Abstract

Economic analysis has so far said little about how an individual's cognitive skills (CS) are related to the individual's economic preferences in different choice domains, such as risk taking or saving, and how preferences in different domains are related to each other. Using a sample of 1,000 trainee truckers we report three findings. First, there is a strong and significant relationship between an individual's CS and preferences. Individuals with better CS are more patient, in both short- and long-run. Better CS are also associated with a greater willingness to take calculated risks. Second, CS predict social awareness and choices in a sequential Prisoner's Dilemma game. Subjects with better CS more accurately forecast others' behavior and differentiate their behavior as a second mover more strongly depending on the first-mover's choice. Third, CS, and in particular, the ability to plan, strongly predict perseverance on the job in a setting with a substantial financial penalty for early exit. Consistent with CS being a common factor in all of these preferences and behaviors, we find a strong pattern of correlation among them. These results, taken together with the theoretical explanation we offer for the relationships we find, suggest that higher CS systematically affect preferences and choices in ways that favor economic success.

Keywords: cognitive ability, discount rate, Prisoner's Dilemma, risk aversion, turnover

Economic, financial, and many other decisions in life require choosing between options that vary along several distinct dimensions, such as the probability or the delivery times of the outcomes. Variation in these factors affects the choices of different individuals differently; for example, some people are more prudent in risk taking, whereas others are more patient in their choices of saving versus consumption. Individuals also vary in their cognitive skills (CS). Economists have only recently begun to analyze how the general CS of an individual might be related to that individual's economic preferences and whether and how the preferences of the same individual in different choice domains, such as risk taking or saving, might be related to each other (1–5). Psychologists have studied the relationship between various CS and job success, among other outcome variables, but without focusing on the link between CS and preferences (6). Similarly, little is known about how CS influence behavior in strategic interactions. However, an understanding of the effects CS may have on preferences (7) and strategic behavior, and the relations that may exist among preferences, is of considerable potential importance in constructing theories of human decision making and in selecting managerial and public policies.

We examine whether and how CS are related to attitudes toward risk and intertemporal choices and how choices in these distinct domains are related to each other in a large sample (n = 1,066) of trainee tractor–trailer drivers at a sizable U.S. trucking company (see SI Appendix and ref. 8). We also examine how CS are related to two types of behavior by these subjects: laboratory choices in a strategic game, and an important on-the-job outcome. In each case we are able to control for potentially confounding socioeconomic and psychological factors that earlier studies left unexamined. Our results are enabled by a comprehensive data collection design, which gives us the opportunity to observe socioeconomic, demographic, psychological, experiment-based, and employment-related outcome variables for the same subjects. Details of the experimental design and implementation are presented in Methods (also see SI Appendix and ref. 8).

We collected three measures of CS: a nonverbal IQ test (Raven's matrices), a test of the ability to plan (referred to as the Hit 15 task), and a quantitative literacy (or numeracy) test. In our analysis, we will focus on IQ because this is the most conventional measure of CS, although all results are robust to using the common factor obtained from a factor analysis of all three measures.2

To measure risk preferences we used an experiment in which subjects chose between various fixed payments and a lottery. Time preferences are measured in an experiment in which subjects chose between earlier but smaller payments and later but larger ones. Our laboratory measure of strategic behavior is provided by a sequential form of the Prisoner's Dilemma. In this game, first movers decide whether or not to trust second movers by sending them money, whereas second movers choose whether to reciprocate (depending on what first movers did), with the experimenters doubling all amounts sent (see Methods).3

Our on-the-job measure of behavior results from our access to internal human resource data maintained by the firm: in a high-turnover setting, we observe the length of time each subject remained with the company and the reason for leaving. We also collected a demographic and socioeconomic profile and a standard personality questionnaire from each subject.

CS and Choice Consistency

If choice requires information processing, then an initial hypothesis about CS and preferences is that individuals with higher CS should make fewer errors in translating their preferences into choices. In our sequences of risky choices, the risky lottery is held constant, while the fixed payment m is increased. Each time, the subject has to decide whether to take the riskless fixed payment or the lottery. A subject might always take the fixed payment (if very risk-averse) or the lottery (if very risk-seeking). However, a subject who switches choices should switch at most once. For example, if a subject first prefers the lottery to m and then switches to the fixed payment at m′>m, he should also prefer all fixed amounts higher than m′ to the lottery. Switching back to the lottery at m″>m′ is inconsistent. Similar reasoning applies to our sequences of intertemporal choices.

