Abstract

Purpose

In 2014, the Kuwaiti parliament enacted the private health insurance law for Kuwaiti retirees ie, Afya to enhance service quality for retirees through the involvement of the private sector. The study aimed to comprehensively analyze Afya across three crucial dimensions: efficiency, inclusiveness, effectiveness, and service quality; delivery of services throughout the revenue management cycle; and its long-term sustainability in Kuwait.

Methods

Conducted between June 2021 and August 2022, the study employed both web-based and hardcopy questionnaires, reaching a response rate of 78.79% from a random sample of 514 Kuwaiti beneficiaries holding Afya insurance cards. Exclusions were made for those who did not receive cards or declined participation, resulting in analysis of 405 completed surveys.

Results

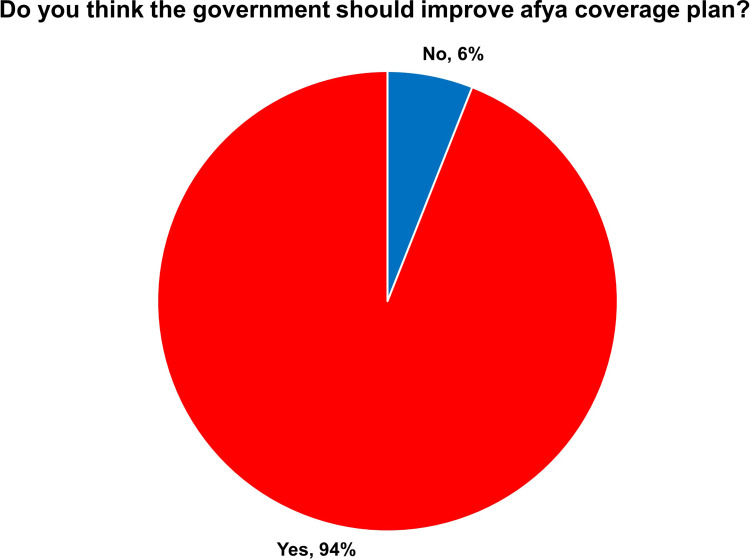

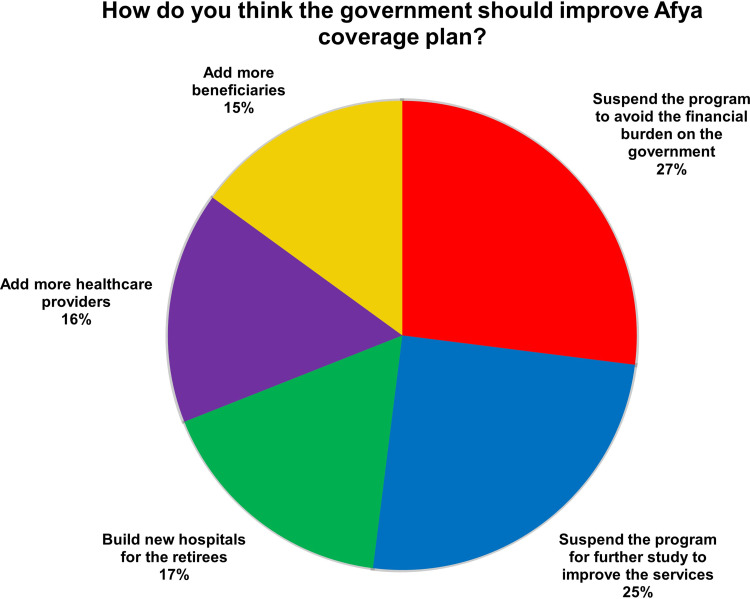

The findings revealed that 95% of participants frequently utilized services from private hospitals, with a corresponding 78.79% satisfaction rate. However, when seeking medical services from government hospitals, respondents often opted to repeat procedures to ensure accurate results and diagnoses. Despite a strong endorsement for enhancing Afya’s coverage plan (94%), over half of the respondents suggested a temporary suspension of the scheme to conduct thorough research and alleviate potential financial burdens on the government. Notably, a significant positive correlation (0.578, p < 0.01) was observed between beneficiary satisfaction and their experience with Afya coverage, underscoring the importance of aligning scheme operations with beneficiary needs.

Conclusion

Addressing these disparities and improving access to healthcare services for retirees necessitate a thorough reformation of the Afya scheme. To address these challenges, the study recommends comprehensive reform through evidence-based research, enhanced information exchange mechanisms between public and private sectors, and broader coverage targeting younger demographics. These measures are crucial for ensuring the scheme’s efficacy, sustainability, and alignment with the evolving healthcare landscape in Kuwait.

Keywords: health insurance, health policy, afya insurance scheme, Kuwait

Introduction

The evaluation of the Afya healthcare insurance scheme, initiated by the Kuwaiti government to provide retired nationals access to services from private hospitals, revealed a noteworthy gap between beneficiary satisfaction and the scheme’s ability to fully meet their expectations. This disparity is compounded by the rising prevalence of noncommunicable diseases and the complex relationship dynamics between public and private healthcare facilities.

Currently, Kuwait is the only country in the world that has a National Health Service system and is offering paid health insurance (Afya) to retired Kuwaiti nationals. Ever since the Kuwaiti government launched Afya insurance for Kuwaiti retirees in July 2016 at the cost of 82 KWD million (272 million US$), several critical issues have been raised, including an increase in the number of retirees, a delay in the payment of dues to the insurance company by the ministry, and demands for the extension of services.1 In addition to the increased cost of the government, the introduction of Afya has introduced distortion in the market by increasing the number of players in the health system. The significant asymmetry of information between private hospitals and patients increases the availability of moral hazard without public control systems. In addition, the migration of experienced doctors from the public sector to the private sector is an alarming phenomenon. Therefore, evaluating the impact of the Afya insurance programme on the Kuwaiti healthcare system is urgently needed.

The research aims to assess the performance of the Afya health insurance scheme in terms of service quality and beneficiaries’ satisfaction. Specifically, the detailed objectives are to evaluate the services provided by Afya through the study of beneficiaries’ satisfaction in terms of the frequency of services and encounters, the frequency of types of services and diseases, the awareness of beneficiaries of the term of services, and satisfaction with the services rendered; additionally, partnership evaluation includes the assessment of the services provided, the revenue management cycle, the impact of the Afya of healthcare providers, beneficiaries, and the government. The research addresses the following questions:

Q1. Does the Afya health insurance scheme ensure efficiency, inclusiveness, effectiveness, and quality services?

Q2. Does the Afya health insurance include total health care services through the stage of the revenue management cycle?

Q3. Is the Afya health insurance scheme suitable and sustainable in the long-term Kuwait health service system?

