Abstract

Objective

To explore whether adding a gender and HIV training programme to microfinance initiatives can lead to health and social benefits beyond those achieved by microfinance alone.

Methods

Cross-sectional data were derived from three randomly selected matched clusters in rural South Africa: (i) four villages with 2-year exposure to the Intervention with Microfinance for AIDS and Gender Equity (IMAGE), a combined microfinance–health training intervention; (ii) four villages with 2-year exposure to microfinance services alone; and (iii) four control villages not targeted by any intervention. Adjusted risk ratios (aRRs) employing village-level summaries compared associations between groups in relation to indicators of economic well-being, empowerment, intimate partner violence (IPV) and HIV risk behaviour. The magnitude and consistency of aRRs allowed for an estimate of incremental effects.

Findings

A total of 1409 participants were enrolled, all female, with a median age of 45. After 2 years, both the microfinance-only group and the IMAGE group showed economic improvements relative to the control group. However, only the IMAGE group demonstrated consistent associations across all domains with regard to women’s empowerment, intimate partner violence and HIV risk behaviour.

Conclusion

The addition of a training component to group-based microfinance programmes may be critical for achieving broader health benefits. Donor agencies should encourage intersectoral partnerships that can foster synergy and broaden the health and social effects of economic interventions such as microfinance.

Résumé

Objectif

Examiner si l’adjonction d’un programme de formation sur la violence liée au sexe et sur le VIH aux initiatives relevant du microcrédit peut apporter des bénéfices sur les plans sanitaire et social supplémentaires par rapport à ceux fournis par le microcrédit seul.

Méthodes

Des données transversales ont été obtenues pour trois agrégats spatio-temporels sélectionnés au hasard dans des zones rurales d’Afrique du Sud : (i) quatre villages ayant bénéficié pendant 2 ans de l’Intervention IMAGE (Intervention with Microfinance for AIDS and Gender Equity), combinant une intervention de type microcrédit et un programme de formation sanitaire ; (ii) quatre villages ayant bénéficié pendant 2 ans de services de microcrédit uniquement ; et (iii) quatre villages témoins n’ayant été visés par aucune intervention. La détermination des rapports de risques ajustés (RRa) à partir de données sommaires pour les villages a permis de comparer les groupes en fonction des valeurs des indicateurs de bien-être économique, d’autonomisation, de violence exercée par le partenaire intime (VPI) et de comportements à risque pour le VIH. Les effets supplémentaires ont été estimés d’après l’amplitude et la cohérence des RRa.

Résultats

Au total, 1409 sujets (uniquement des femmes, âge médian : 45 ans) ont été recrutés. Au bout de 2 ans, on a constaté des améliorations économiques par rapport au groupe témoin dans les deux groupes bénéficiant d’une intervention : celui desservi par l’Intervention IMAGE et celui ayant accès uniquement à des services de microcrédit. Néanmoins, seul le groupe bénéficiant de l’Intervention IMAGE présentait des associations cohérentes sur l’ensemble des domaines avec l’autonomisation des femmes, la violence exercée par le partenaire intime et les comportements à risque pour le VIH.

Conclusion

L’adjonction d’une composante formation aux programmes de microcrédit destinés à des groupes peut être essentielle pour obtenir des bénéfices sanitaires plus larges. Les agences donatrices devraient encourager les partenariats intersectoriels propices aux synergies et élargir les effets sur le plan sanitaire et social des interventions économiques telles que la microfinance.

Resumen

Objetivo

Determinar si la inclusión de un programa de formación en materia de género y VIH en iniciativas de microfinanciación puede redundar en beneficios sanitarios y sociales superiores a los conseguidos solo mediante la microfinanciación.

Métodos

Se obtuvieron datos transversales a partir de tres conglomerados emparejados seleccionados aleatoriamente en zonas rurales de Sudáfrica: (i) cuatro aldeas con dos años de exposición a la Intervención de Microfinanciación para el SIDA y la Equidad de Género (IMAGE), una intervención que combina medidas sanitarias y de microfinanciación; (ii) cuatro aldeas con dos años de exposición a servicios de microfinanciación únicamente; y (iii) cuatro aldeas de control en las que no se llevó a cabo ninguna intervención. A partir de los resúmenes de aldea se calcularon las razones de riesgos ajustadas (RRa), con las que se compararon las asociaciones entre los grupos en relación con los indicadores de bienestar económico, empoderamiento, violencia de pareja y comportamientos de riesgo para el VIH. Los efectos incrementales se estimaron a partir de la magnitud y coherencia de las RRa.

Resultados

Se reclutó en total a 1409 participantes, todas ellas mujeres, con una edad mediana de 45 años. Al cabo de dos años, tanto el grupo en el que solo se aplicó la intervención de microfinanciación como el grupo IMAGE mostraron mejoras económicas respecto al grupo de control. Sin embargo, solo en el grupo IMAGE se observaron asociaciones coherentes en todos los dominios en lo que atañe al empoderamiento de las mujeres, la violencia de pareja y los comportamientos de riesgo para el VIH.

Conclusión

La inclusión de un componente de formación en los programas de microfinanciación por grupos puede ser decisiva para lograr beneficios más amplios para la salud. Los organismos donantes deberían fomentar fórmulas de colaboración intersectorial que propicien sinergias y amplíen los efectos sanitarios y sociales de intervenciones económicas como la microfinanciación.

ملخص

الغرض

استكشاف إذا ما كان إضافة برامج التدريب الخاصة بالجندر وفيروس الإيدز إلى مبادرات التمويل البالغ الصغر يمكن أن يؤدي إلى فوائد صحية واجتماعية تتخطي ما يحققه التمويل البالغ الصغر وحده.

الطريقة

استُنبِطَت بيانات مقطعية من ثلاث مجموعات متطابقة منتقاة عشوائياً من مناطق ريفية في جنوب أفريقيا: (1) أربع قرى جرّبت لمدة عامين التمويل البالغ الصغر من أجل الإيدز والعدالة بين الجنسين والمعروف اختصاراً بـ(IMAGE)، وهو تدخل مشترك بين التمويل البالغ الصغر والتدريب الصحي؛ (2) أربع قرى جرّبت لمدة عامين خدمات التمويل البالغ الصغير وحده؛ (3) أربع قرى استخدمت كشواهد ولم تستهدف بأي تدخل. واستخدمت معدلات الخطر المصححة باستخدام موجز عن مستوى القرية في مقارنة الارتباطات بين المجموعات من حيث مؤشرات الرفاهة الاقتصادية، والتمكين، وعنف العشير، والسلوكيات الخطرة المُعَرِّضة للإصابة بفيروس الإيدز. وقد أتاح مقدار وتطابق معدلات الخطر المصححة تقدير وجود تأثيرات تصاعدية.

