Abstract

A national formulary has been proposed as a priority element of Canada’s National Pharmaceuticals Strategy. We review a variety of formulary-based policies that might be used in conjunction with a national formulary, drawing on the policies and practices of the Pharmaceutical Management Agency of New Zealand. We consider the potential price impact of an actively managed national formulary by conducting a Canada–New Zealand price comparison for equivalent products in the four largest drug classes: statins, angiotensin-coverting enzyme (ACE) inhibitors, selective serotonin reuptake inhibitors (SSRIs) and proton pump inhibitors (PPIs). The results suggest that potential price savings for Canada in these drug classes are on the order of 21% to 79%. Such price differences would translate into billions of dollars in annual savings if applied across Canada, potentially offsetting the costs of the expansion of pharmacare coverage necessary to achieve both equity and efficiency goals in this sector.

Abstract

Un formulaire national a été proposé comme élément prioritaire de la Stratégie nationale relative aux produits pharmaceutiques du Canada. Nous examinons une variété de politiques axées sur des formulaires, qui pourraient être utilisées conjointement avec un formulaire national, puisant dans les politiques et les pratiques de la Pharmaceutical Management Agency de Nouvelle-Zélande. Nous examinons l’incidence potentielle, sur les prix, d’un formulaire national géré de façon active en effectuant une comparaison des prix entre le Canada et la Nouvelle-Zélande pour des produits équivalents dans les quatre plus importantes catégories de médicaments : les statines, les inhibiteurs ECA, les inhibiteurs spécifiques du recaptage de la sérotonine et les IPP. Les résultats suggèrent que le Canada pourrait réaliser des économies de l’ordre de 21 à 79 % pour ces catégories de médicaments. De telles différences de prix se traduiraient par des milliards de dollars d’économies annuelles si elles étaient appliquées à l’échelle du Canada, ce qui suffirait potentiellement à couvrir les coûts d’extension de l’assurance-médicaments nécessaire pour réaliser des gains d’équité et d’efficience dans ce secteur.

The creation of a common list of drugs to be covered under Canada’s many pharmacare programs (i.e., a national formulary) is a priority element of Canada’s National Pharmaceuticals Strategy (NPS) (Canada 2004; NPS 2006). Currently, federal, provincial and territorial drug plans all operate their own formularies, and these lists of benefits have been shown to vary widely across jurisdictions (Anis et al. 2001; Gregoire et al. 2001; MacDonald and Potvin 2004; Ungar and Witkos 2005). Creating a common list of benefits for pharmacare programs might provide equity in terms of medicines available for public coverage across Canada. However, given that decision-makers will not always agree on which drugs should be covered for their constituents, harmonizing the list of benefits under different pharmacare programs will impose costs on regional decision-makers (Birch and Gafni 2004). Whether savings generated through formulary-based expenditure management policies could offset these costs will be an important consideration for federal, provincial and territorial governments considering participation in a common formulary.

In this paper, we explore how expenditure management policies associated with a national formulary might promote savings on specific products or product classes. We review a variety of formulary-based policies as applied by the Pharmaceutical Management Agency of New Zealand (PHARMAC), which is given much of the credit for New Zealand’s remarkable success in managing pharmaceutical expenditure while maintaining universal access to medically necessary pharmaceuticals over the past 14 years (Braae et al. 1999; Davis 2004). To illustrate the potential magnitude of savings generated through an actively managed national formulary, we compare prices for Canadian pharmaceuticals to those in New Zealand. We focus this price comparison on four of the largest long-established therapeutic categories, because it is in such categories of medicine that sufficient savings might be found to offset the cost of harmonizing coverage for new, breakthrough medicines across pharmacare programs. We conclude with comments on the practicality of a national formulary for Canada and the political choices that would be required to establish one that promoted both equity and efficiency goals.

Formularies as Management Tools

In the community setting, the traditional role of a formulary has been passive: to define and list the drugs that will or will not be reimbursed under a specific drug plan. However, drug benefit plans are increasingly applying a range of formulary-based policies similar to formulary management practices used in hospitals. Hospital formularies have long been used to identify drugs available for use, to secure price discounts for drugs purchased and, often, to specify conditions under which a physician may prescribe certain drugs for patients. Community-based formularies are increasingly being used in these ways. They can restrict coverage to broad classes of drug, but also to specific products within classes; they can be used as a negotiating tool when determining prices that a drug plan will pay; and they can list conditions under which a drug will be covered – even using electronic health information systems to monitor appropriateness and adjudicate claims. As such, formularies have become the backbone for many emerging expenditure management policies.

In economic terms, formularies concentrate buying power by “steering” the purchases of drug plan beneficiaries towards particular products (Garber 2001). This is because drugs that are “on formulary” are available at lower cost to the patient than drugs that are “off,” and because certain drugs on the formulary may be available at lower cost to patients than others. It is common among American formularies, for example, to list only one or two products within otherwise large drug classes or to provide select manufacturers with a “preferred” listing under which patient co-payments are significantly lower than co-payments for competing products (Malkin, Goldman et al. 2004; Quinn and Barisano 1999). Where there are multiple products in a given therapeutic submarket, being listed on a formulary gives a manufacturer a significant advantage in terms of potential sales volume. This is particularly true when a formulary is run by large drug plans, where the terms of coverage are more likely to be known by prescribers (Shih and Sleath 2004). When a formulary is national in scope, potential inclusion on a formulary is a very powerful incentive for manufacturers to price their products competitively (Braae et al. 1999; Huskamp et al. 2003).

National formularies exist in many countries, including Australia, France, Italy, Sweden, New Zealand and the United States (Veterans Affairs). In the sections that follow, we outline various policies used to manage New Zealand’s national formulary. Though on a smaller scale than would be the case for Canada, New Zealand’s experience illustrates the potential for coordinating formulary-based policies across regions that separately finance pharmaceutical expenditures for populations in their catchment areas. We also believe that the NZ experience illustrates the breadth of formulary-based policies that can be used to manage expenditure.

