Abstract

This article bridges the literatures on the economic consequences of divorce for women with that on marital transitions and health by focusing on women's health insurance. Using a monthly calendar of marital status and health insurance coverage from 1,442 women in the Survey of Income and Program Participation, we examine how women's health insurance changes after divorce. Our estimates suggest that roughly 115,000 American women lose private health insurance annually in the months following divorce and that roughly 65,000 of these women become uninsured. The loss of insurance coverage we observe is not just a short-term disruption. Women's rates of insurance coverage remain depressed for more than two years after divorce. Insurance loss may compound the economic losses women experience after divorce, and contribute to as well as compound previously documented health declines following divorce.

Social scientists have accumulated a large body of evidence showing that married individuals tend to have better health than their never married and previously married counterparts (e.g., Waite and Gallagher 2000; Liu and Umberson 2008). Marriage is associated with lower mortality rates, better self-rated health, and lower prevalence of specific conditions such as heart disease (Carr and Springer 2010; Koball et al. 2010). One factor contributing to these marital health disparities is selection: healthier people are more likely to get and stay married (Canady and Broman 2003; Sbarra and Nietert 2009). But several studies have also found that health may deteriorate, at least temporarily, following marital disruption (Priegerson, Maciejewski, and Rosencheck 1999; Williams and Umberson 2004; Lorenz et al. 2006; Hughes and Waite 2009; Liu 2012).

The two primary pathways through which marital disruption is thought to impact health are stress and the loss of health-enhancing resources (Carr and Springer 2010). Our paper builds on this body of work by examining changes in health insurance coverage following marital disruption. Health insurance coverage has received surprisingly little attention in discussions regarding the negative effects of marital disruption on health outcomes. The sparse research on marital status and health insurance has been acknowledged in recent reviews addressing the marriage-health link and multiple scholars have called for more information on the topic (Priegerson et al. 1999; Wood, Goesling, and Avellar 2007; Liu and Umberson 2008; Carr and Springer 2010; Koball et al. 2010).

Loss of health insurance coverage may help to account for the health declines that some individuals experience following marital disruption. Health insurance coverage is a resource more available within than outside of marriage, especially for women, and arguably one which is health-enhancing (Bernstein et al. 2008; McWilliams 2009). It facilitates access to medical care, which may in turn promote healthy behaviors (e.g., medical professionals may encourage exercise or discourage smoking). Losing health insurance may also induce additional stress during the process of marital disruption. Its loss signifies a loss of financial protection during a period of already heightened financial vulnerability, especially for women. Past research finds that uninsured women frequently worry about getting sick, and about whether they will be able to see a doctor, afford medications or pay their medical bills if they do (Vuckovic 2000).

In order to understand the role health insurance may play in the poorer health of the previously married, we must first document the changes to health insurance coverage following marital disruption. At present, the little research available shows that married women are more likely than others to be insured (Bernstein et al. 2008). But little is known about how transitions in marital status are associated with changes in coverage.

Using nationally representative panel data from the Survey of Income and Program Participation (SIPP), we provide the most comprehensive portrait to date of what happens to women's health insurance coverage upon divorce. We first document women's rates of health insurance coverage and the sources of this coverage both before and after divorce. We then test whether women tend to lose coverage after divorce, identify characteristics that heighten or buffer this risk, and examine the duration of observed effects. Our analytic approach exploits the strengths of panel data to help account for selection. Observed differences in health insurance coverage between married and divorced women shown in previous studies may result from the greater disadvantages of women who divorce relative to those remain married (see Smock, Manning, and Gupta 1999). Our fixed-effects models control for a set of observed time-varying characteristics, as well as stable unobserved characteristics, which may be correlated with both divorce and insurance coverage.

BACKGROUND

In the current U.S. health system, non-elderly Americans access and pay for health care through a fragile patchwork of employer-sponsored group insurance policies, individual health plans purchased on the private market, and public programs. As a result, life course events such as job transitions, marital transitions, and the onset of health problems allow individuals to slip through the cracks (Quadagno 2004). Multiple studies have documented that job losses frequently trigger insurance loss (e.g., Gruber and Madrian 1997). In contrast, very little is known about how marital transitions relate to health insurance coverage.

Most current knowledge on marital status and health insurance coverage is based on cross-sectional data (see Short (1998) for an exception). These studies find that unmarried women are between 1.5 and 2 times as likely as married women to be uninsured, and when insured, are more likely to rely on public insurance programs like Medicaid (Jovanovic, Lin, and Chang 1993; Meyer and Pavalko 1996; Bernstein et al. 2008; Montez, Angel and Angel 2009). Observed differentials in insurance coverage by marital status may result from the higher likelihood of divorce among women with lower levels of socioeconomic resources or other unobserved differences.

But past research indicates that women who divorce not only start out with fewer resources than their counterparts that remain married, they also experience substantial declines in income after divorce, far greater than their spouses (Smock et al. 1999). This study extends the economic consequences of divorce literature to examine the extent to which women lose another key economic resource—health insurance. As outlined in the next two sections, considering insurance loss can elaborate our understanding of the two primary mechanisms whereby marital disruption is thought to impact health—through the loss of health-enhancing resources and the stress of divorce.

The Loss of Resources Following Divorce

The loss of economic resources after divorce experienced by many women is predicated on their poorer compensation in the labor market relative to men and their continued economic dependence within marriage (Bianchi, Subaiya, and Kahn 1999; Smock et al. 1999). These factors may similarly jeopardize women's health insurance coverage in the event of marital disruption.

One-quarter of women in the U.S. younger than 65 receive dependent health insurance coverage through the benefits package of a spouse or other family member, substantially higher than the dependent coverage rate for men (Kaiser Family Foundation 2011).1 Part of this differential comes from married women's lower rates of labor force participation. Another part is because women tend to work in jobs and occupations with poorer fringe benefits than their husbands (Currie 1997). Women also frequently decline health insurance coverage through their own employers and instead elect coverage through a husband's employer, presumably because they assess this coverage to be more comprehensive or a better value (Buchmueller 1997).

Women may lose health insurance after marital disruption both directly through the loss of dependent coverage or indirectly through their inability to access or afford other forms of coverage. The federal COBRA law grants former spouses the option to temporarily purchase an extension of dependent coverage for up to 36 months, but premiums are high (nearly $500 per month for individual coverage in 2011; Claxton et al. 2011). Financial hardship may hinder women's ability to maintain uninterrupted insurance coverage, making it difficult to purchase COBRA or to continue paying premiums for coverage through their own employers or for private market policies. But despite women's substantial economic losses following divorce, few become eligible for public coverage. As of 2012, Medicaid, the state-run health insurance program for low-income people, was limited to parents with incomes (often substantially) below the poverty line in two-thirds of states, and was available to low-income childless adults in only nine states (Kaiser State Health Facts 2012). Medicare, the federal health insurance program for the elderly and disabled, is rarely available because most divorces occur before retirement age and few meet stringent disability standards.

Like the loss of economic and other health-enhancing resources after divorce, the loss of health insurance may harm women's health. Compared to those with coverage, uninsured adults experience significantly worse health outcomes and die at younger ages (Institute of Medicine 2002). Recent quasi-experimental and random assignment studies consistently find positive and often significant effects of health insurance on health outcomes, especially for low-income adults, those with chronic health conditions, and other vulnerable populations (Levy and Meltzer 2008; McWilliams 2009; Finkelstein et al. 2011). Health insurance loss is also associated with subsequent declines in health (Baker et al. 2002).

Health insurance may preserve health in large part because it facilitates access to more and higher-quality health care services; this is the primary mechanism articulated in the health economics and public health literatures (Hadley 2003; McWilliams 2009; Finkelstein et al. 2011). Uninsured individuals are more likely than those with coverage to postpone or forego medical checkups, prescribed medications, and other needed medical care, and may receive poorer quality care when they do seek medical attention (Berk, Schur, and Cantor 1995; Ayanian et al. 2000; Baker, Shapiro and Schur 2000; Institute of Medicine 2002; Jovanovic et al. 2003; McWilliams 2009). If some women become uninsured after divorce and subsequently skip medications or forego visits to the doctor, this could compound existing health problems and lead to deteriorating health over time.

