Abstract

Objective

To determine the effect of joining HMOs (health maintenance organizations) on the inpatient utilization of Medicare beneficiaries.

Data Sources

We linked enrollment data on Medicare beneficiaries to patient discharge data from the California Office of Statewide Health Planning and Development (OSHPD) for 1991–1995.

Design and Sample

A quasi-experimental design comparing inpatient utilization before and after switching from fee-for-service (FFS) to Medicare HMOs; with comparison groups of continuous FFS and HMO beneficiaries to adjust for aging and secular trends. The sample consisted of 124,111 Medicare beneficiaries who switched from FFS to HMOs in 1992 and 1993, and random samples of 108,966 continuous FFS beneficiaries and 18,276 continuous HMO enrollees yielding 1,227,105 person-year observations over five years.

Main Outcomes Measure

Total inpatient days per thousand per year.

Principal Findings

When beneficiaries joined a group/staff HMO, their total days per year were 18 percent lower (95 percent confidence interval, 15–22 percent) than if the beneficiaries had remained in FFS. Total days per year were reduced less for beneficiaries joining an IPA (independent practice association) HMO (11 percent; 95 percent confidence interval, 4–19 percent). Medicare group/staff and IPA-model HMO enrollees had roughly 60 percent of the inpatient days per thousand beneficiaries in 1995 as did FFS beneficiaries (976 and 928 versus 1,679 days per thousand, respectively). In the group/staff model HMOs, our analysis suggests that managed care practices accounted for 214 days of this difference, and the remaining 489 days (70 percent) were due to favorable selection. In IPA HMOs, managed care practices appear to account for only 115 days, with 636 days (85 percent) due to selection.

Conclusions

Through the mid-nineties, Medicare HMOs in California were able to reduce inpatient utilization beyond that attributable to the high level of favorable selection, but the reduction varied by type of HMO.

Keywords: Medicare, risk HMO, inpatient utilization, selection

Over the past two decades, Congress has directed the Medicare program to foster the growth of managed care by offering generous payments to health maintenance organizations (HMOs) (General Accounting Office 1999). Health maintenance organizations in the Medicare+Choice program now cover 14 percent (July 2003) of the Medicare population but the question of whether HMOs can successfully adapt their managed care practices to an older and sicker population remains unanswered.

Lower costs in Medicare HMOs have been attributed primarily to favorable selection (Miller and Luft 1994; Riley et al. 1996; Cox and Hogan 1997; Morgan et al. 1997; Hamilton 1999; Thiede Call et al. 1999; Riley, Lubitz, and Rabey 1991). Since Medicare HMOs receive capitated payments that vary minimally with enrollee health status, they have an incentive to enroll and retain the healthiest beneficiaries, a process known as risk selection (Newhouse, Buntin, and Chapman 1997). Health maintenance organizations can also lower costs through managed care practices that alter the delivery of care and by negotiating lower prices with providers.

Research on HMO practice patterns in younger populations has shown reductions of 0 to 35 percent in inpatient utilization between HMO enrollees and FFS (fee-for-service) beneficiaries (Miller and Luft 1994; Luft 1987; Manning et al. 1984; Miller and Luft. 1997; Weinick and Cohen 2000). However, the literature is not consistent in reporting whether HMOs achieve lower utilization by reducing admissions or length of stay (Miller and Luft 1994; Luft 1987; Manning et al. 1984; Miller and Luft. 1997; Congressional Budget Office 1995; Glied 2000.)

Studies on the effects of HMOs on the inpatient utilization of the Medicare population are limited (Kasper et al. 1988; Langwell and Hadley 1989; Hill et al. 1992; Congressional Budget Office 1997; Physician Payment Review Commission 1996b). The Medicare Tax Equity and Fiscal Responsibility Act (TEFRA) Evaluation (Hill et al. 1992) surveyed a national sample of 12,000 FFS and HMO Medicare beneficiaries, which was too small to estimate differences in inpatient utilization precisely. The estimated 17 percent reduction in hospital days observed in Medicare HMOs after controlling for selection was not statistically significant. A recent study using panel data from the Medicare Current Beneficiary Survey (MCBS) from 1993 to 1996 found much larger reductions in inpatient days after controlling for selection. Inpatient claims are filed selectively by HMOs, resulting in missing claims, which may inflate the differences between FFS and HMO use (Mello, Stearns, and Norton 2002).

A more developed body of literature has consistently reported that Medicare HMOs experience substantial favorable selection at enrollment (Miller and Luft 1994; Riley et al. 1996; Cox and Hogan 1997; Morgan et al. 1997; Hamilton 1999; Thiede Call et al. 1999; Riley, Lubitz, and Rabey 1991). These studies suggest Medicare HMO enrollees use approximately 20–40 percent fewer resources in the 6 to 12 months prior to enrollment. Studies on selection at disenrollment have found that disenrollees are generally sicker than continuous FFS beneficiaries or members who remain enrolled (Cox and Hogan 1997; Morgan et al. 1997; Riley, Lubitz, and Rabey 1991).

The dominance of research on HMO selection rather than the effect of HMOs on resource use is due largely to data availability. Medicare routinely collects data on the utilization of services by FFS beneficiaries for payment purposes. However, similar data on HMO enrollees have not been available, making it difficult to examine what happens to Medicare beneficiaries after they join an HMO.

We have generated a unique database on the utilization of inpatient services for all Medicare HMO and FFS beneficiaries in California from 1991 to 1995. These data on utilization before, during, and after enrollment into HMOs enable us to look into the “black box” of service utilization in HMOs.

Methods

Study Design Overview

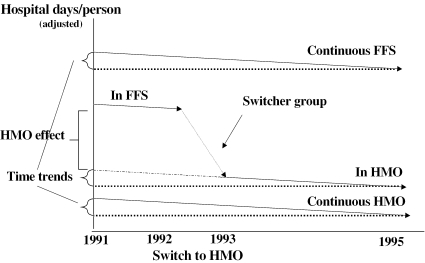

We used a “before and after with a comparison group” design to evaluate the impact of Medicare HMOs on hospital inpatient utilization (Cook and Campbell 1979). To estimate the HMO effect on inpatient utilization, we examined beneficiaries who started in FFS and switched to an HMO. We compared use in FFS before switching to use in HMOs after switching to estimate the managed care or HMO effect.

