Abstract

Why do some people take risks and live for the present, whereas others avoid risks and save for the future? The evolutionary framework of life history theory predicts that preferences for risk and delay in gratification should be influenced by mortality and resource scarcity. A series of experiments examined how mortality cues influenced decisions involving risk preference (e.g., $10 for sure vs. 50% chance of $20) and temporal discounting (e.g., $5 now vs. $10 later). The effect of mortality depended critically on whether people grew up in a relatively resource-scarce or resource-plentiful environment. For individuals who grew up relatively poor, mortality cues led them to value the present and gamble for big immediate rewards. Conversely, for individuals who grew up relatively wealthy, mortality cues led them to value the future and avoid risky gambles. Overall, mortality cues appear to propel individuals toward diverging life history strategies as a function of childhood socioeconomic status, suggesting important implications for how environmental factors influence economic decisions and risky behaviors.

Keywords: financial risk, temporal discounting, childhood development, socioeconomic status, mortality

Ray Otero grew up in a poor neighborhood in Puerto Rico. He later immigrated to the United States and found work as a mechanic in New York City. After the deadly tragedy of September 11, 2001, Otero began spending his savings on the lottery. Otero was not unique in his newfound proclivity for financial risk: Although post-9/11 consumer spending decreased, spending on the New York state lottery increased considerably every year after 2001 (DiNapoli, 2008). Although Otero has yet to win, years later he continues to spend $500–$700 per week—more than $30,000 per year—for a small chance to win it big (Feuer, 2008).

How did a New York mechanic become one of the biggest lottery spenders in the United States? One possibility is that Otero's financial choices are idiosyncratic and irrational. We propose, however, that Otero's shift in preferences for risk and immediate rewards reflect responses to specific types of environmental cues, both from his childhood and from adulthood. From this perspective, Otero's seemingly irrational financial choices may reflect a deeper evolutionary logic.

Like Ray Otero, most people must make choices concerning how to invest their resources. Broadly speaking, a person can choose between two types of strategies. He (or she) could choose a safe investment strategy, earning minimal growth over time but not needing to worry about losing the savings (e.g., putting the money in a savings account, buying U.S. bonds, or stuffing cash inside a mattress). Alternatively, he could a follow risky strategy: He could potentially lose large sums of money for a chance of a much larger and quicker payoff (e.g., investing in risky stocks, buying lottery tickets, or becoming a professional poker player).

The underlying psychology of how people make such choices goes beyond the financial realm. From an evolutionary perspective, such choices are likely to be related to two fundamentally different life courses that species follow. These life courses fall on a continuum from a “slower” course related to slower pace of reproduction and prioritizing offspring quality to a “faster” course related to a faster pace of reproduction and prioritizing offspring quantity (Belsky, Steinberg, & Draper, 1991; Bielby et al., 2007; Ellis, Figueredo, Brumbach, & Schlomer, 2009; Griskevicius, Delton, Robertson, & Tybur, 2010). In the current research we examine experimentally how specific features of people's childhood and adult ecologies might lead individuals to adopt slower versus faster life courses. Because these different life courses are likely to be associated with specific preferences for risk and for delayed rewards, we examine how ecological factors predicted by life history theory influence preferences for financial risk and delay in gratification. This research aims to shed light on why some individuals are risk takers and others are risk averse from an evolutionary perspective, while also highlighting how the environments in which children develop can have important consequences on the way in which those individuals react to their environments as adults.

Life History Theory

All organisms face the fundamental challenge of how to successfully allocate time, resources, and energy among the various tasks necessary for survival and reproduction. Because natural selection favors allocation strategies that optimize resource use over the life course (Schaffer, 1983; Williams, 1957), evolutionary biologists and behavioral ecologists developed life history theory to help explain how and why organisms, including humans, allocate resources to different goals across the life span (Charnov, 1993; Daan & Tinbergen, 1997; Horn, 1978; Low, 2000; Roff, 1992; Stearns, 1992). Life history theory has become a foundational component within evolutionary biology and behavioral ecology, and it is becoming increasingly useful in explaining human behavior (see, e.g., Belsky, Houts, & Fearon, 2010; Belsky et al., 1991; Chisholm, 1993; Davis & Werre, 2008; Del Giudice, 2009; Eibl-Eibesfeldt, 1989; Ellis, 2004; Ellis et al., 2009; Figueredo et al., 2006; K. Hill & Kaplan, 1999; Horn & Rubenstein, 1984; Kaplan & Gangestad, 2005; Low, Simon, & Anderson, 2002; Promislow & Harvey, 1990; Quinlan, 2007; Walker, Gurven, Burger, & Hamilton, 2008).

Although multiple correlational studies have provided useful insights into how traits relevant to life history theory covary (e.g., Ellis, McFadyen-Ketchum, Dodge, Pettie, & Bates, 1999; Figueredo, Vásquez, Brumbach, & Schneider, 2004; Kruger & Nesse, 2006; Nettle, 2010; Wilson & Daly, 1997), life history predictions regarding psychology and decision making have rarely been examined experimentally. We set out to use experimental methods to examine how ecological cues derived from life history theory might influence risk and temporal discounting.

The Trade-Off Between Current Versus Future Reproduction

All organisms face trade-offs in how they divide energy and effort between important goals. For example, time spent gathering food is time not spent sleeping; metabolic energy allocated toward intrasexual competition is energy not allocated toward immune function; and effort spent on parenting is effort not spent on acquiring new mates (Kaplan & Gangestad, 2005; Roff, 2002). Life history theory highlights that all organisms face a fundamental trade-off between investing into somatic effort versus reproductive effort. Somatic effort involves investment in the growth and maintenance of physiological systems and embodied capital (e.g., knowledge, skills). Reproductive effort involves investment in activities directly related to intrasexual competition, courtship, reproduction, and, in some species, parenting.

This fundamental life history trade-off can be illustrated with an analogy to a bank account (Kenrick & Luce, 2000). Somatic effort is akin to building a bank account, whereas reproductive effort is akin to spending this account in ways that help replicate the investor's genes. However, just as people do not save money for the sake of having a savings account, organisms do not invest in somatic effort for the sake of growth, maintenance, and learning. Instead, investment in somatic effort is investment in future reproduction. By saving for a larger bank account now, an organism can improve its reproductive success in the future. Thus, the fundamental trade-off between reproductive and somatic effort can be conceptualized as a trade-off between spending resources on current reproduction versus future reproduction. When and how this trade-off is made—for example, when and how an individual begins to spend his or her bank account—constitutes that organism's life history strategy.

Organisms that invest largely in reproductive effort at the expense of somatic effort and longevity can be categorized as following a faster strategy, whereas organisms that invest heavily in somatic effort and delay reproduction can be categorized as following a slower strategy. Life history strategies vary substantially between species. Some organisms reach sexual maturity rapidly and invest little in maintenance and longevity relative to reproduction; others mature slowly and safely, building physical and mental capital, and delay reproduction until a robust phenotype has developed. For example, small, short-lived animals such as rabbits and mice possess fast life history strategies, whereas larger, later maturing animals such as ungulates and primates have slower strategies (Stearns, 1983).

Environmental Contingency in Life History Strategies

What are the factors that lead some organisms to adopt faster strategies and lead others to adopt slower strategies? Life history theory highlights that strategies develop in response to ecological factors. These ecological factors include harshness (e.g., the age-specific rates of mortality–morbidity), unpredictability (e.g., the consistency of harshness from one period to another), and resource scarcity (e.g., the availability of energetic resources and level of competition for these resources; Ellis et al., 2009).

Life history theory notes that a given species tends to evolve strategies that maximize reproductive fitness within the specific ecology that a species inhabits. For example, members of species that typically live under conditions of high environmental unpredictability and harshness (e.g., seasonal hurricane threat that may kill large proportions of the population) do not gain much from high investment in somatic effort, as that investment could be wiped out by forces outside that organism's control. Instead, such species evolve a relatively fast strategy in which members reach sexual maturity quickly without heavy, long-term somatic investment. In contrast, species that typically live under more predictable conditions may invest more heavily in somatic effort to build a robust phenotype that can resist threatening but predictable ecological challenges.

Individual Differences in Life History Strategies

Species tend to differ in their life history strategies, but there is substantial variability in strategies within a given species (Daan & Tinbergen, 1997; Tinbergen & Both, 1999). For example, shrews tend to follow a fast strategy: small adult body mass, early age at maturity, short gestation period, and high quantity of offspring per year. However, some individual shrews mature slower and reproduce later, and other shrews mature faster and reproduce earlier.

Humans similarly show a high degree of variation in life history strategies. Although people generally having a slow life history strategy characterized by a long developmental period, heavy investment in a few offspring, and a long expected life span (Kaplan, Hill, Lancaster, & Hurtado, 2000), some individuals reach sexual maturity and become sexually active earlier, whereas others delay reproduction and invest more in embodied capital (Ellis, 2004). Considerations of life history theory suggest that some proportion of these individual differences may develop in response to environmental cues of mortality (Chisholm, 1993, 1996; Ellis et al., 2009; Kaplan & Gangestad, 2005; Quinlan, 2007; Simpson & Belsky, 2008; Worthman & Kuzara, 2005).

