Abstract

The birth and explosive growth of mobile money in Kenya has provided economists with an opportunity to study the evolution and impact of a new financial system. Mobile money is an innovation that allows individuals to store, send, and receive money on their mobile phone via text message. This system has opened up basic financial services to many who were previously excluded, and has had real and measurable impacts on the ability of households to protect themselves against health risks. Using a unique survey instrument covering nearly 2,300 households over 2008–2010, we first document the lightning-fast adoption of mobile money in Kenya, which was faster than most documented modern technologies in the United States. We then present evidence on how this innovation allows households to respond better to unexpected adverse health events. We find that in the face of these events, users of mobile money are better able to tap into remittances to finance additional health care costs without having to forego necessary expenditures on education, food, and other consumption needs.

Keywords: technology adoption, social networks, Africa, financial inclusion

Modern economic growth is not possible without a well-functioning monetary and financial system. The financial system affects virtually every economic transaction, and improvements to that system can make transactions easier and faster, and enable new types of transactions, including those that allow households to cope with and spread risk. The substantial benefits of a well-functioning financial system are perhaps most evident when the system fails—a lesson made very clear in 2008, when the near collapse of the global financial system had devastating effects around the world.

In this paper we present evidence of the impact of an unanticipated and rapid financial expansion in Kenya. We exploit this opportunity to study the birth of a new financial system and how it affects basic economic activity. Recent advances in cell phone technology across sub-Saharan Africa have created reasonably sophisticated financial functionality in economies that previously supported only rudimentary systems. Although Kenya’s mobile money revolution is the most prominent, similar innovations are taking hold in other African nations (Tanzania, South Africa, Uganda, and Rwanda) and other developing countries (Pakistan, Afghanistan, and the Philippines).

Before 2007, most personal economic transactions in Kenya required the use of cash or barter. Credit cards, debit cards, and checks were rare, and although a formal banking system existed, access to it was limited. Even the cash economy operated inefficiently, because the country—larger in area than France, and with a population of more than 35 million—supported fewer than 1,000 automated teller machines (ATMs) and roughly 700 bank branches. If you were lucky enough to have cash, you would keep it “under your mattress”; and if you needed to send cash to someone, you would most likely have to do so in person. (Although Western Union and postal bank transfers are available in Kenya, from our survey data only 0.4% and 2.9% of remittances were received by these services, respectively. In addition, there are only about 590 Western Union agents across the country, all of which are either bank branches or foreign exchange bureaus.) Sending money home could involve a long, costly, and potentially dangerous bus trip (due to both crashes and banditry), as well as foregone wages.

Under these conditions, only the most essential transactions took place, constraining the development of a potentially vibrant economy. Though the exchange of goods and personal services was limited, financial services such as credit and insurance were even more circumscribed, which held back investment and exposed individuals to risk. In Kenya, a large component of household income is subject to the vicissitudes of climate, because 78% of the population is rural and 96% of cropland is rain fed. Figures for sub-Saharan Africa are similar (http://www.fao.org/nr/water/aquastat/main/index.stm and http://data.worldbank.org/data-catalog/world-development-indicators). With the further uncertainty of nonagricultural employment, physical insecurity, and political instability, households face substantial and sometimes insurmountable economic risks.

Without markets for credit and insurance (and with limited government safety net programs), individuals and households often depend on informal arrangements with family members, friends, and others to manage the risks they face. Studies, like Townsend’s seminal work (1), have shown that within villages, households are able to partially “smooth” their consumption, keeping expenditures somewhat steady in the face of unexpected shocks to income due to, say, crop failures, drought, or illness. However, insurance attained through this means of risk spreading is often incomplete.

Since the 1990s, cell phone use in Kenya has grown rapidly, tripling between 2006 and 2011, reaching 25 million subscribers and over 80% of households by 2011 (2, 3). In 2007, the country’s dominant cell phone company, Safaricom Ltd. (whose market share was 73% at the time), launched M-PESA, a mobile money service that permitted individuals to deposit, withdraw, send, and receive money via short message service (SMS) on their cell phones. The initial maximum transaction allowed was nearly $500, although on average most have been in the $10 to $100 range.