Health insurance may also encourage healthy behaviors. Employer-based health plans are increasingly tied to wellness programs that encourage participants to quit smoking, exercise and lose weight (Baicker, Cutler, and Song 2010). Losing health insurance may also eliminate the monitoring of one's health by medical professionals, making it less likely that one will take timely steps, for example, to change diet and exercise in response to high blood pressure.

The Stress that Accompanies Divorce

The second major reason posited to explain why health may decline in the wake of divorce is that the stress of marital disruption depletes both psychological and physical health (Johnson and Wu 2002; Williams and Umberson 2004). Becoming uninsured after divorce may compound the other stresses of the divorce process, potentially further damaging health. For those experiencing financial hardship and medical issues simultaneously, losing insurance coverage after divorce may initiate the need to make stressful tradeoffs such as either paying rent or complying with a doctor's orders for medication or treatment.

Whether or not one needs immediate access to medical services, health insurance may enhance well-being by providing an increased sense of security. It reassures that one will have access to medical services should the need arise, and that in that event, one will be financially protected (Hahn 1993). Uninsured Americans have high levels of financial stress and many carry medical debt, which itself is strongly associated with stress (Drentea 2000; Schoen et al. 2011).

A recent ethnographic study of uninsured women illustrates how the stress of being uninsured can harm women's health (Vuckovic 2000). Women in the study frequently worried about getting sick and whether they would be able to see a doctor or cope financially if they did. One respondent summed it up: “Worry wears you down and you don't even realize it” (199).

The Present Study

Using a recent (1996–2007) longitudinal (up to 48 months per respondent) dataset, we provide the most comprehensive portrait to date of what happens to women's health insurance coverage upon divorce. We focus on divorce rather than marital disruption (separation and divorce) because most separations are informal rather than legal and do not change one's eligibility for dependent coverage.

We start by documenting the extent to which women who remain married and those who divorce differ on baseline (pre-divorce) characteristics and rates of health insurance coverage. We then examine descriptive estimates of total changes in health insurance coverage after divorce. Next we employ multivariate fixed-effects models to fulfill three additional research goals. Our first goal is to estimate the overall association between divorce and women's health insurance coverage, net of both measured and unmeasured (time-invariant) characteristics. By using women's pre-divorce insurance coverage as their own `counterfactuals,' we control for those factors that are stable but not measured in SIPP (e.g., unmeasured aspects of family background, or `taste' for insurance coverage). Our second goal is to determine whether the association between divorce and health insurance coverage is stronger for some groups of women than for others (subgroup heterogeneity). We consider factors that may moderate a woman's risk of insurance loss after divorce such as the source of coverage she has while married, her employment status, job tenure, age and health status. Our third goal is to determine whether the association between divorce and health insurance wanes over time as women adjust to life after divorce (time heterogeneity).

DATA AND METHODS

Data

We analyze pooled data from the three most recent complete panels of the Survey of Income and Program Participation (1996, 2001, and 2004), a series of longitudinal surveys administered by the Census Bureau. Each panel follows a large nationally representative clustered sample of civilian non-institutionalized households, and interviews household members every four months for between three and four years. Respondents are asked about core topics including demographic characteristics, labor force participation, income sources, program participation and health insurance coverage, reporting monthly data for each month since the prior interview.

The SIPP has three key advantages for studying divorce and changes in health insurance coverage. First, it follows individuals over time whether or not they remain in the original sampled household, essential for a study on marital transitions. Second, it allows us to construct a monthly calendar of marital and insurance history for a large nationally representative sample of women for a period of up to 48 months. For women who experience both divorce and insurance loss, this temporal detail allows us to determine precisely which event came first and how much time elapsed between the two. Third, whereas many datasets lack detailed information on sources of health insurance, SIPP data identify whether a private employer-based insurance policy is held in a woman's own name or in her spouse's name. This information enables us to examine whether the source of a woman's insurance prior to divorce impacts her risk of insurance loss following divorce.

Together, the three SIPP panels cover the period from 1996 through 2007. The analytic sample includes 54,541 women who remain married and 1,442 women who divorce across the data collection period.2 This sample includes original female sample members between the ages of 26 and 64 (no longer eligible for dependent coverage from parents, and not yet eligible for Medicare) observed as married in at least one month of the panel. Women enter the analysis sample in the first month in which they are married and in the valid age range (for many, the first month of the panel; we refer to this as the baseline month). Sample members who turn 26 or who turn 65 over the course of the panel are retained in the sample, but only contribute person-months while in the valid age range. Those who become widowed (1% of sample members) are censored in the month of husband's death. Women who divorce and then remarry are censored in the month of remarriage.3 On average, women who divorce contribute 20.5 pre-divorce person-months and 14.0 post-divorce person-months.

As with any longitudinal data set, some attrition of the sample occurs over time. For example, at 6 months after divorce, we observe 997 of the 1,442 total women who divorce in our analysis sample. 18.4 percent of the original sample is censored before 6 months after divorce (because divorce occurred fewer than 6 months before the end of the panel or due to age or remarriage), 8.6 percent attrite before 6 months after divorce, and 3.9 percent have a missing time point at 6 months after divorce. To gauge the effect of attrition on estimates, we re-estimated all analyses using final full-panel weights that adjust for attrition, available for slightly fewer than half of our study sample of women who divorce (676). Patterns of findings using the full analysis sample with baseline month weights or the reduced sample with attrition-adjusted panel weights are very similar. Final analyses use the full analysis sample with baseline weights to preserve statistical power.

Measures

Health insurance

The main analyses examine health insurance coverage as the key outcome variable. For each month, respondents report whether they are insured, and if so, by what type of coverage. Based on responses, we code a woman's health insurance coverage into five categories: (1) job-based coverage through a woman's own job; (2) job-based coverage through her husband's job; (3) other private coverage; (4) public insurance (Medicaid or Medicare)4; and (5) uninsured. For sake of simplicity and to minimize measurement error, coverage types are coded hierarchically; a woman who reports more than one type is coded as the first to appear on the above list. Job-based coverage includes insurance policies purchased through or received from a current employer, a former employer, a union, or the military, and held in a woman's own name or that of her husband. Other private coverage consists primarily of individual insurance policies purchased on the private market, but also includes a small number of cases in which employer-based coverage is accessed through a non-spouse family member or an individual outside of the household. In many analyses, we collapse job-based and other private coverage into the larger category of private coverage (1, 2 or 3). Some analyses dichotomize insurance status, examining whether women had any coverage (1, 2, 3 or 4) or were uninsured (5).

Marital transitions

By design, all women in our analysis sample are married at baseline. The marital transition of interest, divorce, occurs when women revise their marital status to divorced. Nearly half of women who divorce report at least one month of marital separation preceding divorce. Although separation rarely initiates a change in eligibility for dependent health insurance coverage, it may be associated with residential and employment changes and decreased sharing of financial resources between spouses. For this reason, all multivariate models control for separation.

Employment

Women's labor force attachment also strongly predicts her health insurance status (Montez et al. 2009). As such, multivariate models control for women's employment status and job tenure. Employment status is tabulated in three categories: full-time (>=35 hours per week); part-time (0–34 hours per week); or not working. Because many employers have waiting periods before which new employees are eligible for health insurance, we dichotomize job tenure, indicating whether a woman has worked for the same employer for more than six months (Claxton et al. 2011). In addition to employment status and job tenure, descriptive analyses also examine women's (annualized) earnings in the baseline survey month, inflation-adjusted to 2010 real dollars using the CPI-U.

Health

We measure health in two ways. First, we code a woman's self-rated health (1=good, very good, or excellent; 0=poor or fair) at her earliest available time point prior to divorce (or censoring, if applicable). Using this variable, we consider how a woman's changes in health insurance after divorce relate to her pre-divorce health status. Self-rated health serves as a good summary measure of baseline health status because it captures both manifest illnesses and symptoms of conditions not yet diagnosed, and it predicts a range of subsequent health outcomes including physician assessments of health and mortality (Idler and Benyamini 1991; Ferraro and Farmer 1999). Second, we construct a monthly indicator for disability. This variable is equal to one if women responded yes to “hav[ing] a physical, mental, or other health condition that limits the kid of work [she] can do,” and zero otherwise. All multivariate models control explicitly for time-varying disability status and implicitly for baseline health status (captured by fixed effect).

