Abstract

Higgins and colleagues’ recently-completed randomized controlled trial and pooled data with 4 related trials of smoking cessation in pregnant women in Vermont (USA) showed that abstinence-contingent financial incentives (FI) increased abstinence over control conditions from early pregnancy through 24-weeks postpartum. Control conditions were best practices (BP) alone in the recent trial and payments provided independent of smoking status (noncontingently) in the others. This paper reports economic analyses of abstinence-contingent FI. Merging trial results with maternal and infant healthcare costs from all Vermont Medicaid deliveries in 2019, we computed incremental cost-effectiveness ratios (ICERs) for quality-adjusted life years (QALYs) and compared them to established thresholds. The healthcare sector cost (±standard error) of adding FI to BP averaged $634.76±$531.61 per participant. Based on this trial, the increased probability per BP+FI participant of smoking abstinence at 24-weeks postpartum was 3.17%, the cost per additional abstinent woman was $20,043, the incremental health gain was 0.0270±0.0412 QALYs, the ICER was $23,511/QALY gained, and the probabilities that BP+FI was very cost-effective (ICER≤$65,910) and cost-effective (ICER≤$100,000) were 67.9% and 71.0%, respectively. Based on the pooled trials, the corresponding values were even more favorable--8.89%, $7,138, 0.0758±0.0178 QALYs, $8,371/QALY, 98.6% and 99.3%, respectively. Each dollar invested in abstinence-contingent FI over control smoking-cessation programs yielded $4.20 in economic benefits in the recent trial and $11.90 in the pooled trials (very favorable benefit-cost ratios). Medicaid and commercial insurers may wish to consider covering financial incentives for smoking abstinence as a cost-effective service for pregnant beneficiaries who smoke.

TRIAL REGISTRATION: ClinicalTrials.gov identifier: NCT02210832.

Keywords: cigarette smoking, pregnancy, quality-adjusted life year, QALY, smoking cessation, financial incentives, contingency management, birth outcomes, cost-effectiveness, benefit cost analysis, sudden unexplained infant death, postpartum, infant, tobacco

Introduction

Smoking during pregnancy is the leading preventable cause of poor pregnancy outcomes in developed countries, increasing risk for catastrophic pregnancy complications, preterm birth, intrauterine growth restriction and small for gestational age (SGA)1 birth, sudden unexpected infant death (SUID), and latter-in-life metabolic diseases (Anderson et al., 2019; Cnattingius, 2004; Gould et al., 2020; Higgins et al., 2020; US Department of Health and Human Services, 2020). Efficacious cessation treatments for pregnant women are available but quit rates are typically low (<15%), especially among socioeconomically disadvantaged women (Higgins & Solomon, 2016). Usual care for smoking cessation in the US typically entails referral to a tobacco quitline; best practice involves coupling such referrals with clinical follow-up and further referrals for women who continue smoking (Centers for Disease Control and Prevention, 2014).

In a recent published secondary analysis of pooled data from a series of five randomized effectiveness trials that all tested essentially the same financial incentives (FI) model for smoking cessation among pregnant women, Higgins et al. (2022) provide strong evidence that their FI approach increases smoking abstinence in pregnant and recently postpartum women approximately fourfold compared with usual care. The pooled sample in Higgins et al. (2022) was created by combining 284 pregnant women from four prior controlled trials examining the efficacy of voucher-based FI for smoking cessation (Heil et al., 2008; Higgins et al., 2004; Higgins et al., 2014; Higgins, 2012) with 169 pregnant women randomized in their recent trial comparing best practices (BP) plus FI to BP only (BP+FI vs. BP). Assignment to treatment conditions was fully randomized in three of those four trials while the fourth was a pilot study in which participants were initially assigned sequentially before moving to random assignment later in the trial. All trials enrolled participants from referring Obstetrics/Gynecology clinics and Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) offices in Burlington, Vermont (USA) and surrounding communities.

In the recent BP+FI vs. BP trial, participants averaged 25–26 years of age. Most had completed ≤12 years of education and were non-Latino White race/ethnicity. BP+FI showed consistent improvements in the rate of smoking abstinence over BP alone through 48-weeks postpartum, with statistical significance through 12-weeks postpartum, the period during which incentives remained in effect. The adjusted odds ratios (AOR) for smoking abstinence in BP+FI versus in BP during early and late pregnancy were 9.97 (95%CI: 3.32–29.93) and 5.61 (95%CI: 2.37–13.28), respectively, and at 12-, 24- and 48-weeks postpartum were 2.46 (95%CI: 1.05–5.75), 1.31 (95%CI: 0.54–3.17), and 1.33 (95%CI: 0.55–3.25), respectively. In the pooled trials, the corresponding AORs of early- and late-pregnancy abstinence were 10.96 (95%CI: 5.80–20.71) and 6.20 (95%CI: 3.60–10.67), respectively, while the AOR for abstinence at 12- and 24-weeks postpartum were 3.02 (95%CI: 1.86–6.02) and 2.47 (95%CI: 1.32–4.63), respectively. Postpartum assessments were not conducted beyond 24 weeks in prior trials.

Despite the importance of assisting pregnant women to quit smoking, there have been few economic evaluations of such programs. We found one systematic review that summarized results of eight studies in the US (Ruger & Emmons, 2008). Those studies were based on combinations of in-person, telephone, and written information and counseling. Noting “significant net positive economic benefits,” the review concluded: “In summary, prenatal smoking cessation offers both health and economic benefits for women, infants, providers and society.” Four of the studies reported benefit-cost analyses comparing the economic value of improvements in both morbidity and mortality from an intervention to its net costs to the healthcare system (net program costs less expected savings in subsequent medical costs) (Glick et al., 2015). Results are often expressed as a benefit-cost ratio (benefits divided by costs), where both benefits and costs are expressed in monetary terms. A ratio of 1.0 is neutral. The greater the benefit-cost ratio relative to 1.0, the more favorable the intervention. All four of these studies reported favorable ratios, ranging from 2.0 to 6.6.

We are aware of only one prior economic evaluation of FI to increase smoking cessation among pregnant women. Boyd et al. (2016) conducted an economic analysis of a 2013 randomized controlled trial of FI in Glasgow, Scotland. In the Glasgow study, participants were randomized either to usual care plus FI or to usual care only, in which participants were offered of in-person counseling. The intervention group received usual care plus FI worth up to $668 for setting a quit date, attending an initial counseling session, and having three negative breath carbon-monoxide tests. The intervention arm, incentivizing both participation in counseling and abstinence, achieved an antepartum absolute difference percent (ADP, the difference in smoking prevalence between the intervention and control arms), of 13.9 percentage points.