New Zealand’s Formulary-Based Policies

New Zealand’s healthcare system involves universal public health insurance provided through 21 District Health Boards that, not unlike regional health authorities in Canadian provinces, are responsible for the funding and provision of a range of primary and secondary health services for residents in their catchment areas. Unlike Canadian regional health authorities, the District Health Boards also pay for medicines. Specifically, District Health Boards must provide the drug subsidies listed in the national Pharmaceutical Schedule (PHARMAC 2005). Approximately 80% of all pharmaceutical expenditures in New Zealand are funded in this way, with the balance consisting of patient co-payments and charges for drugs not listed on the Pharmaceutical Schedule (Braae et al. 1999; Davis 2004).

PHARMAC was established in 1993 as a non-profit agency governed by the District Health Boards. While its corporate status has changed over the years (it is currently a Crown Entity), PHARMAC has always remained accountable to the public (by way of the District Health Boards and/or the Minister of Health). The District Health Boards established PHARMAC to improve the management of the national Pharmaceutical Schedule and to keep year-to-year pharmaceutical expenditures within predetermined budget targets. They had incentive to do so because District Health Boards must finance any prescription drug cost overruns – which had become common by the early 1990s – out of revenues that would otherwise pay for other healthcare services, such as hospitals or primary care. In addition to having incentive to seek pharmaceutical cost savings, District Health Boards would also bear health system costs associated with excessive pharmaceutical expenditure reductions, e.g., increased hospitalizations if access to necessary medicines was impeded.

In order to meet budgetary goals, PHARMAC employs a variety of formulary-based expenditure management tools on behalf of the District Health Boards. First and foremost, PHARMAC makes product listing decisions based on nine decision criteria, including the health needs of all eligible New Zealanders; product safety, efficacy and cost; and the availability and suitability of existing medicines (PHARMAC 2006). PHARMAC’s coverage decisions are informed by guidance provided by a Pharmacology and Therapeutics Advisory Committee that, like Canada’s Canadian Expert Drug Advisory Committee, is composed of medical clinicians who provide advice on population health needs and the pharmacological and therapeutic benefits of pharmaceuticals for community use (Morgan, McMahon et al. 2006). When a product is deemed to meet a health need of the population safely and effectively, relative cost-effectiveness (vis-à-vis existing alternatives) becomes a primary consideration for PHARMAC.

The cost-effectiveness of a product is profoundly influenced by its price. Once a drug has been developed, and particularly after it has been marketed for many years, there is relatively little that a manufacturer can do to change the clinical evidence concerning whether and to what extent the product meets the health needs of a population. What a manufacturer can change is price.

If a clinically effective product is offered at a price that reflects comparative value-for-money in the NZ context, it will be listed on the Pharmaceutical Schedule. For PHARMAC, determining the price at which comparative value is reached is a matter of negotiation. What distinguishes the related policies of PHARMAC from extant negotiations of Canada’s drug plans is the breadth and consistency with which PHARMAC’s policies are used to negotiate prices that reflect value and the consolidated negotiating power that the single management agency has – there are no opportunities for “whipsawing” in the context of New Zealand’s public drug coverage.

Rebates and Discounts: Because many countries use international comparisons when determining eligible prices for drugs, and many others seek foreign sources of products for import, pharmaceutical manufacturers often prefer to provide price reductions through rebates and other forms of discount that are not reflected in posted prices. PHARMAC commonly uses negotiated rebates and discounts to achieve a cost-effective price without affecting the manufacturer’s international list price. Similar techniques are widely used within multi-payer markets, most notably in the United States (US General Accounting Office 2000). Expenditure caps are among PHARMAC’s methods for securing rebates. These act as risk-sharing agreements that ensure that if sales of a listed product exceed an agreed-upon level, the manufacturer is responsible for covering all or part of excess costs. The manufacturer thereby has the opportunity to achieve sales volume targets, while the purchaser is protected against unforeseen or excessive costs.

Package Agreements: Package agreements (also called cross-product, cross-deal or bundling arrangements) are also used to negotiate product listings by way of considering the prices of suites of products offered by firms. PHARMAC may agree to list a certain new drug that is deemed effective but not cost-effective at the posted international price if the manufacturer agrees to discount one or more of its other currently listed drugs. The new product then becomes cost-effective in the NZ context because the “true” price will be the posted international price less the implicit discount given through the package agreement; this makes it possible for PHARMAC to provide the new drug within its overall budget while allowing the manufacturer to post its international price (Davis 2004; PHARMAC 2006).

Tendering Sole-Supply: When products are off-patent – and therefore available through both brand-name and generic suppliers – PHARMAC will tender contracts for supply. Tenders offer fixed-term contracts for the supply of a specific medicine. The contracts are awarded based on a bidding (tendering) system, and guarantee the winning manufacturer all or a significant share of the national market. PHARMAC began tendering a limited set of products shortly after its establishment in 1993 and now applies the purchasing strategy widely across off-patent drug purchases. Because of the incentives created through these auction-style contracts for sole-source supply, tendering of drug purchases can drive prices down substantially, often to “commodity pricing” levels that are a hallmark of perfect competition and economic efficiency. Moreover, it is often original brand-name manufacturers that win contracts for supplying medicines at such prices.

Reference Pricing: With off-patent drugs priced competitively, significant variation in cost (and therefore cost-effectiveness) can arise within therapeutic submarkets. Newer, patented drugs may be priced at levels that make them comparatively unattractive, given the value inherent in the low-cost alternatives within class. Under such circumstances, reference pricing is used to engender price competition between patented and non-patented alternatives while allowing for choice within therapeutic submarkets. Reference pricing sets the public subsidy for drugs within a therapeutic subgroup at a level determined by low-cost alternatives within that subgroup. Patients are fully covered for products priced competitively with the low-cost alternatives, but are required to pay the excess cost if they wish to use drugs priced above the reference-based subsidy.

