Abstract

Objective

To assess whether new premiums in SCHIP affect rates of disenrollment and reenrollment in SCHIP and whether they have spillover enrollment effects on Medicaid.

Data Source

We used SCHIP administrative enrollment data from Arizona and Kentucky. The enrollment data covered July 2001 to December 2005 in Arizona and November 2001 to August 2004 in Kentucky.

Study Design

We used administrative data from two states, Arizona and Kentucky, which introduced new premiums for certain income categories in their SCHIP programs in 2004 and 2003, respectively. We used multivariate hazard models to study rates of disenrollment and re-enrollment for the recipients who had been enrolled in the categories of SCHIP in which the new premiums were implemented. Competing hazard models were used to determine if recipients leaving SCHIP following the introduction of the premium were obtaining other public coverage or exiting public insurance entirely at higher rates. We also used time-series models to measure the effect of premiums on changes in caseloads in premium-paying SCHIP and other categories of public coverage and we assessed the budgetary implications of imposing premiums.

Principal Findings

In both states, the new premiums increased the rate of disenrollment and decreased the rate of re-enrollment in premium-paying SCHIP among the children who were enrolled in those categories before the premiums were implemented. The competing hazard models indicated that almost all of the increased disenrollment is caused by recipients leaving public insurance entirely. The time-series models indicated that the new premium reduced caseloads in premium-paying SCHIP, but that it might have increased caseloads for other types of public coverage. The amount of premiums collected net of the costs associated with administering premiums is small in both states. Estimating the full budgetary effects with certainty was not possible given the imprecision of the key time-series estimates.

Conclusion

These results suggest that the new premium reduced enrollment in the premium-paying group by 18 percent (over 3,000 children) in Kentucky and by 5 percent (over 1,000 children) in Arizona, with some of these children apparently leaving public coverage altogether. While most children enrolled in these categories did not appear to be directly affected by the imposition of $10–$20 monthly premiums, the premiums may have caused some children to go without health insurance coverage, which in turn could have adverse effects on their access to care. Imposing nominal premiums may reduce state spending, but projected savings appear to be small relative to total state SCHIP spending and resulting increases in enrollment in other public programs and in uninsurance rates could offset those savings.

Keywords: Financing/Insurance/Premiums, SCHIP and Medicaid, State Health Policies

BACKGROUND

Premiums have become a prominent feature of public health insurance programs for children in recent years. This trend started in the late 1990s when many states that adopted separate non-Medicaid programs required premium payments from some income groups as part of the State Children's Health Insurance Program (SCHIP). By the end of 2004, 30 states had premiums in either their SCHIP or Medicaid waiver programs (Smith and Rousseau 2005). Earlier this decade, a number of factors, including tight state budgets and political pressures to increase financial contributions from families participating in public programs, led many states to raise premium levels or to impose premiums for the first time on children living in families just above the poverty level.

While some premium increases in SCHIP and Medicaid waiver programs have been driven by the rising costs of providing care to enrollees, many states have looked to premiums as a tool for constraining public outlays (Fox and Limb 2004). There is a growing empirical literature documenting the extent to which premiums affect enrollment in public programs (Shenkman et al. 2002; Herndon et al. forthcoming; Kenney et al. 2007; Marton 2007). Taken together, these studies suggest that higher premiums for public insurance coverage increase disenrollment rates, particularly in the months following the premium increase.

This paper examines the impacts of introducing premiums in two states—Arizona and Kentucky. In July 2004, Arizona introduced premiums in KidsCare, their SCHIP program, of $10 per month for one child and $15 per month for two or more children for families with incomes at or below 150 percent of the Federal Poverty Level (FPL); this eligibility category includes all children ages 6–18 with incomes between 101 and 150 percent of the FPL and children ages 1–5 with family incomes between 134 and 150 percent of the FPL.1 Arizona had already been charging premiums for children whose family incomes were between 151 and 200 percent of the FPL.2 In the KidsCare program, children have eligibility periods of 12 months but are disenrolled from the program if premiums are more than 2 months past due. KidsCare re-enrollment can occur without a black-out period but requires payment of all past due premiums and submission of a new KidsCare application.

In December 2003, Kentucky introduced a premium of $20 per month per family for children covered under their KCHIP III category of SCHIP that includes families with incomes between 151 and 200 percent of the FPL. Kentucky also covers children with family incomes below 150 percent of the FPL and above Medicaid income thresholds in its KCHIP II program,3 but the state charges no premiums for that program. The eligibility period, nonpayment, and re-enrollment guidelines in Kentucky are similar to those in Arizona.

This study builds on earlier analysis that showed that the introduction of premiums in Kentucky led to faster disenrollment and smaller caseloads in the enrollment category where the premium was introduced (Kenney et al. 2007; Marton 2007). In this paper, we provide new analysis for Arizona and extend the prior research on Kentucky, by assessing impacts on disenrollment patterns (i.e., the extent to which children are disenrolling to other types of public coverage or disenrolling from public coverage altogether) and re-enrollment rates. In addition, we consider whether premiums could be having spillover effects on enrollment in other types of public coverage that do not require premiums. The introduction of a premium could affect nonpremium-paying caseloads if, for example, during the 12-month eligibility period, the new premium makes families more likely to report reductions in income that take them out of a premium-paying category and less likely to report increases in income that would put them into a premium-paying category. We also lay out a framework for considering the budgetary implications of premiums in SCHIP and assess the extent to which they may have generated savings in Arizona and Kentucky.

