Abstract

Objective

To examine the effect of the Medicare prospective payment system (PPS) for skilled nursing facilities (SNF) on the delivery of rehabilitation therapy to residents.

Data Sources

Resident-level data are based on the Resident Assessment Instrument Minimum Data Set for nursing facilities. All elderly residents admitted to SNFs in Michigan and Ohio in 1998 and 1999 form the study population (n=99,952).

Study Design

A differences-in-differences identification strategy is used to compare rehabilitation therapy for SNF residents before and after a change in Medicare SNF payment. Logistic and linear regression analyses are used to examine the effect of PPS on receipt of physical, occupational, or speech therapy and total therapy time.

Data Extraction

Data for the present study were extracted from the University of Michigan Assessment Archive Project (UMAAP). One assessment was obtained for each resident admitted to nursing facilities during the study period.

Principal Findings

The introduction of PPS for all U.S. Medicare residents in July of 1998 was associated with specific targeting of rehabilitation treatment time to the most profitable levels of therapy. The PPS was also associated with increased likelihood of therapy but less rehabilitation therapy time for Medicare residents.

Conclusions

The present results indicate that rehabilitation therapy is sensitive to the specific payment incentives associated with PPS.

Keywords: Prospective payment system, case-mix payment, nursing homes, rehabilitation

Payment for nursing home care is an important policy concern for federal and state governments. Total government expenditures for nursing home care in the United States amounted to $58.2 billion in 1999 (Centers for Medicare and Medicaid Services 2002). The federal government paid for more than half of these expenditures through the Medicare program and through matching contributions to state Medicaid programs. While Medicaid expenditures are nearly four times higher than Medicare expenditures, the Medicaid proportion has declined through the 1990s and Medicare expenditures have tripled, both in magnitude and as a proportion of government nursing home expenditures. To restrain cost growth, Medicare introduced a prospective payment system (PPS) for Part A skilled nursing facility (SNF) benefits in July of 1998. The PPS increases control over government expenditures by transferring the financial risk for Medicare residents to nursing home facilities (Grimaldi 1999; 2002). The change may affect nursing home resident treatments because PPS changes the factors that drive reimbursement rates. To date, there has been no research on the effect of PPS on treatment patterns for residents.

The purpose of the present research is to identify the effect of PPS on the delivery of rehabilitation therapy treatment. Rehabilitation therapy is an important focus for study because this treatment (1) is an expensive component of care and hence sensitive to payment; (2) is measurable at the individual resident level; (3) is provided to between one-third and one-half of all nursing home residents (Murray et al. 1999); and (4) is an important component of care that may have substantial effects on resident outcomes such as functional health and return to the community (Joseph and Wanlass 1993).

While past research has examined overall effects of various payment methods at the facility level, the present research contributes to the literature by examining resident-level treatment within the nursing home. Past studies may have been constrained by data limitations. Siu (1998) suggests that new data from the Minimum Data Set Resident Assessment Instrument (MDS) is a valuable source of information for examining provider behavior within the nursing home. The results from this study demonstrate a marked change in nursing home rehabilitation therapy following the implementation of PPS.

Policy Goals and Levers

A prime concern to government long-term care program administrators and policymakers is the need to control expenditures. Payment methods used by government programs are an important policy lever used to control expenditures. Payment methods affect expenditures because the payment method determines the reimbursement rate and marginal revenue for care provided to residents. The effect of government payment on provider behavior is a particular concern to policymakers because providers determine the type and amount of care that is delivered to nursing home residents. While some payment methods may lead to excessive utilization, other payment methods may put too much pressure on cost containment and potentially lead to underprovision of resident care (Coburn et al. 1993; Cohen and Spector 1996; Murtaugh et al. 1988).

Residents

The present study uses data from Medicare-certified SNFs. Medicare, Medicaid, or private sources may finance care for residents in these facilities, with each payer employing a different payment method. Medicare Part A is the first-payer and primary payment source for rehabilitation in nursing homes. To qualify for Medicare Part A SNF payment, Medicare beneficiaries must be admitted to nursing home within 30 days following an acute hospital stay of at least 3 days and must require skilled-level nursing and other services. The Part A benefit provides up to 100 days of post-acute care and a daily resident copayment of about $100 is required after 20 days of care. Medicaid and private-pay residents are not eligible for Medicare benefits either because they have used up their Medicare benefit, or they did not have a qualifying acute hospital stay, or the services that they require do not meet the conditions for skilled-level care. Rehabilitation for the latter residents is paid for first by (limited) Medicare Part B benefits, then by private or Medicaid sources. Rehabilitation for each type of resident may differ because of differences in clinical conditions that necessitate nursing home care. This study suggests that rehabilitation is also affected by payment.

Cost-based Payment

Before July of 1998, Medicare Part A reimbursed SNFs using retrospective reasonable-cost-based payment. Although Medicare imposed limits on routine service payments, ancillary services such as rehabilitation were not limited. Under this regime, providers are reimbursed for virtually all costs, do not bear the risk for marginal costs of care, and thus have little incentive to minimize costs or behave as efficient producers (Grimaldi 1999; 2002). Because price is determined only by production costs, cost-based payment offers no control over the price of nursing home care. Moreover, the marginal revenue for rehabilitation care under cost-based payment is directly related to treatment costs because all reasonable costs, including a return on investment, are reimbursed. Cost-based payment provides no financial restriction on rehabilitation treatments, allows the highest level of rehabilitation treatment, and may lead to overuse of services.

The Medicare Prospective Payment System

The Medicare PPS system provides payment rates to facilities that are adjusted for resident severity or case mix. Case-mix adjusted prospective payment determines an explicit price for nursing home care ex ante, but rates provide higher payments for residents who require higher levels of care. If the case-mix adjustment reflects resident need, this form of payment can ensure efficient production and maintain equal incentives to admit and care for residents at any level of need (Cohen and Dubay 1990).

