Abstract

Inhalers are the mainstay of treatment for asthma and chronic obstructive pulmonary disease. These products face limited generic competition in the US and remain expensive. To better understand the strategies that brand-name inhaler manufacturers have employed to preserve their market dominance, we analyzed all patents and regulatory exclusivities granted to inhalers approved by the Food and Drug Administration between 1986 and 2020. Of the 62 inhalers approved, 53 were brand-name products, and these brand-name products had a median of 16 years of protection from generic competition. Only 1 inhaler contained an ingredient with a new mechanism of action. More than half of all patents were on the inhaler devices themselves, not the active ingredients or other aspects of these drug-device combinations. Manufacturers further augmented periods of brand-name market exclusivity by moving active ingredients from one inhaler device into another (“device-hops”). The median time from approval of an originator product to the last-to-expire patent or regulatory exclusivity of branded follow-ons was 28 years (across device-hops on 14 originator products). Regulatory reform is critical to ensure that the rewards bestowed on brand-name inhaler manufacturers better reflect the added clinical benefit of new products.

Inhalers are the mainstay of treatment for asthma and chronic obstructive pulmonary disease (COPD).1,2 Despite being on the market for several decades, these products remain expensive, now representing approximately 5% of total net retail spending on prescription drugs in the US.3,4 High prices for inhalers lead to increased out-of-pocket spending, which may result in poor adherence5 and more frequent asthma and COPD exacerbations.6,7 The costs of inhalers in the US are now recognized as a significant public health concern.8

Key to addressing this concern is understanding the barriers that impede generic inhaler competition. Inhalers, like insulin pens, nicotine patches, and other drug-device combinations, contain medications that are sold together with the apparatus required for medication administration.9 Due to the complexities of producing drug-device combinations, the FDA employs a special set of regulatory requirements (an aggregate “weight-of-evidence” approach) when approving interchangeable generic inhalers.10,11 Generic manufacturers must perform in vitro, in vivo, and pharmacodynamic or clinical endpoint studies along with “human factors” studies demonstrating that patients can use their generic inhalers without error, just as they would use the brand-name inhaler.12,13 In satisfying these regulatory requirements, designed to ensure the quality of interchangeable generic drug-device combinations, generic manufacturers must avoid infringing the patents of brand-name products. When a brand-name manufacturer lists patents for a product with the FDA, the FDA is prohibited from approving a generic version of that product until the patents expire or are challenged and overturned.14

Patent protection, and its linkage to the regulatory system, creates circumstances enabling brand-name inhaler manufacturers to limit generic competition through certain “lifecycle management” strategies. For example, manufacturers can prolong patent protection by obtaining later-expiring patents on the inhaler devices themselves, not just the medications contained within these devices.15,16 They may also receive statutory regulatory exclusivities granted by the FDA alongside patents, add new patents and regulatory exclusivities to inhalers after approval, combine old ingredients into new products, and shift active ingredients from one inhaler device to another.

The FDA’s ban on inhalers containing ozone-depleting chlorofluorocarbons (CFCs) in the mid-2000s, while protective for the environment, also created opportunities for manufacturers to pursue new tactics to preserve their exclusive rights.17 Understanding the full gamut of lifecycle management strategies employed by brand-name inhaler manufacturers is crucial if regulators and policy makers are to achieve the goal of fostering more robust generic inhaler competition, which the FDA has identified as a key priority.18

Despite substantial anecdotal evidence and individual reports on specific inhalers or classes, no study to our knowledge has systematically examined how manufacturers of brand-name inhalers have used patents and regulatory exclusivities to preserve their market dominance. We built a novel database of all patents and regulatory exclusivities granted to FDA-approved inhalers from 1986-2020 and analyzed how brand-name manufacturers used these patents in combination with regulatory exclusivities to limit generic competition.

Methods

Cohort identification

We used annual FDA Approved Drug Products with Therapeutics Equivalence Evaluations (Orange Book)19 and product labels from Drugs@FDA20 to identify inhaled drug products for asthma and COPD approved from 1986-2020. We started with products approved in 1986, because consecutive annual editions of the Orange Book were available starting that year. This meant excluding inhalers that were already on the market at the time such as early albuterol products (see Appendix Exhibit A1 for a complete list of these inhalers).21 We also excluded products delivered as nebulized solutions.

Data extraction

We obtained the FDA approval date for all inhalers from Drugs@FDA. For each year following approval, we used the Orange Book from that year to extract all recorded patents and regulatory exclusivities for the inhaler along with the dates that these patents and exclusivities expired. Regulatory exclusivities are issued by the FDA pursuant to statutory requirements, while patents are granted by the US Patent and Trademark Office (USPTO), but both function to block FDA approval of generic competitors.22 We distinguished further between regulatory exclusivities granted for new chemical entities--defined by the FDA as novel active moieties that have not been approved in other new drug applications23--and regulatory exclusivities granted for other purposes. For the sake of simplicity, the terms “regulatory exclusivity” and “exclusivity” are used interchangeably.

