Abstract

Objective

To evaluate whether community-based health insurance (CBHI) protects household assets in rural Burkina Faso, Africa.

Data Sources

Data were used from a household panel survey that collected primary data from randomly selected households, covering 41 villages and one town, during 2004–2007(n = 890).

Study Design

The study area was divided into 33 clusters and CBHI was randomly offered to these clusters during 2004–2006. We applied different strategies to control for selection bias—ordinary least squares with covariates, two-stage least squares with instrumental variable, and fixed-effects models.

Data Collection

Household members were interviewed in their local language every year, and information was collected on demographic and socio-economic indicators including ownership of assets, and on self-reported morbidity.

Principal Findings

Fixed-effects and ordinary least squares models showed that CBHI protected household assets during 2004–2007. The two-stage least squares with instrumental variable model showed that CBHI increased household assets during 2004–2005.

Conclusions

In this study, we found that CBHI has the potential to not only protect household assets but also increase household assets. However, similar studies from developing countries that evaluate the impact of health insurance on household economic indicators are needed to benchmark these results with other settings.

Keywords: Health insurance, Burkina Faso, instrumental variable, fixed effects, assets

Burkina Faso is one of the poorest countries in the world with 43 percent of its population living below the poverty line. As 90 percent of the population is engaged in subsistence agriculture, cash flows of the households are unreliable and subject to seasonal fluctuations. Households often find it impossible to pay for health services, especially before the rainy season. Households who can pay and decide to visit a doctor incur out-of-pocket (OOP) expenditures that can sometimes be catastrophic for them. This does not necessarily mean that the OOP expenditures are large, but as the income of the households is low, OOP expenditures can constitute a large proportion of their income, thereby reducing funds available for basic needs like food, clothes, etc. (McIntyre et al. 2006; van Doorslaer et al. 2007; Leive and Xu 2008). A study conducted in 2000–2001 in this area found that 6–15 percent of the households incurred health expenditures that can be regarded as catastrophic (Su, Kouyaté, and Flessa 2006). In the absence of adequate cash savings, households often resort to selling assets, especially livestock, to pay for health care costs (Sauerborn, Adams, and Hien 1996). This can have an added disadvantage, as assets or livestock, such as plows or donkeys, could also assist the household in agricultural production. Moreover, loss of livestock leads to loss of their produce, for example, milk that could have been used for self-consumption or sold in the market.

Expectation of large health care costs can induce households to delay treatment or opt for self-treatment or traditional medicine, perceived as cheaper options (Mugisha et al. 2002; Dong et al. 2008; Uzochukwu et al. 2008). Traditional medicine and self-treatment lead to delay in accessing care from trained professionals. Makinen et al. (2000) estimated that in Burkina Faso only 13 percent of those reporting ill visited a doctor. Delay in appropriate treatment is likely to worsen illnesses. This can cause productivity and income losses for the sick and the caregiver. It can also warrant urgent and more costly treatment at the health facilities.

Against this backdrop, in Burkina Faso and in other countries in Africa, where national health insurance programs were lacking, community-based health insurance (CBHI) became popular in the 1990s. The aim of such schemes is to facilitate access to health care and increase financial protection against the cost of illness. Recently, many of these countries have shown an interest to achieve universal coverage in the future. Some are contemplating linking and expanding the coverage of the already existing CBHI schemes as a step toward achieving this goal (Tabor 2005; Coheur et al. 2007). However, in spite of the increasing interest in CBHI, evidence on the impacts of such schemes still remains mixed (Preker et al. 2002; Carrin 2003; Ekman 2004; Palmer et al. 2004).

Two of the main reasons for this gap in evidence are methodological challenges and lack of adequate data. For most of the schemes, enrollment is voluntary. Simply comparing the level of outcomes between the insured and the uninsured will generate biased results. This is because the insured and the uninsured are not only different in terms of observed aspects, which can be measured, but also in terms of unobserved aspects. Studies that fail to control for these differences can give misleading program effects. There are methods available to correct for this selection bias, but they require appropriate data. For many of these schemes that function in a resource-poor setting, collecting data to measure program impacts is not a priority. Hence, either the data is not available or even if it is available, self-selection problem is not properly addressed (Savedoff, Levine, and Birdsall 2006).

For a majority of the schemes when cross-sectional data were available, propensity score matching (PSM) and instrumental variable (IV) approach have been used. PSM, introduced in statistics by Rosenbaum and Rubin (Rosenbaum and Rubin 1983, 1984, 1985), balances the observed characteristics between the insured and uninsured at the pre-implementation level. The extent to which this method can control for self-selection depends on the number of observable variables balanced. It does not correct for bias due to unobservable variables. Gnawali et al. (2009) used PSM and found that outpatient visits were 40 percent higher in the insured group compared with the uninsured for the CBHI scheme in Burkina Faso. An alternative to PSM is the IV technique. For a discussion of IV techniques, see Angrist and Pischke (2009). In the absence of randomization or natural experiment (e.g., change in policy) it is not always easy to identify an appropriate IV—a variable that determines the insurance status but is not correlated with any other determinant of the dependent variable. Jowett and Thompson (1999) used an IV technique to study the effect of health insurance on treatment-seeking behavior in Vietnam. Trujillo, Portillo, and Vernon (2005) applied both PSM and IV and found that the Columbian subsidized health insurance program increased health care utilization for the poor.

In few cases, when panel data were available, fixed effects (FE), differences-in-differences (DD), or IV has been applied (Angrist and Pischke 2009). FE and DD correct for selection bias by canceling out the effect of any time-invariant variables, but they do not correct for selection bias due to time-varying variables. FE controls for time-invariant variables at the individual or household level, whereas the DD corrects for differences at the group level. Sepehri, Sarma, and Simpson (2006) used FE to analyze Vietnam's health insurance scheme and concluded that it reduced OOP expenditures between 16 and 18 percent. If the schemes are introduced such that there are some areas where insurance is introduced, but data are also available from comparable controls, then DD can be applied. If comparable controls are not available, studies have used PSM to control for observable pre-implementation differences and have then applied DD (Newman et al. 2002; Wagstaff and Pradhan 2005; Wagstaff and Yu 2007; Wagstaff et al. 2009). The IV method can also be applied to panel data if an appropriate IV is available. Wagstaff and Lindelow (2008) studied the impact of health insurance on OOP payments in China. They used IV and FE with IV models to control for self-selection.

