Abstract

Objective financial stress, which incorporates all medical and non-medical financial stressors by households, shapes patients’ subjective perceptions of financial strain. This study addresses whether patient age and disability days reveal patients to have different perceptions of financial strain even when their households incur the same level of financial stress. Among patients with the same level of household financial stress, older patients perceived less financial strain from difficulty paying bills than younger patients. However, among patients reporting above-average disability days, older patients also perceived more financial strain than younger patients about the adequacy of their health insurance and finances in the future. Thus, financial strain measures that focus on projected health needs should supplement those that describe current household circumstances to improve screenings of older patients who are under-prescribed, or unable to adhere to, a regimen for all necessary health care.

In several western nations, regardless of public or private health system financing, the dramatic shift of cancer care from inpatient hospital settings to the home has reduced financial costs within the health care system while increasing the psychosocial, caregiving, and financial costs to patients and their families [1]. Older adults and their families are disproportionately affected, and this trend is likely to escalate. In the USA, adults over age 65 are ten times more likely to develop cancer than younger persons [2], and the aging of the baby boom generation is expected to result in swelling numbers of patients and family members who must cope with financial and home care burdens. Even so, the problems of younger patients and families contending with multiple roles should not be neglected, for while the proportion of all cancer patients comprised by this age group is smaller, and will continue to decline, the numbers of younger cancer survivors continues to grow.

There is a critical need for research about how subgroups of patients and families cope with costs of care at home [3]. This includes research on financial burden, which comprises a major area within the panoply of opportunity costs borne by patients and families. In countries with private health systems, out-of-pocket prescription costs constitute one of the most visible and publicized sources of financial stress shared by older adults regardless of physical health status. However, in private and public health systems, non-pharmaceutical costs are increasingly borne out-of-pocket as patients and families cope with advancing illness conditions [1]. These costs may result from lack of insurance coverage or diminishing local access to private or community services, such as home health care and housekeeping assistance, as well as repercussions such as lost income by patients and family caregivers and increased transportation costs for more frequent out-patient visits. We must not lose sight of the wide range of financial costs, including hard-to-quantify and hidden costs, to patients and families of all ages who are coping with serious and protracted conditions [1,4].

The current study addresses an important gap in our understanding by investigating the relationship between two interrelated aspects of financial burden in adults receiving palliative radiation to relieve pain from recurrent cancer. Specifically, the focus is on the extent to which various groups of patients with similar financial resources and illness-related financial costs (that is, with similar levels of overall objective financial stress) differ in their subjective perceptions of financial strain. These groups will be distinguished based on patient age and disability.

This general hypothesis is qualified further for indicators of financial strain that reflect perceptions of current, rather than future, financial conditions. The basis for such a qualification is provided by various sociological and social psychological perspectives (social stratification, relative deprivation perceptions, adaptation-level processes, and life event stressor/chronic strain relationships) that support an age-related process of psychological accommodation to current circumstances. That is, despite the same level of financial stress, as patients grow older they would be expected to perceive lower financial strain about their current financial conditions. Older patients, or others on their behalf, may also limit the level of financial stress incurred, maintaining these more accommodating perceptions of lower financial strain.

This process would mean older patients are at greater risk of foregoing needed medical care and would provide one basis for understanding that pain in older patients, including those with cancer, is under-reported and under-treated. Recent findings suggest that older patients with cancer experience more severe pain, are more willing to tolerate pain, and perceive less control over pain [5]. Based on this framework, perceptions and fears of resource depletion and poverty could be critical yet neglected attitudinal barriers to effective cancer pain management in older patients, especially perhaps in private health systems, but also in public health systems forced to make difficult rationing decisions that result in new opportunity costs for patients and families [1].

Consistent empirical support for this process of psychological accommodation is suggested by studies of the American general population [6–8]. These studies suggest that older adults tend to adapt more readily, or accommodate, in their perceptual responses of financial strain (either subjective economic well-being or income satisfaction) compared to younger adults with similar levels of objective financial stress, typically family income.

However, notwithstanding the lack of international comparisons, age-related accommodation to overall financial stress has not been tested with other measures of financial strain nor in targeted populations of patients coping with chronic illness. Thus, compared to younger patients, it is unknown whether older patients accommodate in their global perceptions of economic well-being or across other measures of financial strain. Moreover, it is important to determine whether older patients respond in an opposite way to particular measures of financial strain by endorsing them to a greater degree than similar younger patients. Such measures of financial strain would reveal ways in which older patients accommodate less readily than younger patients to their overall financial stress, affording insights into differential response patterns.

There is a practical rationale for such research. In addition to enhancing phenomenological and clinical insights, differential response patterns across financial strain measures would suggest more sensitive items of financial strain that should be incorporated into high-risk screening instruments. This will require a body of evidence derived from studies that focus on specific disease stages and trajectories. A major goal of the current study is to begin this search for differential response patterns with advancing age, across three items of financial strain that were reported by patients initiating palliative radiation for recurrent cancer.

Stress and Strain Components of Financial Burden

The distinction between financial stressors and strains as separate components of financial burden is critical if we are to distinguish objective events that pose financial stress from subjective, reactionary perceptions of financial distress experienced by the patient or family. This distinction is important because financial stresses and strains differ in their impacts on illness behaviors and outcomes. Although objective levels of family financial stress due to the illness episode may impinge directly on access to care as well as upon the quality, intensity, and continuity of treatment [9], subjective perceptions of financial strain by patients and family caregivers may be more proximal causes of emotional strain and of the extent that patients and family will continue to seek out and comply with needed medical care and supportive services [10]. Perceptions of current, impending, and potential financial strain may result in delayed or missed medical appointments or neglect in meeting important needs (refilling important prescriptions, for instance) [11] which might have impacts on emotional strain, pain and symptomatology, prognosis, and mortality [12]. Subjective financial worries, for instance, may constitute a barrier to care beyond the barrier posed by the objective financial costs of that care [13].