We used LexisNexis TotalPatent One to extract the title, abstract, claims, US application date, and US publication date for each patent. We used Google Patents to extract priority dates, which are the earliest filing dates for any member of a given patent family, including patents filed outside the US. These priority dates govern the starting point for 20-year patent terms in the US (which can be extended under unique regulations governing pharmaceutical patents). We reviewed the titles and abstracts of each patent, and when necessary the full text, to determine if the patent was filed on the device delivering the medications or other aspects of the product, such as the active ingredients, excipients, or methods of use. We divided regulatory exclusivities into those granted at the time of FDA approval (approval exclusivities) and those granted after FDA approval (post-approval exclusivities), and we divided patents into those filed before FDA approval (pre-approval patents) and those filed after FDA approval (post-approval patents). Filing dates were determined based on US applications that became issued patents. To further characterize the nature of post-approval patents, we also analyzed whether post-approval patents had priority dates occurring before or after FDA approval.

Duration of protection from direct competition

We calculated the duration of protection from direct competition by subtracting the FDA approval date for a given product from the expiration date of the last-to-expire exclusivity or patent listed in the Orange Book for that product. We distinguished between protection at the time of approval (the difference between the expiration of the last-to-expire approval exclusivity or pre-approval patent and the date of approval) and the added protection obtained after approval (the difference between the last-to-expire post-approval exclusivity or patent and the last-to-expire approval exclusivity or pre-approval patent). Authorized generic drugs, which are versions of brand-name products that are sold or licensed by the brand-name manufacturer, were not considered direct competitors for the purposes of this analysis.

Statistical analyses

All analyses were completed in STATA 16.1 (College Station, TX) and Excel 16.16.27 (Microsoft). Institutional Review Board approval was not required since this study did not include human subjects.

Limitations

For recently approved products, we may be underestimating the number of pre-approval patents (and the duration of pre-approval patent protection), because patents filed close to FDA approval may still be under review or not yet listed in the Orange Book. Similarly, because manufacturers of recently approved inhalers have had little time to add post-approval patents or regulatory exclusivities, we may be underestimating these additions and the duration of post-approval protection. We addressed this limitation by analyzing the rate at which manufacturers added patents and exclusivities following FDA approval rather than just the absolute numbers of added patents and exclusivities. Still, our analysis represents a conservative estimate of how frequently manufacturers add patents and exclusivities following FDA approval. Finally, not all patents and exclusivities prevent generic competitors from entering the market. To avoid overstating the role of patents and exclusivities in preventing generic competition, we also analyzed how often generic competitors entered the market when brand-name competitors still had active patents or exclusivities.

Results

Between 1986 and 2020, the FDA approved 62 inhalers for asthma and COPD (Appendix Exhibit A2).21 Fifty-three (85%) were brand-name products, and 9 (15%) were generics, including 7 generic albuterol inhalers and 2 generic fluticasone-salmeterol inhalers. These inhaled drugs had 4 different mechanisms of action: muscarinic antagonists, ß2-agonists, corticosteroid anti-inflammatories, and mast cell stabilizers. Prior to the study period, drugs with all 4 mechanisms had been on the US market and were available as inhalers for ß2-agonists, corticosteroids, and mast-cell stabilizers (Appendix Exhibit A1).21 The only inhaler to enter the US market during the study period with a new mechanism of action was ipratropium (Atrovent), which was approved in 1986.

With long-acting versions of inhalers and combination products containing 2 or more active ingredients, there were 10 therapeutic classes in the cohort of drugs: inhaled corticosteroids (ICS), long-acting muscarinic antagonists (LAMA), long-acting beta-agonists (LABA), ICS-LABAs, LAMA-LABAs, ICS-LAMA-LABAs, short-acting muscarinic antagonists (SAMAs), short-acting beta-agonists (SABAs), SAMA-SABAs, and mast-cell stabilizers. The 62 inhalers from these 10 therapeutic classes contained 20 different active ingredients (Exhibit 1).

Exhibit 1:

Chemical entities included in the 62 inhalers for asthma and COPD approved by the Food and Drug Administration, 1986-2020

| Ingredient | First approvala |

Brand of first approval |

Formulation of first approval |

|---|---|---|---|

| epinephrine | 07/13/1950 | Levophed | injectable |

| glycopyrrolate | 08/11/1961 | Robinul Forte | oral tablet |

| beclomethasone dipropionate | 05/12/1976 | Vanceril | metered-dose inhaler |

| albuterol sulfateb | 05/01/1981 | Proventil | metered-dose inhaler |

| flunisolide | 09/24/1981 | Nasolide | nasal spray |

| ipratropium bromide | 12/29/1986 | Atrovent | metered-dose inhaler |

| pirbuterol acetate | 12/30/1986 | MaxAir | metered-dose inhaler |

| mometasone furoate | 04/20/1987 | Elocon | topical ointment |

| fluticasone propionateb | 12/14/1990 | Cutivate | topical ointment |

| nedocromil sodium | 12/30/1992 | Tilade | metered-dose inhaler |

| salmeterol xinafoate | 02/04/1994 | Serevent | metered-dose inhaler |

| budesonide | 02/14/1994 | Rhinocort | nasal spray |

| formoterol fumarate | 02/16/2001 | Foradil | dry powder inhaler |

| tiotropium bromide monohydrate | 01/30/2004 | Spiriva Handihaler | dry powder inhaler |

| ciclesonide | 10/20/2006 | Omnaris | nasal spray |

| indacaterol maleate | 07/01/2011 | Arcapta Neohaler | dry powder inhaler |

| aclidinium bromide | 07/23/2012 | Tudorza Pressair | dry powder inhaler |

| vilanterol | 05/10/2013 | Breo Elliptac | dry powder inhaler |

| umeclidinium bromide | 12/18/2013 | Anoro Elliptad | dry powder inhaler |

| olodaterol hydrochloride | 07/31/2014 | Striverdi Respimat | metered-dose inhaler |

Source: FDA Orange Book, Drugs@FDA, authors’ analysis.

