Abstract

We review existing research and policy evidence about income as an essential component to meeting children’s basic needs—that is, income represented as the purest monetary transfer for increasing the purchasing power of low income families. Social scientists have made great methodological strides in establishing whether income has independent effects on the cognitive development of low-income children. Our review of that research suggests that a $1,000 increase in income has positive, but small, effects on children, rarely exceeding 1/10th of a standard deviation change in outcomes for children. We argue that researchers are well-positioned for more rigorous investigations about how and why income affects children, but only first with thoughtful and creative regard for conceptual clarity, and on understanding income’s potentially inter-related influences on socio-emotional development, mental, and physical health. We also argue for more focus on the effects of income transfers, including when conditional on employment, as compared to more targeted direct investments in children. We end with a description of two-generation and cafeteria-style programs as the frontiers of the next generation in income-enhancement policies, and with the promise of insights from behavioral economics.

Introduction

The sharp economic downturn of 2008 is likely to have profound influences on the lives of American children across the economic distribution. Particularly disheartening is the fact that, after decreasing over the course of the 1990s, child poverty rates are inching back upwards, and they may escalate through 2009, as employment opportunities for parents shrink, earned income decreases, and pressures on public finances squeeze the social safety net. Although the United States has made great strides toward eradicating extreme deprivation, policymakers continue to grapple with the need to break intergenerational cycles of persistent poverty.1 In this paper, we review existing evidence about income as an essential component to meeting children’s basic needs—that is, income represented as the purest monetary transfer for improving the purchasing power of low-income families. We focus on economic deprivation as it can be resolved by enhanced income to ensure housing, food, clothing, and investments in education and health care—components of basic needs described in more detail in the other chapters of this special issue.2

We begin with a brief overview of child poverty in the United States, followed by a more in-depth discussion of antipoverty and income-related policies. We then describe a conceptual framework that has served as a foundation for understanding how antipoverty policy—through its effects on family income—can affect children’s developmental outcomes. Our discussion of research evidence on income effects is organized around the following questions: Does income matter? Why does income matter? What is the magnitude of the income effect? What is its cumulative influence on children’s developmental outcomes? Does the influence of income vary by children’s stages of development? Does the effect of income vary by developmental domain?

These questions are not only important for scientific knowledge, but also, in our view, they are integral to informing policy. There are clear policy tradeoffs in debating income enhancement: Should we target income directly (allowing parents to spend the increased resources as they choose), or should we target the intervening mechanisms that may mediate the relation between income and outcomes for children (Mayer, 2002), thereby encouraging the use of early education, childcare, and health insurance? Such policy tradeoffs can be informed by theory and evidence, such as the theory and evidence we review in this paper.

Does income matter? This fundamental question has drawn more attention from researchers than any other related one, and has fueled a large body of research that points mainly to income’s statistically discernible role on children’s developmental outcomes. The evidence that income does matter is essentially only a starting place. The crux of the poverty policy dilemma is to understand tradeoffs: We highlight what is known and what remains uncertain in relation to questions about the ways in which increased income can affect the development of children. How much does income matter and does it matter more or less than family environment, parenting, or schools? Small primary effects of increased income may or may not influence secondary effects on parenting or investments in the home environment. What are the immediate effects of increased income, and how does increased income reinforce other aspects of family life? These debates raise important questions about whether income enhancement should be coupled with policy goals to minimize income loss and preserve a social safety net. Or, should such policy goals be re-cast to focus on income volatility, because economic instability traps families into deep poverty?

Next, why does income matter? There is accumulating evidence from prior and current research to suggest that an increase in income improves child wellbeing, or rather, that poverty is detrimental to children’s development (see Magnuson & Votruba-Drzal, 2009, for a recent review). But how much is improvement in child well-being a result of parents providing more material or educational resources for their children, and how much is a result of parents being less stressed? Traditionally, two theoretical paradigms for the mediating effects of income have emerged from research: one might conceptualize the effects of income on children with the parenting stress model: Parents with increased incomes feel less stressed and therefore practice better parenting (McLloyd, 1990). Or, one might consider the effects of income from an investment perspective: More income allows parents to provide material goods such as nutrition and health care, and to invest in educational resources for their children, including books and trips to museums (Becker, 1981; Becker & Tomes, 1986). More recently, researchers have taken a more holistic approach to understanding the effects of income on child development. Understanding why income matters is, in our view, essential for guiding policy debates and assessing the most cost-effective policy strategies for improving children’s developmental outcomes. For example, if the policy goal is to improve children’s cognitive development, are resources better spent increasing families’ income through income transfers so that families can afford high-quality early care settings, or investing directly in universal access to high-quality early care settings? Would a focused investment on a key mediator (such as high-quality early care settings) have a bigger impact on children’s lives? Or is it critical to allow families to have discretionary control over their spending?

In addition to these questions about the effects of income on children’s environment, there is a body of research tying income to facets of children’s developmental growth; some of the key areas of inquiry include whether the influence of income varies across a child’s developmental life course, how it varies by developmental domain, and what its cumulative effects are. This research informs discussions about allocating resources, such as whether it is better to make investments that are tailored to early childhood or to adolescence, and whether income supplements should target mothers of very young children or mothers whose oldest child is an adolescent. A related line of inquiry could investigate targeting income-enhancing policies or programs that might have direct influences on cognitive outcomes (for example, purchasing books, educational trips, literacy curricula) versus behavioral outcomes (mental health services, smaller classroom sizes) or health-related elements (access to preventive health care, health insurance subsidies).

We end our review by proposing an interdisciplinary and integrated conceptual framework that is slightly revised from the one most commonly used, and by suggesting productive areas for future research and policy debate.

A Recent Historical Overview of Childhood Poverty and Cash-Transfer Policies in the United States

We begin with a history of income policy in the U.S. as the background for understanding the motivation behind much of the research on income and income-enhancement policy effects on children. The challenge of eliminating poverty in post-industrial America took center stage under President Johnson’s administration during the 1960s.3 That administration’s agenda formulated the poverty dilemma as a problem of underinvestment in human capital—low earnings, low income, and low consumption—and this has fueled poverty thinking to this day. The policy response of the 1960s launched a platform for decades of program and policymaking to enhance earnings capacity broadly construed as Head Start and early education, to youth and adult job, education, and training programs. And, this policy focus simultaneously nurtured support for a social safety net to ensure the poor can meet their basic day-to-day needs. It was at this time that Molly Orshansky, then at the Social Security Administration, developed a poverty threshold based on the Department of Agriculture’s Thrifty Food Plan in which her analyses showed that a family spent approximately one-third of their after-tax income on food (Orshansky, 1963). In 1965, the Office of Economic Opportunity under the Johnson administration adopted Orshansky’s poverty threshold as a working definition of poverty. The poverty measure has been used ever since to track the poverty levels of the U.S. population, determine eligibility for a number of programs (Porter, 1999), and fuel decades of research on poverty effects on children.

