Abstract

Objective

To investigate, in the Republic of Korea, whether local governments’ participation in an anti-smoking programme supported by the National Health Promotion Fund in 2002–2003 was related to the percentage of local tax revenue comprised by the tobacco consumption tax (TCT).

Methods

Using financial and administrative data on 163 municipalities, the authors estimated logit models of local governments’ participation in the anti-smoking programme as a function of the proportion of local tax revenue that came from the TCT and a set of control variables, namely local socioeconomic characteristics and the size of the staff in the local public health centre (PHC).

Findings

Local governments that derived a greater percentage of their local tax revenue from the TCT, particularly those that ranked in the upper fourth in terms of this percentage, were less likely to participate in the anti-smoking programme. Insufficient staff in the PHC was also found to be associated with lower participation in the anti-smoking programme.

Conclusion

Local governments’ dependence on revenue from the TCT may be a deterrent to tobacco control in the Republic of Korea.

Résumé

Objectif

Étudier l’existence éventuelle d’un lien, en République de Corée, entre la participation des gouvernements locaux à un programme de lutte antitabac appuyé par le Fonds coréen pour la promotion de la santé sur la période 2002-2003 et le pourcentage des recettes fiscales locales tiré de la taxe à la consommation sur le tabac.

Méthodes

A l’aide de données financières et administratives concernant 163 municipalités, les auteurs ont évalué des modèles logit de la participation des gouvernements locaux au programme de lutte antitabac en fonction de la proportion des recettes fiscales locales provenant de la taxe à la consommation sur le tabac et d’une série de variables de contrôle, à savoir les caractéristiques socioéconomiques locales et l’effectif du personnel dans le centre de santé publique local.

Résultats

Pour les gouvernements locaux tirant une forte proportion de leurs recettes fiscales de la taxe à la consommation sur le tabac, notamment les quatre premiers par ordre décroissant de cette proportion, la probabilité de participation au programme de lutte antitabac était plus faible. On a aussi constaté que le manque de personnel dans le centre de santé publique local était associé à une participation plus réduite à ce programme.

Conclusion

La dépendance des gouvernements locaux à l’égard des revenus tirés de la taxe à la consommation sur le tabac peut avoir un effet dissuasif sur la participation à la lutte antitabac en République de Corée.

Resumen

Objetivo

Investigar en la República de Corea si la participación de los gobiernos locales en un programa contra el tabaquismo respaldado por el Fondo Nacional de Promoción de la Salud en 2002–2003 guardaba relación con el porcentaje de ingresos fiscales locales que representaba el impuesto al consumo de tabaco.

Métodos

Partiendo de datos financieros y administrativos sobre 163 municipios, los autores elaboraron modelos logit de la participación de los gobiernos locales en el programa contra el tabaquismo como función de la proporción de ingresos tributarios locales atribuible al impuesto sobre el consumo de tabaco y de un conjunto de variables de control, como la situación socioeconómica local y la dotación de personal en el centro de salud pública local.

Resultados

Los gobiernos locales que obtenían un mayor porcentaje de sus ingresos fiscales en forma de impuestos al consumo de tabaco, en particular los situados en el intervalo cuartílico superior de la distribución de ese porcentaje, tendían a participar menos en el programa contra el tabaquismo. Se observó también que la insuficiencia de personal en el centro de salud pública se asociaba igualmente a una menor participación en el programa contra el tabaco.

Conclusión

La dependencia de los gobiernos locales de los ingresos tributarios derivados del tabaco puede estar frenando la lucha contra el tabaquismo en la República de Corea.

ملخص

الغرض

استقصاء ما إذا كانت مشاركة الحكومة المحلية، في جمهورية كوريا، في برنامج لمناهضة التدخين أقيم بدعم من صندوق تعزيز الصحة الوطنية في عامَيْ 2002 – 2003، لها علاقة بنسبة العائد من الضرائب المحلية ممثلة في ضريبة استهلاك التبغ.

الطريقة

قام الباحثون، من خلال استخدام المعطيات المالية والإدارية في 163 بلدية، بتقدير نماذج لوغاريتم الأرجحية لمشاركة الحكومات المحلية في برامج مناهضة التدخين، كدالة لنسبة العائد من الضريبة المحلية التي تأتَّت من ضريبة استهلاك التبغ، ومجموعة من متغيرات الضبط، مثل الخصائص الاجتماعية والاقتصادية وحجم العاملين في مركز الصحة العمومية المحلي.

الموجودات

الحكومات المحلية التي استمدت نسبة أكبر من عائدات ضرائبها المحلية الناشئة عن ضريبة استهلاك التبغ، ولاسيَّما تلك التي صنِّفت ضمن الربع الأعلى في ما يتعلق بهذه النسبة، كانت أقل احتمالاً للمشاركة في برنامج مناهضة التدخين. ووجد أيضاً ارتباط بين عدم كفاية العاملين في مركز الصحة العمومية وبين انخفاض المشاركة في هذا البرنامج.