We determined the date of first approval using Drugs@FDA.

Levalbuterol tartrate, the (R)-isomer of racemic albuterol, and fluticasone furoate, a “stable ester” of fluticasone propionate, were not considered new chemical entities (NCE) by the Food and Drug Administration (FDA) and are therefore not treated as separate new active ingredients in this table.

Breo Ellipta is a combination inhaler with fluticasone and vilanterol.

Anoro Ellipta is a combination inhaler with umeclidinium and vilanterol

Regulatory exclusivities and patents at FDA approval

Seventeen brand-name inhalers (32%) received regulatory exclusivities at approval as new chemical entities. These exclusivities applied to 13 of the 20 active ingredients in the cohort (some manufacturers received exclusivities for ingredients contained in more than one inhaler). Of the 36 brand-name inhalers (68%) that did not receive exclusivities as new chemical entities at approval, 30 (57%) received other exclusivities (including exclusivities as new combinations, new products, and new dosage forms), while 6 (11%) received no exclusivities at approval.

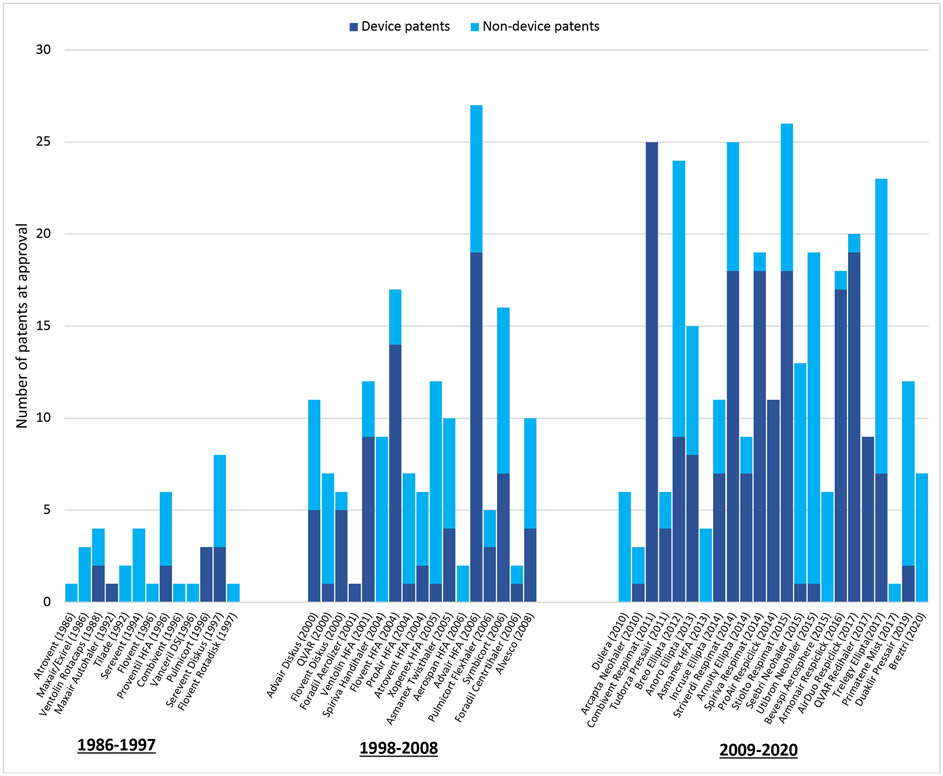

Manufacturers listed a median of 7 pre-approval patents per inhaler (interquartile range [IQR] 3-13). Patents on devices accounted for 55% of these patents (268/490). The median number of pre-approval patents per drug increased during the study period from 2 (IQR 1-4) in the first decade (1986-1997) to 8 (IQR 6-11) in the second decade (1998-2008) to 11 (IQR 6.5-19) in the final decade (2009-2020) (Exhibit 2). The median number of device patents per drug increased from 0 (IQR 0-2) in the first decade to 3 (IQR 1-5) in the second decade to 7 (IQR 1-14) in the final decade. Advair HFA (fluticasone-salmeterol) had the most pre-approval patents at 27 (including 19 device patents) followed by Stiolto Respimat (tiotropium-olodaterol) with 26 (18 device patents), Striverdi Respimat (olodaterol) with 25 (18 device patents), and Combivent Respimat (ipratropium-albuterol) with 25 (25 device patents).

Exhibit 2: Patents per inhaler at FDA approval, 1986-2020.

Source: FDA Orange Book, Drugs@FDA, authors’ analysis

This figure includes patents granted to inhalers that were filed prior to FDA approval. The median number of pre-approval patents grew from 2 per inhaler (interquartile range [IQR] 1-5) from 1986-1997 to 9 per inhaler (IQR 6-12) from 1998-2008 and 12 per inhaler (IQR 6.5-19.5) from 2009-2020.

The median duration of protection available at the time of approval was 15.4 years (IQR 11.5-17.4). There was a weak correlation between the number of pre-approval patents for a given inhaler and the total duration of pre-approval protection afforded by these patents (R2 = 0.25) (Appendix Exhibit A3).21

Post-approval exclusivities and patents

After FDA approval, manufacturers obtained 68 additional statutory exclusivities (Appendix Exhibit A4).21 These exclusivities were added at an average rate of one every 8.2 years per inhaler following inhaler approval.