Like well employees, working cancer patients and caregivers may worry and feel inconvenienced by potential losses in wages due to time away from work in order to attend outpatient appointments with long waiting periods. Longitudinal evidence suggests that cancer outpatients reporting financial strain are more likely to have new unmet needs regarding instrumental tasks and transportation [14]. Other evidence suggests that the more frequent unmet needs of younger adult cancer patients may be attributed to their loss of wage income [15], although this does not distinguish between initial and recurrent episodes.

Negative consequences from unmet needs may be especially serious for those living on fixed incomes, such as patients who are outside the workforce, working to make ends meet, or retired. In the USA, lower-income patients and family members who must work to make ends meet typically do not receive paid illness leave, flexible work hours, comprehensive health insurance, or reasonable income from unemployment compensation and savings. On the other hand, in nations experiencing high levels of unemployment, employed workers may fear that missing work would threaten their job security.

Elderly cancer outpatients who do not drive or do not live with someone who drives are four times less likely than other elderly patients to receive outpatient radiation when this is an appropriate treatment option [16], a problem that would appear to occur across developed nations with different systems of health care funding. Indirect evidence suggests lower-income disabled elderly may consume fewer health services, compared to other disabled elderly, because they are unable to afford additional out-of-pocket costs [17]. These results imply that at some threshold of family financial burden, patients, families, and physicians may act to limit additional financial stresses and strains due to out-of-pocket expenditures by forgoing optimal medical care alternatives and neglecting many needs in order to continue financing the most basic needs (e.g., food, utilities, housing).

Age-Related Accommodation to Financial Stress

In a classic national American survey, Campbell, Converse, and Rogers graphed the relationships between adult age and satisfaction with a variety of life domains, revealing relatively impressive age-related increases in satisfaction for nine of fourteen objective conditions of everyday living, including economic well-being [6]. Typically, much of the increase in satisfaction over the adult lifespan appeared to be linear; however, Campbell and colleagues note that curvilinear increases in satisfaction tend to occur with increasing age, especially beginning in middle age. Within each of the nine objective conditions, significant upward shifts in slope tended to occur at age fifty or older and persisted through the elderly ages. Positive yet less dramatic responses for four of the five remaining life domains were also detected. Only health satisfaction fell dramatically over the adult years–a unique finding we will revisit in the next section.

As Campbell and colleagues explain, although the linear component of the increase may reflect a “progressive sorting into better fitting situations” over the life course (at least until retirement), the curvilinear component of the increase may reflect “psychological mechanisms … such that beyond a certain initial point of familiarity, satisfaction with a situation increases as one becomes increasingly accommodated to it” (original emphasis, p. 163).

Hypotheses

The current study involves a targeted sample of adult recurrent cancer outpatients initiating palliative radiation, a setting in which age and disabilities become important factors. In this sample, the following hypothesis of psychological accommodation will be tested:

As age advances, adult recurrent cancer outpatients initiating palliative radiation accommodate to a greater extent to any given level of objective financial stress (our overall measure of objective economic conditions) by reporting less subjective financial strain from “difficulty paying bills” (and not just bills related to health care). This growth in the tendency to accommodate by age may depend, entirely or in part, upon the actual level of objective financial stress. It may also depend upon disability days, which is associated with age.

Let us return to Campbell and colleagues’ specific findings that advancing age is associated with increasing satisfaction with economic well-being and decreasing satisfaction with health. These findings suggest an interesting qualification to the accommodation hypothesis to be tested in the current study since two of the three measures of subjective financial strain in the dataset tap into perceptions that involve both domains (i.e., economic well-being and health). One measure is “worry about health care expenses,” which may pertain to current and/or future expenses. The other measure, with an exclusive focus on the future, is “inadequacy of financial resources/insurance to meet future health needs.” Specifically, we qualify our hypothesis to allow these two measures to demonstrate either accommodation or its opposite (i.e., inflated or exacerbated responses) as age advances.

This qualification affords an important practical justification for the current study. If advancing age is associated with heightened perceptions that financial resources and health insurance will be inadequate to meet future health needs, or is associated with worry about health care expenses, yet reflects accommodation to the global measure of current “difficulty paying bills,” this would provide further evidence that as patients age, they may be at greater risk of forgoing medical and other needs in order to meet the most basic necessities. Furthermore, the age-related variable of disability days may be important in this process. Thus, compared to global financial strain measures of current conditions, financial strain measures that tap future perceptions of financial burden associated with health needs may be more promising to detect older adults at risk for financial burden and reduced access to care.

Material and methods

Sample

The current study is a secondary analysis of a sample collected in 1992–1993. The recurrent cancer patients, while differing according to cancer diagnosis, had recently begun a course of outpatient palliative radiation to relieve metastatic bone pain. Eligible patients referred by hospital staff were living at home and receiving care at five hospitals within an urban center of the northeastern USA. Eligible patients were: 1) at least thirty years old; 2) no longer receiving curative treatment; 3) not terminally ill; and 4) likely to live at least one year. 46.6 percent of all eligible patients agreed to participate, resulting in a non-random sample of 268. A trained interviewer met each patient at home. In addition, medical information was obtained from the patient’s health care team and medical records.

The moderate participation rate limits external validity, a common constraint in studies involving seriously ill cancer patients. And yet, other data do not appear to exist that target cancer patients in a specific illness stage, such as the initial phase of palliative radiation, while capturing the range and depth of measures for financial variables, as well as other important variables, in the current study. Despite the weakness of a moderate participation rate, there are several important reasons why this dataset is adequate for a conservative test of the study hypotheses.

Internal validity and generalizability are enhanced due to the use of a consistent social scientific theoretical framework, the integration of prior empirical findings, the highly targeted sample (i.e., involving only patients recently initiating palliative radiation), and the further targeting of analyses to specific age-related contexts (in contrast to a crude “main effects” specification that excludes interactions). Moreover, the scope for generalizability among older adults is enhanced because the population of recurrent cancer patients initiating palliative care consists of a greater share of older adults than our sample, which has nearly equivalent numbers of patients above and below age 65.

