Abstract

Objective:

Extensive marketing of ‘toddler milks’ (sugar-sweetened milk-based drinks for toddlers) promotes unsubstantiated product benefits and raises concerns about consumption by young children. The present study documents trends in US toddler milk sales and assesses relationships with brand and category marketing.

Design:

We report annual US toddler milk and infant formula sales and marketing from 2006 to 2015. Sales response models estimate associations between marketing (television advertising spending, product price, number of retail displays) and volume sales of toddler milks by brand and category.

Setting:

US Nielsen retail scanner sales and advertising spending data from 2006 to 2015.

Participants:

Researchers analysed all Universal Product Codes (n 117·4 million) sold by seven infant formula and eight toddler milk brands from 2006 to 2015.

Results:

Advertising spending on toddler milks increased fourfold during this 10-year period and volume sales increased 2·6 times. In contrast, advertising spending and volume sales of infant formulas declined. Toddler milk volume sales were positively associated with television advertising and retail displays, and negatively associated with price, at both the brand and category levels.

Conclusions:

Aggressive marketing of toddler milks has likely contributed to rapid sales increases in the USA. However, these sugar-sweetened drinks are not recommended for toddler consumption. Health-care providers, professional organizations and public health campaigns should provide clear guidance and educate parents to reduce toddler milk consumption and address misperceptions about their benefits. These findings also support the need to regulate marketing of toddler milks in countries that prohibit infant formula marketing to consumers.

Keywords: Breast-milk substitutes, Young children, Advertising, Retail marketing, Sales analysis, Toddler milks

Children’s diet in the first 1000 d establishes the foundation for healthy dietary patterns and reduced risk for obesity and diet-related diseases throughout their lives(1). Age 1–2 years (12–24 months) is a critical period for developing healthy eating habits and preferences for healthy foods and drinks, including plain milk and unsweetened drinks for thirst. By about 24 months, children should have transitioned to the family diet and learned to enjoy the same healthy foods that the family eats(2,3). However, most toddlers’ diets in the USA do not conform to recommendations for healthy eating, including low consumption of vegetables(4) and overconsumption of sodium and saturated fat(5). High consumption of sugar, including sugar-sweetened beverages, also presents health risks. Approximately one-third (31 %) of young toddlers (12–23·9 months) consume sugar-sweetened beverages on a given day(6), a proportion which increases to 45 % among pre-schoolers (24–47·9 months)(4). An additional 15 % consume flavoured milk. On the other hand, there is no evidence that US toddlers consume inadequate micronutrients(5).

Extensive marketing of foods and drinks specifically for ‘toddlers’ may influence caregivers’ decisions about what to feed their children during this developmentally critical period. One relatively new product category, toddler milks, raises substantial concerns. These milk-based products are typically produced by formula manufacturers and are marketed for toddlers (12–36 months) as the ‘next step’ after infant formula(7). They consist primarily of powdered low-fat milk, corn syrup solids or other caloric sweeteners, and vegetable oil. Compared with plain whole cow’s milk (which is recommended for young toddlers), they contain added sugar, more sodium and less protein(7). Therefore, providing these sweetened drinks does not conform with recommendations that children under 2 years of age should not consume any added sugar. Serving them may also contribute to conditioned preferences for sweet drinks over plain drinks, including plain milk, and less-sweet foods(8). In addition, toddler milks typically use similar labelling as infant formulas(9,10), which results in consumer confusion and can lead caregivers to inappropriately serve these products to infants under 12 months old(11,12). Furthermore, toddler milk packages contain numerous nutrition-related and child development claims, such as ‘DHA and iron to help support brain development’ and ‘probiotics to help support digestive health’, which have not been supported by scientific research(9). These claims may mislead caregivers to believe that toddler milk provides benefits for their child’s nutrition and development.

In 2016, the World Health Assembly passed Resolution 69·9 to include toddler milk products (known as ‘growing-up milks’ outside the USA) in its definition of breast-milk substitutes (BMS) under the WHO’s International Code of Marketing of Breast-milk Substitutes (hereafter, ‘the Code’), which calls on countries to enact regulations to prohibit all marketing of BMS directly to consumers(10). As a result, 16 % of countries that regulate BMS marketing explicitly ban marketing of toddler milks(13). Of note, the USA is one of just 30 % of countries that have not adopted any provisions of the Code and allow direct-to-consumer marketing of infant formulas. Furthermore, US formula manufacturers have substantially increased their investment in toddler milk marketing. In 2015, they spent approximately $US 17 million to advertise toddler milks, compared with less than $US 10 million on infant formula advertising. From 2011 to 2015, toddler milk advertising increased by 74 %, whereas infant formula advertising declined by 68 %(7).

