Abstract

For 30 years, the orthopaedic faculty at Case Western Reserve University worked as an independent private corporation within University Hospitals Case Medical Center (Hospital). However, by 2002, it became progressively obvious to our orthopaedic practice that we needed to modify our business model to better manage the healthcare regulatory changes and decreased reimbursement if we were to continue to attract and retain the best and brightest orthopaedic surgeons to our practice. In 2002, our surgeons created a new entity wholly owned by the parent corporation at the Hospital. As part of this transaction, the parties negotiated a balanced employment model designed to fully integrate the orthopaedic surgeons into the integrated delivery system that included the Hospital. This new faculty practice plan adopted a RVU-based compensation model for the physicians, with components that created incentives both for clinical practice and for academic and administrative service contributions. Over the past 5 years, aligning incentives with the Hospital has substantially increased the clinical productivity of the surgeons and has also benefited the Hospital and our patients. Furthermore, aligned incentives between surgeons and hospitals could be of substantial financial benefit to both, as Medicare moves forward with its bundled project initiative.

Introduction

From 1907 until 1971, the physicians who comprised the orthopaedic surgical facility at Case Western Reserve University (the “University”) and the orthopaedic medical staff at University Hospitals Case Medical Center (the “Hospital”) practiced in a collaborative affiliation with the University and the Hospital for research, academic, and clinical purposes. In 1972, after the promulgation of state legislation permitting the incorporation of professional associations, these orthopaedic surgeons formed an independent Ohio professional corporation with shareholders and an elected Board of Directors, and began doing business as University Orthopaedic Associates, Incorporated (UOAI). UOAI was one of approximately 21 independent physician groups that served as faculty practice plans for the University and Hospital. UOAI’s physicians were all appointed faculty at the University and were all credentialed on the medical staff of the Hospital. Its orthopaedic surgeons therefore comprised the Department of Orthopaedics for the University and the Hospital.

Over the next 30 years, UOAI’s clinical, academic, and research practice expanded and succeeded. By 2002, however, healthcare regulatory changes coupled with decreasing reimbursement for the provision of orthopaedic clinical care to patients placed economic and management stresses on UOAI’s ability to attract and retain the best and brightest orthopaedic surgeons for employment in its group practice. As a result, UOAI, along with its academic and hospital affiliates, endeavored to identify a physician practice and compensation paradigm that would allow for continued growth and recruitment, while simultaneously responding to the relentless economic and legal pressures present in the modern practice of medicine.

This report describes the challenges and opportunities of aligning incentives between hospitals and academic clinical departments, the 5-year results of our experience, and the future challenges that face hospitals and their orthopaedic departments.

The Challenges of Aligning Incentives with the Hospital in an Academic Setting

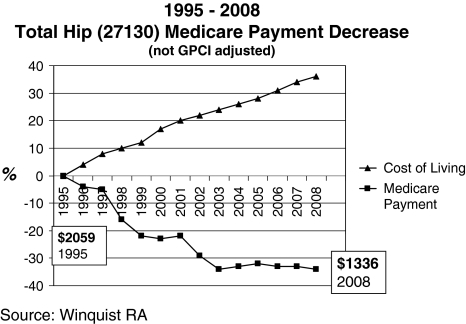

Medicare payments for the most common orthopaedic surgical procedures have decreased dramatically since 1995, compared with the increase in the cost of living [17] (Fig. 1), and corresponding increases in physician compensation benchmarks. The decrease in Medicare payments for these procedures is closely linked to the decrease in reimbursement from most commercial insurance payors [12].

Fig. 1.

The 1995–2008 total hip 27130 Medicare payment decrease and cost-of-living increases [17] contribute to the compensation problems confronting practice plans. (Reprinted with permission from SLACK Incorporated: Marcus RE, Dennis DA, Morrey BF, Winquist RA, Zenty TF. A team approach to orthopedics: surgeons and hospitals working together. Orthop Today. 2009;29:32–38.)

