Abstract

Some employers are using reference-based benefit (RBB) designs, also known as “reference-based pricing,” to encourage patients to select lower-price ambulatory surgery centers instead of expensive hospital outpatient departments. This article analyzes the impact of such benefit designs for cataract removal surgery from the period 2009–13, using data on 2,347 surgical patients covered by the California Public Employees Retirement System (CalPERS), in comparison to 14,867 patients enrolled in non-CalPERS Anthem Blue Cross plans, which are not covered by RBB. After adjusting for changes in patient case-mix and other factors, the shift to RBB was associated with an increase in ambulatory surgery center use by 8.6 percentage points compared to trends among Anthem enrollees. Total employer and employee payments per procedure, after adjusting for changes in case-mix severity and market factors, declined by 19.7 percent compared with Anthem enrollees not subject to RBB. Consumer cost-sharing requirements increased for CalPERS patients who continued to use hospital outpatient departments but who were not exempted from RBB because of geographic or clinical factors. Reference-based benefits for cataract surgery saved CalPERS $1.3 million in the two years after implementation.

Changes in clinical technology and organizational capabilities permit an ever-increasing share of surgical and diagnostic procedures to be done as ambulatory rather than inpatient services. Hospitals have responded by developing outpatient departments that provide these services, but they face competition from freestanding ambulatory surgery centers. The prices for procedures provided in hospital outpatient departments are typically much higher than those charged in freestanding centers because of the hospitals’ higher costs and stronger bargaining position with insurers. Medicare reimburses hospital-based outpatient procedures at rates substantially higher than those it pays freestanding ambulatory facilities.1

The lower prices charged by freestanding ambulatory centers have stimulated interest among employers and insurers in encouraging employees and enrollees to select these facilities. Traditionally, however, consumers have been faced with insurance cost-sharing requirements that do not distinguish between facilities according to the prices charged. Surgical procedure prices exceed most patients’ annual deductibles, and copayments do not vary by choice of facility. Payers are now experimenting with novel benefit designs that reward price-conscious consumer choice—for example, by requiring lower cost sharing from patients who select a low-price ambulatory center compared to those who select a high-price hospital outpatient department. Patients who need to use a hospital outpatient department because of special clinical needs or because their home is located in a remote geographic location are exempted from the cost-sharing initiatives.

In this article we examine the effect of reference-based benefits (RBB), a new health insurance design, on consumers’ choices between hospital-based and freestanding surgical facilities. Under RBB designs, often called “reference-based pricing,” the employer makes a fixed contribution toward payment for a procedure, with the patient paying the full difference between this contribution limit and the actual price charged by the facility.2,3 We assessed the impact of RBB on consumers’ choices between an ambulatory surgical center and a hospital outpatient department for cataract surgery after adjusting for patient demographics, severity of illness, and the structure of local medical markets. We then analyzed changes in the total payments made by the employer and the employees, respectively, taking into account changes in facility choice.

Reference-Based Benefit Designs

RBB designs apply the principle of defined contribution, which traditionally has been applied to consumer choice among health insurance plans, to choice among hospitals, ambulatory facilities, and other providers that offer similar services but charge different prices. The employer or insurer establishes a contribution toward payment for each product or service, leaving the consumer to pay the difference between this contribution and the actual price charged by the provider.

RBB sometimes is used as an alternative to “narrow network” insurance designs in which the enrollee has no insurance coverage at all if using a high-price provider. It also can be combined with some versions of narrow network designs, as when the insurer imposes cost sharing for most services but exempts those obtained in a specially contracted “center of excellence,” such as a provider with a national or global reputation for treating a specific condition. The relationship between RBB, narrow networks, and centers-of-excellence contracting has been discussed elsewhere.4

Reference-based pricing is also a pharmaceutical purchasing strategy pursued by national insurers outside of the United States. These insurers base the maximum they are willing to reimburse for all drug products within one therapeutic class on the maximum price paid in another nation.5,6 In the United States, employers and insurers do not have the authority unilaterally to establish prices. Rather, they can establish benefit limits. Therefore, the term “reference-based benefits” rather than “reference-based pricing” is more appropriate for the US context.

The California Public Employees Retirement System (CalPERS) provides health insurance to 1.3 million employees of the State of California and other public entities, such as municipalities and school districts. Among the covered employees, approximately 450,000 are enrolled in the CalPERS self-insured preferred provider organization (PPO) option, managed by Anthem Blue Cross.

CalPERS originally implemented RBB for knee and hip replacement surgery. In 2009, prior to the implementation of RBB, CalPERS had been paying prices that ranged from approximately $20,000 to approximately $120,000, without evidence of quality differences.4,7 It established an RBB limit of $30,000 and initiated a communication program for its enrollees, indicating which hospitals charged prices below that limit and offered acceptable quality and geographic accessibility. In the first year after implementation, the share of orthopedic surgeries occurring in low-price hospitals increased by 21.2 percent. High-price hospitals reduced their prices by an average of 34.3 percent. CalPERS saved $2.8 million on these two orthopedic procedures, compared to what it would have spent in the absence of reference–based benefits.8

In January 2012 CalPERS extended RBB to ambulatory surgery procedures because of the wide variation in prices across hospital outpatient departments and ambulatory surgery centers. It established the reference-based limits for hospital outpatient departments on the prices charged by ambulatory centers for the same procedures and continued to pay the centers their allowed charge. (The allowed charge is the rate negotiated by the insurer with and paid to the facility. The allowed charge is not the same as the facility’s list price or charge-master price, which is rarely paid by insurers or enrollees.) Consumers who selected an ambulatory surgery center would not pay any RBB cost sharing, regardless of the price the center charged. However, consumers who selected a hospital outpatient department would pay the difference between the allowed charge of that department and the RBB limit.