The Ministry of Health (MoH) in Kuwait is the major provider of healthcare services where the MoH “provides appropriate and timely healthcare for those who fall ill”.2 Kuwait’s healthcare system has six health regions where each region controls its finance, administration, workforce training, health information, management, and service delivery.2 The MoH provides primary, secondary, and tertiary healthcare services via these regions. Dental health, occupational medicine, preventive medicine, treatment abroad, and Hajj season healthcare services are also provided by the MoH.3

In 2014, the Kuwaiti parliament enacted Law 114 of 2014, which established the private health insurance scheme for retirees, known as Afya.4 Generally, the purpose of this law was to improve the quality of service available to retirees via the private sector.5

The objective of introducing health insurance for retirees was to reduce waiting times for healthcare services among this demographic, enhance collaboration between public and private healthcare sectors, and stimulate growth in the health insurance market in Kuwait.2

The estimated cost of the first year of Afya was based on 107,000 retirees in 2014, which was approximately 82 million KWD (272 million US$); however, the appropriate number at the launch of Afya was 114,952.2

The private insurance scheme for retirees (Afya) has been operated by the Gulf Insurance Group (GIG) since July 2016.2,5 Retirees have access to private healthcare services ranging from primary, secondary, and tertiary services, with a 17,000 KWD (approximately 55,000 US$) maximum annual limit.2

Afya health insurance introduced a network of health service providers consisting of more than 400 providers inside Kuwait which includes more than 2000 physicians. The initial insurance plan provided coverage for each patient with an annual limit of 17,000 KWD divided into four categories.6 The inpatient services limit was 10,000 KWD; the outpatient services limit was 4000 KWD; and the dental services limit was up to 1500 KWD. Moreover, there were obstetrics and gynaecology services for female retirees with coverage of up to 1500 KWD. In the revised versions of Afya, obstetrics and gynaecology services were replaced with 12 sessions of physical therapy annually.7,8

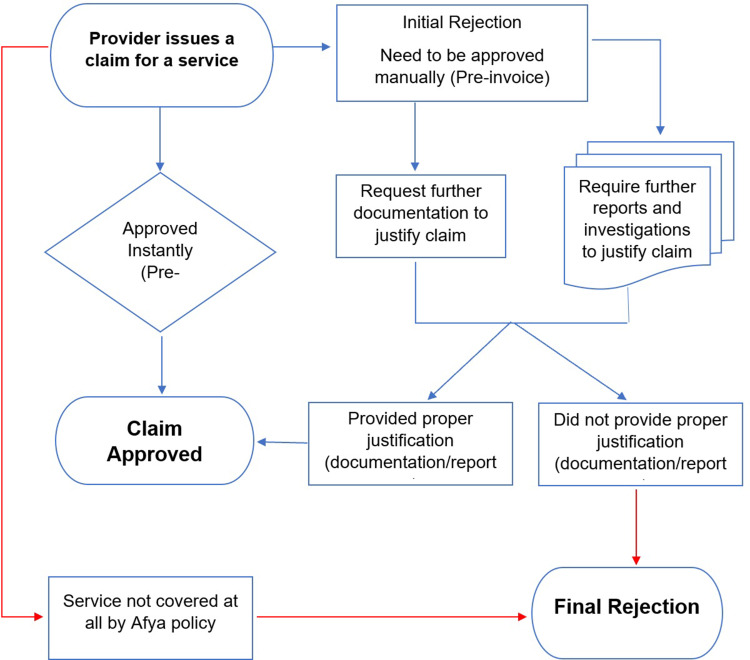

The plan also covered all previously pre-existing medical conditions prior to the patient’s eligibility for Afya, accidents and emergency cases, disc and vertebrae operations, routine eye examinations, and routine hearing examinations.7,8 Some medical services under Afya require prior approval before they can be obtained, such as inpatient services, one-day surgeries, and specific diagnostic tests such as MRI and CT scans.6–8 The responsibility of obtaining prior approval lies with the medical service providers, and the process typically takes place through the company’s automated system. However, emergency cases that pose a threat to the patient’s life do not require prior approval.6–8 Most importantly, access to public healthcare services is also provided for retirees and is not limited to Afya.2 Figure 1 depicts the major steps in claiming Afya benefits.

Figure 1.

Steps in claiming Afya benefits.

Another public-private project is Health Insurance Scheme for Expatriates (DHAMAN) which is an ownership between the government of Kuwait (24%), the Kuwait population (50%), and the private sector (26%).2,9 With this scheme, expatriates will be provided with primary (10 clinics) and secondary (three 250-bed hospitals) healthcare services while tertiary services will still be provided by the public sector.2 This partnership is expected to improve healthcare services and alleviate the financial burden on the government.1,2

Materials and Methods

This descriptive and evaluative study aimed to assess the satisfaction of beneficiaries with the services provided by the Afya health insurance scheme between June 2021 and August 2022.

Ethical approval for this study was obtained from the Kuwait University Health Sciences Center (HSC) ethical committee on December 5, 2020, under reference number VDR/EC/3686. The study adhered to all relevant ethical guidelines and regulations governing research involving human participants.

Data Collection Instrument

The research instrument was a self-developed survey based on an extensive literature review of the subject under study.3,4,10–12 The theoretical framework of this study was based on informatics evaluation and outcome research related to customer satisfaction.13 Trochim and Donnely discussed two evaluation categories: formative and summative evaluation. Formative evaluations are conducted during the development or implementation of a new program, while summative evaluations are conducted after the implementation of the program or intervention and are designed to examine effects or outcomes.14

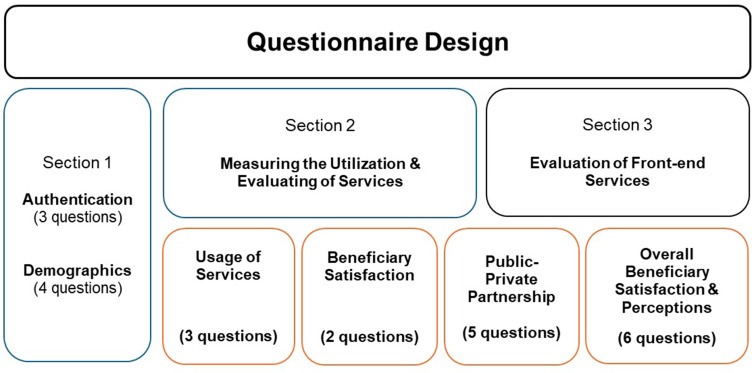

The survey was designed to address three main research questions regarding the Afya Health Insurance Scheme’s efficiency, inclusiveness, effectiveness, quality of services, coverage of healthcare services through the revenue management cycle, and long-term suitability and sustainability within the Kuwaiti healthcare system. It consists of three sections, as illustrated in Figure 2.

Figure 2.

Questionnaire Design.

The target population included approximately 135,000 Kuwaiti retirees who had received Afya insurance cards. A random sample of 514 Kuwaiti beneficiaries who had received Afya insurance cards was used to complete the survey. The researchers excluded beneficiaries who did not receive their cards or declined to participate for various reasons. A total of 405 questionnaires were completed in the study.

Conducting the Survey

A web-based survey was developed using Microsoft Forms in two languages (English and Arabic) and was distributed via social media. The researchers decided to increase the response rate by using an identical hard copy of the survey and distributing it randomly among Kuwaiti retirees visiting outpatient clinics in hospitals. An experienced team of five data collectors was employed to gather the data manually. The team attended two-day meetings conducted by the primary researcher to explain the purpose of the study, the content of the questionnaire, how to complete the consent form, and how to answer certain expected questions. The team was given hard copies of the questionnaire which was randomly distributed among 13 private hospitals that were frequently visited by retirees. To permit the data collectors to distribute and gather the beneficiaries’ replies, hospital managers received letters stating the objectives of the study and copies of the ethical approval form. To avoid duplication, each questionnaire had a unique number, and participants were asked if they had answered the online version of this survey. All of the questionnaires were self-administered. To establish the face validity of the research instrument, the researchers and one IT specialist performed multiple reviews of the questionnaire, both web-based and hardcopy, to ensure that it effectively addressed the study purpose. The online survey was tested thoroughly before its final release. The researchers incorporated comments and feedback into the last version of the survey, such as removing the names of healthcare providers and eliminating misleading questions. The final version of the survey instrument was found to be comprehensible with a logical flow, ascertaining the instrument’s face validity.

Data collection took place from June 2021 to June 2022 with the following challenges:

The first version of the questionnaire was too lengthy, leading to respondent fatigue. To address this issue, the questionnaire was revised and shortened to improve usability and response rates. The Web-based survey in Microsoft Forms needed to be modified several times to incorporate the Arabic translation.