الاستنتاج

يمكن أن يمثِّل اعتماد الحكومات المحلية على العائدات المتأتية من ضرائب استهلاك التبغ عائقاً أمام مكافحة التبغ في جمهورية كوريا.

Introduction

Cigarette smoking is a major public health problem in the Republic of Korea. Smoking prevalence among males 20–39 years of age still exceeds 50%, although it has decreased from 70% in the 1990s.1 High smoking rates in the Republic of Korea translate into a large disease and economic burden,2–4 and in recent years, the central government has introduced a wide array of tobacco control policies. Most notably, in December 2004, the average retail price per cigarette pack was raised by 500 wons of the Republic of Korea (approximately 29%) through increases in various taxes, including the tobacco consumption tax (TCT) and the health promotion charge (HPC), which was to be used for various health promotion activities at the central and local levels. With the tax increases, the total cost of each cigarette pack (2000 and 2500 wons for the two most popular brands) now comprises 641 wons for the TCT and 354 wons for the HPC.5 This policy is particularly noteworthy not only because the price increase was unprecedentedly large but also because, for the first time in the history of the Republic of Korea, its explicit purpose was to reduce smoking rates.

Several studies in 2005 suggested that smoking rates dropped after the tax increase,5 a finding consistent with the evidence that higher tobacco taxes reduce smoking.6–9 Furthermore, the increase in the HPC led to a dramatic growth in the government budget for anti-smoking activities through increased contributions to the National Health Promotion Fund (NHPF) administered by the Ministry of Health and Welfare.5 These national efforts were spurred by the government’s signing in 2003 and ratification in 2005 of the WHO Framework Convention on Tobacco Control,5 the first international health treaty making it compulsory for ratifying countries to adopt comprehensive tobacco control measures.10

While tobacco control in the Republic of Korea may have gained momentum at the health ministry level, this has not evolved into concerted action by the central government or extended to local governments. One key barrier is the policy conflict between health officials and the tobacco industry, highlighted in recent debates about tobacco tax increases in the Republic of Korea. Such a policy conflict is not unique to this country; other countries’ experience also suggests that tobacco control policy is heavily influenced by politics. For example, tobacco tax increases driven by the Chinese health ministry have received little support from the ministries in charge of the economy or the agricultural sector.6,11

Another important barrier at the local level in the Republic of Korea, besides lack of resources and capacity, is the conflict between deriving revenue from tobacco sales taxes and promoting public health. The TCT is a major source of many local governments’ revenue. Researchers have also examined local tobacco politics and highlighted the role of local communities in tobacco control.12 In the United States, some have found that state legislatures allocate more funds to tobacco control in states whose citizens favour more restrictive indoor air policies13 and that state funding for tobacco control has a positive effect on tobacco control policies in cities and towns.14 However, little research has been conducted on how local revenue from the tobacco industry conflicts with public health and may be acting as a deterrent to tobacco control.

This study focuses on the revenue local governments obtain through the TCT in the Republic of Korea. In this country, lower-level local governments receive TCTs monthly from tobacco companies in proportion to the volume of tobacco products sold within their jurisdiction. For many local governments, the TCT provides a substantial percentage of local tax revenue; in 2001 this percentage exceeded 30, on average, in rural areas.15

When viewed in light of tax assignment principles,16 the TCT has several attractive features that favour its assignment to a local tax: (i) It is a substantial and reliable source of tax revenue for local governments; (ii) the tax base (i.e. the smoking population) is evenly distributed across localities; and (iii) virtually no local administrative effort is needed to collect taxes. Once a national tax, the TCT was changed to a local tax to serve as a major tax base for local governments in 1989, when the Republic of Korea was preparing for subnational elections. As intended, the TCT has indeed become a critical source of tax revenue for local governments.

Despite its benefits, the TCT is detrimental to local tobacco control efforts. Because local TCT revenue depends on the volume of tobacco products sold within a given jurisdiction, local governments have a financial incentive to encourage people to buy cigarettes locally. In fact, they often conduct campaigns with slogans such as “Buy cigarettes in our hometown for our local economy” and fly banners in bus terminals, distribute cigarette lighters, and place public advertisements on community bulletins. Such campaigns tend to intensify when a large number of residents are expected to travel home during traditional holidays. Through campaigns they even try to persuade local government employees to purchase extra cigarettes before travelling on business. While some feel that such measures merely encourage smokers to buy cigarettes at home instead of in other places, central government policymakers claim that many local governments are in fact promoting smoking.15 Local residents, particularly youth, may receive mixed messages about the harms of smoking, in addition to being influenced to purchase tobacco products through direct propaganda. Furthermore, the more local governments depend on the TCT for revenue, the less they are committed to tobacco control. In short, the TCT provides many local governments with a financial incentive to promote smoking and be lax in tobacco control efforts.