This insurance design encouraged consumers to select ambulatory surgery centers instead of hospital outpatient departments because patients selecting the latter would be exposed to substantial cost sharing that did not count toward their out-of-pocket maximums. (CalPERS waived the RBB limit and paid the full hospital outpatient allowed charge if the patient’s physician indicated medical reasons for choosing a hospital outpatient department or if the patient lived in a geographic region without easy access to an ambulatory center.)

Study Data And Methods

We obtained comprehensive claims data from CalPERS for all members undergoing cataract removal surgery between January 2009 and December 2013.We chose cataract surgery to study because it is a common and nonemergency procedure that is “shoppable,” in the sense that consumers have time to assess alternative providers and travel to more distant facilities if they so choose. The data included three years of claims prior to and two years of claims post-implementation of reference-based benefits. For CalPERS, procedure volume ranged from 197 cases in 70 hospital outpatient departments and 467 cases in 104 ambulatory centers in 2009 to 108 cases in 38 hospital outpatient departments and 595 cases in 117 ambulatory centers in 2013.

The data included the allowed charge, the portion of that allowed charge paid by CalPERS, and the portion paid by the patient (through cost sharing and RBB provisions). The claims included an identifier for the facility where the procedure was performed and its ZIP code. These identifiers were used to categorize each facility as an ambulatory surgery center or hospital outpatient department and to assign to it a hospital market regional indicator, using the hospital referral regions identified by the Dartmouth Atlas of Health Care.9

We restricted the analysis to CalPERS enrollees ages 18–64 who lived in and received their procedures in California because reference-based benefits were restricted to that state. Measured characteristics of the patients included age, sex, and the diagnostic and procedure codes from all claims incurred for all purposes. These diagnostic and procedure codes were used to develop a measure of patient health status and comorbidities using the Charlson comorbidity index.10

Patients in CalPERS who were exempted from the RBB initiative were excluded from the statistical analyses because their facility selection and payments could not be influenced by the initiative; 4 percent of such patients were exempted in 2012, and 7 percent were in 2013.

To control for determinants of consumer choice and spending other than RBB, we used as a control group non-CalPERS enrollees covered by Anthem Blue Cross who underwent cataract surgery during these five years in California and were not subject to RBB. (For the sake of simplicity, we refer to the RBB arm as “CalPERS” and the non-RBB arm as “Anthem.”) The Anthem data were structured in a manner identical to the CalPERS data to facilitate comparisons. Descriptive statistics on the CalPERS and Anthem enrollees are presented in online Appendix Table 1.11 Anthem procedures ranged from 1,155 cases in 116 hospital outpatient departments and 2,798 cases in 162 ambulatory centers in 2009 to 1,015 cases in 104 outpatient departments and 3,967 cases in 186 ambulatory centers in 2013.

We analyzed trends between 2009 and 2013 for three outcome variables: the probability that a patient selected an ambulatory center instead of a hospital outpatient department; the average price per procedure, which captures the combined impact of RBB on selection of ambulatory centers and of changes in ambulatory center and hospital outpatient prices; and trends in payments by CalPERS and cost-sharing obligations for individual CalPERS enrollees. These calculations took into account the changing financial responsibility between employer and employee for patients who selected a hospital outpatient department after implementation of RBB limits but were not exempted by CalPERS from the RBB initiative.

We then conducted multivariate difference-in-differences regressions using the CalPERS and Anthem populations during the five-year period. These regression analyses included four dependent variables: the probability that the consumer selected an ambulatory center (compared to a hospital outpatient department); the average price (allowed charge) for the procedure (including patients using an ambulatory surgery center and those using a hospital outpatient department); the total CalPERS payment per procedure, taking into consideration both price and volume; and consumer cost-sharing responsibility per procedure. Covariates included year, payer (CalPERS versus Anthem), interaction terms between year and payer, the Charlson comorbidity index, patient age categories, patient sex, and geographic hospital market indicators.

Study Results

FACILITY PRICES AND CONSUMERS’ CHOICES

Exhibit 1 presents the distribution of prices charged for cataract removal surgery at hospital outpatient departments and ambulatory surgery centers in 2011, prior to implementation of RBB. Prices in the former ranged from $1,218 to $14,099, with a median of $6,546, while prices in the latter ranged from $1,009 to $8,658, with a median of $1,524. Exhibit 1 highlights differences in average prices between hospital-based and freestanding centers plus the price variability within each type of facility. It also shows the $2,000 RBB limit subsequently established by CalPERS. This contribution limit reflected approximately the seventieth percentile in the distribution of ambulatory surgery center prices. In 2011, 94 percent of hospital outpatient departments and 27 percent of ambulatory surgery centers charged prices above this contribution limit.

