Abstract

The authors examined relationships between the wealth of older adults and their early-life decisions regarding investment in human capital, family formation, and work activities in Mexico, using the 2001 Mexican Health and Aging Study. The authors examined correlates of accumulated financial wealth by gender and across three age cohorts: 50 to 59, 60 to 69, and 70 years or older. The authors outline the changing context these cohorts experienced during their lifetimes; describe patterns of net financial worth by main covariates across groups defined by age, sex, and marital status; and present the results of multivariate models of net worth. Simulations were conducted to illustrate patterns of net worth associated with alternative scenarios depicting differing representative combinations of life-course characteristics by age cohort. The findings suggest that old-age financial wealth in Mexico is more closely associated with family formation and human capital decisions than with employment decisions over the lifetime.

Keywords: Mexico, wealth, elderly, life course, employment

Population aging is well under way in Mexico and is expected to accelerate in the coming decades. As is common in many developing countries, the social and political contexts in which the aging of the population is taking place are characterized by two dominant concerns (Wong and Palloni forthcoming). First, the traditional social order, in which the well-being of the elderly depends on the younger generation, is gradually shifting because of the rapid fertility decline and a transformation in living arrangements. Unlike in developed countries in which traditional living arrangements changed prior to aging, these transformations and population aging are occurring at the same time in Mexico (DeVos and Palloni 2002). Second, aging is occurring in a fragile institutional environment (Cutler et al. 2000), in which the proportion of the population protected by public health and social security systems has been and continues to be limited. According to the 2000 Mexican population census, about half of the population aged 65 year or older has no health care coverage, while only about one fifth receive old-age pensions (Instituto Nacional de Estadística y Geografía 2000). Social security systems are undergoing vast reform toward privatization that is expected to produce further reductions in access to social protection (Cruz-Saco and Mesa-Lago 1998; Klinsberg 2000). Thus, the condensed aging process in Mexico is taking place under changing family relations and a weak institutional context with decreasing access to social security and health care.

These dynamics create reasons for concern about the late-life well-being of the rapidly aging population in Mexico. Financial resources in particular form a key dimension of well-being. These resources help cushion shocks that are common in old age, such as declining health, the loss of a job, or the loss of a spouse. Financial resources also make possible the purchase of assistance with personal care or hands-on health care and facilitate the acquisition of technology to improve the quality of life of disabled individuals with decreasing functionality. The stock of old-age assets results from initial endowments and accumulated contributions and subtractions over the life cycle, yet we know little about how various decisions throughout the life course, most notably regarding family formation, human capital, and work activities, contribute to old-age economic resources. For example, how does the population that started working early in life compare with those who postponed work debut for additional years of education? How does early marriage instead of more years of education or market work, or high fertility versus low fertility, translate in terms of economic resources in old age?

We examined the relationships between early-life decisions regarding investment in human capital, family formation, and work activities and the wealth holdings of the elderly in Mexico using data from the 2001 Mexican Health and Aging Study (MHAS). Wealth is an important characteristic on which to focus in assessing the well-being of the elderly, because it can serve as both a source of income (e.g., interest, dividends, rent) to supplement any labor earnings or other sources of cash flow and a stock that can be drawn down if needed to finance current expenditures. We examined correlates of accumulated financial wealth among the population aged 50 years and older in Mexico. These cohorts were born roughly in 1950 and earlier and have experienced enormous changes in social, economic, and institutional contexts during their lifetimes, such that behaviors at certain ages or points in the life course may translate differently across age cohorts into effects on later-life wealth. The article is organized as follows: We first discuss the theoretical foundation for our research and then briefly describe the aging and historical contexts of Mexico, the MHAS data, and the methods of analysis. Then, we provide the results of descriptive and multivariate analyses, and we conclude with a discussion of directions for future research.

Conceptual Framework

Aging has been increasingly studied using a life-course perspective (Settersten 2003). According to this approach, late-life well-being is a result not only of current social and economic forces and individual resources but also of all the life stages that precede the late-life stage. This literature recognizes that aging is a process and has concentrated in particular on the health aspects of aging. Health stock in this literature is considered a result of lifetime health-related investments, so the approach includes early health status and conditions in models of old-age health, as well as the role that lifetime occupation plays as a factor that erodes or reinforces health stock (Barker 1998; elo and Preston 1992; Hertzman 1994). A life-course perspective has also been adopted in the study of retirement behavior, in which measures of early-life work experience and family formation are considered determinants of late-life labor force participation (Henretta 2003; O’Rand and Henretta 1982). Another branch of the literature focuses on late-life financial wealth as the outcome and considers earlier labor force participation and income as determinants of late-life economic well-being (Keister and Deeb-Sossa 2001; Keister and Moller 2000; Poterba, Venti, and Wise 1998; Smith, Stafford, and Walker 2003).

The majority of this research, particularly that focusing on determinants of wealth, has been conducted in high-income countries (Keister and Deeb-Sossa 2001; Keister and Moller 2000). Much of the research regarding individual well-being in old age also focuses on men, because the spotlight tends to be on the cumulative effect of work and retirement decisions, and the information on wages and occupations is richer for men (Keister 2000; Palloni 2006). In this study, we sought to adapt this theoretical perspective to the context of developing countries and integrate more fully the experience of women. We then applied this perspective to the case of Mexico, a country that has experienced rapid social, demographic, and economic change, to examine factors reflective of these changes, such as family formation behavior and human capital investment, in addition to measures of engagement in the labor force, as potential determinants of late-life financial wealth. We paid particular attention to the timing of events such as first marriage and first job and to total accumulated outcomes over the life cycle, such as the total number of children, the total years of education, and total years worked.

In the conceptual framework adopted in this analysis, aging was considered to be a process over the whole life, so our goal was to construct models of late-life well-being that took into account the possible influences of key early-life experiences and decisions that may be endogenous, while incorporating the effects of current exogenous characteristics of individuals and their environments. This life-course perspective on old-age wealth traces individuals along a series of age-differentiated, socially marked transitions (i.e., points at which new roles are initiated; Hagestad 2003). We considered particularly timing and duration as the dimensions that help describe transitions and life-course trajectories. Timing involves the age at which transitions occur, and duration captures the length of time that individuals spend in given states. We paid particular attention to differential paths determined by gender and postulated that the effects of timing, duration, and the related transitions might have different impacts on the old-age well-being of men versus women. This is especially so in the context of many developing countries, where institutional protection to secure old-age needs is limited, and where the family may be the source of care and well-being of individuals in old age (Wong and Espinoza 2003). For the case of Mexico, as for many developing countries, women who were born prior to 1950 would be more likely, relative to men, to follow a path that emphasizes family rather than market transitions across the life cycle. Thus, we expected that factors capturing the family aspects of life-cycle transitions, such as age at first marriage and number of children, would have stronger relationships with old-age economic outcomes for women than men. On the other hand, the factors that capture the path of participation in the labor market, such as age at first job, number of years worked, and occupation, are more likely to be strong determinants of old-age economic resources for men. Both women and men may have invested in the human capital of their children, and the education of the children of these cohorts is likely to be increasingly higher than parental education, but the relative importance of this factor on the economic resources of men and women may be different. For women, particularly those who outlive their spouses, their children may be an important source of support in old age, and the attributes of their children may be powerful determinants of their own economic well-being.

Among the cohorts of current elderly in many developing countries, marriage is nearly universal. Mexico is no exception. Only 5% of women and 3% of men aged 50 years and older in Mexico have never been married or in union. Among older Mexicans, about 58% of women and 83% of men report being currently married or in union, 11% of women and 5% of men are currently divorced or separated, and 26% of women and 9% of men are widowed. This implies that for the vast majority of the population of middle and old age, their old-age economic status may be importantly influenced by marriage transitions and the timing of marriage. Also, among men in Mexico, as elsewhere, participation in the labor market over the life cycle (whether paid or not) is essentially universal; 99.3% of men report having been employed at some point in their lives, whereas this is true for only about two thirds of women.