Multiple studies show that mortality cues have a particularly strong relationship with reproductive timing. In a study examining the association between life expectancy at birth (an indicator of mortality) and age at first birth in 170 nations, variation in life expectancy accounted for 74% of the variation in age at first birth, with shorter life expectancy predicting earlier age at first birth (Low, Hazel, Parker, & Welch, 2008). Similar patterns emerged in a study comparing different neighborhoods within the same city (Chicago, Illinois). In the 10 neighborhoods with the highest life expectancy, the median age of mothers giving birth was 27.3 years, whereas in the 10 neighborhoods with lowest life expectancy it was 22.6 years (Wilson & Daly, 1997). The same pattern emerged in a study examining the relationship between violent crime and age of reproduction across 373 counties in the United States that represent over 146 million people (Griskevicius et al., 2010). Higher violent crime rates (but not property crime rates) were associated with earlier ages of reproduction, even when controlling for socioeconomic status (SES). Taken together, these findings suggest that instead of having a set life history strategy at birth, people might monitor their environment to calibrate how and when they invest in somatic and reproductive efforts.

Influences of Childhood and Adult Environments

Recent experimental research has begun to examine whether and how mortality cues might influence psychologies associated with different life history strategies. Focusing on the trade-off between current and future reproduction, a series of experiments tested how mortality cues (e.g., perceived increases in local homicide rates) influenced people's desire to have their first child sooner versus later (Griskevicius et al., 2010). Three different experiments revealed that mortality cues had a markedly different effect on reproductive timing, unlike the straightforward associations found in correlational studies, depending on a person's childhood environment. Mortality cues had a different effect on people who grew up in a relatively resource-scarce environment (e.g., “I felt relatively poor when growing up”) than on those who grew up in a relatively resource-plentiful environment (e.g., “I felt relatively wealthy compared to the other kids in my school”). For individuals who perceived themselves to have had lower childhood SES, mortality cues led them to want to have their first child sooner. This suggests that mortality cues might shift people from lower SES childhoods toward a faster strategy. Conversely, for individuals who grew up in higher SES environments, mortality cues motivated them to want to delay reproduction, consistent with shifting to a slower strategy.

The precise reasons why mortality cues appear to lead different individuals to adopt diverging life history strategies are currently unclear. However, this emerging research is notable for three reasons. First, people's life history strategies appear to shift following exposure to ecological stimuli predicted by life history theory (e.g., mortality cues). Second, the influence of mortality cues in one's adult environment depended on particular life history cues from a person's childhood environment (i.e., resource scarcity). In fact, the effect of mortality cues was not related to people's current or expected future SES across these studies. Recent medical findings are also consistent with this childhood-SES effect, whereby the effects of stress on adult health have been shown to vary as a function of an individual's childhood SES but not the individual's adult SES (e.g., Cohen, Doyle, Turner, Alper, & Skoner, 2004; Galobardes, Lynch, & Davey Smith, 2004). These converging findings from multiple fields suggest that people may nonconsciously calibrate or sensitize their life history strategies during a sensitive window in childhood, much like the early “critical period” for language acquisition (Belsky, 2007; Belsky et al., 1991, 2010; Boyce & Ellis, 2005).

Finally, this emerging research showed that mortality threats elicited psychologies consistent with different life history strategies, even when those strategies were not detectable in neutral control conditions. This suggests that the psychology and behavior associated with different life history strategies might be dormant in benign environments but may be especially likely to emerge in conditions that suggest environmental unpredictability and harshness.

Life History Strategies and Risk

Building on experimental research examining how mortality cues influence reproductive timing, we examined how cues to mortality influence risky decision making. At first blush, it might appear that reproductive timing bears little relation to risk. However, the reproductive decisions characterizing fast and slow life history strategies are laden with risks similar to those relevant to financial decision making (E. Hill, Ross, & Low, 1997). If a given organism delays reproduction to invest in growth and maintenance, it risks not reproducing at all, just as an investor who saves for years without spending risks dying without realizing the fruits of his or her investment. Conversely, if an organism reproduces too quickly without investing in somatic effort, it may die before its full reproductive potential can be met, just as an individual who spends liberally risks financial insolvency later in life. Thus, we propose that slow and fast life history strategies are linked to specific preferences for risk: Whereas a slower strategy should be associated with preference for less risk, a faster strategy should be associated with preference for more risk.

Consider the choice between a safe and a risky investment (e.g., opening a low-yield savings account vs. purchasing shares in a start-up company). This type of choice involves choosing between outcomes with different payoff probabilities (e.g., getting $20 for sure vs. a 10% chance of receiving $100). Although taking highly uncertain gambles is often deemed irrational from a classic economic perspective, choosing to gamble can be an optimal strategy when expected profits from safer choices are negligible (e.g., Kacelnik & Bateson, 1996; Rubin & Paul, 1979). Such economic decisions mirror life history strategies. Just as individuals who observe cues suggesting environmental uncertainty and potential mortality threats should choose a faster strategy prioritizing mating effort and early reproduction over heavy somatic investment, the same individuals should prioritize potential high-yield, risky investments over low-yield, safe investments. That is, the expected payoff from a safe but low-yield decision is lower for an individual following a fast strategy than for one following a slow strategy, because the individual following a fast strategy acts under assumptions of limited longevity. In other words, the benefits of certainty that accompany the low-risk investment are dulled when survival itself is uncertain.

Experiment 1: Mortality, SES, and Risk

The first study examined how mortality cues influenced risk preferences. Drawing on previous research showing that the influence of mortality cues on reproductive timing differed specifically as a function of people's relative childhood SES (Griskevicius et al., 2010), we assessed both childhood and current/future expected SES in the current studies. Previous research has found that individuals who grew up in resource-scare environments appear to respond to mortality cues in their current environment by shifting to a faster strategy. Conversely, individuals who grew up in resource-plentiful environments appear to respond to mortality cues by shifting to a slower strategy. Thus, considering the links between life history strategies and preferences for risk discussed earlier, we predicted that the influence of mortality cues on risk taking would depend on a person's perceived childhood SES.

Method

Participants

Ninety-seven students (67 male, 30 female) at a large public university participated in the study for course credit.

Procedure

Participants came to the lab in small groups and were seated at computers between partitions. Participants read one of two news articles. The first article was designed to prime mortality threat; the second story was designed as a control. After reading the news articles, participants made a series of financial choices and reported their current and childhood SES. They were told, as a cover story, that they would participate in multiple studies within the session and the first study concerned memory. Participants were told that, after reading the article, they would complete questionnaires related to financial investing to allow for memory decay. A suspicion probe during survey development showed that participants believed this cover story, and they made no connections between the financial questions and news articles.

Following Griskevicius et al. (2010), the specific content of the news articles was fictitious, but care was taken to make the articles appear genuine. For example, the article was formatted like a New York Times web story, with the proper logo and font. The mortality article was titled “Dangerous Times Ahead: Life and Death in the 21st Century,” and it described recent trends toward violence and death in the United States. It concluded with a statement that these trends reflected the reality of the future environment, which would be treacherous.

The control article had identical formatting and font, with similar length (approximately 600 words). It described a person searching for his lost keys over the course of an afternoon. Pilot testing revealed that the two articles elicited the same amount of general arousal, but the mortality prime led participants to view the world as more uncertain and more unsafe (for additional details, see Griskevicius et al., 2010).

Dependent measure

Participants responded to two types of questions to assess willingness to take risk. Each type of question involved a series of 21 dichotomous financial choices between a certain outcome and a riskier outcome (e.g., Rachlin, Raineri, & Cross, 1991). The first question asked, “Do you want $____ for sure OR a 20% chance to get $1,000?” The dollar amount to be received for sure varied systematically and included 21 options, ranging from $20 to $550. The choices were presented in sequence from low ($20) to high ($550), whereby the probabilistic equivalent choice of $200 was in the middle of the sequence.

The second question asked, “Do you want $____ for sure OR an 85% chance to get $1,000?” The dollar amount to be received for sure varied systematically and included 21 options, ranging from $970 to $370. The choices were presented in sequence from high ($970) to low ($370), whereby the probabilistic equivalent choice of $850 was in the middle of the sequence. The order of the two questions was randomized.

Responses for each of the two types of questions were combined into a risk index. The dependent measure consisted of the total number of times a participant chose the riskier, uncertain option (which could range from 0 times to 21 times for each type of question). This means that the higher the number, the more times a participant chose the riskier option, indicating a higher preference for risk.