In 1989, changes in healthcare law had considerable impact on the practice of medicine. In 1989, Congressman Fortney “Pete” Stark, representing California’s 13th congressional district, sponsored legislation (commonly known as the Stark Law) enacted by Congress that substantially affected the scope, structure, and nature of compensation and financial relationships between physicians and other types of healthcare providers such as hospitals [6]. The crux of the Stark Law is a prohibition against physicians referring Medicare patients for designated health services (or DHS such as referring patients to an offsite imaging facility in which the physician has ownership) to an entity with which the physician or member of the physician’s family has a financial relationship unless the relationship fits within a statutory or regulatory “exception” [29]. Similarly, if such a referral does not fit within a statutory or regulatory exception, the Stark Law prohibits the entity (such as a hospital) receiving the referral from billing the federal government for reimbursement for services provided to the Medicare patient. Subsequent amendments to the Stark Law in 1993 and 1994 expanded this prohibition by including additional categories of services in the definition of DHS and also included referrals of patients who are covered under the Medicaid program [7, 22]. In 1995, 2001, 2004, 2006, 2007, and 2008, the Centers for Medicare & Medicaid Services (formerly known as the Health Care Financing Administration) issued, reissued, revised, and replaced a multitude of regulations concerning acceptable and prohibited arrangements under the Stark Law [11, 23–27]. In 2003, the Social Security Act was amended to include an 18-month moratorium on physician referrals to certain specialty hospitals (specifically including orthopaedic hospitals) in which the referring physician maintained an ownership or investment interest [4]. In combination, this evolution of the Stark Law resulted in severe limitations on the ability of physicians, including UOAI, to own and/or share in revenue generated from clinical services performed ancillary to the physician’s treatment of his or her patients. As the Stark Law evolved and other healthcare regulatory changes took effect, the practice of medicine became increasingly complex. The effect of the increased legal scrutiny and regulation substantially restricted the ability of hospitals to support and effectively utilize the professional services of independent physicians’ practices, even if such practices served as the faculty practice plan for a hospital and/or its medical school affiliate.

Other critical federal regulatory schemes enacted and implemented about the same time as the Stark Law also materially impacted the business operations of medical practices. For example, the Health Insurance Portability and Accountability Act of 1996 (HIPAA) mandated standards for the privacy of individually identifiable health information [13]. HIPAA markedly increased the overhead expenses for independent medical practices such as UOAI, requiring medical practices to make substantial investments in personnel, consultants, and new or upgraded technology to remain in compliance with the law.

Orthopaedic practices affiliated with universities and teaching hospitals, most of which are tax-exempt pursuant to Internal Revenue Code Section 501(c)(3), faced additional challenges. A fundamental requirement of Section 501(c)(3) is that a charitable organization such as a tax-exempt hospital or university must ensure no part of its net earnings inures “to the benefit of private shareholders or individuals” such as an independent, for-profit physician group. Internal Revenue Service oversight and enforcement of the inurement prohibition added to the limitations on the ability of for-profit physician groups to partner with tax-exempt hospitals and/or medical schools [15].

As the Stark Law evolved and the plethora of other healthcare regulations took effect and were applied and enforced in new and unexpected ways, the ability of academic medical centers to provide funding or loans to independent physician practices for the recruitment of new physicians necessary to support the medical center’s tax-exempt mission became extremely complex. Alternatives to academic medical center funding for independent physician practices, although limited, included funding recruitments out of declining practice revenues, seeking commercial loans, and/or increasing capital contributions from physician shareholders. All of these options created burdens on the ability of physician practices to maintain necessary operating revenue and margin, let alone equitable physician compensation arrangements in the face of ever-increasing competition.

By 2002, UOAI was struggling with the prospect of severely contracting its recruiting efforts as well as its programs and services, due in large part to the substantial changes in the healthcare environment. The Stark Law, HIPAA, and the prohibition on private inurement under the Internal Revenue Code put at risk UOAI’s ability to function as an independent professional corporation serving as the orthopaedic faculty practice plan for a major, tax-exempt academic medical center comprised of the University and the Hospital.

Opportunities for Alignment Between the Hospital and the Academic Orthopaedic Department

An independent analysis of UOAI’s orthopaedic practice revealed differences between the revenue generated by UOAI and the revenue generated by private orthopaedic practices. These differences were attributable to the fact that such private practices were not required to participate in the charitable activities of the Hospital and University, including teaching, research, and caring for the indigent and uninsured. In particular, unaffiliated private orthopaedic practices concentrated on private-pay patients and were also able to invest in equipment and capabilities to provide ancillary services (eg, imaging), surgical services (eg, ambulatory surgical facilities), and related services (eg, physical therapy). One estimate UOAI obtained from an outside consultant stated that for every $1 of professional revenue a practice generated, it also generated $6 to $10 of other revenue from these services.

It was obvious that to properly remain competitive while serving as the orthopaedic faculty plan with a charitably focused academic practice, UOAI would require subsidization from the University and/or Hospital. UOAI needed to identify an economically feasible means of setting, evaluating, and providing benchmark physician compensation in an increasingly competitive marketplace. In reviewing successful orthopaedic practice models, UOAI concluded there were three general ways of structuring compensation for its employed surgeons: cash-based, salary-based, and work relative value unit (wRVU)-based [1, 3]. Each compensation model offered unique advantages and disadvantages.

A cash-based physician compensation plan is one in which a physician’s compensation is dependent on collections from patient care. Adoption of this compensation model would permit UOAI to remain legally independent from the University and the Hospital and would include an incentive compensation component based on productivity—an important component of equitable compensation in a private-practice model. On the other hand, due to the pressure to identify and capture additional revenue to maintain competitive market salaries, adoption of this compensation model could require UOAI to purchase, own, and manage the ancillary services that are most used in connection with the clinical treatment of patients with musculoskeletal disorders. Further, UOAI recognized the potential for such a model to create internal competition between surgeons based on the fact that the compensation model, if not properly structured, could provide disproportionate economic benefits to those physicians who cared for patients needing complex diagnostic and other ancillary services in conjunction with their higher acuity underlying clinical issues. Since UOAI physicians were also actively involved in substantial teaching and research efforts, the practice was concerned that adoption of the cash model would not encourage physicians to participate in academics and/or other programs designed to fulfill the charitable missions of the University and the Hospital.