Because changes in utilization in this switcher group could also be due to other factors (e.g., aging, death, or secular trends), we included two comparison groups in our study to adjust for these factors: (1) beneficiaries continuously enrolled in FFS and (2) beneficiaries continuously enrolled in HMOs. We compare the difference in utilization before and after HMO enrollment for switchers, to the differences in utilization in the comparison groups in that time (see Figure 1). The differences-in-differences design meant we did not have to adjust for any selection differences directly. Nevertheless, we estimated an analytic model that includes sociodemographic characteristics and measures of health status for two reasons. First, there is a general interest in the effects of these measures on inpatient utilization. Second, our study design assumed that decisions to enroll and disenroll were not related to changes in health status and that the underlying health status of HMO enrollees changed at the same rate over time as that of people who stayed in FFS (Morgan et al. 1997; Physician Payment Review Commission 1996a). To control for the possibility that changes in health occur at different rates in these groups, we included time-varying measures of health in the model. We tested these model assumptions by estimating and comparing two models: (1) with (the “full” model) and (2) without (the “no predictors” model) the health and sociodemographic variables. Given that we made valid assumptions, the estimate of the HMO effect on utilization should be the same for each model.

Figure 1.

Hospital Days before and after Switching to an HMO

After using our restricted analytic sample to determine the effects of being in an HMO on hospital days, we went to the larger California sample. The overall observed difference in hospital days per member was then split between that due to “managed care practices” (the estimated effect of being in an HMO), and the remainder due to selection.

Data Linkage

The data for this study were derived from linking Medicare enrollment data on all beneficiaries in California between 1991 and 1995 from the CMS (Centers for Medicare and Medicaid Services) Denominator files to inpatient discharge data for short-term stays from the California Office of Statewide Health Planning and Development (OSHPD). All nonfederal hospitals in California submit discharge records to the state agency irrespective of payer source. Records were linked using social security number, zip code of residence, date of birth, gender, and race. The Medicare enrollment file was the primary file used for the linkages. Discharges that were coded as Medicare in the OSPHD data without corresponding links in the enrollment files were excluded (<5 percent). These included beneficiaries who moved out of state during the study period. If they had discharges during the study period, we were able to link them based on the unique patient identifier in the OSPHD data, the Record Linkage Number (RLN). The linkages were performed by OSHPD under IRB (Internal Review Board) approvals from the California Department of Health and Welfare, CMS Data User Agreements between all parties with access to the confidential data, and the RAND Committee for Protection of Human Subjects. The linked data were returned to RAND after all potential identifiers were stripped. Medicare patients who had at least one admission during the study period had greater than a 90 percent probability of being matched. The CMS plan contract numbers from our data were linked to the Monthly Report on Medicare Coordinated Care Health Plans from CMS to obtain data on model type.

Sample Selection

We excluded from the study beneficiaries who met any of the following criteria: (1) death in 1991 or in 1992, (2) had ESRD (end-stage renal disease), (3) did not have both Part A and B coverage, (4) resided in counties with fewer than 500 HMO enrollees in 1991, (5) were enrolled in a cost-reimbursed HMO, or (6) were less than 65 years old. Because we differentiated HMOs into group/staff and independent practice association (IPA) model type, the 1.5 percent of HMO Medicare beneficiaries who could not be matched to a specific Medicare risk HMO were dropped (Gabel 1997). The analytic sample used to compute the HMO effect consisted of three groups: (1) The switcher group included all beneficiaries who were enrolled in FFS for all of 1991 and continued in FFS until they switched to an HMO during 1992 or 1993; (2) a random sample of beneficiaries who remained in FFS from 1991 through 1995 or until their death in 1994–1995; and (3) a random sample of HMO members who were continuously enrolled from 1991 through 1995 or until their death in 1994–1995.1 To estimate the magnitude of selection, we used data on all California beneficiaries in 1995 after applying the same six exclusion criteria used to derive our analytic sample.

Model Specification

Our unit of analysis was the person-year. We used a two-part model to analyze differences in an individual's total inpatient days per year based on theory and statistics (Duan et al. 1983; Diehr et al. 1999). A technical appendix with the rationale and statistical tests underlying model specification, retransformation, validation, and computing standard errors of the combined model can be found at http://www.rand.org/publications/WR/WR138. The first part of the model was a logistic regression of the probability of at least one inpatient day in a year. The second part was an ordinary least squares regression of the natural logarithm of total hospital days per year given at least one day in the hospital. The focus on days meant that the 0.2 percent of admissions with zero length of stay were excluded.

We used the same set of predictor variables in both parts of the model. Because our data covered a five-year period, we have up to five observations per person and each person-year was treated as an independent observation. For both parts of the model we estimated robust standard errors based on Huber clustering corrections by HMO to account for correlation among the results for the different HMOs (Huber 1967).

While hospital use involves both admission and length of stay decisions, we were ultimately concerned with the resulting effect of being in an HMO on total inpatient days. Overall days were the product of the predicted probability of at least one hospital day and the predicted total number of days given a stay of at least one day. Before these predictions could be combined, the second prediction had to be retransformed from the logarithmic scale to the original scale (log days to days). All statistical calculations were performed using Stata 7.0 (StataCorp 2001).