Exhibit 1.

Prices From Hospital Outpatient Departments And Ambulatory Surgery Centers Prior To Implementation Of Reference-Based Benefits In California, 2011

SOURCES 2011 California Public Employees Retirement System (CalPERS) and Anthem Blue Cross medical claims data for California cataract surgeries. NOTES Each dot represents one facility. The horizontal line represents the reference-based benefits contribution limit imposed by CalPERS in January 2012.

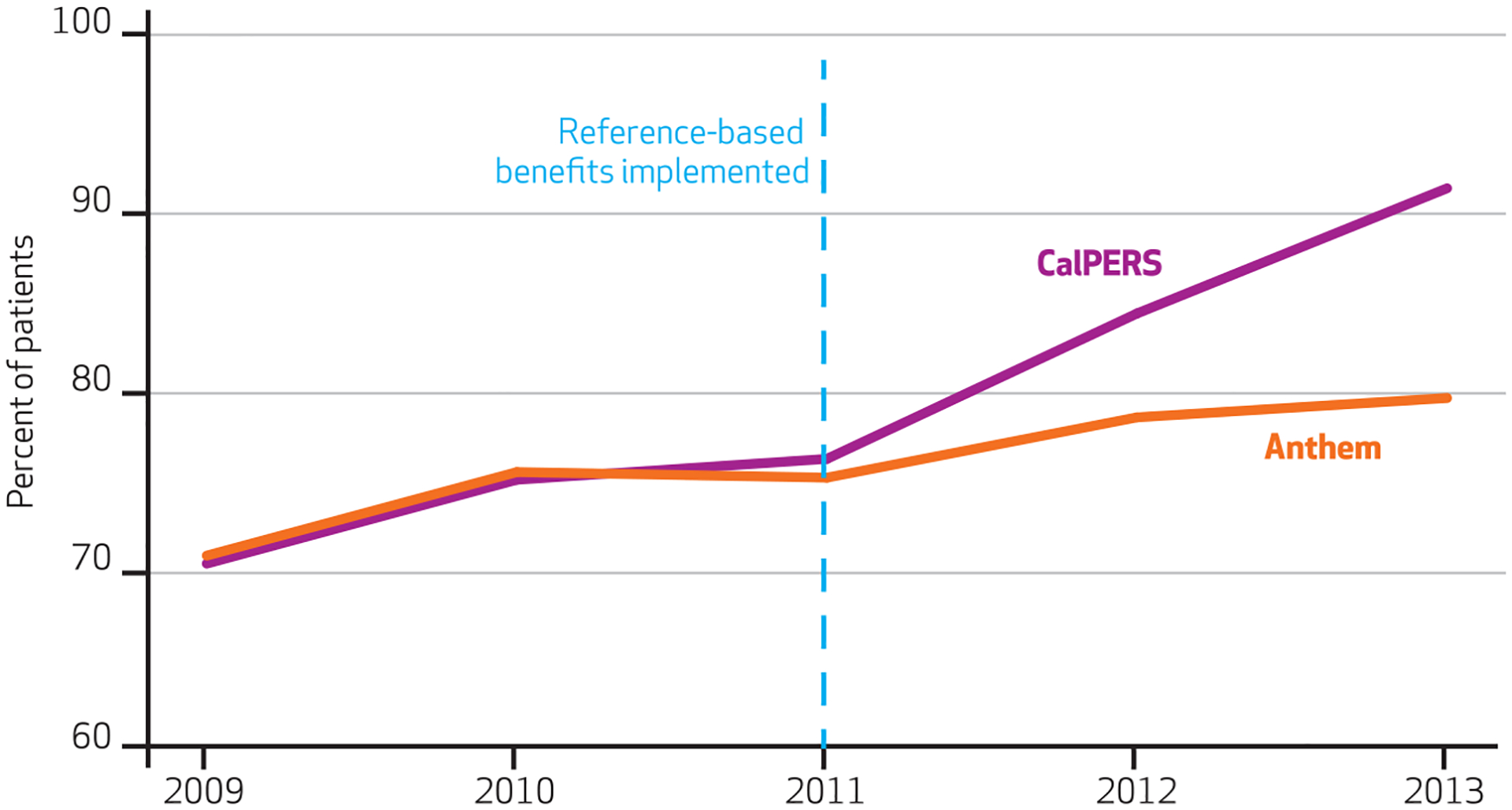

Exhibit 2 shows the trend toward greater use of ambulatory surgery centers versus hospital-based departments during the 2009–13 period. The use of ambulatory centers increased by 21.1 percentage points between 2009 and 2013 for CalPERS but only by 8.8 percentage points for Anthem, the study’s control group. By 2013, 91.4 percent of CalPERS members were using an ambulatory surgery center compared to 79.6 percent of Anthem enrollees.

Exhibit 2.

Percentage Of Patients Selecting Ambulatory Surgery Centers Over Hospital Outpatient Departments Before And After Implementation Of Reference-Based Benefits In California, 2009–13

SOURCES 2009–13 California Public Employees Retirement System (CalPERS) and Anthem Blue Cross medical claims data for California cataract surgeries.