Manufacturers also obtained 90 post-approval patents during the study period, or 1 every 6.2 years following inhaler approval. Seventy-seven percent of post-approval patents (69/90) had priority dates before FDA approval, while 23% (21/90) had priority dates after FDA approval. Device patents represented 73% of post-approval patents (66/90). Of the 25 inhalers that received at least one post-approval patent, 11 inhalers had post-approval patents extending the duration of patent protection; the median extension for these 11 inhalers was 7.1 years (IQR 1.8-8.2).

Total duration of protection from competition

Overall, manufacturers received a median of 16.0 years of protection (IQR 11.8-19.6) from regulatory exclusivities and patents. The last-to-expire patent was a device patent 53% of the time (28/53). Inhalers in the SABA class achieved the longest median protection after FDA approval at 19.6 years (IQR 10.0-21.4), followed by the SAMA-SABA class at 18.8 years (IQR 18.7-18.9) and the ICS-LABA class at 18.5 years (IQR 16.4-20.1).

Only 1 of the 53 brand-name products in the study sample faced interchangeable generic competition prior to the expiration of its exclusivities and patents: Teva’s ProAir HFA (albuterol), which had a 27-year period of patent protection that ended 11 years early in 2020 when a generic competitor received FDA approval despite patent listings in the Orange Book. In this case, the generic manufacturer Perrigo had reached a settlement with Teva in 2012 to delay market entry until 2016, with further delays resulting from the FDA’s rejection of Perrigo’s initial application for approval.24,25 After subtracting the 11 years that Teva lost from early generic entry, the median duration of market exclusivity for brand-name inhalers in the cohort was 15.4 years (IQR 11.7-19.2).

Recycled Patents

Patents frequently covered more than one product. The median number of times inhaler-related patents were listed in the Orange Book was 2 (IQR 1-3). In 35 cases, manufacturers listed the same patent on 4 or more products in our cohort. Twenty-six (74%) of these cases were for patents on devices, including 18 by Boehringer on its Respimat line, 4 by GSK on its Ellipta and Diskus lines, and 2 by Teva on its HFA and Respiclick/Digihaler lines. These lines each span multiple classes: Respimat (LAMA, LABA, LAMA-LABA, and SAMA-SAMA), Ellipta (ICS, LAMA, LABA, LAMA-LABA, and ICS-LAMA-LABA), Diskus (ICS, LABA, and ICS-LABA), and Respiclick/Digihaler (ICS, ICS-LABA, and SABA).

Device hopping

While drug manufacturers obtained lengthy protection on inhalers through patents and exclusivities, they obtained even longer durations of protection on the individual active ingredients contained in these inhalers through “device-hopping.” This strategy entails placing the same active ingredient into a new device with new patents and exclusivities that ensure longer protection. For example, our analysis shows that GSK received 35 years of protection from competition after FDA approval on its fluticasone inhalers through the successive release of new inhaler devices containing fluticasone: Flovent (approved in 1996), Flovent Rotadisk (1997), Flovent Diskus (2000), Flovent HFA (2004), and most recently Arnuity Ellipta (2014).