The Resource Utilization Groups (RUG-III) case-mix measurement system, developed by Fries and colleagues (Fries et al. 1994) was adopted for the Medicare program.1 RUG-III provides 44 different levels of payment depending on resident functional health status. Of particular importance to this study, the RUG-III system also includes actual rehabilitation treatment in the severity-adjustment algorithm. Because rehabilitation therapy time is explicitly included in the RUG-III algorithm, payments to nursing facilities for rehabilitation are reimbursed in part based on the treatments provided.

The RUG-III algorithm specifies the level of reimbursement based on the average cost of total weekly minutes of physical, occupational, and speech rehabilitation therapy services. The algorithm provides a fixed reimbursement rate for the following rehabilitation therapy time periods: 45 through 149 minutes, 150 through 324 minutes, 325 through 499 minutes, 500 through 719 minutes, and 720 minutes and over. Between the minimum levels of rehabilitation therapy associated with each payment level, the marginal revenue of additional therapy time is zero. Positive marginal revenue exists only at “nodal” levels of therapy (45, 150, 325, 500, and 720 minutes).2 Since total costs increase between nodes, therapy times just below nodes have the highest cost relative to revenue.

Fee-for-Service Payment

Rehabilitation for all residents whose care is not paid for by Medicare Part A payments in the present study is paid for using fee-for-service (FFS) payment. Medicare Part B FFS payments are determined by a schedule and an annual benefit limit exists. State Medicaid rehabilitation benefits vary substantially. For all states in the present study, limited rehabilitation treatments are paid for using FFS payment (though at lower rates than Medicare Part B). Private-pay patients similarly pay for additional rehabilitation with FFS, but at higher rates and without billing limits. For rehabilitation care, FFS payment rates are constant for each additional unit of care (generally recorded in units of 5 minutes). Since the marginal cost of an additional unit of rehabilitation therapy is essentially constant for an individual resident, the FFS payment is comparable to a cost-based payment system with payment rates that vary by payment source.

Nursing Home Provider Behavior: Empirical Evidence

There is very little research yet available that examines the effect of the Medicare payment change on nursing home behavior. A Medicare demonstration project evaluated 18 participating facilities and found that more residents were given rehabilitation therapy under PPS payment (Hutt et al. 2001). Other studies examining SNF provider behavior relied on interstate Medicaid program differences and changes in state Medicaid programs to identify the effects of payment methods. The empirical evidence suggests that resident access and staffing levels are at least as good under prospective case mix as under cost-based payment (Cohen and Dubay 1990; Norton 1992; Reschovsky 1996; Schlenker 1991). However, past research is largely limited to facility-level analyses and results do not address potential differences in resident-level treatment based on payment source. If facilities differentiate between residents on the basis of payer when admitting residents, they might similarly differentiate between residents within the nursing home. The present study uses resident-level data to examine the effect of payment on the delivery of rehabilitation treatment to nursing home residents.

Rationale for Hypothesis

Under per-diem payment systems, marginal revenue associated with a given resident is equal to the per-diem rate and facility total revenue is equal to the marginal resident revenue multiplied by the number of resident days. Facilities select their mix of patients based on private demand and the level of reimbursement set by public payers. The mix of patients determines the facility budget constraint and potentially also the capacity of the facility to provide rehabilitation.3

The allocation of rehabilitation care within a facility will follow the incentives associated with marginal revenue for each payment method (marginal cost is assumed to be constant for the individual resident). Marginal revenue is constant for Medicare residents under cost-based payment and for all non-Medicare payers (total revenue will track total costs and every additional minute comes at the same cost as the previous minute). Thus the Medicare pre-PPS group and non-Medicare payer groups both serve as useful comparison populations. Post-PPS Medicare residents have discrete marginal revenue peaks at nodal levels of rehabilitation care and otherwise have zero marginal revenue associated with rehabilitation care. This motivates the principal hypothesis for the present study:

H0: PPS causes facilities to provide Medicare resident rehabilitation at ‘nodal’ levels.

Facility cost structure would determine whether facilities are more likely to provide any therapy or whether therapy is increased or decreased to attain nodal therapy times under PPS. Since facility costs are not observed directly, changes in the use of rehabilitation therapy and total weekly therapy are examined through exploratory analyses.

There are several reasons that the effects of PPS payment could differ from the hypothesis or that there would be no effect on rehabilitation care. First, U.S. federal regulations specify that all residents should receive the same quality of care, irrespective of payment source. Thus changes in care for non-Medicare residents may occur (a spillover effect). In addition, unobserved dynamics such as cross-subsidization may occur between payer groups and less-generous payers' residents (e.g., Medicaid) may receive more rehabilitation than suggested by economic incentives; PPS may also affect cross-subsidization. (An interaction between the post-PPS time indicator and Medicaid residents is used to identify the latter spillover effect.) Second, the use of the MDS for all residents implies similar care planning protocols, such that residents with the same conditions and health impairments should receive similar treatment. Third, the study includes only the first year of PPS, in which 25 percent of facility reimbursement is based on PPS and 75 percent based on the old reasonable cost method; the four-year phase-in period for Medicare PPS could reduce the likelihood of any detectable changes in resident care for the Medicare PPS payment group during this study period. These constraints will lead to attenuation bias and estimates provided here serve as a lower bound on the effect of PPS.

