Abstract

Microeconomic theory maintains that purchases are driven by a combination of consumer preference and price. Using event-related FMRI, we investigated how people weigh these factors to make purchasing decisions. Consistent with neuroimaging evidence suggesting that distinct circuits anticipate gain and loss, product preference activated the nucleus accumbens (NAcc), while excessive prices activated the insula and deactivated the mesial prefrontal cortex (MPFC) prior to the purchase decision. Activity from each of these regions independently predicted immediately subsequent purchases above and beyond self-report variables. These findings suggest that activation of distinct neural circuits related to anticipatory affect precedes and supports consumers’ purchasing decisions.

Introduction

The decision whether to purchase a product is the fundamental unit of economic analysis. From the bazaar to the Internet, people typically consider characteristics of available products, determine their cost, and then decide whether or not to purchase. The success of economic theory rests on its ability to characterize this repeated and elementary decision process. Neuroeconomic methods offer the hope of separating and characterizing distinct components of the purchase decision process in individual consumers.

In addition to being attracted to preferred products, consumers avoid prices that seem excessive. Many incentive schemes for promoting purchasing appear designed to diminish the salience of payments (e.g., credit cards), or to create the illusion that products have no cost (e.g., frequent flyer mileage) (Prelec and Simester, 2001). To explain these phenomena, recent behavioral economic theories have postulated a hedonic competition between the immediate pleasure of acquisition and an equally immediate pain of paying (Prelec and Loewenstein, 1998). The notion that people consider prices as a potential loss can be contrasted with a different economic account in which people represent prices as potential gains of alternative products that could be purchased for the same amount of money (Deaton and Muellbauer, 1980).

The idea that purchase decisions involve a tradeoff between the potential pleasure of acquisition and the pain of paying is consistent, however, with recent neuroscientific evidence that distinct neural circuits related to anticipatory affect provide critical input into subsequent decisions (Bechara et al., 1996; Kuhnen and Knutson, 2005). Mounting neuroimaging evidence suggests that activity in different neural circuits correlates with positive and negative anticipatory affect. In the absence of choice, anticipation of financial gains activates the nucleus accumbens (NAcc) and correlates with self-reported positive arousal, whereas gain outcomes activate the mesial prefrontal cortex (MPFC) (Knutson et al., 2001b). These findings have been interpreted to indicate that NAcc activation correlates with gain prediction, while MPFC activation correlates with gain prediction errors (Knutson et al., 2003). Further findings suggest that anticipation of physical pain activates the insula among other areas, and insula activation also correlates with self-reported negative arousal (Buchel and Dolan, 2000; Paulus et al., 2003). Thus, insula activation has been hypothesized to play a critical role in loss prediction (Paulus and Stein, 2006). Emerging evidence also suggests that activation in these circuits may influence subsequent choice. For instance, during an investing task involving choice of risky (e.g., stocks) or riskless (e.g., a bond) alternatives, NAcc activation preceded switching to risk seeking strategies (in which anticipated gain should outweigh anticipated loss), while insula activation preceded switching to risk-averse strategies (in which anticipated loss should outweigh anticipated gain) (Kuhnen and Knutson, 2005).

Compared to choices involving purely financial risks, purchasing of products represents a less constrained decision scenario, because products can potentially vary along infinite dimensions. However, decisions to purchase may recruit common anticipatory affective mechanisms. For instance, a growing number of FMRI studies have explored neural correlates of product preference. Specifically, men who view pictures of sports cars versus less desirable types of cars show increased mesolimbic activation (midbrain, NAcc, MPFC) (Erk et al., 2002). Both men and women who view pictures of preferred versus nonpreferred drinks show increased MPFC activation (Paulus and Frank, 2003). Both men and women who taste preferred versus nonpreferred drinks also show greater MPFC activation (McClure et al., 2004). Finally, men who view pictures of preferred versus nonpreferred brands of beer show increased MPFC activation, and women who view pictures of preferred versus nonpreferred brands of coffee also show increased MPFC activation (Deppe et al., 2005). Together, these findings implicate mesolimbic dopamine projections areas in the representation of anticipated gain, but do not clarify different roles of these distinct projection areas (Knutson et al., 2005). Additionally, subjects did not actually purchase products in any of these studies. Preference may lead to purchasing, but only when the price is right.

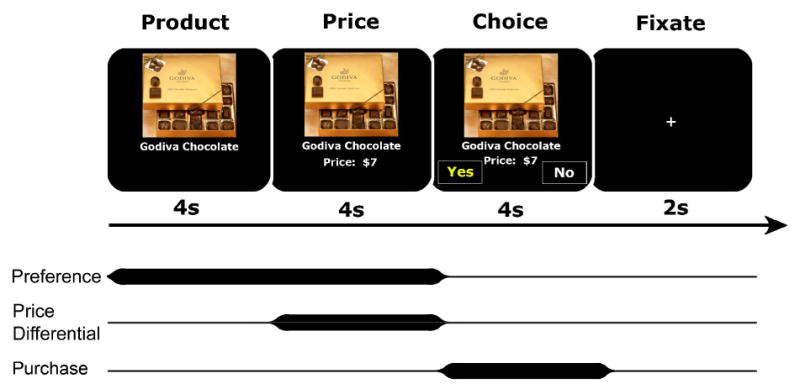

The goal of this study was to determine whether distinct neural circuits respond to product preference versus excessive prices, and to explore whether anticipatory activation extracted from these regions could independently predict subsequent decisions to purchase. Subjects were scanned while engaging in a novel SHOP (i.e., “Save Holdings Or Purchase”) task, which consisted of a series of trials of identical temporal structure, in which subjects could purchase products. Subjects saw a labeled product (4 s), saw the product’s price (4 s), and then chose either to purchase the product or not (by selecting either “yes” or “no” presented randomly on the right or left side of the screen; 4 s), before fixating on a crosshair (2 s) prior to the onset of the next trial. Timing for each trial period was intentionally limited to minimize distractions and maximize affective engagement in the task (Slovic et al., 2002). We predicted that during product consideration, preference would activate neural circuits associated with anticipated gain (Knutson et al., 2001a). We also predicted that during price presentation, excessive prices would activate circuits associated with anticipated loss (Paulus et al., 2003), as well as deactivate brain regions previously associated with balancing potential gains against losses (de Quervain et al., 2004). Finally, we predicted that activation extracted from these regions prior to the purchase decision would predict whether individuals would subsequently choose to purchase a product, above and beyond self-report variables. Thus, this work represents the first attempt to distinguish neural correlates of consumer reactions to preference versus price information, and also to use brain activation to predict purchasing.