There are three market outcomes that can occur under such reference pricing policies: (1) firms choose to price at a level that is competitive with the reference price, (2) patients choose to switch to those products that are priced at or below the reference price or (3) patients choose to pay the difference for products that remain above the reference price. In established therapeutic markets where there are multiple off-patent (and therefore tendered) products, the threat of patients switching to fully covered products is sufficient to force new, patented products to price competitively. Where patients may be required to switch away from high-cost options in a therapeutic subgroup, there may be controversy surrounding the similarity of drugs. PHARMAC has responded to this situation by developing an extensive system of exemptions for patients needing drugs other than those covered by the reference pricing policy (PHARMAC 2006).

Contracts: The final formulary-based policy applied by PHARMAC is the contract. PHARMAC contracts for virtually all of its listed products to ensure that the manufacturer supplies the product on an ongoing basis. As part of a negotiation, terms of a contract can be used to exchange a current price reduction for protection against the future use of certain saving tools. For example, a manufacturer may agree to list its product at a lower price today in exchange for protection against reference pricing or other forms of price negotiation for a given period of time into the future.

Comparing Prices in New Zealand and Canada

To illustrate the potential impact of an actively managed national formulary on prices within established drug classes, we conducted a Canada–New Zealand price comparison. This comparison was restricted to the four largest established drug classes in Canada: HMG CoA reductase inhibitors (statins), angiotensin-converting enzyme inhibitors (ACE inhibitors), selective serotonin reuptake inhibitors (SSRIs) and proton pump inhibitors (PPIs). These drugs are primarily used to treat relatively common conditions: high cholesterol, high blood pressure, depression and ulcers/heartburn, respectively. They account for approximately one-third of retail expenditure on prescription drugs in Canada (Morgan, McMahon et al. 2005). These drug classes were first established with products launched in 1981 (ACE inhibitors), 1987 (statins, SSRIs) and 1989 (PPIs).

Given the age and size of the drug categories selected for study here, standard economic theory would predict significant opportunity for price competition within them, particularly given that pioneering brands within these classes are no longer protected by patent (Tirole 1988). However, research has found that producers of comparable prescription drugs often compete on advertising (or brand differentiation) rather than on price (Canada 1985a,b; Grabowski and Vernon 1992; Frank and Salkever 1997; Berndt et al. 2002). To the extent that the formulary-based management tools outlined above promote competition based on prices within therapeutic categories that would not otherwise occur, New Zealand’s prices for these products are expected to be lower than those found in Canada.

Price comparison methods

Price information for New Zealand was obtained from the 2005 Pharmaceutical Schedule managed by PHARMAC. These prices were adjusted to include mark-ups and discounts using information obtained from PHARMAC. We explored three exchange rates for currency conversion: the geometric mean of Bank of Canada daily spot rates for 2005 (NZ/CAD=1.147), the 2005 exchange rate reported by the OECD (NZ/CAD=1.176) and the 2005 Purchasing Power Parity rate reported by the OECD (NZ/CAD=1.174) (OCED 2006). To bias towards overreporting NZ prices (by 3%), prices were converted to Canadian dollars using the Bank of Canada rate.

There are no Canadian sources of national drug price and consumption information that would be comparable to the PHARMAC pricing information. The best available market-level data (from IMS Health Canada, Inc.) are limited to wholesale prices or retail prices that include pharmacists’ professional fees. Canadian price information was therefore obtained from a recent study of drug costs in British Columbia, one of the few provinces having the necessary population-level data (Morgan, Schaub et al. 2005). These data were for 2004 retail prices, including mark-ups, and pertain to both private and public drug purchases. Pricing policies of the Patented Medicine Prices Review Board and the provincial drug benefit plans – e.g., the government drug plan in Quebec (Morgan et al. 2003) – ensure that average retail drug prices do not differ significantly across provinces (Morgan 2004). The prices charged per unit of drug in British Columbia are therefore expected to be reasonably representative of Canadian prices.

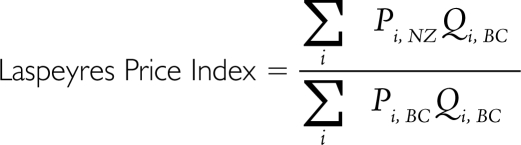

A price index formula is required in order to compare prices of multiple goods across jurisdictions. An unweighted average of price differences could overreport effective differences if, for example, there were very large price discrepancies for drugs that are not commonly used by the local population. To avoid this situation, we conducted price comparisons using Laspeyres price indexes, arguably the most commonly used price index formula. A Laspeyres price index weights differences in prices for each product according to the share of domestic (British Columbian) expenditure on that product. This provides an estimate of the overall price differential. The Laspeyres price index has a particularly convenient interpretation because it reports how much lower local (BC) expenditure would be if the goods that we purchase were available at foreign (NZ) prices, after taking into account exchange rate conversions.

The mathematical formula is as follows, where Pi,NZ stands for the New Zealand price of each individual drug product (i) in the price index and Qi,BC stands for the BC quantity of the type of given drug product:

|

There are three forms of potentially conservative bias associated with the BC data used in this price comparison. First, prices in British Columbia have been increasing slightly over time (Morgan, Schaub et al. 2005), so the use of 2004 data for Canadian prices will tend to understate any price differences between the two countries.

Second, the Laspeyres price index is known to understate price differences from the perspective of cost of living (or cost of providing healthcare) (Diewert 1993). Specifically, our results will understate the relative savings available in Canada because the Laspeyres index is based on a fixed basket of products (the BC mix, as we found it). In fact, we would expect formulary-based policies to steer utilization towards the products for which the lowest prices are negotiated. By not attempting to account for such extra savings in this study, we almost certainly underestimate the potential use-weighted price differences (and expenditure differences) that would emerge in the face of a New Zealand–like formulary policy in British Columbia.