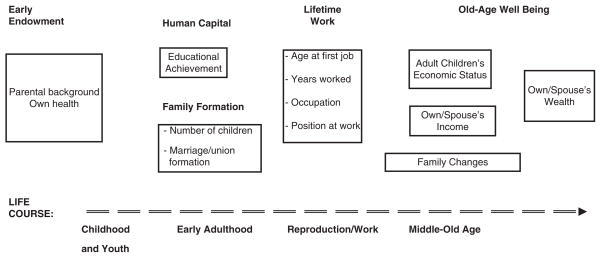

The elements of our conceptual framework are illustrated in Figure 1. The bottom of the figure enumerates in simple form the stages of a typical life cycle. The initial endowment, proxied by parental socioeconomic background and childhood health, affects the relative social standing of an individual, setting the stage for early paths of schooling and accumulation of human capital. As in many traditional societies such as that of Mexico in the early half of the 20th century, men and women were likely to follow different paths. Because the opportunity cost of pursuing education was high, and access to education was limited in the early part of the century, members of these cohorts may have received limited education. In the case of early cohorts, the opportunity cost of attending school was particularly high because of the need for labor in family farms and businesses. Later cohorts may have found that, particularly for women, the investment in schooling had low returns, because early marriage was the norm and family formation the priority for women. Educational achievement, age at first marriage, and age at first job indicate the early family and work paths followed by an individual, while number of children, work characteristics. and the intensity of work, proxied by the number of years of the work career, are reflective of decisions throughout the early to middle adult years. Upon reaching middle and old age, the attributes of adult children may become powerful determinants of accumulated financial wealth and, particularly for women, may enhance an individual’s ability to meet their economic needs. The possible loss of a spouse in the case of individuals who were once married (and whether they remarry in such cases) will also influence the relative wealth position in old age.

Figure 1.

Conceptual Framework to Study the Impact of Life-Course Family and Human Capital Decisions on Old-Age Economic Well-Being Among Persons of Middle and Old Age in Mexico

In this study, our aim was to examine covariates that indicate the timing and duration of transitions followed throughout the life cycle that may determine old-age financial wealth. We adopted a reduced-form approach, in that we did not separately estimate the several pathways suggested by Figure 1, nor did we model other intermediate outcomes, such as old-age health, the availability of social and family support, or the availability of health insurance, pensions, and other sources of income, that may contribute to old-age accumulated wealth. Rather, in this initial analysis, we aimed for the modest goal of contrasting the roles that family, human capital formation, and labor force participation behaviors play as covariates of old-age wealth, for the case of one developing country, Mexico.

Mexico: Setting and Historical Background

The institutional context for the aging of the Mexican population encompasses several important dimensions. Population aging is expected to accelerate in Mexico after 2000, a pattern that characterizes most Latin American countries. The observed changes in life expectancy in Mexico in the past 65 years imply that mortality risk declined by more than 80% from 1930 to 1995. Life expectancy at birth for those born in 2000 is estimated at 73.1 years for men and 77.6 years for women. The total fertility rate has continuously declined since the mid-1960s, from 7.2 children per woman to about 2.5 in 2000 (Partida 1999). As a result of these demographic and epidemiologic transitions in the past two decades, the age structure of the Mexican population has undergone important transformations. The percentage of the population aged 60 years and older is projected to increase from 4.4% in 2000 to about 25% by 2050. By way of comparison, 13% of the U.S. population was aged 60 and older in 1950, and this percentage is projected to increase to about 25% by 2025 (Partida 1999; U.S. Census Bureau 1998).

Today’s elderly in Mexico have experienced dramatic changes in political, economic, and social institutions and conditions. The middle- and old-age cohorts (currently aged 50 years or older) were born roughly between 1900 and 1950. These cohorts are survivors of a revolutionary war from 1910 to 1921 and, in 1917, saw the establishment of the (still governing) constitution of Mexico. The ensuing decades, which coincided with key life-cycle stages of the current elderly, brought the gradual development of government institutions and infrastructure aimed at increasing levels of education and literacy, improving health conditions, and providing old-age income security. These developments contributed to the major declines in mortality mentioned above, experienced in the last two thirds of the 20th century. The political origins of the social institutions and their evolution, however, resulted in a system of segregated and unequal access to education, health care, and social security, with large gaps in the education, health, and income of the population by social class and in urban versus rural areas that remain today (Ham-Chande 2003; Lozano et al. 1993; Montes de Oca 2001; Parker and Wong 1997; Secretaría de Salud 2004).

The Mexican economy has also experienced substantial transformation since the 1930s, including the nationalization of oil and the growth of industrial production. The agricultural sector subsidized the growth of industry, enabling the economic development of the country during the 1950s, particularly in urban centers. Two important labor programs that affected the current elderly generation emerged: the bracero program exported male workers to the United States from 1943 to 1964, and the maquila program started around 1965, employing mostly young women in assembly manufacturing for export. The country experienced industrial and oil booms during the 1960s and 1970s, ending with economic crises starting around 1976. The 1990s saw an economic revitalization and a definite transformation into a service economy by 2000 (Fleck 2001; Ramirez-Lopez 2000).

In summary, the current generations of Mexicans aged 50 years and older have lived through periods of dramatic changes, because of the social and technological transformation inherent not only in the demographic transition but also in the institutional, economic, and political contexts. Gradual changes and vast inequalities imply that the historical experience across age cohorts varies widely, with intracohort differences as well. Given this historical context, we sought not only to examine relationships between early-life behaviors and financial wealth in later life but also to explore differences in such relationships across age cohorts.

Data and Methods

The MHAS is a nationally representative, prospective panel study of Mexicans aged 50 years and over in 2000.1 The study design and content are comparable to the U.S. Health and Retirement Study. Interviews were sought with the spouses or partners of sampled persons regardless of their own age. Data were collected on multiple domains of health; demographic traits, including marriage, fertility, and the migration histories of respondents, their parents, and offspring; family networks and transfers exchanged; some aspects of work history; current income and assets; and the built environment. States with high rates of outmigration to the United States were oversampled. Baseline interviews were completed with about 15,000 respondents in 2001. These data were particularly useful for the purpose of this research because the survey gathers retrospective information on labor force participation, including age at first employment, total years worked, main occupation, and attributes of the work environment, and on marriage, including age at first marriage and details on the first and last unions. The survey also includes information on a variety of indicators of current economic well-being, such as income and wealth. The MHAS data include information for both persons in a couple; the 2001 sample contained roughly 4,500 couples, 950 unmarried men, and 2,800 unmarried women.

We selected financial wealth as the outcome of interest in our analysis because it is a powerful indicator of late-life economic well-being. Particularly in developing countries, where credit markets are not fully developed and institutional support for old age is scarce, as has been mentioned, the population may be highly dependent on accumulated assets to provide for their old-age consumption needs.2 Even if the elderly continue to engage in income-generating activity in the labor market, as is common in developing countries, income earning potential is likely to decrease substantially with age. Wealth, although capable of generating income itself, is distinct from income in that it is a cumulated stock that can be drawn on if needed to augment any flow of income (Keister and Moller 2000; Shapiro 2006). Although wealth is a household concept, we used a measure of an individual’s or a couple’s wealth, as explained below, because these were the data available to us.

The MHAS data are unusual for a developing country for including detailed information on wealth. Wealth in the MHAS was obtained from questions on an individual’s or a couple’s gross value and debt on properties to live in or rent, businesses, vehicles, as well as the value of capital assets, debts, and other assets.3 Similar to studies in the United States, such as the Health and Retirement Study, the use of brackets for economic values proved to be an effective method to recover nonresponse in the survey. On average, about 60% of a person’s net worth in the MHAS is represented by his or her home, compared with 20% from businesses and other real estate and 6% from capital assets and vehicles. We have found in previous work using MHAS data that the measure of wealth is externally and internally consistent and that it is a good indicator of economic well-being, highly correlated with current health and education.

