Summary:

Simply working hard is not enough to maintain a profitable clinical practice. Prompt and complete payment for services is just as critical. Revenue cycle management (RCM) tracks the payment process from patient scheduling through treatment, coding, billing, and reimbursement. Even though reimbursement rates for service codes are preset, and the service is documented, this apparently straightforward process is complicated by insurance payors, negotiated contracts, coding requirements, compliance regulators, and an ever-changing reimbursement environment. Not typically trained in RCM, physicians struggle with its demands of timeliness, accuracy, paperwork, and the constant scrutiny for underpayment or unfulfilled reimbursements. Consequently, they often relent to the pressures and simply accept the decreased reimbursements as “cost of doing business” or else relegate RCM to others on the team. In either case, they leave significant amounts of money on the table. Using published work in health care and other allied sectors, we present a systematic method to understand and improve RCM processes. It also creates a strong partnership between clinicians and their administrative counterparts. Optimizing RCM improves patient experience, reduces the time between submission of claims and payment, eliminates fraud at both the coding and patient levels, and increases cash flow, all of which create a financially stable clinical practice.

Takeaways

Question: What role does revenue cycle management (RCM) play in a clinical practice?

Findings: Well-implemented RCM, as measured by key performance indicators, offers the following benefits: It (1) improves patient experience, (2) reduces/eliminates denial of claims, (3) reduces gap between submission of claims and payment, (4) reduces administrative cost of billing and denial processing, (5) increases cash flow, (6) eliminates coding and billing fraud, (7) eliminates patient fraud, and (8) enhances compliance.

Meaning: By leveraging analytics and computing key performance indicators, RCM can help practices maintain their financial stability while delivering high-quality care.

INTRODUCTION

Managing clinical revenue should be a simple matter. However, it has become far more challenging than ever: American health care is inherently complex1; insurance payors have arduous and highly variable claims submission processes; they are quick to deny claims or underpay; and reimbursements drop every year, making every dollar earned more precious.

The revenue cycle (RevCycle), an accounting term, is a recurring set of business activities and associated information processing related to providing goods/services to customers and getting paid for these. Health care RevCycles are complex because:

Most payments come not from patients but from (large) third-party payors, so that RevCyles involve more types of activities (eg, insurance contracting of fee, service preauthorization, detailed and timely documentation, accurate billing and coding, collections, denial and claim management).

Payors, whose business models often aim to maximize their cash flow at the claimant’s (your) expense, introduce significant delays between activities.

Health care delivery is increasingly long term and delivered in steps. Therefore, a patient may be involved in multiple activities simultaneously, with older claims still unresolved as new services are provided.

Revenue cycle management (RCM) is the process of optimizing the RevCycle’s various activities to maximize revenue by improving their timeliness and accuracy, in part by improving communication between the various humans involved in each activity. Although RCM efficiency can make or break a practice, it is never formally taught in residency training,2,3 and learning RCM on-the-job is often too little, too late.

Here, we explain the basic framework of RCM, the factors affecting revenue flows and ways to manage them, and common RCM errors and mitigators. We provide a rich bibliography with readily accessible materials.

COMMON MISCONCEPTIONS ABOUT RCM

Once bills are sent, payments magically appear.

The insurers automatically receive every submitted paper claim. (Sadly, they do not: a claim may well be marked “not received,” “pending,” or even “missing”).

“RCM is the biller’s/coder’s/administrator’s job, not mine!”

Clinical productivity generates bills. Money simply follows.

Denials are an unavoidable part of clinical practice. Accept them.

Small losses are insignificant—do not pursue them.

RCM is a linear process that guarantees payment.

Once purchased, RCM software need not be reviewed. Do not ask: “What can improve the process?”

Delayed payments are OK. Line of credit will cover the loss.

These misconceptions can have disastrous consequences. Not understanding that “it’s not just the work you do, but whether (and how soon) you get paid for it” results in unrecoverable losses.