Individual differences in perceived resource availability

Following Griskevicius et al. (2010), we measured childhood SES and current/future SES. We assessed these constructs by asking participants to indicate their agreement with six statements on a 7-point scale with anchors from 1 (strongly disagree) to 7 (strongly agree). Childhood SES was measured with the following items: (a) “My family usually had enough money for things when I was growing up”; (b) “I grew up in a relatively wealthy neighborhood”; (c) “I felt relatively wealthy compared to the other kids in my school.” Current/future SES was measured with the following items: (a) “I have enough money to buy things I want”; (b) “I don't need to worry too much about paying my bills”; (c) “I don't think I'll have to worry about money too much in the future.”

A principal-axis factor analysis of the six SES items yielded two factors with eigenvalues above 1.0 (3.34 and 1.07). Consistent with results reported by Griskevicius et al. (2010), a visual inspection of the scree plot also suggested that two factors be extracted. Hence, we extracted and rotated two factors using direct oblimin criteria to allow for correlated factors. The first rotated factor consisted of the three childhood SES items, and it accounted for 47% of item variance. The second rotated factor consisted of the three current SES items, and it accounted for 27% of item variance. Although the factors were moderately correlated (r = .41), they were nevertheless empirically distinct. Thus, we created a composite for childhood SES (α = .87) and a composite for current SES (α = .70), analyzing each one separately.

Results

We first examined the results for potential sex differences. Using a general linear model approach, we examined a model in which probability risk was the dependent measure, participant sex and prime were categorical factors, and both types of SES were centered and entered as continuous factors. A main effect of participant sex emerged, whereby women took less risk than men (p = .029). In the current study, we were specifically interested in whether prime and/or SES were having a similar or different influence on men's and women's risk. An analysis of potential interactions did not reveal a three-way interaction with participant sex, prime, and either type of SES or a two-way interaction with participant sex and prime or with participant sex and either type of SES (ps > .20). Thus, the effects of all factors were indistinguishable across male and female participants, meaning that mortality cues influenced men and women in a similar manner.

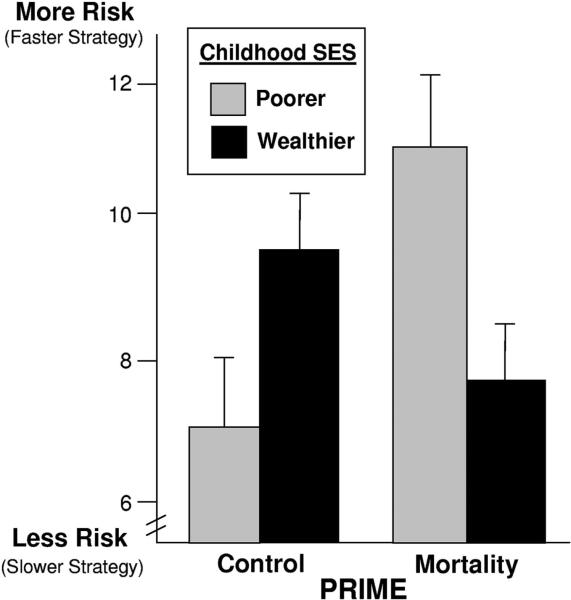

Our main prediction was that childhood SES would moderate the effect of prime on risk taking. Indeed, for childhood SES, the predicted interaction with prime was significant, F(1, 93) = 6.86, p = .01 (see Figure 1). This means that the influence of mortality cues on preference for risk depended on a person's childhood SES. When we examined current/expected SES, this variable did not interact significantly with prime, F(1, 93) = 2.30, p = .14. Thus, it appears that the influence of mortality cues on life history strategies—and the risky decisions associated with such strategies—depends more on a person's relative childhood SES than on a person's current and expected future SES. Hence, although childhood and adult SES are related, individuals’ adult life history strategies may be particularly sensitive to the availability of resources when the individuals were growing up.

Figure 1.

Risk preferences as a function of mortality cues and relative childhood SES (Experiment 1). Graphed means represent one standard deviation above and below the mean of childhood SES with standard error bars. SES = socioeconomic status.

We next tested whether individuals with differing childhood SES responded differently in each prime condition. In the control condition, childhood SES was not significantly related to risk taking (β = .22, p = .15, ). However, in the mortality condition, individuals with lower childhood SES were significantly more likely to prefer risks than were individuals with higher childhood SES (β = –.31, p < .05, ; see Figure 1). This suggests that mortality cues lead people with different childhood experiences to diverge in their risk preferences.

Following Aiken and West (1991), we next probed the interaction between prime and childhood SES by calculating the mean difference in risk taking between participants in the mortality prime versus control prime for individuals at ±1 standard deviations (SDs) from the mean of childhood SES (i.e., we tested for effects of prime for individuals who grew up “wealthy” and “poor”). This analysis showed that people who grew up in subjectively disadvantaged economic environments increased risk taking when exposed to cues of mortality: At 1 SD below the mean of childhood SES, there was greater risk taking in the mortality condition relative to the control condition, t(93) = 2.60, p < .05, η2 = .07. For people who grew up in relatively advantaged economic environments, on the other hand, mortality cues did not lead to greater risk taking. Instead, at 1 SD above the mean of childhood SES, there was a nonsignificant trend in the opposite direction, such that there was slightly less risk taking in the mortality condition than in the control condition, t(93) = 1.10, p = .27, η2 = .01.

Discussion

The first experiment showed that mortality cues had a different effect on risk taking depending on the economic conditions under which people grew up. In particular, despite the moderate correlation between childhood and current SES, the effects of mortality cues were contingent on people's childhood SES more than people's current SES. This childhood-SES contingency effect replicates previous experimental research examining the influence of mortality cues on reproductive timing (Griskevicius et al., 2010).

People who grew up feeling that they had relatively few resources responded to mortality cues by preferring risky financial decisions to lower yield but safe decisions. This is consistent with adopting a faster life history strategy. Such a strategy is designed to operate when there will be no opportunity to amass a large number of small rewards, which makes larger, immediate rewards more preferable, even though they are less certain. In contrast, individuals who grew up with relatively more resources responded to mortality cues by preferring lower risk but lower yield rewards (although a test of this simple effect did not reach conventional levels of statistical significance in this study). This pattern is consistent with adopting a slower life history strategy in which multiple, safe long-term investments (e.g., somatic investment in embodied capital) are favored.

Experiment 2: Risk Preferences and Temporal Discounting

The first experiment examined how slower and faster life history strategies relate to risk preferences. Life history strategies are also likely to relate to specific patterns of preferences on another important dimension: time. Time preference, also known as temporal discounting, intertemporal choice, or delay of gratification, involves choosing between a smaller, immediate reward and a larger, delayed reward (for recent evolutionary applications, see Adams & Nettle, 2009; Daly & Wilson, 2005; for a general overview, see Green & Myerson, 2004). Consider, for example, a person who finds a fruit tree with fruit that are still a few days from being ripe. The person could choose to eat the inferior and less rewarding fruit now or could choose to come back a few days later when the fruit will be ripe and more rewarding. Although delaying gratification and valuing the future has traditionally been deemed the wise choice, a life history perspective highlights an important drawback of waiting: If the person forgoes picking the fruit immediately, there is no guarantee that either he or the fruit will be around a few days later.

For organisms expecting to live longer, valuing the future and choosing to wait for more valuable payouts can have significant benefits. For organisms expecting to have shorter life spans, however, the payoffs for waiting may not be realized. This uncertainty associated with time increases the relative benefits of taking smaller immediate rewards. When considering age at reproduction, for example, the risky temporal choice is to delay reproduction, as one may die before successful reproduction. Similarly, investing time and energy in acquiring skills and knowledge makes sense only if one can expect to make use of them later in life (Kaplan et al., 2000). If not, one should forgo the costs of knowledge acquisition and use that energy on tasks with more immediate payoffs. Life history theory predicts that a preference for the future should be associated with a slower life history strategy; organisms with slow life histories “expect” that they will be alive in the future and thus can benefit by waiting for a larger but delayed reward. Conversely, a preference for the present should be associated with a faster strategy; organisms with fast life histories are less likely to “expect” that they will be alive in the future, meaning that they can benefit more by taking smaller but immediate rewards.

The second experiment examined how mortality cues influenced preferences for risk and preferences for time. For risk preferences, we predicted a replication of Experiment 1. For time preferences, we predicted that mortality cues should again have a different effect as a function of a person's childhood SES. We predicted that mortality cues would lead people who grew up in resource-plentiful environments to value the future (consistent with a slower strategy). Conversely, we predicted that mortality cues would lead people who grew up in resource-scarce environments to value the present (consistent with a faster strategy).

Method

Participants

Seventy-one students (36 male, 35 female; mean age = 20.8 years) at a large public university participated in the study for course credit. All participants came to the lab in small groups and were seated at computers between partitions.