UOAI considered a second model designed around a salary-based compensation program, in which physician compensation is standardized and does not change with productivity over the contract period. UOAI determined this model would allow the UOAI physician shareholders to maintain their corporate independence from the Hospital and the University while eliminating competition based on the nature of internal referrals and/or clinical acuity. Further, UOAI determined this model would facilitate funding for academic work and encourage its employed physicians to spend time providing clinical services to fulfill the Hospital’s mission to provide high-quality care to treat underserved, indigent, and other high-risk populations. This model, however, also could have necessitated UOAI’s purchase and management of certain ancillary services in order to maintain revenue required to fund otherwise unreimbursed and under-reimbursed activities of its physicians. On top of this, the model contained no entrepreneurial component or incentives for clinical productivity.

Throughout 2002, as UOAI surveyed successful orthopaedic practices across the country, it became clear that regardless of the type of compensation model, the universally accepted method for measuring clinical productivity was based on wRVU measurements. The advantages of a third model, the wRVU compensation model, were substantial. Such a model included clear productivity incentives, eliminated the potential for internal competition for “select” patients, and favored entrepreneurial physicians who filled their schedules and provided access to all patients, and eliminated the potential for “adverse selection” of patients who have no insurance, insufficient insurance, or low acuity.

In analyzing how a wRVU model could work for UOAI, it became clear that the per-wRVU payment that was available based on UOAI’s actual collections would need to be increased in order to maintain market competitiveness. For example, UOAI’s analysis found that private groups that owned their own ancillary and related services were able to offer potential recruits a higher per-wRVU payment: in 2007, the MGMA 50th percentile for wRVUs generated by orthopaedic surgeons without ownership of ancillary services was $42.46, whereas during the same time period the value of wRVUs generated by orthopaedic surgeons owning their own ancillary services was $57.10, almost a $15 difference per wRVU. It is important to note there is no correlation between orthopaedic physician compensation and any referrals made by such physicians to any ancillary services owned/provided by the Hospital (or any other entity). Moreover, but for the fact that the Faculty Practice Plan was structured to comply with state corporate practice of medicine doctrine, the Hospital and/or the University directly would have most likely employed the orthopaedic physicians directly. Since this option was not pursued, the corporate structure of the Faculty Practice Plan and its relationship to the Hospital was designed to permit the Hospital to indirectly subsidize the Faculty Practice Plan in order to facilitate its charitable mission. This in turn permits the Faculty Practice Plan to provide funding for various activities of the Department of Orthopaedics, including key recruitments and charitable clinical services and related programs. Funding provided to the Faculty Practice Plan is consistent with the Academic Medical Center exception under the Stark Law and other regulatory requirements as well as state corporate law. Key aspects of this structure include the facts that no individual orthopaedic physician compensation is linked directly to any subsidization, physician compensation does not vary based on the volume or value of any referrals or other business made by an orthopaedic physician to the Hospital (or any affiliated entity), and all physician compensation is evaluated for compliance with fair market value.

UOAI would need to work with the Hospital and University in order to design a compensation system that was both competitive and geared toward the fulfillment of the Hospital and University’s charitable missions. Fortunately, our Hospital recognized the continuing importance of the Department of Orthopaedics’ academic mission to pursue scholarly activities including research and education. Therefore, UOAI would be able to redistribute a portion of the compensation based on the surgeons’ academic contributions.

UOAI recognized, however, that in order to fully implement a wRVU model, it would need to cease operating its corporation and cede operations and governance of the orthopaedic service line to the Hospital and the University. Even more concerning to UOAI shareholders and physician employees was the requirement that all of the orthopaedic surgeons become employees of an entity owned and controlled by the Hospital. Despite these drawbacks, UOAI recognized that in order to adjust to and comply with the ever changing healthcare regulatory and reimbursement landscape, UOAI would need to relinquish its independence.

From the perspective of the Hospital and the University, the advantage of securing a world-class group of high-quality orthopaedic subspecialists as employees of a tax-exempt wholly owned faculty plan was clear. Such an arrangement would facilitate simpler, legally compliant funding of programs necessary to serve underserved populations, indigent and Medicaid patients, and provide the means for enhancing teaching, academic, and cutting-edge research activities. In addition, this arrangement would further integrate the orthopaedic surgeons into the clinical and economic structure of the academic medical center all the while aligning incentives among all three constituents: the physicians, the University, and the Hospital. For UOAI, this was the best possible solution.

