Abstract

This paper examines the role that population vulnerabilities play in insurance coverage for a representative sample of Latinos and Asians in the U.S. Using data from the National Latino and Asian American Study (NLAAS), these analyses compare coverage differences among and within ethnic subgroups, across states and regions, among types of occupation and among those with or without English language proficiency. Extensive differences exist in coverage between Latinos and Asians, with Latinos more likely to be uninsured. Potential explanations include the type of occupations available to Latinos and Asians, reforms in immigration laws, length of time in the U.S., and regional differences in safety net coverage. Policy implications are discussed.

Reliance on public health insurance or having no health insurance of any form is more common among racial/ethnic minorities as compared to white Americans. Findings from the 2005 Current Population Survey (CPS) show that in 2004, 32.7% of Latinos, 19.7% of blacks, and 16.8% of Asians in the U.S. lacked health insurance in comparison to 11.3% of non-Latino whites (DeNavas-Walt, Proctor, and Lee 2005). While this pattern in insurance coverage appears consistently, racial/ethnic minority populations in the U.S. with large numbers of immigrants encounter additional obstacles to accessing insurance, such as ineligibility for government-sponsored programs and language barriers. This paper presents new data from the National Latino and Asian American Study, fielded in 2002/2003, to examine factors that influence health insurance coverage for Latinos and Asians in the U.S.

Asian Americans and Latinos each are growing rapidly as a share of the U.S. population. In 2000, Latinos numbered approximately 35.3 million people, or 12.5% of the U.S. population (Guzman 2001), and Asian Americans numbered 11.6 million people or 4.2% of the population (Reeves and Bennett 2004). Latinos already account for more than half of the newborns in California (Murphy 2003) and soon will account for one of every three people born in the U.S. (Ginzberg 1991). Asian Americans are the fastest-growing ethnic category in the U.S. in terms of percentage increase; their numbers are expected to triple to more than 20 million by the year 2025 (Lee 1998). Between 14 million and 16 million immigrants have entered the U.S. in the last decade, coming primarily from Latin America (54%) and Asia (26%) (Capps and Passel 2004), with projections for an additional 15 million for the next decade. This accelerated growth of the Latino and Asian immigrant population has not been matched with policies to meet the social and economic needs of these populations.

Understanding the similarities and differences in how Asian and Latino populations access health insurance and health care are critical for making policy decisions and planning service delivery that are appropriate for the different groups. Although Latinos and Asian Americans are both ethnic minorities in the U.S. and share experiences that include a recent immigration history, and language and acculturation issues, health insurance rates differ dramatically between the two groups. This makes the Asian and Latino comparison potentially telling for identifying the factors that influence coverage for new minorities.

Table 1 lists studies conducted to date that have examined health insurance status among Latinos and Asians in the U.S. Data from the 1996 Medical Expenditure Panel Survey (MEPS) demonstrated that after controlling for demographic factors, Latinos were .39 times as likely, Asians were .64 times as likely, and blacks were .70 times as likely to have health insurance compared to non-Latino whites. While large differences in rates of insurance coverage have been found between Latinos and Asians, further analyses within these two subgroups have shown an even wider range of disparities in coverage. For example, data from the National Health Interview Survey (NHIS) in the early 1990s showed that among Asian Americans, Japanese Americans and Filipino Americans had the highest rates of insurance (79.0% and 73.4%, respectively), while Korean Americans had the lowest (51.9%). Similarly, in a study of Latinas who participated in the 1982-1984 Hispanic Health and Nutrition and Examination Survey (HHANES), 81% of Cuban women, 81% of Puerto Rican women, and only 73% of Mexican women reported being insured.

Table 1. Study Description: Rates of uninsurance for Latino and Asian subgroups.

| Study | Description | Sample | Findings | Language | Limitations |

|---|---|---|---|---|---|

|

De la Torre, Friis, and Hunter 1996 HHANES of 1982-1984 |

Examines the correlates of health insurance status among three major Latino subgroups (Mexican, Puerto Rican, and Cuban) of adult Latino women. |

N= 11653. A stratified, multistage probability sampling strategy obtained a representative sample of English and Spanish speaking Mexicans in five Southwestern states, Puerto Ricans in the New York City area, and Cubans in Dade County, Fla. ages 1-74. Data were collected from 1982-1984. Response rate: Puerto Ricans=75%, Cubans=61%, Mexicans=75% De la Torre, Friis, and Hunter limited their sample to adult Latino women ages 20-64. |

|

English Spanish |

Data were not collected on other Latino subgroups. Sample not generalizable to the greater U.S. population |

|

Fronstin, Goldberg, and Robins 1997 CPS 1989-1994 |

Examines differences in private health insurance coverage for working male Hispanics (Mexican-American, Puerto Rican, and Cuban-American men). | N= 50,000 households. The CPS is designed to be representative of the civilian noninstitutional population. Respondents age 15 and older. However, published data focus on those ages 16 and older. |

|

English | Data were not collected on other Latino or Asian subgroups. Interview was conducted only with English speaking respondents |

|

Hall, Collins, and Glied 1999 CPS 1997 |

Explores the relationship between minority status and the distribution of employer-sponsored health insurance. | N= 50,000 households. The CPS is designed to be representative of the civilian noninstitutional population. Respondents age 15 and older. However, published data focus on those ages 16 and over. This paper focuses on white, black, and Hispanic employed adults ages 18-64. |

|

English | Data were not collected on Latino subgroups. Interview was conducted only with English speaking respondents |

|

Shi 2000 1996 MEPS Household Component |

Profiles health insurance for certain vulnerable populations including children, racial/ethnic minorities, low-income families, non-MSA residents, and those with poor health status. | N= 21571. The household component collects data on a sample of families and individuals, drawn from a nationally representative subsample of households that participated in the prior year’s NCHS National Health Interview Survey. This study included people younger than 65 years who completed the first two rounds of the survey. Response rate: 70.7% |

|

English Spanish |

Interviews only conducted with English- and Spanish-speaking respondents |

|

Vitullo and Taylor 2002 1996 MEPS Household Component |

Compares factors associated with health insurance status for Mexican and Puerto Rican adults. | N= 21571. The household component collects data on a sample of families and individuals, drawn from a nationally representative subsample of households that participated in the prior year’s NCHS National Health Interview Survey. The study has a panel design which features several rounds of interviewing covering two full calendar years. Response rate: 70.7% |

|

English Spanish |

Data not collected on other specific racial/ethnic subgroups. Interviews only conducted with English- and Spanish-speaking respondents |

|

Berk et al 2000 1996/1997 survey of undocumented Latino immigrants |

Examines how much health care undocumented people use and what extent undocumented people receive benefits from government health programs. | N= 973. Representative samples of undocumented Latino immigrants were identified in four major communities in two states (Houston and El Paso Tex; Fresno and Los Angeles Calif). 1990 census data were used to identify neighborhoods likely to have concentrations of undocumented persons. R esponse rate: 73%. |

|

English Spanish |

The sample cannot be generalized to the larger U.S. population. Individual Latino subgroups not sampled. |

|

Abe-Kim, Takeuchi and Hwang 2002 CAPES |

Explores predictors of help-seeking for emotional distress. | N= 1503. Chinese immigrants and U.S.-born residents of the U.S, ages 18-65 years were interviewed. The CAPES is a strata-cluster survey conducted in 1993-1994 in the greater Los Angeles area. A three-stage probability sample generally represents the Chinese American population residing in the area. Response rate: 82%. |

|

English Mandarin Cantonese |

The sample focused on residents living in high density areas, constraining generalizability to all Chinese Americans living in Los Angeles. |

|

Ryu Young and Kwak 2002 NHIS |

Identifies ethnic differences in health insurance coverage and service utilization by focusing on differences among Asian American groups (Chinese, Filipino, Korean, Vietnamese, Japanese, and Asian Indian Americans). | N= 5847 Asian civilian noninstitutionalized US adults (ages 18+) from the 1992, 1993, and 1994 NHIS data. The NHIS is a cross-sectional household interview survey. The sampling plan follows a multistage area probability design that permits the representative sampling of households. |

|

English | Interview conducted only with English speaking respondents |

|

Ku and Waidmann 2003 1999 NSAF |

Examines the roles of race, language and citizenship status on insurance coverage, access and quality of health care for the low income Latino population. | N= 100000. The survey is representative of the noninstitutionalized, civilian population of people under age 65 with sample drawn separately in 13 states and for the balance of the nation. The sample was oversampled for low income families with children. Response rate: 86.1%. |

|

English Spanish |

Interview conducted only with English and Spanish speaking respondents. |

HHANES = Hispanic Health and Nutrition Examination Survey; CPS = Current Population Survey; MEPS = Medical Expenditure Panel Survey; CAPES = Chinese American Psychiatric Epidemiological Study; NHIS = National Health and Interview Survey; NSAF = National Survey of American’s Families

References for Table 1 : (De la Torre, Friis, and Hunter 1996); (Fronstin, Goldberg, and Robins 1997); (Hall, Collins, and Glied 1999); (Shi 2000); (Vitullo and Taylor 2002); (Berk et al. 2000); (Abe-Kim, Takeuchi, and Hwang 2002); (Ryu, Young, and Kwak 2002); (Ku and Waidmann 2003)

While research conducted to date provides compelling evidence that Latinos and Asians disproportionately lack health insurance coverage compared to their white, U.S.-born counterparts, these analyses have been conducted predominantly with the same four datasets: the Current Population Survey, the Medical Expenditure Panel Survey, the National Health Interview Survey, and the National Survey of American Families (see Table 1 for detailed information). Some of these surveys are conducted only in English and offer limited generalizability to subgroups within the Latino and Asian populations. This paper presents analyses based on new data from the National Latino and Asian American Study (NLAAS), an epidemiological and service use study of Latinos and Asian Americans that employs a national sampling frame to select interview respondents. The NLAAS uses recently collected data with good measures of factors related to lack of insurance coverage, and has large numbers of respondents from Asian and Latino ethnic subgroups (Puerto Rican, Mexican, Cuban, and other Latinos; Chinese, Vietnamese, Filipino, and other Asians). In addition, interviews for the NLAAS were conducted in English as well as four other languages (Spanish, Mandarin, Tagalog, and Vietnamese) to ensure respondents could be interviewed in their native language. Data from the NLAAS provide the opportunity to document and explore explanations for subgroup differences in insurance outcomes among a representative sample of Latinos and Asians residing in the U.S.