Despite concerns about marketing of sweetened toddler milks to young children, few studies have examined sales and consumption of toddler milks in the USA or how marketing may influence caregivers’ purchases of these products. One analysis of international formula sales data found that US consumption of toddler formula was 5·0 kg per toddler (13–36 months)(14). However, publicly available sales data do not break out toddler milks when reporting infant formula sales. Furthermore, analyses of public nutrition data sets (e.g. National Health and Nutrition Examination Survey (NHANES); Feeding Infants and Toddlers Study (FITS)) have not tracked separately or reported consumption of toddler milks by infants or toddlers.

To help inform public health efforts to improve toddlers’ diets and reduce sugar-sweetened beverage consumption, the present study documents trends in US toddler milk sales from 2006 to 2015, compares them with sales of infant formulas offered by the same manufacturers, and examines the relationship between marketing practices (including advertising, retail displays and price) and volume sales for individual toddler milk brands and the total category.

Methods

Researchers utilized Nielsen data to assess toddler milk and infant formula sales and advertising trends over the 10-year period. Regression models estimated relationships between marketing practices and toddler milk sales.

Sales and advertising data

Nielsen US retail scanner data provided weekly volume and dollar sales and in-store displays at the individual store level for toddler milk and infant formula products for the period 2006–2015. Researchers also licensed weekly national advertising spending data from Nielsen for the same period. Researchers utilized the brand and brand variant provided by Nielsen in the ‘Baby Milk and Milk Flavoring’ product category in its retail scanner data and the ‘Infant Formula’ and ‘Milk’ categories in its advertising data to identify infant formula and toddler milk products. Table 1 shows the products categorized as ‘infant formula’ and ‘toddler milk’ by brand in the two data sets.

Table 1.

List of study products

| Brand | Infant formula products† | Toddler milk products† |

|---|---|---|

| Baby’s Only Organics | N/A | Toddler Formula: Standard, LactoRelief |

| Bright Beginnings | Ultra, Ultra Gentle | 2 |

| Earth’s Best | Sensitivity | Standard |

| Enfamil/Enfagrow | Enfamil: Standard; A.R.; EnfaCare; for Supplementing; Gentlease; LactoFree; Nutramigen; Pregestimil; ProSobee; PurAmino; Reguline; Restful | Enfagrow (Toddler Next Step): Standard; Gentlease; Lipil; ProSobee Lipil; Premium; Soy; Soy Lipil; Toddler Transitions; Toddler Transitions Gentlease; Toddler Transitions Soy |

| Gerber (Gerber Good Start, Nestle Good Start) | Good Start 2 (Good Start): Essentials; Extensive HA; Gentle; Protect; Soy; Nourish; Soothe; Soy; Supreme | Gerber Graduates: Gentle, Protect, Soothe, Soy |

| Happy Tot | N/A | Grow & Shine Organic |

| Kabrita | Standard | N/A |

| Neocate | Standard | N/A |

| Nestle Nido | N/A | Kinder 1+ |

| Similac | Standard; Alimentum; Calcilo Xd; Elecare; for Supplementation; Isomil, NeoSure; NeoSure Advance; PM 60/40; Sensitive; Sensitive R.S; Total Comfort | Go & Grow by Similac: Standard; Sensitive |

N/A, not applicable.

Some brand names changed over the years examined. ‘Standard’ indicates the regular variety of the brand.

The sales data include weekly store-level sales for every Universal Product Code (UPC) sold at each store location in the system. The Nielsen database includes more than ninety participating retail chains, including supermarkets, convenience stores, drug stores, liquor stores and mass merchandisers across all US markets, totalling approximately 35 000 stores(15). Weekly UPC sales-by-store are reported by the number of units sold (count) and price of the unit ($US/count). In addition to brand and brand variant, each UPC provides product attributes, such as form (powder, concentrate and ready-to-feed), number of goods in a unit (e.g. six-pack of cans) and size of the individual good (e.g. ounces per can). The data set also includes information about weekly promotions for individual UPC collected from a representative sample of retailers, including retail displays in a secondary selling space (i.e. not the shelf where the product is usually stocked). Retailer location, including state and county, is also provided. Using this information, weekly volume sales (ounces; 1 oz = 28·3495 g) and dollar sales ($US) were calculated for each UPC in the analysis. Products excluded from analysis included liquid concentrate and ready-to-feed products (due to difficulty of comparison with powder products) and various products where the UPC did not specify a package size. These exclusions represented 3 % of toddler milk dollar sales. Private-label store brands were also excluded as their UPC did not provide enough information to specify the product category (i.e. infant formula or toddler milk). In total, private-label brands represent 5 % of all dollar sales in the combined ‘formula’ category.