DRIVERS AFFECTING PRACTICE REVENUE

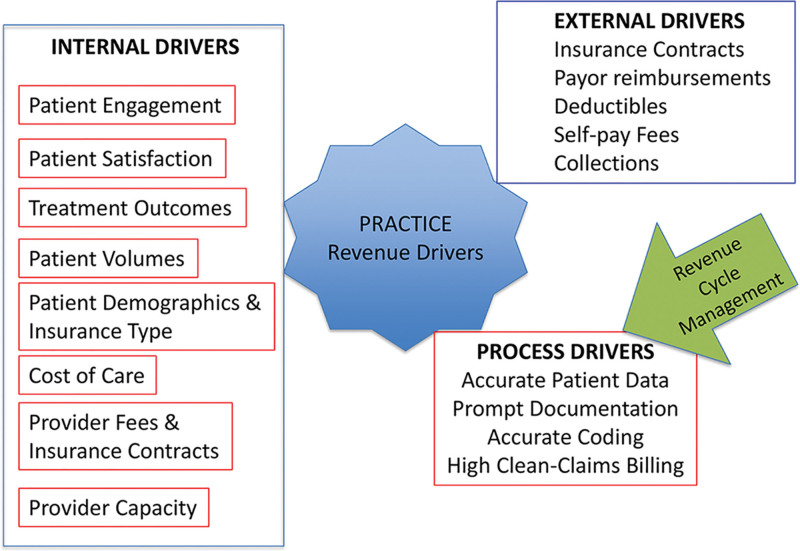

These are depicted in Figure 1.

Fig. 1.

Drivers affecting practice revenue: RCM focuses on process drivers.

Internal drivers: patient volumes, treatment outcomes, patient satisfaction, cost of care, etc;

Process drivers: (In-)efficiencies in various RevCycle activities;

External drivers: insurance contracts, payor reimbursements, etc.

Although the last driver may be beyond your control, the first two can be managed: RCM focuses specifically on process drivers.

ORGANIZATION OF THIS ARTICLE

We describe how to optimize RCM by accelerating RevCycle speed, streamlining flow of billing information, reducing denials and bad debts, and minimizing revenue leakage.

We discuss each RCM-workflow step in detail, including pros, cons, and nuances of what works and what does not.

We elucidate key performance indicators (KPIs) and their application. Monitoring these, coupled with appropriate corrective changes, can help effectively grow the bottom line.

We describe clearly defined, easily doable, scalable, and reproducible RCM solutions at each step.

EIGHT STEPS OF THE REVCYCLE

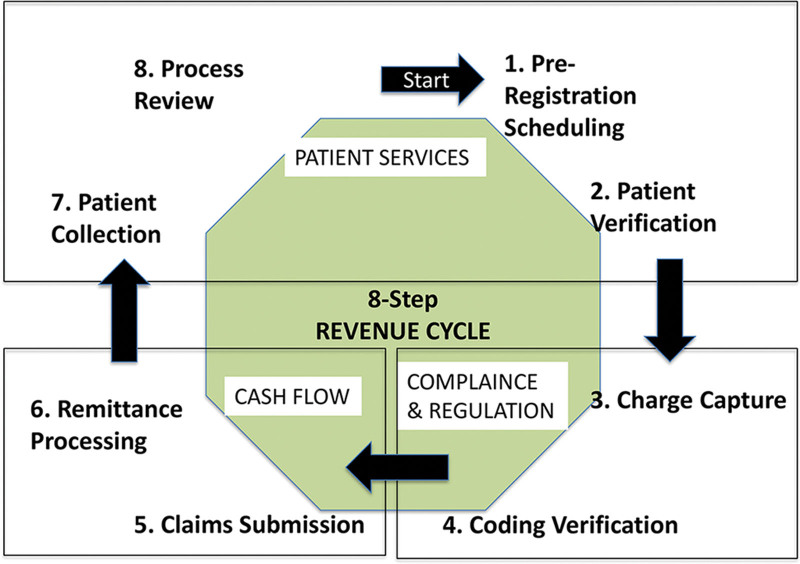

Figure 2 categorizes the steps below into three buckets, related to patient services (steps 1, 2, 7, 8), compliance (3, 4), and cash flow (5, 6).

Fig. 2.

Eight steps of the RevCycle.

Patient Preregistration

New or established patients provide demographic, medical, and insurance data via paper or electronically. It is critical to identify the following: deductibles, coverage, change in insurances (for established patients), referrals, and co-pays. Streamlining this step avoids billing delays.