The effect of CS on consistency is significant and large: a regression of consistency on the quartiles of IQ shows that a change from the lowest to the highest quartile in the IQ index increases the likelihood of being consistent by ≈25% in risky choice (Fig. 1A) and by ≈15% in choices over time (Fig. 1B).4 The difference in the effect of IQ on consistency suggests that in our setting choosing certain but time-specific payments is simpler than choosing between certain and risky ones.

Fig. 1.

IQ and consistency. Regression-adjusted relationship between CS and consistency (green) along with the simple relationship (blue) is shown. Standard errors (gray) are adjusted for clustering on individuals where appropriate.

To confirm that these results are not caused simply by correlations of both dependent and independent variables with potentially confounding factors such as race, age, education, or personality, we use here a procedure we apply systematically throughout: we reestimate the relationship adding a standard set of demographic control variables such as age and race, and our standard personality profile, on the right side (SI Appendix).5 We display the regression-adjusted relationship between CS and consistency (green) along with the simple relationship (blue), showing that the results are robust to controlling for these factors.

CS and Economic Preferences: Theory

We have seen that CS affect the consistency of choices. This effect might be limited to a reduction in the noise in observed choices, but it might also be deeper: CS might directly affect the content of economic preferences. How might such a deeper effect occur?

If one thinks of perceived utility as noisy, one may model the perception of utility as the observation of a random variable equal to the true utility plus noise (9). The more complex is the option, the larger is the noise. The utilities of simple options, such as a sure payment of $10, are perceived precisely. However, a lottery, two outcomes with an expected value of $10, is complex and its utility noisy. Similarly, $10 paid immediately is simple, and its utility is clear, whereas $10 to be paid in 2 weeks is complex, multiple factors could intervene, and its utility is noisy.

This difference in perception may systematically affect choices. We assume that subjects dislike what they do not perceive precisely: an option that is perceived more noisily is, everything else equal, less likely to be chosen than one perceived more precisely. We also assume that the noise in perception increases faster with complexity for low-CS than for high-CS subjects.

If this is correct, those with higher CS should more often choose the larger but later payment over the earlier but smaller one, and in choosing fixed payments versus lotteries, they should be more inclined (relative to those with lower CS) to choose the lottery as long as its expected value is larger than the fixed amount because they perceive its utility more precisely. Individuals with lower CS should choose the earlier but smaller payment more often, and the certain amount relatively more frequently than the lottery, compared with those with higher CS. In addition, when lotteries are involved, among those with lower CS we should observe the effects of option simplification and of pessimism or optimism, particularly in the differential evaluation of gains versus losses.

In a similar manner, a higher level of CS may also increase sensitivity to the potential social consequences of one's actions because in many social settings one's present actions affect the future behavior of others, through repeated interactions or one's reputation. As above, we hypothesize that the higher the CS of an individual, the clearer is the individual's perception of these uncertain and therefore noisy future consequences. Just as consistency is a simple first test of the effect of CS on risk- or time-related decisions, a simple but telling test of this hypothesis is whether individuals with higher CS are better able to predict the actions of others in a strategic setting.

But the effect may be deeper in this case as well. Subjects with higher CS might have higher awareness of the social consequences of their actions. If so, we conjecture that this knowledge will guide behavior in the setting of our game. The direction of the effect depends on auxiliary assumptions, but our approach suggests that there may be an effect on second-mover behavior and possibly also on first-mover choices.6

The effect of different CS should also extend to job-related behavior and choices. The firm's training comes with the liability of staying for a year to cancel the training debt, so taking the job implies the ability to foresee both whether one can learn to do the job and whether one will want to stay a year. Approximately 25% of the exits from our firm are discharges. One of the driver's tasks is planning long and complicated trips. Those with higher CS are more likely to avoid planning mistakes that could lead to performance failures such as arriving late for deliveries, and thus should be discharged less frequently. Approximately 75% of the exits from our firm are voluntary quits. Although the pay at our firm is attractive for those with modest education levels, there are important features that many people dislike about the job, such as long work weeks on an irregular daily schedule and multiple weeks away from home at a time, with little predictability about when and how long stops at home will be. And because pay is by piece rates (miles) it takes significant effort to earn a lot. Those with higher CS will have better foreseen both their ability to earn enough with tolerable effort levels and their willingness to abide the working conditions for a year, and should therefore quit less.