Results

Behavior

Subjects purchased 23.58 ± 13.31 (mean ± SEM) out of 80 products total (i.e., approximately 30% of the products they saw). Percentage products purchased did not significantly differ for men versus women. Therefore, these groups were combined in subsequent analyses. Subjects who purchased several products from one set were more likely to purchase several from the other set (r=.62, t(25)=3.91, p<.001). Thus, subsequent prediction analyses controlled for individual fixed effects. Purchasing also was consistent over repeated presentations of the same product (r=.83, t(25)=47.73, p<.001). Specifically, 87% of products purchased during the first presentation were also purchased during the second presentation, while 95% of products not purchased during the first presentation were also not purchased during the second presentation. Reaction time did not differ between products that were purchased (median ln(rt) = 6.70) versus not purchased (median ln(rt) = 6.69; t(25)=0.54, n.s.). For purchased products, (log) reaction time correlated negatively with preference (r=−.21, t(25)=3.47, p<.01), while for unpurchased products, (log) reaction time correlated positively with preference (r=.11, t(25)=3.04, p<.01). Thus, subjects deliberated longer prior to purchasing a product for which they had a relatively weak preference, as well as prior to not purchasing a product for which they had a relatively strong preference, suggesting that reaction time indexed response conflict. To control for these associations, reaction time was included in regression models during the choice period as a covariate (Knutson et al., 2005).

Localization

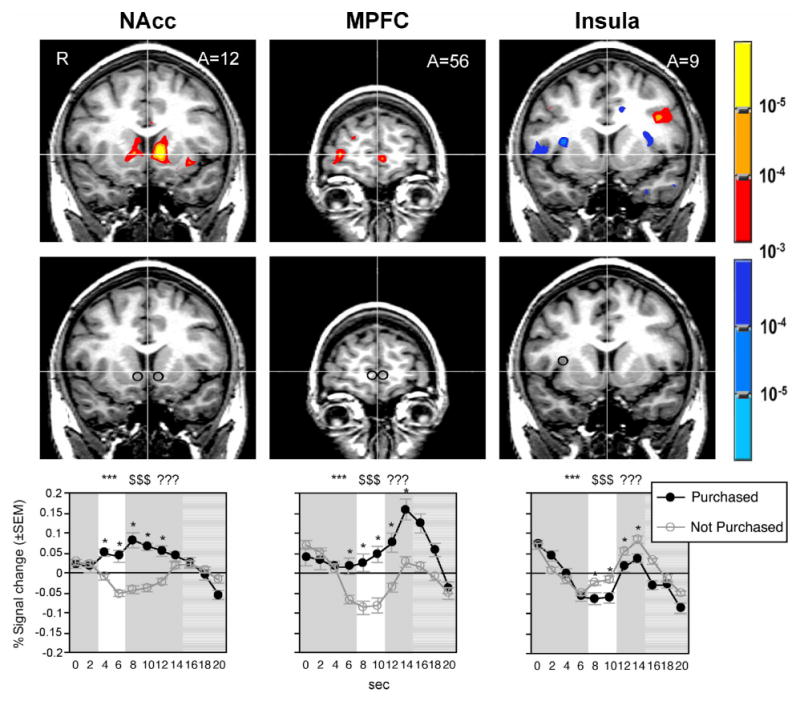

Preference was correlated with activation in the NAcc (TC: ±12,13,−2; Figure 2) during product and price periods, as well as other regions (Table 1). Price differential (the difference between what the subject was willing to pay and the displayed price of the product) was correlated with activation in MPFC (−4,59,−3; Figure 2) during the price period, as well as other regions (Table 2). Purchasing was correlated with deactivation of the bilateral insula (TC: ±32,10,9; Figure 2) during the choice period, as well as activation of other regions (Table 3). In summary, as predicted, NAcc activation was positively correlated with preference during the product and price periods (i.e., when the product was displayed), MPFC activation was positively correlated with price differential during the price period (i.e., when the price was displayed), and insula activation was negatively correlated with purchasing during the choice period (i.e., when subjects chose to purchase or not). Data were extracted from the predicted regions and submitted to verification, prediction, and validation analyses. Data were also extracted from other regions identified in the localization analysis and submitted to prediction analyses in order to determine whether they would add to the predictive power of the three hypothesized regions.

Figure 2.

Correlated activation, volumes of interest, and corresponding activation time-courses. Top row (L-R): Conjoined correlations of NAcc activation with preference during product and price periods; MPFC activation with price differential during the price period; and insula activation with decision not to purchase during the choice period (n=26). Middle row (L-R): Volumes of interest superimposed on structural images of the bilateral NAcc, bilateral MPFC, and right insula. Bottom row (L-R): Bilateral NAcc activation time-courses for trials in which products were subsequently purchased versus not; bilateral MPFC activation time-courses; right insula activation time-courses (white=predicted divergence, ***=product period, $$$=price period, ???=choice period, all lagged / shifted right by 4 s; n=26, *p<.05).

Table 1.