The third and final conservative bias stems from the prevailing patterns of drug use in British Columbia vis-à-vis the rest of Canada. The province represents what might be the “best case” for Canada in terms of controlled spending in the therapeutic categories studied here, because BC PharmaCare applies reference pricing to ACE inhibitors and PPIs. The government does not negotiate low prices through its reference pricing, but the policies do steer utilization towards products of lower cost (within the Canadian pricing context). Because of these three forms of bias, our study results represent conservative estimates of price differences between New Zealand and Canada.

Prices were compared only for products that matched in terms of active ingredient(s), dose, form and, where applicable, brand or manufacturer. Several submarkets of each drug class were analyzed. We compared the prices of brand-name drugs that were available in both British Columbia and New Zealand. We also compared generic drug prices (though we did not require that the generic manufacturer be identical). Finally, because PHARMAC’s tendering usually lists only one supplier for off-patent drugs, and because this supplier is often the brand-name firm, we also compared average prices paid for the combined sales of brand and generic versions of equivalent drugs (identified by ingredient, form and strength). In effect, this latter form of comparison makes tendered brand-name products in New Zealand the comparators for Canadian generics when a product is multisourced in British Columbia; it has no impact on the way domestic and foreign prices are compared for drugs that are patented or otherwise single-sourced in Canada.

Price comparison results

Table 1 lists average price differences between New Zealand and British Columbia for ACE inhibitors, SSRIs, PPIs, statins and for all four of these drug classes combined. Because prices were compared only for matching BC and NZ products, the price comparisons reflect differing shares of the BC market. Table 1 therefore lists the percentage of BC expenditure in the relevant submarket (e.g., the submarket of brand-name ACE inhibitors) for which there are matching BC and NZ products; the remaining share of a given submarket is expenditure on products sold in British Columbia for which an identical dosage form of the drug could not be found on New Zealand’s Pharmaceutical Schedule.

TABLE 1.

Comparison of New Zealand and British Columbia prices for ACE inhibitors, SSRIs, statins and PPIs*

| ACE Inhibitors | SSRIs | Statins | PPIs | All 4 Classes | |

|---|---|---|---|---|---|

| Brand-Name Products | |||||

| Matched products as a share of BC expenditure | 25% | 0% | 62% | 31% | 36% |

| Price difference for matched products | –78% | 0% | –45% | –15% | –45% |

| Generic Products | |||||

| Matched products as a share of BC expenditure | 1% | 52% | 18% | 0% | 16% |

| Price difference for matched products | –93% | –32% | –91% | 0% | –58% |

| Brand or Generic Products | |||||

| Matched products as a share of BC expenditure | 34% | 63% | 82% | 34% | 57% |

| Price difference for matched products | –79% | –38% | –56% | –21% | –51% |

BC data were collected based on prices paid for all 2004 sales of products tracked through the BC PharmaNet. New Zealand price data for 2005 were collected from PHARMAC and were adjusted for exchange rates. All prices exclude pharmacists’ professional fees but include relevant wholesale and retail mark-ups. Price comparisons are weighted based on sales volumes in British Columbia. Only products of the same ingredient, form, strength and, where appropriate, brand were compared.

ACE INHIBITORS

For ACE inhibitors, the oldest of the four drug classes studied, products found in both British Columbia and New Zealand account for only a minority of BC expenditures, because ramipril products, which account for over one-half of ACE inhibitor expenditure in British Columbia, are not listed on the NZ Pharmaceutical Schedule. For those ACE inhibitors that are listed on the Pharmaceutical Schedule, however, NZ prices are a fraction of the BC cost. Brand-name ACE inhibitors in New Zealand are 78% less expensive than in British Columbia. Relatively few generic ACE inhibitors are in the NZ Pharmaceutical Schedule because brand-name manufacturers offer sufficient discounts. Those generics that are listed in New Zealand are, however, 93% less costly than their Canadian counterparts. Averaged across generic and brand versions of drugs, the price of comparable ACE inhibitor products in New Zealand is 79% lower than in British Columbia; such price differences apply to products accounting for roughly one-third of BC expenditure on ACE inhibitors.

SSRIS

Leading SSRIs are listed on the NZ Pharmaceutical Schedule, but only in generic form. Those generics that are listed in New Zealand account for over half the total expenditure on SSRIs in British Columbia, and are priced 32% lower than in BC. When the NZ prices of these SSRIs are compared to the average of both brand and generic versions in British Columbia, the difference increases to 38% and applies to almost two-thirds of the BC expenditure on SSRIs.

STATINS

The brands of statins listed on the NZ Pharmaceutical Schedule account for 62% of BC expenditures in this category. The average price of these brand-name statins is 45% lower in New Zealand than in British Columbia. Generic statins with available prices in both countries account for 18% of the BC submarket and are 91% less expensive in New Zealand. Overall, statins available in both British Columbia and New Zealand account for almost all (82%) of the BC market and are available at half the cost (priced 56% lower) in New Zealand.

PPIS

Relatively new brands of PPIs account for over two-thirds of expenditure in British Columbia and are not listed on the NZ Pharmaceutical Schedule. The average price of brands that are listed in New Zealand is 15% lower than in British Columbia. The one off-patent brand of PPI is priced 91% lower in New Zealand than in BC. Because of the lack of concordance between what is listed in New Zealand and what is used in British Columbia, potential savings from formulary-based policy in this drug class would depend on securing lower prices for the preferred products in British Columbia or steering drug utilization away from newer drugs within this class towards the off-patent product, for which tendering processes can secure prices near that of a perfectly competitive marketplace (i.e., near the cost of production and distribution).