Finally, our theory predicts that CS are a common factor in a wide array of preferences and choices. Therefore, it also implies that the different preferences should be correlated with each other, with choice consistency, and with behaviors in the Prisoner's Dilemma and on the job.

CS and Economic Preferences: Evidence

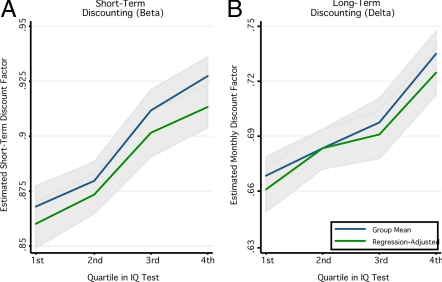

Our measure of patience is estimated with a β–δ model (10) (SI Appendix). In this model the utility of all future payments (after today) is discounted by a common factor β <1; in addition, for every additional period of waiting the utility is further discounted by δ <1. The factor β captures the special importance of today versus the future. The factor δ measures how the individual trades off two future payments. Higher values, discounting the future less, indicate greater patience in both cases. Consistent with our prediction, we observe that subjects in higher quartiles of the IQ index are more patient by both measures (Fig. 2 A and B). As before, Fig. 2 shows both the simple effect (blue lines) and the effects adjusting for the control variables (green lines).

Fig. 2.

IQ and time preferences. Discount factors are estimated according to the β–δ model described in the text. Standard errors are shown in gray.

An alternate theory about the effects of CS to the one we propose is the view that higher CS increase patience primarily through the control of impulsivity (11). This suggests that CS should have a stronger effect on β than on δ, because impulsivity should play a role only in choices involving today. Among our subjects, however, the effect of CS on discounting is qualitatively similar for both measures (see also ref. 12).

Risk aversion is measured by a coefficient of risk aversion, σ. To estimate it, we assume that the utility of a choice is evaluated as expected utility and that the utility function is a power function, with exponent 1 − σ: the larger σ, the more risk-averse the subject is. Higher CS lead to a higher willingness to take calculated risks in the domain of gains, that is, to a lower σ (Fig. 3C). As with all results, we show both the simple relationship and the relationship adjusted for the effects of our comprehensive set of controls.

Fig. 3.

IQ and risk preferences. Standard errors (gray) are adjusted for clustering on individuals where appropriate. A fair (unfair) gamble has expected value larger (smaller) than the fixed payment. Risk aversion is estimated from choices over positive-outcome lotteries assuming constant relative risk aversion utility function.

Differences in CS also affect the treatment of gains and losses. When the lottery involves only gains, individuals with better CS are more willing to take gambles with positive expected gain than are those with lower CS (Fig. 3A). However, when a loss is possible, those with better CS are more likely to take a small certain loss to avoid a lottery with a bigger expected loss. In this case, individuals with worse CS tend to focus on the sure loss from the choice of the certain amount and are more likely to gamble, even though the expected loss is bigger than the certain one (Fig. 3B).

Last, we examine mean IQ by number of risky choices in a positive-domain choice set. We see that those individuals making choices just shy of risk neutrality have significantly higher CS than those making more either risk-averse or more risk-seeking choices (Fig. 3D).7 All of these results are in line with our prediction that individuals with better CS find it easier to evaluate complex options, making them more sensitive to the expected value of gambles.

CS and Strategic Choices

In our sequential Prisoner's Dilemma game, first movers decide whether or not to send $5 (that the experimenters will double on the way) to those moving second, whereas second movers respond to the possible choices of first movers by sending back from $0 to $5 (with experimenters again doubling positive amounts sent on the way). Subjects stated their choices in both first- and second-mover roles and their beliefs about the moves of others (see Methods). Consistent with our prediction, subjects with higher levels of CS are better able to anticipate the behavior of first movers. Our subjects underestimated the probability of positive first-mover transfers: 67% of the subjects chose to send $5 as first mover, whereas the average belief was 50.2%. However, subjects with higher IQ more accurately predicted first-mover behavior (Fig. 4A), with almost a 28% increase over the entire range of the index.8 As before, Fig. 4 shows both the simple effect (blue lines) and the effects adjusting for the control variables (green lines). We also find the predicted effect of CS on subjects' beliefs about return transfers by the second mover after a $5 transfer: beliefs of those with higher IQ tend to be closer to the actual mean of $3.73 (Fig. 4B).9 There is one exception: the prediction of the average amount returned after a $0 transfer becomes less accurate for the top IQ quartile. In fact, the top quartile significantly underestimates the amount of money sent back after a transfer of 0 (P < 0.01).