Nielsen also provides total weekly advertising spending in seventeen different media, including national (network, cable and syndicated) and local (spot) television (TV), Spanish-language TV, Internet, radio, magazines, newspapers, free-standing insert coupons and outdoor advertising. For each infant formula and toddler milk brand and brand variant identified, researchers calculated total weekly advertising spending in all seventeen measured media, as well as total weekly TV advertising spending (including national, local and Spanish-language TV) and advertising spending in all other media.

Data aggregation for trends analysis

Researchers aggregated total weekly UPC-level data to provide annual US volume (ounces) and dollar sales ($US) and retail displays (number) for the infant formula and toddler milk categories. Total price per ounce was calculated by dividing annual total dollar sales by volume sales for each category. Weekly advertising spending data were also aggregated to calculate annual total advertising spending, TV advertising spending and other advertising spending for the infant formula and toddler milk categories.

Modelling the relationship between product sales and marketing practices

Sales response models examined the relationship between marketing and toddler milk volume sales at the brand and total category levels(16). The dependent variables were monthly county-brand-level volume sales for the brand-level model and monthly county-category-level volume sales for all toddler milk products combined for the category model. Monthly county-brand-level and county-category-level volume sales were calculated by aggregating weekly store-UPC-level volume sales by month, brand and county (Vijt, volume sales of brand j at county i in month t) and by month and county for all brands combined (Vit, volume sales at county i in month t).

Marketing practices examined included price per ounce, retail displays and TV advertising spending (representing 73 % of total advertising spending over the entire period). The brand-level model included average unit price for the brand (pijt, own price) and average unit price for other brands’ products (cpijt, competitors’ price), calculated by dividing dollar sales by volume sales for each brand in every county (price/oz). Price per ounce (pit, average price) for the category model was calculated by dividing total dollar sales by volume sales for each county. Weekly store-level retail display counts by UPC were also aggregated by month, brand and county (dpijt), and by month and county (dpit).

TV advertising spending (×103 $US) was included at the national level. Weekly TV advertising spending was aggregated by brand and month (adjt) and in total by month (adt) for the category model to assess relationships with current sales. To measure the lagged effect of current advertising on future product sales, we also included a measure of advertising goodwill stock developed by Dubé and colleagues(17). This approach calculates goodwill as a distributed lag of a non-linear transformation of advertising spending. In the present models, a log transformation of TV advertising spending with a 0·7 monthly depreciation from month t – 11 to month t was calculated for the advertising goodwill variables (gwjt and gwt).

The regressions controlled for county-level demographics that could also explain toddler milk sales, including county-level percentage of the adult population with a bachelor or higher degree (eduit) and the population of 12- to 36-month-old children (popit) for each study period year(18). To account for potential spillover effects of the infant formula brands supplied by the Special Supplemental Nutrition Program for Woman, Infants, and Children (WIC) on toddler milk sales for the same brands, the brand-level model included a WIC brand dummy wicijt, which is 1 if brand i was a WIC brand at county j in month t. WIC spillover effects describe the increase in sales of a manufacturer’s products, beyond sales through WIC, in states where the manufacturer provides the state’s WIC infant formula products(19). Spillover effects are hypothesized to occur due to increased shelf space in retailers for WIC brand products, perceived endorsement of the brand by WIC and brand loyalty by WIC participants. These spillover effects have been previously demonstrated with infant formula sales, but they have not been examined with toddler milk sales(19).

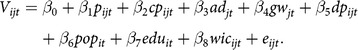

The final volume sales regression model equations are as follows.

Brand-level model:

|

Category model:

Finally, to control for unobservable factors across brands and counties or unobservable changes over time in the panel data, we ran the model with fixed effects using the statistical software package Stata MP version 15.

Results

The final sample included 117·4 million UPC offered by seven infant formula and eight toddler milk brands, including five brands with products in both categories (see Table 1).