Independent Variables

The key independent variable representing the effect of Medicare HMOs on inpatient utilization was defined as the proportion of time spent in an HMO each year. Because beneficiaries can enroll and disenroll from Medicare HMOs each month, our measure of the HMO effect captures partial-year enrollment. For example, a beneficiary switching from FFS to an HMO on July 1, 1992, and remaining in the HMO for the rest of the year would have a value of 0 for the HMO effect variable in 1991, a value of 6/12 or 0.5 in 1992 to reflect six months of enrollment, and a value of 1 for the subsequent years (if they remain alive).2 For all years, the value of the HMO effect variable for enrollees in the continuous HMO comparison groups was set to 1, and to 0 for the beneficiaries in the continuous FFS comparison group. Because this variable changed only for those who switched, its estimated coefficient represented the effect of being in an HMO after controlling for selection and time trends in the model.

We grouped control variables associated with inpatient use into four categories: (1) enrollment history group, (2) health status, (3) sociodemographic characteristics, and (4) year.

To control for selection, we split HMO enrollees into two groups based on their enrollment history: (1) continuous HMO—those who were in a group/staff HMO or IPA HMO from the beginning to the end of the study period or until death; (2) switchers—those who switched from FFS into a group/staff HMO or IPA HMO in 1992 or 1993. The switchers were then split into those that remained in their respective HMO type until the end of the study period or death (switch and stay) and those who disenrolled (from either HMO type) back into FFS (switch and disenroll). Disenrollees who switched into another HMO were treated as switchers who stayed in an HMO. Switchers with more than one HMO enrollment separated by a spell in FFS during the study period were excluded. The third group in our study consisted of those who remained in FFS continuously from the beginning until the end of the study or their death. The characteristics of beneficiaries across each enrollment history group are presented in Table 1.

Table 1.

Descriptive Statistics of Model Variables in Selected Years for the Enrollment History Groups*

| Enrollment History Groups | |||||

|---|---|---|---|---|---|

| 1992–1993 HMO Switchers | Continuous HMO | ||||

| Model Variables | Group/Staff | IPA | Group/Staff | IPA | Continuous FFS |

| Dependent Variables (Mean) | |||||

| Admissions/beneficiary | |||||

| 1991 | .18 | .14 | .16 | .14 | .23 |

| 1995 | .29 | .25 | .24 | .22 | .33 |

| Total inpatient d/y | |||||

| 1991 | 1.05 | .82 | .75 | .71 | 1.49 |

| 1995 | 1.41 | 1.17 | 1.05 | .92 | 1.96 |

| Part I: Probability of one stay of at least one d/y | |||||

| 1991 | .12 | .11 | .11 | .11 | .15 |

| 1995 | .18 | .16 | .15 | .15 | .20 |

| Part II: Log (inpatient d/y given one stay of at least one day) | |||||

| 1991 | 1.73 | 1.64 | 1.52 | 1.50 | 1.83 |

| 1995 | 1.62 | 1.54 | 1.50 | 1.37 | 1.80 |

| Independent Variables (Mean) | |||||

| Proportion of year in HMO (HMO Effect) | |||||

| 1991 | 0 | 0 | 1 | 1 | 0 |

| 1995 | .92† | .94† | 1 | 1 | 0 |

| Other Independent Variables (Percentage in 1991)‡ | |||||

| Male | 43.2 | 42.3 | 43.7 | 41.8 | 39.5 |

| African American | 7.9 | 2.8 | 7.9 | 1.6 | 4.1 |

| Medicaid-eligible | 11.3 | 4.9 | 5.3 | 2.7 | 18.9 |

| Disabled, >64 years | 7.4 | 6.2 | 5.9 | 5.7 | 7.2 |

| Age, years | |||||

| 65–69 | 33.0 | 30.2 | 31.9 | 25.5 | 25.1 |

| 70–74 | 28.6 | 30.4 | 30.5 | 31.3 | 27.8 |

| 75–79 | 19.3 | 20.6 | 20.1 | 22.2 | 21.0 |

| 80–84 | 11.6 | 11.6 | 10.8 | 12.7 | 13.9 |

| 85+ | 7.5 | 7.2 | 6.7 | 8.3 | 12.2 |

| Death from ’93 through ’96 | 18.5 | 16.5 | 17.5 | 17.4 | 24.7 |

| No. of Beneficiaries in 1991 | 39,383 | 84,728 | 10,861 | 7,415 | 108,966 |

HMO indicates health maintenance organization and FFS indicates fee-for-service.

Less than 100 percent because of disenrollment to FFS. Over the course of the study 8.6 percent of the beneficiaries who joined either a group/staff or IPA HMO in 1992 or 1993 disenrolled to FFS. This variable is 0 for those who disenrolled before 1995 and between 0 and 1 for those disenrolling in 1995.

The number of beneficiaries will change over time due to deaths and therefore so will the percentage. All percentages refer to 1991 except death.

The enrollment history groups were dummy variables that did not change over time. For example, consider those who switched to an IPA HMO in 1992 or 1993 and stayed there. Their indicator variable “switch to IPA HMO and stay” was set equal to one in every year. The coefficients on these variables were meant to represent each group's average use relative to those that remained continuously enrolled in FFS during the study period after controlling for the HMO effect on inpatient use. Thus, these variables controlled for selection differences and were estimates of their relative magnitude among the enrollment history groups.

The second category of variables provided controls for differences in health status. The “time-to-future-death” measures indicated whether and when a beneficiary died during the study period. Given the steady increase in use of inpatient services near death, we categorized deaths by splitting the time they occurred relative to the current year into four periods: death in the first half or second half of the current year, and death in first half or second half of the following year (Lubitz, Beebe, and Baker 1995; Lubitz and Riley 1993; Lubitz and Prihoda 1984).

Disability status as determined by the original reason for Medicare entitlement was also used to control for differences in health status in this age-65-and-over study sample.

Sociodemographic variables included race (African American or not), gender, age category, and Medicaid eligibility. Beneficiaries were deemed Medicaid-eligible if they were covered by Medicaid during any part of 1991. Lastly, we included dummy variables for each year to control for secular changes in utilization over the five-year study period.