Within the sample, the continuous age variable affords very desirable properties related to statistical power and internal validity. The normal distribution for this variable and the virtually identical numbers of patients above and below age 65 generates an even distribution of statistical power across the adult age range, preventing the findings from being over-determined by certain age groups.

Collectively, convergence of several background characteristics also attests that tests of hypotheses will be conservative and that internal validity should not be compromised.

First, all eligible patients were invited to participate in the survey; patients who gave reasons for not participating cited poor health (30.9%) and time limitations (28.7%). Participants did not differ significantly by gender from non-participants.

A second assurance is based on the following rationale. Those citing poor health as a reason for non-participation are suspected to include patients with higher levels of cognitive or physical disability and a greater portion of older adults with comorbid medical conditions. Older adult non-participants may encounter more time limitations from the additional treatment demands and mobility restrictions of comorbid conditions, whereas younger patients non-participants may encounter more time limitations from employment and child/elder care responsibilities. Even if only one of these expectations is true, the impact of the disability co-moderator is likely to be weaker in the sample than in the population of recurrent cancer patients initiating palliative care. Thus, as age advances, any detected exacerbation effect in the sample involving perceptions about the inadequacy of insurance and financial resources to meet future health needs could be even greater in the population of recurrent cancer patients at the start of palliative radiation.

Measures

Patients were requested to report all but two of the objective and subjective financial variables to reflect the period of the previous four months. Given differences in disease progression between patients, a later period of data would have confounded hypothesis testing by shifting some patients into the terminal illness phase, a crisis phase which may entail a different phenomenology of financial stressors and strains. In the transactional model of stress, a distinction is made between financial stressors (single and repetitive events as well as chronic conditions that result in inner tension) and strains (subsequent reactions to and appraisals of that inner tension) [18].

In this section, the objective family financial stress index, a related missing data variable, and the three items reflecting subjective patient perceptions of financial strain are described. While the scaling of the continuous “age” variable in years is self-evident, a necessary transformation of the other moderator variable, “disability days,” is also described.

Objective Family Financial Stress Index

All of the objective financial variables within the survey are measures of stress. Each variable is included within an additive index of Objective Family Financial Stress (OFFS). More accurately, the variables comprise six categories or subcomposites (each expressed as a standardized z-score), which are then summed to derive the overall OFFS index [19]. These subcomposites are:

Out-of-Pocket Medical Expenses adjusted for Family Size and Income;

Objective Family Financial Stress due to Medical Bills Management;

Extent of Wage Loss due to the Patient’s Illness(es);

Diversity of Financial Resources Tapped due to the Patient’s Illness(es);

Employment Status Changes by the Patient and Spouse Caregiver; and

Overall Finances Trend

The overall OFFS index reflects cumulative stress effects from the “stress load” across repetitive and different types of stressors [20], in which severe stress may accrue from the accumulation of residual stress, even when the patient is coping successfully with individual stressors (e.g., build-up of stress from coping with multiple hassles).

In about one-quarter of the observations, an important confluence of missing data in the income variable affects the first subcomposite of the OFFS index. A missing data dummy variable for the first subcomposite is included as a control variable within the MIMIC and regression models. Each model is estimated twice using 1) all 267 respondents and mean-substituted values for missing data; and 2) only the 200 respondents without missing data. The missing data dummy variable does not become statistically significant in any of the analyses nor do multivariate interpretations change.

Subjective Patient Perceptions of Financial Strain

Strain reflects the transactional and cyclical process of stress reaction and appraisal, which may occur repeatedly after the onset of a stressor and across stressors. Stress reaction and appraisal may lead to coping responses that shift and modulate the “stress load” by reducing and even replacing some stressors with other, less “stressful” stressors while nonetheless contributing to residual stress.

The shared variation across three measures was used to derive a psychometric latent construct of Subjective Patient Financial Strain. These three measures, based on the recurrent cancer experience, are: 1) Difficulty Paying Monthly Bills (5-categories: ‘Never’ to ‘All of the time’); 2) Inadequacy of Health Insurance and Financial Resources to Meet Future Health Needs (3-categories: ‘Inadequate’ to ‘More than adequate’, reverse-coded); and 3) Worry about Health Care Expenses (3-categories: ‘Don’t worry at all’ to ‘Worry a great deal’).

Voydanoff and Donnelly [20] consider economic or financial strain to include measures of “the perceived adequacy of financial resources, financial concerns and worries, and expectations regarding one’s future economic situation” (p. 98). All three measures of financial strain meet this definition. Krause, Jay, and Liang [21] consider the degree of “Difficulty Paying Monthly Bills” to be a measure of strain; it is an appraisal of the perceived impact of cumulative financial stressors (i.e., affording, interpreting, managing, and paying bills on time, as well as the efficacy of instrumental coping efforts such as reducing consumption). Williamson and Schulz [22] consider “Adequacy of Health Insurance and Financial Resources to Meet Future Health Needs,” to be a measure of strain since it reflects appraisals or evaluations of current and cumulative financial stressor event(s). Finally, “Worry about Health Care Expenses” is a measure of strain because it reveals an affective reaction to cumulative financial stress.

Disability Days

Patients were asked: “During the past 4 months, about how many days were you so sick that you could not perform your usual daily duties, such as going to your job, or working around the house?”

As respondents continue to recount disability days, systematic error may grow. Further, the meaning of what constitutes a disability day is likely to shift as disability itself is accommodated. It follows that subjective perceptions of financial strain should not be over-predicted beyond what may truly be attributed to the linear, curvilinear, and buffering impacts of age and disability days.

Therefore, using the distribution mean as the cutoff, a disability dummy variable was constructed. This dummy variable was used to plot findings at ‘no’ disability days (i.e., at mean – 1 s.d. = 0 of 120 days) and ‘above-average’ disability days (mean + 1 s.d. = 51 of 120 days). Of 264 patients responding, 44 reported no disability days and 40 reported at least 45 disability days.