Previous studies from developing countries have concentrated mainly on health care costs that capture the immediate effects of CBHI incurred by those who access health facilities. Other causal effects on household well-being like on household assets have been rarely studied, and this article aims to fill this gap in evidence.

The purpose of this study was to measure the impact of a CBHI on household assets in Burkina Faso. CBHI was randomly offered to the villages in the study area in a step-wedge cluster randomized community-based trial (CRCT). In the context of CBHI, CRCT is rarely conducted in low-income countries. In the past, similar CRCTs have been conducted in India and Mexico (Ranson et al. 2006; King et al. 2007; Morris et al. 2007; Ranson et al. 2007). Availability of this rare experiment coupled with panel data, which is also not commonly available from low-income countries, made it possible for us to provide unbiased estimates of the impact of CBHI on household assets.

Methods

The CBHI Scheme

A CBHI scheme, Assurance Maladie à Base Communautaire, was introduced in the Nouna Health District (NHD), Burkina Faso in 2004 in a CRCT. This area, with approximately 70,000 individuals spread over 41 villages and Nouna town, was divided into 33 clusters: 24 rural (villages) and nine urban (town of Nouna). Small neighboring villages that shared common ethnic and kin ties were grouped together to form a single cluster. One sector of Nouna town and another village were divided into two clusters each. Each year, 11 randomly selected clusters were to be progressively offered the opportunity to enroll into CBHI. The trial is described in more details elsewhere (De Allegri et al. 2008). Due to practical and ethical considerations, the two larger regions that were divided into smaller clusters were offered CBHI at the same time. Therefore, for this study, we regarded them as two clusters instead of four. Consequently, we counted 31 clusters instead of 33.

Enrolment into CBHI was voluntary. The unit of enrollment was a household, but the premium was set on an individual basis: 1,500 CFA (2.29€) for an adult and 500 CFA (0.76€) for a child (less than 15 years old), based on prior feasibility and willingness-to-pay (WTP) studies (Dong et al. 2003; Dong et al. 2004). The premiums were not enough to cover all the costs associated with providing CBHI and extra funds were provided by the Burkinabe Ministry of Health and an international donor. The premium for the entire household was paid in one single installment, at the beginning of the year. Membership had to be renewed yearly. To limit adverse selection, insured were asked to maintain a 3-month waiting period during which they were not entitled to receive CBHI benefits. Due to low enrollment among poorer households, from 2007 onward, the premium was subsidized for the poor: 750 CFA (1.14€) for an adult and 250 CFA (0.38€) for a child.

The benefit package included a wide range of medical services available in the public health facilities in the NHD. There were no copayments, deductibles, or ceiling on the benefits.

Data Sources

This study used data from the Nouna Health District Household Survey (NHDHS), a household panel survey introduced in 2003, in the 33 clusters as used in the CRCT. The sampling frame for the survey was provided by the Demographic Surveillance System already operating in this region. A total of 990 households, that is, 30 households per cluster, were randomly selected to be part of the NHDHS, approximately 10 percent of the population. This sample size was estimated in advance to have a 90 percent power of detecting an increase in health service utilization of one visit per year between the insured and the uninsured. It was based on the assumption of 50 percent enrollment rate.1 Sampling design is described in detail elsewhere (De Allegri et al. 2008). We used data pertaining to years 2004–2007. We did not include households for whom data on household assets were missing.

Every year, the NHDHS team interviewed household members to collect data on demographic and socio-economic indicators, self-reported morbidity, health care–seeking behavior, and insurance membership. Information on agricultural production, livestock, and durable goods ownership of the household was also collected.

Prices of livestock and durable goods were collected by means of a market survey in Nouna town in 2004, alongside the NHDHS data collection period. Prices were collected from all the vendors in the market.

Variables

In this study, we modeled the effect of CBHI on household assets. NHDHS provided the information on the quantity of assets, that is, durable goods and livestock owned by the households. From the 2004 asset prices, we selected the most common market price for each asset. We then multiplied the quantity with the price to get the value of household assets. We used the same price list for all years.2

Even though in principle, the unit of enrollment for CBHI was the household, this was not strictly enforced. Hence, there were instances when some members in the household enrolled, whereas others did not. We therefore used the number of insured members in the household as our insurance variable. Consequently, we used per capita household assets as the dependent variable.

All variables that were considered in the analysis are described in Table 1.

Table 1.

Variable Definitions

| Variable | Definition |

|---|---|

| Dependent variable | |

| Household assets per capita † | ln (monetary value of goods and livestock owned by the household in CFA/size) Goods: plow, bicycle, radio, television, and telephone |

| Livestock: poultry, sheep, goat, cattle, donkey, pig, and horse | |

| Household characteristics | |

| Insurance | Number of individuals insured in the household |

| Chronic‡ | Any member in the household having a chronic illness. 1 = yes; 0 otherwise* |

| Size | Number of individuals in the household |

| Age | Age of household head in years |

| Ethnicity | Ethnicity of the household head. 1 = Bwaba*; 2 = Dafing; 3 = Mossi; 4 = Peulh; 5 = Samo |

| Gender | Gender of the household head. 1 if male; 0 otherwise* |

| Occupation | Occupation of the household head. 1 = Agriculture/livestock; 0 otherwise* |

| Education | Education level of the household head. 1 = can read/write; 0 otherwise* |

| Eligibility | Household eligible for insurance. 1 = yes; 0 otherwise* |

| Subsidy | Household eligible for premium subsidy. 1 = yes; 0 otherwise* |

| Village characteristic | |

| VillageCluster | 1 = villages offered insurance since 2004; 2 = villages offered insurance since 2005; 3 = villages offered insurance since 2006 |

| Literacy | Proportion of individuals who can read/write in the village |

| Distance | Average distance to the nearest health facility in kilometers |

| Health facility | Nearest health facility from the village. 1 = Bourasso*; 2 = Dara; 3 = Goni; 4 = Koro; 5 = Lekuy; 6 = Nouna; 7 = Toni |

| Water | Main source of water in the village. 1 = running water*; 2 = well; 3 = river/lake/pond |

| Town | Location of households. 1 = Nouna town; 0 otherwise* |

| Time shock | |

| Year | 4 = 2004*, 5 = 2005, 6 = 2006, and 7 = 2007 |

Reference category.