Sales and marketing trends by product category

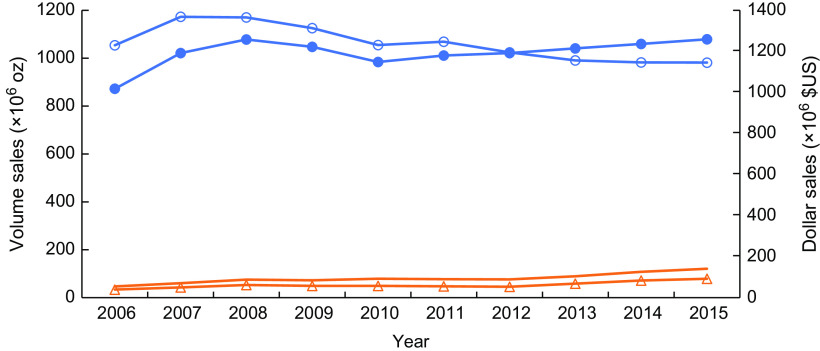

Figure 1 presents annual sales trends for the infant formula and toddler milk categories from 2006 to 2015 in the USA. During this time, annual volume sales of toddler milks increased by 158 % from 1 million kg (47 million oz) in 2006 to 3 million kg (121 million oz) in 2015. Toddler milk dollar sales increased at a somewhat lower rate of 133 % (from $US 39 million to $US 92 million), due to a decline in average price from $US 29·63/kg ($US 0·84/oz) in 2006 to $US 26·81/kg ($US 0·76/oz) in 2015. In contrast, volume sales of infant formula declined by 7 % from 30 million kg (1054 million oz) in 2006 to 28 million kg (982 million oz) in 2015. However, infant formula dollar sales increased by 24 % from $US 1017 million in 2006 to $US 1259 million in 2015, due to a 33 % increase in average price per ounce ($US 34·22/kg ($US 0·97/oz) in 2006 to $US 45·15/kg ($US 1·28/oz) in 2015).

Fig. 1.

Annual volume (1 oz = 28·3495 g) and US dollar sales of infant formula and toddler milk products (all brands except store brands, powdered formula type only), 2006–2015:  , volume sales of infant formulas;

, volume sales of infant formulas;  , volume sales of toddler milks;

, volume sales of toddler milks;  , dollar sales of infant formulas;

, dollar sales of infant formulas;  , dollar sales of toddler milks. (Researchers’ own analyses of Nielsen retail scanner data provided through the Nielsen Datasets at the Kilts Center for Marketing Data Center at The University of Chicago Booth School of Business)

, dollar sales of toddler milks. (Researchers’ own analyses of Nielsen retail scanner data provided through the Nielsen Datasets at the Kilts Center for Marketing Data Center at The University of Chicago Booth School of Business)

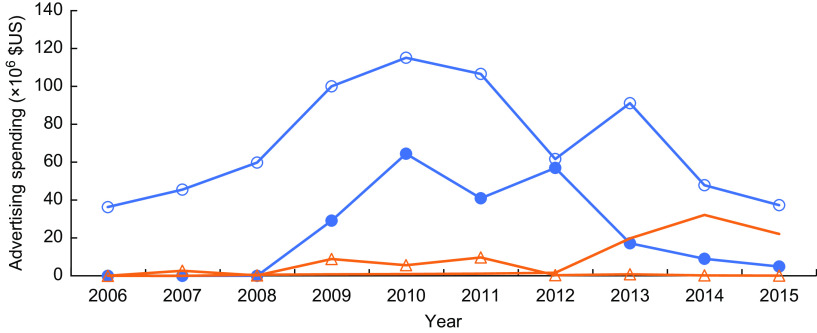

Figure 2 presents trends in advertising spending for toddler milks and infant formulas during the same time. Similar to volume sales trends, total advertising spending on toddler milks increased dramatically from 2006 to 2015, from less than $US 5 million annually in 2006–2008 to more than $US 20 million in 2013–2015. For the four years from 2012 to 2015, TV advertising represented nearly all advertising spending by toddler milk brands. These brands spent less than $US 1 million in total on non-TV advertising (including $US 0·7 million on magazine and $US 0·1 million on Internet advertising) during these four years, compared with $US 76 million spent on TV advertising. For infant formula brands, both TV and non-TV advertising peaked in 2010 and then declined. From 2013 to 2015, manufacturers spent more to advertise toddler milks on TV than spent on infant formula TV advertising.

Fig. 2.

Annual US advertising spending on infant formula and toddler milk brands, 2006–2015:  , television (TV) advertising of infant formulas;

, television (TV) advertising of infant formulas;  , TV advertising of toddler milks;

, TV advertising of toddler milks;  , other advertising of infant formulas;

, other advertising of infant formulas;  , other advertising of toddler milks. (Researchers’ own analyses of Nielsen advertising spending data provided through the Nielsen Datasets at the Kilts Center for Marketing Data Center at The University of Chicago Booth School of Business)

, other advertising of toddler milks. (Researchers’ own analyses of Nielsen advertising spending data provided through the Nielsen Datasets at the Kilts Center for Marketing Data Center at The University of Chicago Booth School of Business)

Sales response models

Table 2 reports summary statistics for all variables in the models. The final sample included 2121 US counties for 120 months. A Hausman test confirmed use of a fixed-effects model (P < 0·001). Table 3 shows the final model estimation results, including standardized β coefficients.

Table 2.