Patient Data Verification

Patient data verification avoids claim rejections, delays, or denials. All collected patient-data need verification (full name; age; insurance eligibility; billing-address; and most importantly, preauthorizations). Insurers have let claims languish because of patient name misspellings rather than informing claimants about name-match failure.

Charge Capture

Starting immediately after care delivery, charge capture assembles documented patients’ visits, services provided, and facility fees, sending them to the billing department. Concurrently, patient co-pays are collected/recorded.

Coding

Prompt, accurate ICD-10 and CPT/HCPCS coding avoids billing errors and delays.

Claim Submission/Denial Resolution

Claims are sent to insurance payors. Separate claim forms are prepared for different services, using standard CMS-15004 and American Dental Association’s dental claim5 formats for outpatient/ambulatory and maxillofacial services. Scrubbing claims detect coding errors (formatting, wrong codes, and unsupported documentation).

Remittance Processing

After payors approve the claim, an explanation of benefits6 or electronic remittance advice (ERA)7 is issued, listing covered services and reasons for unpaid services. Subsequently, payments are posted. The explanation of benefits/ERA must align with the agreed payments (fee schedules) in your contract. Further, ensuring that contractual and noncontractual write-offs are defined helps resolve denials and reduces noncontractual write-offs.

Patient Collections

Collecting co-pays and the patients’ portion of the bill requires regular follow-up via automated payment reminders or email or text.

Process Review

This step, which impacts all three categories, identifies RevCycle gaps to improve operational efficiency and avoid losses.

KPIS OF RCM

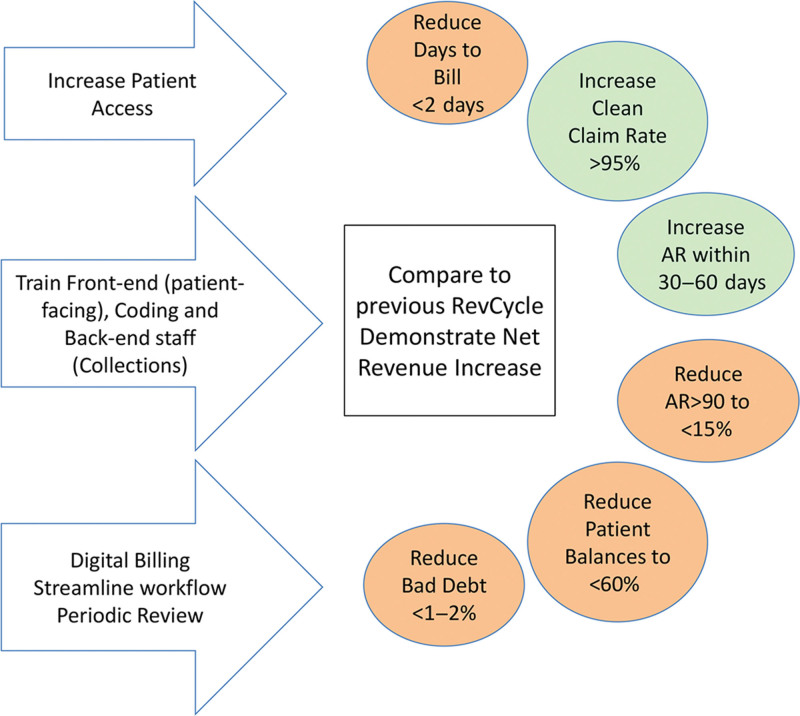

KPIs of RCM (RCM-KPIs) maintain revenue integrity (Fig. 3) and identify RCM practices with high compliance risks, bottlenecks impeding payments’ speed/rate, and factors affecting patient experience. Electronic data management greatly facilitates tracking KPIs. They fall into four groups:

Fig. 3.

KPIs of RCM (RCM-KPIs).

