Abstract

In the context of recent state budget shortfalls and the repeal of the Boren amendment, state Medicaid expenditures for nursing home care were considered a potential target for payment cuts. We examine this issue using data from a survey of state nursing home payment policies. Our results indicate aggregate inflation-adjusted Medicaid payment rates increased steadily through 2004, and this growth was partly attributable to the adoption of nursing home provider taxes in many states. A recent proposal to cap provider taxes, if enacted, may lead to a decrease in Medicaid payment rates for nursing home care.

Prior to 1998, federal law linked Medicaid nursing home payment policy with minimum federal and state quality of care standards through the “Boren amendment,” which was adopted as part of the Omnibus Budget Reconciliation Act of 1980 and required that Medicaid nursing home rates be “reasonable and adequate to meet the costs which must be incurred by efficiently and economically operated facilities in order to provide care and services in conformity with applicable state and federal laws, regulations, and quality and safety standards” (Section 1902(a)(13) of the Social Security Act). State Medicaid officials opposed the Boren amendment, because they believed it caused states to spend too much on nursing home care relative to other services (Wiener & Stevenson, 1998). Thus, the federal Balanced Budget Act of 1997 repealed the Boren amendment and gave states greater latitude to set payment rates for nursing home care.

In the context of the economic recession in 2001 and resulting state budget shortfalls, state Medicaid nursing home expenditures were targeted as a potential area of cost savings. A 2003 Kaiser Family Foundation survey of state Medicaid directors found that 49 states had planned to reduce the rate of growth in Medicaid spending, while 19 states planned actual cuts in their Medicaid spending for long-term care (Smith, Gifford, & Ramesh, 2003). One approach to lowering state nursing home expenditures is a reduction in the Medicaid payment rate.

State Medicaid payments are financed in part by the federal government. Over the last two decades, states have used a range of “creative financing” mechanisms to increase Federal matching funds, especially during periods of fiscal stress (Coughlin, Bruen, & King, 2004). In 1991, Congress enacted legislation amending the Federal Medicaid statute to establish specific rules for when states could levy provider taxes on the gross patient revenues of health care providers.1 Under this legislation, states can assess a tax, which along with federal matching funds, can be used to increase Medicaid payment rates for nursing homes. Provider taxes are “allowable costs” under Medicaid, which implies Medicaid covers the part of the tax that is attributable to revenues from Medicaid residents and then subsequently receive federal matching funds for these paid claims. A recent analysis commissioned by a nursing home provider organization estimated that provider taxes generated $3.8 billion in Federal matching dollars in fiscal year 2006 (BDO Seidman LLP, 2006).

New Contribution

Researchers have not examined Medicaid nursing home payment rates in the context of the increased use of provider taxes. The last published survey of state nursing home policy concluded that payment growth was relatively stable over the 1999-2002 period in spite of the repeal of the Boren amendment and state budget shortfalls (Grabowski, Feng, Intrator, & Mor, 2004). However, this earlier study did not consider the potential role of provider taxes towards stabilizing Medicaid nursing home payments. In this current study, the results of a survey of state Medicaid programs are reported through 2004, with a particular focus on the role of provider taxes towards explaining Medicaid payment rate growth over the most recent years.

Methods

Data Collection

Building upon the protocol used in an earlier survey for 1999-2002 (Grabowski et al., 2004), we collected data on state Medicaid policies for nursing home care through 2004. In September 2005, we field tested the draft version of the new survey instrument in nine pilot states (Alabama, Arizona, Arkansas, Florida, Maine, Massachusetts, Michigan, Minnesota and Rhode Island). Based on the responses and comments from these states, we revised the survey questions and mailed the final survey in October and November to a contact person in each state. Some of the state contacts remained unchanged from our previous survey. In instances where a state contact had changed, we successfully identified a new contact via the state's Medicaid office. Similar to our previous survey, we collected data for the 48 contiguous U.S. states, not including Alaska, District of Columbia, Hawaii and other U.S. territories. Collectively, Alaska, Hawaii and Washington DC account for 0.5% of nursing homes in the U.S.

In order to facilitate completion of the current survey, we also provided the opportunity to correct any prior errors or inaccuracies by enclosing the state's responses to the previous survey. The states returned the completed surveys either by mail or fax. The study team then reviewed the completeness and cross-checked the state's responses with our previous survey. Additionally, survey responses were validated with information available from other sources on an ongoing basis (BDO Seidman LLP, 2006; Grabowski et al., 2004). If any missing items or inconsistencies were found, we followed up with our state contact for clarification or additional information. The survey process was initiated in September 2005 and was completed for all 48 states in August 2006.

