Medicaid eligibility threshold gives the discontinuity in the outcome (without adjustment for covariates). Estimates are adjusted for survey weights. Based on 7508 observations from the 2016–2019 MCBS. When weighted, this sample represented 26,776,719 beneficiary‐years in the community‐dwelling Medicare population. See Appendix (Supporting information) for plots of other study outcomes [Color figure can be viewed at wileyonlinelibrary.com]

TABLE 2.

Regression‐adjusted discontinuities in study outcomes above versus below Medicaid income eligibility thresholds

| Mean or proportion below Medicaid income eligibility thresholds a | Adjusted discontinuity above versus below Medicaid income eligibility thresholds b | |||

|---|---|---|---|---|

| Dependent variable | Estimate | 95% confidence interval c | p‐value | |

| Primary outcomes | ||||

| Enrolled in Medicaid for ≥1 month of the year, % d | 49.5 | −28.9 | (−34.0, −23.7) | <0.001 |

| Difficulty getting dental care due to cost or insurance coverage, % d | 15.0 | 5.0 | (0.2, 9.8) | 0.04 |

| Number of annual dental visits per beneficiary e | 0.72 | 0.02 | (−0.21, 0.25) | 0.89 |

| Out‐of‐pocket dental care costs ≥$100, % e | 16.8 | 4.0 | (−2.3, 10.3) | 0.21 |

| Secondary outcomes | ||||

| Difficulty getting dental care due to factors other than cost or insurance coverage, % d | 6.5 | −1.3 | (−4.1, 1.5) | 0.36 |

| Enrolled in a Medicare Advantage plan for ≥1 month of the year, % d | 44.5 | 1.5 | (−4.5, 7.5) | 0.62 |

Mean or proportion of the outcome among individuals whose income was just below state‐specific Medicaid eligibility thresholds (pooled across states), adjusted for respondent characteristics and the supply of dentists per 1000 county residents (as shown Table 1), state fixed effects, year fixed effects, and survey weights (Appendix, Supporting information).

Estimated discontinuity in the outcome above versus below state‐specific Medicaid eligibility thresholds (pooled across states), adjusted for respondent characteristics from Table 1, the county‐level supply of dentists per 1000 residents, state fixed effects, year fixed effects, and survey weights. Dividing the estimated discontinuity by the mean or proportion of that outcome gives the effect of the Medicaid coverage cliff in relative terms.

Confidence intervals and p‐values calculated using used robust standard errors adjusted to account for clustering within respondents across survey years.

Based on 7508 observations from the 2016–2019 MCBS (analyses limited to community‐dwelling Medicare beneficiaries). When weighted, this sample represented 26,776,719 beneficiary‐years in the community‐dwelling Medicare population.

Based on 3641 observations from the 2016–2018 MCBS Cost Supplement. The Cost Supplement is fielded on a subsample of MCBS respondents. We used survey weights in the Cost Supplement file to weight this subsample to be nationally representative of the community‐dwelling Medicare population. When weighted, this sample represented 22,482,340 beneficiary‐years in the community‐dwelling Medicare population. The 2019 Cost Supplement was not available at the time of our analyses.

The proportion of Medicare beneficiaries who reported difficulty obtaining dental care due to cost or a lack of insurance was higher above Medicaid's income thresholds (discontinuity: 5.0 percentage points; 95% CI: 0.2, 9.8; p = 0.04). This difference represents a one‐third increase over the proportion of beneficiaries reporting such difficulty below the thresholds (15.0%). We did not detect a discontinuity in the probability of experiencing a difficulty due to factors other than cost or a lack of insurance, suggesting that difficulties were linked to the Medicaid coverage cliff and not to other factors. We were unable to detect a difference in the probability of incurring ≥$100 in annual out‐of‐pocket dental care costs above versus below the thresholds (regression discontinuity estimate: 4.0 percentage points; 95% CI: −2.3, 10.3; p = 0.21).

On average, beneficiaries with incomes just below Medicaid's eligibility thresholds had approximately 0.7 annual visits with dentists—fewer than one per person‐year (Table 2). We did not detect a difference in visits across these thresholds. However, our estimates were imprecise, and we could not rule out sizable positive or negative differences (discontinuity of 0.02 visits per beneficiary; 95% CI: −0.21, 0.25; p = 0.89). We did not detect a discontinuity in Medicare Advantage enrollment.

