Abstract

Private practice physicians in Hawai‘i were surveyed to better understand their impressions of different insurance plans and their willingness to care for patients with those plans. Physician experiences and perspectives were investigated in regard to reimbursement, formulary limitations, pre-authorizations, specialty referrals, responsiveness to problems, and patient knowledge of their plans. The willingness of physicians to accept new patients from specific insurance company programs clearly correlated with the difficulties and limitations physicians perceive in working with the companies (p < 0.0012). Survey results indicate that providers in private practice were much more likely to accept University Health Alliance (UHA) and Hawai‘i Medical Services Association (HMSA) Commercial insurance than Aloha Care Advantage and Aloha Quest. This was likely related to the more favorable impressions of the services, payments, and lower administrative burden offered by those companies compared with others.

Introduction

The private practice of medicine is in jeopardy, especially for primary care specialties, as physicians are increasingly burdened by complex medical billing procedures as well as the time and costs associated with managed care. It has become routine for a primary care physician to spend at least two uncompensated hours per day dealing with managed care pre-authorizations, pharmacy benefit managers, formulary restrictions, confidentiality requirements, and care coordinations.1 Many plans will not pay for services without pre-authorization forms that can only be completed by the physician. Newer insurance plans in Hawai‘i are offering lower compensation for services, more billing problems, and increased managed care requirements.2 The average private practitioner spends an estimated $70,000 per year on office staff functions largely devoted to managing insurance related issues.1 In addition, Medicare's “Sustainable Growth Rate” payment formula is slated to reduce physician fees by 30% over the next few years.3

Administrative burdens including payment delays, inadequate reimbursements, and complex rules and regulations as to how claims should be filed are affecting the majority of primary care practitioners. Even physicians who join large groups in an attempt to avoid the billing and business aspects of medicine still must deal with all the pre-authorization requirements and formulary restrictions imposed by different insurance plans. Due to the ever-changing complexities of medical billing, there are no “economies of scale” for primary care practitioners, and even large practice groups can get into financial trouble due to inadequate collections resulting from inability to keep up with so many administrative insurance-related requirements.

Because of these limitations, many physicians in primary practice are restricting their practices to only a few insurance plans that offer better reimbursement, and some are opting out of participation with insurance plans entirely, expecting patients to pay cash. Issues such as these are driving many physicians to leave private practice, and are deterring young physicians from entering primary care as a vocation after residency.4,5 In a 2007 survey of fourth year students at eleven US medical schools, only seven percent planned careers in adult primary care.6 The American College of Physicians warned that “primary care, the backbone of the nation's health care system, is at grave risk of collapse.”7

These forces are leading to severe problems for many patients in getting access to health care, even if they have insurance. Finding a primary care physician has become increasingly difficult for patients with Medicaid, Medicare, and some private plans that offer low fees and high managed care hassles. A 2006 California survey found that one of the principal reasons for emergency room visits was due to lack of access to a primary care physician.8

In order to assess the variety and magnitude of these problems, private practice doctors in Hawai‘i were surveyed to identify issues that they encounter with different insurance plans, and to determine their willingness to accept patients with various plans. Specifi- cally, the insurance plans evaluated in this survey were Aloha Care Advantage, Aloha Quest, Hawai‘i Medical Assurance Association (HMAA), Hawai‘i Medical Service Association (HMSA) 65C+, HMSA Commercial, HMSA Quest, Medicaid-fee-for-service, Summerlin Commercial, Summerlin Quest, Tricare, and University Health Alliance (UHA). HMSA is the largest, preferred-provider health insurance network in Hawai‘i with 689,000 members, while HMAA is the second largest with 46,000 members after absorbing the Summerlin Hawai‘i insurance plans in 2010.9,10 Data for this survey were collected prior to the HMAA-Summerlin merge.

Methods

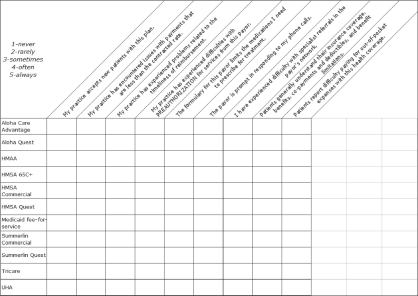

Patterned after the Harris County Medical Society Analysis of Payor Survey,11 a survey instrument was constructed with the input of practicing physicians in Hawai‘i. In early 2009, this survey was sent to 1,000 physicians who were in private practice according to the Hawai‘i Medical Association mailing list. A self-addressed, stamped envelope was included in the mailing. The questionnaire portion of the survey, shown in Figure 1, asked physicians to indicate whether their practice was accepting new patients from different local insurance companies and included specific questions about physician's experiences with those insurance companies with regard to reimbursement, authorizations, referrals, and patient input. The form was structured using a graduated scale for each statement with the following scoring system: 1 = never, 2 = rarely, 3 = sometimes, 4 = often, and 5 = always.