Conjoint activation foci for preference (whole brain, p<.001 uncorrected for each product set, conjoint for both product sets, cluster=3 voxels, predicted activations in boldface, Product + Price Periods)

| Preference | Set 1 Z | Set 2 Z | R | A | S |

|---|---|---|---|---|---|

| R Anterior Cingulate / Med FG | 3.63 | 4.73 | 8 | 33 | 24 |

| L Anterior Cingulate | 3.85 | 4.82 | −10 | 37 | −6 |

| R DLPFC | 3.39 | 4.60 | 37 | 33 | 11 |

| L DLPFC | 3.24 | 4.09 | −45 | 37 | 4 |

| L Medial Frontal Gyrus | 4.30 | 4.94 | −4 | 31 | 30 |

| L Superior Frontal Gyrus | 3.35 | 3.71 | −21 | 25 | 51 |

| R Anterior Insula | 3.22 | 5.63 | 29 | 21 | −1 |

| L Anterior Insula | 4.05 | 4.27 | −27 | 21 | −3 |

| R NAcc | 3.47 | 4.30 | 10 | 12 | −1 |

| L NAcc | 4.97 | 4.35 | −10 | 11 | 0 |

| R Caudate | 3.29 | 3.96 | 7 | 5 | 5 |

| L Caudate | 3.78 | 3.85 | −12 | 11 | 10 |

| L Globus Pallidus | 3.24 | 4.77 | −8 | 2 | −1 |

| L Posterior Cingulate | 3.48 | 4.79 | −3 | −34 | 31 |

Table 2.

Conjoint activation foci for price differential (whole brain, p<.001 uncorrected for each product set, conjoint for both product sets, cluster=3 voxels, predicted activations in boldface, Price Period)

| Price Differential | Set 1 Z | Set 2 Z | R | A | S |

|---|---|---|---|---|---|

| R Frontopolar Cortex | 3.43 | 4.22 | 30 | 60 | −4 |

| L Frontopolar Cortex | 3.24 | 4.02 | −13 | 68 | −1 |

| L MPFC | 3.61 | 3.35 | −4 | 59 | −3 |

| R MPFC | 3.85 | 3.12 | 4 | 46 | −6 |

| R Anterior Cingulate | 4.03 | 3.41 | 3 | 34 | 1 |

| L Parahippocampal Gyrus | 3.50 | 3.46 | −9 | −47 | 5 |

Table 3.

Conjoint activation foci for purchase (whole brain, p<.001 uncorrected for each product set, conjoint for both product sets, cluster=3 voxels, predicted activations in boldface, Choice Period)

| Choice | Set 1 Z | Set 2 Z | R | A | S |

|---|---|---|---|---|---|

| L VMPFC | 3.97 | 4.71 | −5 | 62 | −4 |

| 4.39 | 4.10 | −4 | 38 | −11 | |

| L Middle Frontal Gyrus | 4.69 | 5.54 | −19 | 34 | 42 |

| L Inferior Frontal Gyrus | 4.08 | 4.66 | −44 | 15 | 24 |

| R OFC | 3.92 | 4.04 | 30 | 29 | −9 |

| L OFC | 3.58 | 3.58 | −34 | 33 | −10 |

| R Insula | −3.48 | −4.91 | 32 | 9 | 9 |

| L Insula | −3.13 | −4.67 | −31 | 9 | 11 |

| −3.38 | −4.92 | −38 | −2 | 15 | |

| −3.34 | −4.11 | −38 | −16 | 20 | |

| L Postcentral Gyrus | −3.44 | −4.69 | −49 | −19 | 21 |

| −3.30 | −3.40 | −25 | −35 | 58 | |

| Posterior Cingulate | 4.36 | 5.57 | 0 | −30 | 34 |

| R Inferior Parietal Lobule | −3.75 | −4.80 | 55 | −35 | 27 |

| L Inferior Parietal Lobule | −4.36 | −4.07 | −49 | −31 | 28 |

| L Paracentral Lobule | −3.71 | −4.13 | 8 | −41 | 53 |

| L Posterior Cingulate | 3.93 | 4.73 | −8 | −52 | 20 |

| L Superior Parietal Lobule | 3.94 | 3.79 | −25 | −69 | 46 |

Verification

Comparison of volume-of-interest (VOI) activation time courses verified that bilateral NAcc activation distinguished between purchase versus nonpurchase trials during the product period as predicted (ps<.001), as well as during subsequent price and choice periods (ps<.001; ps<.05). Bilateral MPFC activation distinguished between purchase versus nonpurchase trials during the price period as predicted (ps<.001), as well as during the second half of the previous product period (p<.01) and the subsequent choice period (ps<.001). Right, but not left, insula activation also distinguished between purchase versus nonpurchase trials during price period as predicted (ps<.01), as well as during the subsequent choice period (ps <.01; Figure 2). Therefore, based on predicted and subsequently verified initial points of significant divergence in activation, we included bilateral average NAcc activation during the product period, bilateral average MPFC during the price period, and right insula activation during the price period in subsequent prediction analyses.

Prediction

We ran logistic regressions to determine whether brain activation could predict purchases, and whether they could do so above and beyond self-report variables. We hypothesized that NAcc activation during the product period as well as MPFC activation and right insula deactivation during the price period would predict subsequent decisions to purchase. Regressions pooled all subjects and choices, but included subject fixed effects to control for individual differences in percentage purchased (although models without fixed effects yielded similarly significant results). The first model regressed the purchase decision on preference and price differential, two self-report measures provided by subjects post-scan. Both self-report variables positively predicted purchasing. The second model regressed the purchase decision on brain activation extracted from the three VOIs at predicted time points prior to the purchase decision (i.e., NAcc activation during the product period, and MPFC and insula activation during the price period). Brain activation from all three regions significantly predicted purchasing. Specifically, bilateral NAcc activation during the product period and bilateral MPFC activation during the price period significantly predicted subsequent decisions to purchase, while right insula activation during the price period significantly predicted subsequent decisions not to purchase (all p’s<.001). A third model combined both self-report and brain activation variables. Brain activation variables still significantly predicted decisions to purchase, although coefficient magnitudes decreased by about half. These findings implied that activation in these three brain regions correlated with the two self-report variables (Supplement 10). Nevertheless, the third model also demonstrated that above and beyond self-reported preference and price differential, NAcc, MPFC, and right insula activation independently and significantly predicted subsequent decisions to purchase a product (i.e., higher R2) and that including both self-report and brain parameters significantly improved the fit of the model to the data (i.e., lower AIC) (Table 4). In a further analysis, brain activation extracted from other regions identified in localization analyses did not significantly add to the ability of the hypothesized brain activation variables to predict purchasing (Supplement 4). Specifically, other regions correlated with preference did not enhance the ability of NAcc activation during the product period to predict purchasing, and other regions correlated with price differential did not enhance the ability of MPFC or right insula activation during the price period to predict purchasing.