The negative effects of the TCT on local tobacco control are reinforced by two characteristics of the health system of the Republic of Korea. First, lower-level governments bear no financial responsibility for residents’ health expenditures because health services are covered by national health insurance with subsidies from the central government, complemented by out-of-pocket spending by patients. Local governments, therefore, have little reason to be concerned financially about the health expenditures related to smoking. Second, the public health centre (PHC), which is the local health planning and health promotion agency in each jurisdiction, is a part of the local government and does not report directly to the health ministry or central health promotion organizations. Even if the PHC and the local government office are housed in different buildings, the local government exerts a strong and direct influence on the appointment of the PHC director and on other administrative decisions. Because of this, PHCs may find that their mission to promote health is at odds with other local concerns.

This study investigated whether local governments’ dependence on the TCT negatively affects tobacco control at the local level in the Republic of Korea. Specifically, we examined whether the PHCs of local governments that derived a higher percentage of their local tax revenues from the TCT were less likely to participate in the anti-smoking programme supported by the central NHPF in 2002–2003.

Methods

Setting and sample

From September 2002 to December 2003, the Ministry of Health and Welfare provided NHPF funds to support the PHC-based health promotion programme in four areas: anti-smoking, physical activity, good nutrition and moderation in drinking. This financial support was provided on a competitive basis according to a point system that included evaluations of submitted work plans.

We excluded 69 district governments from Seoul and six other metropolitan cities from the list of all lower-level local governments in 2002 because district governments’ TCT revenue does not depend on tobacco sales within their jurisdictions.17 The final sample included a total of 163 local governments.

Data, variables and statistical analysis

The data for this study came from three sources. First, the list of PHC-based health promotion areas for 2002–2003 was obtained from the Management Centre for Health Promotion, a central organization providing technical support for a variety of health promotion activities.18 Second, the information on revenues from the TCT and other local taxes in 2002 came from the Local Financial Open System, administered by the Ministry of Government Administration and Home Affairs.19 Third, population size in 2000 and PHC staff size in 2002 were retrieved, for each local government’s jurisdiction, from the Statistical Information Service of the Republic of Korea.20

The dependent variable was a binary variable indicating whether a local government participated in the PHC-based anti-smoking programme in 2002–2003. This variable captures a local government’s commitment to tobacco control. The explanatory variable of primary interest was the percentage of local tax revenue that came from the TCT, which served as our operational indicator of how much local governments depended on TCT revenue. In addition to this variable, which was continuous, we also divided it into four quartiles for use as a dummy variable to account for possible nonlinear and threshold effects.

Given the small sample size, this study used a parsimonious set of control variables available in the data. To account for local socioeconomic differences, we included three variables: (i) per capita local tax revenue, (ii) population size, and (iii) an indicator of whether or not the local government was a county government. We also included PHC staff size because insufficient staff could be a deterrent to participation a new health promotion programme.21 Because each PHC serves from 10 000 to 944 000 people, PHCs were classified into several categories to reflect different capacity levels. We created a set of dummy variables to capture relatively homogeneous capacity within categories.

We estimated two standard logit models using different specifications for TCT revenue as a percentage of local tax revenue. To answer the research question, we examined whether the coefficient(s) for the percentage of local revenue derived from TCT revenue were negative and statistically significant, which would point to a negative association between local governments’ dependence on TCT revenue and participation in the anti-smoking programme. Robustness checks focused on two possible scenarios that could affect the key finding. First, because TCT revenue as a percentage of local tax revenue was highly correlated with per capita local tax revenue, we estimated two additional models that included only one of the two variables. Second, recognizing that there were multiple health promotion areas, we also estimated a multinomial logit model. A likelihood ratio test was used to determine whether the multinomial logit model had a statistically significant advantage in terms of goodness-of-fit compared with the binomial logit model.22,23

Results

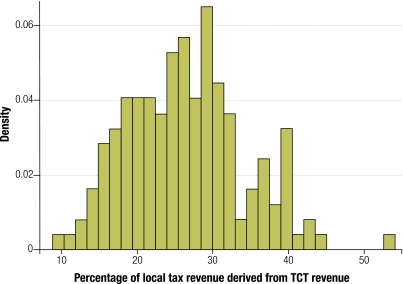

Table 1 presents summary statistics for the study sample. Of the 163 local governments, 43 (26.38%) participated in the anti-smoking programme, and 32 (19.63%) participated in other areas of health promotion. TCT revenue as a percentage of local tax revenue varied from 8.8% to 54.1% among local governments (Fig. 1) and was 26.4% on average (Table 1).