Access to health insurance for Latinos and Asians in the U.S. often depends upon many of the same factors as for white Americans. However, with a high proportion of immigrants and foreign-born people, Latino and Asian populations in the United States often face additional barriers to securing coverage beyond those related to labor market and socioeconomic factors. These include finding that the American health care system differs substantially from that in their home countries (Feld and Power 2000). Furthermore, depending on their country of origin, Asian and Latino immigrants often differ in resources, including human and social capital (Ryu, Young, and Kwak 2002; De la Torre, Friis, and Hunter 1996), both of which may shape the types of jobs they obtain as well as the compensation and benefits provided by their employer. Limited English proficiency also may compound the difficulties confronted by foreign-born Latinos and Asians in securing health insurance (Perkins 2003). These outcomes may be a product of limited options for obtaining jobs that offer coverage and of language barriers to navigating the health insurance and medical systems effectively.

Public policies, such as the 1996 welfare reform, also have restricted access to public insurance programs, resulting in declines in Medicaid coverage (Wang and Holahan 2003). However, even among Latino and Asian families who are eligible to enroll in Medicaid and other publicly funded insurance programs, under-enrollment has occurred due to misunderstandings over policy requirements as well as persistent rumors that receipt of Medicaid benefits may jeopardize immigrant residency status (Capps, Ku, and Fix 2002). Additionally, various citizenship and immigration categories confer different rights. Whereas those qualifying for refugee status (e.g., Vietnamese, Cambodians) have options for health insurance coverage through public programs for seven years after their arrival, most other immigrants (e.g., undocumented immigrants or legal permanent residents) must either obtain insurance through an employer, purchase individual insurance, or go without insurance (Ku and Matani 2001).

Employer characteristics continue to play an important role in shaping patterns of coverage among nonelderly adults (Claxton et al. 2003; Institute of Medicine 2002), but employer-based insurance is not distributed equally among groups. Latinos and African Americans have substantially lower rates of job-based insurance than their white counterparts (Zuvekas and Taliaferro 2003; Fronstin, Goldberg, and Robins 1997). Limited data on Asian Americans’ sources of coverage reflect diversity in the pattern of insurance (Brown et al. 2000; Ryu, Young, and Kwak 2002).

Finally, state variations in coverage policies also may affect access to insurance. For example, the federal government defines broad categories of Medicaid eligibility criteria. However, states may expand the scope of their programs or find separate programs to provide insurance coverage to individuals who may be ineligible for other public programs (Zimmermann and Tumlin 1999). Access to employer-based insurance also may depend upon local labor markets. Differences in state Medicaid and other public insurance programs and in local labor market conditions are reflected in state uninsured rates, which vary from 8% in Minnesota to a high of 24% in Texas (Mills and Bhandari 2003). Regionally, the South and West have high proportions of uninsured as compared to the Midwest and Northeast (Institute of Medicine 2002). Recent analyses from the Kaiser Commission on Medicaid and the Uninsured (Kaiser Commission on Medicaid and the Uninsured 2003) showed that among the four states with the greatest immigrant populations (California, Florida, New York, and Texas), Texas had the highest rates of uninsurance of noncitizens (56%), while California and New York had lower rates (46%).

The pervasiveness of uninsurance among certain subgroups of the population underscores the importance of identifying factors linked to these negative outcomes and corresponding leverage points that may decrease uninsurance for different minority groups. This study contrasts insurance outcomes for Asian Americans and Latinos, including analyses of subgroups. We also compare differences in uninsurance rates across states, regions, types of occupation, household income, education, and level of English language proficiency in an effort to guide public policy and service planning.

Survey Design and Sample

The National Latino and Asian American Study is based on a stratified area probability sample design that included Latino and Asian American adults, age 18 and older, in the noninstitutionalized population of the 50 states and District of Columbia. Interviews took place over a 20-month period between 2002 and 2003. For the analyses presented here, the sample was restricted to respondents aged 18 to 64. Latinos were divided into four strata (Puerto Rican, Cuban, Mexican and all other Latinos), as were Asian Americans (Chinese, Filipino, Vietnamese, and all other Asians), relying on self-reports by household members at the time of the household screening. The final sample consisted of 2,554 English- and Spanish-speaking Latinos, and 2,095 English-, Mandarin-, Cantonese-, Tagalog-, and Vietnamese-speaking Asian Americans, for a total of 4,649 respondents. The overall response rate was 73.2%; the response rate was 75.5% for Latinos and 65.6% for the Asian Americans. The NLAAS provides sample-based coverage of the full national population for these groups.

Participants initially were contacted with an introductory letter and study brochure, followed by screening, scheduling, and interviewing. Interviews were conducted using computer-assisted interviewing software, and were administered by trained bilingual interviewers with linguistic and cultural backgrounds similar to those of the target population. Face-to-face interviews were conducted with participants in the core and high-density samples, unless the respondent specifically requested a telephone interview, or if face-to-face interviewing was prohibitively expensive. As a measure of quality control, a random sample of participants with completed interviews was re-contacted to validate the data. A detailed description of the sampling design can be found elsewhere (Alegria, Vila et al. 2004; Alegria, Takeuchi et al. 2004; Heeringa et al. 2004; Pennell et al. 2004).

The NLAAS weighted sample for Latinos and Asians was similar to the 2000 census in gender, age, education, marital status, and geographical distribution (data not shown), but different in nativity and household income, with more immigrants and lower-income respondents in the NLAAS sample. This discrepancy may be due to census undercounting of immigrants (Anderson and Fienberg 1999; U.S. General Accounting Office 1998), exclusion of undocumented workers (Margolis 1995), lack of fully bilingual interviewers of Latino and Asian ethnicity conducting the census interviews, or differences in sample recruitment of participants between a survey targeted to the Latino and Asian population and one for the general population.

The NLAAS survey questions on insurance ask about current coverage. Insurance status data include information about the source of coverage, if any, and about the extent and nature of the coverage for health and mental health conditions. The survey also collects comprehensive information on the interviewees’ demographic and social economic status, including characteristics such as age, gender, marital status, household income, education level, region, family employment status, nativity, English language proficiency, percentage of lifetime spent in the U.S., type of occupation, self-reported general health status, self-reported mental health status, and type of disabilities. These are described in detail later (see Table 2 for the insurance outcomes, health status, and sociodemographic characteristics of the sample). Respondents’ household income was constructed from six questions that assess diverse sources of personal and family income using categories. Missing values of household income were imputed by a hotdeck method using information on ethnicity, gender, age, education, region, household composition, and employment status. The midpoint of the range for each distinct income source was summed to yield the final household income range estimate.

Table 2. Insurance outcomes, sociodemographics, and health factors1 for Latino and Asian subgroups (ages 18-64).

| Latinos | Asians | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Puerto Rican | Cuban | Mexican | Other Latino | Total Latino | Vietnamese | Filipino | Chinese | Other Asian | Total Asian | |

| Sample | ||||||||||

| N | 454 | 461 | 826 | 582 | 2323 | 471 | 461 | 558 | 441 | 1931 |

| % of ethnic sample | 9.8 | 3.9 | 57.5 | 28.8 | 100.0 | 12.7 | 21.0 | 28.5 | 37.8 | 100.0 |

| Insurance status (%) | ||||||||||

| Private insurance | 51.8 | 52.4 | 39.2 | 54.2 | 45.3 | 57.1 | 73.0 | 73.9 | 74.6 | 71.8 |

| Public insurance | 27.3 | 13.1 | 13.9 | 15.1 | 15.6 | 19.8 | 6.7 | 7.2 | 6.1 | 8.3 |

| Uninsured | 17.3 | 31.7 | 44.9 | 28.2 | 36.8 | 20.2 | 12.8 | 14.5 | 13.3 | 14.4 |

| Other insurance | 3.6 | 2.8 | 1.9 | 2.5 | 2.3 | 2.8 | 7.4 | 4.5 | 6.1 | 5.5 |

| Gender (%) | ||||||||||

| Male | 48.4 | 52.5 | 54.8 | 48.5 | 52.3 | 46.7 | 45.5 | 47.3 | 50.4 | 48.0 |

| Female | 51.6 | 47.5 | 45.2 | 51.5 | 47.7 | 53.3 | 54.5 | 52.7 | 49.6 | 52.0 |

| Age (%) | ||||||||||

| 18-24 | 19.5 | 11.9 | 23.7 | 22.0 | 22.3 | 13.0 | 19.2 | 12.6 | 18.4 | 16.2 |

| 25-34 | 23.7 | 21.4 | 32.8 | 30.1 | 30.7 | 21.2 | 21.9 | 22.9 | 36.8 | 27.7 |

| 35-49 | 35.9 | 33.9 | 31.4 | 33.4 | 32.5 | 41.1 | 37.2 | 41.8 | 29.0 | 35.9 |

| 50-64 | 20.9 | 32.8 | 12.1 | 14.6 | 14.5 | 24.7 | 21.7 | 22.6 | 15.8 | 20.1 |

| Marital status (%) | ||||||||||

| Married | 39.3 | 56.7 | 57.4 | 45.7 | 52.2 | 70.8 | 60.1 | 67.9 | 62.7 | 64.7 |

| Never married | 36.9 | 19.6 | 30.2 | 35.5 | 32.0 | 21.9 | 30.3 | 23.3 | 31.2 | 27.6 |

| Divorced/separated/widowed | 23.9 | 23.7 | 12.4 | 18.8 | 15.8 | 7.4 | 9.5 | 8.8 | 6.1 | 7.7 |

| Household income (%) | ||||||||||

| 0-$14,999 | 24.7 | 20.2 | 27.9 | 21.5 | 25.4 | 25.1 | 12.1 | 16.8 | 14.8 | 16.1 |