Summary statistics

| Mean | Min | Max | ||

|---|---|---|---|---|

| Monthly county-brand-level | Volume sales (oz) | 1889 | 12 | 1 443 127 |

| Own price ($US/oz) | 0·82 | 0·00 | 5·49 | |

| Competitor’s price ($US/oz) | 0·83 | 0·00 | 1·86 | |

| TV advertising spending (×103 $US) | 186 | 0·00 | 4452 | |

| TV advertising goodwill stock | 1·57 | 0·00 | 11·15 | |

| Displays at stores | 0·03 | 0·00 | 45·00 | |

| Monthly county-level | Volume sales (oz) | 4020 | 12·00 | 1 457 056 |

| Average price ($US/oz) | 0·83 | 0·00 | 1·86 | |

| TV advertising spending (×103 $US) | 636 | 0·00 | 4832 | |

| TV advertising goodwill stock | 6·52 | 0·27 | 11·55 | |

| Displays at stores | 0·07 | 0·72 | 53·00 | |

| Toddler population (age 1–2 years, annual) | 4226 | 1·00 | 270 497 | |

| Education (% of adult population with a bachelor degree or higher, annual) | 0·24 | 0·06 | 0·72 | |

| No. of months (1/2006–12/2015) | 120 | |||

| No. of counties | 2121 | |||

| No. of brands | 9 | |||

TV, television.

1 oz = 28·3495 g.

Table 3.

Regression models to estimate relationships between US toddler milk volume sales and marketing practices

| Models to estimate: | Monthly county-brand-level volume sales | Monthly county-category-level volume sales | ||||||

|---|---|---|---|---|---|---|---|---|

| Unstandardized coefficient | Standardized β coefficient | Unstandardized coefficient | Standardized β coefficient | |||||

| Own (average) price | −6138 | *** | −0·090 | *** | −23 445 | *** | −0·110 | *** |

| Competitor’s price | 0·016 | 0·004 | ||||||

| TV advertising spending | 0·051 | 0·003 | 0·490 | *** | 0·022 | *** | ||

| Goodwill stock of TV advertising | 217·8 | *** | 0·049 | *** | 4853 | *** | 0·135 | *** |

| Display at stores | 2 845 | *** | 0·101 | *** | 43 595 | *** | 0·171 | *** |

| Toddler population (age 1–2 years) | 2·019 | *** | 2·208 | *** | 0·490 | *** | 0·022 | *** |

| Percentage of highly educated population | 21 818 | *** | 0·157 | *** | 275·5 | *** | 0·034 | *** |

| WIC brand dummy (1 = state WIC brand) | 1471 | *** | 0·053 | *** | ||||

| Constant | −17 924 | *** | −0·489 | *** | −32 312 | *** | −1·01 | *** |

| Observations | 231 255 | 81 867 | ||||||

| County(-brand) fixed effects | yes | yes | ||||||

| Year fixed effects | yes | yes | ||||||

TV, television; WIC, Special Supplemental Nutrition Program for Woman, Infants, and Children.

P < 0·001.

Most marketing variables showed the expected relationship with volume sales in the model predicting county-level brand sales. In the brand model, brands’ own price was negatively correlated with sales (i.e. a lower price predicted higher sales), although there was not a significant relationship with competitors’ prices. Goodwill stock of TV advertising (i.e. cumulative advertising spending) also had a significant positive association with toddler milk brand volume sales. However, after controlling for all other factors, brands’ current TV advertising spending was not significantly related to their volume sales in the same month. The number of retail displays was also positively associated with brand volume sales. In addition, county-brand-level volume sales were higher for the toddler milk brand with the state WIC infant formula contract than for other brands, after controlling for all other factors in the model. In the category model, all marketing variables, including current TV advertising spending, were associated with volume sales in the expected directions.

As expected, county toddler population (children 12–36 months) was also a significant predictor of volume sales in both the brand-level and category models. In addition, education was positively associated with volume sales, such that toddler milk sales were higher in counties with a higher proportion of college-educated individuals.

Discussion

These data confirm that US toddler milk sales are growing rapidly, as evidenced by a more than doubling of sales over the 10-year period examined. Furthermore, these data demonstrate that manufacturers’ marketing practices have likely contributed to this increase, including through current price reductions and retail displays and longer-term influences of TV advertising. These relationships were significant in both the brand-level and the category models, which suggests that the marketing may increase consumer demand for toddler milks in total, and not just selection of one brand over another. It is also interesting that toddler milk sales were higher for brands that had the state WIC infant formula contract for the county. This finding indicates a potential WIC spillover effect on sales of toddler milks, in addition to the effect on infant formula sales that has been demonstrated in previous research(19).

During the same time period, advertising and sales of infant formulas declined, while price per ounce increased. The decline in infant formula advertising and sales represents a positive development for public health and may reflect public health efforts in the USA to promote breast-feeding(20) and accompanying increases in breast-feeding rates(21). However, it also indicates that manufacturers may be responding by refocusing their marketing effort towards toddler milks. Furthermore, the increase in price of infant formula raises concerns that consumers may be purchasing more higher-priced specialty formulas. Previous research has demonstrated that manufacturers have added n-3 fatty acids, prebiotics and probiotics to infant formulas to increase the retail price of their products(22,23), but these reformulations are not necessary for most infants.