Table 1. Summary statistics of local governments (n = 163) included in study of the percentage of local tax revenue coming from TCT revenue and local government participation in an anti-smoking programme, Republic of Korea, 2002–2003.

| Variable | Mean (SD or %) | Range |

|---|---|---|

| Dependent variable | ||

| For binomial logit: | ||

| Participation in anti-smoking programme (1 if yes, 0 if no) | 43 (26.38%) | |

| For multinomial logit: | 43/32/88 | – |

| Anti-smoking/other/none | (26.38%/19.63%/53.99%) | |

| Explanatory variable of main interest | ||

| Percentage of local tax revenuea derived from TCT revenue (ranked by fourths) | 26.4 (7.8) | (8.8–54.1) |

| 1st (8.79–20.48) | 41 (25.15%) | – |

| 2nd (20.50–25.90) | 41 (25.15%) | – |

| 3rd (25.97–31.01) | 41 (25.15%) | – |

| 4th (31.08–54.11) | 40 (24.54%) | – |

| Other explanatory variables | ||

| Per capita local tax revenuea (in wons of the Republic of Korea × 100 000) | 2.06 (0.71) | (0.83–4.63) |

| Population size (× 1000) | 148.81 (167.36) | (10.15–944.24) |

| Size of PHC staff | ||

| < 40 | 67 (41.10%) | – |

| 40–49 | 39 (23.93%) | – |

| 50–59 | 28 (17.18%) | – |

| ≥ 60 | 29 (17.79%) | – |

| Location (1 if county, 0 if city) | 89 (54.60%) | – |

PHC, public health centre; SD, standard deviation; TCT, tobacco consumption tax. a Local tax revenue denotes revenues from city and county taxes only, not from provincial taxes. It does not include revenue from the previous year. Based on data from the Local Financial Open System and the Statistical Information Service of the Republic of Korea.

Fig. 1.

TCT revenue as a percentage of local tax revenue for local governments (n = 163), Republic of Korea, 2002–2003

TCT, tobacco consumption tax.

The results of two binomial logit models suggest that local governments with a higher dependence on TCT revenue were less likely to participate in the anti-smoking programme supported by the National Health Promotion Fund (Table 2). For the model with the continuous specification, the coefficient estimate was –0.98 (P < 0.05), which suggests that the greater the TCT revenue as a percentage of local tax revenue, the lower the likelihood of local governments’ participation in the anti-smoking programme. In the model in which the percentages were ranked into quartiles used as dummies, the coefficient for each of the three upper quartiles showed a negative sign, which suggests that those local governments had a lower likelihood of participating in the anti-smoking programme than the ones in the reference quartile (i.e. the ones least dependent upon the TCT). However, only the coefficient for the highest quartile yielded statistical significance. Another interesting finding was that the size of the PHC staff was negatively and significantly associated with participation in the anti-smoking programme.

Table 2. Binomial logit regressions of the participation of local governments (n = 163) in anti-smoking programme as a function of the percentage of local tax revenue comprised by TCT revenue, Republic of Korea, 2002–2003.

| Variable | Coefficient | Coefficient |

|---|---|---|

| (95% CI)a | (95% CI)a | |

| Explanatory variable of main interest | ||

| TCT revenue as a % of local tax revenue | –0.98** | – |

| (–1.73 to –0.22) | ||

| Quartile (dummy variable) | ||

| 1st (reference) | – | – |

| 2nd | – | –0.43 |

| (–1.62 to 0.76) | ||

| 3rd | – | –0.88 |

| (–2.59 to 0.83) | ||

| 4th (highest) | – | –2.36** |

| (–4.58 to –0.15) | ||

| Other explanatory variables | ||

| Per capita local tax revenue (in wons of the Republic of Korea × 100 000) | –0.48 | –0.48 |

| (–1.09 to 0.13) | (–1.24 to 0.29) | |

| Population (× 100 000) | –0.22** | –0.19 |

| (–0.42 to –0.02) | (–0.43 to 0.06) | |

| Size of PHC staff | ||

| < 40 | –1.94*** | –1.86* |

| (–3.19 to –0.68) | (–3.11 to –0.61) | |

| 40–49 | –0.88* | –0.74 |

| (–1.89 to –0.12) | (–1.72 to 0.24) | |

| 50–59 | –1.02*** | –1.02* |

| (–1.73 to –0.32) | (–1.76 to –0.27) | |

| ≥ 60 (reference) | – | – |

| County | 0.59 | 0.75 |

| (–0.52 to 1.71) | (–0.61 to 2.12) | |

| Constant | 3.58* | 1.68 |

| (0.44 to 6.72) | (–1.33 to 4.68) | |

| Pseudo R squaredb | 0.0950 | 0.1140 |

| Log pseudolikelihood | –85.12 | –83.32 |

PHC, public health centre; TCT, tobacco consumption tax. *P < 0.10; **P < 0.05; ***P < 0.01. a Robust standard errors were used to allow for potential clustering between lower-level local governments from the same upper-level (provincial) local government. Five county governments from metropolitan cities were regarded as one cluster because they shared relative urbanicity. b A measure of goodness-of-fit for non-linear models, including logistic models.