Users of M-PESA open their accounts, and deposit and withdraw cash through M-PESA agents, who act like microbank branches or ATMs. M-PESA transactions can be made at most bank branches, and withdrawals from most ATMs. Over 4 y, the network of M-PESA agents exploded to about 30,000, more than 30× the number of bank branches in the country. Though the number of bank branches and ATMs per 100,000 people in the United States is 22× that in Kenya (the number in France is 19× higher than in Kenya), if M-PESA agents are included as cash-in and cash-out services, then the density in the United States is only double that in Kenya (4). [In 2010, gross domestic product (GDP) per capita (purchasing power parity) was only $1,621 in Kenya compared with $47,084 in the United States (http://data.worldbank.org/data-catalog/world-development-indicators).]

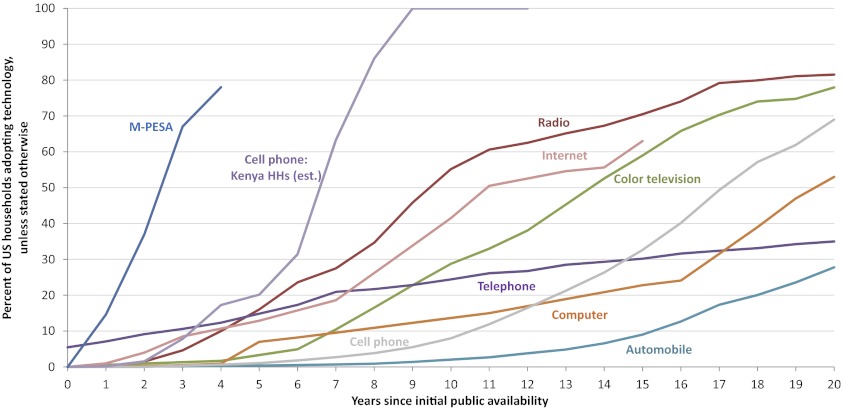

Within a mere 4 y, M-PESA has been adopted by over 14 million people and over 70% of households (2). Fig. 1 shows how these growth rates compare with rates of adoption of other more familiar technologies by households in the United States (5). The explosive growth of mobile money evidences a change of historic magnitude. As Fig. 1 illustrates, the adoption path for mobile money has been far steeper (faster) than those of most modern technologies, such as cell phones and the internet in the United States. Even within Kenya, mobile money penetrated 75% of households in just over half the time that it took cell phones to reach this depth of adoption.

Fig. 1.

Comparative adoption of technologies in the United States and Kenya. Data sources for this figure and the methods for estimating the cell phone adoption rate in Kenya are discussed in detail in Methods.

Mobile money in Kenya has achieved take-up rates far superior to those of Green Revolution technologies in South Asia, which are often cited as technology adoption success stories (6). Technology adoption is an important component of economic development, and a vast literature has documented the importance of total factor productivity (7–9) and technology adoption for economic growth (10). However, some regions of the developing world, in particular sub-Saharan Africa, have struggled to adopt new technologies (11–13). The fact that mobile money expanded so quickly despite all of the constraints to growth and productivity in the economy makes its adoption all the more remarkable.

The phenomenon of mobile money in Africa is providing an unprecedented opportunity for economic research—a brand new financial system has been created. In our analysis of the impact, we begin by studying how the system affects the ability of households to cope with ill health. Health is a natural focus, because of the devastating burden of disease (infant mortality per 1,000 live births was 55 in Kenya vs. 7 in the United States in 2009) and relatively low public expenditure on healthcare (about 4% of GDP in Kenya, compared with 16% in the United States; http://apps.who.int/ghodata/). To study these and other effects, Jack and Suri (14) designed and undertook the first panel survey on mobile money, administered precisely at the time of its most rapid expansion.

Results

Analysis of How Mobile Money Affects Households.

We examine the responses to illness shocks for households with and without access to M-PESA, in terms of the level and composition of their expenditures. We recognize that M-PESA is not randomly allocated across households, and take-up of M-PESA was correlated with education and the use of other financial instruments, both of which are likely to help households smooth risk. In light of this, we present both our basic specification as well as one that uses the rollout of the agent network and controls for an index of potential demand factors.