Regression analyses of the association between RBB and ambulatory surgery center choice, controlling for age, sex, Charlson comorbidity score, and market characteristics, are presented in Appendix Table 2.11 After adjustment for these factors, the 2013 shift by CalPERS to RBB was associated with an 8.6-percentage-point increase in ambulatory center use compared to rates of use by Anthem enrollees. The regression-adjusted association between RBB and consumers’ choice of ambulatory surgery centers thus is similar in magnitude to the unadjusted association depicted in Exhibit 2.

IMPACT ON PRICES AND SPENDING

Exhibit 3 shows trends in average prices paid per cataract surgery procedure between 2009 and 2013 for CalPERS and Anthem members, respectively. These trends capture the changing relative mix of ambulatory and hospital-based utilization, with the former charging substantially lower prices. In the years prior to implementation of RBB, average prices paid by CalPERS were higher than the average prices paid by Anthem members. This was largely because many CalPERS members were located in and around Sacramento, the state capital—a region in which consolidation of hospitals has fostered high prices.12 The Anthem membership, on the other hand, was more broadly distributed across the state, with a large percentage living in the more competitive Los Angeles regional market.

Exhibit 3.

Total Payment Per Procedure Before And After Implementation Of Reference-Based Benefits In California, 2009–13

SOURCES 2009–13 California Public Employees Retirement System (CalPERS) and Anthem Blue Cross medical claims data for California cataract surgeries.

In the year following implementation of RBB, the average price paid by CalPERS declined by 10.2 percent as a result of the shift by its members to lower-price ambulatory surgery centers. Average prices charged to Anthem enrollees not subject to RBB declined only slightly because they did not shift to ambulatory surgery centers at the same rate as did CalPERS members. In 2013 the average price paid per procedure by CalPERS was 8 percent below that paid by Anthem.

Appendix Table 211 presents multivariate regression results for the association between implementation of RBB and the average prices paid, after controlling for differences over time in patient demographics, disease severity, and market location. After these factors were controlled for, the average price fell by 17.9 percent for CalPERS members in 2013 compared to Anthem enrollees. The regression-adjusted association between RBB and prices thus is larger than the unadjusted association presented in Exhibit3 (that is, RBB is found to have a stronger price-reducing effect after case-mix and market factors are controlled for).

Exhibit 4 presents trends in payments per procedure by CalPERS and Anthem plus trends in patient cost-sharing responsibilities. These figures take into account the changing use of ambulatory surgery centers and hospital outpatient facilities and the fact that a greater share of the total hospital-based payments were shifted from CalPERS to its members after 2011 if they did not meet clinical or geographic criteria for exemption.

Exhibit 4.

Financial Responsibility Before And After Implementation Of Reference-Based Benefits In California, 2009–13

SOURCES 2009–13 California Public Employees Retirement System (CalPERS) and Anthem Blue Cross medical claims data for California cataract surgeries.

In 2011, prior to the implementation of RBB limits, the average CalPERS payment per procedure was $2,751—16.6 percent higher than the $2,360 average payment by Anthem. Two years after implementation of RBB, CalPERS payments had declined by 38.5 percent. By 2013 the CalPERS payment was 25.4 percent below the Anthem rate.

Appendix Table 211 presents regression analyses of CalPERS and Anthem payments per procedure, accounting for patient and market factors in addition to the implementation of RBB. After adjustment for other factors, in 2013 CalPERS paid $1,019, which is equivalent to 45 percent less per procedure that it would have paid absent RBB. This regression-adjusted association is larger than the unadjusted association presented in Exhibit 4.

The multivariate regression analyses in Appendix Table 211 present the changes attributable to RBB in dollar as well as percentage terms, after adjustment for patient case-mix and other factors. CalPERS in 2012 paid $764 less per procedure than in 2011, prior to the RBB initiative. Payments continued to decrease in the second year after RBB implementation ($1,019 below 2011 levels). In the first two years after implementation of RBB, CalPERS saved $1.3 million on cataract surgery compared to what it would have spent in the absence of reference-based benefit design.

IMPACT ON CONSUMER FINANCIAL RESPONSIBILITY

Under RBB designs such as the one implemented by CalPERS, individual patients are responsible for two forms of cost sharing. First, they must pay the amounts owed under their traditional deductible and coinsurance provisions, limited by the annual out-of-pocket maximum. The size of these cost-sharing requirements depends on whether they select an ambulatory surgery center or hospital outpatient department. Second, patients are responsible for the difference between the RBB limit and the actual price negotiated by the hospital if they select a hospital outpatient department and are not otherwise exempted from the RBB limit as the result of clinical or geographic criteria. The difference between the RBB limit and the actual price is not subject to the annual out-of-pocket maximum.

