Abstract

We calculated prescription drug usage in two groups of Medicare beneficiaries: employer group with no coverage gap, and individual Part D group with no coverage or some generic drug coverage in the coverage gap. Among those with employer coverage, 40 percent reached the doughnut hole, compared with 25 percent of those without such coverage. Overall, 5 percent went through the doughnut hole to reach the catastrophic coverage level. Those lacking coverage in the doughnut hole reduced their drug use by 14 percent; those with generic coverage reduced their use by 3 percent. Coverage of generic drugs with a $0–$10 copayment in the doughnut hole could be financed by, at most, a six-to-nine-percentage-point increase in initial coinsurance.

Medicare part d, which offers prescription drug coverage for Medicare beneficiaries, took effect 1 January 2006. It was designed to meet several different goals, including protection against catastrophic drug spending and reduction in the under use of some medications. The standard Part D benefit in 2006 included an initial $250 deductible, an insured period in which the beneficiary paid 25 percent coinsurance between drug spending of $250 and $2,250, a coverage gap (or doughnut hole) in which the beneficiary paid everything out of pocket until drug spending reached a catastrophic limit of $5,100; and a catastrophic coverage period after the beneficiary spent $3,600 out of pocket. In the latter, beneficiaries paid either 5 percent coinsurance or a $2/$5 copayment for generic/brand-name drugs, whichever was higher.1 Most companies offering Part D drug plans, however, modified this standard design to be similar to commercial drug insurance and offered tiered formulary plans that were either “actuarially equivalent” to the standard plan or “enhanced.”2

A controversial aspect of the benefit design was the doughnut hole, a gap in coverage of expenditures between $2,250 and $5,100, which was included to keep the cost of the program within the amount specified by the congressional budget resolution. Although almost all public and private drug benefits include cost sharing, the doughnut-hole feature of Part D was unusual, if not unique. To date there have been few studies of what happens when beneficiaries enter the doughnut hole.3

In this paper we examine data on the drug usage and spending by Medicare beneficiaries who were enrolled in drug plans offered by a large insurer. We answer the following questions: what proportion of people spent up to $2,250 (the doughnut-hole threshold) in 2006, and what was the impact of chronic illness on the likelihood of reaching the doughnut hole? How many months did it take to reach the doughnut hole, and how many months did beneficiaries remain there? How did beneficiaries respond to the increase in out-of-pocket drug spending after reaching the doughnut hole in terms of the number of monthly prescriptions filled and use of generics? How did spending compare among those with and without a doughnut-hole feature in their policy? Finally, to inform policymakers of the implications of partially “filling” the doughnut hole, we estimated how much greater initial cost sharing would need to be to cover the cost of generic drugs in the doughnut hole.

Study Data And Methods

Setting

We obtained enrollment, benefits, and claims information for Medicare beneficiaries enrolled in one of several drug benefit plans offered by a large Pennsylvania insurer. In 2006 Medicare beneficiaries were enrolled with this insurer either through their prior employer group or by purchasing an individual Medicare Advantage Prescription Drug (MA-PD) plan.

We believe that self-selection into both the employer-group and MA-PD plans was negligible. Members had employer insurance only if their former employers chose to provide it, and few would probably decline such coverage if their former employers provided it, although we do not have data on this point. Moreover, less than 15 percent of those without employer insurance did not enroll in Part D nationally, and we have no reason to think that experience in Pennsylvania differed appreciably.4

Like most Part D plan offerings, the MA-PD products in this study did not include a deductible but did have differential copayments for generic and brand-name drugs.5 The great majority of MA-PD plan members (93 percent) paid a copay of $8/$20 (generic/brand name); 7 percent paid $15/$30 in the initial coverage period. A majority had coverage of generics ($8 copay) during the doughnut hole. The employer group had coverage for both generic and brand-name drugs irrespective of their total drug spending but faced copayments that varied from $8 to $30 for generic and brand-name drugs, with a median $20 copayment for brands (26 percent, $8/$20; 36 percent, $10/$10; 33 percent, $20/$20; and 5 percent, $15/$30). The employer group faced no gap in coverage.