Although the survey broadly collected information on state nursing home policies, this paper reports only the data we collected on average Medicaid payment rates and the use of provider taxes. Specifically, the states were asked to provide their average Medicaid nursing home payment rate per resident day for 2003 and 2004 (usually averaged over the state fiscal year). Twenty-two states reported different Medicaid per diem rates for freestanding and hospital-based facilities in 2003 and 2004. In these states, we present average per diem rates for freestanding facilities rather than a weighted average rate for all facilities. In a previous survey, the weighted rate across all facilities was found to be very similar to the Medicaid rate for freestanding facilities due to the small number of Medicaid patient-days in hospital-based facilities (Grabowski et al., 2004).

In terms of provider taxes, the states provided detailed information on their use of these taxes, but for the purposes of this paper, we used this information to simply identify whether a provider tax was in place by state and year. Although the underlying rationale for provider taxes is common across states, the actual mechanics differ along several dimensions including the percent of overall revenues taxed (roughly two-thirds of all states are at the Federal 6% limit), the Federal match rate (varies between 50% and 76%), and the applicable population (a minority of states have received waivers to allow multi-tiered tax rates or the exemption of certain facilities). Importantly, because the provider taxes levied on Medicaid bed-days are allowable costs (i.e., fully reimbursable) under Medicaid, payment rates are comparable in states and years with and without a provider tax. Specifically, we confirmed with our state contacts that the reported Medicaid payment rates were “net” of the provider tax. In other words, the reported Medicaid payment rates included only the amount retained by the provider and not the amount taxed away by the state.

Multivariate Analyses

We conducted multivariate analyses to assess the relationship between provider taxes and payment rates using state-year level data for the period 1999 through 2004 for the 48 contiguous states (N=288). The dependent variable is the percentage change in the Medicaid rate from the previous year and the primary independent variable of interest is a dummy variable indicating the use of a provider tax within the particular state-year cell.

We controlled for a range of covariates by state and year including the average per capita income, percent of the population aged 65+, a hospital health care wage index, unemployment rate, other nursing home policies (i.e., case-mix payment; bed moratorium), empty beds per 1,000 elderly population (aged 65+), the percent of government-owned nursing home beds and the percent of Medicaid long-term care spending on home- and community-based services. These data were obtained from multiple sources including the Area Resource File, the Online Survey Certification and Reporting System, the U.S. Census Bureau and Burwell et al (2005). Moreover, we also include state and year fixed effects. The state fixed effects control for time invariant factors that might influence the adoption of provider taxes and the growth in payment rates, and the year fixed effects control for any national trends. Thus, the model is identified by within-state variation in provider taxes and payment rates. With this model, we effectively compare the change in payment rates over time in states adopting provider taxes relative to the change in states not adopting provider taxes.

The model was estimated using least squares regression. All dollar values were adjusted to 2004 using the overall consumer price index.2

Results

Medicaid Payment Rates

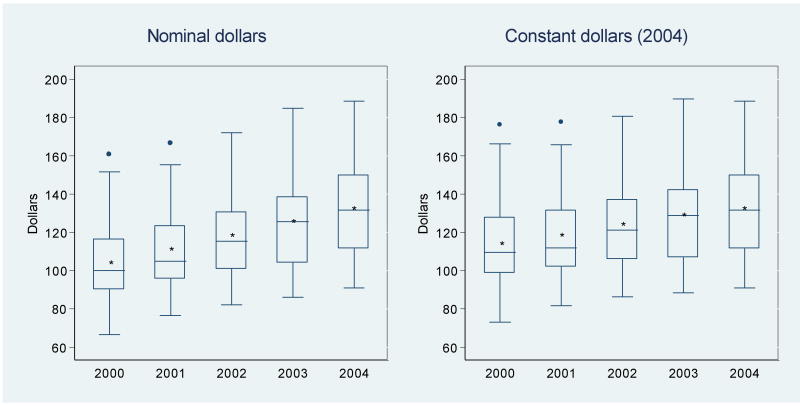

The national trends in average Medicaid per diem rates in real and nominal terms over the 2000-2004 period are illustrated using box-plot graphs (Figure 1). The left-hand panel shows the annual distribution of nominal (unadjusted) rates, which reveals a strong upward trend over the five-year period. The average state Medicaid per diem rate was $103.29 in 2000, $110.28 in 2001, $117.54 in 2002, $124.90 in 2003 and $131.66 in 2004 for an average annual increase of 6.4%. The right-hand panel shows the annual distribution of adjusted rates in constant 2004 dollars (using the overall consumer price index). The average inflation-adjusted rate of growth for the years 2000 through 2004 was 3.9%, and more specifically, the rate of growth was 4.0% in 2003 and 2.7% in 2004. As a point of comparison, the inflation-adjusted average annual increase for the years 1996 through 2000, a period of substantial economic growth, was 2.5% (not shown in the Figure). Based on these trends, it would be difficult to conclude that the economic recession caused a significant decline in the generosity of state Medicaid payment rates.