Table 4.

Logistic regression models predicting decisions to purchase or not (n=26)

| Self Report | Brain Activation | Combined | |

|---|---|---|---|

| Constant | −16.14 *** | −1.74 | −16.05 *** |

| −6.12 (0.379) | −0.30 (0.170) | −6.12 (0.381) | |

| Preference | 18.95 *** | 18.79 *** | |

| 1.21 (0.064) | 1.20 (0.064) | ||

| Price differential | 12.35 *** | 11.97 *** | |

| 0.14 (0.011) | 0.13 (0.011) | ||

| NAcc (Bilateral) | 5.59 *** | 2.79 ** | |

| 0.85 (0.153) | 0.60 (0.217) | ||

| MPFC (Bilateral) | 7.27 *** | 3.42 *** | |

| 0.78 (0.107) | 0.51 (0.150) | ||

| Insula (Right) | −5.31 *** | −2.53 ** | |

| −0.85 (0.160) | −0.61 (0.239) | ||

|

| |||

| Number of observations | 3,909 | 3,909 | 3,909 |

| Pseudo-R2 | 0.528 | 0.105 | 0.533 |

| AIC | 2279.6 | 4271.8 | 2259.7 |

| Notes: Subjects with significant fixed effects (out of 26; p<.01) | 11 | 16 | 13 |

Regression includes subject fixed effects, Z-scores above coefficients with standard errors in parentheses

Significance: p<.001;

p<.01;

p<.05.

AIC: Akaike Information Criterion (lower score indicates better fit to the data)

Validation analyses established the robust generalizability of brain activation to predict purchasing in other scenarios

Specifically, relative to chance prediction (50%), leave-one-out cross-validation indicated that the brain activation variables accurately predicted purchasing at 60% (±1%; p<10−10).

Discussion

The goal of this study was to characterize neural predictors of purchasing. We hypothesized and found that activation in regions associated with anticipating gain (the NAcc) correlated with product preference, while activation in regions associated with anticipating loss (the insula) correlated with excessive prices. Further, activation in a region implicated in integrating gains and losses (the MFPC) correlated with reduced prices. Analyses of time course data extracted from each of these regions indicated that while NAcc activation initially predicted subsequent purchasing decisions during product presentation, insula and MPFC activation initially predicted subsequent purchasing decisions during price presentation. Even after controlling for retrospective self-reported preference and purchasing price, activation in these brain regions independently predicted decisions to purchase. Validation analyses indicated that the ability of brain activation to predict purchasing would generalize to other purchasing scenarios. The results did not vary significantly as a function of subjects’ sex, and replicated across two different sets of products. Together, these findings suggest that activation of distinct brain regions related to anticipation of gain and loss precedes and can be used to predict purchasing decisions.

While several other brain regions have been implicated in decision-making in both comparative and human research, these regions did not play central roles in the present study, perhaps due to specific aspects of the SHOP task (Supplement 4). For instance, the parietal cortex has been implicated in decision-making (Huettel et al., 2005; Platt and Glimcher, 1999). However, while many decision-making tasks that elicit parietal activation involve a spatial component, the SHOP task minimizes spatial demands by presenting items and prices sequentially in the center of the screen. Thus, parietal activation may play a role in mapping evaluative information to spatial action plans, but was not observed in relation to the variables of interest in this task. Anterior cingulate activation has also been implicated in decision-making (Volz et al., 2005), but may be more related to conflict between potentially competing courses of action (Botvinick et al., 1999). For instance, in a financial decision-making task, while anterior cingulate activation was related to response conflict, it did not predict subsequent risk-seeking versus risk-averse choices (Kuhnen and Knutson, 2005). Similarly, in the SHOP task, anterior cingulate activation was greatest in situations involving high response conflict (e.g., long reaction times to choose, items with high preference but also high price, etc.), but did not significantly add to other brain regions’ ability to predict purchasing decisions. Thus, while anterior cingulate activation may facilitate conflict resolution, activation in this region does not necessarily predict how conflict will be resolved. Amygdalar and orbitofrontal cortex activation have also been implicated in decision-making (Bechara et al., 2000), but did not significantly predict purchasing in this task. While activation of these regions has been most robustly elicited in situations involving learning, the SHOP task is designed to minimize learning demands. Unlike studies that focus on how preferences are established, this study instead focused on how people decide to purchase based on already-established preferences.

The study’s design and additional analyses ruled out a number of alternative accounts of brain activation prior to the purchase decision. First, anticipatory activation could not be attributed to increased motor preparation prior to purchasing, since subjects had to press a button to indicate either the choice to purchase or not to purchase a product, and did not know which button would indicate purchasing versus not purchasing until the choice prompt appeared (thus sequestering motor preparation and execution to the choice period). Further, reaction times did not differ between decisions to purchase or not to purchase. Self-reported familiarity with products (collected in a subset of 20 subjects) also could not account for the correlation between NAcc activation and preference, since additional localization analyses indicated that familiarity was not correlated with NAcc activation during the product and price periods, and prediction analyses including familiarity as an independent variable did not reduce the ability of NAcc activation to predict purchasing, and only slightly increased overall model fit (Supplement 5). Additionally, the few trials involving previously-owned items were omitted from analyses. Similarly, price alone could not account for the correlation between MFPC activation and price differential, since additional localization analyses indicated that price was not significantly correlated with MPFC activation during the price period, and prediction analyses including price did not reduce the ability of MPFC activation to predict purchasing, although inclusion of price did increase overall model fit (Supplement 6). These findings are consistent with the idea that people do not react as much to absolute price as to the price relative to what they think is acceptable for a given product (Thaler, 1985) (making it difficult to determine whether prices are high or low without knowing their associated product). Finally, anticipatory activation could not be attributed to a global increase in neural recruitment (as might be expected in the case of general arousal), since while NAcc and MPFC showed increased activation prior to purchasing, insula instead showed decreased activation prior to purchasing.