Marital characteristics

Descriptive analyses examine the baseline prevalence of first marriages and the length of marriages for women in the sample.

Demographics

A woman's overall economic situation is measured by her total family income relative to the poverty threshold for a family of that size and composition. In 2010, for example, the Federal Poverty Line (FPL) for a family with two adults and two children was $22,113. The income-to-poverty ratio is then collapsed into four categories: poor (<100% FPL), near-poor (100–200% FPL), moderate-income (200–300% FPL), and higher-income (>300% FPL). Descriptive analyses consider the baseline differences between women who remain married and women who get divorced in age (years), poverty status (<100% FPL), presence of own children in the household (any children <18 years old), as well as women's education (less than high school, high school, some college, college graduate) and race/ethnicity (non-Hispanic white, non-Hispanic black, Hispanic, and other). Multivariate models include monthly (time-varying) measures of age, children in the household, and income-to-poverty ratio.

Analytic Strategy

We utilize the longitudinal variation in health insurance coverage and marital status to estimate the association between divorce and changes in women's health insurance coverage. Because women who divorce differ from those who remain married, loss of coverage cannot be inferred from coverage differentials between married and divorced women in cross-sectional data. We use fixed-effects models to remove from our estimates as much selection bias as possible. Women who divorce are more socioeconomically disadvantaged than those who remain married, and may also differ on unobserved characteristics such as planning aptitude or `taste' for health insurance coverage (Smock et al. 1999). Fixed-effect models remove confounding from these and other stable, individual characteristics.

The general model specification is pit =αi + βXit + εit, where the dependent variable, pit, represents the latent probability of individual i being insured in month t. This probability is modeled as a linear function of a vector of time-varying covariates including divorced status, Xit, an individual-level fixed effect, αi, and a person-month random error, εit. Additional time-varying covariates include: separated status, full-time employment, job tenure, disability, age, any children, income-to-poverty ratio, as well as year and region.5 We choose the linear probability model (LPM) specification primarily for ease of interpretation; fixed-effect logit analyses generate the same general findings. All analyses are run in Stata and weighted, and we utilize robust standard errors to account for clustered data. Our approach is consistent with Gruber and Madrian (1997), who utilize fixed-effects linear probability models to examine how job loss predicts health insurance loss.

We run three sets of multivariate models, which correspond to our three primary research questions. First, we examine how women's insurance coverage changes after divorce, holding other factors constant. Next, we add interaction effects to examine how various factors moderate the association between divorce and insurance loss. Last, we examine this association longitudinally by predicting insurance coverage from time since divorce.

One limitation of our study is that the SIPP does not measure overall health status at regular intervals. While controlling for variation in overall health over time would be ideal, we believe its omission is unlikely to substantially bias results for three reasons. First, by controlling for a time-varying indicator of work-limiting disability, major changes in health—those most likely to impact health insurance coverage—are captured in the analysis. Second, fixed-effects models control for stable aspects of overall health. If women who divorce are in generally poorer health (as has been suggested, but is not evident in these data), this will be captured by the fixed effect and not bias estimates. Third, while it is plausible that the negative impact of divorce on physical health documented in previous studies may eventually impact health insurance coverage, it is unlikely to happen in the relatively short timeframe of the SIPP panels. Furthermore, past studies suggest that divorce has delayed, not immediate, effects on physical health (Lorenz et al. 2006), whereas our results show immediate, not delayed, effects of divorce on insurance coverage.

RESULTS

Baseline Descriptives

Table 1 compares the baseline characteristics of women who remain married with those who divorce. Consistent with past studies, the two groups differ. Women who go on to divorce are less likely to be in a first marriage (64.3 vs. 77.0%), have been married a shorter time (9.7 vs. 15.6 years), on average, and are more likely to have children (60.9 vs. 50.3%) compared to women who remain married. They are also younger (37.8 vs. 42.1 years), have lower levels of education (20.8 vs. 27.7% college graduates), and are more likely to be poor (12.7 vs. 8.2%). There are no statistically significant baseline differences in self-rated overall health status or disability by marital trajectory, although the limited variability in these dummy variables may mask health differences in the two groups found in previous studies (e.g., Canady and Broman 2003). Women who go on to divorce are more likely to work full-time (59.4 vs. 51.1%) compared to women who remain married, yet exhibit shorter job tenure. While the average earnings for women who divorce is lower than for women who remain married, the difference does not attain statistical significance.

Table 1.

Baseline Descriptives by Marital Trajectory

| Women Who Remain Married | Women Who Divorce | Diff.a | |

|---|---|---|---|

| Marital Characteristics | |||

| First Marriage | 77.0% | 64.3% | *** |

| Years Married | 15.6 | 9.7 | *** |

| Employment | |||

| Status | |||

| Full-Time | 51.1% | 59.4% | *** |

| Part-Time | 17.0% | 15.2% | |

| Not Employed | 31.9% | 25.3% | *** |

| Job Tenure > 6 Months | |||

| Full-Time Workers | 89.9% | 85.6% | ** |

| Part-Time Workers | 83.6% | 76.2% | * |

| Earnings (2010$) | |||

| Full-Time Workers | $42,005 | $40,398 | |

| Part-Time Workers | $18,584 | $17,498 | |

| Self-Reported Health | |||

| Good, Very Good or Excellentb | 89.8% | 89.8% | |

| Disabled | 9.2% | 10.4% | |

| Demographics | |||

| Age | 42.1 | 37.8 | *** |

| Poor (<100%FPLc) | 8.2% | 12.7% | *** |

| Any Children | 50.3% | 60.9% | *** |

| Education | |||

| Less Than High School | 10.9% | 9.8% | |

| High School | 29.1% | 30.3% | |

| Some College | 32.2% | 39.0% | *** |

| College Graduate | 27.7% | 20.8% | *** |

| Race/Ethnicity | |||

| NH White | 75.2% | 76.3% | |

| NH Black | 7.5% | 9.0% | |

| Hispanic | 11.3% | 10.3% | |

| Other | 6.0% | 4.5% | ** |

| N (persons) | 54,541 | 1,442 |

Notes: Data reflect characteristics of sample members at baseline, at which point all women are married. Sample size reported reflects total sample, before dropping missing cases in each analysis. All variables presented have less than 10% missing, with the exception of self-reported health (14.4%) and length of marriage (12.6%); neither is used in multivariate models, except interaction models in Table 4.

Heteroskedasticity-robust t-tests are weighted and adjusted for the SIPP's clustered sampling design.

Measured at earliest available timepoint prior to divorce or censoring.

Federal Poverty Line.

p<.05;

p<.01;

p<.001 (two-tailed tests)

Women who go on to divorce may be more likely to work full-time at baseline for multiple reasons. Some scholars have suggested that women's economic independence reduces their incentive to remain married (Becker 1981), but this theory has received little empirical support (Oppenheimer 1997). Although wives who contribute a larger percentage to family income are more likely to divorce, the association becomes insignificant after accounting for gender ideology (Sayer and Bianchi 2000). On the other hand, women who anticipate divorce may prepare for economic independence by increasing their labor supply (Johnson and Skinner 1986). Rogers (1999) documented that increasing marital discord raises the odds that non-working women will enter the labor market. Although we do not observe a substantial increase in women's employment until the month of divorce in our data, we control for monthly employment status in all multivariate models to take account of changing employment situations.

Overall, Table 1 suggests that women who divorce are more socioeconomically disadvantaged than women who remain married. This is consistent with prior studies (Amato 2010; Smock et al. 1999) and implies that selectivity underlies some of the observed differences in health insurance between married and divorced women.

Insurance Coverage by Marital Status

Women who get divorced are less likely to have health insurance coverage compared to those who remain married, even while married. But their probability of being uninsured climbs even higher following divorce.