The sample comes from surveys undertaken by Jack and Suri (14, 15), which collected information on demographics, wealth, expenditure income shocks, remittances, and the use of other financial services. The first round of the survey was conducted in September 2008, covering 3,000 households across most of Kenya, with follow-up surveys in December 2009 and June 2010. A description of the sampling strategy is provided in Methods. All statistics and regressions are reweighted to account for the sampling. Due to attrition, the final sample we use is a two-period panel of 2,283 households, as described in Methods. We also use data on the global positioning system (GPS) locations and start dates of 7,762 M-PESA agents across the country.

Table 1 reports basic summary statistics for the sample. The share of households that reported owning at least one cell phone rose from 69% to 76%, and the share with at least one M-PESA user increased from 43% to 70%. Annual per capita consumption expenditure was ∼73,000 Kenyan shillings (KSh; or about $975) in round 1, but fell to about 64,000 KSh ($850) in round 2 (a drop attributable to a drought). (Consumption expenditure is collected via a standard expenditure module, collecting food expenditure at a weekly recall; other regular expenses at the monthly level; and durables, assets, bride price, and education at an annual level.) Food consumption is roughly half of total consumption, whereas nonfood subsistence consumption is roughly one-fourth of the same total. (Nonfood subsistence consumption covers cooking fuel, personal care, clothing, transport, phone calls, rent, utilities, house maintenance, and entertainment.) Only 42–46% of households report positive medical care expenditures (with average per capita expenses at 3,000–4,000 KSh), and 53–60% spend on education (with average per capita expenses at 4,000–5,000 KSh). Domestic remittances are important for households: nearly 40% reported receiving a transfer. Similarly, risk is a dominant feature of the lives of Kenyans. Between 24% and 40% of households experienced an illness shock. Finally, between the surveys, the average distance to the closest M-PESA agent fell 20%.

Table 1.

Summary statistics for full panel sample, including Nairobi

| Round 1 |

Round 2 |

|||

| Mean | SD | Mean | SD | |

| M-PESA user | 0.432 | 0.496 | 0.698 | 0.459 |

| Own cell phone | 0.692 | 0.462 | 0.758 | 0.428 |

| Per capita expenditure | 73,137 | 131,229 | 64,025 | 87,078 |

| Per capita food expenditure | 31,825 | 31,123 | 30,092 | 25,612 |

| Per capita nonfood subsistence expenditure | 13,795 | 44,218 | 16,587 | 44,308 |

| Propensity to spend on medical care | 0.418 | 0.493 | 0.456 | 0.498 |

| Per capita medical care expenditure | 3,653 | 22,142 | 3,019 | 22,480 |

| Propensity to spend on education | 0.527 | 0.499 | 0.603 | 0.489 |

| Per capita education expenditure | 5,364 | 22,717 | 4,362 | 14,809 |

| Illness shock | 0.239 | 0.427 | 0.401 | 0.490 |

| Propensity to receive remittances | 0.387 | 0.487 | 0.419 | 0.494 |

| Total remittances received (includes zeros) | 9,041 | 86,817 | 4,840 | 13,832 |

All expenditure variables are measured in Kenyan shillings, and the exchange rate during the survey period was approximately KSh 75 = US $1.

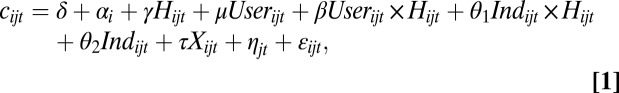

To analyze how household consumption responds to illness shocks, we use a difference-in-differences strategy as per the regression specification:*

|

where cijt is the log of per capita consumption† for household i in location j in period t, αi is a household fixed effect that controls for fixed unobserved factors at the household level, ηjt is a set of province by time dummies, Hijt is a dummy variable equal to 1 if the household reports experiencing a negative illness shock in the last 6 mo,‡ Userijt is a dummy for whether there is an M-PESA user in the household at the time of the survey, Indijt is an index of the household being in a rich neighborhood,§ and Xijt is a set of control variables—in particular, measures of household demographics (age/sex composition, size, and size squared), years of education of the household head, household head occupation dummies (for the categories of farmer, business and profession), the use of three main financial instruments (bank accounts, savings and credit cooperatives, and rotating savings and credit associations), and a dummy for cell phone ownership. The SEs for all regressions are clustered at the sublocation level. In addition to total consumption cijt, we looked at a variety of components of total consumption, including medical expenses, health expenses, and food expenses.¶ We also looked at remittances in our examination of the mechanisms through which M-PESA helps households smooth risk.

