Abstract

Objective

To assess the coming challenges of caring for large numbers of frail elderly as the Baby Boom generation ages.

Study Setting

A review of economic and demographic data as well as simulations of projected socioeconomic and demographic patterns in the year 2030 form the basis of a review of the challenges related to caring for seniors that need to be faced by society.

Study Design

A series of analyses are used to consider the challenges related to caring for elders in the year 2030: (1) measures of macroeconomic burden are developed and analyzed, (2) the literatures on trends in disability, payment approaches for long-term care, healthy aging, and cultural views of aging are analyzed and synthesized, and(3)simulations of future income and assets patterns of the Baby Boom generation are developed.

Principal Findings

The economic burden of aging in 2030 should be no greater than the economic burden associated with raising large numbers of baby boom children in the 1960s. The real challenges of caring for the elderly in 2030 will involve: (1) making sure society develops payment and insurance systems for long-term care that work better than existing ones, (2) taking advantage of advances in medicine and behavioral health to keep the elderly as healthy and active as possible, (3) changing the way society organizes community services so that care is more accessible, and (4) altering the cultural view of aging to make sure all ages are integrated into the fabric of community life.

Conclusions

To meet the long-term care needs of Baby Boomers, social and public policy changes must begin soon. Meeting the financial and social service burdens of growing numbers of elders will not be a daunting task if necessary changes are made now rather than when Baby Boomers actually need long-term care.

Keywords: Long-term care, financing, Baby Boomers, community-based delivery system

A major public policy concern in the long-term care field is the potential burden an aging society will place on the care-giving system and public finances. The “2030 problem” involves the challenge of assuring that sufficient resources and an effective service system are available in thirty years, when the elderly population is twice what it is today. Much of this growth will be prompted by the aging of the Baby Boomers, who in 2030 will be aged 66 to 84—the “young old”—and will number 61 million people. In addition to the Baby Boomers, those born prior to 1946—the “oldest old”—will number 9million people in 2030.

This paper assesses the economic dimensions of the 2030 problem. The first half of the paper reviews the literature and logic that suggest that aging in general, and long-term care services in particular, will represent an overwhelming economic burden on society by 2030. Then, a new analysis of burden is presented to suggest that aggregate resources should not be a major issue for the midcentury economy. Finally, the paper presents four key challenges that represent the real economic burden of long-term care in the twenty-first century. These challenges are significant but different from macro cost issues.

What type of economic burden might be considered overwhelming? Existing literature never explicitly defines this but the sense is that the burden might be considered overwhelming if: (a) tax rates need to be raised dramatically, (b) economic growth is retarded due to high service costs that preclude other social investments, or (c) the general well-being of future generations of workers is worse than that of current workers due to service costs and income transfers.

The discussion has significant implications for public policy and for private actors focused on developing an effective care system for the mid–twenty-first century. Public policy goals related to an aging society must balance the need to provide adequate services and transfers with an interest in maintaining the economic and social well-being of the nonelderly. The economic challengesdiscussed are such that public and private progress that begins in the near future will make the future burden substantially easier to handle.

Definitions and Background

Various aspects of economic burden are associated with an aging population: social security payments will increase, medical care insurance costs will grow, the burden associated with uncovered medical expenses such as pharmaceuticals will become quite serious, and long-term care costs will grow. Much of the logic of the paper applies to each of these financial resource challenges. However, we focus principally on the implications of long-term care services, which along with prescription drugs, have had the fastest growing costs in the list cited.

Every elder has to prepare for four key “aging shocks”: uncovered costs of prescription drugs, the costs of medical care that are not paid by Medicare or private insurance, the actual costs of private insurance that partially fills in the gaps left by Medicare, and the uncovered costs of long-term care.

If the lifetime costs of each of these “aging shocks” are calculated, the long-term care burden is the worst by far. The typical 65-year-old faces present value lifetime costs for uncovered long-term care of $44,000. By contrast, the present value of lifetime out-of-pocket prescription drugs costs averages $12,000, uncovered medical care comes to $16,000, and uncovered private insurance premiums come to $18,0001 (Table 1). It should be noted that because of the United States’ approach to financing these services, aging shocks represent burdens borne by individuals more than society. In most other countries, these items tend to be financed socially.

Table 1.

Expected Lifetime Costs of Significant “Aging Shocks” for a 65-Year-Old Today

| •Uncovered Prescription Drugs | $12,000 |

| •Uncovered Medical Care | $16,000 |

| •Uncovered Insurance Premiums | $18,000 |

| •Uncovered Long-term Care | $44,000 |

Estimates calculated by authors. See footnote 1 for assumptions used.

Long-term care includes a broad continuum of services that address the needs of people who are frail or disabled and require help with the basic activities of everyday living. The services can vary from informal care delivered by family and friends to the formal services of home care, assisted living, or nursing homes (see Table 2).

Table 2.

Continuum of Long-term Care Services

| INCREASING SEVERITY | Informal Care by Family and Friends |

| Volunteer Services | |

| In-home Supports (e.g., meals) | |

| Personal Care | |

| Adult Day Care | |

| Assisted Living | |

| Home Health Care | |

| Nursing Home Care | |

| Hospice Care |

Long-term care professionals generally distinguish two types of supportive care needs for the frail: assistance with instrumental activities of daily living (IADLs), such as shopping or cleaning, and assistance with physical activities of daily living (ADLs), such as eating, bathing, or moving around.2 Among the 31million noninstitutionalized elderly, 1.8 million have IADLs and 3.3 million have ADLs (Table 3). Of the 3.3 million, 1.5 million need help with three or more ADLs, indicating a very high level of need that requires extensive home care or institutional care. Another 1.4 million elderly are cared for in nursing homes and most of these elderly have 3 or more ADLs (Georgetown University Institute for Health Care Research and Policy 1994–5).

Table 3.

Population Needing Long-term Care

| There are 31.2 million community-dwelling elderly | |

| with only IADLs* | 1.8 million |

| with 1–2 ADLs** | 1.8 million |

| with 3+ ADLs** | 1.5 million |

| Total w/LTC needs | 5.1 million in the community |

| There are 1.4 million elderly residing in nursing homes | |

IADLs include problems with light housework, laundry, meal preparation, transportation, grocery shopping, telephoning, and medical and money management.

ADLs include problems with eating, bathing, dressing, toileting, transfers, and continence.

These statistics measure the number of elderly who are disabled at any given point in time. Most elderly who live beyond 75 or 85 years of age become frail at some point and need some form of assistance, making lifetime risks much higher. In fact, 42 percent of people who live to the age of seventy will spend time in a nursing home before they die (Murtaugh et al. 1997).

The current “long-term care system” is built around private providers of services—some nonprofit and some for-profit. When resources expand, new services develop quickly, and when resources contract, capacity can also shrink quickly. In home health care, for example, annual expenditure growth rates went from more than 10 percent in the 1980s and early 1990s to minus 3 percent between 1998 and 1999 (Levit et al. 2000). Recent policy revisions including the Home Health Prospective Payment System and the Balanced Budget Refinement Act, along with projected strong growth in out-of-pocket spending by individuals and families, cause many analysts to believe that home health care spending will rise again in the coming decade (Heffler et al. 2001). Of course, expansion and contraction of nursing home beds respond more slowly to market forces because of the durable capital aspect of nursing home care.

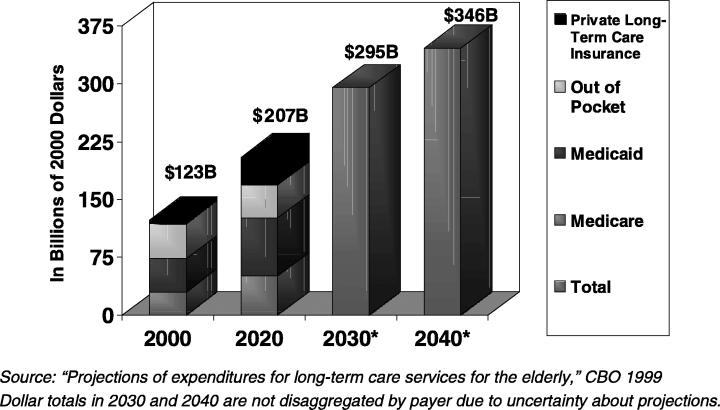

The Congressional Budget Office (CBO) estimates that expenditures on long-term care totaled more than $120 billion in 2000, with 59 percent of all expenses covered by the public sector (Congressional Budget Office 1999). Out-of-pocket expenses account for almost all of the balance, with private insurance covering just 1 percent of long-term care costs (See Figure 1). Conservative CBO estimates suggest total long-term care expenditures will increase at a rate of 2.6 percent per year above inflation over the next thirty years, to $154 billion in 2010, $195 billion in 2020, and a staggering $270 billion in 2030. The numbers are slightly different if one assumes that long-term care insurance does not become more common, but the stark upward trend remains.