The information in Exhibit 4 on consumers’ financial responsibility presents data on CalPERS patients using an ambulatory surgery center, those using a hospital outpatient department but exempt from the RBB initiative, and those using a hospital-based facility but not exempt from the RBB initiative. The data in the exhibit thus underestimated the impact of RBB on the group of patients targeted by the initiative—those using a hospital-based facility but not exempt from RBB limits. In contrast, Exhibit 5 presents trends in cost-sharing obligations for three distinct categories of CalPERS members, according to whether they selected an ambulatory- or hospital-based facility and, for those selecting the latter, on whether or not they were exempted from the RBB initiative. The actual amounts paid by patients vary according to their choice of facility. They also differ according to how much the patients have incurred in cost sharing for services aside from cataract surgery, given that deductible and coinsurance provisions are limited by an annual out-of-pocket payment maximum.

Exhibit 5.

Average CalPERS Consumer Cost-Sharing Responsibility In Ambulatory Surgery Centers And Hospital Outpatient Departments, 2009–13

| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

| Ambulatory surgery center | $ 517 | $ 766 | $ 529 | $ 505 | $ 587 |

| Hospital outpatient department without exemption from RBB limits | 1,024 | 1,092 | 1,045 | 4,918 | 5,681 |

| Hospital outpatient department with exemption from RBB limits | —a | —a | —a | 1,004 | 959 |

SOURCE 2009–13 California Public Employees Retirement System (CalPERS) and Anthem Blue Cross medical claims data for California cataract surgeries. NOTES RBB is reference-based benefit.

The CalPERS RBB program did not exist prior to 2012; therefore, no employees were exempted from it.

As indicated in Exhibit 5, cost-sharing obligations for CalPERS patients were much lower if they selected an ambulatory surgery center rather than a hospital outpatient department. For the three years prior to implementation of RBB, cost sharing for hospital outpatients averaged 79 percent above the obligation incurred by ambulatory surgery center patients. For patients who were exempt from the RBB limits, this difference remained unchanged in the subsequent two years. However, financial responsibilities increased substantially in 2012 and 2013 for CalPERS patients selecting a hospital outpatient department while not exempted from the RBB limits. The average patient responsibility for nonexempt hospital outpatient users increased from $1,045 in 2011 to $4,918 in 2012 and to $5,681 in 2013.

Discussion

In recent years many employers have shifted from comprehensive benefit designs to high-deductible health plans that expose employees to greater out-of-pocket expenses for routine services.13 Reference-based benefit designs extend these incentives to more expensive services such as inpatient and outpatient surgery. Implementation of RBB for pharmaceuticals in Europe has been associated with an average 11.5 percent reduction in drug prices and 14.0–52.0 percent reductions in insurer expenditures.14 In the United States, the implementation of RBB for inpatient knee and hip replacement surgery was associated with a 28.0 percent increase in market share for lower-price hospitals, an overall 20.2 percent reduction in total payments per procedure, and a reduction in spending by $6 million over two years.9

This study assessed the impact of RBB design on cataract removal surgery, where the patient faces a choice between a hospital-based outpatient department or a freestanding ambulatory surgery center. Prior to implementation of RBB in 2012, there were major price differences between the two types of facilities, as well as among the facilities themselves, as highlighted in Exhibit 1. The CalPERS initiative established a benefit limit for patients selecting a hospital outpatient department but continued to offer traditional coverage for patients who chose an ambulatory surgery facility.

It was to be expected that the RBB limit would increase the share of patients selecting an ambulatory center instead of a hospital outpatient department and consequently reduce employers’ spending on these procedures. The empirical analysis produced results consistent with this hypothesis. It was also to be expected that consumers’ financial responsibility would increase significantly for patients selecting a hospital outpatient facility after the implementation of RBB limits, unless the patients were exempted because their physician indicated a clinical reason or they lived in a rural area without access to an ambulatory center. The results were consistent with these expectations as well.

The available data do not permit insight into whether nonexempt CalPERS patients using a hospital outpatient department actually paid the cost-sharing amounts for which they became responsible after the implementation of the RBB initiative. Hospitals could waive cost sharing above the RBB limit in order not to lose patients to competing ambulatory surgery centers. It is possible that these patient responsibilities in fact were waived because hospital patients might be reluctant to pay $4,000 for cataract surgery when they could obtain the same procedure for much less money at a nearby ambulatory surgery center. If hospitals did waive the patient’s responsibility, the RBB program would have instigated de facto price competition in the market for ambulatory surgery.

It should be emphasized that RBB has only modest potential to limit the overall rate of cost growth in health care because it is most logically applied to products and procedures that are discrete and can easily be priced and compared. To date, RBB has been applied to drugs; laboratory tests; diagnostic radiology procedures; scheduled orthopedic surgery; and, now, scheduled ambulatory surgery. It is not easily applicable to conditions requiring many different services, such as diabetes, or to procedures where there is a large and unmeasured variation in case-mix severity. Paul Fronstin and Christopher Roebuck estimate that RBB could save employers 1.6 percent of annual health care costs if applied to seven surgical and radiological procedures.2 These procedures do not include ambulatory surgery, drugs, laboratory tests, or major procedures for which patients frequently travel to regional centers of excellence.