Data Accuracy

These RCM-KPIs ensure accurate medical coding that truly reflects patient conditions and properly documents their care. They capture information beyond DRG (diagnosis related group) codes, facilitating complete documentation. Compliance efforts closely monitor these RCM-KPIs to prevent fraudulent activity:

Medical Coding Accuracy

Coders aim for more than 95% accuracy, even higher when coding DRGs. It is critical for favorable audit results.8

First-pass Resolution Rate

The first-pass resolution rate is the percentage of claims paid on first submission, indicating overall RCM effectiveness.9

Missed Charges

Continually missed charges indicate either unrecovered reimbursement from human error/technology issues, or persistent, undisputed insurer denials.10

Code and Charge Productivity

Revenue integrity managers consistently monitor coding and billing errors to ensure correct reimbursement.11 The relevant KPIs include:

Charge Capture Lag Time

This identifies delays in charge-capture workflow, revealing problems in getting patient information to coding staff for completing documentation.12

Discharged, Not Final Billed

The number and dollar amount of discharged, not final billed charts identify workflow issues, specifically, documentation or charge-capture bottlenecks.13

Coding Productivity

The target coding productivity rate is more than 95%14; that is, less than 5% of the coding load should be stuck in a queue at any time. The obvious solution, adding coders, may prove ineffective if faulty process or technology is the root cause.

Revenue Reconciliation

Four KPIs help gather insights on revenue reconciliation:

Denial Volume

Claim denial costs hospitals roughly $262 billion per year, creating significant cash-flow issues.15 To avoid lost revenue, analysts look at denial percentages and the dollar amounts from denied claims. Denial rates are typically 5%–10%, which can improve after automating workflows.16

Denial Appeal Rate

This is the ratio of total number of denials appealed to the total volume of denials. A high ratio is ideal: a low ratio suggests opportunities for automatic write-offs or adjustments.

Days in Receivables Outstanding

Days in receivables outstanding tracks the average number of days it takes to collect payments. Aim for a days in receivables outstanding of 30 days or less to collect all payments due.

Underpayment Recoveries

Providers fail to collect 2%–5% of net patient revenue, due in part to inefficient RCM, or the frustration of disputing the claims.17 Certain insurers are so notorious for attempts to wear down claimants that many practices and hospitals have stopped accepting them.

Cost and Cash Flow

The relevant KPIs include:

Patient or Payors Volume Trend

Lower payors volume trend indicates problems in patient-related RCM processes: scheduling, less operative availability, provider absences/inefficiencies, lower referrals, higher no-shows, and cancellations. Payors too might cancel their agreement with you or direct patients to other providers, resulting in smaller volumes. Close monitoring to identify gaps and root causes helps correct declining payors volume trends.

Lag: Days to Bill/Charge

Benchmark should be 2 days or less, Days to bill/charge delays are caused by:

Late or missing dictation/documentation/reports (op notes, pathology/radiology reports, implant information).

Unaddressed coding queries, co-signatures, or edits.

Overwhelmed or undertrained billing personnel.

Clerical delays.

Mitigators

Prompt documentation (<24 hours delay). Incentives and penalties may help.

Track and obtain missing documents.

Identify bottlenecks, including billing team productivity, clean claim submission percentage, tracking of held cases, and charge entry accuracy.

Address billing team deficiencies promptly.

Days to Pay

Benchmarks vary by payor—private insurance: 12-20 days; Medicare: 18-30 days; Bureau of Workers’ Compensation: 55-75 days. Delays are due in part to:

Billing errors; wrong demographic data.

Missing/incomplete documentation.

Paper versus electronic bill submissions. (Paper always takes longer, giving the payor “haven’t received it” or “takes time to process” excuses to delay.)

Mitigators

Accurate demographic data gathering and verification for coverage, etc.

Accurate billing.

Crosscheck all entries before claim submissions.

Verify that the claims submitted have indeed been received and processed.

Set up reminders to check on all claims within 21 days from submission.

Days in Accounts Receivable

Higher days in accounts receivable (AR) typically indicates claim submission errors, delayed appeals for denials, secondary insurances, and delayed workers’ compensation settlements.

Auditing types of insurance payors with higher DIAs and identifying recurring patterns helps address them directly. Typically, days in AR is stable or decreasing, when patient volumes are consistent. An increase in days in AR (without corresponding patient volume increase) reveals gaps in the RCM that need addressing.

AR > 90 days

The benchmark for AR is that less than 15% of claims must be more than 90 days. AR more than 90 days is due to:

Claim-submission errors,

Inefficient/delayed appeals for denials, and

Delayed insurance processing.

Solutions Include

21-day tracking,

Identifying missing documents early and submitting promptly within 48 hours, and

Processing denials immediately, addressing all incomplete materials (eg, implant details, pathology reports).