The response rate was low due to the difficulty in answering web-based surveys by elderly retirees or respondents who did not have access to the internet.

The researchers found difficulties in obtaining a database of Kuwaiti beneficiaries.

The data inclusion criteria were Kuwaiti retirees who received Afya insurance cards and utilized healthcare services that are covered in the Afya insurance scheme.

Statistical Analysis

The study results were analyzed using IBM SPSS version 26 and Microsoft Excel, MOS 365. In accordance with the research methods and study objectives, we used descriptive and explanatory analyses, such as univariate, cross tabulation, and Pearson correlation analyses.

Results

Response Rate

A total of 514 respondents meeting the inclusion criteria were included in the study. Out of the 109 cases excluded from the study, 13 were found not to be retirees, 30 refused to participate for personal reasons, 15 cited religious reasons for non-participation, 35 were excluded due to administrative reasons, and 16 were excluded for financial reasons. A total of 405 completed surveys were analyzed, for a total response rate of 78.79%.

Demographics of the Survey Participants

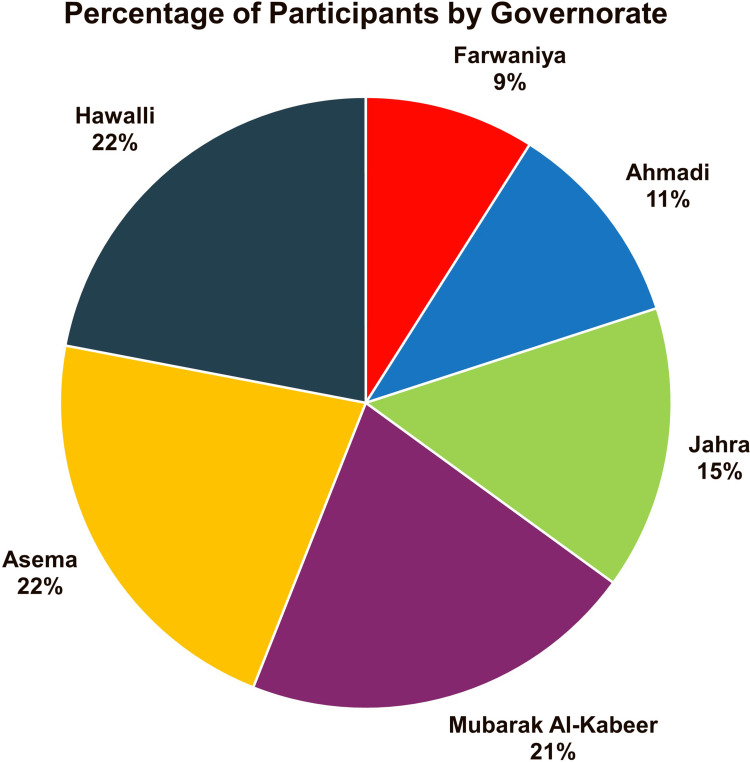

Table 1 provides the demographic profile of the respondents who were beneficiaries of healthcare insurance in our study. The profile is based on five parameters, as given in Table 1. For the sex parameter, the sample comprised 38.8% males and 61.2% females. The results also presented a mixed population in terms of education parameters; 50.9% of the participants held a bachelor’s degree or higher. A total of 54.3% of the participants were aged between 55 and 64 years. Participants were categorized by their governorate residency. Kuwait has six governorates, namely Alasema, Hawally, Mubarak Al Kabir, Ahmadi, Farwaniya and Jahra. Respondents living in Hawalli, Alasema, or Mubarak Al Kabeer were the most likely to respond to the survey, as shown in Figure 3. In brief, our sample has an excellent mix of gender, level of education, age group and residency location.

Table 1.

Respondents’ Characteristics

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| Gender | Male | 157 | 38.8 | 38.8 | 38.8 |

| Female | 248 | 61.2 | 61.2 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Age Group | 25–29 | 2 | 0.5 | 0.5 | 0.5 |

| 35–39 | 3 | 0.7 | 0.7 | 1.2 | |

| 40–44 | 7 | 1.7 | 1.7 | 3.0 | |

| 45–40 | 36 | 8.9 | 8.9 | 11.9 | |

| 50–54 | 80 | 19.8 | 19.8 | 31.6 | |

| 55–59 | 116 | 28.6 | 28.6 | 60.2 | |

| 60–64 | 104 | 25.7 | 25.7 | 85.9 | |

| 65–59 | 44 | 10.9 | 10.9 | 96.8 | |

| 70+ | 13 | 3.2 | 3.2 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Education | Elementary | 4 | 1.0 | 1.0 | 1.0 |

| Intermediate | 10 | 2.5 | 2.5 | 3.5 | |

| Secondary | 60 | 14.8 | 14.8 | 18.3 | |

| Training Course | 31 | 7.7 | 7.7 | 25.9 | |

| Diploma | 94 | 23.2 | 23.2 | 49.1 | |

| Bachelor | 166 | 41.0 | 41.0 | 90.1 | |

| Master | 34 | 8.4 | 8.4 | 98.5 | |

| PhD | 6 | 1.5 | 1.5 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Governorate | Farwaniya | 35 | 8.6 | 8.6 | 8.6 |

| Hawalli | 88 | 21.7 | 21.7 | 30.4 | |

| Mubarak Al-Kabeer | 86 | 21.2 | 21.2 | 51.6 | |

| Ahmadi | 46 | 11.4 | 11.4 | 63.0 | |

| Jahra | 62 | 15.3 | 15.3 | 78.3 | |

| Asema | 88 | 21.7 | 21.7 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

Figure 3.

Percentage of Participants per Governorate.

Evaluation of the Usage of Services

As shown in Table 2, participants were asked to determine which of the services was used the most. The respondents utilized hospital admission, dental services, the emergency room, and laboratory services the most.

Table 2.

Services Used the Most

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| ER | Yes | 248 | 61.2 | 61.2 | 61.2 |

| No | 157 | 38.8 | 38.8 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| OPD | Yes | 119 | 29.4 | 29.4 | 29.4 |

| No | 286 | 70.6 | 70.6 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Laboratory | Yes | 220 | 54.3 | 54.3 | 54.3 |

| No | 185 | 45.7 | 45.7 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Admission | Yes | 347 | 85.7 | 85.7 | 85.7 |

| No | 58 | 14.3 | 14.3 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Radiology | Yes | 247 | 61.0 | 61.0 | 61.0 |

| No | 158 | 39.0 | 39.0 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Dental | Yes | 280 | 69.1 | 69.1 | 69.1 |

| No | 125 | 30.9 | 30.9 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

In response to the question about the most utilized specialized services, as depicted in Table 2, the majority of respondents (85.7%) reported utilizing admission services the most. A total of 69.1% of respondents reported using dental services, indicating a significant proportion of individuals seeking dental care within the Afya health insurance scheme. Out of the respondents, 69.1% utilized dental services, 61.2% visited the emergency room, and only 29.4% utilized outpatient department services.

As shown in Table 3, the OPD and the Laboratory services were the most utilized services by age group ranging from 55–64, 57.3% and 57.8% respectively.

Table 3.