Figure 1.

Projections of National Long-term Care Expenditures for the Elderly

The $120 billion in current expenses underestimates the economic resources devoted to long-term care, however, because most care is delivered informally by family and friends and is not included in economic statistics. Among the elderly who require assistance with daily activities, 65 percent rely exclusively on families and friends and another 30 percent rely, at least in part, on informal care. It has been estimated that the economic value of such informal care-giving in the United States reaches $200 billion a year—one and a half times the amount spent on formal care giving (Arno, Levine, and Memmott 1999).

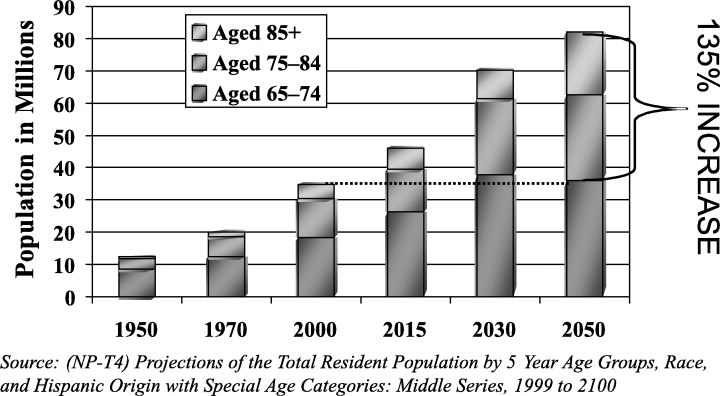

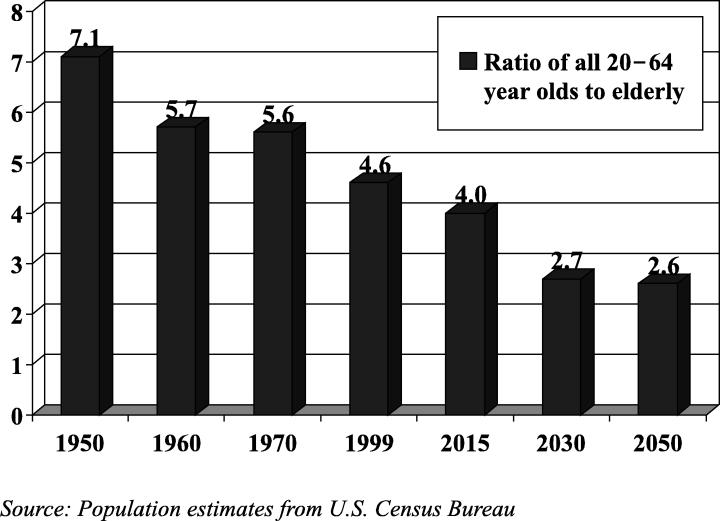

Economic Burden of Long-term Care: The Dire Case

The argument that caring for an aging society could disable the American economy has been made by various commentators, perhaps most forcefully by Peter Peterson and others in the Concord Coalition (Peterson 1996). Their concern focuses on the large growth in the number of elderly over the coming years, from 35 million in 2000 to more than 80 million in 2050 (Figure 2). This growth in elderly could lead to a precipitous drop in the number of workers per elderly if current working and retirement patterns do not change (Figure 3).

Figure 2.

Population of Americans Aged 65 and over, in Millions

Figure 3.

Will the Old Overwhelm Us?

These trends could be particularly troublesome for the long-term care system because the largest growth in the over-65 population will be among the “oldest-old,” who are disabled at the highest rates. Thus, the ratio of workers to frail elderly could decrease even more dramatically than the ratio of workers to all elderly.

A second part of the argument that long-term care could be a large burden focuses on the rapid inflation in expenditures for long-term care in recent years. Medicare and Medicaid expenditures on nursing home care were $9 billion in 1980, more than doubling to $25 billion by 1990, and doubling again to $54 billion by 1999. Likewise, Medicare and Medicaid expenditures on home health care increased from less than $1 billion in 1980 to $5 billion in 1990 and to $16.1 billion in 1999, down from a high of $17 billion in 1996 (Health Care Financing Administration 2000; Heffler et al. 2001). These increases have not been offset by lower out-of-pocket payments, although growth rates for the latter have been lower and more consistent, with average increases of 7 percent for home health care and 3.3 percent for nursing home care each year over the last decade (Levit et al. 2000). Finally, many professionals believe that even at current expenditure levels, there is a significant amount of unmet need for long-term care among the frail, and no foreseeable end in upward pressure on per diem service costs (Allen and Mor 1998).

A final part of the argument for concern about long-term care costs comes from unsettling survey results reported by Curran, McLanahan, and Knab (in review) suggesting that children who experience divorce may be less willing or able to care for their aging parents. Their data indicate that the probability of an elderly person perceiving an availability of emotional support from his or her children is reduced from 71 percent for those who marry once and remain married to 56 percent for those who marry and divorce. Remarrying after divorce provides some additional support, but does not completely offset the result of the first divorce. With the legacies of the divorce boom getting older, the percent of the elderly who are divorced or separated is projected to double for men and triple for women between now and 2030. It may be the case that informal care resources will shrink and thus result in even more pressure on public and private resources that support the formal care system.

A Reassessment of Future Economic Burden

It is possible to construct a counter-case that is more optimistic about the macro burden of long-term care in the twenty-first century. Most importantly, the typical analysis of dependency ratios overstates the impacts of aging on burden. While standard calculations include only the 20- to 64-year-old population as producers, and places all of the 65-and-older population in the dependency group (because of eligibility for Social Security and Medicare), this approach is not appropriate in the case of long-term care.

At the very least, the denominator should include only people 75 and older since the 65- to 74-year-old age group does not use large amounts of long-term care. The percentage of elderly older than 85 years who are ADL impaired or institutionalized is more than six times the rate of 65- to 74-year-olds (Manton, Corder, and Stallard 1997). In fact, if the Baby Boom generation is healthier than past generations (as argued later in the paper), it very well could be that the young elderly might work longer and thus be considered producers. In addition, in considering macroeconomic burden, the other group of dependents in society—children—should be included in the denominator with the elderly, as both groups are dependent on the adult population.

Recalculating dependency ratios using these new principles (see Table 4) indicates improvements rather than deteriorations in the adult to dependency ratios, especially when the year 2030 is compared to 1960 when children were present in the population in peak numbers. When 20- to 64-year-olds are compared to children and individuals 75 or older, the dependency ratio actually improves between 1960 and 2030. If the 65- to 74-year-old cohort is considered “productive” and enters the numerator, the dependency ratio becomes substantially more favorable in 2030 than it was in 1960.

Table 4.

Calculating Dependency Ratios

| Ratios | 1960 | 2030 | % Change |

|---|---|---|---|

| 20–64/65+ (i.e., The number of 20–64 year olds for every 75+ year old) | 5.66 | 2.67 | −53% |

| 20–64/0–19 & 65+ | 1.10 | 1.15 | +4.5% |

| 20–64/0–19 & 75+ | 1.26 | 1.50 | +19% |

| 20–74/0–19 & 75+ | 1.40 | 1.80 | +29% |

Source: Population estimates from U.S. Census Bureau

All of these ratios change in unfavorable directions between 2000 and 2030, but the changes are not substantial.3 The key point is that the United States prospered through the 1960s with dependency ratios less favorable than will be experienced in 2030 and the burden did not overwhelm the economy. Richard Leone, among others, has argued this point (Friedland and Summer 1999; Leone 1997; Singer and Manton 1998). Many other countries are years ahead of the United States in population aging; some will reach the “2030 burden level” as early as 2010 (Congressional Budget Office 1994). The United States will have more time to prepare than most industrialized nations and will be able to learn from these nations’ experiences.