Value of assets at the end of the insurance period (lead variable).

Chronic illness was defined as any illness lasting for at least 3 months at the time of the survey.

Descriptive Statistics

As described in Table 2, the sample decreased over the years. In 2003, 990 households were randomly selected, but our analysis is based on 890 households, 90 percent of the original sample. Number of households offered insurance increased during 2004–2006, as CBHI was progressively offered to more villages. From 2006, CBHI was offered to the entire sample.

Table 2.

Description of the Sample

| Insured Households | ||||||

|---|---|---|---|---|---|---|

| Year | No. of Insured Households | No. of Uninsured Households | Total Households | No. of Households Offered Insurance (Cumulative) | Sample* | Study Population |

| 2004 | 21 | 814 | 835 | 354 | 5.9% | 5.2% |

| 2005 | 35 | 747 | 782 | 628 | 5.6% | 6.3% |

| 2006 | 38 | 738 | 776 | 776 | 4.9% | 5.2% |

| 2007 | 65 | 686 | 751 | 751 | 8.7% | 9.1% |

| 2004–07‡ | 95 | 874 | 890 | 890 | 6.3% | |

Number of insured households/number of households offered insurance.

For 2004–2007, the numbers are for the overall sample. Therefore, column 2 represents number of ever insured households, column 3 represents number of ever uninsured households, and column 4 represents number of households ever included in this sample.

During the study period, enrollment varied between 5 and 9 percent. There was a steep increase in enrollment in 2007. Premium subsidies offered to the poor households this year could explain this increase. Although enrollment increased over the years, it remained low. De Allegri, Sanon, and Sauerborn (2006a), De Allegri et al. (2006b), and Dong et al. (2009) highlight possible reasons for low enrollment that include unit of enrollment being a household, which made it difficult for larger households to enroll, premium collected at one point in year, poor perception of quality of care at the health facilities, and pre-assigned health facility. Enrollment rates were substantially lower than that predicted by the WTP study. Dong et al. (2003) mentioned that the WTP technique itself could have overestimated consumers’ preferences due to starting point bias. The WTP scenario was also slightly different from reality. It did not describe the premium collection process and did not mention that the health facility would be pre-assigned.

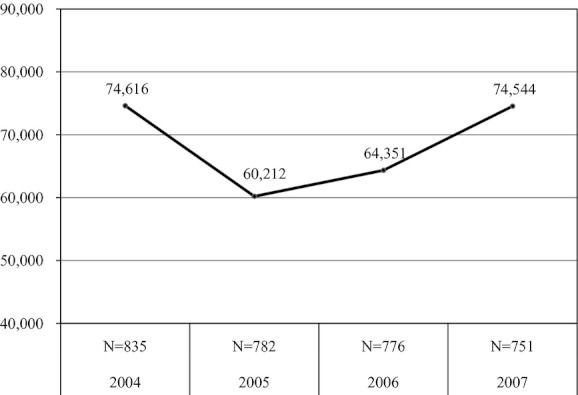

As shown in Figure 1, the per capita household assets dropped by 0.1 percent during 2004–2007. From 2004 to 2005, there was a severe drop of 19 percent. The next 2 years, the households assets recovered: 7 percent increase in 2006, and 16 percent increase in 2007. The fluctuations in household assets can be explained by the fluctuations in the economy of this region. In 2004, Burkina Faso faced a drought and locust invasion (United Nations 2006a). In 2005, the prices increased due to the low food production in 2004. In 2005–2006, the harvest improved, whereas in 2007 the harvest was modest (United Nations 2006b). In a subsistence agrarian region, households’ economic indicators including asset are closely linked to agriculture production, and so these fluctuations in household assets are not surprising.

Figure 1.

Mean Household Assets per Capita in CFA (2004–2007) (1€ = 656 CFA)

Econometric Approach

We estimated three models:

Ordinary least squares (OLS) for 2004–2007

Two-stage least squares (2SLS) for 2004–2005 (simple OLS for comparison)

FE for 2004–2007

Our model can be described as follows:

| (1) |

where i = 1,…,n represents households and t = 4, 5, 6, 7 represents years. HAit+1 is a measure of household assets at the end of the insurance period (lead variable); Iit denotes the insurance status; Zi is a vector of time-invariant household characteristics (like ethnicity and gender of the household head) and Xit is a vector of time-varying observed characteristics (like household size); Yt denotes year dummies that capture time shocks; ui represents the unobserved household effects; and εit captures the random shock.

We first estimated a simple OLS regression with no covariates. Conceptually, insurance status of the household may be correlated with important omitted variables like household size and health status that may predict ownership of household assets. If these variables are not controlled, as in the case of simple OLS,  will be biased, because it represents not only the effect of insurance on household assets but also the effect of some of the omitted variables. We therefore re-ran the OLS with various household- and village-level covariates that proxy for the omitted variables and observed the change in β3.

will be biased, because it represents not only the effect of insurance on household assets but also the effect of some of the omitted variables. We therefore re-ran the OLS with various household- and village-level covariates that proxy for the omitted variables and observed the change in β3.