Study population

We obtained a random sample of 16,120 members who were continuously enrolled in 2006. We excluded 626 members under age sixty-five and 1,040 others who had a nursing home or long-term care stay during the study period, because we could not observe their complete drug usage. Of the remaining 14,454 members, 20 percent were enrolled through employer groups and 80 percent through MA-PD plans.

Beneficiaries with major chronic conditions

To examine how chronic illnesses altered the likelihood of reaching the doughnut hole and assess the resulting financial burden, we identified beneficiaries with hypertension (International Classification of Diseases, Ninth Revision [ICD-9], codes 401, 402, 403, and 404) and diabetes (ICD-9 250) because of their high prevalence and large disease burden. For each condition we distinguished between those who had only the condition and those who had various comorbidities, including hypertension, hyperlipidemia, diabetes, and congestive heart failure (CHF). In our analysis we distinguished patients with only hypertension, with hypertension and one other condition, with hypertension and two other conditions, and so forth. We thereby evaluated incremental changes in the probability of reaching the doughnut hole and responses after reaching the doughnut hole as beneficiaries experienced additional chronic conditions.

Proportion of beneficiaries reaching the doughnut hole

We calculated the proportion of beneficiaries whose total drug spending reached the doughnut-hole threshold of $2,250, among members in employer-group and MA-PA plans. To balance the two groups in observed variables, we adjusted for members’ sex, age, and prospective risk scores. The prospective risk score is calculated by the insurer to predict a person’s risk level next year using the current year’s diagnoses and demographic variables.6 It is a proxy for health status—a higher number indicates higher expected future medical spending.

To assess the financial burden faced by beneficiaries in the doughnut hole, we calculated out-of-pocket drug spending after they reached the doughnut hole but before they reached catastrophic coverage. We compared the out-of-pocket spending during this coverage gap period incurred by enrollees in the MA-PD plan with that incurred by members enrolled in employer plans (who did not experience a gap in coverage), stratified by the number of months they spent in the doughnut hole. Out-of-pocket drug spending did not include the monthly insurance premium.

For beneficiaries who reached the doughnut hole in 2006, we ascertained the cumulative proportion whose total drug spending reached $2,250 in each month. We compared the time to reach the doughnut hole by chronic condition and by the number of conditions.

Responses to the doughnut hole

To assess beneficiaries’ responses to the doughnut hole, we measured the number of monthly prescriptions filled before and after they reached it. We defined as the index date the first day that total drug spending reached $2,250, and we allocated prescriptions spanning that date based on days’ supply. We then calculated the average number of monthly prescriptions standardized by thirty days’ supply (for example, we treated a ninety-day supply as three prescriptions) before and after the index date. We also calculated the number of monthly generic versus brand-name prescriptions filled before and after reaching the doughnut hole.

We used regression analyses to estimate the impact on the number of monthly prescriptions filled after reaching the doughnut hole in individual plans compared with the employer group, which did not experience the doughnut hole but still had modest copayments. In these models we calculated the number of generic and brand-name prescriptions filled after reaching the doughnut hole. To account for the effect of generic coverage in the doughnut hole, we created a dummy variable indicating no coverage during the doughnut hole and another indicating only generic coverage during the doughnut hole. We controlled for the number of prescriptions filled before reaching the doughnut hole, sex, age, prospective risk score, and duration in the doughnut hole. In the regression analyses we excluded beneficiaries whose spending was large enough to put them above the catastrophic limit, because we expected that they would anticipate going through the doughnut hole and therefore would have no reason to decrease their spending.7

What would it cost to mandate coverage of generics in the doughnut hole?

Richard Frank and Joseph Newhouse have proposed mandating coverage of generic drugs in the doughnut hole and increasing cost sharing in the initial coverage period to offset the associated costs.8 Based on medication use in our sample, we estimated the increase in initial cost sharing that would be necessary to cover the costs associated with mandated generic coverage. To do so, we calculated the average unit price of a monthly generic prescription in our overall sample, and the number of generic prescriptions used among those with coverage for generics during the doughnut hole. We then assessed the increase in cost sharing that would be needed in the initial expenditure region to offset the increased costs to the plans generated by mandated generic coverage.