A second factor that might make the burden of long-term care less striking than expected in 2030 is improvement in the health status of the elderly. Recent data from the National Long-Term Care Survey reported by Manton and Gu (2001) indicates that the disability rate for all elderly dropped from 26.2 percent in 1982 to 19.7 percent in 1999. This meant that there were more than 100,000 fewer disabled elderly in 1999 than in 1982, despite a one-third increase in the population of the elderly. In prior work, Singer and Manton (1998) estimated that a relative rate of disability decline of 1.5 percent a year over the next few decades would maintain the current level of burden each disabled elderly places on economically active Americans. This decline is actually significantly less than the 2.6 percent relative rate of decline experienced between 1994 and 1999. Declines in the nursing home population, particularly among the oldest old, have accompanied these disability trends (Bishop 1999). A more mixed, although guardedly optimistic, picture of disability trends has been offered by other demographers (Crimmins 1997; Reynolds et al. 1998; Schoeni, Freedman, and Wallace 2001). Schoeni, Freedman, and Wallace's analysis of NHIS disability data reports a 1.1 percent average annual decline in disability between 1982 and 1996. However, they caution that this decline was not persistent or consistent through this period, with most of the decline occurring in the 1980s.

Although trends will need to be watched closely over the coming decades, declines in disability probably will continue.4 This is because the two most salient factors influencing the recent declines in disability—better-educated elderly and better science—will continue to exist in the coming decades (Freedman and Martin 1999; 2000).

The elderly of 2030 will be much better educated, with a college graduation rate twice (and high school drop out rate one-third) that of the current generation of elderly (U.S. Department of Education 1998). This bodes well for the future physical health of aging Baby Boomers, as there is a strong correlation between education level and disability; college graduates have a disability rate about half that of high school dropouts.

Expected advances in medicine, through prevention, pharmaceuticals, and surgical treatments, should also reduce the need for long-term care. More and more older patients are benefiting from restorative treatments, such as knee replacements and coronary angioplasty, once unavailable due to age (Lubitz et al. 2001). Although such advances in medicine tend to increase acute health care costs, these treatments can delay entrance into nursing homes and other long-term care needs. Better pharmaceuticals for preventing and treating disabling conditions such as osteoporosis, arthritis, and rheumatism will continue to decrease the number of elderly who need assistance with IADLs and ADLs (Neer et al. 2001). Because about 60 to 70 percent of nursing home residents have dementia-related symptoms (Rovner and Katz 1993), progress in treating or preventing Alzheimer's and other dementias associated with later life could lead to large reductions in the number of elderly with the most intensive long-term care needs. This is already happening: Freedman, Aykan, and Martin (2001) found that the proportion of noninstitutionalized elderly—particularly the very elderly—with severe cognitive impairment between 1993 and 1998 fell from 6.1 percent to 3.8 percent.

If as a result of further medical advances and social shifts, the disability rates continue to decline in the coming years at the same pace that Manton reported for 1994 to 1999, or an average 0.56 percent a year, the number of disabled elderly in the year 2030 would be a remarkably low 1.6 million people, or less than three percent of the elderly population. This seems extremely unlikely. A more conservative estimate for declines in disability rates would be an average annual decline of 0.13 percent between 1994 and 2030. Although this decline would be half the 0.26 percent average annual rate of decline experienced between 1982 and 1989, about one-third of the 0.38 percent average annual decline experienced between 1989 and 1994, and significantly less than the 0.56 percent average annual decline experienced between 1994 and 1999, it would still result in a manageable 11 million disabled elderly in 2030, 40 percent less than the estimate in 1982 of 18 million disabled elderly. Even a moderate decline in disability would have dramatic impacts on the economic burden of long-term care.

The optimistic forecasts could be affected by demographic changes that are difficult to forecast. Most relevant perhaps are trends in immigration. It is possible that unexpected growth in immigration could increase the number of elderly in the year 2030, making burdens worse. Or, immigration trends might also bring larger than expected numbers of working-age adults to America, thus decreasing dependency ratios. In addition, Wolf (2001) makes the case that decreases in disability rates that are due to higher educational attainments among the Baby Boom generation will not continue past the year 2050.

The final and most important factor that will affect the macro burden of aging is the future of the American economy. When the pessimistic literature on the burden of an aging society was published, the economy was growing at anemic rates and inflation rates were relatively high. If the economy grows at a steady, healthy pace, the overall burden of long-term care will be moderate. Social security actuaries issue three different economic scenarios for the coming century. In their “bad” economic growth scenario, with average real Gross Domestic Product (GDP) growth a little more than 1 percent over each of the next 30 years, long-term care expenses for the elderly would be almost 40 percent higher as a percentage of GDP than in their “great” economic scenario, with real GDP growth averaging 2.1 percent. During the 1990s, a decade when yearly change in real GDP shifted from negative numbers to above 4 percent, GDP actually averaged about 3 percent real annual growth per year. If GDP growth were to continue at 3 percent over the next three decades, a rate which few believe is possible, LTC expenditures as a percentage of GDP would actually decline between 2000 and 2030. Whether real GDP growth averages 1, 2, or 3 percent will make an enormous difference over a thirty-year timeframe.

Taken together, these three factors—newly calculated dependency ratios, declines in disability rates, and healthy economic growth—could work together to make the macro burden of long-term care no worse than it is the beginning of the twenty-first century. While the future remains uncertain, there seems to be little reason for dire concerns about the future burden of long-term care. Our estimates are meant to be broad outlines rather than specific forecasting. Others have eloquently discussed the power of and caveats to making demographic and economic projections (Lee and Skinner 1996).5

The Real Economic Challenges for Long-term Care in 2030

Despite the preceding positive analysis of the macroeconomics of aging, there remain some substantial challenges to getting ready to meet the long-term care needs of Baby Boomers. In fact, four types of challenges need to be addressed:

Creating a finance system for long-term care that works

Building a viable and affordable community-based delivery system

Investing in healthy aging in order to achieve lower disability rates, and

Recharging the concept of family and the value of seniors in American culture.

Each of these challenges is considered in the remaining sections of this paper.

A Workable Long-term Care Financing System

Current Sources of Financing

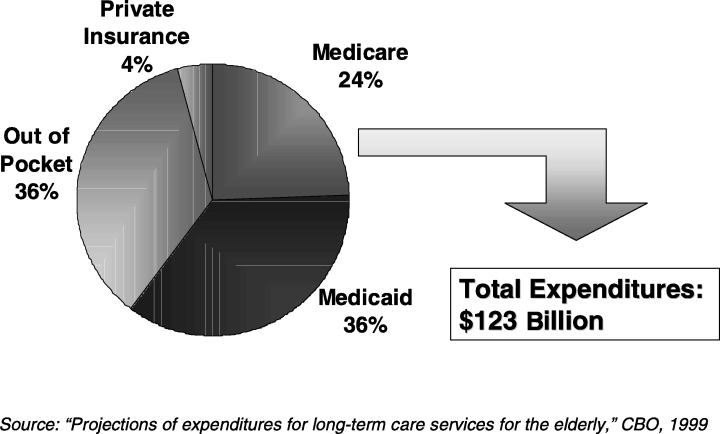

Four sources of payments currently finance long-term care services for the elderly: Medicare, Medicaid, private insurance, and out-of-pocket payments (see Figure 4).

Figure 4.

Expenditures on Long-term Care for the Elderly

The federal Medicare program pays for approximately 24 percent of all long-term care costs (Congressional Budget Office 1999). Medicare's long-term coverage, however, focuses mostly on home care that is related to medical problems, such as broken hips. Services generally are restricted to people receiving rehabilitation for some medical condition. In principle, Medicare does not cover custodial long-term care, but in practice it is an ongoing challenge for Medicare and providers to distinguish custodial care and rehabilitative care.

The federal/state Medicaid program is perhaps the most important player in the long-term care financing system. Medicaid acts as a backstop, paying for long-term care services for the frailest elders when they are poor. In most states, the Medicaid program pays for care for the poor and for elders who become poor when long-term care expenses impoverish them. In 1995, 64 percent of elderly nursing home residents used Medicaid to finance at least some of their care (Dey 1997). In many states, a large share of all Medicaid long-term care dollars supports frail elders who had been middle class before becoming frail. In New York State, for example, the Medicaid program pays for 80 percent of all nursing home costs; clearly, 80 percent of New York elders are not poor before they become frail.