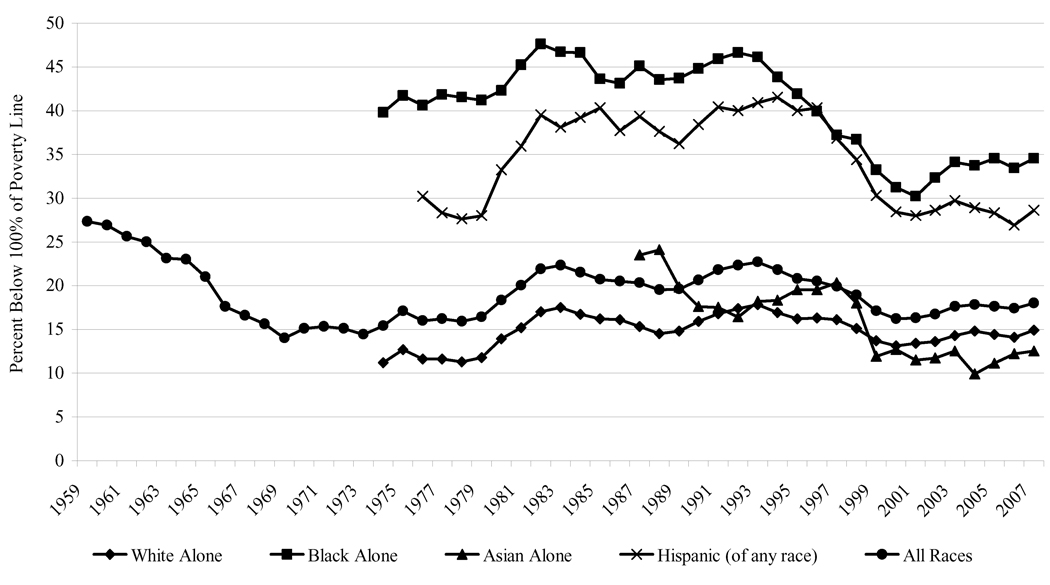

Tracking poverty through this measure has also served as an effective device to monitoring the economic state of children through time. Figure 1 shows trends in child poverty from 1974 to 2006, overall and by racial/ethnic group. The poverty rate for children increased by more than 50 percent by 1983 (Betson & Michael, 1997), when the United States experienced the highest poverty rate since 1958 (Corcoran & Chaudry, 1997; Lewitt, 1993).4 The poverty rate for children under 18 years of age was at 21 percent in 1995, comparable to the rate in 1983. The gradual declines in poverty in the late 1990s were met with increases by 11 percent from 2000 to 2006. Data from 2007 show that nearly 13 million (or 17 percent) of American children live in families with income below the official poverty level, with substantial variability across states, ranging from 6 percent in New Hampshire to 29 percent in Mississippi (Fass & Cauthen, 2007).

Figure 1. Poverty Status of Children Under 18 Years of Age, by Race and Ethnicity: 1959–2007.

Source: U.S. Census Bureau, Current Population Survey, Annual Social and Economic Supplement (formerly called the March Supplement), various years. see http://www.census.gov/hhes/www/poverty.

The causes of poverty in the U.S. are multifold, including both compositional (i.e., due to changing composition of demographic groups that are more likely to be poor, like single parents) and structural roots (i.e., due to changing economic policies).5 Breakdowns of the relative contribution of these factors are rare, but one example (Lewit, 1993) shows that of the 3.2 percent of the increase in child poverty between 1980 and 1991, over half can be attributed to a change in family structure, about a fifth to a decline in the value of cash benefits and a change in the basket of government support programs, and the rest to the decline in real wages of workers lacking a college education and to an increased number of children born to unmarried teenagers.

Compositionally, because children who are disproportionately poor are more likely to belong to minority groups, single-parent families, and large families, or to be children of high school dropouts (Betson & Michael, 1997; Hook, Brown, & Kwenda, 2004), shifts in poverty tend to follow general demographic shifts in the U.S. population. This trend is most evident as the United States witnesses substantial increases in an immigrant Hispanic population that commonly finds its entry point through the informal and less skilled U.S. labor market. It is also evident through pockets of concentrated poverty in highly urban areas and far-flung rural ones: Of the 100 counties with child poverty rates above 40 percent, 95 are rural and 74 of those rural counties are in the South. Demographic and residential shifts also bring with them changes in societal expectations that can drive poverty trends. For example, community-level characteristics, such as rates of divorce at the census-tract level, are highly correlated with teens’ own decisions to become parents or to get married.

Employment and public policy are additional structural factors that can affect poverty rates. Indeed, employment has taken on increased prominence as a key force underlying poverty-alleviation strategies (see recent discussions by Haskins, 2008 and Blank, 2009): The poverty rate of children in female-headed families is three times higher if the mother is nonemployed than if she is employed (Lichter & Eggebeen, 1994). With declines in real wages and fewer opportunities for career advancement and earnings growth, higher proportions of parents in working families cannot work their way out of poverty. More than 80 percent of low-income children reside in families with at least one parent who is employed, and 55 percent reside in families with a parent who is employed full-time, year-round (Fass & Cauthen, 2007).

Lyndon B. Johnson’s War on Poverty in the 1960s spurred decades of policy reform with some of the most influential and controversial policies the United States has known, including the Family Support Act in the 1980s; expansions in Earned Income Tax Credit (EITC); the 1996 welfare reform; and a range of expansions in work supports, most notably childcare assistance and children’s health insurance (State Children’s Health Insurance Program, SCHIP). A review of the effects of these policies on income, detailed below, suggest that many of them have been quite successful in meeting their targets of improving economic well-being, at least in the short term, and that in some cases, the improvements associated with more income are offset by the effects of these same policies on parents’ employment.

The most significant contemporary policy reform for poor families was the replacement of Aid to Families with Dependent Children (AFDC) with Temporary Assistance for Needy Families (TANF), upon the passage of the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) in 1996. From 1935 to 1996, AFDC was an entitlement program financed by a federal matching grant that offered cash benefits to all families that met its income and asset limits. The 1996 reform law transformed welfare into federally-funded block grants whose main purpose is to promote self-sufficiency by requiring and supporting work. The block grants allow states considerable discretion in how to attain this goal, though central features include time limits, work requirements, and work supports such as childcare and transportation assistance (Moffitt, 2003).

Research points to the beneficial effects of welfare reform on work participation, earnings, and family income (see Haskins, 2006, for an overview), though debate remains about the extent to which the effects were additionally fueled by a forgiving economy with a high demand for labor (Blank, 2001; Schoeni & Blank, 2003). Schoeni and Blank (2003) use aggregated, state-level, panel data from the Current Population Survey to estimate the effects of state-specific welfare waivers granted prior to welfare reform and the implementation of the 1996 TANF legislation on family earnings, income, and poverty for working-age women at different education levels. In their research, the effects of welfare waivers are estimated separately from the effect of the official implementation of TANF, because many states began implementing work-oriented policies, such as time limits, work requirements, and earnings disregards, in the early 1990s, under waivers of the AFDC law. Schoeni and Blank find that, among women with less than a high school education, welfare waivers increased women’s own earnings by about 5 percent, primarily attributable to new employment among women not formerly employed; increased total family income by about 6 percent; and decreased the percentage of working-age women living in poverty by 9 percent. TANF did not affect all parts of the income distribution similarly, however. Among women with less than a high school education, TANF increased income by nearly 8 percent at the fiftieth percentile, but there was no evidence of an effect on income in the lowest quintile of the income distribution.

Morris, Gennetian, and Duncan (2005) use pooled data from 7 random assignment studies evaluating 13 welfare-to-work programs to estimate the impacts of these types of programs on earnings and income. Welfare-to-work programs began in the early- to mid-1990s under AFDC welfare waivers, and were designed to mimic different components of welfare reform. Prior work by Bloom and Michalopoulos (2001) found that these programs fall under two broad categories: (1) earnings supplements programs that provided generous monthly cash supplements to earnings or earnings disregards, and (2) mandatory employment services programs with no earnings supplements, some with time limits. Using this categorization of the programs, Morris, Gennetian, and Duncan show that, for their sample of parents of young children, the earnings supplements programs increased average earnings by $926 and total family income by $1,703 (14 percent). The programs with no earnings supplements increased earnings by $645, but this increase was offset by a decrease in welfare payments, resulting in no statistically significant increase in family income across programs.