ALL FOUR DRUG CLASSES

Overall, the average NZ price of comparable brand-name ACE inhibitors, SSRIs, PPIs and statins was 45% lower than the BC price. The average NZ price of comparable generic products in these categories was 58% below the BC price. Finally, when averaged across brand and generic versions of drugs available in both markets, prices paid in New Zealand were 51% lower than those paid in British Columbia, and this price difference applies to over half of BC expenditure on these particular drug classes.

Total expenditure implications of a managed, national formulary

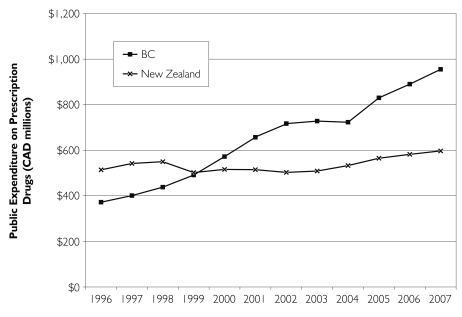

When applied on a national scale, formulary-based management tools can achieve considerable savings. New Zealand’s experience illustrates this clearly. For the period of 1996 to 2007, Figure 1 shows actual and forecast expenditures for BC PharmaCare and New Zealand’s PHARMAC. In viewing differences in expenditure levels, note that (1) the population of New Zealand (4.0 million) is approximately equal to that of British Columbia (4.1 million) and (2) PHARMAC funds roughly 80% of drug expenditures in New Zealand, while PharmaCare funds 43% of expenditures in British Columbia.

FIGURE 1.

Public drug expenditures for New Zealand and British Columbia, 1996 to 2007

Expenditure under BC PharmaCare grew at approximately 8.3% per year from 1996 to 2004 – notably less than the 11% average growth in provincial drug expenditure across Canada (CIHI 2005) – and is forecast to grow at an annual rate of 7% through 2007. In stark contrast to the BC experience, actual PHARMAC expenditures grew at a rate of 0.5% per year from 1996 to 2004 and are forecast to grow at approximately 3% per annum through 2007. As documented elsewhere, the continuous price competition created by PHARMAC’s policies has enabled New Zealand to maintain near-zero expenditure growth while drug consumption continues to rise (Braae et al. 1999; Davis 2004).

Discussion

A national formulary such as that in New Zealand can be an important component of a country’s pharmaceutical policy. In Canada, the application of formulary-based expenditure management policies may provide savings necessary to offset the costs of pharmacare harmonization and, perhaps, expansion of benefit coverage. Our analysis compared New Zealand and BC prices in the four largest, long-established prescription drug classes in Canada in order to determine the magnitude of potential savings from an actively managed Canadian formulary. Despite the fact that our methods have, in all likelihood, under-estimated the savings possible from using New Zealand–style formulary policies in Canada, our price comparisons suggest that such policies can produce significant savings in established therapeutic categories. The estimated savings ranged from 21% to 79% across the categories of statins, ACE inhibitors, SSRIs and PPIs. Given that formulary-based policies would concentrate utilization among those products that are priced most competitively, it is not unreasonable to assume that Canadian provinces and territories could save 50% or more across these four well-established therapeutic categories.

The size of the savings in the drug classes studied here suggests that drug coverage necessary to achieve equity goals could be expanded in Canada within our current drug budgets. In any drug class where formulary-based savings could be roughly 50% of current spending, harmonization and even expansion of public coverage could be funded without significant increases in what public plans already spend on related products. Almost a decade ago, the National Forum on Health identified this as a primary motivation for expanded public drug coverage in Canada: increased coverage to achieve both efficiency and equity goals (Canada 1998).

If it were simple to do, however, it would already have been done. As with virtually any program that offers benefits, there will be costs to implementing a national formulary in Canada. The most notable of these will be political.

As Evans reminds us, every dollar of healthcare expenditure is also a dollar of someone’s income (Evans 1984; Evans 1997). Not paying premium prices for drugs within established classes will mean lower revenues and profits for the manufacturers of such drugs, all else being equal. While firms will price competitively if necessary – as the New Zealand experience illustrates – sellers and shareholders invariably prefer monopoly pricing. Firms will therefore lobby government, health professionals, patient groups and the general public to try to muster opposition to any formulary-based policy that requires competitive pricing. New Zealand may have a comparative advantage here: it is a much smaller market than Canada (approximately 4 million residents), is home to no brand-name drug manufacturers, and is located very far from where most pharmaceutical companies reside. Canada, in comparison, is relatively large in terms of geography, population and economy; it has significant domestic investment by multinational drug companies, most of which is concentrated in two provinces whose support would be central to any national policy of this nature (PMPRB 2006); and it borders the United States, which is the home of most of the world’s largest drug makers (Pharmaceutical Executive 2006). These political obstacles are not trivial; nor, however, are they insurmountable.

In debates about expenditure management, it is often argued that one of the costs of price control is that it stifles innovation. This argument deserves careful consideration because few would knowingly support policies that reduce or eliminate incentives for the efficient production of truly valued innovations. In long-established therapeutic categories (like the ACE inhibitors, statins, PPIs and SSRIs studied here), the truly innovative research that led to pioneering products occurred decades ago and was rewarded during the years in which the pioneers held now-expired patents. When society continues to pay high prices for “me-too” drugs in such classes, this encourages imitation rather than true innovation. As reported by the 1984 Commission of Inquiry on the Pharmaceutical Industry, it is better to encourage price competition in established drug categories “… because this avoids the waste of resources used in imitating the [pioneering] product and in promoting the imitation” (Canada 1985: 7). New Zealand offers an example of how formulary-based expenditure management tools can encourage manufacturers to compete on price in established drug classes. Were such policies adopted more broadly on a global scale, the effect would not be to reduce true innovation. On the contrary, as recently argued by the Office of Fair Trade in the UK, such value-based pricing and reimbursement policies would improve innovation by diverting resources from imitative research efforts and related me-too advertising towards the science and product development required to bring breakthrough drugs for otherwise unmet health needs to market (UK 2007). Thus, one of the opportunity costs of paying non-competitive prices for drugs that replicate health outcomes that are already achievable is the delay in developing the next generation of true breakthrough medicines.