The economic analysis, which did not consider the cost of testing as part of the intervention cost and incorporated only limited adjustment for potential smoking relapse after the termination of incentives, calculated a cost of $282 per participant, $20.23 per ADP (percentage point) at the end of pregnancy, and $865 per quality adjusted life year (QALY). It found the FI intervention “highly cost-effective.”

In this study, we estimated the incremental cost-effectiveness ratio (ICER) and benefit-cost ratio of FI for smoking abstinence in Vermont. We used effectiveness data from the most recent trial and pooled trials (Higgins et al., 2022) and obtained cost data from the most recent trial. With analyses from Vermont Medicaid on the public costs of infants born SGA, we estimated savings to Medicaid associated with reductions in the chances of SGA births when women quit smoking prior to their third trimester. Our results provide some of the most comprehensive information to date about the cost and economic value of FI among pregnant women in the US.

Methods

Study Conditions

In all trials, the intervention condition entailed FI provided contingent on biochemically verified abstinence and no abstinence-contingent FI for controls. Conditions in the BP+FI vs. BP trial are fully described in Higgins et al. (2022) and summarized briefly here. Following study enrollment, all trial participants assigned to BP were encouraged to choose a quit date within the subsequent two weeks. Once a quit date was selected, staff faxed a signed referral to the Vermont quitline, which offered up to five brief phone calls with a quit coach antepartum and four postpartum visits and counseling. Procedures followed the brochure “Need Help Putting Out That Cigarette?” (National Partnership for Smoke Free Families, 2008).

Women assigned to the BP+FI condition received the same BP intervention combined with a voucher-based FI program available from antepartum quit date through 12-weeks postpartum. Clients were asked to select a Monday as their quit date and to attend their clinic or be met by a staff member at an alternate site for the initial 5 days of the cessation effort. Monitoring continued, although less frequently (twice a week for the next 7 weeks, weekly for 4 weeks, and then biweekly), until delivery. Following delivery, monitoring reverted to weekly for 4 weeks, followed by every other week through 12-weeks postpartum, when abstinence monitoring ended for BP+FI. Vouchers redeemable for retail items were earned contingent on biochemical verification based on carbon monoxide specimens during the initial 5 days, and urine cotinine specimens thereafter. Heavier smokers at enrollment received higher incentive payments but the same frequency (Table 1). The BP+FI vs. BP trial began enrollment in Jan. 2014 and completed the last 12-month follow up in Jan. 2020; neither it nor prior trials were affected by the COVID-19 pandemic.

Table 1.

Financial Incentives for scheduled biochemical verifications of abstinence based on average cigarettes per day (CPD) at enrollmenta

| Item | <10 CPD | ≥10 CPD |

|---|---|---|

|

| ||

| Incentive per abstinent visit | ||

| Intake | $6.25 | $12.50 |

| Escalation per successive negative specimen | $1.25 | $2.50 |

| Maximum | $45.00 | $90.00 |

| Potential maximum per participantb | ||

| All antenatal visits (up to 32 weeks) | $865.00 | $1,730.00 |

| All postpartum visits (up to 12 weeks) | $360.00 | $720.00 |

| All visits | $1,225.00 | $2,450.00 |

| Actual values per participantc | ||

| Mean | $467.70 | $560.34 |

| Standard error of the mean | $68.21 | $146.84 |

In addition to these financial incentives (FI), under best practices (BP), each participant in both BP and BP+FI arms was offered up to 5 antepartum and 4-postpartum brief telephone calls with the quitline coach and received $65 for each completed call. These payments were not dependent on abstinence. All amounts are in 2020 US dollars.

Maximums were lower for participants enrolling later in pregnancy or at early postpartum.

For all participants, the average and standard error are $510.02 and $76.27, respectively.

In the four prior trials, the control was a noncontingent condition wherein vouchers of comparable monetary value to the average given in the intervention condition were provided to women independent of their own smoking status. This control condition kept the average amount of material resources provided to women in the intervention and control conditions comparable. The key difference was that women in the intervention condition received vouchers only if they were biochemically confirmed to have abstained from recent smoking (i.e., contingently), while women in the control condition received vouchers independent of recent smoking (i.e., noncontingently). All participants in these five trials gave written informed consent.

Intervention Costs

Intervention costs included all resources used for clinical purposes (labor, testing and office supplies, clinic space, overhead, and transportation). A micro-costing approach was used to estimate intervention costs per visit and per study participant in the BP+FI vs. BP trial sample (N=169) using cost data drawn from various sources. Intervention costs included all resources used for clinical purposes (labor, testing and office supplies, clinic space, overhead, and transportation). Societal costs included clinic costs plus participants’ travel costs (based on distance) and the value of participants’ time (valued at $20/hour, see Supplement). Table 2 lists the breakdown of cost categories and the corresponding data sources. Clinic intervention staff time for a research assistant and a registered nurse was expensed based on corresponding occupation-specific earnings per hour multiplied by the amount of time allocated to various clinical activities. The cost per hour was based on the mean hourly pay within occupation the US for 2020 multiplied by 1.54 to account for the University of Vermont’s fringe benefits expense and then by 1.26 to incorporate administrative and other university “off campus” overhead costs. These were associated with use of campus resources (e.g., administration and the maintenance staff). An adapted version of the Brief Drug Abuse Treatment Cost Analysis Program (Brief DATCAP) (French et al., 2010; French et al., 2004), an instrument for tallying costs of behavioral health programs, was used for BP+FI vs BP participants (Table 2).

Table 2.

Data Input Categories and Sources

| Activity | Data Source and Explanation |

|---|---|

|

| |

| Costs of Clinical Tasks | |

| Prepare for visit | Clinic staff estimated average time spent preparing for each visit. Time estimate multiplied by labor cost per hour (see text and supplement). |

| Brief counseling | Time recorded on DATCAP and valued using labor cost per hour (see text) |

| Deliver smoking- contingent voucher incentive | Time recorded on DATCAP and valued using labor cost per hour (see text) |

| Purchase client vouchers | Time recorded on DATCAP and valued using labor cost per hour (see text) |

| Drive to/from off-site visits | Time recorded on DATCAP and valued using labor cost per hour (see text) |

| Follow-up after missed appointments | Clinic staff estimated average time spent per week. Converted to average time per visit using client visits per week in each group. Time spent multiplied by labor cost per hour (see text and supplement). |

| Urine processing, review results, disposal | Clinic staff estimated average time spent per visit. Time spent multiplied by labor cost per hour (see text). |

| Purcard verification | Staff members verified voucher purchases made for clients on University Purcards: credit cards used in this study to purchase retailer credits for clients awarded financial incentives. Clinic staff estimated average time spent per week on the verifications. Results were converted to average time per visit using visits per week. Time per visit was multiplied by labor cost per hour (see text). |