الموجودات

أُدْرِجَت في البحث 1409 مشتركة، جمعيهن من النساء، ومتوسط أعمارهن 45 سنة. وبعد مرور سنتين، شهدت كل من مجموعة التمويل البالغ الصغر وحده ومجموعة التمويل البالغ الصغر من أجل الإيدز والعدالة بين الجنسين تحسناً اقتصادياً مقارنة بمجموعة الشواهد. إلا أن مجموعة التمويل البالغ الصغر من أجل الإيدز والعدالة بين الجنسين أظهرت ارتباطات ثابتة عبر جميع الميادين بالنسبة لتمكين المرأة، وعنف العشير، والسلوكيات الخطرة المعرّضة للإصابة بفيروس الإيدز.

الاستنتاج

إن إضافة مكون التدريب إلى برامج التمويل البالغ الصغر القائم على المجموعات يمكن أن يكون مؤثراً في تحقيق مزايا صحية أوسع نطاقاً. وينبغي على الوكالات المانحة تشجيع الشراكة بين القطاعات المختلفة التي تعزز التآزر وتوسع نطاق التأثيرات الصحية والاجتماعية للتدخلات الاقتصادية مثل التمويل البالغ الصغر.

Introduction

The United Nations Millennium Development Goals have articulated a global agenda that explicitly recognizes the importance of addressing the intersections between poverty, gender inequalities and health.1 Microfinance programmes expand access to credit and savings services. Globally they reach over 100 million poor clients, most of them women.2 In addition to the economic benefits of microfinance, there is some evidence to suggest that it may be an effective vehicle for empowering women. Acquiring new business skills may enhance their self-esteem, self-confidence, conflict-resolution ability and household decision-making power and expand their social networks.3–5 Reductions in child mortality and improvements in nutrition, immunization coverage and contraceptive use have also been demonstrated,3,6–8 which has sparked interest in the potential of microfinance to bring about improvements in connection with other health-related issues, such as HIV/AIDS and gender-based violence.9–12

Both HIV/AIDS and intimate partner violence (IPV) are major public health challenges in sub-Saharan Africa. In South Africa alone, 29.1% of women visiting public antenatal clinics in 2006 were HIV-positive,13 and national prevalence surveys suggest that women and girls make up 55% of the HIV-infected population.14 In addition, 1 in 4 South African women reports having experienced IPV,15 which has been identified as an independent risk factor for HIV infection.16

We conducted the Intervention with Microfinance for AIDS and Gender Equity (IMAGE) study, a cluster randomized trial, to evaluate the effect of a combined microfinance and training intervention on poverty, gender inequalities, IPV and HIV/AIDS. Carried out in rural South Africa, IMAGE combined group-based microfinance with a 12-month gender and HIV training curriculum. Women received the training at loan meetings held every two weeks. After 2 years, IMAGE participants showed improvements in economic well-being and multiple dimensions of empowerment.17 Furthermore, levels of physical and sexual IPV were 55% lower among IMAGE participants compared with controls,18 and young programme participants reported higher levels of HIV-related communication and HIV testing and greater condom use with non-spousal partners.19

These findings highlight the potential synergy that can be generated by integrating targeted public health interventions into development initiatives such as microfinance. By addressing the immediate economic priorities of participants, IMAGE was able to gain access to a particularly vulnerable target group and to maintain sustained contact for over 1 year – a critical opportunity rarely afforded to stand-alone health interventions.

Because the IMAGE study tested a combined microfinance–training model, the findings raise additional policy- and programme-related questions. For example, how much of the observed effect is attributable to the microfinance component of the intervention and how much to the training programme? In a donor climate where microfinance institutions are under growing pressure to recover their operational costs and achieve financial sustainability, what added value does health training contribute? Is it possible that the provision of microfinance services alone would produce a similar range of economic, social and health benefits?

To address these questions, we analysed data from villages participating in IMAGE, matched villages receiving microfinance alone and a control group. Our analysis compared indicators of economic well-being, empowerment, IPV and HIV-risk behaviour in these three groups after similar duration of exposure.

Methods

The study was conducted between June 2001 and March 2005 in rural Limpopo province, an area where, despite South Africa’s status as a middle-income country, poverty remains widespread and more than 60% of adults are unemployed.20,21

Study design

Data on IMAGE participants and controls were derived from a cluster randomized trial and are presented in detail elsewhere.18 Briefly, the socioeconomic characteristics of villages in the study site were assessed through field reconnaissance surveys and interviews with village leaders and community members. Eight villages were then pair-matched according to size and accessibility, and one village from each pair was randomly allocated to receive the intervention at study onset; the other received the intervention on study completion. In both sets of villages, eligible intervention participants were recruited on the basis of participatory wealth ranking criteria, which were used to identify women aged 18 years and over from the poorest households in each village.22 Women from control villages were matched by age and poverty status and were recruited contemporaneously. Surveys were conducted in October 2004 and were scheduled such that all participants were evaluated at a uniform point in time: 24 months following the introduction of IMAGE.18

Surveys were conducted by a team of female researchers who had received 4 weeks of intensive training that included technical, ethical and safety considerations in conducting research on HIV and IPV.23 The construction of outcome indicators has been described in detail elsewhere.17,18 Indicators measuring economic well-being and empowerment were drawn from the development and microfinance literature, piloted and then adapted to the local South African context. Quantitative indicators of empowerment included measures of self-confidence, financial confidence, challenging of gender norms, relationship with partner, autonomy in decision-making, perceived contribution to the household and social group membership. Measures of IPV assessed participants’ attitudes towards and experiences of physical and sexual violence by an intimate partner, and were drawn from the WHO Violence Against Women Instrument.24 In each interview women were asked directly about their experience of different acts of physical or sexual violence by male partners, ever and in the past year. They were also asked about their experience of controlling behaviour by an intimate partner in the past year and about their attitudes towards the acceptability of IPV in different circumstances. HIV-related indicators captured information about sexual behaviour, household communication and collective action against HIV/AIDS.