DATA AND METHODS

The analysis draws primarily on individual enrollment records from 2001 to 2004–2005 for premium-paying categories of the separate SCHIP programs in Arizona and Kentucky. The study population in Arizona is defined as enrollees under age 1 with family incomes between 141 and 150 percent of poverty, enrollees ages 1–5 with family incomes between 134 and 150 percent of poverty, and enrollees ages 6–18 with family incomes between 101 and 150 percent of poverty. The study population in Kentucky consists of enrollees ages 1–18 with family incomes between 151 and 200 percent of poverty and enrollees under age 1 with family incomes between 186 and 200 percent of poverty.

Individual monthly enrollment files were combined to create a single data set for each state covering the entire study period. We use duration analyses to examine changes in disenrollment and re-enrollment rates, competing hazard models to assess changes in disenrollment patterns, and time-series models to examine changes in caseloads.4 Where possible, comparable measures were defined in each state. A child who was enrolled at any point in a given month was considered a current enrollee; new enrollees were defined as those who were in the premium-paying category in a given month, but who had not been enrolled in that premium-paying category the prior month; and disenrollees were defined as children enrolled in the premium-paying SCHIP category for at least 1 month, but not enrolled in that premium-paying SCHIP category the subsequent month.

The administrative files contain limited demographic information on the children enrolled in the premium-paying categories. Because of differences in the administrative data available from the two states, the variables used in the analysis presented in the next section differ slightly by state. In both states, information is provided on the age, gender, race/ethnicity and the county or region of residence. In Arizona, the file contains information on household size whereas in Kentucky we estimated the number of siblings each child has by using their family identification number to match enrolled siblings. In Kentucky, the file contains information on managed care enrollment and enrollment status5 of children before enrollment in the premium-paying category. We used family income and household size data for Arizona to calculate a recipient's income as a proportion of the FPL.

Monthly data on state-level unemployment rates for both states were obtained from the website of the Bureau of Labor Statistics. In addition, we included a measure of the amount of economic activity in Arizona, using data from the Arizona Business Conditions Index.6

We also analyzed comparable administrative data from Kentucky for its Medicaid program and its nonpremium-paying separate SCHIP program, KCHIP II. In Arizona, we analyzed monthly caseloads from the SOBRA program, the Medicaid poverty expansion program for children ages 0–5 with family incomes from 101–133 percent of the FPL. In Kentucky, these administrative data are contained in the same database, so the child and family identifiers remain the same as children move across programs. In Arizona, only SCHIP enrollment data were available which indicated whether a child left the program and enrolled directly in Medicaid, but not whether the child had been enrolled in Medicaid before enrolling in SCHIP or whether the child subsequently enrolled in Medicaid after leaving SCHIP and not having public insurance.

Hazard Model Analysis

Analyses of disenrollment patterns were performed using a proportional hazard model with linear and quadratic time trends based on cohorts of children entering the 101–150 percent of FPL category of KidsCare between April 2002 and June 2004 and cohorts of children entering KCHIP III between December 2001 and November 2003. We limited our analysis to the cohorts of children who were enrolled before the premium was implemented because we did not have sufficient data on cohorts entering later and because we were concerned that the new cohorts might be different in ways that are not adequately captured in the administrative data. We also chose to estimate proportional hazard models with linear and quadratic time trends instead of Cox proportional hazard models because the linear and quadratic time trends allowed us to capture the effects of time explicitly, separately from the effects of key time-varying policy variables in our models.7

Hazard models were estimated for all premium-paying SCHIP exit routes considered together and for each individual exit route separately. In Kentucky, exit routes included moving to Medicaid, moving to KCHIP II and all other exits (which included disenrollment due to premium nonpayment); in Arizona, exit routes included moving to Medicaid, moving to other KidsCare categories, and all other exits. These models have the following form:

| (1) |

where Recertsi represents a vector of recertification time-varying dummy indicators (i.e., separate variables are included for the first and second recertification points in both states and for the third recertification point in Arizona), Post_Premi represents the impact of the premium change and it takes the value 1 in the months following the imposition of the new premium, T and T2 represent linear and quadratic time trends, and the vector Xi includes the demographic characteristics described above (age, gender, race/ethnicity, household size, and income in Arizona, and age, gender, race/ethnicity, number of siblings, managed care enrollment, and prior enrollment status in public insurance programs in Kentucky). In Kentucky, controls are included for the monthly unemployment rate and region of residence.8 In Arizona, the model includes controls for the county of residence, the monthly state unemployment rate and economic activity level in the state, and a dummy variable for the month of April, due to re-assessments of eligibility that occur that month based on changes in FPLs.

The re-enrollment hazard model has the following form:

| (2) |

where Post_Premi represents the effect of the new premium on re-enrollment, T and T2 represent linear and quadratic time trends, and Xi represents the demographic and geographic factors listed above for each state and controls for the exit route associated with disenrollment from the premium-paying SCHIP category.