Even after controlling for observable characteristics of the household, there may still be unobserved factors, ui, which may be correlated with both insurance status and household assets. For instance, more risk averse households are likely to take insurance, and at the same time, risk aversion is also correlated with ownership of household assets inducing a bias in the OLS estimates of β3. We employed two different empirical strategies to deal with this problem, 2SLS that exploited the randomization of eligibility as an instrument and FE model.

The 2SLS approach relied on the existence of an instrument that came from the CRCT. The instrument “offer of insurance” or eligibility was (1) correlated with insurance status (relevance) and (2) not correlated with other factors determining household assets (validity). As eligibility was randomized, it was not correlated with unobserved factors, ui, ensuring that we had a valid instrument. We will show later that eligibility was also strongly correlated with insurance status.

Two-stage least squares was split into two steps. In the first-stage regression, insurance status was regressed on all covariates and the instrument, Eit.

| (2) |

Predicted value of endogenous Iit (Îit) calculated was used in the second stage.

| (3) |

As Îit was not correlated with ui and εit by construction, the coefficient  gave the unbiased estimate of the effect of Iit on HAit+1

gave the unbiased estimate of the effect of Iit on HAit+1

As eligibility differed among the households during 2004–2005 (in 2003 there was no CBHI and from 2006 CBHI was offered to the entire region), this approach could be applied to only these 2 years.

The IV, eligibility, was tested for relevance by the first-stage F-statistic that tests whether the endogenous regressor is weakly identified. F-statistic should be above 10 for the IV to be relevant (Stock and Yogo 2002). We included covariates in this model to reduce some of the variability in HAit+1 to get more precise 2SLS estimates.

Standard errors in panel data models need to be adjusted for autocorrelation in the error term. This is generally done by adjusting for clustering at the household level. In this model, as the IV was dependent on village clusters, we adjusted for clustering at the village-cluster level.

A drawback of the IV strategy was that we could only rely on observations for 2004 and 2005 leading to rather imprecise estimates. We therefore also estimated a FE model covering the whole period, 2004–2007. An FE model takes advantage of the panel nature of the sample, that is, repeated observations of households. Using repeated observations, the unobserved time-invariant characteristics were essentially differenced out by estimating the following equation:

| (4) |

where the bars over variables indicate their within-household average. Observed Zi was not explicitly included because in a FE model, household- specific dummy variables were created that captured all time-constant variation—observed and unobserved. Hence, FE assumed that the self-selection was due to characteristics that were constant over time. This is a limitation of this model. There could be time-varying omitted variables correlated to Iit. Health status was one such variable that could influence the insurance status of the household. We included the variable chronic to capture this.

Results

OLS (2004–2007)

Table 3 columns 1 and 2 show the results for the OLS models—without covariates and with covariates. When covariates were included, the coefficient for insurance decreased from 0.058 to 0.045, that is, insurance increased per capita household assets by 5.9 percent (=e0.058) according to the first model, and by 4.5 percent (=e0.045) according to the second model. The first model suffered from omitted variable bias, whereas the second model corrected for some of this bias.

Table 3.

Regression Results

| Variables time period | (1) OLS without covariates† 2004–2007 | (2) OLS with covariates† 2004–2007 | (3) OLS-comparison for (4)† 2004–2006 | (4) 2SLS‡ 2004–2006 | (5) FE† 2004–2007 |

|---|---|---|---|---|---|

| Insurance | 0.058 (0.011)*** | 0.045 (0.010)*** | 0.024 (0.020) | 0.220 (0.121)* | 0.009 (0.005)* |

| Chronic_1 | 0.033 (0.047) | 0.065 (0.060) | 0.050 (0.048) | 0.022 (0.032) | |

| Size | 0.072 (0.031)*** | 0.114 (0.065)* | 0.115 (0.091) | −0.125 (0.049)*** | |

| Age | 0.073 (0.028)** | −0.052 (0.053) | −0.020 (0.066) | −0.031 (0.040) | |

| Gender_1 | −0.106 (0.115) | −0.375 (0.120)*** | −0.374 (0.106)*** | – | |

| Occupation_1 | −0.104 (0.069) | −1.186 (0.453)*** | −0.842 (0.537) | – | |

| Education_1 | 0.318 (0.058)*** | 0.314 (0.066)*** | 0.273 (0.082)*** | – | |

| Subsidy_1 | −0.496 (0.090)*** | – | – | 0.029 (0.061) | |

| Literacy | 0.008 (0.505) | 0.571 (0.515) | 0.736 (0.527) | – | |

| Distance § | 0.027 (0.028) | 0.017 (0.029) | 0.014 (0.021) | 0.048 (0.033) | |

| Water_2 | −0.150 (0.176) | −0.424 (0.274) | −0.480 (0.190)*** | 0.051 (0.098) | |

| Water_3 | 0.047 (0.133) | 0.005 (0.146) | −0.044 (0.182) | −0.012 (0.067) | |

| Year_5 | −0.132 (0.038)*** | −0.161 (0.041)*** | −0.192 (0.035)*** | −0.157 (0.027)*** | |

| Year_6 | −0.149 (0.057)*** | – | – | −0.085 (0.031)*** | |

| Year_7 | – | 0.141 (0.072)* | – | – | 0.124 (0.034)*** |

| F-statistic | 30 (p = .00) | 8.97 (p = .00) | 4.86 (p = .00) | – | 10.68 (p = .000) |

| R2 | 0.013 | 0.074 | 0.128 | – | 0.0007 |

| No. of clusters | 890 | 890 | 846 | 31 | 890 |

| No. of observations | 3,144 | 3,144 | 1,588 | 1,588 | 3,144 |

| First stageF-statistic | – | – | – | 16.47 (p = .0003) | – |

Notes. Refer to Table 1 for variable definitions. Subsidy that came into effect in 2007 was included in only models (1) and (2). Eligibility was included in only model (4) as an instrumental variable. For model (5), only time-varying variables were included. Standard errors in parentheses.

Standard errors were adjusted for clustering at the household level.

Standard errors were adjusted for clustering at the VillageCluster level as the instrumental variable was dependent on village clusters.