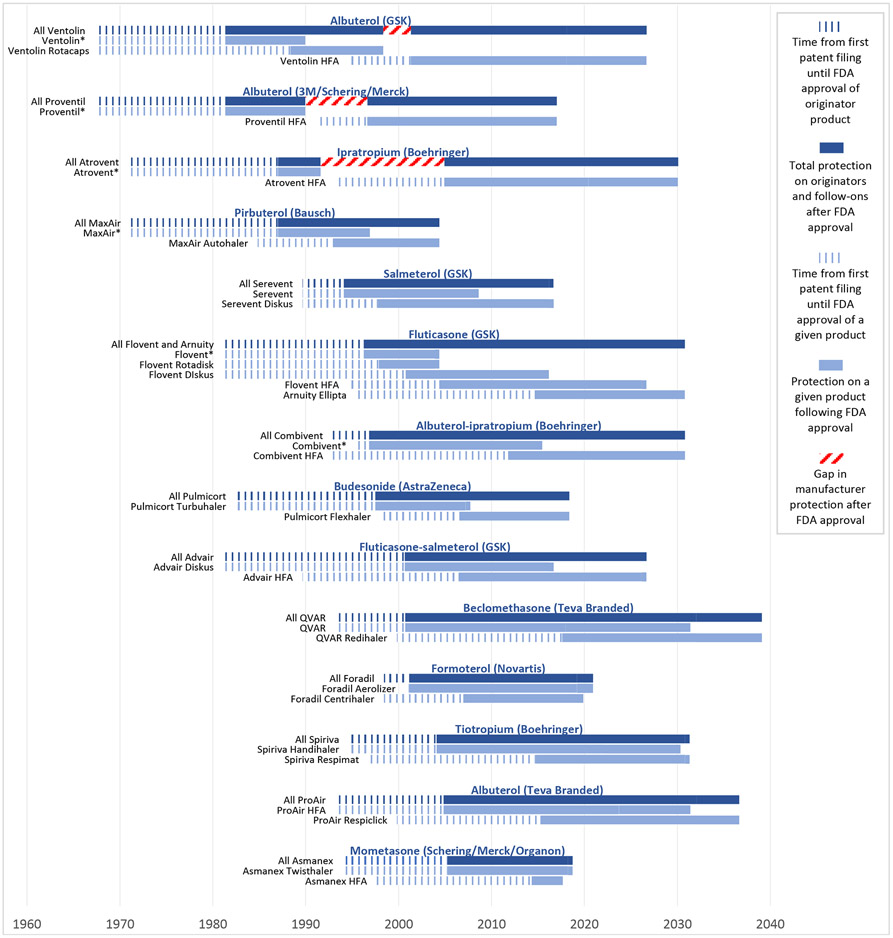

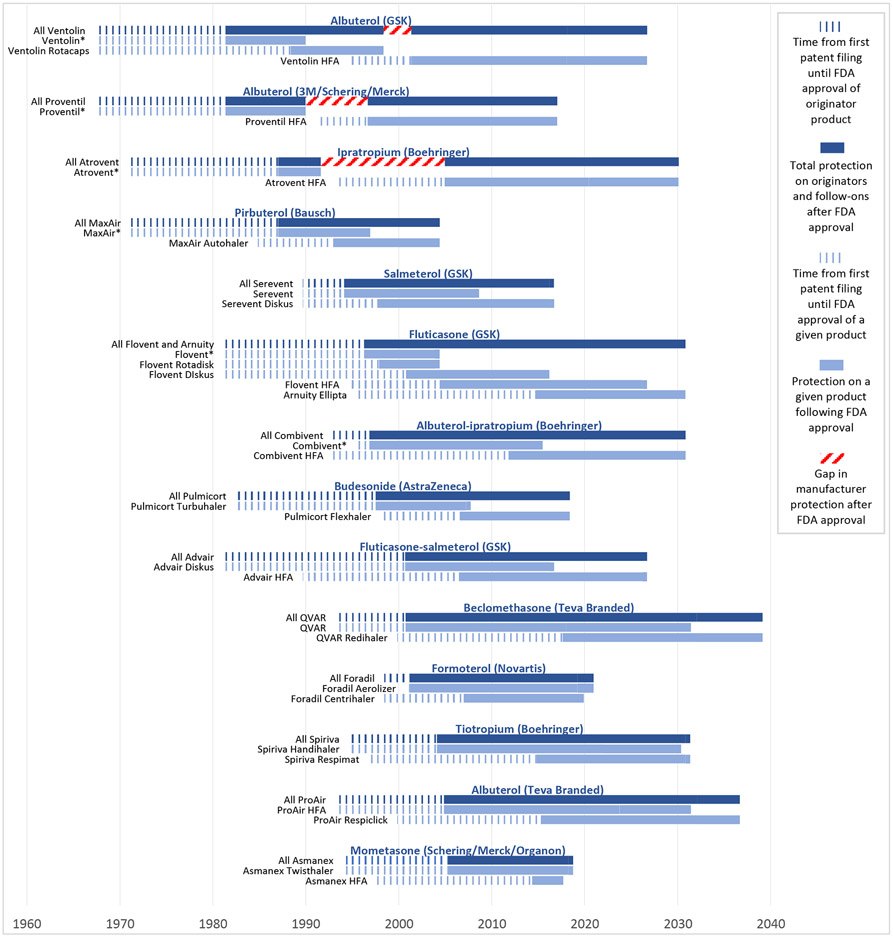

Overall, manufacturers pursued this strategy with 15 different originator inhalers, leading to 19 different follow-on brand-name products (Exhibit 3). Three originator inhalers, Primatene Mist, Ventolin, and Proventil, were approved prior to the study period; all other originator inhalers and follow-ons were approved during the study period. Seven (37%) of the 19 follow-on inhalers were HFA inhalers that replaced ozone-depleting CFC-inhalers. After excluding one product from analysis (Primatene Mist, whose originator was approved in 1967, prior to the existence of Orange Books), manufacturers received a median of 28.1 years (IQR 21.3-33.5) of protection from competition following approval of the originator product to the last-to-expire exclusivity or patent for follow-ons. This strategy can work because generic versions of a brand-name reference inhaler are only approved for a specific brand-name product (i.e., one specific drug-device combination). Thus, when brand-name manufacturers release a new version of an inhaler (with a new drug application), generic versions of the older product are not interchangeable with the new product and cannot automatically be substituted at the pharmacy for that new product.

Exhibit 3: Device hops by inhaler manufacturers.

Source: FDA Orange Book, Drugs@FDA, authors’ analysis

GSK: GlaxoSmithKline

*Denotes an inhaler containing chlorofluorocarbons (CFCs), which were removed from the market by the Food and Drug Administration beginning in the 2000s.

This figure shows how manufacturers have preserved monopolies on inhaled medications by pairing old active ingredients with new devices. The notched dark blue bars represent the time that elapsed between the first patents filed for an originator product and FDA approval of that product. The solid dark blue bars represent the time that elapsed between FDA approval of an originator product and the last-to-expire exclusivity or patent on the originator or follow-on products. This reflects the total protection that a manufacturer has obtained on inhalers with a given active ingredient (or ingredients). The notched grey bars represent the time that elapsed between the first patents filings for a given product and FDA approval of that product. The solid grey bars represent the time that elapsed between FDA approval of a given product and the last-to-expire exclusivity or patent on that product. A median of 40.3 years (IQR 33.9-45.8) elapsed between the first patent filed on originator inhalers and the last-to-expire exclusivity or patent on these inhalers or their follow-ons. Manufacturers enjoyed a median of 28.1 years (IQR 21.3-33.5) of protection on these inhalers after FDA approval of the originator.