Figure 1. Annual Distribution of State Average Medicaid Per Diem Rates, 2000-2004.

SOURCE: Data collected by the authors.

NOTES: The Consumer Price Index (U.S. city average of all items for all urban consumers, obtained from the Bureau of Labor Statistics, U.S. Department of Labor) was used to adjust the nominal rates to constant dollars. The length of the box represents the interquartile range—the distance between the 25th (lower edge) and the 75th (upper edge) percentiles. The horizontal line and the * marker inside the box represent the median and mean, respectively. The vertical lines issuing from the box (whiskers) extend to the lower (25th percentile − 1.5 × interquartile range) and upper (75th percentile + 1.5 × interquartile range) adjacent values, and the circles represent values outside the adjacent lines (outliers).

Importantly, however, the national trend in Medicaid payment rates may mask cross-state differences over time. As shown in Table 1, significant variation exists across states in the rate of growth. In nominal terms, every state had a higher payment rate in 2004 relative to 2000. In inflation-adjusted terms however, Illinois, North Carolina and New Hampshire did not increase their Medicaid payment rates over this period. Oregon experienced the largest percentage growth in its per diem rate from $95.43 in 2000 to $165.89 in 2004 for an inflation-adjusted annual growth rate of 12.4%. Our informant in Oregon attributed this large rate of growth to both the rebasing of payment rates at a higher ceiling of allowable costs, and the adoption of a provider tax in 2003. Other states that experienced a large inflation-adjusted annual increase in Medicaid payment rates included Michigan (11.7%), Delaware (10.4%), Arkansas (10.3%) and Nevada (8.0%). Our informant in Michigan attributed the large increase to the adoption of a provider tax in 2003. The states with the lowest annual inflation-adjusted growth rates in Medicaid payment rates were Illinois (−2.0%), New Hampshire (-0.5%), North Carolina (-0.5%), Pennsylvania (0.3%) and Connecticut (0.3%). According to our informant in Illinois, the negative real growth in Illinois was attributed to a payment rate “freeze” over the 1999-2004 period.

Table 1. Medicaid Nursing Home Payment Rates, 2000-2004.

| Medicaid per diem rates ($) | ||||||||

|---|---|---|---|---|---|---|---|---|

| State | 2000 | 2001 | 2002 | 2003 | 2004 | Average annual percent change | CPI-adjusted Average annual Percent change | Provider Tax in 2004? |