Study Results

Comparison of enrollees in MA-PD plans and employer plans

Members enrolled in the employer plans were younger than members enrolled in MA-PD plans, and a higher proportion were men (Exhibit 1). However, the likelihood of having hypertension or diabetes and other comorbid chronic illnesses was similar in the two groups.

EXHIBIT 1.

Characteristics Of Study Population: Elderly Medicare Beneficiaries With Drug Coverage Through An Individual Part D Plan Or An Employer-Group Plan, 2006

| Demographic variables | Individual Part D plans | Employer plans | p_value |

|---|---|---|---|

| Female | 60% | 53% | <0.0001 |

| Age (years) | |||

| 65–74 | 44% | 53% | <0.0001 |

| 75–84 | 44 | 39 | <0.0001 |

| 85+ | 12 | 8 | <0.0001 |

| Prospective risk score | 0.96 (0.85) | 1.01 (0.88) | 0.00312 |

|

Diagnosed with selected medical conditions | |||

| Hypertension | |||

| Any | 70% | 69% | 0.1431 |

| Only | 14 | 11 | 0.0002 |

| + Hyperlipidemia | 29 | 32 | 0.003 |

| + CHF | 1 | 1 | 0.7999 |

| + Diabetes | 4 | 4 | 0.5899 |

| + Hyperlipidemia + CHF | 3 | 1 | 0.0005 |

| + Hyperlipidemia + diabetes | 15 | 16 | 0.4513 |

| + CHF + diabetes | 1 | 1 | 0.1720 |

| + Hyperlipidemia + CHF + diabetes | 3 | 2 | 0.1380 |

| Diabetes | |||

| Any | 28 | 27 | 0.6207 |

| Only | 2 | 1 | 0.1924 |

| + Hypertension | 4 | 4 | 0.5899 |

| + Hyperlipidemia | 2 | 3 | 0.3820 |

| + CHF | 0 | 0 | 0.5776 |

| + Hypertension + hyperlipidemia | 15 | 16 | 0.4513 |

| + Hypertension + CHF | 1 | 1 | 0.1720 |

| + Hyperlipidemia + CHF | 0 | 0 | 0.7436 |

| + Hypertension + hyperlipidemia + CHF | 3 | 2 | 0.1380 |

SOURCE: Authors’ calculations using study population as described in the text.

NOTES: For individual Part D plans, n = 11,661 (81 percent of sample). For employer-group plans, n = 2,793 (19 percent of sample). Study sample was defined as age sixty-five and older; continuously enrolled in 2006; and no institutional stay in 2006. “Any” hypertension means patients with hypertension, irrespective of identified chronic illnesses. “Only” hypertension is defined as hypertension without the other major chronic illnesses shown. CHF is congestive heart failure.

Proportion of members reaching the doughnut hole

Overall, 25 percent of beneficiaries in the MA-PD plans reached the doughnut-hole region, compared with 40 percent of beneficiaries in employer plans (Exhibit 2). (These and subsequent numbers are adjusted for differences in age, sex, and prospective risk score between the MA-PD and employer-group plan members.) Among beneficiaries with hypertension only, 17 percent of those enrolled in MA-PD plans reached the doughnut hole, compared with 30 percent of those enrolled in employer plans.

EXHIBIT 2.

Proportion Of Elderly Medicare Beneficiaries Who Spent $2,250 Or More On Prescription Drugs (The “Doughnut Hole” Threshold), By Selected Conditions, 2006