The negative and statistically significant coefficient for the percentage of local tax revenue comprised by TCT revenue were robust to our additional model estimations (Table 3). Local governments’ dependence on TCT revenue consistently showed negative associations regardless of whether or not per capita local tax revenue was included (Table 3, columns 1 and 2 under “binomial logit”), while per capital local tax revenue alone did not produce a statistically significant coefficient (Table 3, column 3 under “binomial logit”). The multinomial logit model did not produce qualitatively different coefficients for the proportion of local tax revenue comprised by TCT revenue (Table 3, column 1 under “multinomial logit”). The null hypothesis could not be rejected on the basis of the likelihood ratio test, so the binomial logit model was favoured on grounds of parsimony.

Table 3. Robustness check in study of the percentage of local tax revenue coming from TCT revenue and participation of local governments (n = 163) in an anti-smoking programme, Republic of Korea, 2002–2003.

| Model estimation |

Binomial logit |

Multinomial logit |

|||||

|---|---|---|---|---|---|---|---|

| Dependent variable |

y = 1 if participated | Anti-smoking [versus NP] |

Othera [versus NP] |

||||

| y = 0 if otherwise | |||||||

| Explanatory variableb | Coefficient (95% CI) | Coefficient (95% CI) | Coefficient (95% CI) | Coefficient (95% CI) | Coefficient (95% CI) | ||

| Percentage of local tax revenue derived from the TCT | –0.98** | –0.58** | – | –1.04*** | –0.30 | ||

| (–1.73 to –0.22) | (–1.14 to –0.04) | (–1.76 to –0.33) | (–1.23 to 0.62) | ||||

| Per capita local tax revenue (in wons of the Republic of Korea × 100 000) | –0.48 | – | 0.20 | –0.45 | 0.06 | ||

| (–1.09 to 0.13) | (–0.29 to 0.68) | (–0.92 to 0.02) | (–0.66 to 0.78) | ||||

| Pseudo R squaredc | 0.0950 | 0.0884 | 0.0706 | 0.0646 | |||

| Log pseudolikelihood | –85.12 | –85.74 | –87.41 | –153.07 | |||

| Likelihood ratio testd χ² (df = 7) | – | – | – | 3.27 | |||

*P < 0.10; **P < 0.05; ***P < 0.01. CI, confidence interval; df, degrees of freedom; NP, no participation; TCT, tobacco consumption tax. a The other category collectively includes the promotion of physical activity, good nutrition and moderation in drinking. b Other explanatory variables include population size, public health centre staff size and being a county or not. c A measure of goodness-of-fit for non-linear models, including logistic models. d The null hypothesis is that the other category can be pooled into the NP category. For this test, robust standard errors were not used.

Discussion

The main results of this study show that local governments’ dependence on TCT revenue is associated with lower commitment to tobacco control in the Republic of Korea. Although the international literature has shown that public health goals are at odds with tobacco tax revenue policy at the central government level, this study shows that this is also true at the local level. It also suggests that local governments’ dependence on TCT revenue may be hindering current national tobacco control efforts and compromising their effectiveness and long-term success.

The key policy implication of this study is that the central government of the Republic of Korea must reduce local governments’ dependence on TCT revenue. However, it would be unwise to simply remove the TCT from the list of local taxes because it is a major source of local tax revenue. A better option would be to support alternative sources of tax revenue, particularly in financially vulnerable jurisdictions. While finding alternative tax sources is considered challenging, national tobacco control targets are already being negatively affected by continued local government dependence on TCT revenue. One of the top priorities of Health Plan 2010, a comprehensive national health promotion plan for the Republic of Korea, includes reducing male smoking prevalence from 50.3% in 2005 to 30.0% in 2010.24 For this goal to be attainable, local TCT revenue must decrease in the near future and alternative tax sources must be sought regardless of whether or not the TCT remains a local tax. One immediate policy goal should be to reduce dependence on the TCT among local governments whose TCT revenue currently exceeds 30% of local tax revenue. Addressing this group with the strongest dependency would also make it easier to make the policy recommendation that all TCT revenue be dedicated to tobacco control.