Evidence of the effects of the federal EITC, a refundable tax credit based on a family’s household composition and earnings, also demonstrates that earnings supplements reduce poverty and increase family income among low-income working families by both supplementing wages and providing incentives for people to enter the labor force. After sizeable legislative expansions in 1986, 1990, and 1993, the EITC is now the country’s largest cash or near-cash antipoverty program (Scholz, Moffitt, & Cowan, 2008). In tax year 2003, the average tax credit was $2,100 for families with children (Greenstein, 2005), and in tax year 2008, the maximum credit was $4,824.6 Analyzing 2003 Current Population Survey data, Greenstein (2005) finds that the EITC lifted 2.4 million children out of poverty, and that in its absence the child poverty rate would have been almost 25 percent higher. Kim (2001) finds that in 1997, the EITC raised average disposable income by 9.9 percent for recipient families with children and by 22.5 percent for those living in poverty. Among EITC recipient families with children, the EITC reduced poverty from 37.1 percent to 27.0 percent (a decrease of 27.2 percent).

In 24 states, the federal EITC is supplemented with state EITC, which is refundable in 21 states. The state EITC partially matches the federal credit, and the match rate ranges from 3.5 percent (Louisiana and North Carolina) to 40 percent (District of Columbia). The impact of the state EITC on child poverty also varies by state. A study by the National Center for Children in Poverty (2001) estimates that the additional impact of the state EITC on closing the gap between a family’s income-to-needs ratio and the poverty line for children in working families ranges from 0.2 percent in Maine to 9 percent in Minnesota.7

Another tax policy that can increase the income of low-income families is the Child Tax Credit. Families can claim up to $1,000 per child (in 2007).8 While this credit is normally nonrefundable, the Additional Child Tax Credit created in 2002 is partially refundable and available to taxpayers with no tax liabilities and earnings over $11,750.9 We could not locate any research that separately examines the effects of the Child Tax Credit.

Increasing the minimum wage has often been cited as a tool for alleviating poverty. Furman and Parrott (2007) examine how an increase in the hourly minimum wage from the then current level of $5.15 to a proposed level of $7.25 would affect family income for a typical family of four with one full-time worker who earned the minimum wage. They calculate that this increase would raise a worker’s annual earnings by $4,200, which would then trigger a $1,140 increase in the family’s EITC and refundable Child Tax Credit. Taking into account the subsequent decrease in the family’s food stamp benefits, the $7.25 minimum wage would put such a family five percent above the poverty line in 2009, instead of 11 percent below the poverty line, as it would be otherwise. They also point out that 48 percent of minimum-wage workers are their household’s primary breadwinner, and that 47 percent of minimum-wage workers live in families with cash incomes below 200 percent of the poverty line.

Studies that consider both the costs and benefits of increasing the minimum wage find that the benefit derived from the increase in family income for minimum-wage workers may be offset by the loss of jobs and number of hours of work that would occur as employers respond to the increased cost of labor. Neumark and Wascher (2002) use variation from state-level minimum wage changes to look at the effects of minimum wages on family incomes and the probability of transitions into and out of poverty, and they find that over a one- to two-year period, a minimum wage increase raises the probability that poor people escape poverty (through increased earnings) and also raises the probability that nonpoor people fall into poverty (through a decrease in employment). The probability of the latter is larger, though the net effect is not statistically significant. Sabia (2008) uses CPS data to examine the relationship between minimum wage increases and single mothers’ economic wellbeing. He finds that, while minimum wage increases do raise wages for single mothers without a high school education, they do not reduce poverty for these women. The reason, he explains, is that the increase in wages is offset by significant decreases in employment and hours worked: A 10 percent increase in the minimum wage is associated with an 8.8 percent reduction in employment and a 9.2 percent reduction in weekly hours worked for this group.

The aforementioned research focuses on unpacking the effects of specific cash transfer and tax policies on family income and child poverty. An equally important literature assesses the aggregate effect of these policies. Scholz, Moffitt, and Cowan (2008) estimate the extent to which the combination of income supports close the poverty gap.10 The bundle of income supports that they use includes social security, unemployment insurance, workers compensation, SSI, AFDC/TANF, the EITC, the child tax credit, general assistance, other welfare, foster-child payments, food stamps, and housing assistance. They find that this safety net reduces the poverty gap for the overall population by 63 percent, leaving about 14 percent of families poor. Among non-elderly single-parent families, these transfers fill 75 percent of the poverty gap, leaving about 18 percent of single-parent families in poverty.

The Common Conceptual Framework

Debates about the detriments of child poverty and the appropriate policy response are based on a theoretical framework, but this framework is not often featured during policy forums. The framework serves as a foundation for a body of social science research, and it informs the ways in which income affects children’s development—but even more significantly, it elucidates how such effects may occur. Understanding the mediators of income effects on children is not, therefore, just an important theoretical exercise in the service of enhancing scholarship, but also the lynchpin for informing cost-efficient policy strategies to improve the outcomes of low-income children.

As discussed previously, the theoretical background of income’s influence on children’s development is dominated by two complementary theories—family stress, highlighting the role of stress, mental health, and parenting practices in the association between low income and children’s development; and investments, emphasizing the limited ability of low-income parents to invest in their children’s human capital.

One pathway by which income can affect children’s well-being is through changes in family functioning and parenting practices. Increased income may influence children's development in this theoretical model by reducing parental stress and thereby changing the parent-child relationship (Mcloyd, 1990; McLoyd, Jayartne, Ceballo, & Borquez, 1994). This work builds from Glen Elder's seminal work on economic hardship during the Great Depression, which identified a link between job and financial loss and punitive, inconsistent parenting behavior (Elder, 1974, 1979; Elder, Liker, & Cross, 1984). McLoyd further expanded this model for relevance to African-American single-parent families (McLoyd, 1990), concluding that job loss, through financial strain and psychological distress, affected parenting behavior and, ultimately, adolescent wellbeing (McLoyd et al., 1994). Her work suggests evidence that economic changes and parenting are mediated by changes in parents' emotional wellbeing, such as the onset of depression (see McLoyd, 1998, for a review).

In addition, income can affect the resources that families can provide for their children, which in turn can influence children's development (Becker, 1981; Coleman, 1988). Increased resources include both material investments (goods such as food or books), and nonmonetary investments (such as time). Evidence from nonexperimental studies has suggested that the provision of cognitively stimulating home environments differs across poor and nonpoor households, and may account for a sizeable amount of the variance in educational outcomes for children (Duncan & Brooks-Gunn, 2000; Voltruba-Drzal, 2006). Working parents have less time to spend with their children, although families who are not working may actually have greater time resources to spend.

The Effects of Income on the Development of Low-Income Children

Decades of research support some of the hypotheses in the conceptual framework described above and tend to point to a strong correlation between family income and children’s developmental outcomes. Children in higher-income families consistently do better developmentally than children in lower-income families (Haveman & Wolfe, 1994, 1995; Duncan & Brooks-Gunn, 1997). Much of this research, however, does not attempt to estimate the causal relationship between income and child development (see Mayer, 1997 and Mayer, 2002, for critical reviews). It is often not clear whether the differences between poor and nonpoor children are caused by poverty itself or by the many correlates of poverty, such as low-education and single-parenthood. Even when controlling for such measurable characteristics, any factors that are positively correlated with family income, that positively affect child outcomes, and that are not included in the estimation of the income-child development relationship, will bias these estimates upward (omitted variable bias). For example, higher motivation may lead a parent both to earn more money and to encourage her children to do well in school. If motivation is not taken into account in the estimation of the effects of income on children’s cognitive skills, the positive effect of parents’ motivation on children’s cognitive skills will be inappropriately attributed to family income. Other commonly unmeasured characteristics include parents’ innate ability and mental or emotional health. This section reviews evidence of the effects of family income on child wellbeing, focusing on studies that convincingly address this bias, either through experimental or nonexperimental methods.