| Record mileage | Clinic staff estimated average time spent per week. Results were converted to average time per visit using visits per week. Time spent was multiplied by labor cost per hour (see text). |

| Complete required training | Clinic staff estimated annual training time. Converted to average time spent per visit using total study months and total visits over the timespan of the study. |

| Costs of Other Inputs | |

| Voucher Spending Amounts | Recorded on Purcard invoices and abstracted to study database |

| Supplies | |

| Office supplies | Study receipts |

| Urinalysis supplies | Study receipts Lease cost/sq. ft. for clinical office space multiplied by workspace area (299 |

| Clinic Workspace | sq. ft.) multiplied by fraction of time used for study and then apportioned to participants based on time spent in visits |

| Office Cubicle (desk, chair, divider walls) | Total purchase cost of $750 was amortized over 20 years at a 3% rate per year and apportioned to the study timeframe based on the duration of the study and then divided by number of participants |

| Clinic Staff Vehicle Use | $0.57 per mile times number of miles (University rate) |

| Client Transportation & Time Costs | |

| Transportation | Total transportation cost for bus/taxi and care recorded on DATCAP (see text) |

| Travel time | Time recorded on DATCAP and valued using a travel cost per hour (Verbooy et al., 2018). |

| Intervention Benefits | |

| Medicaid Cost Offsets | Reduction in rate of infants small for gestational age (SGA) times difference in Medicaid payments for delivery, newborn, and first year of life for infant SGA versus not SGA |

| ADP (Absolute Difference in Percent) | Excel calculation based on abstinence in control and adjusted odds ratio for abstinence (intervention versus control) at 24 weeks postpartum |

| Mother’s QALY Gain | Using Stapleton & West (2012), Table 2 for 48 weeks since quit date, interpolate entry corresponding to 3% discount rate and ADP. |

| Infant’s QALY Gain | Multiply lives saved based on improvement in abstinence at end of pregnancy times infant’s discounted life expectancy at birth. |

| Economic Benefits | Mother’s plus infant’s QALY gains times value per QALY ($100,000) |

We modeled the budgetary savings and societal benefits using data from the BP+FI vs. BP trial on the timing of quits and on infants born SGA coupled with Medicaid claims and matched birth record data on offspring born to Vermont residents in 2019 and national estimates of the value of a year of life in the US (Neumann et al., 2014; see Supplement). We converted amounts to constant 2020 dollars using the Producer Price Index (US BLS, 2021) and the Consumer Price Index (FRED, 2021). While cost data were not collected for the previous trials, similarities in the population, setting, and general approach suggest that net costs were comparable in the prior trials.

Healthcare Savings.

We hypothesized that the FI intervention might result in lower average Medicaid costs (i.e., budgetary savings) via its impact on SGA births (Anderson et al., 2019; Cnattingius, 2004; Gould et al., 2020; Higgins et al., 2020; US Department of Health and Human Services, 2020). We combined BP+FI vs. BP trial estimates of the FI intervention effect on the probability of an SGA birth with estimates of the mean excess Medicaid costs associated with infants born SGA versus non-SGA from delivery through the end of the first year of life to obtain an estimate of the average Medicaid savings per participant associated with the FI intervention (see Supplement). The cost savings estimates were obtained via a collaboration with the Vermont Department of Health, which analyzed Vermont Medicaid claims data and matched birth record data for all matched live singleton deliveries in Vermont in 2020 (excluding births to women with opioid use disorders). SGA indicators were obtained from matched birth records. Medicaid costs for infants born SGA ($17,961) averaged $8,973 higher than for those born not-SGA ($8,988). The BP+FI intervention was associated with a 38.75% reduction in the probability of an SGA birth compared to BP (10.81% versus 17.65%, respectively). Medicaid covered 40.75% of the 5,083 mother-infant pairs (Vermont Department of Health and Agency of Human Services, 2021) in the pooled trials and is a representative source of cost data for the population of women who smoke during pregnancy.

Cost-Effectiveness and Benefit-Cost Analyses

Using Microsoft Excel, we converted the control and AOR from the BP+FI vs. BP and pooled trials into the ADP between intervention and control groups and then derived the mother’s gains in discounted life years (and confidence bounds) using the two-piece normal distribution (Wallis, 2014) and Stapleton & West (2012). This approach kept methods comparable to the lifetime cost-effectiveness modeling in Boyd et al. (2016). Higgins et al. (2020) quantified how improved smoking abstinence lowered the risk of sudden and unexplained infant death (SUID). We then converted life years gained to QALY gains and summed the mother’s and infant’s benefits (Anderson et al., 2019; Higgins et al., 2020; see Supplement).

Consistent with recommended guidelines (Drummond et al., 2005; Neumann et al., 2017), we calculated net costs from health systems and societal perspectives. We also calculated an intervention perspective, which combined client transportation and travel time with the health system perspective. We calculated the incremental cost per quitter at 24-weeks postpartum (about one year after their quit date), which was available for the BP+FI vs. BP and pooled trials, stable from 24- to 48-weeks postpartum in the BP+FI vs. BP trial and aligned with the 1-year ICER table in Stapleton & West (2012). We then estimated the ICERs by dividing the incremental cost of incentives compared to the estimated increase in QALYs per participant, i.e.

| (1) |

We addressed uncertainty using a cost-effectiveness acceptability curve (CEAC) to indicate the likelihood that the FI intervention was cost-effective compared with controls at alternative thresholds (Marseille et al., 2015). If the ICER was at or below the US per capita Gross National Income (GNI), the intervention was considered “very cost-effective” based the criteria developed by a commission under the World Health Organization (Marseille et al., 2015). In 2019 (the latest year available) the numerical value was $65,910 (World Bank, 2021). The other threshold was $100,000 per QALY, suggested by leading health economists (Neumann et al., 2014) and used in the recent cost-effectiveness analysis of a cancer screening and treatment program (Criss et al., 2019; Young & Hopkins, 2020).

To conduct the benefit-cost analysis of FI, we valued each QALY at the $100,000 threshold. We calculated the 95% confidence interval on the benefit-cost ratio based on the uncertainty in the trials’ cost and effectiveness.