Table 2 displays health insurance profiles by marital trajectory. The first two columns compare the baseline insurance coverage for women who remain married and women who divorce. At baseline, 11.6 percent of women who remain married are uninsured, compared to 15.9 percent of women who go on to divorce. Women who divorce are also less likely to be covered by private insurance at baseline (78.5 vs. 84.4%) and more likely to have public insurance such as Medicaid (5.6 vs. 3.9%). Additionally, those with private coverage are less likely to rely on husbands' health plans at baseline, and more likely to receive coverage through their own jobs.

Table 2.

Insurance Coverage by Marital Status

| Women Who Remain Married | Women Who Divorce | Women Who Divorce Insured at Baseline | |||

|---|---|---|---|---|---|

|

|

|

|

|||

| Baseline | Baseline | 6 Months After Divorce | Baseline | 6 Months After Divorce | |

| Insured | |||||

| Job-Based, Own Job | 36.0% | 42.4% | 55.0% | 50.5% | 60.7% |

| Job-Based, Husband's Job | 40.8% | 28.9% | 0.0% | 34.4% | 0.0% |

| Other Private | 7.6% | 7.2% | 12.2% | 8.5% | 13.8% |

| Public | 3.9% | 5.6% | 10.3% | 6.6% | 8.7% |

| Uninsured | 11.6% | 15.9% | 22.5% | 0.0% | 16.8% |

| Net Loss of Coverage | 6.6% | 16.8% | |||

Notes: Using heteroskedasticity-robust two-sample t-tests, all baseline differences between women who remain married and women who divorce found to be significant (p<.05) except for other private coverage. All pre-post divorce differences significant (p<.05) using paired-sample t-tests on reduced sample that included women with non-missing data at both timepoints (N=997; percentages shown for this sample).

Compounding divorced women's lower baseline probabilities of insurance coverage, some women lose insurance coverage after divorce. Women are 6.6 percent less likely to be insured six months after divorce than they had been before divorce. If we consider only the subgroup of women insured at baseline, nearly 17 percent are uninsured six months after divorce.

The proportion losing coverage would be greater if some women were not able to switch from private to public coverage. Six months after divorce, 10.3 percent of women hold public insurance coverage, compared to 5.6 percent at baseline. More women also acquire their own employer-based coverage after divorce. The majority of women insured through their own jobs six months after divorce were employed at the same job prior to divorce, although some increased their hours from part- to full-time employment (analyses not shown).

Partitioning the sample by pre-divorce source of insurance coverage demonstrates substantial heterogeneity in the loss of coverage following divorce (not in table). In particular, nearly one-quarter (23.2%) of women insured as dependents on a husband's insurance policy at baseline become uninsured by six months after divorce, more than double the rate of women with their own employer-based health insurance at baseline (10.6%).

The risk of insurance loss also differs by a woman's family income at baseline, and the magnitude of economic loss she experiences after divorce (not in table). Women who experience the greatest economic losses after divorce (in terms of income-poverty ratio) are most likely to lose health insurance coverage. Significant declines in the probability of holding health insurance occur only for women from moderate- or higher-income families (> 200% FPL). The loss of private coverage experienced by low-income women is largely offset by their take-up of public coverage. In contrast, few moderate-income and higher-income women who lose private coverage can access public coverage because most states restrict Medicaid to families with incomes less than twice the poverty line (Kaiser State Health Facts 2012).

Changes in Insurance Coverage after Divorce

Women are less likely to be insured after divorce than before. Net of changes in employment, economic resources and other factors, divorce leads to an approximately 8 percentage point decline in women's private health insurance coverage, and an increase of 3 percentage points in women's public health insurance coverage, for a total drop of 5 percentage points.

Table 3 presents a series of six multivariate fixed-effects models examining the relationship between divorced status and the likelihood of holding any insurance coverage (Models 1 and 2), private coverage (Models 3 and 4), and public coverage (Models 5 and 6), net of other factors. These models compare each woman's health insurance coverage in the months before divorce with the same woman's coverage in the following months.

Table 3.

Changes in Insurance Coverage After Divorce: Evidence from Fixed-Effects Models

| Any Insurance |

Private Insurance |

Public Insurance |

||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

| Divorced | −.063*** | −.046*** | −.091*** | −.076*** | .028*** | .031*** |

| Covariates | ||||||

| Separated | −.008 | −.035* | .026** | |||

| Full-Time Work | .017 | .042** | −.024** | |||

| Job Tenure > 6 Months | .079*** | .091*** | −.012 | |||

| Disabled | .068* | .009 | .059* | |||

| Age | .003 | −.002 | .004 | |||

| Any Children | .058** | .024 | .033* | |||

| Income-to-Poverty Ratio | ||||||

| Poor (<100% FPLa) | −.113*** | −.149*** | .035* | |||

| Near-Poor (100–200% FPL) | −.072*** | −.065*** | −.007 | |||

| Moderate-Income (200–300% FPL) | −.023* | −.013 | −.009* | |||

| Higher Income (>300% FPL) | --- | --- | --- | |||

| Constant | .855*** | .617*** | .781*** | .715*** | .074*** | −.106 |

| N (persons) | 1,410 | 1,410 | 1,410 | 1,410 | 1,410 | 1,410 |

| N (person-months) | 45,209 | 45,209 | 45,209 | 45,209 | 45,209 | 45,209 |

Notes: Sample includes person-months from women who divorce in 1996, 2001, and 2004 SIPP. Results based on weighted LPM models with robust standard errors. Coefficients for survey year and region fixed-effects in Models 2, 4, and 6 not shown.

Federal Poverty Line.

p<.05;

p<.01;

p<.001 (two-tailed tests)

Model 1 estimates the gross change in health insurance coverage after divorce. Compared to when they were married, divorced women are six percentage points less likely to have any type of health insurance. The addition of time-varying covariates in Model 2 (including year and region fixed-effects) attenuates the main effect by less than two percentage points. Findings show that when women have children in the household, when they are employed in stable jobs, and when they are disabled, they are more likely to be insured. Household financial resources are also important. When women are living in poverty, they are 11 percentage points less likely to have health insurance relative to when their incomes are more than three times the federal poverty line, holding other factors constant.

Models 3 through 6 examine private and public insurance separately. As Model 4 shows, after divorce, women are 8 percentage points less likely to have private insurance coverage than before, net of other factors. Results suggest that employment status, job tenure and financial resources are more strongly associated with private insurance coverage than with the overall probability of any coverage. The table also shows that separated status has a negative impact on women's private health insurance coverage. Rather than a single event, divorce may be best thought of as a longer process during which partners may prepare for and adjust to the impending divorce in the months prior to its occurrence (Amato 2000). For example, during this pre-divorce period partners may move out of the house and/or change jobs, both of which could be associated with instability in health insurance coverage. Individuals may also remove estranged spouses from employer-based health plans during annual open enrollment periods, even prior to any legal termination of eligibility for dependent coverage.

In contrast to private insurance, women's probability of holding public health insurance increases after divorce. Women are 3 percentage points more likely to have public health insurance coverage after divorce than before, net of other factors. When women have children, are disabled, are poor, or are not working full-time they are more likely to hold public insurance coverage, consistent with eligibility requirements.

Changes in Insurance Coverage after Divorce: Subgroup Heterogeneity

To examine heterogeneity in the relationship between divorce and health insurance changes, we estimate a second series of models in which the divorced status dummy variable is fully interacted with time-invariant characteristics of interest (implicitly, the omitted comparison group is `still married'). Table 4 presents these results. Each model includes the same covariates as the previous set of models.

Table 4.

