Abstract

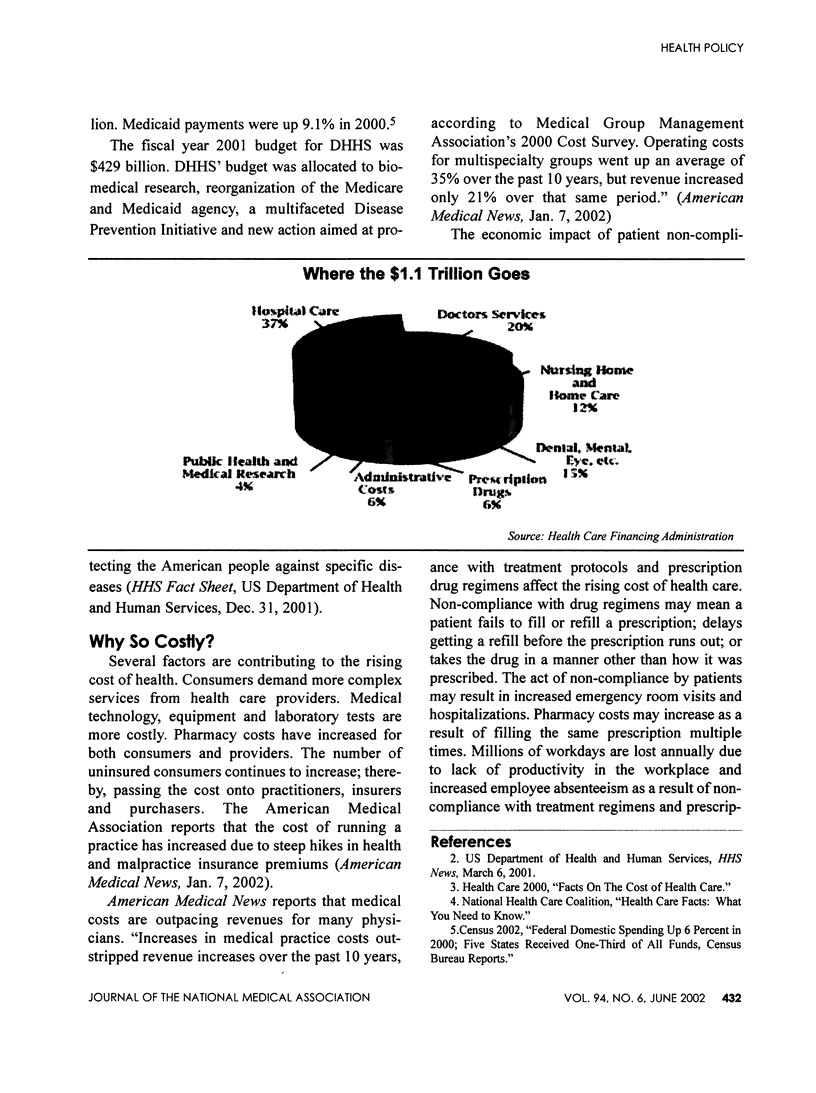

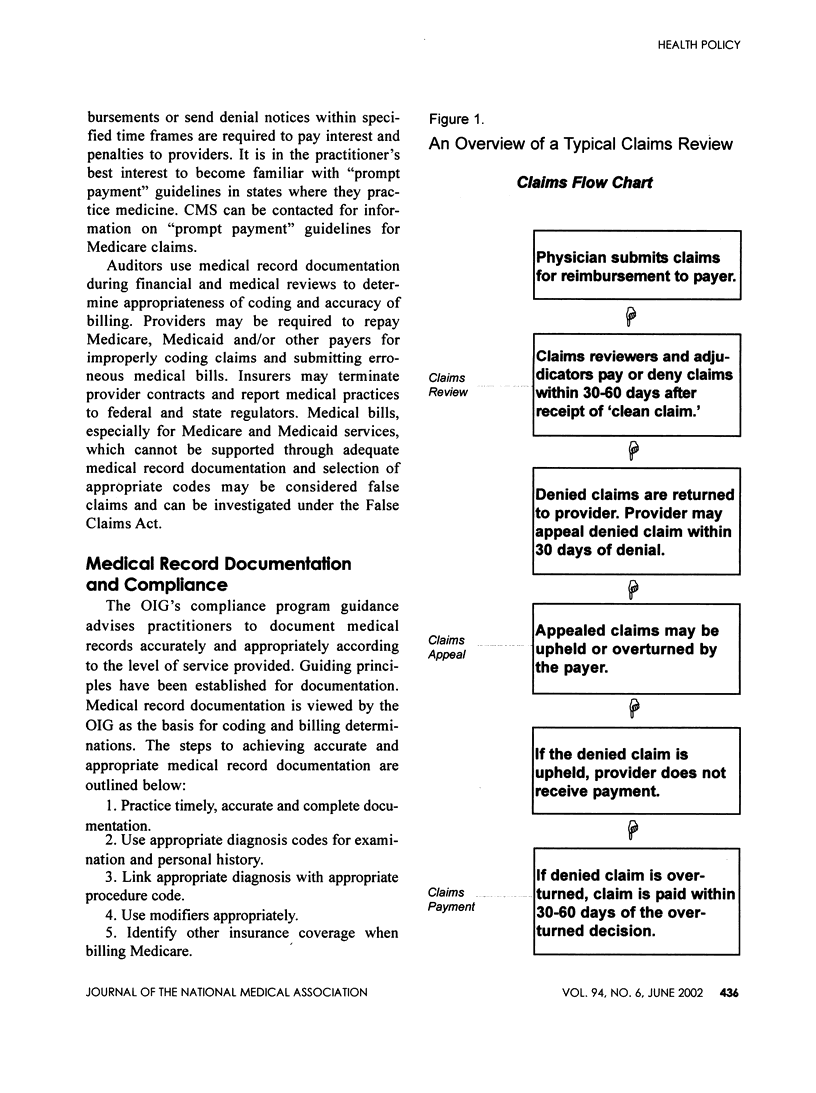

Medical practice today, more than ever before, places greater demands on physicians to see more patients, provide more complex medical services and adhere to stricter regulatory rules, leaving little time for coding and billing. Yet, the need to adequately document medical records, appropriately apply billing codes and accurately charge insurers for medical services is essential to the medical practice's financial condition. Many physicians rely on office staff and billing companies to process their medical bills without ever reviewing the bills before they are submitted for payment. Some physicians may not be receiving the payment they deserve when they do not sufficiently oversee the medical practice's coding and billing patterns. This article emphasizes the importance of monitoring and auditing medical record documentation and coding application as a strategy for achieving compliance and reducing billing errors. When medical bills are submitted with missing and incorrect information, they may result in unpaid claims and loss of revenue to physicians. Addressing Medical Audits, Part I--A Strategy for Achieving Compliance--CMS, JCAHO, NCQA, published January 2002 in the Journal of the National Medical Association, stressed the importance of preparing the medical practice for audits. The article highlighted steps the medical practice can take to prepare for audits and presented examples of guidelines used by regulatory agencies to conduct both medical and financial audits. The Medicare Integrity Program was cited as an example of guidelines used by regulators to identify coding errors during an audit and deny payment to providers when improper billing occurs. For each denied claim, payments owed to the medical practice are are also denied. Health care is, no doubt, a costly endeavor for health care providers, consumers and insurers. The potential risk to physicians for improper billing may include loss of revenue, fraud investigations, financial sanction, disciplinary action and exclusion from participation in government programs. Part II of this article recommends an approach for assessing potential risk, preventing improper billing, and improving financial management of the medical practice.

Full text

PDF