The Multiple Indicators-Multiple Causes (MIMIC) Model

Specification Issues

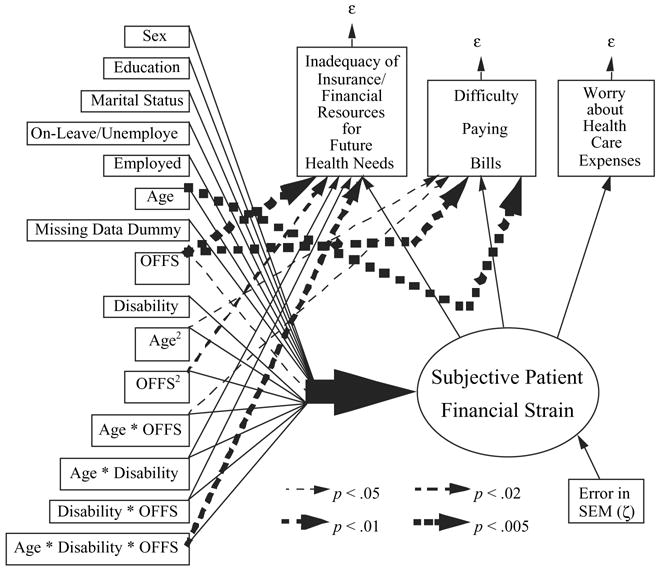

In the current study, a multiple indicators-multiple causes (MIMIC) structural equations model is estimated using LISCOMP software (see Figure 1). The three observed “multiple indicators” of an overall, latent construct of Subjective Patient Financial Strain are: 1) Difficulty Paying Bills; 2) Inadequacy of Insurance/Financial Resources to Meet Future Health Needs; and 3) Worry about Health Care Expenses. The “multiple causes” are the predictors of these individual “multiple indicators” and of the latent construct of Subjective Patient Financial Strain.

Figure 1.

MIMIC Regression of Subjective Patient Financial Strain: Age and Disability as Co-Moderators.

The Multiple Causes

Relationships are specified between the OFFS index and each of these three “multiple indicators,” as well as with the overall latent construct of Subjective Patient Financial Strain. Each relationship is further qualified through the addition of primary predictors for age, disability days, curvilinear terms for age and OFFS, and interactions involving age, disability days, and OFFS.

The curvilinear and buffering processes involving the continuous variable for age may operate in different ways within the specific contexts of disability days. This flexible MIMIC model allows us to determine whether certain indicators of financial strain reveal less accommodating responses, or even inflated or exacerbated responses, by patients with above-average disability days, compared to other patients of the same age.

Secondary predictors without curvilinear or interaction components are also specified to partial out their effects on Subjective Patient Financial Strain. These secondary predictors also serve as control variables that are related to age, the disability dummy, and the level of OFFS incurred. For both reasons, specifying these variables results in more conservative estimates for the curvilinear terms and interactions, reducing the potential for overestimation of these effects. The secondary predictors are sex, education, marital status, work leave/unemployed, and a missing data variable to capture observations without reported family income, which was used in estimating the first subcomposite of OFFS.

The Multiple Indicators

The simultaneous measurement model loadings reflect the shared variation across all three strain indicators, which is the basis for imputing the overall latent construct for Subjective Patient Financial Strain. These loadings were all moderate to high (Table I, footnote b), revealing good fit.

Table I.

Ordinal Probit MIMIC Model Moderated by Age and Disability.a

| Indirect Effects on Latent Construct: | Direct Effects to Latent Y Indictors:b | |||

|---|---|---|---|---|

| Subjective Patient Financial Strain | Insurance/Finances for Future Health Needs | Difficulty Paying Bills | Worry about Healthcare Expenses | |

| X Variables | b (S.E.) | b (S.E.) | b (S.E.) | b (S.E.) |

| Sex | −.020 (.149) | |||

| Education | .0035 (.047) | |||

| Marital | .289 (.322) | −.190 (.332) | .115 (.313) | |

| On-leave/Unemployed | .380 (.238) | −.653 (.277) | ||

| Employed | .071 (.192) | −.495 (.269) | ||

| Age | −.001 (.009) | .020 (.011) | −.045 ***** c (.012) | |

| Missing 1st Subcomposite | −.049 (.146) | |||

| OFFS | .304 ** (.134) | .141 ***** c,d (.148) | .186 ***** c (.137) | |

| Disability Days | .022 (.139) | |||

| Age2 | −.0047 (.00042) | −.00054 ** c (.00061) | ||

| OFFS2 | −.037 (.061) | −.124 **** (.071) | .041 *** c,d (.088) | |

| Age*OFFS | .002 (.007) | .016 * c (.009) | −.013 (.007) | |

| Age*Disability Days | b = 0 in final model | .022 (.019) | ||

| Disability Days*OFFS | b = 0 in final model | −.274 (.170) | ||

| Age*Disability Days* OFFS | b = 0 in final modele | −.035 **** (.012) | ||

NOTE: MIMIC = Multiple Indicators-Multiple Causes Regression; OFFS = Objective Family Financial Stress Index

n = 267. Fit of the data to the MIMIC model is good based on various indices: Chi-Square (23 df) = 16.074 at p = .8521; Descriptive Fit Value = .0030 < 1.5; and Goodness of Fit = .9958. Although the Root Mean Square Residual = .129, which exceeds the value of .08 recommended by Hu and Bentler [23] for adequate model fit, the MIMIC model moderated only by age (and not disability) has a Root Mean Square Residual = .079. Thus, the deterioration in residuals fit can be attributed to a) the information loss when software memory limitations necessitated the collapse at the mean of the continuous disability days variable into a dummy variable; and b) the specification loss of the curvilinear term.

The respective lambda loadings, representing acceptable fit of the latent y-indicators to the unidimensional latent construct, are 1.000, .6011, and .8915.

The total effect (i.e., direct plus indirect effects) is statistically significant at p < .05 when this unique, direct effect is added to the shared, indirect effect of the latent construct.

Not significant in the MIMIC model based only on observations with non-missing data within the first subcomposite of OFFS (n = 200). Missing data occurs within two of the variables (family income and out-of-pocket costs) used to calculate the first subcomposite. Interpretations of the follow-up simple slopes plots (Figures 2–4) are unaffected.