Results

Intervention Costs

The BP+FI and BP interventions cost an estimated $1,486.26 and $124.93 per participant, respectively (Table 3). These costs consist of clinic costs ($1,440.33 and $111.58, respectively) and participant transportation and time costs ($45.93 and $13.36, respectively). The major components of clinic costs for BP+FI costs were labor ($591.69), voucher spending ($510.01), and clinic workspace ($241.65). The mean difference in intervention costs between arms (i.e., $1,486.26 - $124.93, the intervention cost attributable to FI) was $1,361.33. This intervention cost was offset by an estimated Medicaid savings of $693.99 per participant (95%CI: -$383.46 to $1,771.44), primarily due to lower expected healthcare expenses during the first year of life among infants born SGA ($17,960±$5,236) versus not-SGA ($8,988±$715). From an economic perspective, the net incremental cost of BP+FI intervention compared to the BP intervention was $667.34 per participant (95%CI: -$428.10 to $1,762.77) (see Supplement). The probability that the BP+FI intervention was cost saving compared to BP was 12.5%.

Table 3.

Estimates of the Economic Costs of BP+FI compared to BP ($ in 2020 dollars)

| BP+FI |

BP Only |

Cost Differences: BP+FI versus BP Only |

||||||

|---|---|---|---|---|---|---|---|---|

| Costs | Cost Per Visit ($)a | Cost Per Participant ($) | Standard Error | Cost Per Visit ($)a | Cost Per Participant ($) | Standard Error | Cost Per Participant ($) | Standard Error |

|

| ||||||||

| A. Clinic Costs | $95.24 | $1,440.33 | $99.17 | $38.84 | $111.58 | $1.20 | $1,328.75 | $100.68 |

| Labor | $39.12 | $591.69 | $57.93 | $20.53 | $59.02 | $0.93 | $532.67 | $58.81 |

| Prepare for visit | $9.38 | $141.88 | $13.89 | $8.91 | $25.61 | $0.40 | $116.27 | $14.10 |

| Brief counseling | $1.81 | $27.33 | $2.68 | $9.28 | $26.68 | $0.42 | $0.64 | $2.72 |

| Deliver smoking-contingent voucher incentive | $10.89 | $164.65 | $16.12 | $0.00 | $0.00 | $0.00 | $164.65 | $16.37 |

| Follow-up after missed appointments | $1.15 | $17.45 | $1.71 | $0.00 | $0.00 | $0.00 | $17.45 | $1.73 |

| Urine processing, review results, disposal | $1.09 | $16.42 | $1.61 | $0.00 | $0.00 | $0.00 | $16.42 | $1.63 |

| Purcard verification | $0.38 | $5.73 | $0.56 | $0.00 | $0.00 | $0.00 | $5.73 | $0.57 |

| Purchase vouchers | $2.63 | $39.71 | $3.89 | $0.00 | $0.00 | $0.00 | $39.71 | $3.95 |

| Drive to/from off-site visits | $6.40 | $96.73 | $9.47 | $1.33 | $3.81 | $0.06 | $92.92 | $9.61 |

| Record mileage | $3.69 | $55.78 | $5.46 | $0.69 | $1.99 | $0.03 | $53.79 | $5.54 |

| Complete required training | $1.72 | $26.01 | $2.55 | $0.32 | $0.93 | $0.01 | $25.08 | $2.58 |

| Vouchers amount spent | $33.72 | $510.01 | $76.27 | $0.00 | $0.00 | $0.00 | $510.01 | $76.60 |

| Supplies | $4.48 | $67.75 | $9.69 | $0.00 | $0.00 | $0.00 | $67.75 | $9.83 |

| Office supplies | $0.89 | $13.41 | $1.92 | $0.00 | $0.00 | $0.00 | $13.41 | $1.95 |

| Urinalysis supplies | $3.59 | $54.34 | $7.77 | $0.00 | $0.00 | $0.00 | $54.34 | $7.89 |

| Clinic workspace | $15.98 | $241.65 | $23.66 | $16.90 | $48.59 | $0.76 | $193.06 | $24.02 |

| Office cubicle (desk, chair, divider walls) | $0.03 | $0.39 | $0.04 | $0.03 | $0.08 | $0.00 | $0.31 | $0.04 |

| Clinic staff vehicle use | $1.93 | $29.22 | $2.86 | $1.38 | $3.96 | $0.00 | $25.26 | $2.90 |

| B. Medicaid cost (delivery, newborn, first year) | $1,426.04 | $21,566.68 | $1,281.00 | $7,742.84 | $22,260.67 | $1,594.23 | −$693.99 | $521.99 |

| C. Healthcare costs (A+B) | $1,521.28 | $23,007.01 | $1,284.83 | $7,781.68 | $22,372.25 | $1,594.23 | $634.76 | $531.61 |

| D. Client transportation & time costsc | $3.04 | $45.93 | $5.96 | $4.65 | $13.36 | $1.56 | $32.57 | $3.63 |

| Transportation | $1.35 | $20.48 | $3.74 | $2.57 | $7.40 | $1.15 | $13.08 | $2.77 |

| Travel time | $1.68 | $25.45 | $3.55 | $2.07 | $5.96 | $0.55 | $19.49 | $2.54 |

| E. Total Economic Intervention Cost (C+D) | $1,524.32 | $23,052.94 | $1,287.40 | $7,786.32 | $22,385.60 | $1,595.18 | $667.34 | $558.89 |

Cost per visit is based on an average of 15.12 visits per participant in the BP+FI condition and 2.88 visits per participant in the BP condition;

Confidence intervals were constructed using the normal distribution.

Travel time is valued at $20/hour; see Verbooy et al 2018.

Cost-Effectiveness ICERs

The added healthcare sector cost per participant (±standard error) for BP+FI vs. BP of $634.76±$531.61 was used in the numerator of the ICER. The estimated incremental cost of the incentive interventions per quit (incremental participant who remained abstinent until at least 24-weeks postpartum, approximately 1-year post quit date) was $20,043 (i.e., $634.76/3.17%) in the BP+FI vs. BP trial and $7,138 in the pooled trials (i.e., $634.76/8.89%). The estimated incremental costs of the incentive interventions per percentage point improvement in smoking abstinence at the 24-week postpartum assessment were thus $200.43 (i.e., $20,043 × 1%) and $71.38 (i.e., $7,138 × 1%) in the BP+FI vs. BP and pooled trials, respectively.

In the BP+FI vs. BP trial, the ADP at 24 weeks postpartum was 3.17 percentage points (95%CI: −5.16 to 18.23). In the pooled trials, this ADP was 8.89 percentage points (95%CI: 2.09 to 19.25). The estimated net health gain per participant was 0.0270±0.0412 QALYs in the BP+FI vs. BP trial and 0.0758±0.0373 QALYs in the pooled trials. As the central ICER values for both the BP+FI vs. BP ($23,511) and pooled ($8,371) trials are substantially below the US per capita GNI of $65,910 (World Bank, 2021) BP+FI is “very cost-effective” (Marseille et al., 2015). As it is below the commonly used U.S. threshold of $100,000/QALY (Criss et al., 2019; Neumann et al., 2014; Young & Hopkins, 2020), it is economically favorable (Table 4).