| Condition | Part D plans | Employer plans | p_value |

|---|---|---|---|

| Percent spending up to doughnut hole | |||

| All | 25% | 40% | <0.0001 |

| Hypertension | |||

| Any | 30 | 46 | <0.0001 |

| Only | 17 | 30 | <0.0001 |

| + Hyperlipidemia | 24 | 42 | <0.0001 |

| + CHF | 39 | 39 | 0.9741 |

| + Diabetes | 34 | 47 | 0.0158 |

| + Hyperlipidemia + CHF | 47 | 70 | 0.0067 |

| + Hyperlipidemia + diabetes | 42 | 59 | <0.0001 |

| + CHF + diabetes | 54 | 68 | 0.3056 |

| + Hyperlipidemia + CHF + diabetes | 61 | 82 | 0.0016 |

| Diabetes | |||

| Any | 41 | 58 | <0.0001 |

| Only | 21 | 44 | 0.0038 |

| + Hypertension | 34 | 47 | 0.0158 |

| + Hyperlipidemia | 31 | 46 | 0.0121 |

| + CHF | 45 | 57 | 0.6660 |

| + Hypertension + hyperlipidemia | 42 | 59 | <0.0001 |

| + Hypertension + CHF | 54 | 68 | 0.3056 |

| + Hyperlipidemia + CHF | 48 | 68 | 0.4120 |

| + Hypertension + hyperlipidemia + CHF | 61 | 82 | 0.0016 |

| Percent spending up to catastrophic coverage region | 4 | 9 | <0.0001 |

SOURCE: Authors’ calculations using study population as described in the text.

NOTES: See Exhibit 1. CHF is congestive heart failure.

The proportion of beneficiaries reaching the doughnut hole increased as the number of chronic illnesses increased. Looking at beneficiaries in the MA-PD plans, about 34 percent with both hypertension and diabetes reached the doughnut hole in 2006, while 61 percent with hypertension, hyperlipdemia, CHF, and diabetes did so. We observed a similar pattern for beneficiaries with diabetes only and with diabetes and other chronic conditions. These results suggest that those facing the doughnut hole took account of it in their (or their physicians’) decisions about drug usage. Note that to the degree the employer group is healthier in unobserved ways, those differences understate the effect of any anticipatory behavior.

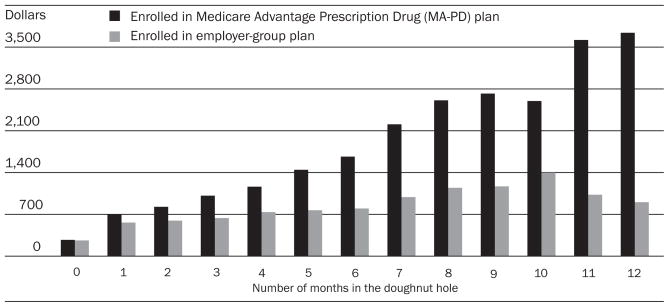

Not surprisingly, out-of-pocket spending among those in the MA-PD plans was much higher than that of beneficiaries enrolled in employer plans because the latter group had coverage for brand-name drugs during the coverage-gap period (Exhibit 3). The difference increased dramatically the longer beneficiaries remained in the doughnut hole.

EXHIBIT 3. Annual Out-Of-Pocket Spending On Prescription Drugs Among Elderly Medicare Beneficiaries In Part D And Employer-Group Plans, 2006.

SOURCE: Authors’ calculations using study population as described in the text.

NOTES: Bars labeled 0 months represent the average annual out-of-pocket drug spending among beneficiaries who did not spend $2,250 or more in 2006 ($2,250 is the level of spending at which the so-called doughnut hole is reached). The bars labeled 1 month display the average out-of-pocket drug spending among those whose total drug spending reached $2,250 in December 2006; the bars labeled 2 months, among those whose spending reached $2,250 in November 2006; and so on.