Design and procedure

The study had a 2 × 2 design, with prime (mortality vs. control) as a between-participants factor and preference (risk, time) as a within-participants factor. Mortality cues were primed with the same New York Times story as in the first experiment. To minimize potential suspicions and demand characteristics, we used the same cover story. In the control condition, there was no prime, meaning that participants simply responded to the financial risk items. At the end of the study, participants indicated their childhood SES with the same items used in Study 1. As in Experiment 1, participant sex did not interact with prime, with childhood SES, or with the interaction between these factors whether considering either preferences for risk or time (ps > .25). Thus, participant sex is not considered in the analyses.

Dependent measures

The measure of risk was similar to that in Experiment 1. Participants made seven dichotomous choices for the following question: “Do you want a 50% chance of getting $800 OR get $____ for sure?” The certain amount ranged systematically from $100 to $700 in $100 increments. The dependent measure consisted of the total number of risky options chosen by a participant (0–7).

For time preferences, participants made seven dichotomous choices for the following question: “Do you want to get $100 tomorrow OR get $____ 90 days from now?” (see Wilson & Daly, 2004). The amount of money that could be received in 90 days ranged systematically from $110 to $170 in $10 increments. The dependent measure consisted of the total number of times participants selected the delayed, larger option (0–7). The order of whether participants first answered the risk items or the time items was randomized.

Data analysis strategy

We predicted two separate Prime × Childhood SES interactions, one for risk preference and one for time preference. In addition to testing for the predicted interactions, we tested our predicted simple effects in the same manner as in Experiment 1. In particular, we tested the simple effects of mortality prime versus control within a given level of childhood SES for risk and for time preference. Given our specific directional predictions and the results of the first experiment consistent with these predictions, we used directed tests (Braver, 1975; Rice & Gaines, 1994). Directed tests allocate .04 of a total alpha level of .05 to the predicted direction of a test statistic and .01 to the unpredicted direction (see, e.g., Gangestad, Garver-Apgar, & Simpson, 2007). Directed tests have enhanced power to detect predicted effects relative to two-tailed tests but do not entail the problem of completely ruling out an unpredicted effect suffered by one-tailed tests (see Rice & Gaines, 1994).

Results

Risk preference

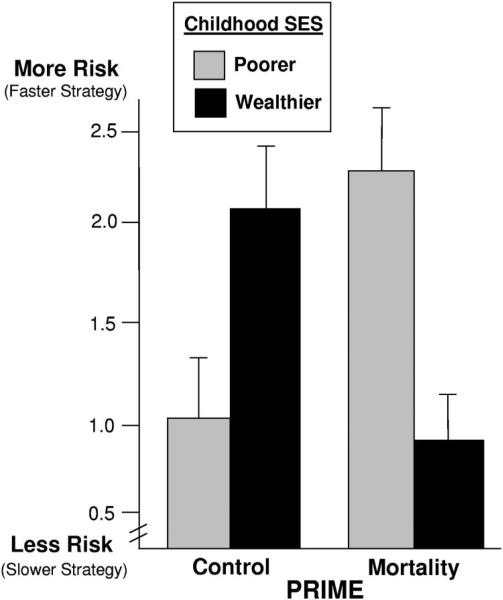

Prime interacted with childhood SES, F(1, 67) = 13.86, p < .001, η2 = .17 (see Figure 2). The pattern of this interaction was identical to that found in Experiment 1: Those from poorer backgrounds—who were –1 SD below the childhood SES mean—took significantly greater risk when primed with cues of mortality, t(67) = 3.57, p < .01, η2 = .14. Conversely, participants from wealthier backgrounds—who were 1 SD above the childhood SES mean—took significantly less risk when primed with mortality, t(67) = 2.84, p < .01, η2 = .10. Thus, mortality cues again led to a different pattern of risk taking as a function of individuals’ childhood SES environment.

Figure 2.

Risk preference as a function of mortality cues and relative childhood SES (Experiment 2). Graphed means represent one standard deviation above and below the mean of childhood SES with standard error bars. SES = socioeconomic status.

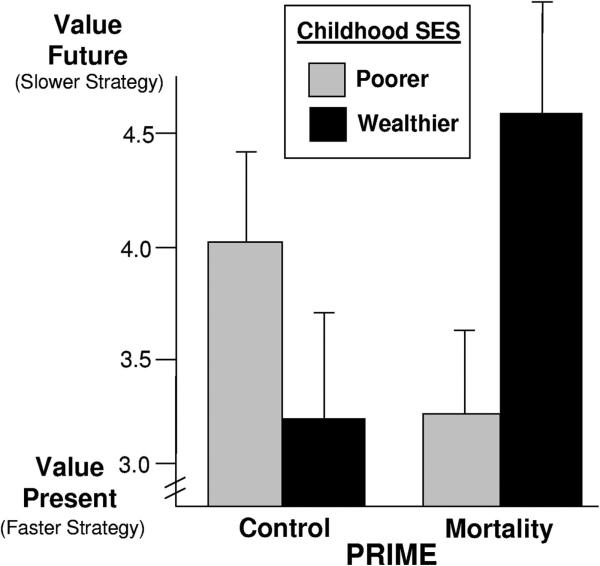

Time preference

For time preference, prime also interacted with childhood SES, F(1, 67) = 3.2, p = .048, η2 = .046 (see Figure 3). As predicted, those from poorer backgrounds—who were –1 SD below the childhood SES mean—preferred the present, choosing more smaller, immediate rewards when primed with mortality, t(67) = 1.62, p = .06, η2 = .04. Conversely, those from wealthier backgrounds—who were 1 SD above the childhood SES mean—showed a preference for the future, choosing more larger, delayed rewards when primed with mortality, t(67) = 1.71, p = .05, η2 = .04.

Figure 3.

Preference for delayed rewards as a function of mortality cues and relative childhood SES (Experiment 2). Graphed means represent one standard deviation above and below the mean of childhood SES with standard error bars. SES = socioeconomic status.

Discussion

The second experiment examined how mortality cues influenced risk preferences (e.g., $10 for sure vs. 25% chance of $20) and time preferences (e.g., $5 now vs. $10 later). For risk, findings replicated the pattern found in the first study: Mortality cues led people who grew up in resource-plentiful environments to take fewer risks and led those who grew up in resource-scarce environments to take more risk. For time preference, mortality cues also had a different effect as a function of childhood SES: Mortality cues led people with higher SES childhoods to value the future and led those with lower SES childhoods to value the present.

Experiment 3: Mortality, Gratification Delay, and Childhood Family Income

In the final experiment, we attempted to replicate the specific pattern of findings for delayed rewards found in Study 2. Experiment 3 assessed time preferences in two ways to ensure the robustness of this effect. Our second purpose in the study was to increase the validity of the childhood SES findings. The previous studies examined childhood SES by asking about a person's subjective childhood experience. Although there is reason to believe that subjective childhood experience is likely to have important ramifications on adult life history strategies, in the current study we aimed to replicate the temporal risk effect from Experiment 2 using a more objective measure of childhood SES: household family income when growing up.

Method

Participants

Forty-four students (mean age = 20.3 years) at a large public university participated in the study for course credit. All participants came to the lab in small groups and were seated at computers between partitions.

Design and procedure

The study had two between-subjects prime conditions: mortality and control. The method of priming was identical to that in Experiment 2. At the end of the study, to assess childhood SES, participants indicated their household family income when they were growing up. They chose one of six options: (a) $10,000 or less, (b) $10,001–$25,000, (c) $25,001–$40,000, (d) $40,001–$50,000, (e) $50,001–$70,000, and (f) more than $70,000.

Dependent measures

Time preference was assessed with two types of measures. The first measure was identical to that used in Experiment 2; it involved a series of seven dichotomous choices between receiving a specific amount of money tomorrow and receiving slightly more money 90 days from now. The second measure consisted of two items that asked participants to indicate their preference between two options: (a) Receive $300 tomorrow OR receive $400 12 months from now and (b) Receive $700 tomorrow OR receive $800 3 months from now. Participants indicated their preferences on a 9-point scale, with anchors of 1 (definitely option A) to 9 (definitely option B), whereby the two options were labeled either A or B. As expected, all of the items showed highly similar patterns, and thus they were combined into a time preference index (α = .90).

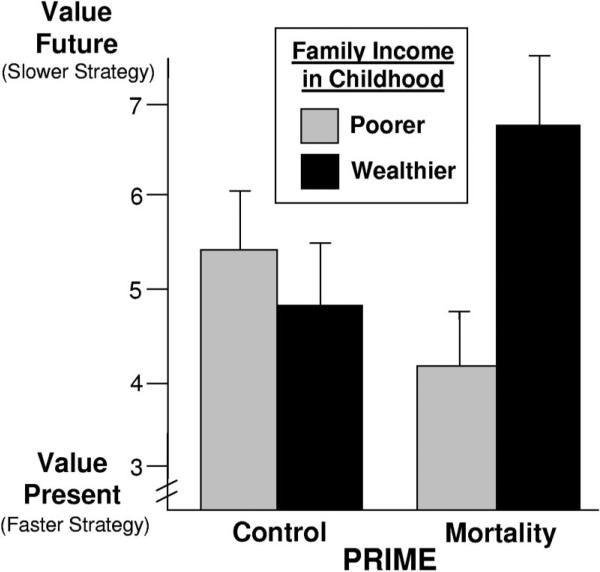

Results and Discussion

Consistent with the findings from the second experiment, there was an interaction between prime and childhood family income, F(1, 40) = 7.55, p = .005 (see Figure 4). For individuals with childhood SES 1 SD above the mean, the mortality prime led to increased valuation of the future, t(40) = 2.55, p = .023, η2 = .12. For individuals with childhood SES –1 below the mean, the mortality prime led to a marginally significant increase in valuing the present, t(40) = 1.46, p = .08, η2 = .04.