Blau (1999) and Mayer (1997) provide some of the first ground-breaking research that applied more sophisticated (though nonexperimental) approaches to identify causality and conclude that income has negligible to nonstatistically significant impacts on children’s developmental outcomes. Blau (1999) uses fixed-effects techniques, controlling for within and multigenerational differences in families (e.g. a grandparent fixed effects that exploits comparisons across children of sisters, claiming that sisters likely have similar background characteristics and parenting behavior since they were raised by the same parents). He finds a positive effect of permanent income on child behavior, but notes that the effects are too small to be policy-relevant. Mayer (1997) includes controls for a host of factors that might confound income estimates, including future income, as a proxy for unmeasured parental characteristics that affect income, and finds that the estimated effects of income on test scores and behavior for five- to seven-year-olds and on teenage motherhood and dropping out of school for adolescents were vastly overestimated using ordinary least squares (OLS) estimation. Notably, however, Blau’s work provides unbiased estimates of income only under the assumption that there are no time-varying unobserved characteristics of families that affect income estimates, and Mayer’s work is based on assumptions about the effects of future income on current behavior.

Some newer similarly sophisticated research by Vortruba-Drzal (2006), who applies change models to estimate the effect of family income, finds that early childhood income has positive effects on both academic outcomes and behavior in middle childhood, but, again, these effects are very small. Shea (2000) uses a two-stage, least-squares approach that exploits the variation in fathers' earnings potentially due to luck (including job loss caused by establishment death, such as plant closings), union membership, and industry, and does not find evidence that family income affects children's labor market outcomes during adulthood.

The evidence herein suggests few and small effects of income. However, importantly for this paper, these estimates are arrived at using socio-economically diverse samples, and the effects of income may substantially differ for children in families at the lower end of the income distribution.

Indeed, it is likely that changes in income have stronger effects on children in low-income families, who may be more vulnerable to material deprivation and stress (Alderson, Gennetian, Dowsett, Imes, & Huston, 2008). A study by Dearing, McCartney, and Taylor (2006) provides some evidence for this hypothesis. They use multilevel modeling to see if variation in income over time is related to variations in behavior over time for children aged 2 years old through the first grade. Although they estimate that a $10,000 increase in family income only reduces externalizing behavior problems (acting out behaviors such as hitting and visible uncooperativeness) by 0.01 standard deviations and that there are no statistically significant effects on internalizing behavior (such as withdrawal) for children in their whole sample, they find larger effects for poor children. More specifically, among children who were never poor, a $10,000 increase in income reduces externalizing behavior by 0.01 standard deviations. The effect among transiently poor children is not statistically significantly different from children who were never poor. But among chronically poor children, a $10,000 increase in income reduces externalizing behavior problems by 0.15 standard deviations.11 Because this article focuses on low-income children, and because there is evidence that the relationship between income and child well-being has a steeper slope at lower levels of the income distribution, the remainder of this section will focus on the effects of income for children from low-income families.

Despite the advances in nonexperimental methodology to address omitted variable bias as previously described, random assignment experiments and natural experiments provide the most promising opportunities to disentangle the effects of family income on child wellbeing from the effects of other correlates of income or poverty. When implemented well, such experiments provide the most reliable evidence of income effects. Since people in the treatment and control groups are similar in measured and unmeasured characteristics, any difference between the two groups can be attributed to the treatment itself. In other words, the estimate of the treatment’s effect is unbiased. A disadvantage of experimental evidence is that it is strong on internal validity, being based on a sample that represents a population specific to the policy context and the time period in which the experiment was conducted, and low on external validity. For example, it may not be possible to generalize evidence from the set of MDRC welfare-to-work experiments to all low-income families, as the experiments included mostly single-parent families receiving welfare in the 1990s. Conversely, much of the nonexperimental research uses datasets with large, nationally representative samples.

Four income-maintenance experiments conducted in the 1970s to evaluate the effects of a negative income tax find that providing guaranteed income levels to parents in poor families lowered those parents’ labor force participation. Although children’s outcomes were not the main focus, the experiments also tested the effects of guaranteed income on children’s health and school performance. In all four experiments, families in the treatment group received a monthly income supplement of an amount based on the family’s income level and structure. The treatment group was also subject to lower tax rates on additional income, compared to a 100 percent tax rate under the welfare system at the time. The four experiments differed in their eligibility criteria and in the selection of noneconomic outcomes measured. In the sites where health outcomes were measured, children in the treatment group had higher quality of nutritional intake and higher birth weight than children in the control group. School performance outcomes were each measured across two or three of the four experiments, and results were consistent: Children whose families received income supplements attended school more regularly and had higher grades and test scores than children not receiving the income supplements (Salkind & Haskins, 1982). However, it is not possible to ascertain how much of these impacts on child outcomes can be attributed to increases in family income versus reduced parental employment.

Results from a set of random assignment experiments conducted by MDRC in the early to mid-1990s also suggest that income had positive effects on child achievement. As mentioned above, while all seven welfare-to-work programs increased employment, only programs that provided earnings supplements increased family income. The mandatory employment programs without earnings supplements that did not raise family income also did not have any statistically significant effects on child achievement. On the other hand, the employment programs with earnings supplements that increased average family annual income by about $1,700 did have positive, albeit small, statistically significant effects on young children’s achievement. An additional $1,000 of income was estimated to increase school achievement by 8 percent of a standard deviation among young children. The analysis finds no effect on children’s achievement in middle childhood. All programs ended after three years, and the effects of parents’ economic outcomes faded soon after. In the absence of these increases in income, the positive effects on achievement faded as well (Morris, Gennetian, & Duncan, 2005). As with the results from the income-maintenance experiments in the 1970s, it is possible that at least part of these positive effects on child achievement can be attributed to other benefits provided through these programs, such as childcare assistance.

A separate analysis of this experimental data by Duncan, Morris, and Rodrigues (2008) uses an instrumental variables technique to leverage the variation in income and achievement that arises from random assignment to the treatment group to more precisely measure the causal effect of income on child achievement. Duncan, Morris, and Rodrigues (2008) find that a $1,000 increase in annual income is expected to increase child achievement by 6 percent of a standard deviation. This is consistent with an earlier paper using the same analytic technique by Morris and Gennetian (2003), which finds positive and statistically significant effects of income on school engagement and positive social behavior but no statistically significant effects on achievement and problem behavior. Applying an instrumental variables method to this experimental data, Gennetian, Hill, London, and Lopoo (2009) find that maternal employment negatively affects young children’s health, but that evidence on the independent effects of income on child health is inconclusive. That programs without an earnings supplement decreased the probability that a child would be in above-average health by 6 percent of a standard deviation, and earnings supplements programs increased this probability by 5 percent of a standard deviation, suggests that income has a positive effect on child health (or at least serves to protect children from the detrimental effects of maternal employment). However, instrumental variable models used to isolate the effect of income from maternal employment on child health are inconclusive (Gennetian et al., 2009).

In addition to the experimental findings, there are some newer natural experiments that also suggest small benefits from income. Natural experiments are different from actual random assignment experiments in that the researcher does not manipulate behavior by assigning part of the sample to a treatment group and the other part to a control group; instead, something occurs outside of the researcher’s control or design to approximate random assignment, and this event yields differences in outcomes that are interpreted as causal impacts. The reliability of estimates from a natural experiment study depends in large part on how closely the event approximates random assignment, and on how well the event targets the outcomes of interest.