This final model is more valid than the one that also estimates the indirect effects since disability days co-moderates only one of the shared and unique effect relationships. Statistical inferences are unaffected.

p < .05

p < .02

p < .01

p < .005.

Furthermore, the inclusion of relationships from predictors to individual strain indicators distinguishes this shared variation across all three strain indicators from situations in which one or two of the indicators contribute disproportionately to financial strain. For instance, a patient may report low financial strain based on difficulty paying bills (health and non-health related), yet as a result of disability or disease progression, may perceive high financial strain based on adequacy of their health insurance and financial resources to meet future health needs. In turn, these divergent responses might lead to moderate or high financial strain based on worrying about health care expenses [19].

Results

Descriptive Analyses

Descriptive analyses of the sample initially were reported in Schulz et al. [3]. Roughly half of this predominantly Caucasian (eighty-eight percent) sample are male and female. The average patient age is 62, with patients’ ages ranging from 30 to 90. One hundred thirty patients were age 65 and older, and all were retired, comprising 70 percent of the men and 28 percent of the women.

Eighty percent of all cancer diagnoses fall into six categories: breast (22%), lung (20%), head and neck (14%), gynecologic (10%), prostate (9%), and colorectal (5%). Lung cancer patients reported greater severity on most indicators of health status compared to other patients. Past cancer treatments include surgery (61% of the patients), radiation (31%), or both (8%). Upon embarking on the current course of palliative radiation, about one-third of the patients (34%) reported that they were also receiving chemotherapy. The most frequently reported co-morbid conditions are arthritis (28%), hypertension (26%), and other cardiovascular problems (20%).

On average, patients reported 22 disability days during the past four months that prevented performance of usual daily duties (e.g. employment, housework). This measure may reflect job insecurity (potentially reflecting wage losses) as well as needs for homemaker and home health services (potentially increasing out-of-pocket costs).

Sixty-five younger adult patients were not in the workforce (i.e., 44 homemakers, 18 on disability pensions, 3 on public assistance). Seventy-three younger adults were in the workforce (i.e., 44 employed either part- or full-time, 21 on-leave, 3 unemployed and looking for work, 5 unemployed and not looking for work). Of the 44 employed patients, 34 claim that the illness forced them to miss work days, 23 claim that they had to reduce the number of hours worked, 7 claim that they had to take on lighter work duties, and 3 claim that they had turned down a job (more than one response is possible). Of the 29 patients who were on-leave or unemployed, 8 were unemployed, with 7 attributing it to the illness.

On average, men and women tended to incur some difficulty paying medical bills, spent $200 to $270 in the prior month on medical expenses and illness-related travel, and considered their resources to meet medical expenses as slightly less than adequate.

Explanatory Analyses

Bivariate comparisons, previously unreported, reveal important age-related differences in family instrumental coping strategies to limit the extent of illness-related objective financial stress (and, subsequently, strain). As age advances, patients were more likely to adopt passive coping behaviors based on their yes/no responses to each of the following items: 1) reduce standard of living (“doing without”) (t265 = −2.50, p < .015); 2) sacrifice “extras” (t265 = −3.82, p < .001); 3) simply not paying bills (t265 = − 3.44, p < .002); 4) use savings (t265 = −1.82, p < .073); and 5) borrow money (t265 = −4.26, p < .001). Furthermore, the centered measure for the overall OFFS index and the continuous variable for Age are significantly and inversely correlated (Pearson r = −0.2495, one-tailed p < .001). A t-test reveals that patients reporting overall OFFS above the mean tend to be younger than patients reporting overall OFFS less than or equal to the mean (t265 = 3.87, p < .001).

Interpretations Involving Moderator Effects

Multivariate findings can be used to assess moderator effects by age and disability days on the financial stress-strain relationships, which are the basis of our hypotheses. The interaction terms in Table I are not directly interpretable because they involve ordinal or continuous variables (in contrast to an all-dummy variable specification, as in a directly interpretable ANOVA). Instead, parameter estimates from the table are used to calculate simple slopes equations, which are plotted in Figures 2–4. These plots reveal the form of each curvilinear and interaction effect (i.e., buffering or exacerbation).

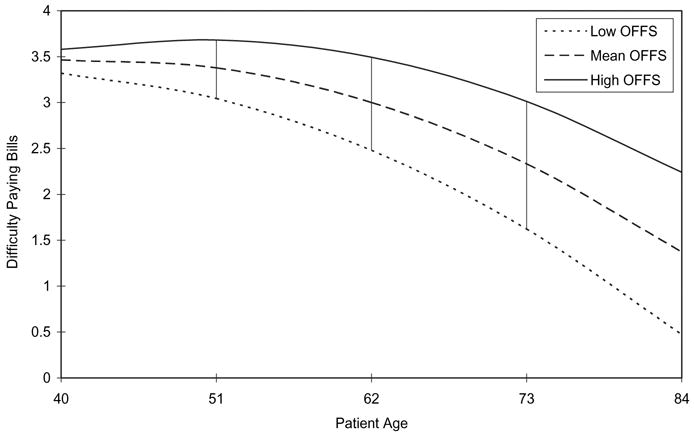

Figure 2.

“Difficulty Paying Bills” as Age Advances across OFFS.

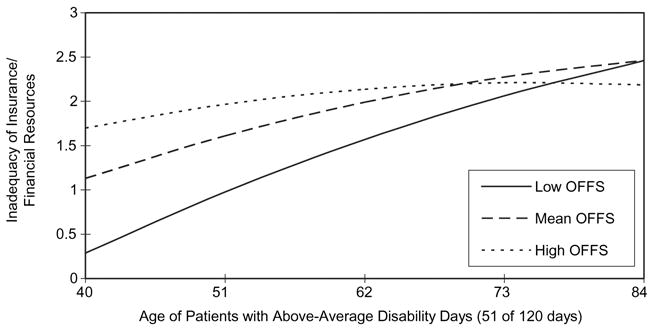

Figure 4.