| AL | 112.54 | 119.61 | 126.99 | 126.99 | 131.90 | 4.1 | 1.7 | Yes |

| AR | 69.36 | 76.69 | 94.21 | 101.67 | 111.76 | 12.8 | 10.3 | Yes |

| AZ | 99.57 | 105.00 | 113.93 | 120.76 | 128.60 | 6.6 | 4.2 | No |

| CA | 110.27 | 112.93 | 113.73 | 118.05 | 124.76 | 3.2 | 0.8 | Yes |

| CO | 111.62 | 114.08 | 123.37 | 131.48 | 143.75 | 6.6 | 4.1 | No |

| CT | 151.59 | 155.41 | 164.64 | 168.00 | 168.00 | 2.6 | 0.3 | No |

| DE | 117.66 | 152.64 | 159.67 | 184.89 | 188.62 | 13.0 | 10.4 | No |

| FL | 113.45 | 120.70 | 134.33 | 147.90 | 151.95 | 7.6 | 5.2 | No |

| GA | 83.64 | 84.52 | 90.92 | 114.25 | 119.51 | 9.7 | 7.2 | Yes |

| IA | 85.90 | 91.90 | 95.26 | 100.88 | 102.56 | 4.6 | 2.2 | No |

| ID | 116.37 | 124.36 | 131.60 | 138.45 | 139.14 | 4.6 | 2.2 | No |

| IL | 90.06 | 94.86 | 89.92 | 90.49 | 90.97 | 0.3 | -2.0 | Yes |

| IN | 92.83 | 97.88 | 102.78 | 128.82 | 130.26 | 9.2 | 6.7 | Yes |

| KS | 83.53 | 90.76 | 95.48 | 98.87 | 101.81 | 5.1 | 2.7 | No |

| KY | 100.35 | 101.76 | 107.76 | 107.76 | 113.63 | 3.2 | 0.8 | Yes |

| LA | 68.97 | 77.57 | 82.26 | 86.21 | 92.47 | 7.6 | 5.2 | Yes |

| MA | 124.47 | 132.40 | 140.63 | 150.23 | 160.63 | 6.6 | 4.1 | Yes |

| MD | 122.15 | 134.42 | 150.64 | 162.49 | 169.35 | 8.5 | 6.1 | No |

| ME | 115.77 | 121.41 | 132.41 | 132.84 | 142.72 | 5.4 | 3.0 | Yes |

| MI | 98.87 | 109.56 | 118.89 | 158.00 | 166.00 | 14.3 | 11.7 | Yes |

| MN | 116.84 | 122.79 | 129.65 | 129.34 | 137.01 | 4.1 | 1.7 | Yes |

| MO | 91.65 | 96.60 | 97.32 | 97.32 | 103.03 | 3.0 | 0.6 | Yes |

| MS | 90.38 | 97.58 | 105.91 | 116.49 | 131.92 | 9.9 | 7.4 | Yes |

| MT | 94.04 | 97.73 | 101.67 | 106.29 | 116.51 | 5.5 | 3.1 | Yes |

| NC | 122.14 | 126.36 | 126.36 | 131.30 | 131.30 | 1.8 | -0.5 | Yes |

| ND | 104.94 | 115.03 | 127.05 | 129.71 | 137.59 | 7.1 | 4.6 | No |

| NE | 81.42 | 91.13 | 100.20 | 102.32 | 102.21 | 6.0 | 3.6 | No |

| NH | 118.91 | 119.82 | 127.09 | 127.29 | 127.71 | 1.8 | -0.5 | Yes |

| NJ | 127.63 | 133.90 | 141.80 | 150.34 | 159.44 | 5.7 | 3.3 | Yes |

| NM | 92.96 | 102.64 | 102.64 | 102.64 | 111.29 | 4.7 | 2.3 | Yes |

| NV | 101.00 | 102.41 | 121.66 | 121.66 | 148.13 | 10.5 | 8.0 | Yes |

| NY | 160.66 | 166.57 | 172.05 | 177.33 | 187.32 | 3.9 | 1.5 | Yes |

| OH | 121.76 | 132.57 | 143.98 | 154.46 | 157.00 | 6.6 | 4.2 | Yes |

| OK | 66.57 | 84.11 | 93.58 | 94.20 | 96.20 | 10.1 | 7.6 | Yes |

| OR | 95.43 | 103.96 | 111.35 | 136.88 | 165.89 | 15.0 | 12.4 | Yes |

| PA | 122.91 | 130.60 | 138.03 | 124.17 | 134.76 | 2.6 | 0.3 | No |

| RI | 116.03 | 125.60 | 133.54 | 141.72 | 155.52 | 7.6 | 5.1 | Yes |

| SC | 94.36 | 97.96 | 103.13 | 108.55 | 117.00 | 5.5 | 3.1 | No |

| SD | 79.60 | 83.57 | 86.62 | 91.61 | 93.72 | 4.2 | 1.8 | No |

| TN | 81.76 | 84.84 | 92.49 | 95.18 | 101.44 | 5.6 | 3.2 | Yes |

| TX | 83.53 | 88.47 | 96.28 | 96.25 | 94.87 | 3.3 | 1.0 | No |

| UT | 90.19 | 94.56 | 102.53 | 105.55 | 105.55 | 4.1 | 1.7 | Yes |

| VA | 89.48 a | 98.86 a | 103.09 a | 112.06 | 117.93 | 7.2 | 4.7 | No |

| VT | 112.56 | 122.10 | 128.25 | 138.64 | 147.24 | 7.0 | 4.5 | Yes |

| WA | 121.79 | 126.01 | 128.79 | 134.45 | 141.47 | 3.8 | 1.4 | Yes |

| WI | 98.77 | 102.48 | 110.27 | 135.42 | 140.17 | 9.4 | 6.9 | Yes |

| WV | 113.68 | 121.85 | 129.88 | 141.50 | 152.69 | 7.7 | 5.2 | Yes |

| WY | 97.89 | 104.86 | 117.11 | 123.53 | 126.24 | 6.6 | 4.2 | No |

| Mean | 103.29 | 110.28 | 117.54 | 124.90 | 131.66 | 6.4 | 3.9 | |

| S.D. | 19.62 | 20.43 | 21.36 | 23.79 | 25.46 | 3.3 | 3.2 | |

| Median | 99.96 | 104.93 | 115.52 | 125.58 | 131.60 | 5.8 | 3.4 | |

SOURCE: Data collected by the authors.

NOTES: CPI is Consumer Price Index. S.D. is standard deviation.

Rates recently corrected by the state; data previously published by the authors (see Health Affairs Web Exclusive, June 16, 2004: W4 363-373) were inaccurate. The corrected rate for 1999 is $82.36, not $93.42, as we published earlier.