Fig. 4.

Beliefs and behavior in the sequential Prisoner's Dilemma game. Standard errors are shown in gray. Mean amount actually sent by first movers was $3.35 (SE 0.07).

The differences associated with CS scores extend from beliefs to behavior, as we conjectured. Better CS are associated with sharper discrimination between kind and unkind first-mover actions: second movers with higher IQ return more if they receive $5 and less if they receive nothing (Fig. 4D).10 The behavior of the first mover is also affected: subjects with higher CS are more likely to send $5 (Fig. 4C). Because we showed above that subjects with higher CS are more inclined to take risks and expect a higher return to sending $5, this could be because sending $5 might be more attractive to them as a purely financial investment.

To explore this, column 1 of Table 1 reports the IQ coefficient in a regression of the amount sent on IQ (also included are all our standard control variables). In column 2 we add the coefficient of relative risk aversion, as estimated from the risk-preference experiment.11 In column 3 we also add the difference in expected repayments when $5 as opposed to $0 is transferred.12 Although both controls matter, the coefficient for IQ drops only slightly in column 2, and it remains positive and significant (at the 10% level) in column 3, suggesting a separate and positive effect of IQ on first-mover sending, even when we control for risk aversion and differences in repayment.

Table 1.

First-mover behavior in Prisoner's Dilemma and CS

| Variables | 1 | 2 | 3 |

|---|---|---|---|

| IQ index | 0.282** | 0.251* | 0.212* |

| (0.127) | (0.128) | (0.129) | |

| σ | −0.025*** | −0.025*** | |

| (0.009) | (0.009) | ||

| Expected difference in second-mover transfer | 0.008** | ||

| (0.003) | |||

| N | 1,012 | 1,012 | 1,012 |

Estimates of marginal effects on the probability of transferring $5 as a first-mover in the Prisoner's Dilemma game are shown. σ is the risk aversion measure described in the text. All control variables are included, but coefficients are omitted here (see SI Appendix). *, **, and *** indicate significance at the 10, 5, and 1% levels.

CS and Job Attachment

In large firms of the type we study, the American Trucking Associations consistently report that annual turnover rates exceed 100% (13). Most driver trainees, including our subjects, borrow the cost of training from their new employer, a debt that is forgiven after 12 months of posttraining service but that becomes payable in full upon earlier exit. Yet, more than half of our subjects exit before 12 months, which makes predicting survival of considerable interest.

We display survival curves for each quartile of the IQ distribution (Fig. 5A). They show large differences in retention. These large differences remain even after adjusting for our standard set of control variables (Fig. 5B and SI Appendix). This graph is typical: differences among the quartiles for any of the CS scores are large. By contrast, typical demographic variables (such as income outside the firm, or married versus single) provide less predictive power (SI Appendix).

Fig. 5.

IQ and survival in the firm. Vertical drop at left is because of exits during initial training.

Recall that we argued that CS should affect retention at the firm in part because better CS lead to better planning. Although factor analysis shows that our three measures of CS are closely related, they are not identical, so a more direct test of this hypothesis is to use the index for the score in our planning task (Hit 15; see Methods). Table 2 presents the results from the Cox proportional hazard model (including standard controls), but with the IQ index instead of IQ quartiles.13 When we include the Hit 15 index in addition to the IQ index, it is highly significant, and the effect of IQ is diminished (i.e., the coefficient is closer to 1). This pattern is sustained when looking at exits broken out into voluntary quits and discharges (SI Appendix).14

Table 2.