Empirical Approach and Identification Strategy

The empirical analysis examines how rehabilitation care changed for Medicare residents following PPS payment by comparing rehabilitation therapy before and after the payment change and using non-Medicare residents as a reference group to control for other changes that affected all residents. The key hypothesis is examined by comparing the difference in treatment between Medicare residents and non-Medicare residents, before and after the implementation of the new payment policy. Specifically one indicator variable is used to identify Medicare payment source, providing control for the existing difference between Medicare residents and residents with other payment sources. A second indicator variable is used to identify the point in time when PPS payment was applied to the facility. The latter post-PPS indicator variable identifies all contemporaneous changes that occurred at the same time as Medicare implemented PPS. The interaction of the Medicare payment source and the post-PPS indicator variable (differences-in-differences or D2 estimator) identifies the change in the difference between Medicare and other residents that occurred coincident with the introduction of PPS payment. The identification assumption of the D2 estimator requires that there were no other contemporaneous changes in delivery of rehabilitation treatment that applied only to Medicare or only to non-Medicare residents. Empirically, the resident populations in the two periods (before and after PPS payment) are made up of all new admissions in each period and thus individual residents are not followed over time. The regression equations estimated are given by:

To examine the primary hypothesis, a logistic model is estimated where Ya identifies nodal therapy levels (Ya is 0/1 representing level of therapy is nodal level), β1 measures the difference between Medicare and non-Medicare patients, β2 captures the change in the odds of nodal therapy coincident with the PPS period, and β12 is the D2 estimator, capturing the marginal effect of PPS on the existing difference between Medicare and non-Medicare residents. Zγ is an array of exogenous risk-adjustment factors and an intercept term; ηj and ɛi capture facility(j)- and individual(i)-specific error terms.

A two-part model is used to explore the effect of PPS payment first on Yb, the likelihood of receiving any rehabilitation therapy (Yb representing any use of therapy) and the amount of rehabilitation therapy provided to residents conditional on treatment Yc|Yb=1 (Yb representing weekly therapy time, only for residents who receive therapy). Because Ya and Yb are binary in logistic regression models, the coefficient on Post-PPS*Medicare (β12) captures a marginal effect but may not capture the total marginal effect of the PPS intervention (Ai and Norton 2003). The direct D2 estimator for the effect of PPS for Medicare residents was derived by differencing the predicted dependent variable pre- and post-PPS for Medicare and non-Medicare residents. This calculation is: where the first subscript identifies Medicare(1) and non-Medicare(0) residents and the second subscript identifies post(1) and pre(0)-PPS periods. These effects and the correct standard error estimates were calculated using Ai and Norton's algorithm.

To control for differences in payment rates, additional indicator variables are used to identify residents for whom the primary payer for rehabilitation is Medicare Part B or Medicaid (throughout the article, however, any reference to Medicare residents represents coverage under Medicare Part A). Empirically, private-pay nursing home residents provide the comparison group for all public payers and constitute the reference category in regression analyses. This assignment is made because the private payment method is consistent across jurisdictions and time. In the private market, access and treatment decisions are individually determined for each resident based on market price. An additional interaction term is created using the post-PPS indicator and Medicaid payment to identify any changes in Medicaid resident use of rehabilitation therapy (potentially due, for example, to changes in cross-subsidization of services between Medicare and Medicaid, or spillover from post-PPS changes in the supply of therapists). Because Medicaid copayment may also influence rehabilitation, a separate indicator is added to identify residents where Medicaid is listed as a secondary payer.

An extensive array of resident-level diagnoses and conditions along with state of residence are used to control for resident heterogeneity and potential selection bias. Because residents are clustered within facilities and resident sorting among facilities may be correlated with payment source, ordinary least squares regression estimates may be biased. Thus, robust standard errors are used throughout the analysis. Fixed and random-effects estimation results are compared.

Data and Sample Selection

Resident data are based on Minimum Data Set (MDS) resident assessments. The MDS is a comprehensive assessment containing more than 400 items including resident demographics, payment source, diagnosis, functioning, and treatment, and is mandated for use in all U.S. nursing homes. Assessments are completed on resident admission to the nursing home, every 90 days, and on significant change in health status or care needs. The reliability and validity of the MDS instrument for research purposes has been demonstrated in repeated studies (Hawes et al. 1995; Morris et al. 1997; Sgadari et al. 1997). The Online Survey and Certification File (OSCAR) was used to determine when PPS began for an individual facility and to identify SNF certification. The OSCAR database includes all Medicare/Medicaid certified nursing facilities in the U.S. and is commonly used to study provider characteristics (Harrington and Carrillo 1998; Harrington et al. 2000).

Residents in this study are aged 65 years and older and were admitted to facilities in 1998 or 1999. The first observed (entry) assessment is retained for analyses. The total population of nursing home residents is 108,576. To ensure all residents had access to rehabilitation, only residents in SNFs that provided rehabilitation therapy are included (8,624 residents excluded). The selections do not limit the study to skilled nursing residents who receive rehabilitation therapy but do ensure the availability of rehabilitation. The exclusions do not completely account for all types of resident sorting among facilities. However, studies that examined both nursing homes and specialized facilities found little difference between settings in characteristics of residents receiving rehabilitation (Kramer et al. 1997; Schlenker et al. 1997). The final analytical sample is 99,952 residents.

Measurement

Total weekly therapy time (in minutes) in the seven days preceding the resident assessment is recorded on MDS assessments for occupational therapy, physical therapy, and speech therapy. A single variable is constructed to represent the total recorded therapy time. Consistent with Centers for Medicare and Medicaid data practices, residents with more than 999 minutes of weekly therapy time were excluded from the analyses. Nodal levels of therapy time are measured as total weekly therapy minutes within 5 percent of the specific nodes (45, 150, 325, 500, and 720 minutes). While the goal is to determine whether facilities are trying to achieve the exact level of therapy time that is most economically advantageous, any number of circumstances could lead to therapy minutes that are slightly more or less than the nodal points. Total therapy times within a few minutes of the target provide reasonable evidence for facility behavior that is targeting these specific intervals. Sensitivity analyses are conducted within 15 percent and within 15 minutes of nodal points. For exploratory analyses, a dichotomous variable is constructed for logistic regression analyses to represent the receipt of any therapy treatment and total therapy time is examined using linear regression. A logarithmic transformation on rehabilitation time is used to ensure normally distributed disturbance terms as nonconstant variance are present in total weekly rehabilitation time.