Heterogeneity in Changes in Insurance Coverage After Divorce: Subgroup Interactions with Divorced Status

| Any Insurance | Private Insurance | Public Insurance | |

|---|---|---|---|

| Insurance Status at Baseline | |||

| Job-Based, Own Job | −.035** | −.052*** | .017 |

| Job-Based, Husband's Job | −.136*** | −.194*** | .058*** |

| Other Private | −.167*** | −.249*** | .082** |

| Public | −.129** | .004 | −.133** |

| Uninsured | .160*** | .087** | .073** |

| Education at Baseline | |||

| Less Than High School | −.041 | −.132*** | .091** |

| High School Grad | −.049* | −.083*** | .035** |

| Some College | −.068*** | −.092*** | .023* |

| College Grad | −.004 | −.015 | .010 |

| Employment Status at Baseline | |||

| Full-Time | −.014 | −.026* | .012 |

| Part-Time | −.076* | −.141*** | .065** |

| Not Employed | −.110*** | −.168*** | .059** |

| Job Tenure at Baseline | |||

| More Than 6 Months | −.016 | −.033* | .018* |

| Less Than 6 Months | −.067* | −.110*** | .042* |

| Not Employed | −.109*** | −.168*** | .059** |

| Race | |||

| NH White | −.060*** | −.082*** | .023** |

| Non-White or Hispanic | −.001 | −.056** | .056** |

| Poverty Status at Baseline | |||

| Poor (<100% FPLa) | −.042 | −.062* | .020 |

| Near-Poor (100–200% FPL) | −.061* | −.128*** | .067** |

| Moderate-Income (200–300% FPL) | −.071** | −.110*** | .039** |

| Higher Income (>300% FPL) | −.032* | −.050*** | .019* |

| Age at Divorce | |||

| 26 – 34 Years | −.053** | −.083*** | .029* |

| 35 – 49 Years | −.029* | −.063*** | .034** |

| 50 – 64 Years | −.082** | −.107*** | .024 |

| Self-Reported Health Before Divorceb | |||

| Poor or Fair | −.029 | −.113** | .085* |

| Good, Very Good or Excellent | −.054*** | −.074*** | .020* |

| Any Children at Time of Divorce | |||

| At Least One Child | −.061*** | −.090*** | .029** |

| No Children | −.029 | −.062*** | .033** |

Notes: Sample includes person-months from women who divorce in 1996, 2001, and 2004 SIPP. Results based on weighted LPM models with robust standard errors. Only coefficients for divorced status interacted with subgroups of interest are shown. Covariates not shown include those in Table 3 models, including year and region fixed-effects.

Federal Poverty Line.

Self-reported health status is measured at earliest available timepoint in the sample prior to divorce or censoring.

p<.05;

p<.01;

p<.001 (two-tailed tests)

Some types of insurance coverage are more vulnerable to loss than others. Women with employer-based insurance in their own names before divorce are largely, although not fully, protected. In contrast, women insured as dependents through a husband's employer at baseline face a 14 percentage point decrease in overall probability of coverage, net of other factors, four times as large as the drop experienced by women with employer-based insurance in their own name. There is also a considerable risk of loss associated with other forms of private coverage (17 percentage point decrease; may be difficult to afford after divorce), and with public insurance coverage as well (13 percentage point decrease).

This magnitude of loss of public coverage is surprisingly high, given that women generally experience economic declines after divorce. Several factors could explain this finding. First, because divorce is a turbulent time of transition, some women may fail to recertify their eligibility. Second, some women may lose eligibility for Medicaid if they enter the labor market or increase their earnings levels after divorce, as documented by a recent study (Tamborini, Iams and Reznik 2011), or if they move to states with less-generous Medicaid programs. Third, our finding may reflect the generally high instability associated with this form of coverage—what other researchers have termed “churning” (Summer and Mann 2006; Saunders and Alexander 2009)—rather than the impact of divorce on public insurance per se. Indeed, when we repeat the same analysis among the group of women who remain married using a randomly generated month in the survey as a cutpoint (rather than month of divorce), we still observe that many women with public insurance lose public coverage after the random cutpoint (18% for public coverage vs. 2% for job-based coverage) and become uninsured (9% for public coverage vs. 2% for job-based coverage). This supports the churning hypothesis.

The more education a woman has and the greater her attachment to the labor force at baseline, the less likely she is to lose insurance coverage. College graduates appear to be immune from the effect altogether. Women with less education tend to lose private coverage. However, for women with less than high school education the net effect is zero, as the loss of private coverage is fully offset by an uptake in public insurance after divorce.

Women working full-time and those in jobs for longer than six months appear to be largely protected from insurance loss. The importance of job tenure is not surprising: Three-quarters of workers whose firms provide health insurance face a short waiting period during which they are ineligible for coverage, meaning that newer employees more often lack coverage (Claxton et al. 2011). Additionally, workers in low-wage, benefit-poor occupations typically have high rates of turnover. Minorities are more likely to work in these occupations, and are less likely in general to have employer-based coverage than whites (Hall, Collins, and Glied 1999). Our analyses indicate that only white women show a significant drop in net health insurance coverage after divorce, both due to a larger drop in private coverage and lower acquisition of public coverage. The smaller drop in private insurance that minorities experience is largely offset by public insurance coverage.

Financial resources at baseline, as measured by the income-to-poverty ratio, moderate the linkage between divorce and insurance coverage. Women in moderate-income families before divorce are most vulnerable to insurance loss, with an estimated drop of 7 percentage points. These women face an 11 percentage point decline in the probability of private insurance, and a 4 percentage point increase in the probability of public insurance. Many lower middle-class women may fall into the ranks of the near-poor after divorce, leaving them with too much money to qualify for Medicaid and other public insurance programs (as their poorer counterparts), but not enough to purchase private insurance policies (as their higher-income counterparts).

Table 4 also shows that women who divorce between ages 50 and 64 are more vulnerable to insurance loss than younger women. This result is consistent with recent findings suggesting that insurance coverage in later middle-age may be particularly tenuous. Angel, Montez and Angel (2011) document greater reliance on dependent coverage among women in this age group relative to those at other ages, and Kirby and Kaneda (2010) find that adults in later middle-age (55–64) have the second highest rates of uninsurance of any age group (highest is young adults 18 to 25). Women are most likely to lose health insurance coverage when they report themselves in good, very good or excellent health before divorce (as opposed to poor or fair), perhaps because women in poorer health may place a greater priority on maintaining continuous coverage. Women in poor or fair health do lose private insurance coverage more than others, but this is offset by their acquisition of public insurance coverage. Some of these women may have chronic illnesses or disabilities that qualify them for Medicare.

The presence of children in the household is associated with a greater risk of insurance loss after divorce, and a smaller rate of take-up of public insurance coverage. Women with children typically face greater financial troubles after divorce, as they frequently become the sole provider, which could help to explain this finding (Smock 1994). Surprisingly, we find that mothers and women without children are about equally likely to acquire public coverage. We would have expected that only mothers would a significant take-up of public coverage, due to eligibility restrictions in many states. One possible explanation is that a greater proportion of women without children at baseline are disabled, so that the take-up of public insurance may in part stem from this subgroup enrolling in Medicare.

Changes in Insurance Coverage after Divorce: Heterogeneity across Time

We now turn to the temporal pattern of insurance loss and recovery, relative to time of divorce. For this investigation, we use a simple form of non-parametric regression called piecewise linear regression. Piecewise linear regression, or spline regression, breaks a continuous variable into intervals and fits a separate linear slope for each interval (Marsh 2001). In our application, we group person-month observations into intervals based on time to divorce such that a sufficient number of observations in each group results (at least 500) to ensure adequate precision of the estimates.6 Because the mass of data points lies at or near the time of divorce, months close to divorce form their own groups; months further from divorce are grouped together.

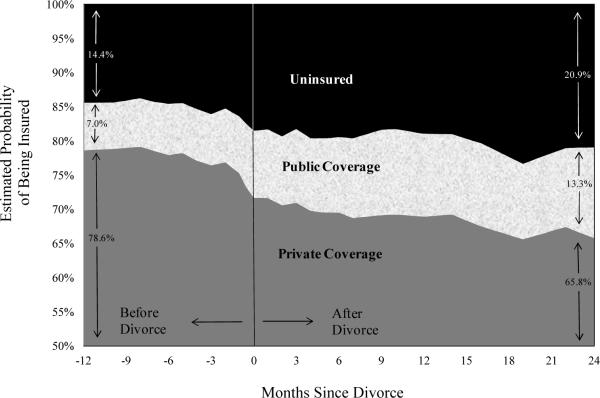

Our three piecewise linear regressions—predicting any coverage, private coverage, and public coverage—are estimated using the same multivariate fixed-effects models (including controls) as in Table 3, but we replace our key predictor, divorced status, with the series of spline terms representing intervals of months relative to divorce. Predicted probabilities are generated from model estimates, and plotted in Figure 1. We calculate predicted probabilities holding constant all covariates at their average values (except separated status, held constant at its pre-divorce value, .188, before divorce, and at 0 post-divorce).