Hospital Issues in Aligning Incentives with an Academic Orthopaedic Department

The same regulatory climate that posed challenges for UOAI also had a direct effect on the clinical, academic, research, teaching, and strategic activities of the Hospital and the University. The Hospital component of the academic medical center faced substantial financial challenges arising from decreasing reimbursement, increased competition, declining populations in primary service areas and the varied pace of integration of the Hospital’s affiliated continuum of healthcare services.

For example, UOAI’s review of orthopaedic referral patterns revealed that approximately 70% of outpatient imaging, physical therapy, and outpatient surgery required by UOAI’s patients was performed at facilities that were not part of the Hospital’s integrated delivery system, resulting in the Hospital’s inability to exercise its quality assurance, utilization review, and risk management activities related to these postsurgical services. In addition, the corporate independence of UOAI inhibited the ability of the Hospital to control the use and purchase of the expensive implants used in both joint replacement and spine surgery. The failure of the Hospital and the orthopaedic surgeons who comprised the academic medical center’s orthopaedic faculty to collaborate on and set appropriate parameters for the purchase and use of medical supplies resulted in inefficiencies and increased cost, due to the loss of volume purchasing opportunities and the need to maintain stocks of too many device types. Similar failures to achieve a high level of collaboration contributed to the Hospital’s difficulties in obtaining comprehensive physician coverage and in recruiting orthopaedic physicians to provide for certain lower-reimbursed orthopaedic services such as pediatric orthopaedics and orthopaedic oncology.

In 2002, it became readily apparent to UOAI and to the Hospital, that a new clinical and financial structure was needed. To create this structure, UOAI agreed to sell its assets for an independently determined fair market value purchase price and move its assembled workforce of approximately 21 orthopaedic surgeons to a newly created nonprofit tax-exempt entity (the “Faculty Practice Plan”), wholly owned by the parent corporation of the Hospital. As part of this transaction, the parties negotiated a balanced employment model designed to fully integrate the orthopaedic surgeons into the integrated delivery system that included, at its hub, the Hospital.

The Faculty Practice Plan adopted a wRVU-based compensation model for the orthopaedic department with additional components that created reasonable incentives both for clinical practice and for academic and administrative service contributions. This model, which requires all compensation to be fair market value, eliminated private inurement concerns since: (1) the Faculty Practice Plan, as a tax-exempt organization, shared the same charitable mission as the Hospital; and (2) the UOAI compensation model was calibrated to offer fair salaries that were related to achievement of the now-shared charitable missions of the Faculty Practice Plan and the Hospital. It was relatively straightforward to establish the basis whereby the Faculty Practice Plan would augment the funds available to implement a per-wRVU compensation system for the UOAI physicians, as compared to only the funds available through professional collections. This process involved an analysis of the services performed by UOAI in furtherance of the charitable mission of the Hospital and University (teaching, research activities, clinical care for the indigent and uninsured, and administrative services), with a concomitant allocation of the fair value of such services to a pool of available compensation. The wRVU value would follow a fairly designated Medical Group Management Association percentile for orthopaedic surgeons who owned their ancillaries. The value based on national data may vary yearly, but the percentile would be set in the contract in order to avoid yearly negotiations. Under such a wRVU model, payor source and level of reimbursement are not factors in the calculation of compensation. Additionally, the compensation for our surgeons is guaranteed based on individual productivity and not at risk based on the Hospital’s economic performance or based on any referrals for any ancillary or other services or business generated by the physicians.

Through the new model, the Faculty Practice Plan’s employed physicians as well as the Hospital were able to enhance the quality and efficiency of the patient experience by ensuring that patients requiring other healthcare services could choose to secure such services from other providers within the integrated delivery system, thereby achieving a continuity of care that had not previously existed. Further, as the Hospital and the Faculty Practice Plan move towards the implementation of their electronic health record, along with the implementation of other critical technology, the benefits of this structure continue to be revealed. The alignment of incentives promoted the participation of the orthopaedic physicians in the management of necessary ancillary services as well as in quality and financial control of implant purchasing strategies. There is no correlation between revenue derived from ancillary services and referrals of patients to such ancillary service by Faculty Practice Plan physicians, including the orthopaedic physicians. Notwithstanding the foregoing, due to the enhanced clinical and economic integration of the physicians with the Hospital resulting from the Faculty Practice Plan structure, there are meaningful opportunities for orthopaedic physicians to provide clinical, management, business, and operational input with respect to various ancillary services provided by the Hospital or that are otherwise part of the academic medical center’s continuum of care. This alignment also further encouraged the Faculty Practice Plan surgeons and the academic medical center to invest jointly in three areas: (1) improved technology; (2) the expansion of orthopaedic practice sites to provide broader community access; and (3) the recruitment and retention of expert orthopaedic surgeons for the academic medical center.