| $15,000-34,999 | 20.6 | 23.9 | 31.9 | 27.1 | 29.1 | 21.0 | 9.3 | 13.0 | 11.2 | 12.6 |

| $35,000-74,999 | 31.4 | 27.3 | 26.6 | 31.5 | 28.5 | 28.1 | 30.1 | 23.8 | 33.2 | 29.2 |

| $75,000+ | 23.3 | 28.6 | 13.6 | 19.9 | 17.0 | 25.8 | 48.5 | 46.4 | 40.8 | 42.1 |

| Education | ||||||||||

| Some high school or less (<12 yrs) | 31.4 | 22.5 | 51.1 | 31.0 | 42.3 | 29.0 | 7.6 | 16.3 | 8.1 | 13.0 |

| High school graduate (12 yrs) | 29.5 | 26.2 | 25.1 | 24.8 | 25.5 | 22.4 | 20.5 | 15.9 | 15.1 | 17.4 |

| Some college or college degree (13-16 yrs) | 27.0 | 24.2 | 16.8 | 29.6 | 21.8 | 23.6 | 35.4 | 21.4 | 26.0 | 26.4 |

| Graduate education (17+ yrs) | 12.0 | 27.1 | 7.0 | 14.6 | 10.4 | 24.9 | 36.5 | 46.4 | 50.8 | 43.3 |

| Family employment a (%) | ||||||||||

| Employed | 74.0 | 82.2 | 84.1 | 81.3 | 82.2 | 84.5 | 83.7 | 81.8 | 84.5 | 83.5 |

| Not employed | 26.0 | 17.8 | 15.9 | 18.7 | 17.8 | 15.5 | 16.3 | 18.2 | 15.5 | 16.5 |

| Nativityb, time in country (%) | ||||||||||

| US born | 58.3 | 18.0 | 41.4 | 38.7 | 41.4 | 3.4 | 31.6 | 18.3 | 28.3 | 23.0 |

| Immigrant (> 5 yrs) | 39.4 | 61.6 | 47.6 | 50.7 | 48.3 | 80.2 | 57.1 | 67.8 | 53.5 | 61.7 |

| Immigrant (≤ 5 yrs) | 2.4 | 20.4 | 10.8 | 10.6 | 10.3 | 16.4 | 11.2 | 13.9 | 18.1 | 15.2 |

| Region | ||||||||||

| Northeast | 61.7 | 5.7 | 2.3 | 37.6 | 18.5 | 17.1 | 7.6 | 17.6 | 18.5 | 15.8 |

| Midwest | 10.9 | 0.0 | 9.3 | 6.0 | 8.1 | 2.5 | 7.4 | 8.6 | 14.2 | 9.7 |

| South | 19.0 | 92.0 | 30.4 | 24.8 | 30.1 | 19.6 | 7.4 | 4.1 | 7.9 | 8.2 |

| West | 8.3 | 2.3 | 58.0 | 31.6 | 43.4 | 60.8 | 77.7 | 69.8 | 59.3 | 66.3 |

| English proficiency (%) | ||||||||||

| Poor/fair | 26.7 | 51.1 | 54.4 | 41.0 | 47.7 | 68.9 | 15.4 | 45.0 | 17.1 | 31.3 |

| Good/excellent | 73.3 | 48.9 | 45.6 | 59.0 | 52.3 | 31.1 | 84.6 | 55.0 | 82.9 | 68.7 |

| General health status (self-report) (%) | ||||||||||

| Good/excellent | 74.4 | 81.6 | 68.3 | 82.0 | 73.3 | 79.4 | 90.7 | 80.1 | 91.6 | 86.6 |

| Poor/fair | 25.6 | 18.4 | 31.7 | 18.0 | 26.7 | 20.6 | 9.3 | 19.9 | 8.4 | 13.4 |

| Mental health status (self-report) (%) | ||||||||||

| Good/excellent | 88.9 | 90.0 | 86.7 | 92.2 | 88.6 | 88.6 | 93.6 | 87.4 | 95.9 | 92.1 |

| Poor/fair | 11.1 | 10.0 | 13.3 | 7.8 | 11.4 | 11.4 | 6.4 | 12.6 | 4.1 | 7.9 |

| Disability | ||||||||||

| None | 94.2 | 95.4 | 96.6 | 97.7 | 96.7 | 96.3 | 98.7 | 99.4 | 98.5 | 98.5 |

| Physical and other | 3.6 | 2.4 | 2.7 | 1.9 | 2.5 | 2.6 | 1.3 | .3 | 1.5 | 1.3 |

| Emotional | .2 | .7 | 0.0 | .2 | .1 | .9 | 0.0 | .1 | 0.0 | .1 |

| Physical and emotional | 2.1 | 1.5 | .7 | .2 | .7 | .2 | 0.0 | .2 | 0.0 | .1 |

| Occupation | ||||||||||

| White collar | 60.0 | 60.5 | 37.6 | 49.4 | 44.2 | 45.2 | 77.6 | 84.5 | 81.3 | 76.8 |

| Blue collar | 25.5 | 28.6 | 45.3 | 27.7 | 37.5 | 40.9 | 15.0 | 9.1 | 13.4 | 16.0 |

| Service sector | 14.5 | 10.9 | 17.1 | 22.9 | 18.3 | 13.9 | 7.4 | 6.4 | 5.3 | 7.1 |

All data except sample N given as weighted percentages;

One or more members of household employed or all not employed;

Persons born in Puerto Rico are U.S. citizens; “U.S.born,” “immigrant,” and “time in country” refer to mainland birth place, island birthplace, and time in mainland residence, respectively.

The insurance variable was constructed by assigning respondents to one of four aggregated groups: uninsurance, public insurance (Medicare and Medicaid), private insurance (i.e., private through employer, privately purchased), and other insurance. If a person reported multiple insurance plans, then he/she was assigned to Medicare as long as the individual was enrolled in Medicare. If the person was not in Medicare but had private insurance from an employer, then she/he was considered privately insured through an employer or individually purchased insurance, regardless of what other plans the person had. If the respondent had a private purchased plan but was not in Medicare or privately insured through an employer, she/he was assigned as private-purchased insurance. The person was classified as uninsured if she/he did not have any type of insurance.

Methods

In the NLAAS, the age and gender distribution varies across different racial/ethnic groups and may contribute to part of the difference in insurance rates. For each of the eight racial/ethnic groups (Puerto Rican, Cuban, Mexican, other Latino, Vietnamese, Filipino, Chinese, and other Asian), we adjusted the insurance rates by making the age and gender distribution the same as the census proportions. Applying the new adjusted weights to the data, we obtained the age- and gender-adjusted insurance rates by racial/ethnic groups and compared these by conducting design-base adjusted F tests (see Figures 1-6). We also compared the adjusted uninsurance outcomes of Latinos and Asian Americans by state of residence, region, type of occupation, household income, education, and level of English proficiency of the respondent.

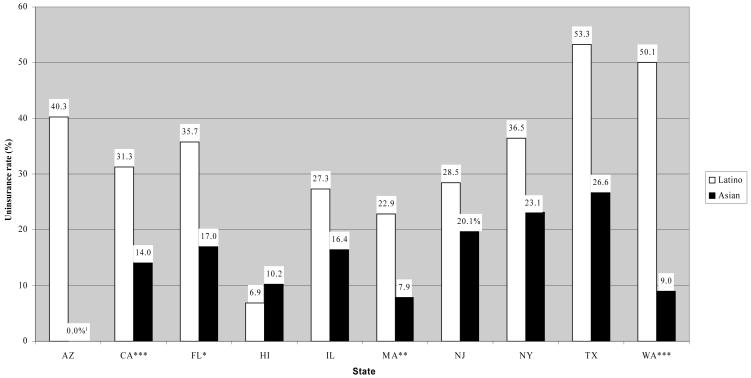

Figure 1. Age- and gender-adjusted uninsurance rates across states, by race/ethnicity.

Source: NLAAS data, calculated by the authors.

***p<.001, **p<.01,*p<.05. Significance shown for the test of difference between Latino and Asian within each State.

a: Of the Asians living in the Arizona, 0.0% were uninsured

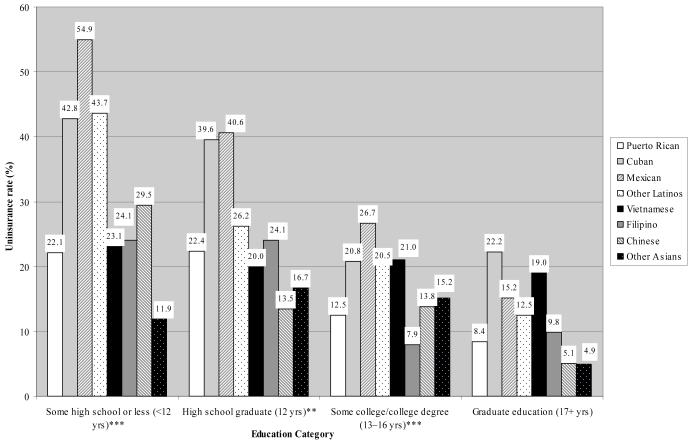

Figure 6. Age- and gender-adjusted uninsurance rates across education category, by subethnicity.

Source: NLAAS data, calculated by the authors.

***p<.001, **p<.01,*p<.05. Significance shown for the test of difference among Latino and Asian subgroups within each level of education.

Tables 3 and 5 show results of the weighted multinomial logistic regression of insurance outcomes on ethnicity, demographics, socioeconomic status, immigration status, health status, and geographic variables for Latino and Asian subsamples, respectively. Based on the regression results in Tables 3 and 5, Tables 4 and 6 report predicted probabilities of the three insurance outcomes: the tables show the model-predicted probabilities of insurance outcomes (with the small “other insurance category” omitted) calculated for a particular observed value of a measure of interest (e.g., gender equal to female) with other variables set to their overall weighted sample means.1 All analyses were conducted using the “svy” commands of the Stata statistical software package (StataCorp 2003) (data not shown).