Estimating Selection

Our study design estimated the differences in use between our enrollment history groups (due to selection) after adjusting for the HMO effect. However, because our analytic samples excluded some beneficiaries (e.g., those turning 65 after 1991, multiple switches between FFS and HMO), these estimates do not represent all Medicare beneficiaries. To derive an estimate of selection more representative of the entire population of California Medicare beneficiaries, we applied the same six general exclusions required of the analytic sample as described earlier to all beneficiaries in California.3 In addition, we had to drop 1.5 percent of the HMO beneficiaries because we could not match them to a specific Medicare risk HMO. We then computed total inpatient days per thousand beneficiaries per year for this larger sample of California beneficiaries by group/staff HMO, IPA HMO, and FFS. Because Medicare beneficiaries may change entitlement (due to death), or enroll and disenroll from HMOs on a monthly basis, we calculated monthly utilization rates and then aggregated these measures over 12 months by calendar year. We then estimated the selection effect by subtracting our model estimate of the HMO effect from the difference between our calculation of the total HMO and the total FFS inpatient days per thousand beneficiaries, attributing any remaining difference between HMO and FFS to selection.

Results

Our sample for estimating the HMO effect consisted of 251,353 Medicare beneficiaries yielding 1,227,105 person-year observations during 1991 to 1995. The initial sample sizes of all groups of interest are shown at the bottom of Table 1 along with descriptive statistics on utilization and the independent variables in the two-part model. In Table 1, the enrollment history group variables are shown as columns to allow readers to compare the different groups of beneficiaries (e.g., 1992–1993 IPA HMO switchers, and continuous FFS beneficiaries) with respect to important model variables.

Hospital utilization increased for each enrollment history group between 1991 and 1995 as expected given their aging, and was the greatest for the continuous FFS group in all years. For the 1992–1993 switcher group, the proportion of time in an HMO was zero in 1991, and 0.92 and 0.94 in 1995 for group/staff versus IPA HMO switchers, respectively. Among the other enrollment history groups, values of time in an HMO were always zero or one.

Approximately 24.7 percent of the continuous FFS group died between 1993 and 1996 compared to 16.5–18.5 percent of the 1992–1993 HMO switchers and 17.4–17.5 percent of the continuous HMO group. The other predictor variables (e.g., disabled status and age) observed in 1991 also indicated generally poorer health status among FFS beneficiaries compared to HMO enrollees. African American beneficiaries tended to join group/staff HMOs. A larger number of FFS beneficiaries were eligible for Medicaid at the start of the study compared to any HMO enrollees.

Total Inpatient Days per Year

Beneficiaries enrolled in group/staff HMOs used 82 percent of the inpatient days they would have used, had they remained in FFS (95 percent confidence interval, 79–86 percent), while enrollees in IPA HMOs used 89 percent (95 percent confidence interval, 82–97 percent) (Table 2, third column).

Table 2.

Determinants of Total Inpatient Days per Year, 1991–1995*

| Full Model | No-Predictors Model | ||

|---|---|---|---|

| Independent Variables | Reference Category | % Total Days per Year Relative to Reference (95% CI)† | |

| HMO Effect | |||

| Proportion of year in group/staff HMO | Continuous FFS | 82 (79, 86) | 80 (77, 83) |

| Proportion of year in IPA HMO | 89 (82, 97) | 88 (82, 94) | |

| Enrollment History Groups | Continuous FFS | ||

| Group/Staff HMO | 73 (71, 76) | 63 (61, 66) | |

| IPA HMO | 64 (60, 67) | 52 (49, 55) | |

| Switch to HMO and Disenroll to FFS | 125 (118, 133) | 128 (117, 140) | |

| Year | 1991 | ||

| 1992 | 97 (95, 98) | 109 (107, 111) | |

| 1993 | 95 (91, 98) | 137 (131, 144) | |

| 1994 | 90 (86, 95) | 153 (147, 159) | |

| 1995 | 80 (76, 84) | 138 (130, 146) | |

| Male | Female | 121 (118, 124) | — |

| African American | Non-African American | 120 (112, 129) | — |

| Medicaid-eligible in 1991 | Not eligible | 151 (145, 157) | — |

| Disabled >64 years | Other>64years | 168 (163, 172) | — |

| Age, years | Age 65–69 years | ||

| 70–74 | 119 (116, 122) | — | |

| 75–79 | 141 (138, 144) | — | |

| 80–84 | 162 (158, 167) | — | |

| 85+ | 161 (150, 173) | — | |

| Death from 1993 through 1996 | Alive | ||

| Death in first half of current year | 429 (388, 475) | — | |

| Death in second half of current year | 743 (698, 791) | — | |

| Death in first half subsequent year | 447 (420, 476) | — | |

| Death in second half subsequent year | 265 (251, 280) | — | |

| Goodness of fit (Efron's R2) | 6.7 | 0.8 | |

| Number of Observations | 1,227,105 | 1,227,105 | |

HMO indicates health maintenance organization and FFS indicates fee-for-service.

Results are based on a two-part model where the first part is a logistic regression of whether the beneficiary had one or more days in the hospital in a year, and the second part is an ordinary least squares regression of the natural log of total hospital days per year given at least one day. Log days are retransformed to days using the smearing estimate. CI indicates confidence intervals, which are based on standard errors adjusted for clustering by HMO. Confidence intervals assume log normality.

The enrollment history group variables revealed that enrollees in both types of HMOs were consistently healthier than the FFS beneficiaries. On average, enrollees in group/staff HMOs who stayed used 73 percent of the inpatient days of continuous FFS beneficiaries after adjusting for the HMO effect and all other covariates compared to the IPA HMO enrollees who used only 64 percent (Table 2, third column). These findings suggest that IPA HMOs experience greater favorable selection than group/staff models. The smaller group of HMO switchers who disenrolled to FFS before the end of the study period would have had 25 percent more inpatient days in FFS than those who remained in FFS. These measures provided estimates of selection while controlling for managed care effects.