To identify a comparable group of villages receiving microfinance alone (MF-only), a stratified random sample was generated from villages where microfinance projects were being implemented without the training component. As before, individual participants were recruited on the basis of participatory wealth ranking. Villages were eligible for inclusion in the sampling frame if they met three criteria: (i) no prior exposure to microfinance; (ii) 2-year exposure to MF-only; (iii) a socioeconomic and cultural context similar to that of the IMAGE and control villages (assessed through field reconnaissance surveys and interviews with community members). Eleven villages meeting those criteria were identified and were grouped according to size and accessibility. Villages were then randomly selected to generate four villages matching the characteristics of the IMAGE and control groups.

A survey of MF-only participants was undertaken in these villages in February 2006, 24 months following the introduction of the MF-only intervention. A list of all women who had received a loan during the previous 2 years was generated. Data were collected from all individuals who had joined the programme, regardless of whether they were still participating 2 years later. Data were thus collected on both current participants and drop-outs. Outcome data were collected in face-to-face interviews by members of the same research team with survey tools from the original trial.

Microfinance-only intervention

The microfinance component was implemented by the Small Enterprise Foundation, a South African nongovernmental organization (NGO) with over 60 000 active clients. The Grameen Bank model25 was applied, with groups of five women serving as guarantors for one another’s loans and all five having to repay before any member of the group was eligible for more credit. Loans were used to support a range of small businesses (e.g. selling fruit and vegetables, second-hand clothes and other products). Loan centres consisting of approximately 40 women (eight groups of five women) met fortnightly to make loan payments, apply for additional credit and discuss business plans.

IMAGE

In addition to the microfinance component described above, IMAGE included a participatory learning programme called “Sisters for Life”, which was integrated into the fortnightly loan centre meetings. The programme comprised two phases, delivered over 12−15 months. Phase 1 (first 6 months) consisted of 10 training sessions of 1 hour and covered topics including gender roles, cultural beliefs, power relations, self-esteem, communication, domestic violence and HIV. Participatory methods were used with a view to increasing confidence, communication skills and critical thinking. Phase 2 encouraged wider community mobilization to engage youth and men in the intervention villages. Women deemed “natural leaders” by their peers were elected by loan centres to undertake a further week of training and subsequently worked with their centres to address priority issues, including HIV and IPV. The Sisters for Life programme was developed and piloted in conjunction with a South African NGO and was delivered alongside microfinance services by a separate team of trainers. Further details about the intervention have been published elsewhere.26

Control group

Women in the control group received neither IMAGE nor microfinance-only interventions during the study period; however, IMAGE was implemented in control villages at study conclusion.

Data analysis

Our analysis first compared baseline sociodemographic data from the 2001 South African census27 for the three study groups. Analysis of outcome data involved three two-way comparisons: MF-only versus control, IMAGE versus control and IMAGE versus MF-only. Since the interventions were administered at the village level, cluster analysis was performed. For each comparison, crude measures of effect (prevalence or risk ratios, identified as RRs) with 95% confidence intervals (CIs) were calculated by entering the log of village-level summaries, weighted by village denominator, into an analysis of variance model that included terms for intervention and village triplet.

To control for possible baseline imbalances between women in intervention and control groups, we calculated adjusted measures of effect (aRRs) by means of a 2-stage process. First, using a logistic regression model fitted to individual-level data from control villages, we derived expected outcomes for each village on the basis of age, marital status, education, parity and sex of the household head for each respondent. We then entered standardized village-level summaries of the ratio of observed to expected outcomes into an analysis of variance model as described above. Stata version 9.0 (StataCorp, College Station, Texas, USA) was used to perform all statistical analyses. In addition to recording results for individual indicators, we assessed the consistency of patterns (direction and magnitude of effect) for all indicators within each of the four outcome domains: economic well-being, empowerment, IPV and HIV risk behaviour.

Informed consent was obtained from all participants. The study was approved by institutional review boards at the University of the Witwatersrand (South Africa) and the London School of Hygiene and Tropical Medicine (United Kingdom).

Results

Study enrolment and baseline characteristics

A total of 1409 participants were enrolled into the interventions or recruited as controls. Of these, 363 of 430 (84%) in the control group, 480 of 549 (87%) in the MF-only group and 387 of 430 (90%) in the IMAGE group were successfully interviewed at 2 years post-intervention. In all groups the median age was similar (43–49 years) and married women outnumbered single, divorced, separated or widowed women (Table 1). At the village level, the three groups were broadly similar in terms of pre-intervention sociodemographic characteristics, including household size, age, sex, income, employment and education.

Table 1. Village and individual characteristics of the IMAGE study population, Limpopo province, South Africa, 2001–2005.

| Study population | Control | MF only | IMAGE |

|---|---|---|---|

| Villages | |||

| No. enrolled | 4 | 4 | 4 |

| Households (no., range) | 1647 (817–3334) | 1489 (212–3099) | 1129 (225–1918) |

| Average household size (mean no. of dwellers, range) | 4.9 (4.5–5.0) | 4.5 (4.3–4.9) | 5.1 (5.0–5.1) |

| Female (%, range) | 55 (54–56) | 56 (55–60) | 55 (54–57) |

| Aged under 15 years (%, range) | 42 (40–44) | 43 (40–44) | 40 (39–44) |

| No income (%, range) | 48 (36–56) | 34 (25–47) | 45 (42–48) |

| Unemployed (% of those of working age, range) | 65 (60–79) | 60 (52–80) | 70 (68–73) |

| Completed primary education or higher (% of those of school age, range) | 45 (40–55) | 48 (41–52) | 49 (39–52) |

| Individuals | |||

| No. surveyed 2 years post-intervention | 363 | 480 | 387 |

| Age (median no., IQR) | 44 (35–52) | 49 (40–59) | 43 (36–51) |

| Female-headed household (no., %) | 232 (55) | 225 (47) | 206 (50) |

| Marital status | |||

| Never married (no., %) | 99 (27) | 84 (18) | 74 (19) |

| Currently married (no., %) | 146 (40) | 221 (46) | 172 (45) |

| Divorced, separated, or widowed (no., %) | 118 (33) | 175 (36) | 140 (36) |

| Microfinance indicators | |||

| Loans taken (median no., IQR) | – | 3 (2–4) | 4 (3–4) |

| Largest loan (median no., IQR) | – | US$ 195 (150–240)a | US$ 150 (905–226)b |

IMAGE, Intervention with Microfinance for AIDS and Gender Equity; IQR, interquartile range; MF, microfinance; R, South African rand. a Equivalent to R1300 (1000–1600) as per exchange rate on 1 January 2004: R1 = US$ 0.15. b Equivalent to R1000 (600–1500) as per exchange rate on 1 January 2004: R1 = US$ 0.15. Data obtained from Statistics South Africa.27