Figure 1.

Questionnaire portion of the survey mailed to physicians in private practice

The survey results were tabulated by pooling all 1 and 2 (never, rarely) scores, and all 4 and 5 (often, always) scores, while counting all 3 (sometimes) scores as neutral replies. After scoring the responses from physicians, insurance companies were ranked according to the number of times they were reported as the top two or bottom two. The survey also asked respondents to indicate the year they graduated from medical school and how long they expected to be in practice. An IRB exemption was granted through the University of Hawai‘i, as there were no patients involved in the study.

Results and Discussion

Out of 1,000 survey form mailings, a total of 95 were returned. Of those, 75 surveys were returned with partial or completed survey information, 12 had wrong or outdated addresses, and 8 respondents returned the survey blank, indicating that they were no longer in practice, retired, or otherwise ineligible to participate. Additional survey results are presented in the following sections.

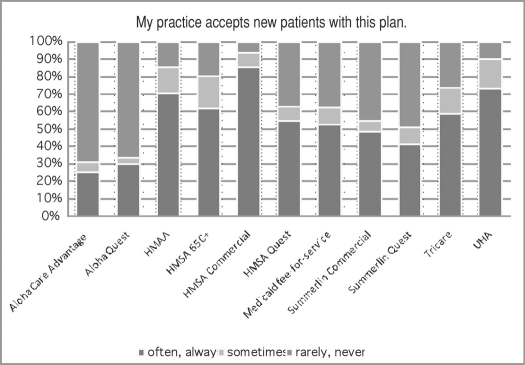

Acceptance of New Patients

Survey results indicated a considerable variation in acceptance of insurance company programs (Figure 2). Physicians responded that they “often or always” accept UHA (73%) and HMSA Commercial (85%) compared with Aloha Care Advantage (25%) and Aloha Quest (30%).

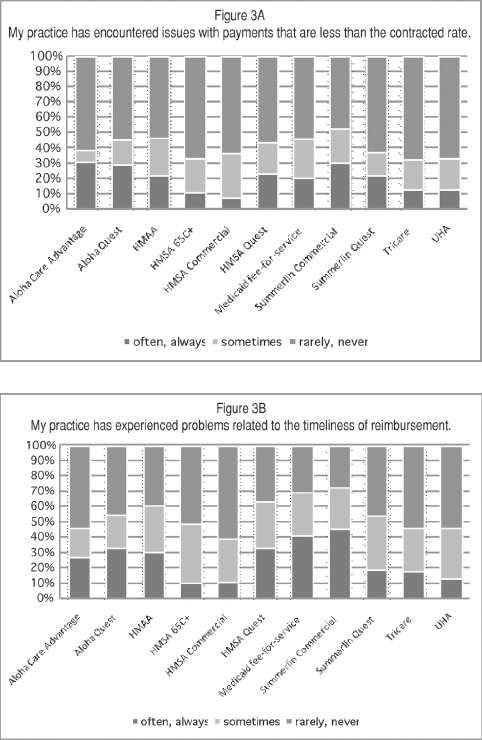

Payments and Reimbursements

Physician responses to several aspects of payments and reimbursements by insurers are shown in Figure 3. Reimbursement below contracted rates was considered a common problem, and physicians reported that they “often or always” had issues with payments that were less than the contracted rate with Summerlin Commercial (30%) and Aloha Care Advantage (31%). Reimbursement issues were considered much less of a problem when working with HMSA Commercial (7%) and HMSA 65+ (11%). A wide range of “sometimes” or neutral responses was noted, and while HMSA Commercial scored positively, it also had the highest percentage of “sometimes” ratings (29%). One survey respondent wrote, “I may not accept patients referred to me by HMAA…they require too many explanations in order to get paid, and the pay is very low.” Another said, “Unfortunately with reimbursement rates in general, it is hard to run a practice that focuses on preventative medicine that keeps patients healthy.”