Table 2 reports our results. When households experience a negative illness shock, those that use mobile money significantly increase their overall consumption expenditures by 11.8%, whereas nonusers reduce theirs by about 3% (column 1). In columns 2 through 4, we break down total consumption into medical and nonmedical expenses, and find that when faced with a shock, M-PESA users spend 6.7% more on nonmedical expenses, whereas nonusers spend about 9.6% less (column 2). Users have a higher propensity to spend on medical care than users when both are faced with a shock (4% higher), but this difference is not significant. In addition, conditional on spending on medical care, nonusers actually spend more than users (about 32% more), but this difference is not significant (column 4). Overall, it appears that nonusers substitute from other expenses to finance the needed medical care.

Table 2.

Effects of illness shocks on expenditure measures, by user status

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

| Total exp | Nonmedical exp | Propensity to spend on medical care | Medical exp | Food exp | Nonfood subsistence exp | Propensity to spend on education | Education exp | Propensity to receive remittances | Total received | |

| M-PESA users | 0.118*** (0.029) | 0.067** (0.028) | 0.334*** (0.035) | 0.310 (0.197) | 0.047* (0.028) | 0.102* (0.058) | 0.037 (0.034) | 0.034 (0.162) | 0.094*** (0.036) | 0.127 (0.186) |

| Nonusers | −0.027 (0.050) | −0.096* (0.051) | 0.296*** (0.041) | 0.625** (0.252) | −0.044 (0.047) | −0.137 (0.087) | −0.059 (0.036) | −0.064 (0.195) | −0.020 (0.041) | 0.107 (0.431) |

| Difference | ** | *** | * | ** | * | ** |

With controls for household demographics (age/sex composition of the household, size of the household, and size squared), years of education of the household head, household head occupation dummies (for the three categories of farmer, business, and professional), the use of three main financial instruments (bank accounts, savings and credit cooperatives, and rotating savings and credit associations), and cell phone ownership. All specifications also include an index capturing the wealth of the neighborhood and the interaction of this with the illness shock, province by time dummies, and household fixed effects (as per Eq. 1). The last row of each column reports the significance level of the difference between users and nonusers. SEs are in parentheses. All expenditure variables (exp) are measured in logs. For the expenditures on health and education, the results are for the sample that spends on health and education and are the intensive margin effects.

*P = 0.10; **P = 0.05; ***P = 0.01.

In Table 2, columns 5–8, we investigate further where nonusers make these expenditure cuts; we find no evidence that they suffer significant reductions in food expenditure (the coefficient is −4.4% with an SE of 4.7%). Although nonusers do not significantly reduce food expenditure in response to an illness shock, users are able to increase theirs significantly (a 4.7% increase with an SE of 2.8%). The difference in food expenditure in response to a shock between users and nonusers is also significant: the estimated difference is 9.1% with P value of 0.082. We also find sizeable reductions in nonfood subsistence expenditure and the propensity to spend on education. Nonfood subsistence expenditure rises 10.2% among users in response to a shock, but declines 13.7% among nonusers, and the difference between the two is significant (an estimate of 23.9% with a P value of 0.022). The rise in nonfood subsistence expenditure for users potentially comes from increases in cooking fuels (food related) and transport costs (also likely associated with food purchases or accessing better medical care).

Finally, after an illness shock, nonusers are less likely to spend on education and spend less on it overall. These regressions (like the others reported above) control for measures of household demographics, including the age/sex composition of the household. The difference in the propensity to spend on education between users and nonusers is 9.6%, and this difference has a P value of 0.053. The mean propensity to spend on education in the sample is about 56%, so a reduction by nonusers of 5.9% in a response to a shock is sizeable. Looking at education expenditures, conditional on spending on education, nonusers spend about 9.8% less than users, but this difference is not significant. (Public primary schools are free in Kenya, although parents pay for transport, uniforms, lunch, and after-school tuition. In Kenya, 15% of primary schools are private. In 2006, annual public secondary school fees were roughly 25,000 KSh, or $350 at then-present exchange rates.)