We conducted a descriptive analysis of the patterns of financial wealth among the elderly in Mexico, and we estimated a multivariate model of the determinants of late-life wealth, controlling for indicators of the economic status of the household of birth. In both analyses, we were particularly interested in examining measures of early-life human capital, family formation, and labor force behaviors. Because the structure of wealth is quite different for individuals who are married or in unions in old age than for those who are unmarried, and because we expected the effects of past behaviors on old-age economic outcomes to be different for men and women, we separated the analysis for the following groups of the population: married men, married women, unmarried men, and unmarried women. In addition, because of the rapidly changing social, economic, and institutional contexts, we paid particular attention to the various age cohorts and to categories of educational achievement.

We acknowledge that the measures of early-life behavior of interest in this study as potential determinants of late-life financial wealth may be endogenous to the dependent variable. The concern is that the same attributes that determine, for example, labor force participation in young years can determine late-life accumulation of assets. To the extent that such attributes are unobserved, models that include early-life labor force participation as an exogenous explanatory factor contributing to late-life wealth can be biased because of this unobserved heterogeneity. Very few studies of aging in developing countries have addressed this potential source of bias (for an exception, see Wong, Palloni, and Soldo 2007). In this analysis, we also did not address this concern statistically. Because of this, we were conservative in our interpretation of results, treating significant effects as indicators of correlation but not necessarily causation. We also discuss the possible implications of endogeneity bias for those results we considered more likely to be affected by such bias.

We estimated multivariate models with the following measures for old-age financial wealth: (1) a log-wealth measure for a continuous dependent variable, (2) a categorical wealth measure representing high wealth (highest tercile), and (3) a categorical wealth measure representing low wealth (lowest tercile). We used these alternative specifications because net worth was highly skewed to the right in the population of study. We focus our presentation of results on the log-wealth measure and briefly mention findings based on the other two measures when they provide additional insight.

Following our conceptual framework, we included explanatory variables capturing (1) initial stock, (2) human capital accumulation, (3) family formation behavior, and (4) labor market activity. As indicators of initial stock, we included two variables: a dummy variable for whether a respondent’s childhood home had a toilet facility before age 10 and a measure of childhood health before age 10.4 The availability of a toilet facility in childhood correlates with urban or rural residence and the quality of residence and reflects hygienic conditions. The childhood illness variable was a dummy variable that indicated having experienced any of four serious diseases in early childhood—tuberculosis, rheumatic fever, polio, or typhoid fever—or having suffered a serious head injury.

The human capital accumulation of respondents was measured with categorical variables to allow for potential threshold effects. The included categories were (1) some education but less than primary school (less than six years of schooling), (2) completed primary school only (six years), and (3) more than completed primary school (more than six years), with no formal schooling as the reference category. Given the ages of the respondents, the majority of the variation in their education levels occurred within these lower levels of schooling. To capture possible intergenerational human capital effects, we also included a measure of the highest years of schooling among a respondent’s children (measured continuously), which was set to zero if the respondent had no children. This variable served to proxy the children’s economic status, which may contribute to the respondent’s wealth. We also controlled for the age of the respondent in quadratic form and for current urban or rural residence.5

We included three variables to represent family formation behavior: age at first marriage, number of marriages, and number of children. Age at first marriage was coded with a value of zero for those who never married and for those who ever married but had missing or problematic data for age at marriage. Because of this small latter group, we also included a dummy variable controlling for cases with missing or problematic data for age at first marriage. The variable for the number of children included birth and adoptive children of both husbands and wives.

Finally, we included several measures of lifetime labor force activity. Age at first employment was included to capture relatively early or late entrance into the labor market. It was based on either paid or unpaid employment (including unpaid work for a family farm or business) and was set to zero for those who had never been employed. We controlled for never having been employed with a set of dummy variables representing occupational codes for primary employment during the life course, with never employed and agriculture workers included in the reference category. The other occupational categories were lower blue collar, upper blue collar, lower white collar, and upper white collar.6 To capture engagement in the labor market over the life course, we included a measure of the percentage of years of life a respondent had been employed. Unlike the variables just mentioned, this variable was based on information about paid employment only. Information about the amount of time spent as an unpaid worker was not available in the data. Last, we included a dummy variable for whether a respondent had ever migrated to the United States.7

Results

Early-Life Covariates of Old-Age Wealth

We found substantial variation across age cohorts in key early-life transition markers. For example, Table 1 shows that age at first marriage was higher for younger cohorts of men (29 years for those aged 50 to 59, compared with 24 years among those aged 60 or older). However, age at first marriage appeared remarkably stable across age cohorts for women (around 20 years). Regarding human capital, older cohorts had lower educational achievement than younger cohorts for both men and women, reflecting the secular increase in education sweeping the country over the 20th century. Men and women aged 50 to 59 in Mexico had on average 4 to 5 years of education, compared with 2 to 3 years among those aged 70 and older. This is a substantial relative increase in education in the span of one generation. Still, average education levels were relatively low for those aged 50 to 59 in 2001 compared with currently younger cohorts, as suggested by the average highest education level among children of the elderly. Also note that the distribution of years of education had a larger standard deviation among those aged 50 to 59 compared with older cohorts, which is indicative of a shift into higher education levels.

Table 1.

Descriptive Statistics for Main Attributes of Human Capital, Family Formation, and Old-Age Net Worth by Age Group and Sex, Individuals Aged 50 Years and Older, in Mexico, 2001

| Main Attribute | Age Group (Years) |

|||||

|---|---|---|---|---|---|---|

| 50 to 59 |

60 to 69 |

70 and Older |

||||

| Men | Women | Men | Women | Men | Women | |

| Years of education | 5.50 (5.20) | 4.42 (5.88) | 4.16 (4.38) | 3.40 (3.99) | 2.86 (4.57) | 2.68 (4.13) |

| Age at first marriage/union | 29.90 (5.52) | 20.37 (5.30) | 24.50 (6.49) | 20.30 (5.49) | 24.30 (7.13) | 20.63 (6.65) |

| Number of marriages | 1.13 (0.58) | 1.08 (0.49) | 1.20 (0.56) | 1.07 (0.40) | 1.31 (0.89) | 1.04 (0.49) |

| Number of children | 5.12 (3.21) | 5.65 (3.36) | 6.37 (3.81) | 6.57 (3.96) | 6.98 (4.22) | 6.31 (3.98) |

| Percentage of people living in more urban areas | 0.69 (0.46) | 0.70 (0.46) | 0.63 (0.48) | 0.66 (0.47) | 0.59 (0.49) | 0.67 (0.47) |

| Highest education among children | 10.75 (4.54) | 10.99 (4.64) | 11.05 (4.87) | 10.75 (5.34) | 9.26 (5.71) | 8.83 (5.79) |

| Percentage ever employed (paid or not) | 99.6 (6.46) | 70.3 (45.71) | 99.5 (7.03) | 67.6 (46.79) | 99.3 (8.23) | 63.5 (48.17) |

| Age at first job (paid or not) | 13.42 (4.79) | 17.79 (9.93) | 13.03 (4.61) | 18.70 (10.68) | 13.05 (5.28) | 20.46 (12.17) |

| Percentage of life worked for pay | 68.9 (13.43) | 35.4 (26.47) | 70.1 (16.22) | 35.0 (26.17) | 67.5 (17.92) | 32.9 (26.34) |

| Current net worth (×1,000 pesos)a | 392.94 (973.34) | 347.62 (606.16) | 406.69 (866.51) | 361.77 (742.94) | 334.63 (547.51) | 259.77 (377.34) |

| Net worth ratio (men aged 50 to 59 years = 100) | 100.00 | 88.47 | 103.50 | 92.07 | 85.16 | 66.11 |

| Number of observationsb | 2,680 | 3,227 | 1,741 | 2,099 | 1,300 | 1,438 |

Source: Authors’ calculations using the 2001 Mexican Health and Aging Study, weighted.