Time from patent filing to expiration of last-to-expire patent or exclusivity

Manufacturers filed the first patents for inhalers a median of 15.1 years (IQR 9.5-16.8) before FDA approval (Appendix Exhibit A5). The median time that elapsed from the first patent-filing for a given product to expiration of the last-to-expire patent or exclusivity on that product was 29.2 years (IQR 23.3-35.4). The median time elapsed was longest for inhalers in the ICS-LABA class at 35.5 years (IQR 35.2-36.7) followed by the LAMA class at 34.6 years (IQR 32.7-35.4).

In the 14 cases of device-hopping analyzed in the previous section, the median time from first patent filing of the originator product to expiration of the last-to-expire patent in the originator or a follow-on was 40.3 years (IQR 33.9-45.8) (Exhibit 3). GSK filed a patent for its albuterol inhaler (Ventolin) in 1967 and has a follow-on albuterol inhaler with patents lasting through 2026, or 59 years after the first filing with just a 3-year gap between products. GSK filed its first patent on a fluticasone inhaler (Flovent) in 1981 and has a follow-on fluticasone inhaler with patents through 2030, or 49 years after the first filing with no gaps between products. We see similar uninterrupted strings of patents running continuously for 46 years on GSK’s fluticasone-salmeterol inhalers and Teva Branded’s beclomethasone inhalers.

Discussion

Over the past 35 years, the FDA has approved 62 inhalers for asthma and COPD across 10 therapeutic classes, but manufacturers have offered few new drug innovations. Only one inhaler contained an active ingredient with a new mechanism of action. Rather than develop new therapeutic modalities, manufacturers have instead changed the design of the devices that deliver inhaled medications and sought to preserve their market shares through regulatory exclusivities and patents, particularly on these devices, which represent more than half of all patents listed by manufacturers for inhalers in our cohort. Manufacturers recycle the same patents on multiple inhalers from different classes and have exercised market power on individual products by shifting old ingredients to new devices. The upshot is that many protected brand-name inhalers contain active ingredients that were first approved decades ago, and only 3 brand-name inhalers on the market in the US at the start of 2022 face any competition from interchangeable generics (2 brand-name albuterol inhalers and 1 brand-name fluticasone-salmeterol inhaler). Though intraclass brand-brand competition may help constrain prices, the paucity of interchangeable generic competition limits savings.

Our findings underscore how the current US regulatory system rewards incremental adjustments to older products. Some of these incremental adjustments to inhalers occurred in response to the FDA banning CFC-containing products between 2008-2013, which was strongly supported by the pharmaceutical industry.17 New inhalers using hydrofluoroalkanes (HFAs) as propellants replaced CFC-containing products and received extended periods of protection from patents and exclusivities. Perhaps the most notorious example was Boehringer’s Combivent (albuterol-ipratropium) line, which now has 34 years of patent protection stretching from the approval of the CFC-containing version in 1996 until the last-to-expire patent on the CFC-free version in 2030. Without regulatory reform, this process may well repeat itself as manufacturers develop more environmentally-friendly inhalers to replace HFA-containing products, which themselves are potent emitters of greenhouse gasses.26

While the CFC ban may have helped extend the market exclusivities obtained by brand-name manufacturers, many of the incremental adjustments to inhalers during the study period were not directly related to the ban. Approximately two-thirds of the device hops involved moves to different types of inhalers (metered-dose, dry-powder, and soft mist products) rather than moves from CFC- to HFA-containing products. Some patients may benefit from one type of inhaler device over another (based on factors including inspiratory force, dexterity, and others), but treatment guidelines tend not to favor any particular devicetypes so long as clinicians provide counselling to patients on proper technique and patients can become comfortable using the selected device.1,2,17

Apart from device hops, the small adjustments to individual products protected by patents--for example, the addition of a dose counter or digital tracking technology--may, in theory, help with adherence and improve outcomes through more effective drug administration. But a recent systematic review identified no improvements with inhaler compliance over the last 40 years, despite countless design changes to inhalers.27 Part of the problem may be inadequate education by clinicians, perhaps exacerbated by the proliferation of device-types, but poor compliance remains a challenge. More importantly, insofar as improved inhaler technology promotes desirable gains, whether related to the environment or patient outcomes, the fundamental question remains whether these gains--which in many cases seem trivially inventive, if inventive at all--warrant the multi-billion dollar rewards bestowed by the current regulatory system.

The Orange Book Transparency Act of 2021 calls on the FDA and the Government Accountability Office to elucidate and address problems that have arisen with contentious Orange Book listings, including patents on drug-device combinations.28 Our findings point to several areas of potential reform. First, brand-name manufacturers could be prohibited from listing device patents in the Orange Book.10,28 Listing patents in the Orange Book allows manufacturers to earn additional exclusivities when there is a patent challenge from a potential generic manufacturer. In addition, the FDA could prevent manufacturers from adding patents to the Orange Book after approval unless these patents protect alterations associated with real clinical benefit.10 Relatedly, the FDA could require that brand-name manufacturers seeking to list patents on new versions of drug-device combinations (e.g., a soft-mist inhaler containing active ingredients that are already sold in an HFA version) show the superiority of the new version in a clinical trial.