Distance was considered a time-varying variable because the number of health facilities in this region increased over the years. Therefore, it was included in the FE model.

1%,

5%, and

10% significance levels.

2SLS, two-stage least squares; FE, fixed effects; OLS, ordinary least squares.

2SLS (2004–2005)

Table 3, columns 3 and 4, present the OLS and 2SLS results for 2004–2005. All variables mentioned in Table 2 except subsidy that came into effect only in 2007, were included in both models. Eligibility was included in only 2SLS as an IV. The IV passed the tests for relevance (F-statistics = 16.47), implying that the IV was strongly correlated with insurance.

According to OLS, insurance had no significant impact on per capita household assets. In the 2SLS, insurance had a positive effect on per capita household assets at 10 percent significant level, that is, insurance increased per capita household assets by 24.6 percent (=e0.22) on an average.

With regard to other key covariates, household head employed in agriculture or livestock rearing (−0.104, 1 percent significance) and bigger households (0.114, 1 percent significance) were found to have a significant association with per capita assets as per the OLS model, these variables were found to be insignificant in 2SLS. The year 2005 was associated with a drop in household assets that affected all households in the region (−0.192, 1 percent significance). As expected, education level of household head was positively associated with household assets (0.273, 1 percent significance). In 2SLS, villages where wells were the main source of water, when compared with running water, were associated with lower per capita household assets (−0.480, 1 percent significance). This was because wealthier villages have access to running water in this region.

FE (2004–2007)

Table 3 column 5, shows the FE results for the entire period 2004–2007. According to this model, insurance increased per capita household assets by 1 percent at 10 percent significant level. Household size and yearly fluctuations were associated with significant changes in per capita household assets. Compared with 2004, household assets dropped significantly in 2005–2006 and improved by 2007. Households who were offered the premium subsidy and households with at least one member with a chronic illness were found to have a positive association with per capita assets, although insignificant.

Discussion

Discussion of Results

The objective of this article was to measure the impact of CBHI on household assets in Burkina Faso. We used different strategies to control for selection bias—OLS, 2SLS, and FE. The last two models, 2SLS and FE, depend on different assumptions. FE assumed that unobserved characteristics were time-invariant and 2SLS used an IV which came from randomization. All three models led to the same conclusion that CBHI in the NHD protected household assets. Specifically, the models predicted that CBHI increased household assets.

The impact of insurance estimated by OLS and FE was much smaller than the one projected by 2SLS. This difference can be attributed to the fact that they analyzed different time periods. 2SLS considered period 2004–2005, which was financially hard for this region because of low agricultural production and rising prices. This period also saw an increase in illnesses. In 2004, 18.3 percent individuals reported being sick3, whereas this number increased to 25.7 percent the following year. In this context, insured households were protected from financial shocks related to medical costs. Clustering of financial shocks (loss in agriculture production and medical costs) for the uninsured during this period could explain why the per capita household assets improved significantly for the insured when compared with the uninsured. For FE, even though the yearly fluctuations in per capita household assets were large, the change in mean per capita household assets during 2004–2007 was very small (see Figure 1), which matches the estimated average increase of 1 percent per year for the insured. The OLS with covariates model predicted an increase of 4.5 percent, which is much more than that predicted by FE. OLS controlled for selection bias only due to the observable variables included in the model. However, FE controlled for the observable variables in the model as well as all unobserved or unmeasured time-invariant variables.

Even though it could be expected that the impact of CBHI in 2004–2005 was greater than in other years, at first glance an increase of 24.6 percent may look like a fairly large impact. However, in this region with per capita household asset averaging at 67,650 CFA (103€) for 2004–2005, this increase would amount to adding assets worth 16,642 CFA (25€)—that is the value of approximately two goats. Consequently, the 1 percent increase during 2004–2007 may not be significant in real terms; however, it clearly indicates that CBHI has protected household assets.

For-profit health insurance schemes are generally expected to protect household wealth. In our case, CBHI not only protected wealth but has also shown to increase wealth in term of household assets. This could be because the premiums are highly subsidized. The premium was set not to cover the cost of providing CBHI but was fixed at what was considered to be affordable in the community. In 2004, premiums covered only 53 percent of the consultation and drug costs of the insured (for 2005, the corresponding figure was 61 percent). Hence, in 2004, 47 percent of the facility costs and the entire cost of running the CBHI scheme were externally funded. This is true for many other CBHI schemes in Africa (Tabor 2005). A second explanation could be that the household assets considered in this analysis included livestock animals that reproduce. By preventing the sale of these animals, CBHI could increase household assets overtime.

Due to lack of a comparable study that analyzed the impact of CBHI on household assets, it is difficult to benchmark these effects with other schemes. However, there are examples from neighboring countries where CBHI has shown positive effects. Jütting (2004) found that CBHI in rural Senegal increased health care utilization and reduced OOP payments. For hospitalizations, he found that members paid on average less than half the amount that nonmembers paid even when this CBHI scheme, unlike in Burkina Faso, included substantial copayments. Chankova, Sulzbach, and Diop (2008) studied CBHI schemes in Ghana, Mali, and Senegal, and found that CBHI provided protection against catastrophic expenditures related to hospitalizations, as concluded by Jütting (2004). Franco et al. (2008) found that CBHI increased utilization of modern health care for fever, diarrhea treatment in children, and prenatal visits in Mali. They also found that CBHI had a positive effect on promoting preventive behavior—insured pregnant women and children were twice as likely to sleep under an insecticide-treated net. These effects of CBHI in increasing health care utilization, reducing health expenditures, and providing financial protection can translate into cost savings for the household. These savings if used for improving nutritional intake, sanitation, and education can lead to improvements in health and productivity, which in the long run can result into increases in household assets.

Policy Implications

Our study demonstrates that CBHI schemes have the potential to protect and also increase household assets in resource poor settings. In particular, the impact of CBHI can be significantly magnified in turbulent times as was experienced in our study area during 2004–2005 when there was a spike in illnesses.