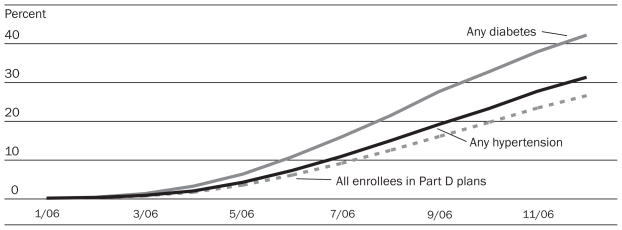

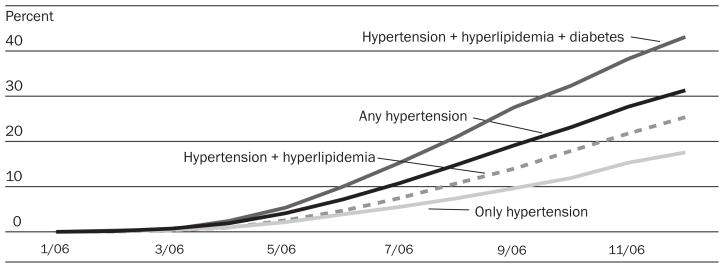

Among beneficiaries who ever reached the doughnut hole, the majority reached it during the second half of 2006. People with different illnesses and combinations of illnesses reached the doughnut hole at different times. Beneficiaries with diabetes not only were more likely to reach the doughnut hole than were beneficiaries with hypertension, they also reached it more quickly. Furthermore, both of these groups reached the doughnut hole more quickly than the average beneficiary enrolled in MA-PD plans (Exhibit 4). Similarly, beneficiaries with multiple conditions were more likely to reach the doughnut hole more quickly than were beneficiaries with only hypertension (Exhibit 5).

EXHIBIT 4. Percentage Of Elderly Medicare Beneficiaries Reaching The “Doughnut Hole” In Each Month, Among Those In Part D Plans With Total Drug Spending Greater Than $2,250 In 2006, With Hypertension Or Diabetes.

SOURCE: Authors’ calculations using study population as described in the text.

EXHIBIT 5. Percentage Of Elderly Medicare Beneficiaries Reaching The “Doughnut Hole” In Each Month, Among Those In Part D Plans With Total Drug Spending Greater Than $2,250 In 2006, With Hypertension And Comorbidities.

SOURCE: Authors’ calculations using study population as described in the text.

On average, 5 percent of all beneficiaries went through the doughnut hole into catastrophic coverage—9 percent in employer-group plans and 4 percent in MA-PD plans. The majority of those who went through the doughnut hole had several chronic conditions.

Responses to the doughnut hole

We examined the medication use of beneficiaries whose spending reached the catastrophic coverage region. As economic theory would have predicted, the number of prescriptions they filled appeared unaffected by the doughnut hole; they filled seven prescriptions per month both before and after reaching it.

Beneficiaries who reached the doughnut hole but not the catastrophic coverage region used five prescriptions per month, on average, before they reached the doughnut hole. Those with no coverage in the doughnut hole, however, reduced medication use by 14 percent, about 0.7 prescriptions per month (0.4 generic and 0.3 brand-name), compared with beneficiaries with coverage of both brand-name and generic drugs (Exhibit 6). Those with coverage for generic but not brand-name drugs in the doughnut hole, however, only reduced use 0.14 prescriptions per month, the net effect of a decrease of 0.5 brand-name prescriptions and an increase of 0.36 generic prescriptions.

EXHIBIT 6.

Impact Of Reaching “Doughnut Hole” On Number Of Monthly Prescriptions Filled

| Number of monthly Rx filled after reaching “doughnut hole” |

|||

|---|---|---|---|

| All Rx | Generic Rx | Brand-name Rx | |

| No coverage vs. full coverage in “doughnut hole” | −0.67**** | −0.40**** | −0.28**** |

| Generic coverage vs. full coverage in “doughnut hole” | −0.14* | 0.34**** | −0.56**** |

| Intercept | 0.64 | 0.51 | 0.44 |

| Number of monthly prescriptions filled before “doughnut hole” | 0.89**** | 0.94**** | 0.71**** |

| Remaining in “doughnut hole” 6 months longer | −0.79**** | −0.20*** | −0.39**** |

| Female | 0.24**** | 0.07 | 0.18**** |

| Age 75–84 | 0.11* | 0.05 | 0.07* |

| Age 85+ | 0.12 | −0.03 | 0.17*** |

| 2006 prospective risk scores | 0.14**** | 0.08**** | 0.02 |

SOURCE: Authors’ calculation using study population as described in the text.

NOTES: Dependent variable is the number of monthly prescriptions filled after reaching the doughnut hole (between $2,250 and $5,100 in spending). Full coverage in the doughnut hole includes copayments, as described in the text.

p < 0.10

p < 0.01

p < 0.001

Thus, some with only generic coverage during the coverage gap switched from brand-name to generic drugs when they reached the coverage gap. Although some with no coverage during the gap may also have switched to generic drugs, we did not detect it.