RBB design will exert sustained impacts on the use and price of health care services only if it is accompanied by complementary changes in the tools available to consumers when making choices. Consumers need price and quality information that is specific to the providers in their community as well as to their individual insurance plans. Health plans and independent data aggregators are beginning to fill this need, taking advantage of mobile health technology to bring transparency on price and quality to the patient at the time of the decision.15,16

Conclusion

Until recently, many consumers have been slow to use price data as part of their choice of providers, because they have lacked a financial incentive to do so. With the spread of high-deductible plans and reference-based benefit designs, however, consumers are increasingly facing those incentives. Together, new benefit designs and transparency tools lay the foundation for an increasingly consumer-driven health care system.

Acknowledgments

Funding was provided by the California Public Employees Retirement System (CalPERS) and the Agency for Healthcare Research and Quality (AHRQ), Grant No. R01 HS022098-01A1.

Appendix

Methods

To examine the effect of reference based benefits (RBB), we estimated three difference-in-differences regression models. The first model used facility type as the dependent variable to model the impact of CalPERS RBB program on facility choice. Facilities were categorized as an Ambulatory Surgical Center (ASC) or Hospital Outpatient Department (HOPD). Under RBB, patients are responsible for paying the difference between the reference price and the actual price for service performed at HOPDs, but all services performed at ASCs were reimbursed as usual, not being subject to the reference price.

The second model used each claim’s allowed amount, which represents the negotiated rate between Anthem and the providers, as the dependent variable to examine the impact of RBB on expenditures per claim. The third model used the portion of the service that is paid for by the insurer as the dependent variable. Allowed charges and insurer payments were converted to constant 2013 dollars and only include facility fees, because professional fees are not subject to the reference price.

Provider utilization and expenditures for CalPERS Preferred Provider Organization (PPO) enrollees were compared with Anthem Blue Cross of California (Anthem) PPO enrollees from January 2009 to December 2013. Only patients between the ages of 18–64 who resided in California and who received services within California were included in this analysis.

The independent variables include an indicator for CalPERS enrollment, the Charlson comorbidity index, gender, age (18–29, 30–39, 40–49, 50–59, 60–64), Hospital Referral Region indicators, and year indicators. The difference in the change in each outcome between CalPERS and Anthem enrollees is identified by interactions of CalPERS enrollment with each year. The 2012 and 2013 interaction terms give the effect of the RBB program on each outcome and represent the difference between CalPERS and Anthem enrollees in each year with the baseline year (2011).

To estimate changes in ASC volume, we used a linear probability model. A non-linear probit or logit model was not used in order to enable easier interpretation of the results. The mean of the dependent variable was 0.73, which is between the 0.2 and 0.8 range where the linear probability, logit, and probit models yield similar results.

The expenditure regression models used a generalized linear (GLM) model with a log-link and a gamma distribution.1 Park tests supported using a gamma distribution. The marginal effects of the interaction terms from these regressions provide the expenditure differences between CalPERS and Anthem following the initiation of RBB, expressed as either proportions or dollars. All analyses were performed using Stata 11.0 and all standard errors were clustered at the provider level and are robust to arbitrary forms of heteroscedasticity.

Results

Appendix Table 1 presents descriptive characteristics for cataract surgery procedures for CalPERS and Anthem enrollees, respectively. The first column of Appendix Table 2 presents the ASC utilization results. The coefficients CalPERS × 2013 and CalPERS × 2012, when multiplied by 100, can be interpreted as the percentage-point change in the probability of ASC utilization attributable to RBB. RBB did not lead to a statistically significant increase in the probability of ASC utilization in 2012, but there was a statistically significant 8.6 percentage point increase in 2013. Based on the mean 2011 CalPERS ASC utilization rates of 76.2%, the 2013 percentage point changes are equivalent to a 17.7% increase in the probability of ASC utilization.

Columns 2–4 of Appendix Table 2 show results from the multivariate regressions that measure changes in the average total payment per patient and average payments by the employer and employee. The coefficient CalPERS × 2013 and CalPERS × 2012 measure the effect of RBB in 2013 and 2012, respectively.1 In 2013, RBB led to a 17.9% decrease in average procedure expenditures. In 2012, the decrease was 7.4% (not statistically significant).

In absolute dollar amounts, RBB reduced average cataract surgery expenditures by $600 in 2013 and $233 (not statistically significant) in 2012. To calculate RBB’s impact on total savings, we multiplied these expenditure differences with the number of CalPERS procedures, which are shown in Appendix Table 1. Across both years, RBB reduced total spending by $598,111 ($176,381 in 2012 and $421,729 in 2013)2.