Costello, Compton, Keeler, and Angold (2003) exploit changes in income after a casino opened on a Native American reservation to conduct a natural experiment. While researchers studied psychiatric disorders of rural children in western North Carolina, a casino opened on the reservation in one of the study’s 11 counties, providing a share of the profits to Native American families on the reservation. Many Native American families (constituting one-fourth of the researchers’ sample) were lifted out of poverty, while the children of other races in the sample did not receive this income supplement. The authors find that the children who stayed poor increased their total psychiatric symptoms by 21 percent, the children who left poverty decreased their total psychiatric symptoms by 40 percent, and those who were never poor showed no change in their low levels of psychiatric symptoms. Specifically, the increase in family income lowered levels of conduct and oppositional disorders but had no effect on anxiety or depression. These estimates of the causal effect of income on psychiatric disorders are reliable to the extent that the changes in psychiatric disorders can be attributed to the increase in family income and not to other factors affected by the casino openings, such as the increase in employment due to the jobs created by the casino. A related study uses these same data, but compares children who were in households with and without the income transfer, without any concurrent changes in human capital (Akee, Copeland, Keeler, Angold, Costello, 2010). Their results also show benefits of income gains for children’s educational attainment and reduced crime, for children of American Indians who received these cash transfers.

Another study uses adoptees in a natural experiment by exploiting the variation in the schooling outcomes among adopted children and their non-adopted siblings (Plug & Vijverberg, 2005). The authors claim that using adoptees mimics a random assignment experiment because adoptees do not get their adoptive parents’ genes, and a relationship between family income and educational outcomes therefore can be estimated as causal. Their estimation models control for the parents’ I.Q., the income of the children’s grandparents’, and the number of years of schooling of both the parents and the grandparents. The authors find evidence that family income increases the number of years of schooling a child completes and the probability that he or she will graduate from college. They also find that family income has a nonlinear relationship with schooling outcomes and that family income while a child is in primary school matters more for children with family income towards the middle of the distribution, and family income while a child is college-age matters more for children in families with income at the lower end of the distribution. As the authors acknowledge, these estimates can be interpreted as causal only if there is no relationship between a parent’s ability to earn more money (not measured by parental I.Q. and education) and parenting quality.

A research method similar to exploiting naturally occurring variation in income is using exogenous variation in income, when the variation is induced by policy changes that affect families unevenly because of differences in timing or locale. Such variation is exogenous because it is unrelated to parent or family characteristics that may affect both family income and child outcomes. An advantage of using variation in income caused by changes in policy is that the resulting estimates are based on a population and a type of income change that would most likely be affected by an actual policy change. One study by Dahl and Lochner (2008) uses changes in the EITC over time and across different types of families as an exogenous source of variation in income to estimate the effect of family income on children’s math and reading scores. The authors use instrumental variables methods to isolate the exogenous variation in income caused by the EITC policy changes over time from other factors that potentially influence family income levels. They find that a $1,000 increase in current income raises combined math and reading test scores by 6 percent of a standard deviation for children aged five to fifteen within a year, and that these effects are much stronger for more disadvantaged children. However, the effects fade out after a year if the family’s higher level of income is not maintained.

Milligan and Stabile (2008) use a similar approach to exploit the variation in income caused by differences in the Canada Child Tax Benefit across province, time, and number of children in the family to estimate income effects on children’s educational outcomes and mental and physical health. They find evidence that among children of parents without a high school education (the education group identified to be most likely to receive child tax benefits), increases in income lead to substantial improvements in education outcomes and physical health for boys, and in emotional wellbeing for girls. They estimate that, within this more disadvantaged group, an additional $1,000 in benefits increases math scores by nearly 20 percent of a standard deviation among six- to ten-year-old boys and cognitive test scores by about 17 percent of a standard deviation among preschool boys; increases overall health by only 2 percent of a standard deviation; reduces incidence of experiencing hunger by 2 percent of a standard deviation; and increases height by about 5 percent of a standard deviation. They did not find evidence of any income effects on these outcomes for girls; however they did find that an additional $1,000 in benefit income reduces physical and indirect aggression by a tenth of a standard deviation for four- to ten-year-old girls.

The evidence across these studies suggests that family income has a positive but small independent influence on child development for low-income children. This contrasts with the early research by Blau (1999) and Mayer (1997) that suggested negligible income effects. These studies, based on a variety of methods using data from planned and natural experiments, suggests that income does indeed have a positive effect on outcomes for children, though effects are small, and much smaller than those initially estimated using correlational approaches. More specifically, estimates of the effects of a $1,000 increase in family income rarely exceed a tenth of a standard deviation improvement in child outcomes. Moreover, while there is less research on emotional and behavioral outcomes as compared to cognitive performance and academic achievement, these studies do suggest effects of income are positive across domains of children’s development. This stands in contrast to the earlier correlational research that had found somewhat larger effects of income on cognitive and academic outcomes compared with effects on emotional and behavioral outcomes.

It is also rare to find work that tests whether the investment pathway (that is, purchasing more books or better education for a child) matters more, less, or the same as the parenting pathway (that is, the idea that the way parents interact with their children can also be a function of children’s psychological health). In one study, Yeung, Linver, Brooks-Gunn (2002) use the 1997 Child Supplement Data from the Panel Study of Income Dynamics and find that income effects seem to be mediated by both investment and maternal psychological wellbeing. Their descriptive models lacked the statistical power to unpack the potential unique contribution of each. More recently, Raver, Gershoff, and Aber (2007) assessed whether the observed influences of income on children’s development are similar across racial/ethnic groups (and take great strides in addressing measurement and modeling equivalence) and find similar paths from family income to material resources for White and ethnic minority children, as well as for parenting processes (for example, lower income is linked to increased hardship and higher stress). Gershoff, Aber, Raver, and Lennon (2007) further incorporated the role of material hardship into their models to better understand the mediating pathways of income and concluded that associations between income and children’s cognitive skills appear mediated by parental investment, whereas associations of material hardship and social-emotional development appear mediated through parent stress and decreased positive parenting behavior. Although each of these careful investigations empirically uncovers potential pathways for income effects, they also each suffer from a notable limitation — that of being unable to control for unobserved characteristics that may confound and co-vary with income, the mediating pathways, and the children’s developmental outcomes.

Gaps in Research: Starting with a Conceptual Framework

Earlier we described a common theoretical framework that has driven child poverty research. This framework has evolved slightly over time, but usually not in a holistic fashion; instead, researchers tend to expand the framework only by honing the areas that are most in line with their respective disciplines. For example, economists may parcel out a new insight based on investment theory, while developmental psychologists may outline a new insight on stress or parenting. It is beyond the scope of this paper to propose a comprehensive review and critique of a framework that has largely served its purposes well, but we do believe that, with the research evidence base developed to date and a welcome blurring of disciplinary lines, revisiting the conceptual framework is merited. We do not address theoretical arguments related to the culture of poverty and to genetic components that drive how individuals interact with their environments, in part because our purpose is to formulate a broad conceptual framework for income enhancement strategies that target the family.12 However, we do think it is time for researchers to expand the conceptual framework in three ways: (1) Refine recognition of family composition in investment theories, (2) streamline the integration of economic and parenting hypotheses, and (3) acknowledge the role of the broader community and neighborhood context.