For the disenrollment and re-enrollment hazard models, tests of significance apply to the underlying beta coefficients. For ease of interpretation, we report the exponentiated betas. Summary statistics for the disenrollment and re-enrollment samples and the estimated coefficients for demographic variables used in the hazard models are given in Appendix A.

Time-Series Analyses

We estimated multivariate time-series models of changes in monthly caseloads between April 2002 and October 2005 in Arizona for KidsCare in the 101–150 percent of FPL category and for Medicaid SOBRA children ages 0–5.9 In Kentucky, the time-series models cover November 2001 to August 2004 for Medicaid and KCHIP II and November 2001 to April 2005 for KCHIP III. The general model specification was as follows:

| (3) |

Where C (t) is the total caseload for one of the public insurance programs mentioned above in month t; T is a time trend that takes the value 1 in the first month of the analysis, 2 in the second month of the analysis, etc.; T2 is the time trend squared (to allow for a nonlinear time trend); Premium (t) is a dummy variable that takes the value 1 in the months following the new premium; EA (t) represents one or more variables to measure economic changes in the state including the monthly unemployment rate (Arizona and Kentucky) and the amount of economic activity reported for month t (Arizona); M is a set of monthly dummy variables10; and u(t) is an error term. For the Kentucky Medicaid analysis, we also included a cubed time trend as the growth in caseload is mostly linear with brief periods of flat growth and shows some resemblance to a cubic function. We tested for auto-correlation in the error term, and where appropriate, we adjusted the estimates using a Cochrane–Orcutt transformation.

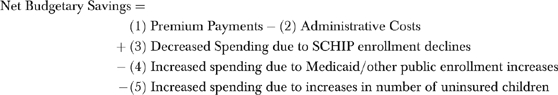

Budget Analyses

The following equation describes the factors that affect the extent to which premiums generate savings to states:

|

(4) |

We estimate state expenditure reductions in Arizona and Kentucky for a typical year from a number of different sources. We use the federal matching rates in Medicaid and SCHIP in each state to determine the share of the costs/savings borne by the state.11 The terms (1) and (2) reflect the net spending decrease for the state that is directly attributable to premiums (Scenario 1). In Arizona, the state provided information on how much revenue was collected during fiscal year 2005 in the 101–150 percent FPL KidsCare group, and what the total administrative cost was to collect premiums for all categories of KidsCare. We estimated the administrative cost for the 101–150 percent FPL category by multiplying the total administrative cost by the share of recipients in that category. In Kentucky, we received data regarding total collections and administrative fees paid to the premium collection entity after the initiation of premium collection in December 2003.

The four other terms reflect potential savings and costs that are driven by behavioral responses to premiums. We draw on estimates of the costs of covering children in the SCHIP programs in each state and on the caseload impacts estimated from the time-series models to provide guidance about the potential magnitude of terms (3) and (4). Because of the uncertainty about the size of the behavioral response caused by premiums, we present one set of estimates (Scenario 2) that assumes an enrollment response in premium-paying SCHIP only and another set (Scenario 3) that assumes that caseloads in other SCHIP categories and in Medicaid can be affected by the premium. Both these scenarios are derived from our time-series models. We do not attempt to estimate the size of terms (5) and (6), as we do not have direct evidence of the impacts of the premiums on uninsurance and on the overall amount of churning in and out of all forms of public coverage.

FINDINGS

Disenrollment Analyses

Table 1a presents the results of hazard models for premium paying SCHIP enrollment in each state in which the exit routes from premium paying SCHIP coverage are not differentiated. In both Arizona and Kentucky, the introduction of a premium led to faster disenrollment among the children who were already enrolled in the affected enrollment category. The rate of disenrollment increased by 52 percent (p<.01) in Kentucky and by 38 percent in Arizona (p<.01) among these cohorts of children.

Table 1:

Estimated Coefficients from Hazard Analyses in Arizona and Kentucky 2001–2005

| Arizona* | Kentucky* | |||

|---|---|---|---|---|

| Variable | Hazard Ratio | p-Value | Hazard Ratio | p-Value |

| 1.a. Disenrollment Hazard Model: Overall Hazard | ||||

| Premium effect | 1.38 | .000 | 1.52 | .000 |

| Recertification | ||||

| First recertification | 4.20 | .000 | 4.05 | .000 |

| Second recertification | 2.19 | .000 | 3.77 | .000 |

| Third recertification | 1.43 | .000 | N/A | N/A |

| Sample size | 50,227 | 38,858 | ||

| Overall | p-Value | Exit to Medicaid | p-Value | |

| 1.b. Disenrollment Hazard Model: Competing Hazards Effect of New Premiums | ||||