To maximize subject engagement and minimize distraction, SHOP task trials progressed at a fairly rapid pace (i.e., 4 sec per trial phase). While prior studies indicate that hemodynamic responses in the volumes of interest (i.e., NAcc, MPFC, insula) typically peak from 4–6 sec after stimulus onset (Knutson et al., 2003), the hemodynamic response can rise as early as 2 sec after stimulus onset, raising potential concerns about the separability of signals during different trial phases. These concerns might specifically affect inferences about localization (e.g., MPFC activation depends on the revelation of price -- but not product -- information), and prediction (e.g., MPFC activation begins to predict purchasing after price -- but not choice -- information is revealed). However, reanalysis indicated that models in which the price differential regressor was lagged forward (by 4 sec into the product period) no longer elicited correlated activation in the MPFC or right insula (Supplement 7). This finding suggests that the correlation of MFPC activation with price differential depended upon the revelation of price information. Additionally, brain activation extracted from the MPFC and right insula during product presentation (i.e., prior to price presentation by 4 sec) did not significantly predict purchasing. Two additional experiments were conducted to verify the dependence of MPFC and right insula results on the appearance of price information (Supplements 8–9). In a first additional experiment (n=8 males), lagging the appearance of price information (by 4 sec) also lagged the correlation of MPFC and right insula activation with price differential. Similarly, lagged MPFC activation also best predicted subsequent purchasing (Supplement 8). In a second additional experiment (n=8 males), lagging the onset of the choice period (by 4 sec) did not alter MPFC or right insula activation’s correlation with price differential, and activation in these regions during the price period continued to predict purchasing (Supplement 9). Together, these findings suggest that whereas NAcc activation reflected subjects’ reaction to products, MPFC and insula activation reflected subjects’ reaction to price information. In all experiments, NAcc activation begins to predict purchasing during the product period, while MPFC and insula activation begin to predict purchasing during the price period.

Activation in the hypothesized regions (i.e., NAcc, MPFC, and insula) conformed to most, but not all, predictions. Activation in all three regions correlated more robustly with subjective variables (i.e., product preference, price differential) than with objective variables (i.e., product identity, price) (Supplement 11). NAcc activation correlated strongly with product preference, discriminating between eventually purchased and not purchased products as soon as the product was displayed, while MPFC activation correlated strongly with price differential, and did not discriminate between eventually purchased and not purchased products until the price was displayed. These findings are consistent with distinct gain prediction accounts of NAcc function and gain prediction error accounts of MPFC function (Knutson et al., 2003). While right insula showed deactivation during the price period, activation in this region did not significantly correlate with price differential, although it did correlate nonsignificantly in the predicted direction (conjoined Z=−1.36), and also discriminated between eventually purchased and unpurchased products. These findings are not inconsistent with a loss prediction account of insula function (Paulus and Stein, 2006), since validation analyses further indicated that insula deactivation predicted purchasing, but may suggest an influence of other factors besides excessive price on insula activation (e.g., responses to nonpreference or a more prolonged response). Thus, the specificity of the insula response to excessive prices remains to be clarified by future research.

The present findings have several implications. With respect to neuroscience, by implicating common circuits (i.e., NAcc, MPFC, and insula) in decisions to purchase diverse products, the findings are consistent with a “common currency” account of purchasing (Knutson et al., 2005; Montague and Berns, 2002; Shizgal, 1997). However, they additionally suggest that decisions to purchase may involve distinct dimensions related to anticipated gain and loss, rather than just a single dimension related to anticipated gain. These findings not only add to prior studies of product preference, but also link to studies of social decisions that implicate NAcc activation in the intention to cooperate (King-Casas et al., 2005; Rilling et al., 2002) and insula activation in the intention to defect (Sanfey et al., 2003). Thus, these findings further illustrate the power of the neuroeconomic approach to elucidate distinct neuropsychological components that may exert consistent collective influences on subsequent purchasing decisions. They also suggest that even commonplace purchasing decisions can be deconstructed with methods adopted from psychology, economics, and neuroscience.

With respect to economic theory, the findings support the historical notion that individuals have immediate affective reactions to potential gain and loss, which serve as inputs into decisions about whether or not to purchase a product (Kuhnen and Knutson, 2005). This finding has implications for understanding behavioral anomalies, such as consumers’ growing tendency to overspend and undersave when purchasing with credit cards rather than cash. Specifically, the abstract nature of credit coupled with deferred payment may “anaesthetize” consumers against the pain of paying (Prelec and Loewenstein, 1998). Neuroeconomic findings thus might eventually suggest methods of restructuring institutional incentives to facilitate increased saving.

Finally, the results illustrate a novel technical application of FMRI, in which brain activation is used to predict purchasing decisions on-line. Whether added information from FMRI data is more cost-effective than simple self-report remains to be established, and may depend upon future methodological and technical advances. FMRI prediction methods may eventually prove most useful in situations when people’s behavior and self-reported preferences diverge.

In summary, this study provides initial evidence that specific patterns of brain activation predict purchasing. Prior to the purchase decision, preference elicits NAcc activation, while excessive prices can elicit insula activation and MPFC deactivation. Anticipatory neural activation in these regions predicts subsequent purchasing decisions. The findings are consistent with the hypothesis that the brain frames preference as a potential benefit and price as a potential cost, and lend credence to the notion that consumer purchasing reflects an anticipatory combination of preference and price considerations. A physiological account of these factors may facilitate neurally-constrained theories of human decision-making (Glimcher and Rustichini, 2004). Such theories may not only help scientists to decompose the components that go into decisions, but also to build neuroeconomic models that better predict choice and inform policy.

Experimental Procedures

Subjects

Twenty-six healthy right-handed adults (12 females; age range 18–26) participated in the study. Along with the typical magnetic resonance exclusions (e.g., metal in the body), subjects were screened for psychotropic drugs and ibuprofen, substance abuse in the past month, and history of psychiatric disorders (DSM IV Axis I), prior to collecting informed consent. Subjects were paid $20.00 per hour for participating and also received $20.00 in cash to spend on products during each of the two sessions. In addition to the 26 subjects who were included in the analysis, six subjects were excluded because they purchased fewer than four items per session (i.e., < 10%) and therefore failed to provide sufficient data to model, and eight subjects were excluded due to excessive head motion (i.e., more than 2 mm from one whole brain acquisition to the next during either of the two scanning sessions).