Note: entries are means, with standard deviations in parentheses.

The exchange rate in 2001 was $1 to 10 pesos.

The number of observations may vary because of missing values.

Regarding continuing family formation behavior, a decline in fertility across age cohorts was evident for both men and women, from more than six children for the oldest cohort to between five and six children for those aged 50 to 59 years. The average number of marriages was also somewhat lower for the younger cohort of men, whereas it was nearly the same across age cohorts for women. In contrast, the main attributes reflecting labor market work participation over the life course were highly stable across age cohorts for men but suggest increases in labor force participation among women of younger cohorts of older Mexican women.

Net worth (wealth), as discussed previously, was calculated as the sum of all financial assets minus debt for each individual, and combining the net worth of the two spouses in the case of couples. Thus, by definition, net worth is greater for married persons. Table 2 displays average net worth by age cohort, education, and marital status. Consistent with life-cycle models of wealth accumulation in developed countries (Keister and Moller 2000; Modigliani 1988), we found that net worth tended to increase somewhat from ages 50 to 59 years to 60 to 69 years and then decreased noticeably for the oldest cohort. We had expected also a strong influence of human capital on wealth (Keister and Deeb-Sossa 2001), and we found that net worth was greater for persons with more years of education regardless of age cohort, particularly for those with seven or more years of education (with net worth that represented three times the net worth of persons with no education). Also note that within marital status categories and age cohorts, there was no clear pattern of net worth by gender.

Table 2.

Individual Net Worth by Category and Age Group, Mexico

| Attribute | Number of Observations | Net Worth (2001 Pesos) |

|

|---|---|---|---|

| Mean | Ratio | ||

| Age group (years) | |||

| 50 to 59 | 5,880 | 367,654.16 | 100.00 |

| 60 to 69 | 3,824 | 382,568.7 | 104.06 |

| 70 and older | 2,733 | 297,146.16 | 80.82 |

| Age by years of education | |||

| 50 to 59 | |||

| 0 | 987 | 212,481.14 | 100.00 |

| 1 to 5 | 1,928 | 259,935.39 | 122.33 |

| 6 | 1,250 | 341,495.05 | 160.72 |

| ≥7 | 1,712 | 687,447.9 | 323.53 |

| 60 to 69 | |||

| 0 | 1,036 | 234,463.56 | 100.00 |

| 1 to 5 | 1,437 | 290,134.83 | 123.74 |

| 6 | 688 | 369,857.05 | 157.75 |

| ≥7 | 661 | 903,037.17 | 385.15 |

| 70 and older | |||

| 0 | 1,073 | 242,329.52 | 100.00 |

| 1 to 5 | 1,032 | 256,174.6 | 105.71 |

| 6 | 298 | 327,197.58 | 135.02 |

| ≥7 | 327 | 606,959.08 | 250.47 |

| Age by current marital status and sex | |||

| 50 to 59 | |||

| Married men | 2,379 | 414,312.67 | 100.00 |

| Married women | 2,229 | 388,795.44 | 93.84 |

| Unmarried men | 290 | 237,828.42 | 57.40 |

| Unmarried women | 982 | 263,080.36 | 63.50 |

| 60 to 69 | |||

| Married men | 1,459 | 447,267.67 | 100.00 |

| Married women | 1,168 | 421,164.03 | 94.16 |

| Unmarried men | 276 | 208,795.88 | 46.68 |

| Unmarried women | 921 | 277,614.31 | 62.07 |

| 70 and older | |||

| Married men | 905 | 319,850.5 | 100.00 |

| Married women | 487 | 367,692.63 | 114.96 |

| Unmarried men | 393 | 360,138.02 | 112.60 |

| Unmarried women | 948 | 204,541.4 | 63.95 |

Source: Authors’ calculations using the 2001 Mexican Health and Aging Study.

To explore these and other potential relationships between early-life decisions and late-life economic well-being, we estimated multivariate models of net worth separately for four subsamples defined by marital status and sex. We separated the sample by marital status because the measure we used for financial wealth was different for those who were currently with spouses and those who were not, and we differentiated by sex to allow for the human capital and family formation factors that may influence old-age net worth to vary by gender.

We were also interested in differences across age cohorts. However, we did not further subdivide the samples by age, because of the limitations of sample size. Rather, we captured differences by age primarily by controlling for age directly and through differences in the values of other explanatory variables that may correlate with age. We also estimated two additional specifications of the model to assess the role of age: one using age cohort dummy variables interacted with selected explanatory variables to allow their coefficients to vary by age cohort and one using subsamples based only on age cohort (50 to 59, 60 to 69, and 70 years and older), combining sex and marital status to maintain sufficient sample size.

Table 3 shows the results of the linear regression using log net worth as the dependent variable and without any age cohort interactions. As mentioned previously, we also estimated two nonlinear specifications: logit regressions of the probability of falling in the top or the bottom 30% of the wealth distribution. The substantive conclusions we derived from the nonlinear specifications, and with the inclusion of age interactions, were highly similar to those presented here. Thus, in the interest of space, we fully present only the results of the continuous dependent variable without age interactions and briefly discuss any additional insights gained from the alternative specifications.8

Table 3.

Regression of Log Net Worth for Four Groups of Marital Status and Sex

| Variable | Married Men | Single Men | Married Women | Single Women |

|---|---|---|---|---|

| Age | 0.091 (1.84)+ | 0.335 (2.14)* | 0.109 (1.56) | 0.222 (2.24)* |

| Age squared | −0.001 (2.14)* | −0.003 (2.37)* | −0.001 (1.67)+ | −0.002 (2.98)** |

| Dummy: urban | 0.080 (0.83) | −0.765 (2.30)* | −0.005 (0.05) | −0.302 (1.43) |

| Poor health around age 10 | −0.046 (0.35) | 0.439 (0.96) | −0.263 (1.75)+ | 0.086 (0.28) |

| Had toilet around age 10 | −0.063 (0.69) | 0.301(0.90) | 0.020 (0.19) | −0.113 (0.56) |

| Education (1 to 5 years) (reference: 0 years) | 0.319 (3.03)** | −0.171 (0.47) | 0.314 (2.77)** | 0.674 (3.04)** |

| Education (6 years) | 0.562 (4.36)** | −0.503 (1.05) | 0.379 (2.59)** | 1.160 (3.99)** |

| Education (≥7 years) | 0.866 (5.78)** | 0.831 (1.52) | 0.887 (4.73)** | 1.238 (3.42)** |

| Age at first marriage | 0.002 (0.27) | −0.027 (1.19) | 0.015 (1.68)+ | 0.024 (1.26) |

| Number of marriages | −0.141 (2.24)* | −0.356 (1.72)+ | −0.376 (3.10)** | 0.003 (0.02) |

| Dummy: bad marriage information | −0.311 (0.54) | −0.821 (0.98) | 1.080 (1.90)+ | 0.946 (1.62) |

| Number of children | 0.034 (2.66)** | 0.032 (0.74) | 0.036 (2.41)* | 0.096 (3.34)** |

| Highest education among children | 0.085 (8.81)** | 0.095 (3.07)** | 0.085 (7.96)** | 0.048 (2.55)* |

| Age at first job | −0.006 (0.72) | 0.027 (0.91) | −0.002 (0.53) | 0.004 (0.45) |