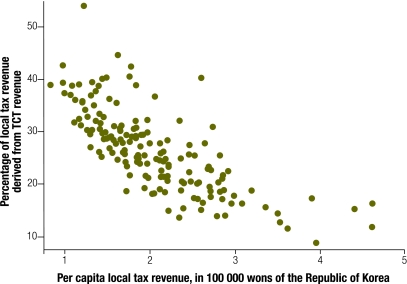

The need to reduce local governments’ dependence on TCT revenue is heightened in light of its potential impact on health equity. Not surprisingly, in economically vulnerable areas without sufficient local tax bases, local TCT revenue as a percentage of local tax revenue tends to be higher (Fig. 2). Furthermore, such areas are more likely to have insufficient PHC staff, which constitutes a further barrier to tobacco control, as this study shows. Thus, local governments in disadvantaged regions face more barriers to tobacco control than their wealthier counterparts. This regional inequity is particularly worrisome because socioeconomic inequalities in smoking are widening in the Republic of Korea.25,26 Different contextual factors by locality may be contributing to such inequalities. Moreover, since smoking has social and economic costs (i.e. expenditure, productivity loss, accidents, healthcare costs, etc.),27–33 the impact of regional inequity in smoking rates could exacerbate regional economic disadvantages.

Fig. 2.

Tax base of local governments (n = 163) and TCT revenue as a percentage of local tax revenue, Republic of Korea, 2002–2003

TCT, tobacco consumption tax.

A third rationale for reducing local governments’ dependence on TCT revenue is based on ethical considerations. The fact that financially hard-pressed local governments operate at the cost of their residents’ health goes against a fundamental responsibility of the government, as stipulated in the Constitution of the Republic of Korea: “The health of all citizens shall be protected by the State”.34 A group of local mayors have acknowledged that “TCT is a tax that increases with more harm done to citizen’s health” and that it “should not be a major source of tax revenue for local governments in charge of citizen’s health and welfare”.35 Such ethical conflicts also underlie the legal conflict between the Tobacco Business Act (formerly, the Tobacco Monopoly Act) administered by the finance ministry and the National Health Promotion Act administered by the health ministry.36

This study also provides several generalizable lessons for the global tobacco control community. First, increasing tobacco taxes alone could do unintended harm if the tax revenues are diverted to uses other than tobacco control. To assuage worries about possible shocks to local economies before the 2004 tobacco tax increase in the Republic of Korea, proponents of the tax increase had to demonstrate that it would not precipitate a sudden reduction in local TCT revenue due to decreased local cigarette sales.6,37 However, this study suggests that local governments’ dependence on TCT revenue hinders tobacco control locally.

A second lesson is that individual countries should invest in building national tobacco control capacity.38,39 Despite several tobacco control measures recently adopted in the Republic of Korea, scepticism prevails as to whether the country can achieve the national objectives of tobacco control listed in Health Plan 2010.40 Clearly, there is a missing link between the stated objectives and current tobacco control measures. National tobacco control policy should identify and tackle emerging barriers and evolve into comprehensive tobacco control activities involving media campaigns, subsidies for nicotine-replacement therapies and disclosure regulations. For this to occur, national tobacco control requires continued investment in capacity and therefore a more adaptive approach in an iterative, rather than linear, policy process.41 The increase of tobacco taxes in 2004 has not necessarily resolved all important issues surrounding tobacco control in the Republic of Korea. It has, however, revealed other weak links in this area that should be addressed.

Third, sound public policy is vital for tobacco control. Too often, tobacco control policies rely on individual-level interventions without addressing the socioeconomic determinants of tobacco use. In 2005, the government of the Republic of Korea started providing funds for PHC-based smoking cessation clinics nationwide. This study suggests that the beneficial effects of such individual-level interventions could be undermined by the far-reaching negative effects of local governments’ dependence on TCT revenue, which is detrimental to the promotion of health as “a core responsibility for all of government.”42 Furthermore, because economically vulnerable localities with fewer stable tax bases depend heavily on TCT revenue, the assignment of the TCT as a local tax is a political issue, reiterating the importance of upstream healthy public policy.43

This study has several limitations that future research could address. First, better indicators from standardized measures might be used to assess the strength of local tobacco control.38 Second, qualitative studies would advance the knowledge of local policy environments and their effect on local governments’ commitment to tobacco control.44 Third, the use of longitudinal data would allow for improved study designs that could account for unobserved local differences and the potential issue of reverse causality. The latter, however, is of little concern in this study because it is highly unlikely that a local government’s initial participation in the anti-smoking programme significantly influenced population-level smoking rates immediately. Fourth, comparative studies on tobacco tax policy would shed further light on the political economy of tobacco control45 and allow such results to be disseminated to inform the global tobacco control community. ■

Acknowledgements

We are grateful for helpful comments from Kwok Cho Tang and Tong Ryoung Jung. Special thanks go to William Alexander for his constructive suggestions on earlier drafts. We also would like to thank three anonymous reviewers for constructive comments and useful suggestions. Karen Eggleston provided invaluable help with the revision of the paper.