In the no-predictors model, the use of the group/staff HMO enrollees and IPA HMO enrollees was even lower at 63 percent and 52 percent of FFS days, respectively. The no-predictors model estimated larger differences in use (due to selection) between the HMO and FFS groups because it did not control for other risk factors such as age and death rates, which were higher among FFS beneficiaries. In the no-predictors model, aging and death in the cohort cause utilization to rise as shown by the increases (up to 53 percent in 1994) for later years relative to 1991. However, after controlling for age and death in the full model, utilization fell steadily over the years of the study.

The effects of sociodemographic characteristics on inpatient utilization were consistent with our expectations and the literature. Men used 21 percent more inpatient days per year than women, and African American beneficiaries used 20 percent more total inpatient days per year than non-African American beneficiaries. Medicare beneficiaries eligible for Medicaid used 51 percent more inpatient days per year compared to those not eligible. Disabled beneficiaries used 68 percent more total days per year than nondisabled beneficiaries of the same age. Finally, inpatient use increased steadily with age over 65, but leveled off for the very oldest (85 years and older). Death during the study period had a considerable effect on utilization. For example, beneficiaries who died in the first half of a given year used 429 percent more days in the same year than beneficiaries who remained alive during the entire study period. Those who died in the second half of a given year had even greater utilization in that year. Utilization in a given year for those who would die in the subsequent year was much higher than that of beneficiaries who remained alive through the end of that year.

All the results in Table 2, and in particular, the 18 percent and 11 percent reduction by group/staff versus IPA model type, came from combining the statistical results of each part of the two-part model. These detailed regression results are shown in Table 3. The coefficients in the top row show that the reductions were largely the result of a decrease in length of stay.4. We validated the decrease in days per year from our regression model by computing differences in length of stay per admission between HMO and FFS. We computed the average length of stay (ALOS) by DRG (diagnosis related groups) for HMO switchers in 1994 and standardized it to the distribution of DRG admissions in FFS. The adjusted HMO ALOS (5.9 days) in our sample in 1994 was 16 percent lower than the actual ALOS (7.0 days) for FFS in 1994.

Table 3.

Two-Part Full and No-Predictors Models of Inpatient Utilization, California Medicare Beneficiaries 1991–1995*

| Full Model | No-Predictors Model | ||||

|---|---|---|---|---|---|

| Part I: Probability Any Days | Part II: Log Days per Year | Part I: Probability Any Days | Part II: Log Days per Year | ||

| Independent Variables | Reference Group | Odds Ratio (95% CI) | Coefficient (95% CI) | Odds Ratio (95% CI) | Coefficient (95% CI) |

| HMO Effect | FFS | ||||

| Proportion of year in group/staff HMO | 1.00 (.960, 1.05) | −.157 (−.186, −.128) | .977 (.946, 1.01) | −.161 (−.183, −.139) | |

| Proportion of year in IPA HMO | 1.07 (.984, 1.16) | −.124 (−.176, −.072) | 1.04 (.981, 1.11) | −.123 (−.166, −.080) | |

| Enrollment History Groups | Continuous FFS | ||||

| Group/staff HMO | .804 (.772, .838) | −.104 (−.116, −.091) | .729 (.695, .764) | −.141 (−.161, −.121) | |

| IPA HMO | .714 (.670, .762) | −.148 (−.167, −.130) | .628 (.593, .666) | −.208 (−.233, −.182) | |

| Switch to HMO and Disenroll | 1.19 (1.13, 1.26) | .068 (.022, .114) | 1.21 (1.11, 1.31) | .068 (−.004, .132) | |

| Year | 1991 | ||||

| 1992 | .990 (.975, 1.01) | −.037 (−.046, −.027) | 1.08 (1.05, 1.10) | .004 (−.005, .012) | |

| 1993 | .894 (.853, .938) | −.026 (−.038, −.013) | 1.18 (1.11, 1.25) | .108 (.096, .119) | |

| 1994 | .982 (.935, 1.03) | .109 (−.141, −.077) | 1.44 (1.38, 1.51) | .066 (.048, .083) | |

| 1995 | .987 (.942, 1.03) | .195 (−.232, −.158) | 1.50 (1.41, 1.59) | −.011 (−.042, .020) | |

| Male | Female | 1.28 (1.25, 1.31) | −.012 (−.035, −.011) | — | — |

| African American | Non-African American | 1.04 (.970, 1.11) | .118 (.070, .166) | — | — |

| Medicaid-eligible in 1991 | Not eligible | 1.378 (1.33, 1.42) | .146 (.114, .178) | — | — |

| Disabled>64 years | Other>64 years | 1.66 (1.63, 1.69) | .123 (.103, .144) | — | — |

| Age, years | Age 65–69 | ||||

| 70–74 | 1.19 (1.16, 1.121) | .060 (.038, .083) | — | — | |

| 75–79 | 1.43 (1.40, 1.45) | .106 (.090, .121) | — | — | |

| 80–84 | 1.70 (1.66, 1.73) | .138 (.116, .160) | — | — | |

| 85+ | 1.78 (1.62, 1.96) | .117 (.081, .153) | — | — | |

| Death from 1993 through 1996 | Alive | ||||

| Death in first half of current year | 5.78 (4.81, 6.96) | .360 (.307, .412) | — | — | |

| Death in second half of current year | 10.47 (8.81, 12.42) | .617 (.599, .635) | — | — | |

| Death in first half of next year | 3.97 (3.57, 4.41) | .552 (.529, .575) | — | — | |

| Death in second half of next year | 2.58 (2.44, 2.68) | .314 (.281, .347) | — | — | |

| Goodness of fit | Pseudo R2=.069 | R2=.077 | Pseudo R2=.011 | R2=.025 | |

| Number of Observations | 1,227,105 | 188,979 | 1,227,105 | 188,979 | |

CI indicates confidence intervals, which are based on standard errors adjusted for clustering. HMO indicates health maintenance organization and FFS indicates fee-for-service.

