Introduction

The way a health system is organized and financed is one of the key determinants of whether it provides equitable access to essential health care and improves population health. Financing is important as it determines access to and availability of health care, and the level of protection against catastrophic costs of illness. In low- and middle-income countries, financing becomes a central issue of health reform, especially in the light of fiscal constraints that result in a large proportion of out-of-pocket payments for health, leading to financial catastrophe and impoverishment for some households.1

In the 58th session of the World Health Assembly in May 2005, WHO Member States endorsed Resolution WHA58.33 urging countries to strive towards sustainable health financing and achieving universal coverage, through applying a mix of prepayment health financing systems such as social health insurance and tax-financed national health services based on their specific context and institutional capacity.

Social health insurance has a limited role in developing countries due to the small size of the formal employment sector. When commitment towards the Millennium Development Goals is at stake, what are effective mechanisms in securing and sustaining resources to the health sector in the light of limited fiscal space and multiple players at international and national levels? This question challenges policy-makers in low-income countries. We review and discuss the contributions of specific diseases funding from global health initiatives (GHIs) and from earmarked taxes on specific goods and services to assess their strengths and weaknesses and provide appropriate policy recommendations.

Global health initiatives

A significant increase in global funding for HIV/AIDS has occurred in the past 5 years, as a response to the UN General Assembly Special Session on HIV/AIDS in June 2001. Three global HIV/AIDS initiatives are contributing most of the direct external funding for scaling-up HIV/AIDS prevention, treatment and care: The World Bank Global HIV/AIDS Program, which includes the Multi-country AIDS Program (MAP); the Global Fund to Fight AIDS, Tuberculosis and Malaria; and the United States of America’s President’s Emergency Plan for AIDS Relief (PEPFAR).

Evaluation of the first 5 years of PEPFAR operation2 proved that scaling-up HIV interventions is feasible in resource-poor settings. By 2006 it had achieved the following results: > 800 000 adults and children on antiretroviral therapy; preventing mother-to-child transmission services for > 6 million women; and care and support for 4.5 million people. However, it did not achieve its commitment towards harmonization, fostering country ownership or the “three ones” principles of UNAIDS (i.e. one national HIV/AIDS plan, one coordinating mechanism and one monitoring and evaluation framework).

The nature of its policies on abstinence, faithfulness and consistent correct use of condoms, limits the harmonization of PEPFAR programmes with governments and other donor’s programmes. Its requirement for approval of antiretrovirals by the Food and Drug Administration (FDA) prevents long-term financial sustainability by the government when support ends. PEPFAR uses rigid congressional budget allocations that do not observe country-led programme and ownership. For example, 33% must be spent on treatment; 20% on prevention of which 33% must be spent on abstinence-until-marriage programmes. In 2006, the Zambian Ministry of Health’s total budget was US$ 136 million while PEPFAR provided an HIV-targeted budget of US$ 150 million.3

Huge resources from the Global Fund flow to AIDS programmes in Mozambique, Uganda, the United Republic of Tanzania and Zambia, but empirical evidence shows that early Global Fund programmes did not promote coordination, harmonization and monitoring at the country level.4 The main challenge for successful implementation of Global Fund and other GHI programmes is human resources; many countries are facing low staff morale and motivation and retention.

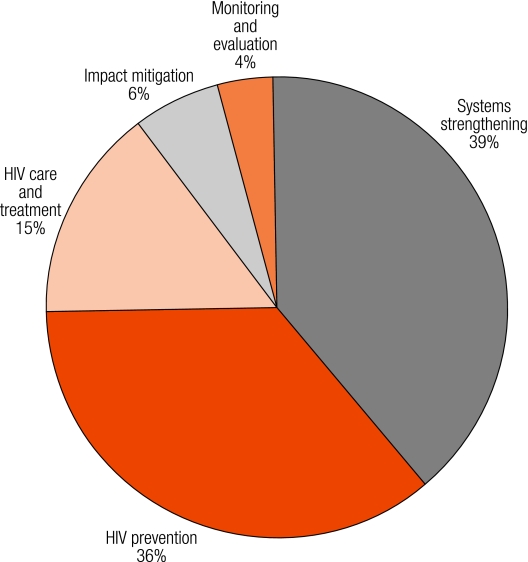

The World Bank’s MAP did better in observing country ownership and focussed not only on disease-specific intervention, but investment in health systems strengthening5 (Fig. 1). MAP helped build political leadership and an institutional environment at the national and subnational levels in which the national HIV response can thrive, set the foundation for significant resource mobilization and provided financial support to other sectors involved in the response to HIV.

Fig. 1.