These findings also support the need for countries to enact Code provisions that include toddler milks in their definition of BMS products covered, especially provisions prohibiting direct-to-consumer advertising of BMS. For example, 57 % of countries with Code provisions prohibit promotion of BMS to the general public, but (as noted earlier) just 16 % of countries regulate milk products for children up to 36 months under the Code(13). The findings in the present study specifically evaluated the relationship between toddler milk sales and two forms of consumer promotion: TV advertising and retail promotions. However, other types of promotions that many countries currently prohibit for infant formulas, such as free samples and gifts and direct contact with mothers, may also affect sales of toddler milks. Furthermore, World Health Assembly Resolution 69·9 calls for bans on packaging and labelling of toddler milks that look similar to infant formula packages, which serves to cross-promote infant formula. Given the substantial increase in toddler milk advertising observed, such regulations may be increasingly necessary.

Additional research questions

Some findings warrant further investigation. County-level education predicted greater toddler milk sales, although education levels also predict higher breast-feeding rates(24). This finding suggests that common marketing messages about benefits from toddler milks (e.g. cognitive development) may have greater appeal for more educated caregivers. Current TV advertising spending was not associated with brand-level sales in the same month, but cumulative advertising did predict long-term sales. This pattern has also been demonstrated in other product categories, such as liquid detergents and frozen food items(17,25). However, it is not clear why current TV advertising was associated with toddler milk sales for the total category. Evidence of potential WIC spillover effects on toddler milk brands also warrants further examination.

These findings also support the need for additional research to understand why sales of toddler milks are increasing and whether marketing messages lead caregivers to believe these products provide substantial benefits for their young children, despite public health concerns. The WHO has stated that marketing of toddler milks ‘undermines progress on optimal infant and young child feeding’(10). The American Academy of Family Physicians counsels against serving them due to the additional cost and the lack of evidence that they provide any advantages over plain whole milk for 1- to 2-year-olds; suggesting a multivitamin instead to provide any missing nutrients in toddlers’ diets(26). The American Heart Association does not recommend serving any added sugars (including the corn syrup solids in toddler milks) to children under the age of 2 years(8).

Researchers have also documented messages used to market toddler milks on product packages and in advertising that could mislead or deceive caregivers to believe that they provide numerous benefits for toddlers’ nutrition, cognitive development and growth(7,9). Furthermore, researchers have demonstrated substantial confusion about the age-appropriateness of toddler milks for infants due to cross-branding with manufacturers’ infant formula brands and their lower cost(11,27). This confusion may result in caregivers providing toddler milks to infants under 12 months old, even though these products do not provide infants with the required nutrients for optimal development. Therefore, toddler milk advertising may also increase sales of infant formula offered by the same brand as a result of this cross-branding. Finally, manufacturers may also be enlisting health-care providers to promote toddler milks to their patients, such as by providing free samples or promotional materials in waiting rooms. Substantial research has documented the extent and negative impact of promoting infant formula through health-care providers and the health-care system(28–30). Additional research is needed to examine whether these marketing practices are also commonly used to promote toddler milk.

Strengths and limitations

The model used in the present study has several advantages. It included current-period TV advertising, as well as carry-over effects from TV advertising goodwill stock, which reflects longer-term effects of advertising(17). The model was also designed for panel data, which allowed us to control unobserved time-invariant heterogeneity in cross-sectional models, prevent omitted variable bias and obtain a more efficient estimator(31). In addition, the Nielsen sales and advertising data are the same data used by US manufacturers to assess sales and marketing by their competitors(32).

The research does have limitations. Sales of toddler milks in 2015 equates to 425 g (15 oz) of powder per capita (12–36-month-old children), or approximately 3 litres (100 fl. oz) of reconstituted product (12·5 × 237 ml (8 fl. oz) servings) for each US toddler. However, the sales data examined do not provide information about purchases by individual users. Future research is needed to assess how many caregivers are serving toddler milks, purchaser demographics and the age of the children drinking them, as well as the frequency and volume that products were served to individual children. In addition, the regression analysis does not allow for conclusions about a direct causal relationship between marketing and sales. The model also does not account for potential cross-promotion effects of advertising for infant formula that may influence sales of toddler formula for the same brand.