Claim Denial Rate

Benchmark: 5%–10%. This rate increases with errors in demographic data/coding/documentation/billing data, leading to an error in claims submission. Occasionally, missed implant invoices or unclear pre-authorization, or procedures billed on “medical necessity” may be denied.

Mitigators

Identify denials specific to ICD-11, seek reasons, and review whether these cases need to be referred away.

If denials are based on missed or denied pre-authorization, identify clear actionable reasons.

If billing CPT varies from preauthorized CPT, either seek to update this information before claims submission, or clearly justify the discrepancy, giving solid reasons.18

If the code changed and authorization was required, address it immediately. Some payors will only change an authorization up to 14 days past the date of service. If the change is not completed during the 14-day period, the payor will likely issue a permanent denial.

Ensure all providers are on board. All medical necessity denials require provider education, to avoid losses. Check all claims before submission; verify coverage and completion of the claims submitted.

If all else fails, follow the path for the right to appeal a health plan decision.19

Net Collection Rate

Net collection rate is defined as the percentage of expected revenue collected within bills more than 120 days; benchmark is more than 95%.20 Low numbers suggest that the AR team is failing to focus on older AR and represents a potential follow-up opportunity.16

Clean Claims Ratio

Clean claim rate is the proportion of claims that do not require edits before submission—calculated by dividing the number of claims passing all edits without manual intervention by the total number of claims accepted into a claims processing tool for billing. Benchmark is 95% or more. Lower values must trigger an evaluation for the claim denials, to identify mitigators.21

Analyze claims by rejection code or denial; if they are noncovered services, evaluate alternative codes.

If denials are related to incomplete information, create practice-wide awareness to explain the cost of unclean claims, with detailed feedback.

Use coding audits, eligibility checking, and demographic edits to help ensure efficiency.

Monitor CCRs monthly, provide feedback to staff, celebrate improvements, and analyze results.

Bad Debt

This is the percentage of claims that are written off. Mitigators:

Identify typical cases that result in bad debt;

Then, create a standard flowchart including codes, preauthorization, etc. that are hard stops before these cases are even scheduled.

BEST PRACTICES FOR REVENUE CYCLE EFFICIENCY

Best practices target reduction of denials and resubmissions, reducing waste and providing significant savings. Reliable RevCycle software solutions save time and money with easy-to-use approaches that do not alter current workflow.22 They eliminate cumbersome paper billing, reduce revenue leakage, and improve documentation quality.

Select the right practice management system for your needs.

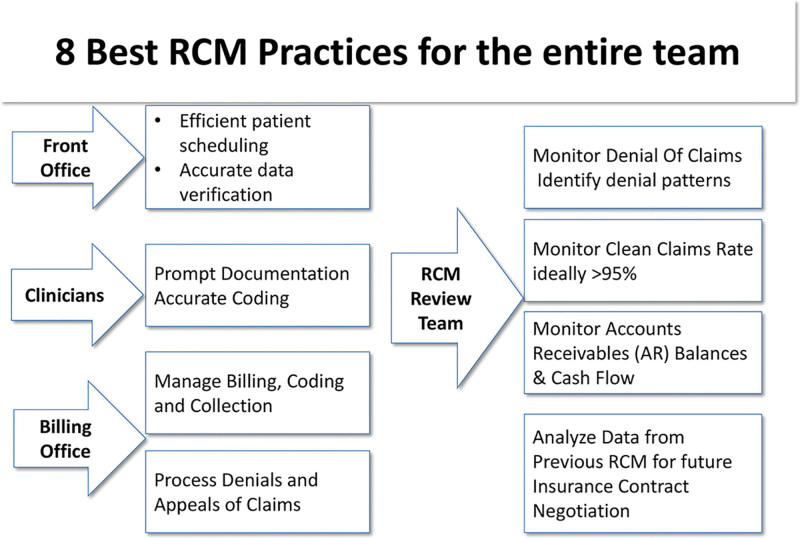

Assign best-practice tasks to the RCM team (Fig. 4).

Verify insurance eligibility electronically before every patient appointment.23

Reduce prior authorization burdens through electronic transactions.24

Submit claims electronically to save time and money.25

Leverage ERA to simplify processing of payment information.