Ill health and poverty feed into each other. Poor households have limited or no access to clean drinking water, sanitation, and adequate nutrition, making them vulnerable to diseases. Health-related costs of medications, hospitalization, and even loss in productivity further pushes them into poverty. Successful CBHI schemes, by protecting and increasing household assets, can work as a catalyst for breaking this vicious cycle of ill health and poverty.

Not all the schemes have been successful in providing financial protection to its members. The extent of financial protection provided by CBHI schemes could depend on the benefit package, coverage, and copayment policies (Chankova, Sulzbach, and Diop 2008). Schemes, like the one in Burkina Faso, that offer a comprehensive benefit package with minimum exclusions and no copayments remove uncertainties at the time of illness and are likely to provide better protection to households. Chankova, Sulzbach, and Diop (2008) cited high copayments for outpatient care that ranged between 25 and 50 percent as a possible reason why the CBHI schemes in Mali and Senegal did not protect households from OOP expenditures relating to outpatient care.

CBHI schemes are seen as possible mechanisms for reaching the households in the rural and informal sectors of developing countries that are not covered by any government or employer provided health insurance. However, the premium that is affordable to the target population is not enough to cover the costs. Hence, government or donor funds are crucial to cover the extra costs as stressed by several others (Atim 1998; Carrin 2003; Zhang and Wang 2008). If the schemes are to offer a comprehensive benefit package with minimum exclusions and copayments, the need for external funds is even greater.

Study Limitations

As CBHI enrollment was low, averaging 5–9 percent, our analysis might suffer from small sample bias. This can bias the estimates of the 2SLS that used an IV. In contrast, our IV passed the test for relevant. Also, as the IV was randomly assigned, it should not be correlated to any determinants of household assets and therefore should be valid. Second, the FE estimates did not correct for self-selection due to time-varying variables. Critical variables like household size and a proxy for health status were included in the model to reduce this bias. Third, there was high attrition in the sample. Originally, 990 households were selected, but our analysis was based on 890 households, 90 percent of the original sample. Most of this attrition could be attributed to emigration that ranged between 7 and 9 percent during this period (Sie et al. 2010). Finally, the 2SLS and FE results were not statistically significant at 5 percent level, but at 10 percent. This was because we applied very demanding techniques to control for endogeneity, but despite using these techniques, our results came close to statistical significance and were in line with the OLS results.

Conclusions

This study shows that CBHI schemes could have a broader impact beyond increasing health care access and protecting households from catastrophic health care expenditures. CBHI schemes can also help to increase household wealth in terms of assets and therefore can break the vicious cycle of poverty and illness. The authors did not find a similar study demonstrating this effect in developing countries. Hence, further research is needed to validate these findings across different settings.

Acknowledgments

Joint Acknowledgment/Disclosure Statement: This work was supported by the collaborative research grant “SFB 544” of the German Research Foundation (DFG). The views expressed in this paper are those of the authors. The sponsor had no involvement in influencing the study design; in the collection, analysis, and interpretation of data; in writing the article; and in the decision to submit it for publication.

The authors thank Dr. Manuela de Allegri for her helpful comments and the Center de Recherche en Sante de Nouna for their valuable support during the data collection process.

Disclosures: None.

Notes

This assumption was based on a prior WTP study (Dong et al. 2003).

We did not explicitly adjust for inflation. We created year dummies that captured all yearly shocks including inflation.

Individuals who reported being sick during the last month at the time of the survey, excluding chronic illnesses, were regarded as sick.

SUPPORTING INFORMATION

Additional supporting information may be found in the online version of this article:

Appendix SA1: Author Matrix.

Please note: Wiley-Blackwell is not responsible for the content or functionality of any supporting materials supplied by the authors. Any queries (other than missing material) should be directed to the corresponding author for the article.

References

- Angrist JD, Pischke J-S. Mostly Harmless Econometrics: An Empiricist's Companion. Princeton, NJ: Princeton University Press; 2009. [Google Scholar]

- Atim C. Contribution of Mutual Health Organizations to Financing, Delivery, and Access to Health Care. Bethesda, MD: Abt Associates Inc; 1998. p. 102. Synthesis of research in nine west and central African countries. [Google Scholar]

- Carrin G. Community Based Health Insurance Schemes in Developing Countries: Facts, Problems and Perspectives. Geneva: World Health Organization; 2003. [Google Scholar]

- Chankova S, Sulzbach S, Diop F. Impact of Mutual Health Organizations: Evidence from West Africa. Health Policy and Planning. 2008;23(4):264–76. doi: 10.1093/heapol/czn011. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Coheur A, Jacquier C, Schmitt-Diabaté V, Schremmer J. Linkages between Statutory Social Security Schemes and Community-Based Social Protection Mechanisms: A Promising New Approach. Moscow: World Social Security Forum; 2007. 10–15 September. [Google Scholar]

- De Allegri M, Sanon M, Sauerborn R. “To Enroll or Not to Enroll?”: A Qualitative Investigation of Demand for Health Insurance in Rural West Africa. Social Science & Medicine. 2006a;62(6):1520–7. doi: 10.1016/j.socscimed.2005.07.036. [DOI] [PubMed] [Google Scholar]

- De Allegri M, Sanon M, Bridges J, Sauerborn R. Understanding Consumers’ Preferences and Decision to Enroll in Community-Based Health Insurance in Rural West Africa. Health Policy. 2006b;76(1):58–71. doi: 10.1016/j.healthpol.2005.04.010. [DOI] [PubMed] [Google Scholar]

- De Allegri M, Pokhrel S, Becher H, Dong H, Mansmann U, Kouyate B, Kynast-Wolf G, Gbangou A, Sanon M, Bridges J, Sauerborn R. Step-Wedge Cluster-Randomised Community-Based Trials: An Application to the Study of the Impact of Community Health Insurance. Health Research Policy and Systems. 2008;6(1):10. doi: 10.1186/1478-4505-6-10. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Dong H, Kouyate B, Cairns J, Mugisha F, Sauerborn R. Willingness-to-Pay for Community-Based Insurance in Burkina Faso. Health Economics. 2003;12(10):849–62. doi: 10.1002/hec.771. [DOI] [PubMed] [Google Scholar]