The rule implementing the prospective payment method provides that facilities are paid for under prospective payment beginning with the first cost-reporting period after July 1, 1998. The cost-reporting date was obtained from OSCAR data and is used to identify the post-PPS indicator variable. The “treatment” effect of the Medicare change to PPS is defined at the facility level as the interaction term of Medicare and the post-PPS indicator variable. Resident controls for diagnoses and functional comorbidity and demographics including payment source, age, gender, discharge expected within 90 days, and staff prognosis of resident's rehabilitation potential are obtained from MDS assessments. Functional impairment was measured using the MDS Activities of Daily Living Scale (ADL) (Morris, Fries, and Morris 1999), and cognitive impairment was measured by the MDS Cognitive Performance Scale (CPS) (Morris et al. 1994). Indicators for several other resident comorbid conditions are also included to account for other reasons that residents might receive rehabilitation. Additional resident heterogeneity is measured by the RUG-III nursing case-mix index, which measures nursing and health aide staff resource use.

Omitted Variable and Selection Biases

The payment variables capture differences in the delivery of rehabilitation therapy between groups of residents categorized by their respective payers. These variables capture everything about residents with particular payment sources not included elsewhere in the model. Omitted variable bias is possible where unobserved characteristics of residents associated with particular payment sources are systematically related to the delivery of rehabilitation therapy. Thus, differences between payers should be interpreted with caution.

Unobserved resident heterogeneity and particularly resident “need” for rehabilitation is a particularly problematic issue and may not be fully captured by the model. If such heterogeneity is correlated with particular payer groups, those coefficients will also be biased in the same direction as the correlation. To address this potential source of bias, a number of algorithms are used to determine resident rehabilitation potential and changes in the payment parameters are examined. Rehabilitation potential is identified where (1) the staff or resident believe that rehabilitation is possible, (2) the presence of no more than moderate cognitive impairment, and (3) the presence of some ADL limitations. Because the first of these criteria could be endogenous to receipt of rehabilitation therapy, a model is tested using only the latter two components.

Results

Resident Conditions

Table 1 presents summary statistics for resident conditions used as risk-adjustment controls in the regression analyses. The prevalence for dichotomous characteristics and the means and standard deviations for continuous variables are presented, classified by receipt of any rehabilitation therapy. Differences are significant for all characteristics. Conditions associated with rehabilitation in prior studies are more prevalent in residents receiving therapy. Falls, fractures, heart conditions, strokes, hypertension, and emphysema are more prevalent in the therapy group. Cancer, terminal condition, depression, and resistance to care are all more prevalent in the nontherapy group. While ADL functioning was similar for both groups, residents receiving therapy had higher cognitive skills (lower CPS).

Table 1.

Resident Conditions by Receipt of Any Therapy

| N | Receives Therapy | No Therapy |

|---|---|---|

| 79,837 | 20,115 | |

| Clinical Characteristic (range) | Prevalence/Mean (S.D.) | |

| Admission Age | 80.7 (7.7) | 81.4 (8.0) |

| Male | 33% | 35% |

| Lived Alone Prior | 38% | 24% |

| Discharge Expected | 52% | 14% |

| Fall | 45% | 32% |

| Fracture | 9% | 4% |

| Hip Fracture | 13% | 4% |

| Cardiac | 47% | 42% |

| Stroke (CVA) | 21% | 18% |

| Hypertension | 55% | 46% |

| Cancer | 13% | 16% |

| Emphysema | 19% | 15% |

| Terminal | 1% | 8% |

| Depressed | 20% | 24% |

| Resists Care | 16% | 29% |

| ADL Hierarchy (0–6) | 3.5 (1.5) | 3.5 (1.8) |

| CPS (0–6) | 1.6 (1.7) | 2.7 (1.9) |

| Nursing Index (0.36–3.98) | 1.3 (0.4) | 1.1 (0.5) |

Rehabilitation Therapy

The prevalence of rehabilitation therapy and average weekly rehabilitation therapy minutes (for residents who do receive therapy) classified by payer, before and after the implementation of PPS for Medicare residents, are shown in Table 2. Prior to PPS, most Medicare residents (89 percent) received therapy and Medicare residents received the most therapy at an average of 522 minutes per week. Sixty-two percent of private-pay residents received some therapy while only 38 percent of Medicaid residents received therapy. Following PPS, the prevalence of therapy increased for Medicare by two percentage points while declining for private-pay and Medicaid residents by two and six percentage points respectively. Among residents who received therapy, average therapy time declined for all payer groups.

Table 2.