Often neglected in the broad theories described earlier in this paper is a refined recognition of the complexity of family compositions, and the ways in which the complexity may affect parental investments. Factors like total family size, the biological and familial relationships of siblings to each other (and to noncustodial parents), the gender and birth order of each child in a given family, and the bargaining that may take place among adults in the household are commonly ignored. For example, parents may respond in different ways to their sons’ and daughters’ needs, and to the needs of their higher-risk children versus their lower-risk children. Economic theory would predict that such decisions might be driven by an evaluation of parental return on investments, so that children with the predicted highest return receive the greatest level of parental investment, or that parents may compensate for inherited or acquired differences in children in such a way that children with lower skills or fewer advantages receive higher levels of parental investment (to optimize on an equal return on each child). The limited evidence on this topic does not suggest that parents favor their most advantaged children, as some might suspect. On the contrary, findings in an experimental antipoverty study tested in Milwaukee, Wisconsin, suggest that parents living in high-poverty neighborhoods who experienced an increased income as a result of an earnings supplement tied to their employment proactively placed their boys—whom they perceived as having a higher risk of getting involved in neighborhood gang activity—in after-school programs (resulting in benefits to boys as compared to girls in these programs; see Huston, Duncan, Granger, Bos, McLoyd, Mistry, et al., 2001). Likewise, studies have shown differential investments depending on whether the money is provided to the mother or the father in two parent families, with mothers, at least in the context of the developing world, being much more likely to use any income gains to invest in their children’s development (Lundberg, McLanahan, & Rose, 2003; Thomas, 1994). In the single-parent families that make up a large proportion of low-income families, how are those investments allocated? Some data show that single mothers affected by welfare reform policies spend their dollars on activities that enable them to work, such as paying for transportation, eating food outside of the home, and buying adult clothing, with lower expenditure related to children (Kaushal, Gao, & Waldfogel, 2006). An experimental antipoverty program conducted in Canada finds that increased income led to greater spending by single parents on food, clothing for adults and children, and childcare (Michalopoulos, Tattrie, Miller, Robins, Morris, Gyarmati, et al., 2002).

Pitting investment theory against parenting may have limitations, and, indeed, we think a more nuanced and integrated view that combines a parenting hypothesis with an economic hypothesis might be more productive. Parents’ choices regarding childcare, school, and after-school arrangements, for example, may be critical in mediating the effects of low income on children’s development—this amounts, in effect, to “family management” (Chase-Lansdale & Pittman, 2002; Huston, 2002, 2005). Such a mediator represents an investment pathway, in that parents are purchasing childcare or after-school programs for their children, yet also, in affecting peer and teacher interactions, increases the social resources available to children, hence building on the psychological notion of the importance of relationships (that is, the interactions, or “proximal processes”; Bronfenbrenner & Morris, 1998, 2006).

Income likely also affects children because of its effects on the neighborhoods and communities in which children are embedded. A number of studies have suggested, for example, that the living conditions of low-income children are quite poor, and environmental hazards can play a toll on psychological and physiological development.13 Children are unfavorably affected by the overcrowding, unsanitary conditions, and environmental pollutants that are more prevalent in low-income housing (see Leventhal & Newman, 2007). Moreover, witnessing violence in the community can also negatively affect children’s social-emotional development (Kitzmann, Gaylord, Holt, & Kenny, 2003).

Agenda for Future Research and Policy

Social scientists have made great methodological strides in establishing whether income has independent effects on the development of low-income children. This can be attributed, in part, to the broader availability of data, in studies designed for developmentalists as well as other social scientists that include measures of children’s environment (parents’ economic behavior, parenting methods, and family structure) as well as validated measures of children’s outcomes. It can also be attributed to increased interest and commitment among social scientists more generally in better understanding investment and consumption among low-income families and their children. All in all, the research community is well poised to continue to learn more about the role of income in children’s lives.

We have several recommendations for future research. First, we make a call for more research on mediating mechanisms, but only with thoughtful and creative regard for conceptual clarity. Which mediators have stronger effects on children: parenting, family management, or resource allocation? Or, is there an amalgam of cumulative or synergistic mediators that might reveal more about the effects of income? Since pathways are difficult to isolate, more experimental research in this area could help disentangle causal effects (see for example a related exposition on unpacking mediation in the context of neighborhood effects, Harding et al., 2009). Child age and developmental stage should take also take a critical role in thinking about mediators. In fact, an evaluation of income enhancement policies that target early care versus those that target after-school care can only be informed with better evidence about how income’s effects differ across the childhood age span. Convincing cases are made through evaluation and cost-benefit analyses about the returns of investing in early childhood education but with little comparison to how equivalent returns may be accrued through investments in programs that target early adolescence or young adulthood (for example, high school dropout prevention programs). Research is also needed to understand whether the effects of income differ for those households that are headed by single or two-parent families, depending on the composition of siblings in the family, the relationship between custodial and noncustodial parents, and on the informal or formal contributions of elder parents, relatives, or partners.

Second, and critically important, no existing random assignment studies, at least to our knowledge, compare the effects of a cash-transfer program, for example, with the effects of a childcare supplement program, making it possible to attribute differences in outcomes between participants in such programs to the policy intervention under study. Such direct comparisons could inform how impacts of targeted investment on mediating mechanisms (childcare, food, health) fare relative to investments in more global, income-enhancement policies. Expectations that cash-transfer programs can have substantial effects on children’s development are tempered by existing research showing that any independent influence of income on children is present but quite small. Do equivalent expenditures on mediators such as childcare and education produce larger effects? Some cost-benefit analyses of preschool programs suggest that well-implemented preschool programs can significantly improve child developmental outcomes and have very favorable benefits-to-costs ratios (see Duncan, Ludwig, & Magnuson, 2007; Aos, Lieb, Mayfield, Miller, & Pennucci, 2004; Masse & Barnett, 2002; Temple & Reynolds, 2007; Barnett, Belfield, & Nores, 2005). Heckman and Masterov (2007) estimate a sizeable (9:1) benefit-to-cost ratio for the Perry Preschool Project and a similar (8:1) benefits-to-costs ratio for the Chicago Child-Parent Centers program. But in fact, there are theoretical reasons grounded in psychology to advocate for allowing families discretion over spending that we describe below.

Third, great strides also have been made through brain and neuro-science research, subsequently corroborated by social science research, on the effects of income and material deprivation on cognitive development (see for example work by Nelson and Sheridan, 2009). New work that considers other domains of outcomes for children is emerging but we still feel the research is lopsided in its emphasis on cognitive performance and academic achievement. We encourage equivalent efforts to better understand social-emotional development, mental, and physical health. Most poverty-alleviation strategies focus on adult employment and earnings enhancement, which may result in greater use of nonparental care arrangements for low-income children in these programs. Yet, recent results suggest that these nonparental care settings, even as they may benefit children’s academic achievement, have the potential to undermine children’s emotional and behavioral adjustment (Magnuson, Ruhm, & Waldfogel, 2007). Such findings signal the need for monitoring additional outcomes beyond academic achievement in the context of income-enhancing policies. And, while research is emerging on this topic (that we discuss above) more studies are needed. Even less is known about the effects of income enhancement on children’s physical health (for exceptions, see Case, Lubotsky, & Paxson, 2002; Case & Paxson, 2006; and Gordon, Kaestner, & Korenman, 2007).

Finally, research needs to address questions about thresholds of income change and the effects of instability of income on outcomes for children. Thus far there is an emerging evidence base that income gains might matter most to children’s development at the low end of the income distribution. Yet, we think that there is little that is sacred about the poverty line per se. Where do the effects of income begin to flatten? Such research will allow us to better target income-enhancing policies to those for whom such gains will make the greatest difference for children.

Now, let’s turn to policy. We previously described the range of income-enhancing programs historically implemented in the United States and compelling evidence about their effects on the lives of low income children and families. Our review supports the contention that that income-enhancing policies can improve children’s developmental outcomes, but that any improvements tend to be small and, often because of data availability, we know very little about improvements other than in cognitive outcomes. With this in mind, what are promising future directions? Recognizing that there is no magic bullet, we structure this discussion as a brief review of what we see as the most recent promising policy innovations for meeting the goals of enhanced income, stabilizing or smoothing current and future consumption, and appropriately tailored to address circumstances in which individuals face multiple barriers to economic mobility. Then, we build on this as a platform for proposing yet-to-be-tested expansions, using the tools of psychology, that we think merit further development.