Exit hazard and CS

| Variables | 1 | 2 |

|---|---|---|

| IQ index | 0.336*** | 0.558* |

| (0.089) | (0.177) | |

| Hit 15 index | 0.585*** | |

| (0.096) | ||

| N | 1,014 | 884 |

Estimates of changes in the baseline hazard of exit from a Cox proportional hazard model are shown. Reported in risk ratios: a <1 lowers baseline risk, a >1 raises it, and a = 1 has no effect. All standard controls, plus previous experience as a truck driver, are included, but their coefficients are here omitted (see SI Appendix). * and *** indicate significance at the 10 and 1% levels.

There is a good reason for the size of the effect of CS and especially Hit 15. This index measures the ability of the individual to effectively reason backward from a goal about how to achieve it. Better planning leads both to a better prediction by the subject of the job's desirability after training and to better performance of key job tasks. Running long and irregular routes requires the calculation each day of the current actions needed to achieve specific near-term future goals under multiple and often conflicting constraints, and drivers update the firm daily about this calculation over a satellite uplink in their truck.15 However, the ability to manage and plan one's work time under conflicting constraints is clearly valuable beyond trucking and should predict success in any occupation requiring a significant amount of independent work.

Relationships Among the Measures

Because our measures of behavior and preferences are all correlated with the common factor of CS, we can expect to find correlations among them. We examine the pattern of correlations between all of the measures of preferences and behavior in Table 3 (see Table legend for definitions of variables).

Table 3.

Correlation among measures of behavior and IQ

β, short-term discount factor. δ, long-term discount factor. σ, coefficient of relative risk aversion. PD1, amount sent as first mover in PD ($0 or $5). PD2_0, amount returned as second mover, if first mover sent $0. PD242>5, amount returned as second mover, if first mover sent $5. ConsF, 1 if future payment choices consistent; 0 otherwise. ConsR, 1 if risky choices consistent; 0 otherwise. Stay6, 1 if job tenure ≥ 6 months; 0 otherwise. IQ, IQ score, normalized to [0,1]. g, unique factor from factor analysis of three measures of cognitive ability [IQ score, numeracy score, and Hit 15 score (see SI Appendix)].

The data show a strong and pervasive pattern of correlations among many of the behaviors. All but two (which are not significant) are of the sign predicted if CS are the common factors underlying the correlation. Consistency in the risk experiment is correlated with patience, particularly in the short run (P < 0.001), but also in the long run (P = 0.058). Consistency in risky choices is negatively correlated with risk aversion (P < 0.001). As anticipated, patience and willingness to take risks are correlated: the correlation with the estimated coefficient of risk aversion, σ, is significant for both short-term (β, P = 0.039) and long-term discounting (δ, P = 0.01). The two measures of impatience, β and σ, are also correlated (P < 0.001). Finally, the behavior of the first mover in the Prisoner's Dilemma is highly correlated with both short-term and long-term discounting (P < 0.01 in each case). Of the correlations we report, more than half are significant at the 1% level, and more than three-quarters are significant at the 5% level.

Size of the Effects

Most of the effects we have reported are not only statistically significant, but economically significant in size. We saw above that consistency increases by 15–25% from the bottom to the top quartile of the IQ index. The effects of CS on preferences are also substantial. The average IQ among those who always prefer the sure payment is 1 SD below those who behave in a risk-neutral way. A measure of risk aversion is the highest premium an individual would be willing to pay for full insurance.16 Among our subjects, the risk premium someone in the bottom third in IQ is willing to pay (at our modest lottery stakes levels) is 7.5% of the expected value of the lottery outcome, compared with 2.3% for the top third.

The effects are substantial also for time preferences and hence for saving behavior. When a subject chooses between an earlier, smaller payment and a larger, future one (as subjects do in our experiment) he is discounting the future payment; this implicitly defines the interest rate required to induce waiting for payment. Going from the top to the bottom quartile of IQ increases this rate by ≈6% per day for short-term discounting and about the same per month for long-term discounting; both of these values accumulate to very high annual interest rates.

The effects are also very large in the case of our job tenure measure. Going from the bottom to the top quartile in IQ approximately doubles the probability of staying with the company for the first 6 months.

Discussion

CS might affect choices in the same way they help to perform calculations: higher skill can reduce the number of errors. We do in fact find that higher error rates are associated with lower levels of CS. However, if this were the only way in which CS affect preferences, we should observe only a larger variance in the choices made by those with lower CS, and no systematic effects, just as we do not see a systematic bias in the results of addition problems solved by those with lower CS.