Utilization of Services by Age Groups1

| Age group | ER | OPD | Laboratory | Admission | Radiology | Dental |

|---|---|---|---|---|---|---|

| 25–29 | 0 | 1 | 0 | 0 | 0 | 2 |

| 30–34 | 0 | 0 | 0 | 0 | 0 | 0 |

| 35–39 | 0 | 2 | 2 | 0 | 1 | 0 |

| 40–44 | 1 | 6 | 5 | 4 | 5 | 4 |

| 45–49 | 15 | 27 | 18 | 3 | 11 | 10 |

| 50–54 | 30 | 46 | 28 | 11 | 29 | 22 |

| 55–59 | 40 | 86 | 57 | 17 | 53 | 44 |

| 60–64 | 45 | 78 | 50 | 17 | 41 | 32 |

| 65–69 | 20 | 33 | 18 | 2 | 15 | 8 |

| 70 + | 6 | 7 | 7 | 4 | 3 | 3 |

| Grand Total | 157 | 286 | 185 | 58 | 158 | 125 |

Note: 1The shaded colored cells indicate the highest values.

Evaluating Specialty Services

Respondents were asked to choose from a list of 23 specialized services, indicating which services they used the most. Table 4 indicates that surgical, dental, chronic, and medical specialties were among the most frequently utilized, with utilization rates of 85.2%, 70.4%, 65.2%, and 63.5%, respectively. However, medical equipment, wheelchairs, hearing aids, and canes were utilized the least often.

Table 4.

Specialized Healthcare Services Used the Most

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| Ambulance | No | 329 | 81.2 | 81.2 | 81.2 |

| Yes | 76 | 18.8 | 18.8 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Chronic Diseases | No | 141 | 34.8 | 34.8 | 34.8 |

| Yes | 264 | 65.2 | 65.2 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| General Medicine | No | 148 | 36.5 | 36.5 | 36.5 |

| Yes | 257 | 63.5 | 63.5 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Surgery | No | 60 | 14.8 | 14.8 | 14.8 |

| Yes | 345 | 85.2 | 85.2 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Orthopedics | No | 291 | 71.9 | 71.9 | 71.9 |

| Yes | 114 | 28.1 | 28.1 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| ENT | No | 322 | 79.5 | 79.5 | 79.5 |

| Yes | 83 | 20.5 | 20.5 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Ophthalmology | No | 326 | 80.5 | 80.5 | 80.5 |

| Yes | 79 | 19.5 | 19.5 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Dialysis | No | 396 | 97.8 | 97.8 | 97.8 |

| Yes | 9 | 2.2 | 2.2 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Dental | No | 120 | 29.6 | 29.6 | 29.6 |

| Yes | 285 | 70.4 | 70.4 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Obstetrics & Gynecology | No | 359 | 88.6 | 88.6 | 88.6 |

| Yes | 46 | 11.4 | 11.4 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Physical Therapy | No | 317 | 78.3 | 78.3 | 78.3 |

| Yes | 88 | 21.7 | 21.7 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| One-Day Surgery | No | 360 | 88.9 | 88.9 | 88.9 |

| Yes | 45 | 11.1 | 11.1 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Prescriptions | No | 308 | 76.0 | 76.0 | 76.0 |

| Yes | 97 | 24.0 | 24.0 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Laboratory | No | 285 | 70.4 | 70.4 | 70.4 |

| Yes | 120 | 29.6 | 29.6 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Diagnostics Radiology | No | 281 | 69.4 | 69.4 | 69.4 |

| Yes | 124 | 30.6 | 30.6 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Intervention Radiology | No | 367 | 90.6 | 90.6 | 90.6 |

| Yes | 38 | 9.4 | 9.4 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Visiting Doctor | No | 394 | 97.3 | 97.3 | 97.3 |

| Yes | 11 | 2.7 | 2.7 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Medical Equipment | No | 396 | 97.8 | 97.8 | 97.8 |

| Yes | 9 | 2.2 | 2.2 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Wheelchair | No | 399 | 98.5 | 98.5 | 98.5 |

| Yes | 6 | 1.5 | 1.5 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Canes | No | 403 | 99.5 | 99.5 | 99.5 |

| Yes | 2 | 0.5 | 0.5 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Hearing Aids | No | 401 | 99.0 | 99.0 | 99.0 |

| Yes | 4 | 1.0 | 1.0 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Emergency Visits | No | 343 | 84.7 | 84.7 | 84.7 |

| Yes | 62 | 15.3 | 15.3 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

Frequency of Utilization of Services

To assess the frequency of service utilization provided by the insurance plan, participants were asked to indicate how often they used major services covered by the plan. As depicted in Table 5, approximately 95% of participants reported always or often using services at private hospitals, while 86.5% reported the same for pharmacies. Laboratory, medical, dental, and radiology centers were frequently utilized, with rates ranging from 78.8% to 75.3%. In contrast, 42% of respondents indicated that they never used physical therapy centers.

Table 5.

Frequency of Utilization of Major Services

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| Private Hospitals | Always | 235 | 58.0 | 58.0 | 58.0 |

| Often | 150 | 37.0 | 37.0 | 95.1 | |

| Never | 20 | 4.9 | 4.9 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Medical Centers | Always | 176 | 43.5 | 43.5 | 43.5 |

| Often | 144 | 35.6 | 35.6 | 79.0 | |

| Never | 85 | 21.0 | 21.0 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Dental Centers | Always | 159 | 39.3 | 39.3 | 39.3 |

| Often | 155 | 38.3 | 38.3 | 77.5 | |

| Never | 91 | 22.5 | 22.5 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Radiology Centers | Always | 132 | 32.6 | 32.6 | 32.6 |

| Often | 173 | 42.7 | 42.7 | 75.3 | |

| Never | 100 | 24.7 | 24.7 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Laboratory Centers | Always | 147 | 36.3 | 36.3 | 36.3 |

| Often | 172 | 42.5 | 42.5 | 78.8 | |

| Never | 86 | 21.2 | 21.2 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Physical Therapy Centers | Always | 105 | 25.9 | 25.9 | 25.9 |

| Often | 130 | 32.1 | 32.1 | 58.0 | |

| Never | 170 | 42.0 | 42.0 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Pharmacies | Always | 172 | 42.5 | 42.5 | 42.5 |

| Often | 178 | 44.0 | 44.0 | 86.4 | |

| Never | 55 | 13.6 | 13.6 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

Evaluating Satisfaction

In the evaluation of the services used, participants were asked to indicate whether they were satisfied with the major services provided. Table 6 shows that approximately 79% of the participants were satisfied with the private hospital services, while approximately 40% stated that they never used physical therapy centers.

Table 6.

Satisfaction with Major Services

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| Private Hospitals | Yes | 318 | 78.5 | 78.5 | 78.5 |

| No | 71 | 17.5 | 17.5 | 96.0 | |

| Never used | 16 | 4.0 | 4.0 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Medical Centers | Yes | 244 | 60.2 | 60.2 | 60.2 |

| No | 65 | 16.0 | 16.0 | 76.3 | |

| Never used | 96 | 23.7 | 23.7 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Dental Centers | Yes | 230 | 56.8 | 56.8 | 56.8 |

| No | 79 | 19.5 | 19.5 | 76.3 | |

| Never used | 96 | 23.7 | 23.7 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Radiology Centers | Yes | 229 | 56.5 | 56.5 | 56.5 |

| No | 77 | 19.0 | 19.0 | 75.6 | |

| Never used | 99 | 24.4 | 24.4 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Laboratory Centers | Yes | 242 | 59.8 | 59.8 | 59.8 |

| No | 77 | 19.0 | 19.0 | 78.8 | |

| Never used | 86 | 21.2 | 21.2 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Physical Therapy Centers | Yes | 155 | 38.3 | 38.3 | 38.3 |

| No | 89 | 22.0 | 22.0 | 60.2 | |

| Never used | 161 | 39.8 | 39.8 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Pharmacies | Yes | 240 | 59.3 | 59.3 | 59.3 |

| No | 104 | 25.7 | 25.7 | 84.9 | |

| Never used | 61 | 15.1 | 15.1 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

In evaluating the services utilized, participants were asked to indicate their satisfaction with the major services provided. Table 6 indicates that approximately 79% of participants reported satisfaction with private hospital services. However, approximately 40% stated that they never used physical therapy centers.