Comparative analysis

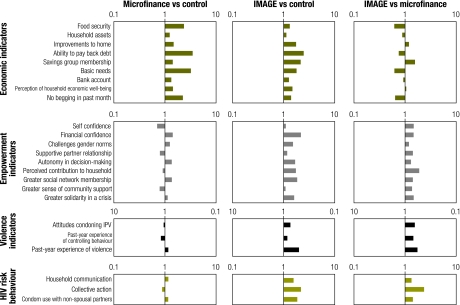

Table 2 shows the results of the analysis comparing intervention effects among the three study groups. These results are summarized graphically in Fig. 1.

Table 2. Comparison of intervention effects on economic well-being, empowerment, IPV and HIV risk behaviour among women participating in IMAGE, women receiving microfinance only and a control group, Limpopo province, South Africa, 2001–2005.

| Outcome | Control |

MF |

IMAGE |

MF vs control |

IMAGE vs control |

IMAGE vs MF |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| No./n | % | No./n | % | No./n | % | RR | 95% CI | aRRa | 95% CI | RR | 95% CI | aRRa | 95% CI | RR | 95% CI | aRRa | 95% CI | |

| Economic well-being | ||||||||||||||||||

| Greater food security | 129/361 | 36 | 350/480 | 73 | 177/371 | 48 | 2.58 | 0.83–8.01 | 2.33 | 0.73–7.42 | 1.34 | 0.22–8.21 | 1.28 | 0.20–8.31 | 0.59 | 0.19–1.85 | 0.63 | 0.22–1.85 |

| Estimated household asset value > US$ 300 | 182/361 | 50 | 313/480 | 65 | 207/370 | 56 | 1.29 | 1.20–1.38 | 1.22 | 1.15–1.30 | 1.10 | 0.79–1.54 | 1.08 | 0.81–1.45 | 0.84 | 0.57–1.25 | 0.88 | 0.64–1.20 |

| Greater expenditure on home improvements | 70/361 | 19 | 147/474 | 31 | 129/370 | 35 | 1.57 | 0.78–3.17 | 1.46 | 0.71–2.97 | 1.82 | 1.25–2.64 | 1.68 | 1.22–2.32 | 1.14 | 0.64–0.03 | 1.14 | 0.62–2.08 |

| Better able to pay back debt | 86/360 | 24 | 340/480 | 71 | 194/371 | 52 | 3.71 | 1.16–11.80 | 3.38 | 1.09–10.50 | 2.41 | 0.55–10.56 | 2.34 | 0.50–11.01 | 0.72 | 0.37–1.40 | 0.77 | 0.38–1.56 |

| Membership in stokvel (savings group) | 55/363 | 15 | 98/480 | 20 | 140/387 | 36 | 1.32 | 1.22–1.43 | 1.38 | 1.03–1.85 | 2.13 | 0.92–4.94 | 2.06 | 0.84–5.08 | 1.64 | 0.74–3.66 | 1.53 | 0.64–3.64 |

| Able to meet basic needs in past year | 39/316 | 12 | 167/434 | 38 | 94/350 | 27 | 3.65 | 1.77–7.49 | 3.17 | 1.69–5.94 | 1.86 | 0.26–13.10 | 1.71 | 0.21–14.25 | 0.58 | 0.11–3.10 | 0.63 | 0.12–3.40 |

| Possesses bank account | 111/360 | 31 | 210/474 | 44 | 147/371 | 40 | 1.42 | 1.02–1.98 | 1.29 | 0.99–1.68 | 1.25 | 0.91–1.71 | 1.21 | 0.87–1.66 | 0.87 | 0.56–1.36 | 0.94 | 0.72–1.24 |

| Better perception of household economic well-being | 186/361 | 52 | 347/474 | 73 | 277/371 | 75 | 1.43 | 0.87–2.42 | 1.40 | 0.86–2.28 | 1.48 | 0.80–2.75 | 1.43 | 0.75–2.71 | 1.03 | 0.78–1.36 | 1.03 | 0.75–1.42 |

| Has not had to beg in past month | 120/362 | 33 | 346/480 | 72 | 201/387 | 52 | 2.31 | 1.29–4.14 | 2.22 | 1.32–3.73 | 1.45 | 0.56–3.73 | 1.36 | 0.47–3.94 | 0.67 | 0.25–1.80 | 0.66 | 0.24–1.81 |

| Empowerment | ||||||||||||||||||

| Individual level | ||||||||||||||||||

| Greater self-confidence | 227/358 | 63 | 235/480 | 49 | 278/383 | 73 | 0.76 | 0.71–0.82 | 0.76 | 0.71–0.82 | 1.16 | 0.83–1.61 | 1.12 | 0.82–1.53 | 1.49 | 1.05–2.13 | 1.44 | 1.00–2.06 |

| Greater financial confidence | 140/360 | 39 | 219/480 | 46 | 278/386 | 72 | 1.50 | 0.32–7.07 | 1.48 | 0.33–6.55 | 2.26 | 0.43–1.91 | 2.13 | 0.42–10.82 | 1.51 | 0.84–2.68 | 1.44 | 0.77–2.69 |

| Challenges gender norms | 154/361 | 43 | 248/478 | 52 | 233/381 | 61 | 1.26 | 0.62–2.58 | 1.30 | 0.68–2.50 | 1.54 | 0.84–2.79 | 1.53 | 0.86–2.71 | 1.19 | 0.99–1.43 | 1.16 | 0.97–1.38 |

| Household level | ||||||||||||||||||

| Supportive partner relationshipb | 151/248 | 61 | 189/338 | 56 | 212/290 | 73 | 0.93 | 0.65–1.31 | 0.85 | 0.61–1.19 | 1.21 | 0.81–1.80 | 1.18 | 0.84–1.67 | 1.28 | 1.02–1.62 | 1.37 | 1.09–1.72 |