Figure 3.

Physician responses to (a) payments and (b) timeliness of reimbursements from various insurance plans

Physician responses regarding their experiences with the poor timeliness of reimbursement varied, with Medicaid fee-for service (41%) and Summerlin Commercial (45%) garnering the most “often and always” responses with respect to delays in payment. Conversely, HMSA 65+ (10%) and HMSA Commercial (11%) were considered the timeliest payors. One respondent indicated in the survey that they were “not planning to accept any more new Medicare patients due to numerous problems with reimbursement…it actually costs me to see Medicare patients when extra administrative costs are factored in.” Other studies have highlighted physician unwillingness to participate in the Medicaid program, which has been shown to be due in part to excessive paperwork, perceptions of limited reimbursement, and reimbursement delays.12

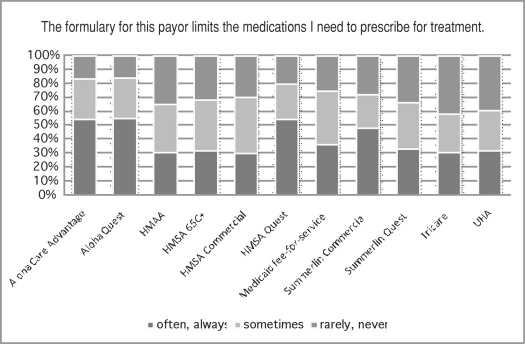

Restricted Formulary Issues

The use of medication formularies is another way to control costs, but it requires valuable time and effort for the physician to continually learn and keep up with the listed medications. It also represents a barrier that must be crossed by the physician when a patient needs a medication that is not on the formulary, along with any additional pre-authorizations or written approvals necessary to prescribe it. Physicians reported that formularies for insurance companies Aloha Care Advantage (54%), HMSA Quest (54%), and Aloha Quest (55%) most “often or always” limited the medications necessary for treatment, while companies that ranked more favorably in this category included HMAA (30%), HMSA Commercial (30%), Tricare (30%), and UHA (32%), and HMSA 65 C+ (Figure 4).

Figure 4.

Physician responses to formulary issues for various insurance plans

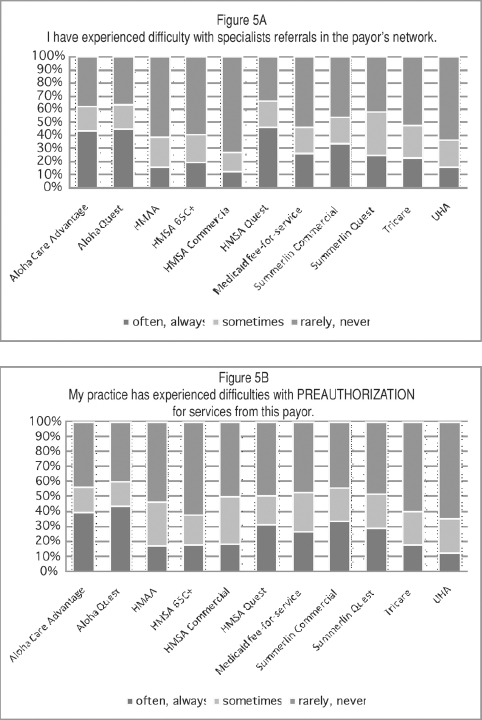

Pre-authorizations and Specialist Referrals

Figure 5 represents responses from physicians in terms of how difficult it is to obtain pre-authorizations and specialist referrals from various insurance companies. The need to pre-authorize diagnostic studies, procedures, laboratory tests and other services is a significant problem which often takes considerable physician and office staff time without any financial compensation for the additional workload. Physicians responded that it was “often or always” difficult to obtain pre-authorization for services through Aloha Care Advantage (39%) and Aloha Quest (43%), while UHA (13%) and HMAA (17%) ranked most favorably.

Figure 5.

Physician responses to difficulties with (a) specialist referrals and (b) preauthorization for services from various insurance plans

The ability to obtain consultation and make referrals to specialist physicians, a vital resource for primary care physicians and their patients, varied considerably among payors, with physicians responding that it was “often or always” difficult to obtain specialist referrals from Aloha Quest (44%) and HMSA Quest (46%); however, HMSA Commercial (12%), HMAA (15%) and UHA (15%) scored more favorably.