Nursing Home Provider Taxes

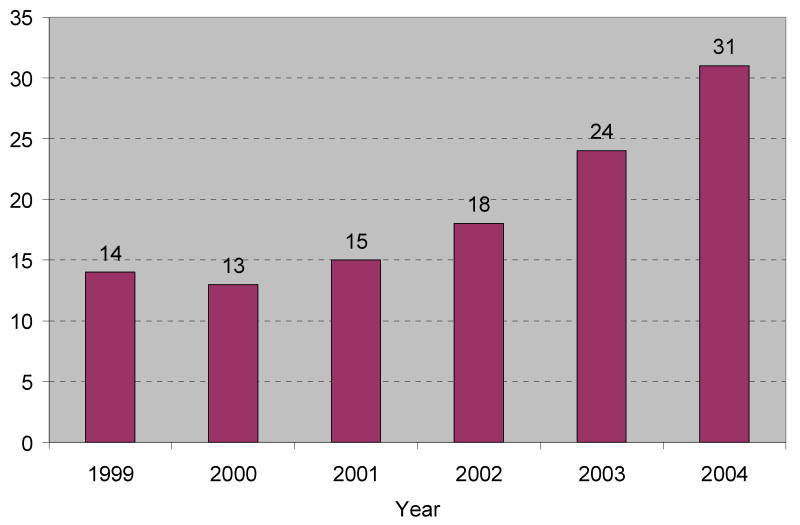

One potential explanation for the relative stability in state Medicaid payment generosity in the context of the recent economic recession and the repeal of the Boren amendment is the use of nursing home provider taxes. By attracting additional Federal matching dollars, these taxes may have stabilized payment rates in recent years. In the final column of Table 1, we identify the 31 states with a provider tax in place in 2004. Our survey found a large expansion in the use of these programs over the last several years, with the number of states having a provider tax increasing from 14 in 1999 (Figure 2). Most of this growth occurred in the latter part of the period, with 6 states adopting provider taxes in 2003 and 7 states in 2004. Since the end of our study period, at least two additional states (Connecticut and Pennsylvania) have adopted provider taxes.

Figure 2. Number of States Collecting a Daily Resident/Bed Tax from Nursing Homes, 1999-2004.

SOURCE: Data collected by the authors.

Provider Taxes and Payment Rates

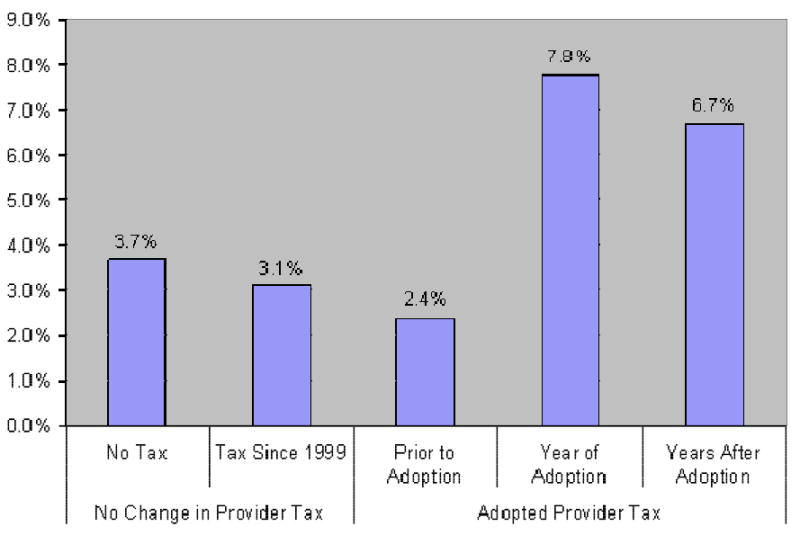

A key issue is whether the adoption of provider taxes was associated with an increase in overall Medicaid payment generosity. In order to investigate this issue, we initially compared the rate of growth in Medicaid payment for states that did and did not change their nursing home provider tax over the period 1999 through 2004 (see Figure 3). For those states that did not change their provider tax, the average annual inflation-adjusted rate of growth was 3.7% in the 16 states that had not adopted a provider tax by 2004, and 3.1% in the 13 states that had a provider tax in place since 1999. The most dramatic change was in the 17 states that adopted and maintained provider taxes after 1999.3 In the years preceding adoption, the annual rate of payment growth was 2.4%. In the year that the tax was adopted, payment rates increased by 7.8%, and then grew by 6.7% in subsequent years.

Figure 3. Average Annual Growth in Inflation-adjusted Medicaid Nursing Home Payment Rates With and Without Provider Taxes (1999-2004).

SOURCE: Data collected by the authors. New York and South Carolina are excluded, because they repealed an existing provider tax over the 1999-2004 period.

NOTES: The Consumer Price Index (U.S. city average of all items for all urban consumers, obtained from the Bureau of Labor Statistics, U.S. Department of Labor) was used to adjust the nominal rates to constant dollars.