| Premium effect–Arizona | 1.38 | .000 | 1.11 | .003 |

| Premium effect–Kentucky | 1.52 | .000 | 1.00 | .955 |

| Exit to Other | Exit for Other | |||

| SCHIP | p-Value | Reason† | p-Value | |

| Premium effect–Arizona | 1.15 | .001 | 1.85 | .000 |

| Premium effect–Kentucky | 1.01 | .796 | 2.34 | .000 |

| Sample size | 50,227 | 38,858 | ||

| Arizona * | Kentucky* | |||

| Variable | Hazard Ratio | p-Value | Hazard Ratio | p-Value |

| 1.c. Reenrollment Hazard Model | ||||

| Premium effect | 0.90 | .009 | 0.95 | .328 |

| Exit effect | ||||

| Exit out of public insurance | N/A | N/A | N/A | N/A |

| Exit to medicaid | 0.82 | .000 | 1.36 | .000 |

| Exit to other SCHIP category or program | 1.91 | .000 | 2.40 | .000 |

| Sample size | 47,430 | 24,104 | ||

Both models control for time trends, household income, county or region, and economic conditions. The Kentucky model also controls for managed care enrollment, and whether the child was previously enrolled in Medicaid or nonpremium-paying State Children's Health Insurance Program (SCHIP). Coefficients for the demographic variables can be found in Appendix A.

Other reasons include premium nonpayment.

Source: Linked monthly administrative enrollment data for Arizona and Kentucky from November 2001 to November 2005.

All of the increases in the rates of disenrollment occurred during the first 2 or 3 months in both states following the introduction of the premium (data not shown). In Kentucky, the rate of disenrollment increased 122 percent (p<.01) within the first 2 months after the new premium while the rate of disenrollment was 7 percent (p<.01) lower than the pre-premium disenrollment rate three or more months after the new premium. Likewise in Arizona, the rate of disenrollment within the first three months after the new premium increased 45 percent (p<.01), but the rate of disenrollment was 4 percent (p<.10) lower four or more months after the new premium.

Table 1b presents the results of a competing hazards model for premium paying SCHIP enrollment in each state. In these models, three exit routes are treated separately (exiting to nonpremium paying SCHIP, exiting to Medicaid, and exiting for an “other” reason), so separate hazards are estimated for each exit route. The overall hazards described above are re-stated here as well in the upper left of the table. In both states, the largest increase in the rate of disenrollment occurred in the category that reflects disenrollment from any type of public coverage for reasons that include premium nonpayment. In Kentucky, disenrollment out of public coverage appears to be the only reason for the increased risk of disenrollment overall. A child was 2.3 times (p<.01) as likely—or 130 percent more likely—to leave public coverage when disenrolling from KCHIP III after the premium was imposed. While the increase in disenrollment rates was broader-based in Arizona than in Kentucky, the primary impact of the premium was also to increase the rate at which enrollees left public insurance altogether. After the new premium, enrollees in Arizona were 85 percent (p<.01) more likely to leave public insurance, but there was an 11 percent (p<.01) increase in the rate of disenrollment to Medicaid and a 15 percent (p<.01) increase in the rate of disenrollment to other KidsCare categories.

Children that leave public coverage altogether are classified as taking the “other reason” exit route in the competing hazards models. This exit route would include (but is not limited to) children leaving due to a move out of state, children leaving due to the acquisition of private health insurance, or children leaving due to premium nonpayment. In the 8 months after Kentucky implemented the new premium, the share of all disenrollments in the sample classified as due to an “other” reason was 58 percent (of which more than half was due to premium nonpayment). In the 8 months before the premium, the share of all disenrollments due to an “other” reason was 38 percent (data not shown). This implies that in Kentucky, a large increase in the rate of disenrollment from pubic insurance for an “other” reason appears to be driven by nonpayment of premiums. In Arizona, in the 15 months after the new premium was introduced, the share of all disenrollments in the sample classified as due to an “other” reason was 55 percent (of which nearly half was due to premium nonpayment). In the 15-month period before the premium was introduced, the share of all disenrollments due to an “other” reason was 42 percent (data not shown).12 Thus, disenrollment because of administrative reasons (including premium nonpayment) became more common in the now premium-paying categories of SCHIP after the new premiums were implemented.

Re-Enrollment Analyses

In both Arizona and Kentucky, it appears that the new premiums led to small reductions in rates of re-enrollment in premium-paying SCHIP, although the magnitude of the effect is weaker in Kentucky and it is not significant at conventional levels (p=.33). The weak significance level for Kentucky is likely a function of the limited number of months of data after the premium was introduced for which data were available. Our findings (Table 1c) indicate that children in Arizona were 10 percent less likely to re-enroll in the 101–150 percent of FPL category of KidsCare (p<.01) after the implementation of the new premium and that children in Kentucky may have also experienced a reduction in their re-enrollment rate in KCHIP III of 5 percent (p<.33). These findings indicate a relatively small reduction in the rate of re-enrollment in both states, in a rate that was already low. For example, before the new premium in Arizona, only 9 percent of children who disenrolled in a given month had re-enrolled in the 101–150 percent of FPL category of KidsCare after 1 year (data not shown).13

Time-Series Findings

In both Arizona and Kentucky, the imposition of premiums was associated with declines in the overall caseloads in the enrollment categories where the premiums were introduced (Table 2).14 The implied effect of the new premiums was to reduce monthly caseloads by 5.3 percent in Arizona and by 18.1 percent in Kentucky relative to the average monthly caseload in that enrollment category during the study period. Thus, the new premiums appeared to reduce the monthly premium-paying caseload by an average of 1,155 children in Arizona and by 3,262 children in Kentucky. Unlike the hazard models for disenrollment, the time-series models do not indicate that the impacts are concentrated in the first 2–3 months following the introduction of a premium (data not shown). This suggests that the premium may have dampened new enrollment into the premium-paying category over a longer period of time.