Figure 4.

Preference for delayed rewards as a function of mortality cues and childhood family income (Experiment 3). Graphed means represent one standard deviation above and below the mean of childhood family income with standard error bars.

The pattern of results in Experiment 3—with additional measures of time preference and a different measure of childhood SES—converged with the results found in Experiment 2: Individuals adopting a slower life history strategy responded to cues of mortality by valuing the future, whereas individuals adopting a faster strategy responded by valuing the present.

General Discussion

At the outset of this paper we presented the puzzling case of Ray Otero, the New Yorker from a poor upbringing who started playing the lottery after the tragedy of 9/11 and now spends more than $500 each week trying to hit the jackpot. We posited that Otero's shift in preferences for risk and immediate rewards might stem from his reactions to specific types of environmental cues and that his seemingly irrational choices may actually reflect a deeper evolutionary logic. To answer these questions, we drew on life history theory—an evolutionary framework proposing that organisms’ life courses fall on a continuum from a “slower” course related to investing in somatic effort and delaying reproduction to a “faster” course related to forgoing somatic effort and reproducing earlier in life. Because life history theory predicts that the adoption of faster versus slower strategies should be related to mortality and because different strategies are associated with specific risk and time preferences, we examined how priming mortality cues influenced risk and time preferences.

Three experiments yielded several consistent findings. First, mortality cues had a markedly different effect on risk preferences and on temporal discounting depending on whether people reported growing up in a relatively resource-scarce or resource-plentiful environment. This moderating effect of childhood SES was stable across subjective attitudes of childhood resource availability (Studies 1 and 2) and recall of objective household income (Study 3). This childhood-SES effect is consistent with recent research examining how mortality cues influence reproductive timing (Griskevicius et al., 2010) and with medical research examining how stress influences health (e.g., Cohen et al., 2004; Galobardes et al., 2004; Miller et al., 2009).

The other key findings relate to how mortality cues influenced preferences for risk (e.g., $10 for sure vs. 25% chance of $20) and preferences for delayed rewards (e.g., $5 now vs. $10 later). For people who grew up in relatively resource-plentiful environments, mortality cues led them to take less risk and value the future more. This specific pattern is consistent with a slow life history strategy, which entails not gambling away current resources but instead investing and waiting for potentially larger payoffs in the future. Conversely, mortality cues led people who grew up in relatively resource-scarce environments to prefer more risk and value the present. This specific pattern is consistent with a fast life history strategy, which entails taking risks for big immediate payoffs and preferring to get any kind of certain reward now rather than a potentially larger reward later.

In summary, the current research shows that different life history strategies—and the specific preferences for risk and delayed rewards associated with different strategies—can shift as a function of specific cues in a person's adult environment. This work substantially extends previous work by demonstrating that life history strategies are not only important for directing reproductive decisions (e.g., when to reproduce) but are also important for behaviors such as financial decision making and desire for immediate versus delayed rewards.

Human Life History Strategies and Psychological Mechanisms

The present research identified a series of specific effects regarding how mortality cues influence preferences for financial risk and delayed rewards. However, there is a need for future research examining psychological and physiological processes driving these robust effects. Below we describe avenues for future research that could help identify specific processes predicted by life history theory.

A life history perspective suggests that there are likely to be critical differences between high and low childhood-SES environments. Lower SES childhood environments are likely to have many more stressors linked to unpredictability and harshness, such as multiple job and residence changes, fluctuating employment status and resource availability, parental stress over resources, and changing household membership (e.g., the coming and going of parents, stepparents, and/or relatives; see Belsky, 2007). Such harsh and unpredictable features should typically be less frequent in the environments of individuals with higher SES childhoods. Early exposure to environmental factors that contain unpredictability and harshness may “sensitize” life history parameters and establish different developmental trajectories, shunting individuals down a slow or a fast pathway (e.g., Caretta, Caretta, & Cavaggioni, 1995). This differential sensitization in childhood ought to affect how individuals respond to certain ecological variables later in life. This possible mechanism suggests that psychologies associated with different life history strategies might lay “dormant” in benign ecological conditions but might become enacted in critical conditions suggesting ecological harshness and unpredictability.

Future research should also examine whether different individuals might perceive the same mortality threats in distinctly different ways. Life history theory suggests that there are important distinctions between two types of mortality: (a) extrinsic mortality, which includes causes of death that are random, unpredictable, and uncontrollable (e.g., a predator that can strike anyone at any moment in any place), and (b) intrinsic mortality, which includes causes of death that are predictable and potentially avoidable, given sufficient efforts (e.g., a deep freeze that occurs every winter). Whereas the prevalence of extrinsic mortality is linked to faster life history strategies, the prevalence of intrinsic mortality is linked to the adoption of slower strategies (Ellis et al., 2009). This is because mortality threat that is intrinsic can be decreased by “investing” in larger body size, better immune system functioning, and/or knowledge and skills that could decrease the threat. For example, dying during cold winters can be avoided by developing a robust immune system and securing shelter from the elements. In contrast, mortality threat that is extrinsic cannot be reduced through effort, because all individuals in a population are at similar level of risk regardless of what actions are taken. For example, if it is impossible to predict when, where, or who a predator will strike, no investment in somatic effort or embodied capital will help decrease this threat.

Given that different types of mortality are linked to different life history strategies, we suggest that the same mortality cues can be interpreted as either extrinsic or intrinsic. Some people, for example, might perceive increasing mortality as intrinsic. This should lead them to adopt a slower strategy whereby they invest in themselves now in order either to wait out the bad times or to become more competitive in this new, high-mortality environment. Others might perceive the same increasing mortality as extrinsic. This should lead them to adopt a faster strategy whereby they try to maximize their current situation in life. Thus, we suggest that individuals who grew up in higher SES environments should typically perceive cues to danger as indicating intrinsic mortality, whereas those who grew up in lower SES environments should perceive the same danger cues as indicative of extrinsic mortality. This means that individuals should enact different life history strategies in response to the same mortality cues.

Limitations and Future Directions

One limitation of the current research is that we sampled from a population with a relatively limited range of SES. It is impossible to know exactly how this restriction of range influenced our results. For example, this restriction may have actually reduced our power to detect a significant interaction between childhood SES and mortality cues, because our low-SES participants developed in conditions that were relatively affluent compared to the full range of economic conditions worldwide and historically. It is possible that individuals raised in more resource-deprived environments might have responded to mortality primes in an even stronger manner, shifting life history strategies even more dramatically. We suspect that sampling at the two extremes of childhood SES would show that wealthier individuals are following a slower strategy, whereas poorer individuals are following a faster strategy. Sampling at the extremes might allow detection of this difference in life history strategies in a neutral control condition. If so, making mortality cues salient for these two populations would likely cause them to diverge even further, leading the already slow individuals to become even slower and leading the already fast individuals to become even faster.

The fact that we have consistently found that perceived childhood SES moderates the effect of mortality cues in this research and in previous work (Griskevicius et al., 2010) suggests that this effect is quite robust in this population and that cues related to relative childhood SES are important in sensitizing life history strategies. Although there is a clear need for future research examining these kinds of effects in more diverse populations, one of the strengths and key contributions of the current studies is the emergence of this pattern for individuals who are not at the extreme ends of SES. This consistent finding suggests that the psychology and behavior associated with different life history strategies is especially likely to emerge in ecologies that imply unpredictability and harshness.

It is also important to note that the pattern for risk preferences in the control conditions was often the reverse (albeit not significantly so) of that in the mortality conditions. When mortality threat was not salient, people from wealthier backgrounds preferred slightly more risk than did those from poorer backgrounds (for a replication of this wealth–risk preference effect in a German sample, see Dohmen, Falk, Huffman, & Sunde, 2010). When we consider how risk preferences changed as a function of the combination of childhood SES and mortality threat, the specific findings in our studies are consistent with recent models of state-dependent risk (Nettle, 2009). This model suggests that individuals in a good state are prepared to take relatively large risks, in line with what we found for people with higher SES childhood when there was no immediate threat. As a person's state deteriorates, such as when threat becomes more pervasive, the maximum risk-iness of behavior declines until the person become risk averse. However, when a person's state becomes dire, such as a low-SES childhood combined with prevalent mortality threat, there is an abrupt shift toward being totally risk prone (Nettle, 2009).