Table 4.

Results of economic evaluation (amounts per participant, 2020 USD)

| Row | Component | BP+FI vs. FI | Pooled trials | Formula |

|---|---|---|---|---|

|

| ||||

| (1) Net ealthcare costs | $634.76 | $634.76 | ||

| (2) Total QALY gain | 0.0267 | 0.0755 | ||

| (3) ICER ($/QALY) | $23,511 | $8,371 | (1) / (3) | |

| (4) GNI per capita | $65,910 | $65,910 | ||

| (5) Percentage of GNI per capita | 36% | 13% | (3 / (4) | |

| (7) Economic value of a life year | $100,000 | $100,000 | ||

| (8) Economic benefits | $2,667 | $7,551 | (2) x (7) | |

| (9) Benefit-cost ratio | 4.20 | 11.90 | (8) / (1) | |

Notes: ICER denotes incremental cost-effectiveness ratio

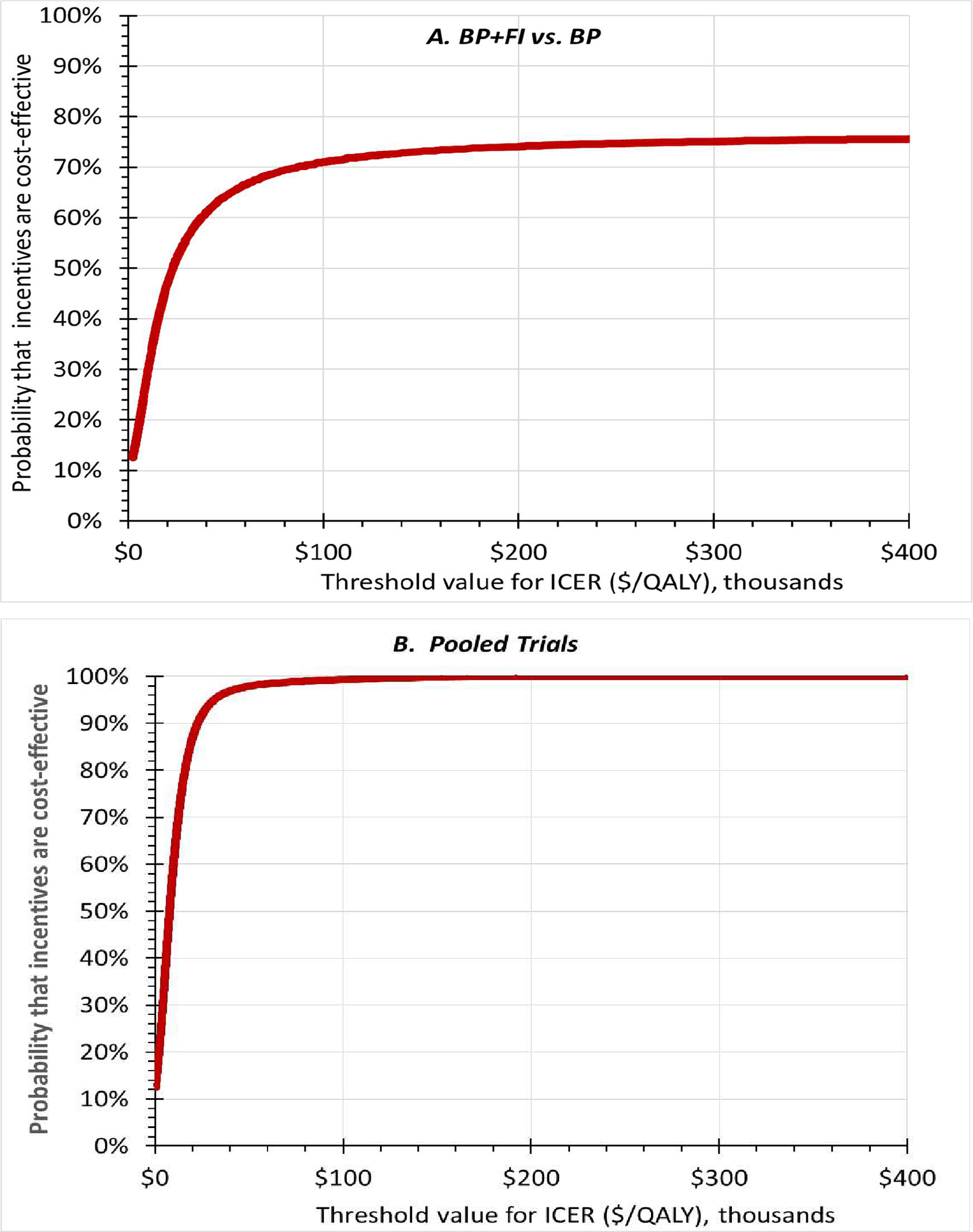

Figure 1 shows the CEACs for the BP+FI vs. BP (panel A) and pooled trials (panel B). The CEACs show the probability that the incentive interventions were cost-effective (on the Y-axis) given alternative thresholds for cost-effectiveness (on the X-axis). The CEACs slope upwards, showing that the incentive interventions are more likely to be cost-effective compared with controls the greater the possible threshold value of a QALY. Under the thresholds of $65,910 and $100,000, the incentive intervention had a 67.9% probability of being very cost-effective and a 71.0% probability of being cost-effective compared with BP in the BP+FI vs. BP trial, and 98.6% and 99.3% probabilities compared with controls in the pooled trials, respectively (Table 4).

Figure 1.

Cost-effectiveness acceptability curves for the BP+FI vs. BP (panel A) and in the pooled trials (panel B). X-axes show alternative thresholds for cost-effectiveness. Y-axes shows the probability that incentives were cost-effective at that threshold. The curves slope upwards, showing that the higher the threshold, the more likely the intervention will be considered cost-effective.