Alternate explanations might exist for why payment rate growth was relatively low for the “early” (pre-2000) adopters of provider taxes. First, this result may simply reflect differential selection in which states were early adopters. For example, if the states experiencing the greatest fiscal pressures were the first to adopt provider taxes, then these states would likely have slower payment rate growth, even after the adoption of a provider tax. Second, this finding may also suggest that—following the adoption of a provider tax—states' ability to sustain a high rate of payment growth dissipates over time.

We next examined the relationship between provider taxes and Medicaid payment rates in a multivariate framework (see Table 2). Once again, this model controls for a range of time-varying state-year factors, and state and year fixed effects. The state fixed effects capture unmeasured time-invariant state-level factors and the year fixed effects control for national trends associated with Medicaid payment generosity. Thus, this model is identified by the within-state variation in the use of provider taxes and payment generosity over time. Overall, this regression model indicated that states increased their annual Medicaid per diem by 5.85% (in 2004 dollars) following the adoption of a provider tax. Given research establishing the important link between Medicaid payment rates and various indicators or process and outcome based quality, including staffing, resident acuity, hospitalizations, and quality indicators (Grabowski & Norton, 2006), this result has particular policy importance.

Table 2. Association between provider taxes and Medicaid payment rates (1999-2004).

| Dependent Variable = Percentage change in Medicaid Rate from previous year | |

|---|---|

| Nursing home provider tax (0/1) | 5.85 (1.33) |

| Medicaid case-mix payment (0/1) | -2.72 (1.87) |

| Per capita income (per $1,000) | -0.95 (1.06) |

| % Medicaid long-term care spending on HCBS | -0.21 (0.11) |

| % population 65+ | 3.90 (3.57) |

| Empty nursing home beds per 1,000 population 65+ | -0.57 (0.38) |

| % nursing home beds government-owned | -0.68 (0.46) |

| Hospital wage index (per 1 standard deviation) | 14.16 (9.70) |

| Unemployment rate | -2.41 (0.83) |

| Nursing home moratorium (0/1) | -2.45 (1.69) |

| Calendar year (reference = 1999): | |

| 2000 | 0.15 (1.48) |

| 2001 | 4.14 (2.09) |

| 2002 | 6.45 (2.30) |

| 2003 | 4.94 (2.39) |

| 2004 | 2.99 (2.47) |

| Constant | 17.30 (11.10) |

| State Fixed Effects | (Not Shown) |

| N | 288 |

Notes: Estimated using least squares regression with standard errors presented in parentheses. All dollar values are converted to 2004. HCBS = home- and community-based services.

Discussion

Our survey results indicate that Medicaid payment rates continued to grow steadily in the most recent years in spite of concerns regarding state budget shortfalls in the context of the recent economic recession. Indeed, the rate of growth observed over the period 2000 through 2004 considerably outpaced that observed over the period 1996 through 2000. One explanation for the continued growth in Medicaid payment rates appears to be the widespread adoption of nursing home provider taxes, which allow states to increase Federal matching dollars. Between 1999 and 2004, the number of states using nursing home provider taxes increased from 14 to 31, and the growth in Medicaid payment rates was highest in states following the adoption of provider taxes. However, given that the annual inflation-adjusted growth rate (3.9%) was relatively steady in states that did not adopt provider taxes, it is important to acknowledge that provider taxes were not the only factor influencing payment growth. Moreover, in order to evaluate the true munificence of these Medicaid payment rate increases, one would have to benchmark payments against the costs of treating Medicaid residents.

There are pros and cons to relying on the provider tax, both in terms of stability of funding and also equity within and across states. As we have shown in this study, the provider tax has been an important source of funding for state Medicaid programs during a period of state fiscal retrenchment. However, the long-term stability of this funding faces potential threats at both the Federal and state levels. At the Federal level, Congress has enacted legislation to address other “creative financing” mechanisms by Medicaid programs such as disproportionate share hospital payments (U.S. General Accounting Office, 2004). In 2006, the Bush Administration proposed decreasing the allowable level of provider taxes from 6% of patient revenues to 3% (Pear, 2006). This action would have significantly decreased the availability of Federal matching dollars, with a nursing home industry sponsored analysis estimating $1.5 billion in lost Federal funding (BDO Seidman LLP, 2006). At the state-level, there is always the issue of whether Medicaid payment growth supported by provider tax revenues is sustainable. Indeed, our results suggest that the annual growth in Medicaid nursing home payment rates is largest during the period immediately following the adoption of a provider tax. Over time, it may be the case that provider tax revenues are increasingly spent on non-nursing home related sources, or alternatively, states may use provider tax revenues to offset general tax funds that would have otherwise been spent on Medicaid-financed nursing home care. These incentives to reallocate program dollars may be particularly strong in periods of state budget shortfalls.