Second, apart from Orange Book reform, another approach recommended to undermine incentives for patent stacking would be to pass new legislation allowing manufacturers to claim only one patent or exclusivity to be honored by the FDA when approving generics (this has been called “one-and-done”).29 Such an approach would raise other complicating factors, such as whether it aligns with international trade agreements, but it would effectively thin out the expansive patent thickets that now protect brand-name drug-device combinations.

Finally, aside from such direct regulatory reforms, changes at the USPTO could help promote the quality of issued patents. Perhaps the most appealing reform would be to create a special art unit focused on pharmaceuticals.30 Under this model, a team of experienced examiners at the USPTO would review patents destined for the Orange Book to search prior art, assess patent validity, and deliberate about challenging cases. This approach may be especially valuable for drug-device combinations, which require a blend of engineering and pharmaceutical expertise for proper review.

Patents and regulatory exclusivities have been key culprits in delaying generic inhaler competition. It should be noted, however, that these are not the only culprits. The FDA imposes numerous requirements on manufacturers seeking approval of generic drug-device combinations that exceed the requirements placed on simpler oral drugs. The FDA is seeking ways to streamline the approval process of drug-device combinations, but the complexity of these products makes it difficult to establish appropriate criteria for interchangeability.18

Conclusions

Drug manufacturers have employed a variety of strategies over the past 35 years to establish thickets of regulatory exclusivities and patents on brand-name inhalers to limit generic competition. Regulatory reform is critical to ensure that the rewards bestowed on brand-name manufacturers better reflect the added clinical benefit of new products.

Supplementary Material

Exhibit 4: Device hops by inhaler manufacturers.

Source: FDA Orange Book, Drugs@FDA, authors’ analysis

GSK: GlaxoSmithKline

*Denotes an inhaler containing chlorofluorocarbons (CFCs), which were removed from the market by the Food and Drug Administration beginning in the 2000s.

This figure shows how manufacturers have preserved monopolies on inhaled medications by pairing old active ingredients with new devices. The notched dark blue bars represent the time that elapsed between the first patents filed for an originator product and FDA approval of that product. The solid dark blue bars represent the time that elapsed between FDA approval of an originator product and the last-to-expire exclusivity or patent on the originator or follow-on products. This reflects the total protection that a manufacturer has obtained on inhalers with a given active ingredient (or ingredients). The notched grey bars represent the time that elapsed between the first patents filings for a given product and FDA approval of that product. The solid grey bars represent the time that elapsed between FDA approval of a given product and the last-to-expire exclusivity or patent on that product. A median of 40.3 years (IQR 33.9-45.8) elapsed between the first patent filed on originator inhalers and the last-to-expire exclusivity or patent on these inhalers or their follow-ons. Manufacturers enjoyed a median of 28.1 years (IQR 21.3-33.5) of protection on these inhalers after FDA approval of the originator.

Funding/disclosures:

This work was funded by Arnold Ventures and a grant (NIH 5T32HL007633-35) to Dr. Feldman. Outside of this work, Dr. Feldman serves as a consultant for Alosa Health. He also consulted for Aetion and received an honorarium from Blue Cross Blue Shield of Massachusetts. Mr Bloomfield is a judicial clerk at the US Court of Appeals for the DC Circuit. This article was drafted before his clerkship and represents only his personal views. Dr. Kesselheim reports serving as an expert witness on behalf of a class of plaintiffs against Gilead related to product life-cycle management strategies for tenofovir-containing products.

References

- 1.Global Initiative for Asthma. Global Strategy for Asthma Management and Prevention (2021 Update) [Internet]. Fontana, WI; 2021. [cited 2022 Jan 29]. Available from: https://ginasthma.org/gina-reports/. [Google Scholar]

- 2.Global Initiative for Chronic Obstructive Lung Disease. Global Strategy for the Diagnosis, Management, and Prevention of Chronic Obstructive Pulmonary Disease: 2021 Report [Internet]. 2020. [cited 2022 Jan 29]. Available from: https://goldcopd.org/wp-content/uploads/2020/11/GOLD-REPORT-2021-v1.1-25Nov20_WMV.pdf.

- 3.Feldman WB, Gagne JJ, Kesselheim AS. Trends in Medicare Part D Inhaler Spending: 2012-2018. Ann Am Thorac Soc. 2021;18(3):548–550. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Sistani F, Reed RM, Shah CH, Zafari Z. Trends in Medicaid spending on inhalers in the United States, 2012-2018. J Manag Care Spec Pharm. 2021;27(12):1744–1749. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Castaldi PJ, Rogers WH, Safran DG, Wilson IB. Inhaler costs and medication nonadherence among seniors with chronic pulmonary disease. Chest. 2010;138(3):614–20. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Engelkes M, Janssens HM, de Jongste JC, Sturkenboom MC, Verhamme KM. Medication adherence and the risk of severe asthma exacerbations: a systematic review. Eur Respir J. 2015;45(2):396–407. [DOI] [PubMed] [Google Scholar]

- 7.van Boven JF, Chavannes NH, van der Molen T, Rutten-van Molken MP, Postma MJ, Vegter S. Clinical and economic impact of non-adherence in COPD: a systematic review. Respir Med. 2014;108(1):103–13. [DOI] [PubMed] [Google Scholar]

- 8.Patel MR, Press VG, Gerald LB, et al. Improving the Affordability of Prescription Medications for People with Chronic Respiratory Disease. An Official American Thoracic Society Policy Statement. Am J Respir Crit Care Med. 2018;198(11):1367–1374. [DOI] [PubMed] [Google Scholar]

- 9.US Food and Drug Administration. Combination Products [Internet]. 2021. [cited 2022 Jan 29]. Available from: https://www.fda.gov/combination-products.