Table 3. Weighted multinomial logistic regression results for Latinos (ages 18-64).

| Public insurance | No insurance | |||||

|---|---|---|---|---|---|---|

| RRRa | Std. err | RRR | Std. err | |||

| All Latinos | ||||||

| Puerto Rican | 1.51 | (.39) | .41 | (.07) | *** | |

| Cuban | 1.74 | (.71) | .54 | (.14) | * | |

| Mexican (reference) | ||||||

| Other Latino | .88 | (.19) | .52 | (.09) | *** | |

| Age | ||||||

| 18-24 | 1.07 | (.22) | 1.55 | (.49) | ||

| 25-34 | .96 | (.15) | 1.19 | (.15) | ||

| 53-49 (reference) | ||||||

| 50-64 | .57 | (.14 | * | .68 | (.18) | |

| Gender | ||||||

| Female | 3.68 | (.60) | *** | 1.19 | (.17) | |

| Male (reference) | ||||||

| Marital status | ||||||

| Married (reference) | ||||||

| Divorced/separated/widowed | 1.04 | (.20) | 1.20 | (.32) | ||

| Never married | .79 | (.19) | 1.34 | (.23) | ||

| Household income | ||||||

| 0-$14,999 | 8.39 | (2.87) | *** | 3.10 | (.73) | *** |

| $15,000-34,999 | 5.37 | (1.54) | *** | 1.51 | (.37) | |

| $35,000-74,999 | 1.91 | (.55) | * | .95 | (.21) | |

| $75,000+ (refere nce) | ||||||

| Education | ||||||

| Some high school or less (<12 yrs) | 3.22 | (1.59) | * | 4.15 | (1.14) | *** |

| High school graduate (12 yrs) | 2.37 | (1.18) | 2.80 | (.86) | ** | |

| Some college or college degree (13-16 yrs) | 1.29 | (.70) | 2.04 | (.52) | ** | |

| Graduate edu cation (17+ yrs) (reference) | ||||||

| Family employment | ||||||

| Not employed | 5.63 | (1.14) | *** | 2.01 | (.50) | ** |

| Employed | ||||||

| Nativity, time in country | ||||||

| US born (reference) | ||||||

| Immigrant (>5 yrs) | .77 | (.17) | 1.09 | (.20) | ||

| Immigrant (<=5 yrs) | .42 | (.20) | 2.15 | (.65) | * | |

| English proficiency | ||||||

| Poor/fair (reference) | ||||||

| Good/excellent | .78 | (.18) | .41 | (.08) | *** | |

| General health status (self-report) | ||||||

| Poor/fair | 1.39 | (.31) | 1.28 | (.22) | ||

| Good/excellent (reference) | ||||||

| Mental health status (self-report) | ||||||

| Poor/fair | .97 | (.37) | .82 | (.36) | ||

| Good/excellent (reference) | ||||||

| Disability | ||||||

| Any | 9.83 | (5.37) | *** | 1.65 | (.55) | |

| None (reference) | ||||||

| Region | ||||||

| Northeast | 1.12 | (.37) | 1.45 | (.38) | ||

| Midwest | 0.44 | (.26) | 0.62 | (.30) | ||

| South | 0.47 | (.16) | * | 1.77 | (.30) | ** |

| West (reference) | ||||||

Outcome for private insurance is the comparison group.

Relative risk ratios.

p<.05

p<.01

p<.001

Table 5. Weighted multinomial logistic regression results for Asians (ages 18-64).

| Public insurance | No insurance | |||||

|---|---|---|---|---|---|---|

| RRRa | Std. err | RRR | Std. err | |||

| All Asians | ||||||

| Vietnamese | 2.98 | (.97) | ** | 1.13 | (.26) | |

| Filipino | 1.32 | (.52) | 1.17 | (.23) | ||

| Chinese (reference) | ||||||

| Other Asian | 1.44 | (.61) | 1.13 | (.29) | ||

| Age | ||||||

| 18-24 | .67 | (.37) | .91 | (.23) | ||

| 25-34 | .85 | (.31) | 1.10 | (.29) | ||

| 35-49 (reference) | ||||||

| 50-64 | .94 | (.29) | .97 | (.19) | ||

| Gender | ||||||

| Female | 1.21 | (.29) | .59 | (.10) | ** | |

| Male (reference) | ||||||

| Marital status | ||||||

| Married (reference) | ||||||

| Divorced/separated/widowed | 1.71 | (.68) | 1.64 | (.56) | ||

| Never married | 1.66 | (.82) | 2.30 | (.69) | ** | |

| Household income | ||||||

| 0-$14,999 | 3.55 | (.93) | *** | 5.70 | (2.05) | *** |

| $15,000-34,999 | 1.70 | (.48) | 3.48 | (.72) | *** | |

| $35,000-74,999 | .85 | (.29) | 2.22 | (.46) | *** | |

| $75,000+ (reference) | ||||||

| Education | ||||||

| Some high school or less (<12 yrs) | 3.75 | (2.10) | * | 3.59 | (1.34) | ** |

| High school graduate (12 yrs) | 4.43 | (1.87) | ** | 3.15 | (1.21) | ** |

| Some college or college degree (13-16 yrs) | 2.54 | (1.32) | 2.47 | (.93) | * | |

| Graduate education (17+ yrs) (reference) | ||||||

| Family employment | ||||||

| Not employed | 4.54 | (1.37) | *** | 2.19 | (.46) | *** |

| Employed | ||||||

| Nativity, time in country | ||||||

| US born (reference) | ||||||

| Immigrant (>5 yrs) | 1.67 | (.71) | 1.42 | (.46) | ||

| Immigrant (<=5 yrs) | 1.90 | (.93) | 2.66 | (.75) | ** | |

| English proficiency | ||||||

| Poor/fair (reference) | ||||||

| Good/excellent | .83 | (.18) | .60 | (.14) | * | |

| General health status (self-report) | ||||||

| Poor/fair | 1.88 | (.73) | 1.06 | (.29) | ||

| Good/excellent (reference) | ||||||

| Mental health status (self-report) | ||||||

| Poor/fair | 1.62 | (.65) | 2.05 | (.68) | * | |

| Good/excellent (reference) | ||||||

| Disability | ||||||

| Any | 2.67 | (1.43) | 1.62 | (1.22) | ||

| None (reference) | ||||||

| Region | ||||||

| Northeast | .84 | (.52) | 1.44 | (.34) | ||

| Midwest | .25 | (.21) | .79 | (.32) | ||

| South | .66 | (.57) | 1.53 | (.49) | ||

| West (reference) | ||||||

Outcome for private insurance is the comparison group.

Relative risk ratios.

p<.05

p<.01

p<.001

Table 4. Predicted probabilities of insurance outcomes for Latinos (ages 18-64).

| Private Insurance | Public Insurance | Uninsured | |

|---|---|---|---|

| (%) | (%) | (%) | |

| All Latinosa | 48.1 | 11.5 | 40.4 |

| Subgroup*** | |||

| Puerto Rican | 55.1 | 19.4 | 25.5 |

| Cuban | 49.7 | 20.2 | 30.1 |

| Mexican | 42.3 | 9.9 | 47.8 |

| Other Latino | 55.7 | 11.4 | 32.9 |

| Gender*** | |||

| Female | 41.8 | 19.7 | 38.4 |

| Male | 52.6 | 6.8 | 40.6 |

| Age | |||

| 18-24 | 40.6 | 11.2 | 48.1 |

| 25-34 | 46.4 | 11.5 | 42.1 |

| 35-49 | 49.4 | 12.8 | 37.8 |

| 50-64 | 60.0 | 8.9 | 31.1 |

| Marital status | |||

| Married | 50.0 | 12.8 | 37.2 |

| Divorced/separated/widowed | 46.3 | 12.4 | 41.3 |

| Never married | 45.5 | 9.1 | 45.4 |

| Household income*** | |||

| 0-$14,999 | 29.8 | 17.8 | 52.4 |

| $15,000-34,999 | 44.7 | 17.1 | 38.2 |

| $35,000-74,999 | 59.6 | 8.1 | 32.3 |

| $75000+ | 61.0 | 4.3 | 34.6 |

| Education*** | |||

| Some high school or less (<12 yrs) | 39.2 | 13.7 | 47.1 |

| High school graduate (12 yrs) | 48.4 | 12.5 | 39.2 |

| Some college or college degree (13-16 yrs) | 57.8 | 8.1 | 34.1 |

| Graduate education (17+ yrs) | 71.5 | 7.8 | 20.7 |

| Family employment b *** | |||

| Not employed | 28.7 | 28.5 | 42.8 |

| Employed | 52.1 | 9.2 | 38.7 |

| Nativityc, time in country ** | |||

| US born | 49.0 | 14.5 | 36.4 |

| Immigrant (>5 yrs) | 49.0 | 11.2 | 39.7 |

| Immigrant (<=5 yrs) | 36.8 | 4.6 | 58.6 |

| Region*** | |||

| Northeast | 42.7 | 14.9 | 42.4 |

| Midwest | 64.0 | 8.8 | 27.3 |

| South | 42.4 | 6.3 | 51.3 |

| West | 50.1 | 15.7 | 34.3 |

| English proficiency*** | |||

| Poor/fair | 38.4 | 10.4 | 51.2 |

| Good/excellent | 56.9 | 12.1 | 31.0 |

| General health status (self-report) | |||

| Poor/fair | 43.3 | 13.2 | 43.5 |

| Good/excellent | 49.9 | 10.9 | 39.2 |

| Mental health status (self-report) | |||

| Poor/fair | 51.7 | 12.0 | 36.3 |

| Good/excellent | 47.7 | 11.4 | 40.9 |

| Disability** | |||

| Any | 22.1 | 47.9 | 30.0 |

| None | 48.9 | 10.8 | 40.3 |

Table gives predicted probabilities from the multinom iallogistic regression in Table 3, with the effect of each covariate adjusted to the mean of all other covariates shown in table.

Adjusted to the mean of all covariates

One or more members of household employed or all members are not employed

Persons born in Puerto Rico are U.S. citizens; “U.S. born”, “immigrant”, and “time in country” refer to mainland birthplace, island birthplace, and time in mainland residence, respectively.

p<.05

p<.01

p<.001

for overall test of difference among indicated covariate(s).