Benefit-Cost Ratios

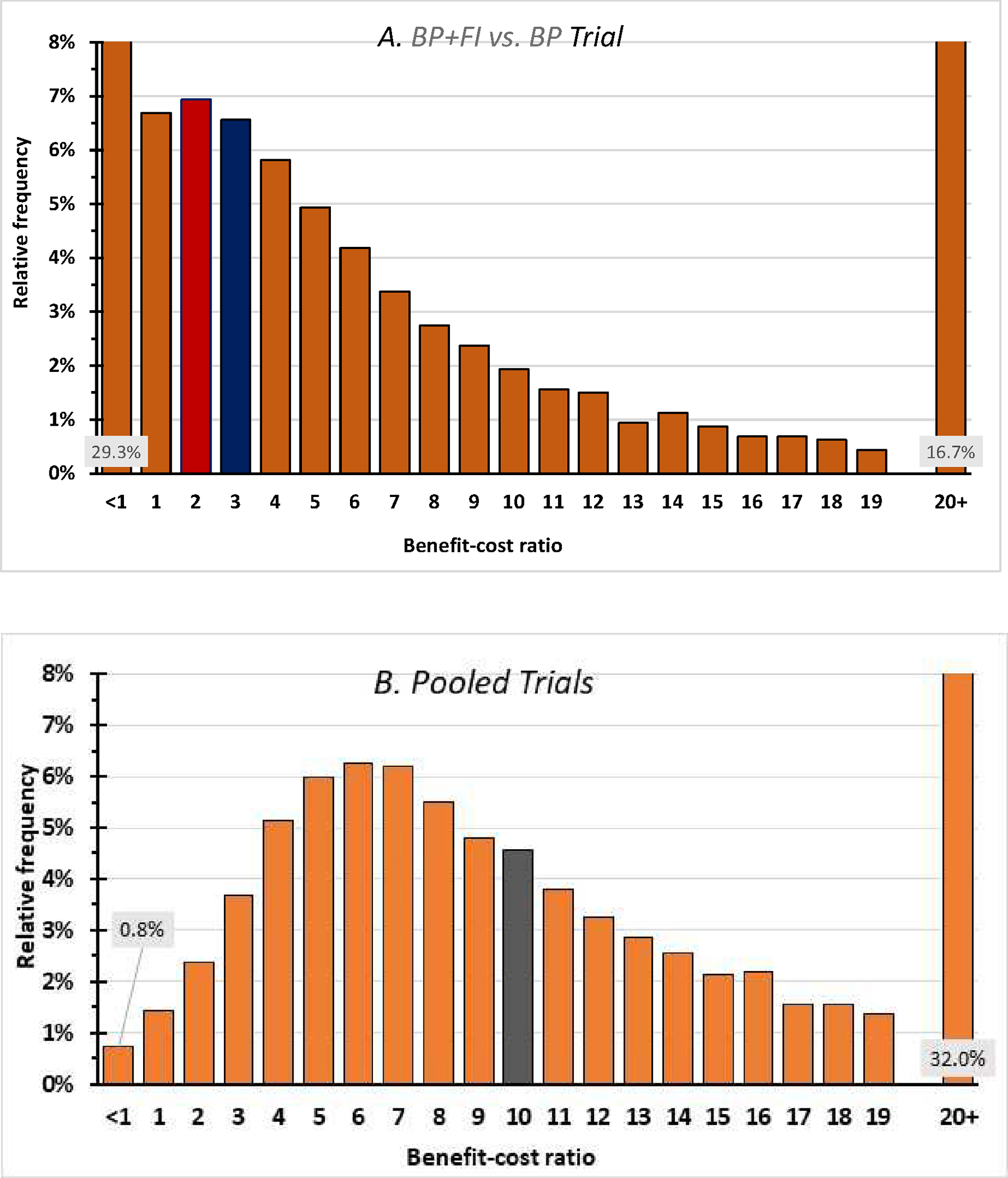

The average healthcare cost per participant in the incentives condition from the BP+FI vs. BP trial ($634.76) gives favorable benefit-cost ratios of 4.20 (i.e., $2,667/$634.76) and 11.90 (i.e., $7,551/$634.76) in the two trials. Figure 2 presents the frequency distribution of the benefit-cost ratios for the BP+FI vs. BP and pooled trial data. The lower limit of the 95% CI for the cost-benefit ratio is <1.00 in the BP+FI vs. BP trial and 2.66 in the pooled trial data. In the BP+FI vs. BP and pooled trials, there are 29.3% and 0.8% probabilities that the benefit cost ratio is <1 (i.e., unfavorable), respectively, and 16.7% and 32.0% probabilities that the ratio is 20 or greater (i.e., extremely favorable). In the BP+FI vs. BP and pooled trials, the probabilities are 9.6% and 12.5%, respectively, that the FI intervention is dominant (i.e., unequivocally beneficial) because it is simultaneously cost saving and improves health.

Figure 2.

Frequency distribution of benefit-cost ratios. The central values of the benefit-cost ratio were 4.20 in the BP+FI vs. BP trial (panel A) and 11.90 in the pooled trial (panel B). The median values (with bars shaded) are 2.70 and 10.65 respectively. The left-most bars corresponding to a benefit-cost ratio below 1 indicate the probabilities that incentives were not cost-beneficial. These probabilities were 29.3% in the BP+FI vs. BP trial and 0.8% in the pooled trials. The right-most bars indicate the probabilities that incentives had a benefit-cost ratio of 20 or above, indicating an extremely favorable benefit-cost ratio, were 16.7% in the BP+FI vs. BP trial and 32.0% in the pooled trials. Each top category incorporates the 12.5% probability that incentives are cost-saving.

Discussion

Higgins et al. (2022) provide strong evidence from controlled trials that FI increase antepartum and postpartum abstinence from cigarette smoking among pregnant and newly postpartum women. Our economic results reinforce the favorable cost-effectiveness results from Boyd et al. (2016) while adding several extensions. To our knowledge, this paper is the first economic analysis that extended FI into the postpartum period, analyzed abstinence after FI had ended, compared FI against best practices, and combined maternal and infant outcomes.

This economic analysis linked several pieces of data together. The cost of each intervention arm came from quantifying and valuing the ingredients in the BP+FI vs. BP trial. The intervention costs attributable to FI, which averaged $1361.33 per participant, came from the cost of incentive vouchers ($510.01, 37%) and other clinic expenses, including personnel and facilities ($851.32, 63%). The fact that “other clinic expenses” constitute the majority of costs highlights the fact that a FI program has more active ingredients than just the incentives themselves. A FI program also requires abstinence monitoring, feedback, attractive incentives (here vouchers exchangeable for retail items) and a supportive setting. The intervention costs of FI were offset by more than half through Medicaid savings per participant from a reduction in the probability of SGA births ($693.99), leaving a net health sector cost of $634.76. These offsets speak to the importance of a holistic view of costs that goes beyond the intervention costs to include offsets.

The core measure of effectiveness was the efficacy from the BP+FI vs BP and pooled trials showing that FI increased smoking abstinence antepartum and postpartum. In both the BP+FI vs. BP and pooled trials, FI improved abstinence significantly over control conditions in the postpartum period. The key measure of postpartum abstinence in this economic analysis was the ADP at 24-weeks postpartum available in the BP+FI vs. BP and pooled trials, which corresponds to about 48 weeks after the participant’s initial quit date. The point estimate of ADP for the BP+FI vs. BP trial (3.17%) was less favorable than that for the pooled trials (8.89%). Also, the 95% CI on ADP for the BP+FI vs. BP trial (−5.16% to 18.23%) was wider and spanned the null effect compared to that for pooled trials (2.09% to 19.25%). The pooled trials had a substantially larger sample size than the BP+FI vs. BP trial and a different control condition. Unlike the BP control condition, the control condition in prior trials did not entail repeated referrals to the tobacco quit line nor $65 payments per completed call (regardless of cessation). Chance variation or efficacy of these additional “attendance” components of BP, like the participation incentives in another Vermont trial (Heil et al., 2008), may have narrowed the efficacy gap in the BP+FI vs. FP trial compared to prior trials.