Table 3 presents findings from our sensitivity analyses. Our results were substantively unchanged in analyses that omitted respondent‐level covariates, suggesting that any imbalances in measured confounders across the Medicaid eligibility thresholds did not affect our estimates. We obtained similar results when we omitted eight states whose Medicaid programs covered emergency‐only dental services. Finally, our results were similar in analyses using different income bandwidths, with regression discontinuity estimates for the proportion of beneficiaries incurring ≥$100 in out‐of‐pocket dental care spending becoming both larger and more precise when we used a bandwidth of ±100 percentage points of the FPL (discontinuity: 5.2 percentage points; 95% CI: −0.5, 10.9; p = 0.08).

TABLE 3.

Sensitivity analyses

| Adjusted discontinuity above versus below Medicaid income eligibility thresholds | ||||

|---|---|---|---|---|

| Adjusted only for state fixed effects and year fixed effects a | Excluding 8 states with emergency‐only coverage of dental services in 2018 b , c | Bandwidth of ±50 percentage points above and below Medicaid threshold b | Bandwidth of ±100 percentage points above and below Medicaid threshold b | |

| Dependent variable | Estimate (95% confidence interval) | |||

| Primary outcomes | ||||

| Enrolled in Medicaid for ≥1 month of the year, % d | −29.1 (−34.7, −23.4) | −28.2 (−33.8, −22.7) | −27.8 (−34.5, −21.2) | −30.5 (−35.0, −26.0) |

| Difficulty getting dental care due to cost or insurance coverage, % d | 5.0 (0.2, 9.8) | 4.4 (−0.5, 9.4) | 5.4 (−0.7, 11.6) | 5.2 (1.1, 9.3) |

| Number of annual dental visits per beneficiary e | 0.04 (−0.20, 0.28) | 0.01 (−0.25, 0.26) | 0.04 (−0.27, 0.35) | −0.05 (−0.26, 0.17) |

| Out‐of‐pocket dental care costs ≥$100, % e | 4.7 (−2.2, 11.7) | 4.0 (−2.5, 10.5) | 3.3 (−4.7, 11.2) | 5.2 (−0.5, 10.9) |

| Secondary outcomes | ||||

| Difficulty getting dental care due to factors other than cost or insurance coverage, % d | −1.6 (−4.4, 1.3) | −1.8 (−4.9, 1.3) | −1.5 (−5.1, 2.1) | −0.3 (−2.8, 2.2) |

| Enrolled in a Medicare Advantage plan for ≥1 month of the year, % d | 0.3 (−5.8, 6.4) | 0.0 (−6.4, 6.4) | 4.5 (−3.2, 12.2) | 2.4 (−3.0, 7.8) |

Estimated discontinuity in the outcome above versus below state‐specific Medicaid eligibility thresholds (pooled across states), adjusted for state fixed effects, year fixed effects, and survey weights. Confidence intervals and p‐values calculated using used robust standard errors adjusted to account for clustering within respondents across survey years.

Estimated discontinuity in the outcome above versus below state‐specific Medicaid eligibility thresholds (pooled across states), adjusted for respondent characteristics and the county‐level supply of dentists per 1000 residents (as shown in Table 1), state fixed effects, year fixed effects, and survey weights. Dividing the estimated discontinuity by the mean or proportion of that outcome gives the effect of the Medicaid coverage cliff in relative terms. Confidence intervals and p‐values calculated using used robust standard errors adjusted to account for clustering within respondents across survey years.

The states whose Medicaid programs covered emergency‐only dental services for adults in 2018 were: Arizona, Georgia, Hawaii, Nevada, New Hampshire, Oklahoma, Utah, and West Virginia.

Analyses limited to community‐dwelling Medicare beneficiaries in the 2016–2019 MCBS. In the first column of results (analyses adjusted only for state fixed effects and year effects), the sample consisted of 7508 respondent‐years, representing 26,776,719 beneficiary‐years in the community‐dwelling Medicare population. In the second column of results, which excluded states with emergency‐only Medicaid dental coverage, our sample consisted of 6578 respondent‐years, representing 23,348,276 beneficiary‐years in the community‐dwelling Medicare population. In the third column of results based on a bandwidth of ±50 percentage points, the sample consisted of 5395 respondent‐years, representing 19,206,140 beneficiary‐years in the community‐dwelling Medicare population. In the fourth column of results based on a bandwidth of ±100 percentage points, the sample consisted of 9611 respondent‐years, representing 34,566,347 beneficiary‐years in the community‐dwelling Medicare population.