The Hospital and the Faculty Practice Plan have developed a synergetic approach to operational and strategic decisions. For instance, while the orthopaedic surgeons are intimately involved in the quality and financial review of implants in order to establish purchasing policies that ultimately benefit the patient community, the Hospital is equally engaged in strategic decisions regarding the recruitment of new orthopaedic surgeons and in evaluating the success of the surgeons’ practices. Both constituencies now measure success in the same manner. They jointly evaluate the orthopaedic surgeons’ contribution to the shared charitable mission of both organizations and the enhancement of the quality and efficient delivery of orthopaedic services to the patient population. This includes an analysis of the individual productivity of the surgeons (including clinical, academic and research productivity) and the development and adoption of best practices, cutting edge technology and sufficiency of other required resources. They also share and review in a transparent manner the same orthopaedic surgery financial data, including profits and losses, revenue and expenses, and other key factors that sustain the ability of the academic medical center to achieve its mission.

Ultimately, the structure selected in 2002 and implemented in 2003 requires both the Hospital and the Faculty Practice Plan to share in each other’s successes and failures. This ability to share in the risks and the rewards was derived from a very simple principle—trust. In 2002, as UOAI was evaluating its next moves, and as the Hospital was undergoing its own transitions and strategic challenges, the parties committed themselves to negotiate in good faith and establish balanced contractual arrangements that served as the catalyst for the development of a lasting trust between all individuals involved, including new leadership and participants that would be added along the way.

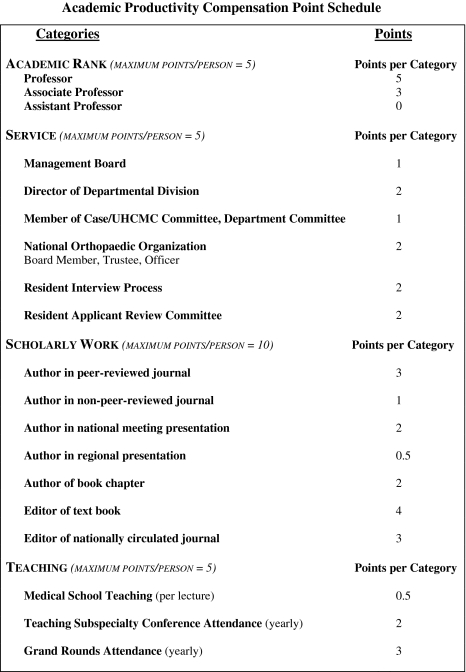

The specifics of the Faculty Practice Plan’s current wRVU compensation plan include direct compensation to the physician, which is based 80% on wRVUs generated from the respective physician’s individual clinical practice. The remaining 20% is based on the respective physician’s academic and service contributions to the academic medical center. In essence, the Faculty Practice Plan takes 20% of all the funds generated by its clinical practice wRVUs and redistributes these funds to its surgeons based on a 25-point scoring system (Fig. 2). Points are provided for: (1) scholarly work; (2) academic rank; (3) service to the Department of Orthopaedics, academic medical center, and orthopaedic profession; and (4) participation in the teaching and education of medical students. The academic points are reviewed and adjusted on a yearly basis in consultation with the Department Chair and corporate leadership of the Faculty Practice Plan.

Fig. 2.

The 25-point academic scoring system provides incentives for scholarly work and contributions in education and service.

Furthermore, there is no cross-subsidy of other departments or specialties by the Department of Orthopaedics. Payments made to the University by the Hospital (“Dean’s tax”) on behalf of the Orthopaedic Department are not considered in the physician compensation formulation.

Results of Our 5-Year Experience in Aligning Incentives with the Hospital

For the last 5 years, this new practice model, incentive-based and transparent to all participants, has substantially increased the clinical productivity of the Faculty Practice Plan’s orthopaedic surgeons (Fig. 3) and has greatly benefited the academic medical center and the patients and communities served thereby. The patients have benefited by the more seamless management of their orthopaedic problems made possible by the enhanced clinical integration of the physicians with the Hospital. The alignment of incentives and vertical integration of the Faculty Practice Plan and the Hospital has resulted in enhanced use of the integrated delivery system when patients, insurance benefits, and/or legal requirements do not otherwise require the use of alternate providers. Additionally, the joint administration and governance of the Faculty Practice Plan has allowed the Hospital to lower costs by working with its orthopaedic physicians to jointly evaluate and update implant-purchasing strategies such as shelf pricing and kit-purchasing policies. Such activities would have been much more difficult, if not impossible, to implement without aligned incentives based on an employment structure and a foundation of collaboration and trust between the Hospital and the orthopaedic surgeons.

Fig. 3.

The increase in work relative value units (wRVU) per FTE productivity, 2003–2007, illustrates the positive effect of incentivizing clinical productivity.