Most states direct the lion's share of Medicaid dollars to nursing homes as opposed to home care. In 1995, almost 85 percent of elderly Medicaid long-term care expenditures were for institutional care and only 10 percent were for home care services (Wiener and Stevenson 1998). This is a result of Medicaid's attempts to focus on the most frail, who tend to be in nursing homes. Many experts feel that this emphasis on nursing homes means that not enough resources are devoted to preventing elders who have some disabilities from becoming more and more frail (Kane, Kane, and Ladd 1998). Since elders tend to avoid nursing homes as long as possible, the Medicaid emphasis on nursing homes means that many elders go without community-based services that really could help them live better lives.

Private insurance accounts for just 4 percent of long-term care costs. Despite aggressive attempts by the insurance industry to develop a private market for long-term care, the growth of this market has proceeded slowly. Part of the reason is the nature of the contract between an insurer and an elder. The insurer needs to guarantee a service that often will occur twenty or more years after the contract is set. The uncertainty leads insurers to keep prices high and makes elders nervous about purchasing a private insurance policy. In addition, the “door-to-door” sales approach by individual agents adds to the costs of long-term care insurance. And, the reluctance of people to think about purchasing such insurance at younger ages makes the payments on an insurance policy beyond the reach of many elders. Finally, the availability of Medicaid as a substitute for private insurance leads many elders to forego insurance premiums and take their chances on remaining healthy (McCall etal.1998).

Out-of-pocket costs finance about 36 percent of long-term care, but the burden of these payments is very unevenly distributed. The 42 percent of elders who spend some time in a nursing home—one-half of them for two years or more—pay most out-of-pocket costs for long-term care.

Barriers to Reforming the Financing System

Why is it so hard to devise a financing system to replace the current patchwork payment approach? One subtle but crucial factor is what Washington officials call the “woodwork” effect, which is the fear that many elders will demand long-term care services if a more hospitable financing system helps them receive care without having to use personal savings. It is very difficult to judge who really needs formal long-term care services, and there may be large amounts of pent up demand currently taken care of by families and friends. The woodwork effect predicts that total expenditures could grow substantially if public and or private insurance expanded (Weissert, Cready, and Pawelak 1988; Kane, Kane, and Ladd 1998). Imbedded within the woodwork issue is the real social challenge of determining how best to allocate limited resources.

A second barrier to reform is Americans’ aversion to taxes and saving. Any expanded public insurance system would require new taxes. And private insurance would be paid for from private savings, which are in short supply for most middle-income elders. One interpretation of the indifference of working-age Americans to either save privately or approve taxes to cover future long-term care services is that Americans are not adequately aware of the implications of these nonactions. Perhaps Americans, more so than other societies, are less mindful of the needs of aging due to a relatively age-stratified society. The other interpretation, however, is that Americans do not value long-term care services. This interpretation is bolstered by the fact that many moderate-income elderly who could benefit from long-term care and could afford to pay for some services choose to make do on their own.

In addition, financing reform has had to compete with various other social priorities. In recent years, lawmakers have directed more attention toward uncovered pharmaceutical costs. Medical care costs in general are high for elders—even with Medicare, elders and their families pay more than a third of their health care costs out of their own pockets. The large number of uninsured among the nonelderly population continues to be a problem that demands attention. The needs of elders also compete for resources with other problems facing other age groups. Many have concluded that elders have done rather well with social policy compared with other needy subgroups of our population. Child poverty, for example, is higher today than it was three decades ago, while poverty among the elderly has decreased significantly. Finally, tax cuts and a sluggish economy could completely eliminate the funds needed for any new social programs.

The result of the patchwork financing system is the “aging shock” presented in Table 1: Uncovered long-term care averages $44,000 in lifetime costs for the typical elder. The $44,000 figure also underestimates the burden of long-term care in that it represents the expected value for a typical elder. Any specific person who becomes frail may face higher burdens because the expected value averages high costs for those who become frail and zero costs for those elders who avoid the need for long-term care services. Conservative estimates suggest that an elder should be prepared for more than $150,000 in costs to cover the small but real probability that he or she will spend two or three years in a nursing home. And, home care costs can be just as high for a frail elder wanting to live at home.

Long-term Care Financial Viability

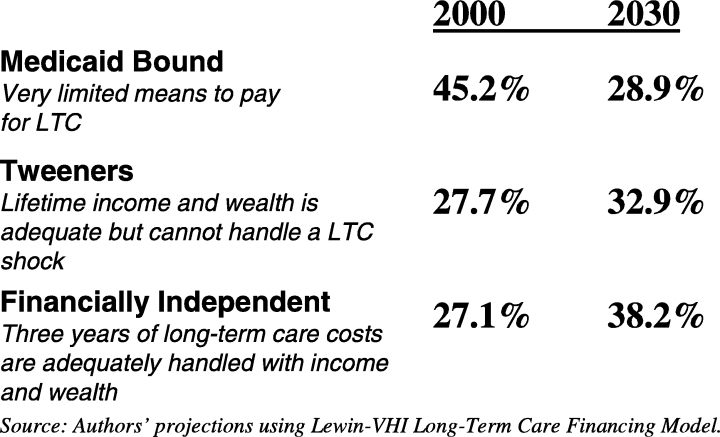

In other research, Knickman, Snell, and Hunt (2000) estimate which elders can afford a $150,000 long-term care “shock” and how long-term care financial viability will change over the coming years as the Baby Boomers reach old age.6 The best way to estimate the elderly's financial viability is to consider three subsets of people (Figure 5): Medicaid Bound, Financially Independent, and Tweeners.7

Figure 5.

Continuum of Ability to Absorb Long-term Care Costs and Distribution of Population in 2000 and 2030

The Medicaid Bound: These are individuals who have few financial resources available for long-term care and who have no choice but to rely on Medicaid. A person is Medicaid Bound if he or she does not have at least $50,000 in liquid assets or current income available for long-term care in the year 2000, or $70,000 in the year 2030.8

The Financially Independent: These are individuals who have $150,000 or more in liquid assets or current income available for long-term care and who can take care of themselves financially with or without private insurance, and surely without Medicaid. In 2030, $210,000 is the minimum amount necessary for independence.

The Tweeners: This is a group whose lifetime income and wealth are adequate but who cannot handle a long-term care shock. Individuals with liquidity between $50,000 and $150,000 and $70,000 and $210,000 comprise the Tweeners in 2000 and 2030, respectively.

Estimates calculated using the Lewin Long-Term Care Financing Model indicate some good news about the future financial viability of elders.9 (See the footnote for an explanation of model.) In the year 2000, an estimated 45 percent of elders are classified as Medicaid Bound but this estimated percentage drops to 29 percent in the year 2030. By contrast, the share of the elderly who are financially independent increases from 27 percent in 2000 to 38 percent in 2030.

As with all simulations and forecasts, the estimates into the future depend on key economic assumptions. The assumptions used follow the principles of the middle estimates of the social security forecasting model: economic growth averaging 1.3 to 2.0 percent per year and real wage growth averaging 0.9 percent per year. Perhaps the most “bullish” assumption in the simulation is that the costs of long-term care will increase just 1 percent per year in real terms. To meet this forecast, long-term care cost inflation would need to be brought under control. If long-term care costs increase at 2.3 percent above inflation, the distribution of the population not able, barely able, and able to pay for long-term care would remain almost identical to the distribution today. Thus, a relatively modest increase in long-term care inflation rates could eliminate the rosy simulation estimates of changes in the Medicaid Bound as reported above.10

The other interesting forecast that emerges from the simulation exercise is that the percentage of people in the Tweeners category will not shrink, but will actually increase from 28 percent to 33 percent. This implies that there will continue to be a large number of middle class elderly who will spend down to Medicaid coverage unless new financing arrangements help make the Tweeners more self-reliant.

How do assumptions about future disability rates affect the simulation results? In fact, disability rates only affect the estimates indirectly in that higher disability rates lead to lower income and asset estimates—particularly for the nonelderly—and this increases the number of Medicaid Bound. Disability rates do not directly affect the simulation estimates because the calculations assess who is able to afford long-term care at a point in time whether a person is disabled or not.