Distribution of funds by activity in The World Bank’s Multi-country AIDS Program in $US millions5

Specific tax on goods and services

Tobacco

Another form of earmarking advocated by the WHO Framework Convention for Tobacco Control are levies on health damaging products that are earmarked directly for health. A global increase in cigarette taxes of 10% would raise cigarette tax revenues by nearly 7%, with relatively larger revenue increases in high-income countries and smaller revenue increases in low- and middle-income countries.6

Despite this evidence, price increases have been underused. Studies in 80 countries found that the real price of tobacco, adjusted for purchasing power, fell in most developing countries between 1990 and 2000. The high price elasticity of tobacco means that this generally results in increased consumption. Despite this distressing situation (in terms of its effect on population health), only a few countries are actively implementing specific levies earmarked to health promotion and other specific activities. Additional tobacco levies for health require a strong political will and social consensus, backed up by legislation and effective governance to implement these resources. Table 1 shows some states or countries with special laws on earmarked taxes for health.

Table 1. Sample countries with special laws on earmarked taxes for public health and health promotion.

| State/country | Related law | Description |

|---|---|---|

| State Government of Victoria, Australia | 1987: Tobacco Act | The Victorian Health Promotion Foundation “VicHealth” (independent statutory body) funded by a 5% dedicated tax levied on tobacco products. Total revenue is US$ 25 million, 40% for promotion of community and school health, 30% for sponsoring sports, 20% for health research, the rest for administration. |

| United States of America: various states | As of 1988: tobacco tax through legislation | Used for tobacco control programmes. |

| New Zealand | 1976: levy on alcohol produced or imported for sales in the country | Used to reduce harm from alcohol use, mainly through education and research. |

| Republic of Korea | 1995: National Health Promotion Act (tobacco tax) | National Health Promotion Fund: health education, antismoking campaigns, limited advertisement of cigarettes and alcohol. Total revenue US$ 1.5 million used to promote health education and antismoking campaigns and to limit advertisements of cigarettes and alcohol. |

| Thailand | 2001: Thai Health Promotion Act (2% earmarked taxes on tobacco and alcohol products) | Thai Health Promotion Fund (Thai Health), an autonomous State Agency aiming to advocate, support and finance organizations active in health promotion, including tobacco and alcohol control, traffic accident prevention, health promotion at various levels in communities across the country. |

A case study of four countries in the south-east Asia region7 (Indonesia, Nepal, Sri Lanka and Thailand) showed interesting results on earmarked taxes for health promotion. The study indicated that governments need to spend double to quadruple the current level of public spending on health promotion.

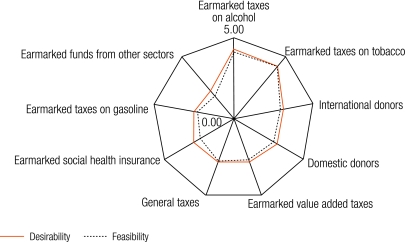

A spider-web diagram in Fig. 2 shows the desirability and feasibility of nine different potential sources of financing health promotion from key informants in four selected countries. Earmarked taxes on tobacco and alcohol are identified as the two most desirable and feasible choices to generate resources of health promotion.

Fig. 2.

Desirability and feasibility of nine potential sources of funding health promotion, average score in four selected countries (Indonesia, Nepal, Sri Lanka and Thailand)

A consensus emerges about the strong potential role of earmarked taxes on alcohol and tobacco in financing health promotion. Not only does it generate more resources to health promotion and disease prevention programmes, it also deters demand for tobacco and alcohol among young adults due to price elasticity. Barriers against the introduction of an earmarked tax for health promotion in these countries included lack of political vision, commitment and social accountability, lack of social mobilization towards a healthy lifestyle and lack of evidence on the magnitude of noncommunicable diseases and their long-term impact.

Airline tickets

UNITAID, launched in 2006, receives some of its funds from an additional levy on air tickets for domestic or international travel in several countries such as Brazil, Chile, France, Norway and the United Kingdom. The levies are earmarked to fund the purchase of medicines (notably for HIV/AIDS and tuberculosis) to support low-income countries. Not only does UNITAID’s innovative concept fill the financial gap, but it drives prices down through bulk purchasing and stronger negotiating power.

Financial support from UNITAID was small when compared to other GHIs. In 2008, the total pledge was US$ 364 million; France is the major contributor, with 65% of total funds, and the United Kingdom contributing 12% of the total (Table 2). UNITAID focuses its spending on artemisinin combination therapy for malaria and on HIV diagnostics. It strategically collaborates with the Global Fund to purchase specific medicines such as second-line antiretrovirals and multidrug-resistance medicines for tuberculosis; and the Global Drug Facility of the Stop TB Partnership in the provision of paediatric tuberculosis medicines. Although UNITAID aims to bring down prices of commodities, prices were not significantly reduced, especially where monopolies exist.

Table 2. UNITAID revenue and budget profile 20088.

| Profiles | US$ in millions | % of total |

|---|---|---|

| Revenue | ||

| Brazil | 12 | 3 |

| Chile | 5 | 1 |

| France | 236.2 | 65 |

| Norway | 25.5 | 7 |

| Republic of Korea | 7 | 2 |

| Spain | 22.1 | 6 |

| United Kingdom | 44.2 | 12 |

| Gates Foundation | 10 | 3 |

| Others | 2 | 1 |

| Total | 364 | 100 |

| Budget | ||

| ACT scale-up | 14.8 | 7 |

| ACT | 100 | 45 |

| Paediatric TB | 8 | 4 |

| MDR-TB | 21 | 9 |

| WHO prequalification | 10 | 4 |

| PMTCT | 30 | 13 |

| Diagnostics HIV | 40 | 18 |

| Total | 223.8 | 100 |

ACT, artemisinin combination therapy; MDR-TB, multidrug-resistant tuberculosis; PMTCT, prevention of mother-to-child transmission; TB, tuberculosis.