Future endeavors should investigate which specific features of the childhood ecology might be driving the effects identified in the current research. For example, future research could formally test whether these effects are driven by ecological features related to unpredictability, harshness, or a combination of these factors (see Ellis et al., 2009). Future research should also consider whether there are “critical periods” in childhood when ecological conditions are most likely to affect psychological aspects of life history strategy. Finally, in the current research we focused on outcomes related to financial risk, but fast and slow life history strategies relate to many types of risky behaviors (e.g., Nettle, 2010). For example, faster strategies are generally associated with higher incidence of criminal behavior, sexual risk, and health risk. However, future research is needed to ascertain the ways in which different types of risk relate to different life history strategies.

Regarding alternative explanations, it is important to note that we developed this research program by attempting to synthesize life history theory with evolutionary psychology research on social cognition (e.g., Ackerman et al., 2006; Griskevicius, Goldstein, Mortensen, Cialdini, & Kenrick, 2006; Griskevicius et al. (2009); Haselton & Nettle, 2006; Maner et al., 2005; Kenrick, Griskevicius, Neuberg, & Schaller, 2010; Navarrete et al., 2009; Schaller, Park, & Mueller, 2003; Van Vugt, De Cremer, & Janssen, 2007). Nevertheless, other theoretical perspectives, such as terror management theory (TMT; Greenberg, Pyszczynski, & Solomon, 1986), have examined how mortality threats influence human behavior and cognition. TMT posits that explicit consideration of one's eventual death produces a suite of responses that function to neutralize anxiety. In particular, TMT argues that people sometimes manipulate and protect their own self-esteem to neutralize the anxiety of impending death. We believe that although there are some similarities between life history theory and TMT, there are also crucial differences between the two perspectives (see the General Discussion of Griskevicius et al., 2010). Ultimately, we believe that the combination of these theories helps us understand more fully the multiple reasons—at multiple explanatory levels—regarding how, why, and when mortality cues have powerful effects on cognition and behavior.

Genetics and Life History Strategies

Throughout this paper, we have assumed that life history strategy is sensitized by events experienced during childhood. An alternative possibility is that one's life history strategy and childhood SES are both the product of underlying genetic factors. Indeed, research shows that responses to stress are moderated by a person's genotype (Caspi et al., 2003). Although we suspect that genetic factors play a role in life history calibration, our findings suggest that genes alone do not provide a complete explanation. For example, we found in the current studies and in previous work (Griskevicius et al., 2010) that childhood SES had consistently stronger moderating effects than did current SES. However, a purely genetic perspective would likely predict the opposite pattern: All else being equal, one's current SES and life history strategy are more under the control of one's own genes than is one's childhood environment; this is largely created by one's parents, who have different, though related, genotypes. Although it is not possible to experimentally manipulate the early environments of humans to test how early experiences shape life history strategies, experimental research on other animals that used cross-fostering methodologies has shown that early experience can affect brain development and later behavior independent of genetic factors (Francis, Diorio, Liu, & Meaney, 1999; Maestripieri, 2005). Thus, childhood experience is likely to play a role in sensitizing life history strategies.

An additional possibility is that life history strategies are calibrated or sensitized by epigenetic factors, by which we mean inheritable differences not due to differences in DNA sequence but instead mediated through gene– environment interactions (Jablonka & Raz, 2009). One possibility is that humans have adaptations allowing adult phenotypes to assess the long-term state of their environments and then to pass life-history-relevant epigenetic information to their offspring. This would allow developing offspring to begin a life history trajectory commensurate with the particular environment into which they are born, even with little to no direct experience with that environment. If such an ability exists, the effects of childhood SES in our studies would not be due to the direct experiences of our participants but to the experiences of their parents, which are correlated with participants’ childhood SES, refracted through epigenetic processes. Future research should examine how genes and the environment might work together to influence life history strategies.

Conclusion

At the surface level, much human behavior seems irrational, unwise, or extreme. For example, frittering away money on lottery tickets or on frivolous overpriced products makes little sense when considered from a rational economic perspective. Yet such behaviors often reveal a deeper rationality when considered from an evolutionary perspective (Griskevicius et al., 2007; Kenrick et al., 2009). For example, purchasing a lottery ticket versus saving that money may be reflective of individuals who are pursuing different life history strategies. Life history theory does not imply that a particular trait or behavior is “good” or “bad,” just as it does not suggest that a fast or a slow strategy is intrinsically superior. Instead, the psychologies and behaviors associated with different life history strategies simply reflect the outputs of mental mechanisms designed to make the best of the circumstances in which individuals find themselves.

The evolutionary framework of life history theory has tremendous potential for helping explain and tie together the why and how of myriad psychological and behavioral phenomena. For example, a recent literature review examining how threats to life influence risky behavior found that studies manipulating mortality salience or manipulating various negative emotions showed inconsistent and often differing effects on risky behaviors (Ben-Zur & Zeidner, 2009). We suggest that these kinds of manipulations are likely to have different effects on risk as a function of other moderating factors, such as a person's childhood environment or the type of risk the person is incurring (e.g., temporal risk).

One elegant feature of life history theory is its emphasis on context and individual differences. Take Ray Otero's lottery spending habits as an example. To his neighbor, who described Otero's behavior as “crazy . . . he's got a ton of worthless tickets” (Feuer, 2008), the fast strategy enacted by Otero was foolish and irrational. However, a consideration of the environment in which Otero was raised and the ecological context in which he later found himself suggests that his lottery habits might have a deeper functional significance. After having grown up in a poor environment and witnessed environmental uncertainty and random death (e.g., the 9/11 terrorist attacks on the World Trade Center), Otero might have enacted a fast economic strategy emphasizing the chance for great fortune at the expense of slow, long-term savings. From the perspective of someone who has received environmental feedback that the fruits of a slow, long-term strategy might not be realized in an unpredictable world, a gambling, fast strategy seems more reasonable. Indeed, from this perspective, Otero's description of his newfound philosophy does not seem all that irrational: “If all you're doing is working, you're never going to win” (Feuer, 2008).

Acknowledgments

This research was supported by National Science Foundation Grant 0843764 awarded to the first author.

Contributor Information

Vladas Griskevicius, Department of Marketing, Carlson School of Management, University of Minnesota, Santa Barbara..

Joshua M. Tybur, Department of Psychology, University of New Mexico, Santa Barbara.

Andrew W. Delton, Department of Psychology, University of California, Santa Barbara.

Theresa E. Robertson, Department of Psychology, University of California, Santa Barbara.

References

- Ackerman JM, Shapiro JR, Neuberg SL, Kenrick DT, Becker DV, Griskevicius V, Schaller M. They all look the same to me (unless they're angry): From out-group homogeneity to out-group heterogeneity. Psychological Science. 2006;17:836–840. doi: 10.1111/j.1467-9280.2006.01790.x. doi:10.1111/j.1467-9280.2006.01790.x. [DOI] [PubMed] [Google Scholar]

- Adams J, Nettle D. Time perspective, personality and smoking, body mass, and physical activity: An empirical study. British Journal of Health Psychology. 2009;14:83–105. doi: 10.1348/135910708X299664. doi:10.1348/135910708X299664. [DOI] [PubMed] [Google Scholar]

- Aiken LS, West SG. Multiple regression: Testing and interpreting interactions. Sage; Thousand Oaks, CA: 1991. [Google Scholar]

- Belsky J. Childhood experiences and reproductive strategies. In: Dunbar R, Barrett L, editors. Oxford handbook of evolutionary psychology. Oxford University Press; Oxford, England: 2007. pp. 237–254. [Google Scholar]

- Belsky J, Houts RM, Fearon RMP. Infant attachment and the timing of puberty: Testing an evolutionary hypothesis. Psychological Science. 2010;21:1195–1201. doi: 10.1177/0956797610379867. doi:10.1177/0956797610379867. [DOI] [PubMed] [Google Scholar]

- Belsky J, Steinberg L, Draper P. Childhood experience, interpersonal development, and reproductive strategy: An evolutionary theory of socialization. Child Development. 1991;62:647–670. doi: 10.1111/j.1467-8624.1991.tb01558.x. doi:10.2307/1131166. [DOI] [PubMed] [Google Scholar]

- Ben-Zur H, Zeidner M. Threat to life and risk-taking behaviors: A review of empirical findings and explanatory models. Personality and Social Psychology Review. 2009;13:109–128. doi: 10.1177/1088868308330104. doi:10.1177/1088868308330104. [DOI] [PubMed] [Google Scholar]

- Bielby J, Mace GM, Bininda-Emonds ORP, Cardillo M, Gittleman JL, Jones KE, Purvis A. The fast–slow continuum in mammalian life history: An empirical reevaluation. American Naturalist. 2007;169:748–757. doi: 10.1086/516847. doi:10.1086/516847. [DOI] [PubMed] [Google Scholar]