Furthermore, this model is limited by the data available. For example, Nielsen scanner data only measure sales at physical retail locations. Therefore, this analysis could not measure purchases through online retailers and likely understates total sales of toddler milks. Similarly, the Nielsen advertising spending data only include company expenditures to place advertising in traditional media (primarily TV). These data do include advertisements purchased in digital media, such as display ads on YouTube, Facebook, Walmart.com or CafeMom.com, but these expenditures were low. However, formula companies have greatly expanded some forms of digital marketing in recent years that are not included in the advertising spending data(7). Infant formula and toddler milk brands frequently compensate Mom bloggers to promote their products. In addition, they maintain active social media accounts on multiple platforms (e.g. Facebook, YouTube, Pinterest)(7) and post content that users spread virally to other members of their networks. These types of marketing can be very effective. For example, a Similac #EndMommyWars campaign in 2015 generated 4·5 million video views and 109 Mom blog posts(7). However, public data are not available to measure these non-traditional forms of marketing, so they could not be included in our model.

Conclusions

There are several opportunities to address public health concerns raised by this rapid increase in toddler milk sales and associated marketing practices. These findings support the need for countries to incorporate marketing of toddler milks (i.e. growing-up milks) in regulations that prohibit direct-to-consumer BMS marketing under the Code, including TV advertising and retail promotions. In the USA, health-care and nutrition professional organizations could publish policy statements and provide clear guidance for parents about serving these products. Government agencies should also monitor serving of these products (e.g. through NHANES), set guidelines and goals for reducing their consumption (e.g. US Surgeon General or through the 2020–2025 Dietary Guidelines for Americans, which will include guidelines for infants and toddlers under the age of 2 years)(33), and educate caregivers through nutrition education programmes (e.g. WIC, Supplemental Nutrition Assistance Program and Head Start). Potential regulatory solutions are also available in the USA. The US Food and Drug Administration should establish a statement of identity and other labelling requirements for toddler milks, to address consumer confusion about these products(9). In addition, if future research confirms concerns that toddler milk claims and advertising mislead caregivers about their benefits for young children, the US Federal Trade Commission and state attorneys general could take action to address false, unfair and deceptive marketing practices(34).

Acknowledgements

Financial support: This work was supported by a grant from the Robert Wood Johnson Foundation, Princeton, NJ, USA (grant number 74436). The Robert Wood Johnson Foundation had no role in the design, analysis or writing of this article. Researchers’ own analyses were calculated (or derived) based in part on data from The Nielsen Company (US), LLC and marketing databases provided through the Nielsen Datasets at the Kilts Center for Marketing Data Center at The University of Chicago Booth School of Business. The conclusions drawn from the Nielsen data are those of the researchers and do not reflect the views of Nielsen. Nielsen is not responsible for, had no role in, and was not involved in analysing and preparing the results reported herein. Conflict of interest: None. Authorship: Y.Y.C. formulated the research question, designed the study, analysed the data and wrote the article. A.L. analysed the data and wrote the article. J.L.H. supervised the study and wrote and revised the article. Ethics of human subject participation: Human participants were not involved in this research.

References

- 1. Healthy Eating Research (2017) Feeding Guidelines for Infants and Young Toddlers: A Responsive Parenting Approach. https://healthyeatingresearch.org/wp-content/uploads/2017/02/her_feeding_guidelines_report_021416-1.pdf (accessed January 2019).

- 2.Fisher J & Dwyer J (2016) Next steps for science and policy on promoting vegetable consumption among US infants and young children. Adv Nutr 7, issue 1, 261S–271S. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Harris G & Coulthard H (2016) Early eating behaviours and food acceptance revisited: breastfeeding and introduction of complementary foods as predictive of food acceptance. Curr Obes Rep 5, 113–120. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Welker EB, Jacquier EF, Catellier DJ et al. (2018) Room for improvement remains in food consumption patterns of young children aged 2–4 years. J Nutr 148, 9S, 1536S–1546S. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Bailey RL, Catellier DJ, Jun S et al. (2018) Total usual nutrient intakes of US children (under 48 months): findings from the Feeding Infants and Toddlers Study (FITS). J Nutr 148, 9S, 1557S–1566S. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Roess AA, Jacquier EF, Catellier DJ et al. (2016) Food consumption patterns of infants and toddlers: findings from the feeding infants and toddlers study (FITS). J Nutr 148, Suppl. 3, 1525S–1535S. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Harris JL, Fleming-Milici F, Frazier W et al. (2017) Baby food FACTS: Nutrition and marketing of baby and toddler food and drinks. http://www.uconnruddcenter.org/files/Pdfs/BabyFoodFACTS_FINAL.pdf (accessed January 2020).

- 8.Vos MB, Kaar JL, Welsh JA et al. (2017) Added sugars and cardiovascular disease risk in children: a scientific statement from the American Heart Association. Circulation 135, e1017–e1034. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Pomeranz JL, Romo Palafox MJ & Harris JL (2018) Toddler drinks, formulas, and milks: labeling practices and policy implications. Prev Med 109, 11–16. [DOI] [PubMed] [Google Scholar]

- 10. World Health Organization (2016) World Health Assembly Resolution on the Inappropriate Promotion of Foods for Infants and Young Children. http://www.who.int/nutrition/netcode/WHA-Policy-brief.pdf (accessed June 2019).