Provider taxes may also generate important equity concerns both across and within states. State Medicaid programs are funded in part by the Federal government, with a higher match rate for poorer states. For example, the Federal match rate is 50% in wealthier states such as California and Massachusetts, and 76% in Mississippi, the poorest state. Thus, one potential source of inequity is that poorer states such as Mississippi can generate a greater Federal match rate on provider taxes relative to wealthier states such as California. However, as was recently noted in a dissent to the Medicaid Commission's findings, the Federal match rate may also introduce inequities favoring wealthier states (U.S. Department of Health and Human Services, 2006). The dissenting report suggested that—because wealthier states can spend more in the aggregate on their Medicaid programs—they ultimately attract more total Federal matching dollars in spite of their lower match rate. In the case of provider taxes, Medicaid covers the part of the tax that is attributable to revenues from Medicaid residents and then Medicaid subsequently receives federal matching funds for these paid claims. Thus, wealthier states with higher Medicaid payment rates (i.e., higher levels of paid claims) may be able to attract greater Federal dollars relative to poorer states with lower payment levels.

Provider taxes also raise equity issues within states. Because the taxes must be uniformly applied to all nursing homes and all nursing home residents within a state, they are an indirect—and some may term inefficient—mechanism towards increasing funding for Medicaid. Importantly, only a minority of states have acquired waivers from the Department of Health and Human Services allowing them to exempt certain nursing homes or levy a multi-tiered tax (although Medicare days are exempt in most states). Thus, a nursing home that cares for predominantly private-pay nursing home residents must pay the tax on all its residents, but will ultimately receive little additional revenue from a more generous Medicaid payment rate. In 2004, 7% of nursing homes in the 31 states with a provider tax (versus 14% in states without a provider tax) had at least 50% private-pay nursing home residents. Moreover, taxes levied on predominantly private-pay facilities may be largely passed through to private-paying consumers in the form of higher prices.

As one would expect, there has been mixed support for provider taxes across nursing homes. For example, when Connecticut was debating the adoption of a provider tax, for-profit nursing homes, which generally care for a higher Medicaid census, supported the provider tax, while not-for-profit nursing homes did not (Cohen, 2004).

Provider taxes may also undermine the “rebalancing” of state Medicaid long-term care service delivery from nursing homes to home- and community-based alternatives. Individuals prefer to receive care in the least institutional – and most homelike – setting possible. However, as long as the Federal government subsidizes Medicaid expenditures for nursing homes via provider taxes, state Medicaid programs will have less incentive (at the margin) to invest in non-institutional alternatives. Moving forward, future research will need to explore how states allocate dollars across institutional and non-institutional long-term care settings in the context of economic downturns and how provider taxes might affect this balance.

As a potential limitation of our study, we cannot necessarily confirm a causal relationship between levying nursing home provider taxes and increases in Medicaid payments. In particular, our data indicated relatively slow payment rate growth (2.4%) in the period preceding the adoption of provider tax, suggesting states may have restricted payments in anticipation of future Federal revenue from the provider tax. Nevertheless, our findings are consistent with both government and industry reports that provider taxes have bolstered Medicaid payment rates (BDO Seidman LLP, 2006; U.S. General Accounting Office, 2003). Moreover, although this study has focused on nursing home provider taxes, these taxes can be used by states in a range of other areas including hospital, physician and home health care services (Verdier, 1993). Provider taxes may raise similar issues in these other areas in terms of stability of funding and equity both across and within states. For example, the Medicaid Commission recommended reforming the provider tax requirement for Medicaid managed care organizations in order to close a loophole that allows states to solely impose the tax on Medicaid (rather than all payers) (U.S. Department of Health and Human Services, 2005).

In sum, in spite of the recent state budget shortfalls, the repeal of the Boren Amendment and forecasts that nursing home care would be targeted as a potential area of Medicaid savings, payment continued to grow in 2003 and 2004 at a rate consistent with historical trends. Our results suggest that this growth may be partially explained by the expanded use of nursing home provider taxes.

Acknowledgments

The collection of data presented in this paper was supported in part by the National Institute on Aging (NIA) grant no. AG23622 (PI: Vincent Mor). Dr. Grabowski was supported in part by a NIA career development award (K01 AG024403). The authors acknowledge the assistance of Marsha Rosenthal, Susan Miller, Melissa Clark, Pedro Gozalo, Andrea Gruneir and Jacqueline Zinn in the development of the survey protocol, Nancy Grossman in data collection, and Hannah Mellion in data entry.