Inadequacy of Insurance/Financial Resources as Age Advances across OFFS: Patients with Above-Average Disability Days.

All Patients

The plot in Figure 2 reveals age curvilinearity and age moderation in the relationship between the OFFS index and the financial strain item “Difficulty Paying Bills.” Older patients accommodate more than younger patients at all OFFS levels (high, mean, low), although the extent of accommodation wanes somewhat as the level increases. Since the disability co-moderator does not predict “Difficulty Paying Bills” in Table I, this plot is the same as the plot derived from an earlier MIMIC model that tested age curvilinearity and age moderation only (and not co-moderation by disability) across all three strain indicators [19].

There is an overall definite tendency to accommodate with age at all three levels of OFFS (this can also be seen in Table I, where age2 is negative and statistically significant as a predictor of “Difficulty Paying Bills”). However, the extent of accommodation with age decreases as financial stress increases (age * OFFS is positive and statistically significant). A series of vertical lines highlights the difference in spread between the curves (low to high) for “Difficulty Paying Bills” as we proceed from the left to the right y-axes, which corresponds to a less dramatic drop in the curve at high OFFS as age advances.

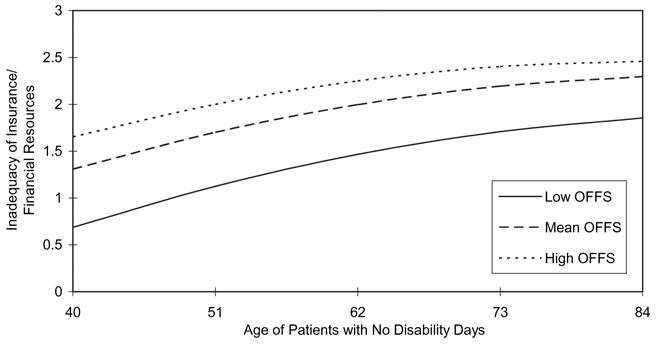

Patients with No Disability Days

Two plots involve age, disability days, and the financial strain item “Inadequacy of Financial Resources/Insurance to Meet Future Health Needs.” These plots pertain to patients with either no disability days (Figure 3) or above-average disability days (Figure 4).

Figure 3.

Inadequacy of Insurance/Financial Resources as Age Advances across OFFS: Patients with No Disability Days.

In Figure 3, older patients reporting no disability days accommodate somewhat less than younger patients. More critically, the three virtually parallel curves suggest that patients reporting no disability days may be no more likely than other patients to forego needed care. Thus, it would appear that patients who limit their OFFS to a low level may be less likely to do so inappropriately since they view their insurance and financial resources for the future to be more adequate than patients with similar disability days but higher OFFS.

Patients with Above-Average Disability Days

In Figure 4, older patients reporting above-average disability days also accommodate less than younger patients, however in contrast to the parallel curves of Figure 3, the intersection of these curves suggest that some patients may be foregoing care inappropriately.

The curves for low OFFS and mean OFFS are similar, and both intersect the curve for high OFFS after retirement age. Although patients with above-average disability days would be expected to incur higher OFFS than patients with no disability days, this expectation is no longer met as the points of intersection with the curve for high OFFS are approached and surpassed.

Thus, when OFFS is average or below, “Inadequacy of Insurance and Financial Resources to Meet Future Health Needs” increases with advancing age for patients with above-average disability days.

Discussion

The patients in the current study were coping with an advanced stage of recurrent cancer. In reaction to the first cancer episode, many families may already have adjusted away from depending on less reliable sources of income based on steady patient employment. Indeed, the results suggest that many younger patients do not need to work for basic necessities since neither “Employed” nor “Work Transition” were statistically significant predictors of any financial strain indicator. None of the remaining secondary variables were significant as well. These findings may be related to the close conceptual and empirical relationship of financial stress with financial strain, compared with a less overlapping outcome (such as depression) that is multi-determined by a variety of factors.

The bivariate comparisons reveal older patients as less likely to use active coping strategies and more likely to report lower overall OFFS, compared to younger patients. Because older patients may be less likely to use active strategies to facilitate coping with financial stress, there is the potential that family members, medical professionals, and insurers might seek or prescribe less than optimal care to limit objective financial stress. This tendency to use fewer active strategies to cope with financial stress could also be related to under-reporting of pain and symptoms by older patients.

Multivariate findings yield stronger support for these potential explanations. The intersecting lines in the prediction of “Inadequacy of Insurance/Financial Resources to Meet Future Health Needs” (Figure 4) may mean older adults or others acting on their behalf (e.g., family members, physicians, insurers) curb out-of-pocket costs after a threshold when they become unaffordable, which may be related to high medical and supportive care needs, as reflected by above-average disability days and to fixed retirement income.

On the other hand, low out-of-pocket costs in the context of above-average disability days may stem from under-reported and under-treated pain and symptoms rather than deliberate rationing based on perceived lack of affordability. Older patients tend to underreport pain and symptoms, and physicians tend to undertreat pain and symptoms in older patients [5]. Those with mild to moderate cognitive impairment (MCI) may encounter difficulties reporting pain and symptoms on a timely and ongoing basis, which may reduce the efficacy of assessments by professionals and caregivers [24]. Although lower out-of-pocket costs for medications and other palliative care may result, older patients, including those with MCI, may interpret unrelieved pain and symptoms to mean that their financial resources and insurance will be inadequate in the future.

In both scenarios, current and future care would be foregone even as tendencies to curb out-of-pocket costs or under-report pain and symptoms foster age-related accommodation to measures of current financial strain, such as “Difficulty Paying Bills” (Figure 2). Data limitations do not allow the relative importance of these potentially deleterious pathways to be assessed. Regardless of scenario, however, this at-risk subgroup of older patients would be missed by high risk screening approaches that focus solely on objective financial stress and neglect future-oriented financial strain. This subgroup appears at risk for difficulties associated with chronic strains, family sacrifice, reductions in access to care and adherence to medical regimens, and pain and symptom miscommunication and mismanagement, which may lead to eventual over-treatment in compensation. Thus, there appear to be critical unmet needs for timely social work and nursing interventions.