Emerging Options to Improve the Financing of Long-term Care

Despite the size of the economic shock associated with long-term care needs, very little policy attention is being given to designing new approaches to pay for long-term care. The Kaiser Family Foundation issued a side-by-side comparison of key health policy positions advanced by the Gore campaign and the Bush campaign in early October 2000. Under the category “long-term care” the policy brief reported that the Gore campaign had no published proposals while the Bush campaign supported tax deductibility of private long-term care insurance. The quiet long-term care issue for the elderly was completely eclipsed by attention to prescription drug coverage and the future of social security during the presidential campaign.

When attention does focus on financing options for long-term care, three serious types of options need to be considered: tax deductions for private insurance, public provision of long-term care insurance, and mandatory savings starting at younger ages for private insurance.

Tax deductibility for private insurance premiums clearly would expand the number of people who purchase long-term care insurance. Deductibility would lower the after tax cost of insurance by 15 percent to 40 percent (the range of the current marginal tax rates). Unfortunately, the largest after-tax price breaks would go to the most wealthy people who do not need insurance because they can afford to pay for long-term care from existing resources. Thevast majority of working age, middle-class people—who comprise the Tweeners—would experience between a 15 and 25 percent reduction in the costs of insurance premiums after tax deductibility. While this would be a welcome incentive, past experience with lowering the marginal cost of insurance for middle class families suggests that most will not begin to purchase long-term care insurance unless a major portion of the premium is paid for. (Bilheimer and Colby 2001)

The most likely option for a public program for insuring long-term care would involve a voluntary-type program based on out-of-pocket payments for premiums similar to Part B of Medicare. This type of program could offer graduated subsidies to make long-term care insurance more affordable for moderate-income people. In order to make the insurance affordable for most people, however, the subsidies would probably need to be large. While this type of program should lead to substantial reductions in Medicaid payments for Tweeners, the net public sector costs would likely be substantial.

Public offerings of insurance would avoid many of the marketing problems associated with private long-term care insurance and would create some healthy competition between existing private insurance policies and the new public offering. A public long-term insurance program with targeted subsidies would likely cause a much bigger expansion of insurance for middle-class families than would occur in a comparably scaled, tax deductibility program.

The third type of financing improvement would follow the logic of advocates for privatizing social security: Mandatory savings in private investment accounts could be required for all individuals starting at an age that would make annual savings affordable.11 Then, the annual savings would grow over time in the private investment accounts, and when a person turned 65 or perhaps 75, a private insurance option could be selected. Deborah Lucas presents a detailed plan for a mandatory savings approach to private financing. Her analysis suggests that saving $40 to $80 a month during working years would cover approximately 80 percent of long-term care expenses. However, the estimated savings rate for prefunding starting at age 55 is almost four times that of prefunding starting at age 35 and would also be quite sensitive to interest rates (Lucas 1996).

More analysis of these options—and others that might emerge—is needed to encourage some consensus about how to improve the financing of long-term care for the Medicaid Bound and Tweeners. A few important principles that should guide reform debates emerge from the analysis presented here:

Long-term care is an expensive item that most middle-class families are not prepared to pay

If some type of insurance plan—whether voluntary or mandatory, whether public or private—does not begin to catch hold, the public sector is going to see its expenditures grow faster and faster

The sooner alternatives to the current Medicaid-based financing system emerge, the less painful the costs of the new system will be.

Perhaps consensus about which option is the best reform approach for long-term care financing can emerge only if there is consensus about the criteria for judging options. Unfortunately, the criteria tend to conflict with one another, forcing stark trade-offs. For example, one desirable criterion for assessing options is the extent to which individuals have free choice to select a method of preparing for their possible long-term care needs. Options strong on this criterion tend to be weak on another desirable criterion: the assurance that a financing approach does not result in people becoming a public burden if they fail to prepare for long-term care needs. A third criterion also may conflict with the other two desirable features: the ability to maintain incentives to allocate scarce long-term care resources efficiently. At the very least, debates about options need to make clear what criteria related to effectiveness are under consideration.

Building a Viable and Affordable Community-based Delivery System

While the Baby Boomers were growing up, the needs of young families were a high priority in community development, with particular concern for family-friendly housing, parks, and schools. In 2011, these children will start turning 65 in large numbers. Many predict that if communities want to be successful in caring for their aging population, they will have to make significant, yet certainly feasible, changes in housing, health care, and human services.

In preparing for the needs of large numbers of elderly, it is crucial to think of the challenge as a community issue. If the care of the elderly begins and ends with entry into a formalized system that takes over when a person is almost unable to function day to day, society will face large service costs and will miss opportunities to help the elderly function as productive, independent citizens for larger portions of their elderly years. A community's social and economic systems need to become attuned to arranging services to meet the needs of an aging society in natural, informal ways.

Most Baby Boomers would like to stay in their own homes, or at least in their own communities, as they age. Nearly three-quarters of all respondents in a recent AARP survey felt strongly that they want to stay in their current residence as long as possible (Bayer and Harper 2000). The image that most elders will move to a retirement village away from their communities is the exception rather than the rule. Most people will not have the resources or the inclination to move to Florida or its equivalents; communities cannot rely on “exporting” to meet the needs of an aging population.

In thinking about community capacity, three stages of community aging can guide planning: the healthy-active phase, the slowing-down phase where the risk of becoming frail or socially isolated increases, and the service-needy phase when an elder can no longer continue to live in the community without some active service in and around the home.

Perhaps the most important challenge of the healthy active phase of aging is for a community to learn how to tap the human resources that elders represent in the community. This is a phase where elders can be key volunteers to improve the life of many segments of a community. Healthy elders can be considered a potential component of the paid workforce if jobs can be structured to meet their changing preferences and capabilities.

The second phase of aging, when elders begin to slow down and may face some challenges in doing the every day activities required of community living, represents a subtle challenge for communities. Elders in this phase often need assistance with transportation to remain independent, and communities need to take the lead to develop affordable transportation systems (U. S. Department of Transportation 1997). Safe and affordable housing options also are a priority for community capacity efforts. At this phase of aging, many elders want to move into smaller housing units that are more aging-friendly but still are affordable and integrated in the community. It is important to begin developing such options on a large scale in the coming 10 to 20 years. In a community with five thousand projected elders, for example, a project with 30 units will not meaningfully attack the problem.

Voluntarism is an important community need for elders who are mostly independent but slowing down (Butler 1997). Volunteers can provide services in a manner that makes elders continue to feel connected to a community and not dependent on a formal care system. And, volunteers often can act as preventive medicine, keeping away the effects of social isolation and keeping elders as active and engaged as possible. Volunteer capacity does not emerge without effort, however. Communities need to recruit, train, and support volunteers.

The most prevalent form of “voluntarism,” of course, is the care provided informally by families and friends. These caregivers also need support through training programs and respite programs. Many believe that additional financial assistance for family caregivers is needed as well (Stone and Keigher 1994). Such efforts to support family care-giving also represent an important aspect of community capacity to support elders.

While communities need to make day-to-day aspects of community life more aging friendly and while volunteers and family caregivers represent crucial “capacity” to meet the needs of elders, a well organized, affordable formal long-term care system still is essential for every community. It is unclear whether such local care systems can emerge naturally through market forces or whether market failures will emerge to block the evolution of care systems that reflect the wants and needs of elders. Clearly, the large financing roles of Medicare and Medicaid give the public sector an interest in ensuring that adequate systems of care emerge.

How many people will require formal services in 2030? As discussed earlier in the paper, this is an unanswerable question in the year 2002. If efforts at healthy aging are successful and if informal caregivers and volunteers can help to meet the needs of elders, the total number of frail who need formal services in a community in 2030 could be quite similar to the number in 2000, even though the number of elders will more than double. Keeping the number of frail constant at 2000 levels must be the goal of every community to keep costs affordable.

However, even if the aggregate number of frail elders stays the same or grows slowly, formal care capacity must be better structured at the community level. Importantly, most communities rely too much on nursing homes as the source of formal care, at least for Tweeners and the Medicaid Bound populations. Sixty-seven cents of every public dollar supporting long-term care for the elderly is spent on institutional care (Congressional Budget Office 1999), despite the clear preferences of frail elders for services in the community.

Why does this mismatch of dollars versus preferences happen? In part, nursing homes are seen as the long-term care “safety net” and most public dollars are invested using a safety-net mentality: only pay for services when it would be socially unconscionable not to do so. We have not developed social consensus about when and for whom community-based services should be supported with public dollars; therefore few public dollars are allocated to community-based services.