Selection Effect

We estimated the selection effect based on the utilization of all Medicare FFS and HMO beneficiaries in 1995 after applying the six general exclusions outlined above plus a small percentage of HMO beneficiaries that were unable to be matched to a specific HMO (N=2,616,942). Medicare FFS beneficiaries in California used 1,679 days per thousand beneficiaries, while group/staff HMO enrollees used 976 days per thousand enrollees, and IPA HMO enrollees used 928 per thousand enrollees yielding differences of 703 and 751 days per thousand between FFS and group/staff and IPA HMOs, respectively. Based on our estimate of the HMO effect for group/staff enrollees, HMO enrollment accounted for 214 days of this difference ([{1/0.82}–1] × [976 days/1000]). In other words, switchers would have used 214 additional days had they remained in FFS. Selection accounted for the remaining 489 days per thousand (703–214 days) or 70 percent (489/703) of the lower use with 30 percent attributed to managed care practice. Similarly, 115 days of the difference between IPA HMO enrollees and FFS beneficiaries ([{1/0.89}−1] × [928 days/1000]) can be attributed to HMO enrollment, with selection accounting for the remaining 636 days per thousand (751–115 days). In the case of IPA HMOs, more of the difference in use is attributed to selection (85 percent [636/751]).

Comment

This study examined the effect of being in a Medicare HMO on inpatient utilization. A unique database constructed by linking Medicare records with California hospital discharge data over five years allowed us to measure inpatient utilization after people switched to HMOs. We also calculated the difference in use between all California Medicare FFS and HMO beneficiaries and apportioned it to an HMO effect and a selection effect. Previously, researchers had no way of estimating the effects of being in a Medicare HMO and had to estimate selection in HMOs based on data before enrollment and after disenrollment. Our data on enrollees before, during, and after they enrolled in Medicare HMOs, provide new evidence on the extent of selection and the impact of joining an HMO on inpatient use.

Our results confirm prior studies showing substantial favorable selection in HMOs, which accounts for most of the difference in inpatient use but it varies by type of HMO. Beneficiaries in group/staff HMOs were less healthy than beneficiaries in IPA HMOs. We also report new estimates on the effect of enrolling in HMOs on inpatient use. Our findings also suggest that after adjustment for population differences, Medicare beneficiaries in HMOs used significantly fewer inpatient days than they would have used had they remained in FFS. Our analytic sample included over a million observations allowing us to calculate fairly precise and robust estimates of the reduction in hospital days due to joining an HMO with the reduction ranging from 11 percent for IPAs to 18 percent for group/staff HMOs. The differences in impact by type of HMO are consistent with the expectation that HMOs with greater utilization control protocols such as group/staff HMOs can be more successful in reducing utilization than IPA HMOs (Welch, Hillman, and Pauly 1990; Hillman, Welch, and Pauly 1992; Miller and Luft 1993).

Surprisingly, the reduction in inpatient days is due entirely to reduced length of stay. Medicare HMOs' large effect on length of stay is unexpected for many reasons. First, the Medicare program has paid hospitals a fixed amount per admission using DRGs since 1983, which has contributed to substantially reduced lengths of stay (Carter and Melnick 1990). This payment method contains a strong incentive for hospitals to lower length of stay, since any savings accrue directly to the hospital. Second, the consensus in the literature on favorable selection in Medicare HMOs challenges the idea that these HMOs can reduce hospital days even further among a healthier population. Finally, California with its history of Medicare and non-Medicare managed care, has long stood out as having the lowest hospital utilization rates in the country (Zwanziger, Melnick, and Bamezai 2000). Thus, in an already lean system, Medicare HMOs might not have been successful at extracting additional reductions in inpatient utilization. However, because many California HMOs pay hospitals on a per diem basis, they do have incentives to reduce days per year.

The Medicare program and CMS have struggled with a wide range of implementation issues surrounding HMOs including payment methods, payment rates, and HMO withdrawals from the program that have forced Medicare beneficiaries to involuntarily switch plans or return to FFS. These problems have made Medicare HMOs increasingly controversial and have reduced support for Medicare HMOs, particularly since most believe that Medicare HMOs increase rather than decrease total Medicare program costs each year (General Accounting Office 1997; 1999; 2000). The implementation of risk-adjusted capitation payments by CMS to Medicare HMOs addresses the issue of favorable selection, and could potentially reduce funds available to subsidize the additional benefits that Medicare HMOs have used to attract members. Thus, the ability of HMOs to maintain and expand membership may depend largely on their ability to generate cost savings.

Although the reduction in inpatient days is substantial, the actual net cost savings may be somewhat less. Because the reduction in inpatient days is due to reduced length of stay, the net inpatient hospital cost-savings to Medicare HMOs are likely to be smaller than the estimated reduction in utilization. The marginal cost of an additional day in the hospital is less than the average cost (Carter and Melnick 1990). It is also plausible that managed care practices involve more intensive treatment per day resulting in additional limits on cost-savings. Moreover, shorter lengths of stay may lead to higher use of post-acute care services.

This study has several limitations. First, our state database does not include federal hospitals, or hospitalizations occurring outside the state. However, because it relies on within-person comparisons, this gap will bias the results only to the extent that use of Veteran's Administration or out-of-state hospitals is systematically affected by joining an HMO. Second, it is based on data from a single state, California. Since almost 40 percent of all Medicare risk enrollment was in California by 1995, our findings are significant for policymakers, but it is unclear whether the experience of California Medicare beneficiaries generalizes to the rest of the country (Zarabozo, Taylor, and Hicks 1996). Third, our findings do not cover noninpatient use. High-quality outpatient data for most HMO and FFS beneficiaries that is needed to quantify the reduction in overall costs is not yet available. However, HMOs have historically achieved their savings primarily through reductions in inpatient use (Miller and Luft 2002). Moreover, results of the Medicare TEFRA evaluation showed no increase in home health services and only slightly higher outpatient use for HMOs (Hill et al. 1992). Finally, this study does not address the extent to which reduced inpatient use from Medicare HMOs affects health outcomes, and in particular outcomes for vulnerable populations (e.g., those age 85 and over, African Americans, those with chronic disease).