Comparison of Rehabilitation by Payer and Study Period

| Pre-Case Mix | Post-Case Mix | |||||

|---|---|---|---|---|---|---|

| N | Prevalence of Therapy | Therapy Time Mean (S.D.) | N | Prevalence of Therapy | Therapy Time Mean (S.D.) | |

| Medicare | 25,682 | 89% | 522 (332) | 43,805 | 91% | 379 (212) |

| Private Pay | 13,672 | 62% | 488 (312) | 10,135 | 60% | 384 (223) |

| Medicaid | 2,701 | 38% | 361 (264) | 3,957 | 32% | 353 (163) |

Medicare Rehabilitation Therapy and PPS Payment

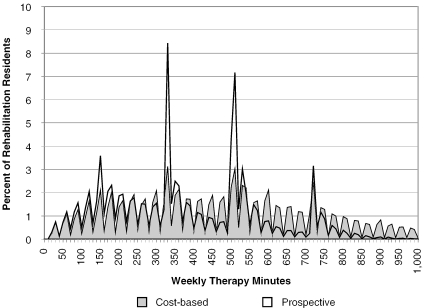

Figure 1 presents the prevalence of each level of therapy minutes for Medicare residents only, before and after the implementation of PPS. The area under each graph represents the total population receiving rehabilitation therapy. The distribution of therapy under cost-based payment was relatively stable, increasing to about 500 minutes and declining thereafter. Following the implementation of PPS however, there are large shifts in the distribution toward several nodal points, particularly the points at 325 and 500 minutes, and to a lesser extent, at 150 and 720 minutes per week. Post-PPS treatment also declines uniformly between nodal levels, corresponding to a declining average revenue for treatment. It is difficult to think of another clinical practice or sudden change in the clinical needs of the Medicare population that might cause such dramatic shifts.

Figure 1.

Weekly Rehabilitation Minutes: Medicare Cost-based and Prospective Payment

Multivariate Results

Logistic regression is used to quantify the effect shown in Figure 1. Non-Medicare residents are included in the sample, identifying the PPS effect specifically for Medicare residents. For the results shown in Table 3, the dependent variable is defined by total rehabilitation therapy minutes within 5 percent of a nodal level of care. Adjusted odds ratios (AOR), 95 percent confidence intervals, and significance levels (based on robust standard errors) are presented. The odds of receiving a nodal level of care (45, 150, 325, 500, 720 minutes of therapy) was higher for Medicare residents than private-pay residents in the pre-PPS period (Medicare coefficient), increased for all residents in the post-PPS period (post-PPS payment coefficient), and increased far more for Medicare residents than private-pay residents (interaction effect). The Ai-Norton direct calculation of the interaction, that is, the differential effect of PPS on nodal therapy for Medicare residents, is a 12 percentage-point increase in the probability of nodal therapy (z-statistic 8.52). These results support the hypothesis that providers are more likely to provide nodal levels of care to Medicare residents under PPS. Additional sensitivity analyses indicate that the interaction effect estimated by the logistic model (1.78) is a representative estimate of the effect size.4

Table 3.

Logistic Regression for Nodal† Levels of Therapy

| Payer | Adjusted Odds Ratio (Robust 95% C.I.) |

|---|---|

| Medicare | 1.33 (1.19, 1.48)*** |

| Post-PPS Period | 1.11 (1.01, 1.23)* |

| Medicare*Post-PPS | 1.78 (1.54, 2.07)*** |

| Medicaid | 1.04 (0.89, 1.22) |

| Medicaid*Post-PPS | 0.80 (0.66, 0.96)* |

| Medicare Part B | 1.03 (0.74, 1.43) |

| Private Co-pay | 0.86 (0.76, 0.97)* |

| Medicaid Co-pay | 0.83 (0.68, 1.02) |

| Ohio | 0.98 (0.85, 1.14) |

| Admission Age | 1.02 (1.00, 1.04) |

| Male | 1.00 (0.96, 1.04) |

| Lived Alone Prior | 1.08 (1.03, 1.12)*** |

| Discharge Expected | 0.92 (0.84, 1.00) |

| Fall | 1.04 (1.00, 1.09)* |

| Fracture | 1.02 (0.96, 1.08) |

| Hip Fracture | 1.07 (1.01, 1.13)* |

| Cardiac | 1.02 (0.98, 1.06) |

| Stroke (CVA) | 1.06 (1.02, 1.11)** |

| Hypertension | 1.04 (1.00, 1.08) |

| Cancer | 0.98 (0.93, 1.04) |

| Emphysema | 0.96 (0.92, 1.01) |

| Terminal | 0.77 (0.66, 0.89)** |

| Depressed | 1.04 (1.00, 1.09) |

| Resists Care | 0.94 (0.91, 0.98)** |

| ADL Hierarchy | 0.98 (0.95, 1.01) |

| CPS | 0.99 (0.98, 1.01) |

| Nursing Case Mix | 1.09 (1.00, 1.19) |

| N | 79,837 |

| Wald chi-square (d.f.) | 513 (27)*** |

within 5% of 45, 150, 325, 500, or 720 weekly therapy minutes.

p<.05;

p<0.01;

p<0.001.

Table 4 presents the results examining the effect of PPS payment on the receipt of rehabilitation therapy and weekly therapy time. Adjusted odds ratios are presented for logistic analyses, while the coefficients on bivariate characteristics for the linear regression model can be interpreted approximately as the average percentage difference in rehabilitation time associated with that characteristic in the conditional sample. The Medicare payment term indicates that in the pre-PPS period, the odds of receiving therapy in the Medicare group were 3.7 times the odds in the private pay reference group, and those residents that did receive therapy received, on average, 12 percent more weekly therapy time than those in the reference group. The interaction term indicates that PPS increased the differential advantage in receiving any therapy that is experienced by Medicare residents, but decreased the conditional differential advantage in weekly therapy time by 7 percent. The Ai-Norton direct estimation of the interaction term is a three percentage-point increase in the probability of therapy (z-statistic=4.05). Because the effect of PPS on the likelihood of therapy and therapy time have opposite directions, the total effect is difficult to identify from the two-part model. A total effect of PPS was calculated by differencing the expected values for therapy time. The expected values were the product of Ai and Norton's probability estimate of therapy multiplied by the model-estimated therapy time. The total estimated effect of PPS is a 4 percent differential decrease in average expected therapy across all Medicare residents.