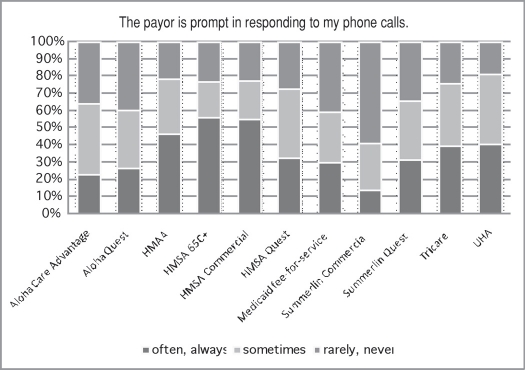

General Communication

Responsiveness to physician questions and concerns by the payor is a valuable part of the physician-payor relationship and an important factor in efficient and appropriate patient care. As shown in Figure 6, physicians reported that HMSA Commercial (55%) and HMSA 65+ (56%) were “often or always” prompt in returning phone calls, compared to Summerlin Commercial (14%) and Aloha Care Advantage (23%) who had the least favorable scores in this category.

Figure 6.

Physican responses to response time for various insurance plans

Excessive paperwork was determined to be an issue based on written responses that physicians provided on the survey. One physician said, “If National Health Insurance requires excessive paperwork, I will consider retirement.” Another indicated that they were planning “to concentrate on HMSA and Tricare and drop Medicaid. Too much headache — all the paperwork.”

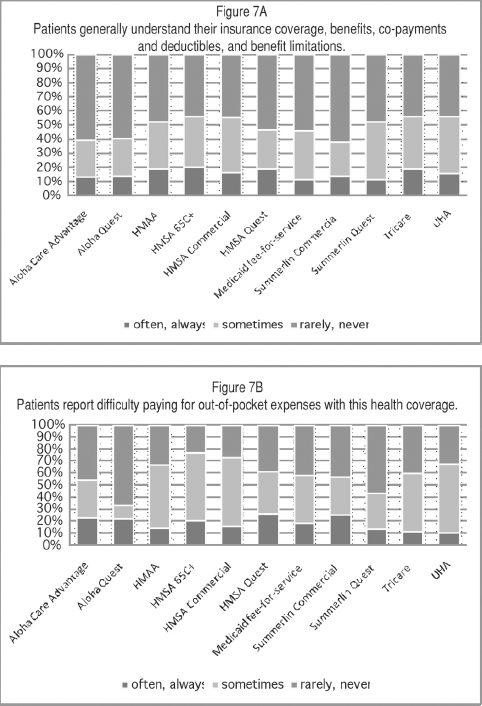

Patient Experiences

Patients are often confused about their health plans, and are not aware of restrictions on which providers they can see, prior authorization requirements, formulary restrictions, and limitations on coverage. Physicians are often called upon to explain and justify the policies of the insurer, even though they may not fully understand the insurance company's evolving policies or find them reasonable. This significantly detracts from the physician's role in focusing on medical care. The practitioner perspective on the problems patients face with understanding their insurance plans, including co-pays and various other out-of-pocket expenses are reflected in Figure 7. Physicians reported that their patients “often or always” understood their insurance coverage and benefits 11% of the time with both Summerlin Quest and Medicaid fee-for-service, and 13% of the time with Aloha Care Advantage and Aloha Quest. Tricare, HMSA Quest, and HMAA all ranked 19% and HMSA 65C+ ranked 20% in this category. Interestingly, respondents thought that at least 50% of their patients “rarely or never” adequately understood their medical coverage for nearly all of the insurance companies represented.

Figure 7.

Physician responses to how they view their patients (a) understanding of insurance coverage, and (b) difficulty paying for out-of-pocket expense from various insurance plans

Physicians responded that their patients reported difficulties paying for out-of-pocket expenses “often or always” with Aloha Care Advantage (23%) and Summerlin Commercial (25%) as opposed to UHA (10%) and Tricare (11%). However, the wide range of “sometimes” responses for both survey statements when scoring patient experiences indicates some neutrality on the part of the physician, perhaps because patients do not communicate these concerns directly to them in many cases, or because the survey statements are more subjective than others.