In Table 2, columns 9–10, we look for evidence for the mechanisms underlying these consumption-smoothing effects by looking at remittances. We find that users are more likely to receive remittances when faced with a shock (9.4%), but conditional on receiving remittances, they do not receive more. We can compare the magnitude of the effects of the illness shock on remittances with the effects on expenditure. The probability of receiving a remittance is 11% higher for users in response to a shock. In the sample, conditional on receiving remittances, the average amount received in a year is about 26% of total expenditures, which suggests that the remittance effects of M-PESA account for a large part of the consumption smoothing we see among users. However, M-PESA may also affect user expenditures through a second mechanism: M-PESA could act as a microsavings device, so it may generate positive liquidity effects for users. Although our survey included questions about which savings instruments households use (including M-PESA), we did not collect data on the amount of savings held by households in each of these instruments, so we cannot directly test for the magnitude of any such liquidity effects of M-PESA. (Security concerns make it impossible for us to ask in surveys how much a household saves in various places, such as the bank, M-PESA, and at home.)

Using M-PESA Agent Data as Validation.

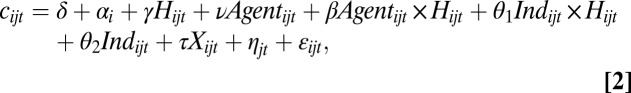

For validation of the results in Table 2 and to address the causality issues more directly, we augment the analysis to include data on the locations of the M-PESA agents across the country. The specification here is similar to Eq. 1, but uses the geographic proximity of households to the agents (measures in log meters) as an indicator of the ease of access to M-PESA. This leads to the following regression specification:

|

where Agentijt is a measure of the access to an M-PESA agent. The assumption behind this specification is that agent density is not systematically higher in areas where the demand for M-PESA is greater, i.e., that agent density is determined by supply-side factors. We defend this assumption and control for any potential demand-side factors by including the rich neighborhood index and its interaction with the illness shock.

Table 3 reports our results. The first row reports the estimated β coefficient from regression Eq. 2. Because the measure of access is the distance to the closest agent, we expect the estimated β to be negative (i.e., the further away a household is from an agent, the worse the outcomes for that household). In the second row of Table 3, we interpret these estimates of β by reporting the effects of the illness shock for households that are at the mean distance to an agent, which is 1.4 km in our data.

Table 3.

Validation check for effects of illness shocks on expenditure measures

| Full sample | Total exp | Nonmedical exp | Propensity to spend on medical care | Medical exp | Food exp | Nonfood subsistence | Propensity to spend on education | Education exp |

| Estimate of β | −0.045*** (0.017) | −0.036** (0.018) | −0.027 (0.021) | 0.049 (0.105) | −0.025 (0.018) | −0.026 (0.030) | −0.031** (0.015) | 0.095 (0.089) |

| Effect of shock for households at mean distance | 0.062** (0.027) | 0.003 (0.028) | 0.322*** (0.029) | 0.430*** (0.159) | 0.011 (0.027) | 0.004 (0.051) | 0.001 (0.026) | −0.014 (0.132) |

With the same controls as in Table 2, including the rich neighborhood index and its interaction with the illness shock (as per Eq. 2). This table looks at differential effects of illness shocks by the distance from a household to the closest M-PESA agent. The table reports the estimated β from Eq. 2 as well as the effect of the illness shock for households that are at the mean distance from an agent. SEs are in parentheses. All expenditure variables (exp) are measured in logs. For the expenditures on health and education, the results are for the sample that spends on health and education and are the intensive margin effects.

*P = 0.10; **P = 0.05; ***P = 0.01.

The results are similar to those in Table 2. Households that are further away from an agent uniformly do worse than those that are close to agents—in response to illness shocks, they lower total expenditure more, they increase medical expenditure less, and they lower their propensity to spend on education. To interpret the results, we find that households who live at the mean distance from an agent increase their total expenditure by 6.2% (with an SE of 2.7%) in response to an illness shock. In addition, looking at the estimated β coefficient, for every additional 10% closer a household is to an agent, that household is able to increase total expenditure by a further 0.5%, which suggests that if the distance to the closest agent was halved, the household would increase its total expenditure by an additional 2.5%. Table 3 therefore reinforces our earlier results. We find strong effects on education, particularly on the propensity to spend. However, we do lose power in the case of food expenditure, with effects shy of significant.

Finally, given the high attrition rates in Nairobi and the fact that Safaricom stopped growing the agent base in Nairobi early on, we present a subset of the results for the non-Nairobi sample in Table 4. For total expenditure and the propensity to spend on education, the results are similar. However, for food expenditure, the results are stronger and significant. An illness shock did not affect food expenditures for households at the mean distance to an agent, but if that distance is halved, there was a 1.7% increase in food expenditure.