Table 4.

Logistic and Linear Regression for All Rehabilitation Therapy

| Payer | Receives Any Therapy Adjusted Odds Ratio (Robust 95% C.I.) | Therapy Time† Estimate (Robust S.E.) |

|---|---|---|

| Medicare | 3.74 (3.39, 4.14)*** | 0.12 (0.01)*** |

| Post-PPS Period | 0.82 (0.75, 0.91)*** | −0.21 (0.01)*** |

| Medicare*Post-PPS | 1.33 (1.15, 1.53)*** | −0.07 (0.01)*** |

| Medicaid | 0.47 (0.42, 0.53)*** | −0.22 (0.02)*** |

| Medicaid*Post-PPS | 1.04 (0.90, 1.20) | −0.07 (0.02)** |

| Medicare Part B | 1.63 (1.35, 1.96)*** | −0.22 (0.02)*** |

| Private Co-pay | 0.88 (0.75, 1.02) | 0.03 (0.01)*** |

| Medicaid Co-pay | 0.77 (0.65, 0.91)** | 0.16 (0.02)*** |

| Ohio | 1.08 (0.95, 1.23) | 0.04 (0.03) |

| Admission Age | 0.99 (0.96, 1.02) | −0.01 (0.00)*** |

| Male | 0.98 (0.93, 1.03) | 0.02 (0.00)** |

| Lived Alone Prior | 1.44 (1.37, 1.51)*** | 0.04 (0.00)*** |

| Discharge Expected | 2.57 (2.28, 2.90)*** | 0.09 (0.01)*** |

| Fall | 1.75 (1.66, 1.84)*** | 0.06 (0.00)*** |

| Fracture | 1.42 (1.29, 1.56)*** | 0.00 (0.01) |

| Hip Fracture | 1.87 (1.70, 2.07)*** | 0.09 (0.01)*** |

| Cardiac | 1.04 (0.99, 1.09) | −0.03 (0.00)*** |

| Stroke (CVA) | 1.33 (1.26,1.41)*** | 0.17 (0.01)*** |

| Hypertension | 1.25 (1.19,1.31)*** | 0.03 (0.00)*** |

| Cancer | 0.80 (0.74,0.86)*** | −0.06 (0.01)*** |

| Emphysema | 0.94 (0.88,1.01) | −0.05 (0.01)*** |

| Terminal | 0.16 (0.14,0.18)*** | −0.37 (0.02)*** |

| Depressed | 0.95 (0.90,1.00) | −0.02 (0.01)** |

| Resists Care | 0.90 (0.87,0.93)*** | −0.07 (0.00)*** |

| ADL Hierarchy | 0.80 (0.77,0.83)*** | −0.03 (0.00)*** |

| CPS | 0.71 (0.69,0.72)*** | −0.03 (0.00)*** |

| Nursing Case Mix | 17.5 (13.8,22.2)*** | 0.21 (0.01)*** |

| N | 99,952 | 79,837 |

| Wald chi-square (d.f.) | 6,158 (27)*** | 9,042 (27)*** |

logarithmic transformation of total weekly therapy time.

p<.05;

p<0.01;

p<0.001.

Table 4 estimates also indicate that in the pre-PPS period, the odds of receiving therapy among Medicaid residents were only half those of private-pay residents, and those that did receive therapy received about 20 percent less therapy time than private pay residents that received therapy. While no significant change in the probability of therapy use for Medicaid residents was observed for the period following Medicare PPS implementation, the number of minutes of therapy for this group declined by about 7 percent. The magnitude of the post-PPS payment effects in the non-Medicare populations suggests the potential for spillover effects.

Coefficients computed for other resident characteristics in both parts of the two-part model are within clinically expected ranges. We conducted additional sensitivity analyses, using various constructed instruments for rehabilitation potential, but these did not change any of the estimates on the main study variables of interest.5

While robust standard errors are used throughout this analysis to account for facility-level clustering, a facility-level fixed-effects model was also tested to examine the potential for any bias due to correlation between facility clustering and other variables. The fixed-effects model estimates were within 0.004 for all estimates and within less than 0.001 for most estimates. Thus the results are also not sensitive to bias from facility-level clustering. The fixed-effects results also mean that differences between payment sources represent within-facility changes and not just changes in resident sorting into different facilities.

Discussion

Results from this study support the hypothesis that facilities respond to financial incentives to provide nodal quantities of care to residents under PPS (see Figure 1 and Table 3). The results suggest that the delivery of rehabilitation therapy for nursing home residents may be driven by economic incentives as well as resident need for therapy. Prospective payment was introduced by the federal government with the objective of reducing unnecessary service use in the Medicare population, yet findings estimated that the overall decrease in expected therapy time across all Medicare residents was only 4 percent. Multivariate results shown in Table 4 indicate that facilities did respond to PPS by decreasing the amounts of therapy provided to those patients that received treatments, but other reimbursement incentives may also have influenced facilities to identify a greater proportion of Medicare residents as appropriate candidates for the treatments.

The magnitude of the “nodal” results suggest potential for reporting bias or error. Although MDS data are used to set payment rates, auditing procedures for reported MDS data are still in their infancy. It is possible that facilities are not actually delivering the care that they are reporting and that up-coding is occurring. The American Nurses Association specifically advises nurses responsible for MDS forms not to “enhance” assessments to qualify for payment above that actually due for the resident (American Nurses Association 2000). Moreover, results here indicate lower therapy time, which is counter to incentives to overreport. Since there would be no financial gain to down-code, the present estimates are subject only to attenuation bias and thus may understate the negative change in total therapy time.