Estimated cost of mandated coverage of generics in the doughnut hole

The average unit price of a monthly generic prescription in our sample was $26, compared with $106 for a monthly brand-name prescription. Neither of these values includes rebates. Those with generic coverage in the doughnut hole filled, on average, sixteen monthly generic prescriptions during the doughnut-hole period, compared with eight among beneficiaries with no coverage. (This difference includes any differences in risk and copayment between the two groups.) Given an assumed $10 copayment for generic drugs in the doughnut hole, mandated generic coverage would cost plans $256 [($26–$10) × 16] per person during the doughnut hole. That number would increase to $335 and $415 for a $5 copayment or a $0 copayment, respectively, for generic coverage in the doughnut hole, assuming no behavioral response.

To offset this additional cost, which would otherwise raise premiums, Frank and Newhouse proposed that plans be allowed to increase initial cost sharing, which is now prohibited by statute.9 To calculate the necessary increase, we used information on the distribution of spending in our sample. Among the MA-PD plan members with no coverage or with generic coverage during the doughnut-hole period in 2006, 25 percent spent more than $2,250; 53 percent spent between $250 and $2,250 with an average of $1,203; and the rest spent less than $250. Among the 25 percent who spent more than $2,250, the additional cost sharing applies to the $2,000 subject to coinsurance ($2,250–$250); among those who exceeded the deductible but did not reach the doughnut hole, the additional cost sharing applies to the average spending of $1,203; those who spent less than $250 do not contribute in additional cost sharing. Based on this distribution, the coinsurance rate during the initial coverage period would have to increase 5.6 percentage points [$256 × 25%/($2,000 × 25% + $1,203 × 53%)]—or the equivalent in copayments—from the current 25 percent to offset the reduction in out-of-pocket spending due to generic coverage with a $10 copay in the doughnut hole. The additional cost sharing would increase to 7.4 or 9.1 percentage points if the copay for generic coverage were $5 or $0 in the doughnut hole.

These estimates, however, are almost certainly an upper bound, because the group with generic coverage in the doughnut hole is a self-selected group with higher-than-average drug usage. As a result, drug usage among those with no coverage, were they to have such coverage, is likely to be less, perhaps much less, than sixteen monthly prescriptions—the average usage among those in our sample who purchased generic coverage.

Discussion

The doughnut hole is one of the most controversial aspects of the Medicare Part D benefit design. A quarter of beneficiaries enrolled in MA/PD products from a Pennsylvania insurer reached the level of spending to put them into the doughnut hole, compared with 40 percent among those enrolled in employer plans without a doughnut hole who reached a similar level of spending, after the varying prevalence of chronic illnesses was adjusted for. The additional spending in the employer plans is consistent with numerous studies of patients’ responses to drug prices and implies that beneficiaries anticipated the doughnut-hole region and reduced their spending accordingly.10 This finding implies that beneficiaries who did not reach the doughnut hole likely also reduced their use of medications.

Not surprisingly, we found that beneficiaries with more than one chronic illness were much more likely than other beneficiaries to reach the doughnut hole; also, beneficiaries with diabetes were more likely to reach it than beneficiaries with hypertension or hyper-lipidemia.

Medicare beneficiaries who entered the doughnut hole decreased the number of monthly prescriptions by 0.7 prescriptions per month, or about 14 percent, relative to their use before entering the doughnut hole. Beneficiaries with some generic coverage in the doughnut hole increased their use of generics and decreased their use of brand-name drugs—and, as a result, reduced their overall use of medications to a much lesser extent than did those with no coverage. On the assumption that the generic drugs taken by beneficiaries in the employer group were appropriately prescribed, one can assume not only that the lack of coverage in the doughnut hole had adverse health consequences but also that it could have increased costs for hospital and physician services. Based on our descriptive data, we calculated that a six-percentage-point increase in initial coinsurance at most would cover the cost of mandated generic drug coverage with a $10 copayment for those who reached the doughnut hole.