Analyses based on the MCBS Cost Supplement, which is fielded on a subsample of MCBS respondents. We used survey weights in the Cost Supplement file to weight the subsample to be nationally representative of the community‐dwelling Medicare population. In the first column of results (analyses adjusted only for state fixed effects and year effects), the sample consisted of 3641 respondent‐years, representing 22,482,340 beneficiary‐years in the community‐dwelling Medicare population. In the second column of results, which excluded states with emergency‐only Medicaid dental coverage, our sample consisted of 3215 respondent‐years, representing 19,667,548 beneficiary‐years in the community‐dwelling Medicare population. In the third column of results based on a bandwidth of ±50 percentage points, the sample consisted of 2618 respondent‐years, representing 16,327,399 beneficiary‐years in the community‐dwelling Medicare population. In the fourth column of results based on a bandwidth of ±100 percentage points, the sample consisted of 4620 respondent‐years, representing 28,858,418 beneficiary‐years in the community‐dwelling Medicare population.

Additional inferential checks supported our main findings and assumptions of the regression discontinuity design (see Appendix E, Supporting information). Specifically, we found that discontinuities in Medicaid enrollment, the probability of having difficulty obtaining dental care due to costs or a lack of insurance, and the probability of incurring ≥$100 annual out‐of‐pocket dental care costs were largest near the Medicaid income eligibility thresholds, but smaller and statistically indistinguishable from 0 at lower income levels. We found no evidence to suggest that respondents sorted around the thresholds at a point in time or across years.

4. DISCUSSION

Limited and incomplete dental coverage among Medicare beneficiaries raise concerns that gaps in coverage contribute to unmet oral health needs, particularly among low‐income beneficiaries. 3 , 12 , 14 To our knowledge, this is the first study to establish a causal link between incomplete dental coverage, arising from a dental coverage “cliff” above income eligibility thresholds for Medicaid, and barriers to dental care access among low‐income individuals with Medicare. Using a regression discontinuity design, we estimated that Medicare beneficiaries whose income exceeded eligibility thresholds for Medicaid were 5 percentage points more likely to report difficulty accessing dental care due to cost concerns or a lack of insurance than beneficiaries below the thresholds—a one‐third increase over the proportion reporting difficulty below these thresholds. These findings reveal how a dental coverage cliff limits access to dental care in a population with substantial unmet oral health care needs. 12

Although we found that the coverage cliff impedes access to dental care, we did not detect an effect on the number of dentist visits. Because we had detailed measures of visits for only half of our main sample, it is possible that our estimate for visits reflects a lack of statistical precision rather than a true null. The different findings could also reflect determinants of access that may not be reflected in use. For example, Medicare beneficiaries affected by the coverage cliff might have experienced greater financial hardship when using dental care or could have sought care from a lower‐cost source such as a free dental clinic or federally qualified health center. 34 However, our data did not allow us to investigate this latter hypothesis. Even without a substantial drop‐off in use, our results underscore concerns about inadequate dental care access among low‐income Medicare beneficiaries 12 , 14 : a sizable proportion of individuals in our sample reported difficulty accessing dental care due to issues of cost or coverage, and the rate of dentist visits was low above and below the Medicaid eligibility thresholds.

Our findings are pertinent to ongoing policy discussions about adding a dental benefit to Medicare. 26 , 35 The American Dental Association, for example, has endorsed a means‐tested dental benefit for Medicare beneficiaries with incomes <300% of FPL, while several versions of a budget reconciliation package considered by Congress in 2021 included funding for a broader dental benefit that would cover all Medicare beneficiaries. 35 Our results speak most directly to the potential gains from expanding dental coverage for low‐income Medicare beneficiaries who are ineligible for Medicaid. For these individuals, a new Medicare dental benefit would alleviate barriers to dental care use that arise from Medicaid's dental coverage cliff. While a means‐tested benefit would target the low‐income population we studied, we note that our findings do not necessarily favor a means‐tested benefit over a broader one, because both means‐tested and broader benefits would cover low‐income individuals affected by the Medicaid coverage cliff, and our analyses did not compare different coverage scenarios. We note that adding a Medicare dental benefit could also improve access to dental care among Medicare beneficiaries with Medicaid, since Medicaid coverage of dental services varies across states and can be limited. However, quantifying potential improvements in dental coverage among Medicare beneficiaries with Medicaid was beyond the scope of our analysis.