Due to the relative infrequency of SUID, the overwhelming share of QALY gains (98.6% in both the BP+FI vs. BP and pooled trials) came from the benefit to the pregnant women’s health through reductions in her risk of disease and premature death.

The central values of the ICER were below (i.e., on the favorable side of) the customary thresholds ($65,910 and $100,000) for both the BP+FI vs. BP ($23,511) and pooled trials ($8,371). The probabilities that the ICER was on the favorable side of the $65,910 (more demanding) threshold were 67.9% and 98.6%, respectively. However, the wide confidence interval in results for the BP+FI vs. BP trial meant that there was a 32.1% probability (i.e., 100.0%–67.9%) that the addition of FI was not cost-effective in that trial. In the larger pooled trials, however, the probability that FI was not cost-effective was only 1.4% (i.e., 100.0%–98.6%). Higgins et al. (2022) found that ADP at 24 weeks postpartum was 71%–88% lower than antepartum ADP. Therefore, cost-effectiveness analyses based on antepartum ADP only may be overly favorable (see Supplement).

The benefit-cost analyses generated similar conclusions to the cost-effectiveness analysis. The central estimates of the economic value per dollar spent were very favorable (i.e., substantially above $1.00) for both the most BP+FI vs. BP ($4.20) and pooled ($11.90) trials. Strengths of the underlying model for maternal benefits were its adjustment for smoking recidivism, spontaneous quitting, and independent causes of death (Stapleton & West, 2012). Whereas significant efficacy could be shown by evaluating outcomes just through 12-weeks postpartum (Higgins et al., 2022), an economic analysis is more demanding. It depends on longer-term outcome measures and involves uncertainty in both costs and effectiveness. This need speaks to the value of being able to pool multiple trials, as was possible here for smoking cessation.

Two limitations should be noted. First, while our cost-effectiveness acceptability analysis considered the uncertainty in our data sets, it did not incorporate uncertainty in the underlying model that converted ADP to QALYs (Stapleton & West, 2012). However, because our results depend on the differences in QALYs associated with different prevalence levels of smoking, possible errors in the absolute QALYs generated by that model tend to cancel out. As an analogy, dieters can accurately measure their weight losses by comparing their before- and after-measurements on the same scale. Even if the scale were not calibrated correctly to zero, the calibration errors would cancel.

Second, the QALY model (Stapleton & West, 2012) did not incorporate possible gains in women’s quality of life from smoking abstinence. Including this consideration would likely have increased QALY gains to women from their lower risk of respiratory, cardiovascular, and other diseases from less smoking over their remaining lifespan. Thus, our estimates of QALY gains and the resulting cost-effectiveness and benefit-cost analyses are conservative.

Conclusions

Financial incentives for smoking abstinence during pregnancy and early postpartum reduce smoking, help protect mothers’ and infants’ health, and may reduce health disparities (Higgins et al., 2022; Verbooy et al., 2018). This study found that such FI programs are also cost-effective and offer good societal value compared to other healthcare services. For FI to be offered by clinics and made accessible to pregnant smokers, they would need to be covered by Medicaid and by commercial insurance plans. This economic evaluation found that covering FI services for pregnant smokers can yield long-term health benefits to the women and their infants, and that about half of the upfront cost of FI is offset by Medicaid savings. Consequently, all insurers should consider covering FI for pregnant smokers through 24 weeks postpartum.

Supplementary Material

Highlights.

Financial incentives for smoking cessation in pregnant women are cost-effective.

Financial incentives offer $4.20 or more in economic benefit for each dollar spent.

Financial incentives in this context are valuable on health and economic grounds.

Insurers may wish to cover financial incentives for pregnant beneficiaries who smoke.

Acknowledgments

The authors thank Clare L. Hurley (Brandeis University) for editorial assistance.

Funding source:

This work was supported by the National Institutes of Health (awards R01HD075669 and P20GM103644).

Footnotes

Conflict of interest disclosures: The authors report no conflicts of interest to disclose.

Abbreviations: ADP - absolute difference percent; AOR - adjusted odds ratios; BP - best practices; Brief DATCAP- Brief Drug Abuse Treatment Cost Analysis Program; CEAC - cost-effectiveness acceptability curve; CI - confidence interval; CPD - cigarettes per day; FI - financial incentives; GNI - Gross National Income; ICER - incremental cost-effectiveness ratio; QALY - quality adjusted life year; SGA - small for gestational age; SUID - sudden unexpected infant death

Data statement

The main underlying data are results of the underlying randomized trials on smoking cessation. For descriptions and availability, see Higgins et al. (2022).

References

- Anderson TM, Lavista Ferres JM, Ren SY, et al. , 2019. Maternal smoking before and during pregnancy and the risk of sudden unexpected death. Pediatrics. 143:e20183325. doi: 10.1542.2018-3325. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Boyd KA, Briggs AH, Bauld L., et al. , 2016. Are financial incentives cost-effective to support smoking cessation during pregnancy? Addiction. 111:360–70. doi: 10.1111/add.13160. [DOI] [PubMed] [Google Scholar]

- Centers for Disease Control and Prevention, 2014. Best Practices for Comprehensive Tobacco Control Programs — 2014. U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, National Center for Chronic Disease Prevention and Health Promotion, Office on Smoking and Health, Atlanta. [Google Scholar]

- Cnattingius S, 2004. The epidemiology of smoking during pregnancy: Smoking prevalence, maternal characteristics, and pregnancy outcomes. Nicotine Tob Res. 6:S125–40. doi: 1080/14622200410001669187. [DOI] [PubMed] [Google Scholar]

- Criss SD, Cao P, Bastani M, et al. , 2019. Cost-effectiveness analysis of lung cancer screening in the United States. A comparative modeling study. Ann Intern Med. 171:796–804. doi: 10.7326/M19-0322. [DOI] [PubMed] [Google Scholar]

- Drummond ME, Sculpher MJ, Torrance GW, et al. , 2005. Methods for the Economic Evaluation of Health Care Programmes, 3rd Ed. Oxford University Press, ISBN 0–19-852945–7. [Google Scholar]