Of course, if such coverage did in fact lower spending for Parts A and B services, we should expect MA-PD plans to cover such drugs, unless the decision to cover engendered adverse selection. The likelihood of such selection, along with the likelihood of savings in Parts A and B from the increased compliance because of coverage, is the rationale for the Frank and Newhouse proposal for mandated coverage of generics in the doughnut hole. Despite the possibility of selection, there is a trend among MA-PD plans toward coverage of generics in the doughnut hole: as of 2008, about half of plans nationwide provided such coverage.11

More generally, one can ask whether the responses to the doughnut hole we observed in a single MA-PD plan might differ in other MA-PD plans or in stand-alone prescription drug plans (PDPs). We believe that the main determinants of differences in behavior across plans are differences in formularies, prior authorization and step-therapy rules, cost sharing, and underlying regional variation in prescribing habits, all of which could vary at least as much among PDPs as between MA-PD plans and PDPs. Because these features do differ among plans, however, the reader should bear in mind that responses to the doughnut hole could vary in other plans.

Acknowledgments

Joseph Newhouse’s research was supported by the Alfred P. Sloan Foundation. He is a director of and holds equity in Aetna, which sells Part D policies. Julie Donohue gratefully acknowledges financial support from the National Center for Research Resources, a component of the National Institutes of Health (NIH), NIH Roadmap for Medical Research (Grant no. KL2-RR024154-01). The University of Pittsburgh Institutional Review Board approved this study. The study design and analysis were done by the authors.

Footnotes

Beneficiaries who entered the “doughnut hole” decreased their monthly prescriptions by about 14 percent per month.

NOTES

- 1.Dollar values for the coverage gap and catastrophic coverage region in subsequent years were indexed to increases in drug spending.

- 2.Medicare Payment Advisory Commission. [accessed 19 May 2008];Report to the Congress: Increasing the Value of Medicare. 2006 June; http://www.medpac.gov/publications/congressional_reports/Jun06_EntireReport.pdf.

- 3.Hsu J, et al. Medicare Beneficiaries’ Knowledge of Part D Prescription Drug Program Benefits and Responses to Drug Costs. Journal of the American Medical Association. 2008;299(16):1929–1936. doi: 10.1001/jama.299.16.1929. [DOI] [PubMed] [Google Scholar]

- 4.MedPAC. [accessed 1 December 2008];A Data Book: Healthcare Spending and the Medicare Program. 2008 June; http://www.medpac.gov/documents/Jun08DataBook_Entire_report.pdf.

- 5.Henry J. Kaiser Family Foundation. [accessed 1 December 2008];Medicare Fact Sheet: The Medicare Prescription Drug Benefit. 2006 November; http://www.kff.org/medicare/upload/7044-05.pdf.

- 6.Pope GC, et al. Risk Adjustment of Medicare Capitation Payments Using the CMS-HCC Model. Health Care Financing Review. 2004;25(4):119–141. [PMC free article] [PubMed] [Google Scholar]

- 7.Relative to other medical spending, prescription drug spending is highly persistent and therefore predictable to consumers. See Pauly MV, Zeng Y. Adverse Selection and the Challenges to Stand-Alone Prescription Drug Insurance. Frontiers in Health Policy Research. 2004;7:55–74. doi: 10.2202/1558-9544.1051.

- 8.Frank RG, Newhouse JP. [accessed 1 December 2008];Mending the Medicare Prescription Drug Benefit: Improving Consumer Choices and Restructuring Purchasing. 2007 April; http://www.brookings.edu/papers/2007/04useconomics_frank.aspx.

- 9.Ibid.

- 10.See, for example, Goldman DP, et al. Pharmacy Benefits and the Use of Drugs by the Chronically Ill. Journal of the American Medical Association. 2004;291(19):2344–2350. doi: 10.1001/jama.291.19.2344.and Huskamp HA, et al. The Effect of Incentive-Based Formularies on Prescription-Drug Utilization and Spending. New England Journal of Medicine. 2003;349(23):2224–2232. doi: 10.1056/NEJMsa030954.

- 11.Kaiser Family Foundation. [accessed 19 May 2008];Medicare Prescription Drug Plans in 2008 and Key Changes since 2006: Summary of Findings. 2008 April; http://kff.org/medicare/upload/7762.pdf.