In the 5 years since UOAI made the decision to sell its assets and to have its physicians become employed by the Faculty Practice Plan (becoming the first of 21 independent, physician-owned and/or controlled medical practices to do so), additional benefits have resulted for the physicians. This critical mass of subspecialty faculty physicians aligned with both the Hospital and the University’s school of medicine enhanced the retirement and benefit packages available to faculty physicians. Moreover, the creation of a unified, tax-exempt faculty practice plan employing all of the specialty physicians who provide the clinical, academic, research, teaching, and strategic physician services for the academic medical center facilitated the consolidation of redundant front office and back office activities as well as the centralization of key corporate functions such as human resources, marketing, legal, compliance, and information technology. The integration of UOAI into the academic medical center has markedly decreased the complexities arising from the ever-evolving healthcare regulatory environment and has provided a legally permissible, compliant vehicle for the academic medical center to fund appropriate clinical programs and administrative positions, including directorships for pediatric orthopaedics, musculoskeletal cancer surgery, and the spine center [28]. Finally, by aligning incentives, the orthopaedic faculty practice can participate in and benefit from the Hospital’s robust institutional relations and development office, which has substantially increased the endowment for chairs in orthopaedic surgery over the last 5 years, as demonstrated by the progression from only one endowed chair to the Department of Orthopaedics’ current level of nine endowed chairs.

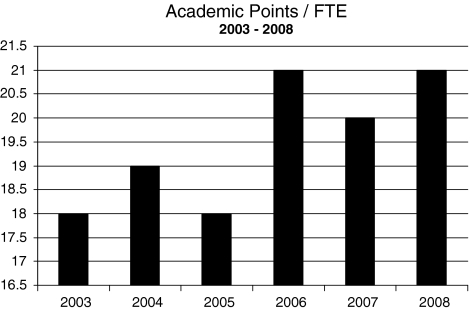

The orthopaedic surgeons in the Faculty Practice Plan expressed early that academic efforts should be recognized and encouraged. The Faculty Practice Plan physicians believed that scholarly work such as peer-reviewed publications and presentations not only benefit the department of orthopaedics, but the entire academic medical center and the patients it serves. By clearly defining expectations and rewards under the Faculty Practice Plan’s compensation program for participation in the academic points program, the surgeons have noted a marked increase in academic participation (Fig. 4).

Fig. 4.

The academic points earned by faculty from 2003 to 2008 demonstrate the positive effect of incentivizing scholarly work and educational and service contributions.

Future Challenges for Hospitals and Academic Orthopaedic Departments

Future challenges facing the profession of orthopaedic surgery include the continually evolving and ever-more complex healthcare regulations and related compliance issues that impact financial and compensation relationships between physicians, hospitals and other healthcare providers [8–11]. These changes, coupled with changes in federal and commercial reimbursement programs, including an increased focus on measuring and paying for quality and performance [14], present opportunities that can be effectively captured under the Faculty Practice Plan model. If handled correctly, the new “Medicare-bundled payment schedule” can facilitate collaboration between hospitals and physicians so they can develop “best practices” and create legally permissible clinical integration models that permit hospitals to share operating room and other savings generated by enhanced efficiencies in surgical practice [18]. This approach, commonly known as “gainsharing”, is made easier when physicians and hospitals participate jointly in the governance, operations, and administration of the clinical departments and physician employment entities.

Risks and benefits exist when physicians, hospitals, and payors, including commercial payors, proceed with a bundling strategy. For instance, the cost of providing care on a case-by-case basis may exceed the net bundling payments received. Accordingly, the parties must ensure the transparent exchange of information concerning the equitable distribution of payments, quality benchmarks and patient satisfaction information so that all parties continue to work from the same set of factual assumptions towards the combined goal. Aligning incentives between all of the participants (the hospital, physician, and payor) in the bundling strategy can minimize risk and enhance the benefits for all involved. Most importantly, aligned incentives can improve the overall patient experience and clinical outcome while decreasing the cost of the service to the patient. The federal government is currently testing this concept [5].

Medicare is currently running a demonstration project called the Acute Care Episode (“ACE”) Demonstration, with Texas, Oklahoma, New Mexico, and Colorado as the pilot states. This demonstration requires the formation of a physician-hospital organization (“PHO”), and encompasses the bundling of 38 cardiac MS-DRGs and nine orthopaedic MS-DRGs. The nine orthopaedic MS-DRGs focus on procedures that are joint-related (hips and knees) [5].

The ultimate goal is to maintain or improve the quality of patient care while reducing costs to the patient and to the Medicare program. The participating hospitals and physicians are required to jointly develop the best practices in a cost-effective manner, and the physicians are permitted to participate in the cost savings through CMS-approved provider incentive programs (gainsharing). Provider incentive programs require the formation of a hospital committee consisting of administrative physicians and an independent patient advocate or consumer representative. The committee is responsible for the development and operation of the provider incentive program [21].

Within these programs, incentives to the physician must not induce the physician to reduce or limit services that are medically necessary to the patient. Additionally, incentives cannot be based on the volume or value of referrals to the hospital participant. Incentives must be based on net savings and must be linked to actions that improve overall quality and efficiency and result in cost savings for the episode of care. Payments to physicians may not exceed 25% of the amount that is normally paid to physicians for the cases. To qualify for financial incentive payments physicians must adequately meet quality performance targets set by the hospital committee [20].