Table 6. Predicted Probabilities of Insurance Outcomes for Asians (Ages 18-64).

| Private Insurance | Public Insurance | Uninsured | |

|---|---|---|---|

| (%) | (%) | (%) | |

| All Asiansa | 82.5 | 5.7 | 11.8 |

| Subgroup* | |||

| Vietnamese | 77.3 | 11.3 | 11.3 |

| Filipino | 82.2 | 5.4 | 12.5 |

| Chinese | 84.8 | 4.2 | 11.0 |

| Other Asian | 82.1 | 5.8 | 12.1 |

| Gender** | |||

| Female | 84.3 | 6.4 | 9.3 |

| Male | 80.0 | 5.0 | 15.0 |

| Age | |||

| 18-24 | 84.7 | 4.4 | 10.9 |

| 25-34 | 81.8 | 5.4 | 12.8 |

| 35-49 | 82.0 | 6.4 | 11.7 |

| 50-64 | 82.6 | 6.0 | 11.4 |

| Marital status | |||

| Married | 85.6 | 5.0 | 9.5 |

| Divorced/separated/widowed | 78.1 | 7.7 | 14.1 |

| Never married | 74.0 | 7.1 | 18.8 |

| Household income*** | |||

| 0-$14,999 | 61.8 | 12.2 | 26.0 |

| $15,000-34,999 | 74.0 | 7.0 | 19.0 |

| $35,000-74,999 | 82.5 | 3.9 | 13.5 |

| $75,000+ | 88.5 | 4.9 | 6.5 |

| Education** | |||

| Some high school or less (<12 yrs) | 74.8 | 8.0 | 17.2 |

| High school graduate (12 yrs) | 75.2 | 9.5 | 15.2 |

| Some or college degree (13-16 yrs) | 81.2 | 5.9 | 12.9 |

| Graduate education (17+ yrs) | 91.5 | 2.6 | 5.9 |

| Family employmentb *** | |||

| Not employed | 65.4 | 16.4 | 18.2 |

| Employed | 84.6 | 4.7 | 10.8 |

| Nativityc, time in country | |||

| US born | 87.3 | 4.0 | 8.7 |

| Immigrant (>5 yrs) | 82.2 | 6.3 | 11.6 |

| Immigrant (<=5 yrs) | 74.0 | 6.4 | 19.6 |

| Region | |||

| Northeast | 79.1 | 5.6 | 15.3 |

| Midwest | 88.7 | 1.9 | 9.4 |

| South | 79.3 | 4.4 | 16.3 |

| West | 82.1 | 6.9 | 11.0 |

| English proficiency | |||

| Poor/fair | 78.0 | 6.1 | 15.9 |

| Good/excellent | 84.3 | 5.5 | 10.2 |

| General health status (self-report) | |||

| Poor/fair | 78.8 | 9.4 | 11.8 |

| Good/excellent | 83.0 | 5.3 | 11.8 |

| Mental health status (self-report) | |||

| Poor/fair | 72.3 | 7.8 | 20.0 |

| Good/excellent | 83.2 | 5.5 | 11.2 |

| Disability | |||

| Any | 70.9 | 12.9 | 16.3 |

| None | 82.7 | 5.6 | 11.7 |

Table gives predicted probabilities from the multinomial logistic regression in Table 5, with the effect of each covariate adjusted to the mean of all other covariates shown in table.

Adjusted to the mean of all covariates

One or more members of household employed or all members are not employed

Persons born in Puerto Rico are US citizens; “US born”, “immigrant”, and “time in country” refer to mainland birthplace, island birthplace, and time inmainland residence, respectively.

p<.05

p<.01

p<.001

for overall test of difference among indicated covariate(s)

Results

Insurance Status Rates and Sample Characteristics

As noted earlier, Table 2 provides the unadjusted rates of insurance status by Latino and Asian subgroups. Latinos had much higher unadjusted rates of uninsurance and public insurance rates than Asians, while private insurance rates were much lower. Uninsurance rates for subgroups of Latinos (36.8%) were strikingly different, with the highest uninsurance rate observed among Mexicans (44.9%) and the lowest among Puerto Ricans (17.3%). Rates of private insurance were very similar among Puerto Ricans, Cubans, and other Latinos (51.8% to 54.2%) but lower among Mexicans (39.2%). Asians’ insurance outcomes were similar among the Filipino, Chinese, and other Asian American subgroups. Vietnamese, however, had higher uninsurance rates (20.2% vs. 12.8% to 14.5% for other Asian subgroups) and higher public insurance rates (19.8% vs. 6.1% to 7.2% for other Asian subgroups).

Because the characteristics of the sample shown in Table 2 are unadjusted, we do not want to place much emphasis on them. We highlight only a few: Latinos were younger, more likely to be born in the U.S., and live in the South than Asians; Asians had higher levels of income, education, English proficiency, and were more likely to live in the West compared to Latinos. Asians also reported higher rates of good/excellent health and mental health status. Among Latinos, Mexicans were younger, more likely to be male, and had lower household income and education than the other three subgroups. Compared with the other Latino subgroups, Puerto Ricans had a higher level of English proficiency. Among Asian Americans, the age, gender, marital status, regional distribution, and employment status distributions were similar across the four subgroups. Vietnamese Americans had the lowest household income and higher percentages of poor or fair English language proficiency compared to the other Asian subgroups.

Adjusted Distributions of Uninsurance Rates by State, Region, Occupation and Level of English Proficiency

Figures 1 through 6 depict age- and gender-adjusted uninsurance rates by several factors. Figure 1 illustrates the adjusted rates of uninsurance for Latinos and Asians residing in each of the ten states with sufficient (n=50 or more cases) representation in the NLAAS data set (excluding Arizona for Asians). Uninsurance rates vary dramatically by state. In six of the ten states (Arizona, California, Florida, New York, Texas, and Washington), at least one of every three Latinos reported being currently uninsured. In all ten states, Latinos had much higher uninsurance rates than Asian Americans. However, as Figure 1 shows, the range of this disparity varied widely by state.

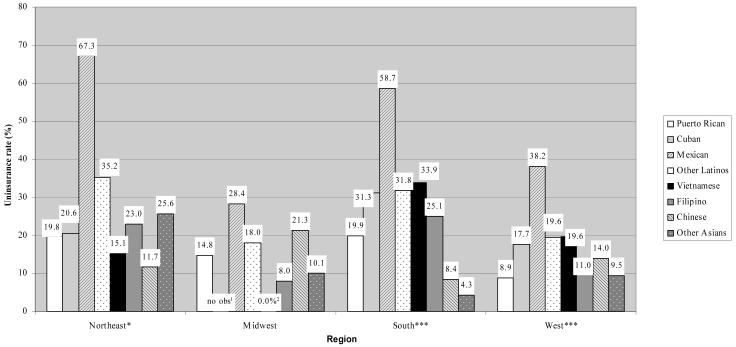

Figure 2 illustrates rates of age- and gender-adjusted uninsurance for each of the eight Latino and Asian American subgroups residing in the four regions of the U.S. We conducted F-tests for the difference across the eight subethnic groups within each region. More than two-thirds of Mexican Americans (67.3%) living in the Northeast reported being uninsured, in comparison to half that number of other Latinos (35.2%) and an even smaller percentage of Chinese Americans (11.7%) living in that same region (p<.01). However, in the Midwest, Mexican (28.4%) and Chinese Americans (21.3%) presented similar rates of uninsurance, after age and gender adjustments.

Figure 2. Age- and gender-adjusted uninsurance rates across region, by subethnicity.

Source: NLAAS data, calculat ed by the authors.

***p<.001, **p<.01,*p<.05. Significance shown for the test of difference among Latino and Asian subgroups within each region

a: There were no observations of Cubans living in the Midwest

b: Of the Vietnamese living in the Midwest, 0.0% were uninsured

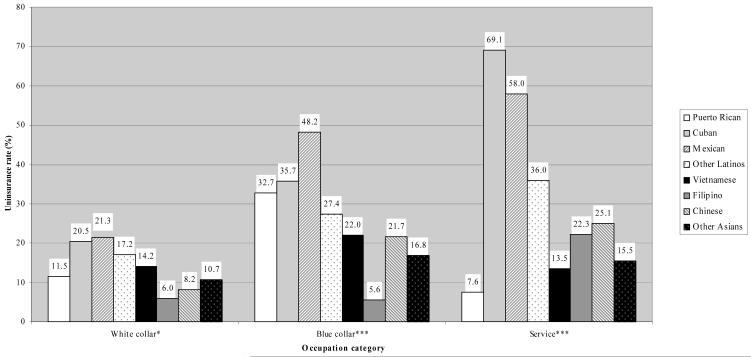

Age- and gender-adjusted uninsurance rates by ethnic subgroup and occupational grouping (white collar, blue collar, and service) are displayed in Figure 3. These broader occupational groupings were created from the Bureau of Labor Statistics Major Occupational Groups, whereby jobs are classified as: white collar (professional, technical and related, executive, administrative and managerial, sales, and administrative support, including clerical, positions); blue collar (precision production, craft and repair, machine operators, assemblers and inspectors, transportation and material moving occupations, and handlers, equipment cleaners, helpers and laborers); and service (service occupations, except private household). The difference in uninsurance rates across subethnicity was significant for each of the three occupational categories. Rates of uninsurance ranged from 6.0% for Filipinos to 21.3% for Mexicans in white collar professions, and from 7.6% for Puerto Ricans to 69.1% for Cubans in the service sector. Within the service sector, Cubans (69.1%), Mexicans (58.0%) and other Latinos (36.0%) were more likely to be uninsured.

Figure 3. Age- and gender-adjusted uninsurance rates across occupation category, by subethnicity.

Source: NLAAS data, calculated by the authors.

***p<.001, **p<.01,*p<.05. Significance shown for the test of difference among Latino and Asian subgroups within each occupation.