Appendix Table 1:

Cataract Surgery Descriptive Statistics

| Year | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|

| Mean price | |||||

| Anthem | $3,053 | $2,967 | $3,001 | $2,914 | $2,951 |

| CalPERS | $3,364 | $3,498 | $3,399 | $3,051 | $2,716 |

| Mean HOPD price | |||||

| Anthem | $5,660 | $6,152 | $6,218 | $6,528 | $6,291 |

| CalPERS | $6,139 | $6,479 | $6,414 | $7,045 | $7,661 |

| Mean ASC price | |||||

| Anthem | $1,977 | $1,932 | $1,937 | $1,926 | $2,097 |

| CalPERS | $2,193 | $2,506 | $2,457 | $2,311 | $2,251 |

| Mean insurer paid amount | |||||

| Anthem | $2,439 | $2,333 | $2,360 | $2,221 | $2,265 |

| CalPERS | $2,696 | $2,667 | $2,751 | $1,856 | $1,691 |

| Mean patient responsibility * | |||||

| Anthem | $614 | $634 | $640 | $693 | $686 |

| CalPERS | $668 | $848 | $652 | $1,195 | $1,025 |

| Mean Charlson score | |||||

| Anthem | 0.05 | 0.04 | 0.04 | 0.04 | 0.04 |

| CalPERS | 0.04 | 0.06 | 0.03 | 0.02 | 0.03 |

| Percent male | |||||

| Anthem | 48.14% | 46.10% | 46.30% | 45.10% | 45.00% |

| CalPERS | 43.83% | 42.21% | 37.21% | 38.87% | 34.41% |

| ASC share | |||||

| Anthem | 70.78% | 75.47% | 75.16% | 78.54% | 79.63% |

| CalPERS | 70.33% | 75.04% | 76.21% | 84.37% | 91.40% |

| Number of procedures | |||||

| Anthem | 3,953 | 4,048 | 4,166 | 4,455 | 4,982 |

| CalPERS | 664 | 661 | 723 | 723 | 651 |

| Exemptions (CalPERS ONLY) | |||||

| Number | 34 | 52 | |||

Includes patient cost-sharing and RBB non-covered amount.

Appendix Table 2:

Difference-in-differences estimates of the impact of reference based benefits on ASC utilization, allowed charges, and employer/insurer spending

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Outcomes | ASC Choice | Total Amount(%) | Total Amount($) | Employer/Insurer Amount(%) | Employer/Insurer Amount($) |

| CalPERS × 2013 | 0.0859*** | −17.92%*** | −599.9*** | −35.04%*** | −1,019*** |

| (0.0317) | (7.127) | (214.6) | (9.070) | (236.5) | |

| CalPERS × 2012 | 0.0336 | −7.382% | −233.0 | −27.62%*** | −763.7*** |

| (0.0300) | (6.001) | (179.1) | (7.798) | (199.2) | |

| CalPERS × 2010 | 0.00740 | 2.383% | 71.56 | −5.221% | −126.7 |

| (0.0254) | (5.779) | (170.7) | (6.031) | (137.8) | |

| CalPERS × 2009 | −0.0115 | −3.458% | −106.9 | −6.088% | −148.4 |

| (0.0314) | (5.678) | (168.9) | (6.196) | (143.3) | |

| CalPERS | −0.0119 | 7.867%* | 230.1* | 9.463%* | 213.7* |

| (0.0225) | (4.269) | (128.8) | (4.798) | (111.4) | |

| 2013 | 0.0504*** | −0.612% | −18.66 | −2.493% | −59.66 |

| (0.0152) | (4.067) | (121.4) | (4.581) | (107.0) | |

| 2012 | 0.0373*** | −2.943% | −90.75 | −6.486%** | −158.5** |

| (0.0123) | (2.444) | (74.20) | (2.819) | (67.49) | |

| 2010 | 0.000686 | −0.490% | −14.92 | −0.634% | −15.02 |

| (0.0110) | (2.177) | (65.57) | (2.565) | (60.02) | |

| 2009 | −0.0362** | 1.554% | 46.86 | 3.234% | 75.22 |

| (0.0163) | (3.576) | (106.4) | (4.052) | (93.07) | |

| male | 0.00807 | −1.434% | −43.89 | −3.150%* | −75.63* |

| (0.00728) | (1.422) | (43.65) | (1.769) | (42.83) | |

| charlson | −0.392*** | 72.38%*** | 1,655*** | 88.09%*** | 1,493*** |

| (0.0458) | (5.465) | (144.6) | (5.991) | (126.2) | |

| age 30–39 | 0.101** | −9.490% | −355.7 | −11.01% | −332.3 |

| (0.0499) | (9.250) | (325.7) | (10.29) | (287.9) | |

| age 40–49 | 0.0788* | −14.34%* | −537.5 | −18.71%** | −564.8* |

| (0.0463) | (9.757) | (350.5) | (11.04) | (315.9) | |

| age 50–59 | 0.119** | −20.06%** | −751.8** | −23.63%*** | −713.3** |

| (0.0468) | (9.364) | (345.6) | (10.66) | (312.0) | |

| age 60–64 | 0.119** | −19.18%** | −718.9** | −21.21%** | −640.3** |

| (0.0482) | (9.389) | (345.8) | (10.73) | (312.9) | |

| Observations | 25,026 | 25,026 | 25,026 | 25,026 | 25,026 |

| R-squared | 0.128 |

p<0.01,

p<0.05,

p<0.1. HRR fixed effects included but not presented. Column 1 uses a linear probability model to estimate the probability of receiving care at an ACO. Column 2 uses a GLM regression to estimate changes in the total cost of each procedure and reports percentage differences. Column 3 presents the absolute dollar changes from the regression results in Column 2. Columns 4 and 4 report percentage and dollar amount changes in employer and insurer payments, respectively.