4.1. Limitations

Our study had several limitations. First, although we used a regression discontinuity design to isolate effects of the Medicaid coverage cliff from confounders, this approach is a quasi‐experimental design using observational data, and it is possible our findings could have been biased by unmeasured confounders. However, we found few differences across Medicaid eligibility thresholds among a rich set of measured confounders, and we obtained similar estimates with and without adjustment for these variables, increasing confidence that our analyses addressed major sources of confounding bias. Second, state Medicaid programs vary considerably in the extent of dental coverage offered to adults (e.g., coverage of preventive, extensive, or emergency coverage and annual limits on utilization), but small sample sizes in the MCBS limited our ability to construct separate estimates in subsets of states with similar Medicaid dental coverage policies. Therefore, we pooled over all states that covered at least some dental services for adults and conducted sensitivity analyses excluding states with emergency‐only dental coverage. These estimates represent an average effect of the Medicaid coverage cliff pooled across states, though the cliff is likely to be more salient in states where Medicaid offers dental coverage that are more comprehensive. Third, our analyses of dental care use and out‐of‐pocket spending were based on the smaller subsample of MCBS respondents who participated in the MCBS Cost Supplement, which limited our ability to detect small but potentially salient effects for these outcomes.

5. CONCLUSION

Dental coverage is incomplete and often limited among Medicare beneficiaries. Our results provide evidence that a Medicaid coverage cliff contributes to low‐income Medicare beneficiaries' difficulty obtaining dental care. Policies now under consideration to expand dental coverage for older adults could close gaps in dental care access that arise from the current lack of comprehensive dental coverage in Medicare—particularly among the program's low‐income beneficiaries.

Supporting information

Appendix S1. Supporting Information.

ACKNOWLEDGMENTS

This project was supported from the Agency for Healthcare Research and Quality by Grant Nos. K01HS026727 and R01HS025422. This work does not necessarily represent the official views of the Agency for Healthcare Research and Quality.

Roberts ET, Mellor JM, McInerny MP, Sabik LM. Effects of a Medicaid dental coverage “cliff” on dental care access among low‐income Medicare beneficiaries. Health Serv Res. 2023;58(3):589‐598. doi: 10.1111/1475-6773.13981

REFERENCES

- 1. Advancing Oral Health in America. National Academies Press; 2011. https://www.hrsa.gov/sites/default/files/publichealth/clinical/oralhealth/advancingoralhealth.pdf [Google Scholar]

- 2. Lee JS, Somerman MJ. The importance of oral health in comprehensive health care. JAMA. 2018;320(4):339‐340. [DOI] [PubMed] [Google Scholar]

- 3. Griffin SO, Jones JA, Brunson D, Griffin PM, Bailey WD. Burden of oral disease among older adults and implications for public health priorities. Am J Public Health. 2012;102(3):411‐418. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4. CDC . Oral Health in America: A Report of the Surgeon General. United States Public Health Service, Office of the Surgeon General; 2000. [Google Scholar]

- 5. Benjamin RM. Oral health: the silent epidemic. Public Health Rep. 2010;125(2):158‐159. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6. Badewy R, Singh H, Quiñonez C, Singhal S. Impact of poor Oral health on community‐dwelling seniors: a scoping review. Health Serv Insights. 2021;14:1178632921989734. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7. Rouxel P, Heilmann A, Demakakos P, Aida J, Tsakos G, Watt RG. Oral health‐related quality of life and loneliness among older adults. Eur J Ageing. 2016;14(2):101‐109. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8. Matsuyama Y, Jürges H, Dewey M, Listl S. Causal effect of tooth loss on depression: evidence from a population‐wide natural experiment in the USA. Epidemiol Psychiatr Sci. 2021;30:e38. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9. Moeller JF, Chen H, Manski RJ. Investing in preventive dental care for the Medicare population: a preliminary analysis. Am J Public Health. 2010;100(11):2262‐2269. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10. Nasseh K, Vujicic M, Glick M. The relationship between periodontal interventions and healthcare costs and utilization. Evidence from an integrated dental, medical, and pharmacy commercial claims database. Health Econ. 2017;26(4):519‐527. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11. Jeffcoat MK, Jeffcoat RL, Gladowski PA, Bramson JB, Blum JJ. Impact of periodontal therapy on general health: evidence from insurance data for five systemic conditions. Am J Prev Med. 2014;47(2):166‐174. [DOI] [PubMed] [Google Scholar]

- 12. Willink A, Schoen C, Davis K. Dental care and Medicare beneficiaries: access gaps, cost burdens, and policy options. Health Aff. 2016;35(12):2241‐2248. [DOI] [PubMed] [Google Scholar]

- 13. Willink A, Schoen C, Davis K. Consideration of dental, vision, and hearing services to be covered under Medicare. JAMA. 2017;318(7):605‐606. [DOI] [PubMed] [Google Scholar]