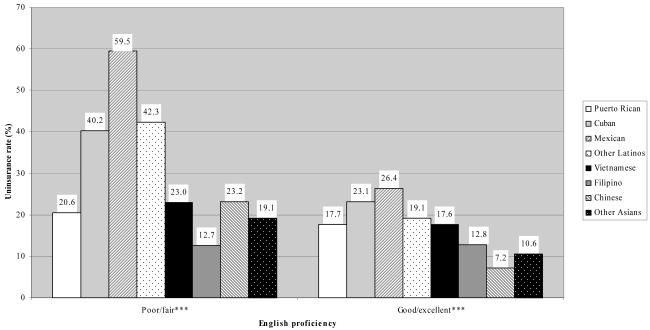

Figure 4 presents age- and gender-adjusted rates of uninsurance for the eight Latino and Asian subgroups across level of English proficiency. Uninsurance rates varied significantly among those reporting excellent or good English proficiency (p<.001), as well as for those reporting poor or fair English proficiency (p<.001). As can be seen, regardless of level of English proficiency, Mexicans were most likely to be uninsured among the eight subgroups.

Figure 4. Age- and gender-adjusted uninsurance rates across English proficiency, by subethnicity.

Source: NLAAS data, calculated by the authors.

***p<.001, **p<.01,*p<.05. Significance shown for the test of difference among Latino and Asian subgroups within each level of English proficiency.

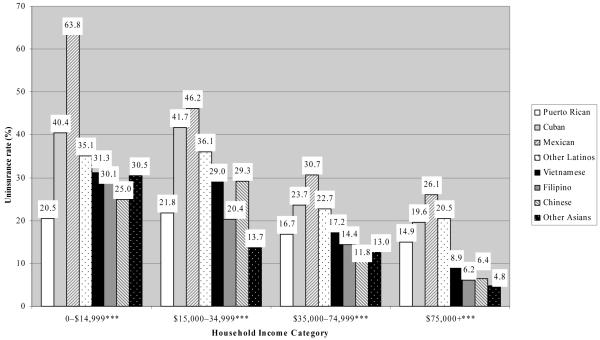

Figure 5 shows age- and gender-adjusted rates of uninsurance for the eight Latino and Asian subgroups across household income category. For all levels of household income, the difference in uninsurance rate was significant across subethnicity (p<.001). Mexicans had the highest uninsurance rates among all subethnic groups in all four income groups, while different subethnic groups had the lowest rates of being uninsured for the other income groups.

Figure 5. Age- and gender-adjusted uninsurance rates across household income category, by subethnicity.

Source: NLAAS data, calculated by the authors.

***p<.001, **p<.01,*p<.05. Significance shown for the test of difference among Latino and Asian subgroups within each household income category.

Figure 6 shows age- and gender-adjusted rates of uninsurance for the eight Latino and Asian subgroups across levels of education. Latinos and Asians at all education levels, with the exception of graduate education category, had significantly different uninsurance rates across subethnic groups. For those with a graduate eduation, no significant difference was found among the eight subethnic groups, suggesting that high levels of education may eliminate the racial/ethnic difference in the uninsurance outcome.

Adjusted Distribution of Insurance Outcomes Among Latinos

Using private insurance outcome as the comparison group, Table 3 reports results of a weighted multinomial logistic regression for the subsample of Latinos. As shown, Mexicans were more likely to be uninsured compared with all other Latino subgroups. Among Latinos, the 50 to 64 age group was less likely to have public insurance than the 35 to 49 age group. Females were more likely to be enrolled in public insurance in comparison to males. Latinos in the highest income category were significantly less likely to have public insurance compared to all other income groups. The lowest income group also was more likely to be uninsured in comparison to the highest income group. Compared to the highest education group, Latinos who did not finish high school were more likely to have public insurance, and all the groups with less than a graduate education were significantly more likely to be uninsured. Unemployment showed positive effects on both public insurance and uninsurance. New immigrants (with fewer than five years in the U.S.) and those with poor or fair English proficiency were significantly more likely to be uninsured. People with a disability were more likely to have public insurance. Those Latinos living in the South appeared to be at increased likelihood of being uninsured and at decreased likelihood of having public insurance as compared to those in the West. The Hosmer-Lemeshow Goodness of Fit Statistic ranged from 5.8, p = .67, for public insurance outcome, to 4.9, p = .77 for uninsurance outcome (see Hosmer and Lemeshow, 2000). The goodness of fit of the model is considered adequate.

Latino subethnic differences in insurance outcomes, after controlling for the other measures (shown in Table 4), were highly significant (p < .001). Mexicans had the highest predicted rate of being uninsured (47.8%) and a much lower predicted rate of public insurance (9.9%), compared with Puerto Ricans (19.4%), Cubans (20.2%), and even other Latinos (11.4%). Pair-wise differences in predicted insurance outcomes were significant after a Bonferroni correction for Mexicans (p<.001) compared to each of the other three Latino groups, but were nonsignificant for each of the pair-wise comparisons among Puerto Ricans, Cubans, and other Latinos.

After adjustment for other covariates, age and marital status were not associated with insurance outcomes for Latinos. However, gender was highly significant (p < .001) with an almost threefold greater adjusted rate of public insurance for Latino females (19.7%) than for males (6.8%). Adjusted uninsurance rates between females and males, however, were very similar (38.4% and 40.6%, respectively). Household income, education, and family employment were all highly significant (p < .001) for insurance outcomes. Examination of the pair-wise differences among household income categories showed that the only significant differences were between Latinos with household incomes less than $15,000 compared to those with greater incomes (data not shown). Pair-wise differences among education categories were significant for all Latinos with less than a college degree or with a college degree compared to those with more than a college degree or graduate education, and also significant for those who did not complete high school compared to those with some college or more; all other differences were nonsignificant (data not shown).

Recent Latino immigrants had significantly different predicted insurance outcomes than immigrants with five or more years in the U.S. and the U.S.-born. However, immigrants with five years or more of residency in the U.S. and the U.S.-born were not significantly different, after controlling for other covariates. Recent immigrants (fewer than five years in the country) had much lower predicted rates of public insurance (about one-third of the U.S.-born rate) and much higher predicted rates of being uninsured (22% higher than immigrants with five years or more of residency in the U.S.). English proficiency also was highly significant after controlling for other measures in insurance outcomes (p<.001).

Regional differences in insurance outcomes remained significant after controlling for other variables (p<.001), with the most significant pair-wise difference being between Latinos in the South and those in the West. After adjusting for the other covariates, 51.3% of Latinos living in the South were predicted to be uninsured compared to 34.3% of those living in the West.

Self-reported general and mental health status were not significant in the model, but disability was significant (p < .01), with a predicted rate for public insurance among Latinos with disabilities of 47.9% compared to a predicted rate of 10.8% for Latinos without any disabilities.

Adjusted Distribution of Insurance Outcomes Among Asian Americans

Table 5 reports the weighted multinomial logistic regression results for the subsample of Asians. Vietnamese was the only Asian subgroup with a significantly higher probability of public insurance compared to Chinese. Female Asians were significantly less likely to be uninsured than males. Asians who never married were more likely to have no insurance as compared to the married. People with household incomes below $15,000 were significantly more likely to have public insurance than the highest income group, while all those with income less than $75,000 had a higher likelihood of being uninsured. The results also indicate that people with lower education levels were more likely to rely on public insurance or to be uninsured. Being a new immigrant, speaking poor or fair English, and having poor or fair mental health increased the likelihood of uninsurance. The Hosmer-Lemeshow Goodness of Fit Statistic ranged from 4.7, p = .79, for public insurance outcome, to 8.5, p = 0.38, for uninsurance outcome, indicating adequate goodness of fit.

Differences in predicted insurance outcomes among Asian subgroups were significant (p < .05) after controlling for the other measures (see Table 6). All Asian subgroups had similar predicted uninsured rates (about 12%), but Vietnamese had slightly more than twice the predicted rate of public insurance (11.3% vs. 4.2% to 5.8%) of the other Asian groups. Examination of pair-wise differences showed that only the difference between Vietnamese and Chinese subgroups was significant after a Bonferroni correction (data not shown). Since the Chinese, Filipino, and other Asian subgroups all had similar predicted insurance rates, the Vietnamese difference was effectively a difference between Vietnamese Americans and all other Asian Americans.

As was the case with Latinos, marital status and age were not significant for Asian insurance outcomes after controlling for other measures. Gender was significant (p < .01), but the differences in predicted insurance rates were small.

Household income and family employment were both highly significant (p < .001) for predicted insurance outcomes of Asian Americans. Public insurance rates were three times higher for the unemployed Asians (16.4%) compared to the employed (4.7%). The only significant insurance difference occurred between Asians in the lowest income category compared to those in higher income categories, with Asians in the lowest category having higher predicted rates of public insurance and uninsurance. Education was significant (p < .01), but tests of pair-wise differences among education categories revealed that only Asians with a high school degree or less differed significantly in their predicted insurance outcomes from those with some college or more; all other predicted differences were nonsignificant.

In terms of nativity, recent immigration, region, and English proficiency, differences in predicted insurance outcomes for Asians were not significant after controlling for the other measures. Yet nativity and time in country for immigrants showed the same pattern for Asians as for Latinos: lower predicted rates of public insurance and higher uninsured rates, with the absolute differences in predicted rates being smaller for Asians. Only the difference between recent Asian immigrants (fewer than five years in the U.S.) and U.S.-born Asians was significant for the uninsured outcome after a Bonferroni correction.

Self-reported general and mental health status was not significant for the predicted insurance outcomes for Asians. Although the size of the predicted insurance rate differences between Asians with disabilities and those without was relatively large, this finding did not reach statistical significance — probably because less than 2% of the Asians in the sample reported any disabilities (as shown in Table 2).

Discussion of Results

The NLAAS data confirm results of earlier studies showing that Latinos are disproportionably uninsured (37%); this is particularly the case for Mexican Americans (45%), who appear to be at greatest disadvantage when compared to other subgroups. Differences in insurance coverage among subgroups of Latinos and Asian Americans are not eliminated by adjusting for a wide range of covariates. Puerto Ricans and Vietnamese have higher public insurance rates within their ethnic groups, suggesting that their citizen or refugee status provides additional opportunities to access public coverage.