Footnotes

Competing interests: None declared.

References

- 1.Kang EJ. In-depth analyses of the third National Health and Nutrition Examination Survey: the health interview and health behavior survey part Seoul: Korea Institute for Health and Social Affairs; 2007. [Google Scholar]

- 2.Lee H, Yoon SJ, Ahn HS. Measuring the burden of major cancers due to smoking in Korea. Cancer Sci. 2006;97:530–4. doi: 10.1111/j.1349-7006.2006.00205.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Ha BM, Yoon SJ, Lee HY, Ahn HS, Kim CY, Shin YS. Measuring the burden of premature death due to smoking in Korea from 1990 to 1999. Public Health. 2003;117:358–65. doi: 10.1016/S0033-3506(03)00142-2. [DOI] [PubMed] [Google Scholar]

- 4.Kang HY, Kim HJ, Park TK, Jee SH, Nam CM, Park HW. Economic burden of smoking in Korea. Tob Control. 2003;12:37–44. doi: 10.1136/tc.12.1.37. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Cho KS. FCTC and tobacco control policy in Korea. Health Welfare Policy Forum. 2006;116:7–23. [Republic of Korea] [Google Scholar]

- 6.Hu TW, Mao Z. Effects of cigarette tax on cigarette consumption and the Chinese economy. Tob Control. 2002;11:105–8. doi: 10.1136/tc.11.2.105. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Gallet CA, List JA. Cigarette demand: a meta-analysis of elasticities. Health Econ. 2003;12:821–35. doi: 10.1002/hec.765. [DOI] [PubMed] [Google Scholar]

- 8.Lee J-M, Liao D-S, Ye C-Y, Liao W-Z. Effect of cigarette tax increase on cigarette consumption in Taiwan. Tob Control. 2005;14(Suppl 1):i71–5. doi: 10.1136/tc.2004.008177. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Wan J. Cigarette tax revenues and tobacco control in Japan. Appl Econ. 2006;38:1663–75. doi: 10.1080/00036840500426900. [DOI] [Google Scholar]

- 10.Framework Convention on Tobacco Control. Geneva: World Health Organization; 2003. [Google Scholar]

- 11.Wang H. Tobacco control in China: the dilemma between economic development and health improvement. Salud Publica Mex. 2006;48(Suppl 1):S140–7. doi: 10.1590/s0036-36342006000700017. [DOI] [PubMed] [Google Scholar]

- 12.Mehl G, Wipfli H, Winch P. Controlling tobacco: the vital role of local communities. Harvard Int Rev. 2005;27:54–8. [Google Scholar]

- 13.Snyder A, Falba T, Busch S, Sindelar J. Are State legislatures responding to public opinion when allocating funds for tobacco control programs? Health Promot Pract. 2004;5(Suppl):35S–45S. doi: 10.1177/1524839904264591. [DOI] [PubMed] [Google Scholar]

- 14.Bartosch WJ, Pope GC. Local enactment of tobacco control policies in Massachusetts. Am J Public Health. 2002;92:941–3. doi: 10.2105/AJPH.92.6.941. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Korea Institute for Health and Social Affairs, Ministry of Health and Welfare, Office of the Prime Minister. Policy discussion for expanding tobacco control programs Seoul: Korea Institute for Health and Social Affairs; 2001. [Google Scholar]

- 16.Lee Y. Adequacy of Korea’s tax assignment: a fiscal federalism approach. Int Rev Public Admin. 2005;9:139–48. [Google Scholar]

- 17.Local Tax Act. Article 227. 2007.

- 18.Management Center for Health Promotion. Health promotion areas, 2002‑2003 2007. Available from: http://mchp.hp.go.kr [accessed on: 17 August 2009].

- 19.Local Financial Open System. City and county tax revenues, 2002 2007. Available from: http://lofin.mopas.go.kr [accessed on: 17 August 2009].

- 20.Korean Statistical Information Service. 2007. Available from: http://www.kosis.kr/ [accessed on: 17 August 2009].