Review electronic payment options and make an informed choice for your practice.28

Use the KPIs well: Knowing RCM-KPIs trends will help clinical practices achieve meaningful, lasting improvements that impact short- and long-term financial stability and profitability.

Fig. 4.

Best-practice tasks of the RCM team yield significant benefits.

COMMON AND AVOIDABLE RCM MISTAKES

Errors in Patient Registration, Data Verification, and Pre-authorization

To avoid this frequent mistake:

Crosscheck data before a procedure. A comprehensive checklist that includes all completed documentation, patient payment receipts, implant details log/invoice, patient identification, insurance identification, and insurance verification and authorization.

If out-of-network, get written approvals and pre-negotiate the reimbursements for the procedure, implants and inpatient stay (if needed), and facility fee before surgery.

Coding Errors

Coding errors are the second commonest cause for denials.

Coding depends on complete, timely documentation (including pathology/radiology reports and implant details) and an up-to-date coding mechanism.

Not coding at the highest level, missing payable implant/supply codes, undercoding bilateral procedures, missing modifiers, and unbundling elicit denials.

Inefficient Processing of Denials

Many payors capitalize on most physicians, who are untrained in the often frustrating appeals process, being too busy/unwilling to dispute reimbursements at lower than the negotiated rate, or even complete claim denial forms.29

Leaving the fight has long-term consequences:

Losses add up, affecting the bottom line; unaddressed underpayment, especially by contracted insurance carriers, become the norm.30

Future renegotiation of contracts undercuts your payment in the future.

Some payors “test the waters” and routinely underpay, counting on the provider “letting the money go.”

A robust mechanism of appeals exists: physicians and patients must proactively address these shenanigans.31

Insurance Contracting

Financially favorable contract negotiation maintains financial viability of the practice and keen attention must be devoted to this aspect of RCM.32

Enlist newer procedures that your practice performs, account for supplies and implants, and verify the rates of both Medicare and private insurances.

Most importantly, cross check every bill submitted and paid with the negotiated fee, so that money is not left unrecovered.33

Understanding Inherent Insurance-based Differences

RCM processes and reimbursement rates vary sharply between commercial insurers and Medicare Fee-For-Service Program. Commercial insurers try to renegotiate lower prices by excluding/reducing scope of services, increasing cost sharing for patients, and/or making adjustments to plans. Medicare Fee-For-Service pays are set administratively through laws and regulations, and providers can either take them or leave them. Incorporating these differences for the very same CPT code is essential to ensure prompt and full payment.

Managing Patient Contribution to RCM

Increasingly, since patients bear higher financial responsibility for procedures, practices are left to collect directly from patients (pre- and postoperatively). Incorporating the following RCM measures34 may help:

Two to three weeks preoperatively, provide patient-specific estimates defining their part of the fees clearly, and a solid payment plan if needed.

Create and adhere to a strict policy of upfront collections to avoid bad debts.

RCM Purchase Indecision: In-house versus Outsource

In practices too small to support a solid RCM, outsourcing works better than a poorly run in-house system. To help make this decision, simply invite an RCM vendor to assess your current RCM. Typically, they will estimate current lost revenues and propose fees to run your RCM. If projected gains exceed outsourcing fees, hiring a professional RCM team is the better decision.

Ignoring Supply Billing and Collections

Plastic surgical services frequently use implants, biologics, intraoperative medications, and dermal regenerative templates that may/may not be covered by payors.35 To ensure payment:

Create a checklist that defines the contracted insurance payment, obtains preapprovals, and posts a charge entry that balances the cost.36

Verify that your negotiated contract has a threshold requirement that defines the use of implants in aggregate or individually.

Verify if the supplies are reimbursed at cost or only a percentage—because that will determine the mark-up in the billing.

Lastly make sure the codes reflect the insurance requirements [HCPCS or generic codes (eg, L8699)]37 before claim submission.

Disregarding Key RCM Indicators

Ignoring RCM-KP is financially disastrous, akin to ignoring one’s own health metrics.

CONCLUSIONS

Well-implemented RCM has the following benefits. It:

Improves patient experience,

Reduces/eliminates denial of claims,

Reduces gap between submission of claims and payment,

Reduces administrative cost of billing and denial processing,

Increases cash flow,

Eliminates coding and billing fraud,

Eliminates patient fraud, and

Enhances compliance.