Table 2:

Time Series Estimates of Caseload Changes in Public Insurance Programs in Kentucky and Arizona, 2001–2005

| Arizona | Kentucky | ||||

|---|---|---|---|---|---|

| Medicaid SOBRA Children* | KidsCare 0–150 Percent of the FPL All Ages | Medicaid | KCHIP II | KCHIP III† | |

| Average monthly premium effect‡ | 1,275 (p=.37) | −1,155 (p=.03) | 2,126 (p=.14) | 634 (p=.02) | −3,262 (p<.01) |

| Premium effect as a percent of premium-paying caseload | 1.7% | −5.3% | 0.7% | 2.0% | −18.1% |

Medicaid SOBRA Children are children ages 1–5 with family incomes up to 133 percent of the FPL and infants under age 1 with family incomes up to 140 percent of the FPL.

Cochrane–Orcutt adjustment was not used for this model.

Premium variable takes the value “1” after premium was increased and is “0” otherwise. The premium effect is interpreted as the average monthly change in caseload due to the premium increase. Two-tailed p-values are given in parentheses.

Source: Tabulations of monthly administrative enrollment data from Arizona and Kentucky, 2001–2005.

Our analyses of caseload changes for other categories of public coverage suggested that the imposition of premiums might have had spillover enrollment impacts, but it was not possible to gain precise estimates of these impacts, due to issues related to auto-correlation.15 In Arizona, it appeared that monthly caseloads for children ages 0–5 in the Medicaid SOBRA program increased by 1,275 children after the implementation of the new premium in the 101–150 percent of the FPL category of KidsCare, although the effect was not significant at conventional levels (p=.37). In Kentucky, the monthly caseload for all children in Medicaid increased by 2,126 children, but again the effect was not significant (p=.14). However, there was a significant increase in the average monthly caseload for KCHIP II of 638 children or 2 percent (p=.02) following the adoption of the new premium in KCHIP III.

Budget Analyses

Table 3 presents three alternative methods to estimate the state-level budget impacts of the new premiums. Combined state and federal budget impacts are found in the footnotes at the end of each paragraph in this section. Under Scenario 1, which assumes there is no behavioral response to the premiums, Arizona in 2005 retained $344,603 in premium payments and spent $36,225 to collect premiums, for a net savings of $308,378. These savings amounted to 0.5 percent of total SCHIP spending by Arizona of approximately $58 million. Likewise under Scenario 1, Kentucky in 2005 saved $415,199 from premium collections net of the costs associated with administering them (retaining $507,634 in premium payments and spending $92,435 to collect premiums). These savings were 2.2 percent of total Kentucky SCHIP spending of approximately $19 million.16

Table 3:

Analysis of Potential Annual State-Level Budget Savings from New Premiums in Arizona and Kentucky

| Arizona | Kentucky | |

|---|---|---|

| Scenario 1. Direct savings | ||

| Premiums collected | $ 344,603 | $ 507,634 |

| Administrative costs | $ (36,225) | $ (92,435) |

| Estimated savings (spending) | $ 308,378 | $ 415,199 |

| Scenario 2. Includes enrollment changes in Premium-Paying SCHIP only* | ||

| Direct savings | $ 308,378 | $ 415,199 |

| Decreased spending from Premium-Paying SCHIP enrollment | $ 370,781 | $ 885,740 |

| Potential estimated savings (spending)* | $ 679,159 | $ 1,300,939 |

| Scenario 3. Includes enrollment changes in Premium-Paying SCHIP and other programs* | ||

| Direct savings | $ 308,378 | $ 415,199 |

| Decreased spending from premium-paying SCHIP enrollment | $ 370,781 | $ 885,740 |

| Increased spending from enrollment increases in other public programs | $ (583,823) | $ (996,836) |

| Potential estimated savings (spending)* | $ 95,336 | $ 304,103 |

Notes: (1) The data for the cost per recipient only include the average capitation rate per recipient in Arizona and the average claim cost per recipient in Kentucky. The data do not include additional administrative costs for claims or capitation payment processing. Therefore, the savings from decreased State Children's Health Insurance Program (SCHIP) enrollment and increased spending because of increased enrollment in other public programs may be underestimated. (2) This analysis excludes potential changes in state spending due to increases in the number of uninsured children and changes in administrative costs due to possible changes in churning in and out of public coverage.

The estimates of budget savings in Scenario 2 and Scenario 3 depend in large part on our time-series estimates of enrollment changes presented in Table 2. These time-series enrollment changes are estimated with such imprecision (lacking statistical significance at conventional levels in some cases) that they should not be treated as definitive, but rather suggestive of what may possibly happen as a result of the introduction of a premium. These estimates also are imprecise because no hard evidence is available to estimate the cost of covering children in these different categories.