- 11.Pereira C, Ford R, Feeley AB et al. (2016) Cross-sectional survey shows that follow-up formula and growing-up milks are labelled similarly to infant formula in four low and middle income countries. Matern Child Nutr 12, 91–105. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Berry NJ, Jones S & Iverson D (2010) It’s all formula to me: women’s understandings of toddler milk ads. Breastfeed Rev 18, 21–30. [PubMed] [Google Scholar]

- 13. World Health Organization (2018) Marketing of Breast-milk Substitutes: National Implementation of International Code. Status Report 2018. Geneva: WHO. [Google Scholar]

- 14.Baker P, Smith J, Salmon L et al. (2016) Global trends and patterns of commercial milk-based formula sales: is an unprecedented infant and young child feeding transition underway? Public Health Nutr 19, 2540–2550. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15. Kilts Center for Marketing (2019) Nielsen Datasets. https://www.chicagobooth.edu/research/kilts/datasets/nielsen (accessed April 2019).

- 16.Tellis G & Weiss D (1995) Does TV advertising really affect sales? The role of measures, models, and data aggregation. J Advert 24, 1–12. [Google Scholar]

- 17.Dubé J, Hitsch G & Manchanda P (2005) An empirical model of advertising dynamics. Quant Mark Econ 3, 107–144. [Google Scholar]

- 18. US Census Bureau (2015) American FactFinder. https://factfinder.census.gov/faces/nav/jsf/pages/index.xhtml (accessed January 2019).

- 19.Oliveira V, Frazao E & Smallwood D (2011) The Infant Formula Market: Consequences of a Change in the WIC Contract Brand. https://www.ers.usda.gov/webdocs/publications/44900/6918_err124.pdf?v=0 (accessed January 2018).

- 20. Centers for Disease Control and Prevention (2019) Healthy People 2020. https://www.cdc.gov/nchs/healthy_people/hp2020.htm (accessed July 2019).

- 21. Centers for Disease Control and Prevention (2019) About Breastfeeding. https://www.cdc.gov/breastfeeding/about-breastfeeding/index.html (accessed June 2019).

- 22.Mascaraque M (2016) Convenience and nutrition important in infant formula innovation. https://blog.euromonitor.com/video/convenience-and-nutrition-important-in-infant-formula-innovation/ (accessed January 2020).

- 23. Euromonitor International (2013) Market Research United States. https://www.euromonitor.com/usa (accessed April 2019).

- 24.Whipps M (2017) Education attainment and parity explain the relationship between maternal age and breastfeeding duration in US mothers. J Hum Lact 33, 220–224. [DOI] [PubMed] [Google Scholar]

- 25.Doganoglu T & Klapper D (2006) Goodwill and dynamic advertising strategies. Quant Mark Econ 4, 5–29. [Google Scholar]

- 26.O’Connor NR (2009) Infant formula. Am Fam Physician 79, 565–570. [PubMed] [Google Scholar]

- 27.Berry NJ, Jones SC & Iverson D (2012) Circumventing the WHO code? An observational study. Arch Dis Child 97, 320–325. [DOI] [PubMed] [Google Scholar]

- 28.Waterston T & Yilmaz G (2016) Sponsorship of paediatricians/paediatric societies by the Baby Feeding Industry – a position paper by the International Society for Social Paediatrics and Child Health. Child Care Health Dev 42, 149–152. [DOI] [PubMed] [Google Scholar]

- 29.Gagnon A, Leduc G, Waghorn K et al. (2005) In-hospital formula supplement of healthy breastfeeding newborns. J Hum Lact 21, 397–405. [DOI] [PubMed] [Google Scholar]

- 30.Howard C, Howard F & Weitzman M (1994) Infant formula distribution and advertising in pregnancy: a hospital survey. Birth 21, 14–19. [DOI] [PubMed] [Google Scholar]

- 31.Hsiao C (2003) Analysis of Panel Data. New York: : The Press Syndicate of the University of Cambridge. [Google Scholar]

- 32. Nielsen (2019) How We Measure. https://www.nielsen.com/us/en/solutions/measurement.html (accessed April 2019).

- 33. US Department of Agriculture, Center for Nutrition Policy and Promotion (2018) Pregnancy and Birth to 24 Months Project. https://www.fns.usda.gov/resource/pregnancy-and-birth-24-months (accessed January 2020).

- 34.Pomeranz JL (2014) Litigation to address misleading food label claims and the role of the state attorneys general. Regent Univ Law Rev 26, 421–455. [Google Scholar]