| Percentage of life worked | 0.253 (0.99) | −0.082 (0.09) | −0.066 (0.31) | −0.208 (0.54) |

| Class of worker: upper white collar (reference: agricultural workers and unemployed) | 0.557 (3.36)** | 0.836 (1.40) | 0.441 (1.86)+ | 0.720 (1.51) |

| Class of worker: lower white collar | −0.164 (0.71) | −0.479 (0.51) | 0.119 (0.49) | 0.086 (0.17) |

| Class of worker: upper blue collar | 0.164 (1.28) | 0.065 (0.15) | 0.132 (0.67) | 0.484 (1.26) |

| Class of worker: lower blue collar | −0.249 (2.21)* | −0.571 (1.50) | −0.119 (0.82) | −0.619 (2.08)* |

| Former migrant to the United States | 0.282 (2.78)** | 0.651 (1.81)+ | 0.342 (1.28) | 0.579 (1.33) |

| Constant | 7.681 (4.85)** | 0.461 (0.09) | 7.168 (3.26)** | 3.090 (0.92) |

| Number of observations | 4,443 | 843 | 3,726 | 2,668 |

| R2 | .08 | .08 | .07 | .07 |

Source: Authors’ calculations using the 2001 Mexican Health and Aging Study.

Note: Absolute values of t statistics are in parentheses.

Significant at 10%.

Significant at 5%.

Significant at 1%.

Table 3 shows that the value of net worth was associated with older ages at a decreasing rate with age, consistent with the bivariate findings. Regarding own human capital formation, higher net worth was also associated with more years of education for both men and women. For each subsample except for currently unmarried men, each educational category had a significantly positive relationship with financial wealth in comparison with the reference category of no education. Furthermore, the association of education with net wealth was progressively stronger at each level of education. It is also interesting to note that the effects of increasing education were particularly strong among women who were currently unmarried. In contrast, for their male counterparts, there was no significant effect of education on their net worth. These same overall patterns also held in the tercile regressions, with higher education associated with a progressively decreasing probability of being in the bottom wealth tercile and an increasing probability of being in the top wealth tercile. Additionally, the analysis by age cohort suggested that the greatest impact of education for the oldest cohort was in moving from less than primary school education to completing primary school, whereas for the younger two age cohorts, the strongest impact was in moving from completed primary school to more than primary school. This is consistent with a scenario in which the completion of primary school was becoming increasingly common over time, so that for the younger age cohorts, it was not as great a distinguishing factor in the labor market as for their predecessors.

Returning to Table 3, we found that the family formation variables also had significant associations with net worth, but the patterns of significance varied across the four subsamples by sex and marital status. For married women, all the variables in this group were significantly associated with old-age net worth, whereas this generalized finding was less consistent for unmarried women or for men. For currently married women, higher net worth was associated with older age at marriage, fewer marriages, more children, and highest education of their children. For married men, the results were similar, with the exception of age at first marriage, which showed no relationship with net worth. On the other hand, for currently unmarried women, only number of children and children’s education were significantly related to old-age financial wealth, whereas for unmarried men, only the number of marriages and the education of their children were significant among this set of variables. The tercile regressions indicated that the most consistent of these results, the positive relationship between highest education among children and wealth, also held in the tails of the wealth distribution. In contrast, the generally positive effect of number of children was less pronounced in that it did not affect the probability of being in the bottom or top wealth tercile.

The positive relationship between the number of children and wealth warrants further comment in light of concerns about potential endogeneity. If interpreted as a causal relationship, one could argue that having more children results in greater income earning potential within the family and/or greater potential for transfers from adult children to their parents in old age, both suggesting a positive effect. However, one could also argue that high fertility acts to reduce the ability of parents to save for old age because of the greater consumption expenditures required with a larger number of children, suggesting a negative effect. The causal effect of high fertility on old-age wealth, therefore, is theoretically ambiguous, and indeed, in the age cohort subsamples (not shown), the estimated effect of number of children was quite different from that found in the subsamples by sex and marital status: It was not significant for the two older cohorts and was negatively significant for the youngest cohort. The theoretical ambiguity is further exacerbated by the possibility of endogeneity of fertility due to reverse causality. It may be the case that greater wealth earlier in life, which was not well controlled in our model, results in higher fertility through an income effect and is also correlated with greater wealth in later life. This type of potential endogeneity bias could also apply to the variable measuring the highest education of children. In sum, although the positive significance of these two sets of estimated coefficients in our primary models is potentially consistent with a causal interpretation, these results are perhaps the most likely to be subject to endogeneity bias, which warrants caution in arguing this interpretation.

Regarding the covariates representing labor market experience during the life cycle, we found that few variables were significantly related to old-age net worth. Age at first job and the percentage of years spent working had no significant effect on net worth in any of the four subsamples. In contrast, the occupational category variables had somewhat different effects across subsamples. Married men and women whose primary occupations throughout their life courses were categorized as upper white collar were estimated to have larger net worth than those in the reference group, which included those employed primarily in agriculture and those never employed. The pattern of point estimates for upper white collar employment was similar (in fact, even larger) for unmarried men and women, but the estimated coefficients did not reach statistical significance, because of the smaller sample sizes. At the other end of the occupational spectrum, lower blue collar employment was associated with smaller net worth than for the reference group for both married men and unmarried women. None of the occupation dummy variables were statistically significant for unmarried men. Finally, consistent with previous research, having been a migrant to the United States was significantly positively related to old-age financial wealth for men only.

To further explore possible differences by age cohort in view of the limitations of small sample size, we interacted two age cohort dummy variables (60 to 69 and 70 years and old, with 50 to 59 as the reference group) with the variables measuring the number of children and the highest education of children within the four subsamples by sex and marital status. We focused on these two explanatory variables because the role that children play in supporting the elderly is one of the areas most likely to be affected by the changes in family relations, economic structure, and social institutions that Mexican society has experienced during the 20th century. Regarding the effect of the number of children, we found a statistically significant cohort result for only 1 of a possible 24 estimated coefficients (2 age dummies × 4 subsamples × 3 models [log asset, top tercile, and bottom tercile]), essentially indicating no meaningful difference across age cohorts within the sex and marital status groups in the relationship between family size and old-age wealth. We also found no differences by age cohort in the estimated effect of the highest education of children, with the exception of the subsample of married men (the largest subsample). For this subsample, the results suggested that the positive association between children’s education and parental wealth in old age was stronger for the youngest age cohort than for the two older cohorts. This finding is consistent with a changing economic environment in which education increasingly plays a stronger role in determining the income-earning potential of adult children, which may translate into greater financial assistance for parents even in the face of possibly weakening systems of family support.

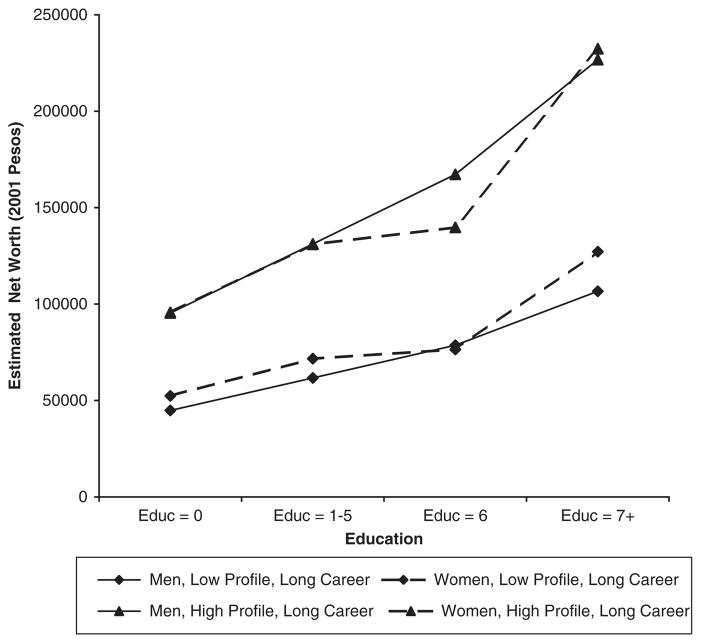

Overall, the results suggest a role for own human capital formation in the determination of old-age financial wealth and a larger and more consistent role for the family formation variables than the labor market experience variables. To illustrate and contrast the roles of these sets of variables, we derived predicted values of log net worth for three alternative scenarios representing differing family formation and job market experience profiles and, within each profile, differing educational categories and age cohorts:

“Low profile, long career” assumed that an individual started the first job at age 13, had six children, achieved a highest education of 6 years among his or her children, and worked about 60% of his or her lifetime primarily in lower blue collar occupations.