Sources: (1) Financial data on premium collections and average recipient costs. State Fiscal Year 2005 and 2006 in Arizona and State Fiscal Year 2005 in Kentucky. (2) Tabulations of monthly administrative enrollment data from Arizona and Kentucky, 2001–2005.

Scenario 2 weakens our assumption of no behavioral response by allowing premium-paying SCHIP enrollment to fall as the result of a premium (without enrollment changes in other eligibility categories). Scenario 3 further allows enrollment to change in other eligibility categories (nonpremium-paying SCHIP and Medicaid) as well. Given the imprecision of the time-series estimates, particularly for the nonpremium eligibility categories, there is considerable imprecision around these budget analyses. There is also a concern about bias, as the validity of the estimates hinges on making accurate assumptions of how average costs would change following a given enrollment change. In addition, as noted above, information is lacking on the possible budget impacts of any increases in the uninsured that result from the premium (Selden and Hudson 2005). Finally, the average cost per recipient includes only the average capitation rate in Arizona and the average claims cost per recipient in Kentucky. Administrative costs involved in processing claims or capitation payments are not included. Therefore, the savings from reduced SCHIP premium-paying enrollment may be greater than what is reported. Likewise the spending caused by enrollment increases in other public programs also may be higher. Notwithstanding these concerns, we present tentative estimates to provide a sense for the possible magnitude of the budgetary impact of premiums.

Under Scenario 2, Arizona's spending would fall by an additional $370,781 due to decreased premium-paying SCHIP enrollment. These savings are derived by multiplying the reduction in enrollment predicted in Table 2 of 1,155 children times the average annual cost of coverage borne by the state. Thus the projected total savings for Arizona under Scenario 2 is $679,159. Under Scenario 3 this decrease is offset by $583,823 in additional expenses due to increased SOBRA enrollment (which is estimated in a similar fashion as above, using the average annual cost of coverage to the state and the time series results to predict enrollment changes in these other categories). Therefore, Arizona's savings decrease to $95,336 under Scenario 3. This analysis may overstate savings in Arizona, as we were only able to observe children in the SOBRA component of Medicaid, whereas enrollment may have increased in other nonpremium-paying enrollment categories as well.17

In Kentucky, under Scenario 2, spending would fall by an additional $885,740 due to decreased KCHIP III enrollment, generating a total savings of $1,300,939. Under Scenario 3, we estimate that these decreases are offset by $996,836 in annual expenses due to increases in KCHIP II and Medicaid enrollment. Thus, under Scenario 3, the KCHIP III premium would reduce annual state spending by $304,103.18

POLICY IMPLICATIONS

This research finds that the imposition of nominal premiums on families between 101 and 200 percent of the FPL led to decreases in monthly premium-paying SCHIP caseloads. Our time-series analysis indicates that premiums reduced the average monthly caseload in the premium-paying enrollment category by over 1,000 children in Arizona and by over 3,000 children in Kentucky. Our hazard analysis suggests that this is due in part to more rapid disenrollment in the premium-paying category, but that these effects were concentrated in the first 2 or 3 months following the imposition of the premium. In contrast, the effects on total caseload lasted for a longer time period and were not concentrated in those early months.

Other research indicates that many low-income children with public coverage lack access to employer-sponsored coverage (Kenney and Cook 2007). Thus, it is likely that the new premiums in Arizona and Kentucky may have left some children without health insurance coverage, which in turn could have adverse effects on their access to care and compromise their health. Prior research in Oregon, where public premium increases were implemented for poor adults, indicated that the majority of the adults who disenrolled from the program became uninsured and that many experienced problems accessing health care (Wright et al. 2005).

At the same time that the new premium may have caused some children in both states to go without insurance coverage, most enrollees appeared to have been unaffected by the imposition of the new monthly premiums which were $10–$15 per family in Arizona for families between 101 and 150 percent of the FPL and $20 per family in Kentucky for families between 151 and 200 percent of the FPL. Moreover, there was some evidence that the premiums may have led to increased enrollment in other categories of public coverage that do not require premiums. The strongest evidence of this spillover effect was in Kentucky, where the time-series models indicated that the new premium increased enrollment in the nonpremium-paying category of SCHIP, which covers families in the income band just below those who faced the premium. Other models had findings that were consistent in direction, but their magnitude could not be measured with much certainty. For these children, the premiums may not have affected whether they had public coverage so much as the category of coverage in which they were enrolled.

While imposing nominal premiums may reduce state outlays, the projected savings to the state appear to be small relative to total state SCHIP spending. In both states, the maximum amount of state-level savings implied by this analysis represented just 1.2 percent of SCHIP spending in Arizona and 6.8 percent of SCHIP spending in Kentucky. If premiums increase enrollment in other programs (as suggested by this research), that would further limit the savings that states experience. These results highlight the usefulness of comprehensive state administrative data and state-specific evaluations to inform policy debates over program design issues such as the premium schedules. The increased flexibility afforded states over program design calls for additional evidence on the impacts of alternative design choices.