This overreliance on nursing homes—what some people call an “unbalanced” long-term care system (Kane, Kane, and Ladd 1998)—may be changing with help from the federal court system. Recent court rulings support the idea that the disabled have a right to receive services in community settings (Pear 2000). Such rulings are putting pressure on public programs to rethink the balance between nursing home services and community-based services.

The challenge over the next 10 to 30 years is to develop new approaches to delivering community-based care. Home care, using a range of unskilled to highly skilled workers, represents the dominant type of community-based care. But, this service type, relying on a one-on-one model, is expensive and creates challenges for providers to assure quality. New models, such as adult day services and housing-based services that can use one caregiver to assist more than one elder at a time, need to become more prevalent (Feldman 1990). In addition, emerging technologies might increase the ability of one caregiver to meet the needs of two or three elders through enhanced ability to communicate and monitor a person's needs (Gottleib and Caro 1999).

One other key challenge in assuring community capacity is to recruit the required numbers of caregivers working in formal settings. With changing demographics and a strong overall labor market, it is becoming increasingly difficult for home care agencies and other providers to find and retain qualified caregivers. New incentives and organizational structures will be required to maintain a stable workforce in long-term care settings.

Finally, every community needs to think about what types of institutional long-term care should be available. Even if community-based services expand, the most frail among the elderly will sometimes require the high level of care that traditionally has been provided by nursing homes. It is possible, however, to think about restructuring nursing homes to make their living environments and caring style more attractive to elders and their families (Allen and Mor 1998). Assisted living is emerging as a significant option for many elderly—both disabled and nondisabled. The idea of institutional care should not be considered as a static model that cannot evolve, improve, and become more responsive to the preferences of elders.

Expansions in community capacity to care for elders need to be paid for in some way. In the case of formal services, the financing options discussed previously are the source of expanded resources. In the case of community-based changes beyond formal services, the give and take of the political process will shape how high a priority health-promoting community programs become among the range of local priorities. And, the willingness of seniors and their families to allocate private resources to long term care and related services will determine the scope of “caring features” in twenty-first century communities.

Investing in Healthy Aging in Order to Achieve Lower Disability Rates

Perhaps the most important challenge related to aging populations is the challenge of healthy aging. Healthy aging (or successful or productive aging) is the concept of keeping seniors disability-free and thus avoiding some of the need for long-term care (Rowe and Kahn 1998). Keeping seniors healthy and functioning could have significant economic impacts (Posner 1997). In addition to reducing long-term care costs, healthier elderly are more likely to be productive members of society. In contrast to the scarce attention being paid to improving financing for long-term care, the healthy aging challenge has generated significant interest.

Both national and cross-national studies indicate that the rate of disability in a population can be extremely variable. Studies of elderly Americans with high, average, and low levels of physical activity have shown ranges in the onset of disability of up to ten years, with much lower lifetime disability among exercisers compared to sedentary people. Right now Americans spend 72 percent of their post-65 years free of disability. Our goal should be to match the Japanese, who spend 91 percent of their time past the age of 65 disability-free. For example, Japanese females at age 65 have an average life expectancy only 4 months longer than American females at age 65, but Japanese elderly women spend just 1.8 years disabled while American elderly women spend almost 5.5 years disabled (Waidman and Manton 1998).12 While researchers caution that some of these differences could be due to varying cultural perceptions of disability and the reporting of disability to survey researchers, most observers of Japanese society believe that there are substantial differences in disability and that they relate to lifestyle choices.

Although disability and disease were once thought to be commensurate with old age, the examples above, along with many others, have made it increasingly clear that for all but the most genetically programmed diseases, lifestyle choices, social factors, and the environment play just as large or larger roles than genetics in influencing health in later life. Less than a third of the biological process of aging is attributed to genetics, and the potency of genes that affect aging declines even further after age 65 (Finch and Tanzy 1997). Thus, society has the ability to promote successful aging and reduce and prevent disability among the elderly.

Efforts to Avoid Disease and Disability Related to Medicine and Medicare

Advances in genomics and medicine may represent the most straightforward strategy (at least compared to changing behaviors and lifestyles) to reduce disease and disability. The budget for the National Institutes of Health more than doubled between 1988 and 2000, from $6.6 billion to $18 billion, and appropriations are projected to reach $27 billion by 2003. More than $2.5 billion has been spent on the Human Genome Project since 1988 (Human Genome Project Information 2000). These investments should lead to advances in earlier detection of disease or genetic predisposition to disease, more rational drug design, and possibly even gene therapy. Future medical interventions might transform the initial stages of chronic disease—such as the onset of Alzheimer's or arthritis—into acute disease events that can be remedied (or even prevented through vaccination) after one or two visits to the primary care physician (Singer and Manton 1998). Consider Alzheimer's disease alone; an estimated 14 million people in the United States could suffer from Alzheimer's in 2040 if today's prevalence rates remain constant. In recent years, however, understanding about the neurobiology of the disease has increased as genes and proteins that increase susceptibility to Alzheimer's have been identified and studied (Selkoe 1999). This new knowledge is leading to earlier diagnosis, the development of better drugs that treat symptoms, and some hope that vaccines and other methods for at least slowing the onset of Alzheimer's will emerge.

Better management by the medical care system of a broad range of chronic diseases could also reduce the incidence of disability. Society's understanding of what the health system needs to do to encourage prevention and clinical care management of chronic diseases has improved tremendously in recent years. Despite this, the right formula has not emerged for setting incentives that will lead to widespread adoption of good clinical care management principles among the numerous medical providers who care for the elderly (Wagner et al. 1999). Increasingly, however, public and private payers are beginning to demand better clinical care management approaches for the chronically ill.

Although Medicare has clearly improved the health status of the elderly through access to acute medical care (Lubitz et al. 2001), additional interventions are necessary to improve health care services for the elderly. Much more must be done to facilitate better clinical care management of chronic diseases (Wagner et al. 1996) and encourage healthy aging. This could include better use of clinical preventive services to reduce the costs of Medicare (Russell 1998), thorough implementation of chronic disease management practices, and incentives to increase the use of behavioral interventions that could help patients quit smoking, better monitor diabetes, and promote physical activity. Although Medicare acute care costs are positively affected by prevention efforts, there is little payoff to medical care providers who invest in preventive efforts. This lack of connection between Medicare prevention efforts and savings is a current barrier to better integration of prevention efforts into Medicare.

Efforts Related to Socioeconomic and Lifestyle Factors

Although medical advances generate the most excitement, basic social and lifestyle factors might have the largest long-term impact on disability rates. Various studies indicate that having income above the lowest quintile, having a high school education or greater, not smoking, and exercising are among the most important determinants of healthy aging (Strawbridge et al. 1996; Stuck etal. 1999).

On the positive side, one factor that could lead to healthier aging among Baby Boomers compared to the current elderly is the changing life circumstances of childhood and adulthood. It appears that neurobiological circumstances in old age may be shaped in part by experiences during early, critical periods of brain development, and that many changes in function during aging show variability related to these early life experiences. That is, childhood diseases, nutritional deficiency, poverty, and lack of education might be contributing to what is now viewed as normal aging. Childhood health problems have been linked to a variety of morbidities later in life, including arthritis, cardiovascular conditions, and cancer, even when socioeconomic status is controlled for (Blackwell 2001). According to the Barker hypothesis, prenatal conditions can have a large effect on health in later life as well, with poor nutrition in utero related to increased cardiovascular disease, diabetes, and other ailments in later life (Barker 1995). Many elderly alive today matured during the two world wars and the long depression period, when malnutrition and vitamin deficiencies were still common. The Baby Boom cohort, by contrast, grew up among much better health, economic, nutritional, and educational conditions. Because of antibiotics and immunizations they will have been largely untouched by the ravages of childhood disease.

Education is also strongly correlated with psychological function, health behaviors, and biological conditions (Kubzsansky et al. 1998). Persons who are not high school graduates are at almost twice the risk for experiencing declines in functional abilities in older adulthood. It is encouraging that national trends in educational attainment among the elderly are so positive, with future cohorts having completed many more years of schooling than the current elderly. However, even older adults without much formal education can benefit from programs and activities that keep their minds supple and active.