Evaluating Insurance Company Services

In Section Three, participants evaluated the services provided by the insurance company. The first question asked participants to rate the information they received about their benefit plans and Explanation of Benefits (EOB). Table 7 shows that approximately 61% of respondents rated the information on plan benefits received as average to above average, while approximately 17.9% rated it as poor or below average.

Table 7.

Evaluation of the Insurance Coverage Plan

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| Information Coverage | Poor | 23 | 5.6 | 5.6 | 5.6 |

| Below Average | 50 | 12.3 | 12.3 | 18.0 | |

| Average | 117 | 28.9 | 28.9 | 46.9 | |

| Above Average | 129 | 31.9 | 31.9 | 78.8 | |

| Excellent | 86 | 21.2 | 21.2 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

In the second question of this section, participants indicated their level of satisfaction, using a 5-point Likert satisfaction scale (ranging from 5 as highly satisfied to 1 as highly dissatisfied), about the speed of granting authorization for requested services. Table 8 indicates that approximately 61.2% of respondents were satisfied or highly satisfied with the speed at which authorization was granted.

Table 8.

Satisfaction with the Speed of Granting Authorization for Services

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| Satisfaction with speed in granting authorization | Highly dissatisfied | 18 | 4.4 | 4.4 | 4.4 |

| Dissatisfied | 56 | 13.8 | 13.8 | 18.3 | |

| Neutral | 83 | 20.5 | 20.5 | 38.8 | |

| Satisfied | 175 | 43.2 | 43.2 | 82.0 | |

| Highly satisfied | 73 | 18.0 | 18.0 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

When participants were asked to indicate the time spent obtaining their coverage approval, 47.7% reported it took less than 15 minutes, while 36.5% stated it took between 15 minutes and one hour. The fourth question assessed front-end services, asking participants to evaluate the services provided during the scheduling and registration process. Table 9 presents the assessment of the scheduling and registration process.

Table 9.

Scheduling and Registration Process Assessment

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| ID check on registration | Yes | 371 | 91.6 | 91.6 | 91.6 |

| No | 12 | 3.0 | 3.0 | 94.6 | |

| I do not know | 22 | 5.4 | 5.4 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Copying insurance card | Yes | 339 | 83.7 | 83.7 | 83.7 |

| No | 13 | 3.2 | 3.2 | 86.9 | |

| I do not know | 53 | 13.1 | 13.1 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Registration staff obtain copy of insurance card | Yes | 379 | 93.6 | 93.6 | 93.6 |

| No | 15 | 3.7 | 3.7 | 97.3 | |

| I do not know | 11 | 2.7 | 2.7 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Registration staff obtain your signature for release of information | Yes | 289 | 71.4 | 71.4 | 71.4 |

| No | 56 | 13.8 | 13.8 | 85.2 | |

| I do not know | 60 | 14.8 | 14.8 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

The fifth question assesses the services performed during the insurance verification process. Table 10 indicates that 87.7% of participants agreed that the registration staff validates their membership in the insurance plan and covers the services that were scheduled.

Table 10.

Assessment of Services During the Authorization Process

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| Registration staff validate membership for scheduled service date | Yes | 355 | 87.7 | 87.7 | 87.7 |

| No | 14 | 3.5 | 3.5 | 91.1 | |

| I do not know | 36 | 8.9 | 8.9 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Registration staff validate insurance plan if within network | Yes | 365 | 90.1 | 90.1 | 90.1 |

| No | 12 | 3.0 | 3.0 | 93.1 | |

| I do not know | 28 | 6.9 | 6.9 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Registration staff validate the expenses that will be covered | Yes | 351 | 86.7 | 86.7 | 86.7 |

| No | 32 | 7.9 | 7.9 | 94.6 | |

| I do not know | 22 | 5.4 | 5.4 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Registration staff explain reasons for out-of-pocket payment | Yes | 331 | 81.7 | 81.7 | 81.7 |

| No | 43 | 10.6 | 10.6 | 92.3 | |

| I do not know | 31 | 7.7 | 7.7 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

Evaluating Beneficiaries’ Satisfaction

Participants were asked to evaluate their satisfaction and experience with the Afya insurance scheme. Table 11 shows that 63% of participants were highly satisfied with the Afya insurance scheme, while approximately 25% were dissatisfied. Moreover, a similar percentage of participants rated their experience as ranging between good and excellent. When comparing the services provided by Afya to those of the public sector, 69.1% of participants stated that their experience with Afya was very good or excellent.

Table 11.

Overall Participant Satisfaction

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| Overall Satisfaction | Highly dissatisfied | 10 | 2.5 | 2.5 | 2.5 |

| Dissatisfied | 90 | 22.2 | 22.2 | 24.7 | |

| Neutral | 96 | 23.7 | 23.7 | 48.4 | |

| Satisfied | 146 | 36.0 | 36.0 | 84.4 | |

| Highly satisfied | 63 | 15.6 | 15.6 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Experience with Afya insurance coverage | Very poor | 6 | 1.5 | 1.5 | 1.5 |

| Poor | 22 | 5.4 | 5.4 | 6.9 | |

| Average | 122 | 30.1 | 30.1 | 37.0 | |

| Very good | 149 | 36.8 | 36.8 | 73.8 | |

| Excellent | 106 | 26.2 | 26.2 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

| Comparing Afya services to government services | Very poor | 10 | 2.5 | 2.5 | 2.5 |

| Poor | 30 | 7.4 | 7.4 | 9.9 | |

| Average | 85 | 21.0 | 21.0 | 30.9 | |

| Very good | 115 | 28.4 | 28.4 | 59.3 | |

| Excellent | 165 | 40.7 | 40.7 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

Evaluating Repetition of Services

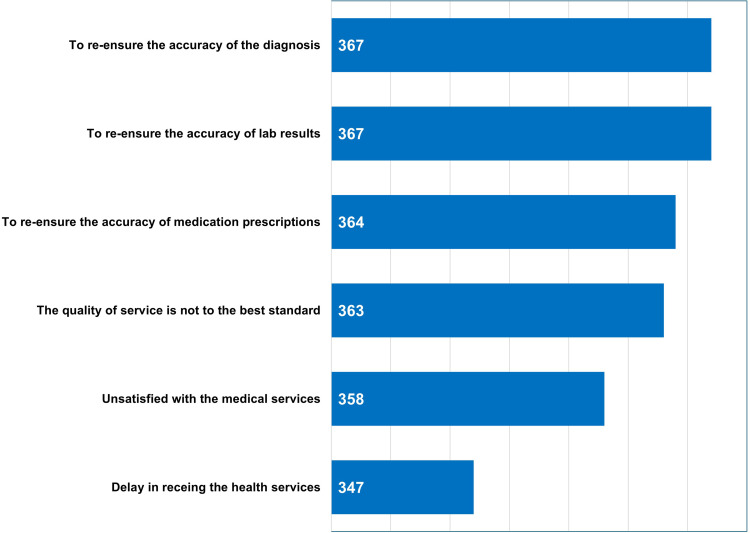

To assess whether beneficiaries repeat the same service in a public hospital after receiving it in the private hospital network, Table 12 shows that more than half of the participants do so. Figure 4 indicates the reasons for repeating the same services, with re-ensuring the accuracy of laboratory results and diagnosis being the top major reasons.

Table 12.