Prior work has suggested a relationship between CS and preferences over risk and time (5, 14). With a larger sample that is of adult subjects, more systematic measures, and controlling for potentially confounding factors that prior studies have not addressed, we confirm this finding: higher CS are associated with a larger willingness to take calculated risks and higher patience. In addition, our comprehensive data collection design permits us to examine within the same subjects the relationship of CS to several further measures of economic interest. We find that CS are also associated with higher social awareness and a greater tendency to be cooperative in a strategic setting. The effects of CS go well beyond laboratory measures because we have also shown that they can significantly affect job success.

Economic theory has considered CS as important variables, but they have generally been treated as endowments that increase the set of feasible options for an individual. Our findings suggest that something deeper is going on. The systematic pattern of correlations between CS and the different preferences and behaviors we show in Table 3 calls out for theoretical explanation, and we have proposed one alternative. We conjecture that there is an underlying causal factor: the effect of CS on the precision with which complex and/or future options are perceived. When options that vary on these dimensions are relevant to choices or to planning, higher CS are likely to lead to better choices, and lower CS to poorer ones (see Theory section above and ref. 9).

Because CS introduce systematic effects in, and correlations among, economic preferences that cut across many domains of choice, they may also offer an explanation of the relative economic success of individuals. This is directly suggested by our findings on job tenure, in a setting with a significant financial liability for early exit. Our results on strategic behavior show that this relationship may be subtle because higher CS do not simply produce blind selfishness.

The role of CS in individual economic success may have implications for our understanding of questions such as why the intelligent live longer (15) or the role of the intergenerational transfer of economic success in the origins of economic growth (16). With regard to the latter, a recent suggestion is that a “survival of the richest” selection process favoring “capitalist” traits that include several of the ones we analyze herein (e.g., risk taking and saving propensity), may be implicated in the origins of economic growth in Europe with the industrial revolution (17).17 If preference traits were independent of each other, it would be hard for such a selection process to induce a bundled concentration in the time frame suggested. However, if these traits are correlated because of their linkage through CS, then a “selection of the richest” explanation operating through selection for CS, although certainly speculative, becomes more plausible.

Our findings are relevant for the development of better theories of human decision making and for the way we look at important policy issues. Decisions about retirement involve using CS to simultaneously apply attitudes toward risk and to the allocation over time of future payments. Numerical skills are already known to affect such decisions significantly (1, 7), and our results generalize this finding. The same holds for a variety of problems in the areas of health insurance, health care, investments in education, and in the area of labor contracts and employment choices. The relationships we find between CS and economic preferences, and among economic preferences, should be taken into account in designing improved decision theories, labor contracts, insurance policies, and public policies.

Methods

Field Setting.

Our data were collected in a temporary laboratory setup in a company-operated training school so that the social framing of the economic experiments was provided by the economic context of interest: training with a new employer for a new occupation. Over the course of a year we ran extensive experiments (4 h per session) with the participating subjects, in groups ranging from 20 to 30 at a time.

Measures of CS.

We collected three different measures of CS.18 The first was a licensed subset of Raven's Standard Progressive Matrices (SPM) (18). The SPM is a measure of nonverbal IQ consisting of a series of pattern matching tasks that do not require mathematical or verbal skill. The second was a section of a standard paper-and-pencil test for adults of quantitative literacy, or numeracy, from the Educational Testing Service. Subjects read and interpreted text and diagrams containing numerical information and performed arithmetic calculations, such as computing percentages, based on that information. In this and the prior measure, two subjects selected at random were paid for correct answers. The third instrument was a simple game, called Hit 15, played against the computer. This game required reasoning backward from the game's goal, which was to reach 15 total points from a varying initial number <15, to which each player had to add between 1 and 3 points on each round. Subjects were paid for each round they won.

Measures of Economic Preferences.

In the experiment on risk preferences subjects made four sets of six choices. The fixed payment increased in value with each choice, whereas the lottery was constant: a promise to pay the subject either a higher or a lower dollar amount, such as $10 or $2, depending on a random device that had a 50% probability for each outcome. Over the four sets of choices the amounts at stake varied between a gain of $10 and a loss of $5, to compare losses with gains and permit examination of stake differences. We identify preferences by using the certainty equivalent method (19). Subjects were paid for one randomly selected choice.