By leveraging analytics and computing KPIs, RCM can help practices maintain their financial stability while delivering high-quality care.

DISCLOSURE

The authors have no financial interest to declare in relation to the content of this article.

Footnotes

Published online 2 July 2024.

Disclosure statements are at the end of this article, following the correspondence information.

REFERENCES

- 1.Braithwaite J. Changing how we think about healthcare improvement. BrMed J. 2018;361:k2014. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Jaqua B, Robinson S, Linkugel A, et al. National resident discussions of the transitions in: medical education and the UME-GME-CME continuum. J Grad Med Educ. 2022;14:733–739. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Mullikin A, Ramkalawan J, Thomason T, et al. Augmenting our training paradigm: formalizing business education during plastic surgery residency. Paper presented at: ACAPS 2023 Winter Meeting; 2023; New Orleans, La. [Google Scholar]

- 4.Centers for Medicare & Medicaid Services. CMS 1500: health insurance claim form. Available at https://www.cms.gov/Medicare/CMS-Forms/CMS-Forms/CMS-Forms-Items/CMS1188854. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 5.American Dental Association. ADA dental claim form. Available at https://www.ada.org/publications/cdt/ada-dental-claim-form. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 6.Centers for Medicare & Medicaid Services. How to read an explanation of benefits (EOB). Available at https://www.cms.gov/medical-bill-rights/help/guides/explanation-of-benefits. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 7.American Medical Association. Electronic remittance advice. Available at https://www.ama-assn.org/topics/electronic-remittance-advice. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 8.Relias Corporation. Healthcare revenue cycle KPIs you should monitor. Available at https://www.relias.com/blog/healthcare-revenue-cycle-kpis-you-should-monitor. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 9.Revcycle Intelligence. Breaking down the top 5 healthcare revenue cycle KPIs. Available at https://revcycleintelligence.com/news/breaking-down-the-top-5-healthcare-revenue-cycle-kpis. Published November 14, 2023. Accessed December 11, 2023. [Google Scholar]

- 10.Business Integrity Services. Common medical billing errors. Available at https://www.businessintegrityservices.com/blog/common-medical-billing-errors. Published October 10, 2021. Accessed December 11, 2023. [Google Scholar]

- 11.Medical Billing and Coding. 3.07: Potential billing problems and returned claims. Available at https://www.medicalbillingandcoding.org/potential-billing-problems-returned-claims/. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 12.PMD Corporation. Charge lag & reconciliation: the bottom line! Available at https://www.pmd.com/news/charge-lag-reconciliation-the-bottom-line. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 13.Coney-McCann D. Cracking the code: mastering DNFB management for a streamlined and profitable healthcare system. Available at https://www.linkedin.com/pulse/cracking-code-mastering-dnfb-management-streamlined-dalilia. Published July 10, 2023. Accessed December 11, 2023. [Google Scholar]

- 14.American Academy of Professional Coders. 10 tips for refining your coding productivity and efficiency. Available at https://www.aapc.com/blog/52376-10-tips-for-refining-your-coding-productivity-and-efficiency/. Published December 1, 2020. Accessed December 11, 2023. [Google Scholar]

- 15.Advantum Health. The cost of denial management in hospital RCM. Available at https://advantumhealth.com/the-cost-of-denial-management-in-hospital-rcm/. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 16.Poland L, Harihara S. Claims denials: a step-by-step approach to resolution. J AHIMA. Available at https://journal.ahima.org/page/claims-denials-a-step-by-step-approach-to-resolution. Published April 25, 2022. Accessed December 11, 2023. [Google Scholar]

- 17.Becker’s Hospital Review. Underpayment recovery and its impact on your bottom line. Available at https://go.beckershospitalreview.com/finance/underpayment-recovery-and-its-impact-on-your-bottom-line. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 18.Brooks E, Giap F, Cassidy V, et al. Strategic operational redesign improves prior authorization access: a validation study. Int J Part Ther. 2023;10:65–72. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Healthcare.gov. How to appeal and insurance company decision. Available at https://www.healthcare.gov/appeal-insurance-company-decision/. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 20.Arias A. Collection rate in medical billing: understanding your practice’s most important metric. NCG Medical. Available at https://education.ncgmedical.com/blog/net-collection-rate-understanding-your-practices-most-important-metric. Published February 26, 2021. Accessed December 11, 2023. [Google Scholar]