- Boyce WT, Ellis BJ. Biological sensitivity to context: I. An evolutionary–developmental theory of the origins and functions of stress reactivity. Development and Psychopathology. 2005;17:271–301. doi: 10.1017/s0954579405050145. doi:10.1017/S0954579405050145. [DOI] [PubMed] [Google Scholar]

- Braver SL. On splitting the tails unequally: A new perspective on one- versus two-tailed tests. Educational and Psychological Measurement. 1975;35:283–301. doi:10.1177/001316447503500206. [Google Scholar]

- Caretta CM, Caretta A, Cavaggioni A. Pheromonally accelerated puberty is enhanced by previous experience of the same stimulus. Physiology & Behavior. 1995;57:901–903. doi: 10.1016/0031-9384(94)00344-5. doi:10.1016/00319384(94)00344-5. [DOI] [PubMed] [Google Scholar]

- Caspi A, Sugden K, Moffitt TE, Taylor A, Craig IW, Harrington H, Poulton R. Influence of life stress on depression: Moderation by a polymorphism in the 5-HTT gene. Science. 2003 July 18;301:386–389. doi: 10.1126/science.1083968. doi:10.1126/science.1083968. [DOI] [PubMed] [Google Scholar]

- Charnov EL. Life history invariants. Oxford University Press; Oxford, England: 1993. [Google Scholar]

- Chisholm JS. Death, hope, and sex: Life-history theory and the development of reproductive strategies. Current Anthropology. 1993;34:1–24. doi:10.1086/204131. [Google Scholar]

- Chisholm JS. The evolutionary ecology of attachment organization. Human Nature. 1996;7:1–38. doi: 10.1007/BF02733488. [DOI] [PubMed] [Google Scholar]

- Cohen S, Doyle WJ, Turner RB, Alper CM, Skoner DP. Childhood socioeconomic status and host resistance to infectious illness in adulthood. Psychosomatic Medicine. 2004;66:553–558. doi: 10.1097/01.psy.0000126200.05189.d3. doi:10.1097/01.psy.0000126200.05189.d3. [DOI] [PubMed] [Google Scholar]

- Daan S, Tinbergen J. Adaptation of life histories. In: Krebs JR, Davies NB, editors. Behavioural ecology: An evolutionary approach. 4th ed. Blackwell; Oxford, England: 1997. pp. 311–333. [Google Scholar]

- Daly M, Wilson M. Carpe diem: Adaptation and devaluing the future. Quarterly Review of Biology. 2005;80:55–60. doi: 10.1086/431025. doi:10.1086/431025. [DOI] [PubMed] [Google Scholar]

- Davis J, Werre D. A longitudinal study of the effects of uncertainty on reproductive behaviors. Human Nature. 2008;19:426–452. doi: 10.1007/s12110-008-9052-2. doi:10.1007/s12110-008-9052-2. [DOI] [PubMed] [Google Scholar]

- Del Giudice M. Sex, attachment, and the development of reproductive strategies. Behavioral and Brain Sciences. 2009;32:1–21. doi: 10.1017/S0140525X09000016. doi:10.1017/S0140525X09000016. [DOI] [PubMed] [Google Scholar]

- DiNapoli TP. 2008 comptroller's report of the financial condition of New York State. 2008 Retrieved from http://www.osc.state.ny.us/finance/finreports/fcr08.pdf.

- Dohmen T, Falk A, Huffman D, Sunde U. Are risk aversion and impatience related to cognitive ability? American Economic Review. 2010;100:1238–1260. doi:10.1257/aer.100.3.1238. [Google Scholar]

- Eibl-Eibesfeldt I. Human ethology. de Gruyter; New York, NY: 1989. [Google Scholar]

- Ellis BJ. Timing of pubertal maturation in girls. Psychological Bulletin. 2004;130:920–958. doi: 10.1037/0033-2909.130.6.920. doi:10.1037/0033-2909.130.6.920. [DOI] [PubMed] [Google Scholar]

- Ellis BJ, Figueredo AJ, Brumbach BH, Schlomer GL. Fundamental dimensions of environmental risk: The impact of harsh versus unpredictable environments on the evolution and development of life history strategies. Human Nature. 2009;20:204–268. doi: 10.1007/s12110-009-9063-7. doi:10.1007/s12110-009-9063-7. [DOI] [PubMed] [Google Scholar]

- Ellis BJ, McFadyen-Ketchum S, Dodge KA, Pettit GA, Bates JE. Quality of early family relationships and individual differences in the timing of pubertal maturation in girls: A longitudinal test of an evolutionary model. Journal of Personality and Social Psychology. 1999;77:387–401. doi: 10.1037//0022-3514.77.2.387. doi:10.1037/0022-3514.77.2.387. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Feuer A. Thousands later, he sees lottery's cruelty up close. The New York Times. 2008 August 21; Retrieved from http://www.nytimes.com/2008/08/22/nyregion/22super.html?_r=1.

- Figueredo AJ, Vásquez G, Brumbach BH, Schneider SMR. The heritability of life history strategy: The K-factor, covitality, and personality. Social Biology. 2004;51:121–143. doi: 10.1080/19485565.2004.9989090. [DOI] [PubMed] [Google Scholar]

- Figueredo AJ, Vásquez G, Brumbach BH, Schneider SMR, Sefcek JA, Tal IR, Jacobs WJ. Consilience and life history theory: From genes to brain to reproductive strategy. Developmental Review. 2006;26:243–275. doi:10.1016/j.dr.2006.02.002. [Google Scholar]

- Francis D, Diorio J, Liu D, Meaney MJ. Nongenomic transmission across generations of maternal behavior and stress responses in the rat. Science. 1999 November 5;286:1155–1158. doi: 10.1126/science.286.5442.1155. doi:10.1126/science.286.5442.1155. [DOI] [PubMed] [Google Scholar]

- Galobardes B, Lynch JW, Davey Smith G. Childhood socioeconomic circumstances and cause-specific mortality in adulthood: Systematic review and interpretation. Epidemiology Review. 2004;26:7–21. doi: 10.1093/epirev/mxh008. doi:10.1093/epirev/mxh008. [DOI] [PubMed] [Google Scholar]

- Gangestad SW, Garver-Apgar CE, Simpson JA. Changes in women's mate preferences across the ovulatory cycle. Journal of Personality and Social Psychology. 2007;92:151–163. doi: 10.1037/0022-3514.92.1.151. doi:10.1037/0022-3514.92.1.151. [DOI] [PubMed] [Google Scholar]

- Green L, Myerson J. A discounting framework for choice with delayed and probabilistic rewards. Psychological Bulletin. 2004;130:769–792. doi: 10.1037/0033-2909.130.5.769. doi:10.1037/0033-2909.130.5.769. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Greenberg J, Pyszczynski T, Solomon S. The causes and consequences of a need for self-esteem: A terror management theory. In: Baumeister RF, editor. Public self and private self. Springer-Verlag; New York, NY: 1986. pp. 189–212. [Google Scholar]

- Griskevicius V, Delton AW, Robertson TE, Tybur JM. Environmental contingency in life history strategies: The influence of mortality and socioeconomic status on reproductive timing. Journal of Personality and Social Psychology. 2010 doi: 10.1037/a0021082. Advance online publication. doi:10.1037/a0021082. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Griskevicius V, Goldstein NJ, Mortensen CR, Cialdini RB, Kenrick DT. Going along versus going alone: When fundamental motives facilitate strategic (non)conformity. Journal of Personality and Social Psychology. 2006;91:281–294. doi: 10.1037/0022-3514.91.2.281. doi:10.1037/0022-3514.91.2.281. [DOI] [PubMed] [Google Scholar]

- Griskevicius V, Tybur JM, Gangestad SW, Perea EF, Shapiro JR, Kenrick DT. Aggress to impress: Hostility as an evolved context-dependent strategy. Journal of Personality and Social Psychology. 2009;96:980–994. doi: 10.1037/a0013907. doi:10.1037/a0013907. [DOI] [PubMed] [Google Scholar]

- Griskevicius V, Tybur JM, Sundie JM, Cialdini RB, Miller GF, Kenrick DT. Blatant benevolence and conspicuous consumption: When romantic motives elicit strategic costly signals. Journal of Personality and Social Psychology. 2007;93:85–102. doi: 10.1037/0022-3514.93.1.85. doi:10.1037/0022-3514.93.1.85. [DOI] [PubMed] [Google Scholar]

- Haselton MG, Nettle D. The paranoid optimist: An integrative evolutionary model of cognitive biases. Personality and Social Psychology Review. 2006;10:47–66. doi: 10.1207/s15327957pspr1001_3. doi:10.1207/s15327957pspr1001_3. [DOI] [PubMed] [Google Scholar]

- Hill E, Ross MLT, Low BS. The role of future unpredictability in human risk-taking. Human Nature. 1997;8:287–325. doi: 10.1007/BF02913037. doi:10.1007/BF02913037. [DOI] [PubMed] [Google Scholar]