- Dong H, Mugisha F, Gbangou A, Kouyate B, Sauerborn R. The Feasibility of Community-Based Health Insurance in Burkina Faso. Health Policy. 2004;69(1):45–53. doi: 10.1016/j.healthpol.2003.12.001. [DOI] [PubMed] [Google Scholar]

- Dong H, Gbangou A, De Allegri M, Pokhrel S, Sauerborn R. The Differences in Characteristics between Health-Care Users and Non-Users: Implication for Introducing Community-Based Health Insurance in Burkina Faso. European Journal of Health Economics. 2008;9(1):41–50. doi: 10.1007/s10198-006-0031-4. [DOI] [PubMed] [Google Scholar]

- Dong H, De Allegri M, Gnawali D, Souares A, Sauerborn R. Drop-out Analysis of Community-Based Health Insurance Membership at Nouna, Burkina Faso. Health Policy. 2009;92(2–3):174–9. doi: 10.1016/j.healthpol.2009.03.013. [DOI] [PubMed] [Google Scholar]

- van Doorslaer E, O'Donnell O, Rannan-Eliya RP, Somanathan A, Adhikari SR, Garg CC, Harbianto D, Herrin AN, Huq MN, Ibragimova S, Karan A, Lee TJ, Leung GM, Lu JF, Ng CW, Pande BR, Racelis R, Tao S, Tin K, Tisayaticom K, Trisnantoro L, Vasavid C, Zhao Y. Catastrophic Payments for Health Care in Asia. Health Economics. 2007;16(11):1159–84. doi: 10.1002/hec.1209. [DOI] [PubMed] [Google Scholar]

- Ekman B. Community-Based Health Insurance in Low-Income Countries: A Systematic Review of the Evidence. Health Policy and Planning. 2004;19(5):249–70. doi: 10.1093/heapol/czh031. [DOI] [PubMed] [Google Scholar]

- Franco LM, Diop FP, Burgert CR, Kelley AG, Makinen M, Simpara CH. Effects of Mutual Health Organizations on Use of Priority Health-Care Services in Urban and Rural Mali: A Case-Control Study. Bulletin of World Health Organisation. 2008;86(11):830–8. doi: 10.2471/BLT.08.051045. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Gnawali DP, Pokhrel S, Sie A, Sanon M, De Allegri M, Souares A, Dong H, Sauerborn R. The Effect of Community-Based Health Insurance on the Utilization of Modern Healthcare Services: Evidence from Burkina Faso. Health Policy. 2009;90(2–3):214–22. doi: 10.1016/j.healthpol.2008.09.015. [DOI] [PubMed] [Google Scholar]

- Jowett M, Thompson R. Paying for Healthcare in Vietnam: Extending Voluntary Health Insurance Coverage. York, England: University of York, Centre for Health Economics; 1999. [Google Scholar]

- Jütting JP. Do Community-Based Health Insurance Schemes Improve Poor People's Access to Health Care? Evidence from Rural Senegal. World Development. 2004;32(2):273–88. [Google Scholar]

- King G, Gakidou E, Ravishankar N, Moore RT, Lakin J, Vargas M, Tellez-Rojo MM, Hernandez Avila JE, Hernandez Avila M, Hernandez Llamas H. A “Politically Robust” Experimental Design for Public Policy Evaluation, with Application to the Mexican Universal Health Insurance Program. Journal of Policy Analysis and Management. 2007;26(3):479–506. doi: 10.1002/pam.20279. [DOI] [PubMed] [Google Scholar]

- Leive A, Xu K. Coping with Out-of-Pocket Health Payments: Empirical Evidence from 15 African Countries. Bulletin of the World Health Organization. 2008;86(11):849–56. doi: 10.2471/BLT.07.049403. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Makinen M, Waters H, Rauch M, Almagambetova N, Bitran R, Gilson L, McIntyre D, Pannarunothai S, Prieto AL, Ubilla G, Ram S. Inequalities in Health Care Use and Expenditures: Empirical Data from Eight Developing Countries and Countries in Transition. Bulletin of the World Health Organization. 2000;78(1):55–65. [PMC free article] [PubMed] [Google Scholar]

- McIntyre D, Thiede M, Dahlgren G, Whitehead M. What Are the Economic Consequences for Households of Illness and of Paying for Health Care in Low- and Middle-Income Country Contexts? Social Science & Medicine. 2006;62(4):858–65. doi: 10.1016/j.socscimed.2005.07.001. [DOI] [PubMed] [Google Scholar]

- Morris SS, Ranson MK, Sinha T, Mills AJ. Measuring Improved Targeting of Health Interventions to the Poor in the Context of a Community-Randomised Trial in Rural India. Contemporary Clinical Trials. 2007;28(4):382–90. doi: 10.1016/j.cct.2006.10.008. [DOI] [PubMed] [Google Scholar]

- Mugisha F, Kouyate B, Gbangou A, Sauerborn R. Examining Out-of-Pocket Expenditure on Health Care in Nouna, Burkina Faso: Implications for Health Policy. Tropical Medicine & International Health. 2002;7(2):187–96. doi: 10.1046/j.1365-3156.2002.00835.x. [DOI] [PubMed] [Google Scholar]

- Newman J, Pradhan M, Rawlings LB, Ridder G, Coa R, Evia JL. An Impact Evaluation of Education, Health, and Water Supply Investments by the Bolivian Social Investment Fund. World Bank Economic Review. 2002;16(2):241–74. [Google Scholar]

- Palmer N, Mueller DH, Gilson L, Mills A, Haines A. Health Financing to Promote Access in Low Income Settings—How Much Do We Know? Lancet. 2004;364(9442):1365–70. doi: 10.1016/S0140-6736(04)17195-X. [DOI] [PubMed] [Google Scholar]