In our experiment on time preferences, subjects made four sets of seven choices. The later payment was always $80, whereas the earlier one ranged from $75 to $45, in increments of $5. We offered time horizons from today to 30 days hence. The goal was to compare shorter time horizons with longer ones, plus to capture any special features of immediacy. Two subjects from each test group were randomly selected to receive payment on the date they had selected in one of the 24 choices, which was also selected at random.

Sequential Prisoner's Dilemma.

Our version of the sequential Prisoner's Dilemma has a first mover and a second mover, and each subject chose actions both as a first and as a second mover. We randomly and anonymously paired subjects and randomly assigned their roles to determine payoffs.

Both the first and second mover were endowed with $5 and were asked whether they wanted to send money to the other player: what was kept would be theirs at the end, and what was sent would be doubled by the experimenters before reaching the other player. The first mover made an unconditional choice to send either none of the endowment ($0) or all of it ($5). The second mover made two choices about returning between $0 and $5 (in dollar increments) from his endowment, once in case the first mover had sent $0, and separately again in case the first mover had sent $5. We also asked each subject what percentage of first movers would send $5 and what the average amount sent by second movers responding to $0 and to $5 transfers would be. We paid subjects extra if their estimates matched the actual behavior.

Turnover in the Firm.

The length of job tenure is a key indicator of economic success for both firm and driver-trainee. The firm has at stake its investment in recruiting and training (between $5,000 and $10,000) and its reputation in the labor market. The trainee has at stake the debt for driver training (which is cancelled after 12 months of service but becomes immediately payable in full upon earlier exit), his job record, and his credit history. To address on-the-job success we examine what affects the survival curve, which is an estimate of the proportion of the initial trainee population remaining at each tenure length that takes into account the inflow of trainees over time and the right-censoring of incomplete tenure spells (20).

Supplementary Material

Acknowledgments.

This work was supported by the MacArthur Foundation's Research Network on the Nature and Origin of Preferences, the Alfred P. Sloan Foundation, the Trucking Industry Program at the Georgia Institute of Technology, the University of Minnesota at Morris, the Federal Reserve Bank of Boston, and financial and in-kind support from the cooperating motor carrier, its staff, and its executives.

Footnotes

The authors declare no conflict of interest.

This article is a PNAS Direct Submission.

There is a single common factor in our three measures (SI Appendix). Its correlation with all of the outcomes we consider is shown in the bottom row of Table 3.

Cash payments contingent upon choices were offered in all experiments; see Methods and SI Appendix.

This article contains supporting information online at www.pnas.org/cgi/content/full/0812360106/DCSupplemental.

The gray area shows the standard error of both estimates (which overlap); the fact that it tracks the estimated value is evidence that the results displayed are statistically reliable.

All regression-adjusted results shown in the figures or described in the text include the following demographic control variables: schooling, age, race, gender, and household income. We also include the 11 personality factors of the Multidimensional Personality Questionnaire (see Methods and SI Appendix).

A possible assumption: subjects with higher CS more effectively learn the efficient equilibrium in a repeated interaction or better acquire reciprocity heuristics and norms. This suggests higher transfers as first mover, and as second mover in response to a positive transfer.

The observed peak of mean IQ in Fig. 3D is statistically significant at P < 0.001 (see SI Appendix).

27.8%, P < 0.0001.

Thus sending $5 paid off among our subjects, returning on average $7.46 ($3.73 doubled), for an expected gain of almost 50%.

Thus, those with better CS behave as they expected others to, when responding as a second mover to receiving $0.

We use the coefficient of risk aversion estimated from the lotteries Win $10/$2 and Win $5/$1.

We use each subject's estimate of the amounts others will return on average; see Methods.

The coefficients are shown as risk ratios, which are multiplied times the baseline hazard, and so increase exit risk if above 1, decrease it if below, and show no effect if equal to 1.

In Table 15 in the SI Appendix, the smaller N leads to statistical insignificance for IQ in both exit subtype models when Hit 15 is added, but Hit 15 is always significant.

The driver must deliver a load to a point perhaps thousands of miles away by a target day and time, taking into account loading time, distances, speed limits, weather and traffic conditions, and especially, the government regulations governing allowable hours of service for drivers.