- Hill K, Kaplan H. Life history traits in humans: Theory and empirical studies. Annual Review of Anthropology. 1999;28:397–430. doi: 10.1146/annurev.anthro.28.1.397. doi:10.1146/annurev.anthro.28.1.397. [DOI] [PubMed] [Google Scholar]

- Horn HS. Optimal tactics of reproduction and life history. In: Krebs JR, Davies NB, editors. Behavioral ecology: An evolutionary approach. Sinauer; Sunderland, MA: 1978. pp. 411–429. [Google Scholar]

- Horn HS, Rubenstein DI. Behavioral adaptations and life history. In: Krebs JR, Davies NB, editors. Behavioural ecology: An evolutionary approach. 2nd ed. Blackwell; Oxford, England: 1984. pp. 279–300. [Google Scholar]

- Jablonka E, Raz G. Transgenerational epigenetic inheritance: Prevalence, mechanisms, and implications for the study of heredity and evolution. Quarterly Review of Biology. 2009;84:131–176. doi: 10.1086/598822. doi:10.1086/598822. [DOI] [PubMed] [Google Scholar]

- Kacelnik A, Bateson M. Risky theories: The effects of variance on foraging decisions. American Zoologist. 1996;36:402–434. [Google Scholar]

- Kaplan HS, Gangestad SW. Life history theory and evolutionary psychology. In: Buss DM, editor. Handbook of evolutionary psychology. Wiley; New York, NY: 2005. pp. 68–95. [Google Scholar]

- Kaplan HS, Hill K, Lancaster JL, Hurtado AM. A theory of human life history evolution: Diet, intelligence, and longevity. Evolutionary Anthropology. 2000;9:156–185. doi:10.1002/1520-6505(2000)9:4<156::AID-EVAN5>3.0.CO;2-7. [Google Scholar]

- Kenrick DT, Griskevicius V, Neuberg SL, Schaller M. Renovating the pyramid of needs: Contemporary extensions built upon ancient foundations. Perspectives on Psychological Science. 2010;5:292–314. doi: 10.1177/1745691610369469. doi:10.1177/1745691610369469. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kenrick DT, Griskevicius V, Sundie JM, Li NP, Li YJ, Neuberg SL. Deep rationality: The evolutionary economics of decision-making. Social Cognition. 2009;27:764–785. doi: 10.1521/soco.2009.27.5.764. doi:10.1521/soco.2009.27.5.764. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kenrick DT, Luce CL. An evolutionary life-history model of gender differences and similarities. In: Eckes T, Trautner HM, editors. The developmental social psychology of gender. Erlbaum; Hillsdale, NJ: 2000. pp. 35–63. [Google Scholar]

- Kruger DJ, Nesse RM. An evolutionary life-history framework for understanding sex differences in human mortality rates. Human Nature. 2006;17:74–97. doi: 10.1007/s12110-006-1021-z. doi:10.1007/s12110-006-1021-z. [DOI] [PubMed] [Google Scholar]

- Low BS. Sex, wealth, and fertility: Old rules, new environments. In: Cronk L, Chagnon N, Irons W, editors. Adaptation and human behavior: An anthropological perspective. de Gruyter; New York, NY: 2000. pp. 323–344. [Google Scholar]

- Low BS, Hazel A, Parker N, Welch KB. Influences on women's reproductive lives: Unexpected ecological underpinnings. Cross-Cultural Research. 2008;42:201–219. doi:10.1177/1069397108317669. [Google Scholar]

- Low BS, Simon CP, Anderson KG. An evolutionary ecological perspective on demographic transitions: Modeling multiple currencies. American Journal of Human Biology. 2002;14:149–167. doi: 10.1002/ajhb.10043. doi:10.1002/ajhb.10043. [DOI] [PubMed] [Google Scholar]

- Maestripieri D. Early experience affects the intergenerational transmission of infant abuse in rhesus monkeys. Proceedings of the National Academy of Sciences, USA. 2005;102:9726–9729. doi: 10.1073/pnas.0504122102. doi:10.1073/pnas.0504122102. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Maner JK, Kenrick DT, Becker DV, Robertson TE, Hofer B, Neuberg SL, Schaller M. Functional projection: How fundamental social motives can bias interpersonal perception. Journal of Personality and Social Psychology. 2005;88:63–78. doi: 10.1037/0022-3514.88.1.63. doi:10.1037/0022-3514.88.1.63. [DOI] [PubMed] [Google Scholar]

- Miller GE, Chena E, Fok AK, Walker H, Lima A, Nicholls EF, Kobor MS. Low early-life social class leaves a biological residue manifested by decreased glucocorticoid and increased proinflammatory signaling. Proceedings of the National Academy of Sciences. 2009;106:14716–14721. doi: 10.1073/pnas.0902971106. doi:10.1073/pnas.0902971106. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Navarrete CD, Olsson A, Ho A, Mendes W, Thomsen L, Sidanius J. Fear extinction to an outgroup face: The role of target gender. Psychological Science. 2009;20:155–158. doi: 10.1111/j.1467-9280.2009.02273.x. doi:10.1111/j.1467-9280.2009.02273.x. [DOI] [PubMed] [Google Scholar]

- Nettle D. An evolutionary model of low mood states. Journal of Theoretical Biology. 2009;257:100–103. doi: 10.1016/j.jtbi.2008.10.033. doi:10.1016/j.jtbi.2008.10.033. [DOI] [PubMed] [Google Scholar]

- Nettle D. Dying young and living fast: Variation in life history across English neighborhoods. Behavioral Ecology. 2010;21:387–395. doi:10.1093/beheco/arp202. [Google Scholar]

- Promislow D, Harvey P. Living fast and dying young: A comparative analysis of life-history variation among mammals. Journal of the Zoological Society of London. 1990;220:417–437. doi:10.1111/j.1469-7998.1990.tb04316.x. [Google Scholar]

- Quinlan RJ. Human parental effort and environmental risk. Proceedings of the Royal Society of London B: Biological Sciences. 2007;274:121–125. doi: 10.1098/rspb.2006.3690. doi:10.1098/rspb.2006.3690. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Rachlin H, Raineri A, Cross D. Subjective probability and delay. Journal of the Experimental Analysis of Behavior. 1991;55:233–244. doi: 10.1901/jeab.1991.55-233. doi:10.1901/jeab.1991.55-233. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Rice WR, Gaines SD. “Heads I win, tails you lose”: Testing directional alternative hypotheses in ecological and evolutionary research. Trends in Ecology and Evolution. 1994;9:235–237. doi: 10.1016/0169-5347(94)90258-5. doi:10.1016/0169-5347(94)90258-5. [DOI] [PubMed] [Google Scholar]

- Roff DA. The evolution of life histories: Theory and analysis. Chapman & Hall; New York, NY: 1992. [Google Scholar]

- Roff DA. Life history evolution. Sinauer; Sunderland, MA: 2002. [Google Scholar]

- Rubin PH, Paul CW. An evolutionary model of taste for risk. Economic Inquiry. 1979;17:585–596. doi:10.1111/j.1465-7295.1979.tb00549.x. [Google Scholar]

- Schaffer WM. The application of optimal control theory to the general life history problem. American Naturalist. 1983;121:418–431. doi:10.1086/284070. [Google Scholar]

- Schaller M, Park JH, Mueller A. Fear of the dark: Interactive effects of beliefs about danger and ambient darkness on ethnic stereotypes. Personality and Social Psychology Bulletin. 2003;29:637–649. doi: 10.1177/0146167203029005008. doi:10.1177/0146167203029005008. [DOI] [PubMed] [Google Scholar]

- Simpson JA, Belsky J. Attachment theory within a modern evolutionary framework. In: Shaver PR, Cassidy J, editors. Handbook of attachment: Theory, research, and clinical applications. 2nd ed. Guilford; New York, NY: 2008. pp. 131–157. [Google Scholar]

- Stearns S. The influence of size and phylogeny on patterns of covariation among life-history traits in the mammals. Oikos. 1983;41:173–187. doi:10.2307/3544261. [Google Scholar]

- Stearns S. The evolution of life histories. Oxford University Press; New York, NY: 1992. [Google Scholar]

- Tinbergen JM, Both C. Is clutch size individually optimized? Behavioral Ecology. 1999;10:504–509. doi:10.1093/beheco/10.5.504. [Google Scholar]

- Van Vugt M, De Cremer D, Janssen D. Gender differences in cooperation and competition: The male-warrior hypothesis. Psychological Science. 2007;18:19–23. doi: 10.1111/j.1467-9280.2007.01842.x. doi:10.1111/j.1467-9280.2007.01842.x. [DOI] [PubMed] [Google Scholar]

- Walker RS, Gurven M, Burger O, Hamilton M. The trade-off between number and size of offspring in humans and other primates. Proceedings of the Royal Society B: Biological Sciences. 2008;275:827–833. doi: 10.1098/rspb.2007.1511. doi:10.1098/rspb.2007.1511. [DOI] [PMC free article] [PubMed] [Google Scholar]