Table 4.

Validation check for effects of illness shocks on expenditure measures

| Non-Nairobi sample | Total exp | Food exp | Nonfood subsistence | Propensity to spend on education |

| Estimate of β | −0.050*** (0.018) | −0.034* (0.020) | −0.023 (0.032) | −0.031* (0.016) |

| Effect of shock for households at mean distance | 0.055* (0.029) | 0.011 (0.029) | −0.014 (0.054) | −0.005 (0.027) |

With the same controls as in Table 2, including the rich neighborhood index and its interaction with the illness shock (as per Eq. 2). This table looks at differential effects of illness shocks by the distance from a household to the closest M-PESA agent. The table reports the estimated β from Eq. 2 as well as the effect of the illness shock for households that are at the mean distance from an agent. SEs are in parentheses. All expenditure variables (exp) are measured in logs. For the expenditures on health and education, the results are for the sample that spends on health and education and are the intensive margin effects.

*P = 0.10; ***P = 0.01.

Discussion

Overall, we find evidence of significant interactions among expenditures on food, health, and education. Though users and nonusers of M-PESA both appear to be willing and able to pay for the necessary health costs in the event of unexpected illness, there is some evidence that users spend more on medical expenses and that nonusers cover their medical expenditure by reducing expenditures on education. Users, however, are able to increase their expenditures on food on other nonfood subsistence items while maintaining education spending. Adequate food consumption and uninterrupted schooling are essential to long-term child development and future productivity; maintaining these is important, especially during times of illness shocks. M-PESA users and households living close to M-PESA agents, especially outside of Nairobi, significantly increase their food consumption levels in response to an illness shock, but nonusers and those far from agents are unable to do this. On the education side, the reductions we see in the propensity to spend on education and in total education expenditure imply that nonuser households or households far from agents may be pulling children out of school to finance health care costs.

The links from illness shocks to education and food expenditures reflect the long-term consequences of unexpected illnesses and the potential long-term benefits of M-PESA. Given the constraints these households face, M-PESA allows more-efficient reallocations of expenditures that likely produce large welfare gains.

Future Developments.

The remittance function of mobile money represents a relatively low-tech financial innovation, but one with considerable economic benefits to households. These benefits would, however, be dwarfed by sustained economic growth that could arise from further financial development. In particular, though M-PESA has allowed the economy to transition from cash to cash plus e-money, second-generation innovations that expand the use of credit on a regular basis could lay the foundation for real long-term growth.

An example of the potential for mobile money to spur economic development is in the small- and medium-sized retail sector. Under current practices in Kenya and much of the developing world, deliveries by wholesalers are made entirely in cash, on an irregular basis, and at high frequency. Sales depend on the retailer’s cash position at the time of delivery. A well-functioning product tracking and credit system that provided retailers with short-term trade credit could help rationalize deliveries, and enable outlets to make better use of their working capital, expand inventories, make capital investments, and increase employment. Mobile money could be critical to the development of such systems. Given the pervasive, nearly universal adoption of mobile money among Kenyan households, adoption costs for businesses should be minimal, further strengthening the rationale for the incorporation of mobile money into broader financial products and systems. A project currently under preparation in Kenya attempts to implement such a credit system and, using a randomized control trial methodology, to measure its impact on business development.

We anticipate that as this system develops and spreads, the financial barriers to commerce will fall. Supply chains should become more efficient, supporting higher volumes and a more diverse range of products in a broader set of markets. The benefits to households—as consumers of these products but also as workers in their production and distribution—could be much greater than we have seen to date.

Compendium.

Developments in Kenya and other African nations have created exciting opportunities for economic science. It is not feasible to run experiments with entire economies, so analyzing deep questions like the role of the financial system in the development process must often wait for unique conditions to arise that permit causal inference. The unprecedented rate of adoption of mobile money and the genesis of the e-financial economy in Kenya have provided such a situation. The fact that adoption success stories are so rare in sub-Saharan Africa makes this case of mobile money all of the more striking.