Trends in healthy behaviors are not as encouraging as the socioeconomic statistics. National trends in healthy behavior have been mixed, with stagnation in exercise, increases in obesity, and decreases in smoking. In 1997, only one-half of all 65- to 74-year-olds and one third of all people aged 75 and older engaged in any leisure time physical activity each week. Twenty-four percent of people aged 60 and older are obese and current obesity trends among younger cohorts indicate that this number will only increase (U.S. Department of Health and Human Services 2000). Obesity is a risk factor in the elderly for arthritis, lung dysfunction, hypertension, diabetes, cardiovascular disease, and certain forms of cancer (Kotz, Billington, and Levine 1999).

Although many suspect that rising obesity rates will increase overall medical costs, it is unknown what effect this will have on long-term care expenditures. Analysis of mortality statistics indicates that obesity has a much larger effect on life expectancy at younger than older ages, but future generations of elderly are likely to have a much higher rate of obesity than current generations. Also, the health implications are unknown for overweight elderly who have been overweight for much of their adult lives (Kotz, Billington, and Levine 1999).

What can be done to change these trends? A sophisticated social marketing campaign might increase awareness and change attitudes about eating and exercising. In the past, successful such efforts made progress in increasing awareness about cardiovascular health risks and the importance of cholesterol monitoring and control of hypertension (Shea and Basch 1990; Dustan, Roccella, and Garrison 1996). Better pharmaceutical agents that help control obesity also are likely to be developed in the coming years.

Communities need to provide more and better opportunities for health promotion for older adults. In 1997, only 12 percent of adults aged 65 years and older participated in one or more organized health promotion activities (U.S. Department of Health and Human Services 2000). Many communities also do not offer activity-friendly environments that encourage seniors to walk or engage in other physical activity.

On a positive note, many researchers have shown that it is possible to reach old age in a healthy condition; those with healthy habits have a very good chance of reaching old age without disability (Vita, Terry, Hubert, and Fries 1998) and without accruing large health care costs (Schauffler, D'Agostino, and Kannel 1993; Daviglus, et al. 1998).

Efforts to Nurture Strong Interpersonal Relationships

Although research has shown that the lack of social relationships is a major risk factor for poor health, as significant as smoking or inactivity, few direct interventions to work on this issue have emerged. Studies suggest that mortality rates rise sharply at low levels of social connection, with death more than twice as likely compared to people with adequate social relationships (Berkman and Syme 1979). Good social connections also affect mental health and cognition as well. One study found that persons who had no social ties were twice as likely to experience cognitive decline compared to those persons with five or six social ties (Bassuk, Glass, and Berkman 1999). The 1986 General Social Survey indicated that twenty percent of the elderly (6.4 million people) are so socially isolated their health is at risk. Two million of them have no social network at all. Clearly, these elderly are at high risk for unhealthy aging.

Opportunities for healthy aging currently are highly related to social and economic status. The inequalities that exist in society translate into health inequalities. Receiving health insurance for the first time at age 65 will not eliminate the impact of years without insurance. Poor dental care as a child leads to lifelong increased susceptibility to many types of infection. Recent research has shown that lifetime differences in social and economic circumstances affect differences in mortality up to age 89 years (Kubzsansky et al. 1998). Although research indicates that as a whole the elderly will be much better off in 2030 than they are today, closer examination reveals a significant minority of elderly—disproportionately women and minorities—in 2030 who could be left behind.

Recharging the Concept of Family and the Value of Seniors in American Culture

The fourth challenge related to meeting the long-term care needs of an aging population is quite intangible and is dependent on culture rather than public policy. The idea of elders as an economic burden or as frail and weak is a twentieth-century construct. An interesting book by Thomas Cole traces the history of society's views on aging (Cole 1992). In ages when death struck randomly and evenly at all ages, people did not focus so much on a birth to death, linear view of life. And, agrarian economies where the young, the middle-aged, and the old all play productive roles enhanced the sense of the value of all ages.

So, in past eras life was viewed more as a circle—the Lion King image. But, since the Victorian Age and especially during the twentieth century, as more people have lived to old age, the linear interpretation of the life cycle has become dominant. The past century's improvements in medical and economic conditions for older people have been accompanied by cultural isolation and a change in the conception of old age. Old age has been removed from its once spiritual location in the journey of life to being redefined as a medical problem.

Perhaps it is time to rethink the value of aging and the positive aspects of aging and to adopt a cultural view captured by the imagery of the “Long Late Afternoon of Life.” While it is difficult to change “culture” per se and the way elders are viewed in society, there are practical steps communities, employers, and individuals can begin to take to prepare for a society with greater numbers of healthy elders.

First, it is worth reassessing the responsibilities and assets of elders. All ages need roles in life. According to Erik Erikson, the hallmark of successful late-life development is the capacity to be generative and to pass on to future generations what one has learned from life. Marc Freedman has called the elderly “America's one growing resource” and views the aging of the population as an opportunity to be seized (Freedman 1999). More than half of all elderly volunteer their time. In the past few decades with the creation of National Senior Service Corps, the Foster Grandparent program, and the Faith in Action initiative, more opportunities than ever are available to elderly who want to contribute to their communities.

Half a million people age fifty and older have gone back to college (Riley 1998). Firms are integrating workforces through programs of “unretirement” or by hiring retirees as temps, consultants, and part-time workers. Surveys suggest that the 60-year trend of a decreasing number of elderly working has reversed itself as Baby Boomers reconsider their financial needs for retirement as well as how they want to spend more than a third of their adult life. In 2000, the percentage of elderly who worked, nearly 13 percent, was higher than it had been in 20 years (Walsh 2001). The young elderly (people in their 60s) have reported increased ability to work, with a 24 percent drop in the inability to work at this age; the percentage of elderly unable to work at age 65 in 1982 was higher than the percentage unable to work at age 67 in 1993 (Crimmins, Reynolds, and Saito 1999). Most forecasters project this trend to continue as more elderly work longer for economic, social, and personal reasons, employers become more flexible and aware of the needs and benefits of older workers, and the labor market remains tight, with a smaller number of available younger workers.

Since the sheer size and energy of the Baby Boom generation has led to other dramatic social shifts, some experts see hope that a new imagery for aging is possible. A growing interest in “age integration”—a process that takes advantage of the broadened range of accumulated “life course” experiences in society—has occurred over the last few decades. In an age-integrated society, changes made to bring older people into the mainstream could simultaneously enlarge personal opportunities and relieve many other people who are in their middle years of the work–family “crunch” (Uhlenberg 2000; Riley 1998).

Actual physical integration between the generations can take place too. Although some towns have seen a trend toward “senior-only” housing, others are exploring options in integrated apartment buildings. Surveys have shown that most older people prefer a mixed-age neighborhood over one restricted to people their own age. Some community centers are integrating senior centers with child-care centers, facilitating cross-age interaction and at the same time conserving space and resources.

Cultural change also is possible, in terms of one-to-one relationships. Baby Boomers have made an art of enjoying and taking pride in everything about caring for children; some even go so far as managing to almost “enjoy” paying $30,000 annually for college tuition. The needed cultural shift is for children and communities to find more enjoyment and pride in providing for the care of parents and neighbors.

The simple message—and the intangible goal—is to recognize the give and take of all parts of society. Anyone who has spent time caring for an elderly friend or relative recognizes that in the end, caregivers receive far more than they give in the relationship. Everyone benefits when the elderly can be integrated fully into a caring society.

Notes

Based on average life expectancy of 17 additional years at age 65, out-of-pocket prescription drug costs of approximately $400 a year (with 5 percent annual increases over inflation), out-of-pocket medical care costs of $900 a year, and uncovered insurance premiums costs of $1,000 a year, and average life long-term care costs.

The ADLs include eating, bathing, dressing, toileting, transfers, and continence. The IADLs include light housework, laundry, meal preparation, transportation, grocery shopping, telephoning, and medical and money management.

According to demographic projections, the ratios continue to moderately worsen between 2030 and 2050 as Baby Boomers reach very old ages.

The Lewin-LTC model used in this paper uses relatively conservative assumptions about declines in disability over the next thirty years and assumes that the average amount of time spent in disability before death will remain the same even as the age of death rises. Thus, disability will decrease at an average annual rate, depending on age, of between 0.5 and 0.6 percent—mirroring the social security trustees assumptions for declines in mortality—and keeping the percentage of elderly in the community who are disabled in 2030 at approximately the same level as in 2000: around 5 percent.