Overall Rankings

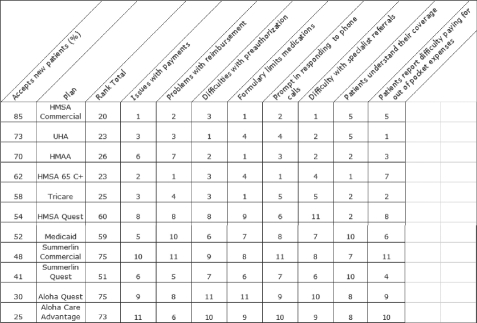

Overall, the top ranked insurance companies, based on the total number of top two positive ratings for all of the survey questions, were UHA and HMSA 65 C+ with five top two ratings and HMSA Commercial with six. The companies with the fewest positive ratings overall were Aloha Quest with five showings in the bottom two and Aloha Care Advantage with seven. Table 1 shows a summary of responses to the survey statements ranked according to the percentage of physicians surveyed willing to accept new patients with different plans.

Table 1.

Summary of the survey responses numerically ranked (1 through 11) based on the total percentage of “often or always” responses to each of the survey statements for each insurance plan. The first column shows the % of “often or always” responses in descending order based on willingness to accept new patients and the overall rank is the total combined rank score.

|

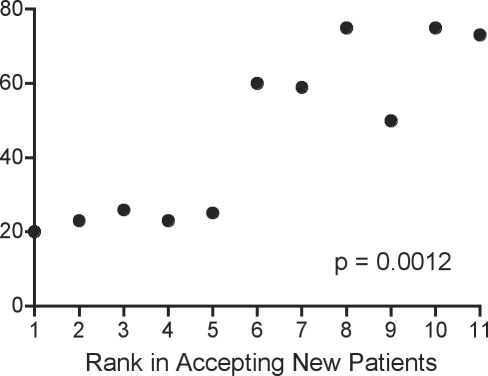

The willingness of physicians to accept new patients from specific insurance company programs clearly correlates to the range of difficulties and limitations physicians perceive in working with them (Figure 8). Spearman ranking correlation analysis shows a significant correlation between total rank scores and accepting new patients with different plans (p = 0.0012; Graphpad Software, San Diego, CA). As emphasized by the overall ranking scores, providers are much more likely to accept UHA and HMSA Commercial than Aloha Care Advantage and Aloha Quest, probably due to the more favorable impressions of the services, payments and reimbursements, and lighter administrative burden offered by those companies that ranked highest.

Figure 8.

Correlation analysis comparing the total rank score from all survey questions with the rank score of physician willingness to accept patients with different insurance plans (p = 0.0012)

Conclusions

The overwhelming majority of physicians agree that all Americans should receive needed medical care regardless of ability to pay.13 However, there are major barriers that are limiting access to primary care, including administrative burdens by private and government funded health care plans. This study documents physician responses to variations in how insurance companies operate, and the vast differences among insurers in problems encountered by physicians. The evaluations of the insurance carriers are important, generally consistent, and may be useful in helping physicians, employers, and prospective patients in choosing an insurance company. Comparisons may also be useful to insurance companies in an effort to improve their programs for both physicians and patients based on the information gathered.

This study is limited by the number of responses. The reason for this is unclear but likely related to the ability to identify doctors who are in private practice and able to take the time to respond. The identification of practicing physicians with knowledge of the insurance companies they work with may not be sufficiently identified by the list we were able to get. It could not distinguish those in private practice from those practicing with large groups or organizations without personal knowledge of the insurance companies they work with. Additional responses about insurors may not be possible if a physician does not accept that carrier. The results of this study are further limited by the fact that health insurance plan policies and physicians' feelings about them are “moving targets.” As with all surveys, question wording and numerical response grading options could have led to misinterpretation of question meaning or bias. Since this survey was performed, Medicaid fee-for-service has been converted to two for-profit managed care plans, with more restrictive formularies, more restricted networks of participating physicians, and more prior authorization requirements. HMSA has turned the pharmacy benefits for many of their plans over to mainland pharmacy benefit management companies that have even more restrictions on formularies and more prior authorization requirements. Additionally, HMAA bought the Summerlin Hawai‘i insurance plans in April 2010, which is not reflected in this survey.

To rank insurance companies with the information from the survey is also very difficult given the many factors involved and the varying importance of them. Our findings can only be presented as a “gestalt” and do not lend themselves well to statistical analysis.