Task

To ensure subjects’ engagement in the SHOP task, one trial was randomly selected after each scanning session to count “for real.” If subjects had chosen to purchase the product presented during the randomly selected trial, they paid the price that they had seen in the scanner from their $20.00 endowment and were shipped the product within two weeks. If not, subjects kept their $20.00 endowment. Subjects were actually shipped products following 15 (29%) of the total of 52 sessions. Products were pre-selected to have above-median attractiveness as rated by an independent sample drawn from the same population prior to the study (Supplement 1). While products ranged in retail price from $8.00–$80.00, to encourage purchasing, the prices subjects saw in the scanner were discounted by 75% of retail value. Consistent with preliminary studies, this discount led subjects to purchase 30% of the products on average, generating sufficient instances of purchasing to adequately power statistical modeling with standard regressors. Consistent with the findings of pilot experiments, the discount yielded an average price differential that did not significantly differ from $0.00 (i.e., mean PD = −$0.54, SD = ±$8.56), indicating that on average, subjects perceived half of the products to be cheap, and the other half to be expensive (Supplement 1).

Subjects were instructed in the task and tested for task comprehension prior to entering the scanner. After leaving the scanner, subjects rated products on several dimensions (i.e., desirability, percentage of retail price that they would be willing to pay for the product, and whether or not they already owned the product). Post-scan ratings of desirability and willingness to pay were used to create individualized regressors that modeled subjective reactions to product preference and price, as described in the FMRI analysis section. After the ratings, subjects were informed which trial had been randomly selected to count “for real.”

To ensure that results would generalize across different product sets, subjects participated in two SHOP task scanning sessions, each separated by less than two weeks. During each session, subjects were presented with opportunities to buy 40 different products twice, allowing subsequent verification of choice consistency. Order was pseudorandomized within a session and repeated, such that each task session took approximately 9 min, 20 s. Thus, a total of 80 different products were used in the experiment. Half of the subjects encountered one group of 40 products in the first session and the other 40 in the second session, while the other half of the subjects encountered the two sets of 40 products in reverse order.

FMRI acquisition and analysis

Images were acquired with a 1.5-T General Electric MRI scanner using a standard birdcage quadrature head coil. Twenty-four 4-mm-thick slices (in-plane resolution 3.75 X 3.75 mm, no gap) extended axially from the mid-pons to the top of the skull, providing whole brain coverage and adequate spatial resolution of subcortical regions of interest (e.g., midbrain, NAcc, OFC). Whole brain functional scans were acquired with a T2*-sensitive spiral in-/out- pulse sequence (TR=2 s, TE=40 ms, flip=90°) designed to minimize signal dropout at the base of the brain (Glover and Law, 2001) (Supplement 3). High-resolution structural scans were also acquired to facilitate localization and coregistration of functional data, using a T1-weighted spoiled grass sequence (TR=100 ms, TE=7 ms, flip=90°).

Analyses were conducted using Analysis of Functional Neural Images (AFNI) software (Cox, 1996). For preprocessing, voxel time series were sinc interpolated to correct for nonsimultaneous slice acquisition within each volume, concatenated across runs, corrected for motion, high-pass filtered (admitting frequencies with period < 90 s), and normalized to percent signal change with respect to the voxel mean for the entire task. Visual inspection of motion correction estimates confirmed that no subject’s head moved more than 2.0 mm in any dimension from one volume acquisition to the next. All regression models included six regressors indexing residual motion and six regressors modeling baseline, linear, and quadratic trends for each of the two runs.

Next, localization, verification, prediction, and validation analyses were conducted. For localization analyses, regressors of interest included individualized and orthogonalized models of: (1) product preference during the product and price display periods, (2) price differential (or the difference between the displayed price and price subjects were willing to pay for a product) during the price display period, (3) decision to purchase the product or not during the choice period. Because product and price presentation overlapped in time, product preference and price differential were modeled simultaneously during price presentation to ensure that each of these regressors would account for unique variance in brain activation prior to the purchase decision. An additional regressor of noninterest included reaction time during the choice period.

Preference was derived from a post-scan rating of desire to own each product (on a 1–7 Likert scale later converted to a −3 to +3 scale), and modeled during the product and price periods. Price differential was calculated as the price that subjects reported they would be willing to pay for a product post-scan (rated as a percentage of retail price) minus price displayed for that product during the scan, and modeled during the price period. Thus, positive price differential indicated that subjects perceived a product as cheap (relative to their willingness to pay for it), while negative price differential indicated that subjects perceived a product as expensive (i.e., similar to “net utility” or “consumer surplus” in economics) (Prelec and Loewenstein, 1998). Together, preference and price differential modeled each subject’s individual subjective reaction to each product and its associated price. The purchasing decision was represented by a simple contrast between purchased versus unpurchased products, and modeled during the choice period. Trials involving products that were already owned were excluded from analyses. Regressors of interest modeling preference, price differential, and purchasing were convolved by multiplying the original “box car” function regressors with a gamma-variate function approximating a hemodynamic response prior to inclusion in regression models (Cohen, 1997).

Maps of contrast coefficients for regressors of interest were transformed into Z-scores, coregistered with structural maps, spatially normalized by manually warping to Talairach space, slightly spatially smoothed to minimize effects of anatomical variability (FWHM=4 mm), and collectively submitted to a one-sample t-test against the null hypothesis of no activation to test for a group difference while controlling for random effects. Separate group maps were constructed for each of the two product sets. Each of these maps were thresholded at p<.001 (uncorrected) and conjoined using an “AND” operation (Knutson et al., 2001a). Conjointly activated regions passing this threshold thus identified replicable activations over both product sets at p<.001 (Nichols et al., 2006). Brain regions of interest were then examined for evidence of conjointly significant activation across both product sets.