| Autonomy in decision-makingb | 55/149 | 37 | 84/220 | 38 | 105/184 | 57 | 1.21 | 0.39–3.75 | 1.35 | 0.42–4.30 | 1.70 | 0.72–4.01 | 1.67 | 0.92–3.03 | 1.41 | 0.66–3.02 | 1.27 | 0.62–2.59 |

| Perceived contribution to householdb | 56/146 | 38 | 148/206 | 72 | 121/185 | 65 | 1.89 | 1.36–2.63 | 0.92 | 0.84–1.02 | 1.70 | 1.12–2.58 | 1.73 | 1.19–2.53 | 0.88 | 0.59–1.30 | 1.84 | 1.35–2.51 |

| Community level | ||||||||||||||||||

| Larger social network | 134/363 | 37 | 267/480 | 56 | 275/386 | 71 | 1.57 | 0.74–3.32 | 1.37 | 0.67–2.77 | 1.95 | 1.00–3.80 | 1.81 | 0.92–3.56 | 1.29 | 0.85–1.96 | 1.38 | 0.94–2.01 |

| Greater sense of community support | 184/362 | 51 | 204/480 | 43 | 232/387 | 60 | 0.86 | 0.54–1.33 | 0.82 | 0.50–1.33 | 1.14 | 0.39–3.36 | 1.10 | 0.38–3.17 | 1.33 | 0.57–3.13 | 1.33 | 0.59–3.01 |

| Greater solidarity in a crisis | 179/363 | 49 | 253/479 | 53 | 306/387 | 79 | 1.12 | 0.56–2.23 | 1.12 | 0.59–2.12 | 1.68 | 0.83–3.39 | 1.60 | 0.81–3.13 | 1.49 | 1.20–1.85 | 1.43 | 1.11–1.83 |

| Intimate partner violence | ||||||||||||||||||

| Attitudes condoning IPV | 233/361 | 65 | 326/472 | 69 | 182/382 | 48 | 1.07 | 0.84–1.37 | 1.05 | 0.81–1.36 | 0.73 | 0.44–0.23 | 0.73 | 0.42–1.27 | 0.66 | 0.48–0.90 | 0.67 | 0.50–0.90 |

| Past year experience of controlling behaviourb | 101/242 | 42 | 158/337 | 47 | 95/282 | 34 | 1.12 | 0.74–1.70 | 1.18 | 0.77–1.80 | 0.78 | 0.34–1.82 | 0.84 | 0.38–1.87 | 0.68 | 0.35–1.33 | 0.69 | 0.35–1.36 |

| Past year experience of physical and/or sexual IPVb | 30/248 | 12 | 39/337 | 12 | 17/290 | 6 | 0.79 | 0.22–2.93 | 0.86 | 0.22–3.36 | 0.50 | 0.28–0.89 | 0.51 | 0.28–0.93 | 0.63 | 0.11–3.61 | 0.59 | 0.09–3.66 |

| HIV-related risk behaviour | ||||||||||||||||||

| Household communication about sex and HIV | 197/361 | 55 | 308/480 | 64 | 331/383 | 86 | 1.15 | 0.76–1.72 | 1.17 | 0.76–1.80 | 1.60 | 1.25–2.05 | 1.57 | 1.20–2.05 | 1.37 | 0.98–1.93 | 1.32 | 0.90–1.93 |

| Participation in HIV march or rally | 124/361 | 34 | 151/480 | 31 | 290/383 | 76 | 0.92 | 0.57–1.49 | 0.91 | 0.58–1.41 | 2.21 | 1.03–4.76 | 2.14 | 1.00–4.54 | 2.37 | 1.32–4.25 | 2.32 | 1.33–4.03 |

| Condom use at last sex with all non-spousal partnersc | 10/45 | 22 | 17/52 | 33 | 23/51 | 45 | 1.74 | 0.37–8.21 | 1.17 | 0.32–4.29 | 2.41 | 0.77–7.54 | 1.83 | 0.94–3.57 | 1.41 | 0.97–2.04 | 1.41 | 0.97–2.04 |

aRR, adjusted risk ratio; IMAGE, Intervention with Microfinance for AIDS and Gender Equity; IPV, intimate partner violence; MF, microfinance; RR, risk ratio. a aRRs adjusted for village triplet, age group, marital status, education, parity and sex of household head. b Among currently partnered women (aRRs do not control for marital status). c Among women aged < 35 years old reporting at least one non-spousal partner.

Fig. 1.

Consistency of intervention effects among IMAGE study groups,a Limpopo province, South Africa, 2001-2005

IMAGE, Intervention with Microfinance for AIDS and Gender Equity; IPV, intimate partner violence.

a All adjusted risk ratios for indicators represented as bar graphs on a logarithmic scale.

Microfinance only versus control

Evaluation of the effects of the MF-only intervention against the control group revealed a clear pattern of improvement across all nine indicators of economic well-being, including household asset value, ability to repay debts and ability to meet basic household needs. For all economic variables, intervention effects were in the same direction, with aRRs ranging from 1.22 to 3.38 and CIs excluding 1 for most indicators. However, this same degree of consistency was not observed across the empowerment, IPV or HIV-related variables, where the direction of intervention effects varied among the indicators in each domain.

IMAGE versus control

Comparison of the effects of IMAGE against the control group showed a clear and consistent pattern of improvement in all 24 indicators across all domains. These included all indicators of economic well-being, empowerment (e.g. greater self-confidence, autonomy in decision-making, and larger social networks), IPV (including reduction in past-year experience of physical or sexual IPV) and HIV risk behaviour (including increased condom use at last sex with a non-spousal partner). For all these variables, aRRs indicated a positive intervention effect, with many attaining statistical significance.

Microfinance only versus IMAGE

When the effects of the MF-only intervention were compared with those of IMAGE, there was no clear pattern to suggest that one of the two types of intervention had produced greater improvements in economic well-being. However, IMAGE consistently showed greater effect on all variables relating to empowerment, IPV and HIV risk behaviour, and in many cases the change was statistically significant.

Discussion

This study set out to explore whether a complex intervention that combines a gender and HIV training programme with group-based microfinance can lead to health and social benefits beyond those achieved through microfinance alone. After 2 years, both the villages that received microfinance-only interventions and those that received the combined microfinance–training intervention (IMAGE) were found to have higher levels of economic well-being than matched control villages. However, only the combined intervention was associated with a wider range of effects in relation to women’s empowerment, reduced risk of IPV and HIV protective behaviour. These findings lend support to the hypothesis that adding a health component to a conventional poverty reduction programme can create synergies that may be critical for achieving broader health and social benefits.