With good measures of factors related to lack of insurance coverage, representative samples of Latino and Asian subgroups, and corresponding instrument language translations, the NLAAS provides some of the most comprehensive data collected to date on insurance coverage among Latinos and Asians in the U.S. However, a number of limitations apply to the present study. We cannot assess ethnic group variations in offer or take-up rates due to lack of data for these measures in the survey. Other research suggests that differences in coverage rates between minorities and whites are due to lower offer rates among minorities, whereas take-up rates are similar between minorities and whites (Cooper and Schone 1997; Dushi and Honig 2004). Also, despite the large total Latino and Asian sample sizes, statistical power might have been too small to detect differences across ethnic subgroups.

Ethnic group disparities in insurance coverage are partly due to differences in occupational distributions. Asian Americans are more likely (U.S. Census Bureau 2004) to work in jobs that offer private insurance (e.g., computer, engineering, or technical occupations) in contrast to Latino employees (Schur and Feldman 2001). In 2004, employment gains for non-Latinos resulted from increased labor market demands for higher-skilled occupations requiring at least some college education (Kochhar 2005). In contrast, more than 80% of new jobs for immigrant Latinos and 76% of new jobs for native-born Latinos were in the two lowest skill level occupational clusters (Kochhar 2005). Latinos, immigrants in particular, are highly concentrated in the construction, eating, drinking and lodging services, and retail trade industries.

The tightening of immigration laws over the past decade may have a greater impact on the immigration patterns of Asians. Although poor and unauthorized Asian immigrants still come to the U.S., new immigration requirements have increased the likelihood that documented migrants have college educations, technical training, and professional backgrounds (Park and Park 2005). Throughout the 1990s, in an effort to attract immigrants considered necessary for domestic economic growth, immigration reform laws greatly expanded possibilities for employment-based immigration (Park and Park 2005). Additionally, the Personal Responsibility and Work Opportunity and Reconciliation Act (PRWORA) of 1996 eliminated safety nets for new immigrants and strengthened laws regarding deportation (Park and Park 2005). This legislation appears to have affected Asian immigrants differentially by easing the process of immigration for skilled and educated migrants who are more likely to have access to private insurance without citizenship.

American occupational demands and immigration laws have shaped Latinos’ and Asians’ post-migration employment opportunities, leaving Latinos at greater risk for uninsurance. However, Figure 3 demonstrates that even within the same occupational category, uninsurance rates vary widely among Latino and Asian American subgroups. This disparity is particularly pronounced within the service sector, where Cubans and Mexicans report rates of uninsurance more than twice that of any of the Asian American subgroups. Reasons for the differences in rates of uninsurance are unclear, but may result from higher rates of Latinos working in part-time positions.

While it is commonly believed that marital status and age affect access to public and private insurance (Zuvekas and Taliaferro 2003), our results show a nonsignificant impact on insurance outcomes after controlling for other covariates. However, gender, household income, education, family employment, and region do relate to public insurance for Latino subgroups. While the likelihood of having private insurance is lower for Latino females than males, the opposite is true for Asian Americans. Married Latinas may be more likely to have young children at home than Asians, keeping them out of the workforce. In 2001, there were 23 live births reported per 1,000 Latinos, and only 16.4 live births reported per 1,000 Asians (Hamilton, Sutton, and Ventura 2003).

Comparing the groups by time in the U.S. shows that uninsured rates also may be related to policies that define eligibility for public insurance programs. One important finding is that only immigrants (Latino and Asian) with fewer than five years in the U.S. display significantly higher rates of uninsurance as compared to their U.S.-born counterparts. PRWORA restricts states from using federal funds to provide Medicaid and State Children’s Health Insurance Program (SCHIP) coverage for most immigrants who have resided in the U.S. for fewer than five years.

Regional disparities in uninsured rates, particularly between the West and the South, are another striking finding of this study. State differences in the eligibility criteria for Medicaid and generosity of public insurance coverage for noncitizens may also explain regional variations in uninsurance outcomes. Through PRWORA, the federal government directly shifted health care costs from the federal level to state and local governments (Zimmermann and Tumlin 1999). As states independently opted to provide substitute benefits to immigrants, wide variation in rates of uninsurance developed at both state and regional levels. This variation is exemplified in Figures 1 and 2. It has been suggested that states with the strongest existing safety net programs available to the general population tend to offer more substitute benefits to immigrants in response to PRWORA (Zimmermann and Tumlin 1999).

Changing immigrant settlement patterns (Passel and Suro 2005) and the unanticipated magnitude of Latino immigration (Schick and Schick 1991) may have caught states unprepared to meet Latinos’ insurance needs. The South, in particular, has experienced the largest growth of the Latino population in any region of the U.S. between 1990 and 2000 (Kochhar, Suro, and Tafoya 2005). States with higher per capita incomes are generally more likely to provide overall assistance to immigrants compared to states with the lowest per capita incomes (Zimmermann and Tumlin 1999). This is particularly relevant to the South, a region that has one of the highest concentrations of immigrants, but also the lowest median household income.

Limited English proficiency for Latino immigrants, but not for Asians, also compounds the difficulties in obtaining private insurance (Ku and Waidmann 2003). This is exemplified in tables 4 and 6 where only 38.4% of Latinos who reported poor/fair English had private insurance. In contrast, 84.3% of Asians who reported poor/fair English proficiency were privately insured. Figure 4 shows a similar pattern; of respondents reporting poor/fair English proficiency, Cubans, Mexicans and other Latinos reported significantly higher rates of uninsurance compared to all of the Asian subgroups. Language skills may keep many Latinos from seeking public coverage (Pollack and Kronebusch 2004) for fear of being deported or they may face greater challenges navigating the health care system than their English-proficient counterparts.

The fact that adjustments by health status and mental health status have minor effects on changing the distribution of insurance outcomes is puzzling and interesting. Poor health affects both the demand for insurance and the willingness of private markets to supply insurance to the individual, and these factors may balance out on average. Sorting out any mechanisms operating through health or mental health status at work is an important area for further research.

Conclusion and Policy Implications

Our findings demonstrate that English proficiency impacts access to health insurance, especially for Latinos. Providing Spanish-language application forms for public programs may help eliminate language barriers to coverage. Although Asians do not appear to share the English proficiency barrier with Latinos, it is important not to ignore insurance access problems among Asians. Asians share with all employed people the increasing fragility of the employer-based coverage system. Furthermore, particular Asian subgroups (such as Vietnamese Americans) are as likely as Latinos to be uninsured, and some Asian Americans may not receive the same quality of coverage as whites - an issue that cannot be addressed with the NLAAS, but one that is worth investigating.

State initiatives targeting immigrant groups ineligible for federal programs could reduce rates of uninsurance among Latinos and Asians. Our data indicate that states with generous safety net programs protect Latinos and Asians against poor insurance outcomes. It is critical that states prioritize funding safety net programs in a continued effort to protect vulnerable populations. This study focused explicitly on nonelderly working age populations, but adults’ experiences also have implications for children’s access to coverage. Native-born Latino children comprise the majority of Latino youths, yet they exhibit similar insurance patterns as their immigrant parents (Ojeda and Brown 2005).

While immigration confers many economic advantages to receiving states, it also strains health, education, and other social services. Welfare reform has exacerbated states’ burden of caring for their residents by obligating them to devise, on an ad-hoc basis, policies and programs to meet the health and social needs of diverse immigrant populations and their families. Foreign-born people continue to settle in California, New York, Texas, Florida, Illinois, and New Jersey, and new data show that immigrants are calling “home” any one of the 22 “new growth” states (e.g., Delaware, North Carolina, Indiana, Minnesota, Colorado, and numerous others) (Passel and Suro 2005). Given the diversification of immigrant flows throughout the U.S. and their permanence within their communities, there is no substitute for federal policies that address the various needs of the foreign-born and their families.

Acknowledgments

The authors are grateful to the Robert Wood Johnson Foundation for support through the Economic Research Initiative on the Uninsured administered through the University of Michigan. The National Latino and Asian American Study was supported by National Institutes of Health Research grant # U01 MH62207 and grant # MH62209 funded by the National Institute of Mental Health as well as the Center for Mental Health Services of the U.S. Substance Abuse and Mental Health Services Administration, and the Office of Behavioral and Social Science Research of the National Institutes of Health. Funding for Victoria Ojeda was provided by the National Institute of Mental Health Post-Doctoral Traineeship grant #T32-MH 019733-10. This publication was also made possible by grant # P20 MD000537 from the National Center on Minority Health and Health Disparities (NCMHD). Its contents are solely the responsibility of the authors and do not necessarily represent the official views of the NCMHD.

Footnotes

Significance tests were calculated using Wald tests of differences of multinomial logistic regression coefficient estimates with variance estimators computed using a first-order Taylor series approximation. Tables 4 and 6 include tests of significance for measures with more than two categories. Tests of pair-wise differences among the categories were also computed using Wald tests and adjusted using a Bonferroni correction of , where k is the number of categories of the measure.