References

- 1.Manning WG, Mullahy J. Estimating log models: to transform or not to transform? Journal of Health Economics 2001;20(4):461–94. [DOI] [PubMed] [Google Scholar]

The coefficients from the GLM regression with a log link were converted to percentage changes 100(exp(coefficient)-1).

The calculations are 757 × $233 (2012) and 703 × $599.9 (2013)

Contributor Information

James C. Robinson, Leonard D. Schaeffer Professor of Health Economics and director of the Berkeley Center for Health Technology, School of Public Health, at the University of California, Berkeley.

Timothy Brown, School of Public Health, University of California, Berkeley..

Christopher Whaley, University of California, Berkeley..

NOTES

- 1.Cassidy A Health policy brief: site-neutral payments [serial on the Internet]. 2014. Jul 24 [cited 2015 Jan 14]. Available from: http://www.healthaffairs.org/healthpolicybriefs/brief.php?brief_id=121

- 2.Fronstin P, Roebuck MC. Reference pricing for health care services: a new twist on the defined contribution concept in employment-based health benefits [Internet]. Washington (DC): Employee Benefit Research Institute; 2014. Apr [cited 2015 Jan 14]. Report No. 398. Available from: http://www.ebri.org/pdf/briefspdf/ebri_ib_398_apr14.refprcng.pdf [Google Scholar]

- 3.Robinson JC. How to turn employees into value shoppers for health care. Harvard Business Review [serial on the Internet]. 2013. Oct 21 [cited 2015 Jan 29]. Available from: https://hbr.org/2013/10/how-to-turn-employees-into-value-shoppers-for-health-care [Google Scholar]

- 4.Robinson JC, MacPherson K. Payers test reference pricing and centers of excellence to steer patients to low-price and high-quality providers. Health Aff (Millwood). 2012;31(9): 2028–36. [DOI] [PubMed] [Google Scholar]

- 5.Ruggeri K, Nolte E. Pharmaceutical pricing: the use of external reference pricing [Internet]. Santa Monica (CA): RAND Corporation; 2015. [cited 2015 Jan 14]. Available from: http://www.rand.org/pubs/research_reports/RR240.html [PMC free article] [PubMed] [Google Scholar]

- 6.Kaiser U, Mendez SJ, Ronde T, Ullrich H. Regulation of pharmaceutical prices: evidence from a reference price reform in Denmark. J Health Econ. 2014;36:174–87. [DOI] [PubMed] [Google Scholar]

- 7.Chi WC, Wu SJ, DeVries A. Value-based purchasing’s effect on quality and costs. (Letter to the editor). Health Aff (Millwood). 2014;33(4): 723. [DOI] [PubMed] [Google Scholar]

- 8.Robinson JC, Brown TT. Increases in consumer cost sharing redirect patient volumes and reduce hospital prices for orthopedic surgery. Health Aff (Millwood). 2013;32(8):1392–7. [DOI] [PubMed] [Google Scholar]

- 9.Dartmouth Institute for Health Policy and Clinical Practice. Dartmouth atlas of health care data by region [Internet]. Lebanon (NH): Dartmouth Institute; c2015 [cited 2015. Jan 14]. Available from: http://www.dartmouthatlas.org/data/region/ [Google Scholar]

- 10.Charlson ME, Pompei P, Ales KL, MacKenzie CR. A new method of classifying prognostic comorbidity in longitudinal studies: development and validation. J Chronic Dis. 1987; 40(5):373–83. [DOI] [PubMed] [Google Scholar]

- 11. To access the Appendix, click on the Appendix link in the box to the right of the article online.

- 12.Tu HT, Felland LE, Ginsburg PB, Liebhaber AB, Cohen GR, Kemper NM. Sacramento: powerful hospital systems dominate a stable market [Internet]. Oakland (CA): California HealthCare Foundation; 2009. Jul [cited 2015 Jan 14]. Available from: http://www.chcf.org/~/media/MEDIA%20LIBRARY%20Files/PDF/A/PDF%20AlmanacRegMktBriefSacramento09.pdf [Google Scholar]

- 13.Claxton G, Rae M, Panchal N, Damico A, Bostic N, Kenward K, et al. Employer health benefits: 2014 survey [Internet]. Menlo Park (CA): Henry J. Kaiser Family Foundation; 2014. Sep 10 [cited 2015 Jan 14]. Available from: http://kff.org/health-costs/report/2014-employer-health-benefits-survey/ [Google Scholar]

- 14.Lee JL, Fischer MA, Shrank WH, Polinski JM, Choudhry NK. A systematic review of reference pricing: implications for US prescription drug spending. Am J Manag Care. 2012;18(11):e429–37. [PubMed] [Google Scholar]

- 15.Wu SJ, Sylwestrzak G, Shah C, DeVries A. Price transparency for MRIs increased use of less costly providers and triggered provider competition. Health Aff (Millwood). 2014;33(8):1391–8. [DOI] [PubMed] [Google Scholar]

- 16.Whaley C, Schneider Chafen J, Pinkard S, Kellerman G, Bravata D, Kocher B, et al. Association between availability of health service prices and payments for these services. JAMA. 2014;312(16):1670–6. [DOI] [PubMed] [Google Scholar]