In our view, the most promising current policy innovations include two- or multiple-generation programs, cafeteria-style approaches and approaches that foster asset accumulation. Many prior policy solutions separately targeted one generation, and sometimes one member, of a family, either the adult caregivers or the children, yet there are undeniable interdependencies within families and across generations. So-called “two-generation” programs acknowledge this, and tailor programs to support the economic self-sufficiency of parents as well as to provide direct services to children. These programs to date have tended to target each generation in parallel as compared to a more integrated approach, i.e. making employment services available to parents of Head Start children, or offering quality on-site child care to parents participating in a job training program. More recently, this cobbled together parallel approach has evolved into a more holistic strategy to meet a family’s needs recognizing that there might be complementarities by maximizing the incentives of all family members. Conditional cash transfers are one example. Opportunity NYC (being evaluated by MDRC), which offers an array of performance-based payments for parents who work full time or complete skills training, as well as for children who have satisfactory school attendance records and academic performance. An alternative more service-oriented holistic strategy is cafeteria-style programs where a selection of services and benefits are offered in one common physical area (or equivalent gateway), which can be tailored to address one or more needs of poor families and their children. One example of this model is the New Hope Program (Bos, Duncan, Gennetian, & Hill, 2007), which would provide an array of work supports including childcare, health care, or temporary community service jobs, to help lift working poor families out of poverty. Another relatively recent strategy that encompasses a broader goal of improving current overall family well being and solid steps to future economic security is those that focus on increasing assets and savings. One example is individual development accounts (IDAs) that aim to improve the financial assets of low-income families with the hopes of decreasing intergenerational transmission of poverty by supporting investments in homes and in the future education of children.14 Other asset-building programs provide vehicles for savings at tax time, when many low-income working families receive windfall income through tax refunds. SaveNYC, for example, matches low-income taxpayers’ savings at 50 percent if they direct deposit at least part of their refund into a special account and don’t withdraw their initial deposit for at least one year.

These policy responses are commendable for several reasons, and while evidence is building, it remains to be seen whether they will succeed or fail. One challenge is that take-up among eligible families for many star programs can be low or erratic. Another is that as programs attempt to increase family income, economic instability is sometimes unintentionally imposed, leaving uncertainty in families’ lives even as they economically progress. Studies of families that leave public assistance find that because families are no longer able to depend on receiving a monthly welfare check, they have trouble managing new financial uncertainty (Meyer & Sullivan, 2004). Participants in programs like New Hope, with its stringent 30-hour work requirements, report the unpredictable nature of receiving their work-conditioned earnings supplement (Duncan, Huston, & Weisner, 2007). Conditional cash transfer programs might succeed in optimizing current family income and behavior but their ability to sustain positive long-term effects can be easily jeopardized through poor financial planning, and lack of contingency resources in the event of unexpected financial or related shocks, etc. The goals of IDAs are noteworthy but also assume that cash-constrained families are able to keep a long-term horizon in perspective relative to the challenges of meeting their day to day basic needs. Finally, these programs do not necessarily support parents’ freedom to budget or expend resources in ways that they perceive is optimal for their families, or supported by a fair financial services market. The psychology of choice and empowerment, and the drain associated with coping under very low and erratic financial resources can easily undo the successes of any of these policy approaches.

Here, we are intrigued with using the tools of psychology to inform ways in which program can be re-engineered (in small and big ways) to improve their impact. One example is evidence on automatic enrollment simplifying the decision-making process for eligible enrollees: Take-up rates on social programs increase when there is automatic enrollment (Currie, 2006). Recipients of Earned Income Tax refunds often opt for a lump-sum payment that strategically acts as a forced savings plan to pay off debt (Beverly, Tescher, Romich, & Marzahl, 2005). Some of the success of IDA savings options, such as matches for dollars saved in bonds, is another example of reengineering to enhance take-up (see Mills et al., 2008).

Having power over consumption and expenditure choices can produce independent psychological benefits. Indeed, a large literature in psychology suggests that choice leads to feelings of autonomy and intrinsic motivation, with the result being that individuals achieve a sense of personal well-being (see discussion of self determination theory; Deci & Ryan, 1985). The question, then, is whether policies that allow parents discretion over spending and even allow for the choice to take up of the benefits in the first place (as in the case of conditional cash transfers) might have psychological benefits to individuals above and beyond the actual income effect. And, notably, how those choices are designed (leveraging the pain of income loss, for example; Tversky & Kahneman, 1981) might matter in designing these kinds of programs. To date, however, no studies have systematically tested alternative models that vary on dimensions of choice and autonomy in field settings with low-income families.

Insights from psychology also suggest that there may be promise in strategies that foster economic stability and help families self-insure and build a financial cushion. Such strategies may be critical for working poor families who can have erratic and unpredictable patterns of employment and little financial slack to buffer life’s problems. For example, the cost of a simple car repair can trigger a family’s downward spiral by causing late arrivals at work, job firing, and, ultimately, eviction. The idea is compelling in light of limited evidence on income instability and children’s environments. For example, Yeung et al. (2002) find that 30 percent or more drops in monthly income are associated with maternal depression, punitive parenting, and unfavorable effects on children’s development. And, insights from Gershoff et al. (2007) suggest that the relationship between material hardship and income seems to be a function of “family resourcefulness,” meaning that some families below the poverty level seem to be able to make ends meet and families above continue to experience extreme hardship. Asset-building strategies such as IDAs are traditionally not designed as independent and individually flexible financial options to handle such small crises, as they are designed to build qualified assets such as housing and human capital. Economic instability can drain financial resources, as well as psychic ones, so that even the best-designed antipoverty policies may fail, as individuals under financial stress typically make bad choices. This is most commonly observed through frequent use of payday loans and check cashers among financially strapped families, and sometimes avoidance of more formal banking options that are available. One idea is to provide families with a customizable financial product that can serve multiple functions: streamlining income, for example, as well as automating withdrawal for basic expenses. This system would potentially minimize the risk of downward-spiraling events (such as a sudden car repair), offering a low-cost credit cushion to handle catastrophic incidences, and setting in place a lending mechanism whereby payback contributes to savings (Mullainathan, Gennetian, Barr, Kling, & Shafir, 2009). This approach provides conditions that might be necessary to help encourage the kind of behavior that will support good financial intentions; for example, automatic withdrawal would put available money “out of sight and out of mind” to ensure coverage of basic needs, and access to low-cost credit would reduce the temptation to default to high-interest payday loans.

Child poverty continues to persist in the United States. The situation is complicated by the structural, demographic, and policy causes of child poverty, as evidenced by the financial fall-out of unregulated financial markets; by the dramatic shift from a welfare system of entitlement to one conditional on work; and by the growth of a low-income Hispanic immigrant community whose livelihood is often dependent on the vagaries of local economic cycles. Estimates suggest that childhood poverty costs the economy $500 billion a year because of lower levels of productivity and earnings, increased crime, and the health-related expenses that are associated with growing up poor (Holtzer, Schanzenbach, Duncan, & Ludwig, 2007). Though most of the poverty in the United States does not match the extreme levels of deprivation observed in the developing world, policymakers understand the long-term productivity costs of poverty to society (and its contradiction with American political and economic rights and principles). We are hopeful about the ongoing research and policy commitment to uncover innovative approaches that can overcome the deleterious consequences of intergenerational poverty.

Footnotes

Publisher's Disclaimer: This is a PDF file of an unedited manuscript that has been accepted for publication. As a service to our customers we are providing this early version of the manuscript. The manuscript will undergo copyediting, typesetting, and review of the resulting proof before it is published in its final citable form. Please note that during the production process errors may be discovered which could affect the content, and all legal disclaimers that apply to the journal pertain.

For a comparison of poverty rates across 16 developed nations, both pre- and post-tax and transfer policies, see http://www.epi.org/content.cfm/webfeatures_snapshots_20060719.