The early results we present here on the impact of financial innovation are encouraging. There is strong evidence that transfers facilitated by mobile money permit households to react to income shocks more effectively. The impact of mobile money on households’ responses to illness shocks is of key concern, because it suggests important spillovers between health, nutrition, and education. When a household member falls ill, education spending tends to suffer, unless mobile money is available, and mobile money similarly allows food spending to be boosted at the time of an illness event.

The growth of mobile money may have parallels with the experience of personal computers in the United States. Nobel Laureate Robert Solow once wrote, “You can see the computer age everywhere but in the productivity statistics,” referring to the fact that computers, although widely used by households, were not particularly valuable to business early on (19). They became “productive” only when the systems integrating them with business practice were developed. Similarly, cell phone technology is ubiquitous in sub-Saharan Africa, and has provided clear consumption benefits to users. However, we may only see the full potential impact of this technology on economic activity and well-being as it becomes more integrated with the productive economy—in particular, through the financial sector. Mobile money is the first major route by which this integration is taking place.

In the developed world, the financial crisis of 2008 showed how dependent economic activity was on credit markets and the financial system as a whole. The Kenyan economy has been evolving in tandem with financial innovations that promise to be transformative. Continued empirical observation will allow a documentation of the financial “nuts and bolts” of economic development first hand.

Methods

Survey-Sampling Strategies.

The sampling frame for the surveys did not include the sparsely populated north and northeast of the country, given their poor cell phone network coverage, low population density, and the seminomadic nature of livelihoods there. Figures showing the GPS-recorded locations of the households sampled and interviewed and the population density across the country are included in SI Text. The area covered by this sample frame included 92% of Kenya's population and 98% of M-PESA agents as of April 2008. For the sample, 118 administrative locations (with an average population of 3,000 households) that had at least one M-PESA agent in 2008 were randomly selected with certain probabilities. Locations were oversampled on the basis of the number of M-PESA agents present. All of the means and regressions presented have been reweighted accordingly. In the 118 locations sampled, there were a total of 300 enumeration areas from which 10 households were randomly sampled, creating a sample of 3,000 households. The households were surveyed in late 2008, December 2009, and June 2010 with nonnegligible attrition rates, although rates were in line with other surveys of this nature. The final sample of 2,283 households is composed of 2,018 of the original 3,000 that were also reinterviewed in late 2009, and an additional 265 that were interviewed in 2008 and early 2010.

Figures.

Fig. 1 illustrates the comparative adoption of technologies in the United States, relative to the adoption of cell phones and mobile money in Kenya. The US data are a subset of the data that was kindly shared by Michael Cox from his own research (5). The estimated cell phone adoption rate among Kenyan households represents an upper bound for household-level adoption. This series contemplates (i) a weighted-average household size of 4.28 individuals, based on the Jack and Suri surveys in 2008–2010 (14), (ii) a maximum of one cell phone user per household, and (iii) a maximum of one subscriber identity module (SIM) card per cell phone user. The use of multiple SIM cards by individual users has exploded in recent years, and therefore the estimated adoption rate presented in Fig. 1 is likely to be an upper bound, especially for more recent years. The nonestimated cell phone adoption rate among Kenyan households is only available from the Jack and Suri survey data for 2008–2010 (14). From these data, the adoption rates by households are 69.7%, 75.2%, and 80.5% for these 3 y, respectively. As a reference point, the cell phone penetration rate measured against the entire Kenyan population of roughly 40 million individuals was 63.2% in 2010 (2).

Supplementary Material

Acknowledgments

We thank Suleiman Asman, Indrani Saran, and Adam Ray for exceptional research assistance. Funding for this work was provided by Financial Sector Deepening and the Consortium on Financial Services and Poverty.

Footnotes

The authors declare no conflict of interest.

This article is a PNAS Direct Submission.

This article contains supporting information online at www.pnas.org/lookup/suppl/doi:10.1073/pnas.1115843109/-/DCSupplemental.

†In this report we use per capita measures of consumption and not consumption per adult equivalent because we control flexibly for the demographic composition of the households as part of the set of covariates included in all of the regression analyses.

‡For the shocks, the survey question reads: “Which of the following unexpected events has this household experienced in the last six months?” The household can also specify other events that are not on the prespecified list. For round 1, for example, the shocks included price shocks as well as the postelection crisis. One of the shocks reported under the unexpected events is illness.