“High profile, long career” assumed that an individual had a higher socioeconomic profile, in the sense that he or she started working later (at age 18), had fewer children (two), achieved higher education for his or her children (12 years), and also worked 60% of his or her life but primarily in upper blue collar occupations.

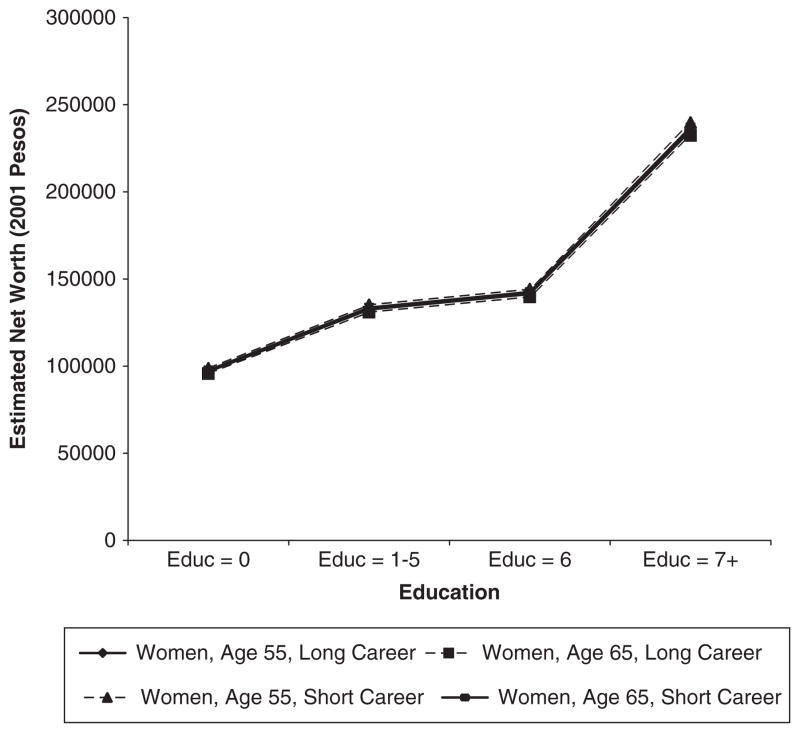

“High profile, short career” made the same assumptions as scenario 2, except that the person worked only 30% of his or her life. This profile was particularly applicable for women, because on average, men work longer careers.

Other variables in the regression were held constant across the simulation scenarios: We assumed that the individual was an urban resident, had one marriage, was healthy during childhood, had relatively low socioeconomic conditions at childhood, was first married at age 22, and had not been a migrant to the United States. The contrast between scenarios 1 and 2 was essentially a comparison of early versus late family formation and large versus small family size, with associated differences in status of employment, while keeping constant the length of work career. The contrast between scenarios 2 and 3 kept family formation and associated status of employment the same while varying the length of the job career. We were interested in the latter contrast particularly for women.

We obtained the estimated value of log net worth for various ages (55, 65, and 75 years) and for the four education groups for men and women under each of the three scenarios. Table 4 presents these results. We found that estimated net worth was greater under scenario 2 than scenario 1 for all levels of education and groups of age and gender. Higher net worth in old age was associated with a profile of higher status employment and fewer children with more years of education compared with a scenario of lower status employment and more children with less education, even though the effect of the number of children alone was positive. This basic result held for all men and women across all education and age categories. The difference between scenarios 1 and 2 is illustrated in Figure 2, for married persons of age 65. The dashed lines in the graph represent women, and the continuous lines represent men. Across all groups, financial wealth was positively associated with education and, within each education group, with the “high profile.”

Table 4.

Estimated Net Worth for Alternative Scenarios by Age, Marital Status and Sex

| Years of education | Estimated Net Worth (2001 Pesos) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Scenario 1a |

Scenario 2b |

Scenario 3c |

||||||||||

| Unmarried |

Married |

Unmarried |

Married |

Unmarried |

Married |

|||||||

| Men | Women | Men | Women | Men | Women | Men | Women | Men | Women | Men | Women | |

| Age 55 | ||||||||||||

| 0 | 12,595 | 9,053 | 47,354 | 52,982 | 42,391 | 25,283 | 100,680 | 96,800 | 43,443 | 26,911 | 93,321 | 98,726 |

| 1 to 5 | 10,621 | 17,765 | 65,140 | 72,519 | 35,746 | 49,613 | 138,510 | 132,495 | 36,633 | 52,807 | 128,374 | 135,131 |

| 6 | 7,619 | 28,868 | 83,058 | 77,381 | 25,645 | 80,628 | 176,592 | 141,365 | 26,281 | 85,811 | 163,685 | 144,177 |

| ≥7 | 28,909 | 31,229 | 112,600 | 128,682 | 97,295 | 87,212 | 239,426 | 235,108 | 99,708 | 92,828 | 221,904 | 239,762 |

| Age 65 | ||||||||||||

| 0 | 13,890 | 6,105 | 44,842 | 52,371 | 46,751 | 17,050 | 95,340 | 95,683 | 47,906 | 18,147 | 88,371 | 97,587 |

| 1 to 5 | 11,712 | 11,980 | 61,685 | 71,682 | 39,419 | 33,456 | 131,164 | 130,967 | 40,397 | 35,611 | 121,564 | 133,573 |

| 6 | 8,402 | 19,468 | 78,653 | 76,481 | 28,280 | 54,372 | 167,226 | 139,735 | 28,981 | 57,867 | 155,003 | 142,515 |

| ≥7 | 31,879 | 21,058 | 106,628 | 127,185 | 107,291 | 58,812 | 226,727 | 232,373 | 109,952 | 62,592 | 210,134 | 236,996 |

| Age 75 | ||||||||||||

| 0 | 8,913 | 2,664 | 36,171 | 43,058 | 29,998 | 7,440 | 76,911 | 78,669 | 30,742 | 7,919 | 71,282 | 80,234 |

| 1 to 5 | 7,516 | 5,228 | 49,762 | 58,936 | 25,296 | 14,600 | 105,799 | 107,678 | 25,923 | 15,539 | 98,066 | 109,820 |

| 6 | 5,392 | 8,495 | 63,443 | 62,881 | 18,148 | 23,725 | 134,901 | 114,887 | 18,597 | 25,253 | 125,029 | 117,172 |

| ≥7 | 20,457 | 9,189 | 86,008 | 104,579 | 68,851 | 25,665 | 182,883 | 191,052 | 70,559 | 27,315 | 169,516 | 194,853 |

Source: Authors’ calculations using the 2001 Mexican Health and Aging Study.

The “low profile, long career” scenario assumed that an individual started the first job at age 13, had six children, achieved a highest education of 6 years among his or her children, and worked about 60% of his or her lifetime primarily in lower blue collar occupations.

The “high profile, long career” scenario assumed that an individual had a higher socioeconomic profile, in the sense that he or she started working later (at age 18), had fewer children (two), achieved higher education for his or her children (12 years), and also worked 60% of his or her life but primarily in upper blue collar occupations.