- Preker AS, Carrin G, Dror D, Jakab M, Hsiao W, Arhin-Tenkorang D. Effectiveness of Community Health Financing in Meeting the Cost of Illness. Bulletin of World Health Organisation. 2002;80(2):143–50. [PMC free article] [PubMed] [Google Scholar]

- Ranson MK, Sinha T, Morris SS, Mills AJ. CRTs–Cluster Randomized Trials or “Courting Real Troubles”: Challenges of Running a CRT in Rural Gujarat, India. Canadian Journal of Public Health. 2006;97(1):72–5. doi: 10.1007/BF03405220. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ranson MK, Sinha T, Chatterjee M, Gandhi F, Jayswal R, Patel F, Morris SS, Mills AJ. Equitable Utilisation of Indian Community Based Health Insurance Scheme among Its Rural Membership: Cluster Randomised Controlled Trial. British Medical Journal (Clinical Research ed.) 2007;334(7607):1309. doi: 10.1136/bmj.39192.719583.AE. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Rosenbaum PR, Rubin DB. Central Role of the Propensity Score in Observational Studies for Causal Effects. Biometrika. 1983;70:41–55. [Google Scholar]

- Rosenbaum PR, Rubin DB. Reducing Bias in Observational Studies Using Sub-Classification on the Propensity Score. Journal of the American Statistical Association. 1984;79:516–24. [Google Scholar]

- Rosenbaum PR, Rubin DB. Bias Due to Incomplete Matching. Biometrics. 1985;41:103–16. [PubMed] [Google Scholar]

- Sauerborn R, Adams A, Hien M. Household Strategies to Cope with the Economic Costs of Illness. Social Science & Medicine. 1996;43(3):291–301. doi: 10.1016/0277-9536(95)00375-4. [DOI] [PubMed] [Google Scholar]

- Savedoff WD, Levine R, Birdsall N. Report of the Evaluation Gap Working Group. Washington, DC: Center for Global Development; 2006. When Will We Ever Learn? Improving Lives through Impact Evaluation. [Google Scholar]

- Sepehri A, Sarma S, Simpson W. Does Non-Profit Health Insurance Reduce Financial Burden? Evidence from the Vietnam Living Standards Survey Panel. Health Economics. 2006;15(6):603–16. doi: 10.1002/hec.1080. [DOI] [PubMed] [Google Scholar]

- Sie A, Louis VR, Gbangou A, Muller O, Niamba L, Stieglbauer G, Ye M, Kouyate B, Sauerborn R, Becher H. The Health and Demographic Surveillance System (HDSS) in Nouna, Burkina Faso, 1993-2007. Global Health Action. 2010;3 doi: 10.3402/gha.v3i0.5284. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Stock JH, Yogo M. Testing for Weak Instruments in Linear IV Regression. Cambridge, MA: National Bureau of Economic Research; 2002. Technical Working Paper Series T0284. [Google Scholar]

- Su TT, Kouyaté B, Flessa S. Catastrophic Household Expenditure for Health Care in a Low-Income Society: A Study from Nouna District, Burkina Faso. Bulletin of the World Health Organization. 2006;84:21–7. doi: 10.2471/blt.05.023739. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Tabor SR. Community-Based Health Insurance and Social Protection Policy. Washington, DC: The World Bank; 2005. [Google Scholar]

- Trujillo AJ, Portillo JE, Vernon JA. The Impact of Subsidized Health Insurance for the Poor: Evaluating the Colombian Experience Using Propensity Score Matching. International Journal of Health Care Finance and Economics. 2005;5(3):211–39. doi: 10.1007/s10754-005-1792-5. [DOI] [PubMed] [Google Scholar]

- United Nations Central Emergency Response Fund. 2006a. Burkina Faso 2006 [accessed on October 5, 2010]. Available at http://ochaonline.un.org/CERFaroundtheWorld/BurkinaFaso2009/BurkinaFaso2008/BurkinaFaso2007/BurkinaFaso2006/tabid/1862/language/en-US/Default.aspx.

- United Nations Food and Agriculture Organization. 2006b. Sahel Weather and Crop Situation Report [accessed on October 5, 2010]. Available at http://www.fao.org/docrep/009/J7948e/J7948e00.htm.

- Uzochukwu BS, Onwujekwe EO, Onoka CA, Ughasoro MD. Rural-Urban Differences in Maternal Responses to Childhood Fever in South East Nigeria. PLoS ONE. 2008;3(3):e1788. doi: 10.1371/journal.pone.0001788. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Wagstaff A, Lindelow M. Can Insurance Increase Financial Risk? The Curious Case of Health Insurance in China. Journal of Health Economics. 2008;27(4):990–1005. doi: 10.1016/j.jhealeco.2008.02.002. [DOI] [PubMed] [Google Scholar]

- Wagstaff A, Lindelow M, Jun G, Ling X, Juncheng Q. Extending Health Insurance to the Rural Population: An Impact Evaluation of China's New Cooperative Medical Scheme. Journal of Health Economics. 2009;28(1):1–19. doi: 10.1016/j.jhealeco.2008.10.007. [DOI] [PubMed] [Google Scholar]

- Wagstaff A, Pradhan M. Health Insurance Impacts on Health and Nonmedical Consumption in a Developing Country. Washington, DC: The World Bank; 2005. Policy Research Working Paper Series. [Google Scholar]

- Wagstaff A, Yu S. Do Health Sector Reforms Have Their Intended Impacts? The World Bank's Health VIII Project in Gansu Province, China. Journal of Health Economics. 2007;26(3):505–35. doi: 10.1016/j.jhealeco.2006.10.006. [DOI] [PubMed] [Google Scholar]

- Zhang L, Wang H. Dynamic Process of Adverse Selection: Evidence from a Subsidized Community-Based Health Insurance in Rural China. Social Science and Medicine. 2008;67(7):1173–82. doi: 10.1016/j.socscimed.2008.06.024. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.