Figure 1.

The Changing Distribution of Women's Health Insurance Coverage Across Time Since Divorce

Figure 1 demonstrates a striking shift in the distribution of women's insurance coverage at the time of divorce. The height of the dark grey area in the bottom of the graph represents the estimated probability of women holding any form of private insurance coverage across time relative to time of divorce. The height of the light band across the middle of the graph represents the estimated probability of public insurance across time. The black area at the top of the graph represents the estimated probability of women being uninsured across time. The vertical line above zero on the x-axis represents the month of divorce; to its left are pre-divorce months and to its right are post-divorce months.

As the graph indicates, there is a significant decrease in the probability of being insured in the month of divorce. This net loss of insurance (widening of black area) is the cumulative effect of an even larger decline in the probability of private insurance coverage (dark grey), which is only partially mitigated by an increase in public insurance coverage (light grey). At twelve months before divorce, 14.4 percent of women are estimated to be uninsured, increasing to 20.9 percent by twenty-four months after divorce. The loss of insurance coverage is statistically significant for as long as our data extends, more than two years after divorce.

DISCUSSION

Using recent longitudinal data from the Survey of Income and Program Participation, we examine how women's health insurance coverage changes after divorce. We find that, even while married, women who later divorce are more likely to be uninsured than women who remain married. Adding to this baseline disparity, a substantial number of women lose health insurance after divorce. Considering that approximately one million divorces occur in the United States every year (Census Bureau 2011), our descriptive estimates (see Table 2) suggest that roughly 115,000 women (1,000,000 × 11.3%) lose private health insurance annually in the months following divorce and that roughly 65,000 of these women (1,000,000 × 6.6%) become uninsured. The loss is not just a temporary disruption to women's health insurance coverage; rather, women's overall rates of health insurance coverage remain depressed for over two years after divorce, as long as our data allow us to test.

Not all women are equally likely to lose health insurance after divorce. Those insured as dependents on husbands' employer-based insurance plans are most vulnerable to insurance loss, while stable, full-time employment buffers against it. Women from moderate-income (200–300% FPL) families are particularly vulnerable. Many of these women fall into the ranks of the near-poor after divorce, with too much money to qualify for Medicaid, but not enough to purchase private health insurance coverage.

Moreover, the loss of health insurance coverage after divorce documented here may underestimate the true latent risk of health insurance loss for two reasons. First, the potential loss of economic resources, including health insurance, may deter divorce. Indeed, some couples choose to separate rather than divorce in order to maintain insurance coverage for both spouses. Second, divorce is not an exogenous shock. Spouses (or at least one spouse) generally anticipate it and may prepare ahead of time for financial independence. Thus women who lose health insurance may represent a subset of women, those who despite their efforts were unable to secure insurance coverage for themselves in advance of divorce.

Admittedly, our modeling strategy has some limitations. Fixed-effects models can control for observed and stable unobserved characteristics of women who divorce. But we cannot conclude that divorce causes women to lose health insurance coverage because in this context unobserved time-varying covariates are important. For example, one recent study suggests that women who divorce have greater risk tolerance than those who stay married (Light and Ahn 2010). If this is so, then some women may become uninsured after divorce not because they lack affordable insurance options, but because they do not place a high value on maintaining coverage. (This represents an omitted time-varying interaction between changing context and stable trait.) Additionally, we do not (nor do we have the data to) explicitly model the decision-making process behind divorce, but we do know from past studies that women are more likely than their husbands to initiate divorce (Wang and Amato 2000). Given this, we cannot claim that loss of health insurance coverage is something that happens to women. Rather, in many cases, a woman's decision to divorce may involve tradeoffs between loss of material resources and anticipated gains well-being in other dimensions.

Regardless of the causes, the loss of health insurance following divorce has important implications for women's financial well-being and health. This study broadens the economic consequences of divorce literature by showing that not only income is at risk but also women's health insurance coverage—an important instrument of financial protection in the event of major injuries or illnesses and a means to pay for routine medical care. Women who experience the greatest economic losses also are most likely to lose insurance coverage. Future studies should assess whether, in parallel to their smaller economic losses after divorce, men are also less likely to lose health insurance coverage.

Women's loss of health insurance may contribute to our understanding of the health declines sometimes experienced following marital disruption (Lorenz et al. 2006; Hughes and Waite 2009). Losing health insurance may compound the other stresses of the divorce process, and stress has negative ramifications for health (Pearlin et al. 2005). Being uninsured also means women are less likely to go to the doctor or to get medical care when they do get sick, potentially exacerbating conditions and illnesses (McWilliams 2009). Future studies using longitudinal data on health as well as health insurance should formally test whether loss of insurance coverage helps to account for some of the health declines women experience after marital disruption (see Lavelle, Lorenz, and Wickrama forthcoming for preliminary evidence).

Our findings also add to the body of evidence that the current health care and insurance system in the United States is inadequate for a population in which multiple family and job changes over the life course are not uncommon. It remains to be seen how effectively the Affordable Care Act (ACA; 2010)—expected to be fully implanted by 2014—will remedy the problem of insurance loss after divorce. In spite of the fact that this issue was all but absent from discussions of insurance system inadequacies leading up to the ACA's passage, the law has provisions which may help substantially. The ACA is slated to expand the availability of insurance to women through their own jobs, make insurance more affordable to women on the private market, and expand eligibility for Medicaid. Moving forward, policymakers should be aware that a system which induces a de facto linkage between marital status and health insurance may have unintentional adverse consequences.

Acknowledgments

This study was supported by the National Poverty Center using funds received from the U.S. Census Bureau, Housing and Household Economics Statistics Division through contract 50YABC266059/TO002. We also gratefully acknowledge use of the services and facilities of the Population Studies Center at the University of Michigan, funded by NICHD Center grant R24 HD041028, and the National Science Foundation's support of Lavelle through a Graduate Research Fellowship. We thank Barbara Anderson, Jacqueline Angel, Sarah Burgard, Charles Brown, Deborah Carr, Sheldon Danziger, Andrew Goodman-Bacon, Jim House, Helen Levy, Katherine Lin, Harold Pollack, and Yu Xie for helpful comments on earlier versions of this paper. The opinions and conclusions expressed herein are solely those of the authors and should not be construed as representing the opinions or policy of the National Poverty Center, the Population Studies Center, or of any agency of the Federal government.

Biographies

Bridget Lavelle is a doctoral candidate in public policy and sociology at the University of Michigan-Ann Arbor. Her broad research interests relate to economic stresses on families and the moderating effects of social and health policies. Supported by a Graduate Research Fellowship from the National Science Foundation, her dissertation focuses on the impact of life course transitions on health insurance coverage in the United States.

Pamela Smock is professor of sociology at the University of Michigan-Ann Arbor and a Research Professor at the Population Studies Center of the Institute for Social Research. Her research focuses on changing family patterns in the U.S. and the implications of social class and gender inequality for families. She has published on an array of topics including unmarried cohabitation, the economic consequences of divorce and marriage for women and men, nonresident fatherhood, and the motherhood wage penalty.

Footnotes

Dependent health coverage comes mainly from spouses' employers. However, young adults may be eligible for health insurance through parents' employers and some cohabiting women have access to domestic partner benefits.

Sample sizes reflect minor cleaning of the longitudinal marital status data for rare inconsistencies. In total, cleaning affected less than 1% of the total sample and less than 5% of the sample of women who divorce. Results presented are nearly identical to those using the raw marital status data.

As a robustness check, we re-ran analyses including person-months of remarriage and controlling for remarried status; results were very similar.

Although the SIPP has generally high reporting rates of public benefits relative to other surveys (Meyer, Mok and Sullivan 2009), we coded an alternative version of the health insurance variable re-categorizing any woman receiving TANF, SSI, or SSDI as being on Medicaid if she originally reported being uninsured, because these women may qualify as categorically eligible. Robustness analyses demonstrated little to no effect of the correction for under-reporting Medicaid on study results. Final analyses use the original self-reported values of health insurance status.