Pros and cons of earmarking

As a crisis response to the HIV epidemic, huge financial resources provided by GHIs sometimes pose more threats than opportunities to low-income countries. The rigidity of PEPFAR regulations, such as only using FDA-approved and not WHO prequalified products, do not ensure long-term financial sustainability. Recipient countries often lack institutional capacity to harmonize multiple donors in consistence with their specific priorities and in compliance with UNAIDS’s “three ones” principles. Low-income countries have limited capacities to translate these huge funds for HIV into strengthening their health systems (such as primary health care) to meet other Millennium Development Goals, notably on maternal and child mortality. A focus on treatment rather than prevention and poorly-managed antiretroviral programmes (that do not enforce adequate adherence to treatment) do more harm than good in the long term.

Although UNITAID has leverage opportunities to bring down prices through bulk purchase and negotiation, and promote access to specific niche products such as multidrug-resistant tuberculosis medicine, paediatric formula and second-line antiretrovirals, its mandates still focus mainly on treatment and not prevention. Price increases through special taxes levied on harmful products like tobacco and alcohol encourage better health of the population through reducing consumption as well as generating more resources to health.

Most macroeconomists and politicians are not in favour of earmarking. Politicians dislike earmarking because it limits their freedom and financial control to implement policies that they promised during election campaigns. Critics argue that earmarking introduces clear restrictions and inefficiencies on public finance and reduces flexibility in the context of changing circumstances, resulting in cutbacks in other general resources. Numerous examples demonstrate earmarked funds were used for other purposes, especially in a poor governance setting.

Conclusion

GHIs can mobilize substantial resources but cannot be sustained in the long term. Earmarking for specific diseases and interventions, notably HIV/AIDS, poses more threats than opportunities to national health systems of developing countries, which require institutional capacity to manage harmonization and ensure programmatic and financial sustainability when GHI support ends. However, our reviews indicate that low-income countries can hardly ensure financial sustainability beyond GHI support. It is vital to grasp the opportunity of these funds to strengthen health system capacity to deliver other relevant services, such as maternal and child health services, and prevent fragmentation.

Earmarked taxes on harmful products have high potential in mobilizing and sustaining resources to health, although they require strong political leadership and social consensus. Amounts generated, even if they are small, can play catalytic roles towards active health promotion. No matter what the sources, efficient and transparent governance is required to manage these funds towards the country’s public health goals. ■

Footnotes

Competing interests: None declared.

References

- 1.Xu K, Evans DB, Kawabata K, Zeramdini R, Klavus J, Murray CJL. Household catastrophic health expenditure: a multi-country analysis. Lancet. 2003;362:111–7. doi: 10.1016/S0140-6736(03)13861-5. [DOI] [PubMed] [Google Scholar]

- 2.Institute of Medicine. PEPFAR implementation: progress and promise Washington, DC: National Academies Press; 2007. [Google Scholar]

- 3.De Maeseneer J, van Weel C, Egilman D, Mfenyana K, Kaufman A, Sewankambo N, et al. Funding for primary health care in developing countries: money from disease specific projects could be used to strengthen primary care. BMJ. 2008;336:518–9. doi: 10.1136/bmj.39496.444271.80. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Brugha R, Cliff J, Donoghue M, Fernandes B, Nhatave I, Ssengooba F, et al. Global Fund tracking study: a cross-country comparative analysis London: London School of Hygiene and Tropical Medicine; 2005. [Google Scholar]

- 5.Gorgens-Albino M, Mohammad N, Blankhart D, Odutolu O. The Africa Multi-country AIDS Program 2000-2006: results of The World Bank’s response to a development crisis Washington, DC: The World Bank; 2007. [Google Scholar]

- 6.Jha P, Frank J. Chaloupka JM, Moore J, Gajalakshmi V, Gupta PC et al. Tobacco addiction. In: Disease control priorities in developing countries Jamison DT, Breman JG, Measham AR, eds. Washington DC: International Bank for Reconstruction and Development/The World Bank; 2006. [PubMed] [Google Scholar]

- 7.Prakongsai P, Bundhamcharoen K, Tisayatikom K, Tangcharoensathien V. Financing health promotion in south-east Asia: does it match with current and future challenges? Nonthaburi: Thai Ministry of Public Health; 2007.

- 8.UNITAID. UNITAID 2008 budget. In: 6th Executive Board meeting, 6-7 December 2007. Available at: http://www.unitaid.eu/en/EB6_resolutions.html [accessed on 6 October 2008].