Assessing the Duplication of Services with Government Hospitals

| Frequency | % | Valid % | Cumulative % | ||

|---|---|---|---|---|---|

| Repeat same services at government hospitals | Yes | 207 | 51.1 | 51.1 | 51.1 |

| No | 198 | 48.9 | 48.9 | 100.0 | |

| Total | 405 | 100.0 | 100.0 | ||

Figure 4.

Reasons for Repeating the Services.

Evaluating Beneficiaries’ Perceptions of the Future of the Afya Scheme

Participants were asked, “Do you think the government should improve the Afya insurance coverage plan?” Figure 5 shows that 94% of participants believe that the government should improve the Afya coverage plan. As shown in Figure 6, opinions on potential actions vary: 27% believe that the program should be suspended to avoid financial burdens on the government, 25% believe that the government should suspend the Afya insurance plan for further studies, 17% suggest that the government should build a new hospital for retirees, 16% indicate the need for adding more healthcare providers, and 15% think that the government should add more beneficiaries to the plan coverage.

Figure 5.

Beneficiaries Perception About Afya Plan.

Figure 6.

Beneficiaries’ perceptions of how the government should improve the Afya scheme.

Correlation Analysis

The correlation between two variables, namely experience with Afya coverage and satisfaction, was significant (0.578) at the 0.01 level, as shown in Table 13.

Table 13.

Correlations Between Experience with Afya and Satisfaction of the Beneficiaries

| Experience with Afya | Satisfaction with Afya | ||

|---|---|---|---|

| Experience with Afya | Pearson Correlation | 1 | 0.578** |

| Sig. (2-tailed) | <0.001 | ||

| N | 405 | 405 | |

| Satisfaction with Afya | Pearson Correlation | 0.578** | 1 |

| Sig. (2-tailed) | <0.001 | ||

| N | 405 | 405 | |

Note: **Correlation is significant at the 0.01 level (2-tailed).

Table 14 shows a significant correlation (0.419) at the 0.01 level between satisfaction with Afya services and experience with Afya in comparison to the public sector. However, no significant correlation was found between governorate type and beneficiaries’ satisfaction (Table 15).

Table 14.

Correlations Between Satisfaction with Afya Services and Experience with Afya Services in Comparison to Public Sector Services

| Evaluate Afya Services | Compare Afya Services with Government Services | ||

|---|---|---|---|

| Evaluate Afya services | Pearson Correlation | 1 | 0.419** |

| Sig. (2-tailed) | <0.001 | ||

| N | 405 | 405 | |

| Compare Afya services with government services | Pearson Correlation | 0.419** | 1 |

| Sig. (2-tailed) | <0.001 | ||

| N | 405 | 405 | |

Note: **Correlation is significant at the 0.01 level (2-tailed).

Table 15.

Correlations Between Governorate Type and Beneficiaries’ Satisfaction

| Governorate Type | Satisfaction Afya Services | ||

|---|---|---|---|

| Governorate type | Pearson Correlation | 1 | 0.088 |

| Sig. (2-tailed) | 0.077 | ||

| N | 405 | 405 | |

| Satisfaction Afya services | Pearson Correlation | 0.088 | 1 |

| Sig. (2-tailed) | 0.077 | ||

| N | 405 | 405 | |

Discussion

Service quality is defined as the extent of which services reach the expectation of consumers. If the performance of the service surpasses the expectations, the observed quality is considered less than satisfactory, thus causing the dissatisfaction of consumers.15–17

Kuwait has experienced substantial changes in its healthcare system, evolving from primarily public national health service (NHS) to a mixed system incorporating private insurance coverage. This shift aims to enhance the overall healthcare infrastructure and services, adapting to the growing and diverse healthcare needs of the population.

In recent years, the government has implemented several initiatives to promote private health insurance. The introduction of the Afya scheme, for example, underscores the growing importance of public-private partnerships in the healthcare sector. This initiative aims to provide comprehensive health insurance coverage not only for national citizens but also for expatriates.2

Afya is a health insurance scheme introduced by the Kuwait government to provide retired nationals with access to services from private hospitals. This initiative not only benefits individuals but also contributes to the growth of the private medical industry. Afya facilitates increased access to health services and patient choices, supports the expansion of specialized services and quality in the private sector, reduces waiting periods, and alleviates the patient load in public hospitals.4

This study aimed to evaluate the Afya Healthcare Insurance Policy in Kuwait by assessing its efficiency, inclusivity, effectiveness, and service quality, along with its delivery of total healthcare services and long-term sustainability. The survey questionnaire addressed the utilization and evaluation of services, including the type and frequency of usage, as well as medical service satisfaction. Additionally, it evaluated front-end services in private and public hospitals, preliminary information dissemination, and overall beneficiary satisfaction.

According to Al-Sabah’s research, hospital managers reported that private hospitals demonstrate greater efficiency, agility, and adaptability to change compared to public hospitals, which are often perceived as slow, centralized, and lacking necessary skills.4 Table 5 from our study further supports this notion, revealing that a majority of participants used private hospitals every time or often (95%), likely due to their efficient management as discussed earlier. Consequently, high beneficiary satisfaction (78.5%, as shown in Table 6) was observed with the high utilization of private hospitals.

Conversely, when utilizing medical services from government hospitals (Table 12), respondents often preferred to repeat the same services to ensure accurate laboratory results, diagnoses, and medication, alongside concerns about inadequate service quality (Figure 4). This tendency may result in duplication of reports, services, and patient records, as highlighted in Alsabah’s study.4

Our study revealed (Table 4) that approximately 65.2% of respondents reported using specialty services mostly for chronic diseases, while outpatient services (29.4%, Table 2) were less commonly utilized. This finding aligns with the broader health context in Kuwait, where almost three-fourths of deaths are attributed to noncommunicable diseases (NCDs). The prevalence of these diseases is expected to rise, with 12% of adults aged 30 to 70 years succumbing to cardiovascular diseases, cancer, respiratory diseases, or diabetes.18

As the incidence of NCDs, or chronic diseases, continues to increase, Kuwait’s healthcare system faces significant challenges in adapting to these conditions.2 Additionally, the population is projected to reach 5.2 million people by 2027, with approximately 35% of individuals aged over 50 years.19 This demographic shift further underscores the urgent need for an improved healthcare system to support the growing number of high-risk retirees.

It’s important to note that lifestyle-related factors such as inactivity, high-calorie diets, and excessive sugar intake are believed to be major contributors to the prevalence of NCDs. Addressing these factors will be crucial in mitigating the burden of chronic diseases and improving overall public health in Kuwait.

The second aim of our study is to comprehend the Revenue Management Cycle (RMC) of the health insurance industry. The health insurance RMC encompasses several stages, typically beginning with patients booking appointments and concluding with payment processing. However, additional phases are involved for inpatients and patients with chronic conditions. These stages include scheduling, insurance registration, insurance plan discussions, and verification, among others.

Our study assessed the information provided by insurance workers, revealing acceptable execution of benefit plans and their diversity (Table 7). Furthermore, satisfaction with the speed of service authorization was reported by 61% of participants (Table 8), alongside adequate representation of front-end services such as scheduling, registration, and verification (Tables 9 and 10).

Overall, retiree satisfaction with insurance coverage was high (63%, Table 11), with Afya being rated “excellent” or “very good” compared to public sector services (69.1%). This resulted in a statistically significant correlation (p<0.001, Table 13) between beneficiaries’ insurance packages offered by Afya and satisfaction with the scheme. The analysis of the results based on respondents’ age reveals important insight into healthcare utilization and satisfaction across different age groups, highlighting the cost implications of an aging population. Younger respondents (ages 18–34) reported lower utilization rates, which can be attributed to their generally better health and lower need for frequent medical attention. In contrast, older respondents (ages 55 and above) showed higher utilization rates, especially for chronic disease management, indicating greater healthcare needs and costs. Satisfaction with healthcare services was highest among middle-aged respondents (ages 35–54) reflecting their increased reliance on comprehensive insurance coverage for managing chronic conditions.