If the random outcome has expected value x, then for a risk-averse individual there is some fixed amount y <x that is subjectively equivalent to facing the gamble on the random outcome. The difference between x and y is the risk premium.

Such a process could be cultural, genetic, or both, but the genetic version is the most controversial.

We ran a factor analysis on these measures; see Footnote 2.

References

- 1.Banks J, Oldfield Z. Understanding pensions: Cognitive function, numerical ability, and retirement saving. Fiscal Studies. 2007;28:143–170. [Google Scholar]

- 2.Borghans L, Duckworth AL, Heckman JJ, ter Weel B. The economics and psychology of personality traits. J Human Resources. 2008;43(4):972–1059. [Google Scholar]

- 3.Bowles S, Gintis H, Osborne M. The determinants of earnings: A behavioral approach. J Econ Lit. 2001;39:1137–1176. [Google Scholar]

- 4.Eckel C, Johnson C, Montmarquette C. Saving decisions of the working poor: Short- and long-term horizons. Res Exp Econ. 2005;10:219–260. [Google Scholar]

- 5.Frederick S. Cognitive reflection and decision making. J Econ Perspect. 2005;19:25–42. [Google Scholar]

- 6.Neisser U, et al. Intelligence: Knowns and unknowns. Am Psychol. 1996;51:77–101. [Google Scholar]

- 7.Peters E, et al. Numeracy and decision making. Psychol Sci. 2006;17:407–413. doi: 10.1111/j.1467-9280.2006.01720.x. [DOI] [PubMed] [Google Scholar]

- 8.Burks S, et al. Using behavioral economic field experiments at a firm: The context and design of the Truckers and Turnover Project. In: Bender S, Lane J, Shaw K, Andersson F, von Wachter T, editors. The Analysis of Firms and Employees: Quantitative and Qualitative Approaches. Chicago, IL: Univ of Chicago; 2008. [Google Scholar]

- 9.Rustichini A. Neuroeconomics: Formal models of decision making and cognitive neuroscience. In: Glimcher PW, Camerer C, Poldrack RA, Fehr E, editors. Neuroeconomics: Decision Making and the Brain. Burlington, MA: Academic; 2008. [Google Scholar]

- 10.Laibson D. Golden eggs and hyperbolic discounting. Q J Econ. 1997;112:443–477. [Google Scholar]

- 11.McClure S, Laibson D, Lowenstein G, Cohen J. Separate neural systems value immediate and delayed rewards. Science. 2004;306:4. doi: 10.1126/science.1100907. [DOI] [PubMed] [Google Scholar]

- 12.Peters E, Slovic P, Västfjäll D, Mertz C. Intuitive numbers guide decisions. Judgem Decis Making. 2008;8:619–635. [Google Scholar]

- 13.Economic and Statistics Group. Truckload line-haul driver turnover quarterly annualized rates. Trucking Activity Rep. 2007;15(No. 3):1. [Google Scholar]

- 14.Benjamin DJ, Brown SA, Shapiro JM. Who is “Behavioral”? Cognitive Ability and Anomalous Preferences. [Accessed September 1, 2008];Social Science Research Network. 2006 May 5; doi: 10.1111/jeea.12055. Available at: http://papers.ssm.com/sol3/papers.cfm?abstract_id=675264. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Deary I. Why do intelligent people live longer? Nature. 2008;456:2. doi: 10.1038/456175a. [DOI] [PubMed] [Google Scholar]

- 16.Galor O, Moav O. Natural selection and the origin of economic growth. Q J Econ. 2002;117:1133–1191. [Google Scholar]

- 17.Clark G. A Farewell to Alms: A Brief Economic History of the World. Princeton, NJ: Princeton Univ Press; 2007. [Google Scholar]

- 18.Raven J, Raven JC, Court JH. Manual for Raven's Progressive Matrices and Vocabulary Scales. San Antonio, TX: Psychological Corp; 2000. Section 3: The Standard Progressive Matrices. [Google Scholar]

- 19.Luce R. Utility of Gains and Losses. Mahwah, NJ: Lawrence Erlbaum; 2000. [Google Scholar]

- 20.Kaplan EL, Meier P. Nonparametric estimation from incomplete observations. J Am Statist Assoc. 1958;53:457–481. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.