For verification analyses, bilateral spherical volumes of interest (VOIs; 8 mm diameter) were constructed at centers of mass within the predicted regions (e.g., NAcc, MPFC, insula), ensuring that equal amounts of data were extracted for each subject in each region. VOIs were superimposed on each subject’s brain and individually adjusted to ensure that they only included gray matter in the predicted regions for each subject (Supplement 3). Spatially averaged activation time courses were extracted from each VOI and then divided by the average activation for each VOI over the course of the entire experiment to derive measures of percent signal change. Percent signal change time courses were then averaged for purchase versus nonpurchase trials within subjects. Paired t-tests then compared percent signal change for purchase versus nonpurchase trials across subjects. Percent signal change was compared at predicted time points (i.e., the onset of product presentation, price presentation, and choice presentation), lagged by four seconds (to account for the lag in hemodynamic response), with a significance threshold that corrected for comparisons at each trial period (i.e., p<.017). These VOI percent signal change data were also used in subsequent prediction analyses.

Prediction analyses also utilized time-courses of percent signal change for each VOI to predict purchasing. Specifically, prediction analyses utilized logistic regression to determine whether NAcc activation during the product period as well as MPFC activation and insula deactivation during the price period (all lagged by 4 sec) would predict the subsequent decisions to purchase a product during the choice period, both before and after controlling for self-report variables (i.e., preference and price differential). Logistic regression models also included fixed effects and motion correction estimates (Kuhnen and Knutson, 2005) (however, analyses remained significant and qualitatively similar when fixed effects were not included in the models). The Akaike Information Criterion was used to compare model fit (Akaike, 1974). Additional analyses used identical models, but included data extracted from additional VOIs (e.g., other cortical regions).

For validation analyses, brain activation data used in logistic regressions for the first presentation of each product were submitted to leave-one-out cross validation analysis to establish generalizability of brain activation as predictors of purchasing to other datasets (Kamitani and Tong, 2005). While brain activation data was collected before choice, self-report variables were not, so were not included in these analyses. Since fewer items were purchased than not purchased (see Results), data for nonpurchase trials were randomly removed until the ratio of purchase to nonpurchase trials (and therefore, the base rate prediction) was 50% for each subject (n=1150 observations total). This adjustment of the prior probability for classification was verified with 10-fold cross-validation.

Supplementary Material

Figure 1.

SHOP task trial structure and regressors.

For task structure, subjects saw a labeled product (product period; 4 s), saw the product’s price (price period; 4 s), and then chose either to purchase the product or not (by selecting either “yes” or “no” presented randomly on the right or left side of the screen; choice period; 4 s), before fixating on a crosshair (2 s) prior to the onset of the next trial. In regression models, preference was correlated with brain activation during the product and price periods, price differential was correlated with brain activation during the price period, and purchasing was correlated with brain activation during the choice period.

Acknowledgments

We thank Cliff Baum and George Wang for assistance in recruitment of subjects and data analysis; Logan Grosenick for assistance with data analysis; as well as Jeffrey C. Cooper, Samuel McClure, Hilke Plassmann, and three anonymous reviewers for advice on earlier versions of the manuscript. This research was supported in part by a National Institute of Aging seed grant AG024957-02 to BK, a National Science Foundation Graduate Research Fellowship to SR, the John Simon Guggenheim Memorial Fellowship to DP, and a MacArthur Foundation network grant to GL.

Footnotes

Publisher's Disclaimer: This is a PDF file of an unedited manuscript that has been accepted for publication. As a service to our customers we are providing this early version of the manuscript. The manuscript will undergo copyediting, typesetting, and review of the resulting proof before it is published in its final citable form. Please note that during the production process errorsmaybe discovered which could affect the content, and all legal disclaimers that apply to the journal pertain.

References

- Akaike H. A new look at the statistical model identification. IEEE Transactions on Automatic Control. 1974;19:716–723. [Google Scholar]

- Bechara A, Damasio H, Damasio AR. Emotion, decision making and the orbitofrontal cortex. Cerebral Cortex. 2000;10:295–307. doi: 10.1093/cercor/10.3.295. [DOI] [PubMed] [Google Scholar]

- Bechara A, Tranel D, Damasio H, Damasio AR. Failure to respond autonomically to anticipated future outcomes following damage to prefrontal cortex. Cerebral Cortex. 1996;6:215–225. doi: 10.1093/cercor/6.2.215. [DOI] [PubMed] [Google Scholar]

- Botvinick M, Nystrom LE, Fissell K, Carter CS, Cohen JD. Conflict monitoring versus selection-for-action in anterior cingulate cortex. Nature. 1999;402:179–181. doi: 10.1038/46035. [DOI] [PubMed] [Google Scholar]

- Buchel C, Dolan RJ. Classical fear conditioning in functional neuroimaging. Current Opinion in Neurobiology. 2000;10:219–223. doi: 10.1016/s0959-4388(00)00078-7. [DOI] [PubMed] [Google Scholar]

- Cohen MS. Parametric analysis of fMRI data using linear systems methods. NeuroImage. 1997;6:93–103. doi: 10.1006/nimg.1997.0278. [DOI] [PubMed] [Google Scholar]

- Cox RW. AFNI: Software for analysis and visualization of functional magnetic resonance images. Computers in Biomedical Research. 1996;29:162–173. doi: 10.1006/cbmr.1996.0014. [DOI] [PubMed] [Google Scholar]

- de Quervain DJ, Fischbacher U, Treyer V, Schellhammer M, Schnyder U, Buck A, Fehr E. The neural basis of altruistic punishment. Science. 2004;305:1254–1258. doi: 10.1126/science.1100735. [DOI] [PubMed] [Google Scholar]

- Deaton A, Muellbauer J. Economics and consumer behavior. Cambridge: Cambridge University Press; 1980. [Google Scholar]

- Deppe M, Schwindt W, Kugel H, Plassman H, Kenning P. Nonlinear responses within the medial prefrontal cortex reveal when specific implicit information influences economic decision making. Journal of Neuroimaging. 2005;15:171–182. doi: 10.1177/1051228405275074. [DOI] [PubMed] [Google Scholar]

- Erk S, Spitzer M, Wunderlich AP, Galley L, Walter H. Cultural objects modulate reward circuitry. NeuroReport. 2002;13:2499–2503. doi: 10.1097/00001756-200212200-00024. [DOI] [PubMed] [Google Scholar]