The last two limitations point to important areas for further research. First, data on outpatient, pharmacy, and home health use would provide a more complete picture of the potential cost savings by Medicare HMOs. While the impact of Medicare HMOs on total costs is itself important, a fair judgment of the program must also consider the impact on patient outcomes, especially those patients who may be less desirable to Medicare HMOs. Investigating use and outcomes for such patients and determining whether reduced hospital days are the result of increased efficiency or decreased quality is a critical next step.

Acknowledgments

We appreciate the computer programming of Bob Reddick, who worked with the original data files, Hongjun Kan for his assistance preparing analysis files, and Beate Danielson of Health Information Solutions for linking the data files. We are grateful to the Centers for Medicare and Medicaid Services and the California Office of Statewide Health Planning and Development for providing us with the data that made this study possible. Finally, we are thankful to the RAND Health Economics seminar and two anonymous referees for helpful suggestions.

Notes

We eliminated persons dying before January 1994 for comparability to the HMO switchers who had to remain alive until the end of the HMO enrollment period in the study.

Because the models are nonlinear, using the average time of enrollment for the transition years could lead to bias. As a sensitivity analysis, we omitted all transition years to make the “in HMO” variable dichotomous. The estimated reduction was 1 percent greater with a standard error that was 10 percent larger than when transition years were included.

In this case, beneficiaries residing in counties with fewer than 500 HMO enrollees in 1995 (as opposed to 1991) were excluded.

Because the mean number of admissions per year for beneficiaries with an admission is very similar across the enrollment groups (1.5 in 1991, falling to 1.4 in 1995), differences in days per year with an admission are proportional to differences in length of stay, and we will use the more familiar term “length of stay” in discussing the results.

This project was supported by grant # R01HS10256-03 from the Agency for Healthcare Research and Quality and funding from the Office of the Assistant Secretary for Planning and Evaluation, United States Department of Health and Human Services. Support for this paper was also provided by a grant from The Robert Wood Johnson Foundation, Princeton, New Jersey.

References

- Carter G M, Melnick G A. How Services and Costs Vary by Day of Stay for Medicare Hospital Stays. Santa Monica, CA: RAND; 1990. [Google Scholar]

- Centers for Medicare and Medicaid Services. Monthly Report: Medicare Coordinated Care Health Plans [accessed February 13, 2004]. Available at http://cms.hhs.gov/healthplans/statistics/monthly/

- Congressional Budget Office. The Effects of Managed Care and Managed Competition. Washington, DC: Congressional Budget Office; 1995. [Google Scholar]

- Congressional Budget Office. Predicting How Changes in Medicare's Payment Rates Would Affect Risk-Sector Enrollment and Costs. Washington, DC: Congressional Budget Office; 1997. [accessed February 13, 2004]. Available at http://www.cbo.gov/ [Google Scholar]

- Cook T D, Campbell D T. Quasi-Experimentation: Design and Analysis Issues for Field Settings. Chicago: Rand McNally College Publishing; 1979. [Google Scholar]

- Cox D F, Hogan C. “Biased Selection and Medicare HMOs: Analysis of the 1989–1994 Experience.”. Medical Care Research and Review. 1997;54(3):259–74. doi: 10.1177/107755879705400301. [DOI] [PubMed] [Google Scholar]

- Diehr P, Yanez D, Ash A, Hornbrook M, Lin D Y. “Methods for Analyzing Health Care Utilization and Costs.”. Annual Review of Public Health. 1999;20:125–44. doi: 10.1146/annurev.publhealth.20.1.125. [DOI] [PubMed] [Google Scholar]

- Duan N, Manning W G, Morris C N, Newhouse J P. “A Comparison of Alternative Models for the Demand for Medical Care.”. Journal of Business and Economic Statistics. 1983;1(2):115–26. [Google Scholar]

- Gabel J. “Ten Ways HMOs Have Changed during the 1990s.”. Health Affairs. 1997;16(3):134–45. doi: 10.1377/hlthaff.16.3.134. [DOI] [PubMed] [Google Scholar]

- General Accounting Office. Medicare HMOs: HCFA Can Promptly Eliminate Hundreds of Millions in Excess Payments. Washington, DC: General Accounting Office; 1997. Available at: http://www.gao.gov/ [Google Scholar]

- General Accounting Office. Medicare+Choice: Reforms Have Reduced, but Likely Not Eliminated, Excess Plan Payments. Washington, DC: General Accounting Office; 1999. [accessed February 13, 2004]. GAO publication no. HEHS-99-144. Available at: http://www.gao.gov/ [Google Scholar]

- General Accounting Office. Medicare+Choice: Payments Exceed Cost of Fee-for-Service Benefits, Adding Billions to Spending. Washington, DC: General Accounting Office; 2000. [accessed February 13, 2004]. GAO publication no. HEHS-00-161. Available at: http://www.gao.gov/ [Google Scholar]

- Glied S. “Managed Care.”. In: Culyer A J, Newhouse J P, editors. Handbook of Economics. 1st ed. New York: Elsevier; 2000. pp. 707–53. [Google Scholar]

- Hamilton B H. “HMO Selection and Medicare Costs: Bayesian MCMC Estimation of a Robust Panel Data Tobit Model with Survival.”. Health Economics. 1999;8(5):403–14. doi: 10.1002/(sici)1099-1050(199908)8:5<403::aid-hec455>3.0.co;2-d. [DOI] [PubMed] [Google Scholar]

- Hill J, Brown R, Chu D, Bergeron J. “The Impact of the Medicare Risk Program on the Use of Services and Costs to Medicare.”. Princeton, NJ: Mathematica Policy Research; 1992. [Google Scholar]

- Hillman A, Welch W, Pauly M. “Contractual Arrangements between HMOs and Primary Care Physicians: Three-Tiered HMOs and Risk Pools.”. Medical Care. 1992;30(2):136–48. doi: 10.1097/00005650-199202000-00005. [DOI] [PubMed] [Google Scholar]