- 21.Rogers EM. Diffusion of innovations New York, NY: Free Press; 2003. [Google Scholar]

- 22.Hill MA. Female labour force participation in developing and developed countries - consideration of the informal sector. Rev Econ Stat. 1983;65:459–68. doi: 10.2307/1924191. [DOI] [Google Scholar]

- 23.Cramer JS, Ridder G. Pooling states in the multinomial logit model. J Econom. 1991;47:267–72. doi: 10.1016/0304-4076(91)90102-J. [DOI] [Google Scholar]

- 24.Ministry of Health and Welfare. Health Plan 2010. Seoul: Ministry of Health Welfare; 2005. [Google Scholar]

- 25.Khang YH, Cho HJ. Socioeconomic inequality in cigarette smoking: trends by gender, age, and socioeconomic position in South Korea, 1989-2003. Prev Med. 2006;42:415–22. doi: 10.1016/j.ypmed.2006.02.010. [DOI] [PubMed] [Google Scholar]

- 26.Cho HJ, Song YM, Davey Smith G, Ebrahim S. Trends in socio-economic differentials in cigarette smoking behaviour between 1990 and 1998: a large prospective study in Korean men. Public Health. 2004;118:553–8. doi: 10.1016/j.puhe.2004.04.006. [DOI] [PubMed] [Google Scholar]

- 27.Hu TW, Mao Z, Liu Y, de Beyer J, Ong M. Smoking, standard of living, and poverty in China. Tob Control. 2005;14:247–50. doi: 10.1136/tc.2004.010777. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28.McGhee SM, Adab P, Hedley AJ, Lam TH, Ho LM, Fielding R, et al. Passive smoking at work: the short-term cost. J Epidemiol Community Health. 2000;54:673–6. doi: 10.1136/jech.54.9.673. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29.Parrott S, Godfrey C, Raw M. Costs of employee smoking in the workplace in Scotland. Tob Control. 2000;9:187–92. doi: 10.1136/tc.9.2.187. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30.Tsai SP, Wen CP, Hu SC, Cheng TY, Huang SJ. Workplace smoking related absenteeism and productivity costs in Taiwan. Tob Control. 2005;14(Suppl 1):i33–7. doi: 10.1136/tc.2003.005561. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31.Wen CP, Tsai SP, Cheng TY, Chan HT, Chung WS, Chen CJ. Excess injury mortality among smokers: a neglected tobacco hazard. Tob Control. 2005;14(Suppl 1):i28–32. doi: 10.1136/tc.2003.005629. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32.Bunn WB, 3rd, Stave GM, Downs KE, Alvir JM, Dirani R. Effect of smoking status on productivity loss. J Occup Environ Med. 2006;48:1099–108. doi: 10.1097/01.jom.0000243406.08419.74. [DOI] [PubMed] [Google Scholar]

- 33.McGhee SM, Ho LM, Lapsley HM, Chau J, Cheung WL, Ho SY, et al. Cost of tobacco-related diseases, including passive smoking, in Hong Kong. Tob Control. 2006;15:125–30. doi: 10.1136/tc.2005.013292. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34.Constitution of the Republic of Korea. Article 36(3).

- 35.Association of Seoul Metropolitan City District Mayors. Statement against the exchange of tax assignments between Tobacco Consumption Tax and Aggregate Land Tax. 4 September 2004.

- 36.Park K, Kim DS, Park D-J, Lee SK. Tobacco control in Korea. Med Law. 2004;23:759–80. [PubMed] [Google Scholar]

- 37.Chaloupka FJ, Warner KE. The Economics of Smoking. In: Cuyler AJ, Newhouse JP, eds. Handbook of Health Economics Amsterdam: Elsevier Science; 2000. [Google Scholar]

- 38.Wipfli H, Stillman F, Tamplin S.da Costa e Silva VL, Yach D, et alAchieving the Framework Convention on Tobacco Control’s potential by investing in national capacity. Tob Control 200413433–7. 10.1136/tc.2003.006106 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 39.Stillman F, Yang G, Figueiredo V, Hernandez-Avila M, Samet J. Building capacity for tobacco control research and policy. Tob Control. 2006;15(Suppl 1):i18–23. doi: 10.1136/tc.2005.014753. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 40.Cho SI. Trends in smoking rates in Korea. Med Observer. 2007;393:36. [Google Scholar]

- 41.Hogwood BW, Gunn LA. Policy analysis for the real world New York, NY: Oxford University Press; 1984. [Google Scholar]

- 42.World Health Organization. The Bangkok Charter for Health Promotion in a Globalized World. Geneva: WHO; 2005. [PubMed] [Google Scholar]

- 43.McKinlay JB, Marceau LD. Upstream healthy public policy: lessons from the battle of tobacco. Int J Health Serv. 2000;30:49–69. doi: 10.2190/2V5H-RHBR-FTM1-KGCF. [DOI] [PubMed] [Google Scholar]

- 44.Jacobson PD, Wasserman J. Tobacco control laws: implementation and enforcement Santa Monica, CA: Rand; 1997. [DOI] [PubMed] [Google Scholar]

- 45.Chantornvong S, Collin J, Dodgson R, Lee K, McCargo D, Seddon D, et al. Political economy of tobacco control in low-income and middle-income countries: lessons from Thailand and Zimbabwe. Bull World Health Organ. 2000;78:913–9. [PMC free article] [PubMed] [Google Scholar]