This analysis has a number of methodological limitations. First, the time-series estimates, while they are essential to understanding the full impacts of premiums on state and federal spending levels, are not very reliable. Obtaining more precise estimates of the behavioral responses to premiums and the effects on service delivery costs is important as they can exceed or negate the direct savings generated through the collection of premiums. In particular, there is concern that we have overstated the savings to states associated with premiums as there is evidence the premiums disproportionately affect healthier children and that they lead to higher uninsurance, factors that are not captured in our estimates (Selden and Hudson 2005; Herndon et al. forthcoming). Second, the short duration of the post period is a problem particularly in Kentucky where we only had 9 months of data for estimating the hazard models. Third, while we considered a broader set of outcomes than in previous studies, in future work, it will be important to assess premium impacts more comprehensively using complete data on enrollment in Medicaid and different SCHIP enrollment categories. Our analysis is limited to disenrollment and re-enrollment effects for those leaving premium-paying SCHIP, but it is also important to consider whether the premium affected reenrollment rates for those leaving Medicaid or transfers from Medicaid to SCHIP.

Our results suggest that states will not generate significant savings from nominal premiums. Moreover, it appears that even very small premiums could leave some children without public coverage, many of whom would lack insurance coverage altogether. Achieving more substantial savings would require charging much higher premiums, particularly for children with family incomes below 150 percent of the FPL, as they constitute 70 percent of all children who have public coverage (unpublished tabulations from the 2005 Current Population Survey). The NGA proposal from August 2005 would have permitted premiums as high as 5 percent of total family income between 101 and 150 percent of the FPL for some children (National Governors Association 2005). Such premium increases threaten an even greater increase in the ranks of the uninsured as many of these lower-income families have trouble meeting their basic needs and lack access to affordable employer-sponsored coverage (Kenney, Hadley, and Blavin 2007).

Given the likely ongoing pressure to rein in federal and state spending on Medicaid and SCHIP, it will be important for states to identify cost-savings approaches to help defray these costs that do not have adverse effects on low-income children. While judicious increases in premiums for low-income children may constitute a small part of the solution, they are unlikely to yield substantial savings unless they significantly reduce caseloads, which in turn would have negative effects on the health and development of children.

Acknowledgments

This research was funded by the David and Lucille Packard Foundation. The authors appreciated the data and support provided by staff of the Arizona Health Care Cost Containment System (AHCCCS) and by Kim Van Pelt of the Children's Action Alliance. We also appreciate the data and assistance provided by J. S. Butler and Jeff Talbert of the University of Kentucky and staff at the Kentucky Cabinet for Health and Family Services. The authors also appreciated research assistance provided by Matt Pantell of the Urban Institute, and acknowledge the helpful comments and suggestions of Sharon Long and Gene Lewit and two anonymous reviewers.

Portions of this research were completed while James Marton was a faculty member at the Martin School of Public Policy and Administration at the University of Kentucky and while he was a postdoctoral research associate at the Taubman Center for Public Policy at Brown University.

Disclosures: None

Disclaimers: None

NOTES

1. Children under age 1 are included in this income category of KidsCare if their family income is between 141 and 150 percent of the FPL. In Arizona, Medicaid covers children under age 1 up to 140 percent of the FPL, children ages 1–5 up to 133 percent of the FPL, and children ages 6–18 up to 100 percent of the FPL.

2. The premiums in Arizona are $20 per month for one child or $30 per month for two or more children for children with family incomes between 151 and 175 percent of the FPL. For children with family incomes between 176 and 200 percent the premiums are $25 per month for one child or $35 per month for two or more children. We did not analyze caseload changes for these higher-income categories because multiple premium increases were made and the first premium increase was introduced early in the analysis period.

3. In Kentucky, Medicaid thresholds are 185 percent of the FPL for children under age 1, 133 percent of the FPL for children ages 1–5, and 100 percent of the FPL for children ages 6–18.

4. For Arizona, the time period for the time-series model was April 2002 to October 2005. The time period for the disenrollment and reenrollment hazard models was April 2002 to November 2005. For Kentucky, the time frame of the time-series model was November 2001 to August 2004 and the time frame of the disenrollment and reenrollment hazard models was December 2001 to August 2004.

5. Enrollment status categories are previously enrolled in Medicaid, previously enrolled in the nonpremium-paying category of SCHIP, or not enrolled previously in any type of public coverage.

6. The Arizona Business Conditions Index is a diffusion index that measures either increases or decreases in the level of economic activity. A reading above 50 indicates a growing economy in Arizona while a reading below 50 indicates a decline in economic activity.

7. In Cox models, the effects of time are captured by the baseline hazard, which is typically not estimated.

8. Because of the large number of counties in Kentucky, we used state-defined Area Development Districts to control for regional effects.

9. Data were not available to analyze Medicaid children with incomes under 101 percent of the FPL in Arizona.

10. Monthly dummy variables were included to control for possible seasonal variation in caseloads and because of annual redefinitions in FPLs, which occur in April in both states, that lead to some children transferring from premium-paying into nonpremium-paying categories.

11. The SCHIP federal matching rates are 77 and 79 percent and the Medicaid federal matching rates are 67 and 70 percent in Arizona and Kentucky, respectively.