The study had several strengths, including efforts to ensure comparability between villages within the three study groups, age- and poverty-matching among participants and cluster-level analysis of outcomes. Outcome indicators were defined before analysis, and the analysis controlled for potential confounding factors. Despite the small number of villages and limited study power to detect cluster-level differences, statistically significant associations were evident for many indicators. What was, however, more striking was the consistent pattern of associations that emerged across all predefined health and social domains when the incremental effects of the combined intervention versus microfinance alone were examined.

We presented measures of effect and confidence intervals for all findings (Table 2), thereby allowing readers to judge the strength of the evidence for themselves. Many of these results were not “significant” in that they did not allow us to reject the null hypothesis of no effect at the 5% significance level. However, researchers recognize that, in addition to significance tests, the directionality, consistency and congruency of observed outcomes are important in evaluating complex interventions with multiple outcomes.28 Taken together, we feel that the data we present in Table 2 and Fig. 1 help to paint a picture of the relative contribution of the intervention components and also illustrate the remarkable consistency of observed changes in predefined indicators and the congruency between pathway variables and health outcomes.

The study also had several limitations. The data employed in the analysis were essentially cross-sectional and were collected after 2 years of exposure to the interventions. Consequently, it is difficult to make definitive statements about causality. However, villages were randomly selected after careful matching, and national census data suggest that the three study groups had similar baseline characteristics. As participants self-selected to join the MF-only or IMAGE interventions, there may have been unmeasured differences between the intervention groups and the control group. However, it is unlikely that this selection bias would influence comparisons between the IMAGE and MF-only groups, since both types of intervention required a similar time commitment – a factor that minimizes a form of bias common to evaluations of microfinance programmes.29 Finally, self-reported outcomes may be subject to bias, although the direction of such bias is difficult to predict. It has been noted that heightened sensitization to issues relating to gender-based violence can lead to increased reporting of IPV,23 a bias that would tend to underestimate the added value of IMAGE over the MF-only intervention.

Why might additional inputs, such as the IMAGE training programme, be important for achieving wider health and social effects? Critics of microfinance have long questioned whether, in the absence of efforts to address broader gender inequalities, simply providing financial services to women can be truly empowering. They note that offering credit to women does not necessarily guarantee their control over its use, and that the pressure to pay back loans can add to the already heavy burden of responsibilities borne by poor women.29–31 Moreover, while some studies have suggested that participation in microfinance can reduce the risk of IPV,31–33 others have noted that attempting to empower women may exacerbate this risk by challenging established gender norms, and provoking conflict within the household.4,34–36 Our study found that provision of the microfinance-only intervention did not exacerbate the risk of past-year IPV, as compared with a matched control group; however, neither did it reduce this risk. Lower IPV risk was observed only in the IMAGE group. Qualitative data from that group suggest that reductions in violence resulted from a range of responses to the intervention that enabled women to challenge the acceptability of violence, expect and receive better treatment from partners, leave violent relationships, give material and moral support to those experiencing abuse, mobilize new and existing community groups and raise public awareness about the need to address domestic violence.17

This study and others suggest several potential strategies for maximizing the health and social benefits of development programmes such as microfinance. Many authors have pointed out that training content is critical in catalysing health gains, noting that it should include an explicit gender focus, raise awareness about gender roles and cultural beliefs and provide an opportunity for women to discuss often stigmatized subjects such as sexuality, HIV/AIDS and gender-based violence in a safe environment.5,36–39 Others have stressed the importance of the training process, in particular the value of participatory, group-based learning. In HIV/AIDS education, group-based interventions have been found to foster critical analysis, collaborative learning, communication skills, problem-solving and peer support, which, in turn, have been regarded as crucial to changing social norms and increasing knowledge, skills and solidarity among women – all important aspects of empowerment.38–42 Recognizing the broader social and political context in which women’s lives are situated, many authors have also highlighted the importance of engaging the broader community, including men and boys.5,37,41–44

IMAGE participants were able to communicate more openly with partners and family members about sexuality, HIV and domestic violence, and to share this knowledge with others in their communities.17,45 Many entered traditionally male-dominated domains, such as police stations, schools and football clubs, engaging with traditional leaders and also organizing numerous village meetings and marches.17,46 In similar programmes in India, women’s participation in microfinance initiatives has formed the basis for organizing around issues such as dowry, domestic violence and alcohol abuse, and in Bangladesh, microfinance programmes have mobilized members to vote for the first time in elections.37,47 In general, however, there has been little attempt to link microfinance to wider social and political activity.

The success of the microfinance sector to date has been impressive. Across a wide range of models, reported loan repayment rates, even among the poorest clients, often exceed 95%.48,49 Global experience has demonstrated that microfinance institutions can recover all or most of their administrative costs through interest rates and user fees. Rapid growth and scaling-up are thus possible, even when donor funds are limited.49 Opportunities are now emerging for microfinance institutions to broaden their scope and benefits by more directly addressing health-related concerns, including reproductive health, HIV/AIDS and gender-based violence.9,11,12 Doing so will not make sense for every programme and population, of course, and microfinance leaders are justifiably wary of weighing down their institutions with added responsibilities. But evidence is mounting to suggest that combining economic and health interventions can create powerful synergies and broaden effects in measurable ways. In Africa, Asia and Latin America, a growing number of programmes have successfully integrated health education, without compromising core financial services or sustainability.9,10,12,50 The time may be right for donor agencies to move beyond financial sustainability targets to encourage the kind of intersectoral partnerships that can broaden the health and social effects of microfinance and other poverty reduction programmes. Innovative and sustainable partnership models are already evolving, but further evaluation and scale-up will be vital. ■

Acknowledgements

We thank the managing director of Small Enterprise Foundation, John de Wit, and the many staff who made this work possible. We would also like to thank Prof. J Gear for his guidance and support throughout the study.

This study has been a partnership between academic institutions in South Africa (School of Public Health, University of the Witwatersrand) and the United Kingdom (London School of Hygiene and Tropical Medicine) and a South African microfinance development organization (Small Enterprise Foundation).