The results also suggest that providers differentiate treatment on the basis of payer. Whether due to higher payment rates or greater need for rehabilitation care, Medicare residents have odds of receiving therapy that are substantially higher than private-pay residents—after controlling for the measured potential confounders. Medicaid residents, whose payment rates are the lowest, have significantly lower odds of receiving therapy and receive less total therapy time. While the cross-sectional comparisons are sensitive to unobserved clinical differences between payment groups, the magnitude of the differences and control for facility fixed effects suggest differential care after admission to nursing homes. Prior research has only shown this effect by selection of residents on admission.

The two-part model indicates an increased incidence of use of therapy among Medicare residents post-PPS, even though there is an overall reduction in the amount of therapy provided across the Medicare and non-Medicare populations. This suggests a targeting of therapy resources to Medicare residents but could also be interpreted as reductions in subsidies from Medicare to non-Medicare residents inhibiting access to therapy for non-Medicare residents. Similarly, the total amount of therapy time decreased markedly for all residents following PPS. While therapy for Medicare residents declined even further, the total reductions in therapy time suggest that the change to PPS has had a profound impact on the overall availability of rehabilitation therapy in nursing homes. Further study is warranted to both confirm these findings and assess their clinical importance.

The present results are based on residents admitted to nursing facilities in two jurisdictions over a two-year period and policy implications must be considered with caution. Although a large number of covariates are included to avoid potential omitted variable and selection biases, further unidentified biases could be present. On the other hand, the magnitude of the findings is relatively strong, the models appear to have a good fit to the data, several sensitivity analyses provided analogous results, and the model appears robust to alternate specifications.

Further analyses should examine the effect of facility factors such as staffing on the delivery of rehabilitation care. The change to prospective PPS also provides incentives for U.S. facilities to change the staffing mix in facilities to use more aides instead of certified therapists to deliver therapy. Differences in facility responses based on ownership type and affiliations with hospitals are useful extensions that require additional facility-level data.

Notes

Grimaldi (1999; 2002) provides a thorough review of RUG-III and the Medicare PPS payment system.

For example, under Medicare case-mix payment in 1999, the payment rate for residents in the highest rehabilitation category was $142.32 for the nursing component and $186.01 for the therapy component (Health Care Financing Administration 1998).

Although excess demand for public-pay (particularly Medicaid) residents has given facilities substantial power over the severity of public-pay total patient mix historically, more recent evidence points to excess capacity and thus less opportunity for arbitrary selection of patients (Grabowski 2001; Harrington et al. 2000).

Several ranges for the dependent variable are explored including (1) exact levels of nodal therapy (to the minute), (2) therapy levels within 10 percent and within 15 percent of nodal levels, and (3) therapy levels within 5, 10, and 15 minutes of nodal levels. These models are tested both including zero and not including zero as a nodal level of therapy, and using only Medicare residents. Nearly all of these models provide results with higher AOR estimates than that for Table 3 for the effect of PPS for Medicare residents. The lowest AOR is 1.31 (C.I. 1.18–1.45), and is found for therapy within 10 percent of nodes and including zero in the full sample; the highest AOR is 1.99 (C.I. 1.77–2.23), and is found in the model using exact nodes of therapy not including zero in the full sample. In all specifications, parameter estimates for all other payers are consistent except for Medicaid payment, which is positively associated with nodal levels of therapy any time zero is included as a nodal level of therapy.

Additional models examined whether the included diagnoses and conditions adequately account for resident need for rehabilitation. Two additional models are run for each analysis using constructed rehabilitation potential variables. These models do not change any estimates presented here. The results presented in Table 4 are not sensitive to unobserved resident rehabilitation potential and the estimates generally provide a lower bound on the effect size.

This research was supported by a Centers for Medicare and Medicaid Services dissertation fellowship grant. The author wishes to thank dissertation committee members B. E. Fries, R. A. Hirth, J. B. Cullen, and J. P. Hirdes, as well as two anonymous reviewers.

References

- Ai C, Norton E C. “Interaction Terms in Logit and Probit Models.”. Economics Letters. 2003;80(1):123–9. [Google Scholar]

- American Nurses Association. “Prospective Payment System for Long Term Care”.”. 2000. [accessed on January 12, 2003]. Available at http://www.nursingworld.org/mods/archive/mod90/ltcfull.htm.

- Centers for Medicare and Medicaid Services. “National Health Care Expenditures: Table 7”.”. 2002. [accessed on July 4, 2002]. Available at http://www.cms.hhs.gov/statistics/nhe/historical/t7.asp.

- Coburn A F, Fortinsky R, McGuire C, McDonald T P. “Effect of Prospective Reimbursement on Nursing Home Costs.”. Health Services Research. 1996;28(1):45–68. [PMC free article] [PubMed] [Google Scholar]

- Cohen J, Spector W. “The Effect of Medicaid Reimbursement on Quality of Care in Nursing Homes.”. Journal of Health Economics. 1996;15(1):23–48. doi: 10.1016/0167-6296(95)00030-5. [DOI] [PubMed] [Google Scholar]

- Cohen J W, Dubay L C. “The Effects of Medicaid Reimbursement Method and Ownership on Nursing Home Costs, Case Mix, and Staffing.”. Inquiry. 1990;27(2):183–200. [PubMed] [Google Scholar]

- Fries B E, Schneider D P, Foley W J, Gavazzi M, Burke R, Cornelius E. “Refining a Case-Mix Measure for Nursing Homes: Resource Utilization Groups (RUG-III).”. Medical Care. 1994;32(7):668–85. doi: 10.1097/00005650-199407000-00002. [DOI] [PubMed] [Google Scholar]

- Grabowski D C. “Medicaid Reimbursement and the Quality of Nursing Home Care.”. Journal of Health Economics. 2001;20(4):549–69. doi: 10.1016/s0167-6296(01)00083-2. [DOI] [PubMed] [Google Scholar]