As with all studies using this analytic approach, omitted factors that change across time and that are correlated with both divorce and health insurance coverage could result in bias in the estimation of our divorced status coefficients.

Specifically, we formed one group for all person-month observations more than 12 months before divorce; the remaining observations are grouped into the maximum number of quantiles such that each has at least 500 observations. This procedure resulted in a total of 28 intervals. We examined various ways to group the observations into intervals. When time points are grouped into pairs (e.g., t=0 to 1 months after divorce, 2 to 3 months after divorce, etc.), the precision of the estimates drops quickly as t grows because sample sizes decline rapidly. When data are grouped into intervals with fewer than 500 observations, the trends remain the same but the data exhibits more noise. When data are binned into intervals with more than 500 observations, the trends remain the same but the estimates are more smoothed.

REFERENCES

- Amato Paul R. Research on Divorce: Continuing Trends and New Developments. Journal of Marriage and Family. 2010;72:650–666. [Google Scholar]

- Amato Paul R. The Consequences of Divorce for Adults and Children. Journal of Marriage and Family. 2000;62:1269–1287. [Google Scholar]

- Angel Jacqueline L., Montez Jennifer K., Angel Ronald J. A Window of Vulnerability: Health Insurance Coverage among Women 55 to 64 Years of Age. Women's Health Issues. 2011;21:6–11. doi: 10.1016/j.whi.2010.07.011. [DOI] [PubMed] [Google Scholar]

- Ayanian John Z., Weissman Joel S., Schneider Eric C., Ginsburg Jack A., Zaslavsky Alan M. Unmet Health Needs of Uninsured Adults in the United States. Journal of the American Medical Association. 2000;284:2061–2069. doi: 10.1001/jama.284.16.2061. [DOI] [PubMed] [Google Scholar]

- Baicker Katherine, Cutler David, Song Zirui. Workplace Wellness Programs Can Generate Savings. Health Affairs. 2010;29:304–311. doi: 10.1377/hlthaff.2009.0626. [DOI] [PubMed] [Google Scholar]

- Baker David W., Shapiro Martin F., Schur Claudia L. Health Insurance and Access to Care for Symptomatic Conditions. Archives of Internal Medicine. 2000;160:1269–1274. doi: 10.1001/archinte.160.9.1269. [DOI] [PubMed] [Google Scholar]

- Baker David W., Sudano Joseph J., Albert Jeffrey M., Borawski Elaine A., Dor Avi. Loss of Health Insurance and the Risk for a Decline in Self-Reported Health and Physical Functioning. Medical Care. 2002;40:1126–1131. doi: 10.1097/00005650-200211000-00013. [DOI] [PubMed] [Google Scholar]

- Becker Gary. A Treatise on the Family. Harvard University Press; Cambridge, MA: 1981. [Google Scholar]

- Berk Marc L., Schur Claudia L., Cantor Joel C. Ability to Obtain Health Care: Recent Estimates from the Robert Wood Johnson Foundation National Access to Care Survey. Health Affairs. 1995;14:139–146. doi: 10.1377/hlthaff.14.3.139. [DOI] [PubMed] [Google Scholar]

- Bernstein Amy B., Cohen Robin A., Brett Kate M., Bush Mary A. NCHS Data Brief, No. 11. National Center for Health Statistics; Hyattsville, MD: 2008. Marital Status is Associated with Health Insurance Coverage for Working-Age Women at All Income Levels, 2007. [PubMed] [Google Scholar]

- Bianchi Suzanne M., Subaiya Lekha, Kahn Joan R. The Gender Gap in the Economic Well-Being of Nonresident Fathers and Custodial Mothers. Demography. 1999;35:195–203. [PubMed] [Google Scholar]

- Buchmueller Thomas C. Marital Status, Spousal Coverage, and the Gender Gap in Employer-Sponsored Health Insurance. Inquiry. 1997;33:308–316. [PubMed] [Google Scholar]

- Canady Renee B., Broman Clifford. Marital Disruption and Health: Investigating the Role of Divorce in Differential Outcomes. Sociological Focus. 2003;36:241–255. [Google Scholar]

- Carr Deborah, Springer Kristen W. Advances in Families and Health Research in the 21st Century. Journal of Marriage and Family. 2010;72:743–761. [Google Scholar]

- Claxton Gary, Rae Matthew, Panchal Nirmita, Lundy Janet, Damico Anthony, Osei-Anto Awo, Kenward Kevin, Whitmore Heidi, Pickreign Jeremy. Employer Health Benefits: 2011 Annual Survey. Kaiser Family Foundation; Health Research and Educational Trust; Menlo Park, CA: Chicago, IL: 2011. Retrieved August 16, 2012 ( http://ehbs.kff.org/pdf/2011/8225.pdf) [Google Scholar]

- Currie Janet. Gender Gaps in Benefits Coverage. In: Lewin David, Mitchell Daniel, Zaidi Mahmood., editors. The Handbook of Human Resource Management. JAI Press; Greenwich, CT: 1997. pp. 175–198. [Google Scholar]

- Drentea Patricia. Age, Debt and Anxiety. Journal of Health and Social Behavior. 2000;41:437–450. [PubMed] [Google Scholar]

- Ferraro Kenneth F., Farmer Melissa M. Utility of Health Data from Social Surveys: Is There a Gold Standard for Measuring Morbidity? American Sociological Review. 1999;64:303–315. [Google Scholar]

- Finkelstein Amy, Taubman Sarah, Wright Bill, Bernstein Mira, Gruber Johnathan, Newhouse Joseph P., Allen Heidi, Baicker Katherine. The Oregon Health Insurance Experiment: Evidence from the First Year. National Bureau of Economic Research; New York: 2011. (NBER Working Paper Series No. 17190). [DOI] [PMC free article] [PubMed] [Google Scholar]

- Gruber Jonathan, Madrian Brigitte. Employment Separation and Health Insurance Coverage. Journal of Public Economics. 1997;66:349–382. [Google Scholar]

- Hadley Jack. Sicker and Poorer—The Consequences of Being Uninsured: A Review of the Research on the Relationship Between Health Insurance, Medical Care Use, Health, Work, and Income. Medical Care Research and Review. 2003;60:3S–75S. doi: 10.1177/1077558703254101. [DOI] [PubMed] [Google Scholar]

- Hahn Beth A. Marital Status and Women's Health: The Effect of Economic Marital Acquisitions. Journal of Marriage and Family. 1993;55:495–504. [Google Scholar]

- Hall Allyson G., Collins Karen S., Glied Sherry. Employer-Sponsored Health Insurance: Implications for Minority Workers. The Commonwealth Fund; New York: 1999. [Google Scholar]

- Hughes Mary E., Waite Linda J. Marital Biography and Health at Midlife. Journal of Health and Social Behavior. 2009;50:344–358. doi: 10.1177/002214650905000307. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Idler Ellen L., Benyamini Yael. Self-Rated Health and Mortality: A Review of Twenty-Seven Community Studies. Journal of Health and Social Behavior. 1997;38:21–37. [PubMed] [Google Scholar]

- Institute of Medicine . Care without Coverage: Too Little, Too Late. National Academies Press; Washington, DC: 2002. [Google Scholar]

- Johnson William R., Skinner Jonathan. Labor Supply and Marital Separation. American Economic Review. 1986;76:455–469. [Google Scholar]

- Johnson David R., Wu Jian. An Empirical Test of Crisis, Social Selection, and Role Explanations of the Relationship between Marital Disruption and Psychological Distress: A Pooled Time-Series Analysis of Four-Wave Panel Data. Journal of Marriage and Family. 2002;64:211–224. [Google Scholar]

- Jovanovic Zorana, Lin Chyongchiou J., Chang Chung-Chou H. Uninsured vs. Insured Population: Variations among Nonelderly Americans. Journal of Health and Social Behavior. 2003;17:71–85. doi: 10.1300/j045v17n03_05. [DOI] [PubMed] [Google Scholar]