§We thank an anonymous reviewer for this suggestion. Given the causality concerns mentioned above, we include an index of the household being in a rich neighborhood and its interaction with the illness shock. We use principal components analysis to create this index of the wealth of the neighbors around a given household (each variable in the index is calculated as a leave-out mean for a given region).

¶All expenditure variables are measured in logs. However, for some measures (like education and health), a large fraction of households do not spend anything, as shown in Table 1. For these expenditure measures, we present results on the propensity to spend on education (the extensive margin) as well as for log expenditures for the sample that spends (the intensive margin). In SI Text, we report results for health and education where the dependent variable is log (1 + expenditure), a common log transform used for data like this.

References

- 1.Townsend R. Risk and insurance in village India. Econometrica. 1994;62:539–591. [Google Scholar]

- 2.Communications Commission of Kenya Quarterly Sector Statistics Report. October-December 2010/2011. Available at http://www.cck.go.ke/resc/statistics/SECTOR_STATISTICS_REPORT_Q2_2010-11_x2x_x3x_x2x.pdf.

- 3.Communications Commission of Kenya Communications Statistics Report 2008. 2008. Available at http://www.cck.go.ke/resc/statistics/Communications_Statistics_Report_2008.pdf.

- 4.Bank for International Settlements Statistics on Payment, Clearing and Settlement Systems in the CPSS Countries: Figures for 2010. 2011. Available at http://www.bis.org/publ/cpss98.pdf.

- 5.Cox WM, Alm R, editors. NY Times, Opinion. February 10, 2008. You are what you spend; p. p WK14. [Google Scholar]

- 6.Evenson RE, Gollin D. Assessing the impact of the green revolution, 1960 to 2000. Science. 2003;300:758–762. doi: 10.1126/science.1078710. [DOI] [PubMed] [Google Scholar]

- 7.Klenow P, Rodríguez-Clare A. The neoclassical revival in growth economics: Has it gone too far? NBER Macroeconomics Annual. 1997;12:73–103. [Google Scholar]

- 8.Hall R, Jones C. Why do some countries produce so much more output per worker than others? Q J Econ. 1999;114:83–116. [Google Scholar]

- 9.Comin D, Hobijn B. Cross-country technology adoption: Making the theories face the facts. J Monet Econ. 2004;51:39–83. [Google Scholar]

- 10.Caselli F. In: Handbook of Economic Growth. Aghion P, Durlauf S, editors. Vol 1A. Amsterdam: Elsevier; 2005. pp. 679–741. [Google Scholar]

- 11.Suri T. Selection and comparative advantage in technology adoption. Econometrica. 2011;79:159–209. [Google Scholar]

- 12.Jack K. Market inefficiencies and the adoption of agricultural technologies in developing countries. 2011 White paper, Agricultural Technology Adoption Initiative (Abdul Latif Jameel Poverty Action Lab/MIT, Cambridge, MA; Center for Effective Global Action/University of California, Berkeley) [Google Scholar]

- 13.Comin D, Hobijn B, Rovito E. A new approach to measuring technology with an application to the shape of the diffusion curves. J Technol Transf. 2008;33:187–207. [Google Scholar]

- 14.Jack W, Suri T. Mobile money: The economics of M-PESA. 2011 National Bureau of Economic Research working paper 16721 (National Bureau of Economic Research, Cambridge, MA) [Google Scholar]

- 15.Jack W, Suri T. Working paper. Cambridge, MA: MIT Sloan School of Management; 2011. Risk sharing and transaction costs: Evidence from Kenya’s mobile money revolution. Available at http://www.mit.edu/∼tavneet/Jack_Suri.pdf. [Google Scholar]

- 16.Gertler P, Gruber J. Insuring consumption against illness. Am Econ Rev. 2002;92:51–70. doi: 10.1257/000282802760015603. [DOI] [PubMed] [Google Scholar]

- 17.Gertler P, Levine D, Moretti E. Is social capital the capital of the poor? The role of family and community in helping insure living standards against health shocks. CESifo Econ Stud. 2006;52:455–499. [Google Scholar]

- 18.Gertler P, Levine DI, Moretti E. Do microfinance programs help families insure consumption against illness? Health Econ. 2009;18:257–273. doi: 10.1002/hec.1372. [DOI] [PubMed] [Google Scholar]

- 19.Solow R, editor. NY Times Book Review. July 12, 1987. We’d better watch out; p. p 36. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.