- Huber P J. Proceedings of the Fifth Berkeley Symposium on Mathematical Statistics and Probability. Berkeley: University of California Press; 1967. “The Behavior of Maximum Likelihood Estimates under Non-Standard Conditions.”; pp. 221–33. [Google Scholar]

- Kasper J D, Riley G F, McCombs J S, Stevenson M A. “Beneficiary Selection, Use, and Charges in Two Medicare Capitation Demonstrations.”. Health Care Financing Review. 1988;10(1):37–49. [PMC free article] [PubMed] [Google Scholar]

- Langwell K M, Hadley J P. “Evaluation of the Medicare Competition Demonstrations.”. Health Care Financing Review. 1989;11(2):65–80. [PMC free article] [PubMed] [Google Scholar]

- Lubitz J, Beebe J, Baker C. “Longevity and Medicare Expenditures.”. New England Journal of Medicine. 1995;332(15):999–1003. doi: 10.1056/NEJM199504133321506. [DOI] [PubMed] [Google Scholar]

- Lubitz J, Prihoda R. “The Use and Costs of Medicare Services in the Last Two Years of Life.”. Health Care Financing Review. 1984;5(3):117–31. [PMC free article] [PubMed] [Google Scholar]

- Lubitz J D, Riley G F. “Trends in Medicare Payments in the Last Year of Life.”. New England Journal of Medicine. 1993;328(15):1092–6. doi: 10.1056/NEJM199304153281506. [DOI] [PubMed] [Google Scholar]

- Luft H S. Health Maintenance Organizations: Dimensions of Performance. New Brunswick, NJ: Transaction; 1987. [Google Scholar]

- Manning W G, Leibowitz A, Goldberg G A, Rogers W H, Newhouse J P. “A Controlled Trial of the Effect of a Prepaid Group Practice on Use of Services.”. New England Journal of Medicine. 1984;310(23):1505–10. doi: 10.1056/NEJM198406073102305. [DOI] [PubMed] [Google Scholar]

- Mello M, Stearns S, Norton E. “Do Medicare HMOs Still Reduce Health Services Use after Controlling for Selection Bias?.”. Health Economics. 2002;11(4):323–40. doi: 10.1002/hec.664. [DOI] [PubMed] [Google Scholar]

- Miller R, Luft H. “Managed Care: Past Evidence and Potential Trends.”. Frontiers in Health Services Management. 1993;9(3):3–37. [PubMed] [Google Scholar]

- Miller R, Luft H. “Managed Care Plan Performance since 1980: A Literature Analysis.”. Journal of the American Medical Association. 1994;271(19):1512–9. [PubMed] [Google Scholar]

- Miller R, Luft H. “Does Managed Care Lead to Better or Worse Quality of Care?.”. Health Affairs. 1997;16(5):7–25. doi: 10.1377/hlthaff.16.5.7. [DOI] [PubMed] [Google Scholar]

- Miller R, Luft H. “HMO Plan Performance Update: An Analysis of the Literature, 1997–2001.”. Health Affairs. 2002;21(4):63–86. doi: 10.1377/hlthaff.21.4.63. [DOI] [PubMed] [Google Scholar]

- Morgan R O, Virnig B A, DeVito C A, Persily N A. “The Medicare-HMO Revolving Door: The Healthy Go In and the Sick Go Out.”. New England Journal of Medicine. 1997;337(3):169–75. doi: 10.1056/NEJM199707173370306. [DOI] [PubMed] [Google Scholar]

- Newhouse J P, Buntin M B, Chapman J D. “Risk Adjustment and Medicare: Taking a Closer Look.”. Health Affairs. 1997;16(5):26–43. doi: 10.1377/hlthaff.16.5.26. [DOI] [PubMed] [Google Scholar]

- Physician Payment Review Commission. Access to Care in Medicare Managed Care: Results from a 1996 Survey of Enrollees and Disenrollees. Washington, DC: Physician Payment Review Commission; 1996a. [Google Scholar]

- Physician Payment Review Commission. 1996 Annual Report to Congress. Washington, DC: Physician Payment Review Commission; 1996b. “Risk Selection and Risk Adjustment in Medicare.”; pp. 257–79. [Google Scholar]

- Riley G, Lubitz J, Rabey E. “Enrollee Health Status under Medicare Risk Contracts: An Analysis of Mortality Rates.”. Health Services Research. 1991;26(2):137–63. [PMC free article] [PubMed] [Google Scholar]

- Riley G, Tudor C, Chiang Y, Ingber M. “Health Status of Medicare Enrollees in HMOs and Fee-for-Service in 1994.”. Health Care Financing Review. 1996;17(4):65–76. [PMC free article] [PubMed] [Google Scholar]

- StataCorp. Stata. College Station, TX: Stata Corporation; 2001. [Google Scholar]

- Thiede Call K, Dowd B, Feldman R, Maciejewski M. “Selection Experiences in Medicare HMOs: Pre-Enrollment Expenditures.”. Health Care Financing Review. 1999;20(4):197–209. [PMC free article] [PubMed] [Google Scholar]

- Weinick R M, Cohen J W. “Leveling the Playing Field: Managed Care Enrollment and Hospital Use, 1987–1996.”. Health Affairs. 2000;19(3):178–84. doi: 10.1377/hlthaff.19.3.178. [DOI] [PubMed] [Google Scholar]

- Welch W, Hillman A, Pauly M. “Toward New Typologies for HMOs.”. Milbank Quarterly. 1990;68(2):221–43. [PubMed] [Google Scholar]

- Zarabozo C, Taylor C, Hicks J. “Medicare Managed Care: Numbers and Trends.”. Health Care Financing Review. 1996;17(3):243–61. [PMC free article] [PubMed] [Google Scholar]

- Zwanziger J, Melnick G, Bamezai A. “The Effect of Selective Contracting on Hospital Costs and Revenues.”. Health Services Research. 2000;35(4):849–67. [PMC free article] [PubMed] [Google Scholar]