Footnotes

Funding: The study received financial support from the Anglo American Chairman’s Fund Educational Trust, Anglo Platinum, the Department for International Development (United Kingdom), the Ford Foundation, the Henry J Kaiser Family Foundation, the Humanistisch Instituut voor Ontwikkelingssamenwerking (HIVOS), the South African Department of Health and Welfare and the Swedish International Development Agency. None of these funders had any role in the design and conduct of the study; the collection, management, analysis or interpretation of data; or the preparation, review or approval of the manuscript.

Competing interests: None declared.

References

- 1.The Millennium Development Goals report New York, NY: United Nations; 2006. Available from: http://unstats.un.org/unsd/mdg/Resources/Static/Products/Progress2006/MDGReport2006.pdf [accessed on 10 April 2008].

- 2.Daley-Harris S. State of the microcredit summit campaign: report 2006 Washington, DC: Microcredit Summit Campaign; 2006. [Google Scholar]

- 3.Schuler SR, Hashemi SM. Credit programs, women’s empowerment and contraceptive use in rural Bangladesh. Stud Fam Plann. 1994;25:65–76. doi: 10.2307/2138085. [DOI] [PubMed] [Google Scholar]

- 4.Hashemi SM, Schuler SR, Riley AP. Rural credit programs and women’s empowerment in Bangladesh. World Dev. 1996;24:635–53. doi: 10.1016/0305-750X(95)00159-A. [DOI] [Google Scholar]

- 5.Cheston S, Kuhn L. Empowering women through microfinance. In: Daley-Harris, S, ed. Pathways out of poverty: innovations in microfinance for the poorest families Bloomfield, CT: Kumarian Press; 2002. pp. 167-228. [Google Scholar]

- 6.Khandker SR. Fighting poverty with microcredit: experience in Bangladesh New York, NY: Oxford University Press; 1998. [Google Scholar]

- 7.Pitt MM, Khandker SR, Chowdhury OH, Millimet DL. Credit programs for the poor and the health status of children in rural Bangladesh. Int Econ Rev. 2003;44:87–118. doi: 10.1111/1468-2354.t01-1-00063. [DOI] [Google Scholar]

- 8.Schuler SR, Hashemi SM, Riley AP. The influence of women’s changing roles and status in Bangladesh’s fertility transition: evidence from a study of credit programs and contraceptive use. World Dev. 1997;25:563–75. doi: 10.1016/S0305-750X(96)00119-2. [DOI] [Google Scholar]

- 9.Dunford C. Building better lives: sustainable integration of microfinance with education in child survival, reproductive health, and HIV/AIDS prevention for the poorest entrepreneurs. In: Daley-Harris, S, ed. Pathways out of poverty: innovations in microfinance for the poorest families Bloomfield, CT: Kumarian Press; 2002. pp. 75-132. [Google Scholar]

- 10.Pronyk PM, Hargreaves JR, Morduch J. Microfinance programs and better health: prospects for sub-Saharan Africa. JAMA. 2007;298:1925–7. doi: 10.1001/jama.298.16.1925. [DOI] [PubMed] [Google Scholar]

- 11.Urdang S. Change, choice and power: young women, livelihoods and HIV prevention. Literature review and case study analysis London: International Planned Parenthood Foundation; 2007. [Google Scholar]

- 12.From microfinance to macro change: integrating health education and microfinance to empower women and reduce poverty New York, NY: Microcredit Summit Campaign and United Nations Population Fund; 2006. [Google Scholar]

- 13.National HIV and syphilis prevalence survey: South Africa 2006 Pretoria: South Africa Department of Health; 2007.

- 14.Nelson Mandela/HSRC study of HIV/AIDS. South African national HIV prevalence, behavioural risks and mass media. Household Survey Cape Town: Human Sciences Research Council Publishers; 2002. [Google Scholar]

- 15.Jewkes R, Levin J, Penn-Kekana L. Risk factors for domestic violence: Findings from a South African cross-sectional study. Soc Sci Med. 2002;55:1603–17. doi: 10.1016/S0277-9536(01)00294-5. [DOI] [PubMed] [Google Scholar]

- 16.Dunkle KL, Jewkes RK, Brown HC, Gray GE, McIntyre JA, Harlow SD. Gender-based violence, relationship power, and risk of HIV infection in women attending antenatal clinics in South Africa. Lancet. 2004;363:1415–21. doi: 10.1016/S0140-6736(04)16098-4. [DOI] [PubMed] [Google Scholar]

- 17.Kim JC, Watts CH, Hargreaves JR, Ndhlovu LX, Phetla G, Morison LA, et al. Understanding the impact of a microfinance-based intervention on women’s empowerment and the reduction of intimate partner violence in South Africa. Am J Public Health. 2007;97:1794–802. doi: 10.2105/AJPH.2006.095521. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Pronyk PM, Hargreaves JR, Kim JC, Morison LA, Phetla G, Watts C, et al. Effect of a structural intervention for the prevention of intimate partner violence and HIV in rural South Africa: a cluster randomized trial. Lancet. 2006;368:1973–83. doi: 10.1016/S0140-6736(06)69744-4. [DOI] [PubMed] [Google Scholar]

- 19.Pronyk PM, Kim JC, Abramsky T, Phetla G, Hargreaves JR, Morison LA, et al. A combined microfinance and training intervention can reduce HIV risk behaviour in young female participants. AIDS. 2008;22:1659–65. doi: 10.1097/QAD.0b013e328307a040. [DOI] [PubMed] [Google Scholar]

- 20.Charlton KE, Rose D. Prevalence of household food poverty in South Africa: results from a large, nationally representative survey. Public Health Nutr. 2002;5:383–9. doi: 10.1079/phn2001320. [DOI] [PubMed] [Google Scholar]

- 21.Lestrade-Jefferis J. Housing, and household access to services and facilities. In: Udjo E, ed. The people of South Africa: population census 1996 Pretoria: Statistics South Africa; 2000. [Google Scholar]

- 22.Hargreaves JR, Morison LA, Gear JS, Kim JC, Makhubele MB, Porter JD, et al. Assessing household wealth in health studies in developing countries: a comparison of participatory wealth ranking and survey techniques from rural South Africa. Emerg Themes Epidemiol. 2007;4:4. doi: 10.1186/1742-7622-4-4. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23.Putting women first: ethical and safety recommendations for research on domestic violence against women. Geneva: World Health Organization; 2001 (WHO/EIP/GPE/99.2).