Proceeding towards the third aim, consumer behavior demonstrates how important it is for people to have information or assurance about their health; for instance, the demand for information and certainty influences the chance of paying and satisfaction of services.20 Research conducted in Nepal10,21,22 and India23,24 has indicated that a significant portion of the population in these areas is unaware of available health insurance schemes. Despite beneficiaries expressing satisfaction with Afya, 109 entries (21%) were excluded from our study because individuals were not registered under the scheme. The lack of awareness about healthcare insurance policies can be influenced by societal,25 cultural,25 and religious11 factors. Adequate knowledge and awareness of insurance schemes have been found to correlate with higher usage of health insurance.26–28

Moreover, the integration of the information-value nexus into the analysis improves the studies conceptual flaw and quality by highlighting how the availability of information influences the perceived value of healthcare services. Respondents with better access to information about Afya scheme and healthcare services were more likely to use private facilities and report higher satisfaction, indicating that the schemes value is closely related to the quality of information provided. Additionally, those well-informed about their coverage options and benefits perceived the scheme as significantly more valuable, understanding the critical role of effective communication in enhancing the insurance scheme success.

While public participation in healthcare resource allocation decision-making can be beneficial for awareness creation,5,29 some studies have highlighted challenges such as costly public priorities, inequitable solutions, and overlooked services such as mental health.5,20,30,31 However, involving the public in decision-making can contribute to acceptance of the system and improve outcomes, such as increasing the number of beneficiaries and enhancing satisfaction levels.

The Kingdom of Saudi Arabia (KSA) has implemented strategies to boost awareness, including collaboration with national media to disseminate information about healthcare insurance systems, benefits, and policies.5,11 Other recommendations include conducting a comprehensive study of the country’s healthcare system to identify and address concerns, possibly through modernization, market competition, and regulatory reforms.25

Creating voluntary participation and ensuring the long-term sustainability and proper integration of the private and public healthcare sectors require addressing identified issues and possibly reforming existing policies or considering complete suspension. Al Sabah’s study demonstrated that majority of individuals expressed a desire to reform their treatment package and increase the number of beneficiaries.5 However, despite 94% advocating for improvements in Afya’s coverage plan (Figure 5), more than half suggested suspending the scheme to facilitate service improvement through proper research and to prevent financial burdens on the government (Figure 6).

Through analysis of the causes of service repetition (Figure 4), beneficiaries expressed needs for improvement (Figure 6), coupled with a review of the literature, we have identified five major problems. These are outlined in Table 16, along with plausible resolutions for each.

Table 16.

Major Problems and Solutions

| Problems | Solutions | Sources |

|---|---|---|

|

|

[5] |

|

[2,11] | |

|

[11] | |

|

|

[11,28] |

|

[5,29] | |

|

|

[11] |

|

[2] | |

|

|

[2,11] |

|

|

[11] |

|

[32] | |

|

[33] | |

|

[33] |

Conclusion

The study limitations include the lack of comparable literature similar to the government-funded Afya scheme, and the inability to access the retirees’ database due to confidentiality constraints. Additionally, limited resources hindered the acquisition of adequate and relevant information about Afya, posing a significant challenge in developing and validating the results. Moreover, many documents such as booklets and reports published by recognized sources like the Public Institution for Social Security and the Afya website were in Arabic, necessitating translation. The allocation of resources, including healthcare spending, is often determined by the share of GDP.34 In 2020, Kuwait allocated 6.3% of its GDP to health expenditures.19 However, the overall development in Kuwait is hindered by frequent changes in health ministers.2 Moreover, the cost implication of Afya Insurance scheme is beyond the scope of the objective of the study.

This study highlights critical aspects of Afya insurance scheme, focusing on service utilization and satisfaction. The findings underscore the significant role of private healthcare services in meeting the needs of beneficiaries, with high utilization and satisfaction rates indicating their effectiveness. However, the frequent need to repeat procedures in government hospitals points to a need for quality improvement in public healthcare services.

A crucial aspect of the analysis is the comparison between the private insurance scheme and the potential expansion of public health services. The private scheme currently offers several advantages, including high satisfaction rates and more reliable service quality, particularly for middle-aged and older adults managing chronic conditions. These benefits highlight the efficiency and responsiveness of private healthcare providers in addressing the specific needs of Afya beneficiaries.

The current challenges within the public health system, such as low satisfaction rates and the necessity for repeated procedures, suggest that substantial improvements in the public health sector are needed to match the effectiveness and quality of private healthcare services.

The introduction of initiatives like Afya and DHAMAN underscores the growing importance of PPPs in the healthcare sector in Kuwait. These partnerships represent a significant step towards providing comprehensive health insurance coverage not only for national citizens but also for expatriates. As the government plans to expand coverage to include other groups or categories with initiatives like Afya, the eventual goal is to establish health insurance on a wider scale for all residents in Kuwait. The MoH’s perspective on the current healthcare system in Kuwait has been influenced by reduced revenues resulting from the drop in oil prices. This has led to considerations regarding the high dependence on public healthcare services, particularly when implementing private insurance coverage for Kuwaiti retirees through initiatives like Afya. It’s worth noting that Kuwait’s level of private health insurance is relatively low compared to other Gulf Council countries (GCC), resulting in higher out-of-pocket expenditures for residents.

Balancing the strength of private scheme with inclusivity of public health services is essential for creating a substantial and comprehensive healthcare system in Kuwait. Enhancing public healthcare quality and integrating successful elements from the private scheme could offer a pathway to a more effective healthcare system. Further reforms should consider these dynamics to ensure that both private and public health services are optimized to meet the evolving healthcare needs of the population.

To address these concerns and enhance the scheme’s effectiveness, we recommend the following measures:

-

a)

Complete reformation of Afya through empirical, methodical, and scientifically rigorous research to identify areas for improvement.

-

b)

Implementation of the Health Information Management System (HIMS) to facilitate proper exchange of patient information between the public and private sectors, enhancing coordination and efficiency.

-

c)

Inclusion of younger family members of retirees in the scheme to broaden the risk pool and potentially reduce premium costs for treatment.

While our paper provides a preliminary overview of the Afya scheme, further studies are warranted to comprehensively assess its efficiency and sustainability. For instance, conducting SERVQUAL service quality analysis can offer insights into service quality and identify areas for enhancement based on beneficiaries’ experiences. Additionally, future studies should explore the economic aspects of Afya to provide a comprehensive understanding of its impact and sustainability.

Acknowledgments

The authors would like to thank Dr.Waleed AlNashmi for his support. This paper has been uploaded to ResearchSquare as a preprint: https://www.researchsquare.com/article/rs-3903149/v1

Disclosure

The authors report no conflicts of interest in this work.

References

- 1.Al-Razouki M, Pradhan M. Kuwait health report 2019; 2019. Available from: https://www.klsc.com.kw/wp-content/uploads/2019/02/KLSC-BDU-Kuwait-Healthcare-Report-2019-vF.pdf. Accessed August 9, 2023.

- 2.Mossialos E, Cheatley J, Reka H, Alsabah A, Patel N. Kuwait: health System Review; 2018. Available from: http://eprints.lse.ac.uk/id/eprint/119461. Accessed August 9, 2023.