There are a number of other political and policy challenges that Canadian provinces and territories would have to overcome in order to implement and manage a national formulary that would achieve a level of success on par with New Zealand’s experience. The first of these challenges stems from the divisions of power in our constitution, which has resulted in a historical legacy of uncoordinated drug coverage and price control (Anis 2000; Anis, Guh et al. 2001). Divisions of spending power and health-related jurisdiction will be significant obstacles to implementing a truly national formulary for pharmacare programs in Canada. But, given the significant savings that New Zealand is capable of securing for a population of only 4 million people, critical mass for formulary-based expenditure management may be achieved through an alliance of willing provinces.

The lack of historic commitment to national standards for pharmaceutical benefit programs has resulted in another policy impediment: the minority role of public purchasers for pharmaceuticals in Canada. No provincial drug plan covers more than 44% of pharmaceutical expenditures in its jurisdiction (CIHI 2006). This means that government incentives for actively managing pharmaceutical expenditures are much lower in Canada than in New Zealand. Canadian governments may find it easier to continue to “pass the buck” – whether onto patients through deductibles and co-payments or onto employers and unions through increasing reliance on private insurance – rather than to manage expenditures in the first place. It also means that, even if Canadian governments were firmly committed to managing expenditures, the bargaining power of a national formulary would be diminished by the significant share of drug purchases that occur without public drug plan involvement, including those purchases “below the deductibles” of income-based drug benefit plans (Morgan, Evans et al. 2006). The task of operationalizing rebates, cross-product deals and tenders in Canada’s multi-payer system would also be far more challenging than in a single-payer pharmacare system like New Zealand’s.

Fragmentation of pharmaceutical financing in Canada has further health system implications that must be taken into consideration. The pharmaceutical industry has criticized Canadian policy makers who are tasked with developing and implementing the National Pharmaceuticals Strategy for not considering pharmaceutical policy within the context of “integration of health delivery” (Rx&D 2006). Again, New Zealand and Canada differ significantly, with advantages to New Zealand. New Zealand’s regional integration of pharmaceutical financing as part of health services funding places the incentive to carefully weigh the benefits and costs of using policy tools to expand or contract pharmaceutical expenditures in appropriate hands. Any clinical, economic and political costs of reduced access to necessary medicines resulting from PHARMAC’s formulary-based policies are borne by the DHBs and the public served by them. These local bodies also directly benefit from savings generated by formulary-based policies because such savings enable more spending on primary healthcare, hospitals or other regional health services. The result is a system that provides incentives to consider carefully the system-wide effects (both positive and negative) of pharmaceutical expenditure management tools such as formulary restrictions and price negotiations.

In contrast, the Canadian system for health and pharmaceutical financing impedes full consideration of inherent tradeoffs. This is because drug budgets are drawn from a multiplicity of sources. Private funders, in particular, have little or no incentive to consider the health system cost of impediments to accessing cost-effective pharmaceuticals, or the health system opportunity cost of paying premium prices for pharmaceutical products. The 1997 National Forum on Health and the 2002 Commission on the Future of Health Care in Canada both recommended options for integrating the financing of pharmaceuticals and primary healthcare to give policy makers, the public and health professions incentives to actively manage related tradeoffs (Canada 1998; Canada 2002).

Conclusions

When considered in light of the recommendations of the National Forum on Health and the Commission on the Future of Health Care in Canada, the findings of this study allude to how a national formulary could contribute to policy options that might overcome obstacles to pharmacare reform in Canada … and do so in the immediate future. The New Zealand experience with a national formulary illustrates that simply listing the drugs that would be covered by participating drug plans is not sufficient for effective formulary-based pharmaceutical expenditure management: a breadth of formulary-based policies is required to secure the savings necessary to improve efficiency and equity, and ensure sustainability. Incremental progress towards such outcomes in Canada could be achieved by providing universal access to drugs on formularies defined for certain chronic conditions.

In effect, Canada could develop several PHARMAC-like funding programs for selected conditions. All Canadians with such conditions, regardless of age or income, would receive coverage as per the terms of a national formulary for treating those conditions. Firms, in turn, would receive significant market access under such programs if they provide their drugs at competitive prices that reflect value-for-money. The initial conditions selected for such programs should be those with unambiguous proof of population health and health system benefits from increased access to appropriate treatments. Similarly, initial drug classes should be those for which the nature of treatment alternatives is such that formulary management is likely to provide the savings necessary to finance the related expansion of “first-dollar” drug coverage. The classes of drugs studied in this paper may be among those that a national program should first target: e.g., cholesterol drugs, hypertension treatment, depression and anxiety, ulcers and acid reflux. The savings generated from such programs could then be re-invested in the expansion of pharmacare benefits for other treatments, including newer “breakthrough” drugs or drugs for the treatment of rare but serious medical conditions.

Creativity and political will to champion broad public interests will be necessary to operationalize a national formulary that provides Canadians with equitable and affordable access to needed medicines. New Zealand’s PHARMAC illustrates a way that this can be done effectively, and we believe there are routes to doing so immediately, though incrementally. Developing an actively managed national formulary that judiciously applies a breadth of formulary-based policies could create vast improvements in efficiency, equity and, by diverting resources away from “me-too” drugs and towards truly innovative products, innovation. While the policies of New Zealand’s PHARMAC cannot be directly translated, barriers to an effective national formulary for Canada are not insurmountable. Making the choice to move forward on this front is just that: a choice.