- 24.Garcia-Moreno C, Jansen H, Ellsberg M, Heise L, Watts C. WHO multi-country study on women’s health and domestic violence against women: initial results on prevalence, health outcomes and women’s responses Geneva: World Health Organization; 2005. [Google Scholar]

- 25.Yunus M. The Grameen Bank. Sci Am. 1999;281:114–9. [Google Scholar]

- 26.Kim J, Gear J, Hargreaves J, Makhubele B, Mashaba K, Morison L, et al. Social interventions for HIV/AIDS: intervention with Microfinance for AIDS and Gender Equity (IMAGE study) Acornhoek, South Africa: Rural AIDS and Development Action Research Programme, School of Public Health, University of the Witwatersrand; 2002 (Intervention Monograph No. 2). Available from: http://web.wits.ac.za/NR/rdonlyres/3C2A3B30-DE20-40E0-8A0A-A14C98D0AB38/0/Intervention_monograph_picspdf.pdf [accessed on 19 August 2009].

- 27.Census 2001 Pretoria: Statistics South Africa; 2003. Available from: http://www.statssa.gov.za/census01/html/C2001publications.asp [accessed on 19 August 2009].

- 28.Habicht JP, Victora CG, Vaughan JP. Evaluation designs for adequacy, plausibility and probability of public health programme performance and impact. Int J Epidemiol. 1999;28:10–8. doi: 10.1093/ije/28.1.10. [DOI] [PubMed] [Google Scholar]

- 29.Goetz AM, Sen Gupta R. Who takes credit? Gender, power, and control over loan use in rural credit programmes in Bangladesh. World Dev. 1996;24:45–63. doi: 10.1016/0305-750X(95)00124-U. [DOI] [Google Scholar]

- 30.Mayoux L. Women’s empowerment and micro-finance programmes: strategies for increasing impact. Dev Pract. 1998;8:235–41. doi: 10.1080/09614529853873. [DOI] [PubMed] [Google Scholar]

- 31.Kabeer N. Conflicts over credit: re-evaluating the empowerment potential of loans to women in rural Bangladesh. World Dev. 2001;29:63–84. doi: 10.1016/S0305-750X(00)00081-4. [DOI] [Google Scholar]

- 32.Schuler SR, Hashemi SM, Riley AP, Akhter S. Credit Programs, patriarchy, and men’s violence against women in rural Bangladesh. Soc Sci Med. 1996;43:1729–42. doi: 10.1016/S0277-9536(96)00068-8. [DOI] [PubMed] [Google Scholar]

- 33.Jejeebhoy SJ, Cook RJ. State accountability for wife-beating: The Indian challenge. Lancet. 1997;349(Suppl 1):sI10–2. doi: 10.1016/S0140-6736(97)90004-0. [DOI] [PubMed] [Google Scholar]

- 34.Bott S, Morrison A, Ellsberg M. Preventing and responding to gender-based violence in middle and low-income countries: a global review and analysis [Policy Research Working Paper WPS3618]. Washington, DC: The World Bank; 2005. [Google Scholar]

- 35.Jewkes R. Intimate partner violence: causes and prevention. Lancet. 2002;359:1423–9. doi: 10.1016/S0140-6736(02)08357-5. [DOI] [PubMed] [Google Scholar]

- 36.Schuler SR, Hashemi SM, Badal SH. Men’s violence against women in rural Bangladesh: Undermined or exacerbated by microcredit programmes? Dev Pract. 1998;8:148–57. doi: 10.1080/09614529853774. [DOI] [PubMed] [Google Scholar]

- 37.Mayoux L. Women’s empowerment and micro-finance: programmes, approaches, evidence and ways forward [Development Policy and Practice Working Paper No. 41]. Milton Keynes: Open University; 1998. [Google Scholar]

- 38.Gupta GR. How men’s power over women fuels the HIV epidemic. BMJ. 2002;324:183–4. doi: 10.1136/bmj.324.7331.183. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 39.Weiss E, Rao Gupta G. Bridging the gap: addressing gender and sexuality in HIV prevention Washington, DC: International Center for Research on Women; 1998. [Google Scholar]

- 40.Malhotra A. Measuring women’s empowerment as a variable in international development Washington, DC: The World Bank Gender and Development Group; 2002. [Google Scholar]

- 41.Mosedale S. Assessing women’s empowerment: towards a conceptual framework. J Int Dev. 2005;17:243–57. doi: 10.1002/jid.1212. [DOI] [Google Scholar]

- 42.Wallerstein N. What is the evidence on effectiveness of empowerment to improve health? [Health Evidence Network Report]. Copenhagen: World Health Organization Regional Office for Europe; 2006. Available from: http://www.euro.who.int/Document/E88086.pdf [accessed on 19 August 2009].

- 43.Rao Gupta G. Gender, sexuality, and HIV/AIDS: the what, the why, and the how. Keynote Address, XIIIth International AIDS Conference Durban, South Africa, 12 July 2000. Available from: http://siteresources.worldbank.org/EXTAFRREGTOPGENDER/Resources/durban_speech.pdf [accessed on 19 August 2009].

- 44.Epstein H. The invisible cure: Africa, the West and the fight against AIDS London: Viking; 2007. [Google Scholar]

- 45.Phetla G, Busza J, Hargreaves JR, Pronyk PM, Kim JC, Watts CA, et al. “They have opened our mouths”: increasing women’s skills and motivation for sexual communication with young people in South Africa. AIDS Educ Prev. 2008;20:504–18. doi: 10.1521/aeap.2008.20.6.504. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 46.Epstein H, Kim J. AIDS and the power of women. New York Rev Books. 2007;54:39–41. [PubMed] [Google Scholar]

- 47.The MBP reader on microfinance and AIDS: first steps in speaking out Bethesda, MD: Microenterprise Best Practices; 2000. [Google Scholar]

- 48.Pronyk PM, Hargreaves JR, Morduch J. Microfinance and better health: prospects for sub-Saharan Africa. JAMA. 2007;298:1925–7. doi: 10.1001/jama.298.16.1925. [DOI] [PubMed] [Google Scholar]

- 49.Armendariz de Aghion B, Morduch J. The economics of microfinance Cambridge, MA: The MIT Press; 2005. [Google Scholar]

- 50.Kim J, Pronyk P, Barnett T, Watts C. Exploring the role of economic empowerment in HIV prevention. AIDS. 2008;22(Suppl 4):S57–71. doi: 10.1097/01.aids.0000341777.78876.40. [DOI] [PubMed] [Google Scholar]