The current study further qualifies the classic findings by Campbell [6] and his colleagues who found evidence of age-related accommodation across most life domains in the general American population, including satisfaction with finances, but age-related exacerbation with regard to satisfaction with health. The current study reveals age-related exacerbation in the responses of older adult patients to measures of subjective economic well-being that are targeted to health needs, at least as projected into the future. The development of measures of financial strain that focus specifically on projected health needs may improve detection of older adults who may be forgoing, or may be at risk of forgoing, effective pain and symptom management (including prescription drugs) and other needed health care for reasons related to perceived lack of affordability. Sensitive measures of economic well-being targeted to health needs should be incorporated into patient screenings and assessments by social workers and nurses working in outpatient palliative radiation and home-based care.

The findings also support an observation by George [25] that while most elderly report satisfaction with their current levels of financial resources [26], forty to forty-five percent of the elderly from multiple studies also believe that these levels will be insufficient to meet future needs. The current study provides an important contribution in that it does not also reveal a similar present-future discrepancy among younger patients with chronic illness reporting low to average levels of OFFS. Additional research is needed with samples from other nations and health systems, and in samples that target other cancer stages, other chronic conditions, and healthy participants, to determine whether the current findings suggest a more general phenomenon among older adults with chronic conditions or more advanced disease.

It is plausible that older patients may accommodate more readily to present financial stressors, such as meeting bills, in order to cope with exacerbated fears about future health insurance, financial resources, health status, and pain and symptom burden. Perhaps the measure of financial strain, “Worry about Health Care Expenses,” reflects neither accommodation (to current circumstances) nor exacerbated responses (from appraisals of future health needs) because it blends the present and future orientations. Older patients reporting low to moderate OFFS but perceiving high “Inadequacy of Insurance/Financial Resources for Future Health Needs” could be at risk of curbing or foregoing additional financial stress, and thus needed care, in order to continue to meet bills and expenses and to manage fluctuations in personal finances. Further, family members, physicians, and insurers may make medical decisions that reduce financial stress.

Compared to similar subgroups of younger patients, older patients characterized by low to moderate levels of OFFS could be perceiving resources for future health needs as less adequate due to their fixed retirement incomes (current or anticipated) and/or their awareness of tendencies to forego current needs and “hedge” against additional expenditures (which may explain why they perceive less difficulty paying bills). This cohort of older adults, who grew up during the Depression Era and World War II, might resist drawing upon savings or selling assets due to strong dispositions to pass on inheritances to their adult children. The process of adapting to the present might occur while fearing and resisting the future. Family members, physicians, and insurers might reinforce these attitudes, especially when their own interests might be served.

Older patients who incur low to moderate levels of OFFS–or family members, physicians, or insurers acting on their behalf–might forego current needs by delaying or not adhering with follow-up appointments or medication regimens or by resisting home health care. Fear of the future might contribute to denial and delay behaviors in the present. For instance, older patients might take less pain medication than prescribed due to fears of tolerance [5] or to delay the need for refills on prescriptions. Thus, measures of financial strain that target projected health needs, rather than simply the capacity to afford current expenditures, may be more effective in detecting at-risk older adults.

A competing explanation may be that older patients with multiple comorbidities benefit less from particular treatments due to interactions with competing age-related health problems [27]. In this perspective, older patients may incur low to moderate OFFS because their physicians appropriately forego harmful and unnecessary medical care. However, this explanation may be less applicable to the current sample since all patients were past the stage of aggressive curative treatment for recurrent cancer. Furthermore, the descriptive findings suggest that the scope and prevalence of comorbid conditions are limited. Other evidence suggests that younger and older adults (over 70) with cancer experience similar levels of comorbidity, and elders with cancer experience much lower comorbidity than elders diagnosed with other conditions [28].

It could also be argued that it is quite normative for older patients contending with disability to be concerned that their financial resources and insurance will become inadequate and that these concerns do not necessarily imply that all health care rationing is undesirable. Older adults often seek to avoid leaving a retired spouse or adult children with financial burden after their death and may seek to preserve wealth transfers. However, it could also be argued that these concerns are likely to be at least as serious for the younger patients in the current study who are contending with disability. Younger patients may feel anxious about the prospect of placing financial burden on a spouse, who may need to become the sole breadwinner, perhaps even as a single parent, and with reduced eligibility for public health insurance. The fact that these financial concerns are predicted to be greater in older patients with low objective financial stress and above-average disability days implies that they may be more likely to forego needed medical care, comparatively speaking, than a similar subgroup of younger patients.

In summary, multiple explanations support the divergent relationships detected between overall family financial stress and two indicators of patient financial strain:

Among patients with the same level of household financial stress, older patients perceived less financial strain from difficulty paying bills than younger patients; and

Among patients reporting above-average disability days, older patients also perceived more financial strain than younger patients related to the adequacy of their health insurance and finances in the future

Considered together, these findings have critical practical utility: Financial strain measures targeted to projected health needs should supplement financial strain measures that describe current household circumstances in order to improve screenings of older patients who are under-prescribed, or unable to adhere to, a regimen for all necessary health care.

Acknowledgments

The author thanks Richard Schulz, M.D., Professor of Psychiatry and Director of Gerontology, University of Pittsburgh, for the opportunity to perform secondary analysis on these data (Hospice Program Grant, CA48635, National Cancer Institute). During the period of this research, the author received financial support from a Social Work Leadership Development Award (Project on Death in America, Open Society Institute), the National Institute of Mental Health, and the Hartford Social Work Faculty Scholar Program.