Also, CMS is designating the providers in the demonstration project as Medicare value-based care centers, which enhances the centers’ community reputation [19]. Medicare beneficiaries are provided financial incentives to receive care at the value-based care centers. CMS is also marketing the demonstration, which may lead to increased patient volume for participating facilities [19].

In response to the proposed Medicare bundling, if the hospitals and orthopaedic surgeons work together to align incentives and develop “best practices” that focus on patient care quality and cost-effectiveness, the bundling should represent minimal risk to the orthopaedic surgeon and may actually present an opportunity for the surgeon to participate in economic efficiencies or “gain share” and realize financial savings.

Participating surgeons would be instrumental in analyzing the effectiveness of the bundled procedures by utilizing recent patient cases as a baseline. The surgeons would conduct an internal peer review of all relevant cases. This analysis would focus on the quality outcomes to be achieved, the surgical procedures that will be the focus of the program, the types and best suppliers of implants, and other items used in developing the guidelines for best-practice cases.

In the bundling demonstration project, Medicare expects discounted base DRG payment amounts for the treatment of the patient, in addition to improved patient quality of care. The discounted payment, with the hospital and the physician components, is applicable to all of the bundled DRGs and is subject to the annual updates each October. In light of the bundling, the hospitals and physicians will be working to reduce costs while maintaining or increasing the quality of patient care. With diligence, the cost savings will be close to or exceed the reduction in payment associated with bundling (Table 1). The advantage therefore is that the cost savings in excess of the baseline may be shared with the physicians. Per Medicare, incentives must be based on quality measurements. If the measurements are met or surpassed, the physician may receive incentives up to 25% of what the physician would have been paid for treating the patient before bundling [20]. This program, if successful, has the potential to create powerful, unprecedented incentive compensation opportunities to physicians premised on two of the chief industry concerns in healthcare—cost reduction and improved quality.

Table 1.

Medicare bundling demonstration project: reimbursement for a procedure normally paying $1,000 to surgeon and $6,000 to hospital

| Reimbursement to hospital (DRG) | Actual cost to hospital | Surgeon fee (CPT) | Total payment | Quality of care gainshare* with surgeon 25% | Total payment to surgeon (CPT) | Increased payment to surgeon | Profit to hospital | |

|---|---|---|---|---|---|---|---|---|

| Current before bundling | $6,000 | $5,600 | $1,000 | $7,000 | 0 | $1,000 | 0 | $400 |

| Implementation of best practices bundling with 10% discount | $5,400 | $4,400 | $900 | $6,300 | $250 | $1,150 | $150 | $1,000 |

* If quality of care improved or stayed static, the hospital would be allowed to “gainshare” the savings with the surgeon up to 25% of the surgeon’s original reimbursement.

Discussion

The past two decades have witnessed dramatic changes in healthcare regulatory law and decreased reimbursement as seen in this report. In order for our academic orthopaedic practice to continue to attract and retain the best and brightest surgeons, we created a new, nonprofit, tax-exempt entity wholly owned by the parent corporation at the Hospital. This new faculty practice plan was adopted to be a RVU-based compensation model with components that created incentives for both clinical practice and for academic and administrative service contributions.

Our practice plan model is one of several that have been described [2, 16, 30] to meet the challenges of supporting an academic department in an era of increased healthcare regulatory legislation and decreased remuneration for service. However, the basic tenet of these plans, in order to achieve success, is the ability to align incentives between the physicians and the hospital.

If incentives are properly aligned between medical centers and physicians, benefits will accrue to the hospitals, physicians and most importantly to the patients. Moving forward in our current healthcare environment, the success of the orthopaedic surgery profession will depend on the ability of hospitals and physicians to align incentives and provide opportunities for the physicians to actively participate in defining quality measurements, providing appropriate oversight, and reporting and communicating data and other information transparently. Only when the physicians are working together in close collaboration with their respective hospitals can they ensure that objective criteria to ensure cost and quality benefit goals are achieved.

Acknowledgment

We thank Valerie Schmedlen for assisting with the manuscript.

References

- 1.American Academy of Family Practice. Physician Productivity Discussion Paper. Available at: www.aafp.org/online/etc/medialib/aafp_org/documents/prac_mgt/physprod.Par.0001.File.tmp/physprod.pdf. Accessed June 9, 2009.

- 2.Barro JR, Bozic KJ, Zimmerman AM. Performance pay for MGOA physicians (A). Harv Bus School. March 2002. 9-902-159.

- 3.Buppert C. Can you explain how reimbursement based on RVUs works? Medscape Nurses. 2006;8. Available at: www.medscape.com/viewarticle/542161. Accessed June 9, 2009.