The “high profile, short career” scenario made the same assumptions as scenario 2, except that the person worked only 30% of his or her life.

Figure 2.

Estimated Net Worth by Family Profile, Education, and Gender

Note: Assuming an individual who was married, had a long work career, and was 65 years old.

The contrast between scenarios 2 and 3 is illustrated in Figure 3, comparing the net worth of a prototypical married woman of high profile with a long labor market career with a comparable woman with a short career. This is shown for women of ages 55 and 65 years, and in all cases, the length of the work career made no appreciable difference in net worth. Similarly, the differences across these two ages of married women were negligible. However, we again found a positive effect of own education, especially for the highest education category.

Figure 3.

Estimated Net Worth by Age, Length of Career, and Education

Note: Assuming married women of high profile.

Conclusion

We examined indicators of the timing and duration of transitions followed throughout the life cycle as covariates of old-age financial wealth, distinguishing among three types of factors: (1) family formation decisions; (2) human capital investments, specifically own education and children’s education; and (3) work experiences. The main finding of our analyses is the lack of significant associations between markers of labor force transitions throughout the life cycle and wealth among the elderly, in contrast to the largely consistent patterns of association for the variables representing family formation behavior.

Our results point to the relatively greater importance of the family “career” factors compared with those of the job market “career” as possible determinants of old-age economic well-being. At least for the cohorts of the population who were currently 50 years old or older in Mexico, the factors that capture labor market transitions over the life cycle seem to have little power in predicting the net worth of older adults. The relevance of family factors was somewhat expected, given that Mexico is a country with low institutional coverage to secure economic well-being in old age, thus enhancing the role of the family. This is consistent with prior research that has found that alternative strategies to formal labor market participation, such as international migration, may be powerful determinants of old age security in Mexico (Sana and Hu 2007; Sana and Massey 2000; Wong et al. 2007). Furthermore, what is somewhat surprising is that, at least in our models, the labor market career shows so little association with net worth, with only status of employment obtaining significance in some cases. It is possible that this result is because in Mexico, much of the labor market participation offers no benefits or old-age income, so a long or short career offers no added benefits in economic terms toward the end of the life cycle. Another interpretation is that in societies with large informal labor markets, a long career may not translate into additional savings to secure old-age assets. Rather, a long career may simply signal an inability to afford retirement from the labor force.

Regarding differences by age, the descriptive results indicate that several key characteristics of respondents differ across age cohorts. In contrast, the multivariate analysis suggests that there is little difference across age cohorts in the effect of explanatory variables on old-age wealth. Of exception to this general conclusion is the interesting result that education, primarily of the respondents’ children but to a limited extent of respondents themselves, plays a greater role in shaping wealth among the younger cohort of the elderly than for the older elderly. This result may reveal important changes in the patterns of wealth accumulation over time and may have implications for the well-being of future elderly in Mexico as the level of education has increased substantially, at the same time that the number of children has declined. Our results also support the important role of human capital investment (in the form of own education) in determining wealth gaps toward the end of the life cycle, as our results consistently show that only those with the highest levels of education had higher net worth as well.

Some limitations of our work merit remarking on because they point to possible directions for future research. It is possible that the results we obtained of a small role in old-age wealth of the job career attributes may be due to inadequate labor force measures. Although there is limited additional retrospective information on labor force characteristics in the MHAS that we have not explored here, the data do not include detailed job histories with information on, for example, wages, benefits, and transitions in and out of the labor market or between jobs. Such data would be very useful in better characterizing the evolution of labor force behavior over the life course. As interest in data collection among the elderly in developing countries increases, we encourage substantial attention to be focused on retrospective labor force participation behavior and outcomes.

We also note the need in our own work on financial wealth among the elderly in Mexico, as well as in the growing literature on the elderly in developing countries more generally, to begin to explore issues of endogeneity and causal pathways. It would also be important to contrast our findings for Mexico with those in other countries, to improve our understanding of the life-cycle conditions that influence well-being during old age. It would be particularly valuable to assess, for example, whether the heightened role of family factors as covariates of old-age wealth compared with work attributes is characteristic of countries at similar stages of the demographic transition, or if this pattern holds for countries that have similar coverage and structure of social support systems.

Acknowledgments

This research was supported by grant AG026509 from the National Institute on Aging to the authors, by infrastructure support from the National Institute of Child Health and Human Development to the Maryland Population Research Center, and by a Faculty Research Fund award from Bowdoin College. We acknowledge excellent research assistance from Rubaba Ali, Ariel Collis, and Cristobal Ruiz-Tagle of the Maryland Population Research Center.

Biographies

Rebeca Wong is a professor of sociomedical sciences at the University of Texas Medical Branch. Her research focuses on the economic determinants and consequences of population aging. She has completed recent work on poverty and the utilization of health services among the elderly, cross-national comparisons of unhealthy behaviors in old age, international migration and later old age well-being, the impact of the social security reform on poverty in Mexico, and health differentials in old age. She was co–principal investigator of the Mexican Health and Aging Study, a prospective study of older adults in Mexico.

Deborah S. DeGraff is a professor of economics at Bowdoin College. Her research focuses primarily on demographic, labor force, and human resource issues in developing countries. She has published articles on the determinants of fertility and contraceptive use in the Philippines and Bangladesh and on the measurement of unmet need for family planning in Sri Lanka. She has also analyzed children’s schooling and work activities in the Philippines, Ecuador, and Brazil; young women’s employment and unemployment in Sri Lanka; and child care and women’s employment in Brazil. She has also done work on employer-sponsored on-site child care in the United States.

Footnotes

An earlier version of this article was presented at the Population Association of America Meetings, New York, March 2007. Helpful comments were received from Douglas Wolfe and audience participants at these meetings and from three anonymous reviewers.

The data and documentation are public use and can be obtained from the Web page of the MHAS (http://www.mhas.pop.upenn.edu).

Our focus on financial wealth was not intended to deny the potential importance of other forms of support in old age, such as social networks and community-based institutions, that might also be described as wealth using a broader definition of the term.

The survey instrument did not explicitly probe for information about the value of future pensions because of the lack of access to old-age pensions and/or knowledge of pensions for the majority of older adults in Mexico. Those for whom pensions were important sources of old-age support tended to include their value in their reported financial assets.

In the models presented here, only characteristics of the respondent (as distinct from characteristics of the respondent’s spouse) were included among the explanatory variables. For individuals who were currently unmarried but were previously married, information on their former spouses was not available for most variables. For individuals who were currently married, we also estimated a “couples” model that included characteristics of both members of the couple when appropriate. However, this approach did not offer useful additional insights, while it substantially reduced the sample size, resulting in less precise estimates, and it did not allow us to make generalized comparisons by gender. Thus, we focus on the results from the separate models for married men and married women.

We also estimated models with age included as dummy variables representing age cohorts rather than as a nonlinear continuous variable, but we found no meaningful differences in the results.

The categories of employment were selected to group types of workers who were similar in aspects of their work, such as job security, working conditions, benefits, and wages. Upper white collar included professionals, executives, and supervisors; lower white collar included support personnel in administrative jobs; upper blue collar included those in repair, machine operators, sales clerks, and protection and security officers; and lower blue collar included those in informal activities such as repair, factory work, mobile sales, and domestic work. All agriculture, fishing, farming, and hunting workers were clustered in the reference group.

Previous research by Wong et al. (2007) that focused on the role of migration in the accumulation of wealth among elderly men in Mexico concluded that migration to the United States has a positive effect on late-life assets, regardless of whether the model controls for selection into migration.

Full results for the alternative specifications are available from the authors on request.

Contributor Information

Rebeca Wong, University of Texas Medical Branch.