- Grimaldi P L. “New Skilled Nursing Facility Payment Scheme Boosts Medicare Risk.”. Journal of Health Care Finance. 1999;25(3):1–9. [PubMed] [Google Scholar]

- Grimaldi P L. “Prospective Per Diem Rates for Skilled Nursing Care.”. Journal of Health Care Finance. 2002;28(3):49–62. [PubMed] [Google Scholar]

- Harrington C, Carrillo H. “The Regulation and Enforcement of Federal Nursing Home Standards 1991–1997.”. Medical Care and Research and Review. 1998;56(4):471–94. doi: 10.1177/107755879905600405. [DOI] [PubMed] [Google Scholar]

- Harrington C, Carrillo H, Thollaug S, Summers P, Wellin V. Nursing Facilities, Staffing, Residents and Facility Deficiencies, 1992 through 1998. San Francisco: University of California; 2000. [Google Scholar]

- Hawes C, Morris J N, Phillips C D, Mor V, Fries B E, Nonemaker S. “Reliability Estimates for the Minimum Data Set for Nursing Home Resident Assessment and Care Screening (MDS).”. Gerontologist. 1995;35(2):172–8. doi: 10.1093/geront/35.2.172. [DOI] [PubMed] [Google Scholar]

- Health Care Financing Administration. “Case Mix Adjusted Federal Rates and Associate Indices Urban [Table 2E]. Medicare Program: Prospective Payment System and Consolidated Billing for Skilled Nursing Facilities. Final Rule.”. Federal Register. 1998;63(91):26270. [Google Scholar]

- Hutt E, Ecord M, Eilertsen T B, Frederickson E, Kowalsky J C, Kramer A M. “Prospective Payment for Nursing Homes Increased Therapy Provision without Improving Community Discharge Rates.”. Journal of the American Geriatrics Society. 2001;49(8):1071–9. doi: 10.1046/j.1532-5415.2001.49211.x. [DOI] [PubMed] [Google Scholar]

- Joseph C L, Wanlass W. “Rehabilitation in the Nursing Home.”. Clinics in Geriatric Medicine. 1993;9(4):859–71. [PubMed] [Google Scholar]

- Kramer A M, Steiner J F, Schlenker R E, Eilertsen T B, Hrincevich C A, Tropea D A, Ahmad L A, Eckhoff D G. “Outcomes and Costs after Hip Fracture and Stroke: A Comparison of Rehabilitation Settings.”. Journal of the American Medical Association. 1997;277(5):396–404. [PubMed] [Google Scholar]

- Morris J N, Fries B E, Mehr D R, Hawes C, Phillips C, Mor V, Lipsitz L A. “MDS Cognitive Performance Scale.”. Journal of Gerontology. 1994;49(4):M174–82. doi: 10.1093/geronj/49.4.m174. [DOI] [PubMed] [Google Scholar]

- Morris J N, Fries B E, Morris S A. “Scaling ADLs within the MDS.”. Journals of Gerontology Series—Biological Sciences and Medical Sciences. 1999;54(11):M546–53. doi: 10.1093/gerona/54.11.m546. [DOI] [PubMed] [Google Scholar]

- Morris J N, Nonemaker S, Murphy K, Hawes C, Fries B E, Mor V, Phillips C A. “Commitment to Change: Revision of HCFA's RAI.”. Journal of the American Geriatrics Society. 1997;45(8):1011–6. doi: 10.1111/j.1532-5415.1997.tb02974.x. [DOI] [PubMed] [Google Scholar]

- Murray P K, Singer M E, Fortinksy R, Russo L, Cebul R D. “Rapid Growth of Rehabilitation Services in Traditional Community-based Nursing Homes.”. Archives of Physical Medicine and Rehabilitation. 1999;80(4):372–8. doi: 10.1016/s0003-9993(99)90272-1. [DOI] [PubMed] [Google Scholar]

- Murtaugh C M, Cooney L M, DerSimonian R R, Smits H L, Fetter R B. “Nursing Home Reimbursement and the Allocation of Rehabilitation Therapy Resources.”. Health Services Research. 1988;23(4):467–93. [PMC free article] [PubMed] [Google Scholar]

- Norton E C. “Incentive Regulation of Nursing Homes.”. Journal of Health Economics. 1992;11(2):105–28. doi: 10.1016/0167-6296(92)90030-5. [DOI] [PubMed] [Google Scholar]

- Reschovsky J D. “Demand for and Access to Institutional Long-Term Care: The Role of Medicaid in Nursing Home Markets.”. Inquiry. 1996;33(1):15–29. [PubMed] [Google Scholar]

- Schlenker R E. “Nursing Home Costs, Medicaid Rates, and Profits under Alternative Medicaid Payment Systems.”. Health Services Research. 1991;26(5):623–49. [PMC free article] [PubMed] [Google Scholar]

- Schlenker R E, Kramer A M, Hrincevich C A, Eilertsen T B. “Rehabilitation Costs: Implications for Prospective Payment.”. Health Services Research. 1997;32(5):651–68. [PMC free article] [PubMed] [Google Scholar]

- Sgadari A, Morris J N, Fries B E, Ljunggren G, Jonsson P V, DuPaquier J, Schroll M. “Efforts to Establish the Reliability of the Resident Assessment Instrument.”. Age and Ageing. 1997;26(2, supplement):27–30. doi: 10.1093/ageing/26.suppl_2.27. [DOI] [PubMed] [Google Scholar]

- Siu A L. “Long-Term Care Research: Demand, Payment, and Outcomes.”. Health Services Research. 1998;33(4, part 1):783–5. [PMC free article] [PubMed] [Google Scholar]