In this paper, Lee and Skinner outline the major caveats in making projections of health care needs, mortality, and disability, the lack of consensus in interpretation of data, the need for stronger modeling strategies, and what would be necessary for more robust, long-term predictive power.

All comparisons were done using 2000 dollars, with projected inflation adjustments. (Knickman, Snell, and Hunt).

Tim Smeeding coined the term “Tweeners” (Smeeding 1986) and Smeeding and Holden have considered their problems in earlier papers (Smeeding and Holden 1990).

The $150,000 amount is used to define a long-term shock because this amount would be needed to support a three-year nursing home stay in many parts of the country. To calculate “current income” we include income over a three-year period since most nursing home stays are less than three years, but many last more than one year. Thus, including only one year of current income might have understated resources available for long-term care. Income includes earnings, social security income, pensions, other annuities, and investment incomes. If a person is single, it is assumed the long-term care resources available include income over three years plus liquid assets. The long-term care resources available to a person who is part of a couple is three times income, minus $16,000 a year for the spouse plus liquid assets, minus the half the liquid assets of $120,000, whichever is smaller. Thus, long term care resources for a couple = 3[MAX (0, income-$16,0001)] + (liquid assets − [MIN (1/2 liquid assets, $120,000)]).

The Long-term Care Financing Model simulates the utilization and financing of long-term care services for elderly individuals through 2050 using national data. The two principal components of the model are the Pension and Retirement Income Simulation Model (PRISM) and the Long-term Care Financing Model. The PRISM simulates future demographic characteristics, labor force participation, income and assets of the elderly. The Long-term Care Financing Model simulates disability, admission to and use of institutional and home and community-based care, and methods of financing long-term care services. The model uses a Monte Carlo simulation methodology. The current version of the model is the second major revision of the model that was developed jointly by Lewin-ICF and the Brookings Institution in 1986.

In almost all cases, PRISM uses the Intermediate assumptions from the 1999 Social Security Trustees’ Report. The PRISM models income from social security, private and public employee retirement plans, Individual Retirement Accounts, Keogh accounts, earnings, assets, and the Supplemental Security Income program. Aggregate changes in wage levels are assumed to increase at the rate assumed in the Intermediate category of the 1999 Trustees’ Report. In general, average wages are assumed to grow by 0.9–1.0 percentage points in excess of the inflation rate in each year after 1998. The PRISM simulates mortality, disability, childbearing, and changes in marital status. Mortality rates vary by age, gender, disability status, years since becoming disabled, and race (black versus nonblack).

In the Long-term Care Financing Model, disabled individuals age 65 and older are defined as those who are unable to conduct at least one instrumental activity of daily living or unable to conduct at least any one of five activities of daily living. The disability prevalence rates used in the model were calculated using data from the 1994 National Long-term Care Survey (NLTCS) while assuming that the overall period during which an individual is likely to have a disability will remain stable. Taking an intermediate view of long-term disability prevalence rates, it assumes that disability will decrease at an average annual rateof between 0.5 and 0.6 percent—mirroring the social security trustees’ assumptions for declines in mortality—depending on age. This rate isapproximately one-half the 1.2 percent per year declines in disability estimated by Manton based on the 1982 and 1994 NLTCS (Alecxih, L. B., J. Corea, and R. Foreman, 2000. “Long-term Care Financing Model: Model Assumptions [Draft],” The Lewin Group.)

It is very difficult to know how fast long-term care costs will inflate over a thirty-year period. On the other hand, if labor becomes more productive in the general economy, service costs could inflate at faster rates than average because productivity gains in the service sector often lag average gains in the economy. However, over the next thirty years it is possible that new technologies and new service strategies could improve the efficiency of the long-term care sector. The assumption of 1 percent inflation above average inflation seems like a moderately—but not unreasonably— optimistic guess.

The grounds for mandatory savings would be based on the following type of thinking: (a) people miscalculate the importance of saving for long-term care, and (b) if individuals fail to save, the costs of long-term care become a social burden. This logic motivates a wide range of regulatory behavior ranging from social security to mandatory automobile insurance.

Some have feared that as life expectancy increases, the time spent in poor health will correspondingly rise. Recent data does not seem to support these fears. Average life expectancy at age 85 was six years in 1980, and, by 1997, had increased by less than four months (U.S. Census Bureau 2000). Declines in disability, however, appear to be quite significant.

References

- Allen S, Mor V, editors. Living in the Community with Disability: Service Needs, Use, and Systems. New York: Springer; 1998. [Google Scholar]

- Arno PS, Levine C, Memmott MM. “The Economic Value of Informal Caregiving. Health Affairs”. 1999;18(2):182–8. doi: 10.1377/hlthaff.18.2.182. [DOI] [PubMed] [Google Scholar]

- Banaszak-Holl J, Allen S, Mor V, Schott T. “Organizational Characteristics Associated with Agency Position in Community Care Networks”. Journal of Health and Social Behavior. 1998;39(4):368–85. [PubMed] [Google Scholar]

- Barker DJ. “Fetal Origins of Coronary Heart Disease”. British Medical Journal. 1995;311:171–4. doi: 10.1136/bmj.311.6998.171. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bassuk SS, Glass TA, Berkman LF. “Social Disengagement and Incident Cognitive Decline in Community-Dwelling Elderly Persons”. Annals of Internal Medicine. 1999;131:165–73. doi: 10.7326/0003-4819-131-3-199908030-00002. [DOI] [PubMed] [Google Scholar]

- Bayer A, Harper L. Fixing to Stay: A National Survey on Housing and Home Modification Issues. 2000. American Association of Retired Persons.

- Berkman LF, Syme SL. “Social Networks, Host Resistance, and Mortality: A Nine-Year Follow-up Study of Alameda County Residents”. American Journal of Epidemiology. 1979;109(2):186–204. doi: 10.1093/oxfordjournals.aje.a112674. [DOI] [PubMed] [Google Scholar]

- Bilheimer LT, Colby DC. “Expanding Coverage: Reflections on Recent Efforts”. Health Affairs. 2001;20(1):83–95. doi: 10.1377/hlthaff.20.1.83. [DOI] [PubMed] [Google Scholar]

- Bishop CE. “Where Are the Missing Elders? The Decline in Nursing Home Use, 1985 and 1995”. Health Affairs. 1999;18:146–55. doi: 10.1377/hlthaff.18.4.146. [DOI] [PubMed] [Google Scholar]

- Blackwell DL, Hayward MD, Crimmins EM. “Does Childhood Health Affect Chronic Morbidity in Later Life?”. Social Science and Medicine. 52:1269–84. doi: 10.1016/s0277-9536(00)00230-6. [DOI] [PubMed] [Google Scholar]

- Butler RN. “Living Longer, Contributing Longer”. Journal of the American Medical Association. 1997;281(16):1372–3. [PubMed] [Google Scholar]

- Cole TR. The Journey of Life: A Cultural History of Aging in America. New York: Cambridge University Press; 1992. [Google Scholar]

- Congressional Budget Office. CBO Memorandum: Projections of Expenditures for Long-Term Care Services for the Elderly. Washington, DC: 1999. [Google Scholar]

- Congressional Budget Office based on data from the Social Security Administration and from Eduard Bos. World Population Projections, 1994–95 Edition. Washington, DC: World Bank; 1994. [Google Scholar]

- Crimmins EM, Reynolds SL, Saito Y. “Trends in Health and Ability to Work among the Older Working-Age Population”. Journal of Gerontology. 1999;54B(1):S31–40. doi: 10.1093/geronb/54b.1.s31. [DOI] [PubMed] [Google Scholar]

- Crimmins EM, Saito Y, Reynolds SL. “Further Evidence on Recent Trends in the Prevalence and Incidence of Disability among Older Americans from Two Sources: The LSOA and the NHIS”. Journal of Gerontology. 1997;52B:S59–71. doi: 10.1093/geronb/52b.2.s59. [DOI] [PubMed] [Google Scholar]

- Cuellar AE, Wiener JM. “Can Social Insurance for Long-Term Care Work? The Experience of Germany”. Health Affairs. 2000;19(3):8–25. doi: 10.1377/hlthaff.19.3.8. [DOI] [PubMed] [Google Scholar]