Deborah S. DeGraff, Bowdoin College

References

- Barker DJP. Mothers, Babies and Health in Later Life. 2. Edinburgh, UK: Churchill Livingstone; 1998. [Google Scholar]

- Cruz-Saco MA, Mesa-Lago C, editors. Do Options Exist? The Reform of Pension and Health Care Systems in Latin America. Pittsburgh, PA: University of Pittsburgh Press; 1998. [Google Scholar]

- Cutler D, Knaul F, Lozano R, Mendez O, Zurita B. NBER Working Article 7746. Cambridge, MA: National Bureau of Economic Research; 2000. Financial Crisis, Health Outcomes and Aging: Mexico in the 1980s and 1990s. [Google Scholar]

- DeVos S, Palloni A. Living Arrangements of Elderly People Around the World. Madison: Center for Demography & Ecology, University of Wisconsin–Madison; 2002. [Google Scholar]

- Elo IT, Preston SH. Effects of Early-Life Conditions On Adult Mortality: A Review. Population Index. 1992;58(2):186–212. [PubMed] [Google Scholar]

- Fleck S. A Gender Perspective on Maquila Employment and Wages in Mexico. In: Katz EG, Correia MC, editors. The Economics of Gender in Mexico. Washington, DC: World Bank; 2001. pp. 133–73. [Google Scholar]

- Hagestad GO. Interdependent Lives and Relationships in Changing Times: A Life Course View of Families and Aging. In: Settersten RA Jr, editor. Invitation to the Life Course: Toward New Understandings of Later Life. Chap 5. Amityville, NY: Baywood; 2003. [Google Scholar]

- Ham-Chande R. Actividad e Ingresos en los Umbrales de la Vejez (Work and Income at the Onset of Old Age) Papeles de Población. 2003;9(37):167–92. [Google Scholar]

- Henretta JC. The Life-Course Perspective on Work and Retirement. In: Settersten RA Jr, editor. Invitation to the Life Course: Toward New Understandings of Later Life. Amityville, NY: Baywood; 2003. pp. 85–105. [Google Scholar]

- Hertzman C. The Lifelong Impact of Childhood Experiences: A Population Health Perspective. Daedalus. 1994;123(4):167–80. [Google Scholar]

- Instituto Nacional de Estadística y Geografía. Encuesta Nacional de Ingresos y Gastos en los Hogares (ENIGH) 2000 (National Survey of Income and Expenditure in Households) [CD-ROM] Aguascalientes, México: Instituto Nacional de Estadística y Geografía; 2000. [Google Scholar]

- Keister L. Wealth in America: Trends in Wealth Inequality. New York: Cambridge University Press; 2000. [Google Scholar]

- Keister L, Deeb-Sossa N. Are Baby Boomers Richer Than Their Parents? Intergenerational Patterns of Wealth Ownership in the United States. Journal of Marriage and Family. 2001;63:569–79. [Google Scholar]

- Keister L, Moller S. Wealth Inequality in the United States. Annual Review of Sociology. 2000;26:63–81. [Google Scholar]

- Klinsberg B. America Latina: Una Region en Riesgo, Pobreza, Inequidad e Institucionalidad Social (Latin America: A Region of Risk, Poverty, Inequality and Social Institutions) Washington, DC: Inter-American Development Bank; 2000. [Google Scholar]

- Lozano R, Infante C, Schlaepfer R, Frenk J. Desigualdad, Pobreza y Salud En México (Inequality, Poverty, and Health in Mexico) Mexico City: Consejo Consultivo del Programa Nacional de Solidaridad; 1993. [Google Scholar]

- Montes de Oca V. Desigualdad Estructural Entre la Población Anciana de México: Factores Que Han Condicionado el Apoyo Institucional Entre la Población de Edad 60 y Más (Structural Inequality Among the Elderly Population in Mexico: Factors That Have Conditioned Institutional Support Among the Population Aged 60 and Older) Estudios Demográficos y Urbanos. 2001;48:585–614. [Google Scholar]

- Modigliani F. The Role of Intergenerational Transfers and Life Cycle Saving in the Accumulation of Wealth. Journal of Economic Perspectives. 1988;2:15–40. [Google Scholar]

- O’Rand AM, Henretta JC. Delayed Career Entry, Industrial Pension Structure, and early Retirement in a Cohort of Unmarred Women. American Sociological Review. 1982;47(3):365–373. [Google Scholar]

- Palloni A. Reproducing Inequalities: Luck, Wallets, and the Enduring Effects of Childhood Health. Demography. 2006;43(4):587–616. doi: 10.1353/dem.2006.0036. [DOI] [PubMed] [Google Scholar]

- Parker SW, Wong R. Household Income and Health Care Expenditures in Mexico. Health Policy. 1997;40:237–55. doi: 10.1016/s0168-8510(97)00011-0. [DOI] [PubMed] [Google Scholar]

- Partida V. Envejecimiento Demográfico en México: Retos y Perspectivas (The Aging Population in Mexico: Challenges and Prospects) Mexico City: Consejo Nacional de Población; 1999. Perspectiva Demográfica del Envejecimiento en México (Overview of the Aging Population in Mexico) [Google Scholar]

- Poterba JM, Venti SF, Wise DA. Personal Retirement Saving Programs and Asset Accumulation: Reconciling the Evidence. In: Wise DA, editor. Frontiers in the Economics of Aging. Chicago: University of Chicago Press; 1998. pp. 23–123. [Google Scholar]

- Ramirez-Lopez B. Envejecimiento Demográfico y Empleo, Memorias del Taller de Expertos en Envejecimiento Demográfico y Políticas de Empleo, Julio 1999 (Aging Population and Employment: A Report of the Expert Workshop on Population Aging and Employment Policies, July 1999) Mexico City: Secretaría del Trabajo y Previsión Social; 2000. Las Perspectivas Económicas y Sociales Frente al Envejecimiento (Economic and Social Perspectives on Aging) [Google Scholar]

- Sana M, Hu CY. Is International Migration a Substitute for Social Security? Well-Being and Social Policy. 2007;2(2):27–48. [Google Scholar]

- Sana M, Massey DS. Seeking Social Security: An Alternative Motivation for Mexico-US Migration. International Migration. 2000;38(5):3–24. [Google Scholar]

- Shapiro TM. Race, Homeownership and Wealth. Journal of Law and Policy. 2006;20:53–74. [Google Scholar]

- Secretaría de Salud. Fair Financing and Universal Social Protection: The Structural Reform of the Mexican Health System. Mexico City: Secretaría de Salud; 2004. [Google Scholar]

- Settersten RA Jr, editor. Invitation to the Life Course: Toward New Understandings of Later Life. Amityville, NY: Baywood; 2003. [Google Scholar]

- Smith JP, Stafford F, Walker JR. Introduction to the JHR’s Special Issue on Cross-National Comparative Research Using Panel Surveys. Journal of Human Resources. 2003;38(2):231–40. [Google Scholar]

- U.S. Census Bureau. Mortality and Health: Gender and Aging International Brief, October 1998. Washington, DC: U.S. Government Printing Office; 1998. [Google Scholar]

- Wong R, Espinoza M. Ingreso y Bienes de la Población de Edad Media y Avanzada en México (Income and Assets of Middle- and Old-Age Population in Mexico) Papeles de Población. 2003;37:129–66. [PMC free article] [PubMed] [Google Scholar]

- Wong R, Palloni A. Aging in Mexico and Latin America. In: Uhlenberg P, editor. International Handbook of Population Aging. New York: Springer; Forthcoming. [Google Scholar]

- Wong R, Palloni A, Soldo BJ. Wealth in Middle and Old Age in Mexico: The Role of Previous U.S. Migration. International Migration Review. 2007;41(1):127–51. doi: 10.1111/j.1747-7379.2007.00059.x. [DOI] [PMC free article] [PubMed] [Google Scholar]