- 10.Sinha M. Costly Gadgets: Barriers to Market Entry and Price Competition for Generic Drug-Device Combinations in the United States (September 15, 2021). Minnesota Journal of Law, Science & Technology. 2021;Forthcoming. [Google Scholar]

- 11.US Food and Drug Administration. FY2018 GDUFA Science and Research Report: Locally-Acting Orally Inhaled and Nasal Drug Products [Internet]. 2019. [cited 2022 Jan 29]. Available from: https://www.fda.gov/media/130621/download.

- 12.Newman B, Witzmann K. Addressing the Regulatory and Scientific Challenges with Generic Orally Inhaled Drug Products. Pharmaceut Med. 2020;34(2):93–102. [DOI] [PubMed] [Google Scholar]

- 13.US Food and Drug Administration. Human Factors Studies and Related Clinical Study Considerations in Combination Product Design and Development: Draft Guidance for Industry and FDA Staff. 2016. [cited 2022 Jan 29]. Available from: https://www.fda.gov/regulatory-information/search-fda-guidance-documents/human-factors-studies-and-related-clinical-study-considerations-combination-product-design-and.

- 14.US Food and Drug Administrastion. Patent Certifications and Suitability Petitions [Internet]. 2022. [cited 2022 Jan 29]. Available from: https://www.fda.gov/drugs/abbreviated-new-drug-application-anda/patent-certifications-and-suitability-petitions.

- 15.Beall RF, Nickerson JW, Kaplan WA, Attaran A. Is Patent "Evergreening" Restricting Access to Medicine/Device Combination Products? PLoS One. 2016;11(2):e0148939. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16.Beall RF, Kesselheim AS. Tertiary patenting on drug-device combination products in the United States. Nat Biotechnol. 2018;36(2):142–145. [DOI] [PubMed] [Google Scholar]

- 17.DeWeerdt S. The environmental concerns driving another inhaler makeover. Nature. 2020;581:S14–S17. [Google Scholar]

- 18.US Food and Drug Administration. Requesting FDA Feedback on Combination Products: Guidance for Industry and FDA Staff [Internet]. 2020. [cited 2022 Jan 29]. Available from: https://www.fda.gov/regulatory-information/search-fda-guidance-documents/requesting-fda-feedback-combination-products.

- 19.FDA Law Blog. The Orange Book Archives [Internet]. 2021. [cited 2022 Jan 29]. Available from: https://www.thefdalawblog.com/orange-book-archives/.

- 20.US Food and Drug Administration. Drugs@FDA: FDA-Approved Drugs [Internet]. 2021. [cited 2022 Jan 29]. Available from: https://www.accessdata.fda.gov/scripts/cder/daf/index.cfm.

- 21.To access the appendix, click on the Details tab of the article online.

- 22.US Food and Drug Administration. Frequently Asked Questions on Patents and Exclusivity [Internet]. 2020. [cited 2022 Jan 29]. Available from: https://www.fda.gov/drugs/development-approval-process-drugs/frequently-asked-questions-patents-and-exclusivity#What_is_the_difference_between_patents_a

- 23.US Food and Drug Administration. Code of Federal Regulations Title 21, Volume 5 (21CFR314.108) [Internet]. 2021. [cited 2022 Jan 29]. Available from: https://www.accessdata.fda.gov/scripts/cdrh/cfdocs/cfcfr/cfrsearch.cfm?fr=314.108.

- 24.Business Wire. Teva Reaches Settlement in ProAir® HFA Patent Case [Internet]. 2014. [cited 2022 Jan 29]. Available from: https://www.businesswire.com/news/home/20140620005338/en/Teva-Reaches-Settlement-in-ProAir%C2%AE-HFA-Patent-Case.

- 25.Perrigo. Perrigo and Catalent Announce FDA Approval of Perrigo's AB-Rated Generic Version of ProAir® HFA [Internet]. 202 [cited 2022 Jan 29]. Available from: https://www.perrigo.com/press-release/perrigo-and-catalent-announce-fda-approval-perrigos-ab-rated-generic-version-proairr.

- 26.Wilkinson AJK, Braggins R, Steinbach I, Smith J. Costs of switching to low global warming potential inhalers. An economic and carbon footprint analysis of NHS prescription data in England. BMJ Open. 2019;9(10):e028763. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27.Sanchis J, Gich I, Pedersen S, Aerosol Drug Management Improvement T. Systematic Review of Errors in Inhaler Use: Has Patient Technique Improved Over Time? Chest. 2016;150(2):394–406. [DOI] [PubMed] [Google Scholar]

- 28.US Food and Drug Administration. Report to Congress: The Listing of Patent Information in the Orange Book [Internet]. 2022. [cited 2022 Jan 29]. Available from: https://www.fda.gov/media/155200/download.

- 29.Feldman R. Drugs, Money, and Secret Handshakes: The Unstoppable Growth of Prescription Drug Prices. Cambridge University Press; 2019. [Google Scholar]

- 30.Tu SS, Lemley MA. What Litigators Can Teach the Patent Office About Pharmaceutical Patents [Internet]. WVU College of Law Research Paper No 2021-015. 2021. [cited 2022 Jan 29]. Available from: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3903513. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.