- Kaiser Family Foundation . Fact Sheet, Women's Health Policy. Kaiser Family Foundation; Menlo Park, CA: 2011. Women's Health Insurance Coverage. [Google Scholar]

- Kaiser State Health Facts Medicaid Income Eligibility Limits for Adults as a Percent of Federal Poverty Level, July 2012. 2012 Retrieved October 3, 2012 ( http://www.state healthfacts.org/comparereport.jsp?rep=130&cat=4)

- Kirby James B., Kaneda Toshiko. Unhealthy and Uninsured: Exploring Racial Differences in Health and Health Insurance Coverage Using a Life Table Approach. Demography. 2010;47:1035–1052. doi: 10.1007/BF03213738. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Koball Heather L., Moiduddin Emily, Henderson Jamila, Goesling Brian, Besculides Melanie. What Do We Know About the Link between Marriage and Health? Journal of Family Issues. 2010;31:1019–1040. [Google Scholar]

- Lavelle Bridget, Lorenz Frederick O., Wickrama KAS. What Explains Divorced Women's Poorer Health?: The Mediating Role of Health Insurance and Access to Health Care in a Rural Iowan Sample. Rural Sociology. doi: 10.1111/j.1549-0831.2012.00091.x. Forthcoming. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Levy Helen, Meltzer David. The Impact of Health Insurance on Health. Annual Review of Public Health. 2008;29:399–409. doi: 10.1146/annurev.publhealth.28.021406.144042. [DOI] [PubMed] [Google Scholar]

- Light Audrey, Ahn Taehyun. Divorce as Risky Behavior. Demography. 2010;47:895–921. doi: 10.1007/BF03213732. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Liu Hui. Marital Dissolution and Self-Rated Health: Age Trajectories and Birth Cohort Variations. Social Science & Medicine. 2012;74:1107–1116. doi: 10.1016/j.socscimed.2011.11.037. [DOI] [PubMed] [Google Scholar]

- Liu Hui, Umberson Debra J. The Times They Are a Changin': Marital Status and Health Differentials from 1972 to 2003. Journal of Health and Social Behavior. 2008;49:239–253. doi: 10.1177/002214650804900301. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lorenz Frederick O., Wickrama KAS, Conger Rand D., Elder Glen H., Jr. The Short-Term and Decade-Long Effects of Divorce on Women's Midlife Health. Journal of Health and Social Behavior. 2006;47:111–125. doi: 10.1177/002214650604700202. [DOI] [PubMed] [Google Scholar]

- Marsh Lawrence. Spline Regression Models. Sage; Thousand Oaks, CA: 2001. [Google Scholar]

- McWilliams J. Michael. Health Consequences of Uninsurance among Adults in the United States: Recent Evidence and Implications. Milbank Quarterly. 2009;87:443–494. doi: 10.1111/j.1468-0009.2009.00564.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Meyer Bruce D., Mok Wallace K., Sullivan James X. The Under-Reporting of Transfers in Household Surveys: Its Nature and Consequences. National Bureau of Economic Research; New York: 2009. (NBER Working Paper Series No. 15181). [Google Scholar]

- Meyer Madonna H., Pavalko Eliza K. Family, Work, and Access to Health Insurance among Mature Women. Journal of Health and Social Behavior. 1996;37:311–325. [PubMed] [Google Scholar]

- Montez Jennifer K., Angel Jacqueline L., Angel Ronald J. Employment, Marriage, and Inequality in Health Insurance for Mexican-Origin Women. Journal of Health and Social Behavior. 2009;50:132–148. doi: 10.1177/002214650905000202. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Oppenheimer Valerie K. Women's Employment and the Gain to Marriage: The Specialization and Trading Model. Annual Review of Sociology. 1997;23:431–453. doi: 10.1146/annurev.soc.23.1.431. [DOI] [PubMed] [Google Scholar]

- Pearlin Leonard I., Schieman Scott, Fazio Elena M., Meersman Stephen C. Stress, Health, and the Life Course: Some Conceptual Perspectives. Journal of Health and Social Behavior. 2005;46:205–219. doi: 10.1177/002214650504600206. [DOI] [PubMed] [Google Scholar]

- Prigerson Holly G., Maciejewski Paul K., Rosenheck Robert A. The Effects of Marital Dissolution and Marital Quality on Health and Health Service Use among Women. Medical Care. 1999;37:858–873. doi: 10.1097/00005650-199909000-00003. [DOI] [PubMed] [Google Scholar]

- Quadagno Jill. Why the United States Has No National Health Insurance: Stakeholder Mobilization Against the Welfare State. Journal of Health and Social Behavior. 2004;45:25–44. [PubMed] [Google Scholar]

- Rogers Stacy J. Wives' Income and Marital Quality: Are There Reciprocal Effects? Journal of Marriage and Family. 1999;61:123–132. [Google Scholar]

- Saunders Milda R., Alexander G. Caleb. Turning and Churning: Loss of Health Insurance among Adults in Medicaid. Journal of General Internal Medicine. 2009;24:133–134. doi: 10.1007/s11606-008-0861-0. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sayer Liana C., Bianchi Suzanne M. Women's Economic Independence and the Probability of Divorce. Journal of Family Issues. 2000;21:906–943. [Google Scholar]

- Sbarra David A., Nietert Paul J. Divorce and Death: Forty Years of the Charleston Heart Study. Psychological Science. 2009;20:107–113. doi: 10.1111/j.1467-9280.2008.02252.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Schoen Cathy, Doty Michelle M., Robertson Ruth H., Collins Sara R. Affordable Care Act Reforms Could Reduce the Number of Underinsured U.S. Adults by 70 Percent. Health Affairs. 2011;30:1762–1771. doi: 10.1377/hlthaff.2011.0335. [DOI] [PubMed] [Google Scholar]

- Short Pamela F. Gaps and Transitions in Health Insurance: What are the Concerns of Women? Journal of Women's Health. 1998;7:725–737. doi: 10.1089/jwh.1998.7.725. [DOI] [PubMed] [Google Scholar]

- Smock Pamela J. Gender and the Short-Run Economic Consequences of Marital Disruption. Social Forces. 1994;73:243–262. [Google Scholar]

- Smock Pamela J., Manning Wendy D., Gupta Sanjiv. The Effect of Marriage and Divorce on Women's Economic Well-Being. American Sociological Review. 1999;64:794–812. [Google Scholar]

- Summer Laura, Mann Cindy. Instability of Public Health Insurance Coverage for Children and their Families: Causes, Consequences, and Remedies. Georgetown University Health Policy Institute; Washington, DC: 2006. [Google Scholar]

- Tamborini Christopher R., Iams Howard M., Reznik Gayle L. Women's Earnings Before and after Marital Dissolution: Evidence from Longitudinal Earnings Records Matched to Survey Data. Journal of Family and Economic Issues. 2011;33:69–82. [Google Scholar]

- U.S. Census Bureau . Table 78. Live Births, Deaths, Marriages, and Divorces: 1960 to 2008. 131st Edition Washington, DC: 2011. Statistical Abstract of the United States: 2012. [Google Scholar]

- Vuckovic Nancy. Self-Care among the Uninsured: `You Do What You Can Do.'. Health Affairs. 2000;19:197–199. doi: 10.1377/hlthaff.19.4.197. [DOI] [PubMed] [Google Scholar]

- Waite Linda J., Gallagher Maggie. The Case for Marriage: Why Married People Are Happier, Healthier, and Better Off Financially. Doubleday; New York: 2000. [Google Scholar]

- Williams Kristi, Umberson Debra. Marital Status, Marital Transitions, and Health: A Gendered Life Course Perspective. Journal of Health and Social Behavior. 2004;45:81–98. doi: 10.1177/002214650404500106. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Wang Hongyu, Amato Paul R. Predictors of Divorce Adjustment: Stressors, Resources, and Definitions. Journal of Marriage and Family. 2000;62:655–668. [Google Scholar]

- Wood Robert G., Goesling Brian, Avellar Sarah. The Effects of Marriage on Health: A Synthesis of Recent Research Evidence. Mathematica Policy Research, Inc.; Washington, DC: 2007. [Google Scholar]