Change and improvements in health care are desperately needed as many forces of change threaten the role of the private practice practitioner. Improving access to primary care will require major macro-level system reform and cooperation from insurance companies. In particular, increases in primary care reimbursement and general reduction of the administrative burden on primary care practitioners would be helpful in attracting more medical school graduates to the field. Future studies are needed to continuously evaluate private practice physician perspectives in Hawai‘i and provide feedback with information and education. Systems to track the responses of insurance companies regarding the problems and concerns physicians face in providing care are also needed for patients as health care programs evolve.

Figure 2.

Physician responses to accepting new patients from various insurance plans

Acknowledgements

This work was supported by the Hawai‘i Medical Group Foundation (now the Hawai‘i Impact Foundation) and the Access to Care component of the Outpatient Parenteral Antimicrobial Therapy (OPAT) Outcomes Registry, both non-profit organizations. We thank Sue Slavish, Anne Copsey, and Cara Empey Campora for providing manuscript reviews and editorial assistance.

Conflict of Interest Statement

None of the authors identify a conflict of interest other than their income from private practice (Tice and Kemble) and the health insurance plan their employers carry.

References

- 1.Casalino LP, Nicholson S, Gans DN, et al. What Does It Cost Physician Practices To Interact With Health Insurance Plans? Health Affairs. 2009;28(4):w533–w543. doi: 10.1377/hlthaff.28.4.w533. [DOI] [PubMed] [Google Scholar]

- 2.Tice A. The frustrations of patient care. InfectiousDiseasesNews.com. 2007 Dec;:6–8. [Google Scholar]

- 3.Inglehart JK. Medicare's Declining Payments to Physicians. N Engl J Med. 2002;346(24):1924–1930. doi: 10.1056/NEJMhpr020324. [DOI] [PubMed] [Google Scholar]

- 4.Bodenheimer T. Primary Care - Will It Survive? N Engl J Med. 2006;355(9):861–864. doi: 10.1056/NEJMp068155. [DOI] [PubMed] [Google Scholar]

- 5.Norenberg DD. The Demise of Primary Care: A Diatribe From the Trenches. Ann Intern Med. 2009;150(10):725–726. doi: 10.7326/0003-4819-150-10-200905190-00011. [DOI] [PubMed] [Google Scholar]

- 6.Hauer KE, Durning SJ, Kernan WN, Fagan MJ, Mintz M, O'Sullivan PS, et al. Factors associated with medical students' career choices regarding internal medicine. JAMA. 2008;300(10):1154–1164. doi: 10.1001/jama.300.10.1154. [DOI] [PubMed] [Google Scholar]

- 7.American College of Physicians, author. The impending collapse of primary care medicine and its implications for the state of the nation's health care. American College of Physicians. 2006. Jan 30, [June 5, 2010]. Available from: http://www.acponline.org/advocacy/events/state_of_healthcare/statehc06_1.pdf.

- 8.Bodenheimer T, Pham HH. Primary Care: Current Problems And Proposed Solutions. Health Aff. 2010;29(5):799–805. doi: 10.1377/hlthaff.2010.0026. [DOI] [PubMed] [Google Scholar]

- 9.Pacific Business News. 2010. Apr 1, [June 5, 2010]. MAA Completes Summerlin Hawai‘i Purchase. Available from: http://pacific.bizjournals.com/pacific/stories/2010/03/29/daily36.html.

- 10.Pacific Business News. 2010. Mar 2, [June 5, 2010]. HMSA Posts $64.4 Million Loss in 2009; pays CEO $1.2M. Available from: http://pacific.bizjournals.com/pacific/stories/2010/03/01/daily13.html.

- 11.Harris County Medical Society Analysis of Payor Survey, Final Report October 31, 2007. [June 5, 2010]. Available from: http://www.hcms.org/Template.aspx?id=468.

- 12.Hall AG, Lemak CH, Steingraber H. Expanding the Definition of Access: It Isn't Just About Health Insurance. J Health Care Poor Underserved. 2008;19(2):625–638. doi: 10.1353/hpu.0.0011. [DOI] [PubMed] [Google Scholar]

- 13.McCormick D, Woolhandler S, Bose-Kolanu A, Germann A, Bor DH, Himmelstein DU. U.S. Physicians' Views on Financing Options to Expand Health Insurance Coverage: A National Survey. J Gen Intern Med. 2009;24(4):526–531. doi: 10.1007/s11606-009-0916-x. [DOI] [PMC free article] [PubMed] [Google Scholar]