Throughout this paper, because researchers and policymakers use varying definitions in their work, we intentionally use “poor” and “low-income” as terms to identify the population living below some poverty threshold. We note how each term is being defined in the context of its use in this paper. We also want to acknowledge but do not explicitly describe discussions and debates on definitions of the poverty level, which determines eligibility for several means-tested social programs (see Blank & Greenberg, 2008). The current poverty measure, initially established in 1960, was set by multiplying food costs by three, based on research indicating that families spent about one-third of their incomes on food.

We will not provide a comprehensive review of poverty policy but recommend that interested readers turn to Cancian and Danziger (2009).

Poverty was measured in 2008 as $21,200 per year for a family of four and $17,600 per year for a family of three.

Behavioral economists also point to poverty’s psychological roots (see Bertrand, Mullainathan, & Shafir, 2006), which we acknowledge but will not review here, as theory-making and evidence-building are still at very early stages.

A family’s income-to-needs ratio is the family’s income divided by the poverty threshold for that family’s household composition.

The poverty gap is the sum of the differences between market income and the poverty line for all families with incomes below the poverty line.

A family was considered chronically poor if its income-to-needs ratio was less than 1.0 at three or more of the five assessments in the study.

We refer readers to the large body of sociological and economics literature on neighborhood poverty that describes the social and cultural components to income effects on children.

See, for example, http://www.cfw.tufts.edu/topic/1/55.htm.

See Mills, Gale, Patterson, EngelHardt, Eriksen, & Apostolov, (2008) for results from a random assignment evaluation of an IDA program in Tulsa, Oklahoma.

Contributor Information

Lisa A. Gennetian, The Brookings Institution

Nina Castells, MDRC.

Pamela Morris, New York University.

References

- Akee KQ, Copeland W, Keeler G, Angold A, Costello J. Parents’ incomes and children’s outcomes: A quasi-experiment. American Economic Journal: Applied Economics. 2010;2(1):86–115. doi: 10.1257/app.2.1.86. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Alderson DP, Gennetian LA, Dowsett CJ, Imes A, Huston AC. Effects of employment-based programs on families by prior levels of disadvantage. Social Service Review. 2008;82(3):361–394. doi: 10.1086/592360. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Aos S, Lieb R, Mayfield J, Miller M, Pennucci A. Benefits and costs of prevention and early intervention programs for youth. Olympia, WA: Washington State Institute for Public Policy; 2004. [Google Scholar]

- Barnett WS, Belfield CR, Nores M. Lifetime cost-benefit analysis. In: Schweinhart LJ, Montie J, Xiang Z, Barnett WS, Belfield CR, Nores M, editors. Lifetime effects: The High/Scope Perry Preschool study through age 40 (Monographs of the High/Scope Educational Research Foundation, No. 14) Ypsilanti, MI: High/Scope Press; 2005. pp. 130–157. [Google Scholar]

- Becker GS. A treatise on the family. Cambridge, MA: Harvard University Press; 1981. [Google Scholar]

- Becker GS, Tomes N. Human capital and the rise and fall of families. Journal of Labor Economics. 1986;4(3):S1–S39. doi: 10.1086/298118. [DOI] [PubMed] [Google Scholar]

- Betson DM, Michael RT. Why so many children are poor. The Future of Children. 1997;7(2):25–39. [PubMed] [Google Scholar]

- Bertrand M, Mullainathan S, Shafir E. Behavioral economics and marketing in aid of decision making among the poor. Journal of Public Policy & Marketing. 2006;25(1):8–23. [Google Scholar]

- Beverly SG, Tescher J, Romich JL, Marzahl D. Linking tax refunds and low-cost bank accounts to bank the unbanked. In: Sherraden M, Morris L, editors. Inclusion in the American dream: Assets, poverty and public policy. Oxford: Oxford University Press; 2005. pp. 167–184. [Google Scholar]

- Blank RM. Declining caseloads/increased work: What can we conclude about the effects of welfare reform? Economic Policy Review. 2001;7:25–36. [Google Scholar]

- Blank RM. What we know, what we don’t know, and what we need to know about welfare reform. In: Ziliak J, editor. Welfare reform and its long-term consequences for America’s poor. Cambridge, UK: Cambridge University Press; 2009. [Google Scholar]

- Blank R, Greenberg M. Improving the measurement of poverty (Hamilton Project Discussion Paper 2008-17) Washington, DC: The Brookings Institution; 2008. [Google Scholar]

- Blau DM. The effect of income on child development. The Review of Economics and Statistics. 1999;81(2):261–276. [Google Scholar]

- Bos H, Duncan GJ, Gennetian LA, Hill HD. New hope: Fulfilling America’s promise to “make work pay” (Hamilton Project Discussion Paper: Discussion Paper 2007-16) Washington, DC: The Brookings Institution; 2008. [Google Scholar]

- Bloom D, Michalopoulos C. How welfare and work policies affect employment and income: A synthesis of research. New York: MDRC; 2001. [Google Scholar]

- Bronfenbrenner U, Morris P. The ecology of developmental processes. In: Lerner RM, editor; Damon William., editor. Theoretical models of human development. Vol. 1 of the Handbook of Child Psychology. 5th ed. Hoboken, NJ: John Wiley & Sons, Inc; 1998. pp. 993–1028. Editor-in-chief. [Google Scholar]

- Bronfenbrenner U, Morris PA. The bioecological model of human development. In: Lerner RM, editor; Damon W, Lerner RM, editors. Theoretical models of human development. Vol. 1 of Handbook of Child Psychology. 6th ed. Hoboken, NJ: John Wiley & Sons, Inc; 2006. pp. 793–828. Editors-in-chief. [Google Scholar]

- Cancian M, Danziger S. Changing poverty and changing antipoverty policies (Discussion Paper no. 1364-09) Focus. 2. Vol. 26. University of Wisconsin – Madison: Institute for Research on Poverty; 2009. [Google Scholar]

- Case A, Lubotsky D, Paxson C. Economic status and health in childhood: The origins of the gradient. American Economic Review. 2002;92(5):1308–1334. doi: 10.1257/000282802762024520. [DOI] [PubMed] [Google Scholar]

- Case A, Paxson C. Children’s health and social mobility. The Future of Children. 2006;16(2):151–173. doi: 10.1353/foc.2006.0014. [DOI] [PubMed] [Google Scholar]

- Chase-Lansdale PL, Pittman LD. Welfare reform and parenting: Reasonable expectations. Future of Children. 2002;12(1):167–185. [PubMed] [Google Scholar]

- Coleman JS. Social capital in the creation of human capital. American Journal of Sociology. 1988;94:S95–S120. [Google Scholar]

- Corcoran ME, Chaudry A. The dynamics of childhood poverty. The Future of Children. 1997;7:40–54. [PubMed] [Google Scholar]

- Costello EJ, Compton SN, Keeler G, Angold A. Relationships between poverty and psychopathology: A natural experiment. Journal of the American Medical Association. 2003;290(15):2023–2029. doi: 10.1001/jama.290.15.2023. [DOI] [PubMed] [Google Scholar]

- Currie J. The take-up of social benefits. In: Auerback AJ, Card D, Quigley J, editors. Public policy and the income distribution. New York: Russell Sage Foundation; 2006. pp. 80–148. [Google Scholar]

- Dahl G, Lochner L. Cambridge, MA: National Bureau of Economic Research; The impact of family income on child achievement: Evidence from the Earned Income Tax Credit. (NBER Working Paper Series: Working Paper No. 14599) 2008

- Dearing E, McCartney K, Taylor BA. Within-Child association between family income and externalizing and internalizing problems. Developmental Psychology. 2006;42(2):237–252. doi: 10.1037/0012-1649.42.2.237. [DOI] [PubMed] [Google Scholar]