Acknowledgments

This research was supported by an operating grant from the Canadian Institutes of Health Research (CIHR) and a Research Unit Award from the Michael Smith Foundation for Health Research (MSFHR). Steve Morgan is supported by a CIHR New Investigator Award and an MSFHR Scholar Award. Data were extracted with permission and assistance of the BC Ministry of Health Services and the BC College of Pharmacists. We are indebted to Wayne McNee, PHARMAC Chief Executive, for assistance with data access and comments on an earlier draft.

Contributor Information

Steve Morgan, Centre for Health Services and Policy Research, Department of Health Care and Epidemiology, University of British Columbia, Vancouver, BC.

Gillian Hanley, Centre for Health Services and Policy Research, University of British Columbia, Vancouver, BC.

Meghan Mcmahon, CIHR Institute for Health Services and Policy Research, University of Toronto, Toronto, ON.

Morris Barer, Centre for Health Services and Policy Research, Department of Health Care and Epidemiology, University of British Columbia, Vancouver, BC.

References

- Anis A.H. Pharmaceutical Policies in Canada: Another Example of Federal–Provincial Discord. Canadian Medical Association Journal. 2000;162(4):523–26. [PMC free article] [PubMed] [Google Scholar]

- Anis A.H., Guh D., Wang X.H. A Dog’s Breakfast: Prescription Drug Coverage Varies Widely across Canada. Medical Care. 2001;39(4):315–26. doi: 10.1097/00005650-200104000-00003. [DOI] [PubMed] [Google Scholar]

- Berndt E.R., Kyle M.K., Ling D. The Long Shadow of Patent Expiration: Do Rx to OTC Switches Provide an Afterlife? In: Feenstra R.C., Shapiro D.M., editors. Scanner Data and Price Indexes: Proceedings from the NBER Conference on Research in Income and Wealth. Chicago: University of Chicago Press; 2002. [Google Scholar]

- Birch S., Gafni A. The ‘NICE’ Approach to Technology Assessment: An Economics Perspective. Health Care Management Science. 2004;7(1):35–41. doi: 10.1023/b:hcms.0000005396.69890.48. [DOI] [PubMed] [Google Scholar]

- Braae R., McNee W., Moore D. Managing Pharmaceutical Expenditure While Increasing Access. The Pharmaceutical Management Agency (PHARMAC) Experience. PharmacoEconomics. 1999;16(6):649–60. doi: 10.2165/00019053-199916060-00004. [DOI] [PubMed] [Google Scholar]

- Canada. Report of the Commission of Inquiry on the Pharmaceutical Industry. Ottawa: Minister of Supply and Services Canada; 1985a. [Google Scholar]

- Canada. Summary of the Report of the Commission of Inquiry on the Pharmaceutical Industry. Ottawa: Minister of Supply and Services Canada; 1985b. [Google Scholar]

- Canada. Canada Health Action: Building on the Legacy, Synthesis Reports and Issues Papers, Volume II. Ottawa: National Forum on Health; 1998. Directions for a Pharmaceutical Policy in Canada. [Google Scholar]

- Canada. Chapter 9 in R. Romanow, Building on Values: The Future of Health Care in Canada – Final Report. Saskatoon: Commission on the Future of Health Care in Canada; 2002. Prescription Drugs. Retrieved May 31, 2007. http://www.hc-sc.gc.ca/english/pdf/romanow/pdfs/HCC_Final_Report.pdf . [Google Scholar]

- Canada. Ottawa: Health Canada; 2004. A 10-Year Plan to Strengthen Health Care. Retrieved May 31, 2007. http://www.hc-sc.gc.ca/hcs-sss/delivery-prestation/fptcollab/2004-fmm-rpm/index_e.html . [Google Scholar]

- Canada’s Research-Based Pharmaceutical Companies (Rx&D) National Pharmaceutical Strategy: Collaboration Required. Discovery: Western Canada’s Quarterly Newsletter from Canada’s Research-Based Pharmaceutical Companies. 2006 Winter;4:1. Retrieved May 31, 2007. http://www.canadapharma.org/Pubs/Discovery/Discovery_Issue_WINTER_BC.pdf .

- Canadian Institute for Health Information (CIHI) Drug Expenditure in Canada, 1985–2004. Ottawa: Author; 2005. [Google Scholar]

- Canadian Institute for Health Information (CIHI) Drug Expenditure in Canada, 1985–2005. Ottawa: Author; 2006. [Google Scholar]

- Davis P. ‘Tough But Fair’? The Active Management of the New Zealand Drug Benefits Scheme by an Independent Crown Agency. Australian Health Review. 2004;28(2):171–81. doi: 10.1071/ah040171. [DOI] [PubMed] [Google Scholar]

- Diewert W.E. The Economic Theory of Index Numbers: A Survey. In: Diewert W.E., Nakamura A.O., editors. Essays in Index Number Theory, Volume 1. Amsterdam: Elsevier Science; 1993. [Google Scholar]

- Evans R.G. Strained Mercy: The Economics of Canadian Health Care. Toronto: Butterworths; 1984. [Google Scholar]

- Evans R.G. Going for the Gold: The Redistributive Agenda Behind Market-Based Health Care Reform. Journal of Health Politics, Policy and Law. 1997;22(2):427–65. doi: 10.1215/03616878-22-2-427. [DOI] [PubMed] [Google Scholar]

- Frank R.G., Salkever D.S. Generic Entry and the Pricing of Pharmaceuticals. Journal of Economics and Management Strategy. 1997;6(1):75–90. [Google Scholar]

- Garber A.M. Evidence-Based Coverage Policy. Health Affairs (Millwood) 2001;20(5):62–82. doi: 10.1377/hlthaff.20.5.62. [DOI] [PubMed] [Google Scholar]

- Grabowski H.G., Vernon J.M. Brand Loyalty, Entry, and Price Competition in Pharmaceuticals After the 1984 Drug Act. Journal of Law and Economics. 1992;35:331–50. [Google Scholar]