12. KidsCare recipients in the 101–150 percent category could have outstanding premiums from prior enrollment in another KidsCare category.

13. We also considered if the way the child exited premium-paying SCHIP was associated with reenrollment rates. Except for transfers to Arizona's Medicaid program, we found that children who exited public coverage altogether reenrolled in premium-paying SCHIP at much lower rates than children who exited to other public coverage. For example, in Arizona the rate of reenrollment for children who transferred into other SCHIP categories is 91 percent higher than the rate for children who exited public insurance. This difference is even larger in Kentucky. Children who exited to Medicaid in Arizona were nearly 20 percent less likely (p<.01) to reenroll in premium-paying SCHIP than children who exited public insurance.

14. The time-series findings are consistent with trends in monthly caseload data in both states. In Arizona, the monthly caseload declined 16.4 percent 6 months after the new premium. In Kentucky, the monthly caseload declined 18.2 percent 6 months after the new premium.

15. There was a high level of auto-correlation in the time-series models, and in some cases there was still high auto-correlation even after using the Cochrane–Orcutt method to correct the problem. For other models, trying to correct for auto-correlation led to nonconvergence.

16. Net federal and state savings from premium collections in Arizona were $1,351,349, which was 0.5 percent of total federal and state SCHIP spending of $265.5 million. For Kentucky, net federal and state savings from premium collections was $1,951,121, which was 2.2 percent of total federal and state SCHIP spending of $89.9 million.

17. Under Scenario 2 in Arizona, combined federal and state savings are $2,976,157. For Scenario 3, combined federal and state savings in Arizona are $1,182,538.

18. Under Scenario 2 in Kentucky, combined federal and state savings are $6,113,433. For Scenario 3, combined federal and state savings in Kentucky are $2,591,673.

Supplementary material

The following supplementary material for this article is available:

Demographic and Span Data for Disenrollment and Reenrollment Hazard Models.

This material is available as part of the online article from: http://www.blackwell-synergy.com/doi/abs/10.1111/j.1475-6773.2007.00772.x (this link will take you to the article abstract).

Please note: Blackwell Publishing is not responsible for the content or functionality of any supplementary materials supplied by the authors. Any queries (other than missing material) should be directed to the corresponding author for the article.

REFERENCES

- Fox HB, Limb SJ. SCHIP Programs More Likely to Increase Children's Cost-sharing Than Reduce Their Eligibility or Benefits to Control Costs. Washington, DC: Maternal and Child Health Research Center; 2004. [Google Scholar]

- Herndon JB, Vogel B, Bucciarelli R, Shenkman E. Forthcoming. The Effect of Premium Changes on SCHIP Enrollment Duration.”Health Services Research. [DOI] [PMC free article] [PubMed]

- Kenney G, Allison R, Costich J, Marton J, McFeeters J. The Effects of Premium Increases on Enrollment in SCHIP Programs. Findings from Three States. 2007;43(4):378–92. doi: 10.5034/inquiryjrnl_43.4.378. Inquiry. [DOI] [PubMed] [Google Scholar]

- Kenney G, Cook A. “Coverage Patterns among SCHIP-Eligible Children and Their Parents.”. [2007 March 21]. Available at http://www.urban.org/UploadedPDF/311420_Coverage_Patterns.pdfHealth Policy Online No. 15. Washington, DC: The Urban Institute.

- Kenney G, Hadley J, Blavin F. The Effects of Public Premiums on Children's Health Insurance Coverage. Evidence from 1999 to 2003. 2007;43(4):345–61. doi: 10.5034/inquiryjrnl_43.4.345. Inquiry. [DOI] [PubMed] [Google Scholar]

- Marton J. The Impact of the Introduction of Premiums into a SCHIP Program. Journal of Policy Analysis and Management. 2007;26(2):261–79. doi: 10.1002/pam.20248. [DOI] [PubMed] [Google Scholar]

- National Governors Association (NGA) “Short-Run Medicaid Reform”. [2007 March 21]. Available at http://www.nga.org/Files/pdf/0508MEDICAIDREFORM.PDF.

- Selden T, Hudson J. How Much Can Really Be Saved by Rolling Back SCHIP? The New Cost of Public Health Insurance for Children. Inquiry. 2005;42(1):16–28. doi: 10.5034/inquiryjrnl_42.1.16. [DOI] [PubMed] [Google Scholar]

- Shenkman E, Vogel B, Boyett J, Naff R. Disenrollment and Re-enrollment Patterns in SCHIP. Health Care Financing Review. 2002;23(5):47–63. [PMC free article] [PubMed] [Google Scholar]

- Smith V, Rousseau D. “SCHIP Enrollment in 50 States: December 2004 Update.”. Publication No. 7348. Washington, DC: Kaiser Commission on Medicaid and the Uninsured.

- Wright B, Carson M, Smith J, Edlund T. Impact of Changes to Premiums, Cost-Sharing, and Benefits on Adult Medicaid Beneficiaries: Results from an Ongoing Study of the Oregon Health Plan. New York: The Commonwealth Fund; 2005. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Demographic and Span Data for Disenrollment and Reenrollment Hazard Models.