References

- Abe-Kim J, Takeuchi D, Hwang W. Predictors of Help Seeking for Emotional Distress among Chinese Americans: Family Matters. Journal of Counseling and Clinical Psychology. 2002;70(5):1186–1190. [PubMed] [Google Scholar]

- Alegría M, Takeuchi D, Canino G, Duan N, Shrout P, Meng X-L, Vega W, Zane N, Vila D, Woo M, Vera M, Guarnaccia P, Aguilar-Gaxiola S, Sue S, Escobar J, Lin K, Gong F. Considering Context, Place and Culture: the National Latino and Asian American Study. International Journal of Methods in Psychiatric Research. 2004;13(4):208–220. doi: 10.1002/mpr.178. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Alegría M, Vila D, Woo M, Canino G, Takeuchi D, Vera M, Febo V, Guarnaccia P, Aguilar-Gaxiola S, Shrout P. Cultural Relevance and Equivalence in the NLAAS Instrument: Integrating Etic and Emic in the Development of Cross-Cultural Measures for a Psychiatric Epidemiology and Services Study of Latinos. International Journal of Methods in Psychiatric Research. 2004;13(4):270–288. doi: 10.1002/mpr.181. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Anderson M, Fienberg S. Who Counts?: The Politics of Census-taking in Contemporary America. Russell Sage Foundation; New York: 1999. [Google Scholar]

- Berk M, Schur C, Chavez L, Frankel M. Health Care Use among Undocumented Latino Immigrants. Health Affairs. 2000;19(4):51–64. doi: 10.1377/hlthaff.19.4.51. [DOI] [PubMed] [Google Scholar]

- Brown R, Ojeda V, Wyn R, Levan R. Racial and Ethnic Disparities in Access to Health Insurance and Health Care. UCLA Center for Health Policy Research & Henry J. Kaiser Family Foundation; Los Angeles: 2000. [Google Scholar]

- Capps R, Ku L, Fix M. Preliminary Evidence from Los Angeles and New York City. The Urban Institute; Washington, D.C.: 2002. How Are Immigrants Faring after Welfare Reform? [Google Scholar]

- Capps R, Passel J. Describing Immigrant Communities (presentation) The Urban Institute; Washington, D.C.: 2004. [Google Scholar]

- Claxton G, Holve E, Finder B, Gabel J, Pickreing J, Whitmore H. Employer Health Benefits: 2003 Annual Survey. The Henry J. Kaiser Family Foundation and the Health Research and Educational Trust; Menlo Park, California: 2003. [Google Scholar]

- Cooper P, Schone B. More Offers, Fewer Takers for Employment -based Health Insurance. Health Affairs. 1997;16(6):142–149. doi: 10.1377/hlthaff.16.6.142. [DOI] [PubMed] [Google Scholar]

- De la Torre A, Friis R, Hunter H. Health Insurance Status of U.S. Latino Women: A Profile from the 1982-1984 HHANES. American Journal of Public Health. 1996;86(4):533–537. doi: 10.2105/ajph.86.4.533. [DOI] [PMC free article] [PubMed] [Google Scholar]

- DeNavas-Walt C, Proctor B, Lee C. Income, Poverty, and Health Insurance Coverage in the United States: 2004. U.S. Census Bureau and Government Printing Office; Washington, D.C.: 2005. [Google Scholar]

- Dushi I, Honig M. Offers or Take-up: Explaining Minorities’ Lower Health Insurance Coverage: Economic Research Initiative on the Uninsured working paper. 2004. [Google Scholar]

- Feld P, Power B. Immigrants’ Access to Health Care after Welfare Reform: Findings from Focus Groups in Four Cities. Kaiser Commission on Medicaid and the Uninsured; Washington, D.C.: 2000. [Google Scholar]

- Fronstin P, Goldberg L, Robins P. Differences in Private Health Insurance Coverage for Working Male Hispanics. Inquiry. 1997;34:171–180. [PubMed] [Google Scholar]

- Ginzberg E. Access to Health Care for Hispanics. Journal of the American Medical Association. 1991;265(2):238–247. [PubMed] [Google Scholar]

- Guzman B. The Hispanic Population: Census 2000 Brief. U.S. Census Bureau; Washington, D.C.: 2001. [Google Scholar]

- Hall A, Collins K, Glied S. Employer-sponsored Health Insurance: Implications for Minority Workers. The Commonwealth Fund; New York: 1999. [Google Scholar]

- Hamilton B, Sutton P, Ventura S. Revised Birth and Fertility Rates for the 1990s and New Rates for Hispanic Populations, 2000 and 2001: United States. National Vital Statistics Reports, Centers for Disease Control and Prevention. 2003;51(12) [PubMed] [Google Scholar]

- Heeringa S, Wagner J, Torres M, Duan N, Adams T, Berglund P. Sample Designs and Sampling Methods for the Collaborative Psychiatric Epidemiology Studies (CPES) International Journal of Methods in Psychiatric Research. 2004;13(4):221–240. doi: 10.1002/mpr.179. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hosmer D, Lemeshow S. Applied Logistic Regression. 2 ed. Wiley and Sons; New York: 2000. [Google Scholar]

- Institute of Medicine . Unequal Treatment: Confronting Racial and Ethnic Disparities in Health Care. The National Academies Press; Washington, D.C.: 2002. [PubMed] [Google Scholar]

- Kaiser Commission on Medicaid and the Uninsured . Immigrants’ Health Care Coverage and Access. The Henry J. Kaiser Family Foundation; Washington, D.C.: 2003. [Google Scholar]

- Kochhar R. Latino Labor Report, 2004: More Jobs for New Immigrants, but at Lower Wages. Pew Hispanic Center; Washington, D.C.: 2005. [Google Scholar]

- Kochhar R, Suro R, Tafoya S. The New Latino South: The Context and Consequences of Rapid Population Growth. Pew Hispanic Center; Washington, D.C.: 2005. [Google Scholar]

- Ku L, Matani S. Left Out: Immigrants’ Access to Health Care and Insurance. Health Affairs. 2001;20(1):247–256. doi: 10.1377/hlthaff.20.1.247. [DOI] [PubMed] [Google Scholar]

- Ku L, Waidmann T. How Race/Ethnicity, Immigration Status, and Language Affect Health Insurance Coverage, Access to Care and Quality of Care Among the Low-Income Population. The Henry J. Kaiser Family Foundation; Washington, D.C.: 2003. [Google Scholar]

- Lee S. Population Bulletin. Vol. 53. Population Reference Bureau; Washington D.C.: 1998. Asian Americans: Diverse and Growing. [PubMed] [Google Scholar]

- Margolis M. Brazilians and the 1990 United States Census: Immigrants, Ethnicity, and the Undercount. Human Organization. 1995;54(1):52–59. [Google Scholar]

- Mills R, Bhandari S. Health Insurance Coverage in the United States: 2002. U.S. Census Bureau; Washington, D.C.: 2003. [Google Scholar]

- Murphy D. New Californian Identity Predicted by Researchers. New York Times. 2003 Feb 17; [Google Scholar]

- Ojeda V, Brown E. Mind the Gap: Parents’ Citizenship as a Predictor of Latino Children’s Health Insurance. Journal of Health Care for the Poor and Underserved. 2005;16(3):555–575. doi: 10.1353/hpu.2005.0057. [DOI] [PubMed] [Google Scholar]

- Park E, Park J. Probationary Americans: Contemporary Immigration Policies and the Shaping of Asian American Communities. Routledge; New York: 2005. [Google Scholar]

- Passel J, Suro R. Rise, Peak, and Decline: Trends in U.S. Immigration 1992-2004. Pew Hispanic Center; Washington, D.C.: 2005. [Google Scholar]

- Pennell B, Bowers A, Carr D, Chardoul S, Cheung G, Dinkelmann K, Gebler N, Hansen S, Pennell S, Torres M. The Development and Implementation of the National Comorbidity Survey Replication, the National Survey of American Life, and the National Latino and Asian American Survey. International Journal of Methods in Psychiatric Research. 2004;13(4):241–269. doi: 10.1002/mpr.180. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Perkins J. Ensuring Linguistic Access in Health Care Settings: An Overview of Current Legal Rights and Responsibilities. The Henry J. Kaiser Family Foundation; Washington, D.C.: 2003. [Google Scholar]

- Pollack H, Kronebusch K. Health Policy and the Uninsured. Urban Institute Press; Washington, DC: 2004. Health Insurance and Vulnerable Populations. [Google Scholar]

- Reeves J, Bennett C. We the People: Asians in the United States. U.S. Census Bureau; Washington, D.C.: 2004. [Google Scholar]

- Ryu H, Young W, Kwak H. Differences in Health Insurance and Health Service Utilization Among Asian Americans: Method for Using the NHIS to Identify Unique Patterns Between Ethnic Groups. International Journal of Health Planning and Management. 2002;17:55–68. doi: 10.1002/hpm.652. [DOI] [PubMed] [Google Scholar]

- Schick F, Schick R. Statistical Handbook on U.S. Hispanics. Oryx Press; Phoenix, Arizona: 1991. [Google Scholar]

- Schur C, Feldman J. Running in Place: How Job Characteristics, Immigrant Status, and Family Structure Keep Hispanics Uninsured. The Commonwealth Fund; New York: 2001. [Google Scholar]

- Shi L. Vulnerable Populations and Health Insurance. Medical Care Research and Review. 2000;57(1):110–134. doi: 10.1177/107755870005700107. [DOI] [PubMed] [Google Scholar]

- Stata Statistical Software: Release 8. StataCorp; College Station, Texas: [Google Scholar]

- U.S. Bureau of Labor Statistics . Employed Persons by Occupation, Race, Hispanic or Latino Ethnicity, and Sex. U.S. Bureau of Labor Statistics; Washington, D.C.: 2004. [Google Scholar]

- U.S. Census Bureau . Educational Attainment in the United States: 2003. Washington, DC: 2004. [Google Scholar]

- U.S. General Accounting Office (GAO) Decennial Census: Overview of Historical Census Issues. U.S. GAO; Washington, D.C.: 1998. [Google Scholar]

- Vitullo M, Taylor A. Latino Adults’ Health Insurance Coverage: An Examination of Mexican and Puerto Rican Subgroup Differences. Journal of Health Care for the Poor and Underserved. 2002;13(4):504–525. [PubMed] [Google Scholar]

- Wang M, Holahan J. The Decline in Medicaid Use by Non-citizens since Welfare Reform. The Urban Institute; Washington, D.C.: 2003. [Google Scholar]

- Zimmermann W, Tumlin K. Patchwork Policies: State Assistance for Immigrants under Welfare Reform. The Urban Institute; Washington, D.C.: 2003. [Google Scholar]

- Zuvekas S, Taliaferro G. Pathways to Access: Health Insurance, the Health Care Delivery System, and Racial/Ethnic Disparities, 1996-1999. Health Affairs. 2003;22(2):139–153. doi: 10.1377/hlthaff.22.2.139. [DOI] [PubMed] [Google Scholar]