- Glimcher PW, Rustichini A. Neuroeconomics: The consilience of brain and decision. Science. 2004;306:447–452. doi: 10.1126/science.1102566. [DOI] [PubMed] [Google Scholar]

- Glover GH, Law CS. Spiral-in/out BOLD fMRI for increased SNR and reduced susceptibility artifacts. Magnetic Resonance in Medicine. 2001;46:515–522. doi: 10.1002/mrm.1222. [DOI] [PubMed] [Google Scholar]

- Huettel SA, Song AW, McCarthy G. Decisions under uncertainty: probabilistic context influences activation of prefrontal and parietal cortices. Journal of Neuroscience. 2005;25:3304–3311. doi: 10.1523/JNEUROSCI.5070-04.2005. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kamitani Y, Tong F. Decoding the visual and subjective contents of the human brain. Nature Neuroscience. 2005;8:679–685. doi: 10.1038/nn1444. [DOI] [PMC free article] [PubMed] [Google Scholar]

- King-Casas B, Tomlin D, Anen C, Camerer CF, Quartz SR, Montague PR. Getting to know you: reptutation and trust in a two-person economic exchange. Science. 2005;308:78–83. doi: 10.1126/science.1108062. [DOI] [PubMed] [Google Scholar]

- Knutson B, Adams CM, Fong GW, Hommer D. Anticipation of increasing monetary reward selectively recruits nucleus accumbens. Journal of Neuroscience. 2001a;21:RC159. doi: 10.1523/JNEUROSCI.21-16-j0002.2001. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Knutson B, Fong GW, Adams CM, Varner JL, Hommer D. Dissociation of reward anticipation and outcome with event-related FMRI. NeuroReport. 2001b;12:3683–3687. doi: 10.1097/00001756-200112040-00016. [DOI] [PubMed] [Google Scholar]

- Knutson B, Fong GW, Bennett SM, Adams CM, Hommer D. A region of mesial prefrontal cortex tracks monetarily rewarding outcomes: Characterization with rapid event-related FMRI. NeuroImage. 2003;18:263–272. doi: 10.1016/s1053-8119(02)00057-5. [DOI] [PubMed] [Google Scholar]

- Knutson B, Taylor J, Kaufman M, Peterson R, Glover G. Distributed neural representation of expected value. Journal of Neuroscience. 2005;25:4806–4812. doi: 10.1523/JNEUROSCI.0642-05.2005. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kuhnen CM, Knutson B. The neural basis of financial risk-taking. Neuron. 2005;47:763–770. doi: 10.1016/j.neuron.2005.08.008. [DOI] [PubMed] [Google Scholar]

- McClure SM, Li J, Tomlin D, Cypert KS, Montague LM, Montague PR. Neural correlates of behavioral preference for culturally familiar drinks. Neuron. 2004;44:379–387. doi: 10.1016/j.neuron.2004.09.019. [DOI] [PubMed] [Google Scholar]

- Montague PR, Berns GS. Neural economics and the biological substrates of valuation. Neuron. 2002;36:265–284. doi: 10.1016/s0896-6273(02)00974-1. [DOI] [PubMed] [Google Scholar]

- Nichols T, Brett M, Andersson J, Wager T, Poline JB. Valid conjunction inference with the minimum statistic. NeuroImage. 2006;25:653–660. doi: 10.1016/j.neuroimage.2004.12.005. [DOI] [PubMed] [Google Scholar]

- Paulus MP, Frank LR. Ventromedial prefrontal cortex activation is critical for preference judgments. NeuroReport. 2003;14:1311–1315. doi: 10.1097/01.wnr.0000078543.07662.02. [DOI] [PubMed] [Google Scholar]

- Paulus MP, Rogalsky C, Simmons A. Increased activation in the right insula during risk-taking decision making is related to harm avoidance and neuroticism. NeuroImage. 2003;19:1439–1448. doi: 10.1016/s1053-8119(03)00251-9. [DOI] [PubMed] [Google Scholar]

- Paulus MP, Stein MB. An insular view of anxiety. biological Psychiatry. 2006;60:383–387. doi: 10.1016/j.biopsych.2006.03.042. [DOI] [PubMed] [Google Scholar]

- Platt ML, Glimcher PW. Neural correlates of decision variables in the parietal cortex. Nature. 1999;400:233–238. doi: 10.1038/22268. [DOI] [PubMed] [Google Scholar]

- Prelec D, Loewenstein GF. The red and the black: Mental accounting of savings and debt. Marketing Science. 1998;17:4–28. [Google Scholar]

- Prelec D, Simester D. Don't leave home without it. Marketing Letters. 2001;12:5–12. [Google Scholar]

- Rilling J, Gutman D, Zeh T, Pagnoni G, Berns G, Kilts C. A neural basis for social cooperation. Neuron. 2002;35:395–405. doi: 10.1016/s0896-6273(02)00755-9. [DOI] [PubMed] [Google Scholar]

- Sanfey AG, Rilling JK, Aronson JA, Nystrom LE, Cohen JD. The neural basis of economic decision-making in the Ultimatum Game. Science. 2003;300:1755–1758. doi: 10.1126/science.1082976. [DOI] [PubMed] [Google Scholar]

- Shizgal P. Neural basis of utility estimation. Current Opinion in Neurobiology. 1997;7:198–208. doi: 10.1016/s0959-4388(97)80008-6. [DOI] [PubMed] [Google Scholar]

- Slovic P, Finucane M, Peters E, MacGregor D. The affect heuristic. In: Gilovich T, Griffin D, Kahneman D, editors. Heuristics and biases: The psychology of intuitive judgment. New York: Cambridge University Press; 2002. pp. 397–420. [Google Scholar]

- Thaler R. Mental accounting and consumer choice. Marketing Science. 1985;4:199–214. [Google Scholar]

- Volz KG, Schubotz RI, von Cramon DY. Variants of uncertainty in decision-making and their neural correlates. Brain Research Bulletin. 2005;67:403–412. doi: 10.1016/j.brainresbull.2005.06.011. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.