- 4.Clarifications to Certain Exceptions to Medicare Limits on Physician Referrals, Medicare Prescription Drug Improvement and Modernization Act of 2003. Pub L No. 108-173, 117 Stat. 2066 (2003) (codified at 42 USC §1395nn).

- 5.CMS Announces Demonstration to Encourage Greater Collaboration and Improve Quality Using Bundled Hospital Payments, Health and Human Resources, Centers for Medicare and Medicaid Services. Press Release. Available at: http://www.cms.hhs.gov/apps/media/. Accessed December 21, 2008.

- 6.Ethics in Patient Referral Act of 1989, Omnibus Budget Reconciliation Act of 1989 (OBRA 1989). Pub L No. 101-239, § 6204, 103 Stat. 2106 (1989) (codified at 42 USC § 1395nn).

- 7.Extension of Self-Referral Ban to Additional Specified Services, Omnibus Budget Reconciliation Act of 1993 (OBRA 1993). PubL No. 103-66, 107 Stat. 312 (1993) (codified at 42 USC § 1395nn).

- 8.Final 2008 hospital outpatient prospective payment system (HOPPS) rule (72 Fed. Reg. 42370 (August 2, 2007)).

- 9.Final 2008 hospital outpatient prospective payment system (HOPPS) rule (72 Fed. Reg. 66580 (November 27, 2007)).

- 10.Final 2008 inpatient hospital prospective payment system (IPPS) rule (72 Fed. Reg. 47130 (August 22, 2007)).

- 11.Final Stark phase III regulations (72 Fed. Reg. 51012 (September 5, 2007)).

- 12.Hariri S, Bozic KJ, Lavernia C, Prestipino A, Rubash HE. Medicare physician reimbursement: past, present, and future. J Bone Joint Surg Am. 2007;89:2536-2546. [DOI] [PubMed]

- 13.Health Insurance Portability and Accountability Act of 1996 (HIPAA). Pub L 104-191, 110 Stat. 2024 (1996) (codified at 42 USC § 1320d-2).

- 14.Home Health Pay for Performance Demonstration, Health and Human Resources, Centers for Medicare and Medicaid Services, Medicare Demonstrations. Available at: http://www.cms.hhs.gov/DemoProjectsEvalRpts/MD/list.asp#TopOfPage. Accessed December 22, 2008.

- 15.Internal Revenue Code §501(c)(3), 1954.

- 16.Joiner KA, Libecap A, Cress AE, Wormsley S, St Germain P, Berg R, Malan P. Supporting the academic mission in an era of constrained resources: approaches at the University of Arizona College of Medicine. Acad Med. 2008;83:837–844. [DOI] [PubMed]

- 17.Marcus RE, Dennis DA, Morrey BF, Winquist RA, Zenty TF. A team approach to orthopedics: surgeons and hospitals working together. Orthop Today. 2009;29:32–38.

- 18.Medicare Acute Care Episode (ACE) Demonstration, Health and Human Resources, Centers for Medicare and Medicaid Services, Medicare Demonstrations. Available at: http://www.cms.hhs.gov/DemoProjectsEvalRpts/MD/list.asp#TopOfPage. Accessed December 22, 2008.

- 19.Medicare Acute Care Episode (ACE) Demonstration. More Information/ Frequently Asked Questions about the Acute Care Episode (ACE) Demonstration. Available at: http://www.cms.hhs.gov/DemoProjectsEvalRpts/MD/list.asp#TopOfPage. Accessed June 9, 2009.

- 20.Medicare Acute Care Episode (ACE) Demonstration. Provider Incentive, or Gainsharing, Program Rules and Proposal Requirements. Available at: http://www.cms.hhs.gov/DemoProjectsEvalRpts/MD/list.asp#TopOfPage. Accessed June 9, 2009.

- 21.Medicare Acute Care Episode (ACE) Demonstration. Terms and Conditions. Available at: http://www.cms.hhs.gov/DemoProjectsEvalRpts/MD/list.asp#TopOfPage. Accessed June 9, 2009.

- 22.Physician Ownership and Referral, Section 152 of the Social Security Act Amendments of 1994 (SSA 1994). Pub L No. 103-432 (1994) (codified at 42 USC § 1395nn).

- 23.Stark regulations. 60 FR 41914 (Aug. 14 1995).

- 24.Stark regulations. 66 FR 856 (Jan. 4, 2001).

- 25.Stark regulations. 69 FR 16054 (Mar. 26, 2004).

- 26.Stark regulations. 71 FR 45140 (Aug. 6, 2006).

- 27.Stark regulations. 73 FR 48434 (Aug. 19, 2008).

- 28.Stark regulations. Limitation on Certain Physician Referrals, 42 USC §1395nn(e) (2008).

- 29.Stark regulations. 42 USC §§1395nn(b)-1395nn(e).

- 30.Warner JJ, Herndon JH, Cole BJ. An academic compensation plan for an orthopaedic department. Clin Orthop Relat Res. 2007;457:64–72. [DOI] [PubMed]