- 21.Medical Group Management Association. You might be losing thousands of dollars per month in “unclean” claims. Available at https://www.mgma.com/articles/you-might-be-losing-thousands-of-dollars-per-month-in-unclean-claims. Published February 1, 2024. Accessed December 11, 2023. [PubMed] [Google Scholar]

- 22.JKS Outsourcing. 7 best practices for revenue cycle management. Available at https://www.linkedin.com/pulse/7-best-practices-revenue-cycle-management-jensen-kobain-solutions. Published September 4, 2023. Accessed December 11, 2023. [Google Scholar]

- 23.Freedman M. How to verify patient healthcare insurance. Available at https://www.businessnewsdaily.com/16499-insurance-verification.html. Published January 16, 2024. Accessed March 29, 2024. [Google Scholar]

- 24.LaPointe J. 3 Strategies to minimize the burden of prior authorizations. Available at https://revcycleintelligence.com/news/3-strategies-to-minimize-the-burden-of-prior-authorizations. Published October 08, 2018. Accessed December 11, 2023. [Google Scholar]

- 25.American Medical Association. Electronic transaction toolkits for administrative simplification. Available at https://www.ama-assn.org/practice-management/claims-processing/electronic-transaction-toolkits-administrative-simplification. Updated October 20, 2023. Accessed December 11, 2023. [Google Scholar]

- 26.Medicare.gov. Check the status of a claim. Available at https://www.medicare.gov/claims-appeals/check-the-status-of-a-claim. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 27.Simple Practice. Checking a claim status: the different phases of an insurance claim. Available at https://support.simplepractice.com/hc/en-us/articles/207622986-Checking-a-claim-status-The-different-phases-of-an-insurance-claim. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 28.American Medical Association Ed Hub. Revenue cycle management: streamline and automate your practice revenue cycle. Available at https://edhub.ama-assn.org/steps-forward/module/2702603. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 29.Medicalbillersandcoders.com. Writing off outstanding receivables as bad debt? Available at https://www.medicalbillersandcoders.com/article/efficient-claims-denials-workflow.html. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 30.Clarity MD. Underpaid claims in healthcare: what providers need to know. Available at https://www.mdclarity.com/blog/underpaid-claims-healthcare. Published February 6, 2023. Accessed December 11, 2023. [Google Scholar]

- 31.Henry TA. Patients, doctors sue to hold Cigna accountable for underpayments. American Medical Association. Available at https://www.ama-assn.org/delivering-care/patient-support-advocacy/patients-doctors-sue-hold-cigna-accountable-underpayments. Published September 28, 2022. Accessed December 11, 2023. [Google Scholar]

- 32.American Medical Association. Private practice tooklit: payor contracting 101. Available at https://www.ama-assn.org/system/files/payor-contracting-toolkit.pdf. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 33.Cave N. Ask an expert part 2: billed amounts versus allowed amounts. Signe Spine & Rehab. Available at https://www.signespine.com/blog/ask-an-expert-part-2-billed-amounts-versus-allowed-amounts. Accessed December 11, 2023. [Google Scholar]

- 34.Greenway Health. Revenue cycle management best practices guide. Available at https://www.greenwayhealth.com/sites/default/files/files/2018-03/Medical-Billing-Best-Practices-eBook-012016.pdf. Published January 2023. Accessed December 11, 2023. [Google Scholar]

- 35.Health Resources & Services Administration. Health center program compliance manual chapter 16: billing and collections. Available at https://bphc.hrsa.gov/compliance/compliance-manual/chapter16. Updated August 2018. Accessed December 11, 2023. [Google Scholar]

- 36.American Hospital Association. The financial stability of America’s hospitals and health systems is at risk as the costs of caring continue to rise. Available at https://www.aha.org/costsofcaring. Updated April 2023. Accessed December 11, 2023. [Google Scholar]

- 37.American Academy of Professional Coders. HCPCS code for prosthetic implant, not otherwise specified. L8699. Available at https://www.aapc.com/codes/hcpcs-codes/L8699. Published January 2023. Accessed December 11, 2023. [Google Scholar]