References

- 1.Zarit S. Family care and burden at the end of life. CMAJ. 2004;170(12):1811–2. doi: 10.1503/cmaj.1040196. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Yancik R, Ries L. Cancer in older persons. Magnitude of the problem–how do we apply what we know? Cancer. 1994;74(7 Suppl):1995–2003. doi: 10.1002/1097-0142(19941001)74:7+<1995::aid-cncr2820741702>3.0.co;2-y. [DOI] [PubMed] [Google Scholar]

- 3.Schulz R, Williamson G, Knapp J, Bookwala J, Lave J, Fello M. The psychological, social, and economic impact of illness among patients with recurrent cancer. J Psychosoc Oncol. 1995;13:21–45. [Google Scholar]

- 4.Emanuel E, Fairclough D, Slutsman J, Emanuel L. Understanding economic and other burdens of terminal illness: the experience of patients and their caregivers. Ann Intern Med. 2000;132:451–9. doi: 10.7326/0003-4819-132-6-200003210-00005. [DOI] [PubMed] [Google Scholar]

- 5.Yates P, Edwards H, Nash R, Walsh A, Fentiman B, Skerman H, et al. Barriers to effective cancer pain management: A Survey of Hospitalized Cancer Patients in Australia. J Pain Symptom Manage. 2002;23:393–405. doi: 10.1016/s0885-3924(02)00387-1. [DOI] [PubMed] [Google Scholar]

- 6.Campbell A, Converse P, Rogers W. The quality of American life: Perceptions, evaluations, and satisfactions. New York: Russell Sage; 1976. [Google Scholar]

- 7.Carp F, Carp A. Test of a model of domain satisfactions and well-being: Equity considerations. Res Aging. 1982;4:503–22. [Google Scholar]

- 8.Fletcher C, Lorenz F. Structural influences on the relationship between objective and subjective indicators of economic well-being. Soc Indicat Res. 1985;16:333–45. [Google Scholar]

- 9.Berkman B, Sampson S. Psychosocial effects of cancer economics on patients and their families. Cancer. 1993;72:2846–9. doi: 10.1002/1097-0142(19931101)72:9+<2846::aid-cncr2820721515>3.0.co;2-3. [DOI] [PubMed] [Google Scholar]

- 10.Francoeur R. Reformulating financial problems and interventions to improve psychosocial and functional outcomes in cancer patients and their families. J Psychosoc Oncol. 2001;19:1–20. [Google Scholar]

- 11.VanderMeer J. The cost of home-based care for dependent elders: Who pays? Nurs Econ. 1993;11:350–7. [PubMed] [Google Scholar]

- 12.Mor V, Guadagnoli E, Wool M. An examination of the concrete service needs of advanced cancer patients. J Psychosoc Oncol. 1987;5:1–16. [Google Scholar]

- 13.Melnyk K. Barriers to care: Operationalizing the variable. Nurs Res. 1990;39:108–12. [PubMed] [Google Scholar]

- 14.Mor V, Masterson-Allen S, Houts P, Siegel K. The changing needs of patients with cancer at home: A longitudinal view. Cancer. 1992;69:829–38. doi: 10.1002/1097-0142(19920201)69:3<829::aid-cncr2820690335>3.0.co;2-i. [DOI] [PubMed] [Google Scholar]

- 15.Guadagnoli E, Mor V. Daily living needs of cancer out-patients. J Commun Health. 1991;16:37–47. doi: 10.1007/BF01340467. [DOI] [PubMed] [Google Scholar]

- 16.Goodwin J, Hunt W, Samet J. Determinants of cancer therapy in elderly patients. Cancer. 1993;72:594–601. doi: 10.1002/1097-0142(19930715)72:2<594::aid-cncr2820720243>3.0.co;2-#. [DOI] [PubMed] [Google Scholar]

- 17.Coughlin T, Liu K, McBride T. Severely disabled elderly persons with financially catastrophic health care expenses: Sources and determinants. Gerontologist. 1992;32:391–403. doi: 10.1093/geront/32.3.391. [DOI] [PubMed] [Google Scholar]

- 18.Singer J, Davidson L. Specificity and stress research. In: Appley M, Trumbull R, editors. Dynamics of Stress: Physiological, Psychological, and Social Perspectives. New York: Plenum; 1986. [Google Scholar]

- 19.Francoeur R. Use of an income-equivalence scale to understand age-related changes in financial strain. Res Aging. 2002;24:445–72. doi: 10.1177/01627502024004003. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Voydanoff P, Donnelly B. Economic distress, family coping, and quality of family life. In: Voydanoff P, Majka L, editors. Families and economic distress: Coping strategies and social policy. Newbury Park, CA: Sage; 1988. pp. 97–116. [Google Scholar]

- 21.Krause N, Jay G, Liang J. Financial strain and psychological well-being among the American and Japanese elderly. Psychol Aging. 1991;6:170–81. doi: 10.1037//0882-7974.6.2.170. [DOI] [PubMed] [Google Scholar]

- 22.Williamson G, Schulz R. Physical illness and symptoms of depression among elderly outpatients. Psychol Aging. 1992;7:343–51. doi: 10.1037//0882-7974.7.3.343. [DOI] [PubMed] [Google Scholar]

- 23.Hu L, Bentler P. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equations Modeling. 1999;6:1–55. [Google Scholar]

- 24.Davies E, Higginson I, editors. Better Palliative Care for Older People. Copenhagen: World Health Organization, Regional Office for Europe; 2004. [Google Scholar]

- 25.George L. Economic status and subjective well-being: A review of the literature and an agenda for future research. In: Cutler N, Gregg D, Lawton M, editors. Aging, money, and life satisfaction: Aspects of financial gerontology. New York: Springer; 1992. pp. 69–99. [Google Scholar]

- 26.National Council on Aging. Aging in the eighties. Washington, DC: Author; 1981. [Google Scholar]

- 27.Kaplan R. The significance of quality of life in health care. Qual Life Res. 2003;12(Suppl 1):3–16. doi: 10.1023/a:1023547632545. [DOI] [PubMed] [Google Scholar]

- 28.Repetto L, Venturino A, Vercelli M, Gianni W, Biancardi V, Casella C, et al. Performance status and comorbidity in elderly cancer patients compared with young patients with neoplasia and elderly patients without neoplastic conditions. Cancer. 1998;82:760–5. [PubMed] [Google Scholar]