Footnotes

In order to gain CMS approval, the provider taxes must be “broad-based” (i.e., the tax rate is the same for all nursing homes) and “applied uniformly” (i.e., all patients are taxed), and the taxes must not violate the “hold harmless” test (i.e., the state cannot repay the provider 100% of the tax). States can pass the hold-harmless test if their tax on each nursing home is applied at a rate that produces revenues less than or equal to 6% of the taxpayer's revenues.

The choice of the general consumer price index (CPI), rather than the nursing home CPI, was driven by the potential endogeneity of Medicaid payment rates and the nursing home CPI. The nursing home CPI is based on overall out-of-pocket spending on nursing home services by consumers, which is a combination of dollars directly paid to nursing homes at the prevailing market price and dollars contributed in the form of deductibles and co-payments under public and private insurance plans. In the latter case, if the individual qualifies for public coverage, the rate of growth of the nursing home CPI is jointly determined by the rate of growth of Medicaid.

New York and South Carolina are excluded from Figure 3, because they repealed an existing provider tax over the period of study.

Contributor Information

David C. Grabowski, Associate Professor, Department of Health Care Policy, Harvard Medical School, 180 Longwood Avenue, Boston, MA 02115, 617-432-3369 voice 617-432-3435 fax, grabowski@med.harvard.edu.

Zhanlian Feng, Assistant Professor (Research), Center for Gerontology and Health Care Research, Brown University, Box G-ST2, Providence, RI 02912, 401-863-9356 voice 401-863-9219 fax, Zhanlian_Feng@brown.edu.

Orna Intrator, Associate Professor (Research), Center for Gerontology and Health Care Research, Brown University, Box G-ST2, Providence, RI 02912, 401-863-3579 voice 401-863-9219 fax, Orna_Intrator@brown.edu.

Vincent Mor, Chair and Professor, Department of Community Health, School of Medicine, Brown University, Box G-A4, Providence, RI 02912, 401-863-3172 voice 401-863-3713 fax, Vincent_Mor@brown.edu.

References

- BDO Seidman LLP. A Report on Shortfalls in Medicaid Funding for Nursing Home Care: Prepared for the American Health Care Association. 2006. [Google Scholar]

- Burwell B. Medicaid Long Term Care Expenditures in FY 2004. Cambridge, MA: The MEDSTAT Group; 2005. [Google Scholar]

- Cohen RK. Nursing Home Provider Tax - Pros and Cons (No. 2004-R-0857) Connecticut General Assembly, Office of Legislative Research; 2004. [Google Scholar]

- Coughlin TA, Bruen BK, King J. States' use of Medicaid UPL and DSH financing mechanisms. Health Affairs (Millwood) 2004;23(2):245–257. doi: 10.1377/hlthaff.23.2.245. [DOI] [PubMed] [Google Scholar]

- Grabowski DC, Feng Z, Intrator O, Mor V. Recent trends in state nursing home payment policies. Health Affairs, W4. 2004:363–373. doi: 10.1377/hlthaff.w4.363. [DOI] [PubMed] [Google Scholar]

- Grabowski DC, Norton EC. Nursing Home Quality of Care. In: Jones AM, editor. The Elgar Companion to Health Economics. Cheltenham, UK: Edward Elgar Publishing, Inc; 2006. pp. 296–305. [Google Scholar]

- Pear R. Planned Medicaid Cuts Cause Rift With States. New York Times; 2006. Aug 13, [Google Scholar]

- Smith V, Gifford K, Ramesh R. State Budgets Under Stress: How are States Planning to Reduce the Growth in Medicaid Costs? Washington, DC: Kaiser Family Foundation, Kaiser Commission on Medicaid and the Uninsured; 2003. [Google Scholar]

- U.S. Department of Health and Human Services, M.C. Report to Congress. 2005 Retrieved December 19, 2007, from http://aspe.hhs.gov/medicaid/090105rpt.pdf.

- U.S. Department of Health and Human Services, M.C. Final Report and Recommendations: Medicaid Commission. 2006 Retrieved December 19, 2007, from http://aspe.hhs.gov/medicaid/122906rpt.pdf.

- U.S. General Accounting Office. Medicaid Nursing Home Payments: States' Payment Rates Largely Unaffected by Recent Fiscal Pressures (No. GAO-04-143) Washington, DC: GAO; 2003. Pub No. GAO-04-143. [Google Scholar]

- U.S. General Accounting Office. Medicaid: Intergovernmental Transfers Have Facilitated State Financing Schemes (No GAO-04-574T) Washington, DC: U.S. General Accounting Office; 2004. GAO-04-574T. [Google Scholar]

- Verdier JM. State Provider Assessments to Fund Medicaid. National Tax Journal. 1993;46(3):377–383. [Google Scholar]

- Wiener JP, Stevenson DG. Repeal of the ‘Boren Amendment’: Implications for Quality of Care in Nursing Homes. Washington D.C.: The Urban Institute; 1998. [Google Scholar]