- 14. Willink A, Reed NS, Swenor B, Leinbach L, Dugoff EH, Davis K. Dental, vision, and hearing services: access, spending, and coverage for Medicare beneficiaries. Health Aff. 2020;39(2):297‐304. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15. Freed M, Neuman T, Jacobson G. Drilling Down on Dental Coverage and Costs for Medicare Beneficiaries. Henry J Kaiser Family Foundation; 2019. [Google Scholar]

- 16. Freed M, Ochieng N, Sroczynski N, Damico A, Amin K. Medicare and Dental Coverage: A Closer Look. Kaiser Family Foundation; July 28, 2021. [Google Scholar]

- 17. Singhal A, Alofi A, Garcia RI, Sabik LM. Medicaid adult dental benefits and oral health of low‐income older adults. J Am Dent Assoc. 2021;152(7):551‐559.e1. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18. Vujicic M, Fosse C, Reusch C, Burroughs M. Making the Case for Dental Coverage for Adults in All State Medicaid Programs. American Dental Association Health Policy Institute; July 2021. [Google Scholar]

- 19. Artiga S, Ubri P, Zur J. The Effects of Premiums and Cost Sharing on Low‐income populations: Updated Review of Research Findings. Henry J Kaiser Family Foundation; 2017. [Google Scholar]

- 20.U.S. Federal Poverty Guidelines Used to Determine Financial Eligibility for Certain Federal Programs. 2021. Accessed September 3, 2021. https://aspe.hhs.gov/topics/poverty‐economic‐mobility/poverty‐guidelines/prior‐hhs‐poverty‐guidelines‐federal‐register‐references/2021‐poverty‐guidelines

- 21. Cornelio N, McInerney MP, Mellor JM, Roberts ET, Sabik LM. Increasing Medicaid's stagnant asset test for people eligible for Medicare and Medicaid will help vulnerable seniors. Health Aff. 2021;40(12):1943‐1952. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22. Venkataramani AS, Bor J, Jena AB. Regression discontinuity designs in healthcare research. BMJ. 2016;352:i1216. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23.Dental Caries (Tooth Decay) in Seniors (Age 65 and Over). 2018. Accessed August 30, 2021. https://www.nidcr.nih.gov/research/data-statistics/dental-caries/seniors

- 24. Huang DL, Park M. Socioeconomic and racial/ethnic oral health disparities among US older adults: oral health quality of life and dentition. J Public Health Dent. 2015;75(2):85‐92. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25. Medicare Dental, Vision, and Hearing Benefit Act of 2021. In. Doggett L, trans. 2021‐2022 2021th ed.

- 26. Elijah E. Cummings lower drug costs now act. In. Pallone FJ, trans. 117th Congress (2021‐2022) 2021th ed.

- 27. MedPAC . Data Book: Beneficiaries Dually Eligible for Medicare and Medicaid. Medicare Payment Advisory Commission and Medicaid and CHIP Payment and Access Commission; 2018. [Google Scholar]

- 28. Roberts ET, Glynn A, Cornelio N, et al. Medicaid coverage ‘cliff’ increases expenses and decreases care for near‐poor Medicare beneficiaries. Health Aff. 2021;40(4):552‐561. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29. Cubanski J, Damico A, Neuman T, Jacobson G. Sources of Supplemental Coverage among Medicare Beneficiaries in 2016. Kaiser Family Foundation; 2018. [Google Scholar]

- 30. Willink A. The high coverage of dental, vision, and hearing benefits among Medicare advantage enrollees. Inquiry: J Health Care Organ Provis Financing. 2019;56:46958019861554. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31. 2018 Medicare Current Beneficiary Survey Data User's Guide: Survey File. Centers for Medicare and Medicaid Services; September 24, 2020.

- 32. Cattaneo MD, Idrobo N, Titiunik R. A Practical Introduction to Regression Discontinuity Designs: Foundations. Cambridge University Press; 2019. [Google Scholar]

- 33. Barreca AI, Lindo JM, Waddell GR. Heaping‐induced bias in regression‐discontinuity designs. Econ Inq. 2016;54(1):268‐293. [Google Scholar]

- 34. Jones E, Shi L, Hayashi AS, Sharma R, Daly C, Ngo‐Metzger Q. Access to oral health care: the role of federally qualified health centers in addressing disparities and expanding access. Am J Public Health. 2013;103(3):488‐493. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35. Simon L, Giannobile WV. Is it finally time for a Medicare dental benefit? N Engl J Med. 2021;385(23):e80. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Appendix S1. Supporting Information.