- Gregoire J.P., MacNeil P., Skilton K., Moisan J., Menon D., Jacobs P., McKenzie E., Ferguson B. Inter-provincial Variation in Government Drug Formularies. Canadian Journal of Public Health. 2001;92(4):307–12. doi: 10.1007/BF03404967. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Huskamp H.A., Epstein A.M., Blumenthal D. The Impact of a National Prescription Drug Formulary on Prices, Market Share, and Spending: Lessons for Medicare? Health Affairs (Millwood) 2003;22(3):149–58. doi: 10.1377/hlthaff.22.3.149. [DOI] [PubMed] [Google Scholar]

- MacDonald K., Potvin K. Interprovincial Variation in Access to Publicly Funded Pharmaceuticals: A Review Based on the WHO Anatomical Therapeutic Chemical Classification System. Canadian Pharmaceutical Journal. 2004;137(7):29–34. [Google Scholar]

- Malkin J.D., Goldman D.P., Joyce G.F. The Changing Face of Pharmacy Benefit Design. Health Affairs (Millwood) 2004;23(1):194–99. doi: 10.1377/hlthaff.23.1.194. [DOI] [PubMed] [Google Scholar]

- McMahon M., Morgan S., Mitton C. The Common Drug Review: A NICE Start for Canada? Health Policy. 2005;77(3):339–51. doi: 10.1016/j.healthpol.2005.08.006. [DOI] [PubMed] [Google Scholar]

- Morgan S.G. Sources of Variation in Provincial Drug Spending. Canadian Medical Association Journal. 2004;170(3):329–30. [PMC free article] [PubMed] [Google Scholar]

- Morgan S.G., Barer M.L., Agnew J.D. Whither Seniors’ Pharmacare: Lessons from (and for) Canada. Health Affairs (Millwood) 2003;22(3):49–59. doi: 10.1377/hlthaff.22.3.49. [DOI] [PubMed] [Google Scholar]

- Morgan S., Evans R.G., Hanley G.E., Caetano P.A., Black C. Income-Based Drug Coverage in British Columbia: Lessons for BC and the Rest of Canada. Healthcare Policy. 2006;2(2):115–127. [PMC free article] [PubMed] [Google Scholar]

- Morgan S., McMahon M., Lam J., Mooney D., Raymond C. The Canadian Rx Atlas (p. 77) Vancouver: Centre for Health Services and Policy Research; 2005. [Google Scholar]

- Morgan S., McMahon M., Mitton C., Roughead E., Kirk R., Kanavos P., Menon D. Centralized Drug Review Processes in Australia, Canada, New Zealand, and the United Kingdom. Health Affairs (Millwood) 2006;25(2):337–47. doi: 10.1377/hlthaff.25.2.337. [DOI] [PubMed] [Google Scholar]

- Morgan S., Schaub P., Mooney D., Lam J., Caetano P., McMahon M., Rahim-Jamal S. The BC Rx Atlas (p. 65) Vancouver: Centre for Health Services and Policy Research; 2005. [Google Scholar]

- National Pharmaceuticals Strategy (NPS) First Ministers’ Task Force. Progress Report (p. 50) Ottawa: Health Canada; 2006. Retrieved May 31, 2007. http://www.councilofthefederation.ca/pdfs/npsreport_web.pdf . [Google Scholar]

- Organisation for Economic Co-operation and Development (OECD) OECD Health Data 2006: Statistics and Indicators for 30 Countries. CD-ROM. Paris: Author; 2006. [Google Scholar]

- Patented Medicine Prices Review Board (PMPRB) Annual Report 2005. Ottawa: Author; 2006. Retrieved May 31, 2007. http://www.pmprb-cepmb.gc.ca/english/view.asp?x=667&all=true . [Google Scholar]

- Pharmaceutical Executive. Pharm Exec 50: The World’s Top 50 Pharmaceutical Companies (pp. 77–88) 2006 Retrieved May 31, 2007. http://www.pharmexec.com/pharmexec/data/articlestandard/pharmexec/182006/323799/article.pdf .

- Pharmaceutical Management Agency of New Zealand (PHARMAC) The Pharmaceutical Schedule. 2005 Retrieved May 31, 2007. http://www.pharmac.govt.nz/schedule.asp .

- Pharmaceutical Management Agency of New Zealand (PHARMAC) Operating Policies and Procedures of the Pharmaceutical Management Agency of New Zealand (3rd ed.: 13) Wellington: Author; 2006. [Google Scholar]

- Quinn C.E., Barisano A. Understanding, Creating, and Working with Formulary Systems. American Journal of Managed Care. 1999;5(10):1311–17–quiz 1318–19. [PubMed] [Google Scholar]

- Shih Y.C., Sleath B.L. Health Care Provider Knowledge of Drug Formulary Status in Ambulatory Care Settings. American Journal of Health Systems and Pharmacy. 2004;61(24):2657–63. doi: 10.1093/ajhp/61.24.2657. [DOI] [PubMed] [Google Scholar]

- Tirole J. The Theory of Industrial Organization. Cambridge, MA: MIT Press; 1988. [Google Scholar]

- Ungar W.J., Witkos M. Public Drug Plan Coverage for Children across Canada: A Portrait of Too Many Colours. Healthcare Policy. 2005;1(1):100–22. [PMC free article] [PubMed] [Google Scholar]

- United Kingdom Office of Fair Trading. Pharmaceutical Price Regulation Scheme: An OFT Market Study. London: Office of Fair Trading; 2007. Retrieved May 31, 2007. http://www.oft.gov.uk/shared_oft/reports/comp_policy/oft885.pdf . [Google Scholar]

- United States General Accounting Office. Prescription Drugs: Expanding Access to Federal Prices Could Cause Other Price Changes. Report to Congressional Requesters (p. 26) Washington, DC: Author; 2000. Retrieved May 31, 2007. http://www.gao.gov/archive/2000/he00118.pdf . [Google Scholar]