- 3.Alsabah AM, Haghparast-Bidgoli H, Skordis J. Measuring the efficiency of public hospitals in Kuwait: a two-stage data envelopment analysis and a qualitative survey study. Glob J Health Sci. 2020;12(3):121. doi: 10.5539/gjhs.v12n3p121 [DOI] [Google Scholar]

- 4.Alsabah A, Haghparast-Bidgoli H, Skordis J. Hospital managers’ perceptions regarding setting healthcare priorities in Kuwait. Glob J Health Sci. 2020;12:79. doi: 10.5539/gjhs.v12n10p79 [DOI] [Google Scholar]

- 5.Alsabah AM, Haghparast-Bidgoli H, Skordis J. Comparing public and provider preferences for setting healthcare priorities: evidence from Kuwait. Healthcare. 2021;9(5):552. doi: 10.3390/healthcare9050552 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Ministry of Health. Afya: health insurance for Kuwaiti retirees policy; 2016. Available from: https://www.gig-health.com/Docs/Introduction_Book.pdf. Accessed August 10, 2023.

- 7.Ministry of Health. Afya: health insurance for Kuwaiti retirees policy; 2019.

- 8.Ministry of Health. Afya: health Insurance For Kuwaiti Retirees Policy; 2022.

- 9.HAHC. Health assurance hospitals company (DHAMAN); 2023. Available from: https://www.dhaman.co/dhaman-corporate-en. Accessed August 13, 2023.

- 10.Ghimire S, Ghimire S, Khanal P, Sagtani RA, Paudel S. Factors affecting health insurance utilization among insured population: evidence from health insurance program of Bhaktapur district of Nepal. BMC Health Serv Res. 2023;23(1):159. doi: 10.1186/s12913-023-09145-9 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Puteh SEW, Aizuddin AN, Salem A. Renewal of healthcare funding systems by national health insurance in the Kingdom of Saudi Arabia (NHI). Haya. 2020;5:236–245. doi: 10.36348/sjls.2020.v05i11.001 [DOI] [Google Scholar]

- 12.Stojisavljević S, Đikanović B, Vončina L, et al. The challenge of ensuring elderly people can access their health insurance entitlements: a mixed methods study on the Republic of Srpska’s Protector of Patients. HEALTH Insur Entit BMJ Glob Health. 2022;7:e009373. doi: 10.1136/bmjgh-2022-009373 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Layman E, Forrestal E, Watzlaf V; Association AHIM. Health Informatics Research Methods: Principles and Practice. American Health Information Management Association; 2009. [Google Scholar]

- 14.Trochim W, Donnelly JP. The Research Methods Knowledge Base. Cengage Learning; 2006. [Google Scholar]

- 15.Ishfaq M, Qadri FA, Abusaleem KSM, Al-Zyood M. Measuring quality of service from consumers’ perspectives: a case of healthcare insurance in Saudi Arabia. Health SciJ. 2016;10(1):1. [Google Scholar]

- 16.Lewis BR, Mitchell VW. Defining and measuring the quality of customer service. Market Intellig Plan. 1990;8(6):11–17. doi: 10.1108/EUM0000000001086 [DOI] [Google Scholar]

- 17.Parasuraman A, Zeithaml VA, Berry LL. A conceptual model of service quality and its implications for future research. J Mark. 1985;49(4):41–50. doi: 10.1177/002224298504900403 [DOI] [Google Scholar]

- 18.Mashreq Bank. 2020 annual overview of healthcare in the GCC: growth opportunities for 2021 and beyond; 2020. Available from: https://www.mashreqbank.com/-/jssmedia/pdfs/corporate/healthcare/2020-Annual-Overview-of-Healthcare-in-The-GCC.ashx. Accessed August 13, 2023.

- 19.Alpen Capital. GCC Healthcare Industry 2023; 2023. Available from: https://alpencapital.com/research/2023/alpen-capital-gcc-healthcare-industry-report-mar-2023.php. Accessed August 13, 2023.

- 20.Vuong QH, Ho TM, Nguyen HK, Vuong TT. Healthcare consumers’ sensitivity to costs: a reflection on behavioural economics from an emerging market. Palgrave Commun. 2018;4(1):70. doi: 10.1057/s41599-018-0127-3 [DOI] [Google Scholar]

- 21.Nepal Health Research Council. Assessment of social health insurance scheme in selected districts of Nepal; 2018. Available from: https://nhrc.gov.np/wp-content/uploads/2019/04/Health-Insurence-CTP.pdf. Accessed August 13, 2023.

- 22.Thapa R, Lamsal S, Badhu A, Shrestha S. Awareness regarding health insurance policy scheme of government of Nepal among local residents of dharan sub-metropolitan city. J BP Koirala Inst Health Sci. 2021;4:32–36. doi: 10.3126/jbpkihs.v4i1.37764 [DOI] [Google Scholar]

- 23.Choudhary M, Goswami K, Khambhati S, Shah V, Makwana N, Yadav S. Awareness of health insurance and its related issues in rural areas of Jamnagar district. Nat J Comm Med. 2013;4:267–271. [Google Scholar]

- 24.Reshmi B, Nair NS, Sabu KM, Unnikrishan B. Awareness of health insurance in a south Indian population: a community based study. Health Popul Persp Iss. 2007;30(3):177–188. [Google Scholar]

- 25.Al-Amri K, Gattoufi S, Al-Muharrami S. Analyzing the technical efficiency of insurance companies in GCC. J Risk Finan. 2012;13(4):362–380. doi: 10.1108/15265941211254471 [DOI] [Google Scholar]

- 26.Basaza R, Kyasiimire EP, Namyalo PK, Kawooya A, Nnamulondo P, Alier KP. Willingness to pay for Community Health Insurance among taxi drivers in Kampala City, Uganda: a contingent evaluation. Risk Man Heal Pol. 2019;12:133–143. doi: 10.2147/RMHP.S184872 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27.Ghaddar S, Byun J, Krishnaswami J. Health insurance literacy and awareness of the Affordable Care Act in a vulnerable Hispanic population. Patient Educ Couns. 2018;101(12):2233–2240. doi: 10.1016/j.pec.2018.08.033 [DOI] [PubMed] [Google Scholar]

- 28.Reshmi B, Unnikrishnan B, Parsekar SS, Rajwar E, Vijayamma R, Venkatesh BT. Health insurance awareness and its uptake in India: a systematic review protocol. BMJ Open. 2021;11(4). doi: 10.1136/bmjopen-2020-043122 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29.Rosén P. Public dialogue on healthcare prioritisation. Health Policy. 2006;79(1):107–116. doi: 10.1016/j.healthpol.2005.11.015 [DOI] [PubMed] [Google Scholar]

- 30.Bowling A. Health care rationing: the public’s debate. BMJ. 1996;312(7032):670–674. doi: 10.1136/bmj.312.7032.670 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31.Lees A, Scott N, Scott SN, MacDonald S, Campbell C. Deciding how NHS money is spent: a survey of general public and medical views. Health Expectations. 2002;5(1):47–54. doi: 10.1046/j.1369-6513.2002.00157.x [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32.Friedman B, Jiang HJ, Elixhauser A, Segal A. Hospital inpatient costs for adults with multiple chronic conditions. Med Care Res Rev. 2006;63(3):327–346. doi: 10.1177/1077558706287042 [DOI] [PubMed] [Google Scholar]

- 33.Fadhil I, Ali R, Al-Raisi SS, et al. Review of national healthcare systems in the gulf cooperation council countries for noncommunicable diseases management. Oman Med J. 2022;37(3):e370–e370. doi: 10.5001/omj.2021.96 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34.Mataria A, El-Saharty S, Hamza MM, Hassan H. Transforming Health Financing Systems in the Arab World Toward Universal Health Coverage. In: Handbook of Healthcare in the Arab World. Springer International Publishing; 2021:1723–1772. doi: 10.1007/978-3-030-36811-1_155 [DOI] [Google Scholar]