- FRED, 2021. U.S. Bureau of Labor Statistics, Producer Price Index by Commodity: Health Care Services: Hospital Inpatient Care, General Medical and Surgical Hospitals [WPU512101011]. Federal Reserve Bank of St. Louis. Economic Data (FRED). https://fred.stlouisfed.org/series/WPU512101011. Accessed: 22 Oct 2021. [Google Scholar]

- French MT, Fang H, Fretz R, 2010. Economic evaluation of a prerelease substance abuse treatment program for repeat criminal offenders. J Subt Abuse Treat. 38:31–41. doi: 10.1016/j.jsat.2009.06.001. [DOI] [PubMed] [Google Scholar]

- French MT, Roebuck MC, McLellan AT, 2004. Cost estimation when time and resources are limited. J Subst Abuse Treat. 27:187–93. doi: 10.1016/j.jsat.2004.07.001. [DOI] [PubMed] [Google Scholar]

- Glick HA, Doshi JA, Sonnad SS, et al. , 2015. Economic Evaluation in Clinical Trials, 2nd Edition. Oxford University Press, New York. [Google Scholar]

- Gould GS, Havard A, Lim LL, et al. , 2020. Exposure to tobacco, environmental tobacco smoke and nicotine in pregnancy: A pragmatic overview of reviews of maternal and child outcomes, effectiveness of interventions, effectiveness of interventions and barriers and facilitators to quitting. Int J Environ Res Public Health. 17:2034. doi: 10.3390/ijerph17062034. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Heil SH, Higgins ST, Bernstein IM, et al. , 2008. Effects of voucher-based incentives on abstinence from cigarette smoking and fetal growth among pregnant women. Addiction. 103:1009–18. doi: 10.1111/j.1360-0443.2008.02237.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Higgins ST, 2012. Unpublished trial results reported in Higgins ST, Washio Y, Heil SH, et al. Financial incentives for smoking cessation among pregnant and newly postpartum women. Prev Med. 55 (Suppl):S33–40. doi: 10.1016/j.ypmed.2011.12.016. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Higgins ST, Heil SH, Solomon L, et al. , 2004. A pilot study on voucher-based incentives to promote abstinence from cigarette smoking during pregnancy and postpartum. Nicotine Tob Res. 6:1015–20. doi: 10.1080/14622200412331324910. [DOI] [PubMed] [Google Scholar]

- Higgins ST, Nighbor TD, Kurti AN, et al. , 2022. Randomized controlled trial examining the efficacy of adding financial incentives to best practices for smoking cessation among pregnant and newly postpartum women. Prev Med. 140:106238. doi: 10.1016/j.ypmed.2020.106238.. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Higgins ST, Slade EP, Shepard DS, 2020. Decreasing smoking during pregnancy: Potential economic benefit of reducing sudden unexpected infant death. Prev Med. 140:106238. doi: 10.1016/j.ypmed.2020.106238. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Higgins ST, Solomon LJ, 2016. Some recent developments on financial incentives for smoking cessation among pregnant and newly postpartum women. Curr Addict Rep. 3::9–18. doi: 10.1007/s40429-016-0092-0. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Higgins ST, Washio Y, Lopez AA, et al. , 2014. Examining two different schedules of financial incentives for smoking cessation among pregnant women. Prev Med. 68:51–7. doi: 10.1016/j.ypmed.2014.03.024. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Marseille E, Larson B, Kazi D, et al. , 2015. Thresholds for the cost-effectiveness of interventions: alternative. approaches. Bull World Health Organ. 93:118–24. doi: 10.2471/BLT.14.138206. [DOI] [PMC free article] [PubMed] [Google Scholar]

- National Partnership for Smoke Free Families, 2008. Smoke Free Families. http://tobacco-cessation.org/sf/. Accessed: 30 July 2021. [Google Scholar]

- Neumann PJ, Sanders GD, Russell LB, et al. , 2017. Cost-effectiveness in Health and Medicine, 2nd edition. Oxford University Press, New York. [Google Scholar]

- Neumann PJ, Cohen JT, Weinstein MC, 2014. Updating cost-effectiveness—the curious resilience of the $50,000-per-QALY threshold. N Engl J Med. 371:796–7. doi: 10.1056/NEJMp1405158. [DOI] [PubMed] [Google Scholar]

- Ruger JP, Emmons K, 2008. Economic evaluations of smoking cessation and relapse prevention programs for pregnant women: a systematic review. Value Health. 11:80–90. . doi: 10.111/j.1524-4733.2007.00239. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Stapleton JA, West R, 2012. A direct method and ICER tables for the estimation of the cost-effectiveness of smoking cessation interventions in general populations: applications to a new cystine trial and other examples. Nicotine Tob Res. 14:463–71. doi: 10.1093/ntr/ntr236. [DOI] [PubMed] [Google Scholar]

- U.S. Department of Health and Human Services, 2020. Smoking Cessation. A Report of the Surgeon General; Chapter 4, The Health Benefits on Smoking, subsection Reproductive Health, pp 320–401. U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, National Center for Chronic Disease Prevention and Health Promotion, Office on Smoking and Health, Atlanta, GA. [Google Scholar]

- US BLS, 2021. The Economics Daily, Consumer Price Index: 2020 in review, U.S. Bureau of Labor Statistics, US Department of Labor. https://www.bls.gov/opub/ted/2021/consumer-price-index-2020-in-review.htm. Accessed: 3 November 2021.

- Verbooy K, Hoefman R, Van Exel J, et al. , 2018. Time is money: investigating the value of leisure time and unpaid work. Value Health. 21:1428–36. 10.1016/j.jval.2018.04.1828. [DOI] [PubMed] [Google Scholar]

- Vermont Department of Health, Agency of Human Services, 2021. Vermont Vital Statistics Annual Report 2019. https://www.healthvermont.gov/sites/default/files/documents/pdf/HS-VR-2019VSB_final.pdf. Accessed: 30 November 2021.

- Wallis KF, 2014. The two-piece normal, binormal, or double Gaussian distribution: its origin and rediscoveries. Statistical Sci 29(1):106–112. doi: 10.1214/13-STS417. [DOI] [Google Scholar]

- World Bank, 2021. GNI per capita, Atlas method (current US$) – United States. https://data.worldbank.org/indicator/NY.GNP.PCAP.CD?locations=US. Accessed: 12 Oct 2021. [Google Scholar]

- Young RP, Hopkins RJ, 2020. Cost-effectiveness analysis of lung cancer screening in the United States Annals Intern Med. 172:705–06. doi: 10.7326/L20-0071. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Data Availability Statement

The main underlying data are results of the underlying randomized trials on smoking cessation. For descriptions and availability, see Higgins et al. (2022).